Credit

Risk Appetite Brings On HY-IG Spreads Compression; HY Distressed Spreads 350bp Tighter YTD

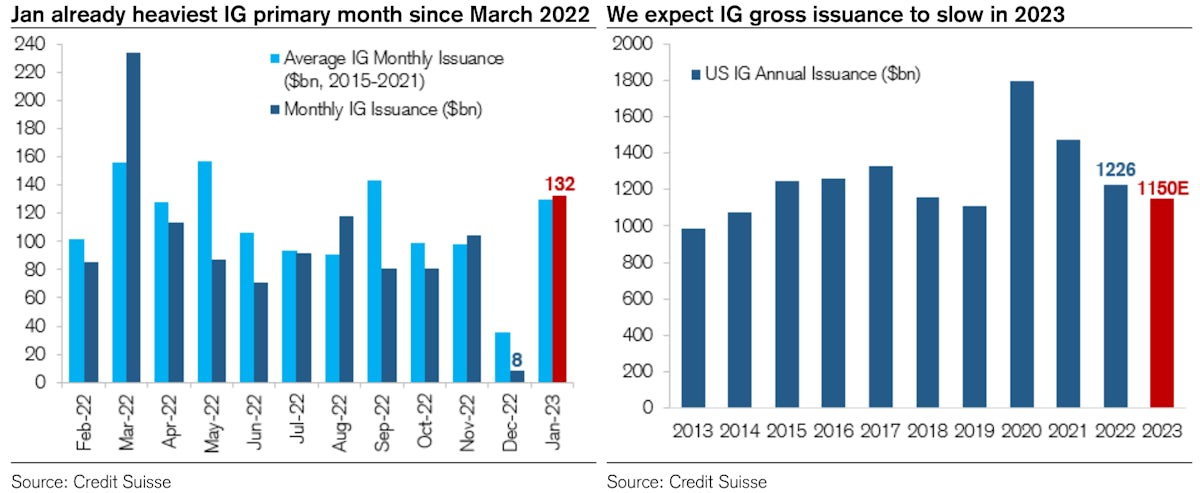

Weekly volumes of new USD corporate bonds priced (IFR Markets data): 26 tranches for $26bn in IG (2023 YTD volume $136.15bn vs 2022 YTD $148.39bn), 5 tranches for $3.75bn in HY (2023 YTD volume $15.45bn vs 2022 YTD $22.36bn)

Published ET

January 2023 US$ IG Issuance & Full Year Estimate | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was down -0.11% today, with investment grade down -0.11% and high yield down -0.10% (YTD total return: +3.74%)

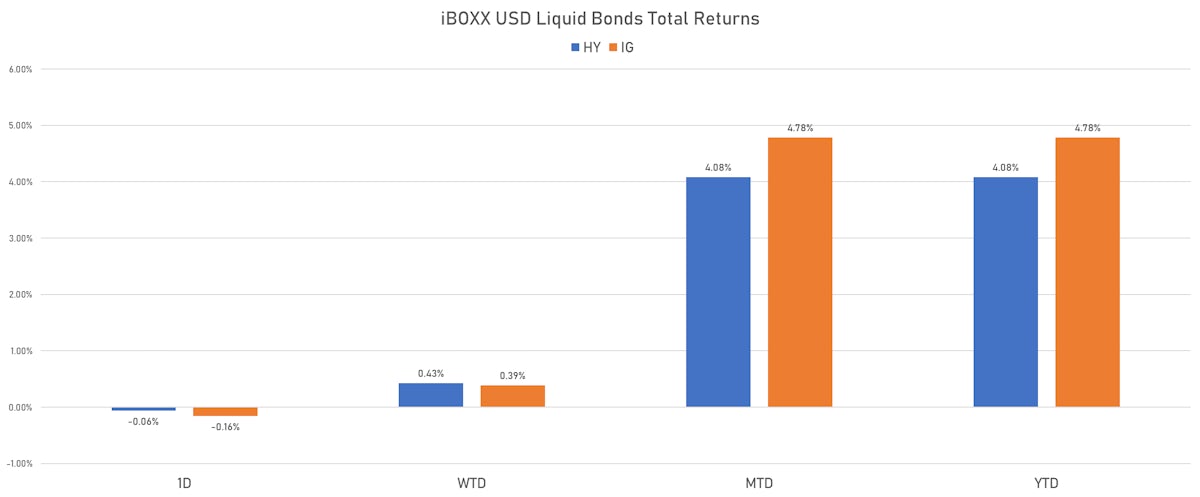

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.155% today (Week-to-date: 0.39%; Month-to-date: 4.78%; Year-to-date: 4.78%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.060% today (Week-to-date: 0.43%; Month-to-date: 4.08%; Year-to-date: 4.08%)

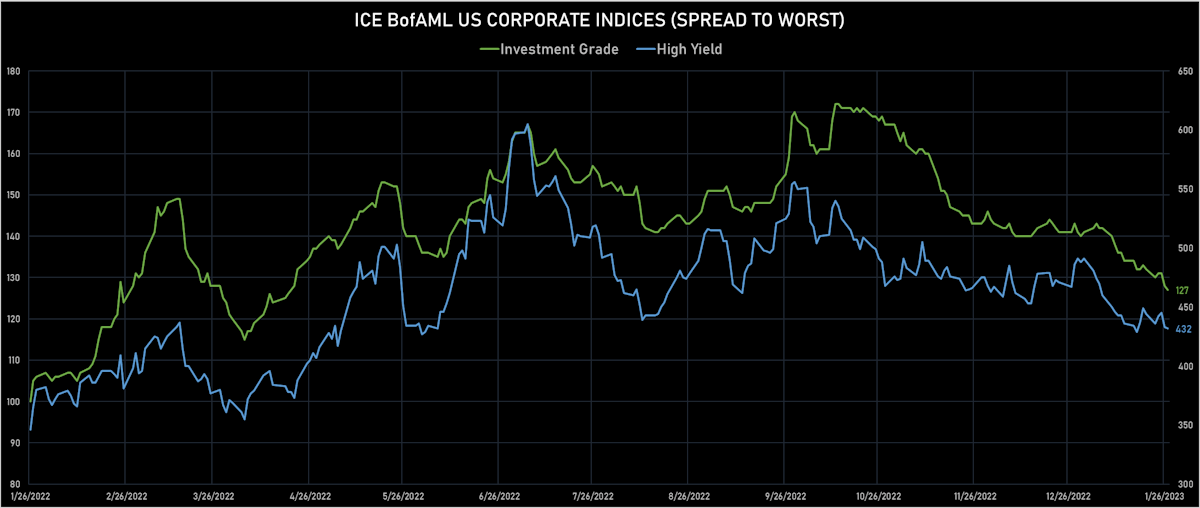

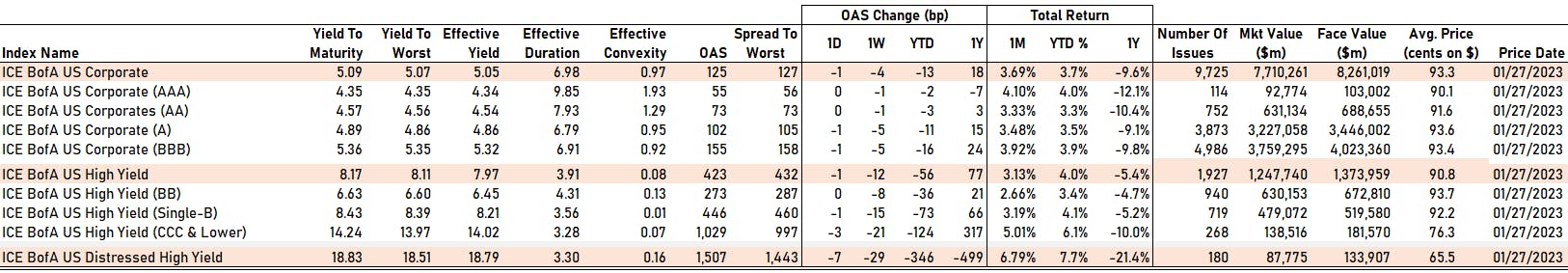

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 127.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 432.0 bp (YTD change: -56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: +2.9%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 55 bp

- AA unchanged at 73 bp

- A down by -1 bp at 102 bp

- BBB down by -1 bp at 155 bp

- BB unchanged at 273 bp

- B down by -1 bp at 446 bp

- ≤ CCC down by -3 bp at 1,029 bp

CDS INDICES TODAY (mid-spreads)

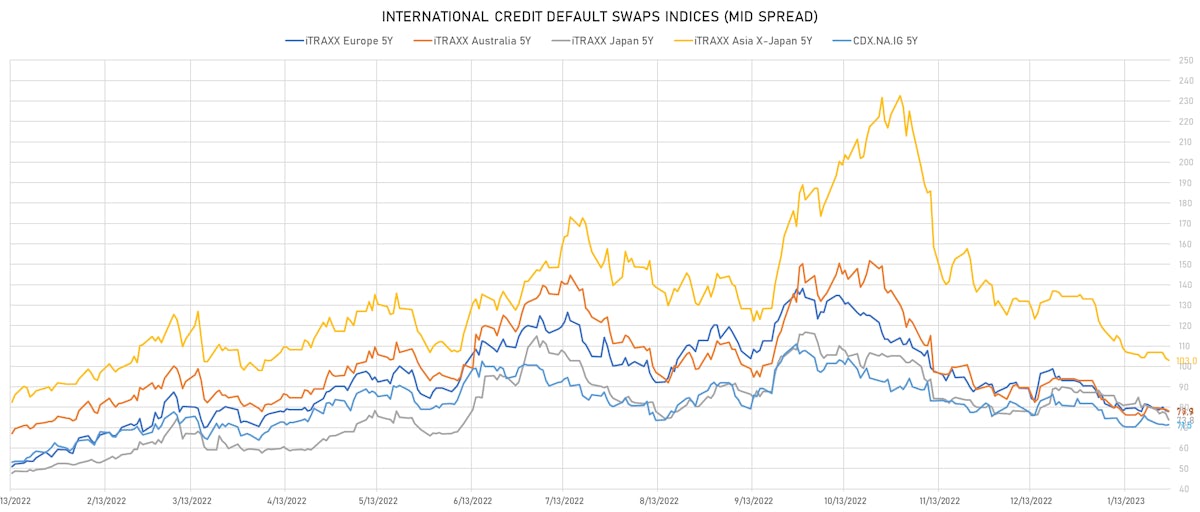

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 71bp (1W change: -2.6bp; YTD change: -10.4bp)

- Markit CDX.NA.IG 10Y up 0.2 bp, now at 112bp (1W change: -1.0bp; YTD change: -6.3bp)

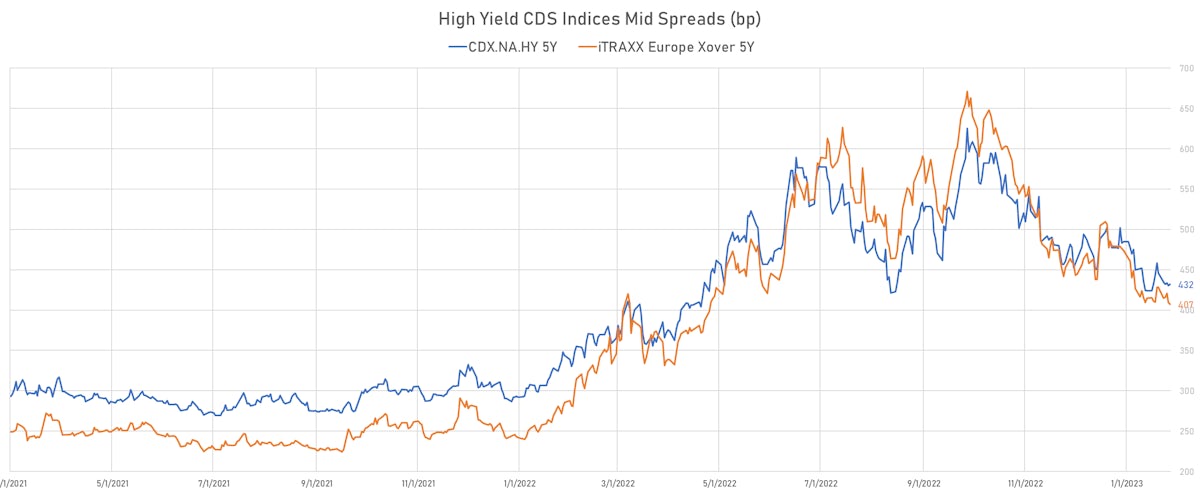

- Markit CDX.NA.HY 5Y up 1.7 bp, now at 432bp (1W change: -14.2bp; YTD change: -52.8bp)

- Markit iTRAXX Europe 5Y down 0.5 bp, now at 78bp (1W change: -3.6bp; YTD change: -12.6bp)

- Markit iTRAXX Europe Crossover 5Y down 2.3 bp, now at 407bp (1W change: -20.7bp; YTD change: -66.7bp)

- Markit iTRAXX Japan 5Y down 3.2 bp, now at 74bp (1W change: -6.8bp; YTD change: -13.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.0 bp, now at 103bp (1W change: -3.8bp; YTD change: -30.0bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: B1): down 601.1 bp to 2,355.3bp (1Y range: 481-2,584bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 171.1 bp to 994.1bp (1Y range: 425-2,117bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 101.0 bp to 821.6bp (1Y range: 688-1,472bp)

- Tegna Inc (Country: US; rated: Ba3): down 77.6 bp to 430.0bp (1Y range: 182-786bp)

- American Airlines Group Inc (Country: US; rated: B2): down 71.1 bp to 821.9bp (1Y range: 607-1,644bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 50.4 bp to 612.5bp (1Y range: 368-1,584bp)

- Onemain Finance Corp (Country: US; rated: Ba2): down 46.3 bp to 371.8bp (1Y range: 121-1,042bp)

- Gap Inc (Country: US; rated: Ba2): down 45.6 bp to 501.2bp (1Y range: 262-819bp)

- Transocean Inc (Country: KY; rated: Caa1): down 44.9 bp to 883.6bp (1Y range: 746-2,858bp)

- Beazer Homes USA Inc (Country: US; rated: A2): down 42.0 bp to 556.7bp (1Y range: 344-899bp)

- Ally Financial Inc (Country: US; rated: A1): down 39.9 bp to 244.4bp (1Y range: 116-356bp)

- KB Home (Country: US; rated: A2): down 35.8 bp to 265.5bp (1Y range: 183-485bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 72.0 bp to 918.3bp (1Y range: 548-1,783bp)

- Community Health Systems Inc (Country: US; rated: B): up 72.6 bp to 2,969.4bp (1Y range: 604-4,371bp)

- Lumen Technologies Inc (Country: US; rated: WR): up 84.7 bp to 1,001.0bp (1Y range: 195-1,001bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 168.8 bp to 764.1bp (1Y range: 402-1,296bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): down 163.3 bp to 2,824.0bp (1Y range: 682-4,917bp)

- TUI AG (Country: DE; rated: B3-PD): down 101.6 bp to 747.5bp (1Y range: 612-1,725bp)

- Credit Suisse Group AG (Country: CH; rated: A+): down 48.6 bp to 269.6bp (1Y range: 68-442bp)

- Air France KLM SA (Country: FR; rated: C): down 45.1 bp to 563.9bp (1Y range: 415-990bp)

- Stena AB (Country: SE; rated: B1-PD): down 27.1 bp to 490.1bp (1Y range: 437-865bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 26.1 bp to 1,480.0bp (1Y range: 1,286-2,910bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 23.9 bp to 757.2bp (1Y range: 324-1,254bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 17.1 bp to 241.3bp (1Y range: 237-606bp)

- Accor SA (Country: FR; rated: A2): down 13.9 bp to 166.0bp (1Y range: 140-347bp)

- Fresenius SE & Co KGaA (Country: DE; rated: BBB-): down 13.4 bp to 175.6bp (1Y range: 61-221bp)

- Atlantia SpA (Country: IT; rated: Ba1): down 13.2 bp to 199.0bp (1Y range: 122-383bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): down 12.6 bp to 400.0bp (1Y range: 229-705bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 12.4 bp to 402.1bp (1Y range: 330-648bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 16.5 bp to 1,084.8bp (1Y range: 566-1,739bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Xerox Corp (Norwalk, Connecticut (US)) | Coupon: 3.80% | Maturity: 15/5/2024 | Rating: BB | CUSIP: 984121CJ0 | OAS up by 54.6 bp to 186.5 bp (CDS basis: -20.6bp), with the yield to worst at 6.3% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 96.0-97.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.66% | Maturity: 8/9/2024 | Rating: BB | CUSIP: 345397WW9 | OAS down by 35.9 bp to 137.0 bp (CDS basis: 45.4bp), with the yield to worst at 5.8% and the bond now trading up to 96.5 cents on the dollar (1Y price range: 94.7-97.2).

- Issuer: Las Vegas Sands Corp (Las Vegas, Nevada (US)) | Coupon: 2.90% | Maturity: 25/6/2025 | Rating: BB+ | CUSIP: 517834AH0 | OAS down by 36.3 bp to 121.7 bp, with the yield to worst at 5.5% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 92.0-94.1).

- Issuer: GLP Capital LP (Wyomissing, Pennsylvania (US)) | Coupon: 5.75% | Maturity: 1/6/2028 | Rating: BB+ | CUSIP: 361841AK5 | OAS down by 39.3 bp to 162.2 bp, with the yield to worst at 5.3% and the bond now trading up to 101.7 cents on the dollar (1Y price range: 97.8-101.8).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS down by 41.2 bp to 115.0 bp, with the yield to worst at 5.1% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 96.0-98.6).

- Issuer: Oceaneering International Inc (Houston, Texas (US)) | Coupon: 4.65% | Maturity: 15/11/2024 | Rating: B+ | CUSIP: 675232AA0 | OAS down by 44.8 bp to 104.5 bp, with the yield to worst at 5.2% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 95.8-98.1).

- Issuer: AECOM (Dallas, Texas (US)) | Coupon: 5.13% | Maturity: 15/3/2027 | Rating: BB- | CUSIP: 00774CAB3 | OAS down by 47.6 bp to 145.3 bp, with the yield to worst at 5.1% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 96.5-99.1).

- Issuer: Western Digital Corp (San Jose, California (US)) | Coupon: 4.75% | Maturity: 15/2/2026 | Rating: BB | CUSIP: 958102AM7 | OAS down by 51.5 bp to 163.7 bp, with the yield to worst at 5.4% and the bond now trading up to 97.1 cents on the dollar (1Y price range: 94.0-97.1).

- Issuer: Crown Americas LLC (Philadelphia, Pennsylvania (US)) | Coupon: 5.25% | Maturity: 1/4/2030 | Rating: BB | CUSIP: 228180AB1 | OAS down by 52.1 bp to 231.7 bp, with the yield to worst at 5.8% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 93.5-96.6).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS down by 53.0 bp to 209.1 bp (CDS basis: -57.4bp), with the yield to worst at 5.9% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 96.6-99.0).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.13% | Maturity: 25/3/2024 | Rating: B+ | CUSIP: 78442FET1 | OAS down by 72.1 bp to 143.5 bp (CDS basis: -30.1bp), with the yield to worst at 5.6% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 98.3-99.9).

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS down by 87.3 bp to 272.1 bp, with the yield to worst at 6.5% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 96.1-99.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS down by 91.7 bp to 275.9 bp (CDS basis: -70.4bp), with the yield to worst at 6.4% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 96.1-99.5).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | CUSIP: 126458AE8 | OAS down by 92.9 bp to 222.6 bp, with the yield to worst at 5.8% and the bond now trading up to 90.6 cents on the dollar (1Y price range: 84.1-90.6).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | CUSIP: 02376RAE2 | OAS down by 125.3 bp to 274.3 bp, with the yield to worst at 6.5% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 85.0-93.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS up by 146.0 bp to 491.4 bp, with the yield to worst at 7.5% and the bond now trading down to 86.2 cents on the dollar (1Y price range: 85.3-93.2).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS up by 118.1 bp to 628.7 bp, with the yield to worst at 9.2% and the bond now trading down to 75.0 cents on the dollar (1Y price range: 74.9-79.1).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 2.00% | Maturity: 29/9/2028 | Rating: BB- | ISIN: XS2391403354 | OAS up by 66.0 bp to 487.6 bp, with the yield to worst at 7.6% and the bond now trading down to 74.4 cents on the dollar (1Y price range: 75.3-80.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | OAS down by 40.5 bp to 334.9 bp, with the yield to worst at 6.2% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 83.5-89.1).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | OAS down by 41.7 bp to 321.4 bp, with the yield to worst at 5.9% and the bond now trading up to 83.1 cents on the dollar (1Y price range: 77.7-83.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS down by 42.3 bp to 304.7 bp, with the yield to worst at 5.8% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 83.7-88.9).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | OAS down by 51.5 bp to 291.2 bp, with the yield to worst at 5.7% and the bond now trading up to 85.8 cents on the dollar (1Y price range: 81.4-86.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS down by 62.0 bp to 503.5 bp (CDS basis: -27.1bp), with the yield to worst at 7.8% and the bond now trading up to 87.6 cents on the dollar (1Y price range: 81.2-87.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS down by 64.6 bp to 449.6 bp (CDS basis: -5.6bp), with the yield to worst at 7.2% and the bond now trading up to 83.5 cents on the dollar (1Y price range: 77.8-83.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: B+ | ISIN: XS1824425182 | OAS down by 64.8 bp to 308.8 bp (CDS basis: 69.4bp), with the yield to worst at 6.0% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 89.3-93.6).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS down by 65.1 bp to 340.8 bp (CDS basis: 58.9bp), with the yield to worst at 6.3% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 87.6-91.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS down by 65.6 bp to 514.6 bp (CDS basis: -10.3bp), with the yield to worst at 7.9% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 77.7-84.9).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.75% | Maturity: 7/5/2025 | Rating: BB | ISIN: FR0013378452 | OAS down by 84.9 bp to 496.7 bp, with the yield to worst at 6.4% and the bond now trading up to 87.2 cents on the dollar (1Y price range: 80.6-87.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 115.4 bp to 563.1 bp (CDS basis: 142.8bp), with the yield to worst at 8.3% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 88.4-95.0).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 170.3 bp to 450.5 bp (CDS basis: 187.5bp), with the yield to worst at 7.2% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 85.3-92.5).

RECENT DOMESTIC USD BOND ISSUES

- Autozone Inc (Vehicle Parts | Memphis, United States | Rating: BBB): US$550m Senior Note (US053332BD36), fixed rate (4.75% coupon) maturing on 1 February 2033, priced at 99.83 (original spread of 140 bp), callable (10nc10)

- Autozone Inc (Vehicle Parts | Memphis, United States | Rating: BBB): US$450m Senior Note (US053332BC52), fixed rate (4.50% coupon) maturing on 1 February 2028, priced at 99.90 (original spread of 96 bp), callable (5nc5)

- Bank of New York Mellon Corp (Securities | New York City, United States | Rating: A): US$750m Senior Note (US06406RBN61), floating rate maturing on 1 February 2029, priced at 100.00 (original spread of 93 bp), callable (6nc5)

- Bank of New York Mellon Corp (Securities | New York City, United States | Rating: A): US$750m Senior Note (US06406RBP10), floating rate maturing on 1 February 2034, priced at 100.00 (original spread of 127 bp), callable (11nc10)

- Caesars Entertainment Inc (Financial - Other | Reno, United States | Rating: B): US$2,000m Note (US12769GAB68), fixed rate (7.00% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 350 bp), callable (7nc3)

- Capital One Financial Corp (Financial - Other | Mclean, United States | Rating: BBB): US$1,250m Senior Note (US14040HCY99), floating rate maturing on 1 February 2034, priced at 100.00 (original spread of 235 bp), callable (11nc10)

- Capital One Financial Corp (Financial - Other | Mclean, United States | Rating: BBB): US$1,000m Senior Note (US14040HCX17), floating rate maturing on 1 February 2029, priced at 100.00 (original spread of 182 bp), callable (6nc5)

- Crescent Energy Finance LLC (Financial - Other | New York City, United States | Rating: B+): US$400m Senior Note (USU4526LAC10), fixed rate (9.25% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 568 bp), callable (5nc2)

- Evergreen AcqCo 1 LP (Financial - Other | Bellevue, United States | Rating: B): US$550m Note (USU3000FAA58), fixed rate (9.75% coupon) maturing on 26 April 2028, priced at 97.99, callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$325m Bond (US3133EN7J33), fixed rate (3.88% coupon) maturing on 2 February 2026, priced at 99.70 (original spread of 3 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133EN7H76), floating rate (AB3DM + 21.5 bp) maturing on 27 January 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EN7K06), floating rate (SOFR + 16.0 bp) maturing on 30 January 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$575m Bond (US3133EPAB14), floating rate (SOFR + 16.5 bp) maturing on 6 February 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$105m Bond (US3130AUQ803), fixed rate (5.08% coupon) maturing on 8 August 2025, priced at 100.00, callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$10,000m Unsecured Note (US3134GYFZ09), fixed rate (5.00% coupon) maturing on 26 January 2028, priced at 100.00, callable (5nc1)

- International Finance Corp (Supranational | Washington, United States | Rating: AAA): US$150m Senior Note (US45950VRT51), fixed rate (3.90% coupon) maturing on 26 January 2026, priced at 100.00, non callable

- International Finance Corp (Supranational | Washington, United States | Rating: AAA): US$600m Senior Note (US45950KDB35), floating rate (SOFR + 28.0 bp) maturing on 16 March 2026, priced at 100.00, non callable

- JP Morgan Structured Products BV (Financial - Other | Amsterdam, United States | Rating: NR): US$200m Unsecured Note (XS2381794325) zero coupon maturing on 28 January 2026, priced at 100.00, non callable

- KeyBank NA (Banking | Cleveland, United States | Rating: A-): US$500m Senior Bank Note (US49327M3G70), fixed rate (4.70% coupon) maturing on 26 January 2026, priced at 99.92 (original spread of 83 bp), callable (3nc3)

- KeyBank NA (Banking | Cleveland, United States | Rating: A-): US$1,000m Senior Bank Note (US49327M3H53), fixed rate (5.00% coupon) maturing on 26 January 2033, priced at 99.52 (original spread of 153 bp), callable (10nc10)

- Kinder Morgan Inc (Gas Utility - Pipelines | Houston, United States | Rating: BBB): US$1,500m Senior Note (US49456BAX91), fixed rate (5.20% coupon) maturing on 1 June 2033, priced at 99.68 (original spread of 175 bp), callable (10nc10)

- M&T Bank Corp (Banking | Buffalo, United States | Rating: BBB+): US$1,000m Senior Note (US55261FAR55), floating rate maturing on 27 January 2034, priced at 100.00 (original spread of 162 bp), callable (11nc10)

- Manufacturers and Traders Trust Co (Banking | Buffalo, United States | Rating: A-): US$1,200m Senior Bank Note (US55279HAW07), fixed rate (4.70% coupon) maturing on 27 January 2028, priced at 99.86 (original spread of 116 bp), callable (5nc5)

- Manufacturers and Traders Trust Co (Banking | Buffalo, United States | Rating: A-): US$1,300m Senior Note (US55279HAV24), fixed rate (4.65% coupon) maturing on 27 January 2026, priced at 99.83 (original spread of 85 bp), callable (3nc3)

- New York Life Global Funding (Financial - Other | Wilmington, United States | Rating: AA+): US$1,000m Note (US64952XEV91), fixed rate (4.55% coupon) maturing on 28 January 2033, priced at 99.82 (original spread of 110 bp), non callable

- Norfolk Southern Corp (Railroads | Atlanta, United States | Rating: BBB+): US$500m Senior Note (US655844CQ90), fixed rate (4.45% coupon) maturing on 1 March 2033, priced at 99.65 (original spread of 100 bp), callable (10nc10)

- PRA Group Inc (Service - Other | Norfolk, United States | Rating: BB+): US$400m Senior Note (USU6949NAC12), fixed rate (8.38% coupon) maturing on 1 February 2028, priced at 100.00 (original spread of 474 bp), callable (5nc2)

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): US$850m Senior Note (US742718GA10), fixed rate (4.05% coupon) maturing on 26 January 2033, priced at 99.99 (original spread of 60 bp), with a make whole call

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): US$600m Senior Note (US742718FZ79), fixed rate (3.95% coupon) maturing on 26 January 2028, priced at 99.90 (original spread of 37 bp), with a make whole call

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): US$650m Senior Note (US742718FY05), fixed rate (4.10% coupon) maturing on 26 January 2026, priced at 99.93 (original spread of 24 bp), with a make whole call

- State Street Corp (Financial - Other | Boston, United States | Rating: A): US$750m Senior Note (US857477CA94), floating rate maturing on 26 January 2034, priced at 100.00 (original spread of 130 bp), callable (11nc10)

- State Street Corp (Financial - Other | Boston, United States | Rating: A): US$500m Senior Note (US857477BZ54), floating rate maturing on 26 January 2026, priced at 100.00 (original spread of 27 bp), callable (3nc2)

- Truist Financial Corp (Banking | Charlotte, United States | Rating: A-): US$1,500m Senior Note (US89788MAL63), floating rate maturing on 26 January 2029, priced at 100.00 (original spread of 112 bp), callable (6nc5)

- Truist Financial Corp (Banking | Charlotte, United States | Rating: A-): US$1,500m Senior Note (US89788MAM47), floating rate maturing on 26 January 2034, priced at 100.00 (original spread of 151 bp), callable (11nc10)

- US Bancorp (Banking | Minneapolis, United States | Rating: A): US$1,650m Senior Note (US91159HJK77), floating rate maturing on 1 February 2029, priced at 100.00, callable (6nc5)

- US Bancorp (Banking | Minneapolis, United States | Rating: A): US$2,000m Senior Note (US91159HJL50), floating rate maturing on 1 February 2034, priced at 100.00, callable (11nc10)

- Wells Fargo Bank NA (Banking | Sioux Falls, United States | Rating: A+): US$127m Certificate of Deposit - Retail (US9497635M46), fixed rate (4.40% coupon) maturing on 27 January 2025, priced at 100.00 (original spread of 40 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- Amwaj Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$114m Unsecured Note (XS2582113754), fixed rate (0.05% coupon) maturing on 10 October 2028, priced at 100.00, non callable

- Amwaj Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$304m Unsecured Note (XS2582115023), fixed rate (0.05% coupon) maturing on 17 April 2030, priced at 100.00, non callable

- Ashtead Capital Inc (Leasing | Fort Mill, United Kingdom | Rating: BBB-): US$750m Senior Note (USU04503AL93), fixed rate (5.55% coupon) maturing on 30 May 2033, priced at 99.77 (original spread of 213 bp), callable (10nc10)

- BNP Paribas Fortis SA (Banking | Brussels, France | Rating: A+): US$200m Bond (BE6340496916), fixed rate (5.10% coupon) maturing on 3 March 2026, priced at 100.00, non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: AA+): US$1,500m Cedula de Internacionalizacion (Covered Bond) (ES0413900921), floating rate maturing on 23 January 2030, priced at 100.00, non callable

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: A-): US$1,250m Senior Note (US06417XAP69), fixed rate (4.85% coupon) maturing on 1 February 2030, priced at 99.93 (original spread of 135 bp), with a make whole call

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: A-): US$1,250m Senior Note (US06417XAN12), fixed rate (4.75% coupon) maturing on 2 February 2026, priced at 99.91 (original spread of 96 bp), with a make whole call

- Borr Drilling Ltd (Oil and Gas | Hamilton, Bermuda | Rating: NR): US$250m Bond (), fixed rate (5.00% coupon) maturing on 8 February 2028, priced at 100.00, non callable, convertible

- City National Bank (California) (Banking | Los Angeles, Canada | Rating: A): US$425m Certificate of Deposit - Retail (US178180GW93), fixed rate (4.35% coupon) maturing on 26 January 2026, priced at 100.00 (original spread of 53 bp), non callable

- City National Bank (California) (Banking | Los Angeles, Canada | Rating: A): US$701m Certificate of Deposit - Retail (US178180GV11), fixed rate (4.50% coupon) maturing on 27 January 2025, priced at 100.00 (original spread of 40 bp), non callable

- Colombia, Republic of (Government) (Sovereign | Bogota, Colombia | Rating: BB+): US$2,200m Bond (US195325EG61), fixed rate (7.50% coupon) maturing on 2 February 2034, priced at 99.26 (original spread of 414 bp), callable (11nc11)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0460012734), fixed rate (4.00% coupon) maturing on 21 February 2025, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A327R3), fixed rate (4.10% coupon) maturing on 8 February 2025, priced at 100.00, non callable

- Garda World Security Corp (Financial - Other | Montreal, Guernsey | Rating: B): US$400m Note (US36485MAM10), fixed rate (7.75% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 412 bp), callable (5nc2)

- MAR Finance LLC (Financial - Other | Qatar | Rating: NR): US$150m Unsecured Note (XS2582539909), fixed rate (4.95% coupon) maturing on 1 February 2025, priced at 100.00, non callable

- Multibank Inc (Banking | Panama City, Colombia | Rating: BB+): US$300m Senior Note (USP69895AB94), fixed rate (7.75% coupon) maturing on 3 February 2028, priced at 98.99 (original spread of 438 bp), callable (5nc5)

- Toronto-Dominion Bank (Banking | Toronto, Canada | Rating: A): US$175m Senior Note (US89114X5Y50), floating rate maturing on 27 January 2025, priced at 100.00, non callable

- Transnet SOC Ltd (Transportation - Other | Midrand, South Africa | Rating: BB-): US$800m Unsecured Note (XS2582981952), fixed rate (8.50% coupon) maturing on 8 February 2028, priced at 100.00, non callable

- Turkiye Cumhuriyeti Ziraat Bankasi AS (Banking | Ankara, Turkey | Rating: B-): US$500m Senior Note (US90014TAH41), fixed rate (9.50% coupon) maturing on 1 August 2026, priced at 99.27 (original spread of 623 bp), non callable

- Turkiye Ihracat Kredi Bankasi AS (Agency | Istanbul, Turkey | Rating: B-): US$500m Senior Note (XS2395576437), fixed rate (9.38% coupon) maturing on 31 January 2026, priced at 99.43 (original spread of 537 bp), non callable

RECENT EURO BOND ISSUES

- A2A SpA (Utility - Other | Milan, Italy | Rating: BBB): €500m Senior Note (XS2583205906), fixed rate (4.38% coupon) maturing on 3 February 2034, priced at 98.82 (original spread of 231 bp), callable (11nc11)

- Achmea Bank NV (Banking | Tilburg, Netherlands | Rating: AAA): €500m Covered Bond (Other) (XS2582112947), fixed rate (3.00% coupon) maturing on 31 January 2030, priced at 99.76 (original spread of 98 bp), non callable

- Amwaj Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): €124m Unsecured Note (XS2582190588), fixed rate (0.03% coupon) maturing on 1 February 2027, priced at 100.00, non callable

- Arkea Home Loans SFH SA (Financial - Other | Brest, France | Rating: AAA): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FJM4), fixed rate (3.00% coupon) maturing on 30 March 2027, priced at 99.81 (original spread of 90 bp), non callable

- BNP Paribas Home Loan SFH SA (Financial - Other | Paris, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FIG8), fixed rate (3.00% coupon) maturing on 31 January 2030, priced at 99.92 (original spread of 84 bp), non callable

- Banco de Sabadell SA (Banking | Alicante, Spain | Rating: BBB): €750m Note (XS2583203950), fixed rate (5.25% coupon) maturing on 7 February 2029, priced at 99.82 (original spread of 303 bp), callable (6nc5)

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (DE000BLB9S99), floating rate (EU06MLIB + 2.0 bp) maturing on 31 January 2030, priced at 100.00, non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: A-): €150m Inhaberschuldverschreibung (DE000BLB9TB0), fixed rate (3.25% coupon) maturing on 8 August 2025, priced at 100.00, non callable

- Bpifrance SA (Banking | Maisons-Alfort, France | Rating: NR): €1,000m Bond (FR001400FKA7), fixed rate (2.88% coupon) maturing on 25 November 2029, priced at 99.93 (original spread of 46 bp), non callable

- British Telecommunications PLC (Telecommunications | London, United Kingdom | Rating: BBB): €750m Unsecured Note (XS2582814039), fixed rate (1.00% coupon) maturing on 14 April 2031, priced at 100.00, non callable

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: AAA): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000CZ43ZS7), fixed rate (2.88% coupon) maturing on 28 April 2026, priced at 99.74 (original spread of 68 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: BBB+): €195m Index Linked Security (DE000CB95S35), floating rate (EU01MLIB + 980.0 bp) maturing on 29 July 2033, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C1R6), fixed rate (2.65% coupon) maturing on 17 February 2028, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C1P0), fixed rate (2.45% coupon) maturing on 17 February 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C1Q8), fixed rate (2.55% coupon) maturing on 17 February 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VAQ6), floating rate maturing on 16 February 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9VAR4), floating rate (HICPEXTM + 0.0 bp) maturing on 16 February 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9VAP8), fixed rate (2.85% coupon) maturing on 16 February 2026, priced at 100.00, non callable

- Deutsche Kreditbank AG (Banking | Berlin, Germany | Rating: A+): €500m Hypothekenpfandbrief (Covered Bond) (DE000SCB0047), fixed rate (3.00% coupon) maturing on 31 January 2035, priced at 99.95 (original spread of 86 bp), non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €300m Inhaberschuldverschreibung (AT0000A327P7), fixed rate (3.75% coupon) maturing on 21 February 2031, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A32KL4), fixed rate (3.10% coupon) maturing on 21 February 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A32KC3), fixed rate (2.90% coupon) maturing on 22 August 2026, priced at 100.00, non callable

- Finland, Republic of (Government) (Sovereign | Helsinki, Finland | Rating: AA+): €3,000m Bond (FI4000546528), fixed rate (2.75% coupon) maturing on 15 April 2038, priced at 98.48, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Russia | Rating: NR): €1,000m Bond (RU000A105RZ4), fixed rate (1.50% coupon) maturing on 17 February 2027, priced at 100.00, non callable

- Hypo Noe Landesbank fuer Niederoesterreich und Wien AG (Banking | Sankt Poelten, Austria | Rating: A): €500m Inhaberschuldverschreibung (AT0000A32HA3), fixed rate (4.00% coupon) maturing on 1 February 2027, priced at 99.77 (original spread of 176 bp), non callable

- Hypo Tirol Bank AG (Mortgage Banking | Innsbruck, Austria | Rating: AA+): €300m Hypothekenpfandbrief (Covered Bond) (AT0000A326N4), fixed rate (3.13% coupon) maturing on 31 January 2028, priced at 99.98 (original spread of 95 bp), non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, France | Rating: AA-): €500m Bond (FR001400FIN4), fixed rate (3.40% coupon) maturing on 25 May 2043, priced at 99.47 (original spread of 94 bp), non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, France | Rating: AA-): €500m Bond (FR001400FIM6), fixed rate (3.05% coupon) maturing on 3 February 2033, priced at 99.92 (original spread of 93 bp), non callable

- Italmatch Chemicals SpA (Chemicals | Genoa, United States | Rating: NR): €390m Note (XS2582796541), floating rate (EU03MLIB + 550.0 bp) maturing on 6 February 2028, priced at 94.00, callable (5nc1)

- Italmatch Chemicals SpA (Chemicals | Genoa, United States | Rating: NR): €300m Note (XS2582788100), fixed rate (10.00% coupon) maturing on 6 February 2028, priced at 100.00 (original spread of 784 bp), callable (5nc2)

- Kapla Holding SAS (Financial - Other | Lyon, France | Rating: B+): €200m Note (XS2463546007), floating rate (EU03MLIB + 550.0 bp) maturing on 15 July 2027, priced at 96.00, callable (4nc1)

- Kutxabank SA (Banking | Bilbao, Spain | Rating: A-): €500m Bond (ES0343307023), floating rate maturing on 1 February 2028, priced at 99.92 (original spread of 164 bp), callable (5nc4)

- La Banque Postale Home Loan SFH SA (Financial - Other | Paris, France | Rating: AAA): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FD12), fixed rate (3.00% coupon) maturing on 31 January 2031, priced at 99.59 (original spread of 95 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB45W4), fixed rate (4.00% coupon) maturing on 8 March 2033, priced at 100.00, callable (10nc7)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €200m Subordinated Note (XS2582098930), fixed rate (5.38% coupon) maturing on 1 February 2033, priced at 98.89 (original spread of 261 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €750m Note (XS2582195207), fixed rate (4.00% coupon) maturing on 4 February 2030, priced at 99.78 (original spread of 193 bp), non callable

- Limacorporate SpA (Service - Other | San Daniele Del Friuli, Luxembourg | Rating: B-): €295m Bond (XS2581396079), floating rate maturing on 1 February 2028, priced at 93.00, non callable

- Lloyds Bank PLC (Banking | London, United Kingdom | Rating: A+): €1,000m Covered Bond (Other) (XS2582348046), fixed rate (3.25% coupon) maturing on 2 February 2026, priced at 99.98 (original spread of 91 bp), non callable

- Lower Saxony, State of (Official and Muni | Hannover, Germany | Rating: AAA): €750m Jumbo Landesschatzanweisung (DE000A30V8Q7), fixed rate (2.75% coupon) maturing on 17 February 2031, priced at 99.96 (original spread of 66 bp), non callable

- Marex Group PLC (Financial - Other | London, Jersey | Rating: BBB-): €300m Senior Note (XS2580291354), fixed rate (8.38% coupon) maturing on 2 February 2028, priced at 100.00 (original spread of 612 bp), callable (5nc5)

- National Australia Bank Ltd (Banking | Melbourne, Australia | Rating: A+): €1,500m Covered Bond (Other) (XS2581397986), fixed rate (3.26% coupon) maturing on 13 February 2026, priced at 100.00 (original spread of 96 bp), non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Germany | Rating: AA): €2,500m Jumbo Landesschatzanweisung (DE000NRW0NX1), fixed rate (2.90% coupon) maturing on 15 January 2053, priced at 99.23 (original spread of 91 bp), non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Germany | Rating: AA): €2,500m Jumbo Landesschatzanweisung (DE000NRW0NW3), fixed rate (2.75% coupon) maturing on 15 January 2032, priced at 99.80 (original spread of 72 bp), non callable

- Oldenburgische Landesbank AG (Banking | Germany | Rating: BBB): €350m Note (DE000A11QJP7), fixed rate (5.63% coupon) maturing on 2 February 2026, priced at 99.68 (original spread of 335 bp), with a regulatory call

- Powszechna Kasa Oszczednosci Bank Polski SA (Banking | Warsaw, Poland | Rating: NR): €750m Note (XS2582358789), floating rate maturing on 1 February 2026, priced at 99.86 (original spread of 317 bp), callable (3nc2)

- Prologis Euro Finance LLC (Financial - Other | Denver, United States | Rating: A-): €650m Senior Note (XS2580271752), fixed rate (4.25% coupon) maturing on 31 January 2043, priced at 98.64 (original spread of 210 bp), callable (20nc20)

- Prologis Euro Finance LLC (Financial - Other | Denver, United States | Rating: A-): €600m Senior Note (XS2580271596), fixed rate (3.88% coupon) maturing on 31 January 2030, priced at 99.36 (original spread of 187 bp), callable (7nc7)

- Raiffeisenlandesbank Oberoesterreich AG (Banking | Linz, Austria | Rating: AAA): €750m Hypothekenpfandbrief (Covered Bond) (AT0000A326M6), fixed rate (3.13% coupon) maturing on 30 January 2026, priced at 99.73 (original spread of 91 bp), non callable

- Region of Bruxelles-Capitale (Official and Muni | Brussels, Belgium | Rating: AA-): €207m Bond (BE0002915966), fixed rate (3.50% coupon) maturing on 24 January 2043, priced at 99.72, non callable

- Region of Ile de France (Official and Muni | Saint-Ouen, France | Rating: AA): €600m Bond (FR001400FG43), fixed rate (2.90% coupon) maturing on 30 April 2031, priced at 99.56 (original spread of 83 bp), non callable

- Slovenska Sporitelna as (Banking | Bratislava, Austria | Rating: AAA): €500m Covered Bond (Other) (SK4000022398), fixed rate (3.25% coupon) maturing on 12 January 2026, priced at 99.70 (original spread of 108 bp), non callable

- Spain, Kingdom of (Government) (Sovereign | Madrid, Spain | Rating: BBB+): €13,000m Obligacion del Estado (ES0000012L52), fixed rate (3.15% coupon) maturing on 30 April 2033, priced at 99.76 (original spread of 107 bp), non callable

- TDC NET AS (Financial - Other | Kobenhavn Sv, United Kingdom | Rating: BB): €500m Note (XS2582501925), fixed rate (5.62% coupon) maturing on 6 February 2030, priced at 100.00 (original spread of 348 bp), callable (7nc7)

- Tatra Banka as (Banking | Bratislava, Austria | Rating: AAA): €500m Covered Bond (Other) (SK4000022430), fixed rate (3.38% coupon) maturing on 31 January 2026, priced at 99.74 (original spread of 122 bp), non callable

- Thulite SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €162m Unsecured Note (XS2583353094) zero coupon maturing on 24 August 2028, priced at 100.00, non callable

- Verisure Holding AB (Electronics | Malmo, Canada | Rating: B): €450m Note (XS2581647091), fixed rate (7.13% coupon) maturing on 1 February 2028, priced at 100.00 (original spread of 494 bp), callable (5nc2)

- ZF Finance GmbH (Financial - Other | Friedrichshafen, Germany | Rating: BB+): €650m Senior Note (XS2582404724), fixed rate (5.75% coupon) maturing on 3 August 2026, priced at 99.66 (original spread of 358 bp), callable (3nc3)

RECENT USD LOANS

- Adobe Inc (United States of America | A+), signed a US$ 3,500m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 09/15/25 and initial pricing is set at Term SOFR +87.5bp

- Africa Finance Corp (Nigeria), signed a € 150m Term Loan, to be used for capital expenditures. It matures on 01/19/33.

- Altice France SA (France | B), signed a US$ 2,500m Term Loan B, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at Term SOFR +550.0bp

- Amadeus IT Group SA (Spain | BBB-), signed a € 1,000m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 01/18/28.

- Brazos Midstream Holdings LLC (United States of America), signed a US$ 800m Term Loan B, to be used for general corporate purposes. It matures on 01/31/30 and initial pricing is set at Term SOFR +425.0bp

- CIENA Corp (United States of America | B), signed a US$ 500m Term Loan B, to be used for general corporate purposes. It matures on 01/19/30 and initial pricing is set at Term SOFR +250.0bp

- Citrix Systems Inc (United States of America | B), signed a € 250m Term Loan B, to be used for general corporate purposes. It matures on 03/20/29 and initial pricing is set at EURIBOR +450.0bp

- Cushman & Wakefield Us (United States of America | BB), signed a US$ 1,000m Term Loan B, to be used for general corporate purposes. It matures on 01/21/30.

- ECL Entertainment LLC (United States of America | B), signed a US$ 335m Term Loan B, to be used for general corporate purposes. It matures on 04/30/28 and initial pricing is set at Term SOFR +750.0bp

- Encevo SA (Luxembourg), signed a € 400m Term Loan, to be used for general corporate purposes. It matures on 01/23/25.

- Encevo SA (Luxembourg), signed a € 350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/20/28.

- France Telecom Cable SA (France), signed a US$ 1,418m Term Loan B, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at Term SOFR +550.0bp

- France Telecom Cable SA (France), signed a € 1,145m Term Loan B, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at EURIBOR +550.0bp

- France Telecom Cable SA (France), signed a US$ 2,150m Term Loan B, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at Term SOFR +550.0bp

- France Telecom Cable SA (France), signed a € 1,000m Term Loan B, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at EURIBOR +550.0bp

- HVPE (Guernsey), signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/04/28.

- Kohl's Corp (United States of America | BB+), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/19/28 and initial pricing is set at Term SOFR +125.0bp

- Ministry Of Fin Of The (Angola), signed a € 149m Export Credit, to be used for capital expenditures and export/import financing.

- Safety-Kleen Europe Ltd (United Kingdom), signed a € 490m Term Loan B, to be used for general corporate purposes. It matures on 01/26/27 and initial pricing is set at EURIBOR +500.0bp

- Sandvik AB (Sweden | A-), signed a € 500m Term Loan, to be used for general corporate purposes. It matures on 01/20/30.

- Securitas AB (Sweden | BBB-), signed a € 1,100m Term Loan, to be used for general corporate purposes. It matures on 01/19/27.

- Southwest Gas Corp (United States of America | BBB), signed a US$ 450m Term Loan, to be used for general corporate purposes. It matures on 01/19/24 and initial pricing is set at Term SOFR +95.0bp

- Tesla Inc (United States of America | BBB), signed a US$ 5,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/20/28.

- The Kantar Group Ltd (United Kingdom), signed a € 185m Term Loan B, to be used for general corporate purposes. It matures on 01/19/27 and initial pricing is set at EURIBOR +425.0bp

- Whitewater Express Car Wash (United States of America), signed a US$ 500m Term Loan B, to be used for leveraged buyout. It matures on 01/25/30 and initial pricing is set at Term SOFR +325.0bp