Credit

Mixed Spreads Across The US Credit Complex This Week, But HY Synthetics Overperformed Equities

Light volume of issuance for US corporate bonds this week: 17 tranches for $12.45bn in IG (2022 YTD volume $1.105tn vs 2021 YTD $1.332tn, down 17% YoY), and a $1.5bn tranche (from Ford Motors) was the lone issue in HY (2022 YTD volume $91.591bn vs 2021 YTD $428.656bn, down 78.6% YoY)

Published ET

S&P 500 Price Index vs. CDX NA HY 5Y | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was down -0.13% today, with investment grade down -0.17% and high yield up 0.29% (YTD total return: -18.43%)

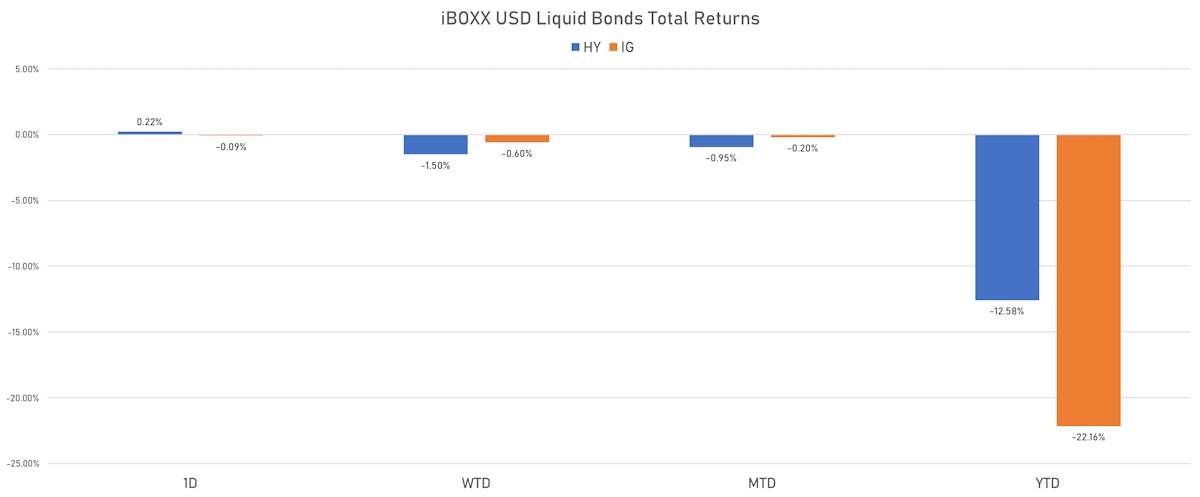

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.086% today (Week-to-date: -0.60%; Month-to-date: -0.20%; Year-to-date: -22.16%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.224% today (Week-to-date: -1.50%; Month-to-date: -0.95%; Year-to-date: -12.58%)

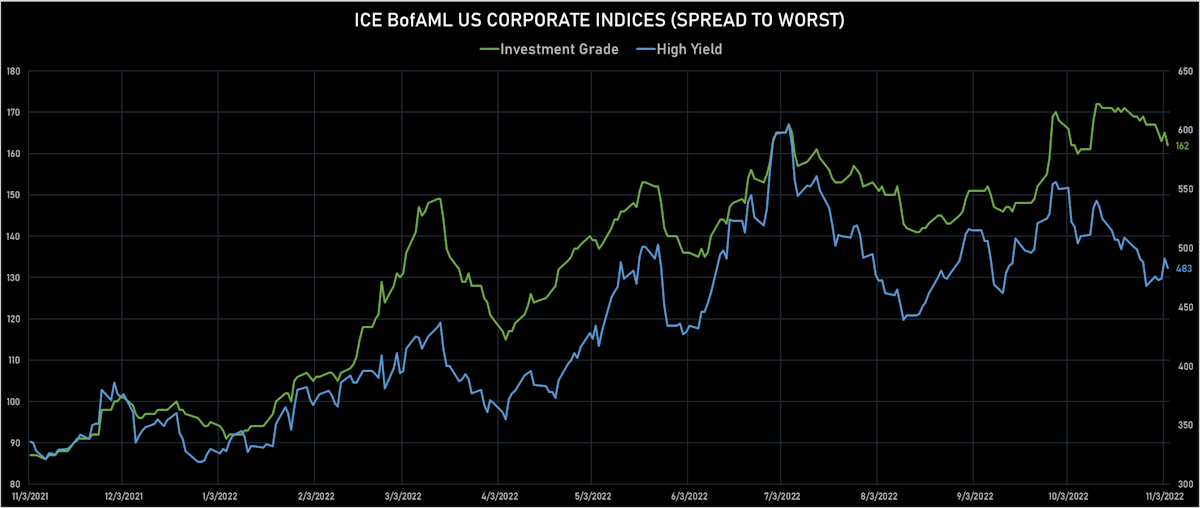

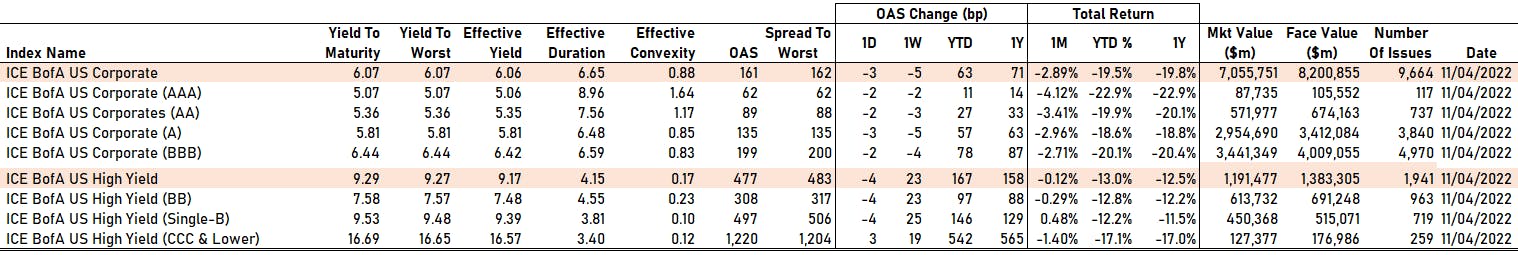

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -3.0 bp, now at 162.0 bp (YTD change: +67.0 bp)

- ICE BofA US High Yield Index spread to worst down -8.0 bp, now at 483.0 bp (YTD change: +153.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.12% today (YTD total return: -2.2%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -2 bp at 62 bp

- AA down by -2 bp at 89 bp

- A down by -3 bp at 135 bp

- BBB down by -2 bp at 199 bp

- BB down by -4 bp at 308 bp

- B down by -4 bp at 497 bp

- ≤ CCC up by 3 bp at 1,220 bp

CDS INDICES TODAY (mid-spreads)

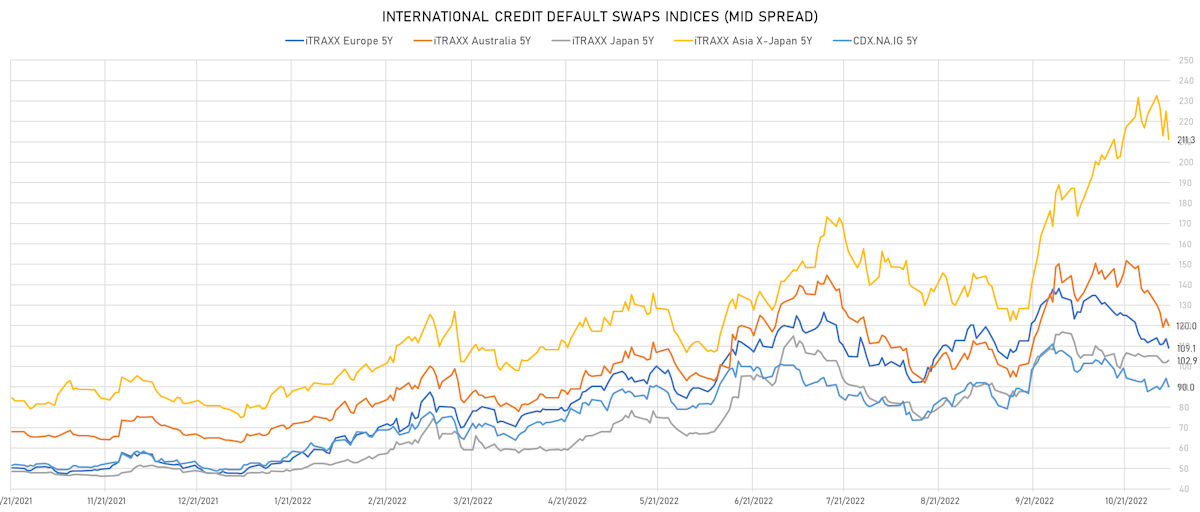

- Markit CDX.NA.IG 5Y down 4.0 bp, now at 90bp (1W change: +2.5bp; YTD change: +40.7bp)

- Markit CDX.NA.IG 10Y down 3.8 bp, now at 124bp (1W change: +2.4bp; YTD change: +34.8bp)

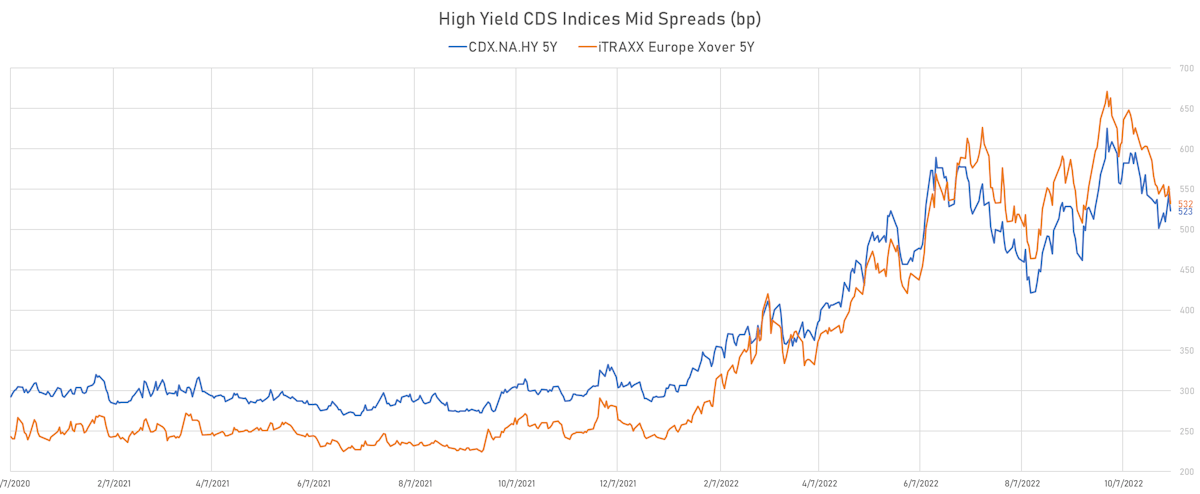

- Markit CDX.NA.HY 5Y down 20.6 bp, now at 523bp (1W change: +21.3bp; YTD change: +231.1bp)

- Markit iTRAXX Europe 5Y down 4.6 bp, now at 109bp (1W change: -2.5bp; YTD change: +61.4bp)

- Markit iTRAXX Europe Crossover 5Y down 20.8 bp, now at 532bp (1W change: -12.0bp; YTD change: +290.2bp)

- Markit iTRAXX Japan 5Y up 1.0 bp, now at 103bp (1W change: -2.3bp; YTD change: +56.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 13.8 bp, now at 211bp (1W change: -12.0bp; YTD change: +132.3bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa1): down 126.4 bp to 1,339.3bp (1Y range: 1,019-2,858bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 122.5 bp to 1,571.5bp (1Y range: 616-1,571bp)

- American Axle & Manufacturing Inc (Country: US; rated: LGD2 - 20%): down 113.2 bp to 485.7bp (1Y range: 395-772bp)

- Nabors Industries Inc (Country: US; rated: B3): down 62.3 bp to 471.8bp (1Y range: 445-887bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 60.5 bp to 821.0bp (1Y range: 299-1,584bp)

- American Airlines Group Inc (Country: US; rated: B2): up 48.3 bp to 1,335.8bp (1Y range: 607-1,644bp)

- Macy's Inc (Country: US; rated: A1): up 49.0 bp to 468.4bp (1Y range: 181-619bp)

- Kohls Corp (Country: US; rated: NR): up 53.0 bp to 617.1bp (1Y range: 112-686bp)

- Gap Inc (Country: US; rated: Ba2): up 58.7 bp to 665.9bp (1Y range: 152-819bp)

- Nordstrom Inc (Country: US; rated: A3): up 76.4 bp to 628.9bp (1Y range: 212-641bp)

- Goodyear Tire & Rubber Co (Country: US; rated: A2): up 78.6 bp to 523.7bp (1Y range: 188-552bp)

- Liberty Interactive LLC (Country: US; rated: BB-): up 90.4 bp to 1,502.7bp (1Y range: 405-1,689bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 169.2 bp to 1,976.1bp (1Y range: 316-2,117bp)

- DISH DBS Corp (Country: US; rated: B2): up 269.7 bp to 1,461.7bp (1Y range: 387-1,506bp)

- Rite Aid Corp (Country: US; rated: D): up 4468.1 bp to 13,599.7bp (1Y range: 885-13,600bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): down 640.8 bp to 6,081.4bp (1Y range: 595-6,081bp)

- Novafives SAS (Country: FR; rated: Caa1): down 301.1 bp to 2,012.6bp (1Y range: 618-2,936bp)

- TUI AG (Country: DE; rated: B3-PD): down 179.6 bp to 1,384.3bp (1Y range: 612-1,725bp)

- Ceconomy AG (Country: DE; rated: A3): down 101.6 bp to 1,228.9bp (1Y range: 185-1,763bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 71.2 bp to 1,008.6bp (1Y range: 261-1,254bp)

- Telecom Italia SpA (Country: IT; rated: C): down 37.0 bp to 487.3bp (1Y range: 174-545bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 31.2 bp to 1,016.2bp (1Y range: 359-1,296bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 28.5 bp to 507.8bp (1Y range: 296-648bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 26.7 bp to 1,433.8bp (1Y range: 566-1,739bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 24.9 bp to 422.1bp (1Y range: 152-600bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 22.0 bp to 391.5bp (1Y range: 199-476bp)

- HSBC Holdings PLC (Country: GB; rated: BBB+): down 21.6 bp to 118.8bp (1Y range: 46-140bp)

- Fresenius SE & Co KGaA (Country: DE; rated: BBB-): up 25.7 bp to 205.8bp (1Y range: 60-206bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 27.0 bp to 2,013.6bp (1Y range: 1,276-2,910bp)

- Credit Suisse Group AG (Country: CH; rated: BBB high): up 58.1 bp to 316.4bp (1Y range: 56-375bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | ISIN: USU3230LAA45 | Z-spread up by 83.8 bp to 313.6 bp (CDS basis: -29.4bp), with the yield to worst at 7.9% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: Crown Americas LLC (PHILADELPHIA, Pennsylvania (US)) | Coupon: 5.25% | Maturity: 1/4/2030 | Rating: BB | ISIN: USU20330AA18 | Z-spread up by 33.9 bp to 261.7 bp, with the yield to worst at 6.8% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 90.0-102.4).

- Issuer: Molina Healthcare Inc (Long Beach, California (US)) | Coupon: 3.88% | Maturity: 15/11/2030 | Rating: BB- | ISIN: USU60868AD52 | Z-spread up by 30.4 bp to 225.6 bp, with the yield to worst at 6.4% and the bond now trading down to 83.5 cents on the dollar (1Y price range: 82.5-103.4).

- Issuer: LGI Homes Inc (The Woodlands, Texas (US)) | Coupon: 4.00% | Maturity: 15/7/2029 | Rating: BB- | ISIN: USU5286JAB53 | Z-spread up by 29.8 bp to 519.8 bp, with the yield to worst at 9.4% and the bond now trading down to 73.0 cents on the dollar (1Y price range: 73.1-99.6).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 5.88% | Maturity: 15/4/2030 | Rating: BB+ | ISIN: USQ3919KAP68 | Z-spread up by 29.4 bp to 375.8 bp, with the yield to worst at 7.9% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 86.1-99.9).

- Issuer: Masonite International Corp (Tampa, Florida (US)) | Coupon: 3.50% | Maturity: 15/2/2030 | Rating: BB+ | ISIN: USC5389UAM20 | Z-spread up by 25.4 bp to 333.6 bp, with the yield to worst at 7.5% and the bond now trading down to 77.1 cents on the dollar (1Y price range: 76.0-99.0).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread up by 24.1 bp to 253.2 bp, with the yield to worst at 6.8% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 88.0-106.3).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | ISIN: USU6500TAG05 | Z-spread up by 23.6 bp to 184.1 bp, with the yield to worst at 6.2% and the bond now trading down to 91.1 cents on the dollar (1Y price range: 89.7-106.0).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 1/3/2029 | Rating: BB | ISIN: USU41441AC75 | Z-spread down by 24.0 bp to 209.9 bp, with the yield to worst at 6.3% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 81.6-100.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | ISIN: USU68337AL58 | Z-spread down by 33.4 bp to 385.4 bp (CDS basis: -50.0bp), with the yield to worst at 7.7% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 93.3-108.0).

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | ISIN: USU3165EAA92 | Z-spread down by 35.5 bp to 379.4 bp, with the yield to worst at 8.2% and the bond now trading up to 81.6 cents on the dollar (1Y price range: 76.9-97.8).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 37.9 bp to 201.5 bp, with the yield to worst at 6.6% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | ISIN: USU6S19GAC10 | Z-spread down by 50.0 bp to 357.8 bp (CDS basis: -23.5bp), with the yield to worst at 7.9% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 92.0-104.1).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread down by 78.0 bp to 366.6 bp, with the yield to worst at 7.9% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: Wynn Resorts Finance LLC (Las Vegas, Nevada (US)) | Coupon: 5.13% | Maturity: 1/10/2029 | Rating: B | ISIN: USU98354AA80 | Z-spread down by 91.7 bp to 423.1 bp, with the yield to worst at 8.4% and the bond now trading up to 82.3 cents on the dollar (1Y price range: 77.0-102.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 49.7 bp to 427.4 bp, with the yield to worst at 7.1% and the bond now trading up to 80.5 cents on the dollar (1Y price range: 74.8-101.8).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread down by 49.8 bp to 303.6 bp, with the yield to worst at 6.0% and the bond now trading up to 87.9 cents on the dollar (1Y price range: 85.0-108.9).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread down by 50.4 bp to 447.4 bp (CDS basis: 127.0bp), with the yield to worst at 6.8% and the bond now trading up to 89.4 cents on the dollar (1Y price range: 83.8-100.0).

- Issuer: thyssenkrupp AG (Essen, Germany) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread down by 51.3 bp to 302.6 bp (CDS basis: 168.1bp), with the yield to worst at 5.5% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 89.0-104.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | Z-spread down by 53.4 bp to 447.6 bp, with the yield to worst at 7.4% and the bond now trading up to 76.9 cents on the dollar (1Y price range: 71.1-100.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | Z-spread down by 55.7 bp to 696.2 bp (CDS basis: -81.3bp), with the yield to worst at 9.8% and the bond now trading up to 74.9 cents on the dollar (1Y price range: 70.1-92.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | Z-spread down by 55.9 bp to 407.6 bp (CDS basis: -8.2bp), with the yield to worst at 6.9% and the bond now trading up to 89.4 cents on the dollar (1Y price range: 85.3-105.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | Z-spread down by 56.7 bp to 475.0 bp, with the yield to worst at 7.7% and the bond now trading up to 81.4 cents on the dollar (1Y price range: 76.8-98.9).

- Issuer: Rexel SA (Paris, France) | Coupon: 2.13% | Maturity: 15/12/2028 | Rating: BB- | ISIN: XS2403428472 | Z-spread down by 57.8 bp to 253.5 bp (CDS basis: 73.8bp), with the yield to worst at 5.4% and the bond now trading up to 82.6 cents on the dollar (1Y price range: 75.9-101.0).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 25/4/2025 | Rating: BB | ISIN: FR0013331196 | Z-spread down by 61.1 bp to 179.3 bp, with the yield to worst at 4.7% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 89.9-100.9).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 27/3/2026 | Rating: BB+ | ISIN: XS1969645255 | Z-spread down by 61.5 bp to 286.8 bp, with the yield to worst at 5.6% and the bond now trading up to 91.7 cents on the dollar (1Y price range: 89.0-106.3).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.75% | Maturity: 12/10/2025 | Rating: BB+ | ISIN: DE000A289Q91 | Z-spread down by 62.1 bp to 226.2 bp, with the yield to worst at 5.2% and the bond now trading up to 93.2 cents on the dollar (1Y price range: 90.2-106.3).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB | ISIN: XS1558491855 | Z-spread down by 63.3 bp to 231.0 bp (CDS basis: -16.5bp), with the yield to worst at 4.8% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 89.8-101.6).

- Issuer: Accor SA (Issy-Les-Moulineaux, France) | Coupon: 2.38% | Maturity: 29/11/2028 | Rating: BB+ | ISIN: FR0014006ND8 | Z-spread down by 64.2 bp to 279.7 bp (CDS basis: -6.3bp), with the yield to worst at 5.8% and the bond now trading up to 82.6 cents on the dollar (1Y price range: 75.6-100.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | Z-spread down by 73.7 bp to 343.0 bp (CDS basis: 18.2bp), with the yield to worst at 6.4% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 86.8-103.1).

RECENT DOMESTIC USD BOND ISSUES

- Accident Fund Insurance Company of America (Property and Casualty Insurance | Lansing, Michigan, United States | Rating: BBB): US$350m Surplus Note (US00452AAA88), fixed rate (8.50% coupon) maturing on 1 August 2032, priced at 100.00 (original spread of 445 bp), callable (10nc9)

- American Electric Power Company Inc (Utility - Other | Columbus, Ohio, United States | Rating: BBB): US$500m Senior Note (US025537AV36), fixed rate (5.75% coupon) maturing on 1 November 2027, priced at 99.74 (original spread of 155 bp), callable (5nc5)

- American Electric Power Company Inc (Utility - Other | Columbus, Ohio, United States | Rating: BBB): US$500m Senior Note (US025537AW19), fixed rate (5.95% coupon) maturing on 1 November 2032, priced at 99.32 (original spread of 195 bp), callable (10nc10)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$1,500m Senior Note (US025816DB21), fixed rate (5.85% coupon) maturing on 5 November 2027, priced at 99.93 (original spread of 160 bp), callable (5nc5)

- Arizona Public Service Co (Utility - Other | Phoenix, Arizona, United States | Rating: A-): US$400m Senior Note (US040555DE14), fixed rate (6.35% coupon) maturing on 15 December 2032, priced at 99.86 (original spread of 220 bp), callable (10nc10)

- Blackstone Holdings Finance Co LLC (Financial - Other | New York City, United States | Rating: A+): US$900m Senior Note (USU0925BAK09), fixed rate (6.20% coupon) maturing on 22 April 2033, priced at 99.83 (original spread of 224 bp), callable (10nc10)

- Blackstone Holdings Finance Co LLC (Financial - Other | New York City, United States | Rating: A+): US$600m Senior Note (USU0925BAJ36), fixed rate (5.90% coupon) maturing on 3 November 2027, priced at 99.80 (original spread of 176 bp), callable (5nc5)

- Church & Dwight Co Inc (Conglomerate/Diversified Mfg | Ewing, New Jersey, United States | Rating: BBB+): US$500m Senior Note (US17136MAC64), fixed rate (5.60% coupon) maturing on 15 November 2032, priced at 99.82 (original spread of 158 bp), callable (10nc10)

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$750m Senior Note (US20030NDZ15), fixed rate (5.25% coupon) maturing on 7 November 2025, priced at 99.97 (original spread of 80 bp), with a make whole call

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$750m Senior Note (US20030NEA54), fixed rate (5.35% coupon) maturing on 15 November 2027, priced at 99.96 (original spread of 110 bp), callable (5nc5)

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$1,000m Senior Note (US20030NEB38), fixed rate (5.50% coupon) maturing on 15 November 2032, priced at 99.37 (original spread of 153 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$225m Bond (US3133ENZ375), fixed rate (4.88% coupon) maturing on 10 January 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133ENY790), floating rate (FFQ + 14.0 bp) maturing on 14 November 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$415m Bond (US3133ENY618), floating rate (SOFR + 14.0 bp) maturing on 7 November 2024, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GY2K76), fixed rate (5.31% coupon) maturing on 15 November 2024, priced at 100.00, callable (2nc6m)

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$1,500m Senior Note (US345397C353), fixed rate (7.35% coupon) maturing on 4 November 2027, priced at 100.00 (original spread of 318 bp), callable (5nc5)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: A-): US$750m First & Refunding Mortgage Bond (US842400HS51), fixed rate (5.85% coupon) maturing on 1 November 2027, priced at 99.94 (original spread of 150 bp), callable (5nc5)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: A-): US$750m First & Refunding Mortgage Bond (US842400HT35), fixed rate (5.95% coupon) maturing on 1 November 2032, priced at 99.35 (original spread of 190 bp), callable (10nc10)

- State Street Corp (Financial - Other | Boston, Massachusetts, United States | Rating: A): US$500m Senior Note (US857477BX07), floating rate maturing on 4 November 2026, priced at 100.00 (original spread of 106 bp), callable (4nc3)

- State Street Corp (Financial - Other | Boston, Massachusetts, United States | Rating: A): US$500m Senior Note (US857477BY89), floating rate maturing on 4 November 2028, priced at 100.00 (original spread of 145 bp), callable (6nc5)

RECENT INTERNATIONAL USD BOND ISSUES

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A+): US$127m Index Linked Security (US13607XCN57) zero coupon maturing on 5 November 2024, priced at 100.00, non callable

- Egyptian Finance Co (Financial - Other | Al-Qaahirah, Egypt | Rating: NR): US$750m Unsecured Note (XS2530049837), fixed rate (10.00% coupon) maturing on 31 October 2027, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A31LN0), fixed rate (4.97% coupon) maturing on 12 December 2024, priced at 98.60, non callable

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BBB): US$1,500m Senior Note (US639057AG33), fixed rate (7.47% coupon) maturing on 10 November 2026, priced at 100.00, callable (4nc3)

- Sasol Financing USA LLC (Financial - Other | Houston, Texas, South Africa | Rating: NR): US$750m Bond (XS2546248373), fixed rate (4.50% coupon) maturing on 8 November 2027, priced at 100.00, non callable, convertible

- UBS Bank USA (Banking | Switzerland | Rating: A+): US$151m Certificate of Deposit - Retail (US90348J6U95), fixed rate (4.65% coupon) maturing on 4 November 2024, priced at 100.00 (original spread of 8 bp), non callable

- UBS Bank USA (Banking | Switzerland | Rating: A+): US$180m Certificate of Deposit - Retail (US90348J6V78), fixed rate (4.70% coupon) maturing on 3 November 2025, priced at 100.00 (original spread of 23 bp), non callable

RECENT EUR BOND ISSUES

- Banco de Sabadell SA (Banking | Alicante, Alicante, Spain | Rating: BBB): €750m Note (XS2553801502), fixed rate (5.13% coupon) maturing on 10 November 2028, priced at 99.75 (original spread of 321 bp), callable (6nc5)

- Belgian Lion NV (Financial - Other | Brussels, Belgium | Rating: AAA): €600m Bond (BE0002884659), floating rate (EU03MLIB + 65.0 bp) maturing on 26 July 2061, priced at 100.00, non callable

- Belgian Lion NV (Financial - Other | Brussels, Belgium | Rating: AAA): €5,398m Bond (BE0002886670), fixed rate (3.75% coupon) maturing on 26 July 2061, priced at 100.00, non callable

- Belgian Lion NV (Financial - Other | Brussels, Belgium | Rating: AAA): €1,000m Bond (BE0002885664), floating rate (EU03MLIB + 70.0 bp) maturing on 26 July 2061, non callable

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): €500m Unsecured Note (XS2110112971), fixed rate (2.00% coupon) maturing on 2 December 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000A30V2V0), fixed rate (3.00% coupon) maturing on 28 March 2028, priced at 99.46 (original spread of 103 bp), non callable

- Eurofima European Company for the Financing of Railroad Rolling Stock (Supranational | Basel, Basel-Stadt, Switzerland | Rating: AA): €500m Senior Note (XS2552880838), fixed rate (3.13% coupon) maturing on 9 November 2031, priced at 99.55 (original spread of 110 bp), non callable

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Inhaberschuldverschreibung (DE000A1RQEG5), fixed rate (2.63% coupon) maturing on 10 September 2027, priced at 99.50 (original spread of 80 bp), non callable

- Liyuan International Co Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): €130m Senior Note (XS2538227088), fixed rate (4.90% coupon) maturing on 7 November 2025, priced at 100.00, non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €250m Bond (IT0005516437), fixed rate (3.45% coupon) maturing on 16 November 2025, priced at 100.00, non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €250m Bond (IT0005512931), fixed rate (3.90% coupon) maturing on 14 November 2025, priced at 100.00, non callable

- NatWest Markets NV (Banking | Amsterdam, Noord-Holland, United Kingdom | Rating: A-): €215m Unsecured Note (XS2554493119), floating rate maturing on 14 November 2024, priced at 100.00, non callable

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €500m Senior Note (XS2553554812), fixed rate (2.75% coupon) maturing on 9 November 2027, priced at 99.65 (original spread of 81 bp), non callable

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €600m Bond (FR001400DTA3), fixed rate (3.50% coupon) maturing on 9 November 2032, priced at 99.33 (original spread of 145 bp), callable (10nc10)

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €500m Bond (FR001400DT99), fixed rate (3.25% coupon) maturing on 9 November 2027, priced at 99.94 (original spread of 126 bp), callable (5nc5)

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A-): €1,000m Note (XS2553798443), fixed rate (4.00% coupon) maturing on 9 November 2026, priced at 99.70 (original spread of 210 bp), with a regulatory call

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): €500m Unsecured Note (XS2554514054), fixed rate (4.54% coupon) maturing on 10 November 2032, priced at 100.00, non callable

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: BBB+): €1,000m Unsecured Note (XS2554356639), floating rate maturing on 15 November 2027, priced at 100.00, non callable

RECENT LOANS

- Albemarle Corp (United States of America | BBB), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/28/27 and initial pricing is set at Term SOFR +91.0bp

- Amerisourcebergen Corp (United States of America | BBB+), signed a US$ 2,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/27/27 and initial pricing is set at Term SOFR +80.5bp

- Chatham Lodging LP (United States of America), signed a US$ 215m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/28/26 and initial pricing is set at LIBOR +165.0bp

- Corporate Office Properties LP (United States of America | BBB-), signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/26/26 and initial pricing is set at Term SOFR +72.5bp

- Corporate Office Properties LP (United States of America | BBB-), signed a US$ 125m Term Loan, to be used for general corporate purposes. It matures on 01/30/26 and initial pricing is set at Term SOFR +85.0bp

- DR Horton Inc (United States of America | BBB), signed a US$ 2,190m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/28/27 and initial pricing is set at Term SOFR +100.0bp

- ERP Operating Limited (United States of America | A-), signed a US$ 2,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/26/27 and initial pricing is set at Term SOFR +70.0bp

- INEOS Group AG (United Kingdom), signed a € 800m Term Loan B, to be used for general corporate purposes. It matures on 11/02/27 and initial pricing is set at EURIBOR +400.0bp

- INEOS Group AG (United Kingdom), signed a US$ 1,200m Term Loan B, to be used for general corporate purposes. It matures on 11/03/27 and initial pricing is set at Term SOFR +375.0bp

- LG Display Vietnam Haiphong (Vietnam), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/27/25 and initial pricing is set at Term SOFR +140.0bp

- New Hope International (Hong Kong), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/26/24 and initial pricing is set at Term SOFR +190.0bp

- Triton Container Intl Ltd (Bermuda | BBB-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/26/27 and initial pricing is set at Term SOFR +137.5bp

- Triton Container Intl Ltd (Bermuda | BBB-), signed a US$ 1,200m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 05/27/26 and initial pricing is set at Term SOFR +162.5bp

- Vontier Corp (United States of America | BBB-), signed a US$ 600m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 12/30/25 and initial pricing is set at Term SOFR +100.0bp

- Watlow Elec Mnfg Co (United States of America), signed a US$ 175m Term Loan B, to be used for acquisition financing. It matures on 03/02/28 and initial pricing is set at Term SOFR +500.0bp