Credit

After November's Huge Rebound, US Credit Is Looking Much Less Attractive Into The December FOMC

US corporate bond issuance is slowing but still decent in IG (IFR Markets data): 27 tranches for $22.15bn in IG (2022 YTD volume $1.204tn vs 2021 YTD $1.447tn, down 16.8% YoY) and no new print in HY (2022 YTD volume $97.701bn vs 2021 YTD $452.631bn, down 78.4% YoY)

Published ET

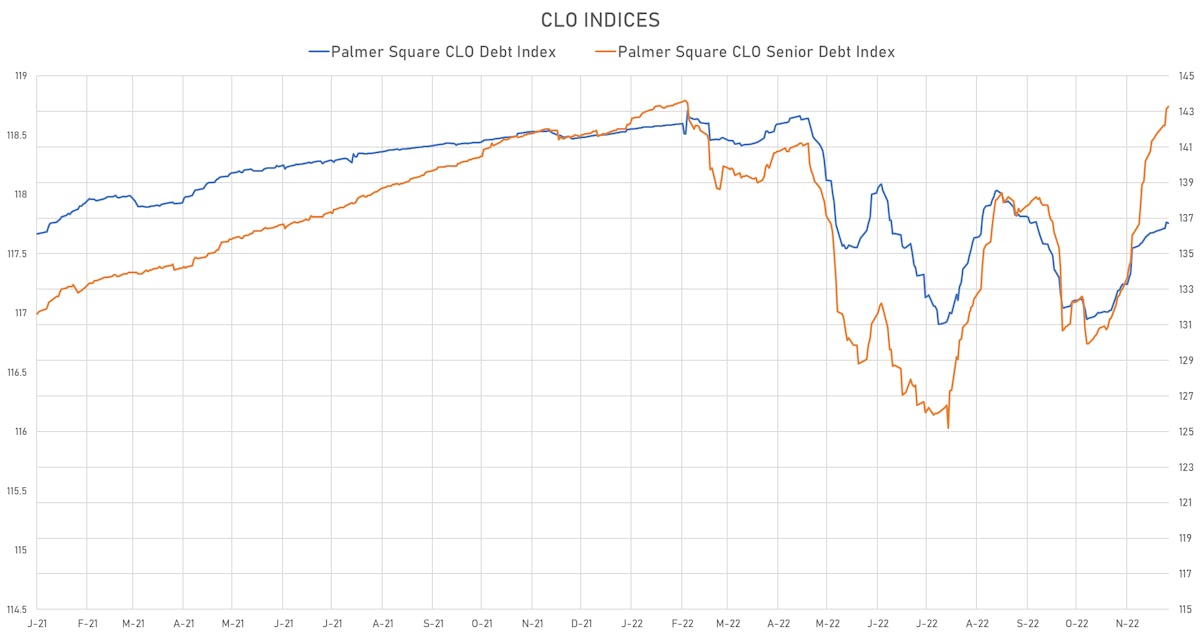

Palmer Square CLO Indices | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.35% today, with investment grade up 0.38% and high yield up 0.01% (YTD total return: -12.94%)

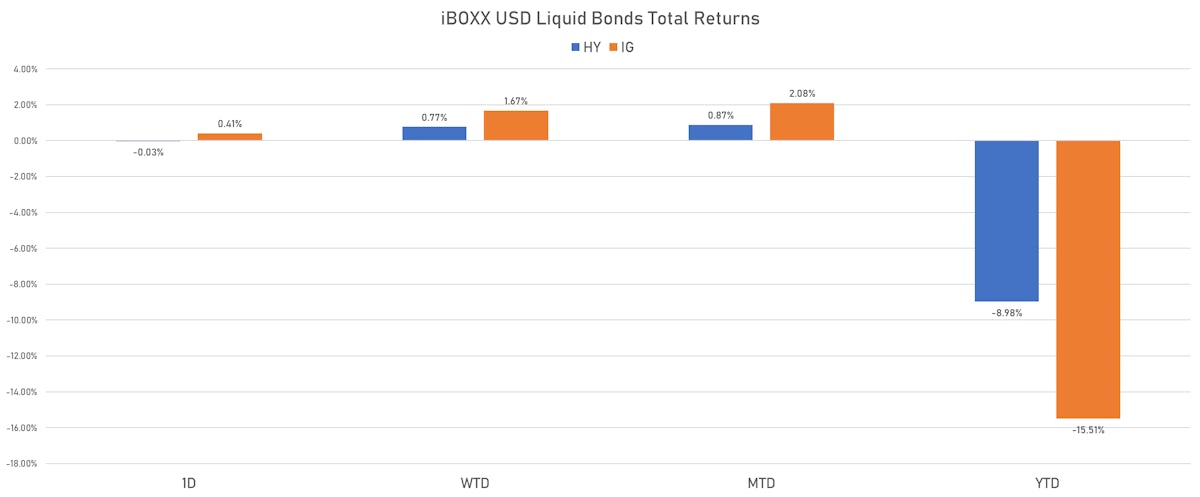

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.413% today (Week-to-date: 1.67%; Month-to-date: 2.08%; Year-to-date: -15.51%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.031% today (Week-to-date: 0.77%; Month-to-date: 0.87%; Year-to-date: -8.98%)

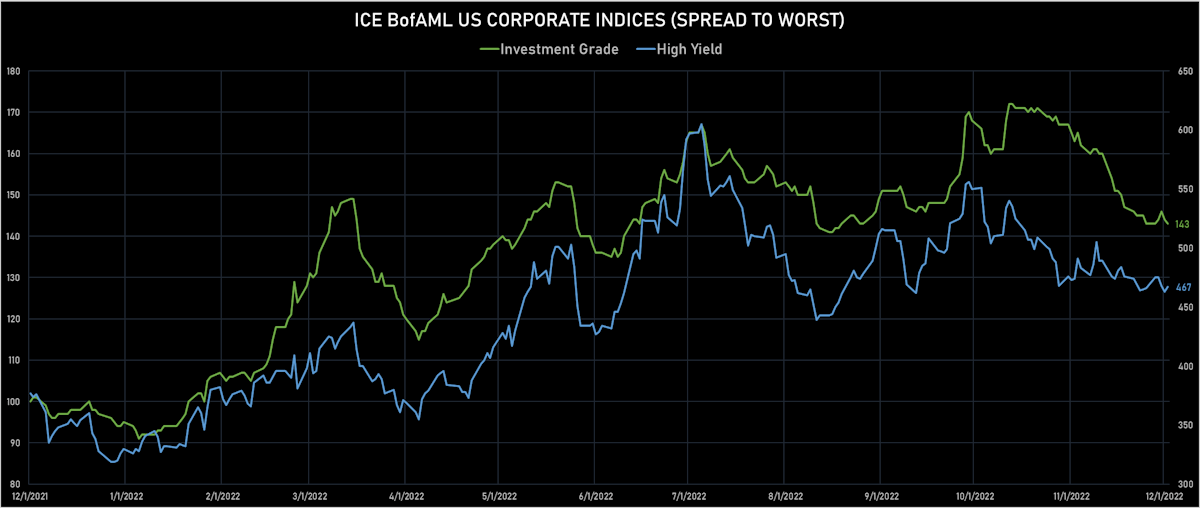

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 143.0 bp (YTD change: +48.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 467.0 bp (YTD change: +137.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.10% today (YTD total return: -0.9%)

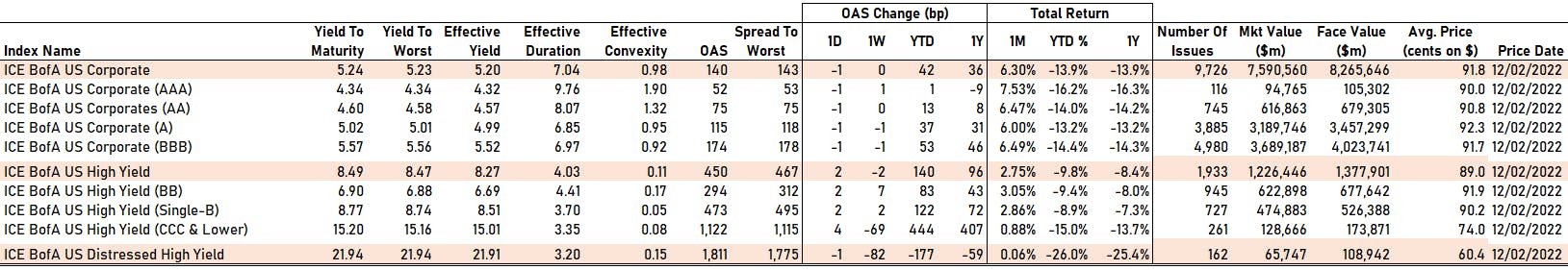

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 52 bp

- AA down by -1 bp at 75 bp

- A down by -1 bp at 115 bp

- BBB down by -1 bp at 174 bp

- BB up by 2 bp at 294 bp

- B up by 2 bp at 473 bp

- ≤ CCC up by 4 bp at 1,122 bp

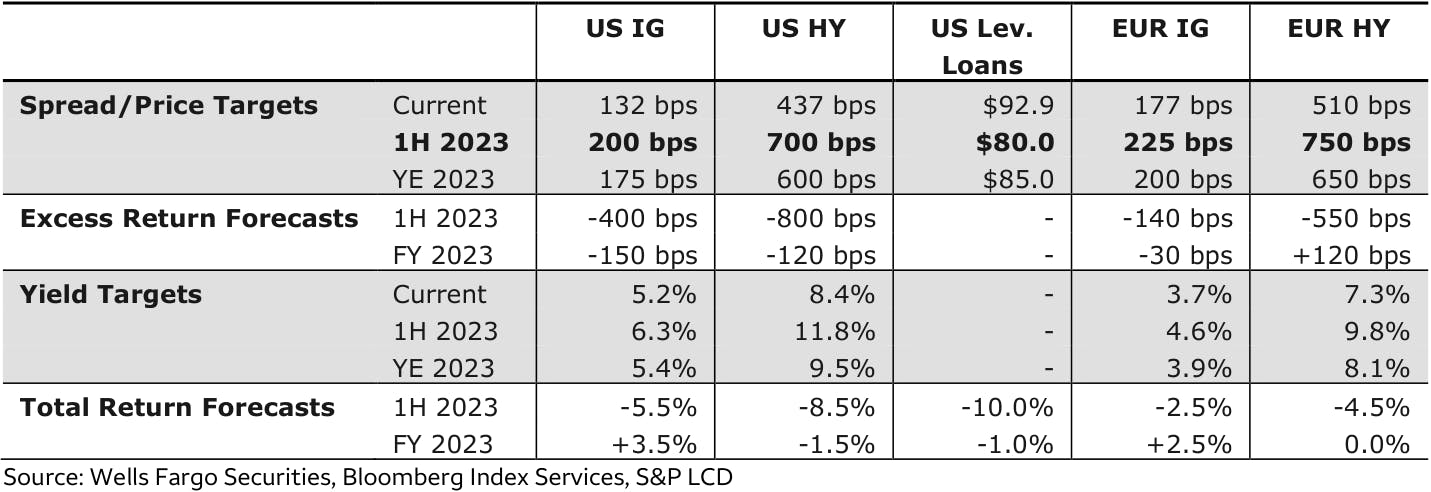

2023 Spread, Yield and Return Forecasts (Source: Wells Fargo Securities)

CDS INDICES TODAY (mid-spreads)

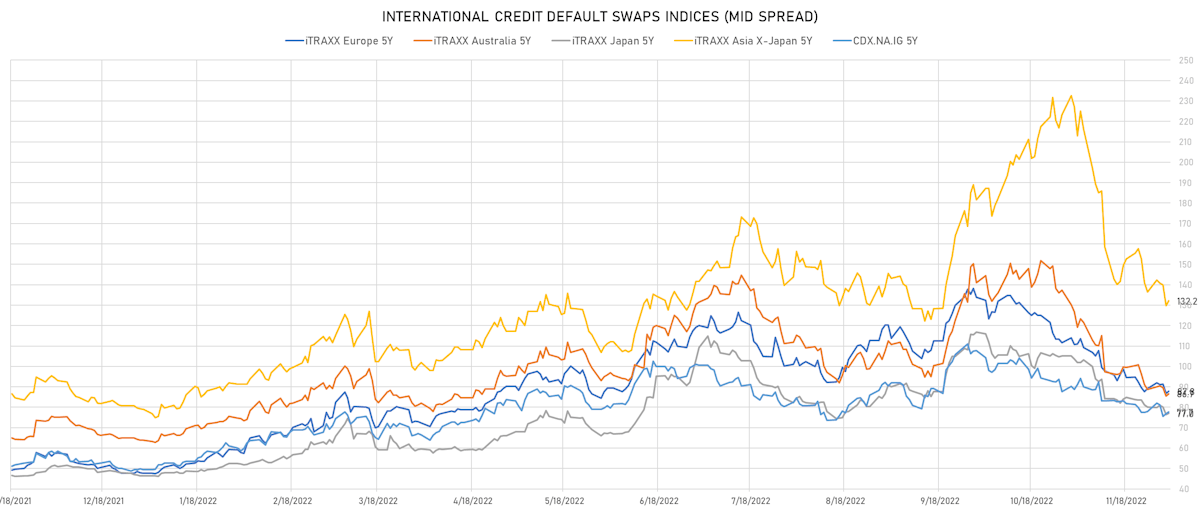

- Markit CDX.NA.IG 5Y up 0.8 bp, now at 78bp (1W change: -0.3bp; YTD change: +28.4bp)

- Markit CDX.NA.IG 10Y up 0.7 bp, now at 114bp (1W change: +0.4bp; YTD change: +25.4bp)

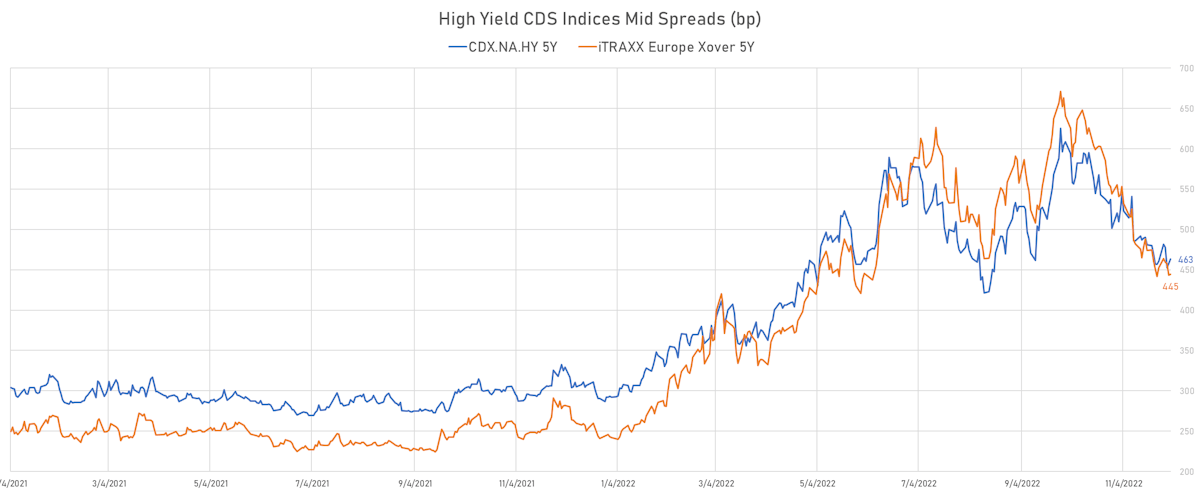

- Markit CDX.NA.HY 5Y up 5.3 bp, now at 463bp (1W change: +2.9bp; YTD change: +171.4bp)

- Markit iTRAXX Europe 5Y up 1.1 bp, now at 88bp (1W change: -1.5bp; YTD change: +40.1bp)

- Markit iTRAXX Europe Crossover 5Y up 1.0 bp, now at 445bp (1W change: -8.1bp; YTD change: +202.4bp)

- Markit iTRAXX Japan 5Y up 0.5 bp, now at 77bp (1W change: -3.0bp; YTD change: +30.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 2.5 bp, now at 132bp (1W change: -4.3bp; YTD change: +53.2bp)

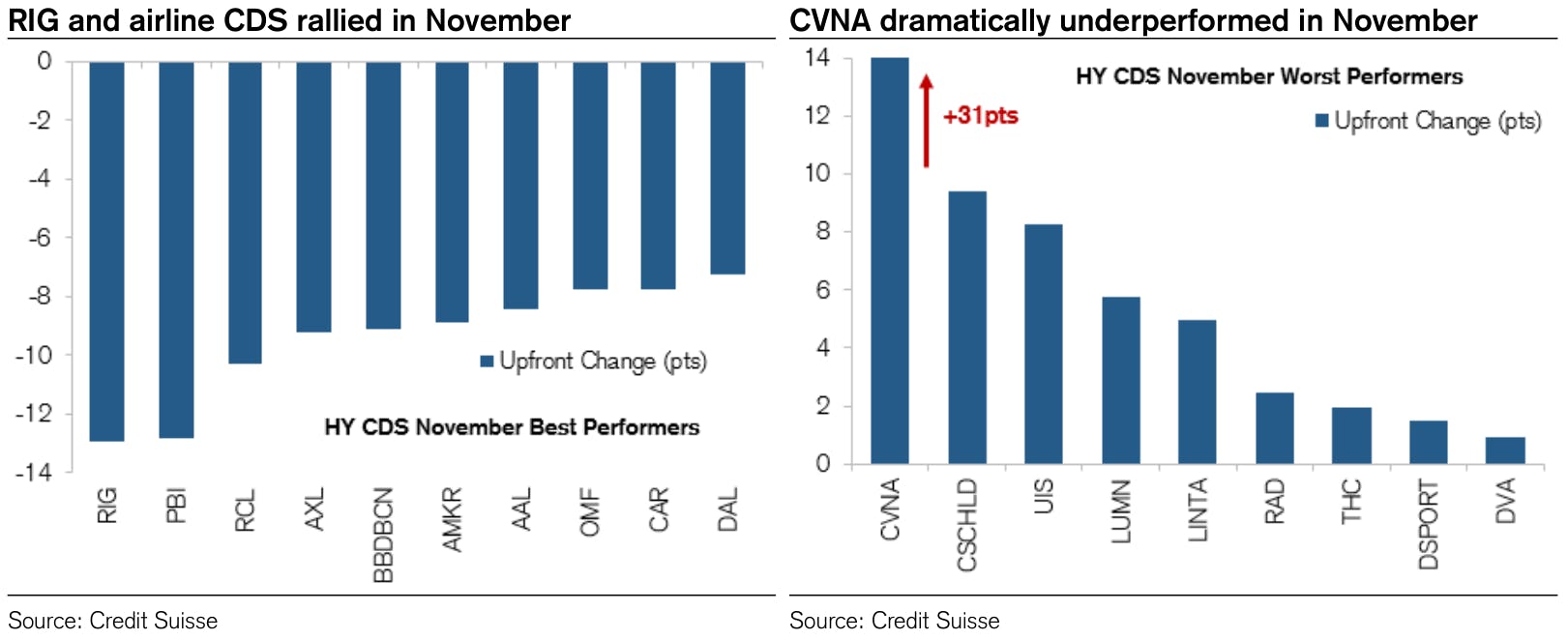

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Rite Aid Corp (Country: US; rated: D): down 1591.0 bp to 12,008.7bp (1Y range: 885-12,009bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 451.4 bp to 1,526.4bp (1Y range: 355-2,117bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 254.0 bp to 1,267.0bp (1Y range: 430-1,783bp)

- American Airlines Group Inc (Country: US; rated: B2): down 190.1 bp to 1,145.7bp (1Y range: 607-1,644bp)

- Gap Inc (Country: US; rated: Ba2): down 143.7 bp to 523.7bp (1Y range: 152-819bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 136.6 bp to 635.5bp (1Y range: 278-899bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): down 117.2 bp to 378.8bp (1Y range: 124-401bp)

- Nordstrom Inc (Country: US; rated: A3): down 97.9 bp to 523.1bp (1Y range: 212-641bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 95.8 bp to 724.0bp (1Y range: 319-1,584bp)

- Petroleos Mexicanos (Country: MX; rated: caa3): down 95.2 bp to 578.0bp (1Y range: 302-768bp)

- Staples Inc (Country: US; rated: B3): down 89.7 bp to 1,955.7bp (1Y range: 985-1,986bp)

- Macy's Inc (Country: US; rated: A1): down 88.7 bp to 376.8bp (1Y range: 181-619bp)

- Kohls Corp (Country: US; rated: NR): down 82.7 bp to 534.4bp (1Y range: 112-686bp)

- Liberty Interactive LLC (Country: US; rated: BB-): up 298.6 bp to 1,801.3bp (1Y range: 405-1,801bp)

- Unisys Corp (Country: US; rated: B1): up 413.4 bp to 1,065.8bp (1Y range: 222-1,096bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: Caa1): down 2379.4 bp to 3,702.1bp (1Y range: 595-4,917bp)

- Novafives SAS (Country: FR; rated: Caa1): down 639.3 bp to 1,373.3bp (1Y range: 618-2,936bp)

- TUI AG (Country: DE; rated: B3-PD): down 234.5 bp to 1,149.8bp (1Y range: 612-1,725bp)

- Ceconomy AG (Country: DE; rated: A3): down 180.5 bp to 1,048.4bp (1Y range: 185-1,763bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 156.0 bp to 1,277.8bp (1Y range: 566-1,739bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 97.3 bp to 868.8bp (1Y range: 394-1,021bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 91.9 bp to 916.7bp (1Y range: 266-1,254bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 79.5 bp to 1,934.0bp (1Y range: 1,286-2,910bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 79.1 bp to 428.8bp (1Y range: 296-648bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 75.7 bp to 318.6bp (1Y range: 186-505bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 65.6 bp to 356.6bp (1Y range: 152-600bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): down 57.7 bp to 278.6bp (1Y range: 125-420bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 55.9 bp to 347.0bp (1Y range: 225-606bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 52.3 bp to 963.9bp (1Y range: 359-1,296bp)

- Alstom SA (Country: FR; rated: P-2): down 51.1 bp to 194.9bp (1Y range: 68-313bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 6.95% | Maturity: 1/7/2024 | Rating: BB+ | CUSIP: 674599DB8 | OAS up by 67.0 bp to 100.6 bp (CDS basis: -21.9bp), with the yield to worst at 5.1% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 101.1-110.9).

- Issuer: Xerox Corp (Norwalk, Connecticut (US)) | Coupon: 3.80% | Maturity: 15/5/2024 | Rating: BB | CUSIP: 984121CJ0 | OAS up by 59.6 bp to 217.0 bp (CDS basis: -25.5bp), with the yield to worst at 6.9% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 94.5-103.6).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.55% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 674599DC6 | OAS up by 56.7 bp to 123.9 bp (CDS basis: -33.8bp), with the yield to worst at 5.1% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 98.6-111.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.06% | Maturity: 1/11/2024 | Rating: BB | CUSIP: 345397ZX4 | OAS up by 48.4 bp to 145.4 bp (CDS basis: 54.4bp), with the yield to worst at 5.9% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 93.3-105.3).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | CUSIP: 65342QAL6 | OAS up by 47.5 bp to 203.8 bp, with the yield to worst at 5.7% and the bond now trading down to 92.9 cents on the dollar (1Y price range: 89.6-106.0).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS up by 45.8 bp to 153.1 bp (CDS basis: -12.5bp), with the yield to worst at 5.6% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 96.1-110.1).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.50% | Maturity: 1/12/2025 | Rating: BB+ | CUSIP: 674599EE1 | OAS up by 43.6 bp to 130.1 bp (CDS basis: -50.6bp), with the yield to worst at 5.2% and the bond now trading down to 99.8 cents on the dollar (1Y price range: 98.0-110.5).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 3.00% | Maturity: 15/2/2027 | Rating: BB+ | CUSIP: 674599CM5 | OAS up by 42.9 bp to 164.9 bp (CDS basis: -50.8bp), with the yield to worst at 5.2% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 89.3-101.0).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 5.13% | Maturity: 1/10/2024 | Rating: BB+ | CUSIP: 013817AW1 | OAS up by 42.7 bp to 119.6 bp, with the yield to worst at 5.4% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 96.0-108.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 37.3 bp to 130.6 bp, with the yield to worst at 5.3% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 97.9-109.6).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | CUSIP: 983130AV7 | OAS down by 54.8 bp to 225.4 bp, with the yield to worst at 6.6% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Tri Pointe Homes Inc (Delaware) (Incline Village, Nevada (US)) | Coupon: 5.88% | Maturity: 15/6/2024 | Rating: BB- | CUSIP: 962178AN9 | OAS down by 71.8 bp to 109.8 bp, with the yield to worst at 5.4% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 97.0-109.0).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 4.35% | Maturity: 1/10/2024 | Rating: B+ | CUSIP: 44106MAZ5 | OAS down by 77.5 bp to 332.5 bp, with the yield to worst at 7.4% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 80.6-98.8).

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 4.50% | Maturity: 1/2/2025 | Rating: BB+ | CUSIP: 81618TAC4 | OAS down by 224.5 bp to 544.0 bp, with the yield to worst at 9.9% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 82.9-105.5).

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 2.65% | Maturity: 15/6/2026 | Rating: BB+ | CUSIP: 67623CAD1 | OAS down by 229.7 bp to 623.8 bp, with the yield to worst at 10.1% and the bond now trading up to 78.1 cents on the dollar (1Y price range: 71.1-99.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS up by 59.5 bp to 318.2 bp (CDS basis: -6.0bp), with the yield to worst at 5.6% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 86.8-103.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | OAS up by 53.3 bp to 346.2 bp (CDS basis: -62.6bp), with the yield to worst at 5.8% and the bond now trading down to 92.5 cents on the dollar (1Y price range: 87.1-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 51.2 bp to 366.6 bp (CDS basis: -37.6bp), with the yield to worst at 6.2% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 84.2-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS up by 49.1 bp to 388.1 bp (CDS basis: 26.8bp), with the yield to worst at 6.2% and the bond now trading down to 83.3 cents on the dollar (1Y price range: 76.4-98.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 47.1 bp to 359.2 bp (CDS basis: -12.3bp), with the yield to worst at 5.9% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 85.3-105.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS up by 42.5 bp to 418.4 bp (CDS basis: 39.7bp), with the yield to worst at 6.4% and the bond now trading down to 74.9 cents on the dollar (1Y price range: 67.6-92.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB | ISIN: XS2363235107 | OAS down by 26.8 bp to 332.0 bp (CDS basis: -20.9bp), with the yield to worst at 5.7% and the bond now trading up to 87.1 cents on the dollar (1Y price range: 72.5-101.7).

- Issuer: Unipol Gruppo SpA (Bologna, Italy) | Coupon: 3.25% | Maturity: 23/9/2030 | Rating: BB+ | ISIN: XS2237434803 | OAS down by 28.4 bp to 131.1 bp, with the yield to worst at 3.8% and the bond now trading up to 95.6 cents on the dollar (1Y price range: 83.6-113.5).

- Issuer: Verallia SA (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | OAS down by 32.6 bp to 139.5 bp, with the yield to worst at 3.9% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 78.3-102.6).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | OAS down by 34.0 bp to 413.0 bp, with the yield to worst at 6.8% and the bond now trading up to 91.4 cents on the dollar (1Y price range: 82.9-99.8).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 2.00% | Maturity: 29/9/2028 | Rating: BB- | ISIN: XS2391403354 | OAS down by 38.0 bp to 394.8 bp, with the yield to worst at 6.4% and the bond now trading up to 78.6 cents on the dollar (1Y price range: 69.0-98.3).

- Issuer: SIG Combibloc PurchaseCo SARL (Munsbach, Luxembourg) | Coupon: 2.13% | Maturity: 18/6/2025 | Rating: BB+ | ISIN: XS2189594315 | OAS down by 44.1 bp to 119.1 bp, with the yield to worst at 3.9% and the bond now trading up to 95.6 cents on the dollar (1Y price range: 91.5-105.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | OAS down by 58.4 bp to 362.3 bp, with the yield to worst at 6.2% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 71.8-100.7).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS down by 58.8 bp to 282.2 bp, with the yield to worst at 5.2% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 82.6-105.2).

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | OAS down by 117.6 bp to 358.5 bp, with the yield to worst at 6.1% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 81.3-98.4).

RECENT DOMESTIC USD BOND ISSUES

- Air Lease Corp (Leasing | Los Angeles, California, United States | Rating: BBB): $700m Senior Note (US00914AAT97), fixed rate (5.85% coupon) maturing on 15 December 2027, priced at 98.96 (original spread of 224 bp), callable (5nc5)

- Amazon.com Inc (Retail Stores - Other | Seattle, United States | Rating: A+): $2,000m Senior Note (US023135CP90), fixed rate (4.55% coupon) maturing on 1 December 2027, priced at 99.94 (original spread of 70 bp), callable (5nc5)

- Amazon.com Inc (Retail Stores - Other | Seattle, United States | Rating: A+): $1,250m Senior Note (US023135CN43), fixed rate (4.60% coupon) maturing on 1 December 2025, priced at 99.99 (original spread of 47 bp), with a make whole call

- Amazon.com Inc (Retail Stores - Other | Seattle, United States | Rating: A+): $1,500m Senior Note (US023135CQ73), fixed rate (4.65% coupon) maturing on 1 December 2029, priced at 99.93 (original spread of 97 bp), callable (7nc7)

- Amazon.com Inc (Retail Stores - Other | Seattle, United States | Rating: A+): $1,250m Senior Note (US023135CM69), fixed rate (4.70% coupon) maturing on 29 November 2024, priced at 99.93 (original spread of 29 bp), with a make whole call

- Amazon.com Inc (Retail Stores - Other | Seattle, United States | Rating: A+): $2,250m Senior Note (US023135CR56), fixed rate (4.70% coupon) maturing on 1 December 2032, priced at 99.98 (original spread of 100 bp), callable (10nc10)

- Avalonbay Communities Inc (Real Estate Investment Trust | Arlington, Virginia, United States | Rating: A-): $350m Senior Note (US053484AD33), fixed rate (5.00% coupon) maturing on 15 February 2033, priced at 99.59 (original spread of 140 bp), callable (10nc10)

- Citigroup Global Markets Holdings Inc (Securities | New York City, United States | Rating: A): $120m Unsecured Note (XS2564930472), fixed rate (8.50% coupon) maturing on 8 December 2025, priced at 100.00, non callable

- Diamondback Energy Inc (Oil and Gas | Midland, Texas, United States | Rating: BBB-): $650m Senior Note (US25278XAW92), fixed rate (6.25% coupon) maturing on 15 March 2053, priced at 99.99 (original spread of 282 bp), callable (30nc30)

- Equitable Financial Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: A+): $400m Note (US29450LAQ05), fixed rate (5.50% coupon) maturing on 2 December 2025, priced at 99.98 (original spread of 125 bp), non callable

- Evergy Missouri West Inc (Utility - Other | Kansas City, Missouri, United States | Rating: A-): $300m First Mortgage Bond (USU3000EAA83), fixed rate (5.15% coupon) maturing on 15 December 2027, priced at 99.81 (original spread of 130 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): $1,150m Bond (US3133EN3K42), floating rate (SOFR + 20.0 bp) maturing on 5 December 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): $125m Bond (US3133EN3L25), fixed rate (5.06% coupon) maturing on 5 December 2024, priced at 100.00 (original spread of 34 bp), callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): $350m Bond (US3133EN3M08), fixed rate (4.63% coupon) maturing on 5 December 2024, priced at 99.95 (original spread of 7 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): $150m Bond (US3133EN3S77), fixed rate (3.75% coupon) maturing on 7 December 2027, priced at 99.46, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): $370m Bond (US3130AU2C75), fixed rate (5.30% coupon) maturing on 6 December 2024, priced at 100.00 (original spread of 109 bp), callable (2nc3m)

- Illumina Inc (Health Care Supply | San Diego, California, United States | Rating: BBB-): $500m Senior Note (US452327AN93), fixed rate (5.80% coupon) maturing on 12 December 2025, priced at 100.00 (original spread of 155 bp), callable (3nc3)

- Illumina Inc (Health Care Supply | San Diego, California, United States | Rating: BBB-): $500m Senior Note (US452327AP42), fixed rate (5.75% coupon) maturing on 13 December 2027, priced at 99.86 (original spread of 187 bp), callable (5nc5)

- Massachusetts Mutual Life Insurance Co (Life Insurance | Springfield, Massachusetts, United States | Rating: AA-): $500m Surplus Note (US575767AT50), fixed rate (5.67% coupon) maturing on 1 December 2052, priced at 100.00 (original spread of 183 bp), callable (30nc30)

- Massmutual Global Funding II (Financial - Other | Wilmington, Delaware, United States | Rating: NR): $750m Note (US57629XCW65), fixed rate (5.05% coupon) maturing on 7 December 2027, priced at 99.96 (original spread of 115 bp), non callable

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): $1,000m Senior Note (US693475BK03), floating rate maturing on 2 December 2028, priced at 100.00 (original spread of 133 bp), callable (6nc5)

- Pacificorp (Utility - Other | Portland, Oregon, United States | Rating: A+): $1,100m First Mortgage Bond (US695114CZ98), fixed rate (5.35% coupon) maturing on 1 December 2053, priced at 99.70 (original spread of 196 bp), callable (31nc31)

- Public Service Electric And Gas Co (Utility - Other | Newark, New Jersey, United States | Rating: A): $400m First Mortgage Bond (US74456QCK04), fixed rate (4.90% coupon) maturing on 15 December 2032, priced at 99.94 (original spread of 119 bp), callable (10nc10)

- Southwest Gas Corp (Gas Utility - Local Distrib | Las Vegas, Nevada, United States | Rating: BBB): $300m Senior Note (US845011AF24), fixed rate (5.80% coupon) maturing on 1 December 2027, priced at 99.87 (original spread of 190 bp), callable (5nc5)

RECENT INTERNATIONAL USD BOND ISSUES

- Agricultural Bank of China Ltd (Macau Branch) (Banking | China (Mainland) | Rating: NR): $200m Certificate of Deposit (XS2564390776), floating rate maturing on 9 December 2024, priced at 100.00, non callable

- Alcon Finance Corp (Financial - Other | Fort Worth, Texas, Switzerland | Rating: BBB): $700m Senior Note (USU01386AE82), fixed rate (5.38% coupon) maturing on 6 December 2032, priced at 99.46 (original spread of 170 bp), callable (10nc10)

- Alcon Finance Corp (Financial - Other | Fort Worth, Texas, Switzerland | Rating: BBB): $600m Senior Note (US01400EAF07), fixed rate (5.75% coupon) maturing on 6 December 2052, priced at 99.67 (original spread of 215 bp), callable (30nc30)

- Australia and New Zealand Banking Group Ltd (New York Branch) (Banking | New York City, New York, Australia | Rating: NR): $1,250m Senior Note (US05254JAA88), fixed rate (5.09% coupon) maturing on 8 December 2025, priced at 100.00 (original spread of 85 bp), non callable

- Australia and New Zealand Banking Group Ltd (New York Branch) (Banking | New York City, New York, Australia | Rating: NR): $1,250m Subordinated Note (US052528AP13), fixed rate (6.74% coupon) maturing on 8 December 2032, priced at 100.00 (original spread of 300 bp), with a regulatory call

- Bank of China (Dubai Branch) (Banking | Dubai, Dubai, China (Mainland) | Rating: A): $300m Senior Note (XS2553801098), fixed rate (4.75% coupon) maturing on 5 December 2025, priced at 99.75 (original spread of 61 bp), non callable

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): $150m Certificate of Deposit (XS2563146906), fixed rate (5.00% coupon) maturing on 5 December 2024, priced at 100.00, non callable

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A-): $1,000m Senior Note (US06417XAL55), fixed rate (5.25% coupon) maturing on 6 December 2024, priced at 99.91 (original spread of 90 bp), with a make whole call

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): $150m Unsecured Note (XS2562984737), fixed rate (1.00% coupon) maturing on 12 December 2030, priced at 100.00, non callable

- Colombia, Republic of (Government) (Sovereign | Bogota, Colombia | Rating: BB+): $1,624m Bond (US195325EF88), fixed rate (8.00% coupon) maturing on 20 April 2033, priced at 99.15 (original spread of 444 bp), callable (10nc10)

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): $1,500m Covered Bond (Other) (US20271AAK34), fixed rate (4.93% coupon) maturing on 9 December 2025, priced at 100.00 (original spread of 70 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): $500m Note (XS0459908181), fixed rate (4.10% coupon) maturing on 6 January 2025, priced at 100.00, non callable

- Deyang Development Holding Group Co Ltd (Financial - Other | Deyang, China (Mainland) | Rating: BBB-): $350m Bond (XS2562889316), fixed rate (7.00% coupon) maturing on 8 December 2025, priced at 100.00, non callable

- Flex Ltd (Electronics | Singapore | Rating: BBB-): $400m Senior Note (US33938XAE58), fixed rate (6.00% coupon) maturing on 15 January 2028, priced at 99.07 (original spread of 225 bp), callable (5nc5)

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): $1,000m Bond (RU000A105JH9), fixed rate (3.00% coupon) maturing on 29 June 2027, priced at 100.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Russia | Rating: NR): $1,000m Bond (RU000A105JT4), fixed rate (3.50% coupon) maturing on 14 July 2031, priced at 100.00, non callable

- HSBC Bank Middle East Ltd (Banking | Dubai, Dubai, United Kingdom | Rating: A+): $350m Unsecured Note (XS2564003593), fixed rate (3.04% coupon) maturing on 9 December 2025, priced at 94.65, non callable

- Icbc London PLC (Banking | London, China (Mainland) | Rating: NR): $300m Unsecured Note (XS2564578909), fixed rate (4.69% coupon) maturing on 8 December 2025, priced at 100.00, non callable

- Indus Gas Ltd (Oil and Gas | Saint Peter Port, British Virgin Islands | Rating: NR): $160m Senior Note (XS2560106150), fixed rate (8.00% coupon) maturing on 30 November 2027, non callable

- Kommunalbanken AS (Agency | Oslo, Norway | Rating: AAA): $150m Senior Note (XS2562043120), floating rate (SOFR + 100.0 bp) maturing on 17 June 2026, priced at 101.79, non callable

- Kunming Rail Transit Group Co Ltd (Railroads | Kunming, China (Mainland) | Rating: BBB+): $253m Bond (XS2558634791), fixed rate (8.50% coupon) maturing on 7 December 2025, priced at 100.00, non callable

- Linde Inc (Industrials - Other | Danbury, Connecticut, United Kingdom | Rating: A): $600m Senior Note (US53522KAB98), fixed rate (4.70% coupon) maturing on 5 December 2025, priced at 99.89 (original spread of 57 bp), callable (3nc3)

- Linde Inc (Industrials - Other | Danbury, Connecticut, United Kingdom | Rating: A): $300m Senior Note (US53522KAA16), fixed rate (4.80% coupon) maturing on 5 December 2024, priced at 99.96 (original spread of 35 bp), with a make whole call

- Nordic Investment Bank (Supranational | Helsinki, Etela-Suomen, Finland | Rating: AAA): $120m Senior Note (XS2561746186), floating rate (SOFR + 100.0 bp) maturing on 27 May 2025, priced at 101.68, non callable

- QNB Finance Ltd (Financial - Other | George Town, Qatar | Rating: A+): $500m Senior Note (HK0000895034), fixed rate (5.15% coupon) maturing on 26 November 2025, priced at 100.00, non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): $15,000m Unsecured Note (XS2558044058), floating rate maturing on 7 December 2027, priced at 100.00, non callable

RECENT EUR BOND ISSUES

- Arkea Home Loans SFH SA (Financial - Other | Brest, Bretagne, France | Rating: NR): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400EEX5), fixed rate (2.75% coupon) maturing on 22 December 2026, priced at 99.55 (original spread of 94 bp), non callable

- Bank of Valletta PLC (Banking | Santa Venera, Malta | Rating: BBB-): €350m Note (XS2539425095), fixed rate (10.00% coupon) maturing on 6 December 2027, priced at 100.00 (original spread of 834 bp), callable (5nc4)

- Bper Banca SpA (Banking | Modena, Italy | Rating: BB+): €500m Bond (IT0005523896), floating rate maturing on 1 February 2028, priced at 99.85 (original spread of 421 bp), callable (5nc4)

- Bremen Free Hanseatic, City of (Official and Muni | Bremen, Bremen, Germany | Rating: AAA): €250m Landesschatzanweisung (DE000A30V349), floating rate (EU03MLIB + 0.0 bp) maturing on 7 June 2028, priced at 100.96, non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000CZ43ZJ6), fixed rate (2.75% coupon) maturing on 8 December 2025, priced at 99.95 (original spread of 81 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400EFP8), fixed rate (2.75% coupon) maturing on 8 December 2027, priced at 99.55 (original spread of 94 bp), non callable

- Credit Suisse Schweiz AG (Financial - Other | Zurich, Switzerland | Rating: A-): €750m Covered Bond (Other) (CH1230759495), fixed rate (3.39% coupon) maturing on 5 December 2025, priced at 100.00 (original spread of 153 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U9H9), floating rate maturing on 5 January 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U9G1), fixed rate (2.60% coupon) maturing on 5 January 2026, priced at 100.50, non callable

- Elo SA (Service - Other | Croix, France | Rating: BBB-): €650m Senior Note (FR001400EHH1), fixed rate (4.88% coupon) maturing on 8 December 2028, priced at 99.19 (original spread of 332 bp), callable (6nc6)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A32232), fixed rate (3.25% coupon) maturing on 15 January 2027, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A321N5), fixed rate (3.25% coupon) maturing on 16 December 2025, priced at 100.00, non callable

- Eurobank Ergasias Services and Holdings SA (Banking | Athina, Greece | Rating: B-): €300m Subordinated Note (XS2562543442), fixed rate (10.00% coupon) maturing on 6 December 2032, priced at 99.06 (original spread of 792 bp), callable (10nc5)

- Eurobank Ergasias Services and Holdings SA (Banking | Athina, Greece | Rating: B-): €300m Unsecured Note (XS2564362643), fixed rate (10.00% coupon) maturing on 6 December 2032, priced at 99.06, non callable

- Fiber Midco SpA (Financial - Other | Milan, Italy | Rating: NR): €300m Bond (IT0005520694), fixed rate (15.00% coupon) maturing on 30 November 2028, priced at 100.00, non callable

- Flemish, Community of (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €120m Bond (BE6339449140), floating rate (EU03MLIB + 0.0 bp) maturing on 29 November 2027, priced at 100.00, non callable

- Glenbeigh 4 Warehouse Issuer DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €126m Bond (XS2556936388), floating rate maturing on 23 November 2025, priced at 100.00, non callable

- Iberdrola Finanzas SA (Financial - Other | Bilbao, Vizcaya, Spain | Rating: NR): €450m Bond (XS2557565830), fixed rate (0.80% coupon) maturing on 7 December 2027, priced at 100.00, non callable, convertible

- Iccrea Banca SpA Istituto Centrale del Credito Cooperativo (Banking | Rome, Roma, Italy | Rating: BB+): €150m Bond (IT0005518698), fixed rate (4.00% coupon) maturing on 28 November 2027, priced at 100.00, non callable

- La Banque Postale SA (Banking | Paris, Ile-De-France, France | Rating: BBB-): €500m Bond (FR001400DLD4), floating rate maturing on 5 March 2034, priced at 99.89 (original spread of 357 bp), callable (11nc6)

- La Banque Postale SA (Banking | Paris, Ile-De-France, France | Rating: A): €150m Bond (FR001400ECJ8), floating rate maturing on 9 February 2028, priced at 87.33 (original spread of 231 bp), callable (5nc4)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000LB36B92), fixed rate (2.15% coupon) maturing on 6 January 2025, priced at 100.00 (original spread of 41 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7AX2), fixed rate (2.40% coupon) maturing on 13 January 2026, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7AW4), fixed rate (2.25% coupon) maturing on 13 January 2025, priced at 100.00, non callable

- Leasys SpA (Service - Other | Rome, Roma, Italy | Rating: BBB+): €750m Senior Note (XS2563348361), fixed rate (4.38% coupon) maturing on 7 December 2024, priced at 99.86 (original spread of 241 bp), callable (2nc2)

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €500m Note (XS2563002653), floating rate maturing on 7 February 2029, priced at 99.83 (original spread of 264 bp), callable (6nc5)

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): €750m Senior Note (XS2561748711), fixed rate (3.75% coupon) maturing on 5 December 2030, priced at 99.53 (original spread of 187 bp), non callable

- Metso Outotec Corp (Metals/Mining | Helsinki, Etela-Suomen, Finland | Rating: BBB-): €300m Senior Note (XS2560415965), fixed rate (4.88% coupon) maturing on 7 December 2027, priced at 99.86 (original spread of 291 bp), callable (5nc5)

- Nord Lb Covered Finance Bank SA (Banking | Findel, Luxembourg | Rating: NR): €150m Unsecured Note (XS2564170814), floating rate maturing on 12 December 2024, priced at 100.00, non callable

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €500m Subordinated Note (XS2563353361), fixed rate (5.25% coupon) maturing on 8 December 3022, priced at 100.00 (original spread of 337 bp), callable (1001nc6)

- Rossbeigh 1 Warehouse Designated Activity Company (Financial - Other | Ireland | Rating: NR): €109m Unsecured Note (XS2559133876), floating rate maturing on 28 November 2051, priced at 100.00, non callable

- Schleswig-Holstein, State of (Official and Muni | Kiel, Germany | Rating: AAA): €250m Landesschatzanweisung (DE000SHFM873), fixed rate (2.50% coupon) maturing on 8 December 2025 (original spread of -9 bp), non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Senningerberg, Netherlands | Rating: NR): €114m Unsecured Note (XS2563843296) zero coupon maturing on 20 March 2031, priced at 100.00, non callable

- Snam SpA (Gas Utility - Local Distrib | San Donato Milanese, Milano, Italy | Rating: BBB): €300m Senior Note (XS2562879192), fixed rate (3.38% coupon) maturing on 5 December 2026, priced at 99.58 (original spread of 152 bp), callable (4nc4)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: BBB): €1,500m Bond (FR001400EHG3), floating rate maturing on 6 December 2030, priced at 99.53 (original spread of 252 bp), callable (8nc7)

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €250m Inhaberschuldverschreibung (DE000HV2AZA8), floating rate (EU03MLIB + 220.0 bp) maturing on 2 December 2027, priced at 100.00, callable (5nc4)

- Vodafone International Financing DAC (Financial - Other | Dublin, United Kingdom | Rating: BBB): €650m Senior Note (XS2560495462), fixed rate (3.25% coupon) maturing on 2 March 2029, priced at 99.74 (original spread of 144 bp), callable (6nc6)

- Vodafone International Financing DAC (Financial - Other | Dublin, United Kingdom | Rating: BBB): €650m Senior Note (XS2560495116), fixed rate (3.75% coupon) maturing on 2 December 2034, priced at 99.57 (original spread of 192 bp), callable (12nc12)

- illimity Bank SpA (Banking | Milan, Milano, Italy | Rating: BB-): €300m Note (XS2564398753), fixed rate (6.63% coupon) maturing on 9 December 2025, priced at 100.00 (original spread of 479 bp), non callable

RECENT LOANS

- Bank of Communications (China | A-), signed a $ 240m Term Loan, to be used for general corporate purposes.

- Barentz Bv (Netherlands), signed a € 150m Term Loan B, to be used for general corporate purposes. It matures on 11/30/27 and initial pricing is set at EURIBOR +375.0bp

- Cofina Group Co (Ivory Coast), signed a € 135m Term Loan, to be used for acquisition financing.

- Ecuador-Peru Power (Ecuador), signed a $ 125m Term Loan, to be used for general corporate purposes.

- INTEK Group SpA (Italy), signed a € 330m Revolving Credit Facility, to be used for working capital.

- Nyanzaga Gold Mine (Tanzania), signed a $ 400m Term Loan, to be used for project finance.

- Orange SA (France | BBB+), signed a € 6,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/24/27 and initial pricing is set at EURIBOR +25.0bp

- QNB Finansbank AS (Turkey), signed a € 253m Term Loan, to be used for general corporate purposes. It matures on 11/25/23 and initial pricing is set at EURIBOR +400.0bp

- QNB Finansbank AS (Turkey), signed a $ 185m Term Loan, to be used for general corporate purposes. It matures on 11/25/23 and initial pricing is set at Term SOFR +425.0bp

- Republic Of Indonesia (Indonesia | BBB), signed a $ 500m Revolving Credit / Term Loan, to be used for general corporate purposes.

- Rio Grande Lng (United States of America), signed a $ 12,000m Term Loan, to be used for project finance.

- Talga Group Ltd (Australia), signed a € 300m Revolving Credit / Term Loan, to be used for capital expenditures.

- Tng Stadtnetz Gmbh (Germany), signed a € 325m Term Loan, to be used for general corporate purposes and capital expenditures.

- Treasure Abundance Ltd (Hong Kong), signed a $ 430m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 11/25/25 and initial pricing is set at Term SOFR +205.0bp

- Turkiye Garanti Bankasi AS (Turkey), signed a € 239m Term Loan, to be used for general corporate purposes, finance linked-trade. It matures on 11/26/23 and initial pricing is set at EURIBOR +400.0bp

- Turkiye Garanti Bankasi AS (Turkey), signed a $ 155m Term Loan, to be used for general corporate purposes, finance linked-trade. It matures on 11/26/23 and initial pricing is set at Term SOFR +425.0bp

- WerfenLife SA (Spain | BBB-), signed a € 1,900m Term Loan, to be used for acquisition financing.

RECENT STRUCTURED CREDIT

- OCP Euro CLO 2022 6 Designated Activity Co issued a floating-rate CLO in 6 tranches, for a total of € 347 m. Highest-rated tranche offering a spread over the floating rate of 188bp, and the lowest-rated tranche a spread of 687bp. Bookrunners: NatWest Markets, Citigroup Global Markets Inc