Credit

Poor Performance Across The US Credit Complex, With A Continued Rise In Rates And Wider Spreads

Very little activity in the USD primary corporate bond market this week: 3 tranches for $6.5bn in IG (2022 YTD volume $1.036trn vs 2021 YTD $1.232trn), 3 tranches for $1.06bn in HY (2022 YTD volume $88.061bn vs 2021 YTD $405.441bn)

Published ET

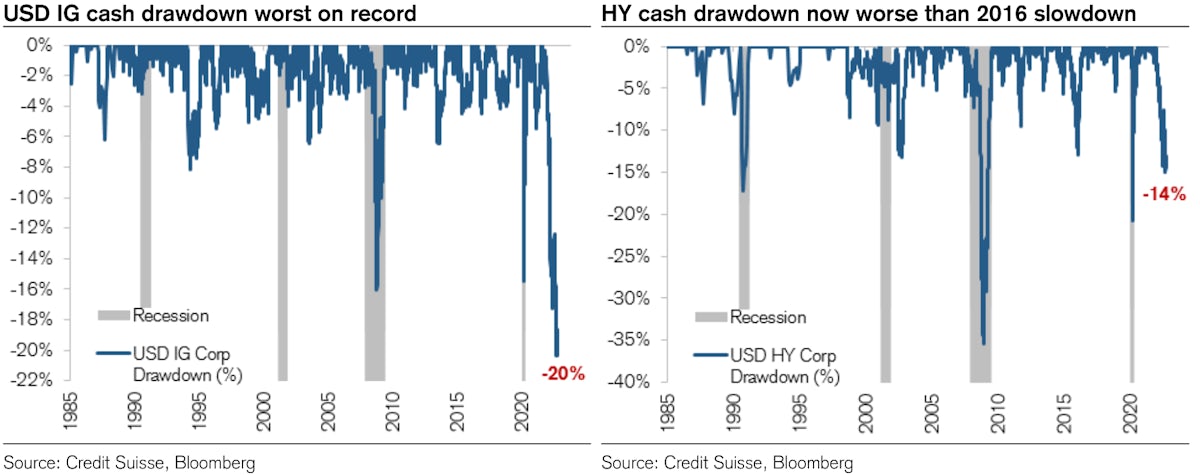

US$ Credit Drawdowns | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was down -0.21% today, with investment grade down -0.24% and high yield up 0.17% (YTD total return: -18.51%)

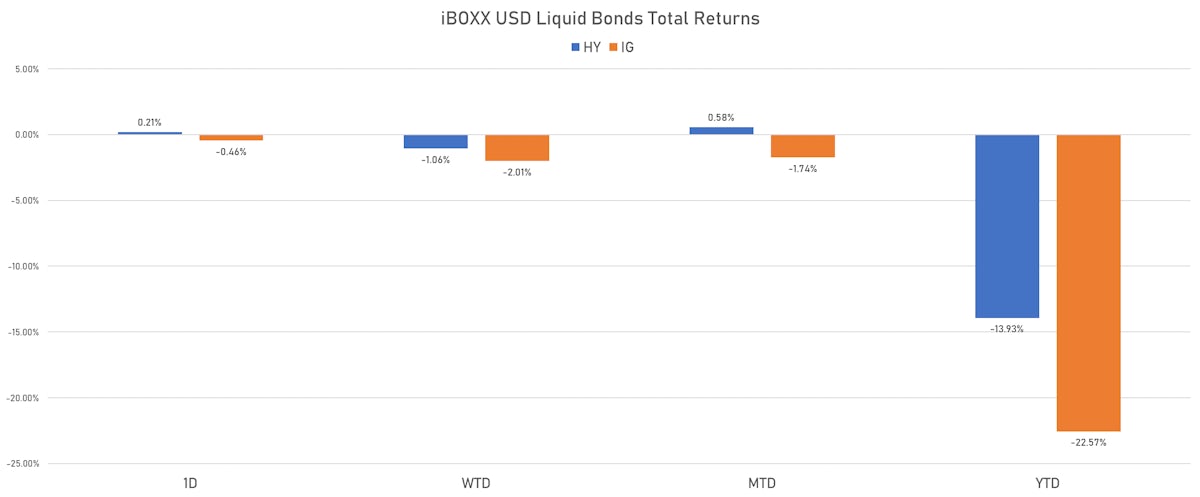

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.460% today (Week-to-date: -2.01%; Month-to-date: -1.74%; Year-to-date: -22.57%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.208% today (Week-to-date: -1.06%; Month-to-date: 0.58%; Year-to-date: -13.93%)

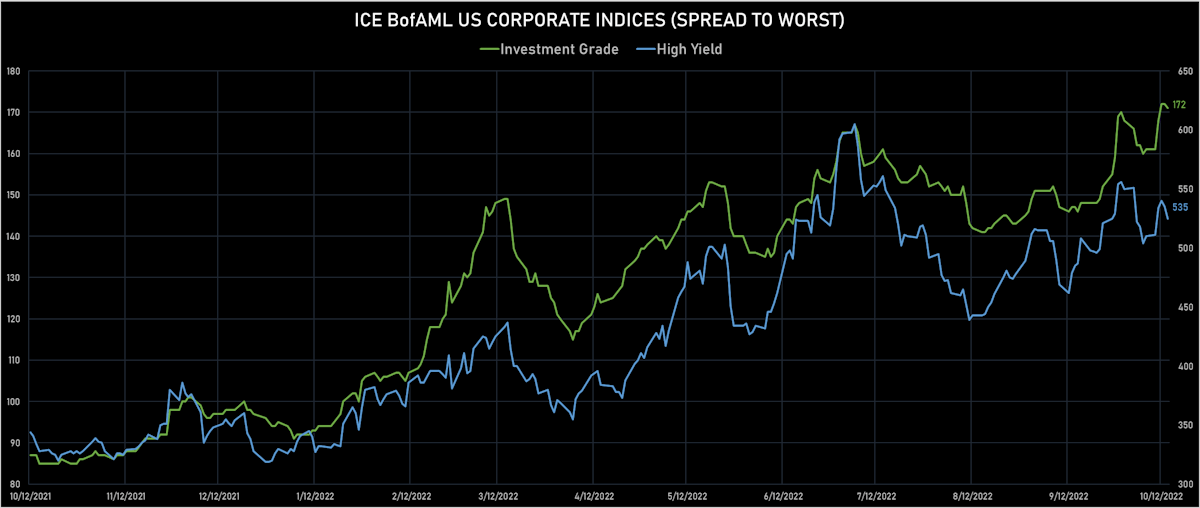

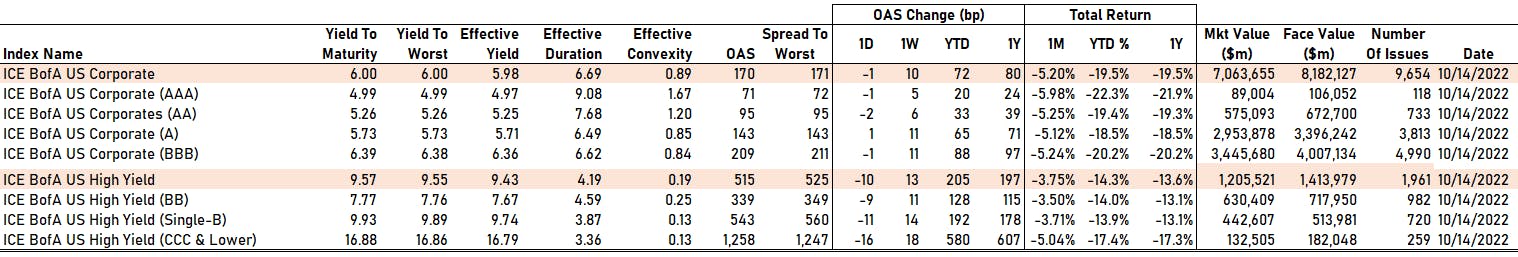

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 171.0 bp (YTD change: +76.0 bp)

- ICE BofA US High Yield Index spread to worst down -10.0 bp, now at 525.0 bp (YTD change: +195.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.20% today (YTD total return: -3.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 71 bp

- AA down by -2 bp at 95 bp

- A up by 1 bp at 143 bp

- BBB down by -1 bp at 209 bp

- BB down by -9 bp at 339 bp

- B down by -11 bp at 543 bp

- ≤ CCC down by -16 bp at 1,258 bp

CDS INDICES TODAY (mid-spreads)

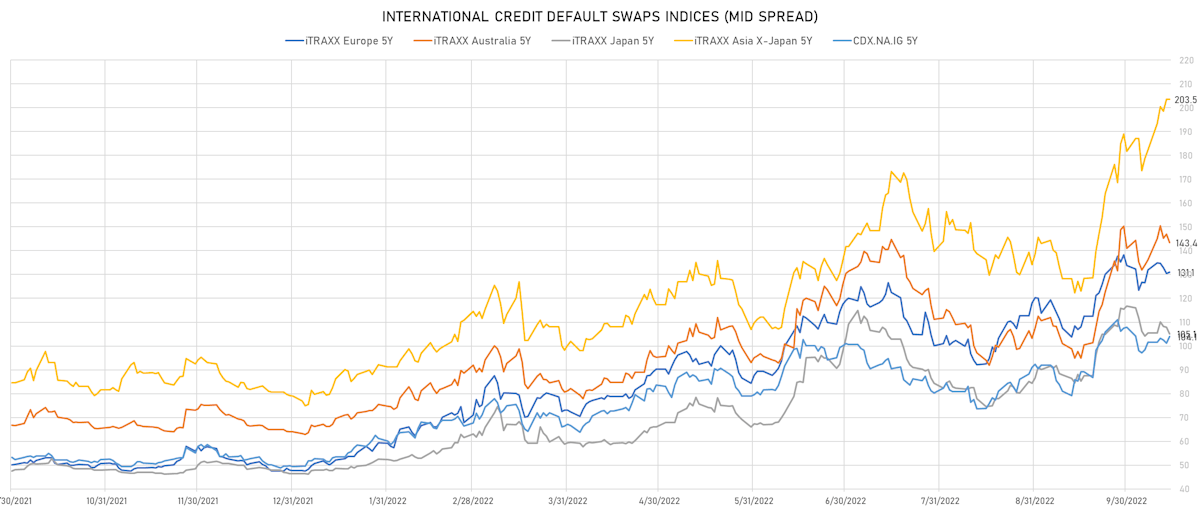

- Markit CDX.NA.IG 5Y up 2.9 bp, now at 104bp (1W change: +2.5bp; YTD change: +54.7bp)

- Markit CDX.NA.IG 10Y up 2.5 bp, now at 135bp (1W change: +1.7bp; YTD change: +46.1bp)

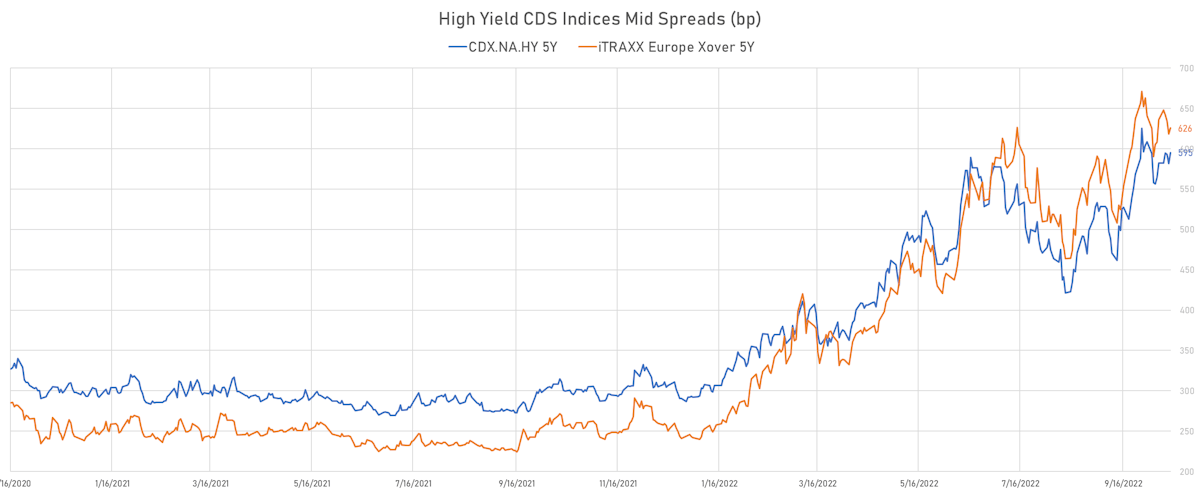

- Markit CDX.NA.HY 5Y up 13.7 bp, now at 595bp (1W change: +13.2bp; YTD change: +303.5bp)

- Markit iTRAXX Europe 5Y up 0.5 bp, now at 131bp (1W change: -0.9bp; YTD change: +83.4bp)

- Markit iTRAXX Europe Crossover 5Y up 7.7 bp, now at 626bp (1W change: -10.1bp; YTD change: +383.9bp)

- Markit iTRAXX Japan 5Y down 2.7 bp, now at 105bp (1W change: -0.4bp; YTD change: +58.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.1 bp, now at 204bp (1W change: +21.2bp; YTD change: +124.5bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: B): down 12950.7 bp to .0bp (1Y range: -3,476bp)

- Transocean Inc (Country: KY; rated: Caa3): down 158.2 bp to 2,117.2bp (1Y range: 1,019-2,858bp)

- Safeway Inc (Country: US; rated: LGD5 - 73%): down 116.0 bp to 172.5bp (1Y range: 147-437bp)

- American Airlines Group Inc (Country: US; rated: B2): down 80.0 bp to 1,476.4bp (1Y range: 607-1,644bp)

- United Airlines Holdings Inc (Country: US; rated: CCC+): down 67.2 bp to 800.4bp (1Y range: 104-800bp)

- DISH DBS Corp (Country: US; rated: B2): down 55.1 bp to 1,381.2bp (1Y range: 366-1,506bp)

- Delta Air Lines Inc (Country: US; rated: A3): down 55.0 bp to 449.2bp (1Y range: 205-573bp)

- Nabors Industries Inc (Country: US; rated: B3): down 48.8 bp to 691.1bp (1Y range: 489-887bp)

- Liberty Interactive LLC (Country: US; rated: BB-): up 51.0 bp to 1,483.9bp (1Y range: 386-1,689bp)

- Lumen Technologies Inc (Country: US; rated: WR): up 61.8 bp to 813.5bp (1Y range: 195-813bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 71.7 bp to 1,796.6bp (1Y range: 430-1,797bp)

- Domtar Corp (Country: US; rated: NR): up 80.2 bp to 1,066.2bp (1Y range: 365-1,066bp)

- Staples Inc (Country: US; rated: B3): up 99.4 bp to 2,096.6bp (1Y range: 967-2,097bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 120.0 bp to 1,750.4bp (1Y range: 616-1,750bp)

- Rite Aid Corp (Country: US; rated: C): up 2487.8 bp to 9,655.1bp (1Y range: 885-9,655bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): down 133.2 bp to 520.1bp (1Y range: 150-790bp)

- Lanxess AG (Country: DE; rated: Baa2): down 21.7 bp to 244.0bp (1Y range: 57-303bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 20.3 bp to 579.2bp (1Y range: 151-600bp)

- Koninklijke Philips NV (Country: NL; rated: Baa1): up 24.2 bp to 145.3bp (1Y range: 25-145bp)

- TUI AG (Country: DE; rated: B3-PD): up 24.9 bp to 1,725.4bp (1Y range: 607-1,725bp)

- Stena AB (Country: SE; rated: B2-PD): up 26.3 bp to 718.2bp (1Y range: 402-865bp)

- Telecom Italia SpA (Country: IT; rated: C): up 28.1 bp to 519.0bp (1Y range: 174-519bp)

- thyssenkrupp AG (Country: DE; rated: A2): up 29.5 bp to 718.0bp (1Y range: 205-718bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 32.5 bp to 1,245.5bp (1Y range: 261-1,254bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 44.0 bp to 1,721.6bp (1Y range: 566-1,722bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 48.4 bp to 1,025.4bp (1Y range: 394-1,025bp)

- Ceconomy AG (Country: DE; rated: A3): up 69.7 bp to 1,714.6bp (1Y range: 185-1,745bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 162.3 bp to 2,746.4bp (1Y range: 1,164-2,892bp)

- Novafives SAS (Country: FR; rated: Caa1): up 187.4 bp to 2,698.1bp (1Y range: 618-2,846bp)

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): up 6985.2 bp to 11,247.3bp (1Y range: 595-11,247bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread up by 102.2 bp to 417.8 bp, with the yield to worst at 8.5% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Masonite International Corp (Tampa, Florida (US)) | Coupon: 3.50% | Maturity: 15/2/2030 | Rating: BB+ | ISIN: USC5389UAM20 | Z-spread up by 61.7 bp to 362.2 bp, with the yield to worst at 7.6% and the bond now trading down to 76.4 cents on the dollar (1Y price range: 76.4-99.0).

- Issuer: Natura &Co Luxembourg Holdings SARL (Luxembourg, Luxembourg) | Coupon: 6.00% | Maturity: 19/4/2029 | Rating: BB | ISIN: USL6S52VAA02 | Z-spread up by 54.3 bp to 581.1 bp, with the yield to worst at 9.8% and the bond now trading down to 81.0 cents on the dollar (1Y price range: 81.0-99.9).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread up by 52.6 bp to 420.5 bp, with the yield to worst at 8.4% and the bond now trading down to 79.5 cents on the dollar (1Y price range: 79.5-102.9).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 52.2 bp to 347.6 bp, with the yield to worst at 7.8% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 88.8-106.9).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 3.88% | Maturity: 15/4/2029 | Rating: BB+ | ISIN: USU58995AJ72 | Z-spread up by 48.1 bp to 387.1 bp, with the yield to worst at 8.0% and the bond now trading down to 79.0 cents on the dollar (1Y price range: 78.5-104.5).

- Issuer: Century Communities Inc (Greenwood Village, United States) | Coupon: 3.88% | Maturity: 15/8/2029 | Rating: BB- | ISIN: USU15662AF37 | Z-spread up by 43.2 bp to 456.8 bp, with the yield to worst at 8.7% and the bond now trading down to 75.3 cents on the dollar (1Y price range: 75.3-101.0).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.50% | Maturity: 15/1/2029 | Rating: BB- | ISIN: USU26886AC29 | Z-spread up by 37.8 bp to 422.7 bp, with the yield to worst at 8.2% and the bond now trading down to 81.0 cents on the dollar (1Y price range: 80.3-103.5).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB+ | ISIN: USU26790AB82 | Z-spread up by 35.4 bp to 305.6 bp, with the yield to worst at 7.3% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 91.3-104.8).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 35.1 bp to 412.6 bp, with the yield to worst at 8.2% and the bond now trading down to 90.6 cents on the dollar (1Y price range: 88.8-105.7).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 33.2 bp to 420.6 bp, with the yield to worst at 8.3% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | ISIN: USU26886AD02 | Z-spread up by 33.0 bp to 402.9 bp, with the yield to worst at 8.0% and the bond now trading down to 79.8 cents on the dollar (1Y price range: 78.5-105.0).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread up by 31.4 bp to 433.6 bp, with the yield to worst at 8.4% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.0-107.1).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 29.1 bp to 474.7 bp, with the yield to worst at 8.7% and the bond now trading down to 80.5 cents on the dollar (1Y price range: 78.0-102.3).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 29.7 bp to 355.3 bp, with the yield to worst at 7.9% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 92.0-108.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | Z-spread up by 98.1 bp to 392.6 bp (CDS basis: -70.6bp), with the yield to worst at 6.7% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.4-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | Z-spread up by 77.0 bp to 377.1 bp (CDS basis: 24.5bp), with the yield to worst at 6.5% and the bond now trading down to 90.2 cents on the dollar (1Y price range: 89.2-105.3).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread up by 72.7 bp to 436.9 bp, with the yield to worst at 7.4% and the bond now trading down to 80.6 cents on the dollar (1Y price range: 80.4-111.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread up by 60.1 bp to 388.1 bp (CDS basis: -33.3bp), with the yield to worst at 6.8% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 86.0-104.8).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | Z-spread up by 59.6 bp to 392.6 bp (CDS basis: -10.1bp), with the yield to worst at 6.8% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 88.2-102.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread up by 58.0 bp to 579.6 bp (CDS basis: -75.5bp), with the yield to worst at 8.6% and the bond now trading down to 78.9 cents on the dollar (1Y price range: 78.0-103.5).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 52.2 bp to 457.8 bp, with the yield to worst at 7.5% and the bond now trading down to 78.9 cents on the dollar (1Y price range: 77.1-92.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | Z-spread up by 51.3 bp to 350.5 bp (CDS basis: 10.0bp), with the yield to worst at 6.5% and the bond now trading down to 90.9 cents on the dollar (1Y price range: 90.5-103.1).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 16/5/2027 | Rating: BB- | ISIN: XS2408458730 | Z-spread up by 50.2 bp to 570.1 bp (CDS basis: -91.6bp), with the yield to worst at 8.5% and the bond now trading down to 78.5 cents on the dollar (1Y price range: 76.9-99.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread up by 49.5 bp to 492.0 bp, with the yield to worst at 7.7% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB | ISIN: XS2332589972 | Z-spread up by 49.1 bp to 384.1 bp, with the yield to worst at 6.7% and the bond now trading down to 84.2 cents on the dollar (1Y price range: 81.0-99.7).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread up by 48.6 bp to 373.2 bp, with the yield to worst at 6.7% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 85.0-108.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 48.4 bp to 528.1 bp, with the yield to worst at 8.3% and the bond now trading down to 69.0 cents on the dollar (1Y price range: 67.8-87.3).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread down by 187.6 bp to 478.8 bp (CDS basis: 83.2bp), with the yield to worst at 7.0% and the bond now trading up to 88.6 cents on the dollar (1Y price range: 83.8-100.0).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread down by 189.1 bp to 447.4 bp (CDS basis: 102.9bp), with the yield to worst at 6.8% and the bond now trading up to 84.4 cents on the dollar (1Y price range: 79.1-97.5).

RECENT DOMESTIC USD BOND ISSUES

- Arbor Realty Sr Inc (Home Builders | Uniondale, New York, United States | Rating: NR): US$150m Senior Note (US03881NAC11), fixed rate (8.50% coupon) maturing on 15 October 2027, callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133ENT261), fixed rate (5.30% coupon) maturing on 19 October 2026, priced at 100.00 (original spread of 121 bp), callable (4nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$350m Bond (US3133ENS925), floating rate (PRQ + -304.0 bp) maturing on 17 October 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133ENU244), fixed rate (6.45% coupon) maturing on 19 October 2037, priced at 100.00, callable (15nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133ENU327), fixed rate (4.50% coupon) maturing on 20 October 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$405m Bond (US3133ENT915), floating rate (SOFR + 30.0 bp) maturing on 20 October 2025, priced at 100.00, non callable

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$3,000m Senior Note (US61747YEY77), floating rate maturing on 18 October 2033, priced at 100.00, callable (11nc10)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$1,250m Senior Note (US61747YEX94), floating rate maturing on 16 October 2026, priced at 100.00, callable (4nc3)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$2,250m Senior Note (US61747YEV39), floating rate maturing on 18 October 2028, priced at 100.00, callable (6nc5)

- Northern Oil and Gas Inc (Gas Utility - Local Distrib | Minnetonka, Minnesota, United States | Rating: B): US$500m Bond (US665531AH25), fixed rate (3.63% coupon) maturing on 15 April 2029, priced at 100.00, non callable, convertible

- Odeon Finco PLC (Financial - Other | United States | Rating: B): US$400m Note (US67585LAA35), fixed rate (12.75% coupon) maturing on 1 November 2027, priced at 92.00 (original spread of 1,091 bp), callable (5nc2)

RECENT INTERNATIONAL USD BOND ISSUES

- CBB International Sukuk Programme Company WLL (Financial - Other | Manama, Capital Governorate, Bahrain | Rating: NR): US$350m Unsecured Note (XS2546355616), fixed rate (6.50% coupon) maturing on 13 April 2028, priced at 100.00, non callable

- EnQuest PLC (Oil and Gas | London, United Kingdom | Rating: B-): US$305m Senior Note (USG315APAG37), fixed rate (11.63% coupon) maturing on 1 November 2027, priced at 98.61 (original spread of 780 bp), callable (5nc2)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A31F25), fixed rate (4.55% coupon) maturing on 21 October 2024, priced at 98.60, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$150m Senior Note (XS2548008486), fixed rate (4.83% coupon) maturing on 20 October 2025, priced at 100.00, callable (3nc1)

- LATAM Airlines Group SA (Airline | Renca, Chile | Rating: B+): US$700m Note (USP6S60VAB44), fixed rate (13.38% coupon) maturing on 15 October 2029, priced at 93.10 (original spread of 1,094 bp), callable (7nc3)

- LATAM Airlines Group SA (Airline | Renca, Chile | Rating: B+): US$450m Note (USP6S60VAA60), fixed rate (13.38% coupon) maturing on 15 October 2027, priced at 94.42 (original spread of 1,085 bp), callable (5nc2)

- Sovkomflot PAO (Transportation - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): US$430m Bond (RU000A105A87), fixed rate (3.85% coupon) maturing on 26 April 2028, priced at 100.00, non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): US$127m Note (XS2544920270), floating rate (SOFR + 100.0 bp) maturing on 22 April 2027, priced at 101.71, non callable

- Syngenta Group Finance Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$500m Senior Note (XS2543373075), fixed rate (5.00% coupon) maturing on 19 April 2026, priced at 99.54 (original spread of 80 bp), callable (4nc3)

- XPO Escrow Sub LLC (Financial - Other | Rating: NR): US$355m Senior Note (US98379JAA34), fixed rate (7.50% coupon) maturing on 15 November 2027, priced at 98.96 (original spread of 357 bp), callable (5nc2)

RECENT EUR BOND ISSUES

- Agence Francaise de Developpement EPIC (Agency | Paris, France | Rating: AA): €1,200m Bond (FR001400DCB7), fixed rate (3.50% coupon) maturing on 25 February 2033, priced at 99.43, non callable

- Argenta Spaarbank NV (Banking | Antwerp, Belgium | Rating: A-): €500m Covered Bond (Other) (BE6338543786), fixed rate (3.25% coupon) maturing on 20 October 2026, priced at 99.87 (original spread of 124 bp), non callable

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €120m Unsecured Note (XS2441474702) zero coupon maturing on 17 March 2027, priced at 100.00, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €300m Inhaberschuldverschreibung (DE000BLB9SL1), fixed rate (3.00% coupon) maturing on 21 October 2024, priced at 99.81, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000BLB6JT9), fixed rate (3.13% coupon) maturing on 19 October 2027, priced at 99.91 (original spread of 112 bp), non callable

- Belfius Banque SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €500m Belgian Mortgage Pandbrieven (Covered Bond) (BE0002892736), fixed rate (3.25% coupon) maturing on 18 October 2027, priced at 99.99 (original spread of 115 bp), non callable

- Brandenburg, State of (Official and Muni | Potsdam, Germany | Rating: AAA): €200m Inhaberschuldverschreibung (DE000A3E5SK7), floating rate (EU06MLIB + 5.0 bp) maturing on 20 October 2042, priced at 100.00, non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: NR): €1,000m Obligation Fonciere (Covered Bond) (FR001400DAI6), fixed rate (3.25% coupon) maturing on 19 February 2029, priced at 99.96 (original spread of 117 bp), non callable

- Caisse des Depots et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR001400DCH4), fixed rate (3.00% coupon) maturing on 25 November 2027, priced at 99.75 (original spread of 95 bp), non callable

- Cassa Depositi e Prestiti SpA (Agency | Rome, Roma, Italy | Rating: BBB): €150m Bond (IT0005514242), fixed rate (4.44% coupon) maturing on 12 October 2030, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,000m Covered Bond (Other) (XS2544645117), fixed rate (3.25% coupon) maturing on 24 October 2025, priced at 100.00 (original spread of 137 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): €150m Inhaberschuldverschreibung (AT0000A31E18), fixed rate (3.10% coupon) maturing on 21 November 2024, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31EW6), fixed rate (2.90% coupon) maturing on 11 May 2026, priced at 100.00, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €6,000m Senior Note (EU000A3K4DV0), fixed rate (3.38% coupon) maturing on 4 November 2042, priced at 99.58 (original spread of 102 bp), non callable

- Fiber Bidco SpA (Financial - Other | Milan, Milano, Italy | Rating: B): €573m Senior Note (XS2548508451), floating rate (EU03MLIB + 600.0 bp) maturing on 25 October 2027, priced at 91.00, callable (5nc1)

- Germany, Federal Republic of (Government) (Sovereign | Berlin, Berlin, Germany | Rating: AAA): €4,000m Bundesanleihe (DE0001102614), fixed rate (1.80% coupon) maturing on 15 August 2053, priced at 88.05 (original spread of 3 bp), non callable

- Hypo Vorarlberg Bank AG (Banking | Bregenz, Vorarlberg, Austria | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (AT0000A30ZH4), fixed rate (3.25% coupon) maturing on 19 February 2027, priced at 99.84 (original spread of 129 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €4,875m Buono del Tesoro Poliennali (IT0005514473), fixed rate (3.50% coupon) maturing on 15 January 2026, priced at 99.90 (original spread of 175 bp), non callable

- La Banque Postale Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400DC98), fixed rate (3.25% coupon) maturing on 23 January 2030, priced at 99.22 (original spread of 120 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA-): €1,000m Oeffentlicher Pfandbrief Jumbo (Covered Bond) (DE000LB381U7), fixed rate (2.75% coupon) maturing on 18 October 2024, priced at 99.76 (original spread of 106 bp), non callable

- Landesbank Berlin AG (Banking | Berlin, Berlin, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000A162BG3), fixed rate (3.00% coupon) maturing on 20 April 2027, priced at 99.73 (original spread of 107 bp), non callable

- OP Yrityspankki Oyj (Banking | Helsinki, Etela-Suomen, Finland | Rating: AA-): €500m Note (XS2546781555), fixed rate (4.13% coupon) maturing on 18 April 2027, priced at 99.69 (original spread of 214 bp), non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €549m Unsecured Note (XS2546370763) zero coupon maturing on 25 February 2025, priced at 100.00, non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €763m Unsecured Note (XS2546370417) zero coupon maturing on 20 October 2026, priced at 100.00, non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €805m Unsecured Note (XS2546370680) zero coupon maturing on 20 December 2024, priced at 100.00, non callable

- Slovak Republic (Government) (Sovereign | Bratislava, Bratislavsky Kraj, Slovakia | Rating: A): €1,000m Bond (SK4000021986), fixed rate (4.00% coupon) maturing on 19 October 2032, priced at 99.32 (original spread of 164 bp), non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €500m Hypothekenpfandbrief (Covered Bond) (DE000HV2AY46), fixed rate (3.00% coupon) maturing on 2 September 2026, priced at 100.00, non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €750m Senior Note (XS2546340188), floating rate maturing on 16 March 2027, priced at 100.00, callable (4nc3)

- Vattenfall AB (Utility - Other | Solna, Stockholm, Sweden | Rating: BBB+): €500m Senior Note (XS2545248242), fixed rate (3.75% coupon) maturing on 18 October 2026, priced at 99.98 (original spread of 181 bp), callable (4nc4)

RECENT LOANS

- Atlantia SpA (Italy | BB+), signed a € 1,500m Term Loan maturing on 03/05/26, to be used for general corporate purposes

- CPI/AHP University Place Mob (United States of America), signed a US$ 102m Term Loan maturing on 07/08/26, to be used for real estate acquisitions

- DEPA Infrastructure SA (Greece), signed a € 190m Term Loan maturing on 10/06/34, to be used for capital expenditures.

- DEPA Infrastructure SA (Greece), signed a € 200m Term Loan maturing on 10/06/27, to be used for capital expenditures.

- DEPA Infrastructure SA (Greece), signed a € 190m Term Loan maturing on 10/06/29, to be used for capital expenditures.

- FAUN Umwelttechnik (Germany), signed a € 115m Revolving Credit Facility maturing on 10/05/27, to be used for general corporate purposes

- Federal Realty Invstmnt Trust (United States of America | BBB+), signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/05/27 and initial pricing is set at Term SOFR +70.0bp

- Federal Realty Invstmnt Trust (United States of America | BBB+), signed a US$ 600m Term Loan A, to be used for general corporate purposes. It matures on 04/16/24 and initial pricing is set at Term SOFR +75.0bp

- Formosa Ha Tinh (Cayman) Ltd (Vietnam), signed a US$ 800m Revolving Credit / Term Loan maturing on 10/06/27, to be used for working capital

- Formosa Ha Tinh (Cayman) Ltd (Vietnam), signed a US$ 400m Revolving Credit / Term Loan maturing on 10/06/25, to be used for working capital

- Gasverbund Mittelland AG (Sweden), signed a € 200m Term Loan, to be used for general corporate purposes.

- Global Switch Holdings Ltd (United Kingdom | BBB), signed a US$ 4,500m Revolving Credit / Term Loan, to be used for leveraged buyout.

- Kachi Lithium Brine (Argentina), signed a US$ 800m Term Loan, to be used for project finance.

- Karavasta Solar PV Plant Proj (Albania), signed a € 125m Term Loan, to be used for project finance.

- Kom Ombo Solar Scheme (Egypt), signed a US$ 165m Term Loan, to be used for project finance

- Mega Northvolt 2 Expansion (Sweden), signed a € 5,000m Term Loan, to be used for project finance

- Mh Teplarensky Holding (Slovak Republic), signed a € 160m Term Loan, to be used for general corporate purposes. It matures on 01/00/00.

- Midland Cogeneration Venture (United States of America | BBB-), signed a US$ 894m Term Loan, to be used for project finance. It matures on 01/00/00.

- PT Harum Energy Tbk (Indonesia), signed a US$ 390m Revolving Credit Facility maturing on 12/31/25, to be used for general corporate purposes, working capital, and capital expenditures

- PT Perusahaan Gas Negara Tbk (Indonesia), signed a US$ 1,000m Revolving Credit / Term Loan maturing on 10/05/27, to be used for general corporate purposes.

- Vetroelektrane Balkana doo (Serbia), signed a € 205m Term Loan, to be used for project finance.

- Voith GmbH & Co KGaA (Germany | BB+), signed a € 600m Revolving Credit Facility maturing on 10/06/27, to be used for general corporate purposes

RECENT ISSUANCE IN STRUCTURED CREDIT

- FHF Trust 2022-2 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 149 m. Highest-rated tranche offering a yield to maturity of 6.19%, and the lowest-rated tranche a yield to maturity of 7.21%. Bookrunners: Goldman Sachs & Co,

Deutsche Bank Securities Inc - Fortress Credit Bsl Xvi Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 218 m. Highest-rated tranche offering a spread over the floating rate of 235bp, and the lowest-rated tranche a spread of 777bp. Bookrunners: Bank of America Merrill Lynch

- Freddie Mac Spc Series K-F144 issued a floating-rate Agency CMBS in 1 tranche, for a total of US$ 808 m. Highest-rated tranche offering a spread over the floating rate of 75bp, and the lowest-rated tranche a spread of 75bp. Bookrunners: Morgan Stanley International Ltd, BMO Capital Markets

- North Mill Equipment Funding 2022-B issued a fixed-rate ABS backed by equipment leases in 4 tranches, for a total of US$ 353 m. Highest-rated tranche offering a yield to maturity of 4.68%, and the lowest-rated tranche a yield to maturity of 8.54%. Bookrunners: Deutsche Bank Securities Inc, Truist Securities Inc

- Penta CLO 12 Dac issued a floating-rate CLO in 5 tranches, for a total of € 238 m. Highest-rated tranche offering a spread over the floating rate of 210bp, and the lowest-rated tranche a spread of 664bp. Bookrunners: Morgan Stanley & Co

- Prpm 2022-Nqm1 Trust issued a fixed-rate RMBS in 6 tranches, for a total of US$ 276 m. Bookrunners: Nomura Securities New York Inc, Goldman Sachs & Co, Barclays Capital Group

- Ready Capital Mortgage Financing 2022-Fl10 issued a fixed-rate CLO in 4 tranches, for a total of US$ 652 m. Highest-rated tranche offering a yield to maturity of 2.59%, and the lowest-rated tranche a yield to maturity of 4.31%. Bookrunners: Credit Suisse, Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc

- Verus Securitization Trust 2022-8 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 419 m. Bookrunners: Credit Suisse, Morgan Stanley International Ltd, JP Morgan & Co Inc, Barclays Capital Group, Deutsche Bank Securities Inc

- Westlake Automobile Receivables Trust 2022-3 issued a fixed-rate ABS backed by auto receivables in 6 tranches, for a total of US$ 1,100 m. Highest-rated tranche offering a yield to maturity of 4.01%, and the lowest-rated tranche a yield to maturity of 6.68%. Bookrunners: RBC Capital Markets, Wells Fargo Securities LLC, Mizuho Securities USA Inc, SMBC Nikko Securities America Inc