Credit

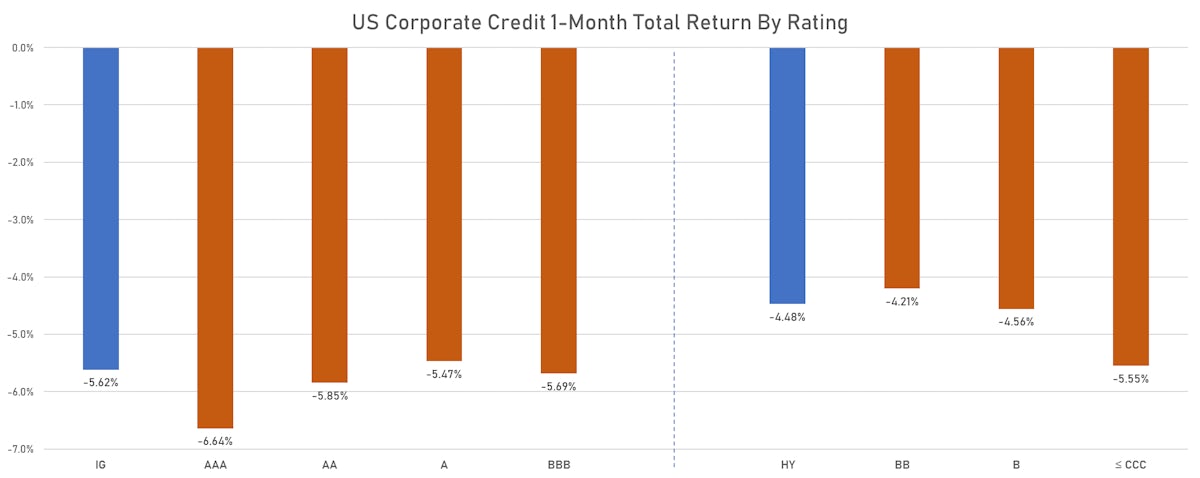

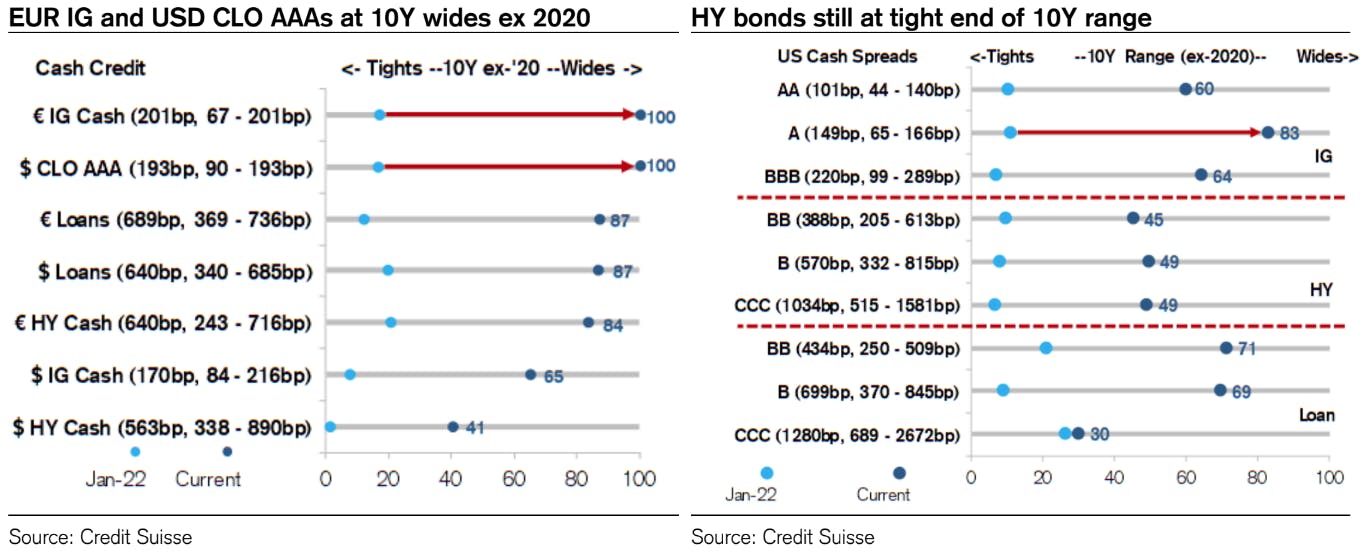

Tough Month Across The US$ Credit Complex, But HY Spreads Still Have A Lot Of Room To Widen Into A Recession

Rates volatility almost completely shut down the US corporate bond primary market this week: only 6 tranches for $2.5bn in IG (2022 YTD volume $1.016tn vs 2021 YTD $1.190tn) and no new issue in HY

Published ET

ICE BofAML US Corporate Credit Total Returns | Sources: ϕpost, FactSet data

DAILY SUMMARY

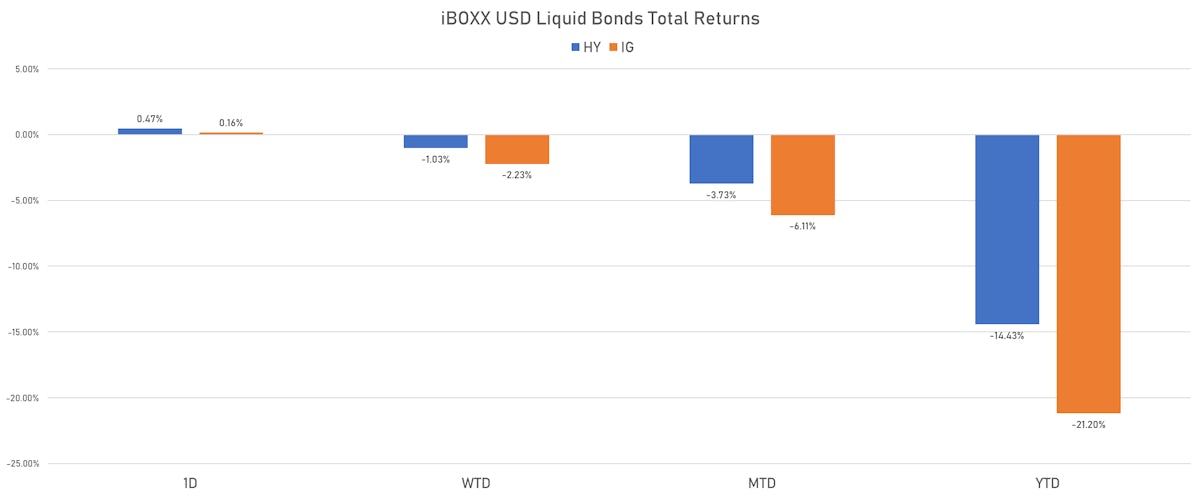

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.158% today (Week-to-date: -2.23%; Month-to-date: -6.11%; Year-to-date: -21.20%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.472% today (Week-to-date: -1.03%; Month-to-date: -3.73%; Year-to-date: -14.43%)

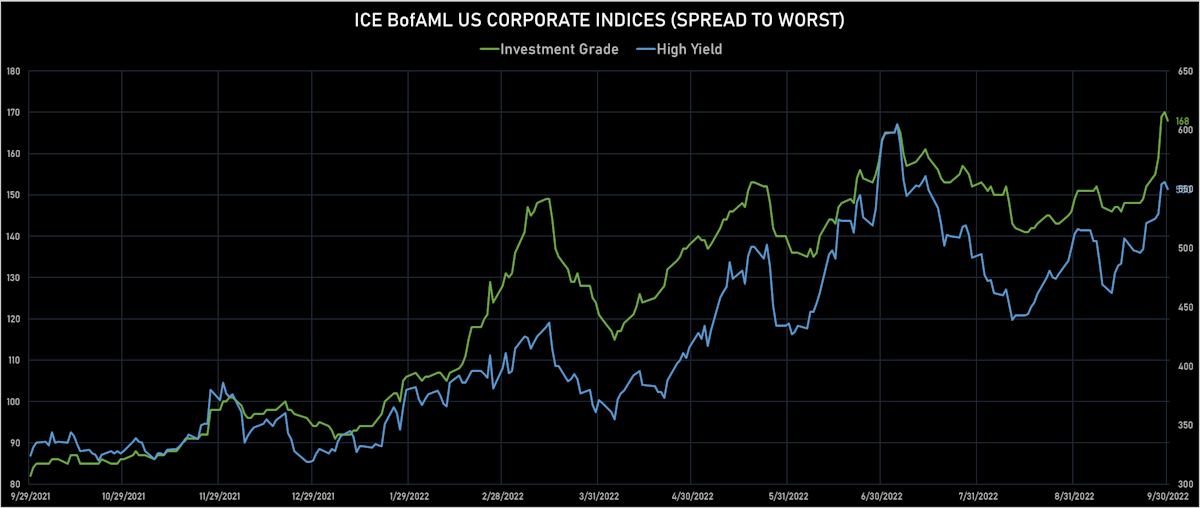

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 168.0 bp (YTD change: +73.0 bp)

- ICE BofA US High Yield Index spread to worst down -6.0 bp, now at 550.0 bp (YTD change: +220.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: -4.3%)

10Y Range of Spreads (excluding 2020), with Current Percentile | Source: Credit Suisse

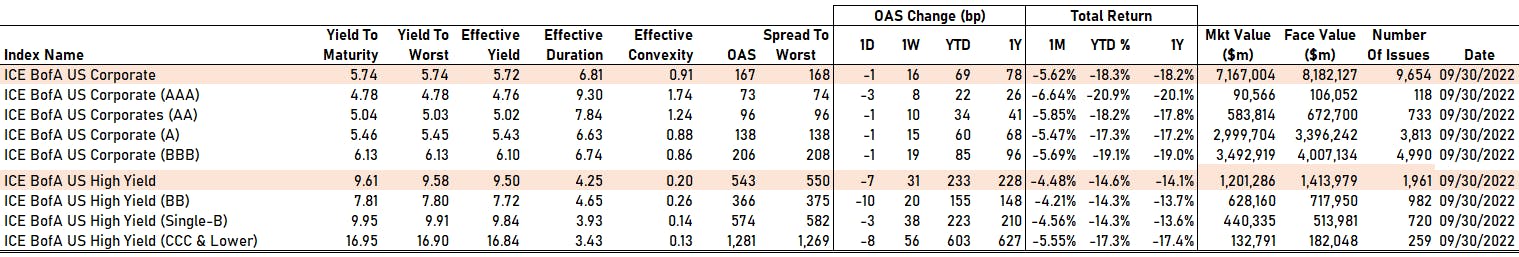

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -3 bp at 73 bp

- AA down by -1 bp at 96 bp

- A down by -1 bp at 138 bp

- BBB down by -1 bp at 206 bp

- BB down by -10 bp at 366 bp

- B down by -3 bp at 574 bp

- ≤ CCC down by -8 bp at 1,281 bp

ICE BofAML US Corporate Credit Spreads By Rating | Sources: phipost.com, FactSet data

CDS INDICES TODAY (mid-spreads)

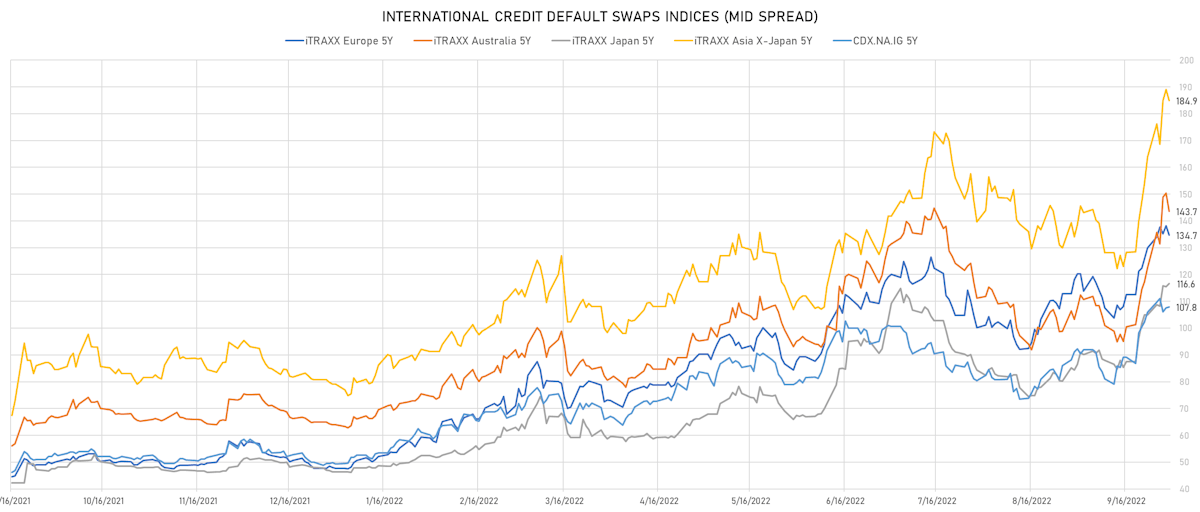

- Markit CDX.NA.IG 5Y up 0.3 bp, now at 108bp (1W change: +2.0bp; YTD change: +58.5bp)

- Markit CDX.NA.IG 10Y up 0.2 bp, now at 138bp (1W change: +1.0bp; YTD change: +48.6bp)

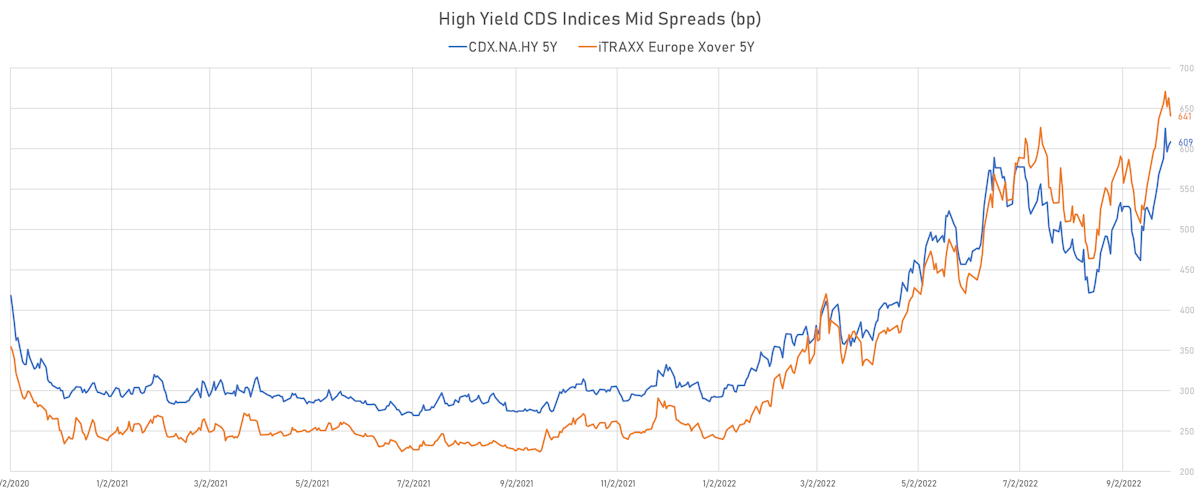

- Markit CDX.NA.HY 5Y up 4.6 bp, now at 609bp (1W change: +40.3bp; YTD change: +316.8bp)

- Markit iTRAXX Europe 5Y down 3.6 bp, now at 135bp (1W change: +4.6bp; YTD change: +87.0bp)

- Markit iTRAXX Europe Crossover 5Y down 21.8 bp, now at 641bp (1W change: +4.1bp; YTD change: +399.0bp)

- Markit iTRAXX Japan 5Y up 1.1 bp, now at 117bp (1W change: +11.6bp; YTD change: +70.2bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 4.1 bp, now at 185bp (1W change: +21.0bp; YTD change: +105.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Macy's Inc (Country: US; rated: A1): down 59.9 bp to 580.3bp (1Y range: 181-619bp)

- Ryder System Inc (Country: US; rated: BB+): up 63.8 bp to 246.8bp (1Y range: 67-247bp)

- Tegna Inc (Country: US; rated: Ba3): up 66.5 bp to 908.0bp (1Y range: 182-908bp)

- DISH DBS Corp (Country: US; rated: B2): up 71.3 bp to 1,534.2bp (1Y range: 358-1,534bp)

- Xerox Corp (Country: US; rated: WR): up 80.1 bp to 559.9bp (1Y range: 203-560bp)

- Liberty Interactive LLC (Country: US; rated: BB-): up 89.9 bp to 1,491.0bp (1Y range: 377-1,689bp)

- Nabors Industries Inc (Country: US; rated: B3): up 130.8 bp to 903.4bp (1Y range: 489-903bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 157.4 bp to 1,511.8bp (1Y range: 616-1,512bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): up 174.5 bp to 1,100.9bp (1Y range: 299-1,584bp)

- Staples Inc (Country: US; rated: B3): up 185.9 bp to 2,022.1bp (1Y range: 946-2,022bp)

- Domtar Corp (Country: US; rated: NR): up 303.6 bp to 1,050.3bp (1Y range: 365-1,050bp)

- Carnival Corp (Country: US; rated: Ba3): up 482.2 bp to 1,589.1bp (1Y range: 316-1,589bp)

- Transocean Inc (Country: KY; rated: Caa3): up 701.8 bp to 3,329.9bp (1Y range: 1,019-3,330bp)

- Rite Aid Corp (Country: US; rated: C): up 2978.8 bp to 5,878.8bp (1Y range: 885-5,879bp)

- Community Health Systems Inc (Country: US; rated: B): up 15476.6 bp to 23,107.0bp (1Y range: 590-23,107bp)

Jaguar Land Rover vs Renault 5Y EUR CDS Mid Spreads | Source: Refinitiv

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Renault SA (Country: FR; rated: A3): up 47.9 bp to 466.6bp (1Y range: 175-476bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 55.3 bp to 1,002.2bp (1Y range: 394-1,002bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): up 59.2 bp to 471.8bp (1Y range: 199-476bp)

- Air France KLM SA (Country: FR; rated: C): up 63.6 bp to 914.0bp (1Y range: 386-990bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 69.6 bp to 1,270.4bp (1Y range: 359-1,296bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 70.0 bp to 1,254.9bp (1Y range: 248-1,255bp)

- Stena AB (Country: SE; rated: B2-PD): up 85.0 bp to 740.1bp (1Y range: 402-865bp)

- ThyssenKrupp AG (Country: DE; rated: A2): up 86.3 bp to 711.2bp (1Y range: 205-711bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 88.4 bp to 636.8bp (1Y range: 122-637bp)

- TUI AG (Country: DE; rated: B3-PD): up 113.9 bp to 1,506.0bp (1Y range: 607-1,641bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 179.6 bp to 1,715.4bp (1Y range: 530-1,715bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 381.1 bp to 2,762.4bp (1Y range: 1,041-2,762bp)

- Novafives SAS (Country: FR; rated: Caa1): up 621.1 bp to 2,522.9bp (1Y range: 618-2,597bp)

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): up 697.6 bp to 4,117.4bp (1Y range: 571-4,117bp)

- Ceconomy AG (Country: DE; rated: Ba2): up 842.2 bp to 1,668.9bp (1Y range: 183-1,669bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: NCL Corporation Ltd (Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 235.6 bp to 1,071.3 bp, with the yield to worst at 14.6% and the bond now trading down to 76.0 cents on the dollar (1Y price range: 76.0-100.0).

- Issuer: Starwood Property Trust Inc (Greenwich, CT (US)) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread up by 200.9 bp to 381.8 bp, with the yield to worst at 8.2% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.0-101.4).

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 179.3 bp to 2,177.8 bp, with the yield to worst at 25.5% and the bond now trading down to 60.0 cents on the dollar (1Y price range: 59.5-84.9).

- Issuer: Starwood Property Trust Inc (Greenwich, CT (US)) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | ISIN: USU85656AF04 | Z-spread up by 147.5 bp to 421.9 bp, with the yield to worst at 8.2% and the bond now trading down to 84.5 cents on the dollar (1Y price range: 84.5-100.1).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 131.3 bp to 913.5 bp, with the yield to worst at 12.9% and the bond now trading down to 73.0 cents on the dollar (1Y price range: 72.5-99.5).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 128.6 bp to 2,115.0 bp, with the yield to worst at 23.5% and the bond now trading down to 70.0 cents on the dollar (1Y price range: 69.5-96.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 117.3 bp to 470.3 bp, with the yield to worst at 8.7% and the bond now trading down to 92.5 cents on the dollar (1Y price range: 92.0-108.5).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | ISIN: USU85656AH69 | Z-spread up by 114.5 bp to 439.7 bp, with the yield to worst at 8.5% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 84.3-100.9).

- Issuer: NCL Corporation Ltd (Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread up by 106.9 bp to 936.8 bp, with the yield to worst at 13.2% and the bond now trading down to 76.0 cents on the dollar (1Y price range: 74.5-103.0).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 5.88% | Maturity: 15/4/2030 | Rating: BB+ | ISIN: USQ3919KAP68 | Z-spread up by 102.7 bp to 424.4 bp, with the yield to worst at 8.1% and the bond now trading down to 86.8 cents on the dollar (1Y price range: 86.1-99.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread up by 94.4 bp to 604.7 bp, with the yield to worst at 9.9% and the bond now trading down to 79.8 cents on the dollar (1Y price range: 79.5-105.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread up by 94.4 bp to 604.7 bp, with the yield to worst at 9.9% and the bond now trading down to 79.8 cents on the dollar (1Y price range: 79.5-105.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | ISIN: USU26886AD02 | Z-spread up by 93.1 bp to 437.5 bp, with the yield to worst at 8.2% and the bond now trading down to 78.8 cents on the dollar (1Y price range: 78.5-105.0).

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU3165EAA92 | Z-spread up by 92.1 bp to 505.3 bp, with the yield to worst at 9.1% and the bond now trading down to 77.8 cents on the dollar (1Y price range: 77.6-97.8).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 79.4 bp to 259.5 bp, with the yield to worst at 7.2% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 91.1-106.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread up by 265.4 bp to 1,207.1 bp, with the yield to worst at 12.5% and the bond now trading down to 68.8 cents on the dollar (1Y price range: 60.9-94.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | Z-spread up by 222.9 bp to 798.6 bp (CDS basis: -133.7bp), with the yield to worst at 10.6% and the bond now trading down to 80.1 cents on the dollar (1Y price range: 80.0-100.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | Z-spread up by 179.1 bp to 855.0 bp (CDS basis: -147.5bp), with the yield to worst at 11.2% and the bond now trading down to 70.4 cents on the dollar (1Y price range: 70.3-92.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | Z-spread up by 178.4 bp to 893.6 bp (CDS basis: -156.1bp), with the yield to worst at 11.7% and the bond now trading down to 73.3 cents on the dollar (1Y price range: 72.6-100.4).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 170.4 bp to 982.1 bp, with the yield to worst at 11.0% and the bond now trading down to 69.0 cents on the dollar (1Y price range: 66.0-95.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | Z-spread up by 167.5 bp to 895.7 bp (CDS basis: -128.3bp), with the yield to worst at 11.8% and the bond now trading down to 69.1 cents on the dollar (1Y price range: 68.7-98.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: B+ | ISIN: XS1824425182 | Z-spread up by 157.9 bp to 688.4 bp (CDS basis: -40.4bp), with the yield to worst at 9.5% and the bond now trading down to 84.2 cents on the dollar (1Y price range: 83.9-101.6).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 146.5 bp to 826.6 bp, with the yield to worst at 10.8% and the bond now trading down to 75.3 cents on the dollar (1Y price range: 74.7-104.2).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 139.1 bp to 817.9 bp, with the yield to worst at 10.8% and the bond now trading down to 83.1 cents on the dollar (1Y price range: 82.9-99.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 5.50% | Maturity: 24/2/2025 | Rating: B+ | ISIN: XS0213101073 | Z-spread up by 122.4 bp to 409.9 bp (CDS basis: 197.0bp), with the yield to worst at 6.6% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 96.8-108.4).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | Z-spread up by 121.2 bp to 862.5 bp, with the yield to worst at 11.3% and the bond now trading down to 77.6 cents on the dollar (1Y price range: 77.5-100.4).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 117.1 bp to 956.3 bp, with the yield to worst at 12.4% and the bond now trading down to 47.9 cents on the dollar (1Y price range: 47.7-77.3).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread up by 114.2 bp to 536.7 bp, with the yield to worst at 7.8% and the bond now trading down to 84.4 cents on the dollar (1Y price range: 84.3-105.2).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread up by 113.0 bp to 811.5 bp, with the yield to worst at 10.9% and the bond now trading down to 66.2 cents on the dollar (1Y price range: 65.7-91.3).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | Z-spread up by 104.5 bp to 840.7 bp (CDS basis: 221.0bp), with the yield to worst at 11.2% and the bond now trading down to 67.8 cents on the dollar (1Y price range: 66.8-99.6).

RECENT DOMESTIC USD BOND ISSUES

- Atmos Energy Corp (Oil and Gas | Dallas, United States | Rating: A-): US$300m Senior Note (US049560AX34), fixed rate (5.45% coupon) maturing on 15 October 2032, priced at 99.78 (original spread of 152 bp), callable (10nc10)

- Atmos Energy Corp (Oil and Gas | Dallas, United States | Rating: A-): US$500m Senior Note (US049560AY17), fixed rate (5.75% coupon) maturing on 15 October 2052, priced at 99.59 (original spread of 231 bp), callable (30nc30)

- Citigroup Global Markets Holdings Inc (Securities | New York City, United States | Rating: A): US$200m Unsecured Note (XS2495896917), floating rate maturing on 4 October 2028, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$550m Bond (US3133ENR281), floating rate (SOFR + 10.5 bp) maturing on 4 October 2024, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENQ861), floating rate (FFQ + 7.0 bp) maturing on 4 October 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENQ788), floating rate (SOFR + 30.0 bp) maturing on 3 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$115m Bond (US3130ATJ735), fixed rate (6.00% coupon) maturing on 25 October 2027, priced at 100.00 (original spread of 8 bp), callable (5nc1m)

- Goldman Sachs Bank USA (Banking | New York City, United States | Rating: A+): US$150m Bond (XS2537267259), floating rate maturing on 10 October 2027, priced at 100.00, non callable

- Goldman Sachs Bank USA (Banking | New York City, United States | Rating: A+): US$150m Bond (XS2538429205), floating rate maturing on 10 October 2027, priced at 100.00, non callable

- Inter-American Development Bank (Supranational | Washington, United States | Rating: AAA): US$500m Senior Note (US4581X0EG91), floating rate (SOFR + 35.0 bp) maturing on 4 October 2027, priced at 100.00, non callable

- PACCAR Financial Corp (Financial - Other | Bellevue, United States | Rating: A+): US$300m Senior Note (US69371RS231), fixed rate (4.95% coupon) maturing on 3 October 2025, priced at 99.93 (original spread of 59 bp), non callable

- Wells Fargo Bank NA (Banking | Sioux Falls, United States | Rating: A+): US$146m Certificate of Deposit - Retail (US9497632E56), fixed rate (4.15% coupon) maturing on 30 September 2024, priced at 100.00 (original spread of -34 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- BMO Harris Bank NA (Banking | Chicago, Canada | Rating: BBB+): US$138m Certificate of Deposit - Retail (US05600XJN12), fixed rate (4.25% coupon) maturing on 30 September 2024, priced at 100.00 (original spread of -34 bp), non callable

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Japan | Rating: A+): US$500m Bond (US471048CU09), fixed rate (4.38% coupon) maturing on 5 October 2027, priced at 99.60 (original spread of 68 bp), non callable

- Komatsu Finance America Inc (Financial - Other | Rolling Meadows, Japan | Rating: A): US$600m Senior Note (US50048WAA62), fixed rate (5.50% coupon) maturing on 6 October 2027, priced at 100.00 (original spread of 150 bp), callable (5nc5)

- Korea Electric Power Corp (Utility - Other | Naju, South Korea | Rating: AA-): US$300m Senior Note (US500631AY22), fixed rate (5.50% coupon) maturing on 6 April 2028, priced at 99.54 (original spread of 160 bp), non callable

- Korea Electric Power Corp (Utility - Other | Naju, South Korea | Rating: AA-): US$500m Senior Note (USY4907LAE21), fixed rate (5.38% coupon) maturing on 6 April 2026, priced at 99.84 (original spread of 120 bp), non callable

- Tongling State owned Capital Operation Holding Group Co Ltd (Financial - Other | Tongling, China (Mainland) | Rating: NR): US$200m Bond (XS2511295334), fixed rate (6.00% coupon) maturing on 12 October 2025, priced at 100.00, non callable

RECENT EUR BOND ISSUES

- Arkea Home Loans SFH SA (Financial - Other | Brest, France | Rating: AAA): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400CZO3), fixed rate (3.00% coupon) maturing on 4 October 2028, priced at 99.40 (original spread of 113 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9SJ5), floating rate (EU03MLIB + 0.0 bp) maturing on 6 October 2025, priced at 100.00, non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9SK3), fixed rate (2.95% coupon) maturing on 6 October 2025, priced at 99.93 (original spread of 106 bp), non callable

- Bng Bank NV (Agency | S-Gravenhage, Netherlands | Rating: AAA): €1,500m Senior Note (XS2540993685), fixed rate (2.75% coupon) maturing on 4 October 2027, priced at 99.79 (original spread of 84 bp), non callable

- Bremen Free Hanseatic, City of (Official and Muni | Bremen, Germany | Rating: AAA): €500m Landesschatzanweisung (DE000A3E5V96), fixed rate (3.00% coupon) maturing on 6 October 2032, priced at 99.24 (original spread of 83 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €500m Unsecured Note (XS2539940457), fixed rate (0.10% coupon) maturing on 6 October 2042, priced at 100.00, non callable

- Electrolux AB (Electronics | Stockholm, Stockholm, Sweden | Rating: A-): €500m Senior Note (XS2540585564), fixed rate (4.13% coupon) maturing on 5 October 2026, priced at 99.49 (original spread of 230 bp), callable (4nc4)

- Eniv SARL (Financial - Other | Luxembourg, Jersey | Rating: NR): €244m Bond (XS2538919809), floating rate maturing on 31 December 2200, priced at 100.00, non callable

- Equitable Bank (Banking | Toronto, Canada | Rating: BBB-): €250m Covered Bond (Other) (XS2540993172), fixed rate (3.25% coupon) maturing on 6 October 2025, priced at 99.66 (original spread of 155 bp), non callable

- Green Bidco SpA (Utility - Other | Milan, Milano, Taiwan | Rating: NR): €270m Bond (XS2530047468), floating rate maturing on 20 June 2029, priced at 100.00, non callable

- Instituto de Credito Oficial (Agency | Madrid, Madrid, Spain | Rating: BBB+): €500m Senior Note (XS2538778478), fixed rate (2.65% coupon) maturing on 31 January 2028, priced at 99.91 (original spread of 95 bp), non callable

- Investitionsbank Berlin (Banking | Berlin, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A289KN1), fixed rate (2.75% coupon) maturing on 4 October 2027, priced at 99.23 (original spread of 90 bp), non callable

- KfW (Agency | Frankfurt, Germany | Rating: AAA): €4,000m Bond (DE000A30VM78), fixed rate (2.88% coupon) maturing on 28 December 2029, priced at 99.84 (original spread of 75 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AAA): €975m Oeffenlicher Pfandbrief (Covered Bond) (DE000HLB42Q3), floating rate (EU06MLIB + -3.0 bp) maturing on 27 September 2024, priced at 100.00, non callable

- Ontario Teachers Finance Trust (Financial - Other | Toronto, Canada | Rating: AA+): €500m Senior Note (XS2539371653), fixed rate (3.30% coupon) maturing on 5 October 2029, priced at 99.77 (original spread of 135 bp), non callable

- Sabadell Boreas 1-2022 DAC (Financial - Other | Ireland | Rating: NR): €105m Bond (XS2527861715), floating rate maturing on 1 December 2043, priced at 100.00, non callable

- Sfil SA (Agency | Issy-Les-Moulineaux, France | Rating: AA-): €500m Bond (FR001400D211), fixed rate (3.25% coupon) maturing on 5 October 2032, priced at 99.87 (original spread of 105 bp), non callable

- Slovenska Sporitelna as (Banking | Bratislava, Austria | Rating: A): €500m Covered Bond (Other) (SK4000021820), fixed rate (3.50% coupon) maturing on 5 April 2028, priced at 99.98 (original spread of 40 bp), non callable

- Sydbank A/S (Banking | Aabenraa, Denmark | Rating: A-): €500m Note (XS2538445581), fixed rate (4.75% coupon) maturing on 30 September 2025, priced at 99.84 (original spread of 287 bp), non callable

- TeamSystem SpA (Information/Data Technology | Pesaro, Italy | Rating: B-): €185m Bond (XS2533816042), floating rate maturing on 15 February 2028, priced at 100.00, non callable

- UniCredit Bank Czech Republic and Slovakia as (Banking | Praha, Italy | Rating: NR): €500m Unsecured Note (XS2541314584), fixed rate (1.00% coupon) maturing on 6 October 2027, priced at 100.00, non callable

- UniCredit SpA (Banking | Milan, Italy | Rating: BBB): €260m Senior Note (XS2541433590), fixed rate (4.00% coupon) maturing on 26 April 2027, priced at 100.00, non callable

- Verisure Holding AB (Electronics | Malmo, Canada | Rating: B): €500m Note (XS2541437583), fixed rate (9.25% coupon) maturing on 15 October 2027, priced at 100.00 (original spread of 727 bp), callable (5nc2)

RECENT USD LOANS

- Trip.com Group Ltd, signed a US$ 600m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/29/25 and initial pricing is set at Term SOFR +140.0bp