Credit

Broad Widening In Spreads Across The US Credit Complex, With IG Overperforming On Duration Bid

USD IG bond issuance continued at a fast clip this week: 53 tranches for $39.275bn in IG (2023 YTD volume $354.665bn vs 2022 YTD $361.14bn), no new issuance in HY (2023 YTD volume $39.575bn vs 2022 YTD $34.076bn)

Published ET

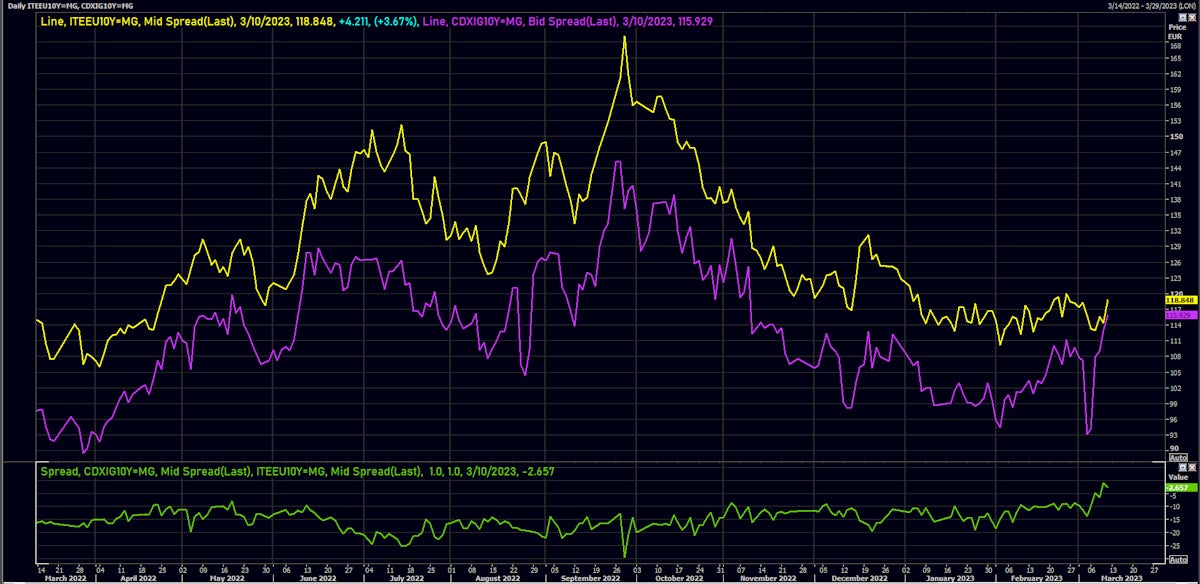

EU vs US 10Y Investment Grade CDS Indices Mid Spreads | Source: Refinitiv

DAILY SUMMARY

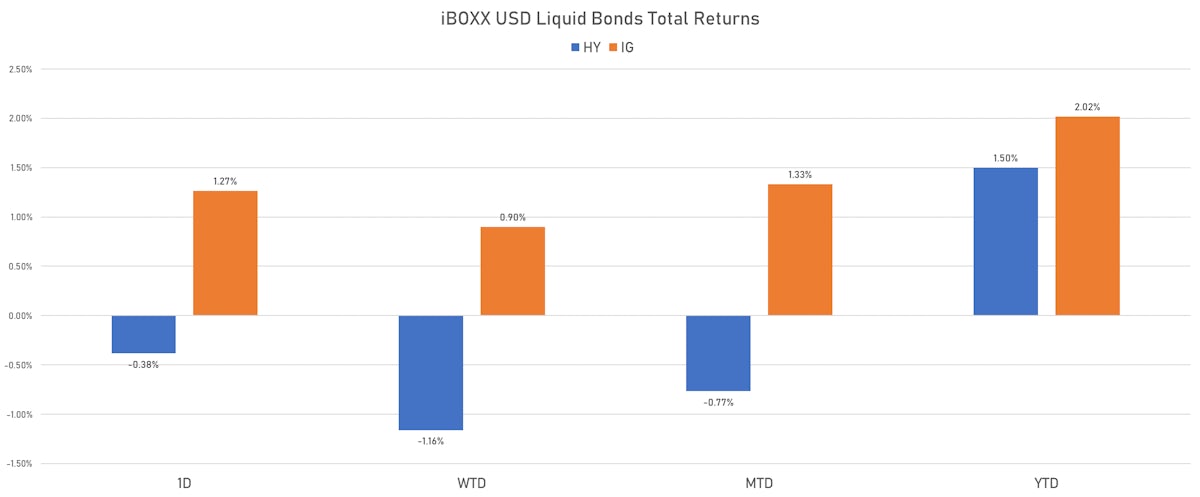

- The iBoxx USD Liquid Investment Grade Total Return Index was up 1.266% today (Week-to-date: 0.90%; Month-to-date: 1.33%; Year-to-date: 2.02%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.383% today (Week-to-date: -1.16%; Month-to-date: -0.77%; Year-to-date: 1.50%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 8.0 bp, now at 133.0 bp (WTD change: +13.0 bp; YTD change: -7.0 bp)

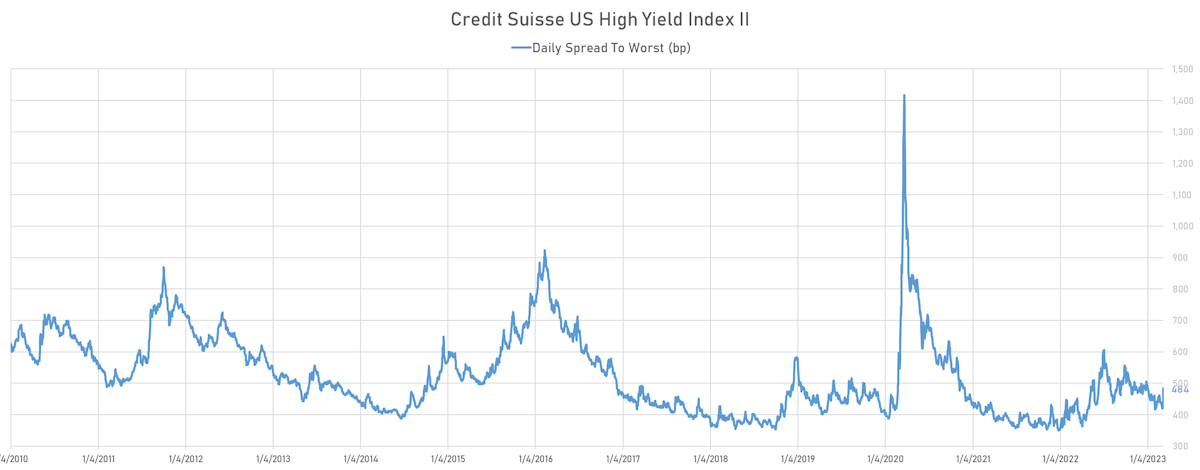

- ICE BofA US High Yield Index spread to worst up 34.0 bp, now at 442.0 bp (WTD change: +56.0 bp; YTD change: -46.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.29% today (YTD total return: +3.0%)

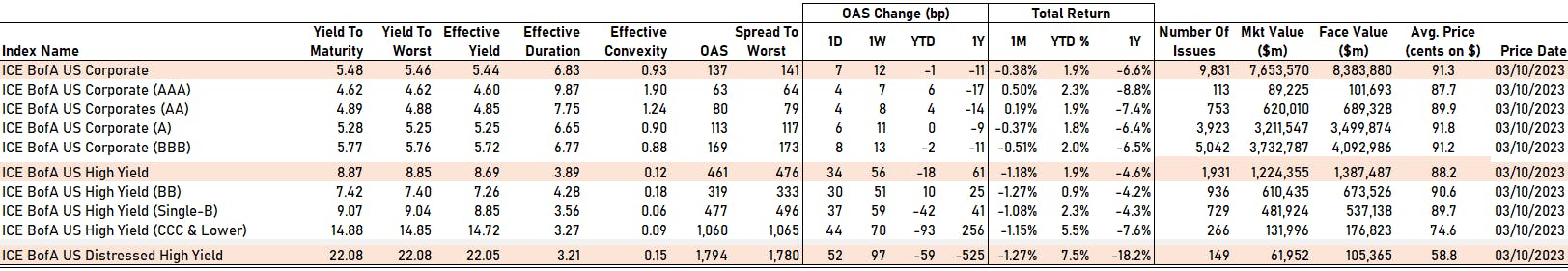

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 4 bp at 63 bp

- AA up by 4 bp at 80 bp

- A up by 6 bp at 113 bp

- BBB up by 8 bp at 169 bp

- BB up by 30 bp at 319 bp

- B up by 37 bp at 477 bp

- ≤ CCC up by 44 bp at 1,060 bp

CDS INDICES TODAY (mid-spreads)

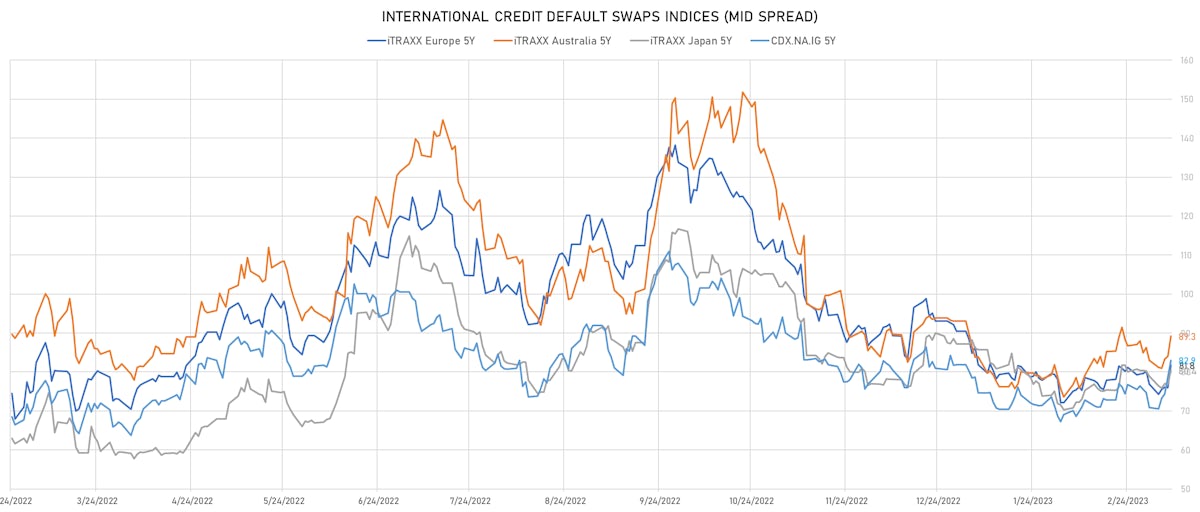

- Markit CDX.NA.IG 5Y up 4.2 bp, now at 83bp (1W change: +12.1bp; YTD change: +1.1bp)

- Markit CDX.NA.IG 10Y up 3.0 bp, now at 121bp (1W change: +10.4bp; YTD change: +3.5bp)

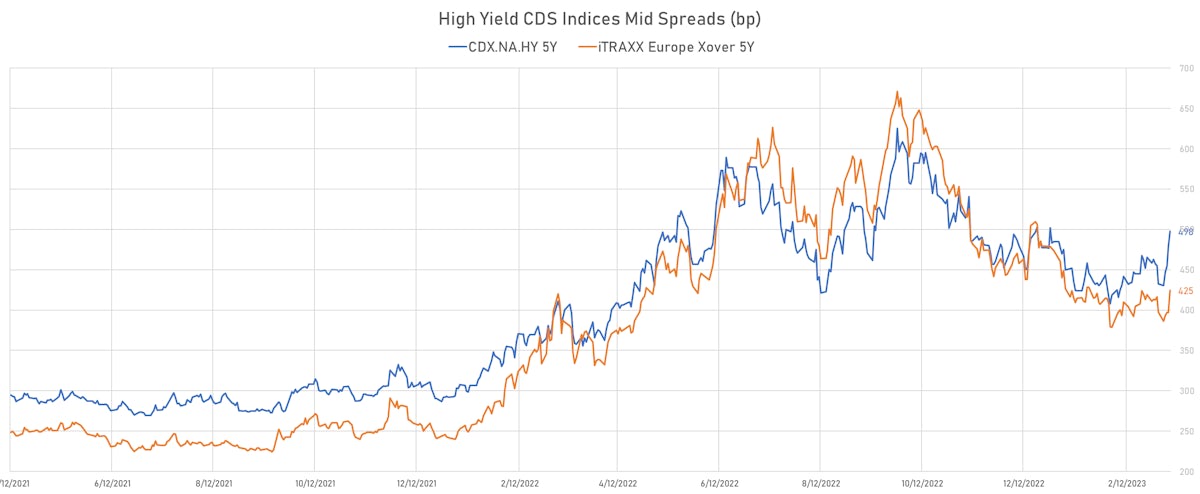

- Markit CDX.NA.HY 5Y up 19.3 bp, now at 498bp (1W change: +65.2bp; YTD change: +13.0bp)

- Markit iTRAXX Europe 5Y up 5.8 bp, now at 82bp (1W change: +4.9bp; YTD change: -8.7bp)

- Markit iTRAXX Europe Crossover 5Y up 27.5 bp, now at 425bp (1W change: +27.0bp; YTD change: -49.5bp)

- Markit iTRAXX Japan 5Y up 3.6 bp, now at 80bp (1W change: +1.5bp; YTD change: -6.8bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 9.9 bp, now at 125bp (1W change: +13.4bp; YTD change: -7.9bp)

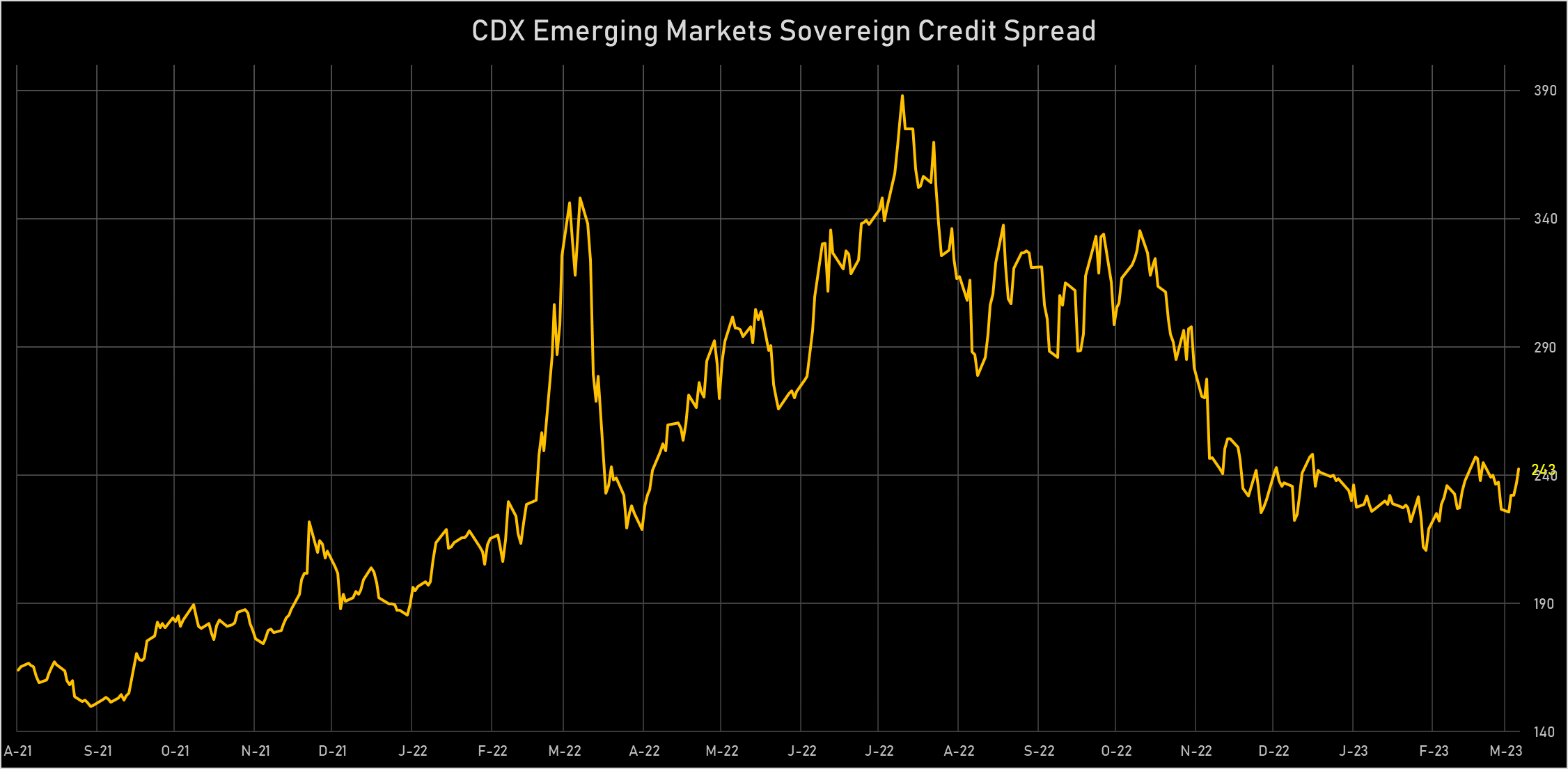

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Indonesia (rated BBB): up 14.4 % to 98 bp (1Y range: 76-166bp)

- Chile (rated A-): up 13.8 % to 99 bp (1Y range: 65-174bp)

- Philippines (rated BBB): up 13.7 % to 94 bp (1Y range: 75-153bp)

- Malaysia (rated BBB+): up 13.0 % to 71 bp (1Y range: 57-122bp)

- Egypt (rated B+): up 11.2 % to 1,237 bp (1Y range: 352-1,453bp)

- China (rated A+): up 10.4 % to 72 bp (1Y range: 47-132bp)

- Vietnam (rated BB): up 9.8 % to 122 bp (1Y range: 101-181bp)

- Nigeria (rated B-): up 9.2 % to 1,243 bp (1Y range: 377-1,538bp)

- Kenya (rated B): down 7.4 % to 736 bp (1Y range: 447-928bp)

- Romania (rated BBB-): down 9.0 % to 203 bp (1Y range: 139-396bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa1): down 43.4 bp to 831.8bp (1Y range: 674-2,858bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 40.0 bp to 972.5bp (1Y range: 625-1,783bp)

- Newell Brands Inc (Country: US; rated: BB): up 42.3 bp to 319.3bp (1Y range: 83-319bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 51.0 bp to 648.8bp (1Y range: 379-1,046bp)

- Community Health Systems Inc (Country: US; rated: B): up 51.1 bp to 1,858.5bp (1Y range: 695-4,371bp)

- American Airlines Group Inc (Country: US; rated: NR): up 56.3 bp to 793.9bp (1Y range: 607-1,644bp)

- Kohls Corp (Country: US; rated: BBB): up 62.3 bp to 616.4bp (1Y range: 356-686bp)

- Nordstrom Inc (Country: US; rated: BBB-): up 76.8 bp to 581.6bp (1Y range: 338-685bp)

- Unisys Corp (Country: US; rated: B1): up 85.3 bp to 1,038.6bp (1Y range: 291-1,096bp)

- Ally Financial Inc (Country: US; rated: A1): up 96.6 bp to 322.5bp (1Y range: 131-356bp)

- Gap Inc (Country: US; rated: Ba2): up 103.4 bp to 599.5bp (1Y range: 302-819bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 112.7 bp to 1,026.2bp (1Y range: 435-2,117bp)

- DISH DBS Corp (Country: US; rated: B2): up 138.2 bp to 1,713.0bp (1Y range: 545-1,713bp)

- Lumen Technologies Inc (Country: US; rated: B2): up 447.3 bp to 2,235.9bp (1Y range: 195-2,236bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 812.7 bp to 10,734.0bp (1Y range: 659-10,734bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Air France KLM SA (Country: FR; rated: C): down 28.7 bp to 410.2bp (1Y range: 409-990bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 19.1 bp to 1,336.9bp (1Y range: 1,286-2,910bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 15.3 bp to 241.4bp (1Y range: 199-476bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): up 9.1 bp to 340.1bp (1Y range: 288-705bp)

- ArcelorMittal SA (Country: LU; rated: WD): up 9.6 bp to 202.9bp (1Y range: 133-353bp)

- Renault SA (Country: FR; rated: Ba2): up 11.6 bp to 262.7bp (1Y range: 236-476bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 11.8 bp to 745.8bp (1Y range: 535-1,296bp)

- Hammerson PLC (Country: GB; rated: A2): up 23.4 bp to 308.8bp (1Y range: 187-482bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 23.7 bp to 1,122.8bp (1Y range: 566-1,739bp)

- TUI AG (Country: DE; rated: B3-PD): up 23.9 bp to 805.8bp (1Y range: 683-1,725bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 25.2 bp to 761.7bp (1Y range: 401-1,021bp)

- Novafives SAS (Country: FR; rated: Caa1): up 31.7 bp to 1,061.1bp (1Y range: 618-2,936bp)

- Credit Suisse Group AG (Country: CH; rated: A+): up 59.0 bp to 416.7bp (1Y range: 117-442bp)

- Ceconomy AG (Country: DE; rated: B1): up 80.1 bp to 994.1bp (1Y range: 287-1,763bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): up 6428.7 bp to 10,073.8bp (1Y range: 905-10,074bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Qwest Corp (Monroe, Louisiana (US)) | Coupon: 7.25% | Maturity: 15/9/2025 | Rating: B+ | CUSIP: 912920AK1 | OAS up by 216.5 bp to 504.6 bp, with the yield to worst at 9.1% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 95.0-102.7).

- Issuer: Kohls Corp (Menomonee Falls, Wisconsin (US)) | Coupon: 4.25% | Maturity: 17/7/2025 | Rating: BB | CUSIP: 500255AU8 | OAS up by 120.0 bp to 270.8 bp (CDS basis: -24.2bp), with the yield to worst at 7.0% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 93.0-97.0).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS up by 115.6 bp to 289.2 bp (CDS basis: -146.0bp), with the yield to worst at 7.1% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.6-99.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.30% | Maturity: 10/2/2025 | Rating: BB | CUSIP: 345397B85 | OAS up by 104.5 bp to 239.2 bp (CDS basis: -101.8bp), with the yield to worst at 7.2% and the bond now trading down to 91.1 cents on the dollar (1Y price range: 90.9-94.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS up by 103.4 bp to 186.8 bp, with the yield to worst at 6.2% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 94.4-96.9).

- Issuer: Block Inc (San Francisco, United States) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | CUSIP: 852234AN3 | OAS up by 95.4 bp to 254.8 bp, with the yield to worst at 6.6% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.0-93.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.95% | Maturity: 6/3/2026 | Rating: BB | CUSIP: 345397C43 | OAS up by 94.0 bp to 259.1 bp (CDS basis: -87.5bp), with the yield to worst at 7.0% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.2-103.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.06% | Maturity: 1/11/2024 | Rating: BB | CUSIP: 345397ZX4 | OAS up by 77.5 bp to 177.0 bp (CDS basis: -48.2bp), with the yield to worst at 6.7% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 95.6-97.9).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 3.50% | Maturity: 15/12/2024 | Rating: BB+ | CUSIP: 343412AC6 | OAS up by 70.1 bp to 140.2 bp, with the yield to worst at 6.3% and the bond now trading down to 95.1 cents on the dollar (1Y price range: 94.9-98.3).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS up by 62.8 bp to 160.3 bp (CDS basis: -65.7bp), with the yield to worst at 6.1% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.1-100.3).

- Issuer: Howmet Aerospace Inc (Pittsburgh, United States) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS up by 62.1 bp to 147.1 bp, with the yield to worst at 6.1% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 100.8-103.4).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.50% | Maturity: 1/12/2025 | Rating: BB+ | CUSIP: 674599EE1 | OAS up by 57.9 bp to 116.4 bp (CDS basis: -63.0bp), with the yield to worst at 5.7% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 98.3-101.0).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 6.00% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 59001AAY8 | OAS up by 56.0 bp to 152.1 bp (CDS basis: 77.0bp), with the yield to worst at 6.0% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 99.0-100.8).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 2.90% | Maturity: 28/10/2024 | Rating: BB | CUSIP: 247361ZU5 | OAS up by 46.9 bp to 122.3 bp (CDS basis: -28.8bp), with the yield to worst at 6.2% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 94.3-96.9).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 40.8 bp to 110.7 bp (CDS basis: -77.9bp), with the yield to worst at 5.9% and the bond now trading down to 92.7 cents on the dollar (1Y price range: 91.8-94.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | OAS up by 60.4 bp to 296.2 bp, with the yield to worst at 6.0% and the bond now trading down to 85.4 cents on the dollar (1Y price range: 82.1-88.0).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | OAS up by 51.3 bp to 317.9 bp, with the yield to worst at 6.2% and the bond now trading down to 82.3 cents on the dollar (1Y price range: 77.7-86.1).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | OAS up by 51.1 bp to 251.9 bp, with the yield to worst at 5.5% and the bond now trading down to 92.2 cents on the dollar (1Y price range: 89.8-95.2).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | OAS up by 49.6 bp to 476.9 bp, with the yield to worst at 7.8% and the bond now trading down to 75.8 cents on the dollar (1Y price range: 76.5-83.0).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | OAS up by 43.5 bp to 288.4 bp, with the yield to worst at 5.9% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 81.4-88.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | OAS up by 41.4 bp to 318.8 bp, with the yield to worst at 6.2% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 83.5-91.8).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | OAS up by 40.3 bp to 449.9 bp, with the yield to worst at 7.5% and the bond now trading down to 82.8 cents on the dollar (1Y price range: 82.1-88.7).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | OAS up by 38.6 bp to 217.6 bp, with the yield to worst at 5.4% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 85.9-92.3).

- Issuer: Mytilineos SA (Athina, Greece) | Coupon: 2.25% | Maturity: 30/10/2026 | Rating: BB | ISIN: XS2337604479 | OAS up by 38.4 bp to 147.2 bp, with the yield to worst at 4.7% and the bond now trading down to 91.6 cents on the dollar (1Y price range: 89.5-92.5).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS up by 38.4 bp to 279.8 bp, with the yield to worst at 5.9% and the bond now trading down to 87.7 cents on the dollar (1Y price range: 83.7-90.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | OAS up by 35.7 bp to 361.2 bp, with the yield to worst at 6.7% and the bond now trading down to 88.9 cents on the dollar (1Y price range: 86.2-92.4).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | OAS up by 34.4 bp to 278.5 bp, with the yield to worst at 5.8% and the bond now trading down to 87.9 cents on the dollar (1Y price range: 85.7-91.7).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | OAS up by 32.7 bp to 344.2 bp, with the yield to worst at 6.4% and the bond now trading down to 83.2 cents on the dollar (1Y price range: 80.0-86.2).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS up by 32.0 bp to 584.1 bp, with the yield to worst at 9.1% and the bond now trading down to 82.8 cents on the dollar (1Y price range: 80.6-83.5).

- Issuer: Rexel SA (Paris, France) | Coupon: 2.13% | Maturity: 15/12/2028 | Rating: BB+ | ISIN: XS2403428472 | OAS up by 30.5 bp to 197.9 bp, with the yield to worst at 5.0% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 84.8-88.5).

RECENT DOMESTIC USD BOND ISSUES

- AEP Transmission Company LLC (Utility - Other | Columbus, Ohio, United States | Rating: A-): US$700m Senior Note (US00115AAQ22), fixed rate (5.40% coupon) maturing on 15 March 2053, priced at 99.47 (original spread of 157 bp), callable (30nc30)

- Advance Auto Parts Inc (Vehicle Parts | Raleigh, North Carolina, United States | Rating: BBB-): US$300m Senior Note (US00751YAJ55), fixed rate (5.95% coupon) maturing on 9 March 2028, priced at 99.92 (original spread of 184 bp), callable (5nc5)

- Advance Auto Parts Inc (Vehicle Parts | Raleigh, North Carolina, United States | Rating: BBB-): US$300m Senior Note (US00751YAH99), fixed rate (5.90% coupon) maturing on 9 March 2026, priced at 99.94 (original spread of 130 bp), with a make whole call

- Ameriprise Financial Inc (Financial - Other | Minneapolis, Minnesota, United States | Rating: A-): US$750m Senior Note (US03076CAM82), fixed rate (5.15% coupon) maturing on 15 May 2033, priced at 99.76 (original spread of 156 bp), callable (10nc10)

- Avery Dennison Corp (Conglomerate/Diversified Mfg | Mentor, Ohio, United States | Rating: BBB): US$400m Senior Note (US053611AN94), fixed rate (5.75% coupon) maturing on 15 March 2033, priced at 99.56 (original spread of 187 bp), callable (10nc10)

- Avnet Inc (Electronics | Phoenix, Arizona, United States | Rating: BBB-): US$500m Senior Note (US053807AW30), fixed rate (6.25% coupon) maturing on 15 March 2028, priced at 99.72 (original spread of 220 bp), callable (5nc5)

- Caterpillar Financial Services Corp (Leasing | Nashville, Tennessee, United States | Rating: A): US$600m Senior Note (US14913R3C97), fixed rate (5.40% coupon) maturing on 10 March 2025, priced at 99.98 (original spread of 40 bp), with a make whole call

- Duke Energy Progress LLC (Utility - Other | Raleigh, North Carolina, United States | Rating: A): US$500m First Mortgage Bond (US26442UAQ76), fixed rate (5.25% coupon) maturing on 15 March 2033, priced at 99.98 (original spread of 144 bp), callable (10nc10)

- Duke Energy Progress LLC (Utility - Other | Raleigh, North Carolina, United States | Rating: A): US$500m First Mortgage Bond (US26442UAR59), fixed rate (5.35% coupon) maturing on 15 March 2053, priced at 99.41 (original spread of 203 bp), callable (30nc30)

- Evergy Kansas Central Inc (Utility - Other | Topeka, Kansas, United States | Rating: A): US$400m First Mortgage Bond (US30036FAB76), fixed rate (5.70% coupon) maturing on 15 March 2053, priced at 99.42 (original spread of 218 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EPDJ13), fixed rate (4.38% coupon) maturing on 15 September 2027, priced at 99.54, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPCX16), fixed rate (4.38% coupon) maturing on 10 March 2028, priced at 99.89 (original spread of 16 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$550m Bond (US3133EPCW33), fixed rate (5.00% coupon) maturing on 10 March 2025, priced at 99.85 (original spread of 18 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$450m Bond (US3133EPCV59), floating rate (SOFR + 13.0 bp) maturing on 10 March 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EPDL68), fixed rate (4.85% coupon) maturing on 1 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$105m Bond (US3130AVDB51), fixed rate (6.00% coupon) maturing on 28 March 2028, priced at 100.00 (original spread of 70 bp), callable (5nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$150m Bond (US3130AVE328), fixed rate (5.00% coupon) maturing on 1 July 2025, priced at 100.00 (original spread of 5 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$500m Unsecured Note (US3134GYN322), fixed rate (5.95% coupon) maturing on 21 March 2025, priced at 100.00 (original spread of 105 bp), callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$600m Unsecured Note (US3134GYMW94), fixed rate (5.82% coupon) maturing on 20 March 2025, priced at 100.00 (original spread of 125 bp), callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$150m Unsecured Note (US3134GYN652), fixed rate (6.00% coupon) maturing on 27 March 2026, priced at 100.00 (original spread of 57 bp), callable (3nc6m)

- Harley-Davidson Financial Services Inc (Financial - Other | Carson City, Nevada, United States | Rating: BBB-): US$700m Senior Note (US41284VAC63), fixed rate (6.50% coupon) maturing on 10 March 2028, priced at 99.68 (original spread of 230 bp), callable (5nc5)

- Hewlett Packard Enterprise Co (Information/Data Technology | Spring, Texas, United States | Rating: BBB): US$400m Senior Note (US42824CBM01), fixed rate (6.10% coupon) maturing on 1 April 2026, priced at 100.00 (original spread of 332 bp), callable (3nc1)

- Idaho Power Co (Utility - Other | Boise, Idaho, United States | Rating: A-): US$400m First Mortgage Note (US45138LBH50), fixed rate (5.50% coupon) maturing on 15 March 2053, priced at 99.06 (original spread of 213 bp), callable (30nc30)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$150m Unsecured Note (XS2599161192), floating rate maturing on 24 March 2026, priced at 100.00, non callable

- Kentucky Utilities Co (Utility - Other | Lexington, Kentucky, United States | Rating: A): US$400m First Mortgage Bond (US491674BN65), fixed rate (5.45% coupon) maturing on 15 April 2033, priced at 99.77 (original spread of 155 bp), callable (10nc10)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$1,250m Senior Note (USU4912XAE32), fixed rate (4.90% coupon) maturing on 22 March 2033, priced at 99.78 (original spread of 120 bp), callable (10nc10)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$750m Senior Note (USU4912XAA10), fixed rate (5.50% coupon) maturing on 22 March 2025, priced at 99.96 (original spread of 45 bp), with a special call

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$750m Senior Note (USU4912XAF07), fixed rate (5.10% coupon) maturing on 22 March 2043, priced at 99.74 (original spread of 156 bp), callable (20nc20)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$750m Senior Note (US49177JAL61), fixed rate (5.10% coupon) maturing on 22 March 2043, priced at 99.74 (original spread of 156 bp), callable (20nc20)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$1,000m Senior Note (US49177JAE29), fixed rate (5.05% coupon) maturing on 22 March 2028, priced at 99.85 (original spread of 96 bp), callable (5nc5)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$1,500m Senior Note (USU4912XAG89), fixed rate (5.05% coupon) maturing on 22 March 2053, priced at 99.36 (original spread of 173 bp), callable (30nc30)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$750m Senior Note (USU4912XAB92), fixed rate (5.35% coupon) maturing on 22 March 2026, priced at 99.94 (original spread of 67 bp), callable (3nc3)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A): US$1,000m Senior Note (US49177JAG76), fixed rate (5.00% coupon) maturing on 22 March 2030, priced at 99.75 (original spread of 112 bp), callable (7nc7)

- Kenvue Inc (Health Care Supply | Skillman, New Jersey, United States | Rating: A+): US$750m Senior Note (USU4912XAH62), fixed rate (5.20% coupon) maturing on 22 March 2063, priced at 99.30 (original spread of 201 bp), callable (40nc40)

- Liberty Media Corp (Cable/Media | Englewood, Colorado, United States | Rating: NR): US$500m Bond (US531229AN28), fixed rate (3.75% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

- Louisville Gas and Electric Co (Utility - Other | Louisville, Kentucky, United States | Rating: A): US$400m First Mortgage Bond (US546676AZ04), fixed rate (5.45% coupon) maturing on 15 April 2033, priced at 99.77 (original spread of 155 bp), callable (10nc10)

- Marsh & McLennan Companies Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: A-): US$600m Senior Note (US571748BT86), fixed rate (5.45% coupon) maturing on 15 March 2053, priced at 99.43 (original spread of 223 bp), callable (30nc30)

- Mastercard Inc (Financial - Other | Purchase, New York, United States | Rating: A+): US$750m Senior Note (US57636QAX25), fixed rate (4.85% coupon) maturing on 9 March 2033, priced at 99.91 (original spread of 112 bp), callable (10nc10)

- Mastercard Inc (Financial - Other | Purchase, New York, United States | Rating: A+): US$750m Senior Note (US57636QAW42), fixed rate (4.88% coupon) maturing on 9 March 2028, priced at 99.90 (original spread of 82 bp), callable (5nc5)

- Model N Inc (Information/Data Technology | San Mateo, United States | Rating: NR): US$220m Bond (US607525AC61), fixed rate (1.88% coupon) maturing on 15 March 2028, priced at 100.00, non callable, convertible

- Principal Financial Group Inc (Life Insurance | Des Moines, Iowa, United States | Rating: BBB+): US$300m Senior Note (US74251VAU61), fixed rate (5.50% coupon) maturing on 15 March 2053, priced at 99.75 (original spread of 225 bp), callable (30nc30)

- Principal Financial Group Inc (Life Insurance | Des Moines, Iowa, United States | Rating: BBB+): US$400m Senior Note (US74251VAT98), fixed rate (5.38% coupon) maturing on 15 March 2033, priced at 99.89 (original spread of 159 bp), callable (10nc10)

- Rivian Automotive Inc (Automotive Manufacturer | Irvine, California, United States | Rating: NR): US$1,300m Bond (US76954AAA16), fixed rate (4.63% coupon) maturing on 15 March 2029, priced at 100.00, non callable, convertible

- SVB Financial Group (Banking | Santa Clara, California, United States | Rating: C): US$500m Preferred Stock (US78486Q8042), fixed rate (6.00% coupon) maturing on 15 February 2026, priced at 100.00, non callable, convertible

- San Diego Gas & Electric Co (Utility - Other | San Diego, California, United States | Rating: A): US$800m First Mortgage Note (US797440CD44), fixed rate (5.35% coupon) maturing on 1 April 2053, priced at 98.95 (original spread of 212 bp), callable (30nc30)

- System Energy Resources Inc (Utility - Other | Jackson, Mississippi, United States | Rating: BBB+): US$325m First Mortgage Bond (US871911AU71), fixed rate (6.00% coupon) maturing on 15 April 2028, priced at 96.20 (original spread of 255 bp), callable (5nc5)

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: AA-): US$750m Senior Note (US882508CB86), fixed rate (4.90% coupon) maturing on 14 March 2033, priced at 99.92 (original spread of 105 bp), callable (10nc10)

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: AA-): US$650m Senior Note (US882508CC69), fixed rate (5.00% coupon) maturing on 14 March 2053, priced at 99.66 (original spread of 160 bp), callable (30nc30)

- WarnerMedia Holdings Inc (Cable/Media | New York City, New York, United States | Rating: BBB-): US$1,500m Senior Note (US55903VBG77), fixed rate (6.41% coupon) maturing on 15 March 2026, priced at 100.00 (original spread of 451 bp), callable (3nc1)

RECENT INTERNATIONAL USD BOND ISSUES

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): US$2,000m Senior Note (US00828EER62), fixed rate (4.38% coupon) maturing on 14 March 2028, priced at 99.73 (original spread of 14 bp), non callable

- Air Lease Corporation Sukuk Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: BBB): US$600m Senior Note (US00914QAA58), fixed rate (5.85% coupon) maturing on 1 April 2028, priced at 98.93 (original spread of 185 bp), callable (5nc5)

- Asian Infrastructure Investment Bank (Supranational | Beijing, Beijing, China (Mainland) | Rating: AAA): US$150m Unsecured Note (XS2599157752), fixed rate (4.48% coupon) maturing on 16 March 2028, priced at 100.00 (original spread of 36 bp), non callable

- BOS Funding Ltd (Financial - Other | George Town, United Arab Emirates | Rating: BBB+): US$500m Senior Note (XS2597110613), fixed rate (7.00% coupon) maturing on 14 March 2028, priced at 98.49 (original spread of 348 bp), non callable

- Bank of East Asia Ltd (Banking | Hong Kong | Rating: A-): US$500m Note (XS2592797398), fixed rate (6.75% coupon) maturing on 15 March 2027, priced at 99.80 (original spread of 210 bp), callable (4nc3)

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): US$500m Senior Note (US2027A1KR77), floating rate (SOFR + 75.0 bp) maturing on 13 March 2026, priced at 100.00, non callable

- Commonwealth Bank of Australia (New York Branch) (Securities | New York City, New York, Australia | Rating: A+): US$1,000m Senior Note (US20271RAR12), fixed rate (5.32% coupon) maturing on 13 March 2026, priced at 100.00 (original spread of 85 bp), non callable

- Compania General de Combustibles SA (Chemicals | Buenos Aires, Buenos Aires, Liechtenstein | Rating: CCC+): US$150m Bond (ARCGCO5600V5) zero coupon maturing on 10 March 2025, priced at 100.50, callable (2nc1)

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB+): US$700m Senior Note (US29250NBQ79), fixed rate (5.97% coupon) maturing on 8 March 2026, priced at 100.00 (original spread of 178 bp), callable (3nc1)

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB+): US$2,300m Senior Note (US29250NBR52), fixed rate (5.70% coupon) maturing on 8 March 2033, priced at 99.87 (original spread of 182 bp), callable (10nc10)

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): US$700m Senior Note (XS2589240451), floating rate (SOFR + 20.0 bp) maturing on 20 April 2028, priced at 100.00, non callable

- Federation of Caisses Desjardins Du Quebec (Banking | Levis, Quebec, Canada | Rating: A-): US$750m Senior Note (US31429LAK70), fixed rate (5.70% coupon) maturing on 14 March 2028, priced at 99.97 (original spread of 140 bp), non callable

- HSBC USA Inc (Banking | New York City, New York, United Kingdom | Rating: A+): US$1,250m Senior Note (US40428HVL31), fixed rate (5.63% coupon) maturing on 17 March 2025, priced at 99.83 (original spread of 80 bp), non callable

- Magna International Inc (Vehicle Parts | Aurora, Ontario, Canada | Rating: A-): US$300m Senior Note (US559222AX24), fixed rate (5.98% coupon) maturing on 21 March 2026, priced at 100.00 (original spread of 125 bp), callable (3nc1)

- Magna International Inc (Vehicle Parts | Aurora, Ontario, Canada | Rating: A-): US$500m Senior Note (US559222AY07), fixed rate (5.50% coupon) maturing on 21 March 2033, priced at 99.78 (original spread of 172 bp), callable (10nc10)

- Nestle Holdings Inc (Consumer Products | Arlington, Virginia, Switzerland | Rating: AA-): US$1,000m Senior Note (USU64106CD47), fixed rate (5.25% coupon) maturing on 13 March 2026, priced at 99.97 (original spread of 55 bp), with a make whole call

- Nestle Holdings Inc (Consumer Products | Arlington, Virginia, Switzerland | Rating: AA-): US$850m Senior Note (USU64106AZ76), fixed rate (5.00% coupon) maturing on 14 March 2028, priced at 99.97 (original spread of 71 bp), callable (5nc5)

- Nestle Holdings Inc (Consumer Products | Arlington, Virginia, Switzerland | Rating: AA-): US$650m Senior Note (USU64106CB80), fixed rate (4.85% coupon) maturing on 14 March 2033, priced at 99.91 (original spread of 91 bp), callable (10nc10)

- Nestle Holdings Inc (Consumer Products | Arlington, Virginia, Switzerland | Rating: AA-): US$500m Senior Note (USU64106CA08), fixed rate (4.95% coupon) maturing on 14 March 2030, priced at 99.92 (original spread of 82 bp), callable (7nc7)

- Nordic Investment Bank (Supranational | Helsinki, Etela-Suomen, Finland | Rating: AAA): US$1,500m Senior Note (US65562QBW42), fixed rate (4.38% coupon) maturing on 14 March 2028, priced at 99.91 (original spread of 11 bp), non callable

- OCI NV (Chemicals | Amsterdam, Noord-Holland, Netherlands | Rating: BBB-): US$600m Senior Note (US67116NAA72), fixed rate (6.70% coupon) maturing on 16 March 2033, priced at 99.83 (original spread of 280 bp), callable (10nc10)

- Popular Inc (Banking | San Juan, Puerto Rico | Rating: BB+): US$400m Senior Note (US733174AL01), fixed rate (7.25% coupon) maturing on 13 March 2028, priced at 99.64 (original spread of 300 bp), callable (5nc5)

- Rio Tinto Finance (USA) PLC (Financial - Other | London, United Kingdom | Rating: A): US$650m Senior Note (US76720AAN63), fixed rate (5.00% coupon) maturing on 9 March 2033, priced at 99.71 (original spread of 122 bp), callable (10nc10)

- Rio Tinto Finance (USA) PLC (Financial - Other | London, United Kingdom | Rating: A): US$1,100m Senior Note (US76720AAP12), fixed rate (5.13% coupon) maturing on 9 March 2053, priced at 98.48 (original spread of 181 bp), callable (30nc30)

- Santander Holdings USA Inc (Banking | Boston, Massachusetts, Spain | Rating: BBB-): US$1,000m Senior Note (US80282KBF21), floating rate maturing on 9 March 2029, priced at 100.00 (original spread of 278 bp), callable (6nc5)

- Shinhan Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$5,000m Index Linked Security (KR6SH0004KG3) zero coupon maturing on 30 March 2026, priced at 100.00, non callable

- Transcanada Pipelines Ltd (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB+): US$400m Senior Note (US89352HBF55), floating rate (SOFR + 152.0 bp) maturing on 9 March 2026, priced at 100.00, callable (3nc1)

- Transcanada Pipelines Ltd (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB+): US$850m Senior Note (US89352HBE80), fixed rate (6.20% coupon) maturing on 9 March 2026, priced at 100.00 (original spread of 150 bp), callable (3nc1)

- Turkey, Republic of (Government) (Sovereign | Ankara, Turkey | Rating: B-): US$2,250m Senior Note (US90014TAJ07), fixed rate (9.38% coupon) maturing on 14 March 2029, priced at 99.44 (original spread of 572 bp), non callable

- Ubs Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$166m Certificate of Deposit - Retail (US90355GCC87), fixed rate (5.00% coupon) maturing on 10 March 2025, priced at 100.00 (original spread of 37 bp), non callable

RECENT EURO BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €250m Covered Bond (Other) (XS2595998068), fixed rate (1.13% coupon) maturing on 23 April 2039, priced at 69.75, non callable

- ASB Bank Ltd (Banking | Auckland, Australia | Rating: A+): €500m Senior Note (XS2597991988), fixed rate (4.50% coupon) maturing on 16 March 2027, priced at 99.60 (original spread of 170 bp), non callable

- Alandsbanken Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: BBB+): €250m Covered Bond (Other) (FI4000549548), fixed rate (3.88% coupon) maturing on 16 March 2026, priced at 99.98 (original spread of 91 bp), non callable

- Amundi Finance Emissions SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €230m Bond (FR001400EMY6), fixed rate (4.50% coupon) maturing on 10 March 2031, priced at 100.00 (original spread of 139 bp), non callable

- Andalucia, Autonomous Community of (Official and Muni | Sevilla, Sevilla, Spain | Rating: BBB): €600m Bond (ES0000090904), fixed rate (3.95% coupon) maturing on 30 April 2033, priced at 99.86 (original spread of 134 bp), non callable

- Anglo American Capital PLC (Financial - Other | London, United Kingdom | Rating: BBB): €500m Unsecured Note (XS2598746290), fixed rate (4.50% coupon) maturing on 15 September 2028, priced at 99.41 (original spread of 189 bp), callable (6nc5)

- Anglo American Capital PLC (Financial - Other | London, United Kingdom | Rating: BBB): €500m Senior Note (XS2598746373), fixed rate (5.00% coupon) maturing on 15 March 2031, priced at 99.59 (original spread of 244 bp), callable (8nc8)

- Autoliv Inc (Vehicle Parts | Stockholm, Stockholm, Sweden | Rating: BBB): €500m Senior Note (XS2598332133), fixed rate (4.25% coupon) maturing on 15 March 2028, priced at 99.59 (original spread of 165 bp), callable (5nc5)

- Azelis Finance NV (Financial - Other | Berchem, Antwerpen, Belgium | Rating: NR): €400m Senior Note (BE6342263157), fixed rate (5.75% coupon) maturing on 15 March 2028, priced at 100.00 (original spread of 310 bp), callable (5nc2)

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Wien, Austria | Rating: A): €200m Oeffenlicher Pfandbrief (Covered Bond) (AT0000A32Y96), fixed rate (3.10% coupon) maturing on 17 April 2026, priced at 100.00, non callable

- Bayerische Landesbodenkreditanstalt (Financial - Other | Muenchen, Bayern, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A161RT4), fixed rate (3.25% coupon) maturing on 15 March 2035, priced at 99.38 (original spread of 72 bp), non callable

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €218m Bond (BE3871287178), fixed rate (2.60% coupon) maturing on 4 March 2026, priced at 100.00 (original spread of 37 bp), non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: NR): €750m Obligation Fonciere (Covered Bond) (FR001400GM85), fixed rate (3.50% coupon) maturing on 16 March 2032, priced at 99.89 (original spread of 92 bp), non callable

- Communaute Francaise (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: A): €700m Bond (BE0002933142), fixed rate (3.75% coupon) maturing on 22 June 2033, priced at 99.96 (original spread of 108 bp), non callable

- Compagnie de Financement Foncier SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,750m Obligation Fonciere (Covered Bond) (FR001400GI73), fixed rate (3.38% coupon) maturing on 16 September 2031, priced at 99.12 (original spread of 91 bp), non callable

- DNB Bank ASA (Banking | Oslo, Oslo, Norway | Rating: AA-): €1,000m Note (XS2597696124), floating rate maturing on 14 March 2029, priced at 99.87 (original spread of 126 bp), callable (6nc5)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C3K7), fixed rate (3.20% coupon) maturing on 2 April 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €1,250m Inhaberschuldverschreibung (DE000DW6C3J9), fixed rate (3.00% coupon) maturing on 3 April 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBQ4), floating rate maturing on 30 March 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBN1), floating rate maturing on 21 March 2025, priced at 100.00, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €6,000m Senior Note (EU000A3K4D41), fixed rate (3.25% coupon) maturing on 4 July 2034, priced at 98.97 (original spread of 71 bp), non callable

- Finsbury Castle DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €150m Unsecured Note (XS2597650303) zero coupon maturing on 27 March 2026, non callable

- Global Payments Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB-): €800m Senior Note (XS2597994065), fixed rate (4.88% coupon) maturing on 17 March 2031, priced at 99.68 (original spread of 237 bp), callable (8nc8)

- HSBC Bank PLC (Banking | London, United Kingdom | Rating: A+): €915m Senior Note (XS2595829388), floating rate (EU03MLIB + 40.0 bp) maturing on 10 March 2025, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): €1,250m Senior Note (XS2597114284), floating rate maturing on 10 March 2032, priced at 100.00 (original spread of 222 bp), callable (9nc8)

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): €1,500m Senior Note (XS2597113989), floating rate maturing on 10 March 2028, priced at 100.00 (original spread of 191 bp), callable (5nc4)

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: A-): €750m Inhaberschuldverschreibung (DE000HCB0BS6), fixed rate (4.88% coupon) maturing on 17 March 2025, priced at 99.95 (original spread of 159 bp), non callable

- Heineken NV (Beverage/Bottling | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €750m Senior Note (XS2599169922), fixed rate (4.13% coupon) maturing on 23 March 2035, priced at 99.36 (original spread of 150 bp), callable (12nc12)

- Heineken NV (Beverage/Bottling | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €750m Senior Note (XS2599730822), fixed rate (3.88% coupon) maturing on 23 September 2030, priced at 99.60 (original spread of 129 bp), callable (8nc7)

- Hellenic Bank PCL (Banking | Nicosia, Cyprus | Rating: B): €200m Subordinated Note (XS2597995112), fixed rate (10.25% coupon) maturing on 14 June 2033, priced at 100.00 (original spread of 740 bp), callable (10nc5)

- Hellenic Bank PCL (Banking | Nicosia, Cyprus | Rating: BB-): €200m Unsecured Note (XS2598069685), fixed rate (10.25% coupon) maturing on 14 June 2028, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,500m Note (XS2597970800), floating rate (EU03MLIB + 63.0 bp) maturing on 17 March 2025, priced at 100.00, with a regulatory call

- Investitionsbank des Landes Brandenburg (Banking | Potsdam, Brandenburg, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A351LE6), fixed rate (3.25% coupon) maturing on 13 March 2030, priced at 99.69 (original spread of 67 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €9,917m Index Linked Security (IT0005532723), fixed rate (2.00% coupon) maturing on 14 March 2028, priced at 100.00, non callable, inflation protected

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €200m Inhaberschuldverschreibung (DE000A30V9L6), fixed rate (3.14% coupon) maturing on 25 June 2027, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €5,000m Inhaberschuldverschreibung (DE000A30V9J0), fixed rate (3.13% coupon) maturing on 7 June 2030, priced at 99.52 (original spread of 55 bp), non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): €500m Senior Note (XS2597673263), fixed rate (3.38% coupon) maturing on 15 March 2027, priced at 99.75 (original spread of 89 bp), non callable

- LCL Emissions SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €375m Bond (FR001400EBK8), fixed rate (4.75% coupon) maturing on 3 March 2033, priced at 100.00 (original spread of 407 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB47G3), fixed rate (3.40% coupon) maturing on 20 April 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB47E8), fixed rate (2.90% coupon) maturing on 20 April 2026, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB47D0), fixed rate (2.85% coupon) maturing on 24 April 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB47F5), fixed rate (3.35% coupon) maturing on 20 April 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB47J7), fixed rate (2.50% coupon) maturing on 14 April 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB47L3), fixed rate (2.65% coupon) maturing on 28 April 2025, priced at 100.00, non callable

- Landsbankinn hf (Banking | Reykjavik, Iceland | Rating: BBB): €300m Unsecured Note (XS2597768485), fixed rate (1.00% coupon) maturing on 16 March 2028, priced at 100.00 (original spread of -171 bp), non callable

- Magna International Inc (Vehicle Parts | Aurora, Ontario, Canada | Rating: A-): €550m Senior Note (XS2597677090), fixed rate (4.38% coupon) maturing on 17 March 2032, priced at 99.93 (original spread of 171 bp), callable (9nc9)

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €750m Note (XS2597999452), floating rate maturing on 14 March 2028, priced at 99.59 (original spread of 211 bp), callable (5nc4)

- NBN Co Ltd (Service - Other | North Sydney, New South Wales, Australia | Rating: A+): €600m Senior Note (XS2590621368), fixed rate (4.38% coupon) maturing on 15 March 2033, priced at 99.82 (original spread of 168 bp), callable (10nc10)

- NBN Co Ltd (Service - Other | North Sydney, New South Wales, Australia | Rating: A+): €750m Senior Note (XS2590621103), fixed rate (4.13% coupon) maturing on 15 March 2029, priced at 99.56 (original spread of 148 bp), callable (6nc6)

- Nationwide Building Society (Financial - Other | Swindon, Wiltshire, United Kingdom | Rating: A): €1,000m Covered Bond (Other) (XS2597919013), fixed rate (3.63% coupon) maturing on 15 March 2028, priced at 99.88 (original spread of 89 bp), non callable

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BBB): €500m Senior Note (XS2596599063), floating rate maturing on 14 March 2028, priced at 100.00 (original spread of 182 bp), callable (5nc4)

- Neste Oyj (Oil and Gas | Espoo, Etela-Suomen, Finland | Rating: A-): €500m Senior Note (XS2599779597), fixed rate (4.25% coupon) maturing on 16 March 2033, priced at 99.94 (original spread of 167 bp), callable (10nc10)

- Neste Oyj (Oil and Gas | Espoo, Etela-Suomen, Finland | Rating: A-): €500m Senior Note (XS2598649254), fixed rate (3.88% coupon) maturing on 16 March 2029, priced at 99.61 (original spread of 136 bp), callable (6nc6)

- Nestle Finance International Ltd SA (Financial - Other | Luxembourg, Switzerland | Rating: AA-): €850m Senior Note (XS2595410775), fixed rate (3.50% coupon) maturing on 13 December 2027, priced at 99.54 (original spread of 74 bp), callable (5nc5)

- Nestle Finance International Ltd SA (Financial - Other | Luxembourg, Switzerland | Rating: AA-): €850m Senior Note (XS2595412631), fixed rate (3.75% coupon) maturing on 13 March 2033, priced at 99.44 (original spread of 112 bp), callable (10nc10)

- North Macedonia, Republic of (Government) (Sovereign | Skopje, Skopski Region, North Macedonia | Rating: BB-): €500m Senior Note (XS2582522681), fixed rate (6.96% coupon) maturing on 13 March 2027, priced at 99.02 (original spread of 418 bp), callable (4nc4)

- Northwestern Mutual Global Funding (Financial - Other | New Castle, Delaware, United States | Rating: AA+): €500m Note (XS2597740476), fixed rate (4.11% coupon) maturing on 15 March 2030, priced at 100.00 (original spread of 144 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Covered Bond (Other) (XS2596528716), fixed rate (3.88% coupon) maturing on 16 March 2026, priced at 99.70 (original spread of 99 bp), non callable

- Sacyr SA (Home Builders | Madrid, Madrid, Spain | Rating: NR): €301m Unsecured Note (XS2597671051), fixed rate (6.30% coupon) maturing on 23 March 2026, priced at 100.00, non callable

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €750m Jumbo Landesschatzanweisung (DE000RLP1403), fixed rate (3.50% coupon) maturing on 16 June 2025 (original spread of 32 bp), non callable

- Stellantis NV (Automotive Manufacturer | Hoofddorp, Noord-Holland, Netherlands | Rating: BBB): €1,250m Senior Note (XS2597110027), fixed rate (4.38% coupon) maturing on 14 March 2030, priced at 99.68 (original spread of 174 bp), callable (7nc7)

- Suomen Hypoteekkiyhdistys (Real Estate Investment Trust | Helsinki, Etela-Suomen, Finland | Rating: BBB): €300m Covered Bond (Other) (FI4000549605), fixed rate (3.63% coupon) maturing on 15 September 2028, priced at 99.62 (original spread of 102 bp), non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): €1,500m Covered Bond (Other) (XS2597408272), fixed rate (3.72% coupon) maturing on 13 March 2030, priced at 100.00 (original spread of 104 bp), non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): €3,500m Covered Bond (Other) (XS2597408439), fixed rate (3.88% coupon) maturing on 13 March 2026, priced at 100.00 (original spread of 87 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): €1,000m Senior Note (XS2597093009), fixed rate (4.05% coupon) maturing on 13 September 2029, priced at 99.82 (original spread of 138 bp), non callable

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €1,250m Bond (CH1255915014), fixed rate (4.75% coupon) maturing on 17 March 2032, priced at 99.52 (original spread of 220 bp), callable (9nc8)

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €1,500m Bond (CH1255915006), fixed rate (4.63% coupon) maturing on 17 March 2028, priced at 99.93 (original spread of 187 bp), callable (5nc4)

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: BBB+): €800m Note (XS2597661847), floating rate (EU03MLIB + 171.0 bp) maturing on 15 March 2029, callable (6nc5)

- Var Energi ASA (Oil and Gas | Sandnes, Rogaland, Italy | Rating: BBB-): €500m Unsecured Note (XS2599156192) maturing on 20 March 2029, priced at 100.00, non callable

- Vestas Wind Systems A/S (Utility - Other | Aarhus, Denmark | Rating: BBB): €500m Senior Note (XS2597973812), fixed rate (4.13% coupon) maturing on 15 June 2026, priced at 99.62 (original spread of 119 bp), callable (3nc3)

- Volksbank Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Inhaberschuldverschreibung (AT000B122155), fixed rate (4.75% coupon) maturing on 15 March 2027, priced at 99.61 (original spread of 200 bp), with a regulatory call

- Westpac Securities NZ Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €750m Covered Bond (Other) (XS2597905905), fixed rate (3.75% coupon) maturing on 20 April 2028, priced at 99.63 (original spread of 106 bp), non callable

RECENT LOANS

- Adani Enterprises Ltd (India), signed a US$ 3,000m Revolving Credit / Term Loan, to be used for general corporate purposes.

- Agsm Aim SpA (Italy), signed a € 250m Term Loan, to be used for working capital.

- Agsm Aim SpA (Italy), signed a € 100m Revolving Credit Facility, to be used for working capital.

- Aircastle Ltd (United States of America | BBB-), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/01/25.

- Atmos Energy Corp (United States of America | A-), signed a US$ 2,020m Term Loan, to be used for refin/ret bank debt. It matures on 12/31/23 and initial pricing is set at Term SOFR +95.0bp

- Bonduelle SA (France), signed a € 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/03/28.

- Boston Scientific Corp (United States of America | BBB+), signed a US$ 2,750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/10/27 and initial pricing is set at Term SOFR +140.0bp

- Carnival Corp (United States of America | B-), signed a US$ 2,100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/01/24.

- Glenveagh Properties PLC (Republic of Ireland), signed a € 100m Term Loan, to be used for general corporate purposes. It matures on 03/01/28.

- Glenveagh Properties PLC (Republic of Ireland), signed a € 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/01/28.

- Help at Home LLC (United States of America), signed a US$ 130m Term Loan B, to be used for general corporate purposes. It matures on 10/29/27 and initial pricing is set at Term SOFR +500.0bp

- IXL Learning Inc (United States of America), signed a US$ 510m Term Loan A, to be used for general corporate purposes. It matures on 03/01/28 and initial pricing is set at Term SOFR +275.0bp

- K3 Capital Group Ltd (United Kingdom), signed a € 95m Other, to be used for leveraged buyout.

- Koch Industries Inc (United States of America | AA-), signed a US$ 4,000m Revolving Credit Facility, to be used for standby commercial paper support. It matures on 03/03/28 and initial pricing is set at Term SOFR +62.5bp

- Koch Industries Inc (United States of America | AA-), signed a US$ 2,000m 364d Revolver, to be used for general corporate purposes. It matures on 03/02/24 and initial pricing is set at Term SOFR +62.5bp

- Koppers Inc (United States of America | B+), signed a US$ 400m Term Loan B, to be used for general corporate purposes. It matures on 03/09/30 and initial pricing is set at Term SOFR +375.0bp

- Liberty Utilities LLC (United States of America | BBB), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/28/24 and initial pricing is set at Term SOFR +150.0bp

- MHC Operating LP (United States of America), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/18/25 and initial pricing is set at Term SOFR +125.0bp

- MHC Operating LP (United States of America), signed a US$ 300m Term Loan A, to be used for general corporate purposes. It matures on 04/17/26 and initial pricing is set at Term SOFR +140.0bp

- Motor Fuel Ltd (United Kingdom), signed a € 787m Term Loan B, to be used for general corporate purposes. It matures on 06/09/28 and initial pricing is set at EURIBOR +500.0bp

- Motor Fuel Ltd (United Kingdom), signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 06/09/28 and initial pricing is set at EURIBOR +500.0bp

- New York 15-Project Cmnty (United States of America), signed a US$ 145m Term Loan, to be used for project finance.

- Nexus Industrial REIT (Canada), signed a US$ 175m Term Loan, to be used for general corporate purposes.

- Nexus Industrial REIT (Canada), signed a US$ 190m Revolving Credit Facility, to be used for general corporate purposes.

- PT Perusahaan Listrik Negara (Indonesia | BBB), signed a € 665m Revolving Credit / Term Loan, to be used for capital expenditures.

- Qlik Technologies Inc (United States of America), signed a US$ 1,390m Term Loan B, to be used for general corporate purposes. It matures on 04/26/27 and initial pricing is set at Term SOFR +425.0bp

- Royal Bank of Scotland Intl (Jersey), signed a US$ 300m Term Loan, to be used for general corporate purposes. It matures on 03/02/26 and initial pricing is set at Term SOFR +125.0bp

- Sherwin-Williams Co (United States of America | BBB), signed a US$ 125m Term Loan, to be used for general corporate purposes. It matures on 12/20/27.

- Starfruit Finco BV (Netherlands | B+), signed a US$ 750m Term Loan B, to be used for general corporate purposes. It matures on 03/02/28 and initial pricing is set at Term SOFR +425.0bp

- Starfruit Finco BV (Netherlands | B+), signed a US$ 637m Revolving Credit Facility, to be used for general corporate purposes.

- THQ Appalachia I LLC (United States of America), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/01/25 and initial pricing is set at Term SOFR +360.0bp

- Tampa Electric Co (United States of America | BBB+), signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/01/24 and initial pricing is set at Term SOFR +80.0bp

- Troms Fylkes Dampskibsselskap (Norway), signed a € 200m Term Loan, to be used for general corporate purposes. It matures on 03/02/28.

- Tunisia (Tunisia), signed a US$ 250m Term Loan, to be used for general corporate purposes.

- Walt Disney Co (United States of America | BBB+), signed a US$ 5,250m 364d Revolver, to be used for general corporate purposes. It matures on 03/01/24 and initial pricing is set at Term SOFR +62.5bp

- World Wide Technology Inc (United States of America), signed a US$ 750m Term Loan B, to be used for general corporate purposes. It matures on 03/01/30.

- Xylem Inc (United States of America | BBB), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/05/28 and initial pricing is set at Term SOFR +91.0bp