Credit

Wider Spreads Across US High Yield After Nice Summer Bounce; Single Bs OAS Up 23bp Over The Past Week

Very limited volume of issuance in US$ corporate bonds this week (IFR Markets data): 3 tranches for $1.3bn in IG (2022 YTD volume $936.1bn vs 2021 YTD $1.02trn) and no new pricing in HY

Published ET

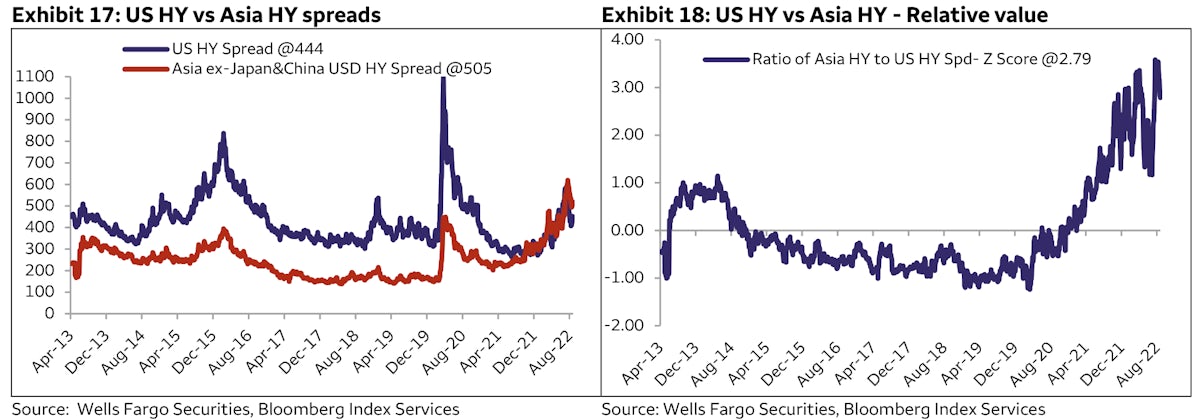

Asia US$ High Yield Looks Expensive Compared to US HY | Source: Wells Fargo Securities

DAILY SUMMARY

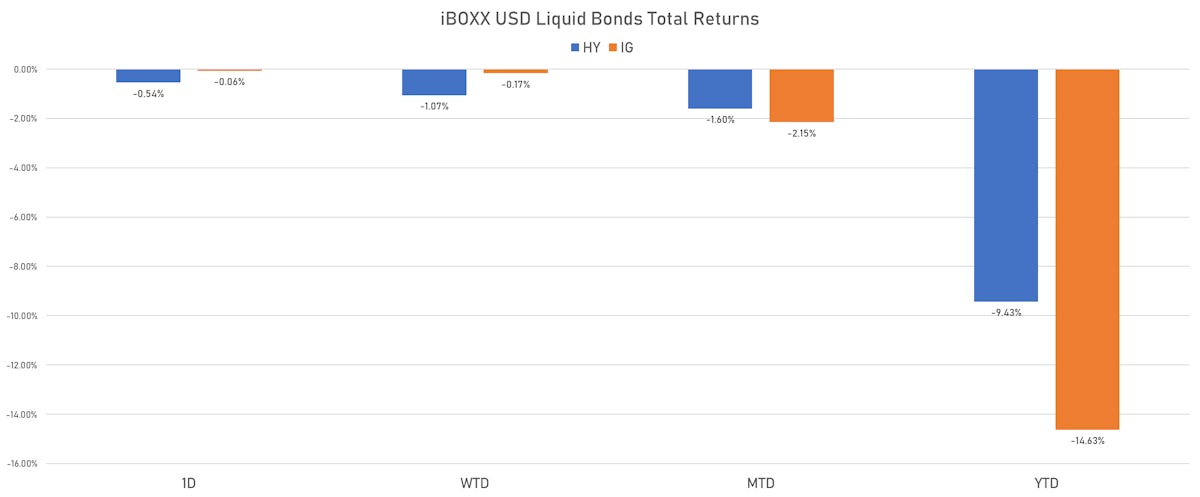

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.064% today (Month-to-date: -2.15%; Year-to-date: -14.63%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.545% today (Month-to-date: -1.60%; Year-to-date: -9.43%)

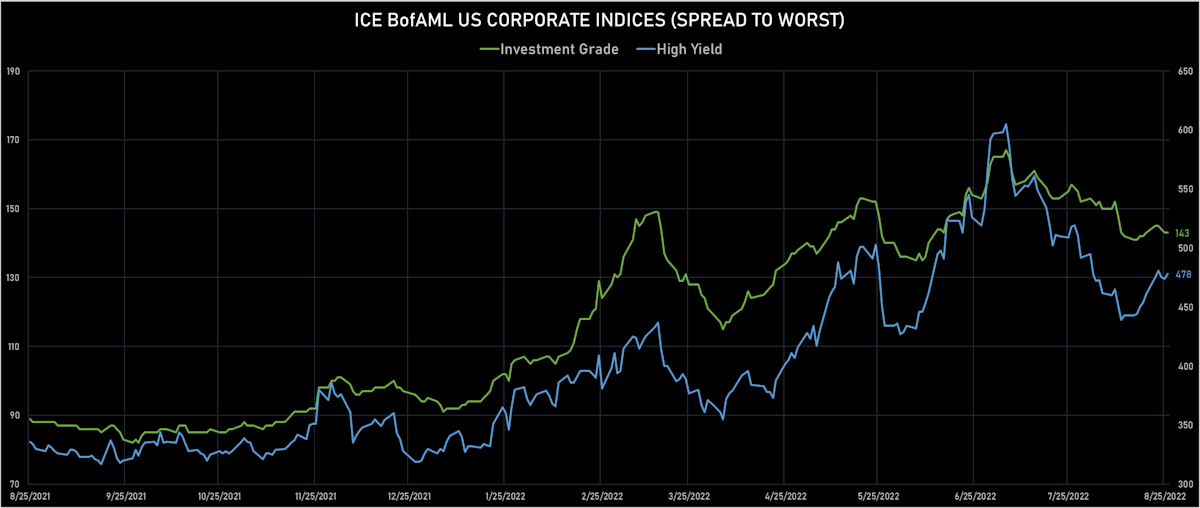

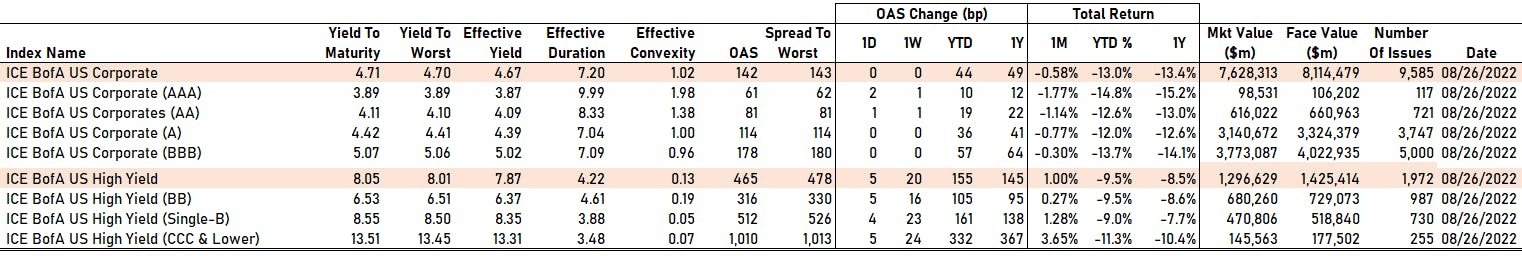

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 143.0 bp (YTD change: +48.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 478.0 bp (YTD change: +148.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: -1.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 2 bp at 61 bp

- AA up by 1 bp at 81 bp

- A unchanged at 114 bp

- BBB unchanged at 178 bp

- BB up by 5 bp at 316 bp

- B up by 4 bp at 512 bp

- ≤ CCC up by 5 bp at 1,010 bp

CDS INDICES TODAY (mid-spreads)

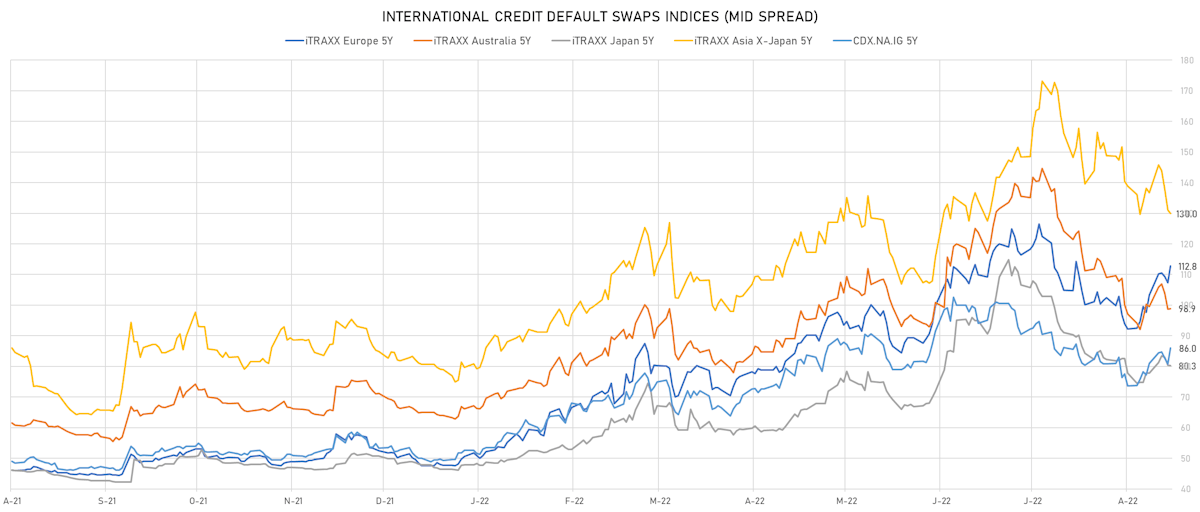

- Markit CDX.NA.IG 5Y up 5.2 bp, now at 86bp (1W change: +5.1bp; YTD change: +36.7bp)

- Markit CDX.NA.IG 10Y up 4.8 bp, now at 122bp (1W change: +4.4bp; YTD change: +33.2bp)

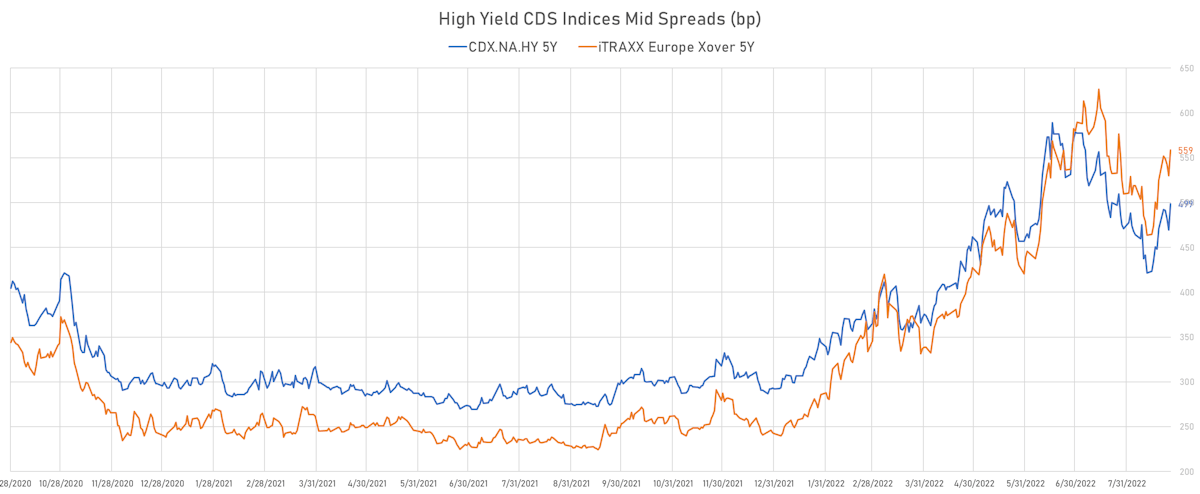

- Markit CDX.NA.HY 5Y up 29.1 bp, now at 499bp (1W change: +27.8bp; YTD change: +206.8bp)

- Markit iTRAXX Europe 5Y up 5.5 bp, now at 113bp (1W change: +9.5bp; YTD change: +65.1bp)

- Markit iTRAXX Europe Crossover 5Y up 28.6 bp, now at 559bp (1W change: +33.6bp; YTD change: +316.6bp)

- Markit iTRAXX Japan 5Y down 0.2 bp, now at 80bp (1W change: +2.4bp; YTD change: +33.8bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.1 bp, now at 130bp (1W change: -6.7bp; YTD change: +50.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 220.0 bp to 2,039.1bp (1Y range: 1,019-2,858bp)

- Occidental Petroleum Corp (Country: US; rated: A2): down 42.7 bp to 111.2bp (1Y range: 110-236bp)

- Bombardier Inc (Country: CA; rated: B3): up 32.1 bp to 586.9bp (1Y range: 432-1,007bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): up 32.1 bp to 442.2bp (1Y range: 244-529bp)

- Beazer Homes USA Inc (Country: US; rated: A3): up 32.4 bp to 703.3bp (1Y range: 278-860bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 34.0 bp to 466.1bp (1Y range: 124-466bp)

- DISH DBS Corp (Country: US; rated: B2): up 37.4 bp to 1,417.0bp (1Y range: 317-1,506bp)

- Delta Air Lines Inc (Country: US; rated: A3): up 40.7 bp to 449.2bp (1Y range: 205-573bp)

- Carnival Corp (Country: US; rated: Ba3): up 41.3 bp to 995.7bp (1Y range: 316-1,583bp)

- Kohls Corp (Country: US; rated: NR): up 42.7 bp to 484.1bp (1Y range: 101-548bp)

- Nordstrom Inc (Country: US; rated: A3): up 55.7 bp to 534.6bp (1Y range: 212-627bp)

- American Airlines Group Inc (Country: US; rated: B2): up 56.9 bp to 1,394.8bp (1Y range: 607-1,644bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): up 56.9 bp to 514.6bp (1Y range: 355-681bp)

- Staples Inc (Country: US; rated: B3): up 65.2 bp to 1,697.1bp (1Y range: 904-1,986bp)

- Rite Aid Corp (Country: US; rated: C): up 306.6 bp to 2,062.9bp (1Y range: 707-3,892bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 24.2 bp to 632.0bp (1Y range: 370-717bp)

- GKN Holdings Ltd (Country: GB; rated: Ba1): up 24.9 bp to 247.3bp (1Y range: 117-277bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 26.4 bp to 485.6bp (1Y range: 222-585bp)

- Centrica PLC (Country: GB; rated: Baa2): up 27.8 bp to 131.7bp (1Y range: 64-132bp)

- CMA CGM SA (Country: FR; rated: Ba2): up 28.0 bp to 553.0bp (1Y range: 259-648bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 32.2 bp to 458.9bp (1Y range: 107-540bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 33.0 bp to 420.0bp (1Y range: 139-424bp)

- Air France KLM SA (Country: FR; rated: C): up 35.3 bp to 753.0bp (1Y range: 386-990bp)

- ThyssenKrupp AG (Country: DE; rated: A3): up 35.4 bp to 584.7bp (1Y range: 205-652bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 43.2 bp to 775.7bp (1Y range: 333-934bp)

- TUI AG (Country: DE; rated: B3-PD): up 88.8 bp to 1,250.4bp (1Y range: 607-1,641bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 97.6 bp to 1,095.8bp (1Y range: 213-1,186bp)

- Casino Guichard Perrachon SA (Country: FR; rated: C): up 104.2 bp to 2,671.6bp (1Y range: 464-2,953bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 114.7 bp to 1,980.8bp (1Y range: 981-2,690bp)

- Novafives SAS (Country: FR; rated: Caa1): up 145.3 bp to 1,427.6bp (1Y range: 618-1,903bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 96.7 bp to 329.0 bp, with the yield to worst at 6.5% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 95.5-108.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 55.2 bp to 370.3 bp, with the yield to worst at 6.9% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | ISIN: USU6500TAG05 | Z-spread up by 53.0 bp to 225.4 bp, with the yield to worst at 5.5% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 91.0-106.0).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 46.8 bp to 357.4 bp, with the yield to worst at 6.8% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 91.0-106.9).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 4.38% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU2928LAB19 | Z-spread up by 40.9 bp to 282.4 bp, with the yield to worst at 5.9% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 88.1-103.8).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | ISIN: USU85656AH69 | Z-spread up by 37.4 bp to 325.6 bp, with the yield to worst at 6.5% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 85.9-100.9).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB | ISIN: USU6500TAB18 | Z-spread up by 32.6 bp to 251.7 bp, with the yield to worst at 5.7% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 91.0-107.8).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread up by 31.8 bp to 448.6 bp, with the yield to worst at 7.5% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 83.1-105.5).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 31.8 bp to 243.1 bp, with the yield to worst at 6.2% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | ISIN: USU3230LAA45 | Z-spread up by 31.2 bp to 326.7 bp (CDS basis: -139.6bp), with the yield to worst at 6.8% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread up by 31.0 bp to 298.4 bp, with the yield to worst at 6.1% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 90.0-106.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 30.0 bp to 346.9 bp, with the yield to worst at 6.7% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 91.5-105.7).

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU3165EAA92 | Z-spread up by 28.9 bp to 332.7 bp, with the yield to worst at 6.5% and the bond now trading down to 87.4 cents on the dollar (1Y price range: 83.4-97.8).

- Issuer: Starwood Property Trust Inc (Greenwich, CT (US)) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | ISIN: USU85656AF04 | Z-spread up by 28.4 bp to 317.3 bp, with the yield to worst at 6.3% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 84.9-100.1).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | ISIN: USU51407AD34 | Z-spread down by 37.3 bp to 330.7 bp, with the yield to worst at 6.7% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 100.6-122.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Amplifon SpA (Milan, Italy) | Coupon: 1.13% | Maturity: 13/2/2027 | Rating: BB+ | ISIN: XS2116503546 | Z-spread up by 87.3 bp to 234.3 bp, with the yield to worst at 4.2% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 85.9-99.9).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread up by 58.9 bp to 453.9 bp, with the yield to worst at 6.3% and the bond now trading down to 86.3 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 52.5 bp to 416.9 bp, with the yield to worst at 5.7% and the bond now trading down to 85.7 cents on the dollar (1Y price range: 77.7-98.3).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 51.2 bp to 615.0 bp, with the yield to worst at 8.2% and the bond now trading down to 74.1 cents on the dollar (1Y price range: 65.7-97.6).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 42.8 bp to 464.3 bp (CDS basis: -109.3bp), with the yield to worst at 6.2% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 88.2-102.3).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread up by 42.0 bp to 269.9 bp, with the yield to worst at 4.6% and the bond now trading down to 92.4 cents on the dollar (1Y price range: 86.4-108.9).

- Issuer: Rolls-Royce PLC (London, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread up by 41.3 bp to 417.9 bp (CDS basis: 30.9bp), with the yield to worst at 6.0% and the bond now trading down to 78.5 cents on the dollar (1Y price range: 72.4-95.8).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.00% | Maturity: 24/1/2025 | Rating: BB+ | ISIN: XS1724626699 | Z-spread up by 40.1 bp to 188.3 bp, with the yield to worst at 3.7% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 92.8-104.1).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Z-spread up by 37.8 bp to 465.9 bp, with the yield to worst at 6.6% and the bond now trading down to 81.6 cents on the dollar (1Y price range: 76.7-100.4).

- Issuer: Leonardo SpA (Rome, Italy) | Coupon: 4.88% | Maturity: 24/3/2025 | Rating: BB+ | ISIN: XS0215093534 | Z-spread up by 32.7 bp to 176.0 bp (CDS basis: -41.9bp), with the yield to worst at 3.3% and the bond now trading down to 102.8 cents on the dollar (1Y price range: 102.3-112.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 21/9/2025 | Rating: BB+ | ISIN: XS2231715322 | Z-spread up by 32.1 bp to 384.6 bp, with the yield to worst at 5.7% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 87.4-105.2).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread up by 31.4 bp to 546.4 bp, with the yield to worst at 6.7% and the bond now trading down to 89.2 cents on the dollar (1Y price range: 84.1-99.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: CCC | ISIN: XS2283225477 | Z-spread down by 34.4 bp to 1,209.0 bp, with the yield to worst at 13.3% and the bond now trading up to 51.8 cents on the dollar (1Y price range: 41.1-84.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.50% | Maturity: 1/3/2025 | Rating: BB- | ISIN: XS1813724603 | Z-spread down by 34.6 bp to 361.8 bp, with the yield to worst at 5.1% and the bond now trading up to 97.7 cents on the dollar (1Y price range: 91.6-103.6).

- Issuer: Immobiliare Grande Distribuzione SIIQ SpA (Bologna, Italy) | Coupon: 2.13% | Maturity: 28/11/2024 | Rating: BB+ | ISIN: XS2084425466 | Z-spread down by 106.6 bp to 331.1 bp, with the yield to worst at 3.9% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 88.4-101.4).

RECENT DOMESTIC USD BOND ISSUES

- Entergy Texas Inc (Utility - Other | The Woodlands, Texas, United States | Rating: A-): US$325m First Mortgage Bond (US29365TAM62), fixed rate (5.00% coupon) maturing on 15 September 2052, priced at 99.43 (original spread of 203 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$550m Bond (US3133ENJ437), floating rate (SOFR + 9.0 bp) maturing on 26 August 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133ENJ924), fixed rate (3.50% coupon) maturing on 1 September 2032, priced at 99.17 (original spread of 49 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$150m Bond (US3130AT3J46), fixed rate (3.23% coupon) maturing on 1 December 2026, priced at 100.00 (original spread of 17 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$250m Bond (US3130AT3W56), fixed rate (3.21% coupon) maturing on 30 September 2026, priced at 100.00 (original spread of 19 bp), non callable

- Great Ajax Operating Partnership LP (Financial - Other | Tigard, United States | Rating: NR): US$105m Senior Note (US38982GAA40), fixed rate (8.88% coupon) maturing on 1 September 2027, priced at 99.01, callable (5nc5)

- Massmutual Global Funding II (Financial - Other | Wilmington, United States | Rating: AA-): US$600m Note (US57629WDK36), fixed rate (4.15% coupon) maturing on 26 August 2025, priced at 99.90 (original spread of 83 bp), non callable

- Pricoa Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$350m Note (US74153WCR88), fixed rate (4.20% coupon) maturing on 28 August 2025, priced at 99.94 (original spread of 83 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): US$209m Unsecured Note (XS2422070255), floating rate maturing on 29 December 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459913421), fixed rate (3.40% coupon) maturing on 16 September 2024, priced at 100.00, non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$4,000m Senior Note (US298785JT41), fixed rate (3.25% coupon) maturing on 15 November 2027, priced at 99.97 (original spread of 14 bp), non callable

- First Abu Dhabi Bank PJSC (Banking | Abu Dhabi, United Arab Emirates | Rating: AA-): US$338m Senior Note (XS2527827534), floating rate (SOFR + 125.0 bp) maturing on 1 March 2027, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$3,500m Unsecured Note (XS2431072961), floating rate maturing on 20 June 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$300m Unsecured Note (XS2431079115), floating rate maturing on 20 June 2027, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$3,500m Unsecured Note (XS2431076012), floating rate maturing on 20 June 2025, priced at 100.00, non callable

- Red Star Macalline Group Corp Ltd (Service - Other | Shanghai, Shanghai, China (Mainland) | Rating: B+): US$250m Bond (XS2516930489), fixed rate (5.20% coupon) maturing on 26 August 2025, priced at 100.00, with a make whole call

- Swedish Export Credit Corp (Agency | Stockholm, Sweden | Rating: AA+): US$1,250m Senior Note (US87031CAG87), fixed rate (3.63% coupon) maturing on 3 September 2024, priced at 99.94 (original spread of 30 bp), non callable

- Ubs Bank USA (Banking | Salt Lake City, Switzerland | Rating: A+): US$300m Certificate of Deposit - Retail (US90348J5D89), fixed rate (3.30% coupon) maturing on 26 August 2024, priced at 100.00 (original spread of -6 bp), non callable

- ZTO Express (Cayman) Inc (Service - Other | Shanghai, China (Mainland) | Rating: NR): US$870m Bond (US98980AAA34), fixed rate (1.50% coupon) maturing on 1 September 2027, priced at 100.00, non callable, convertible

- Zhengzhou Urban Construction Investment Group Co Ltd (Financial - Other | Zhengzhou, China (Mainland) | Rating: BBB+): US$350m Senior Note (XS2499700933), fixed rate (5.20% coupon) maturing on 30 August 2025, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Autoroutes du Sud de la France SA (Transportation - Other | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €850m Senior Note (FR001400CH94), fixed rate (2.75% coupon) maturing on 2 September 2032, priced at 98.92 (original spread of 150 bp), callable (10nc10)

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,500m Bond (FR001400CFW8), fixed rate (3.63% coupon) maturing on 1 September 2029, priced at 99.78 (original spread of 254 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000BLB6JQ5), fixed rate (2.13% coupon) maturing on 1 September 2031, priced at 99.10 (original spread of 99 bp), non callable

- Berlin Hyp AG (Banking | Berlin, Berlin, Germany | Rating: A-): €250m Inhaberschuldverschreibung (DE000BHY0JT1), fixed rate (2.38% coupon) maturing on 1 September 2025, priced at 99.99 (original spread of 139 bp), non callable

- Bpifrance SA (Banking | Maisons-Alfort, France | Rating: NR): €500m Bond (FR001400CHQ6), fixed rate (2.00% coupon) maturing on 2 September 2030, priced at 99.58, non callable

- British Telecommunications PLC (Telecommunications | London, United Kingdom | Rating: BBB): €500m Senior Note (XS2496028502), fixed rate (2.75% coupon) maturing on 30 August 2027, priced at 99.57 (original spread of 185 bp), callable (5nc5)

- British Telecommunications PLC (Telecommunications | London, United Kingdom | Rating: BBB): €500m Senior Note (XS2496028924), fixed rate (3.38% coupon) maturing on 30 August 2032, priced at 99.57 (original spread of 216 bp), callable (10nc10)

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): €3,000m Bond (FR001400CHC6), fixed rate (1.75% coupon) maturing on 25 November 2027, priced at 99.38 (original spread of 75 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000CZ45W99), fixed rate (2.25% coupon) maturing on 1 September 2032, priced at 99.51 (original spread of 98 bp), non callable

- Cooperatieve Rabobank UA (Banking | Utrecht, Utrecht, Netherlands | Rating: BBB+): €750m Subordinated Note (XS2524143554), fixed rate (3.88% coupon) maturing on 30 November 2032, priced at 99.84 (original spread of 281 bp), callable (10nc5)

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400CGA2), fixed rate (2.13% coupon) maturing on 7 January 2030, priced at 99.36 (original spread of 110 bp), non callable

- Deutsche Apotheker und Aerztebank eG (Banking | Dusseldorf, Germany | Rating: A+): €400m Unsecured Note (XS2526832329), floating rate maturing on 2 February 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7Y8), fixed rate (1.75% coupon) maturing on 15 September 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB-): €1,500m Note (DE000A30VT06), floating rate maturing on 5 September 2030, priced at 99.91 (original spread of 289 bp), callable (8nc7)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U7Z5), floating rate maturing on 15 September 2027, priced at 100.00, non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: BBB+): €500m Bond (DE000A30WFV1), fixed rate (4.38% coupon) maturing on 28 August 2026, priced at 99.92 (original spread of 347 bp), non callable

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): €600m Senior Note (XS2526379313), fixed rate (2.13% coupon) maturing on 1 September 2026, priced at 99.67 (original spread of 125 bp), non callable

- E ON SE (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €600m Senior Note (XS2526828996), fixed rate (2.88% coupon) maturing on 26 August 2028, priced at 99.18 (original spread of 196 bp), callable (6nc6)

- Eurogrid GmbH (Utility - Other | Berlin, Berlin, Belgium | Rating: BBB+): €750m Senior Note (XS2527319979), fixed rate (3.28% coupon) maturing on 5 September 2031, priced at 100.00 (original spread of 200 bp), callable (9nc9)

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: AA): €4,000m Senior Note (EU000A2SCAD0), fixed rate (1.50% coupon) maturing on 15 December 2025, priced at 99.63 (original spread of 74 bp), non callable

- Federation of Caisses Desjardins Du Quebec (Banking | Levis, Quebec, Canada | Rating: A+): €750m Covered Bond (Other) (XS2526825463), fixed rate (2.00% coupon) maturing on 31 August 2026, priced at 99.82 (original spread of 116 bp), non callable

- Finland, Republic of (Government) (Sovereign | Helsinki, Etela-Suomen, Finland | Rating: AA+): €3,000m Bond (FI4000527551), fixed rate (1.38% coupon) maturing on 15 April 2027, priced at 99.84 (original spread of 38 bp), non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Japan | Rating: A+): €1,000m Unsecured Note (XS2527914779), fixed rate (1.75% coupon) maturing on 8 September 2025, priced at 100.00, non callable

- Jyske Realkredit A/S (Financial - Other | Kongens Lyngby, Denmark | Rating: AAA): €500m Saerligt Daekkede Obligation (Covered Bond) (DK0009410185), fixed rate (1.88% coupon) maturing on 1 October 2029, priced at 99.70 (original spread of 112 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €150m Inhaberschuldverschreibung (DE000HLB77L0), fixed rate (1.25% coupon) maturing on 7 October 2024, priced at 100.00, non callable

- NIU Invest SE (Financial - Other | Berlin, Germany | Rating: NR): €400m Inhaberschuldverschreibung (DE000A3MQW50), fixed rate (7.75% coupon) maturing on 29 August 2027, non callable

- NN Group NV (Life Insurance | S-Gravenhage, Zuid-Holland, Netherlands | Rating: BBB-): €500m Subordinated Note (XS2526486159), floating rate maturing on 1 March 2043, priced at 99.17 (original spread of 412 bp), callable (21nc10)

- National Australia Bank Ltd (Banking | Melbourne, Victoria, Australia | Rating: A+): €750m Covered Bond (Other) (XS2526882001), fixed rate (2.35% coupon) maturing on 30 August 2029, priced at 100.00 (original spread of 123 bp), non callable

- Nationwide Building Society (Financial - Other | Swindon, Wiltshire, United Kingdom | Rating: A): €750m Note (XS2525246901), fixed rate (3.25% coupon) maturing on 5 September 2029, priced at 99.33 (original spread of 215 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Austria | Rating: A-): €500m Unsecured Note (XS2526835694), fixed rate (0.10% coupon) maturing on 1 September 2025, priced at 100.00, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €750m Hypothekenpfandbrief (Covered Bond) (XS2526846469), fixed rate (2.38% coupon) maturing on 31 August 2032, priced at 99.29 (original spread of 114 bp), non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): €750m Note (XS2527451905), fixed rate (2.63% coupon) maturing on 5 September 2029, priced at 99.36 (original spread of 160 bp), with a regulatory call

- Swiss Life Finance I AG (Financial - Other | Ruggell, Unterland, Switzerland | Rating: A-): €700m Bond (CH1210198136), fixed rate (3.25% coupon) maturing on 31 August 2029, priced at 99.24 (original spread of 225 bp), callable (7nc7)

NEW LOANS

- Oracle Corp (BBB), signed a US$ 4,360m Term Loan A, to be used for acquisition financing; initial pricing is set at Term SOFR +160.0bp

- OpenText Corp, signed a US$ 2,585m Delayed Draw Term Loan, to be used for general corporate purposes and acquisition financing; initial pricing is set at Term SOFR +325.0bp

- OpenText Corp, signed a US$ 2,000m Bridge Loan, to be used for general corporate purposes and acquisition financing. It matures on 08/25/23 and initial pricing is set at Term SOFR +375.0bp

- Argos N America Corp, signed a US$ 750m Term Loan maturing on 09/08/27, to be used for general corporate purposes

- Perpetual Ltd, signed a US$ 128m Term Loan maturing on 11/25/26, to be used for acquisition financing