Credit

Mixed Picture In US Credit, With HY-IG CDS Spreads Differentials Compressing Markedly Post CPI, While HY Cash Performance Lagged

Solid week of bond issuance for US corporates (IFR Markets data): 46 tranches for $45.45bn in IG (2022 YTD volume $1.151tn vs 2021 YTD $1.357tn, down 15.2% YoY), 5 tranches for $6.2bn in HY (2022 YTD volume $97.801bn vs 2021 YTD $442.541bn, down 77.9% YoY)

Published ET

HY-IG Spreads Differentials | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

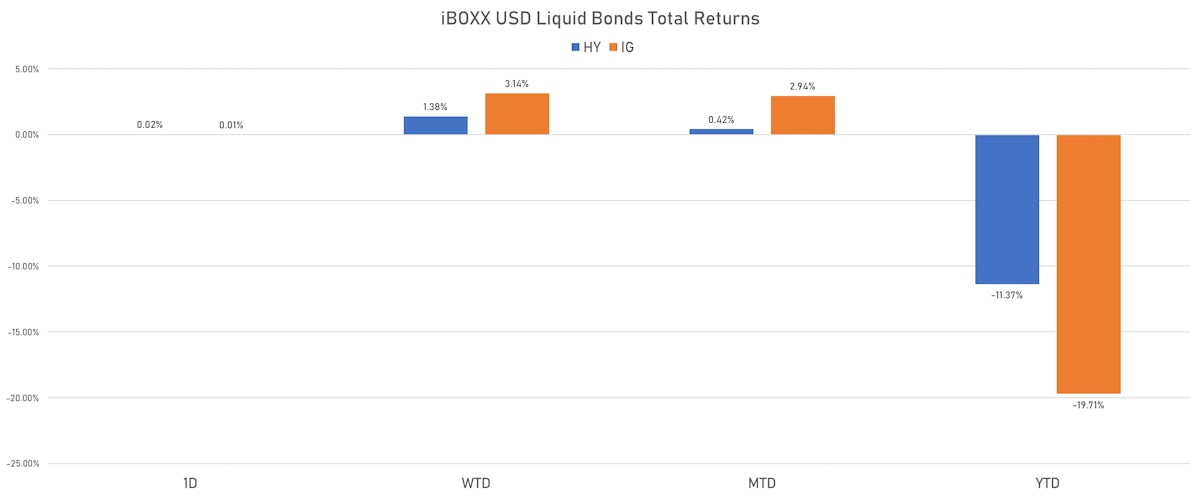

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.012% today (Week-to-date: 3.14%; Month-to-date: 2.94%; Year-to-date: -19.71%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.018% today (Week-to-date: 1.38%; Month-to-date: 0.42%; Year-to-date: -11.37%)

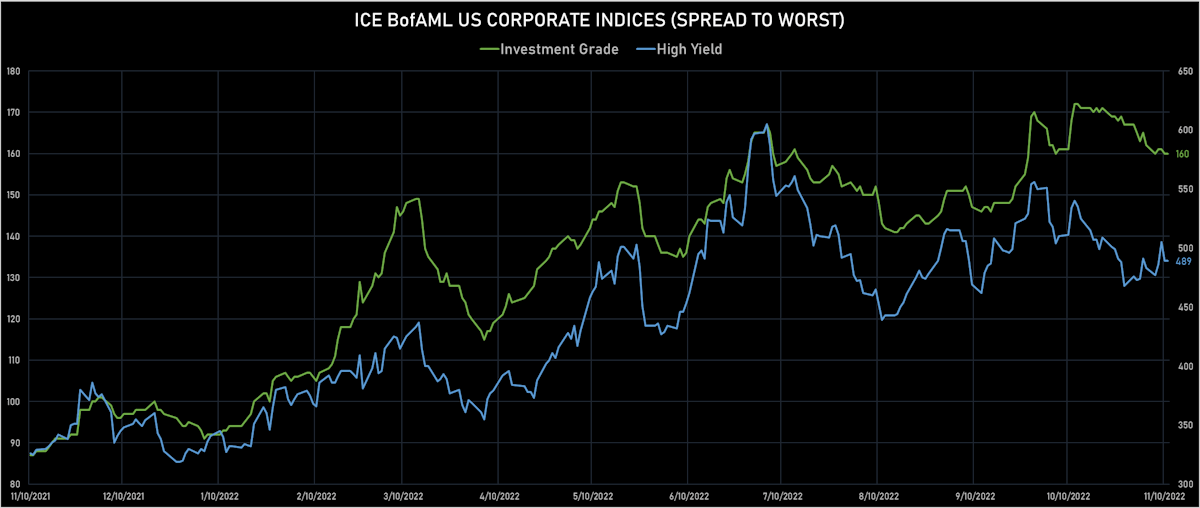

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 160.0 bp (YTD change: +65.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 489.0 bp (YTD change: +159.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: -1.6%)

HY default rates expected to pick up | Source: Wells Fargo Securities

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 59 bp

- AA unchanged at 88 bp

- A unchanged at 132 bp

- BBB unchanged at 194 bp

- BB unchanged at 311 bp

- B unchanged at 503 bp

- ≤ CCC up by 1 bp at 1,228 bp

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y at 83bp (1W change: -7.0bp; YTD change: +33.7bp)

- Markit CDX.NA.IG 10Y at 118bp (1W change: -5.8bp; YTD change: +29.0bp)

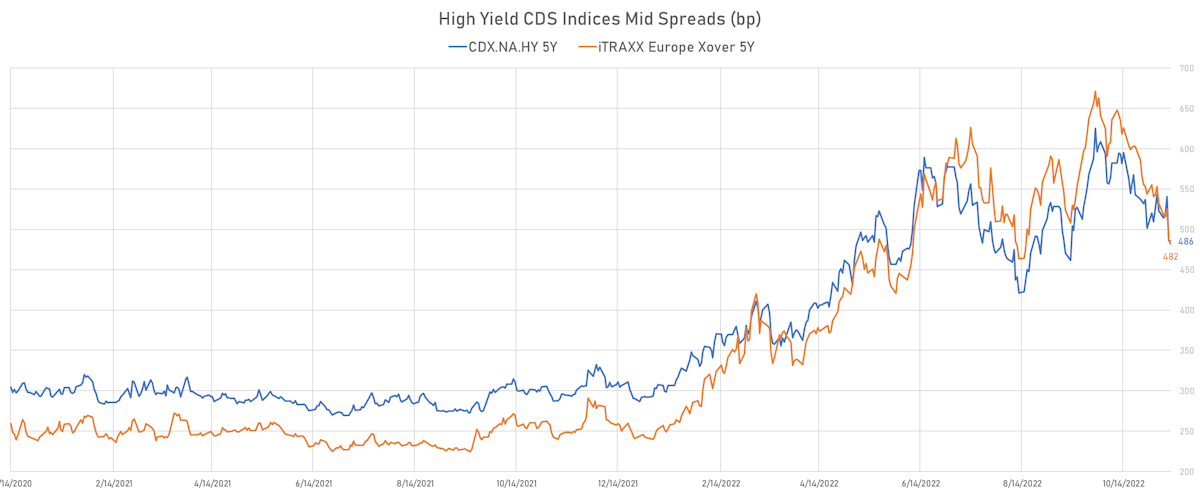

- Markit CDX.NA.HY 5Y at 486bp (1W change: -37.0bp; YTD change: +194.1bp)

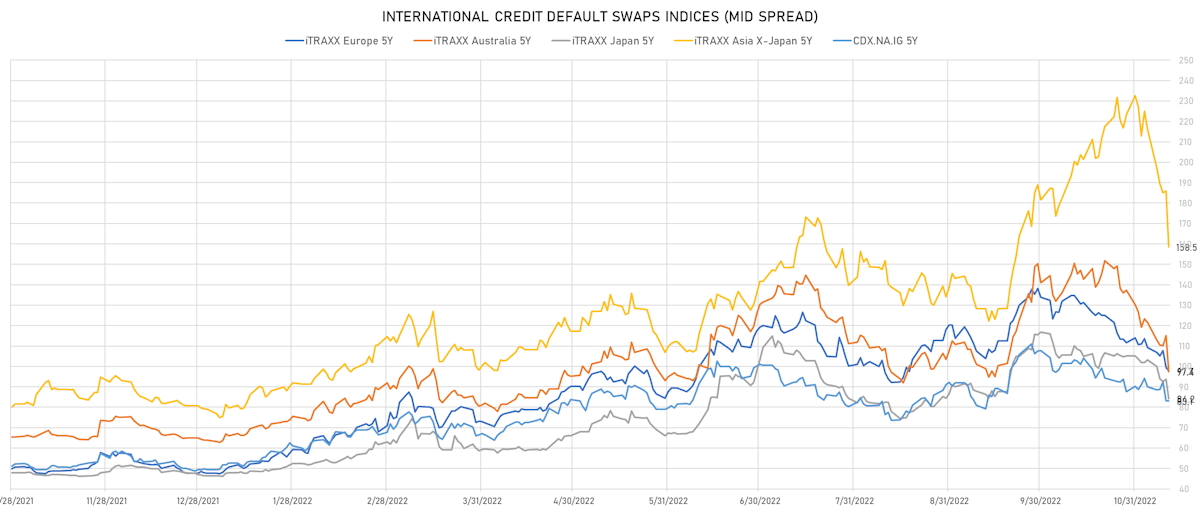

- Markit iTRAXX Europe 5Y down 1.8 bp, now at 98bp (1W change: -11.4bp; YTD change: +50.0bp)

- Markit iTRAXX Europe Crossover 5Y down 4.8 bp, now at 482bp (1W change: -50.2bp; YTD change: +240.0bp)

- Markit iTRAXX Japan 5Y down 9.5 bp, now at 84bp (1W change: -18.9bp; YTD change: +37.8bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 27.5 bp, now at 159bp (1W change: -57.7bp; YTD change: +79.5bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 116.7 bp to 429.8 bp, with the yield to worst at 8.3% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 87.6-106.9).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread up by 78.5 bp to 368.0 bp, with the yield to worst at 7.6% and the bond now trading down to 82.9 cents on the dollar (1Y price range: 79.0-102.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread up by 76.2 bp to 483.1 bp, with the yield to worst at 8.9% and the bond now trading down to 89.8 cents on the dollar (1Y price range: 88.8-105.7).

- Issuer: Graphic Packaging International LLC (Atlanta, United States) | Coupon: 3.75% | Maturity: 1/2/2030 | Rating: BB | ISIN: USU41441AD58 | Z-spread up by 71.8 bp to 269.8 bp, with the yield to worst at 6.4% and the bond now trading down to 83.8 cents on the dollar (1Y price range: 82.3-101.0).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | ISIN: USU2947RAA78 | Z-spread up by 58.4 bp to 205.3 bp, with the yield to worst at 6.1% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 95.0-110.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | ISIN: USU68337AL58 | Z-spread up by 56.5 bp to 441.9 bp (CDS basis: -105.8bp), with the yield to worst at 7.9% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 93.3-108.0).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 4.00% | Maturity: 1/12/2027 | Rating: BB | ISIN: USU81193AQ42 | Z-spread up by 53.0 bp to 309.2 bp (CDS basis: -44.8bp), with the yield to worst at 6.8% and the bond now trading down to 86.9 cents on the dollar (1Y price range: 85.0-104.3).

- Issuer: Starwood Property Trust Inc (Greenwich, United States) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | ISIN: USU85656AF04 | Z-spread up by 52.5 bp to 369.9 bp, with the yield to worst at 7.6% and the bond now trading down to 86.5 cents on the dollar (1Y price range: 83.8-100.1).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | ISIN: USU6S19GAC10 | Z-spread up by 51.2 bp to 409.0 bp (CDS basis: -74.2bp), with the yield to worst at 8.1% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 92.0-104.1).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread up by 49.4 bp to 251.1 bp, with the yield to worst at 6.7% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 4.75% | Maturity: 15/7/2027 | Rating: BB | ISIN: USU41441AA10 | Z-spread up by 49.3 bp to 266.8 bp, with the yield to worst at 6.4% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 91.0-108.5).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 1/3/2029 | Rating: BB | ISIN: USU41441AC75 | Z-spread up by 48.3 bp to 258.3 bp, with the yield to worst at 6.4% and the bond now trading down to 84.5 cents on the dollar (1Y price range: 81.6-100.0).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 15/3/2028 | Rating: BB | ISIN: USU41441AB92 | Z-spread up by 46.3 bp to 302.0 bp, with the yield to worst at 6.4% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 83.6-100.5).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 6.88% | Maturity: 15/7/2033 | Rating: BB | ISIN: USU81193AD39 | Z-spread up by 43.4 bp to 387.9 bp (CDS basis: -43.9bp), with the yield to worst at 7.5% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 93.3-126.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 51.2 bp to 523.7 bp, with the yield to worst at 9.5% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 80.9-95.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 79.3 bp to 295.3 bp, with the yield to worst at 5.5% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | Z-spread down by 80.9 bp to 324.6 bp (CDS basis: 83.6bp), with the yield to worst at 6.0% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 76.4-98.5).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | Z-spread down by 81.7 bp to 353.2 bp, with the yield to worst at 6.2% and the bond now trading up to 86.2 cents on the dollar (1Y price range: 78.2-103.0).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB | ISIN: XS2341724172 | Z-spread down by 82.5 bp to 538.0 bp, with the yield to worst at 8.1% and the bond now trading up to 75.0 cents on the dollar (1Y price range: 65.2-97.6).

- Issuer: thyssenkrupp AG (Essen, Germany) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread down by 88.4 bp to 214.2 bp (CDS basis: 203.1bp), with the yield to worst at 4.5% and the bond now trading up to 94.7 cents on the dollar (1Y price range: 89.0-104.2).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | Z-spread down by 91.0 bp to 315.8 bp (CDS basis: 18.7bp), with the yield to worst at 5.8% and the bond now trading up to 92.7 cents on the dollar (1Y price range: 85.3-105.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread down by 97.6 bp to 344.3 bp, with the yield to worst at 6.1% and the bond now trading up to 90.7 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Z-spread down by 97.8 bp to 177.2 bp, with the yield to worst at 4.5% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 85.0-108.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | Z-spread down by 97.9 bp to 303.1 bp (CDS basis: 14.4bp), with the yield to worst at 5.7% and the bond now trading up to 91.5 cents on the dollar (1Y price range: 84.2-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | Z-spread down by 104.6 bp to 266.8 bp (CDS basis: 2.4bp), with the yield to worst at 5.4% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 87.1-102.4).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread down by 113.1 bp to 919.8 bp, with the yield to worst at 11.9% and the bond now trading up to 84.9 cents on the dollar (1Y price range: 77.4-109.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | Z-spread down by 115.1 bp to 227.9 bp (CDS basis: 70.6bp), with the yield to worst at 5.1% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 86.8-103.1).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 125.7 bp to 323.9 bp, with the yield to worst at 5.9% and the bond now trading up to 78.5 cents on the dollar (1Y price range: 67.8-87.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread down by 171.1 bp to 593.5 bp (CDS basis: 255.2bp), with the yield to worst at 8.4% and the bond now trading up to 88.9 cents on the dollar (1Y price range: 77.5-104.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread down by 179.4 bp to 679.1 bp (CDS basis: 212.7bp), with the yield to worst at 9.3% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 77.4-113.4).

RECENT DOMESTIC USD BOND ISSUES

- Ally Financial Inc (Financial - Other | Detroit, Michigan, United States | Rating: BBB-): US$750m Senior Note (US02005NBR08), fixed rate (7.10% coupon) maturing on 15 November 2027, priced at 99.00 (original spread of 295 bp), callable (5nc5)

- Ameren Illinois Co (Utility - Other | Collinsville, Illinois, United States | Rating: A+): US$350m First Mortgage Bond (US02361DAZ33), fixed rate (5.90% coupon) maturing on 1 December 2052, priced at 99.69 (original spread of 209 bp), callable (30nc30)

- Ball Corp (Containers | Westminster, Colorado, United States | Rating: BB+): US$750m Senior Note (US058498AY23), fixed rate (6.88% coupon) maturing on 15 March 2028, priced at 100.00 (original spread of 261 bp), callable (5nc2)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$2,000m Senior Note (US06051GLC14), floating rate maturing on 10 November 2028, priced at 100.00 (original spread of 191 bp), callable (6nc5)

- Boston Properties LP (Leisure | Boston, United States | Rating: BBB+): US$750m Senior Note (US10112RBG83), fixed rate (6.75% coupon) maturing on 1 December 2027, priced at 99.94 (original spread of 238 bp), callable (5nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$2,750m Senior Note (US172967PA33), floating rate maturing on 17 November 2033, priced at 100.00 (original spread of 208 bp), callable (11nc10)

- Consolidated Edison Company of New York Inc (Utility - Other | New York City, New York, United States | Rating: BBB+): US$700m Senior Debenture (US209111GD93), fixed rate (6.15% coupon) maturing on 15 November 2052, priced at 99.39 (original spread of 233 bp), callable (30nc30)

- DISH Network Corp (Cable/Media | Englewood, Colorado, United States | Rating: B+): US$2,000m Note (USU25507AA97), fixed rate (11.75% coupon) maturing on 15 November 2027, priced at 98.17 (original spread of 784 bp), callable (5nc2)

- Duke Energy Florida LLC (Utility - Other | St. Petersburg, United States | Rating: A): US$500m First Mortgage Bond (US26444HAN17), fixed rate (5.95% coupon) maturing on 15 November 2052, priced at 99.36 (original spread of 207 bp), callable (30nc30)

- Ecolab Inc (Chemicals | Saint Paul, United States | Rating: A-): US$500m Senior Note (US278865BP48), fixed rate (5.25% coupon) maturing on 15 January 2028, priced at 99.40 (original spread of 102 bp), callable (5nc5)

- Edison International (Utility - Other | Rosemead, United States | Rating: BBB-): US$550m Senior Note (US281020AW79), fixed rate (6.95% coupon) maturing on 15 November 2029, priced at 99.09 (original spread of 280 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENZ789), fixed rate (5.50% coupon) maturing on 14 May 2026, priced at 100.00 (original spread of 62 bp), callable (3nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133EN2E90), fixed rate (6.30% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 171 bp), callable (7nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133ENZ862), fixed rate (5.57% coupon) maturing on 14 November 2025, priced at 100.00 (original spread of 142 bp), callable (3nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$185m Bond (US3133EN2G49), fixed rate (5.60% coupon) maturing on 16 November 2026, priced at 100.00, callable (4nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$300m Bond (US3130ATVT12), fixed rate (5.40% coupon) maturing on 21 November 2024, priced at 100.00 (original spread of 110 bp), callable (2nc1m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GY3S93), fixed rate (5.36% coupon) maturing on 22 November 2024, priced at 100.00 (original spread of 68 bp), callable (2nc6m)

- GE Healthcare Holding LLC (Electronics | Chicago, United States | Rating: NR): US$1,500m Senior Note (USU3644QAB15), fixed rate (5.60% coupon) maturing on 15 November 2025, priced at 99.78 (original spread of 120 bp), callable (3nc3)

- GE Healthcare Holding LLC (Electronics | Chicago, United States | Rating: NR): US$1,000m Senior Note (USU3644QAF29), fixed rate (6.38% coupon) maturing on 22 November 2052, priced at 100.00 (original spread of 210 bp), callable (30nc30)

- GE Healthcare Holding LLC (Electronics | Chicago, United States | Rating: NR): US$1,250m Senior Note (USU3644QAD70), fixed rate (5.86% coupon) maturing on 15 March 2030, priced at 100.00 (original spread of 170 bp), callable (7nc7)

- GE Healthcare Holding LLC (Electronics | Chicago, United States | Rating: NR): US$1,000m Senior Note (USU3644QAA32), fixed rate (5.55% coupon) maturing on 15 November 2024, priced at 99.86 (original spread of 105 bp), with a special call

- GE Healthcare Holding LLC (Electronics | Chicago, United States | Rating: NR): US$1,750m Senior Note (USU3644QAE53), fixed rate (5.91% coupon) maturing on 22 November 2032, priced at 100.00 (original spread of 185 bp), callable (10nc10)

- GE Healthcare Holding LLC (Electronics | Chicago, United States | Rating: NR): US$1,750m Senior Note (USU3644QAC97), fixed rate (5.65% coupon) maturing on 15 November 2027, priced at 99.60 (original spread of 151 bp), callable (5nc5)

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB-): US$500m Senior Note (US444859BU54), fixed rate (5.75% coupon) maturing on 1 March 2028, priced at 99.71 (original spread of 143 bp), callable (5nc5)

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB-): US$750m Senior Note (US444859BV38), fixed rate (5.88% coupon) maturing on 1 March 2033, priced at 99.51 (original spread of 180 bp), callable (10nc10)

- KeyBank NA (Banking | Cleveland, Ohio, United States | Rating: A-): US$1,000m Senior Bank Note (US49327M3F97), fixed rate (5.85% coupon) maturing on 15 November 2027, priced at 99.83 (original spread of 160 bp), callable (5nc5)

- Oracle Corp (Service - Other | Redwood City, California, United States | Rating: BBB): US$2,500m Senior Note (US68389XCK90), fixed rate (6.90% coupon) maturing on 9 November 2052, priced at 99.94 (original spread of 297 bp), callable (30nc30)

- Oracle Corp (Service - Other | Redwood City, California, United States | Rating: BBB): US$1,250m Senior Note (US68389XCH61), fixed rate (6.15% coupon) maturing on 9 November 2029, priced at 99.91 (original spread of 185 bp), callable (7nc7)

- Oracle Corp (Service - Other | Redwood City, California, United States | Rating: BBB): US$2,250m Senior Note (US68389XCJ28), fixed rate (6.25% coupon) maturing on 9 November 2032, priced at 99.82 (original spread of 209 bp), callable (10nc10)

- Oracle Corp (Service - Other | Redwood City, California, United States | Rating: BBB): US$1,000m Senior Note (US68389XCF06), fixed rate (5.80% coupon) maturing on 10 November 2025, priced at 99.87 (original spread of 120 bp), with a make whole call

- Qualcomm Inc (Telecommunications | San Diego, California, United States | Rating: A): US$700m Senior Note (US747525BS17), fixed rate (5.40% coupon) maturing on 20 May 2033, priced at 99.94 (original spread of 134 bp), callable (11nc10)

- Qualcomm Inc (Telecommunications | San Diego, California, United States | Rating: A): US$1,200m Senior Note (US747525BT99), fixed rate (6.00% coupon) maturing on 20 May 2053, priced at 99.29 (original spread of 222 bp), callable (31nc30)

- Southern California Gas Co (Gas Utility - Local Distrib | Los Angeles, United States | Rating: A+): US$600m First Mortgage Note (US842434CX83), fixed rate (6.35% coupon) maturing on 15 November 2052, priced at 99.63 (original spread of 230 bp), callable (30nc30)

- Spirit AeroSystems Inc (Aerospace | Wichita, Kansas, United States | Rating: BB-): US$900m Note (USU84591AF05), fixed rate (9.38% coupon) maturing on 30 November 2029, priced at 100.00 (original spread of 525 bp), callable (7nc3)

- Wisconsin Public Service Corp (Utility - Other | Green Bay, Wisconsin, United States | Rating: A-): US$300m Senior Note (US976843BP69), fixed rate (5.35% coupon) maturing on 10 November 2025, priced at 99.98 (original spread of 73 bp), callable (3nc3)

- Zoetis Inc (Health Care Supply | Parsippany, New Jersey, United States | Rating: BBB): US$750m Senior Note (US98978VAV53), fixed rate (5.60% coupon) maturing on 16 November 2032, priced at 99.84 (original spread of 160 bp), callable (10nc10)

- Zoetis Inc (Health Care Supply | Parsippany, New Jersey, United States | Rating: BBB): US$600m Senior Note (US98978VAU70), fixed rate (5.40% coupon) maturing on 14 November 2025, priced at 99.93 (original spread of 85 bp), callable (3nc3)

- eBay Inc (Retail Stores - Other | San Jose, United States | Rating: BBB+): US$425m Senior Note (US278642BC68), fixed rate (5.90% coupon) maturing on 22 November 2025, priced at 99.88 (original spread of 130 bp), callable (3nc3)

- eBay Inc (Retail Stores - Other | San Jose, United States | Rating: BBB+): US$300m Senior Note (US278642BA03), fixed rate (5.95% coupon) maturing on 22 November 2027, priced at 99.86 (original spread of 163 bp), callable (5nc5)

- eBay Inc (Retail Stores - Other | San Jose, United States | Rating: BBB+): US$425m Senior Note (US278642BB85), fixed rate (6.30% coupon) maturing on 22 November 2032, priced at 99.93 (original spread of 210 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Agricultural Bank of China Ltd (Macau Branch) (Banking | China (Mainland) | Rating: NR): US$120m Certificate of Deposit (XS2556148604), floating rate maturing on 16 November 2024, priced at 100.00, non callable

- CFG Investement SAC (Financial - Other | Santiago De Surco, Lima, Hong Kong | Rating: NR): US$300m Bond (XS2550128271), fixed rate (10.00% coupon) maturing on 7 November 2032, priced at 100.00, non callable

- Central American Bank for Economic Integration (Supranational | Tegucigalpa, Honduras | Rating: AA-): US$150m Unsecured Note (XS2557566648), floating rate maturing on 29 November 2027, priced at 100.00, non callable

- Central American Bank for Economic Integration (Supranational | Tegucigalpa, Honduras | Rating: AA-): US$170m Unsecured Note (XS2557570244), fixed rate (5.55% coupon) maturing on 29 November 2032, priced at 100.00, non callable

- Credit Suisse Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: BBB-): US$2,000m Senior Note (US225401BB38), floating rate maturing on 15 November 2033, priced at 100.00, callable (11nc10)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460006173), fixed rate (4.50% coupon) maturing on 9 December 2024, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A31PF7), fixed rate (4.86% coupon) maturing on 12 December 2024, priced at 98.60, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): US$200m Senior Note (XS2551322451), fixed rate (6.05% coupon) maturing on 8 November 2025, priced at 100.00 (original spread of 159 bp), non callable

- Jinan Hi Tech International (Cayman) Investment Development Co Ltd (Financial - Other | George Town, Cayman Islands | Rating: BBB): US$200m Unsecured Note (XS2497140546), fixed rate (6.95% coupon) maturing on 14 November 2025, priced at 100.00, non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$130m Unsecured Note (XS2555224265), fixed rate (5.45% coupon) maturing on 21 November 2028, priced at 100.00, non callable

- Lloyds Banking Group PLC (Banking | Spalding, United Kingdom | Rating: BBB-): US$1,000m Subordinated Note (US539439AW91), fixed rate (7.95% coupon) maturing on 15 November 2033, priced at 100.00 (original spread of 383 bp), callable (11nc10)

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$110m Unsecured Note (XS2554833314), floating rate maturing on 11 November 2027, priced at 100.00, non callable

- Minervathena Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$300m Bond (XS2555964894), fixed rate (7.50% coupon) maturing on 14 November 2025, priced at 100.00, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$200m Unsecured Note (XS2556550601), fixed rate (1.00% coupon) maturing on 21 November 2024, priced at 100.00, non callable

- NatWest Markets NV (Banking | Amsterdam, Noord-Holland, United Kingdom | Rating: A-): US$250m Unsecured Note (XS2555717292), fixed rate (6.26% coupon) maturing on 21 November 2024, priced at 100.00, non callable

- Neptune Bidco US Inc (Financial - Other | Jersey | Rating: B): US$1,960m Note (US640695AA01), fixed rate (9.29% coupon) maturing on 15 April 2029, priced at 92.29 (original spread of 678 bp), callable (6nc3)

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$1,000m Senior Note (XS2555419600), fixed rate (5.00% coupon) maturing on 14 February 2025, priced at 99.97 (original spread of 31 bp), non callable

- Nutrien Ltd (Chemicals | Saskatoon, Canada | Rating: BBB): US$500m Senior Note (US67077MAY49), fixed rate (5.95% coupon) maturing on 7 November 2025, priced at 99.89 (original spread of 135 bp), with a make whole call

- Nutrien Ltd (Chemicals | Saskatoon, Canada | Rating: BBB): US$500m Senior Note (US67077MAZ14), fixed rate (5.90% coupon) maturing on 7 November 2024, priced at 99.96 (original spread of 120 bp), with a make whole call

- Poland, Republic of (Government) (Sovereign | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): US$1,500m Senior Note (US857524AD47), fixed rate (5.50% coupon) maturing on 16 November 2027, priced at 99.49 (original spread of 130 bp), non callable

- Poland, Republic of (Government) (Sovereign | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): US$1,500m Senior Note (US857524AE20), fixed rate (5.75% coupon) maturing on 16 November 2032, priced at 98.95 (original spread of 175 bp), non callable

- SNB Funding Ltd (Financial - Other | George Town, Saudi Arabia | Rating: NR): US$150m Unsecured Note (XS2557664732), floating rate maturing on 22 November 2027, priced at 100.00, non callable

- Standard Chartered PLC (Banking | London, United Kingdom | Rating: BBB+): US$1,000m Senior Note (USG84228FH65), fixed rate (7.78% coupon) maturing on 16 November 2025, priced at 100.00, callable (3nc2)

- Standard Chartered PLC (Banking | London, United Kingdom | Rating: BBB+): US$1,000m Senior Note (USG84228FL77), fixed rate (7.77% coupon) maturing on 16 November 2028, priced at 100.00 (original spread of 345 bp), callable (6nc5)

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$700m Senior Note (US89236TKL88), fixed rate (5.45% coupon) maturing on 10 November 2027, priced at 99.88 (original spread of 111 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$650m Senior Note (US89236TKK06), fixed rate (5.40% coupon) maturing on 10 November 2025, priced at 99.88 (original spread of 80 bp), non callable

- Turkey, Republic of (Government) (Sovereign | Ankara, Turkey | Rating: B-): US$1,500m Senior Note (US900123DF45), fixed rate (9.88% coupon) maturing on 15 January 2028, priced at 99.45 (original spread of 561 bp), non callable

- Var Energi ASA (Oil and Gas | Sandnes, Italy | Rating: BBB-): US$1,000m Senior Note (USR9576ZAD08), fixed rate (7.50% coupon) maturing on 15 January 2028, priced at 99.22 (original spread of 338 bp), callable (5nc5)

- Var Energi ASA (Oil and Gas | Sandnes, Rogaland, Italy | Rating: BBB-): US$1,000m Senior Note (US92212WAE03), fixed rate (8.00% coupon) maturing on 15 November 2032, priced at 99.06 (original spread of 400 bp), callable (10nc10)

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: AA-): US$1,250m Senior Note (US961214FK48), fixed rate (5.46% coupon) maturing on 18 November 2027, priced at 100.00 (original spread of 122 bp), non callable

- Yara International ASA (Chemicals | Oslo, Oslo, Norway | Rating: BBB): US$600m Senior Note (US984851AH89), fixed rate (7.38% coupon) maturing on 14 November 2032, priced at 100.00 (original spread of 325 bp), callable (10nc10)

- Zhenjiang Cultural Tourism Industry Group Co Ltd (Service - Other | Zhenjiang, Jiangsu, China (Mainland) | Rating: NR): US$173m Bond (XS2543128784), fixed rate (7.10% coupon) maturing on 14 November 2025, priced at 100.00, non callable

RECENT EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €1,000m Unsecured Note (XS2557084733), fixed rate (1.00% coupon) maturing on 17 November 2034, priced at 100.00, non callable

- Agence Francaise de Developpement EPIC (Agency | Paris, Ile-De-France, France | Rating: AA): €150m Bond (FR001400DW45) zero coupon maturing on 25 March 2025, priced at 93.68 (original spread of 62 bp), non callable

- Agence France Locale SA (Agency | Lyon, Auvergne-Rhone-Alpes, France | Rating: AA-): €500m Bond (FR001400DLI3), fixed rate (3.25% coupon) maturing on 20 December 2031, priced at 99.36 (original spread of 102 bp), non callable

- Agenza Naziole pr l Atrazone degli Investmenti e lo Svilpo d Imresa SpA (Agency | Rome, Italy | Rating: BBB-): €350m Senior Note (XS2530435473), fixed rate (5.25% coupon) maturing on 14 November 2025, priced at 99.88 (original spread of 320 bp), callable (3nc3)

- Aib Group PLC (Banking | Dublin, Ireland | Rating: BBB-): €750m Senior Note (XS2555925218), fixed rate (5.75% coupon) maturing on 16 February 2029, priced at 99.91 (original spread of 365 bp), callable (6nc5)

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, New South Wales, Australia | Rating: A+): €2,000m Covered Bond (Other) (XS2555209035), fixed rate (3.21% coupon) maturing on 15 November 2024, priced at 100.00 (original spread of 107 bp), non callable

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Wien, Austria | Rating: A): €750m Hypothekenpfandbrief (Covered Bond) (XS2556232143), fixed rate (3.00% coupon) maturing on 17 May 2027, priced at 99.86 (original spread of 96 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €750m Bond (FR001400DZN3), fixed rate (4.00% coupon) maturing on 21 November 2029, priced at 99.89 (original spread of 185 bp), non callable

- Booking Holdings Inc (Service - Other | Norwalk, Connecticut, United States | Rating: A-): €1,000m Senior Note (XS2555220941), fixed rate (4.50% coupon) maturing on 15 November 2031, priced at 99.79 (original spread of 232 bp), callable (9nc9)

- Booking Holdings Inc (Service - Other | Norwalk, Connecticut, United States | Rating: A-): €1,000m Senior Note (XS2555221246), fixed rate (4.75% coupon) maturing on 15 November 2034, priced at 99.72 (original spread of 251 bp), callable (12nc12)

- Booking Holdings Inc (Service - Other | Norwalk, Connecticut, United States | Rating: A-): €750m Senior Note (XS2555220867), fixed rate (4.25% coupon) maturing on 15 May 2029, priced at 99.72 (original spread of 212 bp), callable (7nc6)

- Booking Holdings Inc (Service - Other | Norwalk, Connecticut, United States | Rating: A-): €750m Senior Note (XS2555218291), fixed rate (4.00% coupon) maturing on 15 November 2026, priced at 99.99 (original spread of 182 bp), callable (4nc4)

- Bpifrance SA (Banking | Maisons-Alfort, Ile-De-France, France | Rating: NR): €1,000m Bond (FR001400DXK4), fixed rate (3.00% coupon) maturing on 10 September 2026, priced at 99.89 (original spread of 82 bp), non callable

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): €5,000m Bond (FR001400DZI3), fixed rate (2.88% coupon) maturing on 25 May 2027, priced at 99.51 (original spread of 77 bp), non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: NR): €750m Obligation Fonciere (Covered Bond) (FR001400DXR9), fixed rate (3.13% coupon) maturing on 16 November 2027, priced at 99.82 (original spread of 91 bp), non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB-): €1,000m Note (XS2555187801), floating rate maturing on 14 November 2030, priced at 99.43 (original spread of 309 bp), callable (8nc7)

- Ceska Sporitelna as (Banking | Praha, Praha, Austria | Rating: A-): €500m Note (XS2555412001), floating rate maturing on 14 November 2025, priced at 100.00 (original spread of 447 bp), callable (3nc2)

- Compagnie de Financement Foncier SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,350m Obligation Fonciere (Covered Bond) (FR001400DXH0), fixed rate (3.13% coupon) maturing on 18 May 2025, priced at 99.76 (original spread of 100 bp), non callable

- Covestro AG (Chemicals | Leverkusen, Nordrhein-Westfalen, Germany | Rating: BBB): €500m Senior Note (XS2554997937), fixed rate (4.75% coupon) maturing on 15 November 2028, priced at 99.21 (original spread of 269 bp), callable (6nc6)

- Credit Suisse Group AG (Banking | Zurich, Switzerland | Rating: BBB-): €3,000m Bond (CH1214797172), fixed rate (7.75% coupon) maturing on 1 March 2029, priced at 99.61 (original spread of 574 bp), callable (6nc5)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6CZT8), fixed rate (2.75% coupon) maturing on 2 December 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6CZS0), fixed rate (2.45% coupon) maturing on 2 December 2024, priced at 100.00, non callable

- Denmark, Kingdom of (Government) (Sovereign | Kobenhavn K, Denmark | Rating: AAA): €1,500m Senior Note (XS2547290432), fixed rate (2.50% coupon) maturing on 18 November 2024, priced at 100.00 (original spread of 52 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8V2), fixed rate (2.80% coupon) maturing on 8 December 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8W0), floating rate maturing on 8 December 2027, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31PC4), fixed rate (4.50% coupon) maturing on 7 December 2033, priced at 100.00, callable (11nc3)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31PD2), floating rate maturing on 8 December 2027, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31LT7), fixed rate (3.10% coupon) maturing on 7 June 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31PE0), fixed rate (3.65% coupon) maturing on 18 November 2025, priced at 100.00, non callable

- Faurecia SE (Vehicle Parts | Nanterre, Ile-De-France, France | Rating: BB): €700m Senior Note (XS2553825949), fixed rate (7.25% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 513 bp), callable (4nc2)

- Great-West Lifeco Inc (Life Insurance | Winnipeg | Rating: A+): €500m Senior Note (XS2552362704), fixed rate (4.70% coupon) maturing on 16 November 2029, priced at 100.00 (original spread of 252 bp), non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: BBB): €1,250m Subordinated Note (XS2553547444), fixed rate (6.36% coupon) maturing on 16 November 2032, priced at 100.00 (original spread of 416 bp), with a regulatory call

- Hannover Rueck SE (Life Insurance | Hannover, Niedersachsen, Germany | Rating: A): €750m Subordinated Note (XS2549815913), floating rate maturing on 26 August 2043, priced at 99.75 (original spread of 358 bp), callable (21nc10)

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €1,250m Senior Note (XS2554746185), floating rate maturing on 14 November 2027, priced at 99.90 (original spread of 271 bp), callable (5nc4)

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €1,000m Senior Note (XS2554745708), floating rate maturing on 14 November 2033, priced at 99.76 (original spread of 295 bp), callable (11nc10)

- Inter-American Investment Corp (Supranational | Washington, Washington Dc, United States | Rating: AA+): €650m Senior Note (XS2547604715), fixed rate (3.13% coupon) maturing on 15 November 2027, priced at 99.77 (original spread of 91 bp), non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): €150m Index Linked Security (XS2547935150) zero coupon maturing on 9 November 2026, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): €1,000m Bond (IT0005519332), fixed rate (4.08% coupon) maturing on 22 December 2026, priced at 100.00, non callable

- Investitionsbank Berlin (Banking | Berlin, Germany | Rating: AAA): €300m Inhaberschuldverschreibung (DE000A289KP6), floating rate (EU03MLIB + 100.0 bp) maturing on 16 November 2026, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €4,000m Buono del Tesoro Poliennali (IT0005519787), fixed rate (3.85% coupon) maturing on 15 December 2029, priced at 100.27 (original spread of 191 bp), non callable

- Jyske Bank A/S (Banking | Silkeborg, Denmark | Rating: BBB+): €500m Note (XS2555918270), fixed rate (5.50% coupon) maturing on 16 November 2027, priced at 99.84 (original spread of 331 bp), callable (5nc4)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7960), fixed rate (2.60% coupon) maturing on 16 December 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7952), fixed rate (2.40% coupon) maturing on 16 December 2024, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7A07), fixed rate (2.25% coupon) maturing on 6 June 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB7986), fixed rate (3.00% coupon) maturing on 15 December 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB7978), fixed rate (2.75% coupon) maturing on 16 December 2026, priced at 100.00, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €500m Senior Note (XS2555166128), fixed rate (3.00% coupon) maturing on 14 November 2034, priced at 99.32 (original spread of 125 bp), non callable

- More Boligkreditt AS (Financial - Other | Alesund, More Og Romsdal, Norway | Rating: NR): €250m Covered Bond (Other) (XS2556223233), fixed rate (3.13% coupon) maturing on 16 November 2027, priced at 99.64 (original spread of 106 bp), non callable

- Muenchener Hypothekenbank eG (Banking | Muenchen, Germany | Rating: AA-): €700m Hypothekenpfandbrief (Covered Bond) (DE000MHB32J7), fixed rate (3.00% coupon) maturing on 4 August 2027, priced at 99.77 (original spread of 76 bp), non callable

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €500m Senior Note (XS2553554812), fixed rate (2.75% coupon) maturing on 9 November 2027, priced at 99.65 (original spread of 81 bp), non callable

- Nestle Finance International Ltd SA (Financial - Other | Luxembourg, Switzerland | Rating: NR): €500m Senior Note (XS2555196463), fixed rate (3.00% coupon) maturing on 15 March 2028, priced at 99.59 (original spread of 89 bp), non callable

- Nestle Finance International Ltd SA (Financial - Other | Luxembourg, Switzerland | Rating: NR): €500m Senior Note (XS2555198162), fixed rate (3.38% coupon) maturing on 15 November 2034, priced at 99.15 (original spread of 112 bp), callable (12nc12)

- Nestle Finance International Ltd SA (Financial - Other | Luxembourg, Switzerland | Rating: NR): €500m Senior Note (XS2555198089), fixed rate (3.25% coupon) maturing on 15 January 2031 (original spread of 105 bp), callable (8nc8)

- Orange SA (Telecommunications | Issy-Les-Moulineaux, Ile-De-France, France | Rating: BBB+): €750m Bond (FR001400DY43), fixed rate (3.63% coupon) maturing on 16 November 2031, priced at 99.70 (original spread of 145 bp), callable (9nc9)

- Orano SA (Metals/Mining | Chatillon, Auvergne-Rhone-Alpes, France | Rating: BBB-): €500m Bond (FR001400DAO4), fixed rate (5.38% coupon) maturing on 15 May 2027, priced at 99.70 (original spread of 327 bp), callable (4nc4)

- RAG Stiftung (Metals/Mining | Essen, Nordrhein-Westfalen, Germany | Rating: NR): €500m Bond (DE000A30VPN9), fixed rate (1.88% coupon) maturing on 16 November 2029, priced at 100.00, non callable, convertible

- Schleswig-Holstein, State of (Official and Muni | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €500m Landesschatzanweisung (DE000SHFM865), fixed rate (2.63% coupon) maturing on 17 November 2028 (original spread of -14 bp), non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,000m Bond (FR001400DZM5), fixed rate (4.00% coupon) maturing on 16 November 2027, priced at 99.82 (original spread of 193 bp), non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,250m Bond (FR001400DZO1), fixed rate (4.25% coupon) maturing on 16 November 2032, priced at 99.12 (original spread of 216 bp), non callable

- Sparebanken Sor Boligkreditt AS (Financial - Other | Kristiansand, Vest-Agder, Norway | Rating: AAA): €500m Covered Bond (Other) (XS2555209381), fixed rate (3.13% coupon) maturing on 14 November 2025, priced at 99.95 (original spread of 105 bp), non callable

- Sparkasse Hannover (Banking | Hannover, Niedersachsen, Germany | Rating: AAA): €250m Covered Bond (Other) (DE000A30V3G9), fixed rate (3.00% coupon) maturing on 16 November 2026, priced at 99.97 (original spread of 94 bp), non callable

- Suomen Hypoteekkiyhdistys (Real Estate Investment Trust | Helsinki, Finland | Rating: BBB): €300m Mortgage Bond (FI4000541461), fixed rate (3.25% coupon) maturing on 15 November 2027, priced at 99.83 (original spread of 103 bp), non callable

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): €1,000m Note (XS2555192710), fixed rate (3.75% coupon) maturing on 14 November 2025, priced at 99.98 (original spread of 165 bp), with a regulatory call

- Titan Financing SARL (Financial - Other | Strassen, United States | Rating: NR): €300m Bond (XS2553551479), floating rate maturing on 20 January 2066, priced at 100.00, non callable

- Titan Financing SARL (Financial - Other | Strassen, United States | Rating: NR): €700m Bond (XS2553552014), floating rate maturing on 20 October 2066, priced at 100.00, non callable

- Ubisoft Entertainment SA (Leisure | Carentoir, Bretagne, France | Rating: NR): €470m Bond (FR001400DV38), fixed rate (2.38% coupon) maturing on 15 November 2028, priced at 100.00, non callable, convertible

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB-): €1,000m Note (XS2555420103), floating rate maturing on 15 November 2027, priced at 99.95 (original spread of 367 bp), callable (5nc4)

- Unicaja Banco SA (Banking | Malaga, Malaga, Spain | Rating: NR): €500m Bond (ES0380907065), fixed rate (7.25% coupon) maturing on 15 November 2027, priced at 99.85 (original spread of 508 bp), callable (5nc4)

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: BBB+): €750m Senior Note (XS2554488978), fixed rate (4.25% coupon) maturing on 15 February 2028, priced at 99.80 (original spread of 218 bp), non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: BBB+): €750m Senior Note (XS2554489513), fixed rate (4.38% coupon) maturing on 15 May 2030, priced at 99.45 (original spread of 223 bp), non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: BBB+): €1,000m Senior Note (XS2554487905), fixed rate (4.13% coupon) maturing on 15 November 2025, priced at 99.96 (original spread of 201 bp), non callable

RECENT LOANS

- HTN Towers (Nigeria), signed a US$ 600m Term Loan, to be used for general corporate purposes. It matures on 11/03/25 and initial pricing is set at Term SOFR +375.0bp

- Micron Technology Inc (United States of America | BBB-), signed a US$ 927m Term Loan A, to be used for general corporate purposes. It matures on 11/03/27 and initial pricing is set at Term SOFR +200.0bp

- Micron Technology Inc (United States of America | BBB-), signed a US$ 747m Term Loan A, to be used for general corporate purposes. It matures on 11/03/26 and initial pricing is set at Term SOFR +200.0bp

- Micron Technology Inc (United States of America | BBB-), signed a US$ 927m Term Loan A, to be used for general corporate purposes. It matures on 11/03/25 and initial pricing is set at Term SOFR +200.0bp

- Toyota Motor Credit Corp (United States of America | A+), signed a US$ 5,000m 364d Revolver, to be used for general corporate purposes. It matures on 11/03/23 and initial pricing is set at Term SOFR +83.0bp

- Yapi ve Kredi Bankasi AS (Turkey), signed a € 249m Term Loan, to be used for finance linked-trade. It matures on 11/04/23 and initial pricing is set at EURIBOR +400.0bp

- Yapi ve Kredi Bankasi AS (Turkey), signed a US$ 210m Term Loan, to be used for finance linked-trade. It matures on 11/04/23 and initial pricing is set at Term SOFR +425.0bp

RECENT STRUCTURED CREDIT

- Ares European CLO XVI Designated Activity Company issued a floating-rate CLO in 7 tranches, for a total of € 209 m. Highest-rated tranche offering a spread over the floating rate of 98bp, and the lowest-rated tranche a spread of 836bp. Bookrunners: BofA Securities Inc

- CVC Cordatus Loan Fund XXVI DAC issued a floating-rate CLO in 9 tranches, for a total of € 396 m. Highest-rated tranche offering a spread over the floating rate of 220bp, and the lowest-rated tranche a spread of 842bp. Bookrunners: Societe Generale SA, Barclays Capital Group

- Dryden 103 Euro Clo 2021 DAC issued a floating-rate CLO in 8 tranches, for a total of € 372 m. Highest-rated tranche offering a spread over the floating rate of 229bp, and the lowest-rated tranche a spread of 1,450bp. Bookrunners: Natixis

- Santander Consumer Spain Auto 2022-1 Ft issued a floating-rate ABS backed by auto receivables in 5 tranches, for a total of € 697 m. Highest-rated tranche offering a spread over the floating rate of 80bp, and the lowest-rated tranche a spread of 1,200bp. Bookrunners: Banco Santander SA