Credit

US High Grade Credit Overperformed Last Week, With BBBs Spreads Tighter And BBs Wider

Decent volumes of USD HY corporate bond issuance this week after a slow start to the year: 11 tranches for $16.05bn in IG (2023 YTD volume $110.15bn vs 2022 YTD $145.24bn), 9 Tranches for $6.7bn in HY (2023 YTD volume $11.7bn vs 2022 YTD $16.085bn)

Published ET

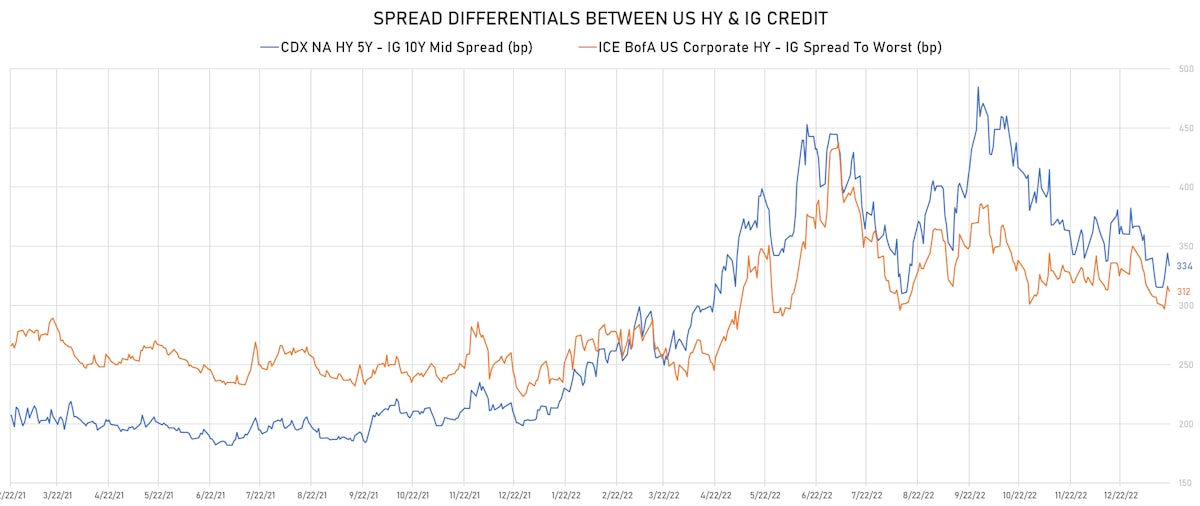

US HY - IG Credit Spreads Differentials | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.57% today, with investment grade down -0.60% and high yield down -0.25% (YTD total return: +3.53%)

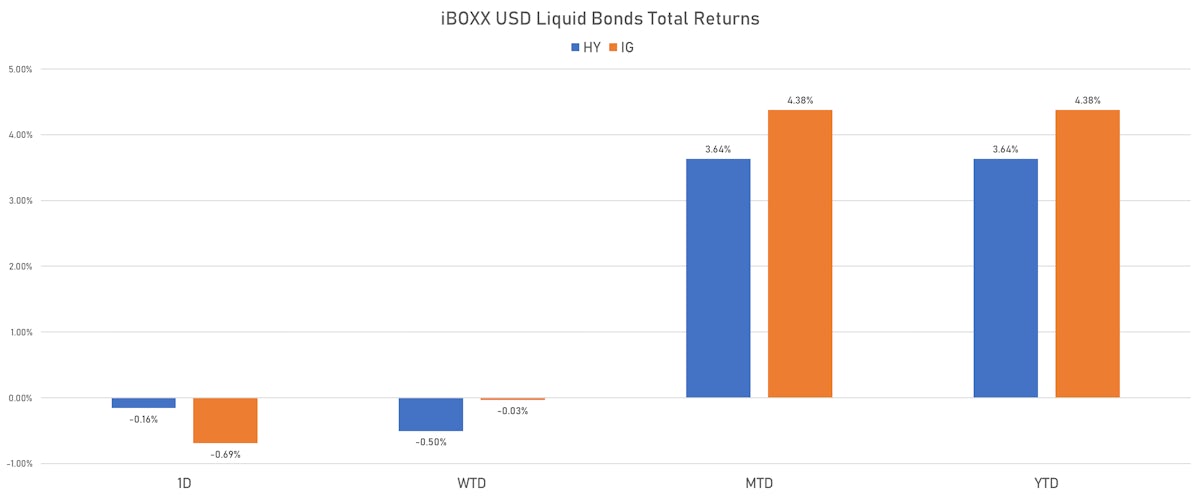

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.693% today (Week-to-date: -0.03%; Month-to-date: 4.38%; Year-to-date: 4.38%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.158% today (Week-to-date: -0.50%; Month-to-date: 3.64%; Year-to-date: 3.64%)

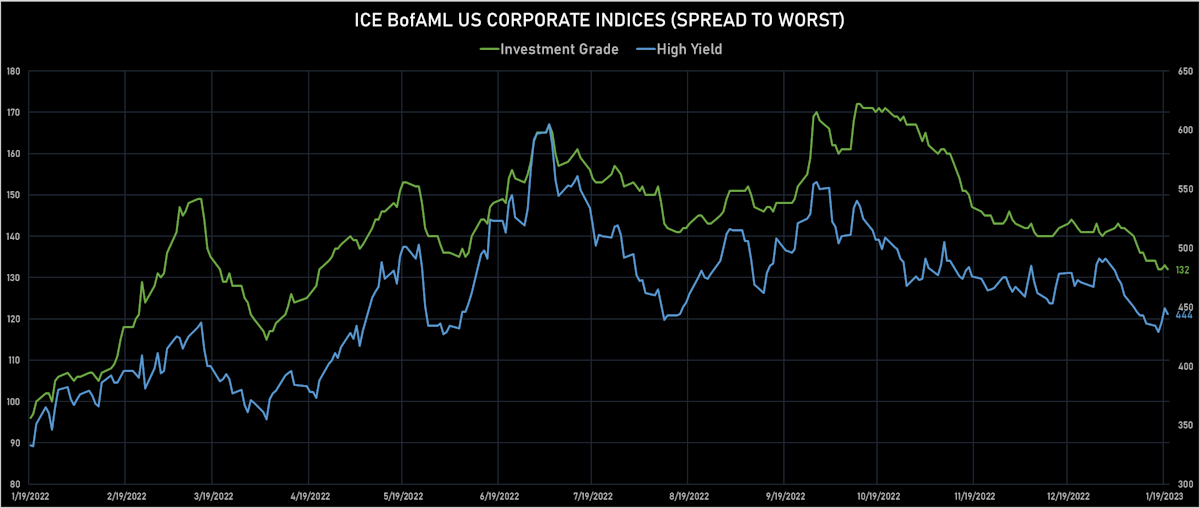

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 132.0 bp (YTD change: -8.0 bp)

- ICE BofA US High Yield Index spread to worst down -5.0 bp, now at 444.0 bp (YTD change: -44.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +2.6%)

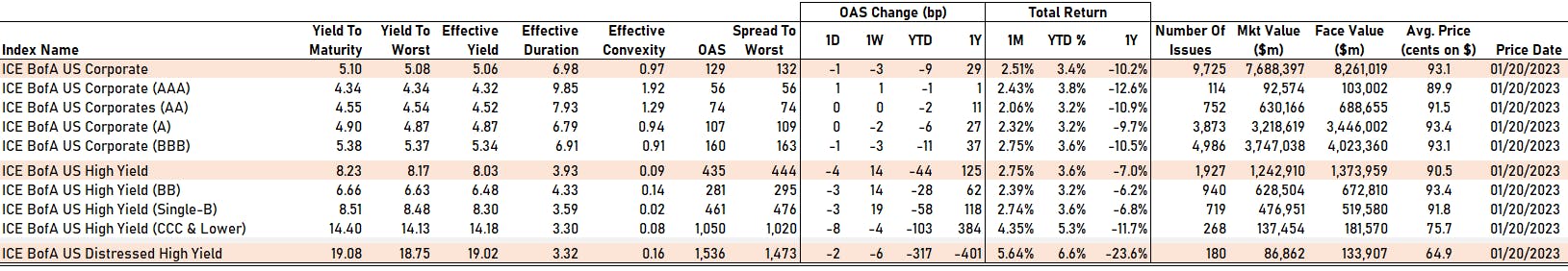

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 56 bp

- AA unchanged at 74 bp

- A unchanged at 107 bp

- BBB down by -1 bp at 160 bp

- BB down by -3 bp at 281 bp

- B down by -3 bp at 461 bp

- ≤ CCC down by -8 bp at 1,050 bp

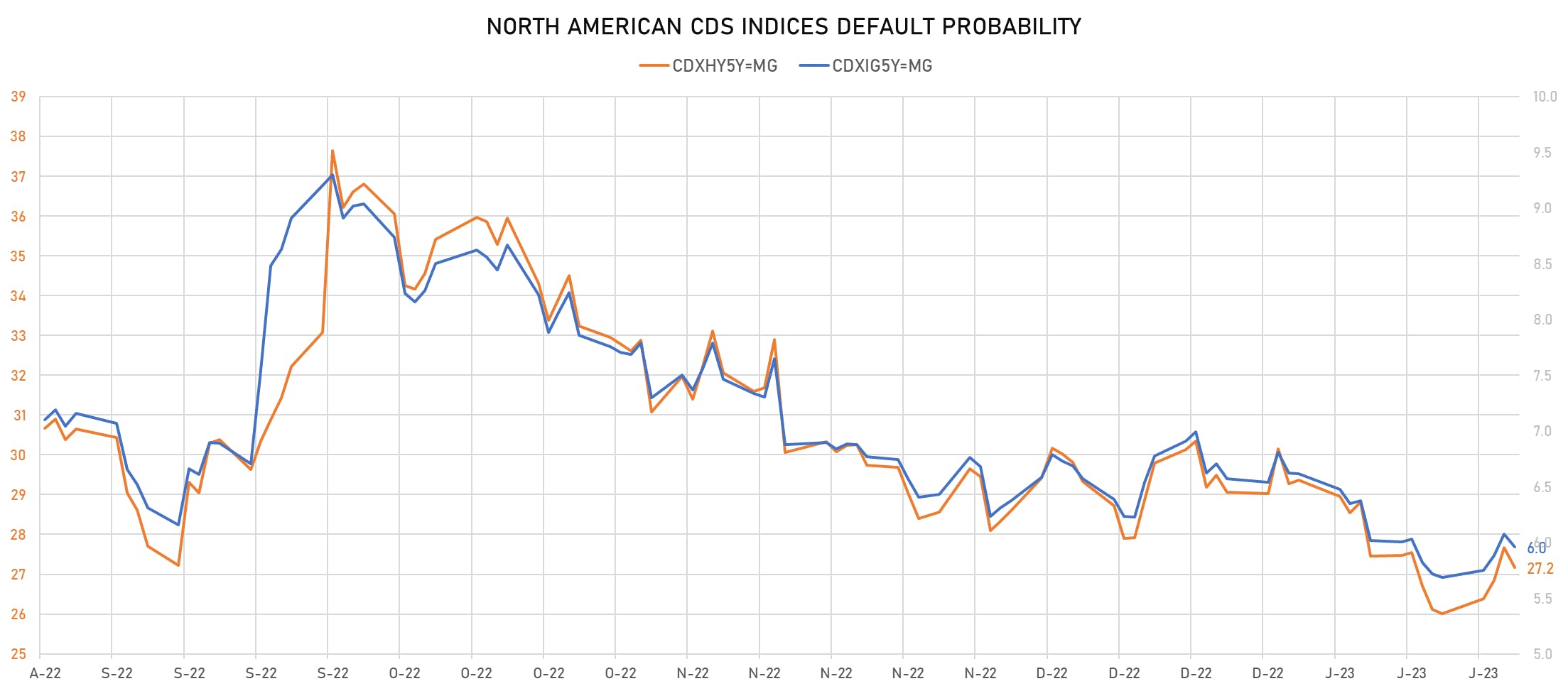

CDS INDICES TODAY (mid-spreads)

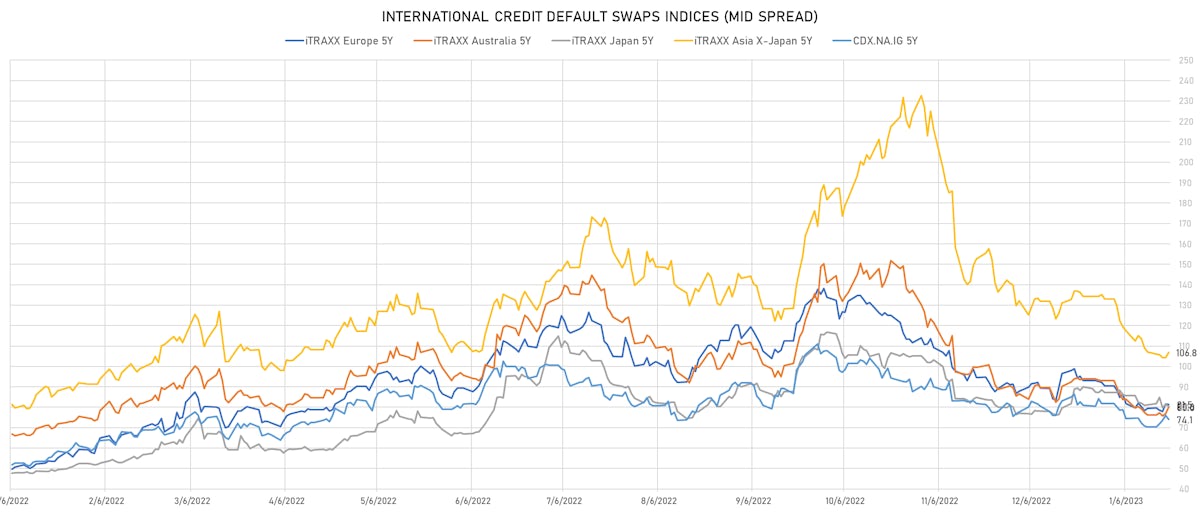

- Markit CDX.NA.IG 5Y down 2.0 bp, now at 74bp (1W change: +3.6bp; YTD change: -7.8bp)

- Markit CDX.NA.IG 10Y down 1.8 bp, now at 112bp (1W change: +3.9bp; YTD change: -5.4bp)

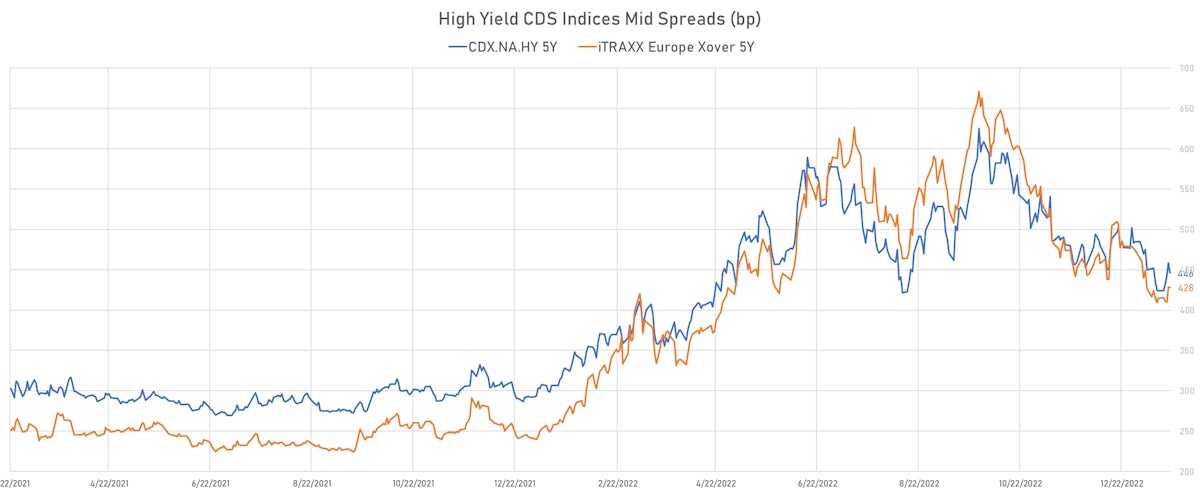

- Markit CDX.NA.HY 5Y down 12.2 bp, now at 446bp (1W change: +22.2bp; YTD change: -38.7bp)

- Markit iTRAXX Europe 5Y down 0.2 bp, now at 81bp (1W change: +2.0bp; YTD change: -9.0bp)

- Markit iTRAXX Europe Crossover 5Y unchanged at 428bp (1W change: +13.3bp; YTD change: -46.0bp)

- Markit iTRAXX Japan 5Y down 0.8 bp, now at 81bp (1W change: -0.5bp; YTD change: -6.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 2.6 bp, now at 107bp (1W change: -0.2bp; YTD change: -26.2bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 22.3 bp to 1,168.6bp (1Y range: 425-2,117bp)

- Tegna Inc (Country: US; rated: Ba3): up 22.5 bp to 507.6bp (1Y range: 182-786bp)

- Murphy Oil Corp (Country: US; rated: A1): up 22.8 bp to 267.8bp (1Y range: 227-446bp)

- Amkor Technology Inc (Country: US; rated: A1): up 23.8 bp to 147.2bp (1Y range: 126-375bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): up 26.7 bp to 409.1bp (1Y range: 354-608bp)

- Nordstrom Inc (Country: US; rated: A3): up 32.9 bp to 593.3bp (1Y range: 334-685bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 33.1 bp to 320.5bp (1Y range: 124-401bp)

- Community Health Systems Inc (Country: US; rated: B): up 35.8 bp to 2,896.8bp (1Y range: 590-4,371bp)

- Kohls Corp (Country: US; rated: Ba1): up 37.8 bp to 572.9bp (1Y range: 206-686bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 40.6 bp to 460.9bp (1Y range: 393-887bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 48.4 bp to 846.3bp (1Y range: 510-1,783bp)

- Unisys Corp (Country: US; rated: B1): up 49.2 bp to 939.2bp (1Y range: 238-1,096bp)

- Staples Inc (Country: US; rated: B3): up 50.2 bp to 1,746.5bp (1Y range: 988-1,986bp)

- Lumen Technologies Inc (Country: US; rated: WR): up 105.6 bp to 912.5bp (1Y range: 195-912bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 220.0 bp to 2,956.5bp (1Y range: 467-2,956bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): down 153.3 bp to 2,987.3bp (1Y range: 657-4,917bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 68.0 bp to 1,506.1bp (1Y range: 1,286-2,910bp)

- TUI AG (Country: DE; rated: B3-PD): down 54.5 bp to 849.1bp (1Y range: 612-1,725bp)

- Stena AB (Country: SE; rated: B1-PD): down 12.9 bp to 517.3bp (1Y range: 417-865bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 11.8 bp to 1,068.3bp (1Y range: 566-1,739bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 11.3 bp to 792.1bp (1Y range: 401-1,021bp)

- Credit Suisse Group AG (Country: CH; rated: A+): down 10.1 bp to 318.2bp (1Y range: 62-442bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 10.1 bp to 781.2bp (1Y range: 292-1,254bp)

- GKN Holdings Ltd (Country: GB; rated: Ba1): up 10.3 bp to 102.8bp (1Y range: 91-314bp)

- Continental AG (Country: DE; rated: Baa2): up 10.4 bp to 136.0bp (1Y range: 80-251bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 12.7 bp to 200.4bp (1Y range: 78-268bp)

- Vivendi SE (Country: FR; rated: A1): up 14.2 bp to 108.2bp (1Y range: 34-108bp)

- Air France KLM SA (Country: FR; rated: C): up 14.3 bp to 609.0bp (1Y range: 405-990bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 15.0 bp to 273.2bp (1Y range: 186-505bp)

- Renault SA (Country: FR; rated: Ba2): up 23.6 bp to 277.8bp (1Y range: 187-476bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS up by 80.9 bp to 359.4 bp, with the yield to worst at 7.3% and the bond now trading down to 98.1 cents on the dollar (1Y price range: 96.1-99.8).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 3.75% | Maturity: 31/12/2024 | Rating: BB- | CUSIP: 85571BAW5 | OAS up by 66.4 bp to 202.4 bp, with the yield to worst at 6.0% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 93.8-96.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.66% | Maturity: 8/9/2024 | Rating: BB | CUSIP: 345397WW9 | OAS up by 60.9 bp to 172.9 bp (CDS basis: 19.3bp), with the yield to worst at 6.1% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 94.7-97.2).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 4.25% | Maturity: 15/9/2028 | Rating: BB+ | CUSIP: 343412AF9 | OAS up by 46.5 bp to 198.7 bp, with the yield to worst at 5.5% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 90.0-95.6).

- Issuer: Newell Brands Inc (Atlanta, Georgia (US)) | Coupon: 4.00% | Maturity: 1/12/2024 | Rating: BB+ | CUSIP: 651229AQ9 | OAS up by 37.3 bp to 112.4 bp, with the yield to worst at 5.7% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-97.5).

- Issuer: Tri Pointe Homes Inc (Delaware) (Incline Village, Nevada (US)) | Coupon: 5.88% | Maturity: 15/6/2024 | Rating: BB- | CUSIP: 962178AN9 | OAS up by 33.2 bp to 151.0 bp, with the yield to worst at 5.7% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.3-100.0).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 6.95% | Maturity: 1/7/2024 | Rating: BB+ | CUSIP: 674599DB8 | OAS up by 30.4 bp to 111.7 bp (CDS basis: -45.6bp), with the yield to worst at 5.1% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.5-102.8).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 3.50% | Maturity: 15/12/2024 | Rating: BB+ | CUSIP: 343412AC6 | OAS up by 29.1 bp to 60.2 bp, with the yield to worst at 5.0% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.3-98.3).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.50% | Maturity: 1/12/2025 | Rating: BB+ | CUSIP: 674599EE1 | OAS up by 25.9 bp to 109.0 bp (CDS basis: -47.0bp), with the yield to worst at 4.9% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 99.3-101.0).

- Issuer: Owens & Minor Inc (Mechanicsville, Virginia (US)) | Coupon: 4.38% | Maturity: 15/12/2024 | Rating: BB- | CUSIP: 690732AE2 | OAS up by 24.6 bp to 106.9 bp, with the yield to worst at 5.1% and the bond now trading down to 97.7 cents on the dollar (1Y price range: 96.0-98.0).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 3.40% | Maturity: 15/4/2026 | Rating: BB+ | CUSIP: 674599CH6 | OAS up by 24.2 bp to 112.2 bp (CDS basis: -31.3bp), with the yield to worst at 4.8% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 93.0-95.5).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.55% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 674599DC6 | OAS up by 23.7 bp to 109.0 bp (CDS basis: -32.1bp), with the yield to worst at 4.8% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 99.5-101.9).

- Issuer: iStar Inc (New York City, New York (US)) | Coupon: 4.25% | Maturity: 1/8/2025 | Rating: BB | CUSIP: 45031UCG4 | OAS up by 12.0 bp to 17.9 bp, with the yield to worst at 4.1% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 97.5-99.5).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS down by 23.3 bp to 108.4 bp (CDS basis: 29.7bp), with the yield to worst at 5.5% and the bond now trading up to 95.4 cents on the dollar (1Y price range: 94.4-95.8).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.13% | Maturity: 1/12/2024 | Rating: BB | CUSIP: 81211KAW0 | OAS down by 26.5 bp to 38.5 bp (CDS basis: 5.0bp), with the yield to worst at 4.6% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 98.4-100.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 74.5 bp to 304.1 bp (CDS basis: 14.4bp), with the yield to worst at 5.7% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 93.0-95.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS up by 70.7 bp to 271.6 bp (CDS basis: 13.8bp), with the yield to worst at 5.5% and the bond now trading down to 93.2 cents on the dollar (1Y price range: 92.7-95.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS up by 69.5 bp to 359.1 bp (CDS basis: 24.3bp), with the yield to worst at 6.1% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 83.4-87.0).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | OAS up by 63.7 bp to 342.6 bp, with the yield to worst at 6.1% and the bond now trading down to 84.4 cents on the dollar (1Y price range: 81.4-86.8).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | OAS up by 61.4 bp to 350.3 bp, with the yield to worst at 6.1% and the bond now trading down to 84.7 cents on the dollar (1Y price range: 82.1-87.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 55.8 bp to 303.6 bp (CDS basis: -0.3bp), with the yield to worst at 5.7% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 91.0-93.9).

- Issuer: Rexel SA (Paris, France) | Coupon: 2.13% | Maturity: 15/12/2028 | Rating: BB+ | ISIN: XS2403428472 | OAS up by 54.0 bp to 235.4 bp, with the yield to worst at 5.0% and the bond now trading down to 85.2 cents on the dollar (1Y price range: 85.1-88.5).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS up by 53.7 bp to 310.5 bp, with the yield to worst at 5.7% and the bond now trading down to 91.1 cents on the dollar (1Y price range: 91.1-93.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS up by 51.8 bp to 347.0 bp, with the yield to worst at 6.2% and the bond now trading down to 86.8 cents on the dollar (1Y price range: 83.7-88.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: B+ | ISIN: XS1824425182 | OAS down by 53.0 bp to 377.2 bp (CDS basis: 11.7bp), with the yield to worst at 6.6% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 89.3-92.1).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 30/7/2027 | Rating: BB- | ISIN: XS1266661013 | OAS down by 54.4 bp to 447.9 bp, with the yield to worst at 6.8% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 86.4-92.7).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | OAS down by 55.1 bp to 341.6 bp (CDS basis: 267.8bp), with the yield to worst at 6.1% and the bond now trading up to 86.6 cents on the dollar (1Y price range: 81.9-87.5).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS down by 58.3 bp to 510.8 bp, with the yield to worst at 7.9% and the bond now trading up to 78.2 cents on the dollar (1Y price range: 75.3-78.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS down by 61.8 bp to 417.1 bp (CDS basis: -7.2bp), with the yield to worst at 7.0% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 87.6-90.6).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 3.50% | Maturity: 28/6/2025 | Rating: BB | ISIN: XS1839682116 | OAS down by 67.3 bp to 344.8 bp (CDS basis: -306.8bp), with the yield to worst at 6.4% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 90.4-93.6).

RECENT DOMESTIC USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$3,000m Senior Note (US06051GLE79), floating rate maturing on 20 January 2027, priced at 100.00 (original spread of 110 bp), callable (4nc3)

- BizLink Holding Inc (Electronics | Fremont, California, United States | Rating: NR): US$150m Bond (XS2559003822) zero coupon maturing on 30 January 2028, priced at 100.00, non callable, convertible

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$113m Senior Note (US17290ALC26), fixed rate (5.40% coupon) maturing on 20 January 2026, priced at 100.00 (original spread of 218 bp), callable (3nc1)

- Clean Harbors Inc (Service - Other | Norwell, Massachusetts, United States | Rating: BB-): US$500m Senior Note (US184496AQ03), fixed rate (6.38% coupon) maturing on 1 February 2031, priced at 100.00 (original spread of 295 bp), callable (8nc3)

- Crestwood Midstream Partners LP (Oil and Gas | Houston, Texas, United States | Rating: BB-): US$600m Senior Note (US226373AT56), fixed rate (7.38% coupon) maturing on 1 February 2031, priced at 100.00 (original spread of 400 bp), callable (8nc3)

- DISH Network Corp (Cable/Media | Englewood, Colorado, United States | Rating: B-): US$1,500m Note (USU25507AB70), fixed rate (11.75% coupon) maturing on 15 November 2027, priced at 102.00 (original spread of 746 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EN6R67), fixed rate (6.00% coupon) maturing on 25 January 2038, priced at 100.00 (original spread of 259 bp), callable (15nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EN6U96), floating rate (PRQ + -300.0 bp) maturing on 24 January 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EN6W52), fixed rate (3.63% coupon) maturing on 24 July 2028, priced at 100.00 (original spread of 8 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$875m Bond (US3133EN6T24), floating rate (SOFR + 17.0 bp) maturing on 24 January 2025, priced at 100.00, callable (2nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$500m Bond (US3130AUMD34), floating rate (SOFR + 16.5 bp) maturing on 17 January 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$300m Unsecured Note (US3134GYFG28), fixed rate (5.13% coupon) maturing on 27 January 2025, priced at 100.00, callable (2nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$130m Unsecured Note (US3134GYEZ18), fixed rate (5.00% coupon) maturing on 27 January 2026, priced at 100.00, callable (3nc9m)

- Genesis Energy LP (Oil and Gas | Houston, United States | Rating: B): US$500m Senior Note (US37185LAN29), fixed rate (8.88% coupon) maturing on 15 April 2030, priced at 100.00 (original spread of 556 bp), callable (7nc3)

- International Finance Corp (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$150m Unsecured Note (XS2580902760), fixed rate (3.90% coupon) maturing on 26 January 2026, priced at 100.00 (original spread of 12 bp), non callable

- Morgan Stanley (Banking | New York City, New York, United States | Rating: BBB+): US$2,000m Subordinated Note (US61747YFB65), fixed rate (5.95% coupon) maturing on 19 January 2038, priced at 100.00 (original spread of 230 bp), callable (15nc10)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$2,500m Senior Note (US61747YFA82), floating rate maturing on 1 February 2029, priced at 100.00 (original spread of 143 bp), callable (6nc5)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$1,500m Senior Note (US61747YEZ43), floating rate maturing on 28 January 2027, priced at 100.00 (original spread of 100 bp), callable (4nc3)

- NCL Corporation Ltd (Leisure | Miami, Florida, United States | Rating: BB-): US$600m Note (USG6436QAQ94), fixed rate (8.38% coupon) maturing on 1 February 2028, priced at 100.00 (original spread of 491 bp), callable (5nc2)

- Nine Energy Service Inc (Financial - Other | Houston, United States | Rating: CCC): US$300m Note (US65441VAE11), fixed rate (13.00% coupon) maturing on 1 February 2028, priced at 95.00 (original spread of 190 bp), callable (5nc3)

- PNC Financial Services Group Inc (Banking | Pittsburgh, United States | Rating: A-): US$1,250m Senior Note (US693475BL85), floating rate maturing on 26 January 2027, priced at 100.00, callable (4nc3)

- PNC Financial Services Group Inc (Banking | Pittsburgh, United States | Rating: A-): US$1,500m Senior Note (US693475BM68), floating rate maturing on 24 January 2034, priced at 100.00, callable (11nc10)

- SMART Global Holdings Inc. (Industrials - Other | Newark California, California, United States | Rating: NR): US$150m Bond (US83205YAC84), fixed rate (2.00% coupon) maturing on 1 February 2029, priced at 100.00, non callable, convertible

- Sealed Air Corp (Containers | Charlotte, North Carolina, United States | Rating: BB): US$775m Senior Note (US812127AA61), fixed rate (6.13% coupon) maturing on 1 February 2028, priced at 100.00 (original spread of 250 bp), callable (5nc2)

- Target Corp (Retail Stores - Other | Minneapolis, Minnesota, United States | Rating: A): US$1,150m Senior Note (US87612EBR62), fixed rate (4.80% coupon) maturing on 15 January 2053, priced at 99.92 (original spread of 151 bp), callable (30nc29)

- Target Corp (Retail Stores - Other | Minneapolis, Minnesota, United States | Rating: A): US$500m Senior Note (US87612EBQ89), fixed rate (4.40% coupon) maturing on 15 January 2033, priced at 99.77 (original spread of 96 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$179m Unsecured Note (XS2580880859), fixed rate (7.38% coupon) maturing on 28 October 2032, priced at 110.94, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$220m Unsecured Note (XS2580877632), fixed rate (5.63% coupon) maturing on 17 January 2028, priced at 98.13, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$150m Unsecured Note (XS2580718596), fixed rate (3.50% coupon) maturing on 16 April 2029, priced at 99.12, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$115m Unsecured Note (XS2580881584), fixed rate (4.00% coupon) maturing on 12 July 2027, priced at 95.21, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$103m Unsecured Note (XS2580879414), fixed rate (5.20% coupon) maturing on 17 May 2027, priced at 100.24, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$112m Unsecured Note (XS2580880008), fixed rate (2.25% coupon) maturing on 2 February 2033, priced at 85.84, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$126m Unsecured Note (XS2580882129), fixed rate (6.63% coupon) maturing on 24 April 2028, priced at 100.86, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$162m Unsecured Note (XS2580875693), fixed rate (6.75% coupon) maturing on 20 September 2029, priced at 103.76, non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): US$1,250m Note (US06675GAZ81), fixed rate (4.94% coupon) maturing on 26 January 2026, priced at 100.00 (original spread of 118 bp), non callable

- Bombardier Inc (Aerospace | Dorval, Quebec, Canada | Rating: B-): US$750m Senior Note (US097751BZ39), fixed rate (7.50% coupon) maturing on 1 February 2029, priced at 100.00 (original spread of 393 bp), callable (6nc3)

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): US$4,000m Senior Note (XS2580310246), fixed rate (4.00% coupon) maturing on 25 January 2026, priced at 99.93 (original spread of 28 bp), non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Distrito Capital, Venezuela | Rating: AA-): US$1,500m Senior Note (US219868CG98), fixed rate (4.75% coupon) maturing on 1 April 2026, priced at 99.78, non callable

- Council of Europe Development Bank (Supranational | Paris, France | Rating: AA+): US$1,000m Senior Note (US222213BB58), fixed rate (3.63% coupon) maturing on 26 January 2028, priced at 99.79 (original spread of 20 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460012650), fixed rate (4.10% coupon) maturing on 9 February 2027, priced at 100.00, non callable

- First Abu Dhabi Bank PJSC (Banking | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$600m Senior Note (XS2580013386), fixed rate (4.38% coupon) maturing on 24 April 2028, priced at 99.34 (original spread of 110 bp), non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): US$1,250m Bond (RU000A105RH2), fixed rate (7.29% coupon) maturing on 16 August 2037, priced at 100.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): US$1,250m Bond (RU000A105RG4), fixed rate (5.15% coupon) maturing on 11 February 2026, priced at 100.00, non callable

- Hana Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$3,141m Index Linked Security (KR6HN0003BJ9) zero coupon maturing on 19 January 2026, priced at 100.00, non callable

- Israel Discount Bank Ltd (Banking | Tel Aviv-Yafo, Israel | Rating: BBB+): US$800m Senior Note (IL0011920878), fixed rate (5.38% coupon) maturing on 26 January 2028, priced at 99.94 (original spread of 190 bp), callable (5nc5)

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Japan | Rating: A+): US$2,500m Senior Note (US471048CV81), fixed rate (4.25% coupon) maturing on 26 January 2026, priced at 99.98 (original spread of 51 bp), non callable

- KasikornBank PCL (Hong Kong Branch) (Banking | Thailand | Rating: NR): US$500m Unsecured Note (XS2580263734), fixed rate (5.00% coupon) maturing on 6 February 2028, priced at 100.00, non callable

- Kbc Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): US$1,000m Bond (BE6340805124), floating rate maturing on 19 January 2029, priced at 100.00, callable (6nc5)

- OPEC Fund for International Development (Financial - Other | Wien, Austria | Rating: AA+): US$1,000m Senior Note (US683483AA98), fixed rate (4.50% coupon) maturing on 26 January 2026, priced at 99.92, non callable

- SFL Corporation Ltd (Transportation - Other | Hamilton, Bermuda | Rating: NR): US$150m Bond (NO0012819988), fixed rate (8.88% coupon) maturing on 1 February 2027, callable (4nc3)

- Serbia, Republic of (Government) (Sovereign | Beograd, Serbia | Rating: BB): US$1,000m Senior Note (XS2580270275), fixed rate (6.50% coupon) maturing on 26 September 2033, priced at 97.70 (original spread of 340 bp), non callable

- Serbia, Republic of (Government) (Sovereign | Beograd, Serbia | Rating: BB): US$750m Senior Note (XS2580269426), fixed rate (6.25% coupon) maturing on 26 May 2028, priced at 99.63, non callable

- Societe Generale Luxembourg SA (Banking | Luxembourg, France | Rating: A): US$500m Unsecured Note (XS2578376373), floating rate maturing on 30 January 2026, priced at 100.00, non callable

- Transocean Inc (Oilfield Machinery and Services | George Town, Switzerland | Rating: B-): US$1,175m Note (US893830BX61), fixed rate (8.75% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 523 bp), callable (7nc3)

- Turkiye Cumhuriyeti Ziraat Bankasi AS (Banking | Ankara, Turkey | Rating: B-): US$500m Unsecured Note (XS2581381634), fixed rate (10.38% coupon) maturing on 23 January 2028, priced at 100.00, non callable

- Woori Bank (Banking | Seoul, Seoul, South Korea | Rating: A+): US$600m Senior Note (US98105GAM42), fixed rate (4.88% coupon) maturing on 26 January 2028, priced at 99.65 (original spread of 135 bp), non callable

RECENT EUR BOND ISSUES

- Acea SpA (Utility - Other | Rome, Roma, Italy | Rating: BBB): €500m Senior Note (XS2579284469), fixed rate (3.88% coupon) maturing on 24 January 2031, priced at 99.66 (original spread of 190 bp), callable (8nc8)

- Aib Group PLC (Banking | Dublin, Ireland | Rating: BBB-): €750m Senior Note (XS2578472339), fixed rate (4.63% coupon) maturing on 23 July 2029, priced at 99.70 (original spread of 255 bp), callable (7nc6)

- Arkema SA (Chemicals | Colombes, Ile-De-France, France | Rating: BBB+): €400m Bond (FR001400FAZ5), fixed rate (3.50% coupon) maturing on 23 January 2031, priced at 98.62 (original spread of 168 bp), callable (8nc8)

- Autostrade per l'Italia SpA (Transportation - Other | Rome, Roma, Italy | Rating: BBB-): €750m Senior Note (XS2579897633), fixed rate (4.75% coupon) maturing on 24 January 2031, priced at 99.40 (original spread of 278 bp), callable (8nc8)

- B2holding ASA (Financial - Other | Oslo, Norway | Rating: B+): €130m Bond (NO0012822750), floating rate (EU03MLIB + 690.0 bp) maturing on 22 September 2026, priced at 98.75, callable (4nc2)

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €200m Bond (FR001400F695), floating rate (EU03MLIB + 35.0 bp) maturing on 17 January 2025, priced at 100.00, non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €500m Bond (FR001400FBR0), fixed rate (4.00% coupon) maturing on 26 January 2033, priced at 99.06 (original spread of 199 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €1,000m Bond (FR001400FBN9), fixed rate (3.88% coupon) maturing on 26 January 2028, priced at 99.66, non callable

- Bausparkasse Schwaebisch Hall Bausparkasse der Volksbanken und Raiffeisenbanken AG (Banking | Schwaebisch Hall, Baden-Wuerttemberg, Germany | Rating: A+): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30V8H6), fixed rate (2.88% coupon) maturing on 24 June 2032, priced at 99.99 (original spread of 76 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €150m Inhaberschuldverschreibung (DE000BLB9S65), fixed rate (3.22% coupon) maturing on 27 January 2025, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): €449m Bond (FR001400DFD6) zero coupon maturing on 20 January 2028, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,170m Bond (FR001400DEM0) zero coupon maturing on 20 January 2028, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB): €1,500m Bond (FR001400FB22), fixed rate (5.13% coupon) maturing on 25 January 2035, priced at 99.54 (original spread of 314 bp), callable (12nc7)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,250m Bond (FR001400FB06), fixed rate (3.50% coupon) maturing on 25 January 2028, priced at 99.25 (original spread of 155 bp), non callable

- Brandenburg, State of (Official and Muni | Potsdam, Brandenburg, Germany | Rating: AAA): €500m Landesschatzanweisung (DE000A3E5SL5), fixed rate (2.50% coupon) maturing on 25 January 2029, priced at 99.60 (original spread of 56 bp), non callable

- Bulgaria, Republic of (Government) (Sovereign | Sofia, Sofia, Bulgaria | Rating: BBB+): €1,500m Unsecured Note (XS2579483319), fixed rate (4.50% coupon) maturing on 27 January 2033, priced at 97.82 (original spread of 273 bp), non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, France | Rating: NR): €1,000m Obligation Fonciere (Covered Bond) (FR001400FFW1), fixed rate (2.88% coupon) maturing on 30 January 2030, priced at 99.50 (original spread of 82 bp), non callable

- Caja Rural de Navarra S Coop de Credito (Banking | Pamplona, Spain | Rating: AA+): €500m Cedula Hipotecaria (Covered Bond) (ES0415306101), fixed rate (3.00% coupon) maturing on 26 April 2027, priced at 99.85 (original spread of 102 bp), non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: AA-): €500m Unsecured Note (XS2580013899), floating rate maturing on 24 January 2025, priced at 100.00, non callable

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): €1,000m Bond (XS2579153524), floating rate maturing on 24 January 2031, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €1,500m Bond (FR001400FB30), fixed rate (3.55% coupon) maturing on 20 July 2029, priced at 100.00, non callable

- Crelan SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB-): €500m Bond (BE0002913946), fixed rate (5.75% coupon) maturing on 26 January 2028, priced at 99.53 (original spread of 376 bp), non callable

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: AAA): €250m Oeffenlicher Pfandbrief (Covered Bond) (XS2579303780), fixed rate (3.00% coupon) maturing on 27 January 2025, priced at 99.88 (original spread of 59 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VAL7), fixed rate (2.55% coupon) maturing on 10 February 2025, priced at 100.00, non callable

- Deutsche Bank AG (Property and Casualty Insurance | Frankfurt, Hessen, Germany | Rating: AA-): €150m Senior Note (XS2580260557), fixed rate (3.25% coupon) maturing on 24 January 2025, priced at 100.00, non callable

- EDP Energias de Portugal SA (Utility - Other | Lisbon, Portugal | Rating: BB+): €1,000m Subordinated Note (PTEDP4OM0025), fixed rate (5.94% coupon) maturing on 23 April 2083, priced at 100.00 (original spread of 381 bp), callable (60nc5)

- ESB Finance DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: A-): €350m Senior Note (XS2579482006), fixed rate (3.75% coupon) maturing on 25 January 2043, priced at 99.57 (original spread of 174 bp), callable (20nc20)

- Electricite de France SA (Utility - Other | Paris, France | Rating: BBB): €1,000m Bond (FR001400FDC8), fixed rate (4.63% coupon) maturing on 25 January 2043, priced at 98.67 (original spread of 262 bp), callable (20nc20)

- Electricite de France SA (Utility - Other | Paris, France | Rating: BBB): €1,000m Bond (FR001400FDB0), fixed rate (4.25% coupon) maturing on 25 January 2032, priced at 99.93 (original spread of 226 bp), callable (9nc9)

- EnBW International Finance BV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: NR): €750m Senior Note (XS2579293536), fixed rate (4.00% coupon) maturing on 24 January 2035, priced at 99.63 (original spread of 199 bp), callable (12nc12)

- EnBW International Finance BV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: NR): €500m Senior Note (XS2579293619), fixed rate (3.50% coupon) maturing on 24 July 2028, priced at 99.82 (original spread of 150 bp), callable (6nc5)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A327M4), fixed rate (3.30% coupon) maturing on 8 February 2031, priced at 100.00, non callable

- Eurobank SA (ATHINA) (Banking | Athina, Attiki, Greece | Rating: B+): €500m Note (XS2579816146), fixed rate (7.00% coupon) maturing on 26 January 2029, priced at 99.49 (original spread of 502 bp), callable (6nc5)

- Greece, Republic of (Government) (Sovereign | Athina, Attiki, Greece | Rating: BB-): €3,500m Senior Note (GR0124039737), fixed rate (4.25% coupon) maturing on 15 June 2033, priced at 99.78 (original spread of 221 bp), non callable

- Greenvolt Energias Renovaveis SA (Utility - Other | Porto, Portugal | Rating: NR): €200m Bond (), fixed rate (4.75% coupon) maturing on 15 February 2030, priced at 100.00, non callable, convertible

- Kbc Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB): €500m Bond (BE0002914951), fixed rate (4.88% coupon) maturing on 25 April 2033, priced at 99.45 (original spread of 284 bp), callable (10nc5)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AAA): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000LB384E5), fixed rate (2.88% coupon) maturing on 23 March 2026, priced at 99.95 (original spread of 59 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7DD8), fixed rate (2.50% coupon) maturing on 24 February 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7DC0), fixed rate (2.25% coupon) maturing on 24 February 2026, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000HLB7DE6), fixed rate (2.65% coupon) maturing on 24 February 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB7DB2), fixed rate (2.20% coupon) maturing on 24 February 2025, priced at 100.00, non callable

- Muenchener Hypothekenbank eG (Banking | Muenchen, Bayern, Germany | Rating: AA-): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000MHB33J5), fixed rate (2.75% coupon) maturing on 24 September 2025, priced at 99.84 (original spread of 66 bp), non callable

- NIBC Bank NV (Banking | S-Gravenhage, Zuid-Holland, United States | Rating: BBB+): €500m Covered Bond (Other) (XS2579199865), fixed rate (2.88% coupon) maturing on 24 January 2030, priced at 99.28 (original spread of 92 bp), non callable

- National Bank of Canada (Banking | Montreal, Quebec, Canada | Rating: BBB+): €500m Senior Note (XS2579324869), fixed rate (3.75% coupon) maturing on 25 January 2028, priced at 99.52 (original spread of 184 bp), with a regulatory call

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €500m Senior Note (XS2579321337), fixed rate (2.75% coupon) maturing on 17 December 2029, priced at 100.00 (original spread of 61 bp), non callable

- Nordic Investment Bank (Supranational | Helsinki, Etela-Suomen, Finland | Rating: AAA): €500m Senior Note (XS2580868482), fixed rate (2.50% coupon) maturing on 30 January 2030, priced at 99.26 (original spread of 55 bp), non callable

- OP Asuntoluottopankki Oyj (Mortgage Banking | Helsinki, Etela-Suomen, Finland | Rating: NR): €1,000m Covered Bond (Other) (XS2580224082), fixed rate (2.75% coupon) maturing on 25 January 2030, priced at 99.99 (original spread of 86 bp), non callable

- Oberoesterreichische Landesbank AG (Banking | Linz, Oberoesterreich, Austria | Rating: AA+): €250m Hypothekenpfandbrief (Covered Bond) (AT0000A32695), fixed rate (2.88% coupon) maturing on 25 August 2027, priced at 99.60 (original spread of 103 bp), non callable

- Pirelli & C SpA (Vehicle Parts | Milan, Milano, Italy | Rating: BBB-): €600m Senior Note (XS2577396430), fixed rate (4.25% coupon) maturing on 18 January 2028, priced at 99.70 (original spread of 210 bp), callable (5nc5)

- Prologis Euro Finance LLC (Financial - Other | Denver, Colorado, United States | Rating: A): €500m Bond (XS2580271752), fixed rate (4.00% coupon) maturing on 27 January 2033, priced at 100.00, non callable

- Prologis Euro Finance LLC (Financial - Other | Denver, Colorado, United States | Rating: A): €500m Bond (XS2580271596), fixed rate (3.88% coupon) maturing on 27 January 2030, priced at 100.00, non callable

- Quebec, Province of (Official and Muni | Quebec City, Quebec, Canada | Rating: AA-): €2,250m Senior Note (XS2579050639), fixed rate (3.00% coupon) maturing on 24 January 2033, priced at 99.07 (original spread of 99 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A): €1,000m Note (XS2579606927), floating rate maturing on 26 January 2027, priced at 99.93 (original spread of 257 bp), callable (4nc3)

- Raiffeisen Landesbank Vorarlberg mit Revisionsverband eGen (Banking | Bregenz, Vorarlberg, Austria | Rating: A-): €300m Hypothekenpfandbrief (Covered Bond) (AT000B067087), fixed rate (3.00% coupon) maturing on 25 January 2027, priced at 99.66 (original spread of 82 bp), non callable

- Raiffeisen landesbank Tirol AG (Banking | Innsbruck, Tirol, Austria | Rating: A-): €500m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A32661), fixed rate (3.00% coupon) maturing on 24 January 2028, priced at 99.79 (original spread of 95 bp), non callable

- Sparebank 1 SR Bank ASA (Banking | Stavanger, Rogaland, Norway | Rating: A+): €1,000m Note (XS2579319513), fixed rate (3.75% coupon) maturing on 23 November 2027, priced at 99.55 (original spread of 172 bp), non callable

- Telecom Italia SpA (Telecommunications | Rome, Italy | Rating: B+): €850m Senior Note (XS2581393134), fixed rate (6.88% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 473 bp), callable (5nc5)

- Tereos Finance Groupe I SA (Financial - Other | Origny-Sainte-Benoite, Hauts-De-France, France | Rating: BB-): €350m Senior Note (XS2532478430), fixed rate (7.25% coupon) maturing on 15 April 2028, priced at 100.00 (original spread of 524 bp), callable (5nc2)

- Thames Water Utilities Finance PLC (Financial - Other | Reading, Berkshire, United Kingdom | Rating: BBB): €1,000m Senior Note (XS2576550672), fixed rate (4.38% coupon) maturing on 18 January 2031, priced at 99.99 (original spread of 226 bp), callable (8nc8)

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €300m Senior Note (DE000A3LC4C3), fixed rate (4.13% coupon) maturing on 18 January 2025, priced at 99.82 (original spread of 154 bp), callable (2nc2)

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €105m Unsecured Note (XS2579191532), fixed rate (4.10% coupon) maturing on 23 February 2027, priced at 100.00, non callable

- Wirtschafts und Infrastrukturbank Hessen (Banking | Offenbach Am Main, Hessen, Germany | Rating: AA+): €600m Inhaberschuldverschreibung (DE000A3SJZT2), fixed rate (2.63% coupon) maturing on 26 January 2033, priced at 99.01 (original spread of 69 bp), non callable

RECENT LOANS

- AFI Europe NV (Netherlands), signed a € 450m Term Loan, to be used for real estate acquisition

- AIP RD Buyer Corp (United States of America | B), signed a US$ 250m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 12/23/28 and initial pricing is set at Term SOFR +500.0bp

- Al Wakrah & Al Wukair Sewage (Qatar), signed a US$ 550m Term Loan, to be used for project finance.

- April International SA (France), signed a € 850m Other, to be used for leveraged buyout.

- April International SA (France), signed a € 100m Revolving Credit Facility, to be used for leveraged buyout.

- April International SA (France), signed a € 100m Acquisition Financing, to be used for leveraged buyout.

- China Solar Energy Invest Ltd (Hong Kong), signed a US$ 1,200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 01/13/28 and initial pricing is set at Term SOFR +100.0bp

- Gunvor Group Ltd (Switzerland), signed a US$ 1,565m Revolving Credit / Term Loan, to be used for working capital

- Kenco Logistics (United States of America), signed a US$ 385m Term Loan, to be used for leveraged buyout

- Macquarie AirFinance Ltd (Republic of Ireland), signed a US$ 1,650m Revolving Credit / Term Loan, to be used for aircraft financing.

- Parts Holding Europe SAS (France), signed a € 200m Revolving Credit Facility, to be used for general corporate purposes.

- Repsol Biofuel Plant (Spain), signed a € 120m Term Loan, to be used for project finance.

- Service Corp International (United States of America | BB-), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 01/11/28.

- Service Corp International (United States of America | BB-), signed a US$ 675m Term Loan A, to be used for general corporate purposes and working capital. It matures on 01/11/28 and initial pricing is set at Term SOFR +225.0bp

- Sina Corp (China), signed a US$ 400m Term Loan, to be used for general corporate purposes. It matures on 01/11/24 and initial pricing is set at Term SOFR +145.0bp