Credit

Significant Tightening In Spreads Brought Positive Performance Across US$ Credit This Week Despite Higher Rates

Good volume of corporate issuance at the tail end of 3Q22 earnings season: 31 tranches for $24.78bn in IG (2022 YTD volume $1.176tn vs 2021 YTD $1.414tn), 2 tranches for $1.9bn in HY (2022 YTD volume $99.701bn vs 2021 YTD $451.381bn)

Published ET

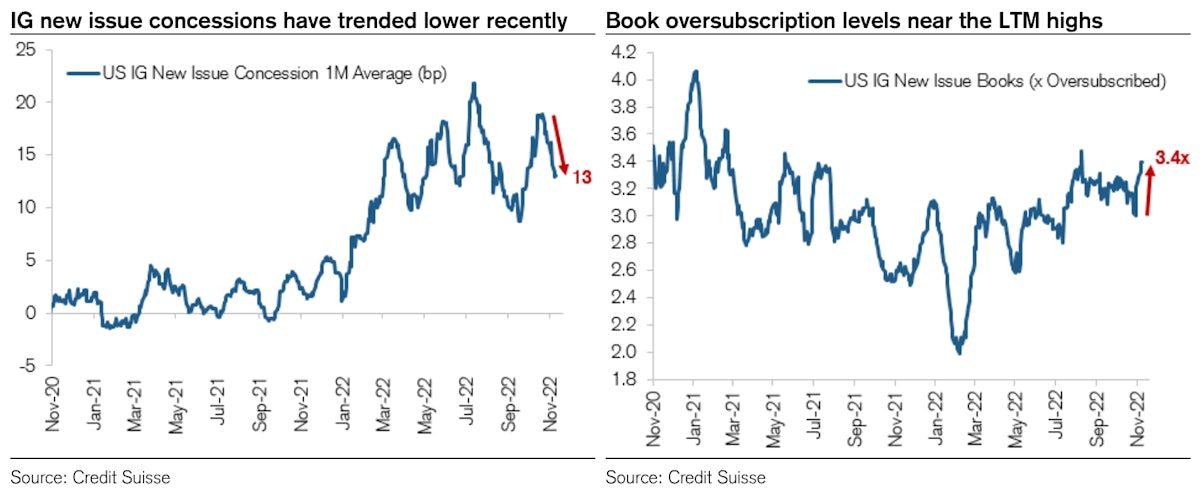

Recent Positive Credit Sentiment Bringing US IG Concessions Down | Source: Credit Suisse

DAILY SUMMARY

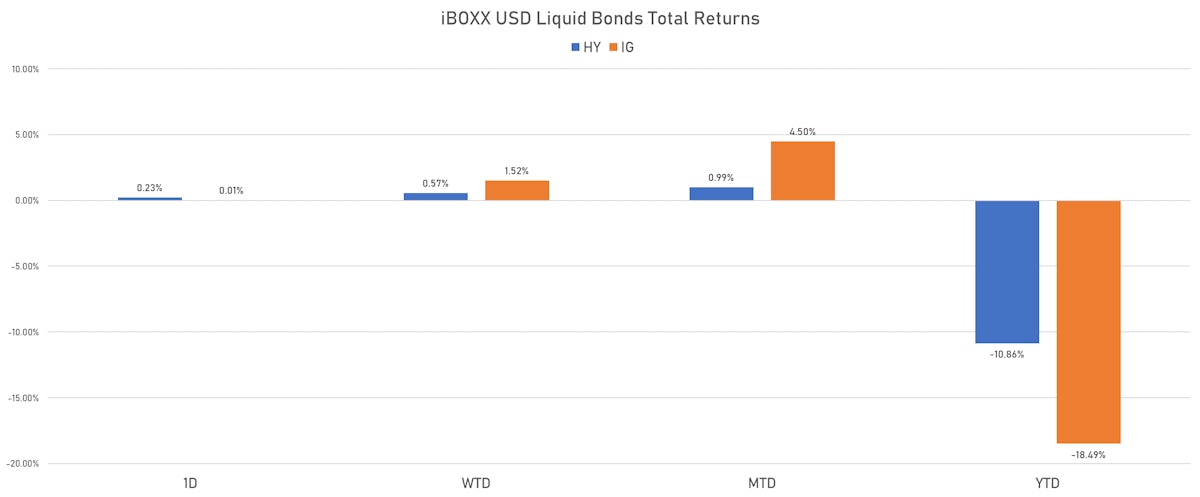

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.014% today (Week-to-date: 1.52%; Month-to-date: 4.50%; Year-to-date: -18.49%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.232% today (Week-to-date: 0.57%; Month-to-date: 0.99%; Year-to-date: -10.86%)

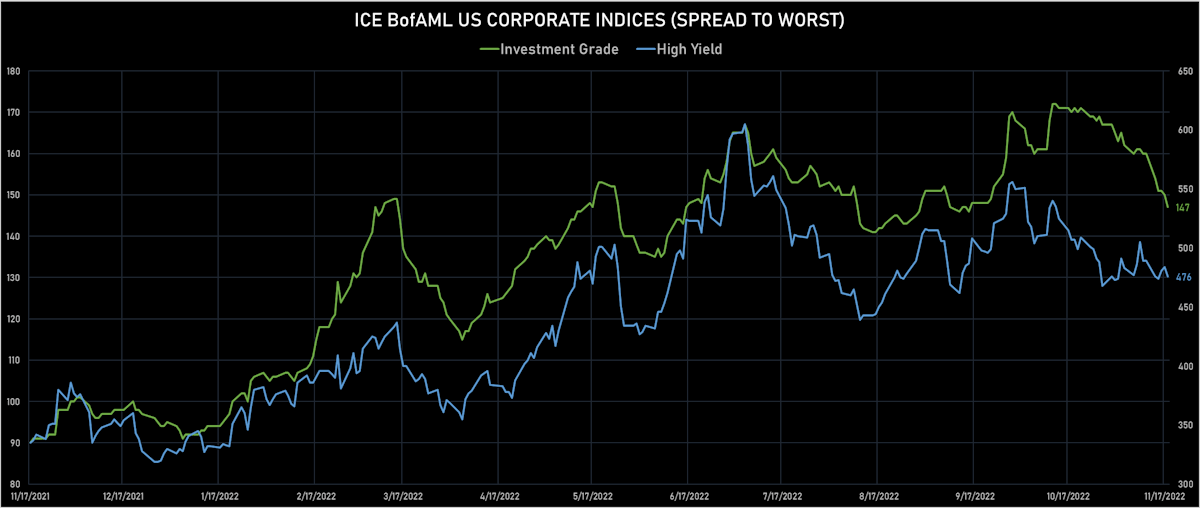

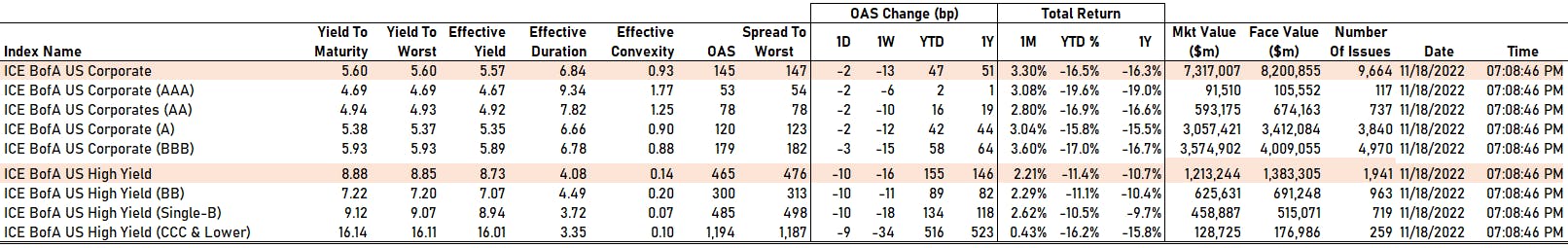

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -3.0 bp, now at 147.0 bp (YTD change: +52.0 bp)

- ICE BofA US High Yield Index spread to worst down -8.0 bp, now at 476.0 bp (YTD change: +146.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.08% today (YTD total return: -1.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -2 bp at 53 bp

- AA down by -2 bp at 78 bp

- A down by -2 bp at 120 bp

- BBB down by -3 bp at 179 bp

- BB down by -10 bp at 300 bp

- B down by -10 bp at 485 bp

- ≤ CCC down by -9 bp at 1,194 bp

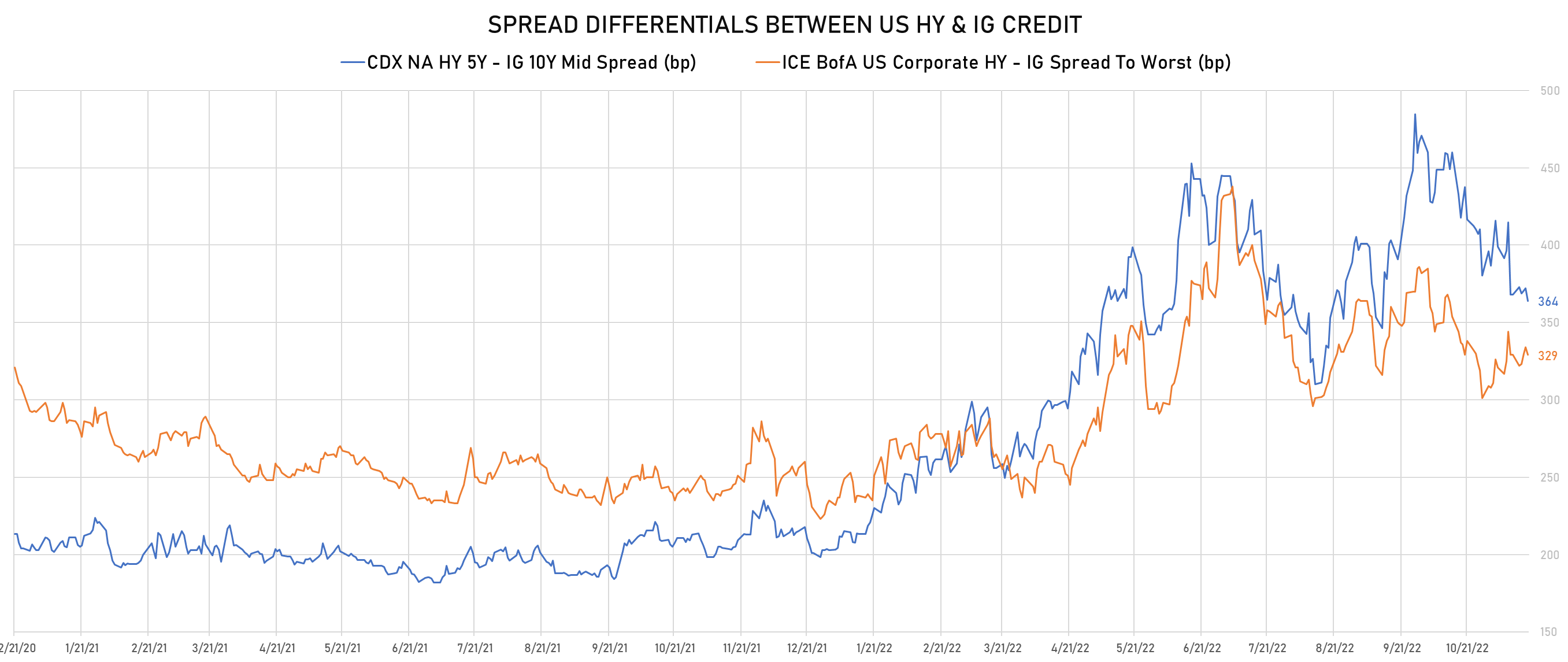

CDS INDICES TODAY (mid-spreads)

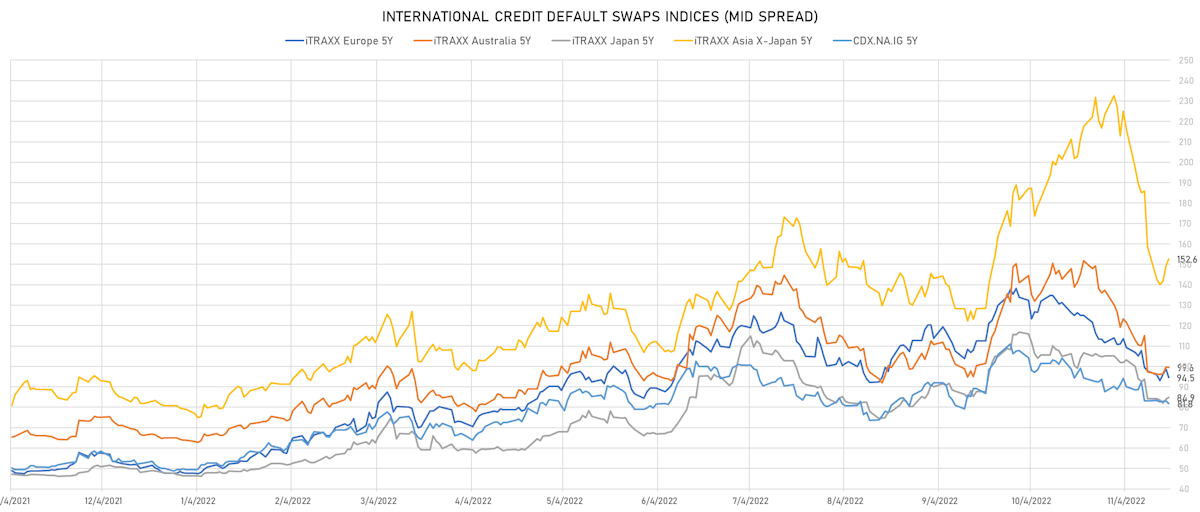

- Markit CDX.NA.IG 5Y down 1.4 bp, now at 82bp (1W change: -1.2bp; YTD change: +32.5bp)

- Markit CDX.NA.IG 10Y down 1.2 bp, now at 117bp (1W change: -1.4bp; YTD change: +27.7bp)

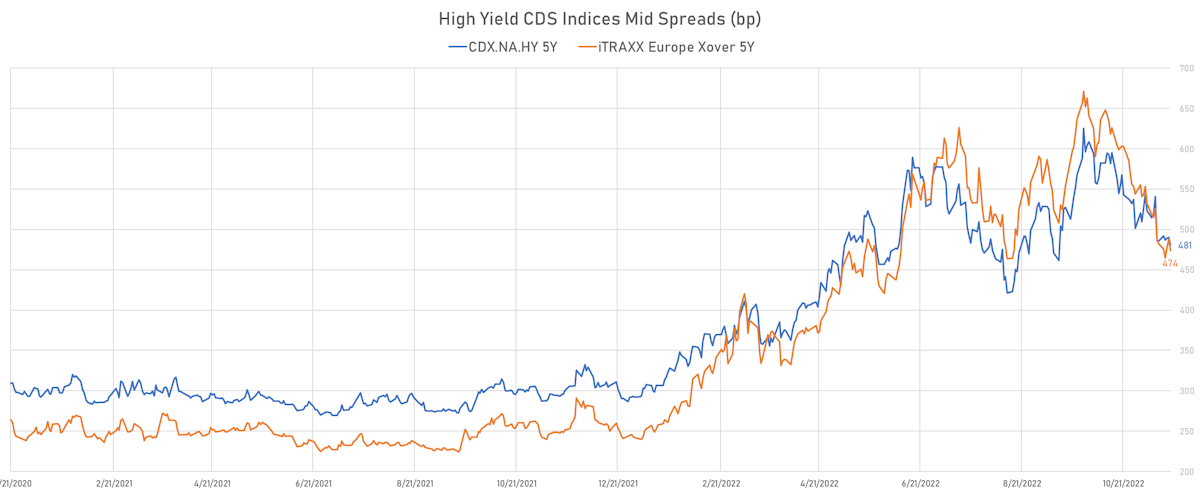

- Markit CDX.NA.HY 5Y down 9.2 bp, now at 481bp (1W change: -5.2bp; YTD change: +188.9bp)

- Markit iTRAXX Europe 5Y down 4.2 bp, now at 95bp (1W change: -3.2bp; YTD change: +46.8bp)

- Markit iTRAXX Europe Crossover 5Y down 14.0 bp, now at 474bp (1W change: -8.3bp; YTD change: +231.7bp)

- Markit iTRAXX Japan 5Y up 0.9 bp, now at 85bp (1W change: +0.7bp; YTD change: +38.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 3.2 bp, now at 153bp (1W change: -5.9bp; YTD change: +73.6bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 451.4 bp to 1,526.4bp (1Y range: 355-2,117bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 254.0 bp to 1,267.0bp (1Y range: 430-1,783bp)

- American Airlines Group Inc (Country: US; rated: B2): down 190.1 bp to 1,145.7bp (1Y range: 607-1,644bp)

- Gap Inc (Country: US; rated: Ba2): down 143.7 bp to 523.7bp (1Y range: 152-819bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 136.6 bp to 635.5bp (1Y range: 278-899bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): down 117.2 bp to 378.8bp (1Y range: 124-401bp)

- Nordstrom Inc (Country: US; rated: A3): down 97.9 bp to 523.1bp (1Y range: 212-641bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 95.8 bp to 724.0bp (1Y range: 319-1,584bp)

- Petroleos Mexicanos (Country: MX; rated: caa3): down 95.2 bp to 578.0bp (1Y range: 302-768bp)

- Staples Inc (Country: US; rated: B3): down 89.7 bp to 1,955.7bp (1Y range: 985-1,986bp)

- Macy's Inc (Country: US; rated: A1): down 88.7 bp to 376.8bp (1Y range: 181-619bp)

- Kohls Corp (Country: US; rated: NR): down 82.7 bp to 534.4bp (1Y range: 112-686bp)

- Liberty Interactive LLC (Country: US; rated: BB-): up 298.6 bp to 1,801.3bp (1Y range: 405-1,801bp)

- Unisys Corp (Country: US; rated: B1): up 413.4 bp to 1,065.8bp (1Y range: 222-1,096bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 234.5 bp to 1,149.8bp (1Y range: 612-1,725bp)

- Ceconomy AG (Country: DE; rated: A3): down 180.5 bp to 1,048.4bp (1Y range: 185-1,763bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 156.0 bp to 1,277.8bp (1Y range: 566-1,739bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 97.3 bp to 868.8bp (1Y range: 394-1,021bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 91.9 bp to 916.7bp (1Y range: 266-1,254bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 79.5 bp to 1,934.0bp (1Y range: 1,286-2,910bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 79.1 bp to 428.8bp (1Y range: 296-648bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 75.7 bp to 318.6bp (1Y range: 186-505bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 65.6 bp to 356.6bp (1Y range: 152-600bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): down 57.7 bp to 278.6bp (1Y range: 125-420bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 55.9 bp to 347.0bp (1Y range: 225-606bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 52.3 bp to 963.9bp (1Y range: 359-1,296bp)

- Alstom SA (Country: FR; rated: P-2): down 51.1 bp to 194.9bp (1Y range: 68-313bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 1.50% | Maturity: 15/3/2027 | Rating: BB+ | ISIN: XS2080318053 | Z-spread up by 30.1 bp to 195.7 bp (CDS basis: 22.6bp), with the yield to worst at 4.4% and the bond now trading down to 87.9 cents on the dollar (1Y price range: 82.9-101.2).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread up by 28.0 bp to 256.4 bp (CDS basis: 4.4bp), with the yield to worst at 5.2% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 86.0-104.8).

- Issuer: Crown European Holdings SA (France) | Coupon: 3.38% | Maturity: 15/5/2025 | Rating: BB+ | ISIN: XS1227287221 | Z-spread up by 27.3 bp to 209.0 bp (CDS basis: -99.4bp), with the yield to worst at 4.8% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 94.5-106.5).

- Issuer: Standard Building Solutions Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 17.1 bp to 489.4 bp, with the yield to worst at 7.1% and the bond now trading down to 82.0 cents on the dollar (1Y price range: 76.9-98.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 15/9/2024 | Rating: BB | ISIN: XS2052337503 | Z-spread up by 16.7 bp to 253.2 bp (CDS basis: 3.4bp), with the yield to worst at 5.2% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 87.0-104.4).

- Issuer: Crown European Holdings SA (France) | Coupon: 2.88% | Maturity: 1/2/2026 | Rating: BB+ | ISIN: XS1758723883 | Z-spread up by 8.3 bp to 216.9 bp (CDS basis: -79.8bp), with the yield to worst at 4.6% and the bond now trading down to 94.1 cents on the dollar (1Y price range: 90.9-105.8).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread up by 5.9 bp to 303.5 bp, with the yield to worst at 5.4% and the bond now trading down to 83.7 cents on the dollar (1Y price range: 77.9-101.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.25% | Maturity: 15/9/2025 | Rating: BB | ISIN: XS2229875989 | Z-spread up by 1.9 bp to 241.2 bp (CDS basis: 10.6bp), with the yield to worst at 5.1% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 89.7-107.6).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.33% | Maturity: 24/3/2025 | Rating: BB+ | ISIN: XS1523028436 | Z-spread down by 4.8 bp to 576.2 bp, with the yield to worst at 8.5% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 82.3-107.7).

RECENT DOMESTIC USD BOND ISSUES

- Athene Holding Ltd (Life Insurance | Hamilton, United States | Rating: BBB+): US$400m Senior Note (US04686JAF84), fixed rate (6.65% coupon) maturing on 1 February 2033, priced at 99.72 (original spread of 300 bp), callable (10nc10)

- Bank of New York Mellon (Banking | New York City, New York, United States | Rating: AA-): US$750m Senior Bank Note (US06405LAC54), floating rate maturing on 21 November 2025, priced at 100.00 (original spread of 53 bp), callable (3nc2)

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: BBB-): US$200m Senior Note (USU0926HAS95), fixed rate (7.05% coupon) maturing on 29 September 2025, priced at 99.23 (original spread of 310 bp), with a make whole call

- Brookdale Senior Living Inc (Health Care Facilities | Brentwood, Tennessee, United States | Rating: NR): US$125m Equity Unit (US1124633025), fixed rate (7.00% coupon) maturing on 15 November 2025, priced at 100.00, non callable, convertible

- Carnival Corp (Leisure | Miami, Florida, United States | Rating: B): US$1,000m Bond (US143658BU55), fixed rate (5.75% coupon) maturing on 1 December 2027, priced at 100.00, non callable, convertible

- Caterpillar Financial Services Corp (Leasing | Nashville, Tennessee, United States | Rating: A): US$750m Senior Note (US14913R2Y27), fixed rate (4.90% coupon) maturing on 17 January 2025, priced at 99.94 (original spread of 53 bp), with a make whole call

- Dominion Energy Inc (Utility - Other | Richmond, United States | Rating: BBB): US$850m Senior Note (US25746UDR77), fixed rate (5.38% coupon) maturing on 15 November 2032, priced at 99.49 (original spread of 179 bp), callable (10nc10)

- Envestnet Inc (Information/Data Technology | Berwyn, Pennsylvania, United States | Rating: NR): US$575m Bond (US29404KAF30), fixed rate (2.63% coupon) maturing on 1 December 2027, priced at 100.00, non callable, convertible

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EN2N99), fixed rate (5.73% coupon) maturing on 17 November 2027, priced at 100.00 (original spread of 183 bp), callable (5nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$1,700m Bond (US3133ENZ946), fixed rate (4.50% coupon) maturing on 18 November 2024, priced at 99.89 (original spread of 10 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$253m Bond (US3133EN2Z20), floating rate (SOFR + 35.0 bp) maturing on 25 November 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$1,100m Bond (US3133EN2V16), floating rate (SOFR + 19.0 bp) maturing on 25 November 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EN2Q21), fixed rate (4.38% coupon) maturing on 21 November 2029, priced at 99.74 (original spread of 37 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$2,500m Bond (US3130ATXF99), floating rate (SOFR + 19.0 bp) maturing on 22 November 2024, priced at 100.00, non callable

- General Mills Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: BBB): US$500m Senior Note (US370334CS18), fixed rate (5.24% coupon) maturing on 18 November 2025, priced at 100.00 (original spread of 110 bp), callable (3nc1)

- Huntington National Bank (Banking | Columbus, Ohio, United States | Rating: A-): US$900m Senior Bank Note (US44644MAJ09), fixed rate (5.65% coupon) maturing on 10 January 2030, priced at 99.77 (original spread of 190 bp), callable (7nc7)

- Huntington National Bank (Banking | Columbus, Ohio, United States | Rating: A-): US$1,100m Senior Bank Note (US44644MAH43), floating rate maturing on 18 November 2025, priced at 100.00 (original spread of 104 bp), callable (3nc2)

- National Securities Clearing Corp (Financial - Other | New York City, New York, United States | Rating: AA+): US$600m Senior Note (US637639AH82), fixed rate (5.10% coupon) maturing on 21 November 2027, priced at 99.97 (original spread of 110 bp), callable (5nc5)

- National Securities Clearing Corp (Financial - Other | New York City, New York, United States | Rating: AA+): US$400m Senior Note (USU7000RAE28), fixed rate (5.05% coupon) maturing on 21 November 2024, priced at 99.98 (original spread of 67 bp), with a make whole call

- ONEOK Inc (Gas Utility - Local Distrib | Tulsa, Oklahoma, United States | Rating: BBB-): US$750m Senior Note (US682680BG78), fixed rate (6.10% coupon) maturing on 15 November 2032, priced at 99.92 (original spread of 230 bp), callable (10nc10)

- Penske Truck Leasing Co LP (Leasing | Reading, Pennsylvania, United States | Rating: BBB): US$500m Senior Note (US709599BR43), fixed rate (5.88% coupon) maturing on 15 November 2027, priced at 99.70 (original spread of 195 bp), callable (5nc5)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,250m Senior Note (US718172CW74), fixed rate (5.63% coupon) maturing on 17 November 2029, priced at 99.91 (original spread of 180 bp), callable (7nc7)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,500m Senior Note (US718172CX57), fixed rate (5.75% coupon) maturing on 17 November 2032, priced at 99.91 (original spread of 200 bp), callable (10nc10)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,500m Senior Note (US718172CV91), fixed rate (5.13% coupon) maturing on 17 November 2027, priced at 99.51 (original spread of 135 bp), callable (5nc5)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,000m Senior Note (US718172CT46), fixed rate (5.13% coupon) maturing on 15 November 2024, priced at 99.88 (original spread of 85 bp), with a make whole call

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$750m Senior Note (US718172CU19), fixed rate (5.00% coupon) maturing on 17 November 2025, priced at 99.76 (original spread of 95 bp), with a make whole call

- SBA Tower Trust (Telecommunications | Jersey City, New Jersey, United States | Rating: NR): US$850m Note (US78403DAZ33), fixed rate (6.60% coupon) maturing on 15 November 2052, non callable

- Sabine Pass Liquefaction LLC (Oil and Gas | Houston, Texas, United States | Rating: BBB): US$430m Note (USU77888AN27), fixed rate (5.90% coupon) maturing on 15 September 2037, priced at 99.86 (original spread of 205 bp), callable (15nc14)

- TTX Co (Railroads | Chicago, United States | Rating: A): US$300m Senior Note (US87302TCP12), fixed rate (5.65% coupon) maturing on 1 December 2052, priced at 99.73 (original spread of 175 bp), callable (30nc30)

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: A+): US$300m Senior Note (US882508BR48), fixed rate (4.70% coupon) maturing on 18 November 2024, priced at 99.96 (original spread of 35 bp), with a make whole call

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: A+): US$500m Senior Note (US882508BV59), fixed rate (4.60% coupon) maturing on 15 February 2028, priced at 99.83 (original spread of 73 bp), callable (5nc5)

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): US$600m Senior Note (US883556CT77), fixed rate (4.80% coupon) maturing on 21 November 2027, priced at 99.96 (original spread of 80 bp), callable (5nc5)

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): US$600m Senior Note (US883556CU41), fixed rate (4.95% coupon) maturing on 21 November 2032, priced at 99.80 (original spread of 110 bp), callable (10nc10)

- United Rentals (North America) Inc (Service - Other | Stamford, Connecticut, United States | Rating: BBB-): US$1,500m Note (US911365BQ63), fixed rate (6.00% coupon) maturing on 15 December 2029, priced at 100.00 (original spread of 215 bp), callable (7nc3)

- Wolfspeed Inc (Electronics | Durham, North Carolina, United States | Rating: NR): US$1,525m Bond (US977852AC61), fixed rate (1.88% coupon) maturing on 1 December 2029, priced at 100.00, non callable, convertible

- indie Semiconductor Inc (Electronics | Aliso Viejo, United States | Rating: NR): US$140m Bond (US45569UAA97), fixed rate (4.50% coupon) maturing on 15 November 2027, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- BSF Finance (Financial - Other | George Town, Saudi Arabia | Rating: NR): US$700m Senior Note (XS2493296813), fixed rate (5.50% coupon) maturing on 23 November 2027, priced at 99.67 (original spread of 170 bp), non callable

- Bank of China Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: A): US$500m Senior Note (XS2557551293), floating rate (SOFR + 95.0 bp) maturing on 25 November 2025, priced at 100.00, non callable

- Bank of China Ltd (Paris Branch) (Banking | Paris, Ile-De-France, China (Mainland) | Rating: A): US$400m Senior Note (XS2555170740), fixed rate (4.75% coupon) maturing on 23 November 2025, priced at 99.94, non callable

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$250m Unsecured Note (XS2559584888), fixed rate (5.13% coupon) maturing on 1 December 2025, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$400m Unsecured Note (XS2443125948), floating rate maturing on 28 November 2024, priced at 99.75, non callable

- CICC Hong Kong Finance 2016 MTN Ltd (Financial - Other | Road Town, China (Mainland) | Rating: BBB+): US$650m Senior Note (XS2539361001), fixed rate (5.42% coupon) maturing on 22 November 2025, priced at 100.00 (original spread of 122 bp), non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Distrito Capital, Venezuela | Rating: A+): US$800m Senior Note (US21989TAA51), fixed rate (5.25% coupon) maturing on 21 November 2025, priced at 99.83 (original spread of 111 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A32067), fixed rate (4.10% coupon) maturing on 12 December 2024, priced at 97.95, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A31PK7), fixed rate (4.54% coupon) maturing on 12 December 2024, priced at 98.60, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): US$750m Note (US46115HBU05), fixed rate (7.00% coupon) maturing on 21 November 2025, priced at 99.80 (original spread of 285 bp), with a regulatory call

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB-): US$1,250m Note (US46115HBV87), fixed rate (8.25% coupon) maturing on 21 November 2033, priced at 100.00 (original spread of 439 bp), callable (11nc10)

- Mashreqbank PSC (Banking | Dubai, Dubai, United Arab Emirates | Rating: A-): US$500m Capital Security (XS2548003503), fixed rate (7.88% coupon) maturing on 24 February 2033, priced at 99.70 (original spread of 400 bp), callable (10nc5)

- Nanjing YangZi State-owned Investment Group Co Ltd (Financial - Other | Nanjing, Jiangsu, China (Mainland) | Rating: A-): US$300m Bond (XS2551147353), fixed rate (5.95% coupon) maturing on 17 November 2025, priced at 100.00, non callable

- National Australia Bank Ltd (Banking | Melbourne, Australia | Rating: A+): US$1,650m Covered Bond (Other) (US6325C1DE63), fixed rate (4.63% coupon) maturing on 22 November 2027, priced at 100.00 (original spread of 80 bp), non callable

- National Australia Bank Ltd (New York Branch) (Banking | New York City, Australia | Rating: NR): US$1,350m Senior Note (US63254ABG22), fixed rate (5.13% coupon) maturing on 22 November 2024, priced at 100.00 (original spread of 80 bp), non callable

- Open Text Corp (Information/Data Technology | Waterloo, Ontario, Canada | Rating: BB+): US$1,000m Note (USC6981BAD40), fixed rate (6.90% coupon) maturing on 1 December 2027, priced at 100.00 (original spread of 305 bp), callable (5nc5)

- Panama, Republic of (Government) (Sovereign | Panama | Rating: BBB-): US$1,500m Bond (US698299BT07), fixed rate (6.40% coupon) maturing on 14 February 2035, priced at 98.95 (original spread of 265 bp), callable (12nc12)

- Santander UK Group Holdings PLC (Banking | London, Spain | Rating: BBB): US$1,500m Senior Note (US80281LAS43), floating rate maturing on 21 November 2026, priced at 100.00, callable (4nc3)

- TFI Overseas Investment Ltd (Financial - Other | Hong Kong | Rating: NR): US$550m Unsecured Note (XS2559193425) maturing on 29 May 2025, priced at 100.00, non callable

- TransAlta Corp (Utility - Other | Calgary, Alberta, Canada | Rating: BB+): US$400m Senior Note (US89346DAH08), fixed rate (7.75% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 391 bp), callable (7nc3)

- UBS Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$286m Certificate of Deposit - Retail (US90348J7C88), fixed rate (4.90% coupon) maturing on 18 November 2024, priced at 100.00 (original spread of 40 bp), non callable

- UBS Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$290m Certificate of Deposit - Retail (US90348J7D61), fixed rate (4.95% coupon) maturing on 17 November 2025, priced at 100.00 (original spread of 66 bp), non callable

RECENT EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB-): €1,000m Subordinated Note (XS2558022591), fixed rate (5.13% coupon) maturing on 22 February 2033, priced at 99.76 (original spread of 317 bp), callable (10nc5)

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €1,000m Note (XS2557084733), fixed rate (4.50% coupon) maturing on 21 November 2034, priced at 99.43 (original spread of 242 bp), non callable

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €1,250m Senior Note (XS2536941656), fixed rate (4.25% coupon) maturing on 21 February 2030, priced at 99.96 (original spread of 221 bp), non callable

- ASR Nederland NV (Property and Casualty Insurance | Utrecht, Utrecht, Netherlands | Rating: BBB-): €1,000m Subordinated Note (XS2554581830), fixed rate (7.00% coupon) maturing on 7 December 2043, priced at 99.23 (original spread of 502 bp), callable (21nc11)

- Adidas AG (Leisure | Herzogenaurach, Bayern, Germany | Rating: A): €500m Senior Note (XS2555178644), fixed rate (3.00% coupon) maturing on 21 November 2025, priced at 99.90 (original spread of 100 bp), callable (3nc3)

- Adidas AG (Leisure | Herzogenaurach, Bayern, Germany | Rating: A): €500m Senior Note (XS2555179378), fixed rate (3.13% coupon) maturing on 21 November 2029, priced at 99.27 (original spread of 119 bp), callable (7nc7)

- Arval Service Lease SA (Financial - Other | Paris, Ile-De-France, France | Rating: A-): €500m Bond (FR001400E3H8), fixed rate (4.75% coupon) maturing on 22 May 2027, priced at 99.87 (original spread of 272 bp), callable (4nc4)

- Banca Mediolanum SpA (Banking | Basiglio, Milano, Italy | Rating: BBB): €300m Note (XS2545425980), floating rate maturing on 22 January 2027, priced at 99.99, non callable

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB): €500m Note (XS2558591967), floating rate maturing on 21 January 2028, priced at 99.62 (original spread of 382 bp), callable (5nc4)

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: A): €200m Inhaberschuldverschreibung (DE000BLB9SQ0), fixed rate (3.39% coupon) maturing on 21 December 2029, priced at 100.00 (original spread of 91 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000BLB9SP2), floating rate (EU06MLIB + 95.0 bp) maturing on 22 November 2027, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,500m Bond (FR001400E797), fixed rate (1.71% coupon) maturing on 18 November 2032, non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB-): €750m Senior Note (XS2558978883), fixed rate (6.25% coupon) maturing on 23 February 2033, priced at 99.86 (original spread of 427 bp), callable (10nc5)

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400E1P5), fixed rate (2.88% coupon) maturing on 23 June 2028, priced at 99.81 (original spread of 95 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U9D8), floating rate maturing on 12 December 2029, priced at 100.00, with a special call

- EnBW International Finance BV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: A-): €500m Senior Note (XS2558395351), fixed rate (3.63% coupon) maturing on 22 November 2026, priced at 99.68 (original spread of 164 bp), callable (4nc4)

- EnBW International Finance BV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: A-): €500m Senior Note (XS2558395278), fixed rate (4.05% coupon) maturing on 22 November 2029, priced at 100.00 (original spread of 200 bp), callable (7nc7)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A31PL5), fixed rate (3.00% coupon) maturing on 6 December 2024, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A320J5), fixed rate (3.65% coupon) maturing on 30 December 2025, priced at 100.00, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €6,000m Senior Note (EU000A3K4DW8), fixed rate (2.75% coupon) maturing on 4 February 2033, priced at 99.38 (original spread of 72 bp), non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €2,500m Senior Note (EU000A3K4DY4), fixed rate (3.00% coupon) maturing on 4 March 2053, priced at 98.71 (original spread of 102 bp), non callable

- Greenvolt Energias Renovaveis SA (Utility - Other | Porto, Portugal | Rating: NR): €150m Bond (PTGNVGOM0004), fixed rate (5.20% coupon) maturing on 18 November 2027, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: BBB): €1,250m Subordinated Note (XS2553547444), fixed rate (6.36% coupon) maturing on 16 November 2032, priced at 100.00 (original spread of 416 bp), callable (10nc5)

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: BBB): €500m Inhaberschuldverschreibung (DE000HCB0BQ0), fixed rate (6.25% coupon) maturing on 18 November 2024, priced at 99.89 (original spread of 418 bp), with a regulatory call

- Hungary (Government) (Sovereign | Budapest, Budapest, Hungary | Rating: BBB): €1,000m Senior Note (XS2558594391), fixed rate (5.00% coupon) maturing on 22 February 2027, priced at 98.77 (original spread of 323 bp), non callable

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A-): €1,750m Covered Bond (Other) (XS2557551889), fixed rate (2.75% coupon) maturing on 21 November 2025, priced at 99.75 (original spread of 86 bp), non callable

- Iberdrola Finanzas SA (Financial - Other | Bilbao, Vizcaya, Spain | Rating: BBB+): €750m Senior Note (XS2558916693), fixed rate (3.13% coupon) maturing on 22 November 2028, priced at 99.86 (original spread of 112 bp), callable (6nc6)

- Iberdrola Finanzas SA (Financial - Other | Bilbao, Vizcaya, Spain | Rating: BBB+): €750m Senior Note (XS2558966953), fixed rate (3.38% coupon) maturing on 22 November 2032, priced at 99.52 (original spread of 137 bp), callable (10nc10)

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): €1,000m Bond (IT0005519571), floating rate (EU03MLIB + 134.0 bp) maturing on 22 December 2027, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): €200m Unsecured Note (XS2560106747), fixed rate (3.88% coupon) maturing on 25 November 2025, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB): €200m Unsecured Note (XS2560106580), fixed rate (4.25% coupon) maturing on 25 November 2027, priced at 100.00, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €11,995m Index Linked Security (IT0005517195), fixed rate (1.60% coupon) maturing on 22 November 2028, priced at 100.00, non callable, inflation protected

- Kbc Groep NV (Banking | Brussels, Belgium | Rating: BBB+): €1,000m Bond (BE0002900810), floating rate maturing on 23 November 2027, priced at 99.77 (original spread of 239 bp), callable (5nc4)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XP6), fixed rate (2.70% coupon) maturing on 21 December 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XM3), fixed rate (2.40% coupon) maturing on 19 December 2024, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XW2), fixed rate (2.15% coupon) maturing on 19 December 2024, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XQ4), fixed rate (2.80% coupon) maturing on 20 December 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XX0), fixed rate (2.25% coupon) maturing on 19 December 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XN1), fixed rate (2.60% coupon) maturing on 19 December 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XR2), fixed rate (2.95% coupon) maturing on 19 December 2029, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB35XY8), fixed rate (2.30% coupon) maturing on 21 December 2026, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB7A56), fixed rate (2.65% coupon) maturing on 23 June 2026, priced at 100.00, callable (4nc2)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7A23), fixed rate (2.10% coupon) maturing on 23 December 2024, priced at 100.00, non callable

- Mercedes-Benz Finance Canada Inc (Financial - Other | Montreal, Germany | Rating: NR): €750m Senior Note (DE000A3LBMY2), fixed rate (3.00% coupon) maturing on 23 February 2027, priced at 99.76 (original spread of 113 bp), non callable

- National Bank of Greece SA (Banking | Athina, Greece | Rating: B+): €150m Unsecured Note (XS2560090214), fixed rate (6.00% coupon) maturing on 25 May 2025, priced at 100.00, non callable

- National Bank of Greece SA (Banking | Athina, Attiki, Greece | Rating: B+): €500m Note (XS2558592932), fixed rate (7.25% coupon) maturing on 22 November 2027, priced at 99.16 (original spread of 544 bp), callable (5nc4)

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000NLB33A4), floating rate (EU06MLIB + 90.0 bp) maturing on 14 February 2025, priced at 100.00, non callable

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000NLB33B2), floating rate (EU06MLIB + 58.0 bp) maturing on 25 November 2026, priced at 100.00, non callable

- OP Asuntoluottopankki Oyj (Mortgage Banking | Helsinki, Etela-Suomen, Finland | Rating: NR): €125,000m Covered Bond (Other) (XS2558247677), fixed rate (2.75% coupon) maturing on 22 June 2026, priced at 99.68 (original spread of 87 bp), non callable

- Oldenburgische Landesbank AG (Banking | Niedersachsen, Germany | Rating: AA+): €150m Hypothekenpfandbrief (Covered Bond) (DE000A11QJQ5), fixed rate (3.36% coupon) maturing on 17 November 2032, priced at 100.00, non callable

- Paccar Financial Europe BV (Financial - Other | Eindhoven, Noord-Brabant, United States | Rating: A+): €500m Senior Note (XS2559453431), fixed rate (3.25% coupon) maturing on 29 November 2025, priced at 99.71 (original spread of 133 bp), non callable

- Piraeus Bank SA (Financial - Other | Athina, Attiki, Greece | Rating: B): €350m Note (XS2559486019), fixed rate (8.25% coupon) maturing on 28 January 2027, priced at 99.38 (original spread of 648 bp), callable (4nc3)

- Raiffeisen Bank Zrt (Banking | Budapest, Budapest, Austria | Rating: BBB-): €300m Note (XS2559379529), floating rate maturing on 22 November 2025, priced at 100.00 (original spread of 614 bp), callable (3nc2)

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): €1,000m Note (XS2558953621), fixed rate (3.25% coupon) maturing on 24 November 2025, priced at 99.73 (original spread of 132 bp), with a regulatory call

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): €1,000m Note (XS2559401802), fixed rate (2.75% coupon) maturing on 23 February 2028, priced at 99.58 (original spread of 94 bp), non callable

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): €750m Senior Note (XS2557526345), fixed rate (3.65% coupon) maturing on 21 November 2034, priced at 99.64 (original spread of 155 bp), callable (12nc12)

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): €500m Senior Note (XS2557526006), fixed rate (3.20% coupon) maturing on 21 January 2026, priced at 99.97 (original spread of 117 bp), callable (3nc3)

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €600m Senior Note (DE000A3LBGG1), fixed rate (4.13% coupon) maturing on 22 November 2025, priced at 99.78 (original spread of 217 bp), callable (3nc3)

- UniCredit Bank SA (Banking | Bucuresti, Bucuresti, Italy | Rating: BBB): €250m Bond (XS2558591884), floating rate maturing on 31 December 2200, priced at 100.00, non callable

- Vonovia SE (Service - Other | Bochum, Nordrhein-Westfalen, Germany | Rating: BBB+): €750m Senior Note (DE000A30VQA4), fixed rate (4.75% coupon) maturing on 23 May 2027, priced at 99.85 (original spread of 276 bp), callable (4nc4)

- Vonovia SE (Service - Other | Bochum, Nordrhein-Westfalen, Germany | Rating: BBB+): €750m Senior Note (DE000A30VQB2), fixed rate (5.00% coupon) maturing on 23 November 2030, priced at 99.65 (original spread of 303 bp), callable (8nc8)

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): €750m Covered Bond (Other) (XS2558574104), fixed rate (3.11% coupon) maturing on 23 November 2027, priced at 100.00 (original spread of 113 bp), non callable

RECENT LOANS

- 3M Co (United States of America | A+), signed a US$ 1,250m 364d Revolver, to be used for general corporate purposes. It matures on 11/09/23 and initial pricing is set at Term SOFR +75.0bp

- AssuredPartners Inc (United States of America | CCC+), signed a US$ 500m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 02/13/27 and initial pricing is set at Term SOFR +425.0bp

- Caldic BV (Netherlands), signed a € 200m Term Loan B, to be used for acquisition financing. It matures on 02/10/29 and initial pricing is set at EURIBOR +350.0bp

- Continental Resources Inc (United States of America | BBB-), signed a US$ 750m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 11/10/25 and initial pricing is set at Term SOFR +100.0bp

- DXP Enterprises Inc (United States of America | B), signed a US$ 330m Term Loan B, to be used for general corporate purposes. It matures on 12/23/27 and initial pricing is set at Term SOFR +525.0bp

- DXP Enterprises Inc (United States of America | B), signed a US$ 105m Term Loan B, to be used for general corporate purposes. It matures on 12/23/27 and initial pricing is set at Term SOFR +525.0bp

- EQT Corp (United States of America | BBB-), signed a US$ 1,250m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 11/09/24 and initial pricing is set at Term SOFR +100.0bp

- Formula One World (United Kingdom), signed a US$ 1,700m Term Loan B, to be used for general corporate purposes. It matures on 01/15/30 and initial pricing is set at Term SOFR +325.0bp

- Four Seasons Holdings Inc (Canada | BB+), signed a US$ 850m Term Loan B, to be used for general corporate purposes. It matures on 11/17/29 and initial pricing is set at Term SOFR +325.0bp

- Industrial Bank Of Korea (South Korea | AA-), signed a US$ 300m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 11/10/27 and initial pricing is set at Term SOFR +100.0bp

- Kroger Co (United States of America | BBB), signed a US$ 2,750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/06/26 and initial pricing is set at Term SOFR +87.5bp

- Kroger Co (United States of America | BBB), signed a US$ 1,750m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 05/09/24 and initial pricing is set at Term SOFR +87.5bp

- Kroger Co (United States of America | BBB), signed a US$ 3,000m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 11/09/25 and initial pricing is set at Term SOFR +87.5bp

- Mastercard Inc (United States of America | A+), signed a US$ 8,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/10/27 and initial pricing is set at Term SOFR +75.0bp

- Natixis Funds Trust Ii (United States of America), signed a US$ 400m 364d Revolver, to be used for general corporate purposes. It matures on 11/09/23 and initial pricing is set at Term SOFR +120.0bp

- Oncor Electric Delivery Co LLC (United States of America | A), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 11/09/27 and initial pricing is set at Term SOFR +87.5bp

- Petron Corp (Philippines), signed a US$ 550m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 11/14/27 and initial pricing is set at Term SOFR +210.0bp

RECENT STRUCTURED CREDIT

- Bank 2022-Bnk44 issued a floating-rate CMBS in 7 tranches, for a total of US$ 866 m. Highest-rated tranche offering a spread over the floating rate of 145bp, and the lowest-rated tranche a spread of 500bp. Bookrunners: Morgan Stanley International Ltd, Wells Fargo Securities LLC, Bank of America Merrill Lynch

- Henley Clo Ix Designated Activity Co issued a floating-rate CLO in 6 tranches, for a total of € 264 m. Highest-rated tranche offering a spread over the floating rate of 195bp, and the lowest-rated tranche a spread of 945bp. Bookrunners: JP Morgan & Co Inc

- Palmer Square European CLO 2022-2 Designated Activity Co issued a floating-rate CLO in 6 tranches, for a total of € 351 m. Highest-rated tranche offering a spread over the floating rate of 220bp, and the lowest-rated tranche a spread of 626bp. Bookrunners: Barclays Capital Group