Credit

Tighter Spreads Across The USD Credit Complex, Led By Single Bs, As BBs Continued To Underperform

Strong volumes of issuance this week (IFR Markets data): 66 tranches for $48.09bn in IG (2023 YTD volume $315.69bn vs 2022 YTD $287.841bn), 11 tranches for $7bn in HY (2023 YTD volume $39.575bn vs 2022 YTD $33.875bn)

Published ET

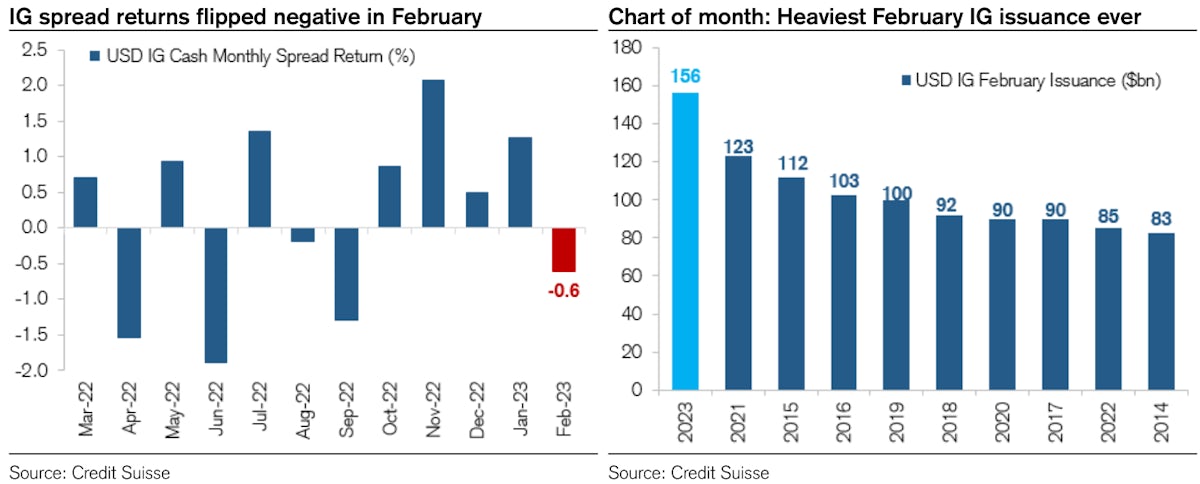

Heaviest February USD IG issuance ever | Source: Credit Suisse

DAILY SUMMARY

- S&P 500 Bond Index was up 0.88% today, with investment grade up 0.90% and high yield up 0.68% (YTD total return: +0.88%)

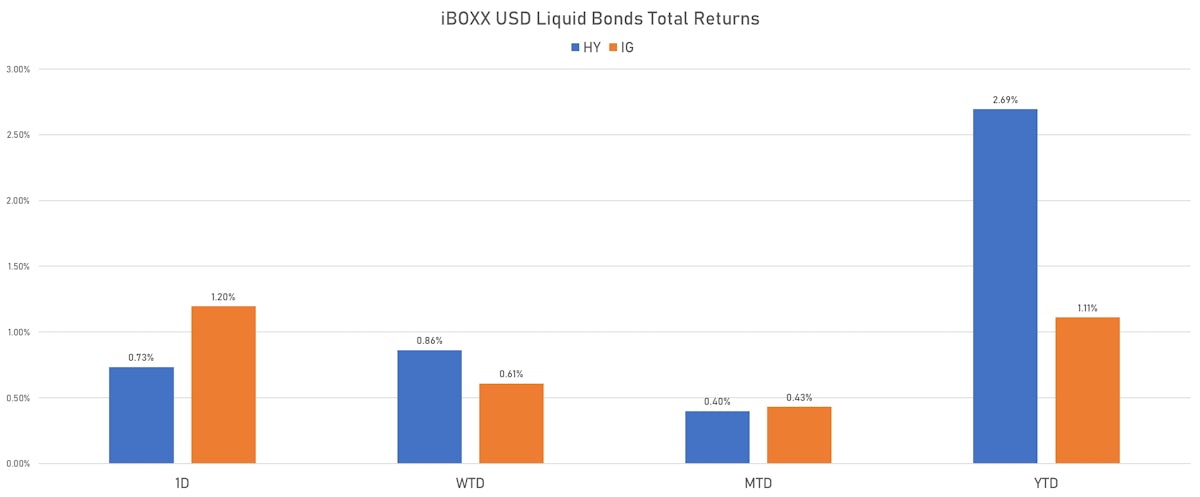

- The iBoxx USD Liquid Investment Grade Total Return Index was up 1.196% today (Week-to-date: 0.61%; Month-to-date: 0.43%; Year-to-date: 1.11%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.734% today (Week-to-date: 0.86%; Month-to-date: 0.40%; Year-to-date: 2.69%)

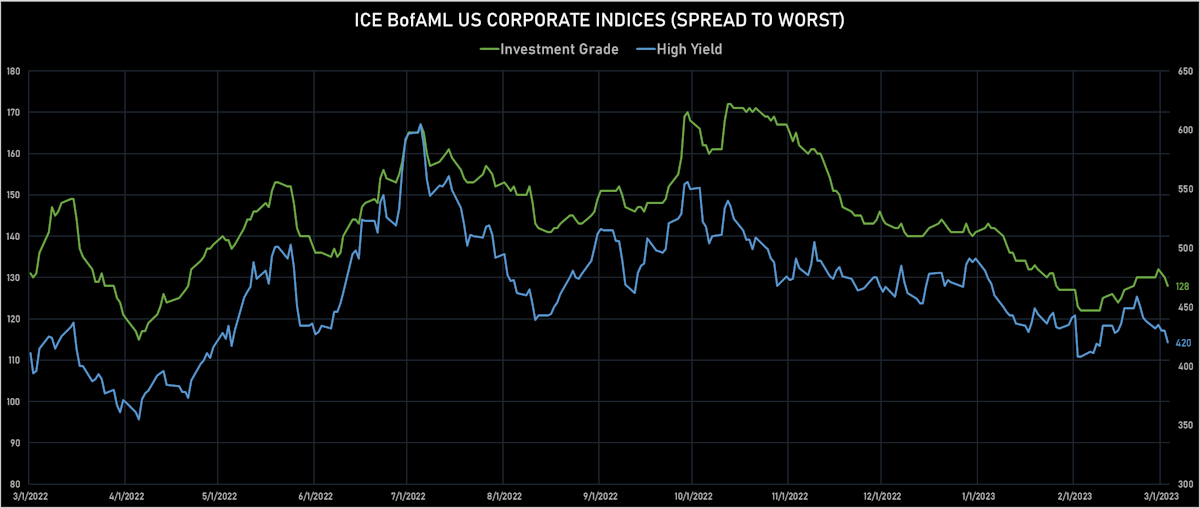

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 130.0 bp (WTD change: -2.0 bp; YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -10.0 bp, now at 430.0 bp (WTD change: -18.0 bp; YTD change: -58.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +3.0%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 56 bp

- AA down by -1 bp at 72 bp

- A down by -2 bp at 102 bp

- BBB down by -2 bp at 156 bp

- BB down by -11 bp at 268 bp

- B down by -14 bp at 418 bp

- ≤ CCC down by -11 bp at 990 bp

CDS INDICES TODAY (mid-spreads)

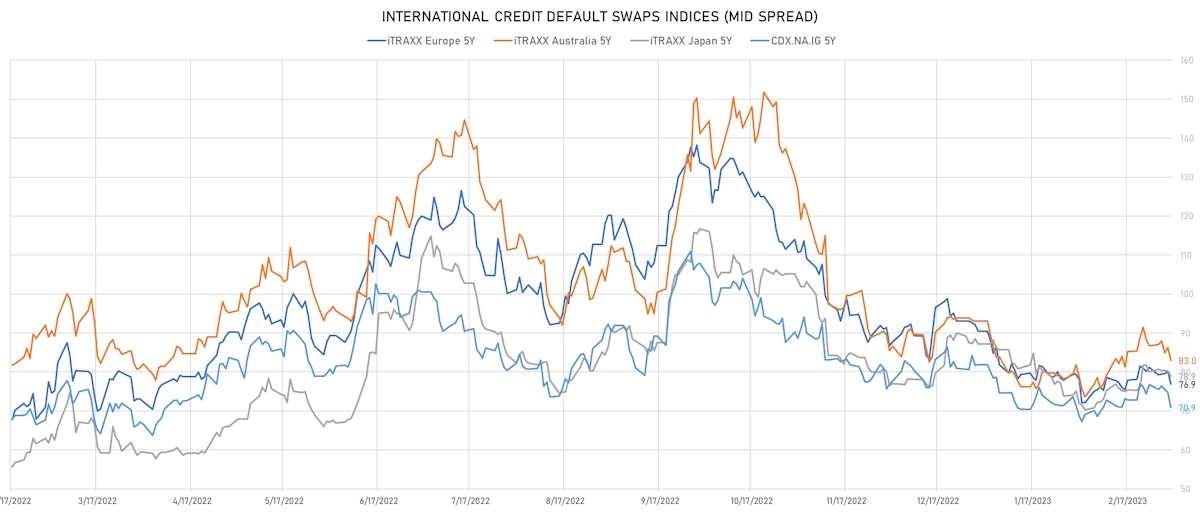

- Markit CDX.NA.IG 5Y down 3.9 bp, now at 71bp (1W change: -6.0bp; YTD change: -11.0bp)

- Markit CDX.NA.IG 10Y down 3.7 bp, now at 111bp (1W change: -5.6bp; YTD change: -7.0bp)

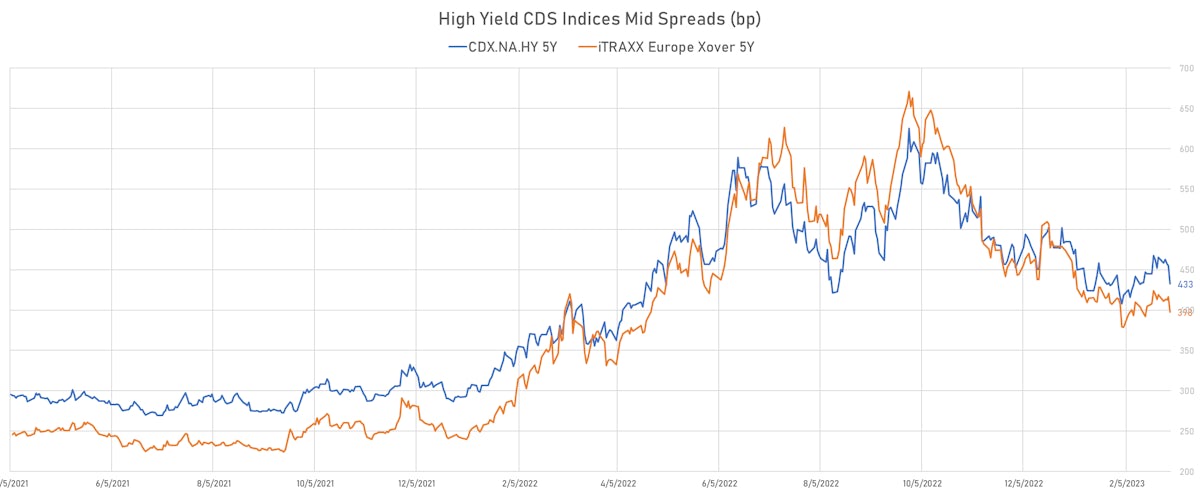

- Markit CDX.NA.HY 5Y down 22.6 bp, now at 433bp (1W change: -32.7bp; YTD change: -52.2bp)

- Markit iTRAXX Europe 5Y down 3.3 bp, now at 77bp (1W change: -4.3bp; YTD change: -13.6bp)

- Markit iTRAXX Europe Crossover 5Y down 19.0 bp, now at 398bp (1W change: -21.8bp; YTD change: -76.6bp)

- Markit iTRAXX Japan 5Y down 1.3 bp, now at 79bp (1W change: -1.1bp; YTD change: -8.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.8 bp, now at 112bp (1W change: -4.3bp; YTD change: -21.3bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: B): down 169.1 bp to 1,807.3bp (1Y range: 695-4,371bp)

- Tegna Inc (Country: US; rated: Ba3): down 136.6 bp to 371.8bp (1Y range: 182-786bp)

- Pitney Bowes Inc (Country: US; rated: B1): down 71.2 bp to 932.5bp (1Y range: 625-1,783bp)

- American Airlines Group Inc (Country: US; rated: NR): down 56.5 bp to 737.6bp (1Y range: 607-1,644bp)

- United States Steel Corp (Country: US; rated: BBB-): down 45.7 bp to 352.2bp (1Y range: 329-780bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 43.9 bp to 827.1bp (1Y range: 747-1,472bp)

- Bombardier Inc (Country: CA; rated: CCC-): down 39.1 bp to 308.7bp (1Y range: 309-1,007bp)

- Staples Inc (Country: US; rated: B3): down 35.9 bp to 1,741.5bp (1Y range: 1,018-1,986bp)

- Univision Communications Inc (Country: US; rated: B1): down 32.1 bp to 472.0bp (1Y range: 447-658bp)

- Murphy Oil Corp (Country: US; rated: A1): down 31.7 bp to 253.5bp (1Y range: 227-446bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B2): down 29.3 bp to 492.2bp (1Y range: 401-1,584bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 73.2 bp to 719.9bp (1Y range: 548-759bp)

- Lumen Technologies Inc (Country: US; rated: B2): up 109.6 bp to 1,778.3bp (1Y range: 195-1,778bp)

- DISH DBS Corp (Country: US; rated: B2): up 142.2 bp to 1,574.9bp (1Y range: 545-1,575bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 6734.3 bp to 9,921.3bp (1Y range: 612-9,921bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Iceland Bondco PLC (Country: GB; rated: B3): down 43.8 bp to 1,099.0bp (1Y range: 566-1,739bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 41.3 bp to 734.1bp (1Y range: 476-1,296bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 39.0 bp to 736.6bp (1Y range: 401-1,021bp)

- Elo SA (Country: FR; rated: ): down 34.9 bp to 207.9bp (1Y range: 83-242bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 26.2 bp to 1,356.1bp (1Y range: 1,286-2,910bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): down 21.6 bp to 331.1bp (1Y range: 288-705bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 20.6 bp to 202.0bp (1Y range: 202-606bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 19.2 bp to 712.8bp (1Y range: 407-1,254bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): down 16.1 bp to 167.7bp (1Y range: 135-268bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 11.7 bp to 266.3bp (1Y range: 218-498bp)

- PostNL NV (Country: NL; rated: WR): up 14.1 bp to 151.2bp (1Y range: 51-179bp)

- Novafives SAS (Country: FR; rated: Caa1): up 18.7 bp to 1,029.3bp (1Y range: 618-2,936bp)

- TUI AG (Country: DE; rated: B3-PD): up 24.0 bp to 782.0bp (1Y range: 683-1,725bp)

- Ceconomy AG (Country: DE; rated: B1): up 50.2 bp to 914.0bp (1Y range: 287-1,763bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): up 658.9 bp to 3,645.0bp (1Y range: 905-4,917bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS up by 46.2 bp to 113.7 bp, with the yield to worst at 5.9% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 95.3-98.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS up by 44.3 bp to 112.3 bp, with the yield to worst at 6.0% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.4-100.5).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.88% | Maturity: 1/9/2025 | Rating: BB+ | CUSIP: 674599EB7 | OAS down by 30.9 bp to 68.4 bp (CDS basis: -13.3bp), with the yield to worst at 5.4% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 99.5-101.9).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS down by 35.6 bp to 75.4 bp (CDS basis: 22.0bp), with the yield to worst at 6.0% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 94.3-96.9).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 7.38% | Maturity: 15/1/2026 | Rating: BB | CUSIP: 247361ZZ4 | OAS down by 42.1 bp to 119.6 bp (CDS basis: 21.9bp), with the yield to worst at 5.9% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 101.8-105.9).

- Issuer: Las Vegas Sands Corp (Las Vegas, Nevada (US)) | Coupon: 2.90% | Maturity: 25/6/2025 | Rating: BB+ | CUSIP: 517834AH0 | OAS down by 42.2 bp to 120.2 bp, with the yield to worst at 6.2% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 91.8-94.6).

- Issuer: Newell Brands Inc (Atlanta, Georgia (US)) | Coupon: 4.88% | Maturity: 1/6/2025 | Rating: BB | CUSIP: 651229BB1 | OAS down by 43.3 bp to 134.2 bp, with the yield to worst at 6.3% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 95.5-98.9).

- Issuer: MGM Resorts International (Las Vegas, Nevada (US)) | Coupon: 5.75% | Maturity: 15/6/2025 | Rating: B+ | CUSIP: 552953CE9 | OAS down by 45.1 bp to 136.4 bp (CDS basis: -18.0bp), with the yield to worst at 6.1% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 96.9-100.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.95% | Maturity: 6/3/2026 | Rating: BB | CUSIP: 345397C43 | OAS down by 54.4 bp to 165.1 bp (CDS basis: 10.4bp), with the yield to worst at 6.4% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 99.2-103.6).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 54.7 bp to 69.9 bp (CDS basis: -36.0bp), with the yield to worst at 5.8% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 91.8-94.4).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.50% | Maturity: 1/12/2025 | Rating: BB+ | CUSIP: 674599EE1 | OAS down by 54.9 bp to 58.5 bp (CDS basis: 2.8bp), with the yield to worst at 5.2% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 98.3-101.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS down by 56.3 bp to 83.4 bp, with the yield to worst at 5.5% and the bond now trading up to 96.1 cents on the dollar (1Y price range: 94.4-96.9).

- Issuer: Tri Pointe Homes Inc (Delaware) (Incline Village, Nevada (US)) | Coupon: 5.88% | Maturity: 15/6/2024 | Rating: BB- | CUSIP: 962178AN9 | OAS down by 58.6 bp to 148.7 bp, with the yield to worst at 6.3% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 98.0-100.0).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS down by 91.0 bp to 173.6 bp (CDS basis: -21.8bp), with the yield to worst at 6.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 96.6-99.5).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | CUSIP: 02376RAE2 | OAS down by 131.4 bp to 272.6 bp, with the yield to worst at 7.3% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 85.0-94.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Wizz Air Finance Company BV (Amsterdam, Netherlands) | Coupon: 1.00% | Maturity: 19/1/2026 | Rating: BB+ | ISIN: XS2433361719 | OAS up by 46.1 bp to 323.5 bp, with the yield to worst at 6.5% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 82.1-89.2).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | OAS up by 40.8 bp to 420.5 bp, with the yield to worst at 7.4% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 76.5-83.0).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | OAS down by 23.9 bp to 349.5 bp, with the yield to worst at 6.7% and the bond now trading up to 76.2 cents on the dollar (1Y price range: 73.9-79.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 30/7/2027 | Rating: BB- | ISIN: XS1266661013 | OAS down by 24.8 bp to 395.2 bp, with the yield to worst at 6.9% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 86.4-94.8).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 25.5 bp to 507.6 bp (CDS basis: 144.0bp), with the yield to worst at 8.3% and the bond now trading up to 94.9 cents on the dollar (1Y price range: 88.4-97.4).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | OAS down by 25.5 bp to 288.4 bp, with the yield to worst at 5.9% and the bond now trading up to 82.8 cents on the dollar (1Y price range: 75.4-85.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS down by 25.6 bp to 310.7 bp, with the yield to worst at 6.3% and the bond now trading up to 91.7 cents on the dollar (1Y price range: 88.9-94.3).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.00% | Maturity: 12/11/2029 | Rating: BB | ISIN: FR0014006G24 | OAS down by 27.2 bp to 376.0 bp, with the yield to worst at 6.1% and the bond now trading up to 68.4 cents on the dollar (1Y price range: 61.6-68.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB | ISIN: XS2265369657 | OAS down by 27.3 bp to 146.6 bp (CDS basis: 8.4bp), with the yield to worst at 4.8% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 89.7-94.9).

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS down by 29.4 bp to 440.8 bp, with the yield to worst at 6.7% and the bond now trading up to 76.4 cents on the dollar (1Y price range: 64.8-76.1).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: B+ | ISIN: XS2270393379 | OAS down by 29.5 bp to 303.0 bp (CDS basis: 112.5bp), with the yield to worst at 6.0% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 85.4-88.5).

- Issuer: Hornbach Baumarkt AG (Bornheim, Germany) | Coupon: 3.25% | Maturity: 25/10/2026 | Rating: BB+ | ISIN: DE000A255DH9 | OAS down by 32.7 bp to 134.2 bp, with the yield to worst at 4.8% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 92.9-94.8).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS down by 41.0 bp to 337.4 bp, with the yield to worst at 6.6% and the bond now trading up to 88.9 cents on the dollar (1Y price range: 85.3-93.2).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | OAS down by 42.0 bp to 325.6 bp, with the yield to worst at 6.6% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 86.2-92.4).

- Issuer: Kennedy Wilson Europe Real Estate Ltd (Saint Helier, Jersey) | Coupon: 3.25% | Maturity: 12/11/2025 | Rating: BB+ | ISIN: XS1321149434 | OAS down by 100.6 bp to 528.1 bp, with the yield to worst at 8.9% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 77.8-85.9).

Delta Air Lines 7.38% 15/1/2026 (CUSIP: 247361ZZ4) and 3Y USD senior CDS spreads | Source: Refinitiv

RECENT DOMESTIC USD BOND ISSUES

- Air Products and Chemicals Inc (Chemicals | Allentown, Pennsylvania, United States | Rating: A): US$600m Senior Note (US009158BF29), fixed rate (4.80% coupon) maturing on 3 March 2033, priced at 99.83 (original spread of 92 bp), callable (10nc10)

- Alliant Energy Corp (Utility - Other | Madison, Wisconsin, United States | Rating: BBB+): US$500m Bond (US018802AB41), fixed rate (3.88% coupon) maturing on 15 March 2026, priced at 100.00, non callable, convertible

- Alteryx Inc (Service - Other | Irvine, California, United States | Rating: B): US$450m Senior Note (US02156BAG86), fixed rate (8.75% coupon) maturing on 15 March 2028, priced at 100.00 (original spread of 449 bp), callable (5nc2)

- American Electric Power Company Inc (Utility - Other | Columbus, Ohio, United States | Rating: BBB): US$850m Senior Note (US025537AX91), fixed rate (5.63% coupon) maturing on 1 March 2033, priced at 99.63 (original spread of 175 bp), callable (10nc10)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): US$800m Senior Note (US03027XBZ24), fixed rate (5.65% coupon) maturing on 15 March 2033, priced at 99.54 (original spread of 185 bp), callable (10nc10)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): US$700m Senior Note (US03027XBY58), fixed rate (5.50% coupon) maturing on 15 March 2028, priced at 99.69 (original spread of 140 bp), callable (5nc5)

- Arrow Electronics Inc (Electronics | Centennial, Colorado, United States | Rating: BBB-): US$500m Senior Note (US04273WAD39), fixed rate (6.13% coupon) maturing on 1 March 2026, priced at 99.98 (original spread of 163 bp), callable (3nc1)

- Arthur J. Gallagher & Co. (Financial - Other | Rolling Meadows, Illinois, United States | Rating: BBB): US$350m Senior Note (US04316JAD19), fixed rate (5.50% coupon) maturing on 2 March 2033, priced at 99.82 (original spread of 164 bp), callable (10nc10)

- Arthur J. Gallagher & Co. (Financial - Other | Rolling Meadows, Illinois, United States | Rating: BBB): US$600m Senior Note (US04316JAE91), fixed rate (5.75% coupon) maturing on 2 March 2053, priced at 99.00 (original spread of 221 bp), callable (30nc30)

- Black Hills Corp (Utility - Other | Rapid City, United States | Rating: BBB): US$350m Senior Note (US092113AV12), fixed rate (5.95% coupon) maturing on 15 March 2028, priced at 99.68 (original spread of 170 bp), callable (5nc5)

- Cigna Group (Life Insurance | Bloomfield, Connecticut, United States | Rating: BBB+): US$700m Senior Note (US125523CR91), fixed rate (5.69% coupon) maturing on 15 March 2026, priced at 100.00 (original spread of 345 bp), callable (3nc1)

- Cigna Group (Life Insurance | Bloomfield, Connecticut, United States | Rating: BBB+): US$800m Senior Note (US125523CS74), fixed rate (5.40% coupon) maturing on 15 March 2033, priced at 99.91 (original spread of 150 bp), callable (10nc10)

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): US$500m Senior Note (US194162AS29), fixed rate (4.60% coupon) maturing on 1 March 2033, priced at 99.81 (original spread of 70 bp), callable (10nc10)

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): US$500m Senior Note (US194162AR46), fixed rate (4.60% coupon) maturing on 1 March 2028, priced at 99.90 (original spread of 45 bp), callable (5nc5)

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): US$500m Senior Note (US194162AQ62), fixed rate (4.80% coupon) maturing on 2 March 2026, priced at 99.88 (original spread of 33 bp), with a make whole call

- DTE Electric Co (Utility - Other | Detroit, Michigan, United States | Rating: A): US$600m Bond (US23338VAS51), fixed rate (5.20% coupon) maturing on 1 April 2033, priced at 99.79 (original spread of 130 bp), callable (10nc10)

- DTE Electric Co (Utility - Other | Detroit, Michigan, United States | Rating: A): US$600m Bond (US23338VAT35), fixed rate (5.40% coupon) maturing on 1 April 2053, priced at 99.82 (original spread of 173 bp), callable (30nc30)

- Edison International (Utility - Other | Rosemead, California, United States | Rating: BB): US$500m Junior Subordinated Note (US281020AX52), fixed rate (8.13% coupon) maturing on 15 June 2053, priced at 100.00 (original spread of 389 bp), callable (30nc5)

- Encore Capital Group Inc (Financial - Other | San Diego, California, United States | Rating: NR): US$200m Bond (US292554AN22), fixed rate (4.00% coupon) maturing on 15 March 2029, priced at 100.00, non callable, convertible

- Equitable Financial Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: A+): US$300m Note (US29449WAQ06), fixed rate (5.45% coupon) maturing on 3 March 2028, priced at 99.88 (original spread of 130 bp), non callable

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$750m Senior Note (US30040WAT53), fixed rate (5.45% coupon) maturing on 1 March 2028, priced at 99.80 (original spread of 123 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$275m Bond (US3133EPCM50), floating rate (SOFR + 12.5 bp) maturing on 7 March 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$500m Bond (US3133EPCR48), fixed rate (4.75% coupon) maturing on 9 March 2026, priced at 99.91, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: NR): US$300m Bond (US3133EPCT04), floating rate (PRQ + -302.5 bp) maturing on 10 March 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AAA): US$1,800m Bond (US3130AV7L02), fixed rate (5.00% coupon) maturing on 28 February 2025, priced at 99.87, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$187m Bond (US3130AV6J64), fixed rate (4.50% coupon) maturing on 13 March 2026, priced at 99.66 (original spread of 2 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$300m Bond (US3130AV6Z07), fixed rate (5.71% coupon) maturing on 14 March 2025, priced at 100.00 (original spread of 96 bp), callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$120m Unsecured Note (US3134GYLK65), fixed rate (5.75% coupon) maturing on 20 March 2026, priced at 100.00 (original spread of 120 bp), callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$10,000m Unsecured Note (US3134GYMP44), fixed rate (5.50% coupon) maturing on 20 March 2026, priced at 100.00, callable (3nc6m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYLR19), fixed rate (5.63% coupon) maturing on 28 March 2025, priced at 100.00 (original spread of 78 bp), callable (2nc9m)

- Fiserv Inc (Information/Data Technology | Brookfield, Wisconsin, United States | Rating: BBB): US$900m Senior Note (US337738BD90), fixed rate (5.45% coupon) maturing on 2 March 2028, priced at 99.87 (original spread of 130 bp), callable (5nc5)

- Fiserv Inc (Information/Data Technology | Brookfield, Wisconsin, United States | Rating: BBB): US$900m Senior Note (US337738BE73), fixed rate (5.60% coupon) maturing on 2 March 2033, priced at 99.79 (original spread of 170 bp), callable (10nc10)

- Five Corners Funding Trust IV (Financial - Other | Delaware, United States | Rating: A-): US$700m Senior Note (US33835PAA49), fixed rate (6.00% coupon) maturing on 15 February 2053, priced at 100.00 (original spread of 232 bp), callable (30nc29)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A+): US$750m First Mortgage Bond (US341081GL58), fixed rate (5.10% coupon) maturing on 1 April 2033, priced at 99.84 (original spread of 120 bp), callable (10nc10)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A+): US$1,000m First Mortgage Bond (US341081GK75), fixed rate (5.05% coupon) maturing on 1 April 2028, priced at 99.87 (original spread of 90 bp), callable (5nc5)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A+): US$750m First Mortgage Bond (US341081GM32), fixed rate (5.30% coupon) maturing on 1 April 2053, priced at 99.50 (original spread of 164 bp), callable (30nc30)

- Frontier Communications Holdings LLC (Financial - Other | Norwalk, Connecticut, United States | Rating: B): US$750m Note (US35908MAE03), fixed rate (8.63% coupon) maturing on 15 March 2031, priced at 100.00 (original spread of 458 bp), callable (8nc3)

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB-): US$750m Senior Note (US444859BX93), fixed rate (5.50% coupon) maturing on 15 March 2053, priced at 96.43 (original spread of 217 bp), callable (30nc30)

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB-): US$500m Senior Note (US444859BW11), fixed rate (5.70% coupon) maturing on 13 March 2026, priced at 99.98 (original spread of 120 bp), callable (3nc1)

- Invitae Corp (Health Care Facilities | San Francisco, California, United States | Rating: NR): US$275m Bond (US46185LAH69), fixed rate (4.50% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$300m Senior Note (US24422EWU99), floating rate (SOFR + 57.0 bp) maturing on 3 March 2026, priced at 100.00, non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$550m Senior Note (US24422EWT27), fixed rate (5.05% coupon) maturing on 3 March 2026, priced at 99.99 (original spread of 55 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$500m Senior Note (US24422EWS44), fixed rate (5.15% coupon) maturing on 3 March 2025, priced at 99.94 (original spread of 40 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$650m Senior Note (US24422EWV72), fixed rate (4.90% coupon) maturing on 3 March 2028, priced at 99.92 (original spread of 75 bp), non callable

- NRG Energy Inc (Utility - Other | Houston, United States | Rating: BBB-): US$740m Note (US629377CT71), fixed rate (7.00% coupon) maturing on 15 March 2033, priced at 98.75 (original spread of 310 bp), callable (10nc10)

- Ppl Electric Utilities Corp (Utility - Other | Allentown, Pennsylvania, United States | Rating: A+): US$750m First Mortgage Bond (US69351UBB89), fixed rate (5.25% coupon) maturing on 15 May 2053, priced at 97.98 (original spread of 168 bp), callable (30nc30)

- Ppl Electric Utilities Corp (Utility - Other | Allentown, Pennsylvania, United States | Rating: A+): US$600m First Mortgage Bond (US69351UBA07), fixed rate (5.00% coupon) maturing on 15 May 2033, priced at 98.98 (original spread of 122 bp), callable (10nc10)

- Simon Property Group LP (Real Estate Investment Trust | Indianapolis, Indiana, United States | Rating: A-): US$650m Senior Note (US828807DV66), fixed rate (5.85% coupon) maturing on 8 March 2053, priced at 99.11 (original spread of 223 bp), callable (30nc30)

- Simon Property Group LP (Real Estate Investment Trust | Indianapolis, Indiana, United States | Rating: A-): US$650m Senior Note (US828807DU83), fixed rate (5.50% coupon) maturing on 8 March 2033, priced at 98.91 (original spread of 165 bp), callable (10nc10)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: BBB+): US$450m First & Refunding Mortgage Bond (US842400HV80), fixed rate (5.70% coupon) maturing on 1 March 2053, priced at 99.53 (original spread of 212 bp), callable (30nc30)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: BBB+): US$750m First & Refunding Mortgage Bond (US842400HU08), fixed rate (5.30% coupon) maturing on 1 March 2028, priced at 99.90 (original spread of 120 bp), callable (5nc5)

- Stanley Black & Decker Inc (Building Products | New Britain, Connecticut, United States | Rating: BBB): US$400m Senior Note (US854502AT83), fixed rate (6.00% coupon) maturing on 6 March 2028, priced at 99.89 (original spread of 175 bp), callable (5nc5)

- Stanley Black & Decker Inc (Building Products | New Britain, Connecticut, United States | Rating: BBB): US$350m Senior Note (US854502AS01), fixed rate (6.27% coupon) maturing on 6 March 2026, priced at 100.00 (original spread of 167 bp), callable (3nc1)

- TPI Composites Inc (Utility - Other | Scottsdale, Arizona, United States | Rating: NR): US$115m Bond (US87266JAA25), fixed rate (5.25% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

- Triumph Group Inc (Airline | Berwyn, Pennsylvania, United States | Rating: CCC+): US$1,200m Note (USU8968GAH75), fixed rate (9.00% coupon) maturing on 15 March 2028, priced at 100.00 (original spread of 481 bp), callable (5nc2)

- Union Electric Co (Utility - Other | St. Louis, Missouri, United States | Rating: A): US$500m First Mortgage Bond (US906548CW07), fixed rate (5.45% coupon) maturing on 15 March 2053, priced at 99.79 (original spread of 185 bp), callable (30nc30)

- United Parcel Service Inc (Transportation - Other | Atlanta, Georgia, United States | Rating: A): US$529m Senior Note (US911312CB06), floating rate (SOFR + -35.0 bp) maturing on 15 March 2073, priced at 100.00, callable (50nc30)

- Verisk Analytics Inc (Service - Other | Jersey City, United States | Rating: BBB): US$500m Senior Note (US92345YAH99), fixed rate (5.75% coupon) maturing on 1 April 2033, priced at 99.04 (original spread of 180 bp), callable (10nc10)

- Viavi Solutions Inc (Electronics | Chandler, Arizona, United States | Rating: BB+): US$250m Bond (), fixed rate (1.63% coupon) maturing on 15 March 2026, priced at 100.00, non callable, convertible

- Vulcan Materials Co (Building Products | Birmingham, Alabama, United States | Rating: BBB): US$550m Senior Note (US929160BA60), fixed rate (5.80% coupon) maturing on 1 March 2026, priced at 99.97 (original spread of 130 bp), callable (3nc1)

- Williams Companies Inc (Gas Utility - Pipelines | Tulsa, Oklahoma, United States | Rating: BBB): US$750m Senior Note (US969457CH11), fixed rate (5.40% coupon) maturing on 2 March 2026, priced at 99.91 (original spread of 93 bp), with a make whole call

- Williams Companies Inc (Gas Utility - Pipelines | Tulsa, Oklahoma, United States | Rating: BBB): US$750m Senior Note (US969457CJ76), fixed rate (5.65% coupon) maturing on 15 March 2033, priced at 99.89 (original spread of 175 bp), callable (10nc10)

- Wynn Macau Ltd (Gaming | United States | Rating: B+): US$600m Bond (USG98149AL45), fixed rate (4.50% coupon) maturing on 7 March 2029, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- Adient Global Holdings Ltd (Financial - Other | Saint Helier, Ireland | Rating: B-): US$500m Senior Note (US00687YAC93), fixed rate (8.25% coupon) maturing on 15 April 2031, priced at 100.00 (original spread of 437 bp), callable (8nc3)

- Adient Global Holdings Ltd (Financial - Other | Saint Helier, Ireland | Rating: BB-): US$500m Note (USG0086CAD59), fixed rate (7.00% coupon) maturing on 15 April 2028, priced at 100.00 (original spread of 281 bp), callable (5nc2)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: A): US$1,100m Senior Note (US04636NAF06), fixed rate (4.88% coupon) maturing on 3 March 2028, priced at 99.80 (original spread of 75 bp), callable (5nc5)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: A): US$650m Senior Note (US04636NAG88), fixed rate (4.90% coupon) maturing on 3 March 2030, priced at 99.59 (original spread of 90 bp), callable (7nc7)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: A): US$500m Senior Note (US04636NAH61), fixed rate (4.88% coupon) maturing on 3 March 2033, priced at 99.73 (original spread of 100 bp), callable (10nc10)

- BOS Funding Ltd (Financial - Other | George Town, United Arab Emirates | Rating: NR): US$500m Unsecured Note (XS2597110613), fixed rate (4.00% coupon) maturing on 15 March 2028, priced at 100.00, non callable

- Bank of England (Agency | London, United Kingdom | Rating: AA-): US$2,000m Senior Note (XS2595379590), fixed rate (4.63% coupon) maturing on 6 March 2026, priced at 99.88 (original spread of 13 bp), non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$500m Unsecured Note (XS2483181710), floating rate maturing on 13 March 2026, priced at 100.00, non callable

- DBS Bank Ltd (Hong Kong Branch) (Banking | Singapore | Rating: NR): US$875m Unsecured Note (XS2595832507), floating rate maturing on 10 March 2026, priced at 100.00, non callable

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): US$2,000m Senior Note (US29874QEX88), fixed rate (4.38% coupon) maturing on 9 March 2028, priced at 99.59 (original spread of 14 bp), non callable

- FAB Sukuk Company Ltd (Financial - Other | George Town, United Arab Emirates | Rating: NR): US$250m Unsecured Note (XS2596075239), fixed rate (1.00% coupon) maturing on 17 January 2028, priced at 100.00, non callable

- Five Corners Funding Trust III (Financial - Other | Rating: A-): US$800m Senior Note (US33830GAA94), fixed rate (5.79% coupon) maturing on 15 February 2033, priced at 100.00 (original spread of 180 bp), callable (10nc10)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,000m Senior Note (US404280DU06), floating rate maturing on 9 March 2029, priced at 100.00, callable (6nc5)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,250m Senior Note (US404280DV88), floating rate maturing on 9 March 2034, priced at 100.00, callable (11nc10)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): US$2,750m Senior Note (US404280DW61), floating rate maturing on 9 March 2044, priced at 100.00, callable (21nc20)

- Jones Deslauriers Insurance Management Inc (Financial - Other | Mississauga, Canada | Rating: B-): US$500m Note (US48020RAB15), fixed rate (8.50% coupon) maturing on 15 March 2030, priced at 100.00 (original spread of 427 bp), callable (7nc3)

- KasikornBank PCL (Hong Kong Branch) (Banking | Thailand | Rating: BBB+): US$600m Senior Note (XS2580263734), fixed rate (5.46% coupon) maturing on 7 March 2028, priced at 100.00 (original spread of 125 bp), non callable

- Keyspan Gas East Corp (Gas Utility - Local Distrib | Hicksville, United Kingdom | Rating: BBB+): US$500m Senior Note (USU49143AD94), fixed rate (5.99% coupon) maturing on 6 March 2033, priced at 100.00 (original spread of 200 bp), callable (10nc10)

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Germany | Rating: AA+): US$2,000m Senior Note (XS2596437918), fixed rate (4.88% coupon) maturing on 9 March 2026, priced at 99.87 (original spread of -7 bp), non callable

- Lloyds Banking Group PLC (Banking | Spalding, United Kingdom | Rating: BBB+): US$1,250m Senior Note (US539439AX74), fixed rate (5.87% coupon) maturing on 6 March 2029, priced at 100.00 (original spread of 161 bp), callable (6nc5)

- Morocco, Kingdom of (Government) (Sovereign | Rabat, Morocco | Rating: BB+): US$1,250m Senior Note (US617726AP96), fixed rate (6.50% coupon) maturing on 8 September 2033, priced at 99.24 (original spread of 262 bp), non callable

- Morocco, Kingdom of (Government) (Sovereign | Rabat, Morocco | Rating: BB+): US$1,250m Senior Note (US617726AN49), fixed rate (5.95% coupon) maturing on 8 March 2028, priced at 98.86 (original spread of 195 bp), non callable

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BBB): US$1,000m Senior Note (US639057AH16), fixed rate (6.02% coupon) maturing on 2 March 2034, priced at 100.00 (original spread of 206 bp), callable (11nc10)

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BBB): US$1,000m Senior Note (US639057AJ71), fixed rate (5.85% coupon) maturing on 2 March 2027, priced at 100.00 (original spread of 122 bp), callable (4nc3)

- Norinchukin Bank (Banking | Chiyoda-Ku, Japan | Rating: A): US$500m Senior Note (US656029AL92), fixed rate (5.43% coupon) maturing on 9 March 2028, priced at 100.00 (original spread of 110 bp), non callable

- Ritchie Bros Holdings Inc (Financial - Other | Lincoln, Nebraska, Canada | Rating: BB): US$550m Note (US76774LAB36), fixed rate (6.75% coupon) maturing on 15 March 2028, priced at 100.00 (original spread of 246 bp), callable (5nc2)

- Ritchie Bros Holdings Inc (Financial - Other | Lincoln, Nebraska, Canada | Rating: B+): US$800m Senior Note (US76774LAC19), fixed rate (7.75% coupon) maturing on 15 March 2031, priced at 100.00 (original spread of 378 bp), callable (8nc3)

- Sumitomo Corp (Conglomerate/Diversified Mfg | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$500m Senior Note (XS2592306752), fixed rate (5.55% coupon) maturing on 9 March 2028, priced at 99.85 (original spread of 125 bp), callable (5nc5)

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (US86563VBH15), fixed rate (5.50% coupon) maturing on 9 March 2028, priced at 99.86 (original spread of 128 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Japan | Rating: A): US$500m Senior Note (USJ7771YRY51), floating rate (SOFR + 112.0 bp) maturing on 9 March 2026, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$1,000m Senior Note (US86563VBG32), fixed rate (5.65% coupon) maturing on 9 March 2026, priced at 99.89 (original spread of 110 bp), non callable

- Teva Pharmaceutical Finance Netherlands III BV (Financial - Other | Amsterdam, Noord-Holland, Israel | Rating: BB-): US$500m Senior Note (US88167AAR23), fixed rate (8.13% coupon) maturing on 15 September 2031, priced at 100.00 (original spread of 413 bp), callable (9nc8)

- Teva Pharmaceutical Finance Netherlands III BV (Financial - Other | Amsterdam, Noord-Holland, Israel | Rating: BB-): US$600m Senior Note (US88167AAS06), fixed rate (7.88% coupon) maturing on 15 September 2029, priced at 100.00 (original spread of 366 bp), callable (7nc6)

- Vista Oil & Gas Argentina SA (Oilfield Machinery and Services | Buenos Aires, Mexico | Rating: NR): US$119m Bond (AROILG5600I0) zero coupon maturing on 3 March 2027, priced at 100.00, callable (4nc1m)

- iQIYI Inc (Service - Other | Beijing, Beijing, China (Mainland) | Rating: NR): US$600m Bond (USG4939KAE67), fixed rate (6.50% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

RECENT EURO BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €250m Unsecured Note (XS2595998068), fixed rate (1.13% coupon) maturing on 23 April 2039, priced at 100.00, non callable

- AT&T Inc (Telecommunications | Dallas, Texas, United States | Rating: BBB): €1,250m Senior Note (XS2595361978), floating rate (EU03MLIB + 40.0 bp) maturing on 6 March 2025, priced at 100.00, non callable

- Air Products and Chemicals Inc (Chemicals | Allentown, Pennsylvania, United States | Rating: A): €700m Senior Note (XS2595036554), fixed rate (4.00% coupon) maturing on 3 March 2035, priced at 99.09 (original spread of 148 bp), callable (12nc12)

- BASF SE (Chemicals | Ludwigshafen Am Rhein, Germany | Rating: A): €500m Senior Note (XS2595418679), fixed rate (4.50% coupon) maturing on 8 March 2035, priced at 99.86 (original spread of 182 bp), callable (12nc12)

- BASF SE (Chemicals | Ludwigshafen Am Rhein, Germany | Rating: A): €500m Senior Note (XS2595418596), fixed rate (4.25% coupon) maturing on 8 March 2032, priced at 99.81 (original spread of 168 bp), callable (9nc9)

- BASF SE (Chemicals | Ludwigshafen Am Rhein, Rheinland-Pfalz, Germany | Rating: A): €500m Senior Note (XS2595418323), fixed rate (4.00% coupon) maturing on 8 March 2029, priced at 99.74 (original spread of 140 bp), callable (6nc6)

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, France | Rating: A+): €1,500m Bond (FR001400GGZ0), fixed rate (4.13% coupon) maturing on 13 March 2029, priced at 99.40 (original spread of 151 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €150m Inhaberschuldverschreibung (DE000BLB9TS4), fixed rate (3.50% coupon) maturing on 10 March 2025, priced at 100.00, non callable

- Berlin Hyp AG (Banking | Berlin, Berlin, Germany | Rating: AA-): €750m Hypothekenpfandbrief (Covered Bond) (DE000BHY0JY1), fixed rate (3.38% coupon) maturing on 7 March 2028, priced at 99.97 (original spread of 66 bp), non callable

- Bper Banca SpA (Banking | Modena, Modena, Italy | Rating: BB): €185m Bond (IT0005532020), floating rate maturing on 23 May 2028, priced at 99.65, non callable

- Brambles Finance Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: NR): €500m Unsecured Note (XS2596458591), fixed rate (1.00% coupon) maturing on 21 March 2033, priced at 100.00, non callable

- CiMA Luxembourg SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €450m Unsecured Note (XS2586741386), floating rate maturing on 2 March 2030, priced at 100.00, non callable

- Citigroup Global Markets Funding Luxembourg SCA (Financial - Other | Bertrange, United States | Rating: A+): €375m Bond (XS2566032095) zero coupon maturing on 15 March 2028, priced at 101.50, non callable, convertible

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €200m Inhaberschuldverschreibung (DE000CZ43ZU3), fixed rate (2.75% coupon) maturing on 24 March 2025, priced at 100.00, non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Venezuela | Rating: AA-): €1,000m Senior Note (XS2594907664), fixed rate (4.50% coupon) maturing on 7 March 2028, priced at 99.86 (original spread of 173 bp), non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400GDF9), fixed rate (4.13% coupon) maturing on 7 March 2030, priced at 99.38 (original spread of 154 bp), non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,750m Bond (FR001400GDG7), floating rate (EU03MLIB + 32.0 bp) maturing on 7 March 2025, priced at 100.00, non callable

- Galicia, Autonomous Community of (Official and Muni | Santiago De Compostela, La Coruna, Spain | Rating: BBB+): €500m Bond (ES0001352626), fixed rate (3.71% coupon) maturing on 30 July 2029, priced at 100.00 (original spread of 98 bp), non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): €750m Bond (RU000A105WH2), fixed rate (2.50% coupon) maturing on 21 March 2026, priced at 100.00, non callable

- Gazprom Capital OOO (Financial - Other | Saint Petersburg, Saint Petersburg, Russia | Rating: NR): €1,000m Bond (RU000A105WJ8), fixed rate (2.95% coupon) maturing on 15 April 2025, priced at 100.00, non callable

- Hsbc Bank Canada (Banking | Vancouver, British Columbia, United Kingdom | Rating: A): €1,000m Covered Bond (Other) (XS2595029344), fixed rate (3.63% coupon) maturing on 7 March 2028, priced at 99.51 (original spread of 97 bp), non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB-): €1,500m Note (XS2592650373), floating rate maturing on 8 March 2028, priced at 99.63 (original spread of 238 bp), callable (5nc4)

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB-): €750m Note (XS2592658947), fixed rate (5.63% coupon) maturing on 8 March 2033, priced at 99.25 (original spread of 314 bp), non callable

- Investitionsbank Schleswig Holstein (Agency | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A30VNP9), fixed rate (3.25% coupon) maturing on 10 March 2031, priced at 99.54 (original spread of 67 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3PF60), fixed rate (3.05% coupon) maturing on 2 April 2026, priced at 100.00 (original spread of 35 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3PEZ4), fixed rate (3.50% coupon) maturing on 5 April 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3PEY7), fixed rate (3.40% coupon) maturing on 3 April 2025, priced at 100.00 (original spread of 52 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3PF78), fixed rate (3.10% coupon) maturing on 3 April 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3PF03), fixed rate (3.60% coupon) maturing on 3 April 2029, priced at 100.00, non callable

- Landesbank Berlin AG (Banking | Berlin, Berlin, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A162BJ7), fixed rate (4.50% coupon) maturing on 6 March 2026, priced at 99.97 (original spread of 166 bp), non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €1,500m Senior Note (XS2595650222), fixed rate (3.25% coupon) maturing on 6 September 2030, priced at 99.98 (original spread of 59 bp), non callable

- Lunar Luxembourg SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €160m Unsecured Note (XS2596599659) zero coupon maturing on 25 July 2026, non callable

- McDonald's Corp (Restaurants | Chicago, Illinois, United States | Rating: BBB+): €500m Senior Note (XS2595417945), fixed rate (4.25% coupon) maturing on 7 March 2035, priced at 99.00 (original spread of 168 bp), callable (12nc12)

- McDonald's Corp (Restaurants | Chicago, Illinois, United States | Rating: BBB+): €500m Senior Note (XS2595418166), fixed rate (4.00% coupon) maturing on 7 March 2030, priced at 99.38 (original spread of 145 bp), callable (7nc7)

- Morgan Stanley (Banking | New York City, United States | Rating: A-): €2,000m Senior Note (XS2595028536), floating rate maturing on 2 March 2029, priced at 100.00 (original spread of 176 bp), callable (6nc5)

- NORD LB Luxembourg Covered Bond Bank SA (Banking | Findel, Germany | Rating: A-): €125m Senior Note (XS2596318829), floating rate (EU06MLIB + 48.0 bp) maturing on 7 March 2025, priced at 100.00, non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €2,000m Jumbo Landesschatzanweisung (DE000NRW0N26), fixed rate (3.40% coupon) maturing on 7 March 2073, priced at 99.74 (original spread of 92 bp), non callable

- Pandora A/S (Textiles/Apparel/Shoes | Copenhagen, Denmark | Rating: BBB): €500m Senior Note (XS2596599147), fixed rate (4.50% coupon) maturing on 10 April 2028, priced at 99.46 (original spread of 182 bp), callable (5nc5)

- Proximus NV (Telecommunications | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): €500m Bond (BE0002925064), fixed rate (4.00% coupon) maturing on 8 March 2030, priced at 99.40 (original spread of 139 bp), callable (7nc7)

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Unsecured Note (XS2596528716), fixed rate (0.10% coupon) maturing on 16 March 2027, priced at 100.00, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: AAA): €2,000m Fundierte Schuldverschreibungen (Covered Bond) (AT000B078845), floating rate (EU03MLIB + 35.0 bp) maturing on 8 March 2027, priced at 100.00, non callable

- SID Banka dd Ljubljana (Banking | Ljubljana, Slovenia | Rating: AA-): €140m Senior Note (XS2596045752), fixed rate (4.03% coupon) maturing on 13 March 2030, non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): €180m Unsecured Note (XS2558208778), floating rate maturing on 22 March 2029, priced at 100.00, non callable

- Teva Pharmaceutical Finance Netherlands II BV (Financial - Other | Amsterdam, Israel | Rating: BB-): €500m Senior Note (XS2592804194), fixed rate (7.88% coupon) maturing on 15 September 2031, priced at 100.00 (original spread of 520 bp), callable (9nc8)

- Teva Pharmaceutical Finance Netherlands II BV (Financial - Other | Amsterdam, Israel | Rating: BB-): €800m Senior Note (XS2592804434), fixed rate (7.38% coupon) maturing on 15 September 2029, priced at 100.00 (original spread of 469 bp), callable (7nc6)

- de Volksbank NV (Banking | Utrecht, Utrecht, Netherlands | Rating: A-): €500m Note (XS2592240712), fixed rate (4.88% coupon) maturing on 7 March 2030, priced at 99.66 (original spread of 224 bp), callable (7nc7)

RECENT LOANS

- Authentic Brands Group LLC (United States of America | B), signed a US$ 600m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 12/21/28 and initial pricing is set at Term SOFR +400.0bp

- Authentic Brands Group LLC (United States of America | B), signed a US$ 1,525m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 12/21/28 and initial pricing is set at Term SOFR +400.0bp

- BHP Group Ltd (Australia | A-), signed a US$ 5,000m Term Loan, to be used for acquisition financing

- Belle Tire Distributors LLC (United States of America), signed a US$ 130m Term Loan, to be used for general corporate purposes and capital expenditures. It matures on 04/15/26.

- Bord na Mona plc (Republic of Ireland), signed a € 160m Revolving Credit Facility, to be used for working capital

- Bord na Mona plc (Republic of Ireland), signed a € 180m Standby Letter of Credit, to be used for working capital

- Building Materials Corp (United States of America | BB), signed a US$ 1,568m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 09/22/28 and initial pricing is set at Term SOFR +250.0bp

- CCMA LLC (United States of America), signed a US$ 190m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/26.

- Cetera Financial Group Inc (United States of America), signed a US$ 750m Term Loan B, to be used for acquisition financing. It matures on 03/08/30 and initial pricing is set at Term SOFR +475.0bp

- China Cinda (HK) Hldg Co Ltd (Hong Kong | BBB+), signed a US$ 200m Term Loan, to be used for general corporate purposes and working capital. It matures on 02/23/28 and initial pricing is set at Term SOFR +130.0bp

- China Modern Dairy Hldg Ltd (China | BBB), signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 02/24/26.

- Enel Green Power Renewable (Spain), signed a € 475m Term Loan, to be used for project finance

- Evergy Inc (United States of America | BBB+), signed a US$ 500m Term Loan A, to be used for working capital. It matures on 02/22/24 and initial pricing is set at Term SOFR +102.5bp

- FACC AG (Austria), signed a € 100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/22/26.

- Hurtigruten ASA (Norway | CCC+), signed a € 200m Term Loan, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at EURIBOR +600.0bp

- Innovation Ventures LLC (United States of America), signed a US$ 970m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/22/28.

- Innovation Ventures LLC (United States of America), signed a US$ 190m Term Loan, to be used for general corporate purposes. It matures on 02/22/28.

- M6 ETX Holdings II MidCo LLC (United States of America | B+), signed a US$ 150m Term Loan B, to be used for general corporate purposes. It matures on 09/19/29 and initial pricing is set at Term SOFR +450.0bp

- Mondelez International Inc (United States of America | BBB), signed a US$ 1,500m 364d Revolver, to be used for general corporate purposes. It matures on 02/21/24 and initial pricing is set at Term SOFR +84.0bp

- Nexity SA (France), signed a € 800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/22/28.

- Nuvei Corp (Canada | BB-), signed a US$ 800m Revolving Credit Facility, to be used for general corporate purposes and acquisition financing. It matures on 09/28/25.

- Pilbara Minerals Ltd (Australia), signed a US$ 113m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 02/22/28.

- Pilbara Minerals Ltd (Australia), signed a US$ 171m Revolving Credit / Term Loan, to be used for general corporate purposes and capital expenditures

- Prasac MicroFin Institution (Cambodia), signed a US$ 150m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 02/24/26.

- RLS Partners LLC (United States of America), signed a US$ 126m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 02/22/28.

- Red Ventures LLC (United States of America | BB-), signed a US$ 850m Term Loan, to be used for general corporate purposes. It matures on 02/24/30 and initial pricing is set at Term SOFR +300.0bp

- Renew Power Pvt Ltd (India), signed a US$ 350m Revolving Credit / Term Loan, to be used for capital expenditures.

- Right Lane International Ltd (Hong Kong), signed a US$ 400m Revolving Credit / Term Loan, to be used for general corporate purposes and working capital. It matures on 02/23/26 and initial pricing is set at Term SOFR +140.0bp

- River City Equip Rental & (United States of America), signed a US$ 160m Revolving Credit Facility, to be used for acquisition financing. It matures on 02/10/27.

- Saudi Arabia-Egypt Elecity (Saudi Arabia), signed a US$ 104m Term Loan, to be used for project finance

- Silk Bidco AS (Norway | CCC+), signed a € 575m Term Loan B, to be used for general corporate purposes. It matures on 02/22/27 and initial pricing is set at EURIBOR +650.0bp

- Storskogen Group AB (Sweden | BB), signed a € 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/24/25.

- Storskogen Group AB (Sweden | BB), signed a € 300m Term Loan A, to be used for general corporate purposes. It matures on 03/24/25.

- Uber Technologies Inc (United States of America | B), signed a US$ 1,750m Term Loan B, to be used for general corporate purposes. It matures on 02/27/30 and initial pricing is set at Term SOFR +275.0bp

- Zhongyu Energy Holdings Ltd (Hong Kong), signed a US$ 300m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 02/22/26 and initial pricing is set at Term SOFR +180.0bp