Credit

A Bifurcated Week For US Corporate Credit, As IG Suffers From Duration Selloff While HY Does Better On Spreads Compression

Good week for US$ IG bond issuance, led by Facebook's first offering: 53 tranches for $57.85bn in IG (2022 YTD volume $881.9bn vs 2021 YTD $969.8bn), 2 tranches for $2bn in HY (2022 YTD volume $71.3bn vs 2021 YTD $325.8bn)

Published ET

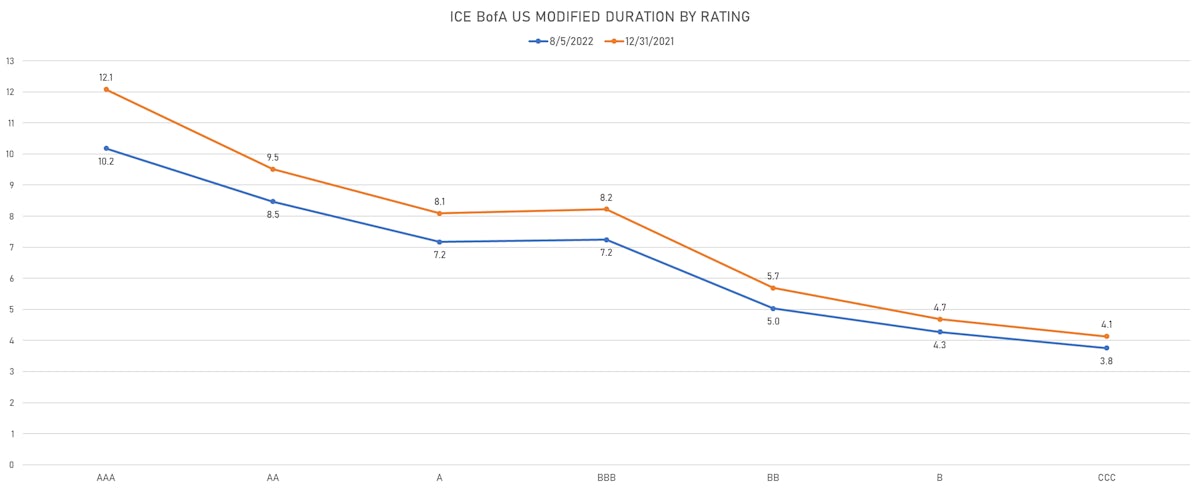

YTD Changes In Duration By Rating | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was down -1.08% today, with investment grade down -1.13% and high yield down -0.53% (YTD total return: -11.40%)

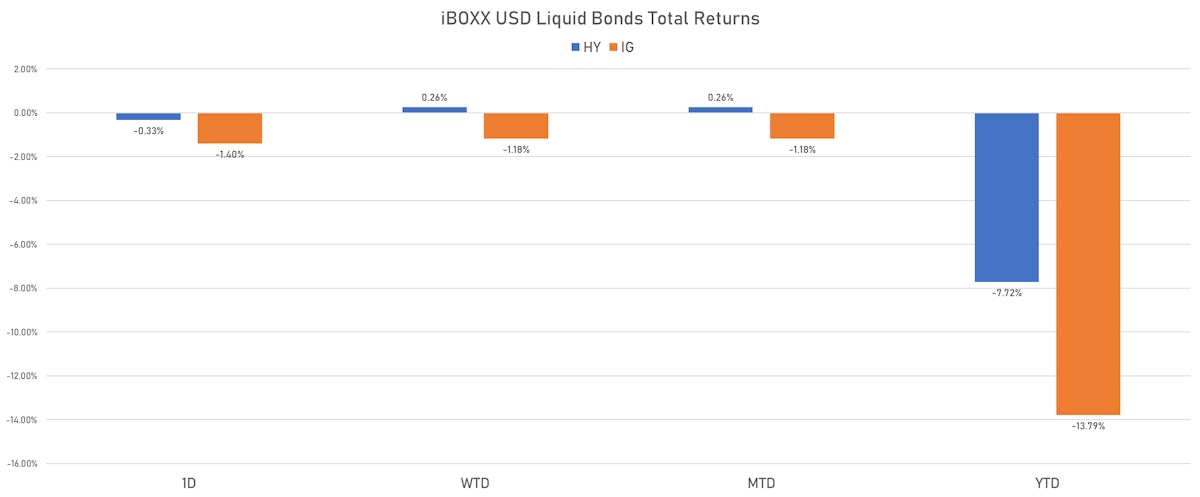

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.400% today (Month-to-date: -1.18%; Year-to-date: -13.79%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.332% today (Month-to-date: 0.26%; Year-to-date: -7.72%)

- ICE BofA Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 150.0 bp (YTD change: +55.0 bp)

- ICE BofA High Yield Index spread to worst down -11.0 bp, now at 462.0 bp (YTD change: +132.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.36% today (YTD total return: -1.6%)

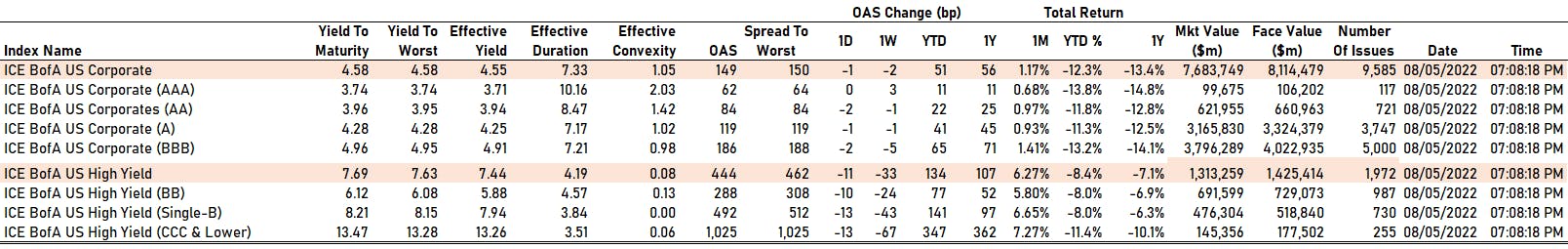

CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 62 bp

- AA down by -2 bp at 84 bp

- A down by -1 bp at 119 bp

- BBB down by -2 bp at 186 bp

- BB down by -10 bp at 288 bp

- B down by -13 bp at 492 bp

- ≤ CCC down by -13 bp at 1,025 bp

CDS INDICES TODAY (mid-spreads)

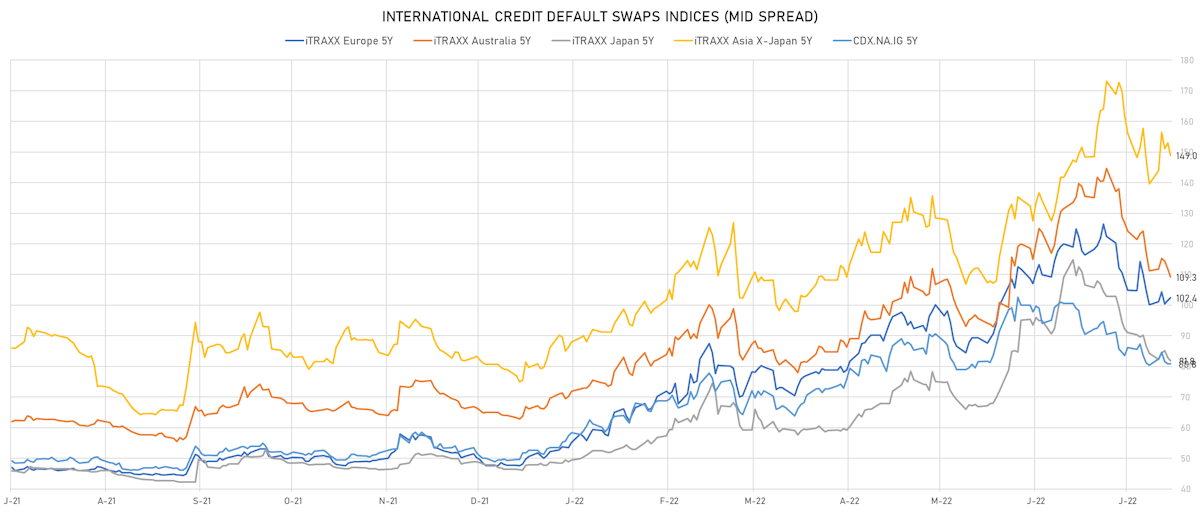

- Markit CDX.NA.IG 5Y unchanged at 81bp (1W change: +0.4bp; YTD change: +31.4bp)

- Markit CDX.NA.IG 10Y down 0.1 bp, now at 116bp (1W change: +0.3bp; YTD change: +27.3bp)

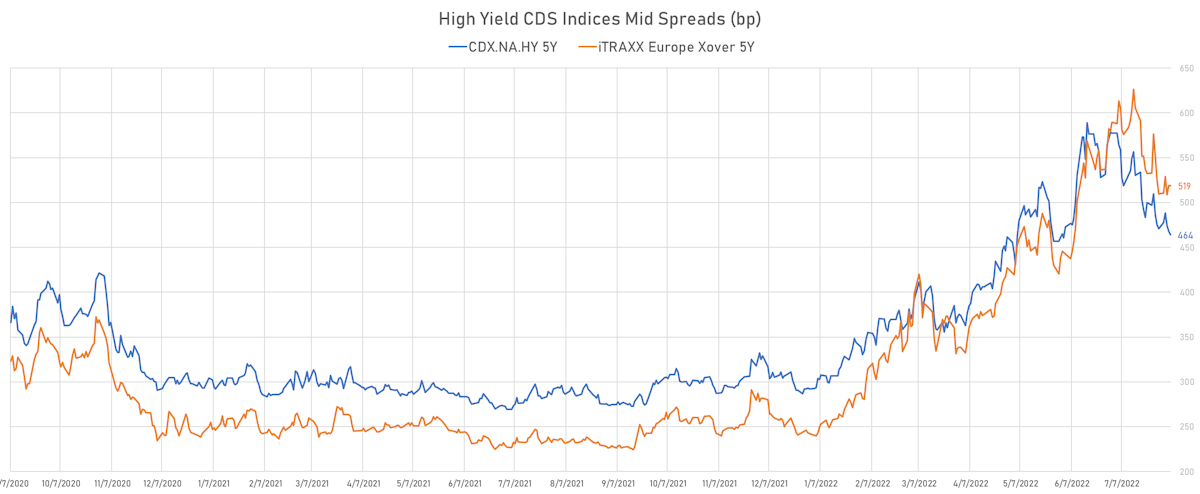

- Markit CDX.NA.HY 5Y down 3.9 bp, now at 464bp (1W change: -7.1bp; YTD change: +172.1bp)

- Markit iTRAXX Europe 5Y up 0.8 bp, now at 102bp (1W change: +2.2bp; YTD change: +54.7bp)

- Markit iTRAXX Europe Crossover 5Y down 0.2 bp, now at 519bp (1W change: +8.9bp; YTD change: +276.6bp)

- Markit iTRAXX Japan 5Y down 1.1 bp, now at 82bp (1W change: -2.5bp; YTD change: +35.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 4.0 bp, now at 149bp (1W change: +9.4bp; YTD change: +70.0bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Pactiv LLC (Country: US; rated: Caa1): down 121.1 bp to 737.2bp (1Y range: 356-1,041bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 119.6 bp to 1,453.2bp (1Y range: 299-1,689bp)

- Carnival Corp (Country: US; rated: B): down 109.4 bp to 979.7bp (1Y range: 316-1,583bp)

- Bombardier Inc (Country: CA; rated: B3): down 96.3 bp to 600.8bp (1Y range: 395-1,007bp)

- iStar Inc (Country: US; rated: Ba2): down 78.4 bp to 208.4bp (1Y range: 199-324bp)

- American Airlines Group Inc (Country: US; rated: B2): down 71.9 bp to 1,449.4bp (1Y range: 607-1,644bp)

- MGM Resorts International (Country: US; rated: B1): down 69.7 bp to 354.5bp (1Y range: 190-524bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B): down 63.4 bp to 1,031.7bp (1Y range: 299-1,584bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): down 61.4 bp to 522.6bp (1Y range: 355-681bp)

- Genworth Holdings Inc (Country: US; rated: Ba3): down 61.2 bp to 330.1bp (1Y range: 330-563bp)

- DISH DBS Corp (Country: US; rated: B2): down 60.1 bp to 1,272.3bp (1Y range: 317-1,506bp)

- Tegna Inc (Country: US; rated: Ba3): down 58.1 bp to 690.7bp (1Y range: 182-786bp)

- Goodyear Tire & Rubber Co (Country: US; rated: A2): down 47.9 bp to 427.2bp (1Y range: 188-552bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 118.9 bp to 1,228.4bp (1Y range: 367-1,228bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 159.2 bp to 1,177.9bp (1Y range: 607-1,641bp)

- Novafives SAS (Country: FR; rated: Caa1): down 101.2 bp to 1,293.9bp (1Y range: 618-1,903bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 79.0 bp to 931.4bp (1Y range: 359-1,296bp)

- Air France KLM SA (Country: FR; rated: C): down 64.7 bp to 711.0bp (1Y range: 386-990bp)

- Iceland Bondco PLC (Country: GB; rated: WR): down 42.1 bp to 1,057.6bp (1Y range: 440-1,326bp)

- thyssenkrupp AG (Country: DE; rated: A3): down 41.3 bp to 531.3bp (1Y range: 205-652bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 37.2 bp to 1,794.8bp (1Y range: 969-2,690bp)

- Atlantia SpA (Country: IT; rated: Ba1): down 36.8 bp to 281.9bp (1Y range: 97-383bp)

- Stena AB (Country: SE; rated: B2-PD): down 32.1 bp to 601.4bp (1Y range: 401-865bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 29.1 bp to 993.3bp (1Y range: 213-1,186bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 28.3 bp to 359.3bp (1Y range: 154-463bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 27.8 bp to 490.0bp (1Y range: 222-585bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 27.3 bp to 417.8bp (1Y range: 107-540bp)

- SES SA (Country: LU; rated: BB+): up 59.4 bp to 176.6bp (1Y range: 66-177bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC+ | ISIN: C10602AJ68 | Z-spread down by 90.0 bp to 623.0 bp (CDS basis: 57.3bp), with the yield to worst at 8.8% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 74.5-122.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 7.50% | Maturity: 1/6/2030 | Rating: BB- | ISIN: U26886AF59 | Z-spread down by 90.1 bp to 360.4 bp, with the yield to worst at 6.5% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 95.0-105.8).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: U98401AB58 | Z-spread down by 92.5 bp to 442.2 bp, with the yield to worst at 7.2% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 83.1-105.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: U98401AD15 | Z-spread down by 92.5 bp to 442.2 bp, with the yield to worst at 7.2% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 83.1-105.5).

- Issuer: Bath & Body Works Inc (Columb, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: U51407AD34 | Z-spread down by 95.2 bp to 384.2 bp, with the yield to worst at 6.9% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 100.6-122.3).

- Issuer: Howard Midstream Energy Partners LLC (San Antonio, US)) | Coupon: 6.75% | Maturity: 15/1/2027 | Rating: B- | ISIN: U4425TAA08 | Z-spread down by 95.5 bp to 734.7 bp, with the yield to worst at 10.0% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 84.8-103.3).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: U75111AK72 | Z-spread down by 98.2 bp to 264.2 bp, with the yield to worst at 5.6% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 88.5-103.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B- | ISIN: U6S19GAC10 | Z-spread down by 108.1 bp to 426.7 bp (CDS basis: -92.9bp), with the yield to worst at 7.1% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 93.0-104.1).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.88% | Maturity: 15/8/2023 | Rating: B- | ISIN: U68337AK75 | Z-spread down by 108.6 bp to 175.3 bp (CDS basis: 154.9bp), with the yield to worst at 4.4% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 99.0-104.6).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: U98737AC03 | Z-spread down by 115.0 bp to 274.9 bp, with the yield to worst at 5.6% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 92.0-107.1).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: U6223WAB01 | Z-spread down by 121.3 bp to 286.0 bp, with the yield to worst at 6.4% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: U26886AA62 | Z-spread down by 122.5 bp to 218.6 bp, with the yield to worst at 5.2% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 95.5-108.5).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: U68337AL58 | Z-spread down by 124.4 bp to 415.0 bp (CDS basis: -80.2bp), with the yield to worst at 6.6% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 94.3-108.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: U2036YAC04 | Z-spread down by 132.9 bp to 461.2 bp, with the yield to worst at 7.6% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 91.5-102.8).

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: L6S52VAA02 | Z-spread down by 140.9 bp to 421.9 bp, with the yield to worst at 7.0% and the bond now trading up to 93.8 cents on the dollar (1Y price range: 84.3-99.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread up by 73.6 bp to 1,230.0 bp, with the yield to worst at 11.5% and the bond now trading down to 70.3 cents on the dollar (1Y price range: 60.9-94.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | Z-spread down by 76.0 bp to 344.9 bp (CDS basis: 7.9bp), with the yield to worst at 4.6% and the bond now trading up to 93.8 cents on the dollar (1Y price range: 89.3-102.4).

- Issuer: Petrobras Global Finance BV (Rotterdam, Netherlands) | Coupon: 4.75% | Maturity: 14/1/2025 | Rating: BB- | ISIN: XS0982711714 | Z-spread down by 77.8 bp to 235.9 bp (CDS basis: -52.4bp), with the yield to worst at 3.3% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 100.2-109.7).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 16/5/2027 | Rating: BB- | ISIN: XS2408458730 | Z-spread down by 78.5 bp to 436.3 bp (CDS basis: 15.5bp), with the yield to worst at 5.6% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 77.2-99.9).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 1.50% | Maturity: 15/3/2027 | Rating: BB+ | ISIN: XS2080318053 | Z-spread down by 81.4 bp to 163.8 bp (CDS basis: 39.4bp), with the yield to worst at 2.9% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 83.8-101.2).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB | ISIN: XS1558491855 | Z-spread down by 85.4 bp to 222.4 bp (CDS basis: 15.4bp), with the yield to worst at 3.2% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 90.4-101.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | Z-spread down by 86.5 bp to 436.5 bp (CDS basis: 48.4bp), with the yield to worst at 5.9% and the bond now trading up to 77.3 cents on the dollar (1Y price range: 71.2-92.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | Z-spread down by 87.5 bp to 376.2 bp (CDS basis: 69.7bp), with the yield to worst at 5.3% and the bond now trading up to 87.1 cents on the dollar (1Y price range: 80.9-98.5).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 87.8 bp to 454.4 bp (CDS basis: 16.5bp), with the yield to worst at 5.9% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 78.0-103.5).

- Issuer: OI European Group BV (Schiedam, Netherlands) | Coupon: 3.13% | Maturity: 15/11/2024 | Rating: B+ | ISIN: XS1405765907 | Z-spread down by 90.2 bp to 351.5 bp, with the yield to worst at 4.3% and the bond now trading up to 96.5 cents on the dollar (1Y price range: 91.5-102.7).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread down by 94.0 bp to 333.6 bp (CDS basis: 24.7bp), with the yield to worst at 4.3% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 88.2-102.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | Z-spread down by 101.8 bp to 286.5 bp (CDS basis: 83.9bp), with the yield to worst at 4.1% and the bond now trading up to 97.7 cents on the dollar (1Y price range: 91.9-105.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB- | ISIN: XS2265369657 | Z-spread down by 101.9 bp to 394.2 bp (CDS basis: 29.9bp), with the yield to worst at 5.1% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 82.7-102.0).

- Issuer: MAS Securities BV (S-Gravenhage, Netherlands) | Coupon: 4.25% | Maturity: 19/5/2026 | Rating: BB | ISIN: XS2339025277 | Z-spread down by 105.2 bp to 1,001.9 bp, with the yield to worst at 11.3% and the bond now trading up to 78.9 cents on the dollar (1Y price range: 72.9-96.2).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread down by 193.8 bp to 816.5 bp, with the yield to worst at 9.1% and the bond now trading up to 75.9 cents on the dollar (1Y price range: 66.0-95.9).

RECENT DOMESTIC USD BOND ISSUES

- 8x8 Inc (Electronics | Campbell, California, United States | Rating: NR): $202m Bond (US282914AD20), fixed rate (4.00% coupon) maturing on 1 February 2028, priced at 100.00, non callable, convertible

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AAA): $1,250m Senior Note (US037833ER75), fixed rate (4.10% coupon) maturing on 8 Augt 2062, priced at 99.65 (original spread of 168 bp), callable (40nc40)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AAA): $1,750m Senior Note (US037833EQ92), fixed rate (3.95% coupon) maturing on 8 Augt 2052, priced at 99.34 (original spread of 139 bp), callable (30nc30)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AAA): $1,500m Senior Note (US037833EP10), fixed rate (3.35% coupon) maturing on 8 Augt 2032, priced at 99.88 (original spread of 80 bp), callable (10nc10)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AAA): $1,000m Senior Note (US037833EN61), fixed rate (3.25% coupon) maturing on 8 Augt 2029, priced at 99.88 (original spread of 63 bp), callable (7nc7)

- CCO Holdings LLC (Cable/Media | St. Louis, United States | Rating: BB-): $1,500m Senior Note (US1248EPCS01), fixed rate (6.38% coupon) maturing on 1 September 2029, priced at 100.00 (original spread of 369 bp), callable (7nc3)

- Citizens Bank NA (Banking | Providence, United States | Rating: BBB+): $800m Senior Note (US75524KPG30), floating rate maturing on 9 Augt 2028, priced at 100.00, callable (6nc5)

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): $500m Senior Note (US194162AP89), fixed rate (3.25% coupon) maturing on 15 Augt 2032, priced at 99.12 (original spread of 75 bp), callable (10nc10)

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): $500m Senior Note (US194162AM58), fixed rate (3.10% coupon) maturing on 15 Augt 2025, priced at 99.91 (original spread of 30 bp), with a make whole call

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): $500m Senior Note (US194162AN32), fixed rate (3.10% coupon) maturing on 15 Augt 2027, priced at 99.88 (original spread of 45 bp), callable (5nc5)

- Consumers Energy Co (Utility - Other | Jackson, Michigan, United States | Rating: A): $450m First Mortgage Bond (US210518DQ64), fixed rate (4.20% coupon) maturing on 1 September 2052, priced at 99.93 (original spread of 125 bp), callable (30nc30)

- Consumers Energy Co (Utility - Other | Jackson, Michigan, United States | Rating: A): $350m First Mortgage Bond (US210518DP81), fixed rate (3.60% coupon) maturing on 15 Augt 2032, priced at 99.93 (original spread of 100 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): $275m Bond (US3133ENF708), floating rate (FFQ + 7.5 bp) maturing on 12 Augt 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): $250m Bond (US3133ENE719), floating rate (PRQ + -308.5 bp) maturing on 8 Augt 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): $425m Bond (US3133ENE891), floating rate (SOFR + 10.0 bp) maturing on 8 Augt 2024, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): $175m Unsecured Note (US3134GXR713), fixed rate (4.00% coupon) maturing on 25 November 2024, priced at 100.00 (original spread of 139 bp), callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): $105m Unsecured Note (US3134GXM763), fixed rate (3.00% coupon) maturing on 25 Augt 2025, priced at 100.00 (original spread of 76 bp), callable (3nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): $1,500m Unsecured Note (US3134GXR630), fixed rate (4.05% coupon) maturing on 28 Augt 2025, priced at 100.00, callable (3nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): $200m Unsecured Note (US3134GXR978), fixed rate (4.16% coupon) maturing on 28 Augt 2025, priced at 100.00, callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): $115m Unsecured Note (US3134GXP733), fixed rate (4.00% coupon) maturing on 28 May 2025, priced at 100.00, callable (3nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): $525m Unsecured Note (US3134GXQ319), fixed rate (4.10% coupon) maturing on 15 Augt 2025, priced at 100.00, callable (3nc1m)

- Infinera Corp (Service - Other | San Jose, California, United States | Rating: NR): $325m Bond (US45667GAG82), fixed rate (3.75% coupon) maturing on 1 Augt 2028, priced at 100.00, non callable, convertible

- Keybank NA (Banking | Cleveland, Ohio, United States | Rating: A+): $1,250m Senior Bank Note (US49327M3E23), fixed rate (4.15% coupon) maturing on 8 Augt 2025, priced at 99.97 (original spread of 113 bp), non callable

- Keybank NA (Banking | Cleveland, Ohio, United States | Rating: A): $750m Subordinated Bank Note (US49327V2C76), fixed rate (4.90% coupon) maturing on 8 Augt 2032, priced at 99.75 (original spread of 225 bp), non callable

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): $2,750m Senior Note (USU59197AE06), fixed rate (4.45% coupon) maturing on 15 Augt 2052, priced at 99.84 (original spread of 145 bp), callable (30nc30)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): $3,000m Senior Note (USU59197AD23), fixed rate (3.85% coupon) maturing on 15 Augt 2032, priced at 99.98 (original spread of 115 bp), callable (10nc10)

- Meta Platforms Inc (Service - Other | Menlo Park, United States | Rating: A+): $1,500m Senior Note (USU30303M8F29), fixed rate (4.65% coupon) maturing on 15 Augt 2062, priced at 99.82 (original spread of 165 bp), callable (40nc40)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): $2,750m Senior Note (USU59197AB66), fixed rate (3.50% coupon) maturing on 15 Augt 2027, priced at 99.80 (original spread of 75 bp), callable (5nc5)

- Moody's Corp (Service - Other | New York City, New York, United States | Rating: BBB+): $500m Senior Note (US615369AZ82), fixed rate (4.25% coupon) maturing on 8 Augt 2032, priced at 99.59 (original spread of 158 bp), callable (10nc10)

- ONE Gas Inc (Gas Utility - Local Distrib | Tulsa, United States | Rating: BBB+): $300m Senior Note (US68235PAM05), fixed rate (4.25% coupon) maturing on 1 September 2032, priced at 99.20 (original spread of 165 bp), callable (10nc10)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): $600m Senior Note (US69371RR993), fixed rate (3.55% coupon) maturing on 11 Augt 2025, priced at 99.93 (original spread of 57 bp), non callable

- Synov Financial Corp (Banking | Columb, United States | Rating: BBB-): $350m Senior Note (US87161CAN56), fixed rate (5.20% coupon) maturing on 11 Augt 2025, priced at 99.89 (original spread of 225 bp), callable (3nc3)

- Williams Companies Inc (Gas Utility - Pipelines | Tulsa, Oklahoma, United States | Rating: BBB): $750m Senior Note (US969457CA67), fixed rate (5.30% coupon) maturing on 15 Augt 2052, priced at 99.95 (original spread of 261 bp), callable (30nc30)

- Williams Companies Inc (Gas Utility - Pipelines | Tulsa, Oklahoma, United States | Rating: BBB): $1,000m Senior Note (US969457BZ28), fixed rate (4.65% coupon) maturing on 15 Augt 2032, priced at 99.64 (original spread of 200 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- AG TTMT Escrow Issuer LLC (Financial - Other | Rating: NR): $500m Note (US00840KAA79), fixed rate (8.63% coupon) maturing on 30 September 2027, priced at 100.00, non callable

- Ashtead Capital Inc (Leasing | Fort Mill, United Kingdom | Rating: NR): $750m Senior Note (US04505AAA79), fixed rate (5.50% coupon) maturing on 11 Augt 2032, priced at 99.01 (original spread of 295 bp), with a make whole call

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): $1,750m Senior Note (US06738EBY05), fixed rate (5.50% coupon) maturing on 9 August 2028, priced at 100.00 (original spread of 265 bp), callable (6nc5)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,000m Senior Note (US06738ECA10), fixed rate (5.75% coupon) maturing on 9 August 2033, priced at 100.00 (original spread of 300 bp), callable (11nc10)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,500m Senior Note (US06738EBZ79), fixed rate (5.30% coupon) maturing on 9 August 2026, priced at 100.00 (original spread of 230 bp), callable (4nc3)

- Bengbu High-Tech Investment Group Co Ltd (Financial - Other | Bengbu, China (Mainland) | Rating: NR): US$200m Senior Note (XS2504383204), fixed rate (5.30% coupon) maturing on 11 August 2025, priced at 100.00, non callable

- CIMA Finance DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$113m Unsecured Note (XS2512378675), floating rate maturing on 11 August 2026, priced at 100.00, non callable

- Guatemala, Republic of (Government) (Sovereign | Guatemala City, Guatemala | Rating: BB-): US$500m Senior Note (US401494AV14), fixed rate (5.25% coupon) maturing on 10 August 2029, priced at 98.85 (original spread of 253 bp), callable (7nc7)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,500m Senior Note (US404280DH94), floating rate maturing on 11 August 2033, priced at 100.00, callable (11nc10)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,250m Senior Note (US404280DG12), floating rate maturing on 11 August 2028, priced at 100.00, callable (6nc5)

- Jinan Hi-tech Holding Group Co Ltd (Financial - Other | Jinan, Shandong, China (Mainland) | Rating: BBB): US$300m Bond (XS2509136995), fixed rate (5.50% coupon) maturing on 9 August 2025, priced at 100.00 (original spread of 242 bp), callable (3nc1m)

- KT Corp (Telecommunications | Seongnam, Gyeonggi-Do, South Korea | Rating: A-): US$500m Senior Note (US48268KAG67), fixed rate (4.00% coupon) maturing on 8 August 2025, priced at 99.84 (original spread of 125 bp), non callable

- Lloyds Banking Group PLC (Banking | Spalding, United Kingdom | Rating: BBB+): US$1,250m Senior Note (US53944YAT01), fixed rate (4.72% coupon) maturing on 11 August 2026, priced at 100.00 (original spread of 175 bp), callable (4nc3)

- Lloyds Banking Group PLC (Banking | Spalding, United Kingdom | Rating: BBB+): US$1,250m Senior Note (US53944YAU73), fixed rate (4.98% coupon) maturing on 11 August 2033, priced at 100.00 (original spread of 265 bp), callable (11nc10)

- Lseries DAC (Financial - Other | Dublin, Ireland | Rating: NR): US$143m Unsecured Note (XS2518624437) zero coupon maturing on 31 August 2052, non callable

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): US$800m Senior Note (US55608KBF12), floating rate maturing on 9 August 2026, priced at 100.00, callable (4nc3)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): US$850m Senior Note (US55608KBG94), floating rate maturing on 9 November 2033, priced at 100.00 (original spread of 276 bp), callable (11nc10)

- Mianyang Investment Holding Group Co Ltd (Financial - Other | Mianyang, Sichuan, China (Mainland) | Rating: BB): US$300m Senior Note (XS2478257202), fixed rate (6.70% coupon) maturing on 8 August 2025, priced at 100.00, non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$325m Unsecured Note (XS2519370360) zero coupon maturing on 6 September 2027, priced at 100.00, non callable

- Phoenix Charm International Investment Ltd (Financial - Other | Zhenjiang, China (Mainland) | Rating: NR): US$205m Senior Note (XS2488073938), fixed rate (6.40% coupon) maturing on 10 August 2025, priced at 100.00, non callable

- Sovkombank PAO (Banking | Kostroma, Kostromskaya Oblast, Russia | Rating: NR): US$600m Bond (RU000A1052C7), fixed rate (6.50% coupon) maturing on 27 January 2031, priced at 100.00, non callable

- Suzhou City Construction Investment Group Holding Co Ltd (Building Products | Suzhou, Anhui, China (Mainland) | Rating: BBB-): US$200m Senior Note (XS2507837792), fixed rate (6.00% coupon) maturing on 9 August 2025, priced at 100.00, non callable

- Ubs Bank USA (Banking | Salt Lake City, Switzerland | Rating: A+): US$300m Certificate of Deposit - Retail (US90348J4W79), fixed rate (3.35% coupon) maturing on 12 August 2024, priced at 100.00, non callable

- Waste Connections Inc (Service - Other | Woodbridge, Canada | Rating: BBB): US$750m Senior Note (US94106BAF85), fixed rate (4.20% coupon) maturing on 15 January 2033, priced at 99.73 (original spread of 153 bp), callable (10nc10)

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: BBB+): US$1,000m Subordinated Note (US961214FG36), fixed rate (5.41% coupon) maturing on 10 August 2033, priced at 100.00 (original spread of 269 bp), callable (11nc10)

SELECTED RECENT EUR BOND ISSUES

- BackB Investments SARL (Financial - Other | Luxembourg, Norway | Rating: NR): €210m Bond (XS2498914527), floating rate maturing on 9 February 2027, priced at 100.00, non callable

- CVC Cordatus Loan Fund XXIV DAC (Financial - Other | Dublin, Ireland | Rating: NR): €211m Bond (XS2511416906), floating rate maturing on 23 October 2034, priced at 100.00, non callable

- Compagnie de Saint Gobain SA (Conglomerate/Diversified Mfg | Courbevoie, Ile-De-France, France | Rating: BBB): €500m Senior Note (XS2517103250), fixed rate (1.63% coupon) maturing on 10 August 2025, priced at 99.76 (original spread of 144 bp), callable (3nc3)

- Compagnie de Saint Gobain SA (Conglomerate/Diversified Mfg | Courbevoie, Ile-De-France, France | Rating: BBB): €500m Senior Note (XS2517103417), fixed rate (2.13% coupon) maturing on 10 June 2028, priced at 99.57 (original spread of 172 bp), callable (6nc6)

- Compagnie de Saint Gobain SA (Conglomerate/Diversified Mfg | Courbevoie, Ile-De-France, France | Rating: BBB): €500m Unsecured Note (XS2517103334), fixed rate (2.63% coupon) maturing on 10 August 2032, priced at 100.00 (original spread of 201 bp), callable (10nc10)

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (XS2517101478), fixed rate (1.13% coupon) maturing on 11 August 2025, priced at 99.94 (original spread of 93 bp), non callable

- Lloyds Bank Corporate Markets PLC (Banking | London, United Kingdom | Rating: A): €200m Senior Note (XS2518861641), floating rate maturing on 12 August 2024, priced at 100.00, non callable

- Madison Park Euro Funding XX DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €240m Bond (XS2507605744), floating rate maturing on 15 October 2036, priced at 100.00, non callable

- Madison Park Euro Funding XX DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €240m Bond (XS2511498953), floating rate maturing on 15 October 2036, priced at 100.00, non callable

- Selp Finance SARL (Financial - Other | Luxembourg, Luxembourg | Rating: BBB+): €750m Senior Note (XS2511906310), fixed rate (3.75% coupon) maturing on 10 August 2027, priced at 99.85 (original spread of 338 bp), callable (5nc5)