Credit

2022 Was A Pretty Grim Year Across The Credit Complex, With Most Of The Damage Coming From Rates

Corporate bond issuance is pretty much done for the year: just 1 tranche for $3bn in IG this week (2022 YTD volume $1.211tn vs 2021 YTD $1.487tn, down 18.6% YoY) and no new pricing in HY (2022 YTD volume $101.971bn vs 2021 YTD $461.811bn, down -77.9% YoY)

Published ET

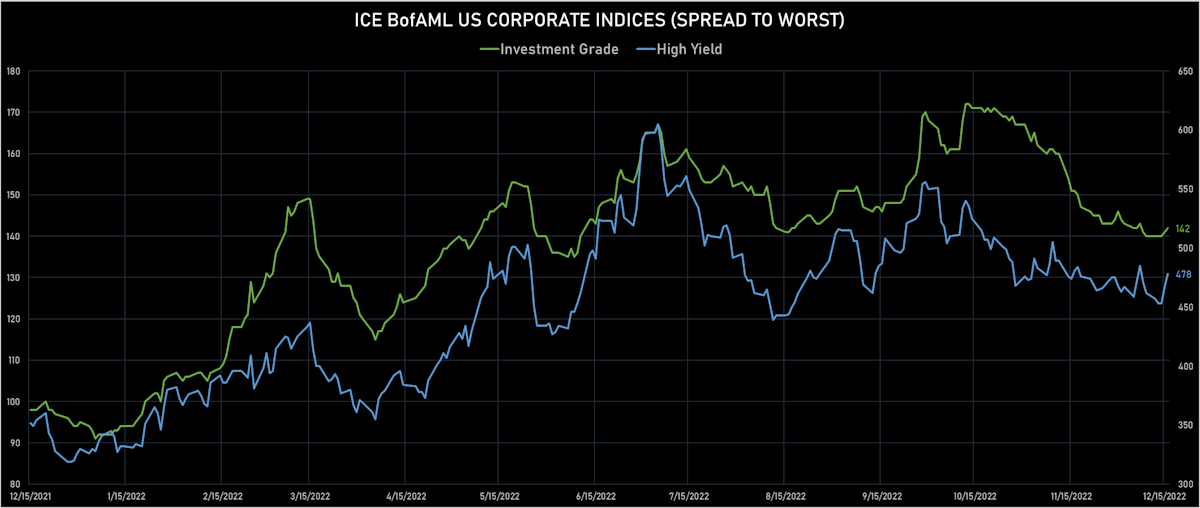

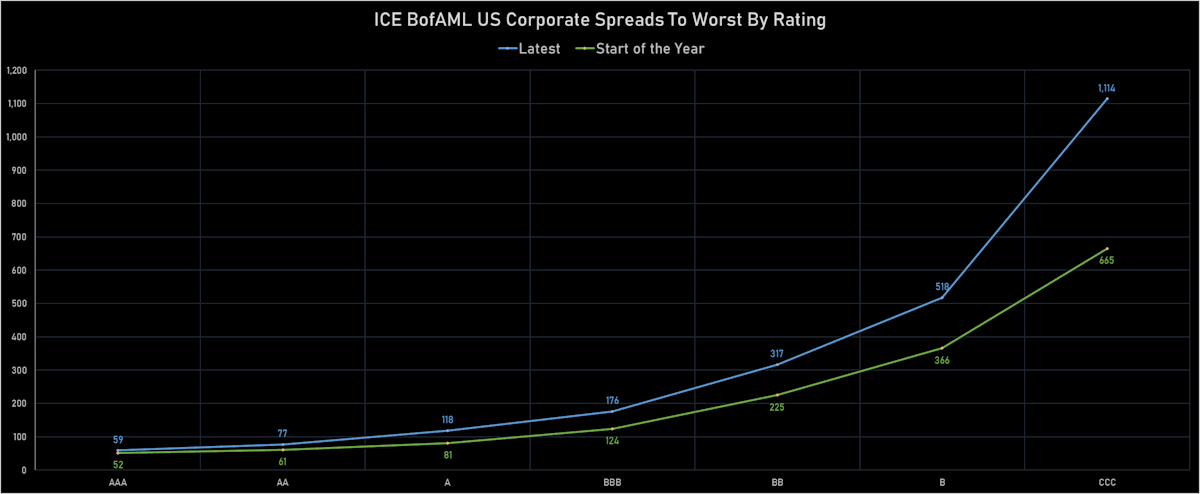

ICE BofAML US Corporate Spreads To Worst By Rating | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.42% today, with investment grade down -0.41% and high yield down -0.45% (YTD total return: -12.66%)

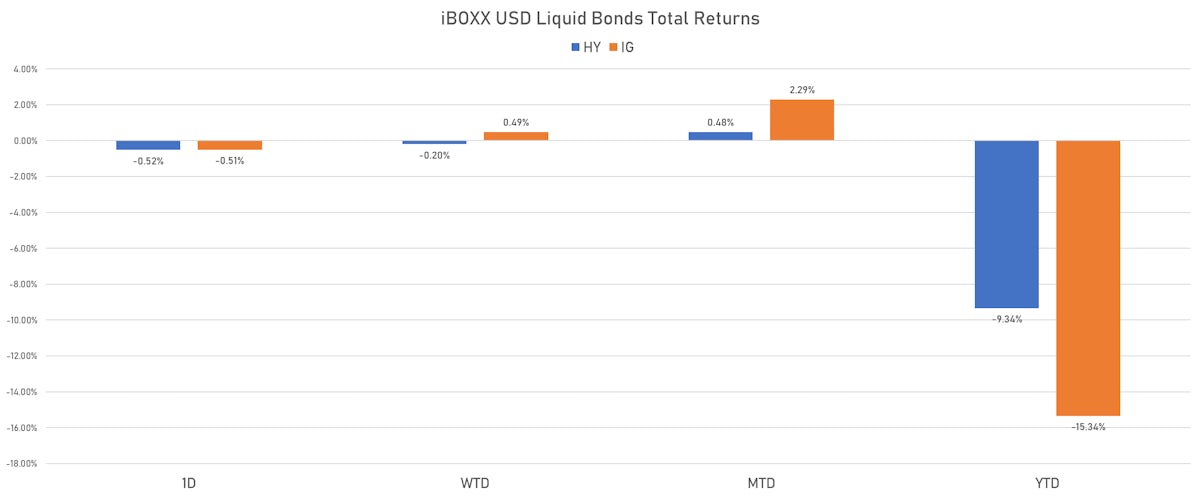

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.510% today (Week-to-date: 0.49%; Month-to-date: 2.29%; Year-to-date: -15.34%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.524% today (Week-to-date: -0.20%; Month-to-date: 0.48%; Year-to-date: -9.34%)

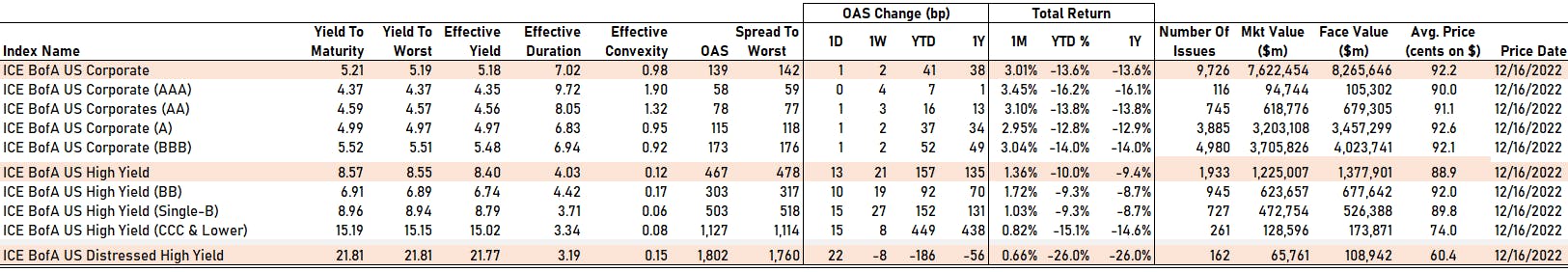

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 142.0 bp (YTD change: +47.0 bp)

- ICE BofA US High Yield Index spread to worst up 11.0 bp, now at 478.0 bp (YTD change: +148.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.17% today (YTD total return: -0.8%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 58 bp

- AA up by 1 bp at 78 bp

- A up by 1 bp at 115 bp

- BBB up by 1 bp at 173 bp

- BB up by 10 bp at 303 bp

- B up by 15 bp at 503 bp

- ≤ CCC up by 15 bp at 1,127 bp

CDS INDICES TODAY (mid-spreads)

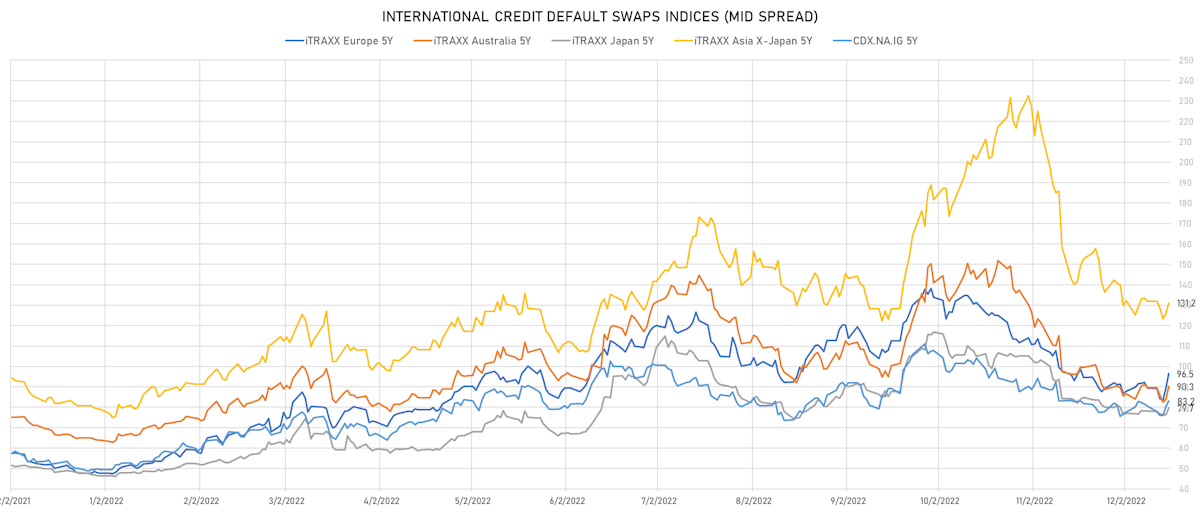

- Markit CDX.NA.IG 5Y up 2.7 bp, now at 83bp (1W change: +2.6bp; YTD change: +33.8bp)

- Markit CDX.NA.IG 10Y up 2.2 bp, now at 119bp (1W change: +2.5bp; YTD change: +30.2bp)

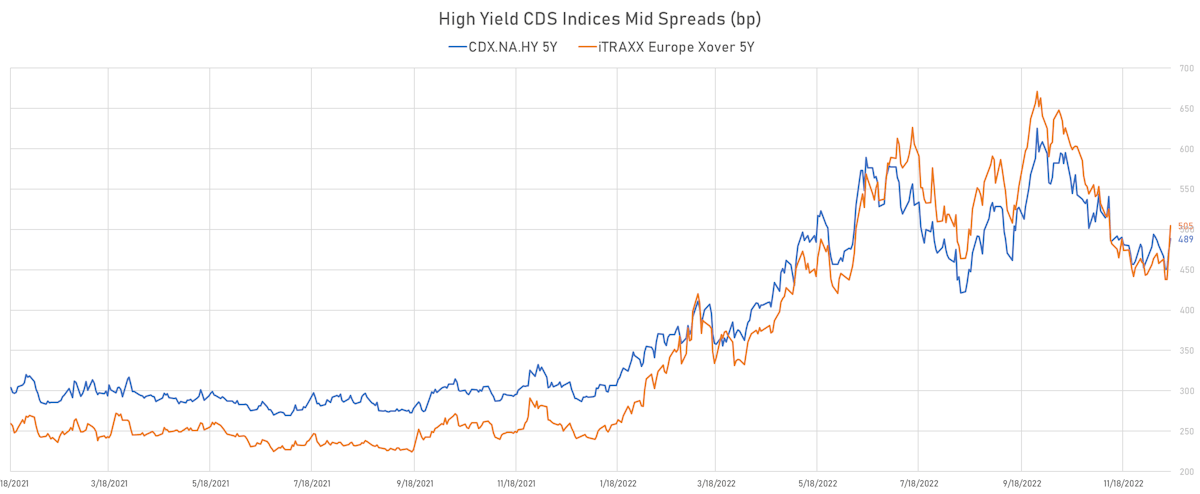

- Markit CDX.NA.HY 5Y up 14.8 bp, now at 489bp (1W change: +8.8bp; YTD change: +196.7bp)

- Markit iTRAXX Europe 5Y up 6.8 bp, now at 97bp (1W change: +7.2bp; YTD change: +48.8bp)

- Markit iTRAXX Europe Crossover 5Y up 35.6 bp, now at 505bp (1W change: +46.9bp; YTD change: +262.5bp)

- Markit iTRAXX Japan 5Y up 3.3 bp, now at 80bp (1W change: +1.5bp; YTD change: +33.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 5.0 bp, now at 131bp (1W change: -0.7bp; YTD change: +52.1bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Rite Aid Corp (Country: US; rated: D): down 15156.2 bp to .0bp (1Y range: -3,892bp)

- Community Health Systems Inc (Country: US; rated: B): down 785.2 bp to 5,388.2bp (1Y range: 590-5,388bp)

- Staples Inc (Country: US; rated: B3): down 220.8 bp to 1,746.5bp (1Y range: 985-1,986bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 90.8 bp to 1,083.7bp (1Y range: 616-1,472bp)

- Pitney Bowes Inc (Country: US; rated: B-): down 83.4 bp to 847.8bp (1Y range: 462-1,783bp)

- Lumen Technologies Inc (Country: US; rated: WR): down 72.0 bp to 981.0bp (1Y range: 195-981bp)

- MBIA Inc (Country: US; rated: CCC-): down 35.2 bp to 291.4bp (1Y range: 291-534bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): up 45.1 bp to 545.4bp (1Y range: 395-772bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): up 55.7 bp to 758.8bp (1Y range: 360-1,584bp)

- Macy's Inc (Country: US; rated: A1): up 66.5 bp to 416.6bp (1Y range: 212-619bp)

- American Airlines Group Inc (Country: US; rated: B2): up 82.9 bp to 1,260.1bp (1Y range: 607-1,644bp)

- Gap Inc (Country: US; rated: Ba2): up 94.9 bp to 576.6bp (1Y range: 208-819bp)

- Nordstrom Inc (Country: US; rated: A3): up 119.7 bp to 705.8bp (1Y range: 321-706bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 225.2 bp to 1,980.2bp (1Y range: 443-1,980bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 245.7 bp to 1,697.4bp (1Y range: 393-2,117bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 87.7 bp to 1,098.4bp (1Y range: 612-1,725bp)

- Novafives SAS (Country: FR; rated: Caa1): down 22.4 bp to 1,070.8bp (1Y range: 618-2,936bp)

- Telecom Italia SpA (Country: IT; rated: BB-): down 17.5 bp to 444.3bp (1Y range: 233-545bp)

- Credit Suisse Group AG (Country: CH; rated: A+): down 11.8 bp to 394.0bp (1Y range: 56-442bp)

- Abertis Infraestructuras SA (Country: ES; rated: WD): down 8.3 bp to 117.1bp (1Y range: 70-203bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): down 8.3 bp to 490.7bp (1Y range: 207-705bp)

- Air France KLM SA (Country: FR; rated: C): up 7.3 bp to 699.6bp (1Y range: 403-990bp)

- Schweizerische Rueckversicherungs Gesellschaft AG (Country: CH; rated: Aa3): up 7.5 bp to 64.9bp (1Y range: 37-118bp)

- Lagardere SA (Country: FR; rated: A3): up 11.0 bp to 93.6bp (1Y range: 94-350bp)

- Stena AB (Country: SE; rated: B2-PD): up 11.6 bp to 642.9bp (1Y range: 402-865bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 12.7 bp to 280.0bp (1Y range: 134-420bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 14.3 bp to 1,978.9bp (1Y range: 1,286-2,910bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 52.6 bp to 1,022.7bp (1Y range: 359-1,296bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): up 83.0 bp to 709.0bp (1Y range: 370-758bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): up 201.7 bp to 3,597.2bp (1Y range: 595-4,917bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Diversified Healthcare Trust (Newton, Massachusetts (US)) | Coupon: 4.75% | Maturity: 15/2/2028 | Rating: CCC+ | CUSIP: 81721MAM1 | OAS up by 379.4 bp to 1,383.2 bp, with the yield to worst at 17.2% and the bond now trading down to 57.6 cents on the dollar (1Y price range: 57.6-99.8).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | CUSIP: 983130AV7 | OAS up by 95.1 bp to 298.8 bp, with the yield to worst at 7.2% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 90.0-103.5).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | CUSIP: 109641AH3 | OAS up by 80.2 bp to 322.8 bp, with the yield to worst at 7.3% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS up by 63.3 bp to 201.2 bp, with the yield to worst at 5.9% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 90.8-103.6).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 5.00% | Maturity: 1/2/2024 | Rating: B- | CUSIP: 910047AH2 | OAS up by 61.3 bp to 147.8 bp, with the yield to worst at 5.5% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 95.0-103.6).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS up by 58.1 bp to 217.1 bp, with the yield to worst at 6.1% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 92.8-104.0).

- Issuer: Owens & Minor Inc (Mechanicsville, Virginia (US)) | Coupon: 4.38% | Maturity: 15/12/2024 | Rating: BB- | CUSIP: 690732AE2 | OAS up by 52.3 bp to 209.8 bp, with the yield to worst at 6.1% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 94.5-106.6).

- Issuer: Western Midstream Operating LP (The Woodlands, Texas (US)) | Coupon: 3.95% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 958254AE4 | OAS up by 51.4 bp to 180.6 bp, with the yield to worst at 6.0% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 93.0-104.5).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 3.50% | Maturity: 15/12/2024 | Rating: BB+ | CUSIP: 343412AC6 | OAS up by 44.7 bp to 77.6 bp, with the yield to worst at 5.2% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 93.5-104.6).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS up by 39.3 bp to 129.9 bp (CDS basis: 63.7bp), with the yield to worst at 5.8% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 90.0-102.3).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS up by 36.7 bp to 147.6 bp (CDS basis: -1.9bp), with the yield to worst at 5.1% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 93.1-109.8).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.55% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 674599DC6 | OAS up by 31.4 bp to 116.4 bp (CDS basis: -14.9bp), with the yield to worst at 5.0% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 98.6-111.3).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 5.13% | Maturity: 1/10/2024 | Rating: BB+ | CUSIP: 013817AW1 | OAS up by 30.2 bp to 70.2 bp, with the yield to worst at 4.9% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 96.0-108.0).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 6.95% | Maturity: 1/7/2024 | Rating: BB+ | CUSIP: 674599DB8 | OAS up by 29.8 bp to 103.6 bp (CDS basis: -16.3bp), with the yield to worst at 5.1% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 101.1-110.9).

- Issuer: iStar Inc (New York City, New York (US)) | Coupon: 4.25% | Maturity: 1/8/2025 | Rating: BB | CUSIP: 45031UCG4 | OAS up by 26.1 bp to 83.0 bp, with the yield to worst at 4.8% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 91.3-102.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 4.25% | Maturity: 31/5/2028 | Rating: BB+ | ISIN: XS2486825669 | OAS up by 43.9 bp to 308.5 bp, with the yield to worst at 5.8% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 85.8-100.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | OAS up by 43.3 bp to 469.4 bp, with the yield to worst at 7.4% and the bond now trading down to 86.2 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | OAS up by 28.6 bp to 478.0 bp, with the yield to worst at 7.6% and the bond now trading down to 79.3 cents on the dollar (1Y price range: 77.1-92.0).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.50% | Maturity: 7/10/2027 | Rating: BB+ | ISIN: XS2240978085 | OAS up by 26.1 bp to 238.5 bp, with the yield to worst at 5.2% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 82.0-108.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | OAS down by 26.0 bp to 330.3 bp, with the yield to worst at 6.2% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 71.8-100.7).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | OAS down by 26.9 bp to 440.7 bp, with the yield to worst at 7.2% and the bond now trading up to 78.1 cents on the dollar (1Y price range: 65.7-91.3).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | OAS down by 27.2 bp to 242.8 bp, with the yield to worst at 5.0% and the bond now trading up to 85.5 cents on the dollar (1Y price range: 77.9-101.9).

- Issuer: Spie SA (Cergy-Pontoise, France) | Coupon: 2.63% | Maturity: 18/6/2026 | Rating: BB | ISIN: FR0013426376 | OAS down by 27.7 bp to 139.9 bp, with the yield to worst at 4.1% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 88.6-104.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS down by 28.2 bp to 366.4 bp (CDS basis: 57.2bp), with the yield to worst at 6.3% and the bond now trading up to 83.1 cents on the dollar (1Y price range: 76.4-98.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | OAS down by 29.9 bp to 350.0 bp (CDS basis: -45.0bp), with the yield to worst at 6.2% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 87.1-102.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS down by 31.4 bp to 350.6 bp (CDS basis: -5.0bp), with the yield to worst at 6.3% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 84.2-102.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | OAS down by 32.1 bp to 450.7 bp, with the yield to worst at 7.3% and the bond now trading up to 81.8 cents on the dollar (1Y price range: 66.6-99.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS down by 32.5 bp to 309.1 bp (CDS basis: 21.5bp), with the yield to worst at 5.8% and the bond now trading up to 92.2 cents on the dollar (1Y price range: 86.8-103.1).

- Issuer: Hornbach Baumarkt AG (Bornheim, Germany) | Coupon: 3.25% | Maturity: 25/10/2026 | Rating: BB+ | ISIN: DE000A255DH9 | OAS down by 33.7 bp to 224.2 bp, with the yield to worst at 5.1% and the bond now trading up to 93.2 cents on the dollar (1Y price range: 87.9-108.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS down by 34.5 bp to 305.5 bp (CDS basis: 57.2bp), with the yield to worst at 5.8% and the bond now trading up to 92.7 cents on the dollar (1Y price range: 85.3-105.3).

RECENT DOMESTIC USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EN4S68), fixed rate (3.75% coupon) maturing on 22 December 2027, priced at 100.00 (original spread of 10 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$195m Bond (US3133EN4K33), fixed rate (5.33% coupon) maturing on 20 December 2027, priced at 100.00 (original spread of 173 bp), callable (5nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EN4U15), floating rate (FFQ + 18.0 bp) maturing on 23 December 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$700m Bond (US3133EN4J69), floating rate (SOFR + 18.0 bp) maturing on 19 December 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$400m Bond (US3133EN4N71), fixed rate (4.25% coupon) maturing on 20 December 2024, priced at 99.82 (original spread of 7 bp), non callable

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$3,000m Senior Note (US46647PDM59), floating rate maturing on 15 December 2025, priced at 100.00 (original spread of 85 bp), callable (3nc2)

- Novavax Inc (Pharmaceuticals | Gaithersburg, Maryland, United States | Rating: NR): US$150m Bond (US670002AC87), fixed rate (5.00% coupon) maturing on 15 December 2027, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- Bank of Montreal (Toronto Branch) (Banking | Toronto, Ontario, Canada | Rating: NR): US$130m Unsecured Note (XS2568709245) zero coupon maturing on 28 December 2037, priced at 100.00, non callable

- CNCBINV 1 (BVI) Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$270m Unsecured Note (XS2568509827) maturing on 20 June 2025, priced at 100.00, non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$500m Unsecured Note (XS2569071439) maturing on 2 February 2028, priced at 100.00, non callable

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AAA): US$200m Senior Note (HK0000895778), fixed rate (4.96% coupon) maturing on 17 November 2025, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): US$200m Unsecured Note (XS2569094050), fixed rate (3.88% coupon) maturing on 31 December 2025, priced at 100.00, non callable

- Sumitomo Mitsui Banking Corp (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$150m Unsecured Note (XS2564925555), fixed rate (4.67% coupon) maturing on 22 December 2027, priced at 100.00, non callable

- UBS Bank USA (Banking | Salt Lake City, Switzerland | Rating: A+): US$200m Certificate of Deposit - Retail (US90348J7R57), fixed rate (4.75% coupon) maturing on 16 December 2024, priced at 100.00 (original spread of 77 bp), non callable