Credit

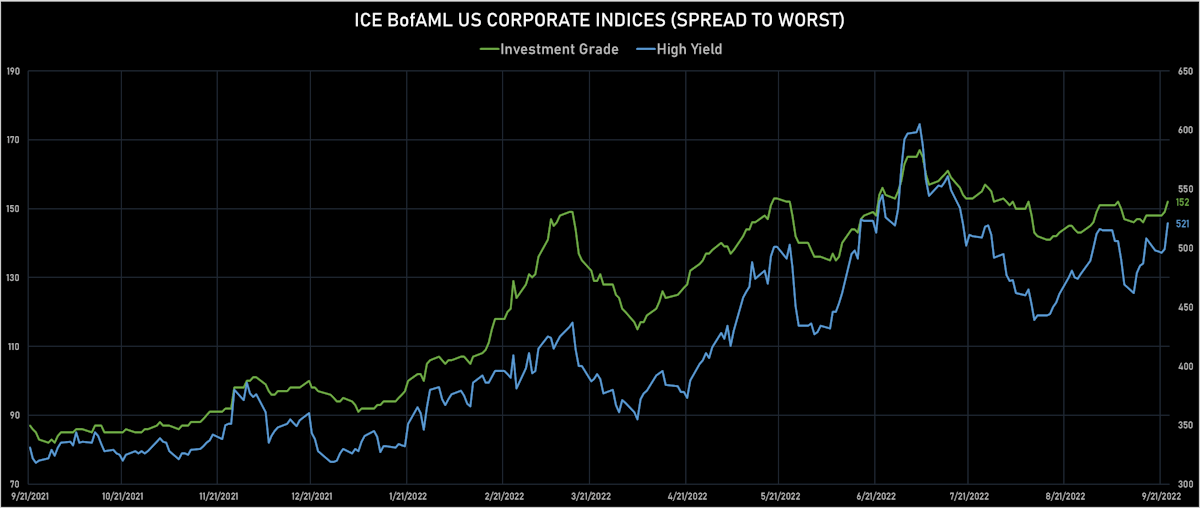

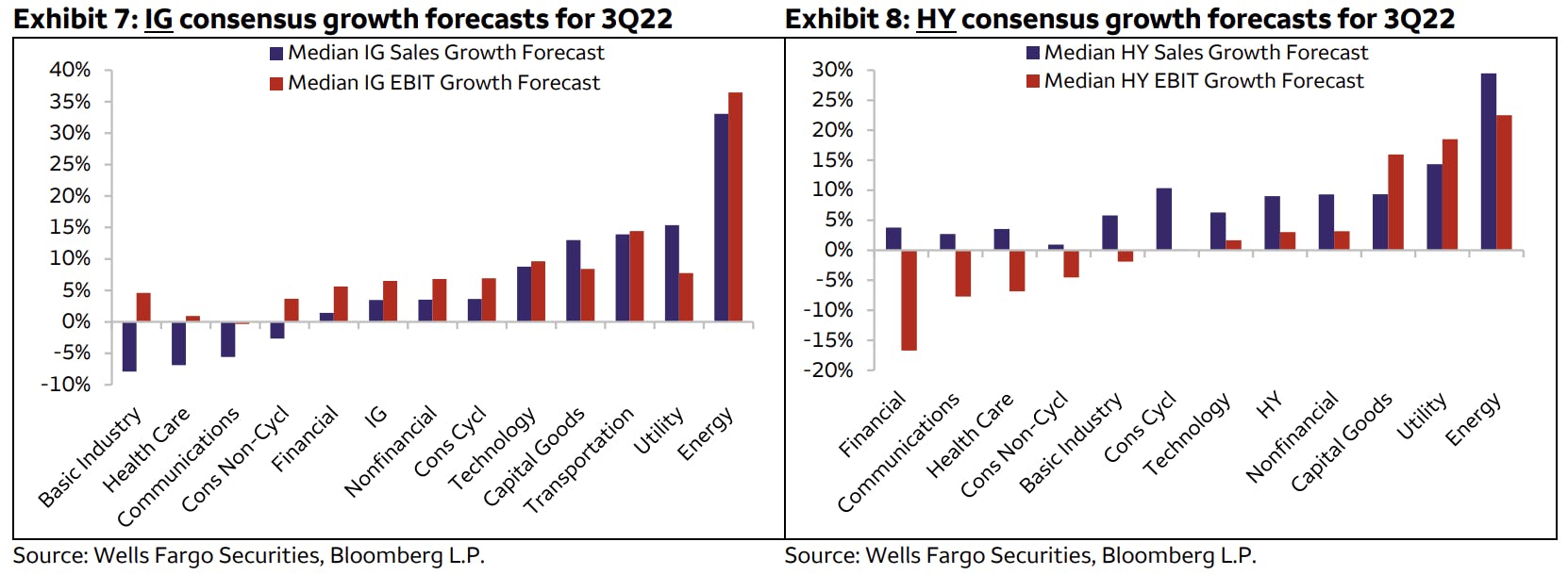

US IG Has Repriced More Violently Than HY And Currently Looks More Attractive On A Relative Basis

Very little volume of issuance for US$ corporate bonds this week (IFR Markets data): 8 tranches for $6.1bn in IG (2022 YTD volume $1.014tn vs 2021 YTD $1.163tn), 3 tranches for $6bn in HY (2022 YTD volume $86.376bn vs 2021 YTD $372.469bn)

Published ET

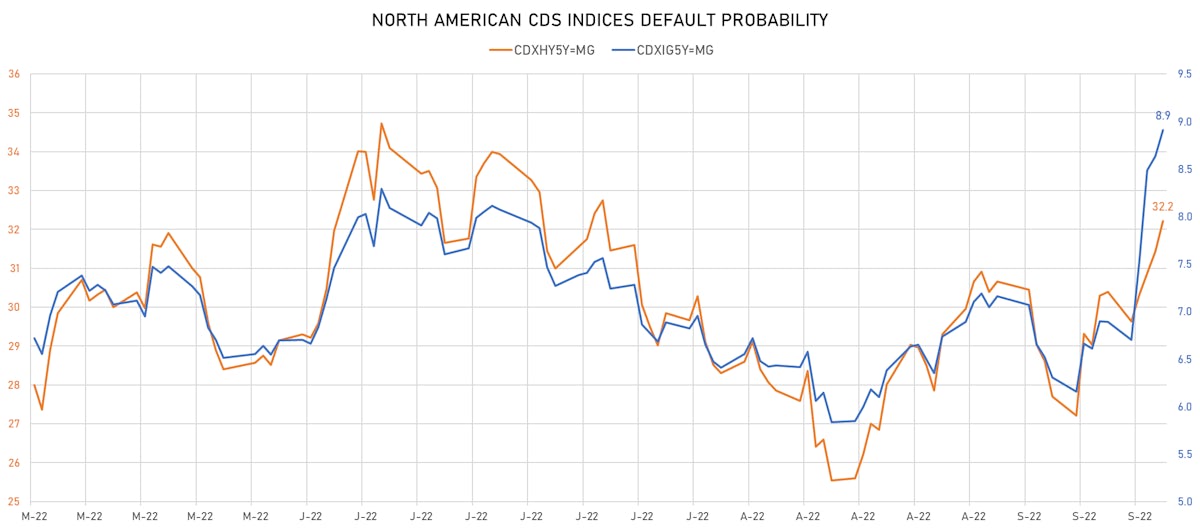

CDX NA IG & HY 5Y CDS Indices Implied Default Probability | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

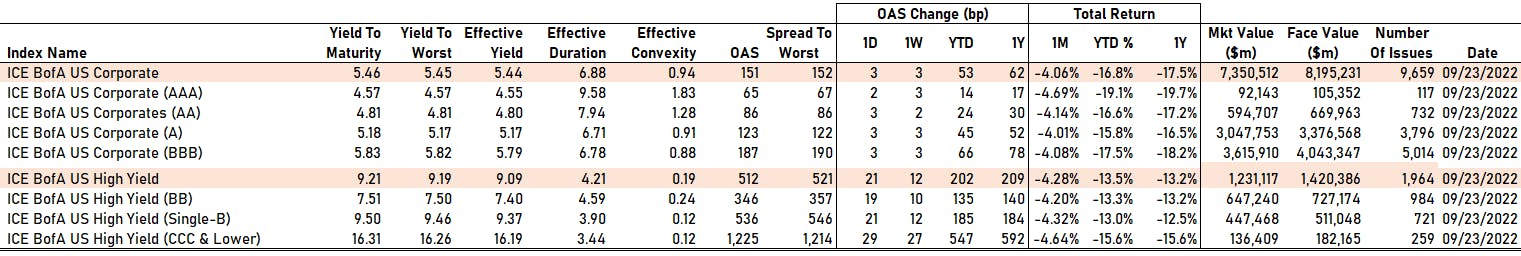

- S&P 500 Bond Index was down -0.12% today, with investment grade down -0.05% and high yield down -0.82% (YTD total return: -15.92%)

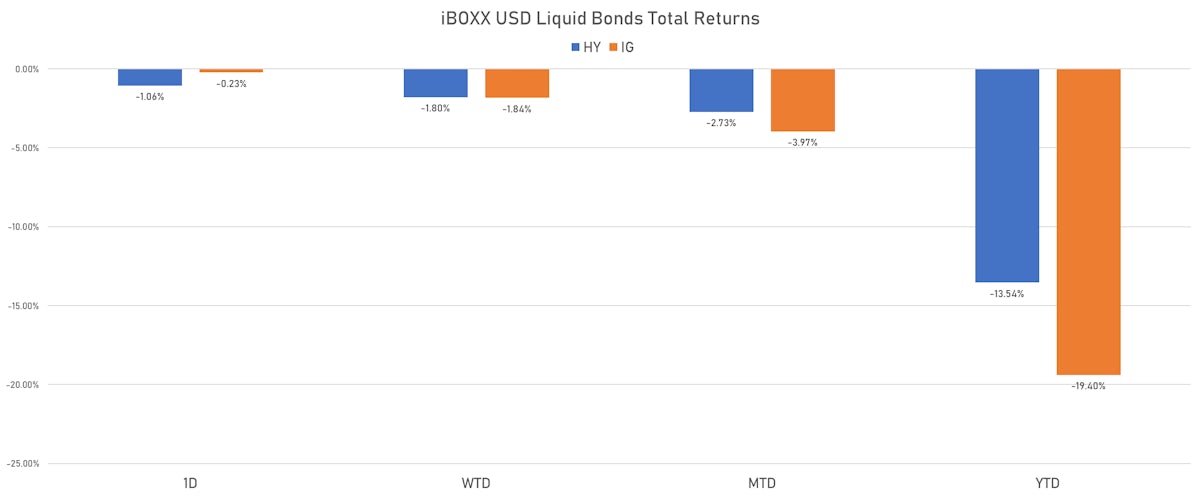

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.233% today (Week-to-date: -1.84%; Month-to-date: -3.97%; Year-to-date: -19.40%)

- The iBoxx USD Liquid High Yield Total Return Index was down -1.063% today (Week-to-date: -1.80%; Month-to-date: -2.73%; Year-to-date: -13.54%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 3.0 bp, now at 152.0 bp (YTD change: +57.0 bp)

- ICE BofA US High Yield Index spread to worst up 22.0 bp, now at 521.0 bp (YTD change: +191.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.59% today (YTD total return: -3.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 2 bp at 65 bp

- AA up by 3 bp at 86 bp

- A up by 3 bp at 123 bp

- BBB up by 3 bp at 187 bp

- BB up by 19 bp at 346 bp

- B up by 21 bp at 536 bp

- ≤ CCC up by 29 bp at 1,225 bp

CDS INDICES TODAY (mid-spreads)

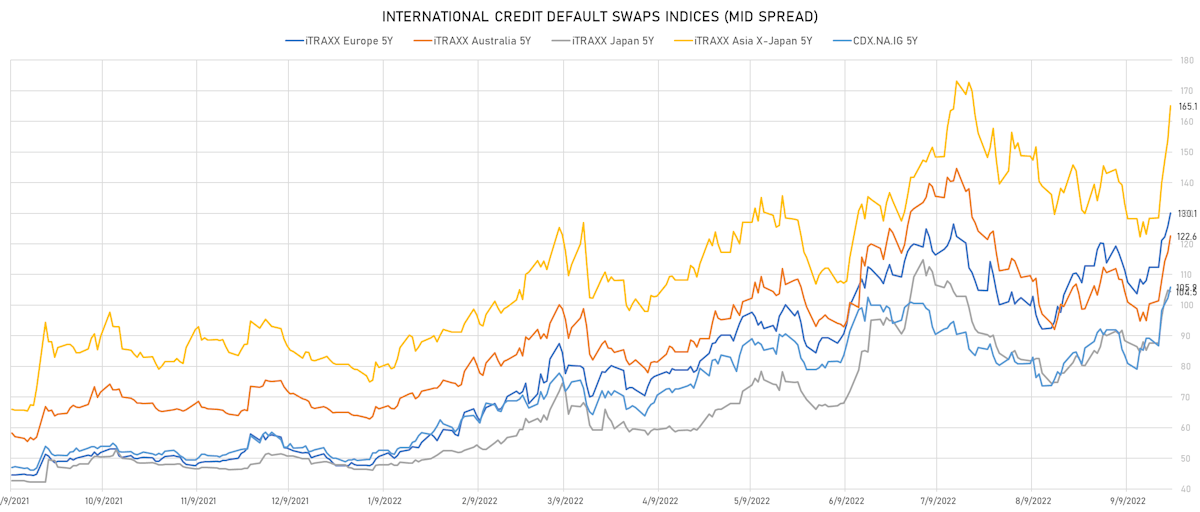

- Markit CDX.NA.IG 5Y up 3.5 bp, now at 106bp (1W change: +16.7bp; YTD change: +56.5bp)

- Markit CDX.NA.IG 10Y up 3.0 bp, now at 137bp (1W change: +12.6bp; YTD change: +47.7bp)

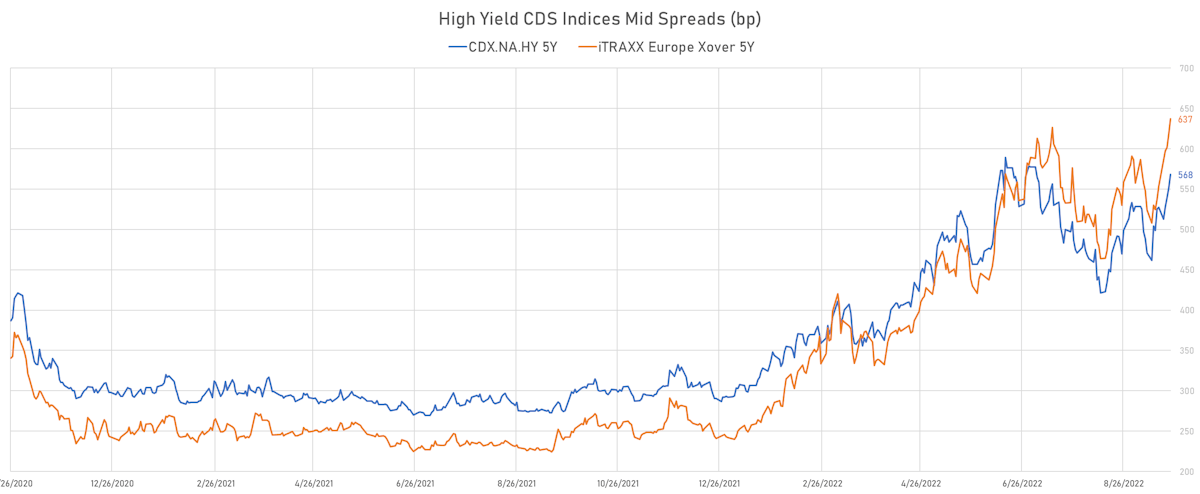

- Markit CDX.NA.HY 5Y up 17.1 bp, now at 568bp (1W change: +41.0bp; YTD change: +276.5bp)

- Markit iTRAXX Europe 5Y up 4.3 bp, now at 130bp (1W change: +17.7bp; YTD change: +82.4bp)

- Markit iTRAXX Europe Crossover 5Y up 18.6 bp, now at 637bp (1W change: +100.1bp; YTD change: +394.9bp)

- Markit iTRAXX Japan 5Y down 0.4 bp, now at 105bp (1W change: +17.0bp; YTD change: +58.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 11.1 bp, now at 165bp (1W change: +36.8bp; YTD change: +86.1bp)

Carnival & American Airlines 5Y USD CDS Spreads (Source: Refinitiv)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Tegna Inc (Country: US; rated: Ba3): up 171.4 bp to 874.4bp (1Y range: 182-874bp)

- Gap Inc (Country: US; rated: Ba2): up 180.5 bp to 790.4bp (1Y range: 136-819bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 182.1 bp to 1,401.1bp (1Y range: 304-1,689bp)

- Bombardier Inc (Country: CA; rated: CCC-): up 184.3 bp to 744.5bp (1Y range: 432-1,007bp)

- United Airlines Holdings Inc (Country: US; rated: CCC+): up 191.5 bp to 924.8bp (1Y range: 104-925bp)

- Beazer Homes USA Inc (Country: US; rated: A3): up 204.0 bp to 869.5bp (1Y range: 278-870bp)

- Kohls Corp (Country: US; rated: NR): up 207.3 bp to 703.2bp (1Y range: 112-703bp)

- Carnival Corp (Country: US; rated: Ba3): up 218.5 bp to 1,113.3bp (1Y range: 316-1,583bp)

- United States Steel Corp (Country: US; rated: BBB-): up 224.0 bp to 758.9bp (1Y range: 268-780bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): up 256.7 bp to 762.5bp (1Y range: 370-763bp)

- American Airlines Group Inc (Country: US; rated: B2): up 283.3 bp to 1,555.4bp (1Y range: 607-1,644bp)

- Transocean Inc (Country: KY; rated: Caa3): up 638.3 bp to 2,628.1bp (1Y range: 1,019-2,858bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 772.1 bp to 2,026.9bp (1Y range: 373-2,027bp)

- Rite Aid Corp (Country: US; rated: C): up 866.3 bp to 2,900.0bp (1Y range: 714-3,892bp)

- Community Health Systems Inc (Country: US; rated: B): up 4049.3 bp to 7,630.3bp (1Y range: 547-7,630bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Fortum Oyj (Country: FI; rated: WR): down 127.9 bp to 161.8bp (1Y range: 40-326bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 75.3 bp to 1,184.9bp (1Y range: 213-1,197bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 82.3 bp to 559.3bp (1Y range: 222-585bp)

- Air France KLM SA (Country: FR; rated: C): up 85.3 bp to 850.4bp (1Y range: 386-990bp)

- Telecom Italia SpA (Country: IT; rated: B1): up 90.8 bp to 556.0bp (1Y range: 154-556bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 94.7 bp to 461.5bp (1Y range: 164-486bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 99.3 bp to 548.4bp (1Y range: 107-548bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 105.1 bp to 826.7bp (1Y range: 167-827bp)

- Stena AB (Country: SE; rated: B2-PD): up 140.1 bp to 655.0bp (1Y range: 401-865bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 160.3 bp to 946.9bp (1Y range: 333-947bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 184.2 bp to 2,381.3bp (1Y range: 1,017-2,690bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 211.8 bp to 1,535.8bp (1Y range: 490-1,536bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 230.2 bp to 1,200.8bp (1Y range: 359-1,296bp)

- Novafives SAS (Country: FR; rated: Caa1): up 262.5 bp to 1,901.8bp (1Y range: 618-1,903bp)

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): up 474.0 bp to 3,419.8bp (1Y range: 464-3,420bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 84.6 bp to 468.7 bp, with the yield to worst at 8.8% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 84.3 bp to 462.7 bp, with the yield to worst at 8.5% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 90.5-107.1).

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: USL6S52VAA02 | Z-spread up by 58.1 bp to 523.7 bp, with the yield to worst at 9.0% and the bond now trading down to 84.5 cents on the dollar (1Y price range: 84.3-99.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 47.3 bp to 798.0 bp (CDS basis: 432.7bp), with the yield to worst at 12.0% and the bond now trading down to 82.8 cents on the dollar (1Y price range: 82.8-95.6).

- Issuer: Ashland LLC (Covington, Kentucky (US)) | Coupon: 3.38% | Maturity: 1/9/2031 | Rating: BB+ | ISIN: USU0442LAA45 | Z-spread up by 42.7 bp to 288.5 bp (CDS basis: -51.4bp), with the yield to worst at 6.5% and the bond now trading down to 78.0 cents on the dollar (1Y price range: 78.0-99.3).

- Issuer: Station Casinos LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 1/12/2031 | Rating: B- | ISIN: USU85731AE46 | Z-spread up by 42.3 bp to 438.6 bp, with the yield to worst at 8.0% and the bond now trading down to 77.3 cents on the dollar (1Y price range: 76.8-100.4).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread up by 35.0 bp to 314.3 bp, with the yield to worst at 7.0% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 90.0-106.3).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 31.3 bp to 851.5 bp, with the yield to worst at 12.4% and the bond now trading down to 81.0 cents on the dollar (1Y price range: 76.5-100.0).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 31.2 bp to 421.0 bp, with the yield to worst at 8.1% and the bond now trading down to 88.3 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 1/8/2030 | Rating: BB- | ISIN: USU8760NAF60 | Z-spread down by 31.1 bp to 497.0 bp, with the yield to worst at 8.7% and the bond now trading up to 79.3 cents on the dollar (1Y price range: 79.0-109.9).

- Issuer: Twitter Inc (San Francisco, California (US)) | Coupon: 5.00% | Maturity: 1/3/2030 | Rating: BB | ISIN: USU8882PAB32 | Z-spread down by 31.4 bp to 193.3 bp, with the yield to worst at 5.7% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 91.5-103.3).

- Issuer: AAG FH LP (Canada) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 35.2 bp to 562.1 bp, with the yield to worst at 9.7% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 93.0-113.6).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread down by 41.6 bp to 359.0 bp, with the yield to worst at 7.5% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 92.0-111.9).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 42.5 bp to 179.9 bp, with the yield to worst at 6.5% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Starwood Property Trust Inc (Greenwich, CT (US)) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread down by 92.9 bp to 186.3 bp, with the yield to worst at 6.2% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 90.0-101.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread up by 177.9 bp to 1,097.6 bp (CDS basis: -9.0bp), with the yield to worst at 13.4% and the bond now trading down to 79.8 cents on the dollar (1Y price range: 79.8-113.4).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread up by 143.3 bp to 990.2 bp (CDS basis: 52.3bp), with the yield to worst at 12.3% and the bond now trading down to 79.2 cents on the dollar (1Y price range: 79.2-104.5).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 97.7 bp to 771.7 bp, with the yield to worst at 10.4% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 87.7-109.5).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 95.9 bp to 680.1 bp, with the yield to worst at 9.3% and the bond now trading down to 79.4 cents on the dollar (1Y price range: 79.4-104.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | Z-spread up by 66.8 bp to 741.9 bp, with the yield to worst at 10.1% and the bond now trading down to 80.5 cents on the dollar (1Y price range: 80.5-100.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Z-spread up by 46.6 bp to 320.8 bp (CDS basis: -42.8bp), with the yield to worst at 5.9% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 88.3-100.9).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 4.25% | Maturity: 31/5/2028 | Rating: BB+ | ISIN: XS2486825669 | Z-spread up by 45.4 bp to 372.4 bp, with the yield to worst at 6.3% and the bond now trading down to 89.3 cents on the dollar (1Y price range: 89.0-100.6).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB | ISIN: XS1558491855 | Z-spread up by 43.1 bp to 276.0 bp (CDS basis: -40.2bp), with the yield to worst at 5.1% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 90.4-101.6).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread up by 41.0 bp to 450.1 bp (CDS basis: -61.3bp), with the yield to worst at 7.2% and the bond now trading down to 74.6 cents on the dollar (1Y price range: 72.7-93.7).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread up by 40.6 bp to 415.8 bp (CDS basis: -95.6bp), with the yield to worst at 6.8% and the bond now trading down to 85.5 cents on the dollar (1Y price range: 85.0-101.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.25% | Maturity: 24/6/2025 | Rating: BB | ISIN: FR0013428414 | Z-spread up by 39.7 bp to 341.1 bp (CDS basis: -74.0bp), with the yield to worst at 6.1% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 86.3-98.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.25% | Maturity: 15/9/2025 | Rating: BB | ISIN: XS2229875989 | Z-spread up by 39.1 bp to 324.2 bp (CDS basis: -34.9bp), with the yield to worst at 5.9% and the bond now trading down to 92.4 cents on the dollar (1Y price range: 91.0-107.6).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | Z-spread up by 37.9 bp to 466.6 bp (CDS basis: -128.0bp), with the yield to worst at 7.4% and the bond now trading down to 81.5 cents on the dollar (1Y price range: 80.2-99.2).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread down by 40.7 bp to 605.9 bp (CDS basis: 235.8bp), with the yield to worst at 8.2% and the bond now trading up to 86.0 cents on the dollar (1Y price range: 83.8-100.0).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread down by 60.1 bp to 468.3 bp, with the yield to worst at 6.8% and the bond now trading up to 89.2 cents on the dollar (1Y price range: 84.1-99.2).

RECENT DOMESTIC USD BOND ISSUES

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: BBB-): US$600m Senior Note (USU0926HAQ30), fixed rate (7.05% coupon) maturing on 29 September 2025, priced at 99.26 (original spread of 320 bp), with a make whole call

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$2,750m Senior Note (US172967NX53), floating rate maturing on 29 September 2026, priced at 100.00 (original spread of 144 bp), callable (4nc3)

- Digital Realty Trust LP (Real Estate Investment Trust | Austin, United States | Rating: BBB): US$550m Senior Note (US25389JAV89), fixed rate (5.55% coupon) maturing on 15 January 2028, priced at 99.92 (original spread of 165 bp), callable (5nc5)

- EQT Corp (Oil and Gas | Pittsburgh, United States | Rating: BB+): US$500m Senior Note (US26884LAQ23), fixed rate (5.70% coupon) maturing on 1 April 2028, priced at 99.63 (original spread of 205 bp), callable (5nc5)

- EQT Corp (Oil and Gas | Pittsburgh, United States | Rating: BB+): US$500m Senior Note (US26884LAP40), fixed rate (5.68% coupon) maturing on 1 October 2025, priced at 100.00 (original spread of 175 bp), callable (3nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$310m Bond (US3133ENN892), fixed rate (4.87% coupon) maturing on 28 September 2026, priced at 100.00 (original spread of 107 bp), callable (4nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$575m Bond (US3133ENP954), fixed rate (4.25% coupon) maturing on 30 September 2025, priced at 100.00 (original spread of 6 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$165m Bond (US3133ENQ291), fixed rate (4.00% coupon) maturing on 29 September 2027, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$105m Bond (US3133ENQ457), fixed rate (4.25% coupon) maturing on 30 September 2030, priced at 100.00 (original spread of 39 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$1,000m Bond (US3133ENP798), fixed rate (4.25% coupon) maturing on 26 September 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$400m Bond (US3133ENP384), floating rate (PRQ + -306.0 bp) maturing on 26 September 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133ENP616), fixed rate (3.96% coupon) maturing on 2 September 2025, priced at 100.00 (original spread of 10 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$190m Bond (US3130ATFY80), fixed rate (5.00% coupon) maturing on 20 October 2025, priced at 100.00 (original spread of 93 bp), callable (3nc3m)

- Ohio Edison Co (Utility - Other | Akron, United States | Rating: BBB): US$300m Senior Note (USU67734AD26), fixed rate (5.50% coupon) maturing on 15 January 2033, priced at 99.79 (original spread of 185 bp), callable (10nc10)

- Royal Caribbean Cruises Ltd (Leisure | Miami, United States | Rating: B-): US$1,000m Senior Note (US780153BR26), fixed rate (9.25% coupon) maturing on 15 January 2029, priced at 100.00 (original spread of 538 bp), callable (6nc2)

- Royal Caribbean Cruises Ltd (Leisure | Miami, United States | Rating: BB-): US$1,000m Note (US780153BS09), fixed rate (8.25% coupon) maturing on 15 January 2029, priced at 100.00 (original spread of 438 bp), callable (6nc2)

- TIBCO Software Inc (Information/Data Technology | Palo Alto, United States | Rating: B): US$4,000m Note (US88632QAE35), fixed rate (6.50% coupon) maturing on 31 March 2029, priced at 98.25 (original spread of 625 bp), callable (7nc3)

- UMB Financial Corp (Banking | Kansas City, United States | Rating: BBB+): US$110m Subordinated Note (US902788AB44), fixed rate (6.25% coupon) maturing on 28 September 2032, priced at 100.00 (original spread of 255 bp), callable (10nc5)

- WEC Energy Group Inc (Utility - Other | Milwaukee, United States | Rating: BBB+): US$500m Senior Note (US92939UAH95), fixed rate (5.00% coupon) maturing on 27 September 2025, priced at 99.93 (original spread of 90 bp), callable (3nc3)

- WEC Energy Group Inc (Utility - Other | Milwaukee, United States | Rating: BBB+): US$400m Senior Note (US92939UAJ51), fixed rate (5.15% coupon) maturing on 1 October 2027, priced at 99.79 (original spread of 129 bp), callable (5nc5)

- Wells Fargo Bank NA (Banking | Sioux Falls, United States | Rating: A+): US$101m Certificate of Deposit - Retail (US949763Z829), fixed rate (3.75% coupon) maturing on 23 September 2024, priced at 100.00 (original spread of -33 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$2,750m Senior Note (US045167FS72), fixed rate (4.13% coupon) maturing on 27 September 2024, priced at 99.96 (original spread of 20 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$1,250m Senior Note (US045167FT55), fixed rate (3.88% coupon) maturing on 28 September 2032, priced at 99.91 (original spread of 32 bp), non callable

- BMO Harris Bank NA (Banking | Chicago, Canada | Rating: BBB+): US$125m Certificate of Deposit - Retail (US05600XJH44), fixed rate (4.05% coupon) maturing on 23 September 2024, priced at 100.00 (original spread of -33 bp), non callable

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, France | Rating: A+): US$400m Unsecured Note (XS2396286309) zero coupon maturing on 26 September 2025, priced at 100.00, non callable

- Clifford Capital Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2539344684), fixed rate (4.14% coupon) maturing on 28 September 2027, non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Venezuela | Rating: A+): US$200m Unsecured Note (XS2536383545), fixed rate (3.50% coupon) maturing on 30 September 2042, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459907886), fixed rate (4.00% coupon) maturing on 17 October 2024, priced at 100.00, non callable

- Eurasian Development Bank (Supranational | Almaty, Almatinskaya Oblast, Russia | Rating: BBB-): US$700m Bond (RU000A1057B8), fixed rate (3.75% coupon) maturing on 14 September 2026, priced at 100.00, non callable

- Export-Import Bank of Korea (Agency | Seoul, South Korea | Rating: AA-): US$500m Unsecured Note (XS2538344636), floating rate maturing on 29 September 2027, priced at 100.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Russia | Rating: NR): US$304m Bond (RU000A1056U0), fixed rate (4.95% coupon) maturing on 23 March 2027, priced at 100.00, non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Japan | Rating: A+): US$500m Unsecured Note (XS2534906164) maturing on 28 September 2027, priced at 100.00, non callable

- Jiangsu Zhongguancun Holding Group International Co Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$200m Bond (XS2533580846), fixed rate (6.20% coupon) maturing on 27 September 2025, priced at 100.00, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Germany | Rating: AAA): US$1,250m Senior Note (US515110CC65), fixed rate (3.88% coupon) maturing on 28 September 2027, priced at 99.73 (original spread of 38 bp), non callable

- Licheng International Development Co Ltd (Financial - Other | Jinan, China (Mainland) | Rating: NR): US$110m Bond (XS2519098656), fixed rate (6.30% coupon) maturing on 26 September 2025, priced at 100.00, non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$115m Unsecured Note (XS2536922276), fixed rate (5.41% coupon) maturing on 27 September 2032, priced at 100.00, non callable

- Oriental Capital Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$230m Bond (XS2529909926), fixed rate (7.00% coupon) maturing on 28 September 2025, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Senningerberg, Netherlands | Rating: NR): US$197m Unsecured Note (XS2535337906) zero coupon maturing on 20 June 2052, priced at 32.99, non callable

RECENT EURO BOND ISSUES

- Action Logement Services SAS (Service - Other | Paris, France | Rating: AA): €750m Senior Note (FR001400CWI2), fixed rate (3.13% coupon) maturing on 28 September 2037, priced at 99.14 (original spread of 53 bp), non callable

- Ai Tiramisu SpA (Financial - Other | Italy | Rating: NR): €650m Bond (IT0005508970), floating rate (EU06MLIB + 725.0 bp) maturing on 27 September 2029, priced at 100.00, non callable

- Amco Asset Management Company SpA (Financial - Other | Milan, Italy | Rating: BBB): €500m Senior Note (XS2502220929), fixed rate (4.38% coupon) maturing on 27 March 2026, priced at 99.90 (original spread of 278 bp), callable (3nc3)

- ArcelorMittal SA (Metals/Mining | Luxembourg, Luxembourg | Rating: BBB-): €600m Senior Note (XS2537060746), fixed rate (4.88% coupon) maturing on 26 September 2026, priced at 99.65 (original spread of 336 bp), callable (4nc4)

- Austria, Republic of (Government) (Sovereign | Wien, Austria | Rating: AA+): €3,500m Bundesanleihe (AT0000A308C5), fixed rate (2.00% coupon) maturing on 15 July 2026, priced at 99.62 (original spread of 46 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: A): €1,500m Note (XS2538366878), fixed rate (3.63% coupon) maturing on 27 September 2026, priced at 99.66 (original spread of 212 bp), callable (4nc3)

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9SG1), floating rate (EU06MLIB + 6.0 bp) maturing on 26 September 2030, priced at 100.00, non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9SH9), floating rate (EU03MLIB + 7.0 bp) maturing on 26 May 2028, priced at 100.00, non callable

- Caisse Amortissement de la Dette Sociale (Agency | Paris, France | Rating: AA): €5,000m Bond (FR001400CVE3), fixed rate (2.75% coupon) maturing on 25 November 2032, priced at 99.27 (original spread of 93 bp), non callable

- Caisse Centrale Credit Immobilier France SA (Financial - Other | Paris, France | Rating: AA): €500m Senior Note (XS2538764684), fixed rate (2.50% coupon) maturing on 29 September 2027, priced at 99.53 (original spread of 80 bp), non callable

- Cassa Centrale Banca Credito Cooperativo Italiano SpA (Banking | Trento, Italy | Rating: BBB-): €200m Note (XS2538365714), floating rate maturing on 26 September 2026, priced at 100.00 (original spread of 456 bp), callable (4nc3)

- Cooperatieve Rabobank UA (Banking | Utrecht, Utrecht, Netherlands | Rating: A+): €144m Unsecured Note (XS2534920231), fixed rate (1.00% coupon) maturing on 19 January 2034, priced at 100.00 (original spread of 209 bp), non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €1,000m Bond (FR001400CUU1), fixed rate (3.39% coupon) maturing on 23 March 2029, priced at 100.00 (original spread of 180 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €150m Inhaberschuldverschreibung (DE000DW6CYR5), fixed rate (2.40% coupon) maturing on 18 October 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8E8), fixed rate (2.25% coupon) maturing on 13 October 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8F5), floating rate maturing on 13 October 2027, priced at 100.00, non callable

- Emissionskonsortium der gemeinsamen Landesfoerderinstitute bestehend aus (Financial - Other | Rating: NR): €500m Inhaberschuldverschreibung (DE000A30VPZ3), fixed rate (2.50% coupon) maturing on 28 September 2029, priced at 99.02 (original spread of 86 bp), non callable

- Engie SA (Oil and Gas | Paris, France | Rating: BBB+): €650m Bond (FR001400A1H6), fixed rate (3.50% coupon) maturing on 27 September 2029, priced at 99.02 (original spread of 187 bp), callable (7nc7)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A30EL1), fixed rate (3.15% coupon) maturing on 27 September 2027, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A30772), fixed rate (3.15% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 137 bp), non callable

- Instituto de Credito Oficial (Agency | Madrid, Spain | Rating: A-): €500m Senior Note (XS2538778478), fixed rate (2.65% coupon) maturing on 31 January 2028, priced at 99.91 (original spread of 88 bp), non callable

- KBC Bank NV (Banking | Brussels, Belgium | Rating: AAA): €2,500m Bond (BE0002882638), fixed rate (2.38% coupon) maturing on 21 September 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA-): €1,000m Oeffentlicher Pfandbrief Jumbo (Covered Bond) (DE000LB38077), fixed rate (2.38% coupon) maturing on 26 February 2027, priced at 99.61 (original spread of 91 bp), non callable

- Nykredit Realkredit A/S (Mortgage Banking | Kobenhavn V, Denmark | Rating: A): €500m Bond (DK0030507694), fixed rate (5.50% coupon) maturing on 29 December 2032, priced at 99.51 (original spread of 378 bp), callable (10nc5)

- Oma Saastopankki Oyj (Banking | Lappeenranta, Etela-Suomen, Finland | Rating: BBB+): €150m Bond (FI4000530977), fixed rate (5.00% coupon) maturing on 26 September 2024 (original spread of 400 bp), non callable

- Paris, City of (Official and Muni | Paris, France | Rating: AA-): €300m Bond (FR001400CVK0), fixed rate (3.00% coupon) maturing on 27 September 2042, priced at 98.34 (original spread of 121 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Austria | Rating: A-): €500m Covered Bond (Other) (XS2537097409), fixed rate (2.88% coupon) maturing on 28 September 2026, priced at 99.91 (original spread of 131 bp), non callable

- Raiffeisenbank Austria dd (Banking | Zagreb, Austria | Rating: NR): €200m Unsecured Note (XS2538444428), fixed rate (1.00% coupon) maturing on 30 September 2026, priced at 100.00, non callable

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): €750m Senior Note (XS2538441598), fixed rate (6.63% coupon) maturing on 27 September 2029, priced at 99.60 (original spread of 499 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): €600m Senior Note (XS2538440780), fixed rate (5.00% coupon) maturing on 27 September 2026, priced at 99.64 (original spread of 358 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): €120m Unsecured Note (XS2536374478), fixed rate (2.76% coupon) maturing on 22 September 2042, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: AAA): €120m Unsecured Note (XS2535724699), fixed rate (2.76% coupon) maturing on 22 September 2042, priced at 100.00, non callable

- Sandvik AB (Metals/Mining | Stockholm, Sweden | Rating: A-): €500m Senior Note (XS2538368221), fixed rate (3.75% coupon) maturing on 27 September 2029, priced at 99.10 (original spread of 222 bp), callable (7nc7)

- Spain, Kingdom of (Government) (Sovereign | Madrid, Spain | Rating: BBB+): €5,000m Bono del Estado (ES0000012K95), fixed rate (3.45% coupon) maturing on 30 July 2043, priced at 99.29 (original spread of 153 bp), non callable

- Stadshypotek AB (Mortgage Banking | Stockholm, Sweden | Rating: AAA): €1,000m Sakerstallda Obligation (Covered Bond) (XS2536938439), fixed rate (2.63% coupon) maturing on 27 September 2029, priced at 99.21 (original spread of 106 bp), non callable

- Sydbank A/S (Banking | Aabenraa, Denmark | Rating: NR): €500m Unsecured Note (XS2538445581), floating rate maturing on 28 September 2025, priced at 100.00, non callable

- UniCredit Bank AG (Banking | Muenchen, Italy | Rating: BBB+): €500m Pfandbrief Anleihe (Covered Bond) (DE000HV2AY12), fixed rate (2.63% coupon) maturing on 27 April 2028, priced at 99.94 (original spread of 93 bp), non callable

- Wolters Kluwer NV (Publishing | Alphen Aan Den Rijn, Zuid-Holland, Netherlands | Rating: BBB+): €500m Senior Note (XS2530756191), fixed rate (3.00% coupon) maturing on 23 September 2026, priced at 99.92 (original spread of 157 bp), callable (4nc4)

RECENT USD LOANS

- Gunvor Group Ltd, signed a US$ 1,000m 364d Revolver, to be used for general corporate purposes. It matures on 10/11/23 and initial pricing is set at Term SOFR +95.0bp

- Gunvor Group Ltd, signed a US$ 225m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/12/25 and initial pricing is set at Term SOFR +165.0bp

- Encompass Health Corp (BB-), signed a US$ 1,000m Revolving Credit Facility, to be used for refinancing. It matures on 09/30/27 and initial pricing is set at Term SOFR +150.0bp

- BNY Mellon Funds, signed a US$ 689m 364d Revolver maturing on 09/27/23, to be used for general corporate purposes.

RECENT ISSUES IN USD STRUCTURED CREDIT

- Lendingpoint 2022-C Asset Securitization Trust issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 293 m. Highest-rated tranche offering a yield to maturity of 6.56%, and the lowest-rated tranche a yield to maturity of 11.24%. Bookrunners: Credit Suisse, JP Morgan & Co Inc

- CFMT 2022-Hb9 LLC issued a fixed-rate RMBS in 4 tranches, for a total of US$ 280 m. Bookrunners: Credit Suisse, Nomura Securities New York Inc, Barclays Capital Group, Performance Trust Capital