Credit

Tighter Spreads Across US Credit This Week, With The CDX HY Trailing HY Cash Performance YTD

Another solid week for US$ corporate bond issuance: 24 tranches for $21.05bn in IG (2023 YTD volume $157.2bn vs 2022 YTD $168.89bn), 5 tranches for $7.6bn in HY (2023 YTD volume $23.05bn vs 2022 YTD $27.936bn)

Published ET

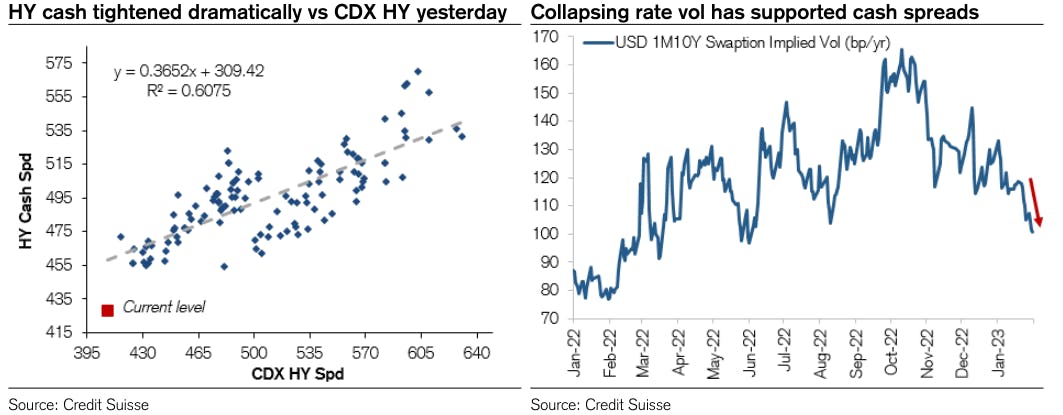

CDX.NA.HY 5Y Bid Spread vs ICE BofAML HY Cash OAS | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was down -0.80% today, with investment grade down -0.82% and high yield down -0.62% (YTD total return: +4.10%)

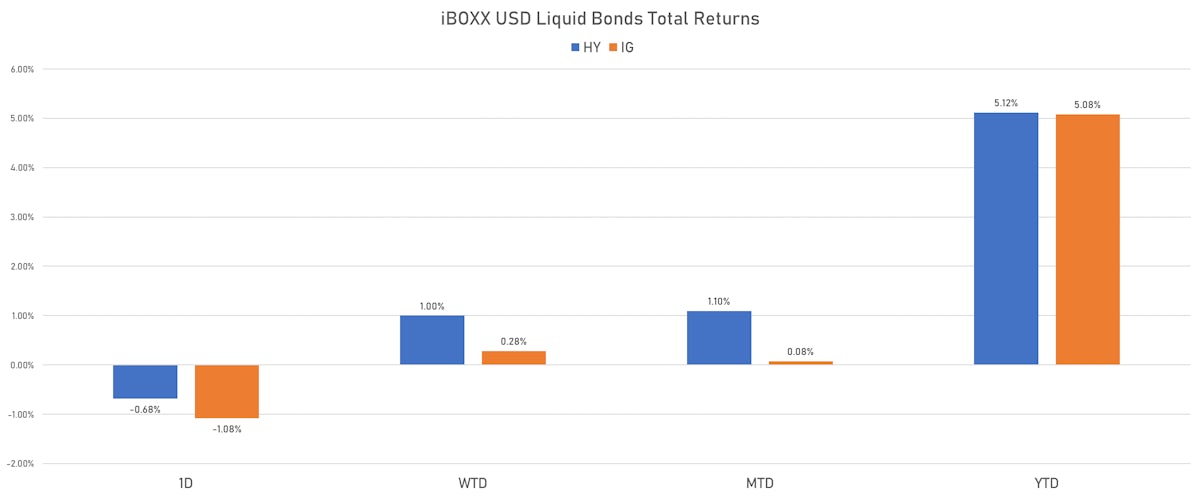

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.078% today (Week-to-date: 0.28%; Month-to-date: 0.08%; Year-to-date: 5.08%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.683% today (Week-to-date: 1.00%; Month-to-date: 1.10%; Year-to-date: 5.12%)

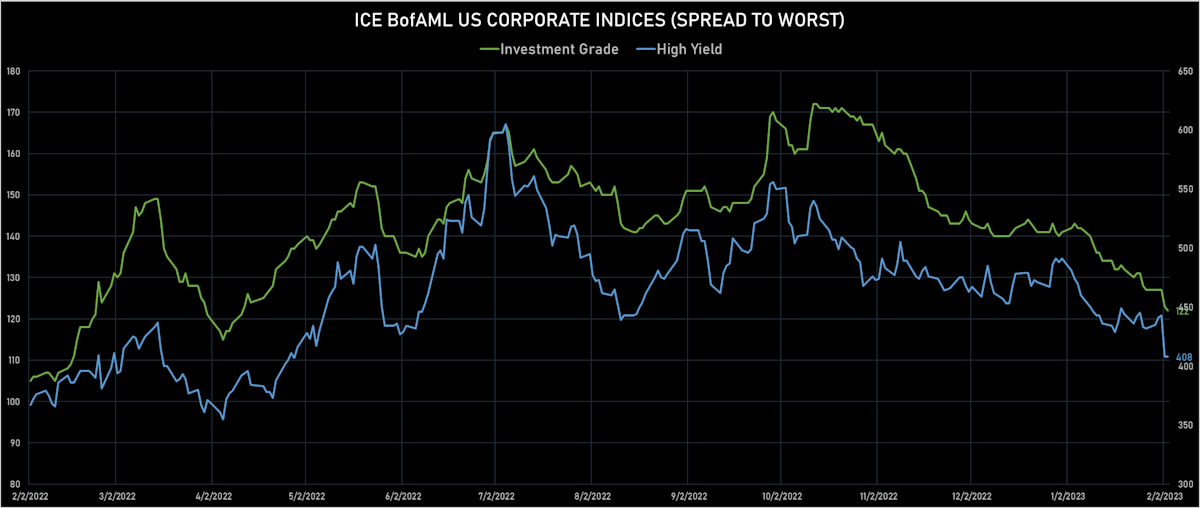

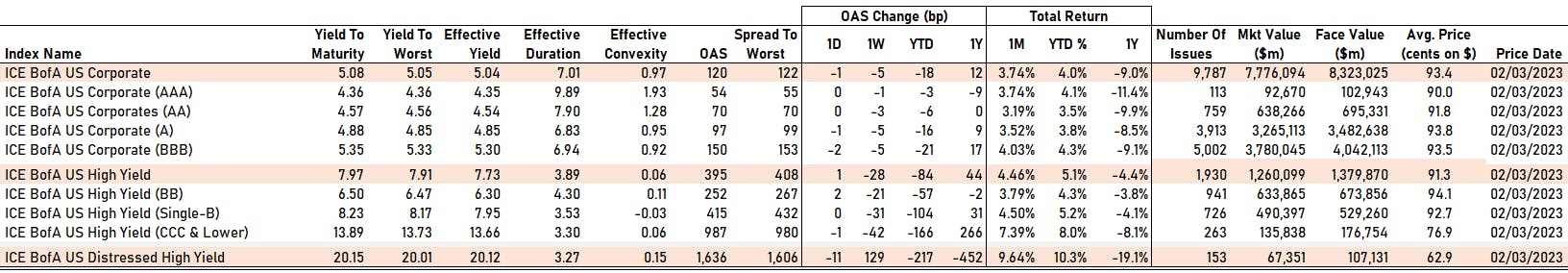

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 122.0 bp (YTD change: -18.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged 0.0 bp, now at 408.0 bp (YTD change: -80.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.17% today (YTD total return: +3.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 54 bp

- AA unchanged at 70 bp

- A down by -1 bp at 97 bp

- BBB down by -2 bp at 150 bp

- BB up by 2 bp at 252 bp

- B unchanged at 415 bp

- ≤ CCC down by -1 bp at 987 bp

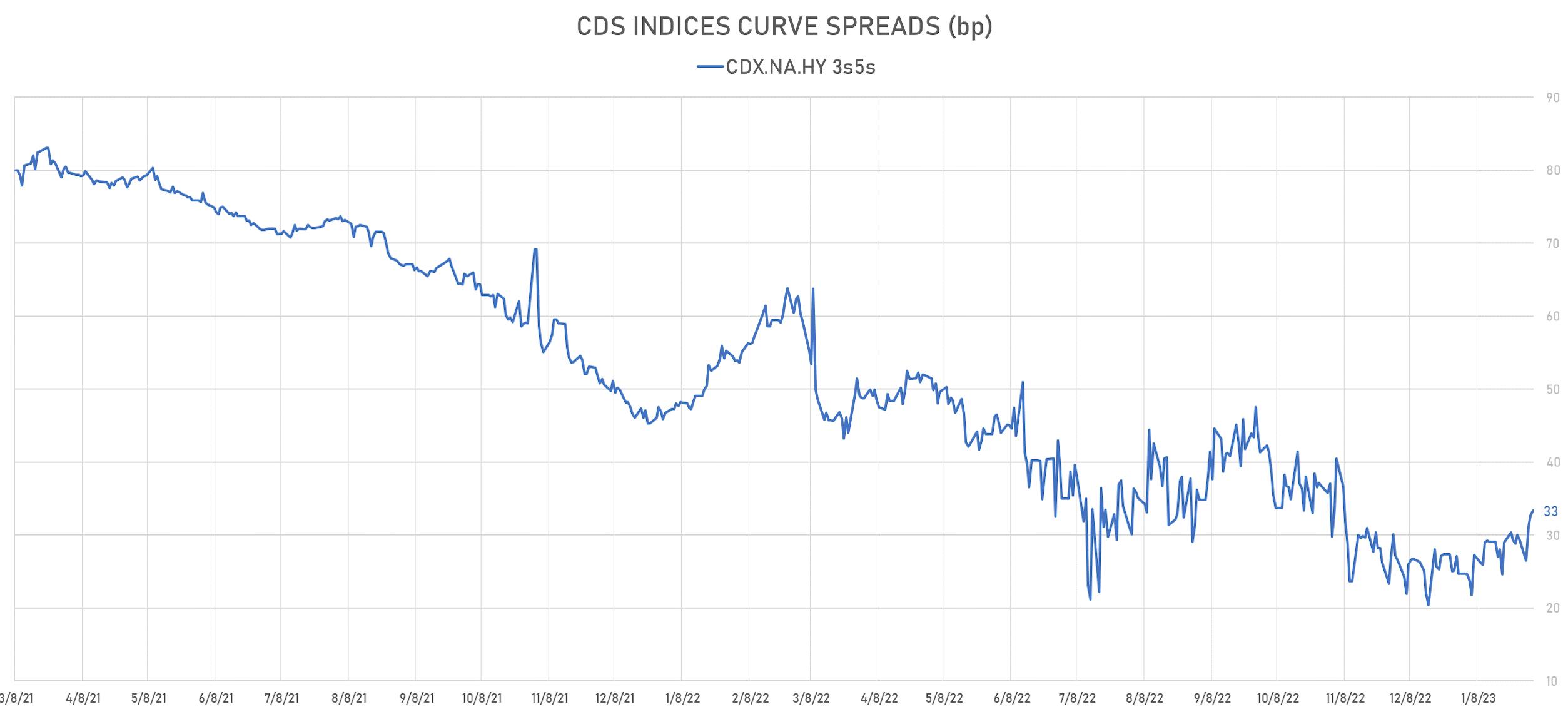

CDS INDICES TODAY (mid-spreads)

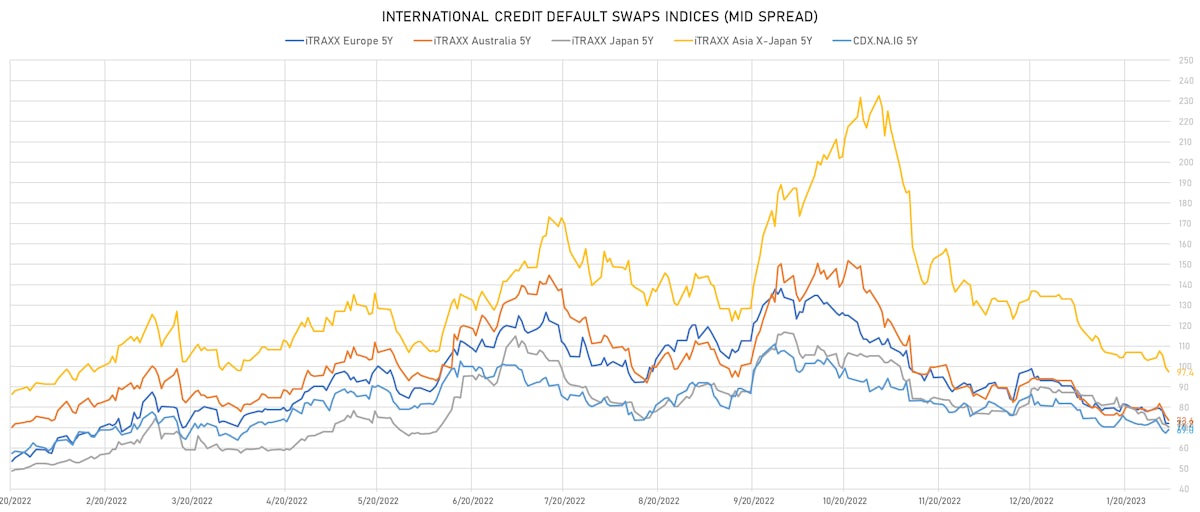

- Markit CDX.NA.IG 5Y up 1.8 bp, now at 69bp (1W change: -2.4bp; YTD change: -12.8bp)

- Markit CDX.NA.IG 10Y up 1.7 bp, now at 109bp (1W change: -2.3bp; YTD change: -8.6bp)

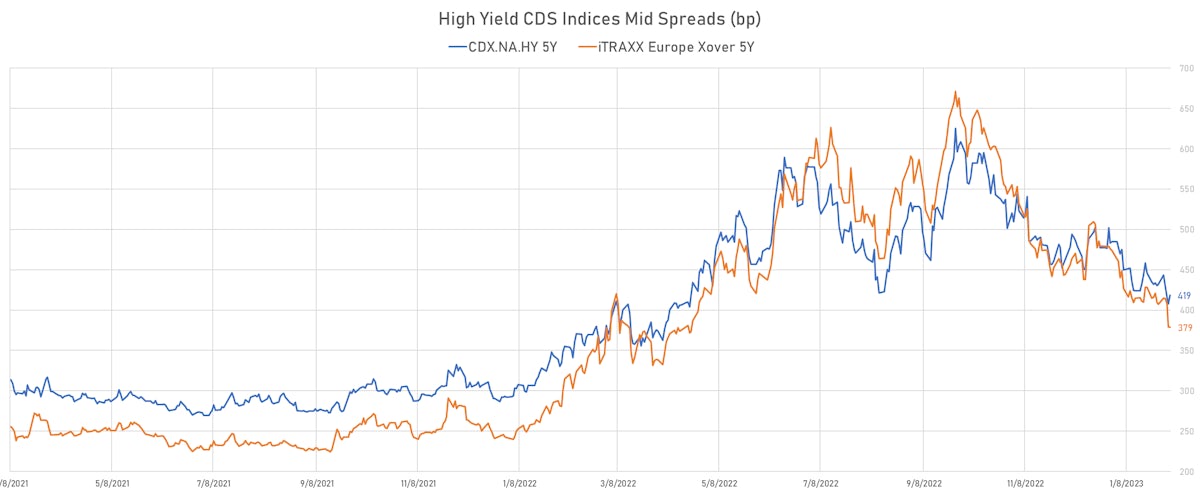

- Markit CDX.NA.HY 5Y up 10.8 bp, now at 419bp (1W change: -13.2bp; YTD change: -66.1bp)

- Markit iTRAXX Europe 5Y unchanged at 72bp (1W change: -5.7bp; YTD change: -18.3bp)

- Markit iTRAXX Europe Crossover 5Y down 0.6 bp, now at 379bp (1W change: -28.8bp; YTD change: -95.6bp)

- Markit iTRAXX Japan 5Y down 1.2 bp, now at 70bp (1W change: -3.5bp; YTD change: -16.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.2 bp, now at 97bp (1W change: -5.7bp; YTD change: -35.7bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: B1): down 241.2 bp to 2,114.1bp (1Y range: 514-2,584bp)

- Nordstrom Inc (Country: US; rated: BBB-): down 127.4 bp to 440.2bp (1Y range: 334-685bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 123.8 bp to 876.2bp (1Y range: 425-2,117bp)

- Transocean Inc (Country: KY; rated: Caa1): down 107.5 bp to 775.7bp (1Y range: 674-2,858bp)

- Staples Inc (Country: US; rated: B3): down 102.0 bp to 1,619.1bp (1Y range: 1,011-1,986bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): down 86.7 bp to 571.6bp (1Y range: 548-739bp)

- Kohls Corp (Country: US; rated: Ba1): down 77.2 bp to 483.0bp (1Y range: 334-686bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): down 66.8 bp to 491.7bp (1Y range: 429-772bp)

- American Airlines Group Inc (Country: US; rated: B2): down 64.8 bp to 754.5bp (1Y range: 607-1,644bp)

- Lumen Technologies Inc (Country: US; rated: WR): down 63.6 bp to 937.3bp (1Y range: 195-937bp)

- Beazer Homes USA Inc (Country: US; rated: A2): down 57.9 bp to 497.1bp (1Y range: 358-899bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 53.8 bp to 558.7bp (1Y range: 368-1,584bp)

- Tenet Healthcare Corp (Country: US; rated: A3): down 51.5 bp to 384.4bp (1Y range: 268-590bp)

- NRG Energy Inc (Country: US; rated: BBB-): down 47.2 bp to 334.6bp (1Y range: 227-442bp)

- Onemain Finance Corp (Country: US; rated: Ba2): down 44.8 bp to 327.0bp (1Y range: 121-1,042bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): down 652.7 bp to 2,171.3bp (1Y range: 764-4,917bp)

- CMA CGM SA (Country: FR; rated: WR): down 163.7 bp to 238.5bp (1Y range: 238-648bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 90.2 bp to 1,389.8bp (1Y range: 1,286-2,910bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 66.7 bp to 697.4bp (1Y range: 416-1,296bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 55.0 bp to 1,029.9bp (1Y range: 566-1,739bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 54.1 bp to 703.1bp (1Y range: 333-1,254bp)

- Telecom Italia SpA (Country: IT; rated: BB-): down 51.3 bp to 348.0bp (1Y range: 258-545bp)

- TUI AG (Country: DE; rated: B3-PD): down 41.7 bp to 705.8bp (1Y range: 612-1,725bp)

- ThyssenKrupp AG (Country: DE; rated: Ba3): down 38.9 bp to 361.1bp (1Y range: 245-705bp)

- Stena AB (Country: SE; rated: B1-PD): down 36.8 bp to 453.4bp (1Y range: 444-865bp)

- Air France KLM SA (Country: FR; rated: C): down 30.5 bp to 533.4bp (1Y range: 419-990bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 27.9 bp to 387.0bp (1Y range: 286-602bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 26.4 bp to 756.9bp (1Y range: 401-1,021bp)

- Renault SA (Country: FR; rated: Ba2): down 25.1 bp to 248.7bp (1Y range: 200-476bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 24.6 bp to 271.5bp (1Y range: 188-498bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Oceaneering International Inc (Houston, Texas (US)) | Coupon: 4.65% | Maturity: 15/11/2024 | Rating: B+ | CUSIP: 675232AA0 | OAS up by 65.2 bp to 169.7 bp, with the yield to worst at 5.8% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 95.8-98.1).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.88% | Maturity: 1/9/2025 | Rating: BB+ | CUSIP: 674599EB7 | OAS down by 19.3 bp to 70.3 bp (CDS basis: -18.6bp), with the yield to worst at 4.7% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 99.5-101.9).

- Issuer: Newell Brands Inc (Atlanta, Georgia (US)) | Coupon: 4.00% | Maturity: 1/12/2024 | Rating: BB+ | CUSIP: 651229AQ9 | OAS down by 22.8 bp to 54.0 bp, with the yield to worst at 5.3% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 96.8-97.8).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS down by 27.2 bp to 76.2 bp, with the yield to worst at 4.8% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 102.0-103.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.06% | Maturity: 1/11/2024 | Rating: BB | CUSIP: 345397ZX4 | OAS down by 30.6 bp to 92.8 bp (CDS basis: 64.9bp), with the yield to worst at 5.5% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 95.7-97.9).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 34.3 bp to 109.7 bp (CDS basis: -10.5bp), with the yield to worst at 4.8% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 96.4-99.3).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 4.00% | Maturity: 1/12/2027 | Rating: BB | CUSIP: 81211KAY6 | OAS down by 51.8 bp to 171.2 bp (CDS basis: -17.6bp), with the yield to worst at 5.2% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 90.0-93.8).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 501797AU8 | OAS down by 55.3 bp to 174.3 bp, with the yield to worst at 5.9% and the bond now trading up to 107.3 cents on the dollar (1Y price range: 106.3-108.0).

- Issuer: Amerigas Partners LP (Valley Forge, Pennsylvania (US)) | Coupon: 5.50% | Maturity: 20/5/2025 | Rating: B+ | CUSIP: 030981AK0 | OAS down by 58.0 bp to 164.2 bp, with the yield to worst at 5.7% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 96.0-99.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | CUSIP: 852234AN3 | OAS down by 66.2 bp to 100.5 bp, with the yield to worst at 4.7% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 89.1-93.9).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS down by 66.5 bp to 81.8 bp, with the yield to worst at 4.7% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 97.0-99.6).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | CUSIP: 37255LAA5 | OAS down by 69.9 bp to 223.1 bp (CDS basis: -141.2bp), with the yield to worst at 6.4% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 97.4-99.3).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS down by 85.6 bp to 43.0 bp (CDS basis: 63.6bp), with the yield to worst at 5.0% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 94.4-96.9).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 4.35% | Maturity: 1/10/2024 | Rating: B | CUSIP: 44106MAZ5 | OAS down by 98.3 bp to 214.2 bp, with the yield to worst at 6.3% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 90.9-96.3).

- Issuer: Nordstrom Inc (Seattle, Washington (US)) | Coupon: 4.00% | Maturity: 15/3/2027 | Rating: BB+ | CUSIP: 655664AS9 | OAS down by 104.3 bp to 285.6 bp (CDS basis: 101.8bp), with the yield to worst at 6.5% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 83.0-90.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 54.2 bp to 508.9 bp (CDS basis: 130.1bp), with the yield to worst at 7.7% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 88.4-96.8).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 6.88% | Maturity: 15/2/2028 | Rating: B+ | ISIN: XS2581393134 | OAS down by 56.4 bp to 360.2 bp (CDS basis: -26.9bp), with the yield to worst at 6.3% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 99.4-102.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS down by 63.7 bp to 258.3 bp (CDS basis: -16.8bp), with the yield to worst at 5.2% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 90.8-93.9).

- Issuer: GTC Aurora Luxembourg SA (Luxembourg, Luxembourg) | Coupon: 2.25% | Maturity: 23/6/2026 | Rating: BB+ | ISIN: XS2356039268 | OAS down by 65.3 bp to 799.6 bp, with the yield to worst at 10.5% and the bond now trading up to 76.5 cents on the dollar (1Y price range: 72.0-75.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS down by 68.2 bp to 251.9 bp (CDS basis: 7.3bp), with the yield to worst at 5.2% and the bond now trading up to 94.6 cents on the dollar (1Y price range: 92.3-95.9).

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS down by 69.9 bp to 617.2 bp, with the yield to worst at 7.9% and the bond now trading up to 71.9 cents on the dollar (1Y price range: 64.8-72.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS down by 74.1 bp to 208.9 bp (CDS basis: 16.4bp), with the yield to worst at 4.9% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 92.7-95.1).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.75% | Maturity: 7/5/2025 | Rating: BB | ISIN: FR0013378452 | OAS down by 81.5 bp to 428.1 bp, with the yield to worst at 5.7% and the bond now trading up to 88.6 cents on the dollar (1Y price range: 80.6-88.8).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 81.6 bp to 368.9 bp (CDS basis: 188.2bp), with the yield to worst at 6.3% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 85.3-94.7).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS down by 92.7 bp to 374.8 bp, with the yield to worst at 6.3% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 85.3-93.2).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC- | ISIN: XS1713464524 | OAS down by 97.9 bp to 991.3 bp, with the yield to worst at 10.6% and the bond now trading up to 75.2 cents on the dollar (1Y price range: 66.6-75.3).

- Issuer: Wizz Air Finance Company BV (Amsterdam, Netherlands) | Coupon: 1.00% | Maturity: 19/1/2026 | Rating: BB+ | ISIN: XS2433361719 | OAS down by 119.3 bp to 222.4 bp, with the yield to worst at 4.8% and the bond now trading up to 88.7 cents on the dollar (1Y price range: 82.1-88.7).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | OAS down by 180.3 bp to 1,008.3 bp, with the yield to worst at 11.6% and the bond now trading up to 70.4 cents on the dollar (1Y price range: 56.2-70.4).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS down by 181.7 bp to 398.3 bp, with the yield to worst at 6.9% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 88.0-97.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | OAS down by 206.7 bp to 448.6 bp, with the yield to worst at 7.3% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 79.3-89.5).

RECENT DOMESTIC USD BOND ISSUES

- Alexandria Real Estate Equities Inc (Real Estate Investment Trust | Pasadena, United States | Rating: BBB+): US$500m Senior Note (US015271BA64), fixed rate (4.75% coupon) maturing on 15 April 2035, priced at 99.74 (original spread of 138 bp), callable (12nc12)

- Alexandria Real Estate Equities Inc (Real Estate Investment Trust | Pasadena, United States | Rating: BBB+): US$500m Senior Note (US015271BB48), fixed rate (5.15% coupon) maturing on 15 April 2053, priced at 99.50 (original spread of 160 bp), callable (30nc30)

- CCO Holdings LLC (Cable/Media | St. Louis, United States | Rating: BB-): US$1,100m Senior Note (US1248EPCT83), fixed rate (7.38% coupon) maturing on 1 March 2031, priced at 100.00 (original spread of 625 bp), callable (8nc3)

- Constellation Brands Inc (Beverage/Bottling | Victor, United States | Rating: BBB-): US$500m Senior Note (US21036PBN78), fixed rate (5.00% coupon) maturing on 2 February 2026, priced at 99.83 (original spread of 116 bp), callable (3nc1)

- Elevance Health Inc (Health Care Facilities | Indianapolis, United States | Rating: BBB): US$500m Senior Note (US28622HAA95), fixed rate (4.90% coupon) maturing on 8 February 2026, priced at 99.90 (original spread of 97 bp), callable (3nc1)

- Elevance Health Inc (Health Care Facilities | Indianapolis, United States | Rating: BBB): US$1,100m Senior Note (US28622HAC51), fixed rate (5.13% coupon) maturing on 15 February 2053, priced at 99.63 (original spread of 174 bp), callable (30nc30)

- Elevance Health Inc (Health Care Facilities | Indianapolis, United States | Rating: BBB): US$1,000m Senior Note (US28622HAB78), fixed rate (4.75% coupon) maturing on 15 February 2033, priced at 99.84 (original spread of 122 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$750m Bond (US3133EPAK13), floating rate (SOFR + 15.5 bp) maturing on 10 February 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EPAG01), fixed rate (4.25% coupon) maturing on 10 February 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$500m Bond (US3130AURD88), floating rate (SOFR + 16.0 bp) maturing on 3 February 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$105m Bond (US3130AUR223), fixed rate (5.02% coupon) maturing on 10 February 2025, priced at 100.00 (original spread of 99 bp), callable (2nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$105m Bond (US3130AUSU94), fixed rate (5.10% coupon) maturing on 15 August 2025, priced at 100.00 (original spread of 44 bp), callable (2nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$250m Bond (US3130AUT955), fixed rate (4.30% coupon) maturing on 3 February 2025, priced at 100.00 (original spread of 12 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$300m Unsecured Note (US3134GYH969), fixed rate (5.20% coupon) maturing on 24 February 2026, priced at 100.00, callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$135m Unsecured Note (US3134GYHC95), fixed rate (5.13% coupon) maturing on 9 February 2026, priced at 100.00, callable (3nc6m)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$350m Senior Note (XS2482777005) zero coupon maturing on 16 February 2028, non callable

- Integer Holdings Corp (Utility - Other | Plano, United States | Rating: BB-): US$500m Bond (US45826HAA77), fixed rate (2.13% coupon) maturing on 15 February 2028, priced at 100.00, non callable, convertible

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$1,000m Senior Note (US459200KX88), fixed rate (4.50% coupon) maturing on 6 February 2028, priced at 99.85 (original spread of 88 bp), callable (5nc5)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$750m Senior Note (US459200KY61), fixed rate (4.75% coupon) maturing on 6 February 2033, priced at 99.98 (original spread of 125 bp), callable (10nc10)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$850m Senior Note (US459200KW06), fixed rate (4.50% coupon) maturing on 6 February 2026, priced at 99.80 (original spread of 60 bp), with a make whole call

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): US$650m Senior Note (US459200KZ37), fixed rate (5.10% coupon) maturing on 6 February 2053, priced at 99.45 (original spread of 183 bp), callable (30nc30)

- MPLX LP (Gas Utility - Pipelines | Findlay, United States | Rating: BBB): US$500m Senior Note (US55336VBW90), fixed rate (5.65% coupon) maturing on 1 March 2053, priced at 99.54 (original spread of 210 bp), callable (30nc30)

- MPLX LP (Gas Utility - Pipelines | Findlay, United States | Rating: BBB): US$1,100m Senior Note (US55336VBV18), fixed rate (5.00% coupon) maturing on 1 March 2033, priced at 99.17 (original spread of 170 bp), callable (10nc10)

- Martin Midstream Partners LP (Transportation - Other | Kilgore, United States | Rating: CCC+): US$400m Note (USU57363AF72), fixed rate (11.50% coupon) maturing on 15 February 2028, priced at 97.00 (original spread of 866 bp), callable (5nc3)

- National Rural Utilities Cooperative Finance Corp (Financial - Other | Dulles, United States | Rating: A-): US$600m Senior Note (US63743HFH03), fixed rate (4.45% coupon) maturing on 13 March 2026, priced at 99.93 (original spread of 70 bp), callable (3nc3)

- Oracle Corp (Service - Other | Redwood City, United States | Rating: BBB): US$750m Senior Note (US68389XCM56), fixed rate (4.50% coupon) maturing on 6 May 2028, priced at 99.81 (original spread of 105 bp), callable (5nc5)

- Oracle Corp (Service - Other | Redwood City, United States | Rating: BBB): US$2,250m Senior Note (US68389XCQ60), fixed rate (5.55% coupon) maturing on 6 February 2053, priced at 99.49 (original spread of 200 bp), callable (30nc30)

- Oracle Corp (Service - Other | Redwood City, United States | Rating: BBB): US$750m Senior Note (US68389XCN30), fixed rate (4.65% coupon) maturing on 6 May 2030, priced at 99.68 (original spread of 125 bp), callable (7nc7)

- Oracle Corp (Service - Other | Redwood City, United States | Rating: BBB): US$1,500m Senior Note (US68389XCP87), fixed rate (4.90% coupon) maturing on 6 February 2033, priced at 99.93 (original spread of 150 bp), callable (10nc10)

- Synchrony Financial (Financial - Other | Stamford, United States | Rating: BB+): US$750m Subordinated Note (US87165BAU70), fixed rate (7.25% coupon) maturing on 2 February 2033, priced at 99.65 (original spread of 384 bp), callable (10nc10)

- Uniti Group LP (Financial - Other | Wilmington, United States | Rating: B): US$2,600m Note (USU91479AA02), fixed rate (10.50% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 701 bp), callable (5nc3)

RECENT INTERNATIONAL USD BOND ISSUES

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, Australia | Rating: A+): US$150m Unsecured Note (XS2583641399), floating rate maturing on 6 February 2026, priced at 100.00, non callable

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$800m Unsecured Note (XS2584378025) maturing on 16 February 2026, priced at 100.00, non callable

- Bank of New Zealand (Banking | Auckland, Australia | Rating: A+): US$850m Senior Note (US06407F2G68), fixed rate (4.85% coupon) maturing on 7 February 2028, priced at 100.00 (original spread of 118 bp), non callable

- Borr Drilling Ltd (Oil and Gas | Hamilton, Bermuda | Rating: NR): US$150m Bond (NO0012829755), fixed rate (9.50% coupon) maturing on 9 February 2026, priced at 100.00 (original spread of 558 bp), callable (3nc1)

- Central American Bank for Economic Integration (Supranational | Tegucigalpa, Honduras | Rating: AA-): US$1,250m Bond (US15238RAH57), fixed rate (5.00% coupon) maturing on 9 February 2026, priced at 99.98 (original spread of 109 bp), non callable

- Corporacion Nacional del Cobre de Chile (Metals/Mining | Santiago, Chile | Rating: A-): US$900m Senior Note (USP3143NBP89), fixed rate (5.13% coupon) maturing on 2 February 2033, priced at 99.94 (original spread of 160 bp), callable (10nc10)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Index Linked Security (XS0460028904), fixed rate (11.03% coupon) maturing on 23 December 2025, priced at 100.00, non callable

- Dominican Republic of (Government) (Sovereign | Santo Domingo De Guzman, Dominican Republic | Rating: BB-): US$700m Senior Note (US25714PET12), fixed rate (7.05% coupon) maturing on 3 February 2031, priced at 100.00 (original spread of 325 bp), callable (8nc8)

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Russia | Rating: NR): US$2,000m Bond (RU000A105SG2), fixed rate (3.25% coupon) maturing on 25 February 2030, priced at 100.00, non callable

- Mauser Packaging Solutions Holding Co (Containers | Atlanta | Rating: B): US$2,750m Note (US57763RAB33), fixed rate (7.88% coupon) maturing on 15 August 2026, priced at 100.00 (original spread of 403 bp), callable (4nc2)

- Petroleos Mexicanos (Oil and Gas | Miguel Hidalgo, Mexico | Rating: BBB): US$2,000m Senior Note (US71654QDN97), fixed rate (10.00% coupon) maturing on 7 February 2033, priced at 97.70 (original spread of 667 bp), callable (10nc10)

- Societe Generale SA (Banking | Paris, France | Rating: A): US$335m Senior Note (XS2558222506) zero coupon maturing on 7 February 2028, priced at 100.00, non callable

- Transnet SOC Ltd (Transportation - Other | Midrand, South Africa | Rating: BB-): US$1,000m Senior Note (XS2582981952), fixed rate (8.25% coupon) maturing on 6 February 2028, priced at 100.00 (original spread of 457 bp), non callable

- Tyco Electronics Group SA (Electronics | Luxembourg, Switzerland | Rating: A-): US$500m Senior Note (US902133AZ06), fixed rate (4.50% coupon) maturing on 13 February 2026, priced at 99.81 (original spread of 60 bp), with a make whole call

RECENT EUR BOND ISSUES

- Abertis Infraestructuras SA (Home Builders | Madrid, Italy | Rating: BBB-): €600m Senior Note (XS2582860909), fixed rate (4.13% coupon) maturing on 7 August 2029, priced at 99.19 (original spread of 200 bp), callable (7nc6)

- Amco Asset Management Company SpA (Financial - Other | Milan, Italy | Rating: BBB): €500m Senior Note (XS2583211201), fixed rate (4.63% coupon) maturing on 6 February 2027, priced at 99.63 (original spread of 215 bp), callable (4nc4)

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, Australia | Rating: BBB+): €1,000m Subordinated Note (XS2577127967), fixed rate (5.10% coupon) maturing on 3 February 2033, priced at 100.00 (original spread of 283 bp), callable (10nc5)

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: NR): €500m Inhaberschuldverschreibung (DE000BLB6JU7), fixed rate (3.75% coupon) maturing on 7 February 2029, priced at 99.56 (original spread of 160 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: A-): €150m Inhaberschuldverschreibung (DE000BLB9TE4), fixed rate (3.10% coupon) maturing on 17 February 2025, priced at 100.00, non callable

- CEC Bank SA (Banking | Bucuresti, Romania | Rating: BB): €119m Note (XS2574275280), floating rate maturing on 7 February 2028, priced at 100.00 (original spread of 449 bp), callable (5nc4)

- CIMA Finance DAC (Financial - Other | Dublin, Ireland | Rating: NR): €698m Unsecured Note (XS2585984078), floating rate maturing on 14 March 2033, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €264m Bond (FRCASA010050), fixed rate (3.70% coupon) maturing on 1 February 2033, priced at 100.00 (original spread of 187 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VAW4), fixed rate (2.80% coupon) maturing on 24 February 2025, priced at 100.00, non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000A30WF84), fixed rate (5.00% coupon) maturing on 5 February 2027, priced at 99.43 (original spread of 246 bp), non callable

- Emeria SAS (Financial - Other | Antony, Luxembourg | Rating: B): €400m Note (XS2582774225), fixed rate (7.75% coupon) maturing on 31 March 2028, priced at 100.00, callable (5nc2)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A32RM7), fixed rate (3.20% coupon) maturing on 8 November 2025, priced at 100.00, non callable

- Hessen, State of (Official and Muni | Wiesbaden, Germany | Rating: AA+): €2,000m Inhaberschuldverschreibung (DE000A1RQEH3), fixed rate (2.88% coupon) maturing on 10 January 2033, priced at 99.99 (original spread of 61 bp), non callable

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): €1,250m Senior Note (XS2583742239), fixed rate (3.63% coupon) maturing on 6 February 2031, priced at 99.43 (original spread of 146 bp), callable (8nc8)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): €1,000m Senior Note (XS2583742668), fixed rate (4.00% coupon) maturing on 6 February 2043, priced at 99.84 (original spread of 166 bp), callable (20nc20)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): €1,000m Senior Note (XS2583741934), fixed rate (3.38% coupon) maturing on 6 February 2027, priced at 99.77 (original spread of 106 bp), callable (4nc4)

- International Business Machines Corp (Information/Data Technology | Armonk, United States | Rating: A-): €1,000m Senior Note (XS2583742585), fixed rate (3.75% coupon) maturing on 6 February 2035, priced at 98.94 (original spread of 158 bp), callable (12nc12)

- Investitionsbank Berlin (Banking | Berlin, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A289KR2), floating rate (EU03MLIB + 100.0 bp) maturing on 10 February 2028, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB4553), fixed rate (3.00% coupon) maturing on 16 March 2028, priced at 100.00, callable (5nc1)

- Nordea Bank Abp (Banking | Helsinki, Finland | Rating: A): €1,000m Note (XS2584643113), floating rate maturing on 10 February 2026, priced at 99.88 (original spread of 129 bp), callable (3nc2)

- Rheinmetall AG (Automotive Manufacturer | Dusseldorf, Germany | Rating: BBB): €500m Bond (DE000A30V8S3), fixed rate (1.88% coupon) maturing on 7 February 2028, priced at 100.00, non callable, convertible

- Rheinmetall AG (Automotive Manufacturer | Dusseldorf, Germany | Rating: BBB): €500m Bond (DE000A30V8T1), fixed rate (2.25% coupon) maturing on 7 February 2030, priced at 100.00, non callable, convertible

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Sweden | Rating: A-): €1,000m Note (XS2583600791), fixed rate (3.75% coupon) maturing on 7 February 2028, priced at 99.75 (original spread of 147 bp), with a regulatory call

- Societe Generale SA (Banking | Paris, France | Rating: A): €200m Senior Note (XS2558209586), fixed rate (2.75% coupon) maturing on 7 March 2026, priced at 100.00, non callable

- Sparkasse Hannover (Banking | Hannover, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000A30V8U9), fixed rate (3.00% coupon) maturing on 7 February 2028, priced at 99.77 (original spread of 75 bp), non callable

- Stena International SA (Transportation - Other | Luxembourg, Sweden | Rating: NR): €325m Note (XS2010025836), fixed rate (7.25% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 499 bp), callable (5nc2)

- Virgin Money UK PLC (Banking | Glasgow, United Kingdom | Rating: BBB-): €500m Unsecured Note (XS2585239200) maturing on 29 October 2028, priced at 100.00, non callable

RECENT USD LOANS

- Caesars Entertainment Inc (United States of America | B), signed a US$ 2,500m Term Loan B, to be used for general corporate purposes. It matures on 02/06/30 and initial pricing is set at Term SOFR +325.0bp

- Del Monte Foods Inc (United States of America | B), signed a US$ 125m Term Loan B, to be used for general corporate purposes. It matures on 05/16/29 and initial pricing is set at Term SOFR +425.0bp

- Enagas SA (Spain | BBB), signed a € 1,550m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/25/28.

- Franchise Group Inc (United States of America | B+), signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 03/10/26 and initial pricing is set at Term SOFR +475.0bp

- Gbt Travel Svcs Uk Ltd (United Kingdom), signed a US$ 135m Term Loan B, to be used for general corporate purposes. It matures on 12/16/26 and initial pricing is set at Term SOFR +675.0bp

- Gt Commodities Llc (United States of America), signed a US$ 180m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/27/24.

- Hastings Technology Metals Ltd (Australia), signed a US$ 130m Revolving Credit / Term Loan, to be used for capital expenditures.

- Hecate Energy Holdings C&C LLC (United States of America), signed a US$ 300m Standby Letter of Credit, to be used for general corporate purposes. It matures on 01/26/28.

- Hecate Energy Holdings C&C LLC (United States of America), signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 01/26/28.

- Kilroy Realty LP (United States of America | BBB-), signed a US$ 500m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 10/03/24 and initial pricing is set at Term SOFR +80.0bp

- Lega Serie A (Italy), signed a € 1,000m Term Loan, to be used for general corporate purposes.

- LifePoint Health Inc (United States of America | CCC+), signed a US$ 800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/27/28 and initial pricing is set at Term SOFR +125.0bp

- Loomis AB (Sweden), signed a € 150m Revolving Credit Facility, to be used for general corporate purposes, working capital and capital expenditures. It matures on 01/27/26.

- Mauser Pkg Solutions Hldg Co (United States of America | CCC+), signed a US$ 800m Term Loan B, to be used for refin/ret bank debt. It matures on 08/15/26 and initial pricing is set at Term SOFR +400.0bp

- Philip Morris International (Switzerland | A-), signed a US$ 1,750m 364d Revolver, to be used for general corporate purposes. It matures on 01/31/24 and initial pricing is set at Term SOFR +15.0bp

- Republic Of The Philippines (Philippines | BBB+), signed a US$ 500m Revolving Credit / Term Loan, to be used for general corporate purposes

- Stena AB (Sweden | BB-), signed a € 515m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/25/28.

- Unique Meghnaghat Power Ltd (Bangladesh), signed a US$ 110m Revolving Credit / Term Loan, to be used for capital expenditures

- Unique Meghnaghat Power Ltd (Bangladesh), signed a US$ 350m Revolving Credit / Term Loan, to be used for capital expenditures

- Vedanta Resources Ltd (United Kingdom | B-), signed a US$ 1,200m Revolving Credit / Term Loan, to be used for general corporate purposes

- Zest Acq Corp (United States of America | B), signed a US$ 320m Term Loan B, to be used for general corporate purposes. It matures on 02/01/28 and initial pricing is set at Term SOFR +550.0bp