Credit

Limited Upside In Rates And Attractive Carry Have Pushed Flows Into USD Credit, Though Spreads Are Likely To Widen This Year

Solid start for investment grade issuance: 106 tranches for $94.1bn in IG in the first couple of weeks of 2023 (vs 2022 YTD $107.1bn), 7 tranches for $5bn in HY (vs 2022 YTD $11.815bn)

Published ET

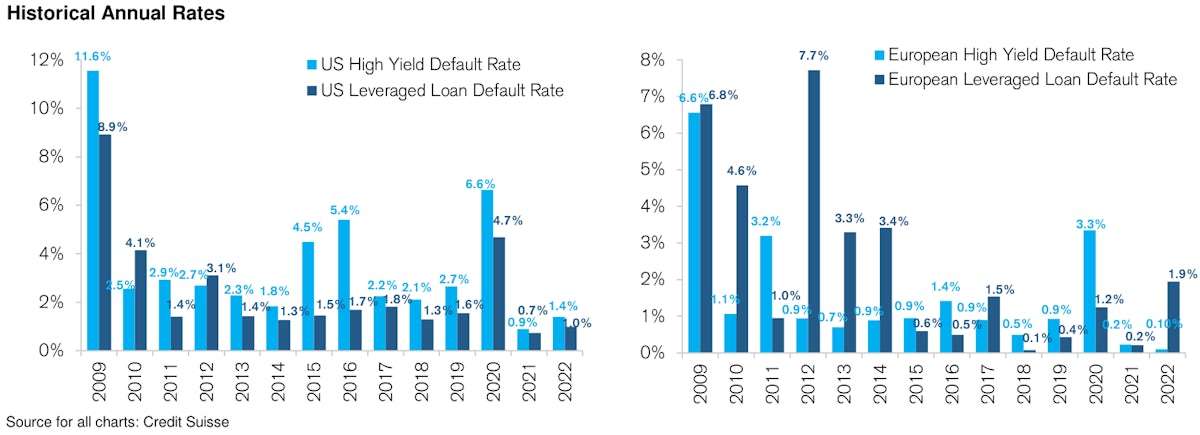

Historical Annual HY Default Rates | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was down -0.26% today, with investment grade down -0.29% and high yield down -0.04% (YTD total return: +3.42%)

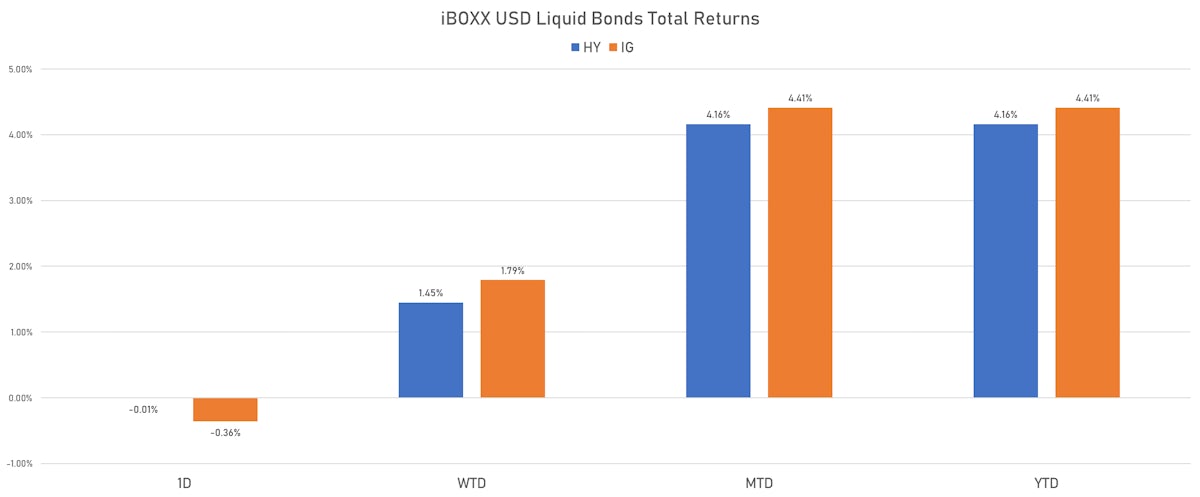

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.361% today (Week-to-date: 1.79%; Month-to-date: 4.41%; Year-to-date: 4.41%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.007% today (Week-to-date: 1.45%; Month-to-date: 4.16%; Year-to-date: 4.16%)

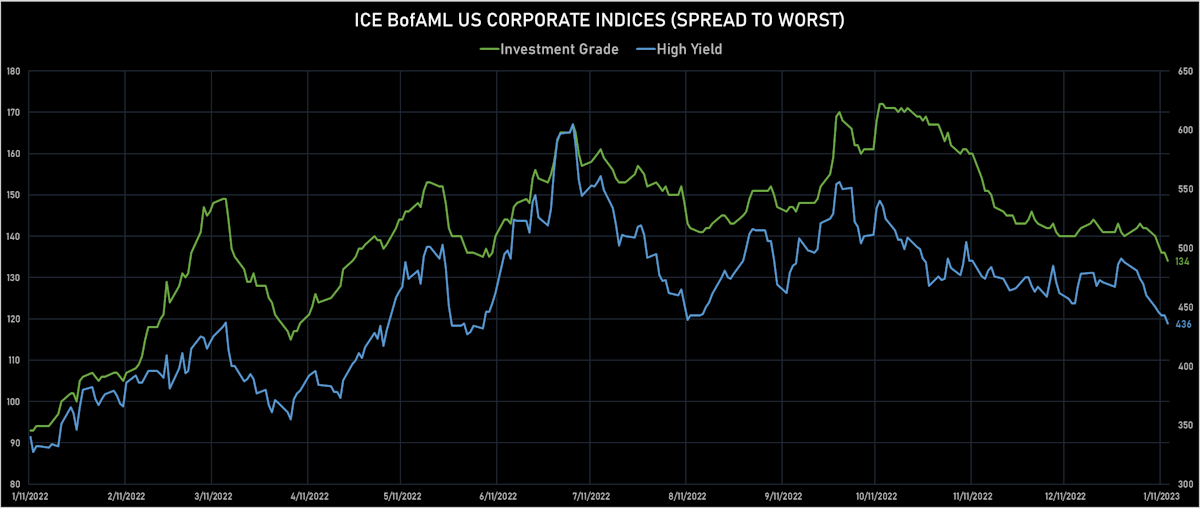

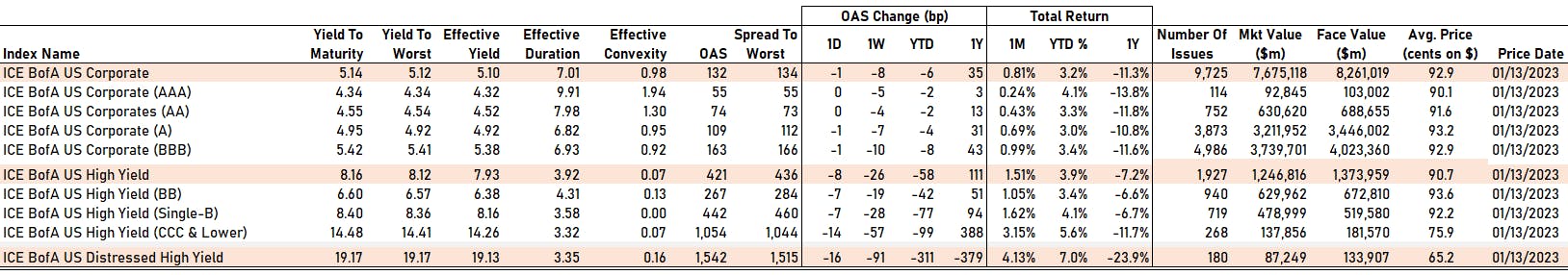

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 134.0 bp (YTD change: -6.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 436.0 bp (YTD change: -52.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.09% today (YTD total return: +2.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 55 bp

- AA unchanged at 74 bp

- A down by -1 bp at 109 bp

- BBB down by -1 bp at 163 bp

- BB down by -7 bp at 267 bp

- B down by -7 bp at 442 bp

- ≤ CCC down by -14 bp at 1,054 bp

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.3 bp, now at 70bp (1W change: -4.1bp; YTD change: -11.4bp)

- Markit CDX.NA.IG 10Y down 0.1 bp, now at 109bp (1W change: -2.9bp; YTD change: -9.3bp)

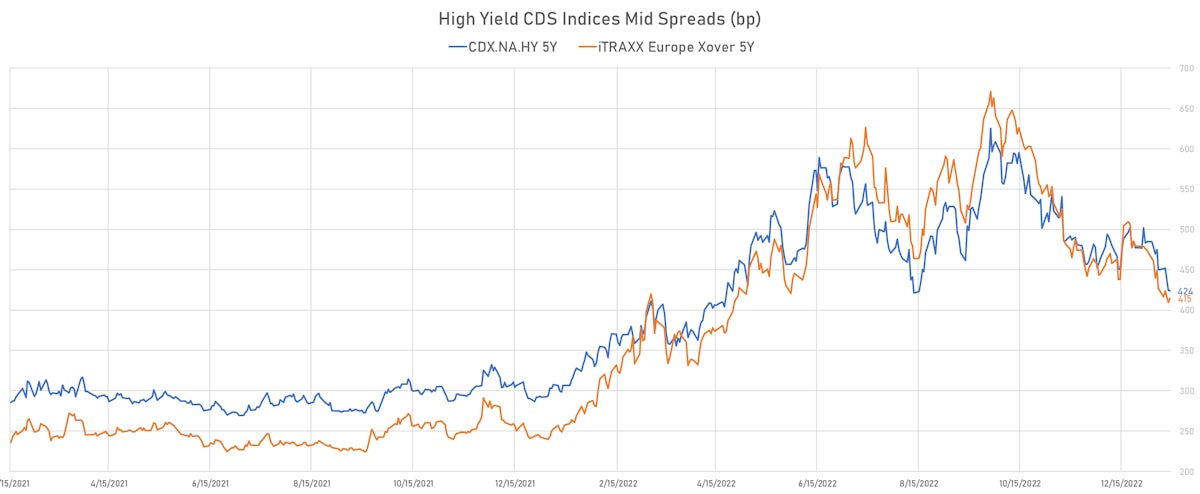

- Markit CDX.NA.HY 5Y down 0.8 bp, now at 424bp (1W change: -25.7bp; YTD change: -60.9bp)

- Markit iTRAXX Europe 5Y up 1.2 bp, now at 79bp (1W change: -2.5bp; YTD change: -11.0bp)

- Markit iTRAXX Europe Crossover 5Y up 5.1 bp, now at 415bp (1W change: -11.9bp; YTD change: -59.4bp)

- Markit iTRAXX Japan 5Y up 0.2 bp, now at 81bp (1W change: -4.6bp; YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.0 bp, now at 107bp (1W change: -10.4bp; YTD change: -26.0bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: B): down 891.0 bp to 2,861.0bp (1Y range: 590-4,371bp)

- Transocean Inc (Country: KY; rated: Caa1): down 318.0 bp to 922.7bp (1Y range: 784-2,858bp)

- American Airlines Group Inc (Country: US; rated: B2): down 243.9 bp to 923.1bp (1Y range: 607-1,644bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 221.2 bp to 1,137.8bp (1Y range: 393-2,117bp)

- Staples Inc (Country: US; rated: B3): down 161.0 bp to 1,696.4bp (1Y range: 985-1,986bp)

- Domtar Corp (Country: US; rated: NR): down 159.2 bp to 577.8bp (1Y range: 379-1,046bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 134.7 bp to 893.1bp (1Y range: 623-1,472bp)

- Tegna Inc (Country: US; rated: Ba3): down 92.4 bp to 498.9bp (1Y range: 182-786bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): down 81.1 bp to 548.4bp (1Y range: 396-772bp)

- Delta Air Lines Inc (Country: US; rated: A3): down 60.7 bp to 289.6bp (1Y range: 217-573bp)

- United States Steel Corp (Country: US; rated: BBB-): down 60.3 bp to 431.3bp (1Y range: 320-780bp)

- Macy's Inc (Country: US; rated: A1): down 57.2 bp to 393.6bp (1Y range: 243-619bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 55.1 bp to 653.0bp (1Y range: 368-1,584bp)

- Onemain Finance Corp (Country: US; rated: Ba2): down 54.1 bp to 419.9bp (1Y range: 121-1,042bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 188.7 bp to 2,739.6bp (1Y range: 452-2,740bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): down 650.3 bp to 3,140.6bp (1Y range: 615-4,917bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 407.7 bp to 1,574.1bp (1Y range: 1,286-2,910bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 246.2 bp to 1,080.2bp (1Y range: 566-1,739bp)

- TUI AG (Country: DE; rated: B3-PD): down 159.1 bp to 903.6bp (1Y range: 612-1,725bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 118.2 bp to 791.3bp (1Y range: 278-1,254bp)

- Novafives SAS (Country: FR; rated: Caa1): down 103.7 bp to 951.4bp (1Y range: 618-2,936bp)

- Air France KLM SA (Country: FR; rated: C): down 75.8 bp to 594.7bp (1Y range: 403-990bp)

- Stena AB (Country: SE; rated: B1-PD): down 63.5 bp to 530.1bp (1Y range: 406-865bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 55.1 bp to 803.4bp (1Y range: 401-1,021bp)

- Credit Suisse Group AG (Country: CH; rated: A+): down 53.8 bp to 328.3bp (1Y range: 59-442bp)

- Ceconomy AG (Country: DE; rated: BB): down 51.9 bp to 982.2bp (1Y range: 207-1,763bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 48.5 bp to 634.5bp (1Y range: 370-758bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 46.1 bp to 302.3bp (1Y range: 176-498bp)

- Renault SA (Country: FR; rated: Ba2): down 43.7 bp to 254.3bp (1Y range: 177-476bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 40.8 bp to 422.3bp (1Y range: 257-602bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 3.50% | Maturity: 15/12/2024 | Rating: BB+ | CUSIP: 343412AC6 | OAS down by 19.0 bp to 54.1 bp, with the yield to worst at 5.1% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 96.3-96.9).

- Issuer: iStar Inc (New York City, New York (US)) | Coupon: 4.25% | Maturity: 1/8/2025 | Rating: BB | CUSIP: 45031UCG4 | OAS down by 23.8 bp to 45.6 bp, with the yield to worst at 4.5% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 97.5-98.5).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS down by 47.4 bp to 84.9 bp (CDS basis: 51.0bp), with the yield to worst at 4.9% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 98.5-100.3).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS down by 49.3 bp to 103.0 bp (CDS basis: -19.2bp), with the yield to worst at 5.0% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 98.5-100.1).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.88% | Maturity: 1/9/2025 | Rating: BB+ | CUSIP: 674599EB7 | OAS down by 62.0 bp to 82.7 bp (CDS basis: -17.3bp), with the yield to worst at 4.8% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 99.5-101.4).

- Issuer: Kohls Corp (Menomonee Falls, Wisconsin (US)) | Coupon: 4.25% | Maturity: 17/7/2025 | Rating: BB | CUSIP: 500255AU8 | OAS down by 64.7 bp to 182.9 bp (CDS basis: 101.1bp), with the yield to worst at 6.2% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 93.6-95.8).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS down by 67.6 bp to 70.1 bp (CDS basis: 120.2bp), with the yield to worst at 5.3% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 94.4-95.8).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 5.00% | Maturity: 1/2/2024 | Rating: B- | CUSIP: 910047AH2 | OAS down by 72.0 bp to 92.6 bp, with the yield to worst at 5.0% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 98.3-98.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.13% | Maturity: 25/3/2024 | Rating: B+ | CUSIP: 78442FET1 | OAS down by 73.3 bp to 186.3 bp (CDS basis: -15.3bp), with the yield to worst at 5.9% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 98.3-98.8).

- Issuer: MGM Resorts International (Las Vegas, Nevada (US)) | Coupon: 5.75% | Maturity: 15/6/2025 | Rating: B+ | CUSIP: 552953CE9 | OAS down by 76.0 bp to 175.7 bp (CDS basis: 44.4bp), with the yield to worst at 5.8% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 96.9-98.9).

- Issuer: Under Armour Inc (Baltimore, Maryland (US)) | Coupon: 3.25% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 904311AA5 | OAS down by 78.8 bp to 209.3 bp, with the yield to worst at 5.8% and the bond now trading up to 91.3 cents on the dollar (1Y price range: 88.3-91.6).

- Issuer: Spirit AeroSystems Inc (Wichita, Kansas (US)) | Coupon: 3.85% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 85205TAG5 | OAS down by 91.0 bp to 180.4 bp, with the yield to worst at 5.5% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 90.5-93.9).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.13% | Maturity: 1/12/2024 | Rating: BB | CUSIP: 81211KAW0 | OAS down by 92.2 bp to 21.8 bp (CDS basis: 26.6bp), with the yield to worst at 4.6% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 98.4-100.1).

- Issuer: Las Vegas Sands Corp (Las Vegas, Nevada (US)) | Coupon: 3.20% | Maturity: 8/8/2024 | Rating: BB+ | CUSIP: 517834AG2 | OAS down by 109.7 bp to 88.2 bp, with the yield to worst at 5.7% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 94.5-95.5).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 4.35% | Maturity: 1/10/2024 | Rating: B | CUSIP: 44106MAZ5 | OAS down by 192.1 bp to 339.8 bp, with the yield to worst at 7.5% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 90.9-94.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS up by 23.5 bp to 613.5 bp (CDS basis: -111.5bp), with the yield to worst at 8.9% and the bond now trading down to 78.3 cents on the dollar (1Y price range: 77.8-78.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | OAS down by 23.8 bp to 395.3 bp, with the yield to worst at 6.7% and the bond now trading up to 80.1 cents on the dollar (1Y price range: 77.7-81.3).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | OAS down by 24.2 bp to 383.4 bp (CDS basis: 106.6bp), with the yield to worst at 6.4% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 89.9-90.9).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | OAS down by 27.4 bp to 405.6 bp, with the yield to worst at 6.8% and the bond now trading up to 79.5 cents on the dollar (1Y price range: 77.3-79.5).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | OAS down by 28.9 bp to 411.6 bp, with the yield to worst at 6.7% and the bond now trading up to 79.1 cents on the dollar (1Y price range: 75.4-79.7).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | OAS down by 30.4 bp to 354.2 bp, with the yield to worst at 6.3% and the bond now trading up to 83.6 cents on the dollar (1Y price range: 81.4-83.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB | ISIN: XS2265369657 | OAS down by 33.4 bp to 294.9 bp (CDS basis: -64.4bp), with the yield to worst at 5.6% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 89.7-91.6).

- Issuer: Standard Building Solutions Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | OAS down by 34.3 bp to 328.6 bp, with the yield to worst at 5.7% and the bond now trading up to 86.6 cents on the dollar (1Y price range: 84.3-86.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | OAS down by 42.4 bp to 391.3 bp, with the yield to worst at 6.7% and the bond now trading up to 82.2 cents on the dollar (1Y price range: 80.0-82.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS down by 43.6 bp to 285.1 bp (CDS basis: 127.3bp), with the yield to worst at 5.4% and the bond now trading up to 86.2 cents on the dollar (1Y price range: 83.4-86.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | OAS down by 49.3 bp to 327.0 bp, with the yield to worst at 6.0% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 85.9-88.2).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS down by 50.2 bp to 210.0 bp (CDS basis: 139.6bp), with the yield to worst at 4.8% and the bond now trading up to 95.4 cents on the dollar (1Y price range: 93.1-95.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS down by 55.6 bp to 200.1 bp (CDS basis: 118.2bp), with the yield to worst at 4.9% and the bond now trading up to 94.7 cents on the dollar (1Y price range: 92.7-94.8).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS down by 58.6 bp to 230.5 bp (CDS basis: 104.0bp), with the yield to worst at 5.0% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 91.0-93.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: B+ | ISIN: XS1982819994 | OAS down by 66.1 bp to 233.2 bp (CDS basis: 63.6bp), with the yield to worst at 5.2% and the bond now trading up to 94.2 cents on the dollar (1Y price range: 92.3-94.2).

RECENT DOMESTIC USD BOND ISSUES

- Air Lease Corp (Leasing | Los Angeles, California, United States | Rating: BBB): US$700m Senior Note (US00914AAU60), fixed rate (5.30% coupon) maturing on 1 February 2028, priced at 98.87 (original spread of 190 bp), callable (5nc5)

- Crown Castle Inc (Real Estate Investment Trust | Houston, Texas, United States | Rating: BBB-): US$1,000m Senior Note (US22822VBA89), fixed rate (5.00% coupon) maturing on 11 January 2028, priced at 99.91 (original spread of 138 bp), callable (5nc5)

- Dell International LLC (Financial - Other | Round Rock, United States | Rating: BBB): US$1,000m Senior Note (US24703DBL47), fixed rate (5.75% coupon) maturing on 1 February 2033, priced at 99.79 (original spread of 230 bp), callable (10nc10)

- Dell International LLC (Financial - Other | Round Rock, United States | Rating: BBB): US$1,000m Senior Note (US24703DBJ90), fixed rate (5.25% coupon) maturing on 1 February 2028, priced at 99.96 (original spread of 160 bp), callable (5nc5)

- F&G Annuities & Life Inc (Service - Other | Des Moines, Iowa, United States | Rating: BBB-): US$500m Senior Note (USU3152BAA09), fixed rate (7.40% coupon) maturing on 13 January 2028, priced at 99.96 (original spread of 375 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EN6H85), fixed rate (5.40% coupon) maturing on 18 January 2028, priced at 100.00 (original spread of 190 bp), callable (5nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$1,000m Bond (US3133EN6L97), floating rate (SOFR + 17.0 bp) maturing on 23 January 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EN6A33), fixed rate (4.00% coupon) maturing on 13 January 2026, priced at 99.94 (original spread of 9 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$950m Bond (US3133EN6E54), floating rate (SOFR + 18.0 bp) maturing on 17 January 2025, priced at 100.00, callable (2nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$379m Unsecured Note (US3134GYEA66), fixed rate (5.30% coupon) maturing on 27 January 2026, priced at 100.00 (original spread of 152 bp), callable (3nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$300m Unsecured Note (US3134GYEK49), fixed rate (5.15% coupon) maturing on 27 January 2026, priced at 100.00, callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$105m Unsecured Note (US3134GYDZ27), fixed rate (5.12% coupon) maturing on 27 January 2025, priced at 100.00 (original spread of 99 bp), callable (2nc6m)

- Healthpeak Properties Inc (Real Estate Investment Trust | Denver, Colorado, United States | Rating: BBB+): US$400m Senior Note (US42250PAE34), fixed rate (5.25% coupon) maturing on 15 December 2032, priced at 99.88 (original spread of 175 bp), callable (10nc10)

- Live Nation Entertainment Inc (Service - Other | Beverly Hills, California, United States | Rating: B+): US$1,000m Bond (US538034AZ24), fixed rate (3.13% coupon) maturing on 15 January 2029, priced at 100.00, non callable, convertible

- Realty Income Corp (Real Estate Investment Trust | San Diego, California, United States | Rating: A-): US$600m Senior Note (US756109BR47), fixed rate (4.85% coupon) maturing on 15 March 2030, priced at 98.81 (original spread of 145 bp), callable (7nc7)

- Realty Income Corp (Real Estate Investment Trust | San Diego, California, United States | Rating: A-): US$500m Senior Note (US756109BQ63), fixed rate (5.05% coupon) maturing on 13 January 2026, priced at 99.62 (original spread of 125 bp), callable (3nc1)

- Regal Rexnord Corp (Machinery | Beloit, Wisconsin, United States | Rating: BB+): US$1,100m Senior Note (US758750AE33), fixed rate (6.30% coupon) maturing on 15 February 2030, priced at 99.92 (original spread of 270 bp), callable (7nc7)

- Regal Rexnord Corp (Machinery | Beloit, Wisconsin, United States | Rating: BB+): US$1,250m Senior Note (US758750AD59), fixed rate (6.05% coupon) maturing on 15 April 2028, priced at 99.94 (original spread of 240 bp), callable (5nc5)

- Regal Rexnord Corp (Machinery | Beloit, Wisconsin, United States | Rating: BB+): US$1,250m Senior Note (US758750AF08), fixed rate (6.40% coupon) maturing on 15 April 2033, priced at 99.64 (original spread of 290 bp), callable (10nc10)

- Regal Rexnord Corp (Machinery | Beloit, Wisconsin, United States | Rating: BB+): US$1,100m Senior Note (USU7584RAA42), fixed rate (6.05% coupon) maturing on 15 February 2026, priced at 99.86 (original spread of 215 bp), with a make whole call

- Sun Communities Operating LP (Financial - Other | Southfield, Michigan, United States | Rating: BBB-): US$400m Senior Note (US866677AJ62), fixed rate (5.70% coupon) maturing on 15 January 2033, priced at 99.73 (original spread of 223 bp), callable (10nc10)

- Venture Global Calcasieu Pass LLC (Oil and Gas | Washington, Washington Dc, United States | Rating: BB): US$1,000m Note (US92328MAE30), fixed rate (6.25% coupon) maturing on 15 January 2030, priced at 100.00 (original spread of 257 bp), callable (7nc7)

- W&T Offshore Inc (Oil and Gas | Houston, United States | Rating: CCC+): US$275m Note (USU85254AG25), fixed rate (11.75% coupon) maturing on 1 February 2026, priced at 100.00 (original spread of 795 bp), callable (3nc2)

- WEC Energy Group Inc (Utility - Other | Milwaukee, Wisconsin, United States | Rating: BBB+): US$650m Senior Note (US92939UAK25), fixed rate (4.75% coupon) maturing on 9 January 2026, priced at 99.88 (original spread of 89 bp), callable (3nc3)

- WEC Energy Group Inc (Utility - Other | Milwaukee, Wisconsin, United States | Rating: BBB+): US$450m Senior Note (US92939UAL08), fixed rate (4.75% coupon) maturing on 15 January 2028, priced at 99.87 (original spread of 113 bp), callable (5nc5)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$594m Certificate of Deposit - Retail (US9497635D47), fixed rate (4.50% coupon) maturing on 13 January 2025, priced at 100.00 (original spread of 33 bp), non callable

- Caterpillar Financial Services Corp (Leasing | Nashville, Tennessee, United States | Rating: A): US$900m Senior Note (US14913R3B15), fixed rate (4.80% coupon) maturing on 6 January 2026, priced at 99.98 (original spread of 63 bp), with a make whole call

- Commonwealth Edison Co (Utility - Other | Chicago, Illinois, United States | Rating: A): US$575m First Mortgage Bond (US202795JY77), fixed rate (5.30% coupon) maturing on 1 February 2053, priced at 99.76 (original spread of 186 bp), callable (30nc30)

- Commonwealth Edison Co (Utility - Other | Chicago, Illinois, United States | Rating: A): US$400m First Mortgage Bond (US202795JX94), fixed rate (4.90% coupon) maturing on 1 February 2033, priced at 99.67 (original spread of 124 bp), callable (10nc10)

- Connecticut Light and Power Co (Utility - Other | Berlin, Connecticut, United States | Rating: A+): US$500m First & Refunding Mortgage Bond (US207597EP64), fixed rate (5.25% coupon) maturing on 15 January 2053, priced at 99.79 (original spread of 180 bp), callable (30nc30)

- Consumers Energy Co (Utility - Other | Jackson, Michigan, United States | Rating: A): US$425m First Mortgage Bond (US210518DS21), fixed rate (4.65% coupon) maturing on 1 March 2028, priced at 99.81 (original spread of 83 bp), callable (5nc5)

- Duke Energy Carolinas LLC (Utility - Other | Charlotte, North Carolina, United States | Rating: A): US$900m First & Refunding Mortgage Bond (US26442CBK99), fixed rate (5.35% coupon) maturing on 15 January 2053, priced at 99.82 (original spread of 195 bp), callable (30nc30)

- Duke Energy Carolinas LLC (Utility - Other | Charlotte, North Carolina, United States | Rating: A): US$900m First & Refunding Mortgage Bond (US26442CBJ27), fixed rate (4.95% coupon) maturing on 15 January 2033, priced at 99.70 (original spread of 131 bp), callable (10nc10)

- Entergy Arkansas LLC (Utility - Other | Little Rock, Arkansas, United States | Rating: A): US$425m First Mortgage Bond (US29366MAD02), fixed rate (5.15% coupon) maturing on 15 January 2033, priced at 99.67 (original spread of 142 bp), callable (10nc10)

- Enterprise Products Operating LLC (Gas Utility - Pipelines | Houston, Texas, United States | Rating: BBB+): US$750m Senior Note (US29379VCC54), fixed rate (5.05% coupon) maturing on 10 January 2026, priced at 99.89 (original spread of 90 bp), with a make whole call

- Enterprise Products Operating LLC (Gas Utility - Pipelines | Houston, Texas, United States | Rating: BBB+): US$1,000m Senior Note (US29379VCD38), fixed rate (5.35% coupon) maturing on 31 January 2033, priced at 99.80 (original spread of 170 bp), callable (10nc10)

- Equitable Holdings Inc (Financial - Other | New York City, New York, United States | Rating: BBB+): US$500m Senior Note (US29452EAC57), fixed rate (5.59% coupon) maturing on 11 January 2033, priced at 100.00 (original spread of 198 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$115m Bond (US3133EN5W61), fixed rate (4.13% coupon) maturing on 11 January 2029, priced at 99.94, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$225m Bond (US3133EN5N62), fixed rate (4.00% coupon) maturing on 6 January 2028, priced at 99.78 (original spread of 6 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$105m Bond (US3133EN5V88), fixed rate (4.13% coupon) maturing on 11 January 2027, priced at 99.86, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133EN5Q93), fixed rate (4.50% coupon) maturing on 10 January 2025, priced at 99.98 (original spread of 3 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$450m Bond (US3133EN5P11), floating rate (PRQ + -298.0 bp) maturing on 9 January 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$250m Bond (US3133EN5Y28), fixed rate (5.07% coupon) maturing on 17 January 2025, priced at 100.00, callable (2nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$125m Bond (US3130AUGJ77), fixed rate (5.02% coupon) maturing on 26 January 2026, priced at 100.00 (original spread of 34 bp), callable (3nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$105m Unsecured Note (US3134GYDX78), fixed rate (5.15% coupon) maturing on 17 January 2025, priced at 100.00, callable (2nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$150m Unsecured Note (US3134GYDD15), fixed rate (5.20% coupon) maturing on 24 January 2025, priced at 100.00, callable (2nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$500m Unsecured Note (US3134GYDT66), fixed rate (5.15% coupon) maturing on 24 January 2025, priced at 100.00, callable (2nc1)

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$300m Senior Note (US345397C502), floating rate (SOFR + 295.0 bp) maturing on 6 March 2026, priced at 100.00, non callable

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$1,300m Senior Note (US345397C437), fixed rate (6.95% coupon) maturing on 6 March 2026, priced at 99.87 (original spread of 285 bp), callable (3nc3)

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$1,150m Senior Note (US345397C684), fixed rate (7.35% coupon) maturing on 6 March 2030, priced at 99.88 (original spread of 377 bp), callable (7nc7)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, Texas, United States | Rating: BBB-): US$500m Senior Note (US37045XED49), fixed rate (6.40% coupon) maturing on 9 January 2033, priced at 99.69 (original spread of 291 bp), callable (10nc10)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, Texas, United States | Rating: BBB-): US$1,000m Senior Note (US37045XEB82), fixed rate (6.00% coupon) maturing on 9 January 2028, priced at 99.99 (original spread of 221 bp), callable (5nc5)

- Inter-American Development Bank (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$2,000m Senior Note (US4581X0EH74), fixed rate (4.00% coupon) maturing on 12 January 2028, priced at 99.60 (original spread of 15 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$1,750m Senior Note (US459058KN26), floating rate (SOFR + 37.0 bp) maturing on 12 January 2027, priced at 100.00, non callable

- Jackson National Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: A): US$500m Note (US46849MCF41), fixed rate (5.50% coupon) maturing on 9 January 2026, priced at 99.79 (original spread of 145 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$1,100m Senior Note (US24422EWR60), fixed rate (4.75% coupon) maturing on 20 January 2028, priced at 99.95 (original spread of 87 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$1,200m Senior Note (US24422EWP05), fixed rate (4.80% coupon) maturing on 9 January 2026, priced at 99.95 (original spread of 65 bp), non callable

- MetLife Inc (Life Insurance | New York City, New York, United States | Rating: A-): US$1,000m Senior Note (US59156RCD89), fixed rate (5.25% coupon) maturing on 15 January 2054, priced at 99.20 (original spread of 195 bp), callable (31nc31)

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$650m Note (US592179KD61), fixed rate (5.00% coupon) maturing on 6 January 2026, priced at 100.00 (original spread of 90 bp), non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$500m Note (US592179KF10), fixed rate (5.05% coupon) maturing on 6 January 2028, priced at 99.99 (original spread of 125 bp), non callable

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA+): US$1,000m Note (US64952WEY57), fixed rate (4.85% coupon) maturing on 9 January 2028, priced at 99.94 (original spread of 100 bp), non callable

- Oklahoma Gas And Electric Co (Utility - Other | Oklahoma City, Oklahoma, United States | Rating: A-): US$450m Senior Note (US678858BX89), fixed rate (5.40% coupon) maturing on 15 January 2033, priced at 99.69 (original spread of 165 bp), callable (10nc10)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$300m Senior Note (US69371RS314), fixed rate (4.60% coupon) maturing on 10 January 2028, priced at 99.83 (original spread of 82 bp), non callable

- Pacific Gas and Electric Co (Utility - Other | San Francisco, United States | Rating: BBB-): US$750m First Mortgage Bond (US694308KH99), fixed rate (6.75% coupon) maturing on 15 January 2053, priced at 99.50 (original spread of 295 bp), callable (30nc30)

- Pacific Gas and Electric Co (Utility - Other | San Francisco, United States | Rating: BBB-): US$750m First Mortgage Bond (US694308KJ55), fixed rate (6.15% coupon) maturing on 15 January 2033, priced at 99.74 (original spread of 250 bp), callable (10nc10)

- Penske Truck Leasing Co LP (Leasing | Reading, Pennsylvania, United States | Rating: BBB): US$750m Senior Note (USU71000BJ85), fixed rate (5.70% coupon) maturing on 1 February 2028, priced at 99.79 (original spread of 185 bp), callable (5nc5)

- Protective Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: A+): US$600m Note (US74368EBL39), fixed rate (5.37% coupon) maturing on 6 January 2026, priced at 100.00 (original spread of 120 bp), non callable

- Public Service Company Of Oklahoma (Utility - Other | Columbus, Ohio, United States | Rating: BBB+): US$475m Senior Note (US744533BQ24), fixed rate (5.25% coupon) maturing on 15 January 2033, priced at 99.69 (original spread of 157 bp), callable (10nc10)

- Public Service Company of New Hampshire (Utility - Other | Manchester, New Hampshire, United States | Rating: A+): US$300m First Mortgage Bond (US744482BP42), fixed rate (5.15% coupon) maturing on 15 January 2053, priced at 99.32 (original spread of 181 bp), callable (30nc30)

- Targa Resources Corp (Financial - Other | Houston, United States | Rating: BBB-): US$850m Senior Note (US87612GAD34), fixed rate (6.50% coupon) maturing on 15 February 2053, priced at 97.84 (original spread of 275 bp), callable (30nc30)

RECENT INTERNATIONAL USD BOND ISSUES

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$500m Senior Note (US02665WEC10), fixed rate (4.75% coupon) maturing on 12 January 2026, priced at 99.94 (original spread of 80 bp), with a make whole call

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$500m Senior Note (US02665WED92), fixed rate (4.70% coupon) maturing on 12 January 2028, priced at 99.80 (original spread of 103 bp), with a make whole call

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$300m Senior Note (US02665WEE75), floating rate (SOFR + 92.0 bp) maturing on 12 January 2026, priced at 100.00, non callable

- Asian Infrastructure Investment Bank (Supranational | Beijing, Beijing, China (Mainland) | Rating: AAA): US$2,000m Senior Note (US04522KAJ51), fixed rate (4.00% coupon) maturing on 18 January 2028, priced at 99.53 (original spread of 39 bp), non callable

- BNP Paribas SA (Banking | Paris, France | Rating: A+): US$1,750m Note (US09659W2V59), fixed rate (5.13% coupon) maturing on 13 January 2029, priced at 100.00, callable (6nc5)

- Bank Leumi Le Israel BM (Banking | Tel Aviv-Yafo, Israel | Rating: A): US$500m Subordinated Note (IL0060406795), fixed rate (7.13% coupon) maturing on 18 July 2033, priced at 100.00 (original spread of 345 bp), callable (11nc5)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): US$600m Note (US05578BAY20), fixed rate (5.13% coupon) maturing on 18 January 2028, priced at 99.81 (original spread of 145 bp), with a regulatory call

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): US$1,500m Note (US05584KAN81), floating rate maturing on 18 January 2027, priced at 100.00 (original spread of 200 bp), callable (4nc3)

- Caisse des Depots et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): US$1,000m Bond (FR001400F638), fixed rate (4.25% coupon) maturing on 20 January 2026, priced at 99.88 (original spread of 22 bp), non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB+): US$1,250m Note (US12803RAA23), floating rate maturing on 18 January 2029, priced at 100.00 (original spread of 234 bp), callable (6nc5)

- City National Bank (California) (Banking | Los Angeles, California, Canada | Rating: A): US$214m Certificate of Deposit - Retail (US178180GU38), fixed rate (4.35% coupon) maturing on 12 January 2026, priced at 100.00 (original spread of 45 bp), non callable

- City National Bank (California) (Banking | Los Angeles, California, Canada | Rating: A): US$294m Certificate of Deposit - Retail (US178180GT64), fixed rate (4.50% coupon) maturing on 13 January 2025, priced at 100.00 (original spread of 33 bp), non callable

- Daimler Truck Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: BBB+): US$650m Senior Note (US233853AP55), fixed rate (5.15% coupon) maturing on 16 January 2026, priced at 99.94 (original spread of 123 bp), with a make whole call

- Daimler Truck Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: BBB+): US$500m Senior Note (USU2340BAQ06), fixed rate (5.13% coupon) maturing on 19 January 2028, priced at 99.94 (original spread of 148 bp), with a make whole call

- Daimler Truck Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: BBB+): US$650m Senior Note (US233853AN08), fixed rate (5.20% coupon) maturing on 17 January 2025, priced at 99.91 (original spread of 103 bp), with a make whole call

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0460011843), fixed rate (4.00% coupon) maturing on 10 February 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB-): US$1,500m Note (US251526CS67), floating rate maturing on 18 January 2029, priced at 100.00, callable (6nc5)

- Ecopetrol SA (Oil and Gas | Bogota, Colombia | Rating: BB+): US$2,000m Senior Note (US279158AS81), fixed rate (8.88% coupon) maturing on 13 January 2033, priced at 99.19 (original spread of 539 bp), callable (10nc10)

- Export Import Bank Of India (Agency | Mumbai, Maharashtra, India | Rating: BBB-): US$1,000m Senior Note (US30216KAG76), fixed rate (5.50% coupon) maturing on 18 January 2033, priced at 99.87 (original spread of 190 bp), non callable

- FAB Sukuk Company Ltd (Financial - Other | George Town, United Arab Emirates | Rating: AA-): US$500m Islamic Sukuk (Hybrid) (XS2576361195), fixed rate (4.58% coupon) maturing on 17 January 2028, priced at 100.00 (original spread of 90 bp), non callable

- GDS Holdings Ltd (Information/Data Technology | Shanghai, China (Mainland) | Rating: NR): US$580m Bond (), fixed rate (4.50% coupon) maturing on 31 January 2030, priced at 100.00, non callable, convertible

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Russia | Rating: NR): US$900m Bond (RU000A105R62), fixed rate (4.95% coupon) maturing on 6 February 2028, priced at 100.00, non callable

- HongKong Xiangyu Investment Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$190m Senior Note (XS2576128727), fixed rate (5.70% coupon) maturing on 23 September 2025, priced at 97.57, non callable

- Industrial and Commercial Bank of China Ltd (Dubai Branch) (Banking | Dubai, Dubai, China (Mainland) | Rating: A+): US$600m Bond (XS2546508461), floating rate (SOFR + 93.0 bp) maturing on 19 January 2026, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$900m Unsecured Note (XS2549908684), fixed rate (4.50% coupon) maturing on 19 January 2026, priced at 99.80 (original spread of 76 bp), non callable

- Israel, State of (Government) (Sovereign | Jerusalem, Israel | Rating: AA-): US$2,000m Bond (US46514BRA79), fixed rate (4.50% coupon) maturing on 17 January 2033, priced at 99.42 (original spread of 102 bp), non callable

- Kbc Groep NV (Banking | Brussels, Belgium | Rating: BBB+): US$1,000m Senior Note (US48241FAB04), floating rate maturing on 19 January 2029, priced at 100.00 (original spread of 191 bp), callable (6nc5)

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$4,000m Senior Note (US500769JW52), fixed rate (3.75% coupon) maturing on 15 February 2028, priced at 99.53 (original spread of 33 bp), non callable

- Kommunalbanken AS (Agency | Oslo, Norway | Rating: AAA): US$1,000m Senior Note (XS2577222792), fixed rate (4.00% coupon) maturing on 19 January 2028, priced at 99.95 (original spread of 30 bp), non callable

- Kommunalbanken AS (Agency | Oslo, Norway | Rating: AAA): US$1,000m Senior Note (US50048MDJ62), fixed rate (4.00% coupon) maturing on 19 January 2028, priced at 99.95 (original spread of 33 bp), non callable

- Liberty Costa Rica Senior Secured Finance (Financial - Other | George Town, Cayman Islands | Rating: B+): US$400m Note (USG53901AA58), fixed rate (10.88% coupon) maturing on 15 January 2031, priced at 100.00 (original spread of 714 bp), callable (8nc3)

- Macquarie Bank Ltd (Banking | Sydney, New South Wales, Australia | Rating: BBB-): US$1,000m Subordinated Note (USQ568A9SS79), fixed rate (6.80% coupon) maturing on 18 January 2033, priced at 100.00 (original spread of 321 bp), non callable

- Mongolia (Government) (Sovereign | Mongolia | Rating: B): US$450m Bond (US60937LAG05), fixed rate (8.65% coupon) maturing on 19 January 2028, priced at 98.81 (original spread of 456 bp), non callable

- National Bank of Canada (Banking | Montreal, Quebec, Canada | Rating: BBB+): US$750m Senior Note (US63307A2T17), fixed rate (5.25% coupon) maturing on 17 January 2025, priced at 99.92 (original spread of 110 bp), non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): US$1,000m Senior Note (US676167CH05), fixed rate (4.13% coupon) maturing on 20 January 2026, priced at 99.86 (original spread of 25 bp), non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$500m Bond (US718286CY18), fixed rate (4.63% coupon) maturing on 17 July 2028, priced at 99.44 (original spread of 105 bp), non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$1,250m Bond (US718286CX35), fixed rate (5.50% coupon) maturing on 17 January 2048, priced at 100.00 (original spread of 205 bp), non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$1,250m Bond (US718286CW51), fixed rate (5.00% coupon) maturing on 17 July 2033, priced at 99.99 (original spread of 145 bp), non callable

- Posco Holdings Inc (Metals/Mining | Seoul, South Korea | Rating: BBB+): US$1,000m Senior Note (USY7S272AG74), fixed rate (5.75% coupon) maturing on 17 January 2028, priced at 99.51 (original spread of 220 bp), non callable

- Posco Holdings Inc (Metals/Mining | Seoul, Seoul, South Korea | Rating: BBB+): US$300m Senior Note (USY7S272AH57), fixed rate (5.88% coupon) maturing on 17 January 2033, priced at 98.85 (original spread of 250 bp), non callable

- Posco Holdings Inc (Metals/Mining | Seoul, Seoul, South Korea | Rating: BBB+): US$700m Senior Note (US73730EAC75), fixed rate (5.63% coupon) maturing on 17 January 2026, priced at 99.40 (original spread of 190 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$750m Senior Note (US78016FZW75), fixed rate (4.90% coupon) maturing on 12 January 2028, priced at 99.95 (original spread of 126 bp), with a make whole call

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$1,000m Senior Note (US78016FZT47), fixed rate (4.88% coupon) maturing on 12 January 2026, priced at 99.97 (original spread of 95 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$1,700m Senior Note (US78016FZX58), fixed rate (5.00% coupon) maturing on 1 February 2033, priced at 99.86 (original spread of 152 bp), with a make whole call

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$300m Senior Note (US78016FZV92), floating rate (SOFR + 108.0 bp) maturing on 12 January 2026, priced at 100.00, non callable

- SK Hynix Inc (Electronics | Icheon, Gyeonggi-Do, South Korea | Rating: BBB-): US$1,000m Senior Note (USY8085FBK58), fixed rate (6.38% coupon) maturing on 17 January 2028, priced at 99.51, non callable

- SK Hynix Inc (Electronics | Icheon, Gyeonggi-Do, South Korea | Rating: BBB-): US$750m Senior Note (US78392BAD91), fixed rate (6.25% coupon) maturing on 17 January 2026, priced at 99.62 (original spread of 240 bp), non callable

- SK Hynix Inc (Electronics | Icheon, Gyeonggi-Do, South Korea | Rating: BBB-): US$750m Senior Note (USY8085FBL32), fixed rate (6.50% coupon) maturing on 17 January 2033, priced at 98.41 (original spread of 320 bp), non callable

- Saudi Arabia, Kingdom of (Government) (Sovereign | Riyadh, Riyadh, Saudi Arabia | Rating: A-): US$3,500m Senior Note (US80413TBD00), fixed rate (4.88% coupon) maturing on 18 July 2033, priced at 98.82 (original spread of 140 bp), non callable

- Saudi Arabia, Kingdom of (Government) (Sovereign | Riyadh, Riyadh, Saudi Arabia | Rating: A-): US$3,250m Senior Note (XS2577136109), fixed rate (5.00% coupon) maturing on 18 January 2053, priced at 92.69 (original spread of 209 bp), non callable

- Saudi Arabia, Kingdom of (Government) (Sovereign | Riyadh, Riyadh, Saudi Arabia | Rating: A-): US$3,250m Senior Note (US80413TBC27), fixed rate (4.75% coupon) maturing on 18 January 2028, priced at 99.65 (original spread of 110 bp), non callable

- Standard Chartered Bank (Banking | London, United Kingdom | Rating: A+): US$140m Unsecured Note (XS2577785764), floating rate maturing on 17 January 2028, priced at 100.00, non callable

- Sunny Optical Technology Group Co Ltd (Health Care Supply | Ningbo, Zhejiang, Hong Kong | Rating: BBB+): US$400m Senior Note (XS2555677215), fixed rate (5.95% coupon) maturing on 17 July 2026, priced at 99.79 (original spread of 228 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$1,000m Senior Note (US89236TKQ75), fixed rate (4.63% coupon) maturing on 12 January 2028, priced at 99.93 (original spread of 98 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$300m Senior Note (US89236TKP92), floating rate (SOFR + 56.0 bp) maturing on 10 January 2025, priced at 100.00, non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$500m Senior Note (US89236TKR58), fixed rate (4.70% coupon) maturing on 12 January 2033, priced at 99.91 (original spread of 121 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$1,200m Senior Note (US89236TKN45), fixed rate (4.80% coupon) maturing on 10 January 2025, priced at 99.96 (original spread of 63 bp), non callable

- Transocean Titan Financing Ltd (Financial - Other | Switzerland | Rating: B-): US$525m Senior Note (USG9007MAA65), fixed rate (8.38% coupon) maturing on 1 February 2028, priced at 100.00 (original spread of 462 bp), callable (5nc2)

- Turkey, Republic of (Government) (Sovereign | Ankara, Turkey | Rating: B-): US$2,750m Senior Note (US900123DG28), fixed rate (9.38% coupon) maturing on 19 January 2033, priced at 97.64 (original spread of 639 bp), non callable

- Vanor Capital Resources Ltd (Financial - Other | London, United Kingdom | Rating: NR): US$3,450m Note (US92212VAA08), fixed rate (5.25% coupon) maturing on 10 January 2026, priced at 100.00, non callable

- Wanda Properties Global Co Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$400m Senior Note (XS2577258713), fixed rate (11.00% coupon) maturing on 20 January 2025, priced at 97.63, non callable

- Airport Authority Hong Kong (Agency | Hong Kong | Rating: AA+): US$500m Senior Note (USY000AKAJ65), fixed rate (4.88% coupon) maturing on 12 January 2026, priced at 99.92 (original spread of 70 bp), with a make whole call

- Airport Authority Hong Kong (Agency | Hong Kong | Rating: AA+): US$1,000m Senior Note (US00946AAG94), fixed rate (4.75% coupon) maturing on 12 January 2028, priced at 99.71 (original spread of 90 bp), callable (5nc5)

- Airport Authority Hong Kong (Agency | Hong Kong | Rating: AA+): US$800m Senior Note (USY000AKAH00), fixed rate (4.88% coupon) maturing on 12 January 2033, priced at 99.26 (original spread of 125 bp), callable (10nc10)

- Airport Authority Hong Kong (Agency | Hong Kong | Rating: AA+): US$700m Senior Note (US00946AAH77), fixed rate (4.88% coupon) maturing on 12 January 2030, priced at 99.38 (original spread of 115 bp), callable (7nc7)

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$179m Unsecured Note (XS2575402602), fixed rate (7.38% coupon) maturing on 28 October 2032, priced at 100.00, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$162m Unsecured Note (XS2575400655), fixed rate (6.75% coupon) maturing on 20 September 2029, priced at 100.00, non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$2,000m Senior Note (US045167FV02), fixed rate (4.00% coupon) maturing on 12 January 2033, priced at 99.81 (original spread of 29 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$3,500m Senior Note (US045167FU29), fixed rate (4.25% coupon) maturing on 9 January 2026, priced at 99.72 (original spread of 29 bp), non callable

- Bank of China (Australia) Ltd (Financial - Other | Sydney, New South Wales, China (Mainland) | Rating: A-): US$150m Certificate of Deposit (XS2574368960), fixed rate (4.86% coupon) maturing on 13 January 2026, priced at 100.00, non callable

- Bank of Montreal (Banking | Toronto, Canada | Rating: A-): US$1,200m Senior Note (US06368LGV27), fixed rate (5.20% coupon) maturing on 1 February 2028, priced at 100.00 (original spread of 130 bp), callable (5nc5)

- Central American Bank for Economic Integration (Supranational | Tegucigalpa, Honduras | Rating: AA-): US$130m Unsecured Note (XS2575911156), fixed rate (4.90% coupon) maturing on 31 January 2033, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: AA-): US$1,200m Senior Note (US2027A0KN80), fixed rate (5.08% coupon) maturing on 10 January 2025, priced at 100.00 (original spread of 68 bp), non callable

- Commonwealth Bank of Australia (Banking | Sydney, Australia | Rating: AA-): US$300m Senior Note (US2027A0KN80), floating rate (SOFR + 63.0 bp) maturing on 10 January 2025, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: AA-): US$300m Senior Note (US2027A1KP12), floating rate (SOFR + 63.0 bp) maturing on 10 January 2025, priced at 100.00, non callable

- Cooperatieve Rabobank UA (New York Branch) (Banking | New York City, Netherlands | Rating: A+): US$1,000m Unsecured Note (US21688AAV44), fixed rate (5.00% coupon) maturing on 13 January 2025, priced at 99.99 (original spread of 65 bp), non callable

- Credit Agricole SA (London Branch) (Banking | London, France | Rating: A+): US$1,200m Note (US22535EAC12), fixed rate (5.30% coupon) maturing on 12 July 2028, priced at 100.00 (original spread of 140 bp), with a regulatory call

- Credit Suisse AG (New York Branch) (Banking | New York City, Switzerland | Rating: BBB+): US$1,250m Senior Note (US22550L2L41), fixed rate (7.95% coupon) maturing on 9 January 2025, priced at 99.80 (original spread of 370 bp), non callable

- Credit Suisse AG (New York Branch) (Banking | New York City, Switzerland | Rating: BBB+): US$2,500m Senior Note (US22550L2M24), fixed rate (7.50% coupon) maturing on 15 February 2028, priced at 99.77 (original spread of 370 bp), non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: BBB): US$1,250m Note (US23636BBF58), fixed rate (6.47% coupon) maturing on 9 January 2026, priced at 100.00, callable (3nc2)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$5,000m Senior Note (US298785JU14), fixed rate (3.88% coupon) maturing on 15 March 2028, priced at 99.49 (original spread of 12 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US302154DU05), fixed rate (4.88% coupon) maturing on 11 January 2026, priced at 99.69 (original spread of 85 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, South Korea | Rating: AA-): US$1,500m Senior Note (US302154DV87), fixed rate (5.00% coupon) maturing on 11 January 2028, priced at 99.65 (original spread of 120 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US302154DW60), fixed rate (5.13% coupon) maturing on 11 January 2033, priced at 99.59 (original spread of 145 bp), non callable

- Hong Kong Special Administrative Region Government (Sovereign | Hong Kong | Rating: AA-): US$500m Senior Note (US43858AAJ97), fixed rate (5.25% coupon) maturing on 11 January 2053, priced at 98.99 (original spread of 145 bp), non callable

- Hong Kong Special Administrative Region Government (Sovereign | Hong Kong | Rating: AA-): US$1,000m Senior Note (US43858AAH32), fixed rate (4.63% coupon) maturing on 11 January 2033, priced at 99.63 (original spread of 95 bp), non callable

- Hong Kong Special Administrative Region Government (Sovereign | Hong Kong | Rating: AA-): US$500m Senior Note (US43858AAF75), fixed rate (4.38% coupon) maturing on 11 January 2026, priced at 99.67 (original spread of 35 bp), non callable

- Hong Kong Special Administrative Region Government (Sovereign | Hong Kong | Rating: AA-): US$1,000m Senior Note (US43858AAG58), fixed rate (4.50% coupon) maturing on 11 January 2028, priced at 99.62 (original spread of 70 bp), non callable

- Hungary (Government) (Sovereign | Budapest, Budapest, Hungary | Rating: BBB): US$1,250m Unsecured Note (US445545AT30), fixed rate (6.75% coupon) maturing on 22 September 2052, priced at 95.73, non callable

- Hungary (Government) (Sovereign | Budapest, Budapest, Hungary | Rating: BBB): US$1,500m Senior Note (US445545AS56), fixed rate (6.25% coupon) maturing on 22 September 2032, priced at 98.17 (original spread of 280 bp), non callable

- Hungary (Government) (Sovereign | Budapest, Budapest, Hungary | Rating: BBB): US$1,500m Senior Note (US445545AR73), fixed rate (6.13% coupon) maturing on 22 May 2028, priced at 99.28 (original spread of 240 bp), non callable

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$1,000m Bond (US455780DQ66), fixed rate (4.55% coupon) maturing on 11 January 2028, priced at 98.90 (original spread of 96 bp), callable (5nc5)

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$750m Bond (US455780DS23), fixed rate (5.65% coupon) maturing on 11 January 2053, priced at 98.58 (original spread of 193 bp), callable (30nc30)

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$1,250m Bond (US455780DR40), fixed rate (4.85% coupon) maturing on 11 January 2033, priced at 98.06 (original spread of 142 bp), callable (10nc10)

- Mexico (United Mexican States) (Government) (Sovereign | Miguel Hidalgo, Mexico, D.F., Mexico | Rating: BBB-): US$2,750m Senior Note (US91087BAV27), fixed rate (6.35% coupon) maturing on 9 February 2035, priced at 99.63 (original spread of 275 bp), callable (12nc12)

- National Australia Bank Ltd (New York Branch) (Banking | New York City, Australia | Rating: NR): US$1,100m Senior Note (US63253QAB05), fixed rate (4.94% coupon) maturing on 12 January 2028, priced at 100.00 (original spread of 110 bp), non callable

- National Australia Bank Ltd (New York Branch) (Banking | New York City, New York, Australia | Rating: A-): US$1,250m Subordinated Note (US632525BC43), fixed rate (6.43% coupon) maturing on 12 January 2033, priced at 100.00 (original spread of 275 bp), non callable

- National Australia Bank Ltd (New York Branch) (Banking | New York City, Australia | Rating: NR): US$1,150m Senior Note (US63253QAA22), fixed rate (4.97% coupon) maturing on 12 January 2026, priced at 100.00 (original spread of 85 bp), non callable

- Natixis SA (Banking | Paris, France | Rating: A): US$130m Unsecured Note (XS2426699836), fixed rate (5.46% coupon) maturing on 18 January 2038, priced at 100.00, non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Japan | Rating: BBB+): US$750m Senior Note (US65535HBK41), fixed rate (6.18% coupon) maturing on 18 January 2033, priced at 100.00 (original spread of 250 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$550m Senior Note (US65535HBH12), fixed rate (5.84% coupon) maturing on 18 January 2028, priced at 100.00 (original spread of 200 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Japan | Rating: BBB+): US$600m Senior Note (US65535HBG39), fixed rate (5.71% coupon) maturing on 9 January 2026, priced at 100.00 (original spread of 166 bp), non callable

- Propifi Bonds PLC (Service - Other | London, United Kingdom | Rating: NR): US$300m Bond (GB00BMFXJ557), fixed rate (8.10% coupon) maturing on 11 January 2028, priced at 100.00, callable (5nc3m)

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): US$1,243m Senior Note (US77586RAQ39), fixed rate (6.63% coupon) maturing on 17 February 2028, priced at 99.61 (original spread of 280 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): US$1,250m Senior Note (US77586RAS94), fixed rate (7.63% coupon) maturing on 17 January 2053, priced at 99.46 (original spread of 385 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): US$1,500m Senior Note (US77586RAR12), fixed rate (7.13% coupon) maturing on 17 January 2033, priced at 99.33 (original spread of 350 bp), non callable

- Santander UK Group Holdings PLC (Banking | London, Spain | Rating: BBB): US$1,250m Senior Note (US80281LAT26), floating rate maturing on 10 January 2029, priced at 100.00, callable (6nc5)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: BBB): US$1,250m Note (US83368RBR21), fixed rate (6.45% coupon) maturing on 10 January 2029, priced at 100.00, callable (6nc5)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: BBB): US$1,250m Note (US83368TBQ04), floating rate maturing on 12 January 2027, priced at 100.00, callable (4nc3)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: BBB): US$1,250m Note (US83368TBR86), floating rate maturing on 10 January 2029, priced at 100.00 (original spread of 267 bp), callable (6nc5)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: BBB): US$1,250m Note (US83368RBQ48), fixed rate (6.45% coupon) maturing on 12 January 2027, priced at 100.00, callable (4nc3)

RECENT EUR BOND ISSUES

- ABB Finance BV (Financial - Other | Rotterdam, Zuid-Holland, Switzerland | Rating: A-): €500m Senior Note (XS2575555938), fixed rate (3.25% coupon) maturing on 16 January 2027, priced at 99.62 (original spread of 102 bp), callable (4nc4)

- ABB Finance BV (Financial - Other | Rotterdam, Zuid-Holland, Switzerland | Rating: A-): €750m Senior Note (XS2575556589), fixed rate (3.38% coupon) maturing on 16 January 2031, priced at 98.70 (original spread of 139 bp), callable (8nc8)

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €1,000m Note (XS2575971994), fixed rate (4.00% coupon) maturing on 16 January 2028, priced at 99.69 (original spread of 180 bp), non callable

- ALD SA (Leasing | Reuil-Malmaison, Ile-De-France, France | Rating: BBB): €750m Bond (FR001400F6E7), fixed rate (4.25% coupon) maturing on 18 January 2027, priced at 99.95 (original spread of 186 bp), non callable

- Agence Francaise de Developpement EPIC (Agency | Paris, Ile-De-France, France | Rating: AA): €1,500m Bond (FR001400F7C9), fixed rate (2.88% coupon) maturing on 21 January 2030, priced at 99.43 (original spread of 90 bp), non callable

- Agence France Locale SA (Agency | Lyon, Auvergne-Rhone-Alpes, France | Rating: AA-): €750m Bond (FR001400F4B8), fixed rate (3.00% coupon) maturing on 20 March 2030, priced at 99.47 (original spread of 93 bp), non callable

- Air France KLM SA (Airline | Paris, Ile-De-France, France | Rating: NR): €500m Bond (FR001400F2R8), fixed rate (8.13% coupon) maturing on 31 May 2028, priced at 99.55 (original spread of 605 bp), callable (5nc5)

- Air France KLM SA (Airline | Paris, Ile-De-France, France | Rating: NR): €500m Bond (FR001400F2Q0), fixed rate (7.25% coupon) maturing on 31 May 2026, priced at 99.70 (original spread of 506 bp), callable (3nc3)

- Arval Service Lease SA (Financial - Other | Paris, Ile-De-France, France | Rating: A-): €800m Bond (FR001400F6O6), fixed rate (4.13% coupon) maturing on 13 April 2026, priced at 99.67 (original spread of 176 bp), callable (3nc3)

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,000m Senior Note (XS2577127884), fixed rate (3.65% coupon) maturing on 20 January 2026, priced at 100.00 (original spread of 126 bp), non callable

- Autoroutes du Sud de la France SA (Transportation - Other | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €700m Senior Note (FR001400F8Z8), fixed rate (3.25% coupon) maturing on 19 January 2033, priced at 99.30 (original spread of 126 bp), callable (10nc10)

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): €1,000m Bond (FR001400DCZ6), floating rate maturing on 13 January 2029, priced at 99.88 (original spread of 249 bp), callable (6nc5)

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400F5R1), fixed rate (3.13% coupon) maturing on 20 July 2027, priced at 99.86 (original spread of 81 bp), non callable

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,000m Obligation Fonciere (Covered Bond) (FR001400F5S9), fixed rate (3.13% coupon) maturing on 20 January 2033, priced at 99.00 (original spread of 96 bp), non callable

- Banca IFIS SpA (Banking | Venice, Venezia, Italy | Rating: BB+): €300m Note (XS2577518488), fixed rate (6.13% coupon) maturing on 19 January 2027, priced at 99.57 (original spread of 403 bp), non callable

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BBB-): €750m Note (XS2577572188), fixed rate (4.88% coupon) maturing on 18 January 2027, priced at 99.61 (original spread of 282 bp), with a regulatory call

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €1,500m Cedula Hipotecaria (Covered Bond) (ES0413211A75), fixed rate (3.13% coupon) maturing on 17 July 2027, priced at 99.81 (original spread of 88 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €2,000m Note (XS2575952341), floating rate (EU03MLIB + 55.0 bp) maturing on 16 January 2025, priced at 100.00, non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €1,750m Note (XS2575952424), fixed rate (3.75% coupon) maturing on 16 January 2026, priced at 99.68 (original spread of 148 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €1,250m Note (XS2575952697), fixed rate (3.88% coupon) maturing on 16 January 2028, priced at 99.48 (original spread of 177 bp), non callable

- Bank of Ireland (Banking | Dublin, Dublin, Ireland | Rating: BBB+): €750m Unsecured Note (XS2577403236), fixed rate (5.27% coupon) maturing on 17 July 2028, priced at 100.00 (original spread of 260 bp), non callable

- Bank of Ireland Group PLC (Banking | Dublin, Ireland | Rating: BBB-): €750m Senior Note (XS2576362839), fixed rate (4.88% coupon) maturing on 16 July 2028, priced at 99.55 (original spread of 268 bp), callable (6nc4)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): €1,750m Covered Bond (Other) (XS2576390459), fixed rate (3.25% coupon) maturing on 18 January 2028, priced at 99.83 (original spread of 99 bp), non callable

- Belfius Banque SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB): €500m Subordinated Note (BE6340794013), fixed rate (5.25% coupon) maturing on 19 April 2033, priced at 99.49 (original spread of 312 bp), callable (10nc5)

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €7,000m Obligation Lineaire (BE0000357666), fixed rate (3.00% coupon) maturing on 22 June 2033, priced at 99.80 (original spread of 95 bp), non callable

- CNP Assurances SA (Life Insurance | Paris, Ile-De-France, France | Rating: BBB+): €500m Bond (FR001400F620), floating rate maturing on 18 July 2053, priced at 99.95 (original spread of 310 bp), callable (31nc10)

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): €5,000m Bond (FR001400F5U5), fixed rate (3.00% coupon) maturing on 25 May 2028, priced at 99.75 (original spread of 71 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB-): €750m Inhaberschuldverschreibung (DE000CZ43ZN8), floating rate maturing on 18 January 2030, priced at 99.51 (original spread of 305 bp), callable (7nc1m)

- Compagnie de Saint Gobain SA (Conglomerate/Diversified Mfg | Courbevoie, Ile-De-France, France | Rating: BBB): €650m Unsecured Note (XS2576245281), fixed rate (3.50% coupon) maturing on 18 January 2029, priced at 99.93 (original spread of 132 bp), callable (6nc6)

- Cooperatieve Rabobank UA (Banking | Utrecht, Utrecht, Netherlands | Rating: A+): €1,250m Covered Bond (Other) (XS2577836187), fixed rate (2.88% coupon) maturing on 19 January 2033, priced at 99.67 (original spread of 79 bp), non callable

- Council of Europe Development Bank (Supranational | Paris, Ile-De-France, France | Rating: AA+): €1,000m Senior Note (XS2576298991), fixed rate (2.88% coupon) maturing on 17 January 2033, priced at 99.19 (original spread of 69 bp), non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400F7K2), fixed rate (4.00% coupon) maturing on 18 January 2033, priced at 99.98 (original spread of 181 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C1B0), fixed rate (2.65% coupon) maturing on 2 February 2026, priced at 100.00 (original spread of 136 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €750m Inhaberschuldverschreibung (DE000DW6C1A2), fixed rate (2.50% coupon) maturing on 3 February 2025, priced at 100.00 (original spread of 104 bp), non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (DE000A3MQUY1), fixed rate (3.00% coupon) maturing on 16 January 2026, priced at 99.83 (original spread of 63 bp), non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (DE000A3MQUZ8), fixed rate (3.00% coupon) maturing on 30 November 2032, priced at 99.87 (original spread of 75 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €750m Senior Note (XS2577042893), fixed rate (3.63% coupon) maturing on 18 December 2037, priced at 99.88 (original spread of 126 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30VG92), fixed rate (3.00% coupon) maturing on 18 January 2027, priced at 99.80 (original spread of 72 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VAG7), floating rate maturing on 9 February 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VAE2), fixed rate (2.85% coupon) maturing on 9 February 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30V5F6), fixed rate (3.00% coupon) maturing on 18 July 2030, priced at 99.69 (original spread of 80 bp), non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: BBB+): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30WF68), fixed rate (2.88% coupon) maturing on 19 January 2029, priced at 99.78 (original spread of 80 bp), non callable

- Elia Transmission Belgium NV (Financial - Other | Brussels, Belgium | Rating: BBB+): €500m Senior Note (BE6340849569), fixed rate (3.63% coupon) maturing on 18 January 2033, priced at 99.71 (original spread of 86 bp), callable (10nc10)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): €750m Inhaberschuldverschreibung (AT0000A32562), floating rate maturing on 16 January 2031, priced at 99.31 (original spread of 185 bp), callable (8nc7)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A325K2), fixed rate (5.00% coupon) maturing on 8 February 2032, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A325A3), fixed rate (2.75% coupon) maturing on 1 March 2026, priced at 100.50, non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: AA): €4,000m Senior Note (EU000A2SCAG3), fixed rate (2.88% coupon) maturing on 16 February 2033, priced at 99.26 (original spread of 69 bp), non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: AA): €2,000m Senior Note (EU000A2SCAF5), fixed rate (2.75% coupon) maturing on 16 August 2026, priced at 99.81 (original spread of 46 bp), non callable

- Export Development Canada (Agency | Ottawa, Ontario, Canada | Rating: AAA): €2,000m Senior Note (XS2577382059), fixed rate (2.88% coupon) maturing on 19 January 2028, priced at 99.97 (original spread of 64 bp), non callable

- HeidelbergCement AG (Building Products | Heidelberg, Germany | Rating: BBB): €750m Senior Note (XS2577874782), fixed rate (3.75% coupon) maturing on 31 May 2032 (original spread of 183 bp), callable (9nc9)

- Holding d'Infrastructures de Transport SAS (Service - Other | Issy-Les-Moulineaux, Ile-De-France, Italy | Rating: BBB-): €500m Senior Note (XS2577384691), fixed rate (4.25% coupon) maturing on 18 March 2030, priced at 99.10 (original spread of 224 bp), callable (7nc7)

- Iccrea Banca SpA Istituto Centrale del Credito Cooperativo (Banking | Rome, Italy | Rating: BB+): €500m Note (XS2577533875), floating rate maturing on 20 January 2028, priced at 100.00 (original spread of 465 bp), callable (5nc4)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €3,000m Bond (XS2577109049), fixed rate (2.90% coupon) maturing on 19 January 2033, priced at 99.91 (original spread of 71 bp), non callable

- Investitionsbank Schleswig Holstein (Agency | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €250m Inhaberschuldverschreibung (DE000A30VNN4), floating rate (EU03MLIB + 0.0 bp) maturing on 19 April 2027, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €7,000m Buono del Tesoro Poliennali (IT0005530032), fixed rate (4.45% coupon) maturing on 1 September 2043, priced at 99.61 (original spread of 216 bp), non callable

- KommuneKredit (Agency | Kobenhavn K, Denmark | Rating: AAA): €500m Senior Note (XS2577526580), fixed rate (2.88% coupon) maturing on 19 January 2035, priced at 99.19 (original spread of 79 bp), non callable

- Kuntarahoitus Oyj (Agency | Helsinki, Etela-Suomen, Finland | Rating: AA+): €1,500m Senior Note (XS2577104321), fixed rate (2.88% coupon) maturing on 18 January 2028, priced at 99.95 (original spread of 67 bp), non callable

- La Banque Postale SA (Banking | Paris, Ile-De-France, France | Rating: BBB-): €750m Bond (FR001400F5F6), fixed rate (4.38% coupon) maturing on 17 January 2030, priced at 99.61 (original spread of 221 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000HLB7CD0), fixed rate (2.50% coupon) maturing on 15 August 2025, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB7CL3), fixed rate (2.55% coupon) maturing on 10 February 2025, priced at 100.00, non callable

- Lansforsakringar Bank AB (Banking | Stockholm, Stockholm, Sweden | Rating: A): €500m Note (XS2577054716), fixed rate (4.00% coupon) maturing on 18 January 2027, priced at 99.68 (original spread of 180 bp), non callable

- Latvia, Republic of (Government) (Sovereign | Riga, Latvia | Rating: A-): €750m Senior Note (XS2576364371), fixed rate (3.50% coupon) maturing on 17 January 2028, priced at 99.13 (original spread of 138 bp), non callable

- Luminor Bank AS (Banking | Tallinn, United States | Rating: BBB+): €300m Note (XS2576365188), floating rate maturing on 16 January 2026, priced at 100.00 (original spread of 459 bp), callable (3nc2)

- Massmutual Global Funding II (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €500m Senior Note (XS2575965327), fixed rate (3.75% coupon) maturing on 19 January 2030, priced at 99.35 (original spread of 169 bp), non callable

- Merrill Lynch BV (Financial - Other | Amsterdam, Noord-Holland, United States | Rating: NR): €375m Bond (XS2576250448) zero coupon maturing on 30 January 2026, priced at 104.30, non callable, convertible

- Motability Operations Group PLC (Leasing | London, United Kingdom | Rating: A): €500m Bond (XS2574870759), fixed rate (3.50% coupon) maturing on 17 July 2031, priced at 99.28 (original spread of 135 bp), callable (9nc8)

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): €750m Senior Note (XS2576255751), floating rate (EU03MLIB + 98.0 bp) maturing on 13 January 2026, priced at 100.00, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): €750m Senior Note (XS2576255249), fixed rate (4.25% coupon) maturing on 13 January 2028, priced at 99.96 (original spread of 193 bp), non callable

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB-): €1,000m Senior Note (XS2576067081), fixed rate (4.28% coupon) maturing on 16 January 2035, priced at 100.00 (original spread of 203 bp), callable (12nc12)

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB-): €750m Senior Note (XS2575973776), fixed rate (3.88% coupon) maturing on 16 January 2029, priced at 100.00 (original spread of 155 bp), callable (6nc6)

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000NLB34Y2), fixed rate (2.88% coupon) maturing on 19 March 2030, priced at 99.38 (original spread of 79 bp), non callable

- PSA Banque France SA (Banking | Poissy, Ile-De-France, France | Rating: BBB+): €500m Bond (FR001400F6V1), fixed rate (3.88% coupon) maturing on 19 January 2026, priced at 99.79 (original spread of 150 bp), callable (3nc3)

- Pirelli & C SpA (Vehicle Parts | Milan, Milano, Italy | Rating: BBB-): €600m Senior Note (XS2577396430), fixed rate (4.25% coupon) maturing on 18 January 2028, priced at 99.70 (original spread of 210 bp), callable (5nc5)

- Raiffeisen Landesbank Steiermark AG (Banking | Graz, Steiermark, Austria | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (AT000B093901), fixed rate (3.13% coupon) maturing on 18 January 2027, priced at 99.75 (original spread of 92 bp), non callable

- Raiffeisenbank as (Banking | Praha, Praha, Austria | Rating: BBB): €500m Note (XS2577033553), floating rate maturing on 19 January 2026, priced at 100.00 (original spread of 455 bp), callable (3nc2)

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Austria | Rating: A-): €250m Inhaberschuldverschreibung (AT000B078811), fixed rate (3.50% coupon) maturing on 24 January 2025, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): €1,750m Senior Note (XS2577030708), floating rate (EU03MLIB + 43.0 bp) maturing on 17 January 2025, non callable

- Saarland, State of (Official and Muni | Saarbruecken, Saarland, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A3H3GK4), fixed rate (2.75% coupon) maturing on 18 January 2030, priced at 99.64 (original spread of 62 bp), non callable

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €600m Bond (FR001400F703), fixed rate (3.13% coupon) maturing on 13 October 2029, priced at 99.20 (original spread of 99 bp), callable (7nc7)

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €600m Bond (FR001400F711), fixed rate (3.38% coupon) maturing on 13 April 2034, priced at 98.67 (original spread of 122 bp), callable (11nc11)

- Sfil SA (Agency | Issy-Les-Moulineaux, Ile-De-France, France | Rating: AA): €1,500m Bond (FR001400F7D7), fixed rate (2.88% coupon) maturing on 18 January 2028, priced at 99.48 (original spread of 92 bp), non callable

- Societe du Grand Paris (Agency | Saint-Denis, Ile-De-France, France | Rating: AA): €1,000m Bond (FR001400F6X7), fixed rate (3.50% coupon) maturing on 25 May 2043, priced at 97.80 (original spread of 124 bp), non callable

- Sparkasse Pforzheim Calw (Banking | Pforzheim, Baden-Wuerttemberg, Germany | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30V5G4), fixed rate (3.00% coupon) maturing on 18 January 2027, priced at 99.70 (original spread of 74 bp), non callable

- Spie SA (Service - Other | Cergy-Pontoise, Ile-De-France, France | Rating: BB): €400m Bond (FR001400F2K3), fixed rate (2.00% coupon) maturing on 17 January 2028, priced at 100.00, non callable, convertible

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €1,250m Inhaberschuldverschreibung (DE000RLP1395), fixed rate (3.00% coupon) maturing on 15 January 2025, priced at 100.07 (original spread of 48 bp), non callable

- Thames Water Utilities Finance PLC (Financial - Other | Reading, Berkshire, United Kingdom | Rating: BBB): €650m Bond (XS2576550326), fixed rate (4.00% coupon) maturing on 18 April 2027, priced at 99.56 (original spread of 184 bp), callable (4nc4)

- Thames Water Utilities Finance PLC (Financial - Other | Reading, Berkshire, United Kingdom | Rating: BBB): €1,000m Senior Note (XS2576550672), fixed rate (4.38% coupon) maturing on 18 January 2031, priced at 99.99 (original spread of 223 bp), callable (8nc8)

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): €2,000m Senior Note (XS2577740157), floating rate (EU03MLIB + 45.0 bp) maturing on 20 January 2025, priced at 100.00, non callable

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €300m Inhaberschuldverschreibung (DE000A3LC4C3), fixed rate (4.13% coupon) maturing on 18 January 2025, priced at 99.97 (original spread of 152 bp), callable (2nc2)

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: BBB+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (AT000B049937), fixed rate (3.00% coupon) maturing on 31 July 2026, priced at 99.71 (original spread of 78 bp), non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,000m Note (XS2577053825), floating rate maturing on 17 January 2029, priced at 99.81 (original spread of 256 bp), callable (6nc5)

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,000m Senior Note (XS2575952853), fixed rate (3.70% coupon) maturing on 16 January 2026, priced at 100.00 (original spread of 127 bp), non callable