Credit

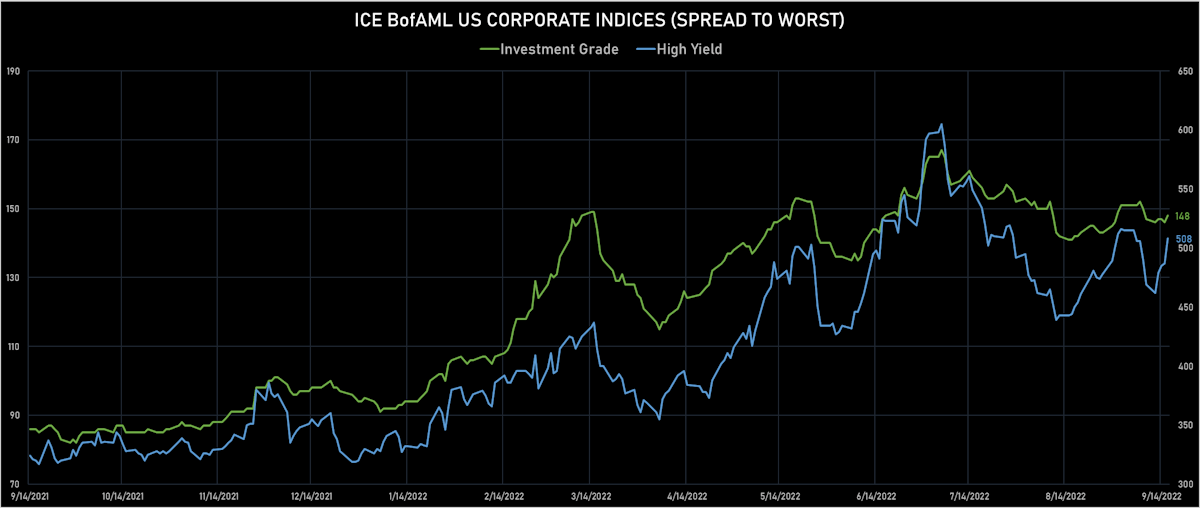

US High Yield Credit Performed Poorly This Week, With A Significant Decompression In HY-IG Spreads

Reasonable amount of USD corporate bond issuance over the past week (IFR Markets data): 25 tranches for $18.85bn in IG (2022 YTD volume $1.008tn vs 2021 YTD $1.147tn), 1 tranche for $500m in HY (2022 YTD volume $80.376bn vs 2021 YTD $360.239bn)

Published ET

ICE BofAML US Corporate Single Bs - Single As Spread | Source: Refinitiv

DAILY SUMMARY

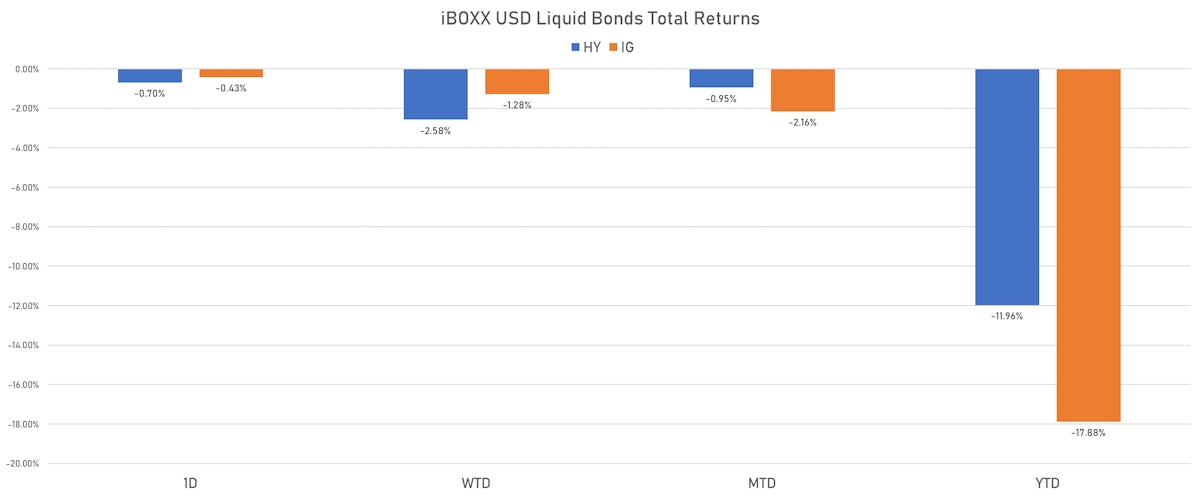

- S&P 500 Bond Index was down -0.32% today, with investment grade down -0.29% and high yield down -0.59% (YTD total return: -14.76%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.427% today (Week-to-date: -1.28%; Month-to-date: -2.16%; Year-to-date: -17.88%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.700% today (Week-to-date: -2.58%; Month-to-date: -0.95%; Year-to-date: -11.96%)

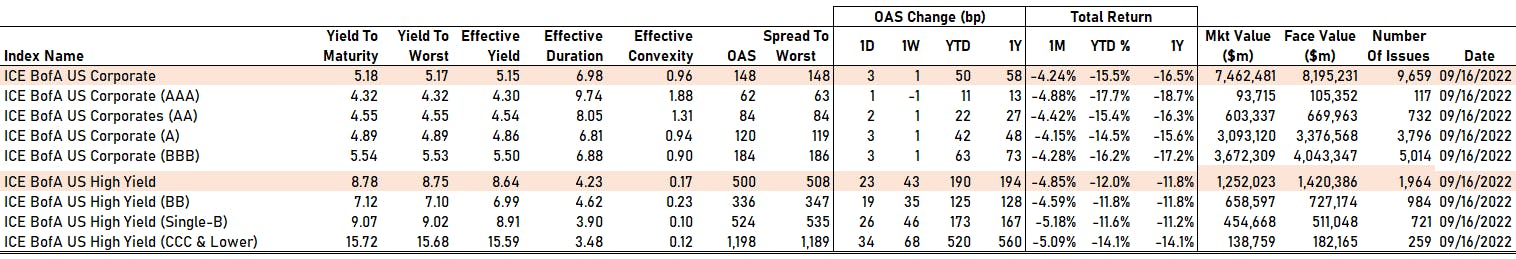

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 148.0 bp (YTD change: +53.0 bp)

- ICE BofA US High Yield Index spread to worst up 21.0 bp, now at 508.0 bp (YTD change: +178.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.28% today (YTD total return: -2.0%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 62 bp

- AA up by 2 bp at 84 bp

- A up by 3 bp at 120 bp

- BBB up by 3 bp at 184 bp

- BB up by 19 bp at 336 bp

- B up by 26 bp at 524 bp

- CCC up by 34 bp at 1,198 bp

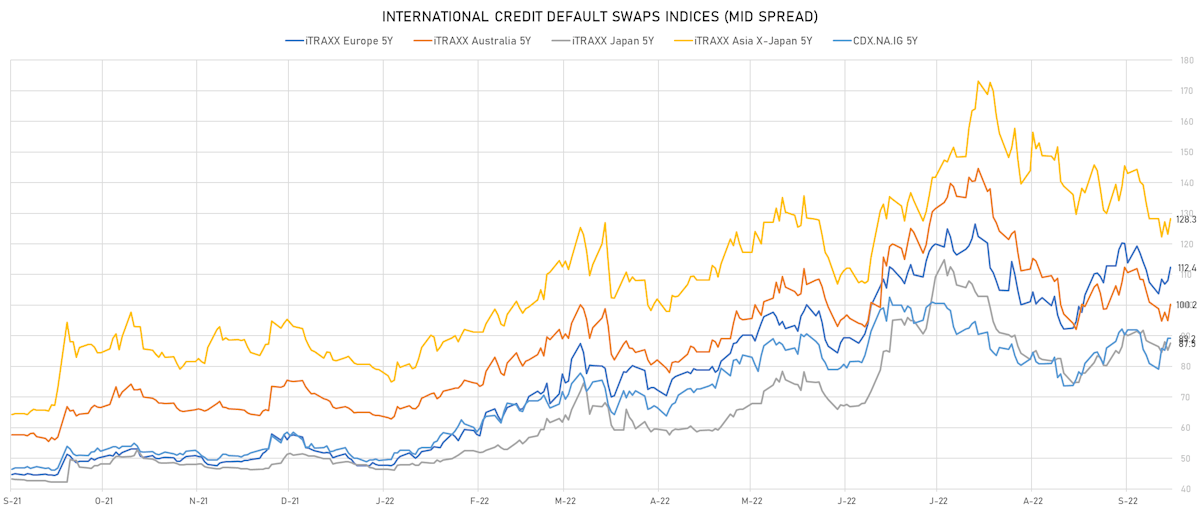

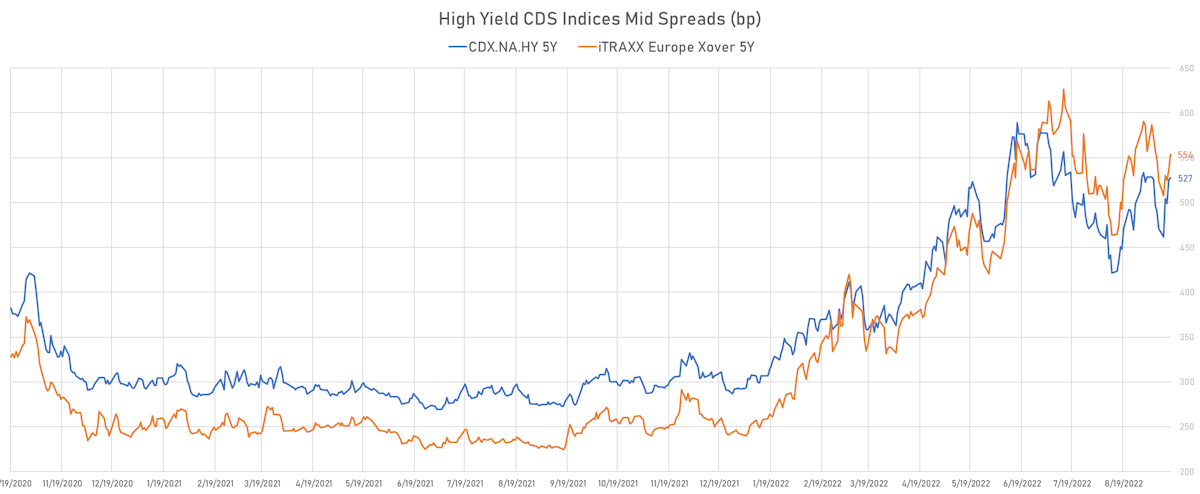

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y unchanged at 89bp (1W change: +8.2bp; YTD change: +39.8bp)

- Markit CDX.NA.IG 10Y down 0.2 bp, now at 124bp (1W change: +6.8bp; YTD change: +35.1bp)

- Markit CDX.NA.HY 5Y up 2.3 bp, now at 527bp (1W change: +56.7bp; YTD change: +235.5bp)

- Markit iTRAXX Europe 5Y up 4.4 bp, now at 112bp (1W change: +4.9bp; YTD change: +64.7bp)

- Markit iTRAXX Europe Crossover 5Y up 16.6 bp, now at 554bp (1W change: +29.2bp; YTD change: +311.4bp)

- Markit iTRAXX Japan 5Y up 2.2 bp, now at 88bp (1W change: -0.4bp; YTD change: +41.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 5.1 bp, now at 128bp (1W change: +0.1bp; YTD change: +49.2bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Staples Inc (Country: US; rated: B3): down 54.2 bp to 1,630.7bp (1Y range: 911-1,986bp)

- Lumen Technologies Inc (Country: US; rated: WR): up 58.7 bp to 583.7bp (1Y range: 195-584bp)

- Macy's Inc (Country: US; rated: A1): up 66.2 bp to 553.9bp (1Y range: 181-617bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): up 69.4 bp to 905.5bp (1Y range: 299-1,584bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): up 75.0 bp to 580.8bp (1Y range: 370-681bp)

- Bombardier Inc (Country: CA; rated: CCC-): up 79.7 bp to 639.9bp (1Y range: 432-1,007bp)

- Kohls Corp (Country: US; rated: NR): up 82.6 bp to 578.5bp (1Y range: 112-578bp)

- United Airlines Holdings Inc (Country: US; rated: CCC+): up 89.1 bp to 822.4bp (1Y range: 104-822bp)

- United States Steel Corp (Country: US; rated: BBB-): up 103.3 bp to 638.2bp (1Y range: 268-780bp)

- Carnival Corp (Country: US; rated: Ba3): up 112.8 bp to 1,007.6bp (1Y range: 316-1,583bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 116.0 bp to 1,335.0bp (1Y range: 304-1,689bp)

- American Airlines Group Inc (Country: US; rated: B2): up 122.1 bp to 1,394.2bp (1Y range: 607-1,644bp)

- Rite Aid Corp (Country: US; rated: C): up 209.4 bp to 2,243.1bp (1Y range: 714-3,892bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 444.2 bp to 1,698.9bp (1Y range: 373-1,699bp)

- Community Health Systems Inc (Country: US; rated: B): up 2195.6 bp to 5,776.6bp (1Y range: 547-5,777bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Fortum Oyj (Country: FI; rated: WR): down 69.1 bp to 220.5bp (1Y range: 40-326bp)

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): up 14.5 bp to 2,960.2bp (1Y range: 464-3,238bp)

- Telecom Italia SpA (Country: IT; rated: B1): up 14.9 bp to 480.1bp (1Y range: 154-480bp)

- TUI AG (Country: DE; rated: B3-PD): up 14.9 bp to 1,350.8bp (1Y range: 607-1,641bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 17.1 bp to 1,341.1bp (1Y range: 490-1,341bp)

- ArcelorMittal SA (Country: LU; rated: WD): up 20.5 bp to 286.9bp (1Y range: 120-350bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 25.9 bp to 502.8bp (1Y range: 222-585bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 26.1 bp to 392.9bp (1Y range: 164-486bp)

- Air France KLM SA (Country: FR; rated: C): up 26.7 bp to 791.9bp (1Y range: 386-990bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 30.4 bp to 479.5bp (1Y range: 107-540bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 32.5 bp to 819.0bp (1Y range: 333-934bp)

- Novafives SAS (Country: FR; rated: Caa1): up 38.6 bp to 1,678.0bp (1Y range: 618-1,903bp)

- Stena AB (Country: SE; rated: B2-PD): up 50.5 bp to 565.4bp (1Y range: 401-865bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 63.0 bp to 1,033.5bp (1Y range: 359-1,296bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 70.6 bp to 2,267.6bp (1Y range: 1,017-2,690bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 83.6 bp to 378.4 bp, with the yield to worst at 7.3% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 92.0-107.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 1/8/2030 | Rating: BB- | ISIN: USU8760NAF60 | Z-spread up by 77.1 bp to 526.8 bp, with the yield to worst at 8.8% and the bond now trading down to 79.0 cents on the dollar (1Y price range: 79.0-109.9).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread up by 62.3 bp to 398.9 bp, with the yield to worst at 7.5% and the bond now trading down to 92.5 cents on the dollar (1Y price range: 92.0-111.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 57.7 bp to 390.3 bp, with the yield to worst at 7.4% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 57.3 bp to 510.1 bp, with the yield to worst at 8.5% and the bond now trading down to 81.3 cents on the dollar (1Y price range: 78.0-102.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 53.2 bp to 544.2 bp, with the yield to worst at 8.9% and the bond now trading down to 83.6 cents on the dollar (1Y price range: 83.1-105.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread up by 53.2 bp to 544.2 bp, with the yield to worst at 8.9% and the bond now trading down to 83.6 cents on the dollar (1Y price range: 83.1-105.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 47.2 bp to 387.5 bp, with the yield to worst at 7.6% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Lamb Weston Holdings Inc (Eagle, Idaho (US)) | Coupon: 4.88% | Maturity: 15/5/2028 | Rating: BB- | ISIN: USU5256PAC50 | Z-spread up by 46.2 bp to 246.8 bp, with the yield to worst at 6.1% and the bond now trading down to 93.6 cents on the dollar (1Y price range: 90.0-108.3).

- Issuer: Century Communities Inc (Greenwood Village, (US)) | Coupon: 3.88% | Maturity: 15/8/2029 | Rating: BB- | ISIN: USU15662AF37 | Z-spread up by 44.8 bp to 450.6 bp, with the yield to worst at 8.0% and the bond now trading down to 77.8 cents on the dollar (1Y price range: 77.3-101.0).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread up by 44.6 bp to 484.5 bp, with the yield to worst at 8.5% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 88.5-112.4).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.50% | Maturity: 15/1/2029 | Rating: BB- | ISIN: USU26886AC29 | Z-spread up by 44.3 bp to 411.4 bp, with the yield to worst at 7.6% and the bond now trading down to 83.8 cents on the dollar (1Y price range: 80.8-103.5).

- Issuer: Yum! Brands Inc (Louisville, Kentucky (US)) | Coupon: 4.75% | Maturity: 15/1/2030 | Rating: BB- | ISIN: USU9T71RAB76 | Z-spread up by 40.3 bp to 277.4 bp (CDS basis: -90.1bp), with the yield to worst at 6.2% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 90.0-108.0).

- Issuer: Station Casinos LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 1/12/2031 | Rating: B- | ISIN: USU85731AE46 | Z-spread up by 40.1 bp to 397.5 bp, with the yield to worst at 7.4% and the bond now trading down to 80.8 cents on the dollar (1Y price range: 76.8-100.4).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread down by 64.9 bp to 339.9 bp, with the yield to worst at 7.1% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 91.5-102.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread up by 89.2 bp to 567.2 bp, with the yield to worst at 8.0% and the bond now trading down to 79.6 cents on the dollar (1Y price range: 78.2-108.1).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.50% | Maturity: 1/3/2025 | Rating: BB- | ISIN: XS1813724603 | Z-spread up by 77.4 bp to 402.2 bp, with the yield to worst at 6.4% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 91.6-103.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 21/9/2025 | Rating: BB+ | ISIN: XS2231715322 | Z-spread up by 74.2 bp to 421.5 bp, with the yield to worst at 6.6% and the bond now trading down to 90.1 cents on the dollar (1Y price range: 87.4-105.2).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread up by 70.4 bp to 383.6 bp, with the yield to worst at 5.9% and the bond now trading down to 99.2 cents on the dollar (1Y price range: 96.8-107.7).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | Z-spread up by 67.3 bp to 552.1 bp, with the yield to worst at 7.8% and the bond now trading down to 74.6 cents on the dollar (1Y price range: 73.0-100.0).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 59.9 bp to 506.7 bp, with the yield to worst at 7.1% and the bond now trading down to 81.5 cents on the dollar (1Y price range: 77.7-98.3).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread up by 53.7 bp to 449.4 bp, with the yield to worst at 6.7% and the bond now trading down to 85.2 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.00% | Maturity: 24/1/2025 | Rating: BB+ | ISIN: XS1724626699 | Z-spread up by 49.6 bp to 230.8 bp, with the yield to worst at 4.7% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 92.8-104.1).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread up by 47.6 bp to 497.2 bp, with the yield to worst at 7.3% and the bond now trading down to 79.5 cents on the dollar (1Y price range: 76.3-101.8).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread up by 45.6 bp to 453.4 bp, with the yield to worst at 6.9% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Z-spread up by 43.6 bp to 468.6 bp, with the yield to worst at 7.1% and the bond now trading down to 80.1 cents on the dollar (1Y price range: 76.7-100.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 41.8 bp to 425.2 bp, with the yield to worst at 6.6% and the bond now trading down to 81.4 cents on the dollar (1Y price range: 77.1-92.0).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: CCC | ISIN: XS2283225477 | Z-spread down by 54.4 bp to 1,036.4 bp, with the yield to worst at 12.0% and the bond now trading up to 55.8 cents on the dollar (1Y price range: 41.1-84.9).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread down by 66.9 bp to 528.4 bp, with the yield to worst at 7.0% and the bond now trading up to 88.6 cents on the dollar (1Y price range: 84.1-99.2).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread down by 75.7 bp to 946.1 bp, with the yield to worst at 9.9% and the bond now trading up to 74.9 cents on the dollar (1Y price range: 60.9-94.5).

RECENT DOMESTIC USD BOND ISSUES

- Alnylam Pharmaceuticals Inc (Pharmaceuticals | Cambridge, Massachusetts, United States | Rating: NR): US$1,035m Bond (US02043QAA58), fixed rate (1.00% coupon) maturing on 15 September 2027, priced at 100.00, non callable, convertible

- CNX Resources Corp (Metals/Mining | Canonsburg, United States | Rating: BB): US$500m Senior Note (US12653CAK45), fixed rate (7.38% coupon) maturing on 15 January 2031, priced at 100.00 (original spread of 405 bp), callable (8nc3)

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, Texas, United States | Rating: A): US$300m Bond (US15189XBA54), fixed rate (4.85% coupon) maturing on 1 October 2052, priced at 99.45 (original spread of 179 bp), callable (30nc30)

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, Texas, United States | Rating: A): US$500m Bond (US15189XAZ15), fixed rate (4.45% coupon) maturing on 1 October 2032, priced at 99.65 (original spread of 121 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$165m Bond (US3133ENM647), fixed rate (3.50% coupon) maturing on 16 June 2026, priced at 99.66 (original spread of 4 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENN223), fixed rate (3.75% coupon) maturing on 22 September 2025, priced at 100.00 (original spread of 12 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133ENM563), floating rate (FFQ + 7.0 bp) maturing on 16 September 2024, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$320m Unsecured Note (US3134GX2U76), fixed rate (4.63% coupon) maturing on 29 September 2025, priced at 100.00 (original spread of 98 bp), callable (3nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$150m Unsecured Note (US3134GX2X16), fixed rate (5.00% coupon) maturing on 30 September 2027, priced at 100.00 (original spread of 150 bp), callable (5nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GX3A04), fixed rate (4.75% coupon) maturing on 30 September 2025, priced at 100.00 (original spread of 95 bp), callable (3nc3m)

- Home Depot Inc (Retail Stores - Other | Atlanta, United States | Rating: A): US$1,250m Senior Note (US437076CS90), fixed rate (4.50% coupon) maturing on 15 September 2032, priced at 99.88 (original spread of 118 bp), callable (10nc10)

- Home Depot Inc (Retail Stores - Other | Atlanta, United States | Rating: A): US$1,000m Senior Note (US437076CT73), fixed rate (4.95% coupon) maturing on 15 September 2052, priced at 98.65 (original spread of 180 bp), callable (30nc30)

- Home Depot Inc (Retail Stores - Other | Atlanta, United States | Rating: A): US$750m Senior Note (US437076CR18), fixed rate (4.00% coupon) maturing on 15 September 2025, priced at 99.96 (original spread of 40 bp), callable (3nc3)

- International Bank for Reconstruction and Development (Supranational | Washington, United States | Rating: AAA): US$1,500m Bond (US459058KK86), floating rate (SOFR + 31.0 bp) maturing on 23 September 2026, priced at 100.00, non callable

- International Bank for Reconstruction and Development (Supranational | Washington, United States | Rating: AAA): US$3,000m Bond (US459058KL69), fixed rate (3.63% coupon) maturing on 21 September 2029, priced at 99.33 (original spread of 23 bp), non callable

- NSTAR Electric Co (Utility - Other | Boston, Massachusetts, United States | Rating: A): US$400m Senior Debenture (US67021CAT45), fixed rate (4.95% coupon) maturing on 15 September 2052, priced at 99.61 (original spread of 176 bp), callable (30nc30)

- Nextera Energy Inc (Utility - Other | Juno Beach, United States | Rating: BBB+): US$2,000m Equity Unit (US65339F7134), fixed rate (6.93% coupon) maturing on 1 September 2025, priced at 97.50, non callable, convertible

- Sarepta Therapeutics Inc (Pharmaceuticals | Cambridge, Massachusetts, United States | Rating: NR): US$980m Bond (US803607AC42), fixed rate (1.25% coupon) maturing on 15 September 2027, priced at 100.00, non callable, convertible

- Valley National Bancorp (Banking | New York City, United States | Rating: BBB-): US$150m Subordinated Note (US919794AG29), floating rate maturing on 30 September 2032, priced at 100.00, callable (10nc5)

- Wisconsin Electric Power Co (Utility - Other | Milwaukee, United States | Rating: A-): US$500m Senior Debenture (US976656CN66), fixed rate (4.75% coupon) maturing on 30 September 2032, priced at 99.79 (original spread of 140 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Agence Francaise de Developpement EPIC (Agency | Paris, Ile-De-France, France | Rating: AA): US$1,250m Bond (FR001400CRX1), fixed rate (4.00% coupon) maturing on 21 September 2027, priced at 99.65 (original spread of 40 bp), non callable

- Athomstart Invest 585 AS (Financial - Other | Oslo, Norway | Rating: NR): US$300m Bond (NO0012554692), fixed rate (11.75% coupon) maturing on 29 September 2026, priced at 97.50, callable (4nc2)

- Bank of Ireland Group PLC (Banking | Dublin, Ireland | Rating: BBB-): US$1,000m Senior Note (US06279JAC36), fixed rate (6.25% coupon) maturing on 16 September 2026, priced at 100.00 (original spread of 269 bp), callable (4nc3)

- CPPIB Capital Inc (Financial - Other | Toronto, Canada | Rating: AAA): US$1,750m Senior Note (US22411VAY48), fixed rate (4.13% coupon) maturing on 21 October 2024, priced at 99.92 (original spread of 39 bp), non callable

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Japan | Rating: A): US$600m Senior Note (US25159MBH97), fixed rate (4.38% coupon) maturing on 22 September 2025, priced at 99.69 (original spread of 64 bp), non callable

- Intact Financial Corp (Property and Casualty Insurance | Toronto, Canada | Rating: BBB+): US$500m Senior Note (USC4R23YAZ16), fixed rate (5.46% coupon) maturing on 22 September 2032, priced at 100.00 (original spread of 200 bp), callable (10nc10)

- JBS USA Lux SA (Beverage/Bottling | Luxembourg, Brazil | Rating: BBB-): US$800m Senior Note (USL56608AU38), fixed rate (6.50% coupon) maturing on 1 December 2052, priced at 100.35 (original spread of 295 bp), non callable

- JBS USA Lux SA (Beverage/Bottling | Luxembourg, Brazil | Rating: BBB-): US$800m Senior Note (USL56608AT64), fixed rate (5.75% coupon) maturing on 1 April 2033, priced at 98.14 (original spread of 263 bp), non callable

- JBS USA Lux SA (Beverage/Bottling | Luxembourg, Brazil | Rating: BBB-): US$400m Senior Note (USL56608AS81), fixed rate (5.13% coupon) maturing on 1 February 2028, priced at 99.06 (original spread of 188 bp), non callable

- Niagara Mohawk Power Corp (Utility - Other | Syracuse, New York, United Kingdom | Rating: BBB+): US$500m Senior Note (US65364UAS50), fixed rate (5.78% coupon) maturing on 16 September 2052, priced at 100.00 (original spread of 257 bp), callable (30nc30)

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$107m Unsecured Note (XS2431043780), floating rate maturing on 19 September 2025, priced at 100.00, non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$1,000m Senior Note (XS2534902767), fixed rate (3.88% coupon) maturing on 15 January 2025, priced at 99.70 (original spread of 25 bp), non callable

- Pd Sukuk Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$300m Islamic Sukuk (Murabaha) (XS2501962539), fixed rate (8.75% coupon) maturing on 23 September 2025, priced at 100.00 (original spread of 506 bp), non callable

- Swedbank AB (Banking | Sundbyberg, Sweden | Rating: BBB+): US$1,000m Note (US87020PAT49), fixed rate (5.34% coupon) maturing on 20 September 2027, priced at 100.00 (original spread of 190 bp), non callable

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB-): US$1,250m Senior Note (US87264ACV52), fixed rate (5.20% coupon) maturing on 15 January 2033, priced at 99.84 (original spread of 197 bp), callable (10nc10)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB-): US$1,000m Senior Note (US87264ACW36), fixed rate (5.65% coupon) maturing on 15 January 2053, priced at 99.74 (original spread of 252 bp), callable (30nc30)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB-): US$750m Senior Note (US87264ACX19), fixed rate (5.80% coupon) maturing on 15 September 2062, priced at 99.32 (original spread of 283 bp), callable (40nc40)

- Transocean Inc (Oilfield Machinery and Services | George Town, Switzerland | Rating: CC): US$300m Bond (), fixed rate (4.63% coupon) maturing on 30 September 2029, priced at 100.00, non callable, convertible

RECENT EURO BOND ISSUES

- A2A SpA (Utility - Other | Milan, Milano, Italy | Rating: BBB): €650m Senior Note (XS2534976886), fixed rate (4.50% coupon) maturing on 19 September 2030, priced at 99.68 (original spread of 309 bp), callable (8nc8)

- Agence Francaise de Developpement EPIC (Agency | Paris, France | Rating: AA): €400m Bond (FR001400CQM6), fixed rate (1.13% coupon) maturing on 2 March 2037, priced at 79.47 (original spread of 94 bp), non callable

- Amprion GmbH (Utility - Other | Dortmund, Germany | Rating: BBB+): €1,000m Senior Note (DE000A30VPM1), fixed rate (3.97% coupon) maturing on 22 September 2032, priced at 100.00 (original spread of 228 bp), callable (10nc10)

- Amprion GmbH (Utility - Other | Dortmund, Germany | Rating: BBB+): €800m Senior Note (DE000A30VPL3), fixed rate (3.45% coupon) maturing on 22 September 2027, priced at 100.00 (original spread of 198 bp), callable (5nc5)

- Anglo American Capital PLC (Financial - Other | London, United Kingdom | Rating: BBB): €745m Senior Note (XS2536431617), fixed rate (4.75% coupon) maturing on 21 September 2032, priced at 99.95 (original spread of 307 bp), callable (10nc10)

- Arion banki hf (Banking | Reykjavik, United Kingdom | Rating: BBB): €300m Note (XS2498976047), fixed rate (4.88% coupon) maturing on 21 December 2024, priced at 99.88 (original spread of 394 bp), with a regulatory call

- Arval Service Lease SA (Financial - Other | Paris, France | Rating: A-): €750m Bond (FR001400CSG4), fixed rate (4.00% coupon) maturing on 22 September 2026, priced at 99.80 (original spread of 261 bp), callable (4nc4)

- B2holding ASA (Financial - Other | Oslo, Norway | Rating: B+): €150m Bond (NO0012704107), floating rate (EU03MLIB + 690.0 bp) maturing on 22 September 2026, priced at 100.00, callable (4nc2)

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €1,250m Note (XS2534785865), fixed rate (3.38% coupon) maturing on 20 September 2027, priced at 99.57 (original spread of 208 bp), non callable

- Banco de Credito Social Cooperativo SA (Banking | Madrid, Madrid, Spain | Rating: BB): €500m Senior Note (XS2535283548), fixed rate (8.00% coupon) maturing on 22 September 2026, priced at 100.00 (original spread of 665 bp), callable (4nc3)

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9SF3), fixed rate (2.35% coupon) maturing on 19 March 2027, priced at 99.87 (original spread of 82 bp), non callable

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €4,500m Obligation Lineaire (BE0000356650), fixed rate (2.75% coupon) maturing on 22 April 2039, priced at 99.96 (original spread of 78 bp), non callable

- Bper Banca SpA (Banking | Modena, Italy | Rating: BB-): €400m Subordinated Note (XS2534908889), fixed rate (8.63% coupon) maturing on 20 January 2033, priced at 100.00 (original spread of 690 bp), callable (10nc5)

- Bulgaria, Republic of (Government) (Sovereign | Sofia, Bulgaria | Rating: BBB): €750m Senior Note (XS2536817484), fixed rate (4.63% coupon) maturing on 23 September 2034, priced at 98.23 (original spread of 306 bp), non callable

- Bulgaria, Republic of (Government) (Sovereign | Sofia, Bulgaria | Rating: BBB): €1,500m Senior Note (XS2536817211), fixed rate (4.13% coupon) maturing on 23 September 2029, priced at 98.69 (original spread of 275 bp), non callable

- Cassa Depositi e Prestiti SpA (Agency | Rome, Italy | Rating: BBB): €750m Senior Note (IT0005508954), fixed rate (3.50% coupon) maturing on 19 September 2027, priced at 99.71 (original spread of 210 bp), non callable

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): €1,000m Senior Note (XS2536364081), floating rate maturing on 22 September 2028, priced at 100.00 (original spread of 220 bp), callable (6nc5)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): €1,000m Senior Note (XS2536362622), floating rate maturing on 22 September 2033, priced at 100.00 (original spread of 239 bp), callable (11nc10)

- Coca Cola HBC Finance BV (Financial - Other | Amsterdam, Switzerland | Rating: NR): €500m Senior Note (XS2533012790), fixed rate (2.75% coupon) maturing on 23 September 2025, priced at 99.45 (original spread of 149 bp), callable (3nc3)

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB-): €600m Inhaberschuldverschreibung (DE000CZ43ZB3), fixed rate (4.63% coupon) maturing on 21 March 2028, priced at 99.97 (original spread of 321 bp), callable (6nc4)

- Coventry Building Society (Mortgage Banking | Coventry, West Midlands, United Kingdom | Rating: A-): €500m Covered Bond (Other) (XS2534984716), fixed rate (2.63% coupon) maturing on 7 December 2026, priced at 99.82 (original spread of 125 bp), non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: BBB+): €3,000m Bond (FR001400COE8), floating rate (EU06MLIB + 175.0 bp) maturing on 14 September 2042, priced at 100.00, non callable

- Crelan SA (Banking | Brussels, Belgium | Rating: BBB-): €300m Bond (BE0002872530), fixed rate (5.38% coupon) maturing on 31 October 2025, priced at 99.71 (original spread of 413 bp), non callable

- DNB Bank ASA (Banking | Oslo, Oslo, Norway | Rating: AA-): €1,250m Note (XS2534985523), floating rate maturing on 21 September 2027, priced at 99.81 (original spread of 182 bp), callable (5nc4)

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: AAA): €750m Hypothekenpfandbrief (Covered Bond) (DE000A3MQUX3), fixed rate (2.50% coupon) maturing on 28 November 2031, priced at 99.37 (original spread of 96 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30VPD0), fixed rate (2.50% coupon) maturing on 20 September 2032, priced at 99.26 (original spread of 93 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000A30VPC2), fixed rate (2.25% coupon) maturing on 20 September 2027, priced at 99.49 (original spread of 99 bp), non callable

- Eika Boligkreditt AS (Mortgage Banking | Oslo, Norway | Rating: NR): €500m Covered Bond (Other) (XS2536806289), fixed rate (2.50% coupon) maturing on 22 September 2028, priced at 99.57 (original spread of 101 bp), non callable

- Elis SA (Service - Other | Saint-Cloud, France | Rating: BB+): €380m Bond (FR001400AFJ9), fixed rate (2.25% coupon) maturing on 22 September 2029, priced at 100.00, non callable, convertible

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: AAA): €750m Hypothekenpfandbrief (Covered Bond) (AT0000A306J4), fixed rate (2.50% coupon) maturing on 19 September 2030, priced at 99.61 (original spread of 104 bp), non callable

- Essity Capital BV (Financial - Other | Zeist, Utrecht, Sweden | Rating: NR): €500m Senior Note (XS2535484526), fixed rate (3.00% coupon) maturing on 21 September 2026, priced at 99.65 (original spread of 164 bp), callable (4nc4)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €4,000m Senior Note (XS2535352962), fixed rate (2.25% coupon) maturing on 15 March 2030, priced at 99.29 (original spread of 74 bp), non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €7,000m Senior Note (EU000A3K4DS6), fixed rate (2.00% coupon) maturing on 4 October 2027, priced at 99.55 (original spread of 60 bp), non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €5,000m Senior Note (EU000A3K4DT4), fixed rate (2.50% coupon) maturing on 4 October 2052, priced at 98.28 (original spread of 84 bp), non callable

- Fresenius Medical Care AG & Co KGaA (Health Care Facilities | Bad Homburg Vor Der Hohe, Hessen, Germany | Rating: BBB-): €750m Senior Note (XS2530444624), fixed rate (3.88% coupon) maturing on 20 September 2027, priced at 99.64 (original spread of 262 bp), callable (5nc5)

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): €1,000m Senior Note (XS2536502227), fixed rate (4.00% coupon) maturing on 21 September 2029, priced at 99.66 (original spread of 249 bp), callable (7nc7)

- ING Bank NV (Banking | Amsterdam Zuidoost, Noord-Holland, Netherlands | Rating: A+): €1,000m Covered Bond (Other) (XS2534912485), fixed rate (2.50% coupon) maturing on 21 February 2030, priced at 99.37 (original spread of 101 bp), non callable

- Iccrea Banca SpA Istituto Centrale del Credito Cooperativo (Banking | Rome, Roma, Italy | Rating: BB-): €350m Note (XS2443527234), floating rate maturing on 20 September 2027, priced at 100.00 (original spread of 515 bp), callable (5nc4)

- Intek Group SpA (Metals/Mining | Milan, Milano, Netherlands | Rating: NR): €130m Bond (IT0005503393), fixed rate (5.00% coupon) maturing on 23 September 2027, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): €700m Bond (IT0005508707), floating rate (EU03MLIB + 415.0 bp) maturing on 14 October 2032, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €250m Inhaberschuldverschreibung (DE000A30VM45), fixed rate (1.61% coupon) maturing on 19 September 2024, priced at 100.00, non callable

- Knorr Bremse AG (Vehicle Parts | Muenchen, Germany | Rating: A): €700m Senior Note (XS2534891978), fixed rate (3.25% coupon) maturing on 21 September 2027, priced at 99.72 (original spread of 183 bp), callable (5nc5)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,500m Hypothekenpfandbrief Jumbo (Covered Bond) (XS2536375368), fixed rate (2.38% coupon) maturing on 21 September 2026, priced at 99.68 (original spread of 98 bp), non callable

- Lottomatica SpA (Gaming | Rome, Luxembourg | Rating: B): €350m Note (XS2536848877), fixed rate (9.75% coupon) maturing on 30 September 2027, priced at 100.00 (original spread of 811 bp), non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €400m Bond (IT0005507832), fixed rate (2.90% coupon) maturing on 28 September 2027, priced at 100.00, non callable

- Medtronic Global Holdings SCA (Health Care Supply | Luxembourg, Ireland | Rating: A-): €1,000m Senior Note (XS2535309798), fixed rate (3.38% coupon) maturing on 15 October 2034, priced at 99.76 (original spread of 168 bp), callable (12nc12)

- Medtronic Global Holdings SCA (Health Care Supply | Luxembourg, Ireland | Rating: A-): €500m Senior Note (XS2535307743), fixed rate (2.63% coupon) maturing on 15 October 2025, priced at 99.65 (original spread of 131 bp), callable (3nc3)

- Medtronic Global Holdings SCA (Health Care Supply | Luxembourg, Ireland | Rating: A-): €1,000m Senior Note (XS2535308477), fixed rate (3.00% coupon) maturing on 15 October 2028, priced at 99.89 (original spread of 143 bp), callable (6nc6)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €1,300m Senior Note (XS2530031546), fixed rate (3.27% coupon) maturing on 19 September 2025, priced at 100.00 (original spread of 211 bp), non callable

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000NLB3Z75), fixed rate (2.25% coupon) maturing on 20 September 2027, priced at 99.63 (original spread of 95 bp), non callable

- POP Asuntoluottopankki Oyj (Mortgage Banking | Espoo, Finland | Rating: NR): €250m Covered Bond (Other) (FI4000526876), fixed rate (2.63% coupon) maturing on 22 September 2025, priced at 99.96 (original spread of 132 bp), non callable

- RCI Banque SA (Financial - Other | Paris, Ile-De-France, France | Rating: BBB-): €650m Mortgage Bond (FR001400CRG6), fixed rate (4.88% coupon) maturing on 21 September 2028, priced at 99.64 (original spread of 338 bp), callable (6nc6)

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Note (XS2534786590), fixed rate (7.38% coupon) maturing on 20 December 2032, priced at 99.48 (original spread of 605 bp), callable (10nc5)

- SGL Carbon SE (Industrials - Other | Wiesbaden, Germany | Rating: B-): €102m Bond (DE000A30VKB5), fixed rate (5.75% coupon) maturing on 21 September 2027, priced at 100.00, non callable, convertible

- SKF AB (Machinery | Goeteborg, Vastra Gotalands, Sweden | Rating: BBB+): €400m Senior Note (XS2532247892), fixed rate (3.13% coupon) maturing on 14 September 2028, priced at 99.29 (original spread of 192 bp), callable (6nc6)

- Schleswig-Holstein, State of (Official and Muni | Kiel, Germany | Rating: AAA): €750m Jumbo Landesschatzanweisung (DE000SHFM857), fixed rate (2.38% coupon) maturing on 22 September 2032, priced at 99.82 (original spread of 66 bp), non callable

- Sparebank 1 SR Bank ASA (Banking | Stavanger, Rogaland, Norway | Rating: A+): €500m Note (XS2534276808), fixed rate (2.88% coupon) maturing on 20 September 2025, priced at 99.72 (original spread of 174 bp), non callable

- Sparebanken Vest Boligkreditt AS (Banking | Bergen, Hordaland, Norway | Rating: NR): €750m Covered Bond (Other) (XS2536376416), fixed rate (2.50% coupon) maturing on 22 September 2027, priced at 99.65 (original spread of 98 bp), callable (5nc5)

- Telia Company AB (Telecommunications | Solna, Stockholm, Sweden | Rating: BBB+): €600m Capital Security (XS2526881532), fixed rate (4.63% coupon) maturing on 21 December 2082, priced at 98.83 (original spread of 345 bp), callable (60nc5)

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (AT000B049929), fixed rate (2.38% coupon) maturing on 20 September 2027, priced at 99.59 (original spread of 107 bp), non callable

- Vier Gas Transport GmbH (Oil and Gas | Essen, Luxembourg | Rating: BBB+): €500m Senior Note (XS2535725159), fixed rate (4.63% coupon) maturing on 26 September 2032, priced at 99.61 (original spread of 295 bp), callable (10nc10)

- Vier Gas Transport GmbH (Oil and Gas | Essen, Luxembourg | Rating: BBB+): €500m Senior Note (XS2535724772), fixed rate (4.00% coupon) maturing on 26 September 2027, priced at 99.43 (original spread of 260 bp), callable (5nc5)

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: A-): €700m Senior Note (XS2534276717), fixed rate (2.63% coupon) maturing on 20 February 2026, priced at 99.68 (original spread of 151 bp), callable (3nc3)

- Western Power Distribution (East Midlands) PLC (Utility - Other | Bristol, Bristol, United Kingdom | Rating: BBB+): €500m Senior Note (XS2528341501), fixed rate (3.53% coupon) maturing on 20 September 2028, priced at 100.00 (original spread of 207 bp), callable (6nc6)

- Western Power Distribution (East Midlands) PLC (Utility - Other | Bristol, Bristol, United Kingdom | Rating: BBB+): €500m Senior Note (XS2528341766), fixed rate (3.95% coupon) maturing on 20 September 2032, priced at 100.00 (original spread of 231 bp), callable (10nc10)

- Wolters Kluwer NV (Publishing | Alphen Aan Den Rijn, Netherlands | Rating: BBB+): €500m Senior Note (XS2530756191), fixed rate (3.00% coupon) maturing on 23 September 2026, priced at 99.92 (original spread of 157 bp), callable (4nc4)

- Wuestenrot Bausparkasse AG (Banking | Ludwigsburg, Germany | Rating: A-): €250m Hypothekenpfandbrief (Covered Bond) (DE000WBP0BE2), floating rate (EU06MLIB + 0.0 bp) maturing on 20 March 2028, priced at 100.00, non callable

NEW ISSUES IN SECURITIZED CREDIT

- Radnor Re Ltd 2022-1 issued a floating-rate RMBS in 4 tranches, for a total of US$ 238 m. Highest-rated tranche offering a spread over the floating rate of 375bp, and the lowest-rated tranche a spread of 1,050bp. Bookrunners: Nomura Securities New York Inc, JP Morgan & Co Inc, Bank of America Merrill Lynch

- Bayfront Infrastructure Capital III Pte Ltd issued a floating-rate CLO in 4 tranches, for a total of US$ 371 m. Highest-rated tranche offering a spread over the floating rate of 150bp, and the lowest-rated tranche a spread of 460bp. Bookrunners: ING, Citigroup Global Markets Ltd, SMBC Nikko Securities Inc, Standard Chartered Bank, MUFG Securities Asia Ltd