Credit

Positive Week For US HY Credit, Though Cash Spreads Widened On Friday, Parting Ways With Equities Into The Weekend

US$ IG corporate issuance rebounded this week as 3Q earnings started to roll in: 24 tranches for $20.25bn in IG (2022 YTD volume $1.056tn, down 18% vs 2021 YTD), and 1 tranche for $2.03bn in HY (2022 YTD volume $90.091bn, down 78.3% vs 2021 YTD)

Published ET

iBOXX USD Liquid Bonds Total Returns | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

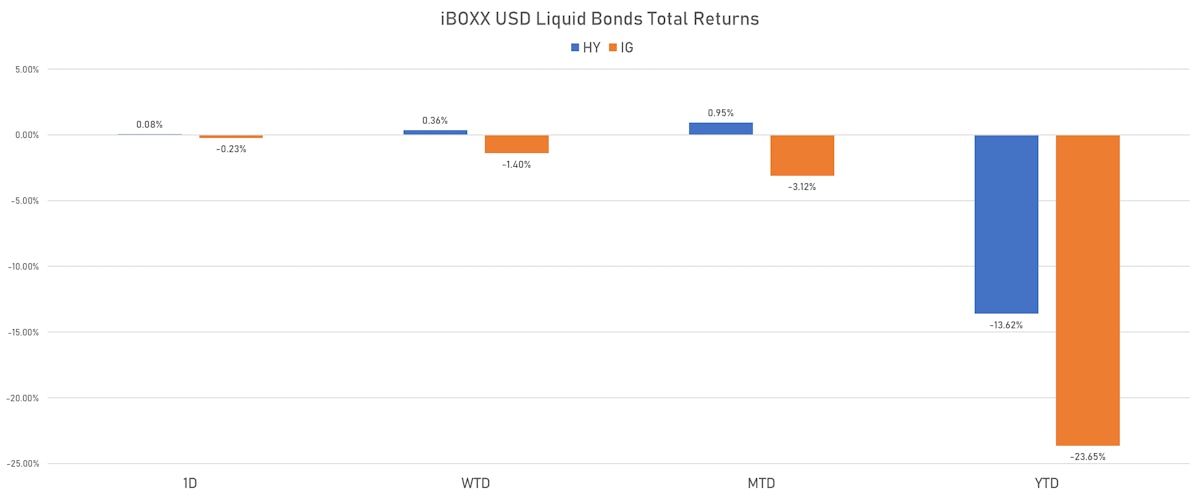

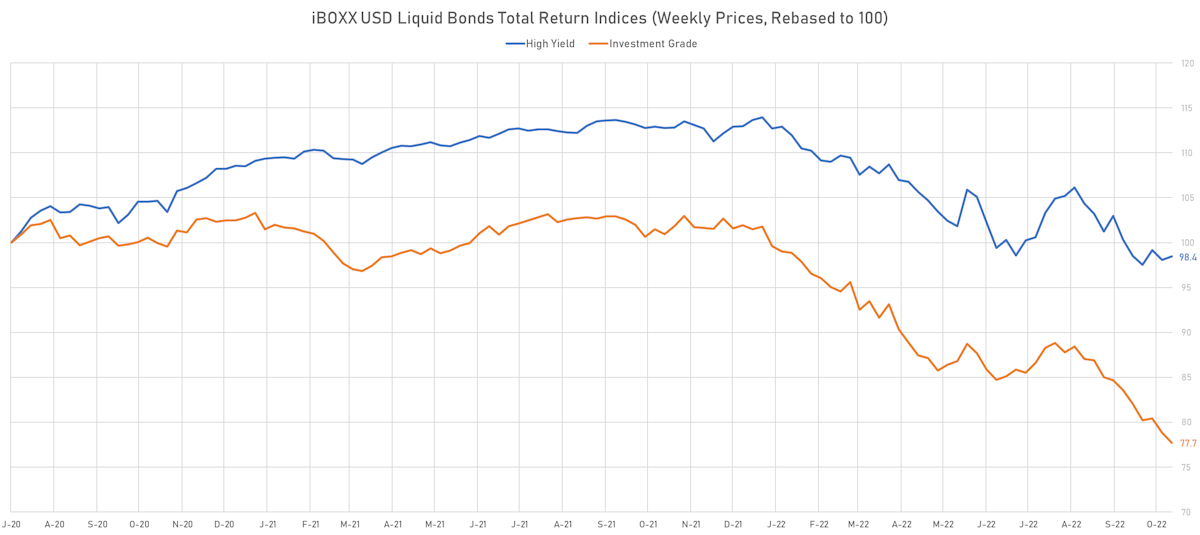

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.231% today (Week-to-date: -1.40%; Month-to-date: -3.12%; Year-to-date: -23.65%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.079% today (Week-to-date: 0.36%; Month-to-date: 0.95%; Year-to-date: -13.62%)

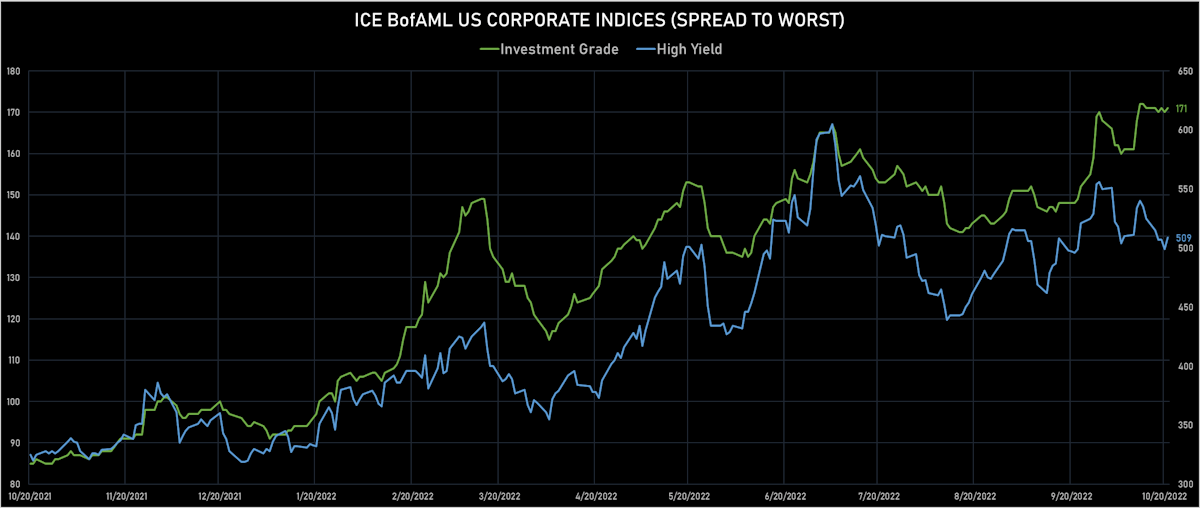

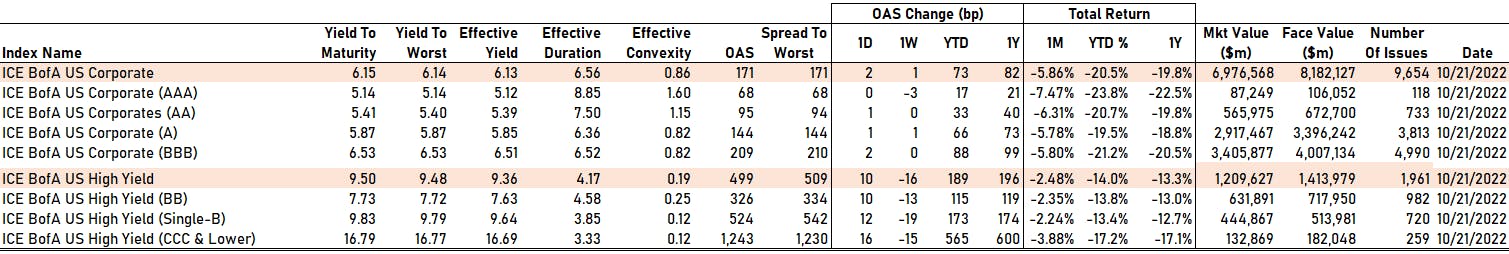

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 171.0 bp (YTD change: +76.0 bp)

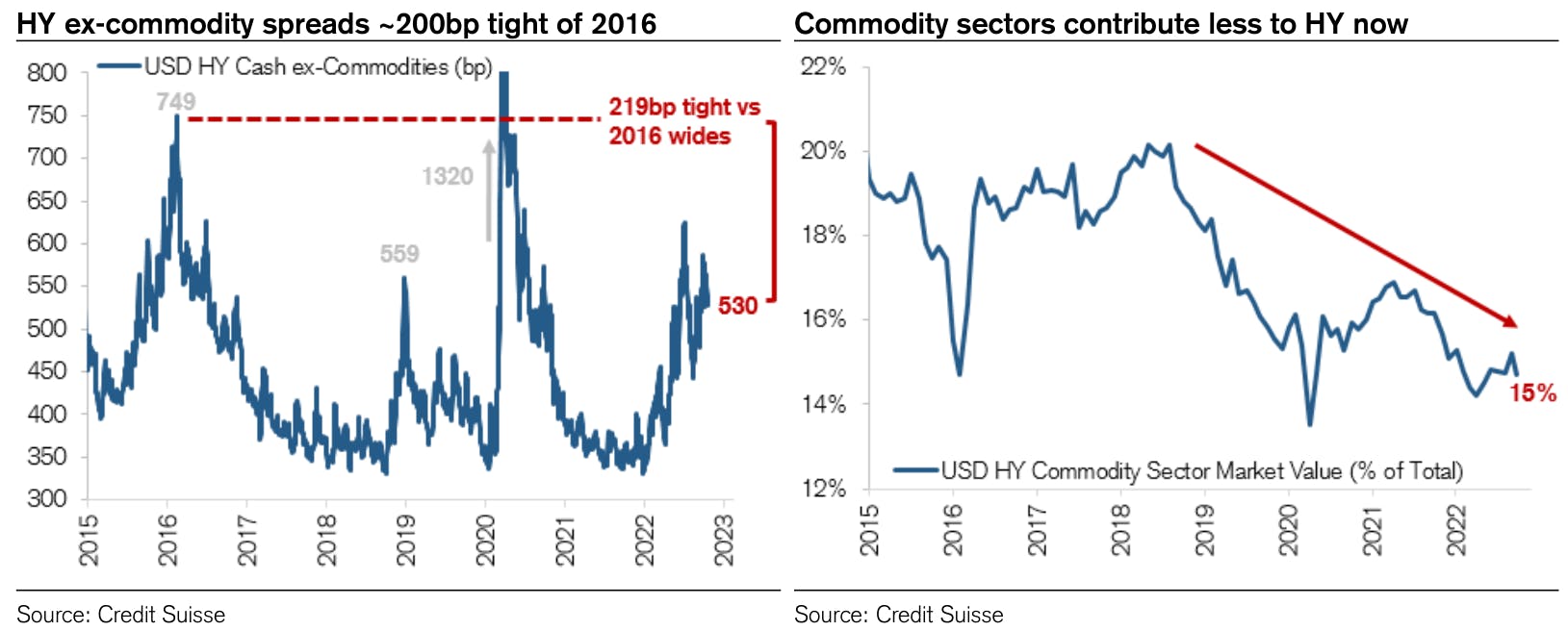

- ICE BofA US High Yield Index spread to worst up 10.0 bp, now at 509.0 bp (YTD change: +179.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.18% today (YTD total return: -3.0%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 68 bp

- AA up by 1 bp at 95 bp

- A up by 1 bp at 144 bp

- BBB up by 2 bp at 209 bp

- BB up by 10 bp at 326 bp

- B up by 12 bp at 524 bp

- ≤ CCC up by 16 bp at 1,243 bp

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 4.7 bp, now at 94bp (1W change: -9.8bp; YTD change: +45.0bp)

- Markit CDX.NA.IG 10Y down 4.4 bp, now at 126bp (1W change: -9.4bp; YTD change: +37.0bp)

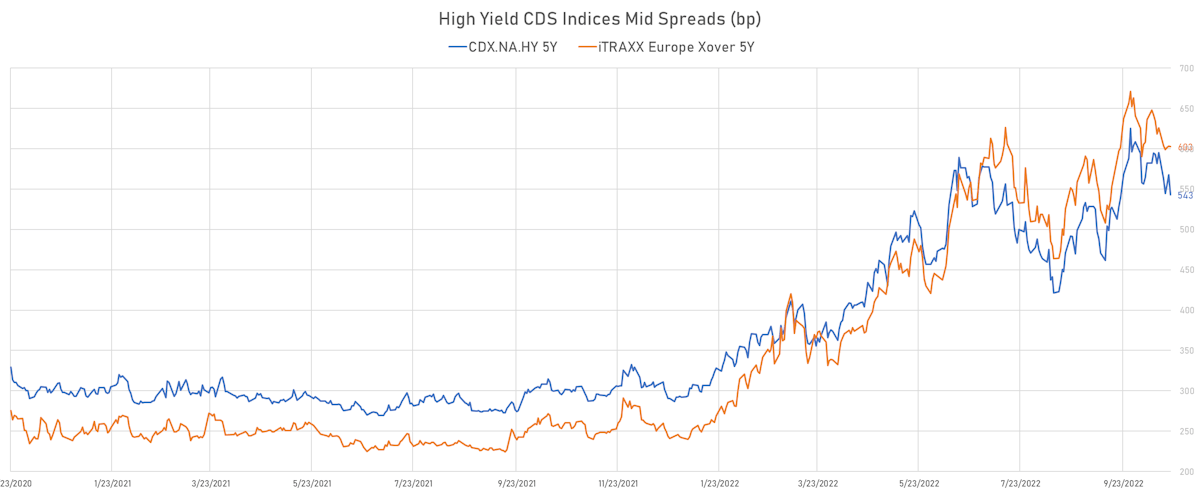

- Markit CDX.NA.HY 5Y down 25.1 bp, now at 543bp (1W change: -52.7bp; YTD change: +250.8bp)

- Markit iTRAXX Europe 5Y up 0.1 bp, now at 125bp (1W change: -6.2bp; YTD change: +77.4bp)

- Markit iTRAXX Europe Crossover 5Y down 0.4 bp, now at 603bp (1W change: -23.4bp; YTD change: +360.5bp)

- Markit iTRAXX Japan 5Y up 2.8 bp, now at 107bp (1W change: +1.9bp; YTD change: +60.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 7.5 bp, now at 219bp (1W change: +17.8bp; YTD change: +140.2bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 158.9 bp to 1,973.7bp (1Y range: 1,019-2,858bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 155.7 bp to 1,654.0bp (1Y range: 430-1,783bp)

- American Airlines Group Inc (Country: US; rated: B2): down 133.9 bp to 1,342.5bp (1Y range: 607-1,644bp)

- United Airlines Holdings Inc (Country: US; rated: CCC+): down 81.9 bp to 718.4bp (1Y range: 104-718bp)

- Kohls Corp (Country: US; rated: NR): down 72.2 bp to 598.0bp (1Y range: 112-686bp)

- United States Steel Corp (Country: US; rated: BBB-): down 56.0 bp to 603.7bp (1Y range: 306-780bp)

- Domtar Corp (Country: US; rated: NR): down 55.7 bp to 1,024.3bp (1Y range: 365-1,046bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): down 49.1 bp to 448.3bp (1Y range: 333-608bp)

- Bombardier Inc (Country: CA; rated: CCC-): down 48.5 bp to 620.8bp (1Y range: 432-1,007bp)

- Tegna Inc (Country: US; rated: Ba3): up 55.7 bp to 907.8bp (1Y range: 182-908bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 66.0 bp to 1,813.5bp (1Y range: 616-1,813bp)

- Tenet Healthcare Corp (Country: US; rated: A3): up 92.5 bp to 538.7bp (1Y range: 268-576bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 147.9 bp to 2,124.7bp (1Y range: 316-2,125bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 89.9 bp to 2,608.2bp (1Y range: 618-2,936bp)

- Credit Suisse Group AG (Country: CH; rated: A1): down 47.5 bp to 269.4bp (1Y range: 56-375bp)

- ThyssenKrupp AG (Country: DE; rated: A2): down 43.3 bp to 674.7bp (1Y range: 205-705bp)

- Renault SA (Country: FR; rated: A3): down 39.3 bp to 382.2bp (1Y range: 175-476bp)

- Air France KLM SA (Country: FR; rated: C): down 35.8 bp to 829.4bp (1Y range: 386-990bp)

- ITV PLC (Country: GB; rated: WR): down 33.9 bp to 254.7bp (1Y range: 109-303bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 27.3 bp to 470.5bp (1Y range: 209-606bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 25.7 bp to 1,695.9bp (1Y range: 566-1,739bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): down 25.6 bp to 466.5bp (1Y range: 161-523bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 25.9 bp to 1,051.3bp (1Y range: 394-1,051bp)

- Stena AB (Country: SE; rated: B2-PD): up 31.5 bp to 749.7bp (1Y range: 402-865bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 37.2 bp to 266.5bp (1Y range: 68-268bp)

- PostNL NV (Country: NL; rated: WR): up 37.7 bp to 182.1bp (1Y range: 33-182bp)

- Telecom Italia SpA (Country: IT; rated: C): up 78.9 bp to 597.9bp (1Y range: 174-598bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread up by 70.8 bp to 542.3 bp, with the yield to worst at 9.5% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 77.0-102.3).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread up by 43.6 bp to 462.4 bp, with the yield to worst at 8.8% and the bond now trading down to 85.9 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: Ashland LLC (Covington, Kentucky (US)) | Coupon: 3.38% | Maturity: 1/9/2031 | Rating: BB+ | ISIN: USU0442LAA45 | Z-spread down by 32.2 bp to 265.1 bp (CDS basis: -53.5bp), with the yield to worst at 6.8% and the bond now trading up to 76.8 cents on the dollar (1Y price range: 75.5-99.3).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 35.9 bp to 353.9 bp, with the yield to worst at 7.9% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 92.0-112.0).

- Issuer: Venture Global Calcasieu Pass LLC (Washington DC, Washington Dc (US)) | Coupon: 4.13% | Maturity: 15/8/2031 | Rating: BB | ISIN: USU9220MAB91 | Z-spread down by 36.0 bp to 250.1 bp, with the yield to worst at 6.7% and the bond now trading up to 82.5 cents on the dollar (1Y price range: 81.3-106.4).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 3.88% | Maturity: 15/4/2029 | Rating: BB+ | ISIN: USU58995AJ72 | Z-spread down by 36.4 bp to 352.0 bp, with the yield to worst at 7.8% and the bond now trading up to 80.0 cents on the dollar (1Y price range: 78.5-104.5).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 15/3/2028 | Rating: BB | ISIN: USU41441AB92 | Z-spread down by 44.7 bp to 247.2 bp, with the yield to worst at 6.3% and the bond now trading up to 85.5 cents on the dollar (1Y price range: 83.6-100.5).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 48.5 bp to 385.1 bp, with the yield to worst at 8.0% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 90.0-107.1).

- Issuer: Starwood Property Trust Inc (Greenwich, United States) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread down by 52.7 bp to 299.4 bp, with the yield to worst at 7.7% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 90.0-101.4).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 52.9 bp to 363.4 bp, with the yield to worst at 7.9% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 88.8-105.7).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | ISIN: USU6S19GAC10 | Z-spread down by 53.1 bp to 396.8 bp (CDS basis: -62.4bp), with the yield to worst at 8.1% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 92.0-104.1).

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU3165EAA92 | Z-spread down by 59.4 bp to 446.1 bp, with the yield to worst at 8.8% and the bond now trading up to 79.2 cents on the dollar (1Y price range: 76.9-97.8).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread down by 60.8 bp to 274.6 bp, with the yield to worst at 6.9% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 88.0-106.3).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread down by 76.0 bp to 347.2 bp, with the yield to worst at 7.8% and the bond now trading up to 82.0 cents on the dollar (1Y price range: 79.0-102.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.50% | Maturity: 15/1/2029 | Rating: BB- | ISIN: USU26886AC29 | Z-spread down by 84.5 bp to 341.0 bp, with the yield to worst at 7.6% and the bond now trading up to 84.0 cents on the dollar (1Y price range: 80.3-103.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB | ISIN: XS2301390089 | Z-spread up by 5.2 bp to 459.1 bp (CDS basis: -139.2bp), with the yield to worst at 7.5% and the bond now trading down to 75.3 cents on the dollar (1Y price range: 74.8-102.6).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 13/7/2027 | Rating: BB | ISIN: XS1645722262 | Z-spread up by .1 bp to 390.3 bp (CDS basis: -79.1bp), with the yield to worst at 6.6% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 79.5-103.0).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 4.13% | Maturity: 24/5/2027 | Rating: BB+ | ISIN: FR001400AK26 | Z-spread down by 7.2 bp to 258.7 bp, with the yield to worst at 5.5% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 91.6-100.9).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.13% | Maturity: 30/4/2029 | Rating: BB | ISIN: XS2332590475 | Z-spread down by 8.6 bp to 350.6 bp, with the yield to worst at 6.5% and the bond now trading up to 76.8 cents on the dollar (1Y price range: 69.3-98.6).

- Issuer: Rexel SA (Paris, France) | Coupon: 2.13% | Maturity: 15/12/2028 | Rating: BB- | ISIN: XS2403428472 | Z-spread down by 9.5 bp to 354.1 bp (CDS basis: 13.2bp), with the yield to worst at 6.5% and the bond now trading up to 77.9 cents on the dollar (1Y price range: 75.9-101.0).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB+ | ISIN: FR0013449998 | Z-spread down by 12.7 bp to 273.2 bp, with the yield to worst at 5.7% and the bond now trading up to 80.8 cents on the dollar (1Y price range: 77.6-99.6).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 28.9 bp to 508.4 bp (CDS basis: -36.8bp), with the yield to worst at 8.0% and the bond now trading up to 76.2 cents on the dollar (1Y price range: 72.5-101.7).

RECENT DOMESTIC USD BOND ISSUES

- Bank of New York Mellon Corp (Securities | New York City, New York, United States | Rating: A): US$1,500m Senior Note (US06406RBM88), floating rate maturing on 25 October 2033, priced at 100.00 (original spread of 184 bp), callable (11nc10)

- Bank of New York Mellon Corp (Securities | New York City, New York, United States | Rating: A): US$1,000m Senior Note (US06406RBL06), floating rate maturing on 25 October 2028, priced at 100.00 (original spread of 160 bp), callable (6nc5)

- Carnival Holdings (Bermuda) Ltd (Financial - Other | United States | Rating: B): US$2,030m Senior Note (US14366RAA77), fixed rate (10.38% coupon) maturing on 1 May 2028, priced at 98.47 (original spread of 649 bp), callable (6nc3)

- CommonSpirit Health (Health Care Facilities | Chicago, Illinois, United States | Rating: BBB+): US$507m Bond (US20268JAK97), fixed rate (6.07% coupon) maturing on 1 November 2027, priced at 100.00 (original spread of 185 bp), callable (5nc5)

- CommonSpirit Health (Health Care Facilities | Chicago, Illinois, United States | Rating: BBB+): US$300m Bond (US20268JAM53), fixed rate (6.46% coupon) maturing on 1 November 2052, priced at 100.00 (original spread of 240 bp), callable (30nc30)

- Diamondback Energy Inc (Oil and Gas | Midland, Texas, United States | Rating: BBB-): US$1,100m Senior Note (US25278XAV10), fixed rate (6.25% coupon) maturing on 15 March 2033, priced at 99.57 (original spread of 232 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$115m Bond (US3133ENV317), fixed rate (5.87% coupon) maturing on 24 October 2029, priced at 100.00 (original spread of 166 bp), callable (7nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$630m Bond (US3133ENV804), floating rate (SOFR + 12.0 bp) maturing on 25 October 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$185m Bond (US3133ENV499), floating rate (SOFR + 42.0 bp) maturing on 25 October 2027, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133ENV721), fixed rate (4.50% coupon) maturing on 27 July 2026, priced at 99.65 (original spread of 7 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$170m Bond (US3133ENV234), fixed rate (5.48% coupon) maturing on 25 October 2027, priced at 100.00 (original spread of 136 bp), callable (5nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$750m Bond (US3130ATR415), floating rate (SOFR + 11.0 bp) maturing on 21 October 2024, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$391m Bond (US3130ATQ599), fixed rate (4.55% coupon) maturing on 30 October 2024, priced at 100.00 (original spread of 16 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$355m Bond (US3130ATRH20), fixed rate (5.40% coupon) maturing on 1 November 2024, priced at 100.00 (original spread of 93 bp), callable (2nc1m)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$1,000m Senior Note (US539830BX60), fixed rate (5.70% coupon) maturing on 15 November 2054, priced at 99.18 (original spread of 193 bp), callable (32nc32)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$750m Senior Note (US539830BY44), fixed rate (5.90% coupon) maturing on 15 November 2063, priced at 99.14 (original spread of 180 bp), callable (41nc41)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$500m Senior Note (US539830BU22), fixed rate (4.95% coupon) maturing on 15 October 2025, priced at 99.72 (original spread of 55 bp), callable (3nc3)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$750m Senior Note (US539830BV05), fixed rate (5.10% coupon) maturing on 15 November 2027, priced at 99.83 (original spread of 88 bp), callable (5nc5)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$1,000m Senior Note (US539830BW87), fixed rate (5.25% coupon) maturing on 15 January 2033, priced at 99.44 (original spread of 124 bp), callable (10nc10)

- Nevada Power Co (Utility - Other | Las Vegas, Nevada, United States | Rating: A): US$400m Note (US641423CF35), fixed rate (5.90% coupon) maturing on 1 May 2053, priced at 99.42 (original spread of 236 bp), callable (31nc30)

- US Bancorp (Banking | Minneapolis, Minnesota, United States | Rating: A): US$1,500m Senior Note (US91159HJH49), floating rate maturing on 21 October 2026, priced at 100.00 (original spread of 120 bp), callable (4nc3)

- US Bancorp (Banking | Minneapolis, Minnesota, United States | Rating: A): US$1,500m Senior Note (US91159HJJ05), floating rate maturing on 21 October 2033, priced at 100.00 (original spread of 188 bp), callable (11nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- AIA Group Ltd (Life Insurance | Hong Kong | Rating: A+): US$850m Senior Note (US00131LAN55), fixed rate (5.63% coupon) maturing on 25 October 2027, priced at 99.54 (original spread of 172 bp), callable (5nc5)

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$150m Unsecured Note (XS2548082960), fixed rate (4.90% coupon) maturing on 24 October 2025, priced at 100.00 (original spread of 24 bp), non callable

- BAT Capital Corp (Financial - Other | Wilmington, Delaware, United Kingdom | Rating: BBB): US$600m Senior Note (US05526DBX21), fixed rate (7.75% coupon) maturing on 19 October 2032, priced at 99.54 (original spread of 380 bp), callable (10nc10)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): US$300m Unsecured Note (XS2440481963) zero coupon maturing on 28 October 2032, priced at 100.00, non callable

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: BBB-): US$750m Junior Subordinated Note (US0641598S88), fixed rate (8.63% coupon) maturing on 27 October 2082, priced at 100.00 (original spread of 445 bp), callable (60nc5)

- Chengdu Sino French Ecological Park Investment Development Co Ltd (Service - Other | Chengdu, Sichuan, China (Mainland) | Rating: NR): US$200m Senior Note (XS2536805984), fixed rate (6.00% coupon) maturing on 21 October 2025, priced at 100.00 (original spread of -4 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$225m Index Linked Security (XS0460016214), floating rate maturing on 20 December 2024, priced at 99.90, non callable

- Diageo Capital PLC (Financial - Other | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$750m Senior Note (US25243YBH18), fixed rate (5.50% coupon) maturing on 24 January 2033, priced at 99.47 (original spread of 145 bp), callable (10nc10)

- Diageo Capital PLC (Financial - Other | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$500m Senior Note (US25243YBF51), fixed rate (5.20% coupon) maturing on 24 October 2025, priced at 99.87 (original spread of 70 bp), with a make whole call

- Diageo Capital PLC (Financial - Other | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$750m Senior Note (US25243YBG35), fixed rate (5.30% coupon) maturing on 24 October 2027, priced at 99.85 (original spread of 100 bp), callable (5nc5)

- Emirates NBD Bank PJSC (Banking | Dubai, Dubai, United Arab Emirates | Rating: A): US$500m Senior Note (XS2546930061), fixed rate (5.63% coupon) maturing on 21 October 2027, priced at 99.49 (original spread of 145 bp), non callable

- Export Finance and Insurance Corp (Agency | Sydney, New South Wales, Australia | Rating: AAA): US$1,500m Senior Note (US30220L2B92), fixed rate (4.63% coupon) maturing on 26 October 2027, priced at 99.59 (original spread of 43 bp), non callable

- Industrial Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$600m Senior Note (US45604HAL15), fixed rate (5.13% coupon) maturing on 25 October 2024, priced at 99.95 (original spread of 94 bp), non callable

- Industrial and Commercial Bank of China Ltd (Dubai Branch) (Banking | Dubai, Dubai, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2546508461), floating rate maturing on 25 October 2025, priced at 100.00, non callable

- JT International Financial Services BV (Financial - Other | Amstelveen, Noord-Holland, Japan | Rating: A): US$500m Senior Note (US480914AA80), fixed rate (6.88% coupon) maturing on 24 October 2032, priced at 98.63 (original spread of 295 bp), callable (10nc10)

- Kommunalbanken AS (Agency | Oslo, Oslo, Norway | Rating: AAA): US$1,000m Senior Note (XS2549048481), fixed rate (4.63% coupon) maturing on 24 October 2025, priced at 99.95 (original spread of 25 bp), non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$1,000m Senior Note (XS2549046865), fixed rate (4.75% coupon) maturing on 22 October 2025, priced at 99.98 (original spread of 37 bp), non callable

- Korea Investment & Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: BBB): US$300m Unsecured Note (XS2547290861) zero coupon maturing on 7 November 2025, priced at 100.00, non callable

- MDGH GMTN (RSC) Ltd (Financial - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: NR): US$1,000m Unsecured Note (XS2546781985), fixed rate (5.37% coupon) maturing on 24 October 2033, priced at 100.00 (original spread of 149 bp), non callable

- MDGH GMTN (RSC) Ltd (Financial - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA): US$1,000m Senior Note (US55285GAB05), fixed rate (5.50% coupon) maturing on 28 April 2033, priced at 98.58 (original spread of 170 bp), callable (11nc10)

- Municipality Finance Plc (Agency | Helsinki, Etela-Suomen, Finland | Rating: AA+): US$150m Unsecured Note (XS2548900146), fixed rate (5.00% coupon) maturing on 27 October 2025, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): US$1,350m Senior Note (US78016FZU10), fixed rate (6.00% coupon) maturing on 1 November 2027, priced at 99.80 (original spread of 160 bp), with a make whole call

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): US$1,150m Senior Note (US78016FZR80), fixed rate (5.66% coupon) maturing on 25 October 2024, priced at 100.00 (original spread of 119 bp), non callable

- Saudi Arabia, Kingdom of (Government) (Sovereign | Riyadh, Riyadh, Saudi Arabia | Rating: A): US$2,500m Senior Note (XS2548892020), fixed rate (5.50% coupon) maturing on 25 October 2032, priced at 100.00 (original spread of 183 bp), non callable

- Standard Chartered Bank (Banking | London, United Kingdom | Rating: A+): US$120m Unsecured Note (XS2546714796), floating rate maturing on 19 November 2029, priced at 100.00, non callable

- Zhenjiang Transportation Industry Group Co Ltd (Transportation - Other | Zhenjiang, Jiangsu, China (Mainland) | Rating: NR): US$163m Senior Note (XS2521007505), fixed rate (6.90% coupon) maturing on 26 October 2025, priced at 100.00, non callable

RECENT EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €175m Covered Bond (Other) (XS2549538812), fixed rate (1.13% coupon) maturing on 23 April 2039, non callable

- ASR Media and Sponsorship SpA (Financial - Other | Rome, Roma, United States | Rating: NR): €175m Bond (XS2548920847), fixed rate (6.04% coupon) maturing on 30 October 2027, priced at 100.00, non callable

- Adif High Speed (Agency | Madrid, Madrid, Spain | Rating: BBB): €500m Bond (ES0200002071), fixed rate (3.50% coupon) maturing on 30 July 2029, priced at 99.91 (original spread of 141 bp), non callable

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: AAA): €1,750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400DGZ7), fixed rate (3.13% coupon) maturing on 24 January 2028, priced at 99.56 (original spread of 119 bp), non callable

- Banco Comercial Portugues SA (Banking | Porto, Portugal | Rating: BB): €350m Note (PTBCPBOM0062), floating rate maturing on 25 October 2025, priced at 100.00 (original spread of 657 bp), callable (3nc2)

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A): €300m Inhaberschuldverschreibung (DE000BLB9SM9), floating rate (EU03MLIB + 21.0 bp) maturing on 21 October 2024, priced at 100.00, non callable

- Bayerische Landesbodenkreditanstalt (Financial - Other | Muenchen, Bayern, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A161RQ0), fixed rate (3.00% coupon) maturing on 21 October 2032, priced at 98.92 (original spread of 88 bp), non callable

- Berlin Hyp AG (Banking | Berlin, Berlin, Germany | Rating: AA-): €750m Hypothekenpfandbrief (Covered Bond) (DE000BHY0JW5), fixed rate (3.00% coupon) maturing on 25 October 2027, priced at 99.55 (original spread of 100 bp), non callable

- Berlin, State of (Official and Muni | Berlin, Berlin, Germany | Rating: AA+): €500m Landesschatzanweisung (DE000A3MQYM8), floating rate (EU03MLIB + 0.0 bp) maturing on 27 January 2027, non callable

- Bpifrance SA (Banking | Maisons-Alfort, Ile-De-France, France | Rating: AA): €1,250m Bond (FR001400DHQ4), fixed rate (3.38% coupon) maturing on 25 November 2032, priced at 99.30 (original spread of 58 bp), non callable

- CDP Reti SpA (Financial - Other | Rome, Roma, Italy | Rating: BBB-): €500m Senior Note (IT0005514390), fixed rate (5.88% coupon) maturing on 25 October 2027, priced at 99.57 (original spread of 391 bp), callable (5nc5)

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: AA+): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30WF27), fixed rate (3.00% coupon) maturing on 25 January 2027, priced at 99.68 (original spread of 110 bp), non callable

- Dolcetto Holdco SpA (Financial - Other | Milan, Milano, Italy | Rating: NR): €735m Bond (XS2547287727), floating rate maturing on 27 October 2028, priced at 100.00, non callable

- Dolcetto Holdco SpA (Financial - Other | Milan, Italy | Rating: NR): €735m Bond (XS2547287644), floating rate maturing on 27 October 2028, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31FE1), fixed rate (3.50% coupon) maturing on 21 November 2025, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31FJ0), fixed rate (4.60% coupon) maturing on 31 October 2032, priced at 100.00, callable (10nc3)

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: BBB): €500m Hypothekenpfandbrief (Covered Bond) (DE000HCB0BP2), fixed rate (3.13% coupon) maturing on 1 July 2026, priced at 99.74 (original spread of 110 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €3,000m Inhaberschuldverschreibung (DE000A30VUG3), fixed rate (2.50% coupon) maturing on 19 November 2025, priced at 99.85 (original spread of 56 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB79C5), fixed rate (3.00% coupon) maturing on 25 November 2026, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB79A9), fixed rate (2.50% coupon) maturing on 25 November 2024, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB79B7), fixed rate (2.75% coupon) maturing on 25 November 2025, priced at 100.00, non callable

- Lithuania, Republic of (Government) (Sovereign | Vilnius, Vilniaus, Lithuania | Rating: A): €900m Senior Note (XS2547270756), fixed rate (4.13% coupon) maturing on 25 April 2028, priced at 99.26 (original spread of 226 bp), non callable

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): €1,750m Senior Note (XS2548081053), floating rate maturing on 25 January 2034, priced at 100.00 (original spread of 292 bp), callable (11nc10)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): €1,000m Senior Note (XS2548080832), floating rate maturing on 25 October 2028, priced at 100.00 (original spread of 283 bp), callable (6nc5)

- Netherlands Development Finance Company NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €500m Senior Note (XS2548490734), fixed rate (3.00% coupon) maturing on 25 October 2027, priced at 99.97 (original spread of 90 bp), non callable

- RRE 14 Loan Management DAC (Service - Other | Ireland | Rating: AAA): €244m Bond (XS2532386153), floating rate maturing on 15 October 2037, priced at 100.00, non callable

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Note (XS2547936984), fixed rate (5.75% coupon) maturing on 27 January 2028, priced at 99.60 (original spread of 365 bp), with a regulatory call

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400DHZ5), fixed rate (3.00% coupon) maturing on 28 October 2025, priced at 99.88 (original spread of 113 bp), non callable

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €250m Landesschatzanweisung (DE000RLP1387), fixed rate (3.13% coupon) maturing on 20 October 2032 (original spread of 77 bp), non callable

- Talanx AG (Property and Casualty Insurance | Hannover, Germany | Rating: A+): €750m Senior Note (XS2547606769), fixed rate (4.00% coupon) maturing on 25 October 2029, priced at 99.67, non callable

- Talanx AG (Property and Casualty Insurance | Hannover, Niedersachsen, Germany | Rating: A+): €500m Senior Note (XS2547609433), fixed rate (4.00% coupon) maturing on 25 October 2029, priced at 99.67 (original spread of 196 bp), callable (7nc7)

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €650m Bond (XS2549543143), fixed rate (3.88% coupon) maturing on 28 October 2028, priced at 99.76 (original spread of 174 bp), callable (6nc6)

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €500m Senior Note (XS2549543226), fixed rate (4.25% coupon) maturing on 28 April 2032, priced at 99.49 (original spread of 201 bp), callable (10nc9)

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €850m Senior Note (XS2549715618), fixed rate (4.75% coupon) maturing on 28 October 2042, priced at 99.15 (original spread of 231 bp), callable (20nc20)

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €1,000m Bond (XS2549543499), fixed rate (4.50% coupon) maturing on 28 October 2034, priced at 99.49 (original spread of 220 bp), callable (12nc12)

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): €1,250m Covered Bond (Other) (XS2549702475), fixed rate (3.25% coupon) maturing on 27 April 2026, priced at 99.94 (original spread of 124 bp), non callable

RECENT LOANS

- Citco Funding LLC (United States of America), signed a US$ 440m Term Loan B, to be used for general corporate purposes. It matures on 04/19/28 and initial pricing is set at Term SOFR +350.0bp

- Citco Funding LLC (United States of America), signed a US$ 355m Term Loan A, to be used for general corporate purposes. It matures on 10/19/27 and initial pricing is set at Term SOFR +275.0bp

- Goodyear Tire & Rubber Co (United States of America | BB-), signed a US$ 800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/14/28 and initial pricing is set at Term SOFR +150.0bp

- Tanger Properties LP (United States of America | BBB-), signed a US$ 325m Term Loan A, to be used for general corporate purposes. It matures on 01/13/27 and initial pricing is set at Term SOFR +70.0bp

- UPL Corp Ltd (Mauritius | BB+), signed a US$ 500m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/14/27 and initial pricing is set at Term SOFR +136.6bp

- UPL Corp Ltd (Mauritius | BB+), signed a US$ 250m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/14/25 and initial pricing is set at Term SOFR +136.6bp

RECENT ISSUANCE IN STRUCTURED CREDIT

- Adagio X Eur Clo Dac issued a floating-rate CLO in 9 tranches, for a total of € 316 m. Highest-rated tranche offering a spread over the floating rate of 205bp, and the lowest-rated tranche a spread of 953bp. Bookrunners: Barclays Capital Group

- Daimler Trucks Retail Trust 2022-1 issued a floating-rate ABS backed by equipment leases in 3 tranches, for a total of US$ 800 m. Highest-rated tranche offering a spread over the floating rate of 90bp, and the lowest-rated tranche a spread of 115bp. Bookrunners: JP Morgan & Co Inc, Bank of America Merrill Lynch, SMBC Nikko Securities America Inc

- Exeter Automobile Receivables Trust 2022-5 issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 568 m. Highest-rated tranche offering a yield to maturity of 3.72%, and the lowest-rated tranche a yield to maturity of 10.56%. Bookrunners: JP Morgan & Co Inc, Deutsche Bank Securities Inc, Wells Fargo Securities LLC

- John Deere Owner Trust 2022-C issued a fixed-rate ABS backed by equipment leases in 4 tranches, for a total of US$ 1,271 m. Highest-rated tranche offering a yield to maturity of 4.14%, and the lowest-rated tranche a yield to maturity of 5.20%. Bookrunners: Citigroup Global Markets Inc, Bank of America Merrill Lynch, Credit Agricole Corporate & Investment Bank, MUFG Securities Americas Inc

- Lake Shore CLO V issued a floating-rate CLO in 4 tranches, for a total of US$ 350 m. Highest-rated tranche offering a spread over the floating rate of 295bp, and the lowest-rated tranche a spread of 731bp. Bookrunners: Wells Fargo Securities LLC

- Prestige Auto Receivables Trust 2022-1 issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 377 m. Highest-rated tranche offering a yield to maturity of 3.99%, and the lowest-rated tranche a yield to maturity of 11.07%. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- Regional Management Issuance Trust 2022-2b issued a fixed-rate ABS backed by consumer loan in 2 tranches, for a total of US$ 184 m. Highest-rated tranche offering a yield to maturity of 7.10%, and the lowest-rated tranche a yield to maturity of 8.51%. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Wells Fargo Securities LLC

- Sierra Timeshare 2022-3 Receivables Funding issued a fixed-rate ABS backed by timeshare loans in 4 tranches, for a total of US$ 250 m. Highest-rated tranche offering a yield to maturity of 5.83%, and the lowest-rated tranche a yield to maturity of 10.52%. Bookrunners: Credit Suisse, Barclays Capital Group, Deutsche Bank Securities Inc, Bank of America Merrill Lynch