Credit

High Yield Spread Compression Continued This Week Across The Credit Complex, Helped By Very Low YTD Issuance

Reasonable volume of US$ investment grade bonds this week: 33 tranches for $30.6bn in IG (2022 YTD volume $912.6bn vs 2021 YTD $1,011bn, down 9.8%) and 2 tranches for $900m in HY (2022 YTD volume $72.2bn vs 2021 YTD $341.3bn, down 78.8%)

Published ET

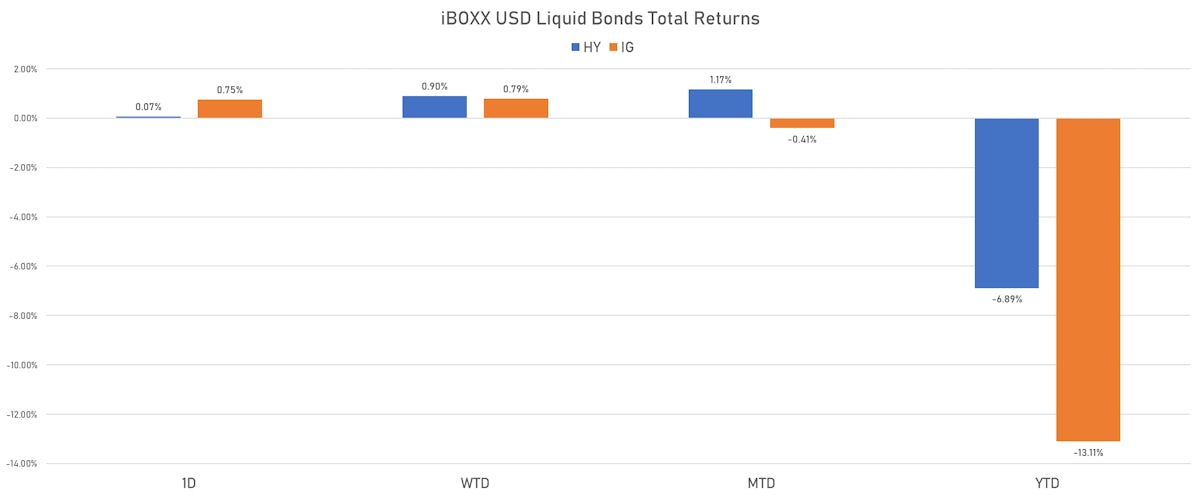

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.41% today, with investment grade up 0.45% and high yield up 0.06% (YTD total return: -10.99%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.750% today (Month-to-date: -0.41%; Year-to-date: -13.11%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.066% today (Month-to-date: 1.17%; Year-to-date: -6.89%)

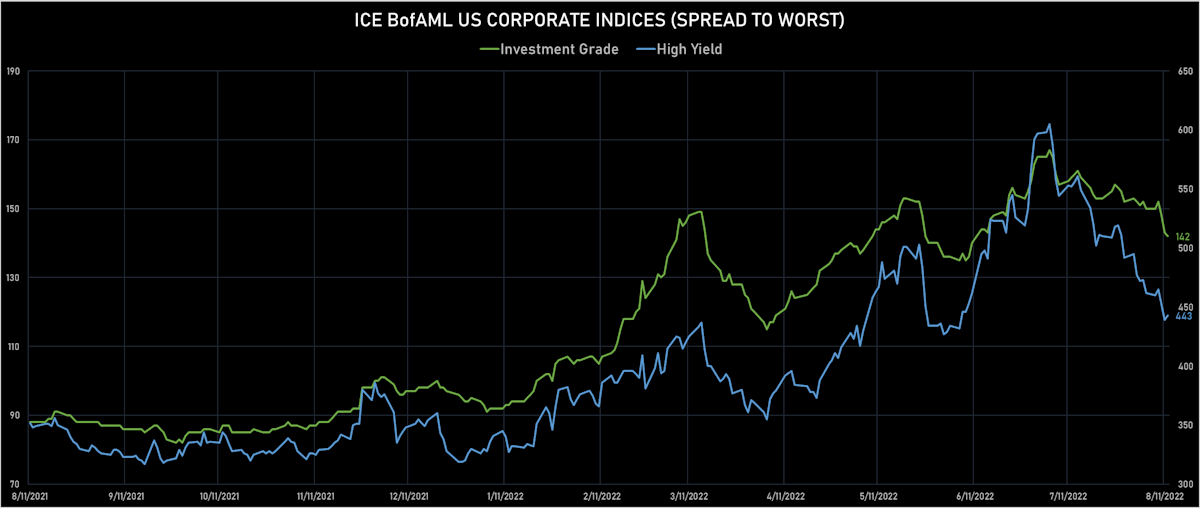

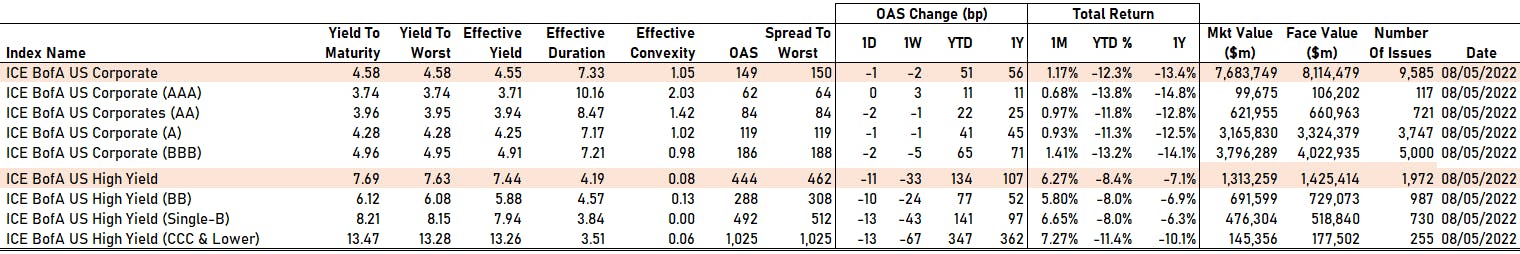

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 142.0 bp (YTD change: +47.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 443.0 bp (YTD change: +113.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: -0.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 57 bp

- AA down by -1 bp at 79 bp

- A down by -2 bp at 112 bp

- BBB down by -2 bp at 177 bp

- BB up by 5 bp at 281 bp

- B up by 2 bp at 463 bp

- CCC up by 2 bp at 977 bp

CDS INDICES TODAY (mid-spreads)

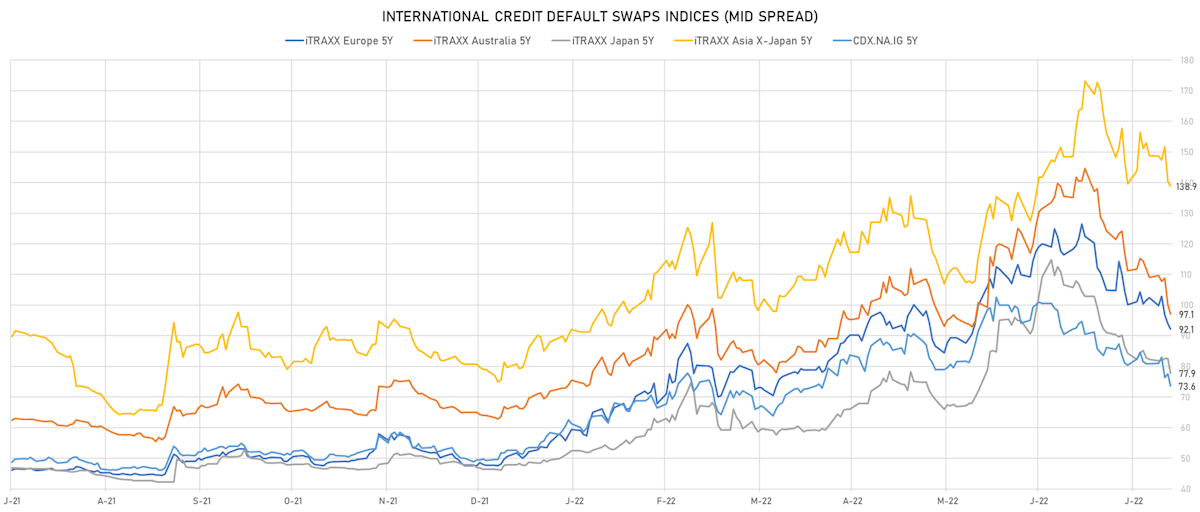

- Markit CDX.NA.IG 5Y down 3.9 bp, now at 74bp (1W change: -7.2bp; YTD change: +24.2bp)

- Markit CDX.NA.IG 10Y down 3.6 bp, now at 111bp (1W change: -5.4bp; YTD change: +21.9bp)

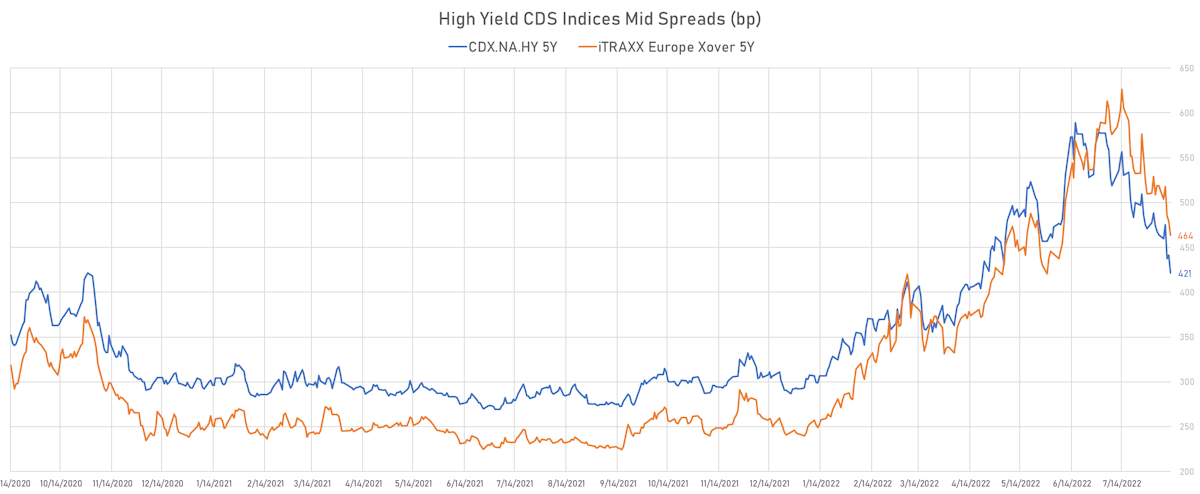

- Markit CDX.NA.HY 5Y down 20.0 bp, now at 421bp (1W change: -42.8bp; YTD change: +129.3bp)

- Markit iTRAXX Europe 5Y down 1.8 bp, now at 92bp (1W change: -10.2bp; YTD change: +44.5bp)

- Markit iTRAXX Europe Crossover 5Y down 15.5 bp, now at 464bp (1W change: -54.9bp; YTD change: +221.6bp)

- Markit iTRAXX Japan 5Y down 4.7 bp, now at 78bp (1W change: -4.4bp; YTD change: +31.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.6 bp, now at 139bp (1W change: -9.9bp; YTD change: +59.9bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Brazil (rated BB-): down 11.4 % to 241 bp (1Y range: 173-328bp)

- Vietnam (rated BB): down 13.3 % to 120 bp (1Y range: 89-177bp)

- Panama: down 13.3 % to 113 bp (1Y range: 66-156bp)

- Mexico (rated BBB-): down 13.4 % to 135 bp (1Y range: 81-200bp)

- Indonesia (rated BBB): down 13.8 % to 98 bp (1Y range: 66-162bp)

- South Africa (rated BB-): down 14.3 % to 232 bp (1Y range: 180-377bp)

- Colombia (rated BB+): down 14.9 % to 221 bp (1Y range: 130-329bp)

- Philippines (rated BBB): down 15.8 % to 87 bp (1Y range: 41-144bp)

- Peru (rated BBB): down 17.4 % to 102 bp (1Y range: 72-156bp)

- Egypt (rated B+): down 26.7 % to 950 bp (1Y range: 333-1,453bp)

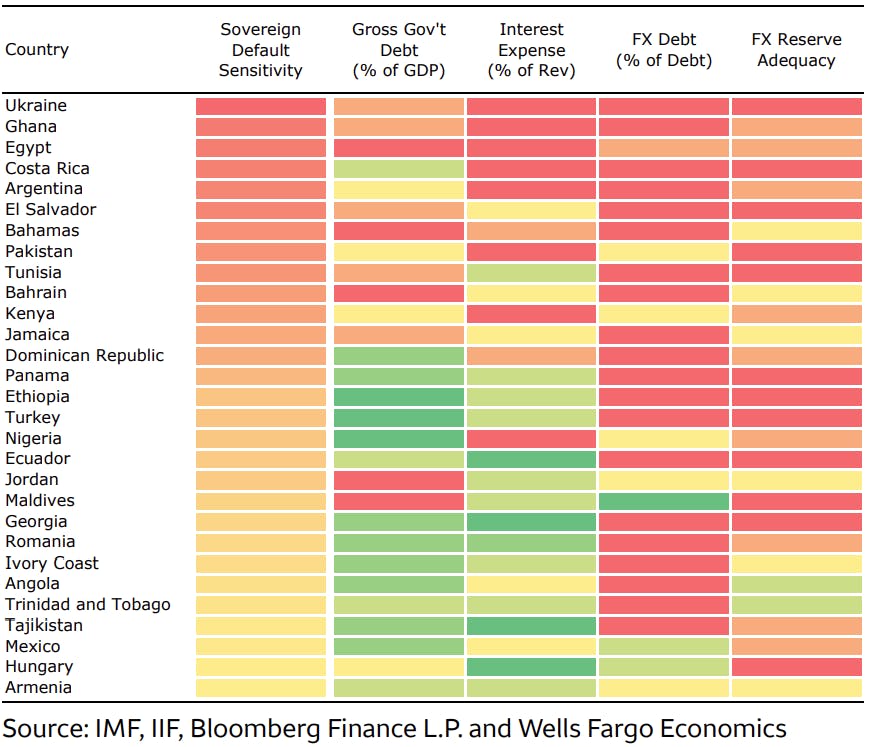

EM COUNTRIES MOST LIKELY TO DEFAULT

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Staples Inc (Country: US; rated: B3): down 301.0 bp to 1,576.9bp (1Y range: 904-1,986bp)

- Rite Aid Corp (Country: US; rated: C): down 258.0 bp to 1,658.7bp (1Y range: 707-3,892bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 189.8 bp to 1,263.4bp

- Transocean Inc (Country: KY; rated: Caa3): down 165.3 bp to 2,113.2bp (1Y range: 1,019-2,858bp)

- American Airlines Group Inc (Country: US; rated: B2): down 121.1 bp to 1,328.3bp

- iStar Inc (Country: US; rated: A2): down 105.9 bp to 102.5bp (1Y range: 103-469bp)

- Pactiv LLC (Country: US; rated: Caa1): down 101.8 bp to 632.6bp (1Y range: 356-1,041bp)

- Carnival Corp (Country: US; rated: Ba3): down 91.7 bp to 888.0bp

- Gap Inc (Country: US; rated: Ba2): down 83.3 bp to 536.4bp

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 82.6 bp to 949.1bp (1Y range: 299-1,584bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 80.8 bp to 1,158.6bp

- Pitney Bowes Inc (Country: US; rated: B-): down 78.7 bp to 1,149.7bp (1Y range: 367-1,178bp)

- Goodyear Tire & Rubber Co (Country: US; rated: A2): down 73.3 bp to 353.9bp

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): down 69.8 bp to 452.8bp

- Petroleos Mexicanos (Country: MX; rated: caa3): down 67.4 bp to 576.0bp (1Y range: 302-760bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- TDC Holding A/S (Country: DK; rated: ): down 107.2 bp to 130.0bp (1Y range: 130-191bp)

- TUI AG (Country: DE; rated: B3-PD): down 103.4 bp to 1,074.5bp (1Y range: 607-1,641bp)

- Stena AB (Country: SE; rated: B2-PD): down 98.0 bp to 503.4bp (1Y range: 401-865bp)

- Novafives SAS (Country: FR; rated: Caa1): down 74.8 bp to 1,219.1bp (1Y range: 618-1,903bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 63.9 bp to 867.5bp

- Virgin Media Finance PLC (Country: GB; rated: WR): down 58.9 bp to 431.0bp (1Y range: 222-585bp)

- Telecom Italia SpA (Country: IT; rated: B1): down 51.2 bp to 397.3bp (1Y range: 149-469bp)

- Iceland Bondco PLC (Country: GB; rated: WR): down 43.6 bp to 1,014.0bp

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): down 40.4 bp to 655.9bp (1Y range: 145-790bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 37.8 bp to 344.1bp (1Y range: 164-486bp)

- Renault SA (Country: FR; rated: A3): down 37.2 bp to 322.6bp (1Y range: 166-476bp)

- Cirsa Finance International SARL (Country: LU; rated: B3): down 33.7 bp to 623.4bp

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 33.4 bp to 325.8bp (1Y range: 154-463bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 32.9 bp to 696.6bp

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 32.2 bp to 433.3bp

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.88% | Maturity: 15/8/2023 | Rating: B | ISIN: USU68337AK75 | Z-spread up by 50.8 bp to 226.1 bp (CDS basis: 104.1bp), with the yield to worst at 4.8% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.0-104.6).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread down by 25.7 bp to 416.8 bp, with the yield to worst at 6.9% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 83.1-105.5).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | ISIN: USU6S19GAC10 | Z-spread down by 28.3 bp to 398.4 bp (CDS basis: -64.5bp), with the yield to worst at 6.9% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 93.0-104.1).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread down by 28.7 bp to 239.8 bp, with the yield to worst at 5.3% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 90.0-106.3).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | ISIN: USU85656AH69 | Z-spread down by 29.0 bp to 279.4 bp, with the yield to worst at 5.8% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 85.9-100.9).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 5.00% | Maturity: 1/3/2030 | Rating: BB | ISIN: USU8882PAB32 | Z-spread down by 33.1 bp to 244.1 bp, with the yield to worst at 5.2% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 91.5-103.3).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread down by 34.4 bp to 333.5 bp, with the yield to worst at 6.1% and the bond now trading up to 92.5 cents on the dollar (1Y price range: 85.0-107.5).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 39.3 bp to 616.8 bp (CDS basis: 568.0bp), with the yield to worst at 9.2% and the bond now trading up to 87.5 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread down by 41.2 bp to 365.3 bp, with the yield to worst at 6.5% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 42.3 bp to 276.2 bp, with the yield to worst at 5.7% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 91.5-105.7).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 3.88% | Maturity: 15/12/2027 | Rating: BB | ISIN: USU8882PAA58 | Z-spread down by 51.1 bp to 146.9 bp, with the yield to worst at 4.3% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 91.5-103.9).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 51.1 bp to 234.6 bp, with the yield to worst at 5.9% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Videotron Ltd (Pre-Merger) (MONTREAL, Canada) | Coupon: 5.38% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USC96225AA22 | Z-spread down by 56.3 bp to 102.2 bp, with the yield to worst at 4.1% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 99.3-107.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread down by 64.3 bp to 398.6 bp, with the yield to worst at 7.0% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 91.5-102.8).

- Issuer: Aag FH LP (Canada) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 174.0 bp to 509.9 bp, with the yield to worst at 8.1% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 93.0-113.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 40.7 bp to 332.0 bp, with the yield to worst at 4.8% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 80.4-111.7).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 2.45% | Maturity: 22/7/2028 | Rating: BB | ISIN: XS2367164576 | Z-spread down by 42.9 bp to 486.6 bp (CDS basis: -367.9bp), with the yield to worst at 6.3% and the bond now trading up to 80.6 cents on the dollar (1Y price range: 77.9-98.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 5.50% | Maturity: 24/2/2025 | Rating: B+ | ISIN: XS0213101073 | Z-spread down by 46.4 bp to 325.3 bp (CDS basis: 102.9bp), with the yield to worst at 4.4% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 98.8-108.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | Z-spread down by 53.1 bp to 582.0 bp (CDS basis: 221.7bp), with the yield to worst at 7.3% and the bond now trading up to 80.8 cents on the dollar (1Y price range: 70.6-99.6).

- Issuer: Petrobras Global Finance BV (Rotterdam, Netherlands) | Coupon: 4.75% | Maturity: 14/1/2025 | Rating: BB- | ISIN: XS0982711714 | Z-spread down by 54.1 bp to 181.7 bp (CDS basis: -22.0bp), with the yield to worst at 2.8% and the bond now trading up to 103.5 cents on the dollar (1Y price range: 100.2-109.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | Z-spread down by 54.7 bp to 543.5 bp (CDS basis: -56.2bp), with the yield to worst at 6.7% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 83.4-100.0).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread down by 57.7 bp to 1,185.0 bp, with the yield to worst at 11.9% and the bond now trading up to 71.3 cents on the dollar (1Y price range: 60.9-94.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | Z-spread down by 58.7 bp to 316.7 bp (CDS basis: 95.1bp), with the yield to worst at 4.7% and the bond now trading up to 89.4 cents on the dollar (1Y price range: 80.9-98.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | Z-spread down by 64.7 bp to 261.0 bp (CDS basis: 37.1bp), with the yield to worst at 3.9% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 92.3-103.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | Z-spread down by 66.2 bp to 231.7 bp (CDS basis: 40.9bp), with the yield to worst at 3.6% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 92.1-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | Z-spread down by 68.4 bp to 218.1 bp (CDS basis: 122.7bp), with the yield to worst at 3.5% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 91.9-105.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | Z-spread down by 70.3 bp to 363.8 bp (CDS basis: 87.9bp), with the yield to worst at 5.0% and the bond now trading up to 80.5 cents on the dollar (1Y price range: 71.2-92.3).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | Z-spread down by 71.8 bp to 574.7 bp, with the yield to worst at 7.1% and the bond now trading up to 86.4 cents on the dollar (1Y price range: 81.3-98.4).

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | Z-spread down by 77.6 bp to 730.5 bp, with the yield to worst at 7.8% and the bond now trading up to 70.2 cents on the dollar (1Y price range: 59.2-109.5).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread down by 124.0 bp to 340.9 bp, with the yield to worst at 4.4% and the bond now trading up to 89.9 cents on the dollar (1Y price range: 77.7-98.3).

RECENT DOMESTIC USD BOND ISSUES

- Allegiant Travel Co (Airline | Las Vegas, Nevada, United States | Rating: BB-): US$550m Note (US01748XAD49), fixed rate (7.25% coupon) maturing on 15 August 2027, priced at 99.49 (original spread of 446 bp), callable (5nc2)

- Becton Dickinson and Co (Health Care Supply | Franklin Lakes, New Jersey, United States | Rating: BBB): US$500m Senior Note (US075887CP25), fixed rate (4.30% coupon) maturing on 22 August 2032, priced at 100.00 (original spread of 153 bp), callable (10nc10)

- Cerevel Therapeutics Holdings Inc (Service - Other | Cambridge, United States | Rating: NR): US$300m Bond (US15678UAA07), fixed rate (2.50% coupon) maturing on 15 August 2027, priced at 100.00, non callable, convertible

- Dominion Energy Inc (Utility - Other | Richmond, Virginia, United States | Rating: BBB): US$400m Senior Note (US25746UDP12), fixed rate (4.35% coupon) maturing on 15 August 2032, priced at 99.32 (original spread of 165 bp), callable (10nc10)

- Dominion Energy Inc (Utility - Other | Richmond, Virginia, United States | Rating: BBB): US$600m Senior Note (US25746UDQ94), fixed rate (4.85% coupon) maturing on 15 August 2052, priced at 98.71 (original spread of 211 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$350m Bond (US3133ENG201), fixed rate (3.30% coupon) maturing on 15 August 2024, priced at 100.00 (original spread of 8 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$155m Bond (US3133ENF963), fixed rate (3.96% coupon) maturing on 17 August 2026, priced at 100.00 (original spread of 111 bp), callable (4nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$1,000m Unsecured Note (US3134GXS885), fixed rate (4.00% coupon) maturing on 28 February 2025, priced at 100.00 (original spread of 90 bp), callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$480m Unsecured Note (US3134GXS471), fixed rate (4.20% coupon) maturing on 28 August 2025, priced at 100.00 (original spread of 111 bp), callable (3nc3m)

- Ford Motor Co (Automotive Manufacturer | Dearborn, United States | Rating: BB): US$600m Senior Note (US3453708113), fixed rate (6.50% coupon) maturing on 15 August 2062, priced at 100.00, callable (40nc5)

- Global Payments Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB-): US$750m Senior Note (US37940XAR35), fixed rate (5.95% coupon) maturing on 15 August 2052, priced at 99.56 (original spread of 311 bp), callable (30nc30)

- Global Payments Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB-): US$750m Senior Note (US37940XAQ51), fixed rate (5.40% coupon) maturing on 15 August 2032, priced at 99.83 (original spread of 265 bp), callable (10nc10)

- Global Payments Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB-): US$500m Senior Note (US37940XAP78), fixed rate (4.95% coupon) maturing on 15 August 2027, priced at 99.92 (original spread of 205 bp), callable (5nc5)

- Global Payments Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB-): US$500m Senior Note (US37940XAN21), fixed rate (5.30% coupon) maturing on 15 August 2029, priced at 99.95 (original spread of 245 bp), callable (7nc7)

- Kimco Realty Corp (Real Estate Investment Trust | Jericho, United States | Rating: BBB+): US$650m Senior Note (US49446RBA68), fixed rate (4.60% coupon) maturing on 1 February 2033, priced at 99.43 (original spread of 190 bp), callable (10nc10)

- M&T Bank Corp (Banking | Buffalo, New York, United States | Rating: BBB+): US$500m Senior Note (US55261FAQ72), floating rate maturing on 16 August 2028, priced at 100.00 (original spread of 147 bp), callable (6nc5)

- NFP Corp (Life Insurance | New York City, United States | Rating: B): US$350m Note (US65342RAF73), fixed rate (7.50% coupon) maturing on 1 October 2030, priced at 100.00 (original spread of 473 bp), callable (8nc3)

- National Rural Utilities Cooperative Finance Corp (Financial - Other | Dulles, United States | Rating: A-): US$400m Collateral Trust (US637432NZ43), fixed rate (4.15% coupon) maturing on 15 December 2032, priced at 99.64 (original spread of 140 bp), callable (10nc10)

- Prudential Financial Inc (Life Insurance | Newark, United States | Rating: BBB): US$300m Junior Subordinated Note (US7443208704), fixed rate (5.95% coupon) maturing on 1 September 2062, priced at 100.00, callable (40nc5)

- Prudential Financial Inc (Life Insurance | Newark, United States | Rating: BBB): US$1,200m Junior Subordinated Note (US744320BK76), fixed rate (6.00% coupon) maturing on 1 September 2052, priced at 100.00 (original spread of 295 bp), callable (30nc10)

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: A+): US$400m Senior Note (US882508BP81), fixed rate (3.65% coupon) maturing on 16 August 2032, priced at 99.71 (original spread of 90 bp), callable (10nc10)

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: A+): US$300m Senior Note (US882508BQ64), fixed rate (4.10% coupon) maturing on 16 August 2052, priced at 98.71 (original spread of 128 bp), callable (30nc30)

- Wells Fargo & Co (Banking | San Francisco, California, United States | Rating: BBB+): US$2,000m Senior Note (US95000U3C57), floating rate maturing on 15 August 2026, priced at 100.00 (original spread of 112 bp), callable (4nc3)

- Wisconsin Power and Light Co (Utility - Other | Madison, Wisconsin, United States | Rating: A-): US$600m Senior Debenture (US976826BQ93), fixed rate (3.95% coupon) maturing on 1 September 2032, priced at 98.82 (original spread of 132 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Asian Infrastructure Investment Bank (Supranational | Beijing, China (Mainland) | Rating: AAA): US$500m Senior Note (US04522KAG13), floating rate (SOFR + 62.0 bp) maturing on 16 August 2027, priced at 100.00, non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: A-): US$1,750m Note (US05964HAR66), fixed rate (5.15% coupon) maturing on 18 August 2025, priced at 100.00 (original spread of 195 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: A-): US$1,750m Note (US05964HAS40), fixed rate (5.29% coupon) maturing on 18 August 2027, priced at 100.00 (original spread of 230 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459923578), fixed rate (3.20% coupon) maturing on 6 September 2024, priced at 100.00, non callable

- Fairfax Financial Holdings Ltd (Property and Casualty Insurance | Toronto, Canada | Rating: BBB-): US$750m Senior Note (US303901BK78), fixed rate (5.63% coupon) maturing on 16 August 2032, priced at 99.86 (original spread of 275 bp), callable (10nc10)

- Mexico (United Mexican States) (Government) (Sovereign | Miguel Hidalgo, Mexico, D.F., Mexico | Rating: BBB-): US$2,204m Senior Note (US91087BAT70), fixed rate (4.88% coupon) maturing on 19 May 2033, priced at 98.12 (original spread of 235 bp), callable (11nc11)

- Nickel Industries Ltd (Metals/Mining | Sydney, New South Wales, Australia | Rating: B+): US$225m Senior Note (XS2517856519), fixed rate (10.00% coupon) maturing on 23 August 2025, callable (3nc3m)

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$400m Unsecured Note (XS2431085609), floating rate maturing on 20 June 2027, priced at 100.00, non-callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$250m Unsecured Note (XS2431094007), floating rate maturing on 20 June 2027, priced at 100.00, non-callable

- SDSC International Finance Ltd (Financial - Other | Qingdao, Shandong, China (Mainland) | Rating: NR): US$200m Senior Note (XS2505176961), fixed rate (5.00% coupon) maturing on 18 August 2025, priced at 100.00, non-callable

SELECTED RECENT EUR BOND ISSUES

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000BLB9SB2), fixed rate (1.80% coupon) maturing on 17 August 2027, priced at 99.89, non-callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000BLB9SA4), floating rate (EU06MLIB + 30.0 bp) maturing on 17 August 2027, priced at 100.00, non-callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U7W2), fixed rate (1.35% coupon) maturing on 1 September 2025, priced at 100.00, non-callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7X0), floating rate maturing on 1 September 2027, priced at 100.00, non-callable

- Volvo Treasury AB (Financial - Other | Goeteborg, Sweden | Rating: A-): €500m Senior Note (XS2521820048), fixed rate (2.00% coupon) maturing on 19 August 2027, priced at 99.84 (original spread of 146 bp), callable (5nc5)

NEW LOANS

- Diversified Energy Co PLC, signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/25/26 and initial pricing is set at Term SOFR +300.0bp