Credit

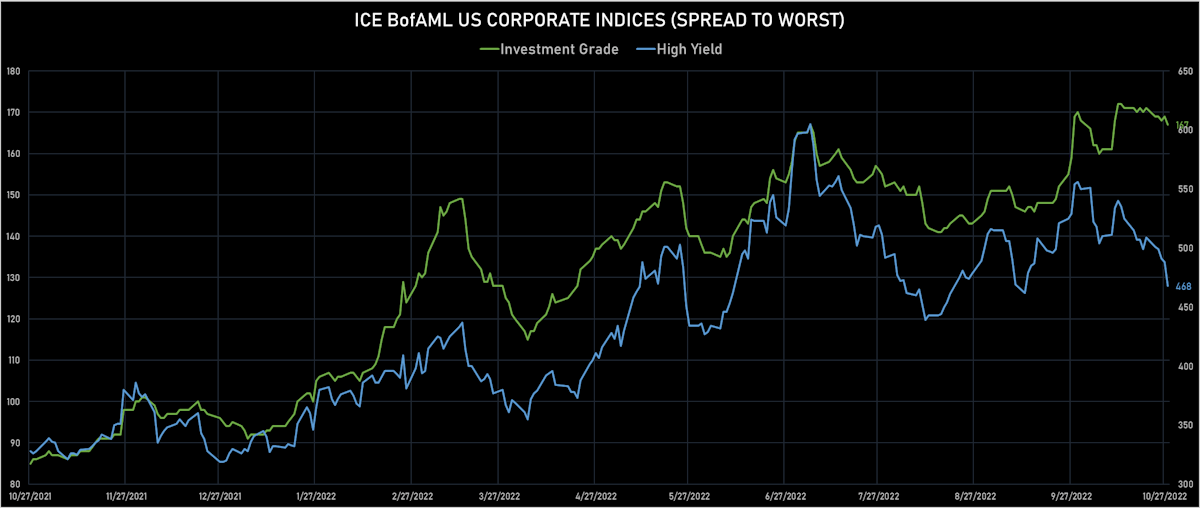

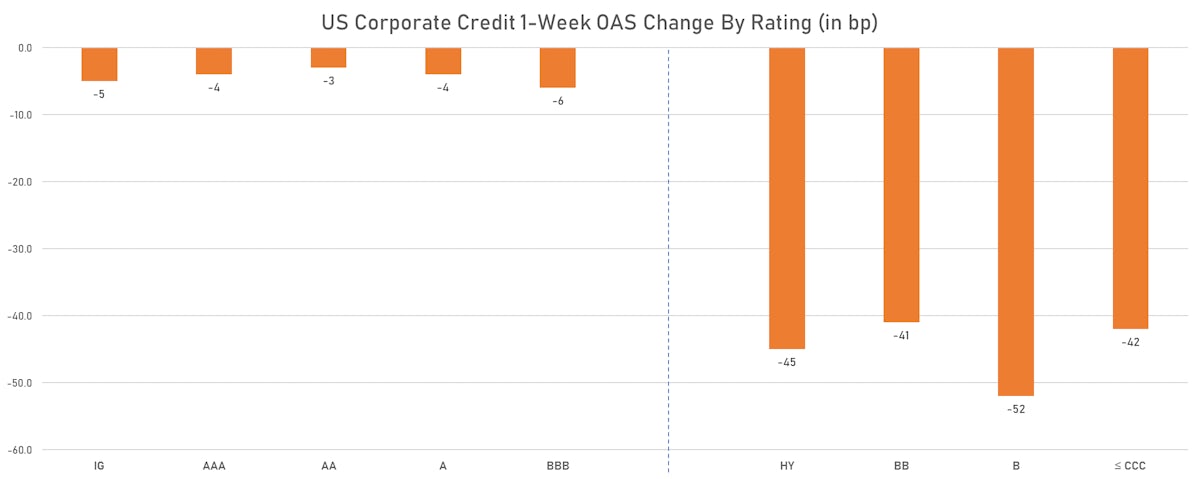

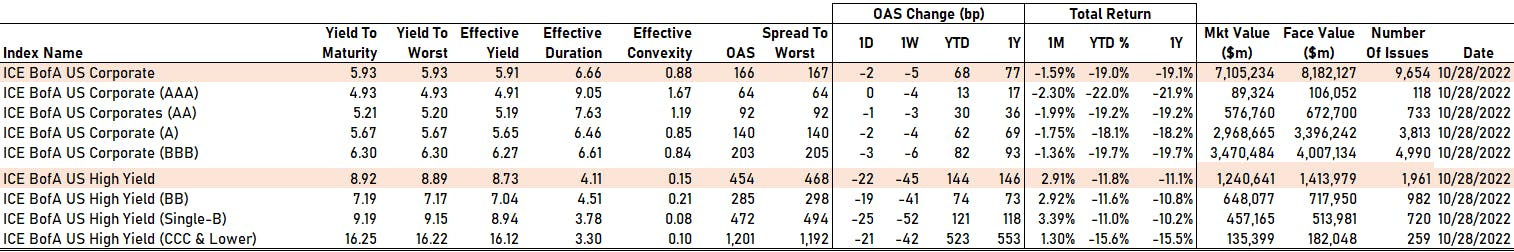

Risk-On Rebound Across The US Credit Complex, With A Significant Compression In Spreads

Solid week of issuance for USD IG corporate bonds, with $36.5bn raised in 33 tranches (2022 YTD volume $1.093tn vs 2021 YTD $1.311tn, down 16.6% YoY), while there was no new issuance in HY (2022 YTD volume $90.091bn vs 2021 YTD $420.331bn, down 78.6% YoY)

Published ET

USD Cash Spreads Tightening This Week | Sources: ϕpost, FactSet data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.23% today, with investment grade down -0.27% and high yield up 0.23% (YTD total return: -17.96%)

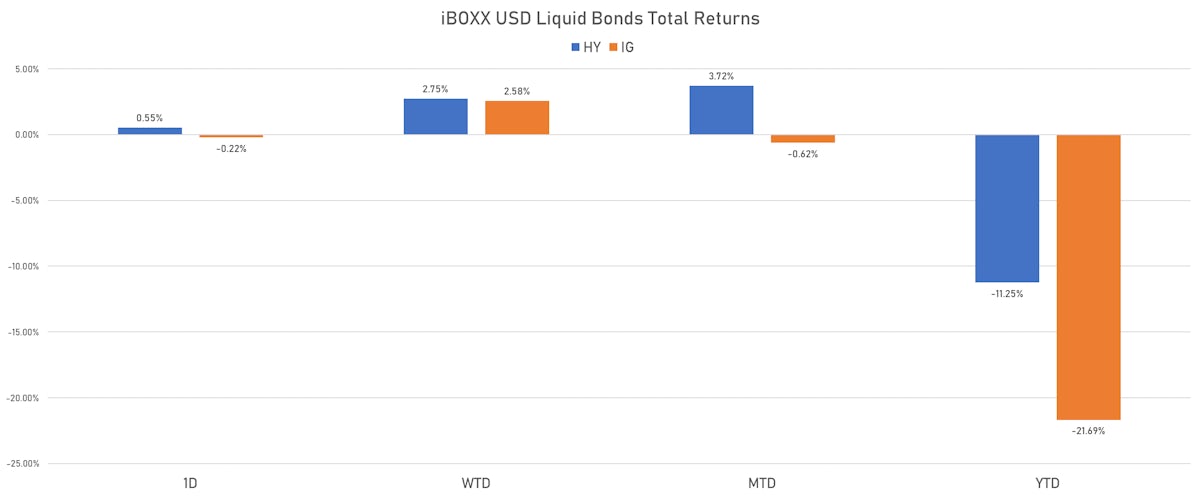

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.222% today (Week-to-date: 2.58%; Month-to-date: -0.62%; Year-to-date: -21.69%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.553% today (Week-to-date: 2.75%; Month-to-date: 3.72%; Year-to-date: -11.25%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 167.0 bp (YTD change: +72.0 bp)

- ICE BofA US High Yield Index spread to worst down -20.0 bp, now at 468.0 bp (YTD change: +138.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.16% today (YTD total return: -2.9%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 64 bp

- AA down by -1 bp at 92 bp

- A down by -2 bp at 140 bp

- BBB down by -3 bp at 203 bp

- BB down by -19 bp at 285 bp

- B down by -25 bp at 472 bp

- ≤ CCC down by -21 bp at 1,201 bp

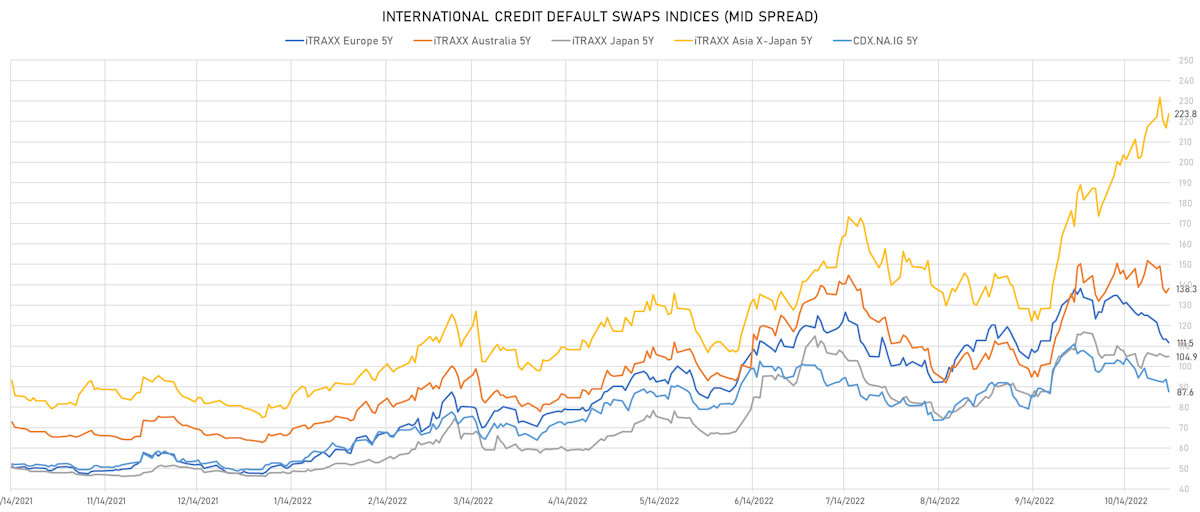

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 6.1 bp, now at 88bp (1W change: -6.7bp; YTD change: +38.2bp)

- Markit CDX.NA.IG 10Y down 5.2 bp, now at 122bp (1W change: -4.5bp; YTD change: +32.5bp)

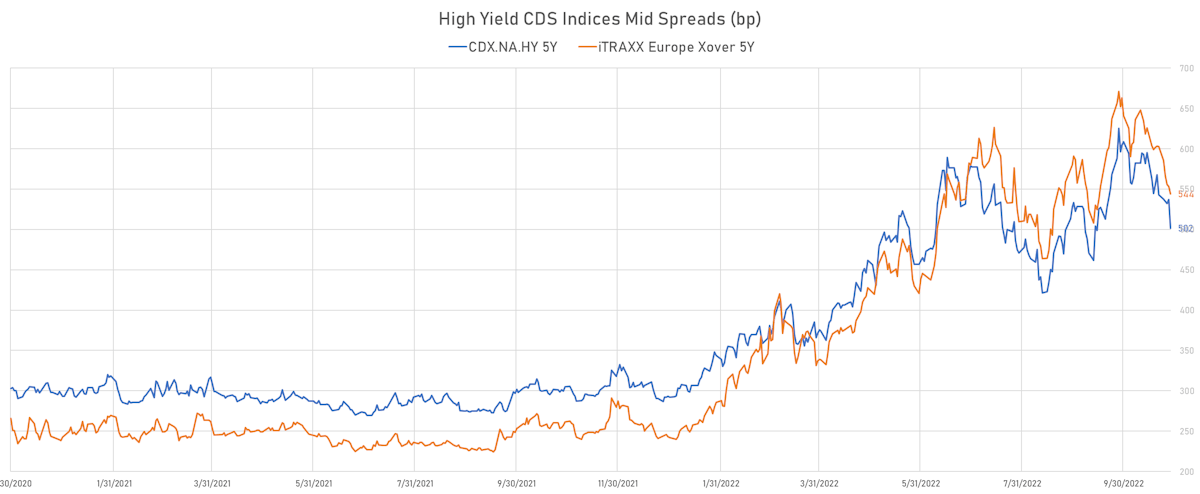

- Markit CDX.NA.HY 5Y down 35.2 bp, now at 502bp (1W change: -41.0bp; YTD change: +209.8bp)

- Markit iTRAXX Europe 5Y down 1.7 bp, now at 112bp (1W change: -13.5bp; YTD change: +63.8bp)

- Markit iTRAXX Europe Crossover 5Y down 9.0 bp, now at 544bp (1W change: -58.3bp; YTD change: +302.2bp)

- Markit iTRAXX Japan 5Y up 0.1 bp, now at 105bp (1W change: -1.6bp; YTD change: +58.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 7.0 bp, now at 224bp (1W change: +6.4bp; YTD change: +144.8bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 667.0 bp to 1,465.7bp (1Y range: 1,019-2,858bp)

- Rite Aid Corp (Country: US; rated: D): down 523.5 bp to 9,131.6bp (1Y range: 885-9,132bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 336.5 bp to 1,473.2bp (1Y range: 430-1,783bp)

- DISH DBS Corp (Country: US; rated: B2): down 189.8 bp to 1,192.0bp (1Y range: 368-1,506bp)

- American Airlines Group Inc (Country: US; rated: B2): down 188.9 bp to 1,287.4bp (1Y range: 607-1,644bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 179.9 bp to 881.5bp (1Y range: 299-1,584bp)

- Domtar Corp (Country: US; rated: NR): down 178.2 bp to 901.9bp (1Y range: 365-1,046bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 169.9 bp to 1,806.9bp (1Y range: 316-2,117bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): down 163.6 bp to 598.9bp (1Y range: 395-772bp)

- Nabors Industries Inc (Country: US; rated: B3): down 157.0 bp to 534.1bp (1Y range: 489-887bp)

- United Airlines Holdings Inc (Country: US; rated: CCC+): down 133.5 bp to 666.8bp (1Y range: 104-667bp)

- Bombardier Inc (Country: CA; rated: CCC-): down 124.2 bp to 545.0bp (1Y range: 432-1,007bp)

- Avis Budget Group Inc (Country: US; rated: B+): down 119.9 bp to 424.3bp (1Y range: 183-591bp)

- Tenet Healthcare Corp (Country: US; rated: A3): up 111.1 bp to 557.3bp (1Y range: 268-576bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): down 4525.0 bp to 6,722.2bp (1Y range: 595-6,722bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 759.9 bp to 1,986.5bp (1Y range: 1,233-2,910bp)

- Novafives SAS (Country: FR; rated: Caa1): down 384.4 bp to 2,313.7bp (1Y range: 618-2,936bp)

- Ceconomy AG (Country: DE; rated: A3): down 384.2 bp to 1,330.4bp (1Y range: 185-1,755bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 261.1 bp to 1,460.5bp (1Y range: 566-1,739bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 165.7 bp to 1,079.9bp (1Y range: 261-1,254bp)

- TUI AG (Country: DE; rated: B3-PD): down 161.5 bp to 1,563.9bp (1Y range: 612-1,725bp)

- thyssenkrupp AG (Country: DE; rated: A2): down 134.1 bp to 583.9bp (1Y range: 205-705bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 132.2 bp to 447.1bp (1Y range: 151-600bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 127.6 bp to 1,047.4bp (1Y range: 359-1,296bp)

- Air France KLM SA (Country: FR; rated: C): down 124.7 bp to 740.6bp (1Y range: 386-990bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 114.2 bp to 621.5bp (1Y range: 370-758bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 81.5 bp to 416.3bp (1Y range: 209-606bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): down 78.3 bp to 413.9bp (1Y range: 161-523bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 76.1 bp to 527.7bp (1Y range: 245-602bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 69.2 bp to 429.9 bp, with the yield to worst at 8.5% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 88.8-105.7).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread down by 54.5 bp to 295.2 bp, with the yield to worst at 7.1% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 79.0-102.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 56.2 bp to 298.1 bp, with the yield to worst at 7.2% and the bond now trading up to 96.5 cents on the dollar (1Y price range: 92.0-112.0).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | ISIN: USU98347AK05 | Z-spread down by 60.4 bp to 335.7 bp, with the yield to worst at 7.6% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: NCL Corporation Ltd (Miami, Florida (US)) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 64.1 bp to 807.8 bp, with the yield to worst at 12.2% and the bond now trading up to 82.0 cents on the dollar (1Y price range: 76.0-100.0).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread down by 66.0 bp to 357.8 bp, with the yield to worst at 7.8% and the bond now trading up to 91.0 cents on the dollar (1Y price range: 86.5-112.4).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | ISIN: USU2947RAA78 | Z-spread down by 66.4 bp to 89.5 bp, with the yield to worst at 5.1% and the bond now trading up to 99.4 cents on the dollar (1Y price range: 95.0-110.0).

- Issuer: Starwood Property Trust Inc (Greenwich, United States) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | ISIN: USU85656AF04 | Z-spread down by 71.8 bp to 319.4 bp, with the yield to worst at 7.3% and the bond now trading up to 87.3 cents on the dollar (1Y price range: 83.8-100.1).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 74.1 bp to 311.1 bp, with the yield to worst at 7.2% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 90.0-107.1).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | ISIN: USU85656AH69 | Z-spread down by 75.5 bp to 345.9 bp, with the yield to worst at 7.7% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 83.0-100.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 78.5 bp to 254.7 bp, with the yield to worst at 6.8% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 92.0-108.5).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | ISIN: USU3230LAA45 | Z-spread down by 84.6 bp to 225.6 bp (CDS basis: 67.7bp), with the yield to worst at 6.9% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: Starwood Property Trust Inc (Greenwich, United States) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | ISIN: USU85656AG86 | Z-spread down by 111.7 bp to 190.3 bp, with the yield to worst at 6.5% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 90.0-101.4).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Z-spread down by 112.3 bp to 167.3 bp, with the yield to worst at 5.9% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 88.5-103.0).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 173.0 bp to 565.7 bp (CDS basis: 520.9bp), with the yield to worst at 10.0% and the bond now trading up to 87.0 cents on the dollar (1Y price range: 80.9-95.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | Z-spread up by 64.7 bp to 785.8 bp, with the yield to worst at 9.8% and the bond now trading down to 82.4 cents on the dollar (1Y price range: 82.4-99.2).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 65.7 bp to 495.5 bp (CDS basis: -86.7bp), with the yield to worst at 7.5% and the bond now trading up to 82.9 cents on the dollar (1Y price range: 78.0-103.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | Z-spread down by 76.4 bp to 459.0 bp (CDS basis: 78.9bp), with the yield to worst at 7.4% and the bond now trading up to 71.7 cents on the dollar (1Y price range: 67.6-92.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.50% | Maturity: 1/3/2025 | Rating: BB- | ISIN: XS1813724603 | Z-spread down by 81.4 bp to 371.4 bp, with the yield to worst at 6.3% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 91.6-103.6).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 25/4/2025 | Rating: BB | ISIN: FR0013331196 | Z-spread down by 82.3 bp to 251.9 bp, with the yield to worst at 5.2% and the bond now trading up to 92.2 cents on the dollar (1Y price range: 89.9-100.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | Z-spread down by 85.0 bp to 463.5 bp (CDS basis: -48.8bp), with the yield to worst at 7.3% and the bond now trading up to 88.3 cents on the dollar (1Y price range: 85.3-105.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | Z-spread down by 85.0 bp to 441.9 bp (CDS basis: 54.8bp), with the yield to worst at 7.3% and the bond now trading up to 80.2 cents on the dollar (1Y price range: 76.4-98.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread down by 92.2 bp to 906.2 bp (CDS basis: 107.9bp), with the yield to worst at 11.5% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 77.4-113.4).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread down by 92.2 bp to 800.7 bp (CDS basis: 182.3bp), with the yield to worst at 10.4% and the bond now trading up to 83.9 cents on the dollar (1Y price range: 77.5-104.5).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 96.1 bp to 581.8 bp, with the yield to worst at 8.5% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 82.9-99.8).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | Z-spread down by 97.4 bp to 445.9 bp (CDS basis: -50.3bp), with the yield to worst at 7.1% and the bond now trading up to 87.7 cents on the dollar (1Y price range: 84.2-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | Z-spread down by 98.9 bp to 416.9 bp (CDS basis: -44.9bp), with the yield to worst at 7.0% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 86.8-103.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | Z-spread down by 164.0 bp to 604.2 bp (CDS basis: 180.2bp), with the yield to worst at 8.8% and the bond now trading up to 75.9 cents on the dollar (1Y price range: 66.6-99.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | Z-spread down by 166.7 bp to 413.6 bp (CDS basis: -79.3bp), with the yield to worst at 6.8% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 87.1-102.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | Z-spread down by 217.7 bp to 559.7 bp (CDS basis: 202.1bp), with the yield to worst at 8.3% and the bond now trading up to 84.5 cents on the dollar (1Y price range: 71.8-100.7).

RECENT DOMESTIC USD BOND ISSUES

- Dow Chemical Co (Chemicals | Midland, Michigan, United States | Rating: BBB+): US$900m Senior Note (US260543DH36), fixed rate (6.90% coupon) maturing on 15 May 2053, priced at 99.87 (original spread of 308 bp), callable (31nc30)

- Dow Chemical Co (Chemicals | Midland, Michigan, United States | Rating: BBB+): US$600m Senior Note (US260543DG52), fixed rate (6.30% coupon) maturing on 15 March 2033, priced at 99.74 (original spread of 231 bp), callable (10nc10)

- Dragon Legacy Partners LLC (Financial - Other | United States | Rating: NR): US$120m Note (US26145DAA00), floating rate maturing on 1 October 2072, priced at 100.00, non callable

- Elevance Health Inc (Health Care Facilities | Indianapolis, Indiana, United States | Rating: BBB): US$650m Senior Note (US036752AW30), fixed rate (5.50% coupon) maturing on 15 October 2032, priced at 99.38 (original spread of 155 bp), callable (10nc10)

- Elevance Health Inc (Health Care Facilities | Indianapolis, United States | Rating: BBB): US$400m Senior Note (US036752AV56), fixed rate (5.35% coupon) maturing on 15 October 2025, priced at 99.97 (original spread of 95 bp), callable (3nc3)

- Elevance Health Inc (Health Care Facilities | Indianapolis, Indiana, United States | Rating: BBB): US$750m Senior Note (US036752AX13), fixed rate (6.10% coupon) maturing on 15 October 2052, priced at 99.99 (original spread of 218 bp), callable (30nc29)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$205m Bond (US3133ENX883), fixed rate (5.20% coupon) maturing on 3 November 2025, priced at 100.00 (original spread of 92 bp), callable (3nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133ENW893), floating rate (PRQ + -304.0 bp) maturing on 28 October 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133ENX214), fixed rate (6.44% coupon) maturing on 1 November 2032, priced at 100.00 (original spread of 245 bp), callable (10nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$1,425m Bond (US3133ENX545), floating rate (SOFR + 13.0 bp) maturing on 1 November 2024, priced at 100.00, non callable

- Fifth Third Bancorp (Banking | Cincinnati, Ohio, United States | Rating: BBB+): US$1,000m Senior Note (US316773DJ68), floating rate maturing on 27 October 2028, priced at 100.00 (original spread of 194 bp), callable (6nc5)

- Fifth Third Bank NA (OHIO) (Banking | Cincinnati, Ohio, United States | Rating: A-): US$1,000m Senior Note (US31677QBT58), floating rate maturing on 27 October 2025, priced at 100.00 (original spread of 93 bp), callable (3nc2)

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): US$2,000m Senior Note (US38141GZV93), fixed rate (5.70% coupon) maturing on 1 November 2024, priced at 99.99 (original spread of 138 bp), non callable

- Guardian Life Global Funding (Financial - Other | Wilmington, United States | Rating: AA+): US$450m Note (US40139MBG50), fixed rate (5.55% coupon) maturing on 28 October 2027, priced at 99.97 (original spread of 130 bp), non callable

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, North Carolina, United States | Rating: A): US$1,100m Senior Note (US438516CK03), fixed rate (5.00% coupon) maturing on 15 February 2033, priced at 99.02 (original spread of 110 bp), callable (10nc10)

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, North Carolina, United States | Rating: A): US$500m Senior Note (US438516CJ30), fixed rate (4.95% coupon) maturing on 15 February 2028, priced at 99.99 (original spread of 75 bp), callable (5nc5)

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, United States | Rating: A): US$400m Senior Note (US438516CH73), fixed rate (4.85% coupon) maturing on 1 November 2024, priced at 99.98 (original spread of 40 bp), with a make whole call

- Marsh & McLennan Companies Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: A-): US$500m Senior Note (US571748BS04), fixed rate (6.25% coupon) maturing on 1 November 2052, priced at 99.01 (original spread of 232 bp), callable (30nc30)

- Marsh & McLennan Companies Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: A-): US$500m Senior Note (US571748BR21), fixed rate (5.75% coupon) maturing on 1 November 2032, priced at 99.30 (original spread of 171 bp), callable (10nc10)

- Micron Technology Inc (Electronics | Boise, United States | Rating: BBB-): US$750m Senior Note (US595112BV48), fixed rate (6.75% coupon) maturing on 1 November 2029, priced at 99.87 (original spread of 265 bp), callable (7nc7)

- New Mountain Finance Corp (Financial - Other | New York City, United States | Rating: BBB-): US$200m Bond (US647551AD22), fixed rate (7.50% coupon) maturing on 15 October 2025, priced at 100.00, non callable, convertible

- NextGen Healthcare Inc (Information/Data Technology | Atlanta, Georgia, United States | Rating: NR): US$230m Bond (US65343CAA09), fixed rate (3.75% coupon) maturing on 15 November 2027, priced at 100.00, non callable, convertible

- Northern Trust Corp (Banking | Chicago, United States | Rating: A): US$1,000m Junior Subordinated Note (US665859AX29), fixed rate (6.13% coupon) maturing on 2 November 2032, priced at 99.65 (original spread of 215 bp), callable (10nc10)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): US$1,500m Senior Note (US693475BJ30), floating rate maturing on 28 October 2033, priced at 100.00 (original spread of 188 bp), callable (11nc10)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): US$1,000m Senior Note (US693475BH73), floating rate maturing on 28 October 2025, priced at 100.00 (original spread of 77 bp), callable (3nc2)

- Truist Financial Corp (Banking | Charlotte, United States | Rating: A-): US$750m Senior Note (US89788MAJ18), floating rate maturing on 28 October 2026, priced at 100.00, callable (4nc3)

- Truist Financial Corp (Banking | Charlotte, United States | Rating: A-): US$750m Senior Note (US89788MAK80), floating rate maturing on 28 October 2033, priced at 100.00, callable (11nc10)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, Minnesota, United States | Rating: A-): US$2,000m Senior Note (US91324PES74), fixed rate (5.88% coupon) maturing on 15 February 2053, priced at 99.24 (original spread of 195 bp), callable (30nc30)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, Minnesota, United States | Rating: A-): US$1,500m Senior Note (US91324PET57), fixed rate (6.05% coupon) maturing on 15 February 2063, priced at 98.82 (original spread of 226 bp), callable (40nc40)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, Minnesota, United States | Rating: A-): US$750m Senior Note (US91324PEN87), fixed rate (5.15% coupon) maturing on 15 October 2025, priced at 99.99 (original spread of 70 bp), with a make whole call

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, Minnesota, United States | Rating: A-): US$2,000m Senior Note (US91324PER91), fixed rate (5.35% coupon) maturing on 15 February 2033, priced at 99.63 (original spread of 130 bp), callable (10nc10)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, Minnesota, United States | Rating: A-): US$1,000m Senior Note (US91324PEP36), fixed rate (5.25% coupon) maturing on 15 February 2028, priced at 99.96 (original spread of 100 bp), callable (5nc5)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, Minnesota, United States | Rating: A-): US$1,250m Senior Note (US91324PEQ19), fixed rate (5.30% coupon) maturing on 15 February 2030, priced at 99.85 (original spread of 123 bp), callable (7nc7)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$293m Certificate of Deposit - Retail (US9497633C81), fixed rate (4.60% coupon) maturing on 28 October 2024, priced at 100.00 (original spread of 12 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): US$2,000m Senior Note (US00828EEP07), fixed rate (4.38% coupon) maturing on 3 November 2027, priced at 99.63 (original spread of 27 bp), non callable

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,500m Senior Note (US06738ECC75), fixed rate (7.33% coupon) maturing on 2 November 2026, priced at 100.00, callable (4nc3)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,500m Senior Note (US06738ECD58), fixed rate (7.39% coupon) maturing on 2 November 2028, priced at 100.00, callable (6nc5)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$2,000m Senior Note (US06738ECE32), fixed rate (7.44% coupon) maturing on 2 November 2033, priced at 100.00, callable (11nc10)

- Bluewater Holding BV (Oilfield Machinery and Services | Hoofddorp, Jersey | Rating: NR): US$240m Bond (NO0012740234), fixed rate (12.00% coupon) maturing on 10 November 2026, callable (4nc2)

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): US$4,000m Senior Note (US12802D2K12), fixed rate (4.63% coupon) maturing on 2 November 2025, priced at 99.77 (original spread of 32 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$480m Bond (XS2548832711), floating rate maturing on 21 April 2032, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459916101), fixed rate (4.40% coupon) maturing on 18 November 2024, priced at 100.00, non callable

- Eastern and Southern African Trade and Development Bank (Supranational | Bujumbura, Burundi | Rating: BB+): US$700m Unsecured Note (XS2443431478), fixed rate (1.00% coupon) maturing on 31 August 2027, priced at 100.00, non callable

- Eastern and Southern African Trade and Development Bank (Supranational | Bujumbura, Burundi | Rating: BB+): US$700m Unsecured Note (XS2443432369), fixed rate (1.00% coupon) maturing on 31 August 2029, priced at 100.00, non callable

- Guotai Junan Financial Products Ltd (Financial - Other | China (Mainland) | Rating: NR): US$77m Unsecured Note (XS2551894764), floating rate maturing on 1 November 2024, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,250m Senior Note (US404280DR76), floating rate maturing on 3 November 2028, priced at 100.00, callable (6nc5)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,000m Subordinated Note (US404280DS59), floating rate maturing on 3 November 2033, priced at 100.00, callable (11nc10)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$1,750m Senior Note (US404280DQ93), floating rate maturing on 3 November 2026, priced at 100.00, callable (4nc3)

- International Finance Facility For Immunisation Co (Supranational | London, United Kingdom | Rating: AA-): US$500m Senior Note (XS2551092435), fixed rate (4.75% coupon) maturing on 3 November 2025, priced at 99.91 (original spread of 37 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): US$200m Unsecured Note (XS2551322451), fixed rate (6.12% coupon) maturing on 8 November 2025, priced at 100.00, non callable

- KCA Deutag Pikco PLC (Financial - Other | Rating: NR): US$250m Bond (XS2549712789), fixed rate (15.00% coupon) maturing on 1 December 2027, priced at 100.00, non callable

- Kca Deutag UK Finance PLC (Financial - Other | Leeds | Rating: NR): US$250m Bond (XS2549710650), floating rate maturing on 1 December 2025, priced at 100.00, non callable

- Korea Development Bank (Agency | Seoul, South Korea | Rating: AA-): US$200m Senior Note (XS2551379998), fixed rate (3.13% coupon) maturing on 7 June 2025, priced at 94.44 (original spread of 100 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$1,000m Senior Note (XS2551489821), fixed rate (4.63% coupon) maturing on 4 November 2025, priced at 99.81 (original spread of 25 bp), non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Austria | Rating: AA+): US$1,000m Senior Note (US676167CG22), fixed rate (4.63% coupon) maturing on 3 November 2025, priced at 99.99 (original spread of 22 bp), non callable

- Shinhan Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$5,000m Index Linked Security (KR6SH00041F6) zero coupon maturing on 17 November 2025, priced at 100.00, non callable

- Shinyoung Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: NR): US$1,000m Index Linked Security (KR6SY00020J1) zero coupon maturing on 17 November 2025, priced at 100.00, non callable

- Yichun Development Investment Group Co Ltd (Financial - Other | Yichun, Jiangxi, China (Mainland) | Rating: BBB-): US$210m Bond (XS2523185424), fixed rate (7.00% coupon) maturing on 3 November 2025, priced at 100.00, non callable

RECENT EUR BOND ISSUES

- AXA Bank Europe SCF SA (Banking | Fontenay-Sous-Bois, Ile-De-France, Belgium | Rating: AAA): €750m Obligation Fonciere (Covered Bond) (FR001400DNT6), fixed rate (3.00% coupon) maturing on 3 November 2026, priced at 99.56 (original spread of 108 bp), non callable

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Poland | Rating: A-): €200m Unsecured Note (XS2551369924), fixed rate (4.40% coupon) maturing on 31 October 2025, priced at 100.00, non callable

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): €2,000m Covered Bond (Other) (XS2550897651), fixed rate (3.05% coupon) maturing on 31 October 2024, priced at 99.96 (original spread of 107 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9SN7), floating rate (EU03MLIB + 5.0 bp) maturing on 31 October 2028, priced at 100.00, non callable

- Bouygues SA (Conglomerate / Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €1,000m Bond (FR001400DNF5), fixed rate (5.38% coupon) maturing on 30 June 2042, priced at 98.80 (original spread of 294 bp), callable (20nc19)

- Bouygues SA (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €1,250m Bond (FR001400DNG3), fixed rate (4.63% coupon) maturing on 7 June 2032, priced at 99.21 (original spread of 242 bp), callable (10nc9)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): €407m Bond (FR001400COI9), fixed rate (3.50% coupon) maturing on 28 October 2027, priced at 100.00, non callable

- Caixa Geral de Depositos SA (Banking | Lisbon, Portugal | Rating: BBB-): €500m Note (PTCGDDOM0036), fixed rate (5.75% coupon) maturing on 31 October 2028, priced at 99.78 (original spread of 373 bp), callable (6nc5)

- Cirsa Finance International SARL (Financial - Other | Luxembourg, Luxembourg | Rating: B-): €425m Senior Note (XS2550380104), fixed rate (10.38% coupon) maturing on 30 November 2027, priced at 98.11 (original spread of 900 bp), callable (5nc2)

- Cooperatieve Rabobank UA (Banking | Utrecht, Netherlands | Rating: AAA): €7,500m Bond (NL00150015W7), fixed rate (3.38% coupon) maturing on 28 October 2031, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €415m Bond (FR01CASA0019), fixed rate (3.20% coupon) maturing on 2 November 2032, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6CZD2), fixed rate (2.40% coupon) maturing on 18 November 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8N9), fixed rate (2.50% coupon) maturing on 17 November 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8P4), floating rate maturing on 17 November 2027, priced at 100.00, non callable

- ESB Finance DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €550m Senior Note (XS2550909415), fixed rate (4.00% coupon) maturing on 2 May 2032, priced at 99.40 (original spread of 203 bp), callable (10nc9)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31L68), fixed rate (2.20% coupon) maturing on 28 November 2024, priced at 100.00, non callable

- Fiber Bidco SpA (Financial - Other | Milan, Milano, Italy | Rating: B): €147m Bond (XS2548508709), floating rate maturing on 25 October 2027, priced at 91.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): €500m Bond (RU000A105BY1), fixed rate (1.85% coupon) maturing on 17 November 2028, priced at 100.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): €750m Bond (RU000A105C51), fixed rate (2.25% coupon) maturing on 22 November 2024, priced at 100.00, non callable

- Istituto per il Credito Sportivo (Banking | Rome, Roma, Italy | Rating: BBB-): €300m Note (XS2541422395), fixed rate (5.25% coupon) maturing on 31 October 2025, priced at 99.86 (original spread of 361 bp), with a regulatory call

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €3,750m Buono del Tesoro Poliennali (IT0005518128), fixed rate (4.40% coupon) maturing on 1 May 2033, priced at 101.71 (original spread of 222 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €150m Inhaberschuldverschreibung (DE000HLB79G6), fixed rate (3.00% coupon) maturing on 9 June 2026, priced at 100.00, callable (4nc2)

- Pernod Ricard SA (Beverage/Bottling | Paris, Ile-De-France, France | Rating: BBB+): €600m Bond (FR001400DOV0), fixed rate (3.25% coupon) maturing on 2 November 2028, priced at 98.78 (original spread of 148 bp), callable (6nc6)

- Pernod Ricard SA (Beverage/Bottling | Paris, Ile-De-France, France | Rating: BBB+): €500m Bond (FR001400DP44), fixed rate (3.75% coupon) maturing on 2 November 2032, priced at 98.53 (original spread of 176 bp), callable (10nc10)

- Raiffeisen Schweiz Genossenschaft (Banking | Sankt Gallen, St. Gallen, Switzerland | Rating: A): €500m Bond (CH1224575899), fixed rate (5.23% coupon) maturing on 1 November 2027, priced at 100.00 (original spread of 311 bp), non callable

- Shero Bidco BV (Financial - Other | Netherlands | Rating: B-): €273m Note (XS2550965326), fixed rate (9.00% coupon) maturing on 15 November 2027, callable (5nc2)

- Societe Nationale SNCF SA (Agency | Saint-Denis, Ile-De-France, France | Rating: A+): €500m Bond (FR001400DNU4), fixed rate (3.13% coupon) maturing on 2 November 2027, priced at 99.92 (original spread of 111 bp), non callable

- Sp Kiinnitysluottopankki Oyj (Financial - Other | Helsinki, Etela-Suomen, Finland | Rating: AAA): €750m Covered Bond (Other) (XS2550557800), fixed rate (3.13% coupon) maturing on 1 November 2027, priced at 99.55 (original spread of 111 bp), non callable

- Sparkasse Pforzheim Calw (Banking | Pforzheim, Baden-Wuerttemberg, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000A30V2H9), floating rate (EU03MLIB + 60.0 bp) maturing on 25 July 2028, priced at 101.94, non callable

- Suedzucker International Finance BV (Financial - Other | Oud-Beijerland, Zuid-Holland, Germany | Rating: BBB-): €400m Senior Note (XS2550868801), fixed rate (5.13% coupon) maturing on 31 October 2027, priced at 99.47 (original spread of 334 bp), callable (5nc5)

- Suez SA (FR) (Service - Other | Courbevoie, Ile-De-France, France | Rating: BBB): €800m Bond (FR001400DQ84), fixed rate (4.63% coupon) maturing on 3 November 2028, priced at 99.79 (original spread of 270 bp), callable (6nc6)

- Suez SA (FR) (Service - Other | Courbevoie, Ile-De-France, France | Rating: BBB): €900m Bond (FR001400DQ92), fixed rate (5.00% coupon) maturing on 3 November 2032, priced at 99.42 (original spread of 296 bp), callable (10nc10)

- Svenska Handelsbanken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): €750m Note (XS2551280436), fixed rate (3.75% coupon) maturing on 1 November 2027, priced at 99.82 (original spread of 171 bp), non callable

- Verizon Communications Inc (Telecommunications | New York City, New York, United States | Rating: BBB+): €1,250m Senior Note (XS2550881143), fixed rate (4.25% coupon) maturing on 31 October 2030, priced at 99.53 (original spread of 212 bp), callable (8nc8)

- Verizon Communications Inc (Telecommunications | New York City, New York, United States | Rating: BBB+): €1,250m Senior Note (XS2550898204), fixed rate (4.75% coupon) maturing on 31 October 2034, priced at 99.89 (original spread of 243 bp), callable (12nc12)

RECENT LOANS

- Aon PLC (United Kingdom | A-), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/19/24 and initial pricing is set at Term SOFR +80.5bp

- Cameco Corp (Canada | BBB-), signed a US$ 300m Term Loan maturing on 10/27/24, to be used for acquisition financing

- Cameco Corp (Canada | BBB-), signed a US$ 1,000m Bridge Loan maturing on 10/26/23, to be used for acquisition financing

- Cameco Corp (Canada | BBB-), signed a US$ 300m Term Loan maturing on 10/27/25, to be used for acquisition financing

- Duke Energy Florida LLC (United States of America), signed a US$ 800m Term Loan, to be used for general corporate purposes. It matures on 04/24/24 and initial pricing is set at Term SOFR +75.0bp

- EdgeConneX Inc (United States of America), signed a US$ 150m Term Loan, to be used for project finance

- GSE (Italy), signed a € 150m Revolving Credit Facility maturing on 10/21/25, to be used for general corporate purposes

- Go Daddy Operating Company LLC (United States of America | BB-), signed a US$ 1,770m Term Loan B, to be used for general corporate purposes. It matures on 10/21/29 and initial pricing is set at Term SOFR +325.0bp

- Illinois Tool Works Inc (United States of America | A+), signed a US$ 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/21/27 and initial pricing is set at Term SOFR +62.5bp

- Ina Industrija Nafte dd (Croatia), signed a € 300m Revolving Credit Facility maturing on 10/20/25, to be used for general corporate purposes

- Indusind Bank Ltd (India), signed a US$ 150m Revolving Credit / Term Loan, to be used for capital expenditures

- Insmed Inc (United States of America), signed a US$ 350m Term Loan, to be used for general corporate purposes. It matures on 10/19/27 and initial pricing is set at Term SOFR +775.0bp

- Oak Parent Inc (United States of America | B-), signed a US$ 347m Term Loan, to be used for general corporate purposes. It matures on 04/25/25 and initial pricing is set at LIBOR +550.0bp

- PT Kayan Hydro Energy (Indonesia), signed a US$ 17,000m Revolving Credit / Term Loan, to be used for project finance

- Pakistan (Pakistan | B-), signed a US$ 1,500m Revolving Credit / Term Loan, to be used for working capital

- RATP (France), signed a € 500m Revolving Credit Facility, to be used for general corporate purposes

- SEEK Ltd (Australia), signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 07/31/29 and initial pricing is set at Term SOFR +210.0bp

- Transmisora Colombiana De (Colombia), signed a US$ 140m Term Loan maturing on 10/19/29, to be used for project finance

- Trimco International Holdings (Hong Kong), signed a US$ 240m Term Loan maturing on 01/22/25, to be used for general corporate purposes

- Union Bank of India (DIFC) (United Arab Emirates), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/20/25 and initial pricing is set at Term SOFR +95.0bp

- Wereldhave NV (Netherlands), signed a € 225m Revolving Credit Facility maturing on 10/20/27, to be used for general corporate purposes

RECENT STRUCTURED CREDIT

- Consumer Portfolio Services Auto Receivables Trust 2022-D issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 307 m. Highest-rated tranche offering a yield to maturity of 6.09%, and the lowest-rated tranche a yield to maturity of 12.13%. Bookrunners: Credit Suisse, Citigroup Global Markets Inc

- Freddie Mac Spc Series K-150 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 85 m. Highest-rated tranche offering a yield to maturity of 3.71%, and the lowest-rated tranche a yield to maturity of 4.36%. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC

- Freed ABS Trust 2022-4fp issued a fixed-rate ABS backed by consumer loan in 3 tranches, for a total of US$ 217 m. Highest-rated tranche offering a yield to maturity of 6.49%, and the lowest-rated tranche a yield to maturity of 8.59%. Bookrunners: Credit Suisse, Jefferies & Co Inc, Truist Securities Inc

- Marble Point CLO Xxv Ltd issued a floating-rate CLO in 8 tranches, for a total of US$ 296 m. Highest-rated tranche offering a spread over the floating rate of 230bp, and the lowest-rated tranche a spread of 878bp. Bookrunners: Deutsche Bank Securities Inc

- Shamrock Residential 2022-2 Dac issued a floating-rate RMBS in 7 tranches, for a total of € 427 m. Highest-rated tranche offering a spread over the floating rate of 200bp, and the lowest-rated tranche a spread of 850bp. Bookrunners: Morgan Stanley International Ltd