Credit

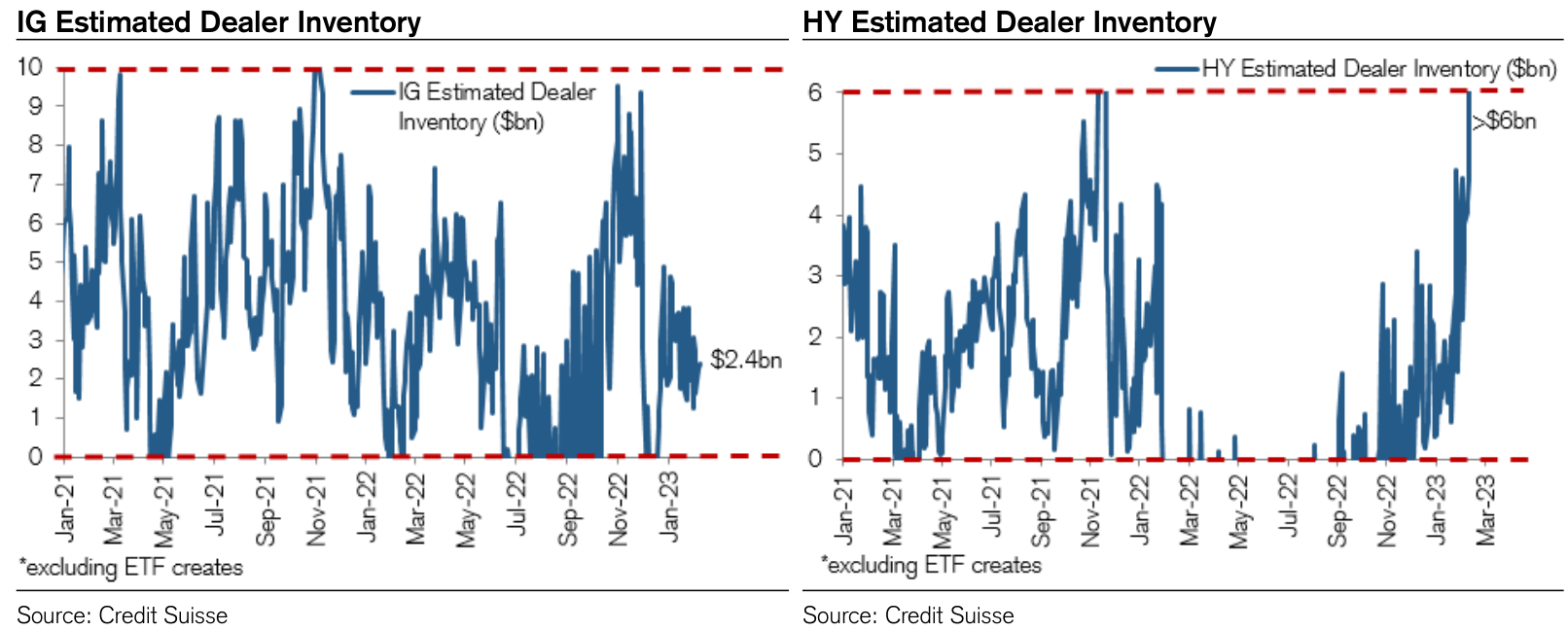

Dealer Inventory For USD HY Bonds Estimated To Be At 12-Month High, While The CDS-Cash Basis Widened This Week

Investors' appetite for high grade USD corporate bonds remains undiminished for now: 29 tranches for US$22.525bn in IG this week (2023 YTD volume US$267.3bn vs 2022 YTD US$234.091bn), 1 tranche for US$1.1bn in HY (2023 YTD volume US$32.757bn vs 2022 YTD US$31.686bn)

Published ET

ICE BofA US HY vs CDX NA HY 5Y | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was down -0.57% today, with investment grade down -0.59% and high yield down -0.32% (YTD total return: +0.63%)

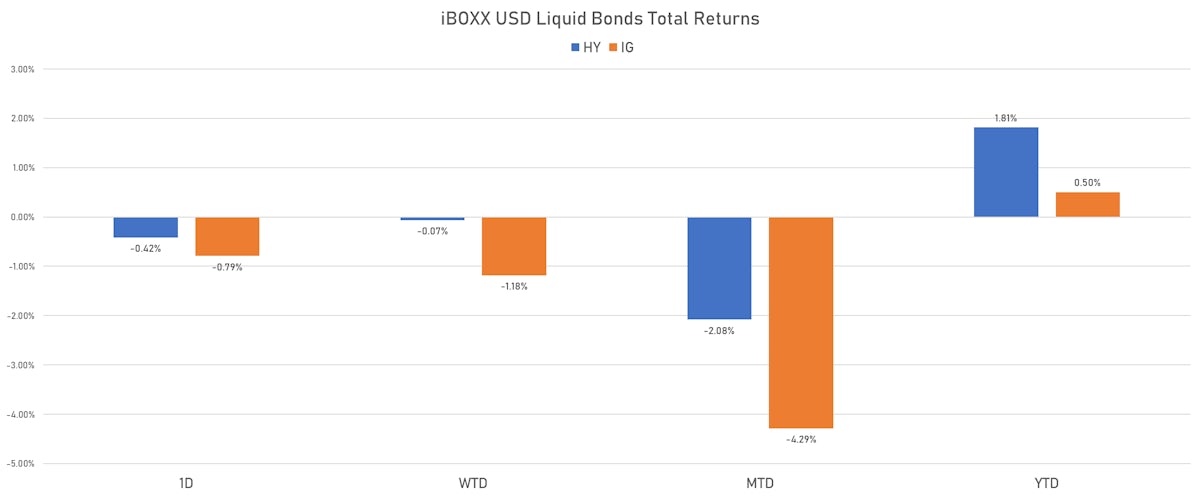

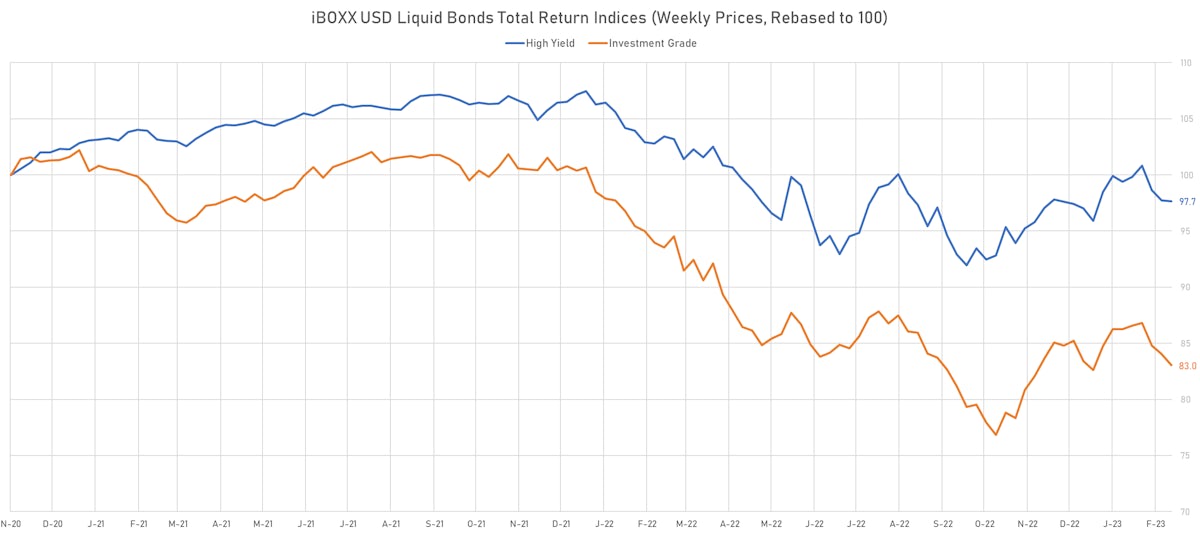

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.793% today (Week-to-date: -1.18%; Month-to-date: -4.29%; Year-to-date: 0.50%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.417% today (Week-to-date: -0.07%; Month-to-date: -2.08%; Year-to-date: 1.81%)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.06% today (YTD total return: +3.1%)

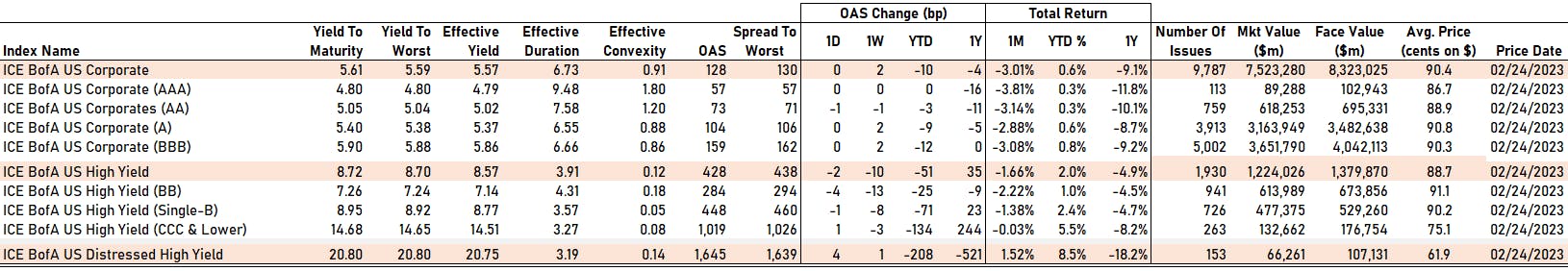

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 57 bp

- AA down by -1 bp at 73 bp

- A unchanged at 104 bp

- BBB unchanged at 159 bp

- BB down by -4 bp at 284 bp

- B down by -1 bp at 448 bp

- ≤ CCC up by 1 bp at 1019 bp

CDS INDICES TODAY (mid-spreads)

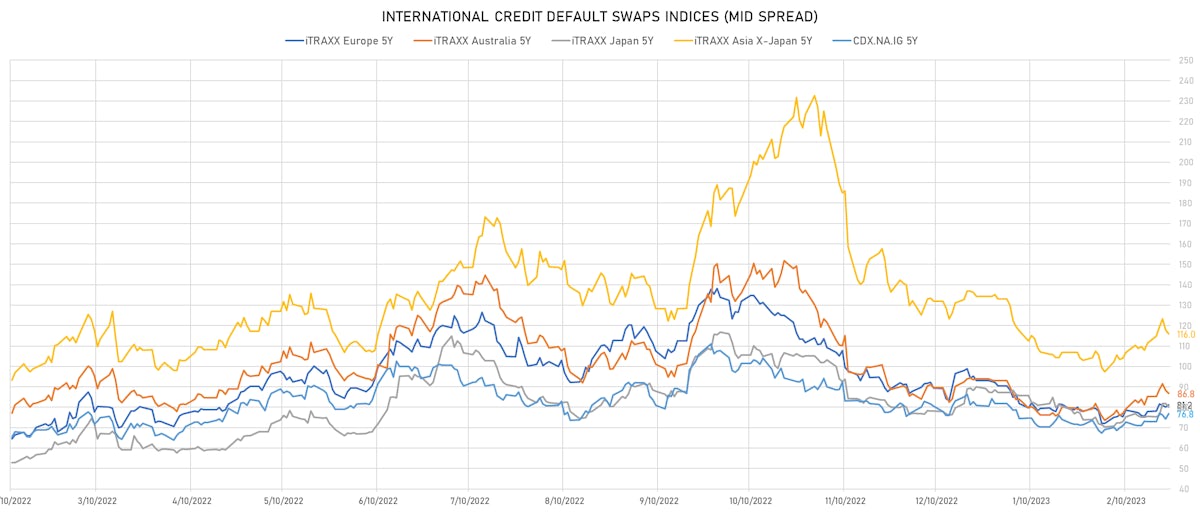

- Markit CDX.NA.IG 5Y up 2.5 bp, now at 77bp (1W change: +4.0bp; YTD change: -5.1bp)

- Markit CDX.NA.IG 10Y up 2.4 bp, now at 117bp (1W change: +3.9bp; YTD change: -1.3bp)

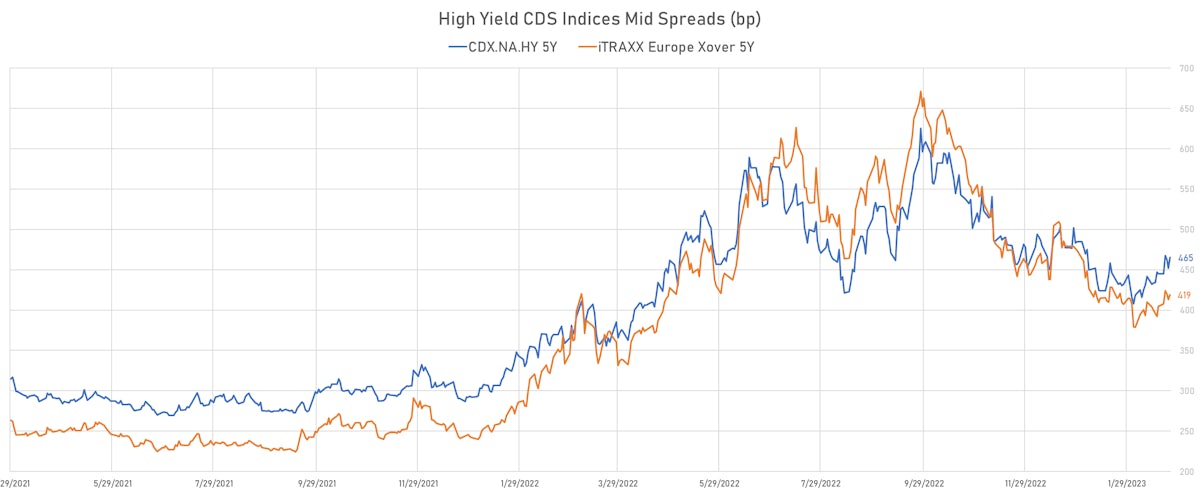

- Markit CDX.NA.HY 5Y up 13.1 bp, now at 465bp (1W change: +20.1bp; YTD change: -19.5bp)

- Markit iTRAXX Europe 5Y up 1.1 bp, now at 81bp (1W change: +3.3bp; YTD change: -9.3bp)

- Markit iTRAXX Europe Crossover 5Y up 5.9 bp, now at 419bp (1W change: +14.6bp; YTD change: -54.8bp)

- Markit iTRAXX Japan 5Y down 1.7 bp, now at 80bp (1W change: +4.6bp; YTD change: -7.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.8 bp, now at 116bp (1W change: +4.6bp; YTD change: -17.0bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Cytec Industries Inc (Country: US; rated: Baa2): down 157.0 bp to 1,976.5bp (1Y range: 695-4,371bp)

- General Dynamics Corp (Country: US; rated: P-2): down 96.7 bp to 385.0bp (1Y range: 182-786bp)

- iHeartCommunications Inc (Country: US; rated: B2): down 34.3 bp to 920.8bp (1Y range: 434-2,117bp)

- AutoNation Inc (Country: US; rated: A1): down 20.0 bp to 777.2bp (1Y range: 607-1,644bp)

- PG&E Corp (Country: US; rated: Ba2): down 16.1 bp to 1,006.0bp (1Y range: 625-1,783bp)

- Commercial Metals Co (Country: US; rated: A1+): down 13.9 bp to 274.8bp (1Y range: 243-648bp)

- Emirate of Abu Dhabi (Country: AE; rated: F1+): down 12.4 bp to 30.3bp (1Y range: 30-71bp)

- SKF AB (Country: SE; rated: BBB+): up 11.6 bp to 243.6bp (1Y range: 175-326bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 13.3 bp to 298.8bp (1Y range: 212-496bp)

- Boeing Capital Corp (Country: US; rated: Baa2): up 15.0 bp to 111.3bp (1Y range: 90-269bp)

- First Data Corp (Country: US; rated: NR): up 19.6 bp to 380.7bp (1Y range: 262-619bp)

- TUI AG (Country: DE; rated: B3-PD): up 31.3 bp to 757.9bp (1Y range: 638-1,725bp)

- Export-Import Bank of Korea (Country: KR; rated: AA-): up 35.6 bp to 971.8bp (1Y range: 499-1,458bp)

- KT&G Corp (Country: KR; rated: WR): up 53.7 bp to 569.6bp (1Y range: 335-686bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): up 455.0 bp to 2,986.1bp (1Y range: 905-4,917bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Air France KLM SA (Country: FR; rated: C): down 15.7 bp to 450.4bp (1Y range: 443-990bp)

- Banco Bilbao Vizcaya Argentaria SA (Country: ES; rated: Baa2): down 12.6 bp to 347.8bp (1Y range: 348-1,007bp)

- TotalEnergies SE (Country: FR; rated: A): up 8.1 bp to 374.0bp (1Y range: 91-416bp)

- Pfizer Inc (Country: US; rated: A1): up 8.4 bp to 262.5bp (1Y range: 199-476bp)

- Medco Health Solutions Inc (Country: US; rated: WR): up 8.5 bp to 252.9bp (1Y range: 229-524bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): up 8.6 bp to 208.7bp (1Y range: 199-443bp)

- KBC Bank NV (Country: BE; rated: A1): up 10.5 bp to 151.5bp (1Y range: 151-572bp)

- PepsiCo Inc (Country: US; rated: Discontinued): up 11.8 bp to 538.4bp (1Y range: 349-768bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 12.1 bp to 400.2bp (1Y range: 300-602bp)

- Telenor ASA (Country: NO; rated: baa2): up 18.2 bp to 137.6bp (1Y range: 117-281bp)

- Equinor ASA (Country: NO; rated: A+): up 20.9 bp to 242.7bp (1Y range: 83-243bp)

- Australia, Commonwealth of (Government) (Country: AU; rated: AAA): up 21.2 bp to 775.5bp (1Y range: 401-1,021bp)

- Tyson Foods Inc (Country: US; rated: Baa2): up 63.4 bp to 646.7bp (1Y range: 548-739bp)

- Scottish Power Ltd (Country: GB; rated: A-): up 68.0 bp to 1,777.4bp (1Y range: 1,015-1,986bp)

- Mandalay Resort Group LLC (Country: US; rated: WR): up 84.1 bp to 863.8bp (1Y range: 281-1,763bp)

NOTABLE CREDIT MOVES IN THE PAST WEEK - USD HY

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 64.9 bp to 124.6 bp (CDS basis: -91.1bp), with the yield to worst at 6.3% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 91.8-94.4).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 6.95% | Maturity: 1/7/2024 | Rating: BB+ | CUSIP: 674599DB8 | OAS up by 60.5 bp to 99.3 bp (CDS basis: -41.8bp), with the yield to worst at 5.6% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.8-102.8).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.13% | Maturity: 1/12/2024 | Rating: BB | CUSIP: 81211KAW0 | OAS down by 17.4 bp to 67.2 bp (CDS basis: -30.9bp), with the yield to worst at 5.6% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 98.3-101.0).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 30.3 bp to 133.5 bp (CDS basis: -18.7bp), with the yield to worst at 5.6% and the bond now trading up to 96.5 cents on the dollar (1Y price range: 96.3-99.3).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.55% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 674599DC6 | OAS down by 31.0 bp to 95.6 bp (CDS basis: -24.6bp), with the yield to worst at 5.5% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 98.5-101.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.30% | Maturity: 10/2/2025 | Rating: BB | CUSIP: 345397B85 | OAS down by 39.6 bp to 160.7 bp (CDS basis: -6.0bp), with the yield to worst at 6.6% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 90.9-94.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS down by 45.7 bp to 125.3 bp, with the yield to worst at 5.8% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | CUSIP: 852234AN3 | OAS down by 47.6 bp to 186.4 bp, with the yield to worst at 6.2% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 87.9-93.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.66% | Maturity: 8/9/2024 | Rating: BB | CUSIP: 345397WW9 | OAS down by 47.8 bp to 115.4 bp (CDS basis: 37.5bp), with the yield to worst at 6.3% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 94.7-97.2).

- Issuer: Western Midstream Operating LP (The Woodlands, Texas (US)) | Coupon: 3.95% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 958254AE4 | OAS down by 51.1 bp to 119.1 bp, with the yield to worst at 6.1% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 94.3-97.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.38% | Maturity: 13/11/2025 | Rating: BB | CUSIP: 345397B28 | OAS down by 56.9 bp to 190.5 bp (CDS basis: -10.0bp), with the yield to worst at 6.7% and the bond now trading up to 91.7 cents on the dollar (1Y price range: 89.9-94.3).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 62.5 bp to 68.0 bp, with the yield to worst at 5.5% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 98.4-100.5).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS down by 65.5 bp to 67.5 bp, with the yield to worst at 5.4% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 95.3-97.6).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS down by 70.6 bp to 192.6 bp (CDS basis: 142.3bp), with the yield to worst at 6.4% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 97.0-99.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | CUSIP: 983130AV7 | OAS down by 75.9 bp to 196.4 bp, with the yield to worst at 6.9% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 94.8-99.5).

NOTABLE CREDIT MOVES IN THE PAST WEEK - EUR HY

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: B | ISIN: XS2356316872 | OAS up by 93.9 bp to 863.5 bp (CDS basis: 44.0bp), with the yield to worst at 10.7% and the bond now trading down to 73.0 cents on the dollar (1Y price range: 61.6-75.8).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS up by 69.2 bp to 490.4 bp, with the yield to worst at 8.3% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 88.0-97.5).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 3.50% | Maturity: 1/11/2025 | Rating: BB+ | ISIN: XS2070311431 | OAS up by 53.1 bp to 1,087.9 bp, with the yield to worst at 12.7% and the bond now trading down to 77.2 cents on the dollar (1Y price range: 72.8-80.7).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | OAS up by 51.9 bp to 498.6 bp, with the yield to worst at 8.3% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 79.3-90.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS up by 48.4 bp to 489.9 bp, with the yield to worst at 7.6% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 84.4-92.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | OAS up by 48.0 bp to 505.4 bp, with the yield to worst at 8.1% and the bond now trading down to 76.9 cents on the dollar (1Y price range: 73.0-82.1).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | OAS up by 43.1 bp to 431.2 bp, with the yield to worst at 7.5% and the bond now trading down to 84.6 cents on the dollar (1Y price range: 81.4-88.7).

- Issuer: Wizz Air Finance Company BV (Amsterdam, Netherlands) | Coupon: 1.00% | Maturity: 19/1/2026 | Rating: BB+ | ISIN: XS2433361719 | OAS up by 38.5 bp to 263.3 bp, with the yield to worst at 5.6% and the bond now trading down to 86.7 cents on the dollar (1Y price range: 82.1-89.2).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | OAS up by 35.9 bp to 933.5 bp, with the yield to worst at 12.4% and the bond now trading down to 49.9 cents on the dollar (1Y price range: 40.4-52.2).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS up by 33.5 bp to 346.4 bp, with the yield to worst at 6.2% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 88.9-94.3).

- Issuer: SIG Combibloc PurchaseCo SARL (Munsbach, Luxembourg) | Coupon: 2.13% | Maturity: 18/6/2025 | Rating: BB+ | ISIN: XS2189594315 | OAS up by 28.9 bp to 121.4 bp, with the yield to worst at 4.2% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 93.7-96.9).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | OAS down by 31.9 bp to 269.7 bp, with the yield to worst at 5.8% and the bond now trading up to 83.9 cents on the dollar (1Y price range: 77.7-86.1).

- Issuer: Rolls-Royce PLC (London, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | OAS down by 32.7 bp to 250.3 bp (CDS basis: -7.9bp), with the yield to worst at 5.5% and the bond now trading up to 81.9 cents on the dollar (1Y price range: 78.2-82.5).

- Issuer: Rolls-Royce PLC (London, United Kingdom) | Coupon: 4.63% | Maturity: 16/2/2026 | Rating: BB- | ISIN: XS2244322082 | OAS down by 37.4 bp to 178.5 bp (CDS basis: -25.9bp), with the yield to worst at 5.0% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 96.1-99.1).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB | ISIN: XS2332589972 | OAS down by 47.9 bp to 196.5 bp, with the yield to worst at 5.0% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 88.2-91.9).

RECENT DOMESTIC USD BOND ISSUES

- Assurant Inc (Property and Casualty Insurance | Atlanta, Georgia, United States | Rating: BBB): US$175m Senior Note (US04621XAP33), fixed rate (6.10% coupon) maturing on 27 February 2026, priced at 99.97 (original spread of 170 bp), callable (3nc3)

- Centerpoint Energy Resources Corp (Gas Utility - Local Distrib | Houston, Texas, United States | Rating: BBB+): US$600m Senior Note (US15189YAH99), fixed rate (5.40% coupon) maturing on 1 March 2033, priced at 99.98 (original spread of 145 bp), callable (10nc10)

- Centerpoint Energy Resources Corp (Gas Utility - Local Distrib | Houston, Texas, United States | Rating: BBB+): US$600m Senior Note (US15189YAG17), fixed rate (5.25% coupon) maturing on 1 March 2028, priced at 99.68 (original spread of 115 bp), callable (5nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$230m Senior Note (US17290AA677), floating rate maturing on 24 February 2026, priced at 100.00, non callable

- Consolidated Edison Company of New York Inc (Utility - Other | New York City, New York, United States | Rating: BBB+): US$500m Senior Debenture (US209111GE76), fixed rate (5.20% coupon) maturing on 1 March 2033, priced at 99.95 (original spread of 131 bp), callable (10nc10)

- Constellation Energy Generation LLC (Utility - Other | Kennett Square, Pennsylvania, United States | Rating: BBB): US$750m Senior Note (US210385AB64), fixed rate (5.60% coupon) maturing on 1 March 2028, priced at 99.99 (original spread of 143 bp), callable (5nc5)

- Constellation Energy Generation LLC (Utility - Other | Kennett Square, Pennsylvania, United States | Rating: BBB): US$600m Senior Note (US210385AC48), fixed rate (5.80% coupon) maturing on 1 March 2033, priced at 99.98 (original spread of 185 bp), callable (10nc10)

- Eastman Chemical Co (Chemicals | Kingsport, Tennessee, United States | Rating: BBB-): US$500m Senior Note (US277432AX86), fixed rate (5.75% coupon) maturing on 8 March 2033, priced at 99.99 (original spread of 191 bp), callable (10nc10)

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, Indiana, United States | Rating: A): US$1,000m Senior Note (US532457CH90), fixed rate (4.95% coupon) maturing on 27 February 2063, priced at 98.65 (original spread of 115 bp), callable (40nc40)

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, Indiana, United States | Rating: A): US$750m Senior Note (US532457CE69), fixed rate (5.00% coupon) maturing on 27 February 2026, priced at 99.84 (original spread of 65 bp), callable (3nc1)

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, Indiana, United States | Rating: A): US$1,000m Senior Note (US532457CF35), fixed rate (4.70% coupon) maturing on 27 February 2033, priced at 99.79 (original spread of 85 bp), callable (10nc10)

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, Indiana, United States | Rating: A): US$1,250m Senior Note (US532457CG18), fixed rate (4.88% coupon) maturing on 27 February 2053, priced at 99.94 (original spread of 100 bp), callable (30nc30)

- Exact Sciences Corp (Pharmaceuticals | Madison, Wisconsin, United States | Rating: NR): US$500m Bond (US30063PAD78), fixed rate (2.00% coupon) maturing on 1 March 2030, priced at 100.00, non callable, convertible

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$275m Bond (US3133EPBV68), floating rate (FFQ + 12.5 bp) maturing on 24 February 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$415m Bond (US3133EPCC78), floating rate (SOFR + 13.0 bp) maturing on 28 February 2025, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EPCG82), fixed rate (4.13% coupon) maturing on 1 December 2027, priced at 99.52, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$310m Bond (US3133EPCF00), fixed rate (4.50% coupon) maturing on 2 March 2026, priced at 99.94, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$500m Unsecured Note (US3134GYKW13), fixed rate (5.65% coupon) maturing on 7 March 2025, priced at 100.00 (original spread of 100 bp), callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYL425), fixed rate (5.55% coupon) maturing on 28 February 2025, priced at 100.00 (original spread of 84 bp), callable (2nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYL839), fixed rate (5.45% coupon) maturing on 28 February 2025, priced at 100.00, callable (2nc1)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$150m Unsecured Note (XS2482813677) zero coupon maturing on 17 February 2028, non callable

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$150m Unsecured Note (XS2482814642) zero coupon maturing on 2 March 2026, non callable

- International Finance Corp (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$150m Senior Note (US45950VSA51), fixed rate (4.38% coupon) maturing on 1 July 2026, priced at 100.00, non callable

- International Finance Corp (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$150m Senior Note (US45950VRY47), fixed rate (4.25% coupon) maturing on 2 March 2026, priced at 100.00, non callable

- Kellogg Co (Food Processors | Battle Creek, Michigan, United States | Rating: BBB): US$400m Senior Note (US487836BZ07), fixed rate (5.25% coupon) maturing on 1 March 2033, priced at 99.82 (original spread of 140 bp), callable (10nc10)

- Liberty Broadband Corp (Cable/Media | Englewood, Colorado, United States | Rating: NR): US$1,100m Bond (US530307AE75), fixed rate (3.13% coupon) maturing on 31 March 2053, priced at 100.00, callable (30nc3), convertible

- ON Semiconductor Corp (Electronics | Phoenix, Arizona, United States | Rating: BB+): US$1,300m Bond (US682189AT21), fixed rate (0.50% coupon) maturing on 1 March 2029, priced at 100.00, non callable, convertible

- PPL Capital Funding Inc (Financial - Other | Allentown, Pennsylvania, United States | Rating: BBB+): US$900m Bond (US69352PAR47), fixed rate (2.88% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

- Prudential Financial Inc (Life Insurance | Newark, New Jersey, United States | Rating: BBB+): US$500m Junior Subordinated Note (US744320BL59), fixed rate (6.75% coupon) maturing on 1 March 2053, priced at 100.00 (original spread of 271 bp), callable (30nc10)

- Raytheon Technologies Corp (Aerospace | Arlington, Virginia, United States | Rating: BBB+): US$1,250m Senior Note (US75513ECS81), fixed rate (5.38% coupon) maturing on 27 February 2053, priced at 99.82 (original spread of 150 bp), callable (30nc30)

- Raytheon Technologies Corp (Aerospace | Arlington, Virginia, United States | Rating: BBB+): US$1,250m Senior Note (US75513ECR09), fixed rate (5.15% coupon) maturing on 27 February 2033, priced at 99.71 (original spread of 130 bp), callable (10nc10)

- Raytheon Technologies Corp (Aerospace | Arlington, Virginia, United States | Rating: BBB+): US$500m Senior Note (US75513ECQ26), fixed rate (5.00% coupon) maturing on 27 February 2026, priced at 99.97 (original spread of 60 bp), callable (3nc3)

- Ryder System Inc (Service - Other | Miami, Florida, United States | Rating: BBB): US$500m Senior Note (US78355HKV05), fixed rate (5.65% coupon) maturing on 1 March 2028, priced at 99.80 (original spread of 153 bp), callable (5nc5)

- Southern Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB): US$1,500m Bond (US842587DN48), fixed rate (3.88% coupon) maturing on 15 December 2025, priced at 100.00, non callable, convertible

- TransDigm Inc (Aerospace | Cleveland, Ohio, United States | Rating: B+): US$1,100m Note (USU8936PAY98), fixed rate (6.75% coupon) maturing on 15 August 2028, priced at 99.00 (original spread of 283 bp), callable (5nc2)

- Trimble Inc (Electronics | Westminster, Colorado, United States | Rating: BBB-): US$800m Senior Note (US896239AE08), fixed rate (6.10% coupon) maturing on 15 March 2033, priced at 99.84 (original spread of 225 bp), callable (10nc10)

- United Parcel Service Inc (Transportation - Other | Atlanta, Georgia, United States | Rating: A): US$1,200m Senior Note (US911312CA23), fixed rate (5.05% coupon) maturing on 3 March 2053, priced at 99.48 (original spread of 120 bp), callable (30nc30)

- United Parcel Service Inc (Transportation - Other | Atlanta, Georgia, United States | Rating: A): US$900m Senior Note (US911312BZ82), fixed rate (4.88% coupon) maturing on 3 March 2033, priced at 99.97 (original spread of 100 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Aon Corp (Financial - Other | Chicago, Illinois, Ireland | Rating: BBB): US$750m Senior Note (US03740LAG77), fixed rate (5.35% coupon) maturing on 28 February 2033, priced at 99.98 (original spread of 147 bp), callable (10nc10)

- Aozora Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$350m Bond (XS2525232430), fixed rate (5.90% coupon) maturing on 2 March 2026, priced at 99.91 (original spread of 155 bp), non callable

- BHP Billiton Finance (USA) Ltd (Financial - Other | Melbourne, New South Wales, Australia | Rating: NR): US$1,000m Senior Note (US055451AY40), fixed rate (4.88% coupon) maturing on 27 February 2026, priced at 99.79 (original spread of 55 bp), with a make whole call

- BHP Billiton Finance (USA) Ltd (Financial - Other | Melbourne, New South Wales, Australia | Rating: NR): US$750m Senior Note (US055451BA54), fixed rate (4.90% coupon) maturing on 28 February 2033, priced at 99.80 (original spread of 105 bp), callable (10nc10)

- BHP Billiton Finance (USA) Ltd (Financial - Other | Melbourne, New South Wales, Australia | Rating: NR): US$1,000m Senior Note (US055451AZ15), fixed rate (4.75% coupon) maturing on 28 February 2028, priced at 99.50 (original spread of 75 bp), callable (5nc5)

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$600m Senior Note (XS2584378025), fixed rate (4.88% coupon) maturing on 28 February 2026, priced at 99.69 (original spread of 57 bp), non callable

- CICC Hong Kong Finance 2016 MTN Ltd (Financial - Other | Road Town, China (Mainland) | Rating: BBB+): US$1,250m Senior Note (XS2585576973), fixed rate (5.49% coupon) maturing on 1 March 2026, priced at 100.00 (original spread of 110 bp), non callable

- China Everbright Bank Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$400m Unsecured Note (XS2526839092), fixed rate (4.99% coupon) maturing on 2 March 2026, priced at 100.00 (original spread of 57 bp), non callable

- Citic Securities Finance MTN Co Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$200m Senior Note (HK0000910544), fixed rate (5.00% coupon) maturing on 21 February 2025, priced at 99.55, non callable

- Cooperatieve Rabobank UA (Banking | Utrecht, Utrecht, Netherlands | Rating: A-): US$1,000m Note (US74977RDS04), fixed rate (5.56% coupon) maturing on 28 February 2029, priced at 100.00 (original spread of 135 bp), callable (6nc5)

- Credit Agricole Corporate and Investment Bank SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): US$300m Unsecured Note (XS2395309078), floating rate maturing on 27 February 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460014276), fixed rate (4.40% coupon) maturing on 24 March 2025, priced at 100.00, non callable

- Egyptian Finance Co (Financial - Other | Al-Qaahirah, Egypt | Rating: B-): US$1,500m Islamic Sukuk (Ijarah) (XS2530049837), fixed rate (10.88% coupon) maturing on 28 February 2026, priced at 99.69 (original spread of 656 bp), non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$250m Unsecured Note (XS2594238136), floating rate maturing on 6 March 2026, priced at 100.00, non callable

- Ganzhou Urban Investment Holdings Group Co Ltd (Service - Other | Ganzhou, Jiangxi, China (Mainland) | Rating: BBB-): US$160m Bond (XS2589270953), fixed rate (7.70% coupon) maturing on 24 February 2026, priced at 100.00, non callable

- HDFC Bank (Gandhinagar Branch) (Financial - Other | Gandhinagar, Gujarat, India | Rating: BBB-): US$750m Senior Note (XS2592028091), fixed rate (5.69% coupon) maturing on 2 March 2026, priced at 100.00 (original spread of 125 bp), non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$150m Unsecured Note (XS2594999174), fixed rate (5.80% coupon) maturing on 3 March 2036, priced at 100.00, non callable

- Hong Kong JY Flower Ltd (Financial - Other | China (Mainland) | Rating: NR): US$220m Bond (XS2585673820), fixed rate (9.80% coupon) maturing on 24 February 2025, priced at 100.00, non callable

- Mitsubishi HC Finance America LLC (Financial - Other | New York City, New York, Japan | Rating: A-): US$500m Senior Note (US606790AA14), fixed rate (5.66% coupon) maturing on 28 February 2033, priced at 100.00 (original spread of 179 bp), non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$900m Senior Note (US60687YCT47), fixed rate (5.75% coupon) maturing on 27 May 2034, priced at 100.00 (original spread of 185 bp), callable (11nc10)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,000m Senior Note (US60687YCP25), fixed rate (5.67% coupon) maturing on 27 May 2029, priced at 100.00 (original spread of 152 bp), callable (6nc5)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$700m Senior Note (US60687YCR80), fixed rate (5.74% coupon) maturing on 27 May 2031, priced at 100.00 (original spread of 165 bp), callable (8nc7)

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): US$1,000m Senior Note (US676167CJ60), fixed rate (4.25% coupon) maturing on 1 March 2028, priced at 99.83 (original spread of 17 bp), non callable

- Shanghai Commercial Bank Ltd (Banking | Taiwan | Rating: BBB): US$350m Subordinated Note (XS2531672892), fixed rate (6.38% coupon) maturing on 28 February 2033, priced at 99.39, with a regulatory call

- Sumitomo Corp (Conglomerate/Diversified Mfg | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$500m Unsecured Note (XS2592306752), fixed rate (1.00% coupon) maturing on 9 March 2028, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- Arcadis NV (Service - Other | Amsterdam, Noord-Holland, Netherlands | Rating: BBB-): €500m Senior Note (XS2594025814), fixed rate (4.88% coupon) maturing on 28 February 2028, priced at 99.58 (original spread of 246 bp), callable (5nc5)

- AstraZeneca PLC (Pharmaceuticals | Cambridge, Cambridgeshire, United Kingdom | Rating: A-): €750m Senior Note (XS2593105476), fixed rate (3.75% coupon) maturing on 3 March 2032, priced at 99.99 (original spread of 124 bp), callable (9nc9)

- AstraZeneca PLC (Pharmaceuticals | Cambridge, Cambridgeshire, United Kingdom | Rating: A-): €750m Senior Note (XS2593105393), fixed rate (3.63% coupon) maturing on 3 March 2027, priced at 99.99 (original spread of 93 bp), callable (4nc4)

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €800m Bond (FR001400G1Y5), floating rate (EU03MLIB + 30.0 bp) maturing on 24 February 2025, priced at 100.00, non callable

- Banca Monte dei Paschi di Siena SpA (Banking | Siena, Siena, Italy | Rating: NR): €750m Note (XS2593107258), floating rate maturing on 2 March 2026, priced at 100.00 (original spread of 384 bp), callable (3nc2)

- Banco de Sabadell SA (Banking | Alicante, Alicante, Spain | Rating: BBB): €1,000m Cedula Hipotecaria (Covered Bond) (ES0413860836), fixed rate (3.50% coupon) maturing on 28 August 2026, priced at 99.69 (original spread of 95 bp), non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): €1,000m Bond (FR001400G6Y4), floating rate maturing on 2 March 2030, priced at 99.45 (original spread of 221 bp), callable (7nc6)

- Brandenburg, State of (Official and Muni | Potsdam, Brandenburg, Germany | Rating: AAA): €600m Landesschatzanweisung (DE000A3E5SQ4), fixed rate (3.00% coupon) maturing on 27 February 2032, priced at 99.98 (original spread of 61 bp), non callable

- Bremen Free Hanseatic, City of (Official and Muni | Bremen, Bremen, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A30V356), fixed rate (3.00% coupon) maturing on 2 March 2033, priced at 99.07 (original spread of 58 bp), non callable

- CVC Cordatus Loan Fund 25 DAC (Financial - Other | Dublin, Ireland | Rating: NR): €244m Bond (XS2540117624), floating rate maturing on 20 May 2036, priced at 100.00, non callable

- Caisse d'amortissement De La Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): €4,000m Bond (FR001400G6E6), fixed rate (3.13% coupon) maturing on 1 March 2030, priced at 99.70 (original spread of 66 bp), non callable

- Caisse des Depots et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): €114m Bond (FR001400G3T1), fixed rate (1.18% coupon) maturing on 25 May 2031, priced at 86.60, non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €200m Inhaberschuldverschreibung (DE000CZ43ZV1) maturing on 24 March 2027, priced at 100.00, non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Distrito Capital, Venezuela | Rating: AA-): €750m Unsecured Note (XS2594907664), fixed rate (1.00% coupon) maturing on 7 March 2028, priced at 100.00, non callable

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400G5S8), fixed rate (3.25% coupon) maturing on 28 September 2026, priced at 99.87 (original spread of 71 bp), non callable

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400G5Z3), fixed rate (3.25% coupon) maturing on 28 September 2032, priced at 99.68 (original spread of 92 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C2V6), fixed rate (2.90% coupon) maturing on 17 March 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C2W4), fixed rate (3.00% coupon) maturing on 16 March 2029, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C2U8), fixed rate (2.75% coupon) maturing on 17 March 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBG5), floating rate maturing on 9 March 2026, priced at 100.00, non callable

- Douro Finance BV (Financial - Other | Amsterdam, Noord-Holland, Netherlands | Rating: NR): €350m Unsecured Note (XS2594012085), fixed rate (0.70% coupon) maturing on 30 September 2026, priced at 100.00, non callable

- European Stability Mechanism (Supranational | Luxembourg, Luxembourg | Rating: AAA): €3,000m Senior Note (EU000A1Z99R5), fixed rate (3.00% coupon) maturing on 15 March 2028, priced at 99.95 (original spread of 53 bp), non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): €500m Bond (RU000A105VL6), fixed rate (4.36% coupon) maturing on 21 March 2025, priced at 100.00, non callable

- Investitionsbank Berlin (Banking | Berlin, Berlin, Germany | Rating: NR): €500m Inhaberschuldverschreibung (DE000A30V216), fixed rate (3.13% coupon) maturing on 1 March 2033, priced at 99.98 (original spread of 65 bp), non callable

- IsDB Trust Services No.2 SARL (Financial - Other | Luxembourg | Rating: NR): €150m Unsecured Note (XS2594773876), fixed rate (3.54% coupon) maturing on 1 March 2026, priced at 100.00, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €3,500m Bond (IT0005534984), floating rate (EU06MLIB + 80.0 bp) maturing on 15 October 2028, priced at 99.12, non callable

- Kering SA (Retail Stores - Other | Paris, Ile-De-France, France | Rating: A): €750m Bond (FR001400G3Y1), fixed rate (3.25% coupon) maturing on 27 February 2029, priced at 99.56 (original spread of 88 bp), callable (6nc6)

- Kering SA (Retail Stores - Other | Paris, Ile-De-France, France | Rating: A): €750m Bond (FR001400G412), fixed rate (3.38% coupon) maturing on 27 February 2033, priced at 99.28 (original spread of 101 bp), callable (10nc10)

- Luxembourg, Grand Duchy of (Government) (Sovereign | Luxembourg, Luxembourg | Rating: AAA): €1,250m Senior Note (LU2591860569), fixed rate (3.00% coupon) maturing on 2 March 2033, priced at 99.09 (original spread of 59 bp), non callable

- Luxembourg, Grand Duchy of (Government) (Sovereign | Luxembourg, Luxembourg | Rating: AAA): €1,750m Senior Note (LU2591861021), fixed rate (3.25% coupon) maturing on 2 March 2043, priced at 98.95 (original spread of 75 bp), non callable

- Nationale Nederlanden Bank NV (Banking | S-Gravenhage, Zuid-Holland, Netherlands | Rating: A-): €750m Covered Bond (Other) (NL0015001BV1), fixed rate (3.25% coupon) maturing on 28 May 2027, priced at 99.64 (original spread of 74 bp), non callable

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BB+): €700m Subordinated Note (XS2592628791), fixed rate (5.76% coupon) maturing on 28 February 2034, priced at 100.00 (original spread of 323 bp), callable (11nc6)

- ORIX Corp (Leasing | Minato-Ku, Tokyo-To, Japan | Rating: A-): €500m Senior Note (XS2583644146), fixed rate (4.48% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 193 bp), non callable

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €700m Senior Note (XS2591032235), fixed rate (4.13% coupon) maturing on 1 March 2035, priced at 99.32 (original spread of 168 bp), callable (12nc12)

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €700m Senior Note (XS2591026856), fixed rate (3.63% coupon) maturing on 1 March 2026, priced at 99.85 (original spread of 97 bp), callable (3nc3)

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €600m Senior Note (XS2591029876), fixed rate (3.75% coupon) maturing on 1 March 2030, priced at 99.26 (original spread of 139 bp), callable (7nc7)

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €250m Inhaberschuldverschreibung (AT000B078837), fixed rate (3.50% coupon) maturing on 4 April 2025, priced at 100.00, non callable

- Roche Finance Europe BV (Financial - Other | Woerden, Utrecht, Switzerland | Rating: AA): €500m Bond (XS2592088400), fixed rate (3.36% coupon) maturing on 27 February 2035, priced at 100.00 (original spread of 94 bp), callable (12nc12)

- Roche Finance Europe BV (Financial - Other | Woerden, Utrecht, Switzerland | Rating: AA): €750m Bond (XS2592088236), fixed rate (3.20% coupon) maturing on 27 August 2029, priced at 100.00 (original spread of 82 bp), callable (7nc6)

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): €1,500m Sakerstallda Obligation (Covered Bond) (XS2592234749), fixed rate (3.25% coupon) maturing on 4 May 2028, priced at 99.98 (original spread of 76 bp), non callable

- Spain, Kingdom of (Government) (Sovereign | Madrid, Madrid, Spain | Rating: BBB+): €5,000m Obligacion del Estado (ES0000012L60), fixed rate (3.90% coupon) maturing on 30 July 2039, priced at 99.98 (original spread of 132 bp), non callable

- Standard Chartered Bank (Banking | London, United Kingdom | Rating: A+): €400m Unsecured Note (XS2593127793), floating rate maturing on 3 March 2025, priced at 100.00, non callable

- Tesco Corporate Treasury Services PLC (Financial - Other | Welwyn Garden City, Hertfordshire, United Kingdom | Rating: BBB-): €500m Senior Note (XS2592301365), fixed rate (4.25% coupon) maturing on 27 February 2031, priced at 99.50 (original spread of 194 bp), callable (8nc8)

- Unilever Finance Netherlands BV (Financial - Other | Rotterdam, Zuid-Holland, United Kingdom | Rating: A+): €500m Senior Note (XS2591848192), fixed rate (3.50% coupon) maturing on 23 February 2035, priced at 99.33 (original spread of 114 bp), callable (12nc12)

- Unilever Finance Netherlands BV (Financial - Other | Rotterdam, Zuid-Holland, United Kingdom | Rating: A+): €500m Senior Note (XS2591848275), fixed rate (3.25% coupon) maturing on 23 February 2031, priced at 99.03 (original spread of 101 bp), callable (8nc8)

- VF Corp (Textiles/Apparel/Shoes | Denver, Colorado, United States | Rating: BBB): €500m Senior Note (XS2592659242), fixed rate (4.13% coupon) maturing on 7 March 2026, priced at 99.70 (original spread of 154 bp), callable (3nc3)

- VF Corp (Textiles/Apparel/Shoes | Denver, Colorado, United States | Rating: BBB): €500m Senior Note (XS2592659671), fixed rate (4.25% coupon) maturing on 7 March 2029, priced at 99.57 (original spread of 184 bp), callable (6nc6)

- Wolters Kluwer NV (Publishing | Alphen Aan Den Rijn, Zuid-Holland, Netherlands | Rating: BBB+): €700m Bond (XS2592516210) maturing on 21 March 2031, priced at 100.00, non callable

RECENT LOANS

- AccessOne MedCard Inc (United States of America), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/28/26.

- B&B Hotels SAS (France), signed a € 155m Term Loan B, to be used for general corporate purposes. It matures on 07/30/26 and initial pricing is set at EURIBOR +550.0bp

- CTP NV (Netherlands | BBB-), signed a € 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/17/26.

- Centerpoint Energy Res Corp (United States of America | BBB+), signed a US$ 500m Term Loan, to be used for refin/ret bank debt. It matures on 02/15/24 and initial pricing is set at Term SOFR +85.0bp

- Charoen Pokphand Foods PCL (Thailand), signed a US$ 150m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 02/17/28 and initial pricing is set at Term SOFR +230.0bp

- Charter NEX Films Inc (United States of America), signed a US$ 250m Term Loan B, to be used for refin/ret bank debt. It matures on 12/23/27 and initial pricing is set at Term SOFR +375.0bp

- Charter NEX Films Inc (United States of America), signed a US$ 1,836m Term Loan B, to be used for general corporate purposes. It matures on 12/23/27 and initial pricing is set at Term SOFR +375.0bp

- Creative Artists Agcy Llc (United States of America | B+), signed a US$ 1,550m Term Loan B, to be used for general corporate purposes. It matures on 11/26/28 and initial pricing is set at Term SOFR +350.0bp

- Eesti Energia AS (Estonia | BBB-), signed a € 600m Term Loan, to be used for refin/ret bank debt. It matures on 02/16/28.

- Emerson Electric Co (United States of America | A), signed a US$ 3,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/17/28 and initial pricing is set at Term SOFR +58.0bp

- Fluor Corp (United States of America | BBB-), signed a US$ 1,800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/17/26 and initial pricing is set at Term SOFR +162.5bp

- Genesis Energy LP (United States of America | B), signed a US$ 850m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/13/26 and initial pricing is set at LIBOR +375.0bp

- Glencore PLC (Switzerland | BBB+), signed a US$ 450m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/31/25 and initial pricing is set at Term SOFR +275.0bp

- Glencore PLC (Switzerland | BBB+), signed a US$ 4,200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/31/26 and initial pricing is set at Term SOFR +275.0bp

- Greatbatch Ltd (United States of America | BB-), signed a US$ 400m Term Loan A, to be used for general corporate purposes. It matures on 02/15/28 and initial pricing is set at Term SOFR +225.0bp

- Greatbatch Ltd (United States of America | BB-), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/15/28 and initial pricing is set at Term SOFR +225.0bp

- Greatbatch Ltd (United States of America | BB-), signed a US$ 350m Term Loan B, to be used for general corporate purposes. It matures on 09/02/28 and initial pricing is set at Term SOFR +250.0bp

- HB Fuller Co (United States of America | BB-), signed a US$ 800m Term Loan B, to be used for general corporate purposes. It matures on 02/15/30 and initial pricing is set at Term SOFR +250.0bp

- Kape Technologies PLC (United Kingdom), signed a US$ 268m Bridge Loan, to be used for mgmt buy-out. It matures on 02/15/24 and initial pricing is set at Term SOFR +300.0bp

- Kape Technologies PLC (United Kingdom), signed a US$ 267m Term Loan, to be used for mgmt buy-out. It matures on 02/15/25 and initial pricing is set at Term SOFR +300.0bp

- Kingston Tech Intl Ltd (Republic of Ireland), signed a US$ 600m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 01/00/00.

- MSP Sports Capital (United States of America), signed a US$ 750m Term Loan, to be used for acquisition financing

- Pertamina Hulu Energi PT (Indonesia), signed a US$ 2,500m Revolving Credit / Term Loan, to be used for general corporate purposes

- Pertamina Intl Shipping Very (Indonesia), signed a US$ 185m Revolving Credit / Term Loan, to be used for general corporate purposes.

- Sally Holdings Llc (United States of America | BB-), signed a US$ 400m Term Loan B, to be used for general corporate purposes. It matures on 02/16/30 and initial pricing is set at Term SOFR +250.0bp

- TMS International Corp (United States of America | B), signed a US$ 450m Term Loan B, to be used for general corporate purposes. It matures on 02/24/30 and initial pricing is set at Term SOFR +475.0bp

- Tyco Submarine Systems Ltd (United States of America), signed a US$ 730m Term Loan B, to be used for general corporate purposes. It matures on 04/27/27 and initial pricing is set at Term SOFR +500.0bp

- Tyco Submarine Systems Ltd (United States of America), signed a US$ 470m Term Loan B, to be used for general corporate purposes. It matures on 04/24/27 and initial pricing is set at Term SOFR +525.0bp

RECENT STRUCTURED CREDIT

- Alliance Funding Group 2023-1 issued a fixed-rate ABS backed by equipment leases in 5 tranches, for a total of US$ 137 m. Highest-rated tranche offering a yield to maturity of 5.46%, and the lowest-rated tranche a yield to maturity of 9.40%. Bookrunners: CIBC World Markets Inc, Truist Securities Inc

- Bosphorus CLO Viii Designated Activity Co issued a floating-rate CLO in 6 tranches, for a total of € 287 m. Highest-rated tranche offering a spread over the floating rate of 180bp, and the lowest-rated tranche a spread of 1,032bp. Bookrunners: Deutsche Bank

- Bushy Park CLO Dac issued a floating-rate CLO in 5 tranches, for a total of € 373 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 746bp. Bookrunners: BofA Securities Inc

- John Deere Owner Trust 2023 issued a fixed-rate ABS backed by equipment leases in 4 tranches, for a total of US$ 983 m. Highest-rated tranche offering a yield to maturity of 5.01%, and the lowest-rated tranche a yield to maturity of 5.28%. Bookrunners: RBC Capital Markets, Bank of America Merrill Lynch, HSBC Securities (USA) Inc, MUFG Securities Americas Inc

- Marlette Funding Trust 2023-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 349 m. Highest-rated tranche offering a yield to maturity of 6.07%, and the lowest-rated tranche a yield to maturity of 8.15%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc

- Palmer Square European Loan Funding 2023-1 Dac issued a floating-rate CLO in 6 tranches, for a total of € 388 m. Highest-rated tranche offering a spread over the floating rate of 160bp, and the lowest-rated tranche a spread of 653bp. Bookrunners: JP Morgan & Co Inc

- Trinitas Euro Clo Iv Dac issued a floating-rate CLO in 7 tranches, for a total of € 336 m. Highest-rated tranche offering a spread over the floating rate of 175bp, and the lowest-rated tranche a spread of 973bp. Bookrunners: JP Morgan & Co Inc