Credit

September Starts Much Like August Ended Across The US Credit Complex: Duration Selloff, Coupled With Wider Spreads

Very little US$ corporate issuance in the first days of September, but next week should see a flurry of deals, with around $50bn expected to price in IG alone

Published ET

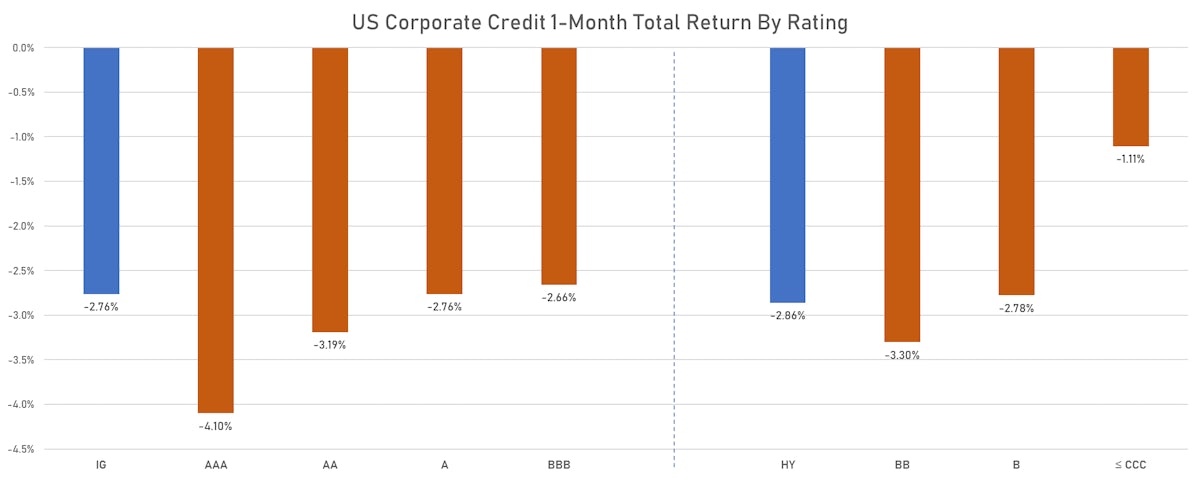

ICE BofAML US Corporate Credit 1-Month Total Returns By Rating | Sources: ϕpost, FactSet data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.44% today, with investment grade up 0.44% and high yield up 0.49% (YTD total return: -13.57%)

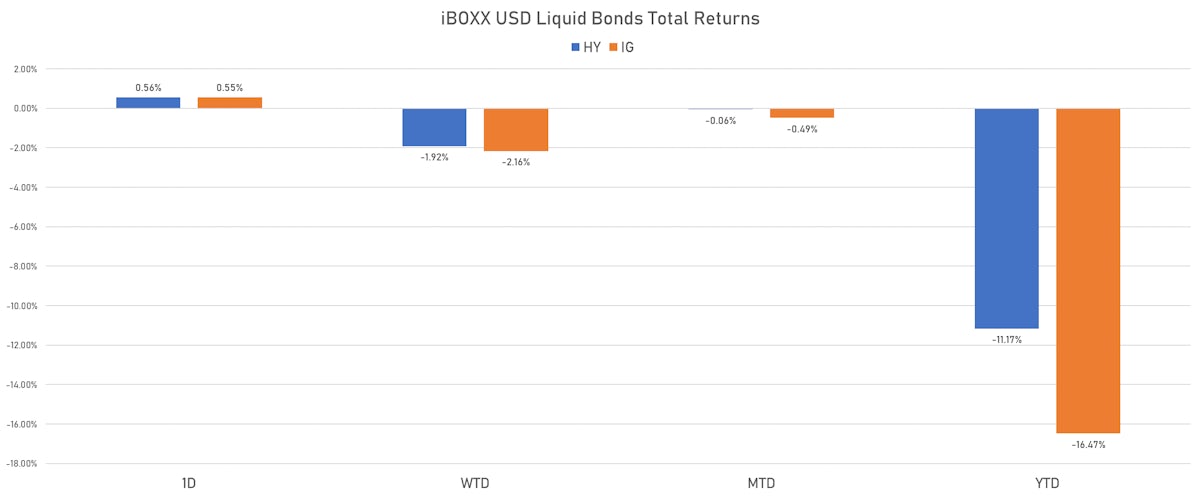

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.552% today (Month-to-date: -0.49%; Year-to-date: -16.47%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.561% today (Month-to-date: -0.06%; Year-to-date: -11.17%)

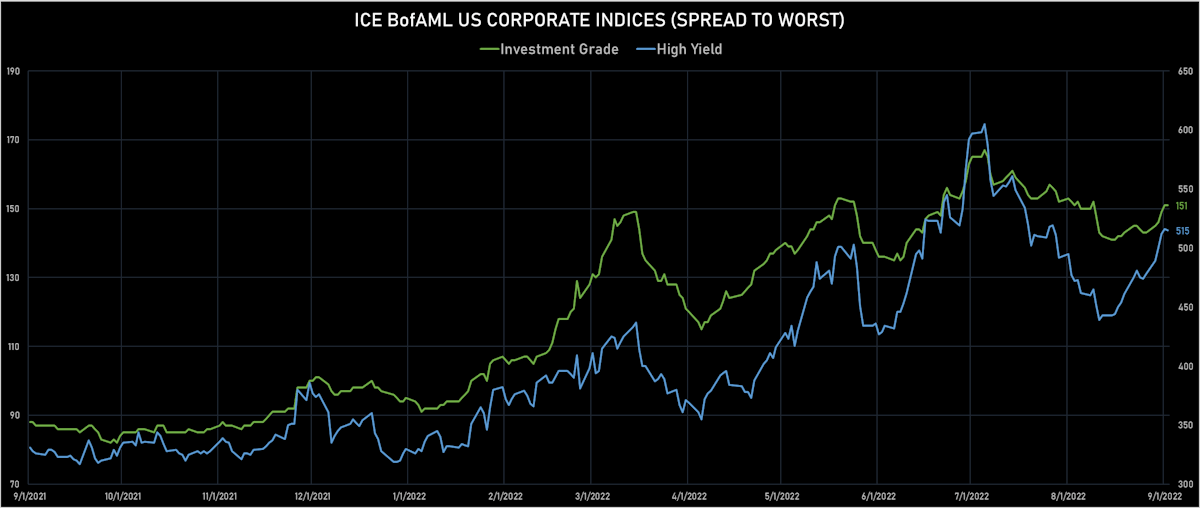

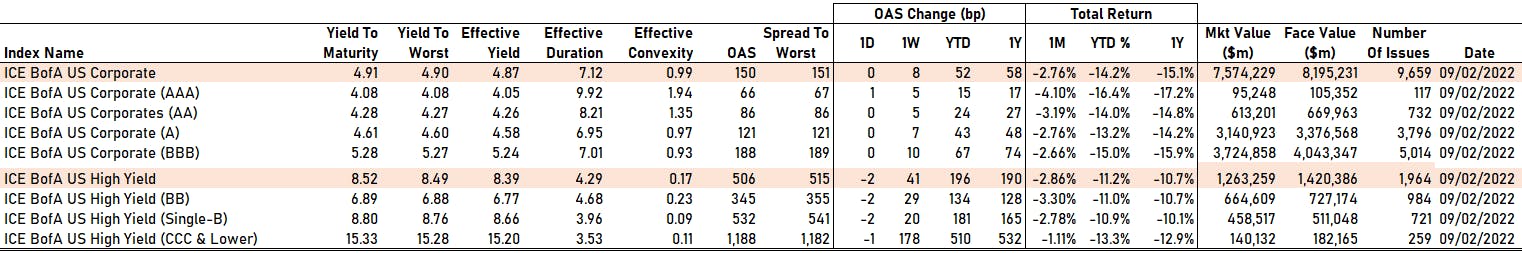

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 151.0 bp (YTD change: +56.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 515.0 bp (YTD change: +185.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.18% today (YTD total return: -1.9%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 66 bp

- AA unchanged at 86 bp

- A unchanged at 121 bp

- BBB unchanged at 188 bp

- BB down by -2 bp at 345 bp

- B down by -2 bp at 532 bp

- ≤ CCC down by -1 bp at 1,188 bp

CDS INDICES TODAY (mid-spreads)

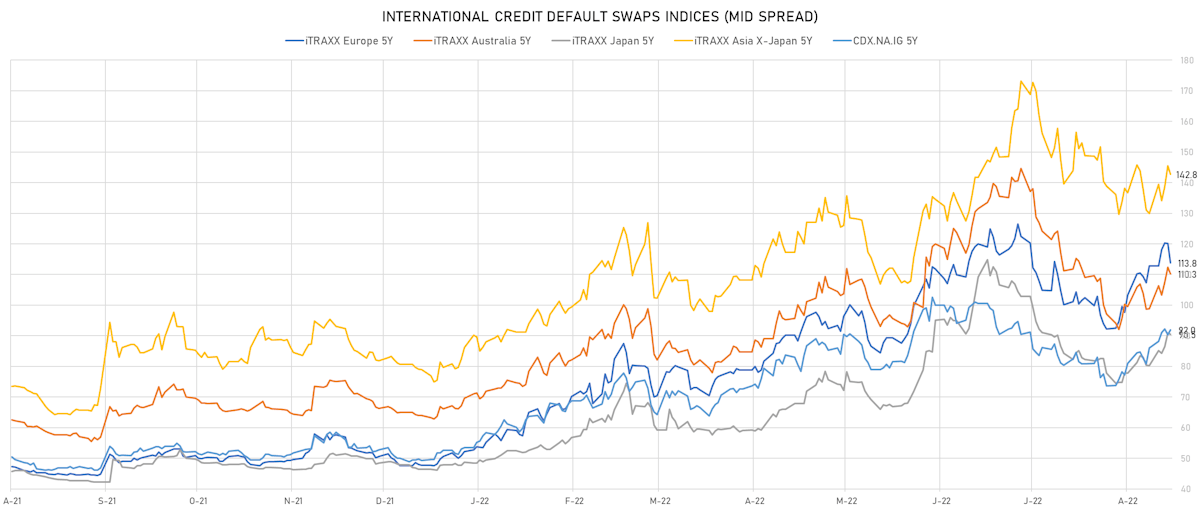

- Markit CDX.NA.IG 5Y up 1.6 bp, now at 92bp (1W change: +6.0bp; YTD change: +42.6bp)

- Markit CDX.NA.IG 10Y up 1.6 bp, now at 128bp (1W change: +5.4bp; YTD change: +38.6bp)

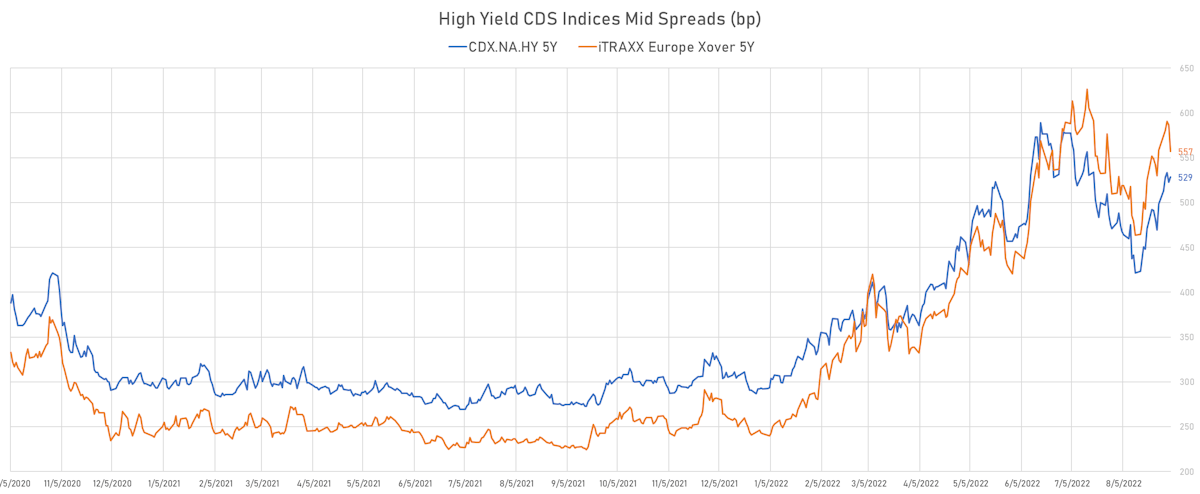

- Markit CDX.NA.HY 5Y up 5.9 bp, now at 529bp (1W change: +29.9bp; YTD change: +236.7bp)

- Markit iTRAXX Europe 5Y down 6.4 bp, now at 114bp (1W change: +1.0bp; YTD change: +66.1bp)

- Markit iTRAXX Europe Crossover 5Y down 29.4 bp, now at 557bp (1W change: +27.1bp; YTD change: +315.1bp)

- Markit iTRAXX Japan 5Y down 0.5 bp, now at 90bp (1W change: +10.2bp; YTD change: +44.0bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.8 bp, now at 143bp (1W change: +12.8bp; YTD change: +63.8bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Unisys Corp (Country: US; rated: B1): up 40.8 bp to 537.1bp (1Y range: 202-565bp)

- DISH DBS Corp (Country: US; rated: B2): up 42.3 bp to 1,459.3bp (1Y range: 317-1,506bp)

- Amkor Technology Inc (Country: US; rated: A1): up 43.1 bp to 226.6bp (1Y range: 109-361bp)

- Macy's Inc (Country: US; rated: A1): up 44.1 bp to 539.6bp (1Y range: 181-617bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): up 48.3 bp to 513.7bp (1Y range: 284-608bp)

- Delta Air Lines Inc (Country: US; rated: A3): up 61.8 bp to 511.0bp (1Y range: 205-573bp)

- Gap Inc (Country: US; rated: Ba2): up 69.7 bp to 682.0bp (1Y range: 132-819bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): up 70.0 bp to 1,021.6bp (1Y range: 299-1,584bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 72.4 bp to 1,307.9bp (1Y range: 367-1,308bp)

- Transocean Inc (Country: KY; rated: Caa3): up 74.7 bp to 2,113.8bp (1Y range: 1,019-2,858bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): up 83.2 bp to 1,275.2bp (1Y range: 616-1,301bp)

- Nordstrom Inc (Country: US; rated: A3): up 98.8 bp to 633.4bp (1Y range: 212-633bp)

- Carnival Corp (Country: US; rated: Ba3): up 109.7 bp to 1,105.4bp (1Y range: 316-1,583bp)

- Rite Aid Corp (Country: US; rated: C): up 111.3 bp to 2,174.2bp (1Y range: 707-3,892bp)

- American Airlines Group Inc (Country: US; rated: B2): up 117.1 bp to 1,511.9bp (1Y range: 607-1,644bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 31.6 bp to 490.5bp (1Y range: 107-540bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): up 32.9 bp to 506.3bp (1Y range: 209-606bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): up 38.0 bp to 307.3bp (1Y range: 46-307bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 44.0 bp to 453.8bp (1Y range: 186-485bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 45.5 bp to 677.4bp (1Y range: 370-717bp)

- thyssenkrupp AG (Country: DE; rated: A3): up 47.4 bp to 632.1bp (1Y range: 205-652bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 49.2 bp to 824.9bp (1Y range: 333-934bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 49.5 bp to 1,057.9bp (1Y range: 359-1,296bp)

- Air France KLM SA (Country: FR; rated: C): up 63.8 bp to 816.8bp (1Y range: 386-990bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 108.0 bp to 1,203.7bp (1Y range: 213-1,204bp)

- TUI AG (Country: DE; rated: B3-PD): up 118.7 bp to 1,369.1bp (1Y range: 607-1,641bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 200.0 bp to 2,180.8bp (1Y range: 993-2,690bp)

- Novafives SAS (Country: FR; rated: Caa1): up 204.0 bp to 1,631.6bp (1Y range: 618-1,903bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 222.2 bp to 1,264.4bp (1Y range: 440-1,326bp)

- Casino Guichard Perrachon SA (Country: FR; rated: C): up 257.2 bp to 2,928.7bp (1Y range: 464-3,014bp)

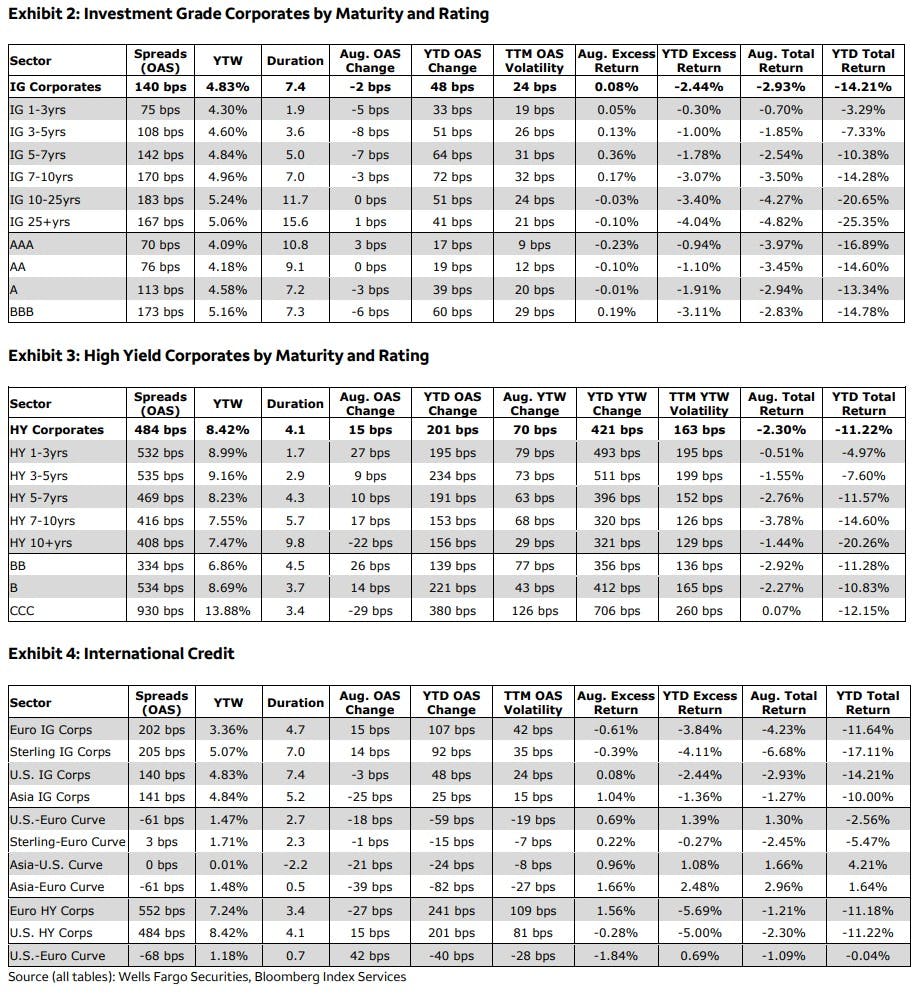

SUMMARY OF CREDIT PERFORMANCE IN AUGUST

Source: Wells Fargo Securities

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | ISIN: USU3230LAA45 | Z-spread up by 151.5 bp to 479.6 bp (CDS basis: -270.8bp), with the yield to worst at 8.3% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 113.0 bp to 421.1 bp, with the yield to worst at 7.3% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 92.0-107.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread up by 86.9 bp to 433.1 bp, with the yield to worst at 7.6% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 88.5-112.4).

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU3165EAA92 | Z-spread up by 83.2 bp to 410.7 bp, with the yield to worst at 7.4% and the bond now trading down to 83.9 cents on the dollar (1Y price range: 83.4-97.8).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 76.1 bp to 318.5 bp, with the yield to worst at 7.0% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread up by 75.4 bp to 260.7 bp, with the yield to worst at 6.0% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 95.0-103.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread up by 72.2 bp to 331.0 bp, with the yield to worst at 6.5% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 88.5-103.0).

- Issuer: Masonite International Corp (Tampa, Canada) | Coupon: 3.50% | Maturity: 15/2/2030 | Rating: BB+ | ISIN: USC5389UAM20 | Z-spread up by 67.1 bp to 366.2 bp, with the yield to worst at 6.8% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 79.5-99.0).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 66.1 bp to 393.5 bp, with the yield to worst at 7.2% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.5-108.5).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread up by 63.4 bp to 341.9 bp, with the yield to worst at 6.6% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 92.0-111.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 61.1 bp to 403.7 bp, with the yield to worst at 7.3% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 91.5-105.7).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread up by 59.8 bp to 398.8 bp, with the yield to worst at 7.3% and the bond now trading down to 83.8 cents on the dollar (1Y price range: 83.8-102.9).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 56.0 bp to 424.0 bp, with the yield to worst at 7.4% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 91.5-102.8).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 54.3 bp to 854.1 bp, with the yield to worst at 11.6% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 72.5-99.5).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 15/3/2028 | Rating: BB | ISIN: USU41441AB92 | Z-spread up by 52.2 bp to 290.1 bp, with the yield to worst at 5.7% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 86.4-100.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread up by 113.3 bp to 956.9 bp (CDS basis: 62.0bp), with the yield to worst at 11.4% and the bond now trading down to 85.2 cents on the dollar (1Y price range: 85.0-113.4).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.75% | Maturity: 12/10/2025 | Rating: BB+ | ISIN: DE000A289Q91 | Z-spread up by 104.6 bp to 347.3 bp, with the yield to worst at 5.5% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 91.2-106.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.50% | Maturity: 1/3/2025 | Rating: BB- | ISIN: XS1813724603 | Z-spread up by 100.0 bp to 473.2 bp, with the yield to worst at 6.7% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 91.6-103.6).

- Issuer: Rexel SA (Paris, France) | Coupon: 2.13% | Maturity: 15/12/2028 | Rating: BB- | ISIN: XS2403428472 | Z-spread up by 94.8 bp to 369.3 bp (CDS basis: -3.8bp), with the yield to worst at 5.7% and the bond now trading down to 80.8 cents on the dollar (1Y price range: 76.7-101.0).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread up by 93.6 bp to 372.4 bp, with the yield to worst at 5.8% and the bond now trading down to 88.1 cents on the dollar (1Y price range: 86.4-108.9).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread up by 91.5 bp to 662.9 bp, with the yield to worst at 7.9% and the bond now trading down to 86.1 cents on the dollar (1Y price range: 84.1-99.2).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread up by 86.9 bp to 502.9 bp, with the yield to worst at 7.0% and the bond now trading down to 86.9 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread up by 85.0 bp to 497.5 bp, with the yield to worst at 6.6% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 96.8-107.7).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 1.50% | Maturity: 15/3/2027 | Rating: BB+ | ISIN: XS2080318053 | Z-spread up by 83.1 bp to 305.6 bp (CDS basis: -34.0bp), with the yield to worst at 5.0% and the bond now trading down to 85.4 cents on the dollar (1Y price range: 83.8-101.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread up by 81.4 bp to 555.4 bp, with the yield to worst at 7.6% and the bond now trading down to 78.4 cents on the dollar (1Y price range: 76.3-101.8).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | Z-spread up by 80.4 bp to 560.1 bp, with the yield to worst at 7.7% and the bond now trading down to 80.7 cents on the dollar (1Y price range: 78.9-98.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 80.3 bp to 513.5 bp, with the yield to worst at 7.2% and the bond now trading down to 72.6 cents on the dollar (1Y price range: 69.8-87.3).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread up by 77.8 bp to 527.5 bp, with the yield to worst at 7.2% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.00% | Maturity: 3/4/2025 | Rating: BB+ | ISIN: FR0013449972 | Z-spread up by 75.5 bp to 244.9 bp, with the yield to worst at 4.2% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 90.1-99.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 73.9 bp to 496.2 bp, with the yield to worst at 7.0% and the bond now trading down to 80.1 cents on the dollar (1Y price range: 77.1-92.0).

RECENT DOMESTIC USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133ENL573), floating rate (FFQ + 7.5 bp) maturing on 9 September 2024, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$173m Bond (US3130ATBB24), fixed rate (3.51% coupon) maturing on 12 February 2027, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$121m Bond (US3130ATBA41), fixed rate (3.54% coupon) maturing on 14 August 2026, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$200m Bond (US3130ATAJ68), fixed rate (3.36% coupon) maturing on 15 March 2027, priced at 100.00 (original spread of 13 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$200m Bond (US3130ATAL15), fixed rate (3.36% coupon) maturing on 15 March 2027, priced at 100.00 (original spread of 13 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$607m Bond (US3130ATAG20), fixed rate (3.48% coupon) maturing on 14 March 2025, priced at 100.00 (original spread of 12 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$300m Bond (US3130AT6G79), fixed rate (3.50% coupon) maturing on 13 September 2024, priced at 99.99 (original spread of 10 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$183m Bond (US3130ATB971), fixed rate (3.55% coupon) maturing on 13 March 2026, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$108m Bond (US3130ATAM97), fixed rate (3.46% coupon) maturing on 13 March 2026, priced at 100.00 (original spread of 11 bp), non callable

- JPMorgan Chase Financial Company LLC (Financial - Other | New York City, New York, United States | Rating: NR): US$148m Unsecured Note (XS1450710899) zero coupon maturing on 20 September 2027, priced at 100.00, non callable

RECENT INTERNATIONAL USD BOND ISSUES

- Aries Capital DAC (Financial - Other | Dublin, Ireland | Rating: NR): US$400m Unsecured Note (XS2530185698), fixed rate (3.00% coupon) maturing on 15 September 2027, priced at 100.00, non callable

- Jincheng State-Owned Capital Investment Operation Co Ltd (Financial - Other | Jincheng, China (Mainland) | Rating: NR): US$200m Bond (XS2509105412), fixed rate (6.90% coupon) maturing on 7 September 2025, priced at 100.00, non callable

- Korea Development Bank (Agency | Seoul, South Korea | Rating: AA-): US$450m Senior Note (US500630DU99), fixed rate (4.25% coupon) maturing on 8 September 2032, priced at 99.81 (original spread of 115 bp), non callable

- Korea Development Bank (Agency | Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US500630DT27), fixed rate (4.00% coupon) maturing on 8 September 2025, priced at 99.84 (original spread of 60 bp), non callable

- New Riches Group Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$500m Bond (XS2426023821), fixed rate (11.00% coupon) maturing on 2 September 2025, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$2,000m Unsecured Note (XS2431066054), floating rate maturing on 22 September 2032, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$170m Unsecured Note (XS2431067961), floating rate maturing on 20 June 2025, priced at 100.00, non callable

- Nordic Investment Bank (Supranational | Helsinki, Finland | Rating: AAA): US$1,250m Senior Note (US65562QBV68), fixed rate (3.38% coupon) maturing on 8 September 2027, priced at 99.70 (original spread of 18 bp), non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Austria | Rating: AA+): US$1,000m Senior Note (US676167CF49), fixed rate (3.63% coupon) maturing on 9 September 2027, priced at 99.95 (original spread of 41 bp), non callable

- SNB Funding Ltd (Financial - Other | George Town, Saudi Arabia | Rating: NR): US$285m Unsecured Note (XS2529291002), floating rate maturing on 7 September 2027, priced at 100.00, non callable

- UBS Bank USA (Banking | Salt Lake City, Switzerland | Rating: A+): US$272m Certificate of Deposit - Retail (US90348J5G11), fixed rate (3.35% coupon) maturing on 3 September 2024, priced at 100.00 (original spread of 0 bp), non callable

- ZoomWe Hong Kong New Energy Technology Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$140m Senior Note (XS2523255060), fixed rate (5.70% coupon) maturing on 5 September 2025, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Germany | Rating: BBB+): €125m Hypothekenpfandbrief (Covered Bond) (DE000A289MD8), fixed rate (2.12% coupon) maturing on 1 October 2024, priced at 100.00 (original spread of 111 bp), non callable

- Abeille Vie Societe Anonyme D Assurances Vie Et De Capitalisation SA (Life Insurance | Bois-Colombes, France | Rating: NR): €500m Bond (FR001400CHR4), fixed rate (6.25% coupon) maturing on 9 September 2033, priced at 99.16 (original spread of 478 bp), with a make whole call

- Alliander NV (Utility - Other | Arnhem, Netherlands | Rating: A+): €500m Senior Note (XS2531420730), fixed rate (2.63% coupon) maturing on 9 September 2027, priced at 99.63 (original spread of 136 bp), callable (5nc5)

- Allianz SE (Property and Casualty Insurance | Muenchen, Germany | Rating: A): €1,250m Senior Subordinated Note (DE000A30VTT8), floating rate maturing on 7 September 2038, priced at 100.00 (original spread of 2 30 bp), callable (16nc6)

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: AA+): €2,250m Cedula Hipotecaria (Covered Bond) (ES0413900848), fixed rate (2.38% coupon) maturing on 9 August 2027, priced at 99.52 (original spread of 107 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: AA+): €1,250m Cedula Hipotecaria (Covered Bond) (ES0413900855), fixed rate (2.75% coupon) maturing on 8 September 2032, priced at 99.20 (original spread of 129 bp), non callable

- Banco de Sabadell SA (Banking | Alicante, Alicante, Spain | Rating: BBB-): €500m Note (XS2528155893), fixed rate (5.38% coupon) maturing on 8 September 2026, priced at 99.79 (original spread of 426 bp), callable (4nc3)

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Poland | Rating: A-): €600m Senior Note (XS2530208490), fixed rate (4.00% coupon) maturing on 8 September 2027, priced at 99.75 (original spread of 275 bp), non callable

- Caixabank SA (Banking | Valencia, Spain | Rating: BBB+): €1,000m Note (XS2530034649), fixed rate (3.75% coupon) maturing on 7 September 2029, priced at 99.34 (original spread of 249 bp), with a regulatory call

- Chorus Ltd (Telecommunications | Wellington, New Zealand | Rating: BBB): €500m Senior Note (XS2521013909), fixed rate (3.63% coupon) maturing on 7 September 2029, priced at 99.35 (original spread of 237 bp), with a make whole call

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: BB+): €500m Inhaberschuldverschreibung (DE000CZ45W81), fixed rate (6.50% coupon) maturing on 6 December 2032, priced at 99.78 (original spread of 525 bp), with a regulatory call

- Compass Group Finance Netherlands BV (Financial - Other | Amsterdam, United Kingdom | Rating: A): €500m Senior Note (XS2528582377), fixed rate (3.00% coupon) maturing on 8 March 2030, priced at 99.20 (original spread of 174 bp), callable (8nc7)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €10m Inhaberschuldverschreibung (DE000DW6CX97), fixed rate (5.28% coupon) maturing on 7 September 2032, priced at 100.00, non callable

- Danone SA (Food Processors | Paris, France | Rating: BBB+): €600m Bond (FR001400CJG3), fixed rate (3.07% coupon) maturing on 7 September 2032, priced at 100.00 (original spread of 152 bp), callable (10nc10)

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: AAA): €250m Oeffenlicher Pfandbrief (Covered Bond) (XS2529513850), fixed rate (2.25% coupon) maturing on 8 September 2028, priced at 99.78 (original spread of 92 bp), non callable

- Deutsche Bank Luxembourg SA (Banking | Luxembourg, Germany | Rating: A-): €105m Unsecured Note (XS2530185854), fixed rate (1.00% coupon) maturing on 5 April 2047, priced at 100.00, non callable

- East Japan Railway Co (Railroads | Shibuya-Ku, Japan | Rating: A+): €500m Senior Note (XS2528170777), fixed rate (3.25% coupon) maturing on 8 September 2030, priced at 100.00 (original spread of 179 bp), non callable

- East Japan Railway Co (Railroads | Shibuya-Ku, Japan | Rating: A+): €700m Senior Note (XS2526860965), fixed rate (2.61% coupon) maturing on 8 September 2025, priced at 100.00 (original spread of 146 bp), non callable

- Finnvera Oyj (Agency | Helsinki, Finland | Rating: NR): €1,000m Senior Note (XS2529521283), fixed rate (2.13% coupon) maturing on 8 March 2028, priced at 99.69 (original spread of 83 bp), non callable

- Germany, Federal Republic of (Government) (Sovereign | Berlin, Germany | Rating: AAA): €5,000m Bundesobligationen (DE0001030740), fixed rate (1.30% coupon) maturing on 15 October 2027, priced at 99.68 (original spread of 2 bp), non callable

- Gestion Securite de Stocks Securite SA (Oil and Gas | Paris, Ile-De-France, France | Rating: AA): €1,000m Bond (FR001400CKB2), fixed rate (2.88% coupon) maturing on 7 September 2032, priced at 99.22 (original spread of 128 bp), non callable

- Groep Brussel Lambert NV (Chemicals | Brussels, Bruxelles-Capitale, Belgium | Rating: A+): €500m Bond (BE0002876572), fixed rate (3.13% coupon) maturing on 6 September 2029, priced at 99.34 (original spread of 195 bp), callable (7nc7)

- HSBC SFH (France) SA (Financial - Other | Courbevoie, Ile-De-France, United Kingdom | Rating: AAA): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400CK81), fixed rate (2.63% coupon) maturing on 7 September 2032, priced at 99.65 (original spread of 113 bp), non callable

- Hypo Noe Landesbank fuer Niederoesterreich und Wien AG (Banking | Sankt Poelten, Austria | Rating: A): €500m Oeffenlicher Pfandbrief (Covered Bond) (AT0000A305R9), fixed rate (2.50% coupon) maturing on 28 June 2030, priced at 99.73 (original spread of 119 bp), non callable

- International Development Association (Supranational | Washington, Washington Dc, United States | Rating: AAA): €2,000m Senior Note (XS2528875714), fixed rate (2.50% coupon) maturing on 15 January 2038, priced at 99.39 (original spread of 93 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB-): €1,000m Note (XS2529233814), fixed rate (4.75% coupon) maturing on 6 September 2027, priced at 100.00 (original spread of 558 bp), callable (5nc1m)

- Investitionsbank Schleswig Holstein (Agency | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A2TR190), fixed rate (2.13% coupon) maturing on 6 September 2030, priced at 99.61 (original spread of 88 bp), non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Japan | Rating: A+): €1,250m Unsecured Note (XS2527914779), fixed rate (2.38% coupon) maturing on 8 September 2027, priced at 99.54 (original spread of 116 bp), non callable

- KommuneKredit (Agency | Kobenhavn K, Denmark | Rating: AAA): €1,000m Senior Note (XS2529234200), fixed rate (2.38% coupon) maturing on 15 September 2032, priced at 99.38 (original spread of 94 bp), non callable

- Korea Development Bank (Agency | Seoul, South Korea | Rating: AA-): €500m Senior Note (XS2529713435), fixed rate (2.63% coupon) maturing on 8 September 2027, priced at 99.88 (original spread of 138 bp), non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): €500m Unsecured Note (XS2530032270), fixed rate (3.50% coupon) maturing on 8 September 2031, priced at 100.00, non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €500m Senior Note (XS2528311348), fixed rate (4.03% coupon) maturing on 5 September 2032, priced at 100.00 (original spread of 251 bp), non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €800m Senior Note (XS2528323780), fixed rate (3.49% coupon) maturing on 5 September 2027, priced at 100.00 (original spread of 223 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,000m Inhaberschuldverschreibung (DE000NWB0AS6), fixed rate (2.50% coupon) maturing on 7 September 2037, priced at 99.70 (original spread of 93 bp), non callable

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BBB): €1,000m Senior Note (XS2528858033), floating rate maturing on 6 September 2028, priced at 100.00 (original spread of 303 bp), callable (6nc5)

- Prologis International Funding II SA (Financial - Other | Luxembourg, Luxembourg | Rating: A-): €550m Senior Note (XS2529520715), fixed rate (3.63% coupon) maturing on 7 March 2030, priced at 99.29 (original spread of 246 bp), callable (8nc1m)

- Raiffeisen Bank International AG (Banking | Wien, Austria | Rating: A-): €500m Senior Note (XS2526835694), fixed rate (4.13% coupon) maturing on 8 September 2025, priced at 99.82 (original spread of 306 bp), with a regulatory call

- Siemens Financieringsmaatschappij NV (Financial - Other | Den Haag, Zuid-Holland, Germany | Rating: A+): €1,000m Senior Note (XS2526839506), fixed rate (3.00% coupon) maturing on 8 September 2033, priced at 99.90 (original spread of 150 bp), callable (11nc11)

- Siemens Financieringsmaatschappij NV (Financial - Other | Den Haag, Zuid-Holland, Germany | Rating: A+): €500m Senior Note (XS2526839761), fixed rate (2.75% coupon) maturing on 9 September 2030, priced at 99.57 (original spread of 146 bp), callable (8nc8)

- Siemens Financieringsmaatschappij NV (Financial - Other | Den Haag, Zuid-Holland, Germany | Rating: A+): €1,000m Senior Note (XS2526839175), fixed rate (2.25% coupon) maturing on 10 March 2025, priced at 99.86 (original spread of 121 bp), callable (3nc2)

- Societe Generale SA (Banking | Paris, France | Rating: BBB-): €500m Bond (FR001400CKA4), floating rate maturing on 6 September 2032, priced at 99.55 (original spread of 406 bp), callable (10nc5)

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €200m Note (XS2529280062), fixed rate (3.90% coupon) maturing on 28 September 2026, priced at 100.00, non callable

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: A-): €500m Senior Note (XS2527786755), fixed rate (2.13% coupon) maturing on 1 September 2024, priced at 99.90 (original spread of 112 bp), non callable

NEW LOANS

- Ministry Of Defense Of The Arab Republic Of Egypt, signed a US$ 2,500m Term Loan, to be used for general corporate purposes. It matures on 09/21/27 and initial pricing is set at Term SOFR +375.0bp

- Hashemite Kingdom of Jordan (B+), signed a US$ 500m Bridge Loan maturing on 12/29/22, to be used for general corporate purposes

- Terragro Co Ltd, signed a US$ 350m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/01/25 and initial pricing is set at Term SOFR +123.0bp

- Forest City Trading Group LLC, signed a US$ 315m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/30/27 and initial pricing is set at Term SOFR +125.0bp

- Lionbridge Capital Co Ltd, signed a US$ 190m Term Loan maturing on 08/31/23, to be used for general corporate purposes.

NEW ISSUES IN SECURITIZED CREDIT

- Onemain Financial Issuance Trust 2022-2 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 1,000 m. Highest-rated tranche offering a yield to maturity of 4.89%, and the lowest-rated tranche a yield to maturity of 6.55%. Bookrunners: Deutsche Bank Securities Inc, RBC Capital Markets, TD Securities (USA) LLC