Credit

US CDS Indices See Spreads Widen Ahead Of FOMC, While Cash Held Up Better With Low Supply Helping

Very little issuance of new corporate bonds this week: 6 tranches for $4.25bn in IG (2022 YTD volume $1.208tn vs 2021 YTD $1.487tn, down 18.8% YoY), 3 tranches for $2.26bn in HY (2022 YTD volume $101.971bn vs 2021 YTD $459.461bn, down 77.8% YoY)

Published ET

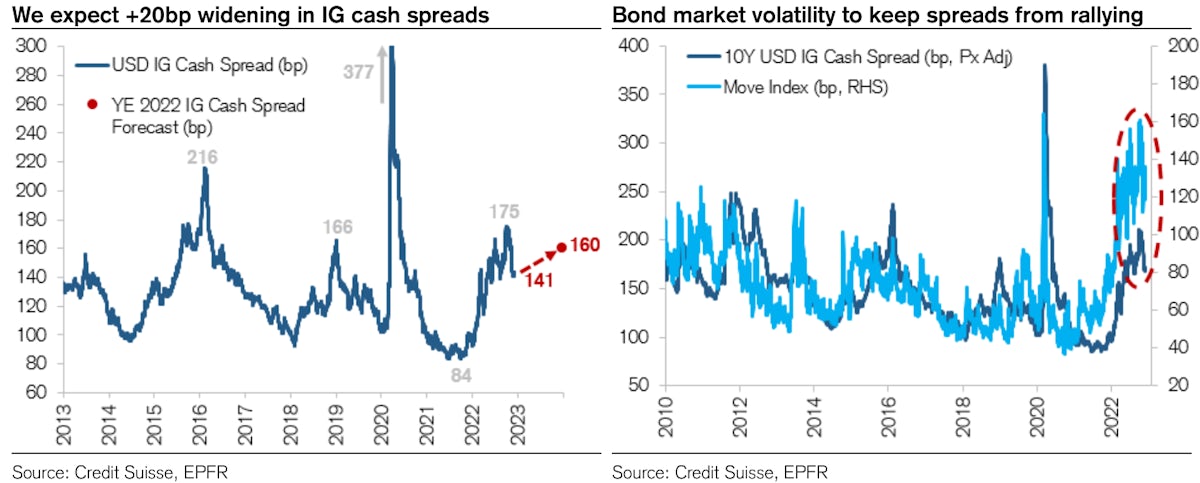

CS Forecast Of IG Cash Spreads In 2023 | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was down -0.64% today, with investment grade down -0.69% and high yield down -0.07% (YTD total return: -13.10%)

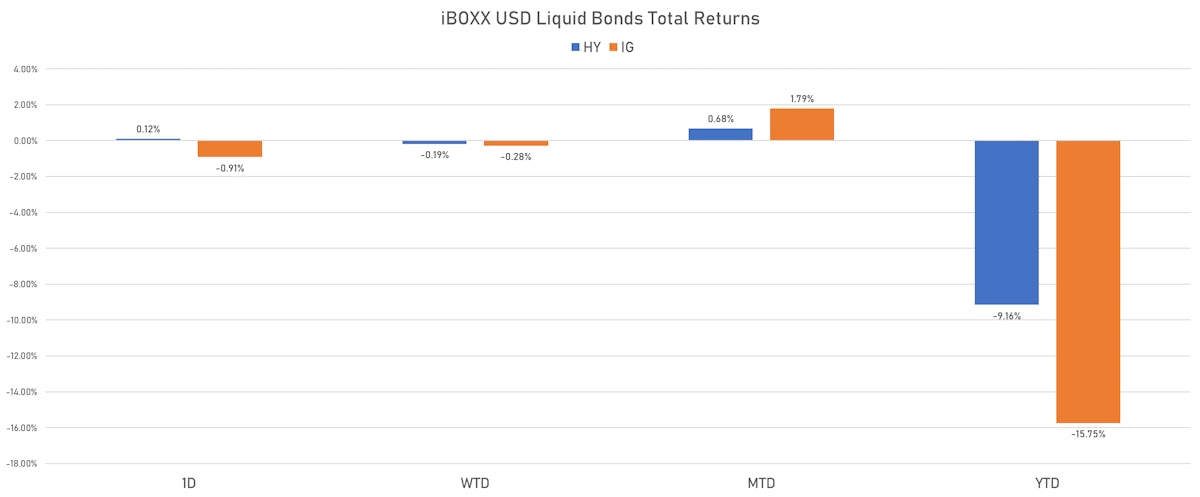

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.914% today (Week-to-date: -0.28%; Month-to-date: 1.79%; Year-to-date: -15.75%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.116% today (Week-to-date: -0.19%; Month-to-date: 0.68%; Year-to-date: -9.16%)

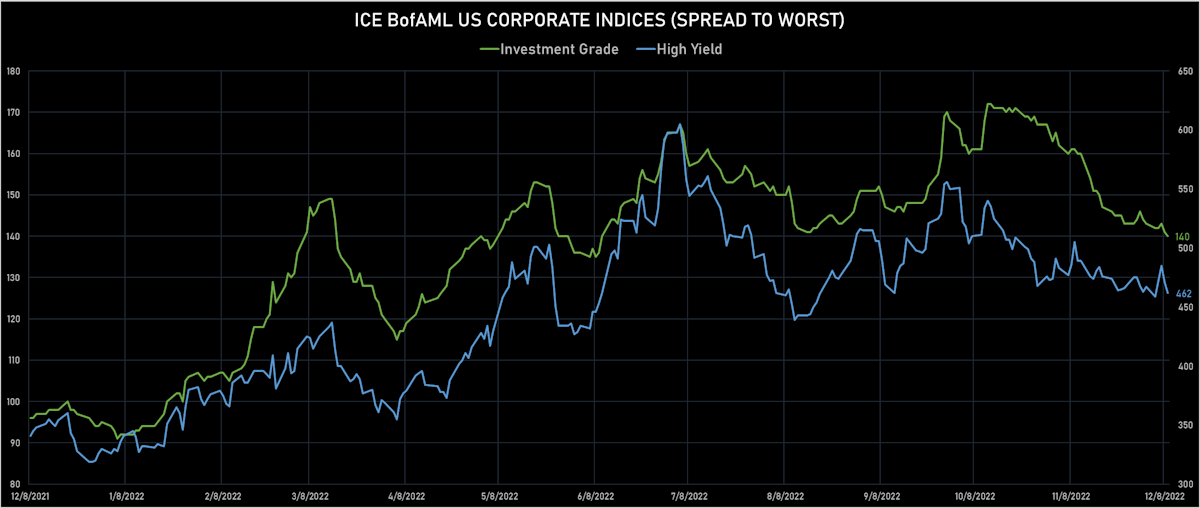

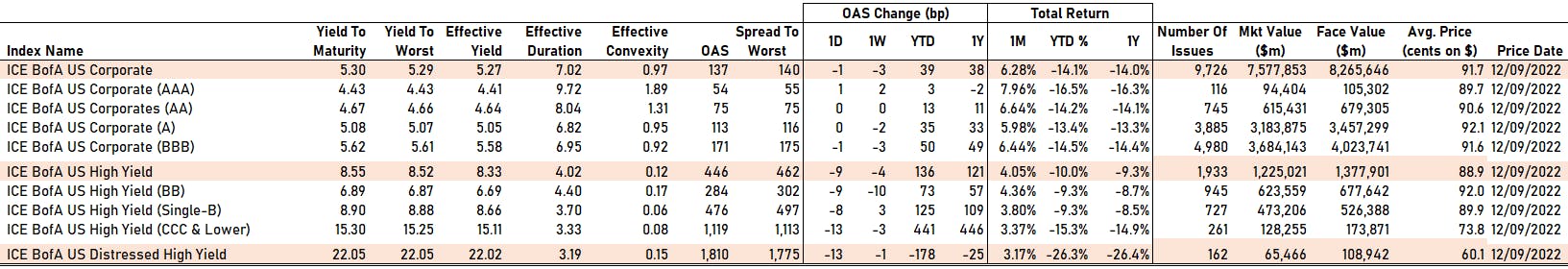

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 140.0 bp (YTD change: +45.0 bp)

- ICE BofA US High Yield Index spread to worst down -9.0 bp, now at 462.0 bp (YTD change: +132.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.03% today (YTD total return: -0.8%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 54 bp

- AA unchanged at 75 bp

- A unchanged at 113 bp

- BBB down by -1 bp at 171 bp

- BB down by -9 bp at 284 bp

- B down by -8 bp at 476 bp

- ≤ CCC down by -13 bp at 1,119 bp

CDS INDICES TODAY (mid-spreads)

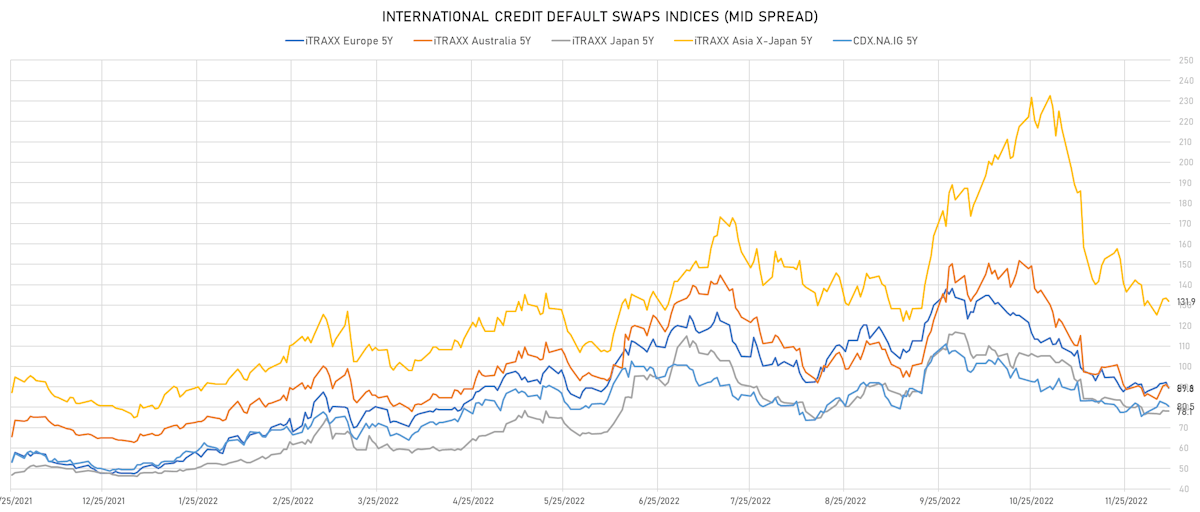

- Markit CDX.NA.IG 5Y down 1.2 bp, now at 81bp (1W change: +2.8bp; YTD change: +31.2bp)

- Markit CDX.NA.IG 10Y down 1.0 bp, now at 117bp (1W change: +2.3bp; YTD change: +27.7bp)

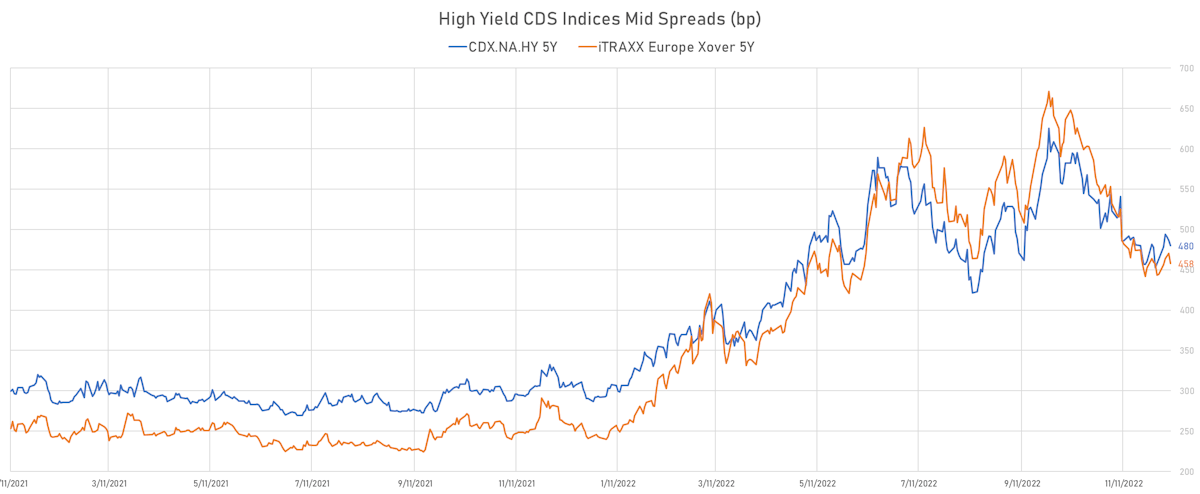

- Markit CDX.NA.HY 5Y down 6.6 bp, now at 480bp (1W change: +16.5bp; YTD change: +187.9bp)

- Markit iTRAXX Europe 5Y down 2.9 bp, now at 89bp (1W change: +1.6bp; YTD change: +41.6bp)

- Markit iTRAXX Europe Crossover 5Y down 12.5 bp, now at 458bp (1W change: +13.2bp; YTD change: +215.6bp)

- Markit iTRAXX Japan 5Y unchanged at 78bp (1W change: +1.1bp; YTD change: +31.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.5 bp, now at 132bp (1W change: -0.3bp; YTD change: +52.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Pactiv LLC (Country: US; rated: Caa1): down 83.3 bp to 469.7bp (1Y range: 420-1,041bp)

- MBIA Inc (Country: US; rated: CCC-): down 59.7 bp to 326.7bp (1Y range: 296-534bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 58.1 bp to 931.3bp (1Y range: 443-1,783bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 53.1 bp to 1,174.4bp (1Y range: 616-1,472bp)

- DISH DBS Corp (Country: US; rated: B2): up 58.0 bp to 1,317.8bp (1Y range: 447-1,506bp)

- Staples Inc (Country: US; rated: B3): up 61.7 bp to 1,967.3bp (1Y range: 985-1,986bp)

- Kohls Corp (Country: US; rated: NR): up 65.8 bp to 541.3bp (1Y range: 144-686bp)

- NRG Energy Inc (Country: US; rated: BBB-): up 79.3 bp to 387.6bp (1Y range: 189-442bp)

- American Airlines Group Inc (Country: US; rated: B2): up 92.7 bp to 1,177.2bp (1Y range: 607-1,644bp)

- Lumen Technologies Inc (Country: US; rated: WR): up 95.2 bp to 1,052.9bp (1Y range: 195-1,053bp)

- Nordstrom Inc (Country: US; rated: A3): up 120.8 bp to 585.2bp (1Y range: 305-641bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 149.1 bp to 1,451.6bp (1Y range: 393-2,117bp)

- Transocean Inc (Country: KY; rated: Caa1): up 149.3 bp to 1,527.0bp (1Y range: 970-2,858bp)

- Community Health Systems Inc (Country: US; rated: B): up 312.9 bp to 6,173.4bp (1Y range: 590-6,173bp)

- Rite Aid Corp (Country: US; rated: D): up 6615.4 bp to 15,156.2bp (1Y range: 885-15,156bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: B-): down 11.1 bp to 449.3bp (1Y range: 230-790bp)

- Renault SA (Country: FR; rated: Ba2): up 6.3 bp to 308.9bp (1Y range: 175-476bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 6.8 bp to 298.8bp (1Y range: 232-606bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): up 7.0 bp to 499.0bp (1Y range: 207-705bp)

- Tesco PLC (Country: GB; rated: A1): up 7.7 bp to 128.7bp (1Y range: 64-184bp)

- Abertis Infraestructuras SA (Country: ES; rated: WD): up 8.3 bp to 125.4bp (1Y range: 70-203bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 11.4 bp to 360.2bp (1Y range: 168-496bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 15.1 bp to 1,341.2bp (1Y range: 566-1,739bp)

- Telecom Italia SpA (Country: IT; rated: BB-): up 15.1 bp to 461.8bp (1Y range: 233-545bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 17.2 bp to 471.1bp (1Y range: 250-602bp)

- TUI AG (Country: DE; rated: B3-PD): up 18.1 bp to 1,186.1bp (1Y range: 612-1,725bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 31.8 bp to 1,964.5bp (1Y range: 1,286-2,910bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 34.0 bp to 845.3bp (1Y range: 401-1,021bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 41.3 bp to 970.1bp (1Y range: 359-1,296bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): up 133.4 bp to 3,395.5bp (1Y range: 595-4,917bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 2.90% | Maturity: 15/8/2024 | Rating: BB+ | CUSIP: 674599CW3 | OAS up by 27.1 bp to 56.7 bp (CDS basis: 24.4bp), with the yield to worst at 4.8% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 94.4-102.1).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 6.95% | Maturity: 1/7/2024 | Rating: BB+ | CUSIP: 674599DB8 | OAS down by 26.8 bp to 73.8 bp (CDS basis: 11.8bp), with the yield to worst at 4.9% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 101.1-110.9).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 5.00% | Maturity: 1/2/2024 | Rating: B- | CUSIP: 910047AH2 | OAS down by 29.3 bp to 86.5 bp, with the yield to worst at 5.0% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 95.0-103.6).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.50% | Maturity: 1/12/2025 | Rating: BB+ | CUSIP: 674599EE1 | OAS down by 30.5 bp to 99.6 bp (CDS basis: -14.2bp), with the yield to worst at 5.0% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 98.0-110.5).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS down by 35.2 bp to 90.6 bp (CDS basis: 103.0bp), with the yield to worst at 5.5% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 90.0-102.3).

- Issuer: Newell Brands Inc (Atlanta, Georgia (US)) | Coupon: 4.88% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 651229BB1 | OAS down by 38.3 bp to 135.0 bp, with the yield to worst at 5.6% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 94.0-108.8).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.55% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 674599DC6 | OAS down by 38.9 bp to 85.0 bp (CDS basis: 15.4bp), with the yield to worst at 4.8% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 98.6-111.3).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 47.6 bp to 110.9 bp (CDS basis: 40.0bp), with the yield to worst at 4.9% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 93.1-109.8).

- Issuer: H.B. Fuller Company (Saint Paul, Minnesota (US)) | Coupon: 4.00% | Maturity: 15/2/2027 | Rating: BB- | CUSIP: 359694AB2 | OAS down by 60.2 bp to 191.0 bp, with the yield to worst at 5.1% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 88.8-105.1).

- Issuer: Crown Cork & Seal Company Inc (Philadelphia, Pennsylvania (US)) | Coupon: 7.38% | Maturity: 15/12/2026 | Rating: BB- | CUSIP: 228255AH8 | OAS down by 64.3 bp to 230.3 bp, with the yield to worst at 6.0% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 99.0-120.6).

- Issuer: GLP Capital LP (Wyomissing, Pennsylvania (US)) | Coupon: 5.75% | Maturity: 1/6/2028 | Rating: BB+ | CUSIP: 361841AK5 | OAS down by 70.2 bp to 223.6 bp, with the yield to worst at 6.0% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 91.5-115.4).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 3.50% | Maturity: 15/12/2024 | Rating: BB+ | CUSIP: 343412AC6 | OAS down by 70.4 bp to 32.9 bp, with the yield to worst at 4.8% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 93.5-104.6).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 5.13% | Maturity: 1/10/2024 | Rating: BB+ | CUSIP: 013817AW1 | OAS down by 79.6 bp to 40.0 bp, with the yield to worst at 4.7% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 96.0-108.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | CUSIP: 690872AB2 | OAS down by 98.0 bp to 231.8 bp (CDS basis: 102.3bp), with the yield to worst at 6.3% and the bond now trading up to 97.1 cents on the dollar (1Y price range: 92.0-104.1).

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 4.50% | Maturity: 1/2/2025 | Rating: BB+ | CUSIP: 81618TAC4 | OAS down by 130.4 bp to 413.6 bp, with the yield to worst at 8.7% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 82.9-105.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 21/9/2025 | Rating: BB+ | ISIN: XS2231715322 | OAS up by 95.6 bp to 350.6 bp, with the yield to worst at 6.1% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 87.4-105.2).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 25/4/2025 | Rating: BB | ISIN: FR0013331196 | OAS up by 34.6 bp to 237.5 bp, with the yield to worst at 4.7% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 89.9-100.9).

- Issuer: PHOENIX PIB Dutch Finance BV (Maarssen, Netherlands) | Coupon: 2.38% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2212959352 | OAS up by 33.2 bp to 194.2 bp, with the yield to worst at 4.2% and the bond now trading down to 94.2 cents on the dollar (1Y price range: 90.8-102.6).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.75% | Maturity: 12/10/2025 | Rating: BB+ | ISIN: DE000A289Q91 | OAS up by 32.2 bp to 174.2 bp, with the yield to worst at 4.4% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 90.2-106.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | OAS up by 28.2 bp to 379.9 bp (CDS basis: -60.1bp), with the yield to worst at 6.3% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 87.1-102.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | OAS up by 22.5 bp to 254.8 bp (CDS basis: -7.4bp), with the yield to worst at 5.2% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 87.0-104.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | OAS up by 21.0 bp to 258.9 bp (CDS basis: -6.3bp), with the yield to worst at 5.2% and the bond now trading down to 91.6 cents on the dollar (1Y price range: 86.0-104.8).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | OAS up by 20.1 bp to 204.2 bp (CDS basis: 21.5bp), with the yield to worst at 4.7% and the bond now trading down to 92.9 cents on the dollar (1Y price range: 87.9-100.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.25% | Maturity: 24/6/2025 | Rating: BB | ISIN: FR0013428414 | OAS up by 19.2 bp to 222.5 bp (CDS basis: -35.6bp), with the yield to worst at 4.9% and the bond now trading down to 91.2 cents on the dollar (1Y price range: 86.3-98.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.25% | Maturity: 15/9/2025 | Rating: BB | ISIN: XS2229875989 | OAS up by 17.2 bp to 250.3 bp (CDS basis: -8.2bp), with the yield to worst at 5.2% and the bond now trading down to 94.9 cents on the dollar (1Y price range: 89.7-107.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS up by 14.0 bp to 341.6 bp (CDS basis: 3.4bp), with the yield to worst at 6.0% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 86.8-103.1).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | OAS down by 13.7 bp to 451.0 bp (CDS basis: 64.0bp), with the yield to worst at 6.6% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 83.8-100.0).

- Issuer: Bper Banca SpA (Modena, Italy) | Coupon: 1.88% | Maturity: 7/7/2025 | Rating: BB+ | ISIN: XS2190502323 | OAS down by 14.7 bp to 229.0 bp, with the yield to worst at 5.0% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 89.3-101.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS down by 17.0 bp to 413.8 bp, with the yield to worst at 6.5% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 83.5-100.4).

- Issuer: illimity Bank SpA (Milan, Italy) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS down by 23.4 bp to 364.3 bp, with the yield to worst at 6.3% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 99.7-101.0).

RECENT DOMESTIC USD BOND ISSUES

- Axon Enterprise Inc (Industrials - Other | Scottsdale, Arizona, United States | Rating: NR): US$600m Bond (US05464CAA99), fixed rate (0.50% coupon) maturing on 15 December 2027, priced at 100.00, non callable, convertible

- Brandywine Operating Partnership LP (Service - Other | Philadelphia, Pennsylvania, United States | Rating: BBB-): US$350m Senior Note (US105340AR47), fixed rate (7.55% coupon) maturing on 15 March 2028, priced at 99.06 (original spread of 403 bp), callable (5nc5)

- Chart Industries Inc (Machinery | Ball Ground, United States | Rating: B+): US$350m Depositary Share of Preferred Stock (US16115Q4073), fixed rate (6.75% coupon) maturing on 15 December 2025, priced at 100.00, non callable, convertible

- Chart Industries Inc (Machinery | Ball Ground, Georgia, United States | Rating: B+): US$510m Senior Note (US16115QAG55), fixed rate (9.50% coupon) maturing on 1 January 2031, priced at 97.95 (original spread of 634 bp), callable (8nc3)

- Chart Industries Inc (Machinery | Ball Ground, Georgia, United States | Rating: B+): US$1,460m Note (US16115QAF72), fixed rate (7.50% coupon) maturing on 1 January 2030, priced at 98.66 (original spread of 424 bp), callable (7nc3)

- Chefs' Warehouse Inc (Retail Stores - Food/Drug | Ridgefield, Connecticut, United States | Rating: B): US$250m Bond (US163086AD32), fixed rate (2.38% coupon) maturing on 15 December 2028, priced at 100.00, non callable, convertible

- Duke Energy Corp (Utility - Other | Charlotte, North Carolina, United States | Rating: BBB): US$500m Senior Note (US26441CBW47), fixed rate (5.00% coupon) maturing on 8 December 2027, priced at 99.89 (original spread of 123 bp), callable (5nc5)

- Duke Energy Corp (Utility - Other | Charlotte, North Carolina, United States | Rating: BBB): US$500m Senior Note (US26441CBV63), fixed rate (5.00% coupon) maturing on 8 December 2025, priced at 99.97 (original spread of 91 bp), with a make whole call

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, United States | Rating: BBB-): US$1,500m Senior Note (US29273VAQ32), fixed rate (5.75% coupon) maturing on 15 February 2033, priced at 99.89 (original spread of 215 bp), callable (10nc10)

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, United States | Rating: BBB-): US$1,000m Senior Note (US29273VAP58), fixed rate (5.55% coupon) maturing on 15 February 2028, priced at 99.97 (original spread of 175 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$175m Bond (US3133EN4D99), floating rate (PRQ + -295.0 bp) maturing on 16 December 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EN4E72), floating rate (FFQ + 18.0 bp) maturing on 16 December 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$160m Bond (US3133EN4B34), fixed rate (4.25% coupon) maturing on 13 June 2025, priced at 99.92 (original spread of 19 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$130m Bond (US3133EN3Y46), fixed rate (5.33% coupon) maturing on 14 June 2027, priced at 100.00 (original spread of 162 bp), callable (5nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$250m Bond (US3133EN3X62), floating rate (SOFR + 21.0 bp) maturing on 12 December 2024, priced at 100.00, callable (2nc2)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: NR): US$300m Unsecured Note (US3134GYAC68), fixed rate (5.40% coupon) maturing on 23 December 2024, priced at 100.00, callable (2nc6m)

- Lantheus Holdings Inc (Pharmaceuticals | North Billerica, Massachusetts, United States | Rating: NR): US$575m Bond (US516544AA14), fixed rate (2.63% coupon) maturing on 15 December 2027, priced at 100.00, non callable, convertible

- Marriott Vacations Worldwide Corp (Lodging | Orlando, Florida, United States | Rating: BB-): US$575m Bond (US57164YAE77), fixed rate (3.25% coupon) maturing on 15 December 2027, priced at 100.00, non callable, convertible

- National Rural Utilities Cooperative Finance Corp (Financial - Other | Dulles, United States | Rating: A-): US$400m Senior Note (US63743HFG20), fixed rate (4.80% coupon) maturing on 15 March 2028, priced at 99.83 (original spread of 120 bp), callable (5nc5)

- Nextera Energy Partners LP (Utility - Other | Juno Beach, Florida, United States | Rating: BB): US$500m Bond (US65341BAG14), fixed rate (2.50% coupon) maturing on 15 June 2026, priced at 97.00, non callable, convertible

- Uniti Group Inc (Real Estate Investment Trust | Little Rock, Arkansas, United States | Rating: B-): US$300m Bond (US91325VAA61), fixed rate (7.50% coupon) maturing on 1 December 2027, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$200m Certificate of Deposit (XS2566147232), floating rate maturing on 13 December 2024, priced at 100.00, non callable

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$200m Certificate of Deposit (XS2565661845), floating rate maturing on 12 December 2024, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$250m Unsecured Note (XS2567587683), fixed rate (1.00% coupon) maturing on 17 December 2025, priced at 100.00, non callable

- EZCORP Inc (Financial - Other | Austin, Texas | Rating: NR): US$200m Bond (US302301AG16), fixed rate (3.75% coupon) maturing on 15 December 2029, priced at 100.00, non callable, convertible

- Export-Import Bank of China (Agency | Beijing, China (Mainland) | Rating: A+): US$340m Unsecured Note (XS2568297621), fixed rate (4.00% coupon) maturing on 16 December 2024, priced at 100.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): US$2,000m Bond (RU000A105KU0), fixed rate (2.95% coupon) maturing on 27 January 2029, priced at 100.00, non callable

- Herbalife Nutrition Ltd (Food Processors | George Town, Cayman Islands | Rating: B+): US$250m Bond (US42703MAE30), fixed rate (4.25% coupon) maturing on 15 June 2028, priced at 100.00, non callable, convertible

- Jones Deslauriers Insurance Management Inc (Financial - Other | Mississauga, Ontario, Canada | Rating: CCC): US$300m Senior Note (US48020RAA32), fixed rate (10.50% coupon) maturing on 15 December 2030, priced at 97.38 (original spread of 747 bp), callable (8nc3)

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): US$1,250m Covered Bond (Other) (USC7976PAG12), fixed rate (4.78% coupon) maturing on 12 December 2025, priced at 100.00 (original spread of 73 bp), non callable

- Spica Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$700m Unsecured Note (XS2567007609), floating rate maturing on 16 December 2027, priced at 100.00, non callable

RECENT EUR BOND ISSUES

- 888 Acquisitions Ltd (Financial - Other | Gibraltar | Rating: NR): €150m Note (XS2566317843), floating rate (EU03MLIB + 550.0 bp) maturing on 15 July 2028, priced at 87.00, callable (6nc7m)

- 888 Acquisitions Ltd (Financial - Other | Gibraltar | Rating: B): €182m Note (XS2566349887), fixed rate (7.56% coupon) maturing on 15 July 2027, priced at 84.50, callable (5nc2)

- Alpha Bank SA (Financial - Other | Athina, Attiki, Greece | Rating: B+): €450m Note (XS2562213145), fixed rate (7.50% coupon) maturing on 16 June 2027, priced at 99.33 (original spread of 587 bp), callable (5nc4)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €120m Unsecured Note (XS2442159716) zero coupon maturing on 31 March 2028, priced at 100.00, non callable

- Credit Agricole Corporate and Investment Bank SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €330m Unsecured Note (XS2395300440), floating rate maturing on 15 December 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U9N7), floating rate (HICPEXTM + 0.0 bp) maturing on 24 January 2029, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A322E2), fixed rate (3.15% coupon) maturing on 15 December 2025, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A322F9), fixed rate (3.25% coupon) maturing on 15 December 2027, priced at 100.00, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €6,548m Senior Note (EU000A3K4D09), fixed rate (2.75% coupon) maturing on 4 December 2037, priced at 99.80 (original spread of 87 bp), non callable

- Iliad SA (Cable/Media | Paris, Ile-De-France, France | Rating: BB): €750m Senior Note (FR001400EJI5), fixed rate (5.38% coupon) maturing on 14 June 2027, priced at 100.00 (original spread of 348 bp), callable (5nc4)

- Intrum AB (Service - Other | Stockholm, Stockholm, Sweden | Rating: BB): €450m Senior Note (XS2566291865), fixed rate (9.25% coupon) maturing on 15 March 2028, priced at 97.02 (original spread of 827 bp), callable (5nc2)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB37GZ6), fixed rate (2.25% coupon) maturing on 9 January 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB37GY9), fixed rate (2.20% coupon) maturing on 9 January 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB37GT9), fixed rate (2.55% coupon) maturing on 9 January 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000LB37GS1), fixed rate (2.40% coupon) maturing on 9 January 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AAA): €975m Oeffenlicher Pfandbrief (Covered Bond) (DE000HLB42X9), floating rate (EU06MLIB + 3.0 bp) maturing on 9 December 2024, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7B22), fixed rate (3.00% coupon) maturing on 12 July 2028, priced at 100.00, callable (6nc2)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7B89), fixed rate (1.90% coupon) maturing on 13 January 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000HLB7B97), fixed rate (2.60% coupon) maturing on 20 July 2026, priced at 100.00, callable (3nc2)

- Landsbankinn hf (Banking | Reykjavik, Iceland | Rating: BBB): €250m Unsecured Note (XS2566125006) zero coupon maturing on 9 December 2025, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): €1,250m Senior Note (XS2565831943), fixed rate (3.63% coupon) maturing on 13 December 2029, priced at 100.00 (original spread of 182 bp), non callable

RECENT LOANS

- Aircastle Ltd (United States of America | BBB-), signed a US$ 450m Revolving Credit / Term Loan, to be used for general corporate purposes, working capital, and aircraft financing. It matures on 11/30/29.

- Altice France SA (France | B), signed a US$ 910m Term Loan, to be used for general corporate purposes. It matures on 10/02/27 and initial pricing is set at Term SOFR +500.0bp

- Altice France SA (France | B), signed a € 400m Term Loan B, to be used for general corporate purposes. It matures on 10/05/27 and initial pricing is set at EURIBOR +500.0bp

- Altice France SA (France | B), signed a US$ 910m Term Loan B, to be used for general corporate purposes. It matures on 10/05/27 and initial pricing is set at Term SOFR +500.0bp

- Anhui Conch Cement Co Ltd (China | A), signed a US$ 1,000m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 12/02/25.

- Archer Daniels Midland Co (United States of America | A), signed a US$ 1,500m 364d Revolver, to be used for general corporate purposes. It matures on 12/01/23 and initial pricing is set at Term SOFR +87.5bp

- Archer Daniels Midland Co (United States of America | A), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/01/27 and initial pricing is set at LIBOR +87.5bp

- Archer Daniels Midland Co (United States of America | A), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/01/25 and initial pricing is set at Term SOFR +87.5bp

- Axalta Coat Sys Dutch Hldg B (Netherlands | BB-), signed a US$ 2,000m Term Loan B, to be used for general corporate purposes. It matures on 12/07/29 and initial pricing is set at Term SOFR +300.0bp

- BJ's Wholesale Club Inc (United States of America | BBB-), signed a US$ 450m Term Loan B, to be used for general corporate purposes. It matures on 02/08/27 and initial pricing is set at Term SOFR +275.0bp

- Comstock Resources Inc (United States of America | B+), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/15/27.

- Concessoc 31 Sas (Mexico), signed a US$ 2,375m Term Loan, to be used for acquisition financing. It matures on 12/07/25.

- Concessoc 31 Sas (Mexico), signed a US$ 2,375m Term Loan, to be used for acquisition financing. It matures on 12/07/27.

- Concessoc 31 Sas (Mexico), signed a US$ 4,000m Term Loan, to be used for acquisition financing. It matures on 12/07/32.

- Cp St Pete LLC (United States of America), signed a US$ 104m Term Loan, to be used for acquisition financing. It matures on 12/01/25.

- Danish Agro AMBA (Denmark), signed a € 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/30/25.

- Dexko Global Inc (United States of America | CCC), signed a US$ 225m Term Loan B, to be used for refin/ret bank debt. It matures on 10/04/28 and initial pricing is set at Term SOFR +650.0bp

- Eagle Bidco Ltd (United Kingdom | B-), signed a € 105m Term Loan B, to be used for general corporate purposes. It matures on 03/21/28 and initial pricing is set at EURIBOR +375.0bp

- Elemental Royalties Corp (Canada), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/01/25.

- Fonds De Garantie Des Depots (Luxembourg), signed a € 1,000m Term Loan, to be used for general corporate purposes. It matures on 01/00/00.

- GPIM (United States of America), signed a US$ 785m Term Loan B, to be used for general corporate purposes. It matures on 12/06/29 and initial pricing is set at Term SOFR +325.0bp

- Gomez Inc (United States of America), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/02/27 and initial pricing is set at Term SOFR +175.0bp

- Intel Corp (United States of America | A+), signed a US$ 5,000m 364d Revolver, to be used for general corporate purposes. It matures on 11/29/23 and initial pricing is set at Term SOFR +62.5bp

- John Wiley & Sons Inc (United States of America), signed a US$ 185m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/30/24.

- John Wiley & Sons Inc (United States of America), signed a US$ 1,115m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/30/27.

- John Wiley & Sons Inc (United States of America), signed a US$ 200m Term Loan A, to be used for general corporate purposes. It matures on 11/30/27.

- Johnson Controls Inc (United States of America | BBB), signed a US$ 500m 364d Revolver, to be used for general corporate purposes. It matures on 11/30/23 and initial pricing is set at Term SOFR +112.5bp

- Koninklijke BAM Groep NV (Netherlands), signed a € 330m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/01/26.

RECENT STRUCTURED CREDIT

- Exeter Automobile Receivables Trust 2022-6 issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 593 m. Highest-rated tranche offering a yield to maturity of 4.46%, and the lowest-rated tranche a yield to maturity of 11.61%. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc