Credit

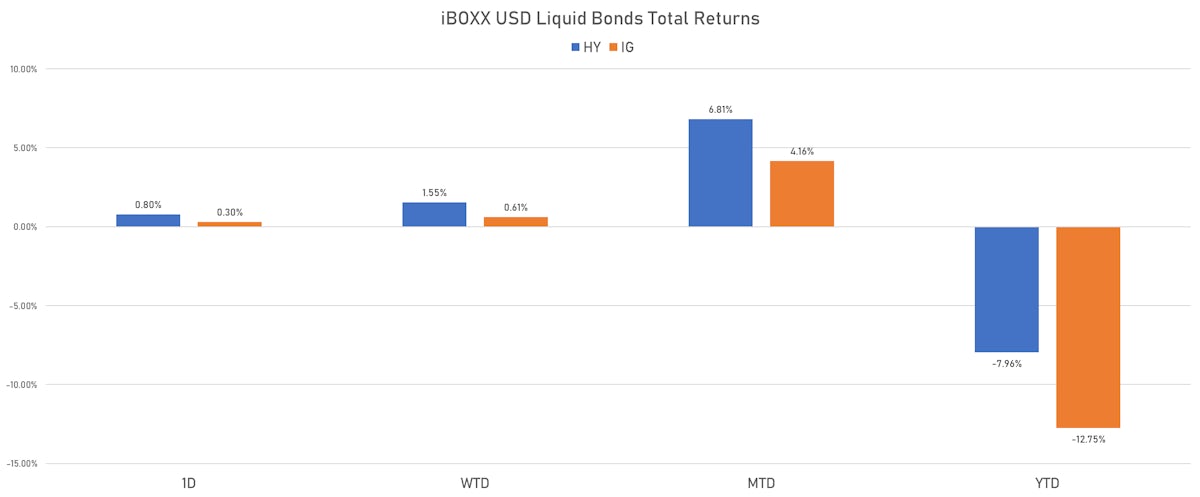

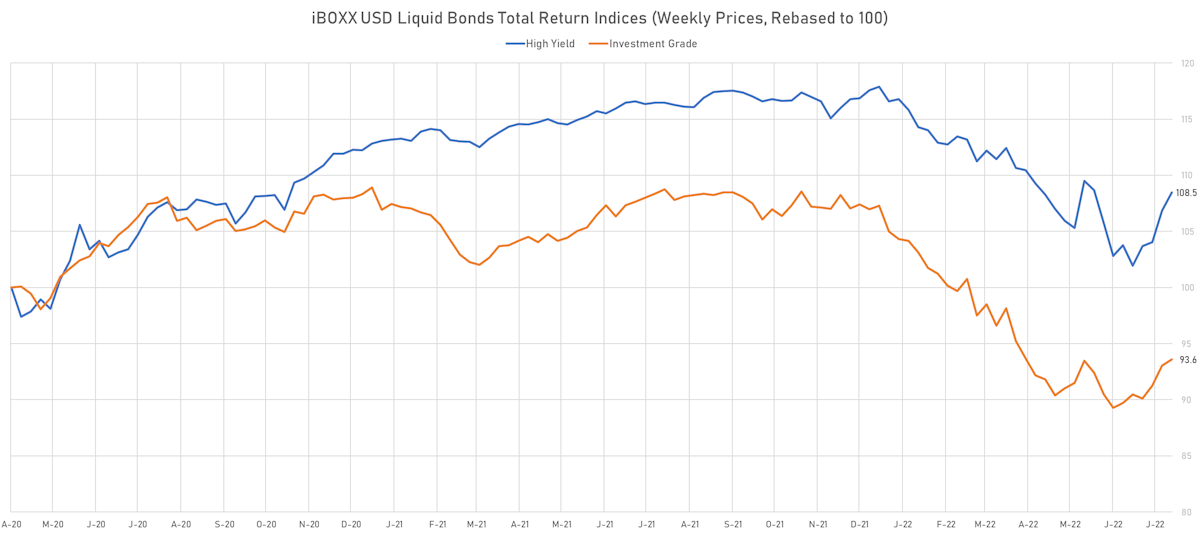

July Was A Good Month For US$ Credit: IG Liquid Bonds Up 4.2%, HY Up 6.8%

Weekly issuance of US$ corporate bonds (IFR Markets data): 17 tranches for $18.6bn in IG (2022 YTD volume $824.09bn vs 2021 YTD $933.973bn) and a single $725m tranche in HY (2022 YTD volume $68.576bn vs 2021 YTD $462.661bn)

Published ET

iBOXX US$ Liquid Bonds Total Return Indices | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.16% today, with investment grade up 0.12% and high yield up 0.56% (YTD total return: -10.79%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.304% today (Month-to-date: 4.16%; Year-to-date: -12.75%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.796% today (Month-to-date: 6.81%; Year-to-date: -7.96%)

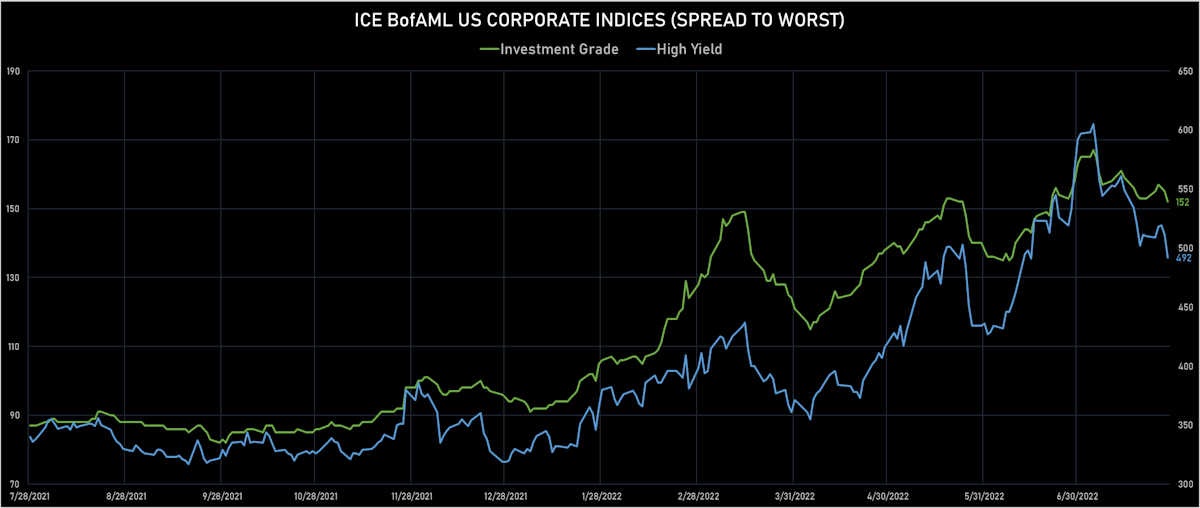

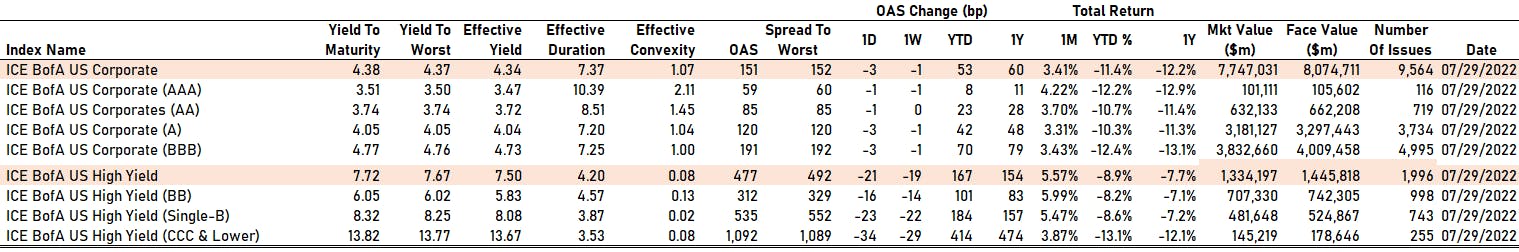

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -3.0 bp, now at 152.0 bp (YTD change: +57.0 bp)

- ICE BofA US High Yield Index spread to worst down -19.0 bp, now at 492.0 bp (YTD change: +162.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.13% today (YTD total return: -2.6%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 59 bp

- AA down by -1 bp at 85 bp

- A down by -3 bp at 120 bp

- BBB down by -3 bp at 191 bp

- BB down by -16 bp at 312 bp

- B down by -23 bp at 535 bp

- ≤ CCC down by -34 bp at 1,092 bp

CDS INDICES TODAY (mid-spreads)

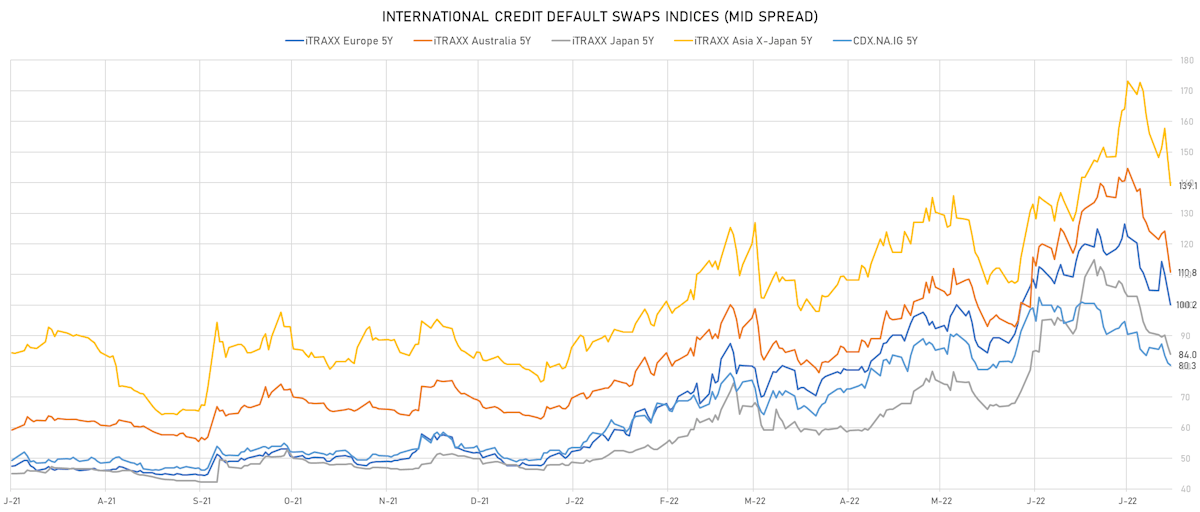

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 80bp (1W change: -5.9bp; YTD change: +31.0bp)

- Markit CDX.NA.IG 10Y down 0.5 bp, now at 116bp (1W change: -5.2bp; YTD change: +27.0bp)

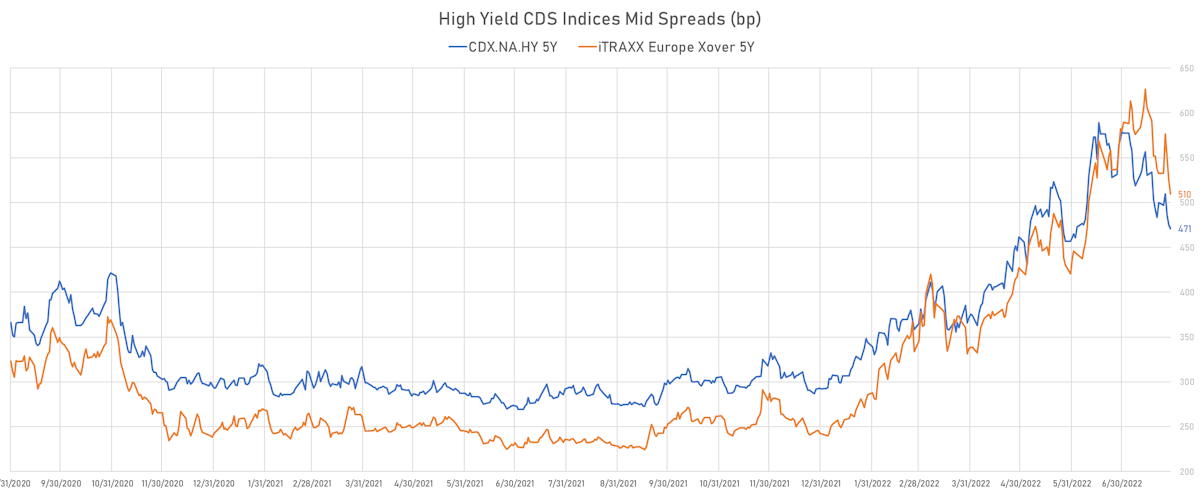

- Markit CDX.NA.HY 5Y down 4.0 bp, now at 471bp (1W change: -28.9bp; YTD change: +179.1bp)

- Markit iTRAXX Europe 5Y down 4.5 bp, now at 100bp (1W change: -4.6bp; YTD change: +52.5bp)

- Markit iTRAXX Europe Crossover 5Y down 15.2 bp, now at 510bp (1W change: -22.8bp; YTD change: +267.6bp)

- Markit iTRAXX Japan 5Y down 2.6 bp, now at 84bp (1W change: -7.0bp; YTD change: +37.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 8.5 bp, now at 139bp (1W change: -17.1bp; YTD change: +60.1bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 3101.8 bp to 3,616.7bp (1Y range: 1,019-3,617bp)

- Nabors Industries Inc (Country: US; rated: B3): down 246.9 bp to 745.5bp (1Y range: 489-1,096bp)

- Weatherford International Ltd (Country: US; rated: B2): down 153.2 bp to 500.6bp (1Y range: -501bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B): down 114.4 bp to 1,095.1bp (1Y range: 299-1,584bp)

- Bath & Body Works Inc (Country: US; rated: A2): down 92.7 bp to 492.2bp (1Y range: 124-492bp)

- Staples Inc (Country: US; rated: B3): down 74.6 bp to 1,923.7bp (1Y range: 904-1,986bp)

- Pactiv LLC (Country: US; rated: Caa1): down 68.9 bp to 872.6bp (1Y range: 356-1,041bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 67.7 bp to 1,572.8bp (1Y range: 299-1,689bp)

- Navient Corp (Country: US; rated: Ba3): down 65.4 bp to 522.8bp (1Y range: -523bp)

- Petroleos Mexicanos (Country: MX; rated: caa3): down 63.6 bp to 646.3bp (1Y range: 302-760bp)

- Murphy Oil Corp (Country: US; rated: A2): down 60.7 bp to 411.0bp (1Y range: 240-446bp)

- Genworth Holdings Inc (Country: US; rated: Ba3): down 55.6 bp to 385.2bp (1Y range: 335-563bp)

- Tegna Inc (Country: US; rated: Ba3): down 39.4 bp to 747.1bp (1Y range: 182-786bp)

- American Airlines Group Inc (Country: US; rated: B2): up 77.2 bp to 1,521.3bp (1Y range: 607-1,644bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 228.5 bp to 1,115.6bp (1Y range: 367-1,116bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Air France KLM SA (Country: FR; rated: C): down 99.7 bp to 775.7bp (1Y range: 386-990bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 72.4 bp to 737.3bp (1Y range: 333-934bp)

- Novafives SAS (Country: FR; rated: Caa1): down 63.8 bp to 1,395.1bp (1Y range: 618-1,903bp)

- Renault SA (Country: FR; rated: A-): down 50.3 bp to 386.9bp (1Y range: 166-476bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 46.0 bp to 521.3bp (1Y range: 259-648bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 42.8 bp to 1,832.0bp (1Y range: 962-2,690bp)

- Iceland Bondco PLC (Country: GB; rated: WR): down 38.9 bp to 1,099.6bp (1Y range: 440-1,326bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): down 34.2 bp to 257.7bp (1Y range: 46-258bp)

- Lagardere SA (Country: FR; rated: A3): down 30.6 bp to 153.3bp (1Y range: 153-350bp)

- Atlantia SpA (Country: IT; rated: Ba1): down 27.7 bp to 318.6bp (1Y range: 97-383bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: WR): down 22.6 bp to 176.1bp (1Y range: -176bp)

- Rexel SA (Country: FR; rated: Ba2): down 21.8 bp to 352.3bp (1Y range: -352bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 20.4 bp to 422.9bp (1Y range: 161-506bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 22.4 bp to 673.6bp (1Y range: 166-674bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC+): up 193.1 bp to 1,885.2bp (1Y range: 464-2,070bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.63% | Maturity: 15/5/2024 | Rating: BB- | ISIN: USU24437AD43 | Z-spread up by 98.4 bp to 168.3 bp, with the yield to worst at 4.4% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 96.5-104.5).

- Issuer: Ohio National Financial Services Inc (Cincinnati, Ohio (US)) | Coupon: 6.63% | Maturity: 1/5/2031 | Rating: BB+ | ISIN: USU6775MAD03 | Z-spread up by 85.4 bp to 366.8 bp, with the yield to worst at 6.1% and the bond now trading down to 102.2 cents on the dollar (1Y price range: 99.1-118.0).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: B | ISIN: USU83854AB29 | Z-spread up by 79.6 bp to 1,035.3 bp, with the yield to worst at 12.9% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 85.0-102.8).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 75.7 bp to 285.8 bp, with the yield to worst at 5.5% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 91.0-106.9).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | ISIN: USU3230LAA45 | Z-spread down by 47.0 bp to 326.9 bp (CDS basis: -85.9bp), with the yield to worst at 6.2% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 7.50% | Maturity: 1/6/2030 | Rating: BB- | ISIN: USU26886AF59 | Z-spread down by 47.0 bp to 446.6 bp, with the yield to worst at 7.1% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 95.0-101.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 48.8 bp to 351.9 bp, with the yield to worst at 6.1% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 91.5-105.7).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 48.9 bp to 313.9 bp, with the yield to worst at 5.8% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread down by 60.9 bp to 370.4 bp, with the yield to worst at 6.3% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 88.5-112.4).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | ISIN: USU26886AD02 | Z-spread down by 62.2 bp to 351.4 bp, with the yield to worst at 6.1% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 79.8-105.0).

- Issuer: LGI Homes Inc (The Woodlands, Texas (US)) | Coupon: 4.00% | Maturity: 15/7/2029 | Rating: BB- | ISIN: USU5286JAB53 | Z-spread down by 67.4 bp to 461.0 bp, with the yield to worst at 7.2% and the bond now trading up to 82.1 cents on the dollar (1Y price range: 74.5-99.6).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 72.4 bp to 334.1 bp, with the yield to worst at 6.0% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 95.5-108.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | ISIN: USU6500TAG05 | Z-spread down by 85.1 bp to 150.3 bp, with the yield to worst at 4.2% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 91.0-106.0).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 89.3 bp to 365.3 bp, with the yield to worst at 6.3% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 93.0-112.0).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.50% | Maturity: 15/1/2029 | Rating: BB- | ISIN: USU26886AC29 | Z-spread down by 91.2 bp to 383.8 bp, with the yield to worst at 6.4% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 80.8-103.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 13/7/2027 | Rating: BB | ISIN: XS1645722262 | Z-spread down by 56.9 bp to 377.3 bp (CDS basis: -54.2bp), with the yield to worst at 4.8% and the bond now trading up to 86.3 cents on the dollar (1Y price range: 79.5-103.0).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: BB- | ISIN: XS1711584430 | Z-spread down by 57.9 bp to 667.9 bp (CDS basis: 177.8bp), with the yield to worst at 7.6% and the bond now trading up to 88.9 cents on the dollar (1Y price range: 73.9-101.2).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.25% | Maturity: 24/6/2025 | Rating: BB | ISIN: FR0013428414 | Z-spread down by 58.0 bp to 315.6 bp (CDS basis: -30.5bp), with the yield to worst at 4.1% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 86.3-98.6).

- Issuer: OI European Group BV (Schiedam, Netherlands) | Coupon: 3.13% | Maturity: 15/11/2024 | Rating: B+ | ISIN: XS1405765907 | Z-spread down by 62.7 bp to 450.0 bp, with the yield to worst at 5.1% and the bond now trading up to 94.9 cents on the dollar (1Y price range: 91.5-102.7).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 63.5 bp to 413.3 bp, with the yield to worst at 5.1% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread down by 74.5 bp to 431.8 bp, with the yield to worst at 5.4% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 75.1 bp to 446.2 bp, with the yield to worst at 5.6% and the bond now trading up to 85.5 cents on the dollar (1Y price range: 76.3-101.8).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread down by 78.9 bp to 412.9 bp, with the yield to worst at 5.3% and the bond now trading up to 85.7 cents on the dollar (1Y price range: 77.1-92.0).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | Z-spread down by 79.2 bp to 498.6 bp, with the yield to worst at 6.3% and the bond now trading up to 87.9 cents on the dollar (1Y price range: 78.9-98.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread down by 80.0 bp to 277.5 bp, with the yield to worst at 3.7% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 88.8-96.7).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 81.8 bp to 447.2 bp, with the yield to worst at 5.7% and the bond now trading up to 78.4 cents on the dollar (1Y price range: 69.8-87.3).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB | ISIN: XS2301390089 | Z-spread down by 82.3 bp to 408.6 bp (CDS basis: -78.3bp), with the yield to worst at 5.2% and the bond now trading up to 83.3 cents on the dollar (1Y price range: 75.2-102.6).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread down by 86.7 bp to 1,017.7 bp, with the yield to worst at 10.9% and the bond now trading up to 71.0 cents on the dollar (1Y price range: 66.0-95.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.50% | Maturity: 1/3/2025 | Rating: BB- | ISIN: XS1813724603 | Z-spread down by 94.1 bp to 357.5 bp, with the yield to worst at 4.5% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 91.6-103.6).

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | Z-spread down by 198.3 bp to 824.0 bp, with the yield to worst at 8.8% and the bond now trading up to 67.5 cents on the dollar (1Y price range: 59.2-109.5).

RECENT DOMESTIC USD BOND ISSUES

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): $2,250m Senior Note (US025816CY33), fixed rate (3.95% coupon) maturing on 1 August 2025, priced at 99.90 (original spread of 100 bp), callable (3nc3)

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): $1,250m Senior Note (US025816DA48), floating rate maturing on 3 August 2033, priced at 100.00 (original spread of 150 bp), callable (11nc10)

- Appalachian Power Co (Utility - Other | Columbus, United States | Rating: BBB+): $500m Senior Note (US037735DA25), fixed rate (4.50% coupon) maturing on 1 August 2032, priced at 99.74 (original spread of 185 bp), callable (10nc10)

- Avient Corp (Chemicals | Avon Lake, United States | Rating: BB-): $725m Senior Note (US05368VAA44), fixed rate (7.13% coupon) maturing on 1 August 2030, priced at 100.00 (original spread of 436 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): $120m Bond (US3133ENE222), fixed rate (4.73% coupon) maturing on 2 August 2032, priced at 100.00 (original spread of 157 bp), callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): $550m Bond (US3133END984), floating rate (SOFR + 10.0 bp) maturing on 1 August 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): $150m Bond (US3133END802), fixed rate (3.00% coupon) maturing on 3 August 2026, priced at 100.00 (original spread of 24 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): $200m Unsecured Note (US3134GXL369), fixed rate (3.88% coupon) maturing on 15 August 2025, priced at 100.00 (original spread of 116 bp), callable (3nc6m)

- General Motors Co (Automotive Manufacturer | Detroit, United States | Rating: BBB-): $1,250m Senior Note (US37045VAZ31), fixed rate (5.60% coupon) maturing on 15 October 2032, priced at 99.76 (original spread of 295 bp), callable (10nc10)

- General Motors Co (Automotive Manufacturer | Detroit, United States | Rating: BBB-): $1,000m Senior Note (US37045VAY65), fixed rate (5.40% coupon) maturing on 15 October 2029, priced at 99.91 (original spread of 270 bp), callable (7nc7)

- Kinder Morgan Inc (Gas Utility - Pipelines | Houston, Texas, United States | Rating: BBB): $750m Senior Note (US49456BAW19), fixed rate (5.45% coupon) maturing on 1 August 2052, priced at 99.63 (original spread of 260 bp), callable (30nc30)

- Kinder Morgan Inc (Gas Utility - Pipelines | Houston, Texas, United States | Rating: BBB): $750m Senior Note (US49456BAV36), fixed rate (4.80% coupon) maturing on 1 February 2033, priced at 99.94 (original spread of 200 bp), callable (11nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A): $1,350m Senior Note (US13607H6M92), fixed rate (3.95% coupon) maturing on 4 August 2025, priced at 100.00 (original spread of 115 bp), with a make whole call

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): $500m Note (XS0459896402), fixed rate (3.00% coupon) maturing on 19 August 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): $280m Index Linked Security (XS0459912969), floating rate maturing on 20 June 2025, priced at 99.90, non callable

- Hanhui International Ltd (Financial - Other | China (Mainland) | Rating: BBB+): $110m Bond (XS2499264690), fixed rate (5.30% coupon) maturing on 1 August 2025, priced at 100.00, non callable

- Lotte Property & Development Co Ltd (Leasing | Seoul, Japan | Rating: AA-): $300m Senior Note (XS2507746993), fixed rate (4.50% coupon) maturing on 1 August 2025, priced at 99.93 (original spread of 146 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): $150m Unsecured Note (XS2431105720), floating rate maturing on 20 June 2027, priced at 100.00, non callable

- Posco Holdings Inc (Metals/Mining | Seoul, South Korea | Rating: A-): $700m Senior Note (US73730EAA10), fixed rate (4.38% coupon) maturing on 4 August 2025, priced at 99.79 (original spread of 160 bp), non callable

- Swedish Export Credit Corp (Agency | Stockholm, Sweden | Rating: AA+): $800m Senior Note (US87031CAF05), floating rate (SOFR + 100.0 bp) maturing on 3 August 2026, priced at 101.67, non callable

SELECTED RECENT EUR BOND ISSUES

- Berlin, State of (Official and Muni | Berlin, Berlin, Germany | Rating: AA+): €500m Landesschatzanweisung (DE000A3MQYL0), fixed rate (1.63% coupon) maturing on 2 August 2032, priced at 99.56 (original spread of 78 bp), non callable

- Credit Industriel et Commercial SA (Banking | Paris, Ile-De-France, France | Rating: A+): €230m Unsecured Note (XS2509090127), floating rate maturing on 7 November 2030, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7V4), fixed rate (1.25% coupon) maturing on 18 August 2025, priced at 100.00, non callable

- European Union (Supranational | Brussels, Belgium | Rating: AAA): €500m Senior Note (EU000A3K73L1), fixed rate (2.13% coupon) maturing on 2 August 2040, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €250m Hypothekenpfandbrief (Covered Bond) (DE000LB2ZWT0), floating rate (EU03MLIB + 50.0 bp) maturing on 3 August 2033, priced at 103.98, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €200m Hypothekenpfandbrief (Covered Bond) (DE000LB2ZWR4), floating rate (EU03MLIB + 50.0 bp) maturing on 3 August 2026, priced at 101.53, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €800m Hypothekenpfandbrief (Covered Bond) (DE000LB2ZWS2), floating rate (EU03MLIB + 50.0 bp) maturing on 3 November 2031, priced at 103.34, non callable

- NRW Bank (Agency | Dusseldorf, Germany | Rating: AA): €1,000m Senior Note (DE000NWB0AR8), fixed rate (1.63% coupon) maturing on 3 August 2032, priced at 99.43 (original spread of 80 bp), non callable

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: AA+): €500m Hypothekenpfandbrief (Covered Bond) (DE000NLB3ZZ5), fixed rate (1.38% coupon) maturing on 3 November 2025, priced at 99.93 (original spread of 89 bp), non callable

- SSE PLC (Utility - Other | Perth, Perthshire, United Kingdom | Rating: BBB+): €650m Senior Note (XS2510903862), fixed rate (2.88% coupon) maturing on 1 August 2029, priced at 99.91 (original spread of 203 bp), callable (7nc7)

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): €1,250m Senior Note (XS2511309903), fixed rate (3.13% coupon) maturing on 3 August 2032, priced at 100.00 (original spread of 210 bp), non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): €1,000m Senior Note (XS2511301322), fixed rate (2.55% coupon) maturing on 3 August 2027, priced at 100.00 (original spread of 184 bp), non callable

NEW ISSUES IN SECURITIZED CREDIT

- Freddie Mac SPC Series K-J41 issued a fixed-rate Agency CMBS in 2 tranches, for a total of $ 265 m. Highest-rated tranche offering a yield to maturity of 3.14%, and the lowest-rated tranche a yield to maturity of 3.47%. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc

- CPS Auto Receivables Trust 2022-C issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of $ 392 m. Highest-rated tranche offering a yield to maturity of 4.18%, and the lowest-rated tranche a yield to maturity of 9.08%. Bookrunners: Citigroup Global Markets Inc, Credit Suisse Securities (USA) LLC

- Verus Securitization Trust 2022-7 issued a fixed-rate RMBS in 4 tranches, for a total of $ 406 m. Bookrunners: Morgan Stanley & Co, Deutsche Bank Securities Inc, Credit Suisse Securities (USA) LLC, JP Morgan Securities LLC, Barclays Capital Inc

- Colt 2022-7 Mortgage Loan Trust issued a fixed-rate RMBS in 4 tranches, for a total of $ 255 m. Bookrunners: Barclays Capital Group