Credit

Decent Rebound For US Credit This Week, With High Yield Overperforming Equities On A Volatility-Adjusted Basis

Continued rates volatility kept volumes of corporate bond issuance low this week: 17 tranches for $13.55bn in IG (2022 YTD volume $1.030trn vs 2021 YTD $1.217trn), 1 tranche for $625m in HY (2022 YTD volume $87.001bn vs 2021 YTD $398.726bn)

Published ET

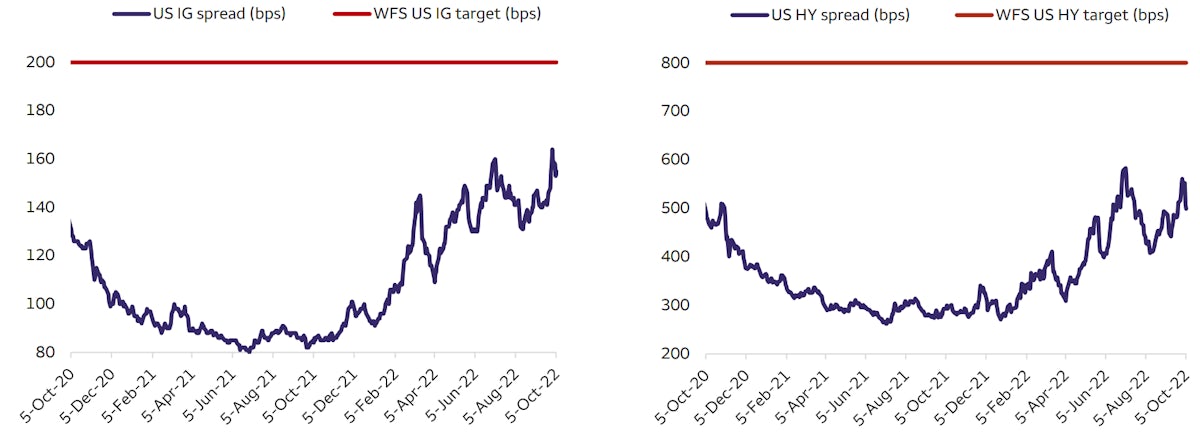

Target Spreads For USD Credit | Source: Wells Fargo Securities

DAILY SUMMARY

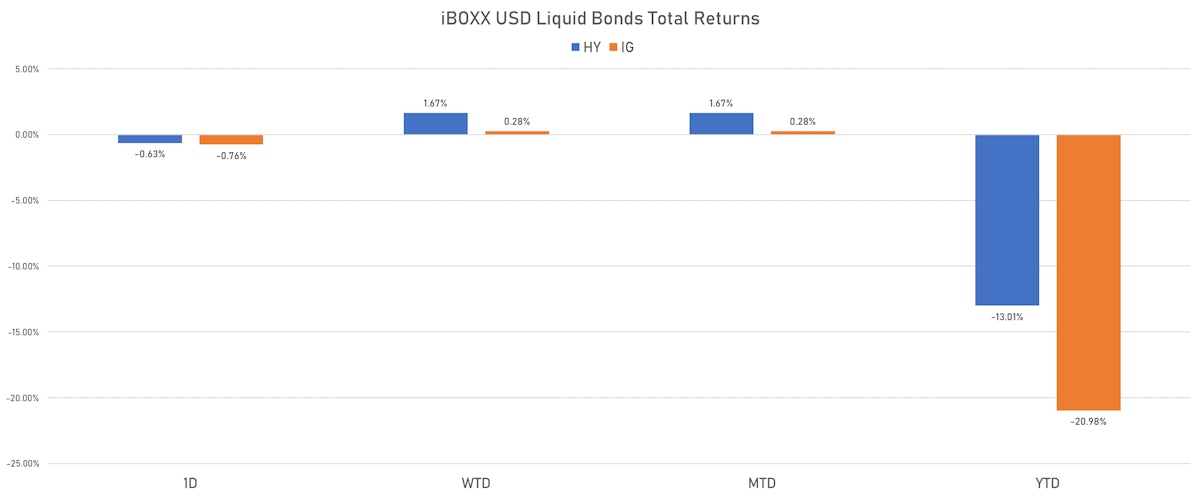

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.761% today (Week-to-date: 0.28%; Month-to-date: 0.28%; Year-to-date: -20.98%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.634% today (Week-to-date: 1.67%; Month-to-date: 1.67%; Year-to-date: -13.01%)

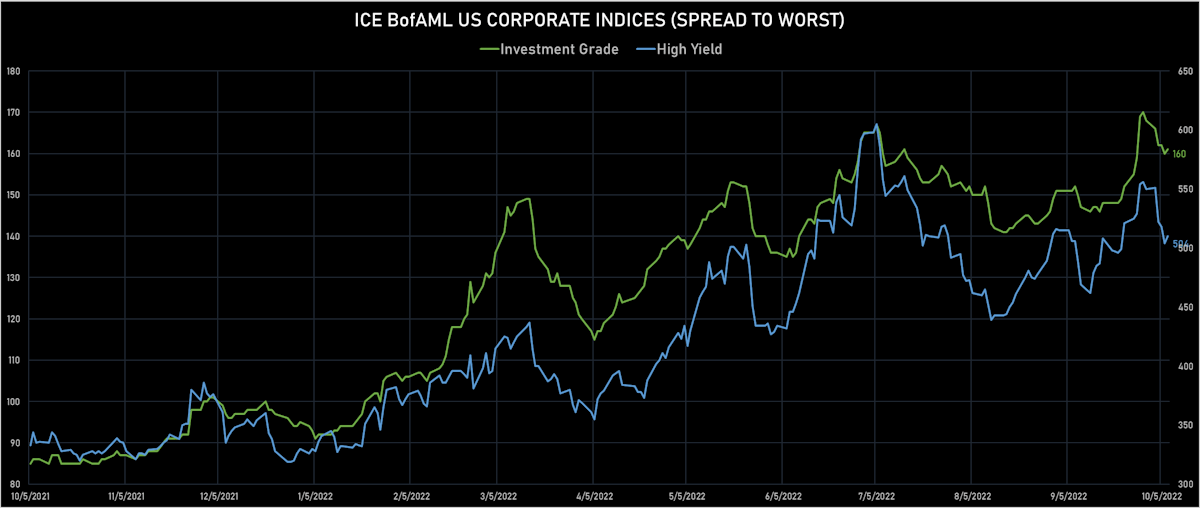

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 161.0 bp (YTD change: +66.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 510.0 bp (YTD change: +180.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: -2.9%)

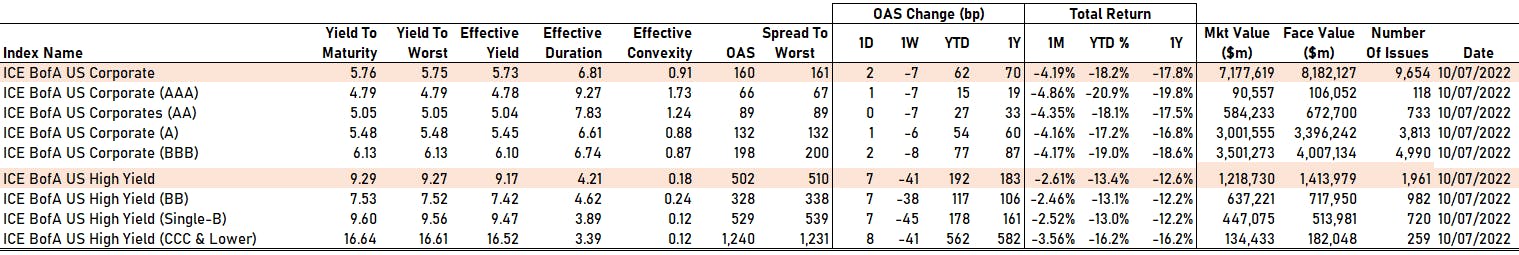

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 66 bp

- AA unchanged at 89 bp

- A up by 1 bp at 132 bp

- BBB up by 2 bp at 198 bp

- BB up by 7 bp at 328 bp

- B up by 7 bp at 529 bp

- ≤ CCC up by 8 bp at 1,240 bp

CDS INDICES TODAY (mid-spreads)

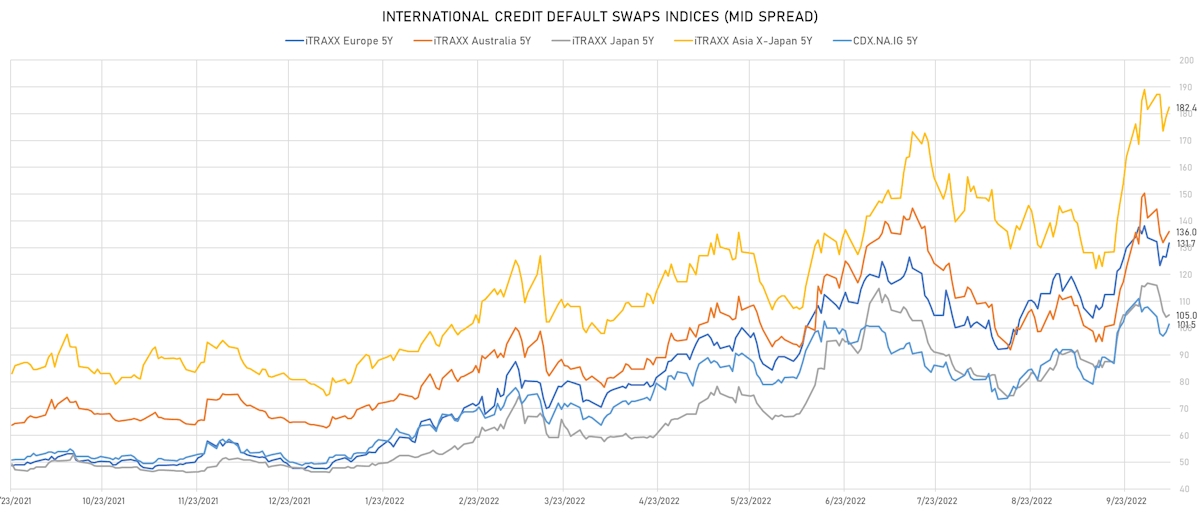

- Markit CDX.NA.IG 5Y up 3.1 bp, now at 102bp (1W change: -6.3bp; YTD change: +52.2bp)

- Markit CDX.NA.IG 10Y up 2.5 bp, now at 133bp (1W change: -4.7bp; YTD change: +43.9bp)

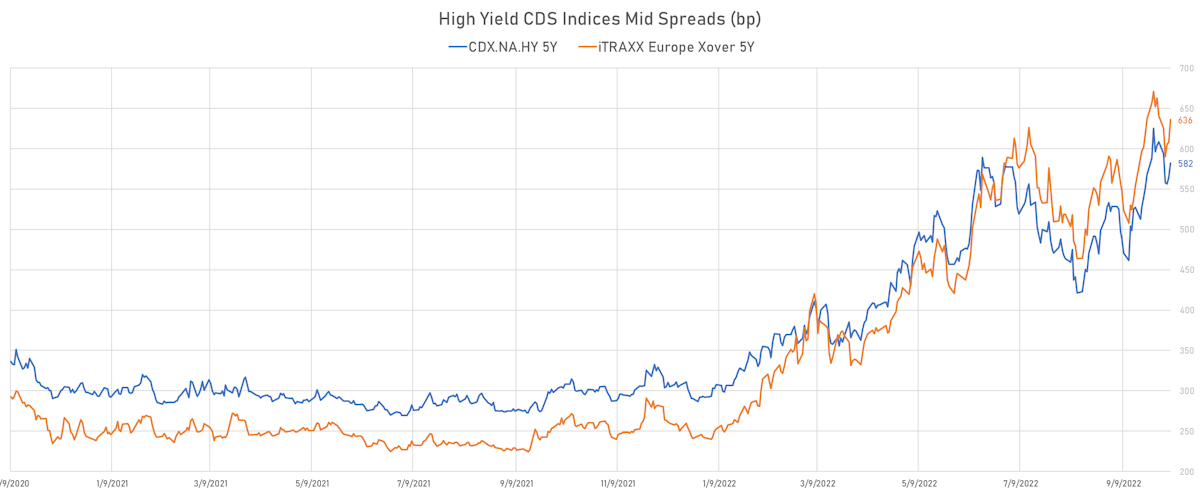

- Markit CDX.NA.HY 5Y up 17.5 bp, now at 582bp (1W change: -26.6bp; YTD change: +290.2bp)

- Markit iTRAXX Europe 5Y up 5.2 bp, now at 132bp (1W change: -2.1bp; YTD change: +84.1bp)

- Markit iTRAXX Europe Crossover 5Y up 27.8 bp, now at 636bp (1W change: -5.0bp; YTD change: +393.9bp)

- Markit iTRAXX Japan 5Y up 0.8 bp, now at 105bp (1W change: -11.8bp; YTD change: +58.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 3.7 bp, now at 182bp (1W change: +0.8bp; YTD change: +103.4bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: B): down 10156.3 bp to 12,950.7bp (1Y range: 590-12,951bp)

- Transocean Inc (Country: KY; rated: Caa3): down 1054.5 bp to 2,275.4bp (1Y range: 1,019-2,858bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 257.8 bp to 1,725.0bp (1Y range: 430-1,783bp)

- Nabors Industries Inc (Country: US; rated: B3): down 163.5 bp to 739.9bp (1Y range: 489-887bp)

- Gap Inc (Country: US; rated: Ba2): down 147.9 bp to 647.2bp (1Y range: 152-819bp)

- Bombardier Inc (Country: CA; rated: CCC-): down 103.4 bp to 671.8bp (1Y range: 432-1,007bp)

- DISH DBS Corp (Country: US; rated: B2): down 91.4 bp to 1,442.8bp (1Y range: 364-1,506bp)

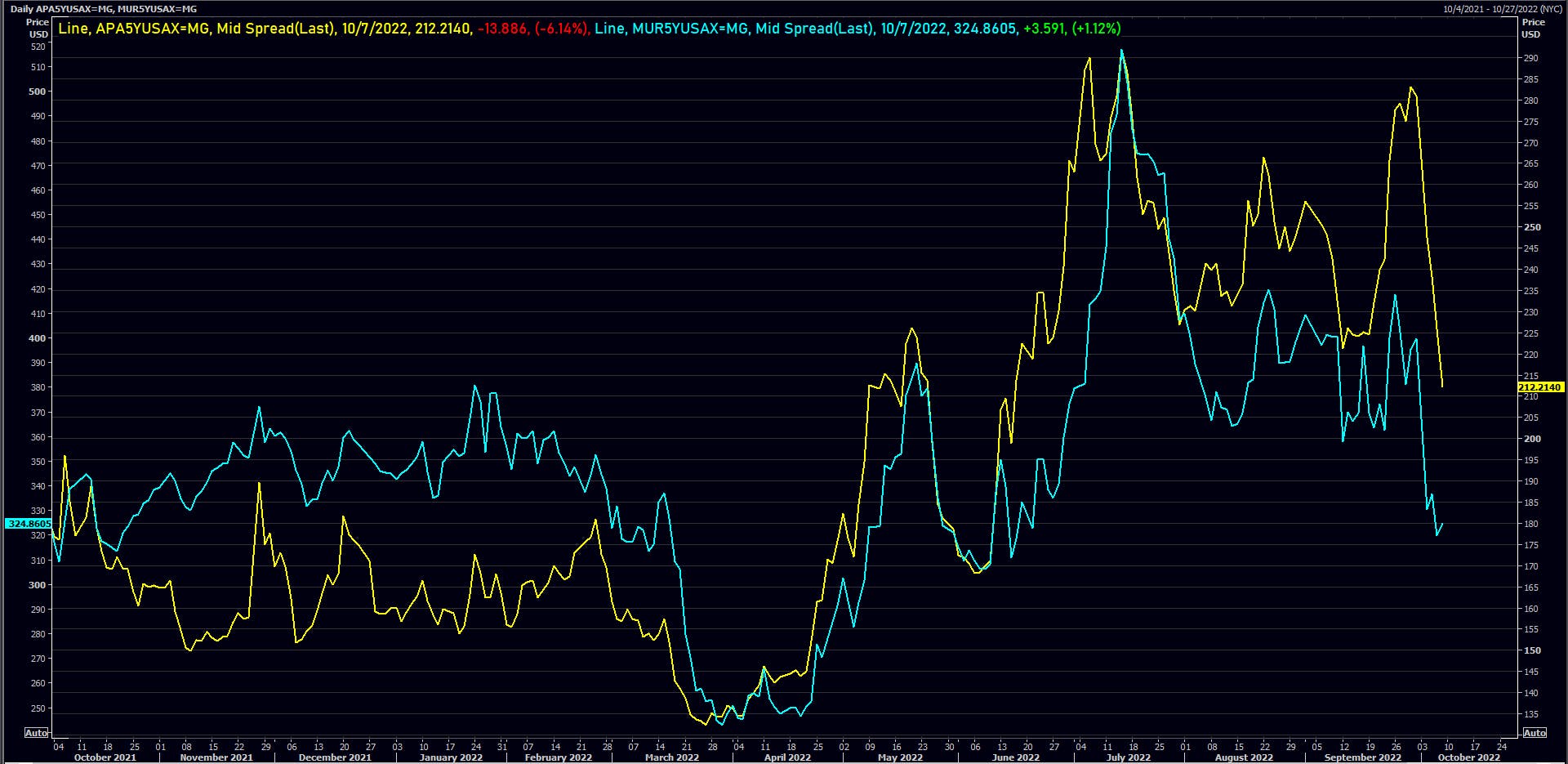

- Murphy Oil Corp (Country: US; rated: A2): down 74.8 bp to 324.9bp (1Y range: 240-446bp)

- United States Steel Corp (Country: US; rated: BBB-): down 74.2 bp to 652.0bp (1Y range: 306-780bp)

- Apache Corp (Country: US; rated: A1): down 68.7 bp to 212.2bp (1Y range: 131-281bp)

- Macy's Inc (Country: US; rated: A1): down 62.8 bp to 516.7bp (1Y range: 181-619bp)

- Tegna Inc (Country: US; rated: Ba3): down 58.5 bp to 857.2bp (1Y range: 182-857bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 119.2 bp to 1,630.4bp (1Y range: 616-1,630bp)

- Carnival Corp (Country: US; rated: Ba3): up 387.5 bp to 1,976.6bp (1Y range: 316-1,977bp)

- Rite Aid Corp (Country: US; rated: C): up 1288.6 bp to 7,167.4bp (1Y range: 885-7,167bp)

Apache and Murphy Oil 5Y USD CDS Mid Spreads | Source: Refinitiv

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: Caa1): down 178.3 bp to 2,584.1bp (1Y range: 1,145-2,892bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 98.9 bp to 1,171.5bp (1Y range: 359-1,296bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 77.9 bp to 558.9bp (1Y range: 130-600bp)

- Air France KLM SA (Country: FR; rated: C): down 49.8 bp to 864.2bp (1Y range: 386-990bp)

- Stena AB (Country: SE; rated: B2-PD): down 48.1 bp to 691.9bp (1Y range: 402-865bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): down 42.4 bp to 487.6bp (1Y range: 161-523bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 41.9 bp to 1,213.0bp (1Y range: 261-1,254bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 40.0 bp to 592.5bp (1Y range: 296-648bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 37.8 bp to 1,677.6bp (1Y range: 566-1,679bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 37.1 bp to 721.8bp (1Y range: 370-758bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 31.2 bp to 515.6bp (1Y range: 209-606bp)

- Renault SA (Country: FR; rated: A3): down 28.5 bp to 438.1bp (1Y range: 175-476bp)

- Credit Suisse Group AG (Country: CH; rated: A1): up 60.4 bp to 310.0bp (1Y range: 56-375bp)

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): up 144.7 bp to 4,262.0bp (1Y range: 595-4,262bp)

- TUI AG (Country: DE; rated: B3-PD): up 194.6 bp to 1,700.6bp (1Y range: 607-1,701bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Aag FH LP (Canada) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread up by 91.9 bp to 660.0 bp, with the yield to worst at 10.7% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 93.0-113.6).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread down by 63.0 bp to 409.4 bp, with the yield to worst at 8.2% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 86.5-112.4).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | ISIN: USU2947RAA78 | Z-spread down by 63.8 bp to 185.3 bp, with the yield to worst at 6.0% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 95.0-110.0).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread down by 64.9 bp to 282.1 bp, with the yield to worst at 6.9% and the bond now trading up to 91.3 cents on the dollar (1Y price range: 88.5-103.0).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | ISIN: USU26886AD02 | Z-spread down by 68.2 bp to 372.1 bp, with the yield to worst at 7.6% and the bond now trading up to 82.0 cents on the dollar (1Y price range: 78.5-105.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread down by 70.9 bp to 319.1 bp, with the yield to worst at 7.3% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 91.5-102.8).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 5.88% | Maturity: 15/4/2030 | Rating: BB+ | ISIN: USQ3919KAP68 | Z-spread down by 71.8 bp to 354.1 bp, with the yield to worst at 7.4% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 86.1-99.9).

- Issuer: Station Casinos LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 1/12/2031 | Rating: B- | ISIN: USU85731AE46 | Z-spread down by 73.2 bp to 386.7 bp, with the yield to worst at 7.7% and the bond now trading up to 79.3 cents on the dollar (1Y price range: 75.5-100.4).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AB58 | Z-spread down by 79.6 bp to 527.9 bp, with the yield to worst at 9.2% and the bond now trading up to 82.6 cents on the dollar (1Y price range: 79.5-105.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | ISIN: USU98401AD15 | Z-spread down by 79.6 bp to 527.9 bp, with the yield to worst at 9.2% and the bond now trading up to 82.6 cents on the dollar (1Y price range: 79.5-105.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread down by 84.2 bp to 298.1 bp, with the yield to worst at 7.1% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 88.8-106.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 86.4 bp to 385.8 bp, with the yield to worst at 8.0% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 92.0-108.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 89.3 bp to 320.2 bp, with the yield to worst at 7.4% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 94.8 bp to 381.6 bp, with the yield to worst at 7.9% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 88.8-105.7).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.13% | Maturity: 1/12/2024 | Rating: BB | ISIN: USU81193AN11 | Z-spread down by 95.3 bp to 148.3 bp (CDS basis: 1.2bp), with the yield to worst at 5.8% and the bond now trading up to 97.9 cents on the dollar (1Y price range: 96.3-107.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.33% | Maturity: 24/3/2025 | Rating: BB+ | ISIN: XS1523028436 | Z-spread up by 254.0 bp to 611.5 bp, with the yield to worst at 8.9% and the bond now trading down to 87.9 cents on the dollar (1Y price range: 92.6-107.7).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | Z-spread up by 231.7 bp to 605.4 bp, with the yield to worst at 9.0% and the bond now trading down to 73.8 cents on the dollar (1Y price range: 73.8-99.4).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 112.7 bp to 1,068.6 bp, with the yield to worst at 13.7% and the bond now trading down to 44.5 cents on the dollar (1Y price range: 45.9-77.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 82.1 bp to 519.4 bp (CDS basis: -14.4bp), with the yield to worst at 7.8% and the bond now trading up to 81.8 cents on the dollar (1Y price range: 78.0-103.5).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 16/5/2027 | Rating: BB- | ISIN: XS2408458730 | Z-spread down by 84.7 bp to 513.8 bp (CDS basis: -44.0bp), with the yield to worst at 7.9% and the bond now trading up to 80.3 cents on the dollar (1Y price range: 76.9-99.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread down by 84.7 bp to 365.1 bp, with the yield to worst at 6.1% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 96.6-107.7).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 84.8 bp to 728.0 bp, with the yield to worst at 10.2% and the bond now trading up to 69.9 cents on the dollar (1Y price range: 66.6-100.3).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread down by 86.4 bp to 307.2 bp, with the yield to worst at 6.0% and the bond now trading up to 87.6 cents on the dollar (1Y price range: 85.0-108.9).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.00% | Maturity: 24/1/2025 | Rating: BB+ | ISIN: XS1724626699 | Z-spread down by 89.0 bp to 263.0 bp, with the yield to worst at 5.4% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 90.7-104.1).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread down by 95.7 bp to 414.2 bp (CDS basis: -41.5bp), with the yield to worst at 6.4% and the bond now trading up to 91.6 cents on the dollar (1Y price range: 88.2-102.3).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.00% | Maturity: 3/4/2025 | Rating: BB+ | ISIN: FR0013449972 | Z-spread down by 107.3 bp to 195.4 bp, with the yield to worst at 4.5% and the bond now trading up to 91.2 cents on the dollar (1Y price range: 88.8-99.6).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread down by 108.4 bp to 682.2 bp, with the yield to worst at 9.7% and the bond now trading up to 69.5 cents on the dollar (1Y price range: 65.7-91.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread down by 117.7 bp to 1,055.9 bp (CDS basis: 50.0bp), with the yield to worst at 13.2% and the bond now trading up to 80.6 cents on the dollar (1Y price range: 77.4-113.4).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 118.8 bp to 690.8 bp, with the yield to worst at 9.7% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 82.9-99.8).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread down by 143.8 bp to 914.4 bp (CDS basis: 167.5bp), with the yield to worst at 11.7% and the bond now trading up to 80.8 cents on the dollar (1Y price range: 77.5-104.5).

RECENT DOMESTIC USD BOND ISSUES

- Cargill Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: A): US$500m Senior Note (USU14178FG49), fixed rate (5.13% coupon) maturing on 11 October 2032, priced at 99.88 (original spread of 140 bp), callable (10nc10)

- Cargill Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: A): US$750m Senior Note (USU14178FF65), fixed rate (4.88% coupon) maturing on 10 October 2025, priced at 99.91 (original spread of 75 bp), callable (3nc3)

- Citigroup Global Markets Holdings Inc (Securities | New York City, United States | Rating: A): US$169m Unsecured Note (XS2495883691) zero coupon maturing on 6 January 2028, priced at 69.70, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$115m Bond (US3133ENS503), fixed rate (4.13% coupon) maturing on 14 October 2027, priced at 99.91, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133ENR778), fixed rate (4.92% coupon) maturing on 12 January 2026, priced at 100.00 (original spread of 79 bp), callable (3nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$450m Bond (US3133ENS438), fixed rate (4.38% coupon) maturing on 17 October 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$1,000m Bond (US3133ENR695), floating rate (SOFR + 10.0 bp) maturing on 7 October 2024, priced at 100.00, non callable

- General Motors Financial Company Inc (Financial - Other | Fort Worth, Texas, United States | Rating: BBB-): US$1,250m Senior Note (US37045XDZ69), fixed rate (6.05% coupon) maturing on 10 October 2025, priced at 99.87 (original spread of 185 bp), with a make whole call

- Gs Finance Corp (Financial - Other | New York City, United States | Rating: NR): US$1,662m Index Linked Security (US40057N3Y11) zero coupon maturing on 5 October 2027, priced at 100.00, with a special call

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$400m Senior Note (US24422EWN56), fixed rate (4.85% coupon) maturing on 11 October 2029, priced at 99.91 (original spread of 100 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$600m Senior Note (US24422EWM73), fixed rate (4.55% coupon) maturing on 11 October 2024, priced at 99.94 (original spread of 43 bp), non callable

- Realty Income Corp (Real Estate Investment Trust | San Diego, California, United States | Rating: A-): US$750m Senior Note (US756109BP80), fixed rate (5.63% coupon) maturing on 13 October 2032, priced at 99.88 (original spread of 200 bp), callable (10nc10)

- Semtech Corp (Electronics | Camarillo, California, United States | Rating: NR): US$300m Bond (US816850AE12), fixed rate (1.63% coupon) maturing on 1 November 2027, priced at 100.00, non callable, convertible

- Southern Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB): US$500m Senior Note (US842587DL81), fixed rate (5.70% coupon) maturing on 15 October 2032, priced at 99.89 (original spread of 205 bp), callable (10nc10)

- Southern Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB): US$500m Senior Note (US842587DM64), fixed rate (5.15% coupon) maturing on 6 October 2025, priced at 99.79 (original spread of 110 bp), with a make whole call

RECENT INTERNATIONAL USD BOND ISSUES

- 1375209 BC Ltd / Bausch Health Companies Inc. (Financial - Other | Canada | Rating: NR): US$999m Note (USC6887TAA63), fixed rate (9.00% coupon) maturing on 30 January 2028, callable (5nc1m)

- Aib Group PLC (Banking | Dublin, Ireland | Rating: BBB-): US$750m Senior Note (US00135TAC80), floating rate maturing on 14 October 2026, priced at 100.00, callable (4nc3)

- CNH Industrial Capital LLC (Financial - Other | Racine, Wisconsin, United Kingdom | Rating: BBB): US$400m Senior Note (US12592BAP94), fixed rate (5.45% coupon) maturing on 14 October 2025, priced at 99.35 (original spread of 145 bp), with a make whole call

- DNB Bank ASA (Banking | Oslo, Norway | Rating: A-): US$900m Note (USR1655VAC20), floating rate maturing on 9 October 2026, priced at 100.00 (original spread of 185 bp), callable (4nc3)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460004558), fixed rate (4.10% coupon) maturing on 4 November 2024, priced at 100.00, non callable

- EDP Finance BV (Financial - Other | Amsterdam, Portugal | Rating: BBB-): US$500m Senior Note (US26835PAJ93), fixed rate (6.30% coupon) maturing on 11 October 2027, priced at 99.87 (original spread of 245 bp), with a make whole call

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: BBB+): US$750m Senior Note (USN30707AS74), fixed rate (6.80% coupon) maturing on 14 October 2025, priced at 99.44 (original spread of 275 bp), with a make whole call

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: BBB+): US$1,250m Senior Note (US29278GBA58), fixed rate (7.50% coupon) maturing on 14 October 2032, priced at 97.87 (original spread of 400 bp), callable (10nc10)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: BBB+): US$1,000m Senior Note (US29278GBB32), fixed rate (7.75% coupon) maturing on 14 October 2052, priced at 95.02 (original spread of 440 bp), callable (30nc30)

- Enel Finance America LLC (Financial - Other | Italy | Rating: BBB+): US$1,000m Senior Note (US29280HAA05), fixed rate (7.10% coupon) maturing on 14 October 2027, priced at 99.15 (original spread of 325 bp), callable (5nc5)

- Enerflex Ltd (Oil and Gas | Calgary, Alberta, Canada | Rating: BB-): US$625m Note (USC3321XAA84), fixed rate (9.00% coupon) maturing on 15 October 2027, priced at 90.68 (original spread of 745 bp), callable (5nc2)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A30SY4), fixed rate (5.10% coupon) maturing on 31 October 2024, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A311V9), fixed rate (4.00% coupon) maturing on 2 November 2024, priced at 100.00, non callable

- Federation of Caisses Desjardins Du Quebec (Banking | Levis, Canada | Rating: A+): US$1,000m Covered Bond (Other) (US31430WSP04), fixed rate (4.85% coupon) maturing on 14 October 2025, priced at 99.98 (original spread of 88 bp), non callable

- First Abu Dhabi Bank PJSC (Banking | Abu Dhabi, United Arab Emirates | Rating: AA-): US$700m Senior Note (XS2539374673), fixed rate (5.13% coupon) maturing on 13 October 2027, priced at 99.30 (original spread of 125 bp), non callable

- GACI First Investment Co (Financial - Other | George Town, Saudi Arabia | Rating: A): US$1,250m Senior Note (XS2542162248), fixed rate (5.25% coupon) maturing on 13 October 2032, priced at 98.83 (original spread of 165 bp), callable (10nc10)

- GACI First Investment Co (Financial - Other | George Town, Saudi Arabia | Rating: A): US$500m Senior Note (XS2542162677), fixed rate (5.38% coupon) maturing on 13 October 2122, priced at 80.25 (original spread of 293 bp), callable (100nc100)

- GACI First Investment Co (Financial - Other | George Town, Saudi Arabia | Rating: A): US$1,250m Senior Note (XS2542162321), fixed rate (5.00% coupon) maturing on 13 October 2027, priced at 99.07 (original spread of 125 bp), callable (5nc5)

- Hazine Mustesarligi Varlik Kiralama AS (Financial - Other | Ankara, Turkey | Rating: B-): US$2,500m Senior Note (US42178TAA25), fixed rate (9.76% coupon) maturing on 13 November 2025, priced at 100.00 (original spread of 551 bp), non callable

- KhK Metalloinvest AO (Metals/Mining | Moscow, Moscow, Russia | Rating: NR): US$650m Bond (RU000A105A04), fixed rate (3.38% coupon) maturing on 22 October 2028, priced at 100.00, non callable

- NK Lukoil PAO (Oil and Gas | Moscow, Moscow, Russia | Rating: NR): US$1,000m Bond (RU000A1059N9), fixed rate (4.75% coupon) maturing on 2 November 2026, priced at 100.00, non callable

- NK Lukoil PAO (Oil and Gas | Moscow, Moscow, Russia | Rating: NR): US$1,500m Bond (RU000A1059Q2), fixed rate (3.88% coupon) maturing on 6 May 2030, priced at 100.00, non callable

- NK Lukoil PAO (Oil and Gas | Moscow, Moscow, Russia | Rating: NR): US$1,150m Bond (RU000A1059P4), fixed rate (2.80% coupon) maturing on 26 April 2027, priced at 100.00, non callable

- NK Lukoil PAO (Oil and Gas | Moscow, Moscow, Russia | Rating: NR): US$1,150m Bond (RU000A1059R0), fixed rate (3.60% coupon) maturing on 26 October 2031, priced at 100.00, non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$500m Bond (US718286CV78), fixed rate (5.17% coupon) maturing on 13 October 2027, priced at 100.00 (original spread of 120 bp), non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$750m Bond (US718286CT23), fixed rate (5.61% coupon) maturing on 13 April 2033, priced at 100.00 (original spread of 185 bp), non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$750m Bond (US718286CU95), fixed rate (5.95% coupon) maturing on 13 October 2047, priced at 98.09 (original spread of 243 bp), non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): US$127m Unsecured Note (XS2544920197), floating rate maturing on 22 April 2027, priced at 100.00, non callable

- Toronto-Dominion Bank (Banking | Toronto, Canada | Rating: BBB): US$1,750m Junior Subordinated Note (US89117F8Z56), fixed rate (8.13% coupon) maturing on 31 October 2082, priced at 100.00 (original spread of 408 bp), callable (60nc5)

RECENT EUR BOND ISSUES

- ALD SA (Leasing | Reuil-Malmaison, Ile-De-France, France | Rating: BBB): €750m Bond (FR001400D7M0), fixed rate (4.75% coupon) maturing on 13 October 2025, priced at 99.96 (original spread of 311 bp), non callable

- AXA SA (Life Insurance | Paris, Ile-De-France, France | Rating: A+): €850m Senior Note (XS2537251170), fixed rate (3.75% coupon) maturing on 12 October 2030, priced at 99.80 (original spread of 191 bp), with a make whole call

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €1,250m Note (XS2545206166), fixed rate (4.38% coupon) maturing on 14 October 2029, priced at 99.56 (original spread of 257 bp), non callable

- Bank of Montreal (Banking | Toronto, Ontario, Canada | Rating: A+): €1,000m Covered Bond (Other) (XS2544624112), fixed rate (2.75% coupon) maturing on 13 October 2026, priced at 99.73 (original spread of 139 bp), non callable

- Caisse de Refinancement de l Habitat SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,850m Obligation Fonciere (Covered Bond) (FR001400D5T9), fixed rate (2.75% coupon) maturing on 12 April 2028, priced at 99.31 (original spread of 122 bp), non callable

- Carlsberg Breweries A/S (Beverage/Bottling | Kobenhavn V, Denmark | Rating: BBB): €500m Senior Note (XS2545263399), fixed rate (3.25% coupon) maturing on 12 October 2025, priced at 99.84 (original spread of 157 bp), callable (3nc1m)

- Carrefour SA (Retail Stores - Food/Drug | Massy, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400D0F9), fixed rate (4.13% coupon) maturing on 12 October 2028, priced at 98.97 (original spread of 246 bp), callable (6nc6)

- Ceske Drahy as (Railroads | Praha, Praha, Czech Republic | Rating: BBB): €500m Senior Note (XS2495084621), fixed rate (5.63% coupon) maturing on 12 October 2027, priced at 99.35 (original spread of 408 bp), callable (5nc5)

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: BBB+): €750m Hypothekenpfandbrief (Covered Bond) (DE000CZ43ZF4), fixed rate (2.88% coupon) maturing on 13 October 2028, priced at 99.44 (original spread of 114 bp), non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A-): €1,000m Bond (FR001400D0Y0), floating rate maturing on 12 October 2026, priced at 99.85 (original spread of 242 bp), callable (4nc3)

- DBS Bank Ltd (Banking | Singapore | Rating: AA-): €750m Covered Bond (Other) (XS2541853532), fixed rate (2.81% coupon) maturing on 13 October 2025, priced at 100.00 (original spread of 135 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €150m Inhaberschuldverschreibung (DE000DW6CYY1), fixed rate (2.25% coupon) maturing on 2 November 2024, priced at 100.00, non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: AAA): €1,000m Saerligt Daekkede Obligation (Covered Bond) (XS2543180868), fixed rate (2.88% coupon) maturing on 6 October 2026, priced at 99.60, non callable

- Dell Bank International DAC (Financial - Other | Dublin, Dublin, United States | Rating: BBB): €500m Senior Note (XS2545259876), fixed rate (4.50% coupon) maturing on 18 October 2027, priced at 99.65 (original spread of 271 bp), callable (5nc5)

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €500m Senior Note (XS2541394750), fixed rate (3.88% coupon) maturing on 13 October 2042, priced at 99.33 (original spread of 180 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8K5), floating rate maturing on 3 November 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8J7), fixed rate (2.30% coupon) maturing on 3 November 2025, priced at 100.00, non callable

- EDP Finance BV (Financial - Other | Amsterdam, Noord-Holland, Portugal | Rating: BBB-): €500m Senior Note (XS2542914986), fixed rate (3.88% coupon) maturing on 11 March 2030, priced at 99.68 (original spread of 220 bp), callable (7nc7)

- Electricite de France SA (Utility - Other | Paris, Ile-De-France, France | Rating: BBB+): €1,000m Bond (FR001400D6N0), fixed rate (4.38% coupon) maturing on 12 October 2029, priced at 99.38 (original spread of 266 bp), callable (7nc7)

- Electricite de France SA (Utility - Other | Paris, Ile-De-France, France | Rating: BBB+): €1,250m Bond (FR001400D6O8), fixed rate (4.75% coupon) maturing on 12 October 2034, priced at 98.75 (original spread of 295 bp), callable (12nc12)

- Electricite de France SA (Utility - Other | Paris, Ile-De-France, France | Rating: BBB+): €750m Bond (FR001400D6M2), fixed rate (3.88% coupon) maturing on 12 January 2027, priced at 99.79 (original spread of 214 bp), callable (4nc4)

- Eniv SARL (Financial - Other | Luxembourg, Jersey | Rating: NR): €225m Bond (XS2540712267), floating rate maturing on 31 December 2200, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A30ZK8), fixed rate (4.40% coupon) maturing on 18 October 2032, priced at 100.00, callable (10nc3)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A30ZJ0), fixed rate (3.20% coupon) maturing on 4 November 2025, priced at 100.00, non callable

- Estonia, Republic of (Government) (Sovereign | Tallinn, Estonia | Rating: AA-): €1,000m Senior Note (XS2532370231), fixed rate (4.00% coupon) maturing on 12 October 2032, priced at 99.81 (original spread of 200 bp), non callable

- Euroclear Bank SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €500m Note (BE6338167909), fixed rate (3.63% coupon) maturing on 13 October 2027, priced at 99.90 (original spread of 175 bp), non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: AA): €3,500m Senior Note (EU000A2SCAE8), fixed rate (2.38% coupon) maturing on 11 April 2028, priced at 99.55 (original spread of 90 bp), non callable

- Finsbury Castle DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €200m Unsecured Note (XS2540993842) zero coupon maturing on 9 December 2024, non callable

- Flemish, Community of (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €1,250m Bond (BE0002889716), fixed rate (3.25% coupon) maturing on 12 January 2043, priced at 98.37 (original spread of 125 bp), non callable

- Flemish, Community of (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €750m Bond (BE0002890722), fixed rate (3.00% coupon) maturing on 12 October 2032, priced at 99.60 (original spread of 108 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): €300m Unsecured Note (XS2544594455), fixed rate (3.86% coupon) maturing on 10 October 2024, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): €750m Note (XS2545759099), fixed rate (5.25% coupon) maturing on 13 January 2030, priced at 99.29 (original spread of 339 bp), with a regulatory call

- Jyske Bank A/S (Banking | Silkeborg, Denmark | Rating: BBB+): €500m Note (XS2544400786), fixed rate (4.63% coupon) maturing on 11 April 2026, priced at 99.81 (original spread of 325 bp), callable (4nc3)

- Madrid, Community of (Official and Muni | Madrid, Madrid, Spain | Rating: A-): €500m Bond (ES00001010J0), fixed rate (2.82% coupon) maturing on 31 October 2029, priced at 100.00 (original spread of 121 bp), non callable

- Raiffeisen Landesbank Steiermark AG (Banking | Graz, Steiermark, Austria | Rating: A-): €250m Inhaberschuldverschreibung (AT000B093810), floating rate (EU03MLIB + 0.0 bp) maturing on 18 October 2027, priced at 100.00, non callable

- Smith & Nephew PLC (Health Care Supply | Watford, Hertfordshire, United Kingdom | Rating: BBB): €500m Senior Note (XS2532473555), fixed rate (4.57% coupon) maturing on 11 October 2029, priced at 100.00 (original spread of 285 bp), callable (7nc7)

- Tendam Brands SAU (Service - Other | Madrid, Madrid, Luxembourg | Rating: B+): €300m Senior Note (XS2537462389), floating rate (EU03MLIB + 750.0 bp) maturing on 31 March 2028, priced at 93.00, callable (5nc1)

- UniCredit Bank Czech Republic and Slovakia as (Banking | Praha, Praha, Italy | Rating: NR): €500m Covered Bond (Other) (XS2541314584), fixed rate (3.13% coupon) maturing on 11 October 2027, priced at 99.62 (original spread of 162 bp), non callable

- Vinci SA (Building Products | Nanterre, Ile-De-France, France | Rating: A-): €650m Bond (FR001400D8K2), fixed rate (3.38% coupon) maturing on 17 October 2032, priced at 97.80 (original spread of 155 bp), callable (10nc10)

RECENT LOANS

- Modulaire Group, signed a € 140m Term Loan B, to be used for general corporate purposes. It matures on 12/31/28 and initial pricing is set at EURIBOR +450.0bp

RECENT STRUCTURED CREDIT

- Ready Capital Mortgage Financing 2022-Fl10 issued a fixed-rate CLO in 4 tranches, for a total of US$ 652 m. Highest-rated tranche offering a yield to maturity of 2.59%, and the lowest-rated tranche a yield to maturity of 4.31%. Bookrunners: Credit Suisse, Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc