Credit

Wider Spreads Across The Credit Complex Driven By The Higher Likelihood Of A Credit Crunch

A quiet week for USD DCM syndicates: zero issuance in IG (2023 YTD volume $354.665bn vs 2022 YTD $392.19bn), and zero issuance in HY for the second straight week (2023 YTD volume $39.575bn vs 2022 YTD $34.876bn)

Published ET

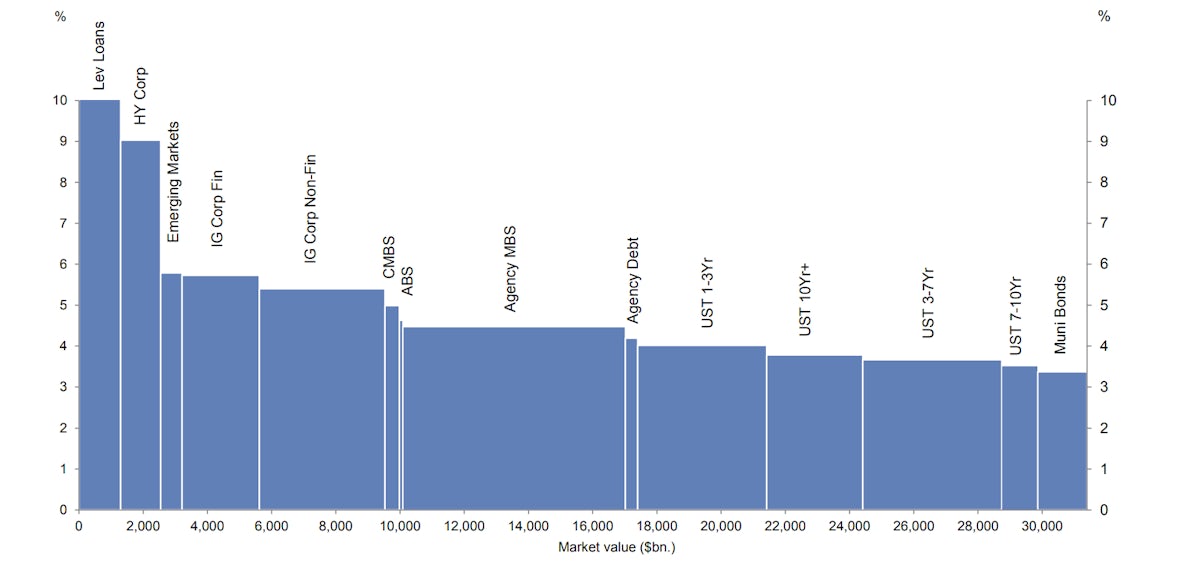

Yield vs Market Value (US$ bn) Across Fixed Income | Source: Goldman Sachs Investment Research

DAILY SUMMARY

- S&P 500 Bond Index was up 0.86% today, with investment grade up 0.93% and high yield up 0.18% (YTD total return: +2.59%)

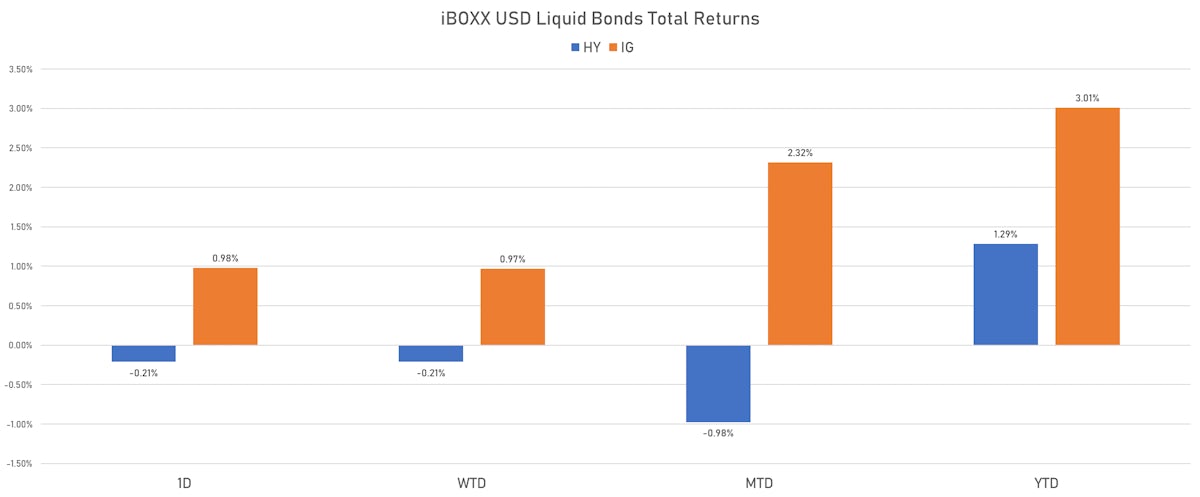

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.979% today (Week-to-date: 0.97%; Month-to-date: 2.32%; Year-to-date: 3.01%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.211% today (Week-to-date: -0.21%; Month-to-date: -0.98%; Year-to-date: 1.29%)

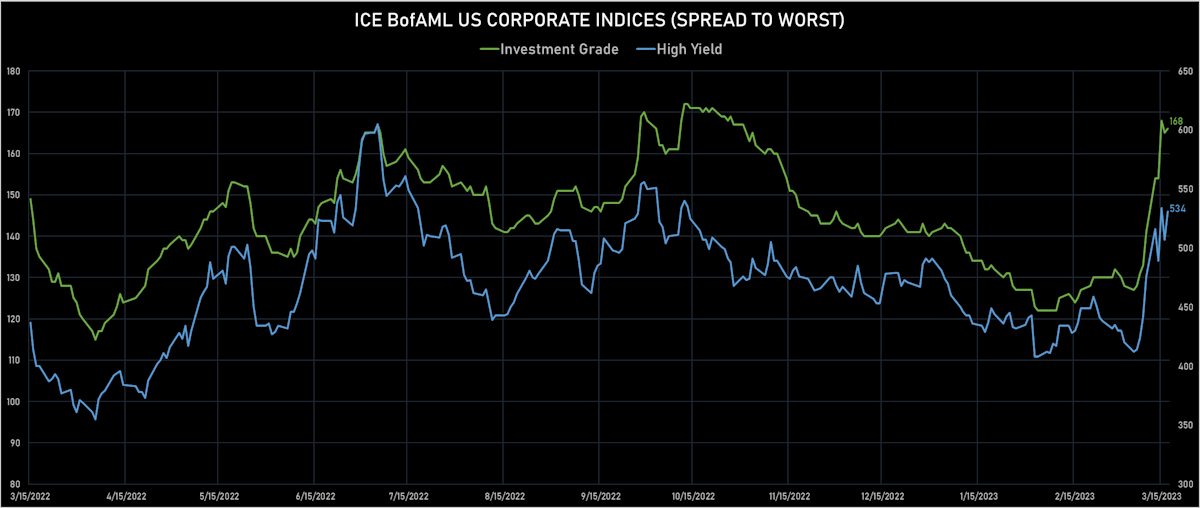

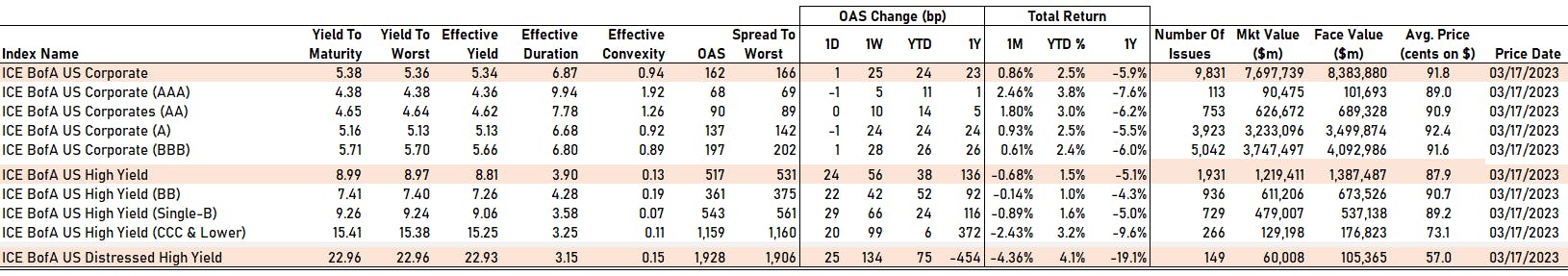

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 165.0 bp (WTD change: +25.0 bp; YTD change: +25.0 bp)

- ICE BofA US High Yield Index spread to worst up 24.0 bp, now at 507.0 bp (WTD change: +55.0 bp; YTD change: +19.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +1.4%)

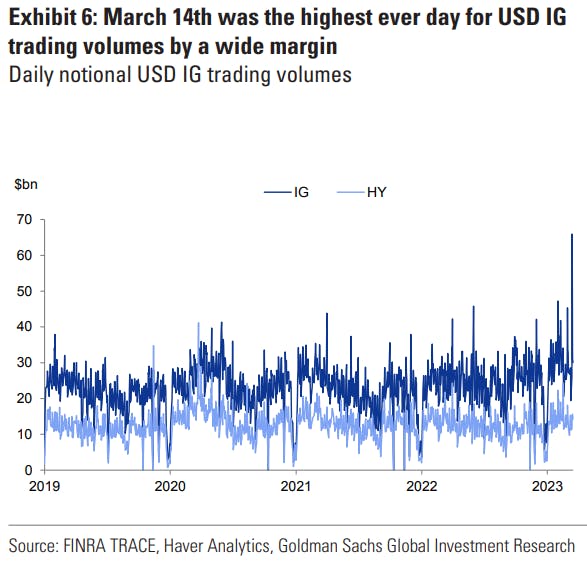

Last week saw the highest daily volume of US$ IG trading ever | Source: GSIR

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 68 bp

- AA unchanged at 90 bp

- A down by -1 bp at 137 bp

- BBB up by 1 bp at 197 bp

- BB up by 22 bp at 361 bp

- B up by 29 bp at 543 bp

- ≤ CCC up by 20 bp at 1,159 bp

CDS INDICES TODAY (mid-spreads)

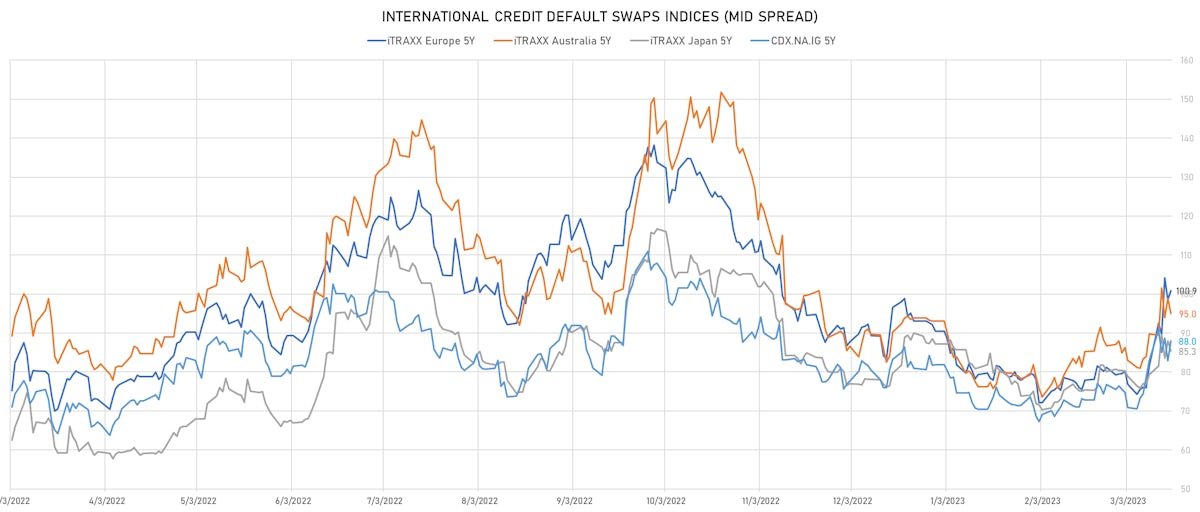

- Markit CDX.NA.IG 5Y up 5.1 bp, now at 88bp (1W change: +5.1bp; YTD change: +6.1bp)

- Markit CDX.NA.IG 10Y up 3.9 bp, now at 124bp (1W change: +2.6bp; YTD change: +5.9bp)

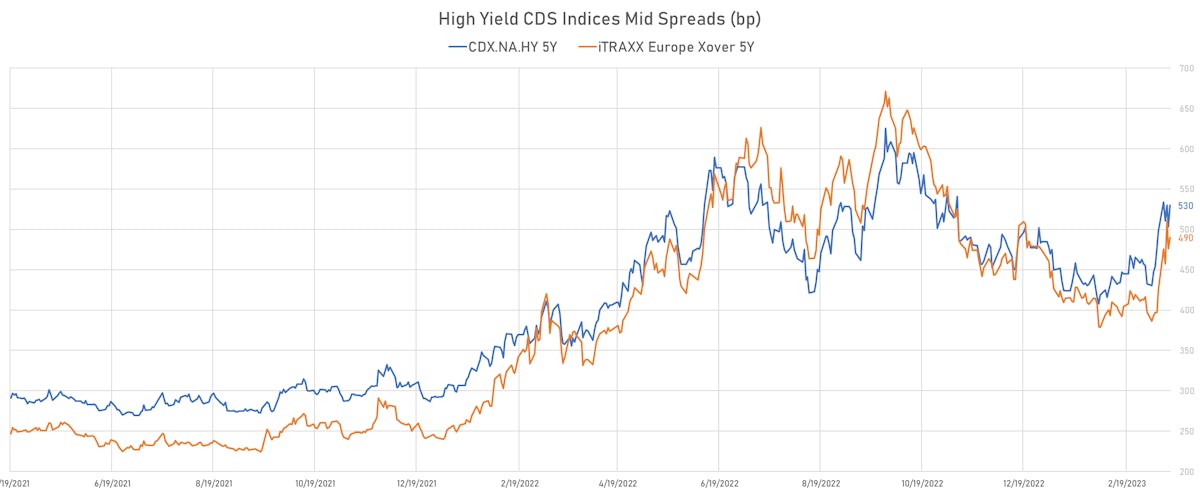

- Markit CDX.NA.HY 5Y up 26.8 bp, now at 530bp (1W change: +32.1bp; YTD change: +45.1bp)

- Markit iTRAXX Europe 5Y up 2.4 bp, now at 101bp (1W change: +19.4bp; YTD change: +10.5bp)

- Markit iTRAXX Europe Crossover 5Y up 13.7 bp, now at 490bp (1W change: +65.4bp; YTD change: +15.8bp)

- Markit iTRAXX Japan 5Y down 2.7 bp, now at 85bp (1W change: +6.0bp; YTD change: -1.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.9 bp, now at 137bp (1W change: +11.2bp; YTD change: +3.6bp)

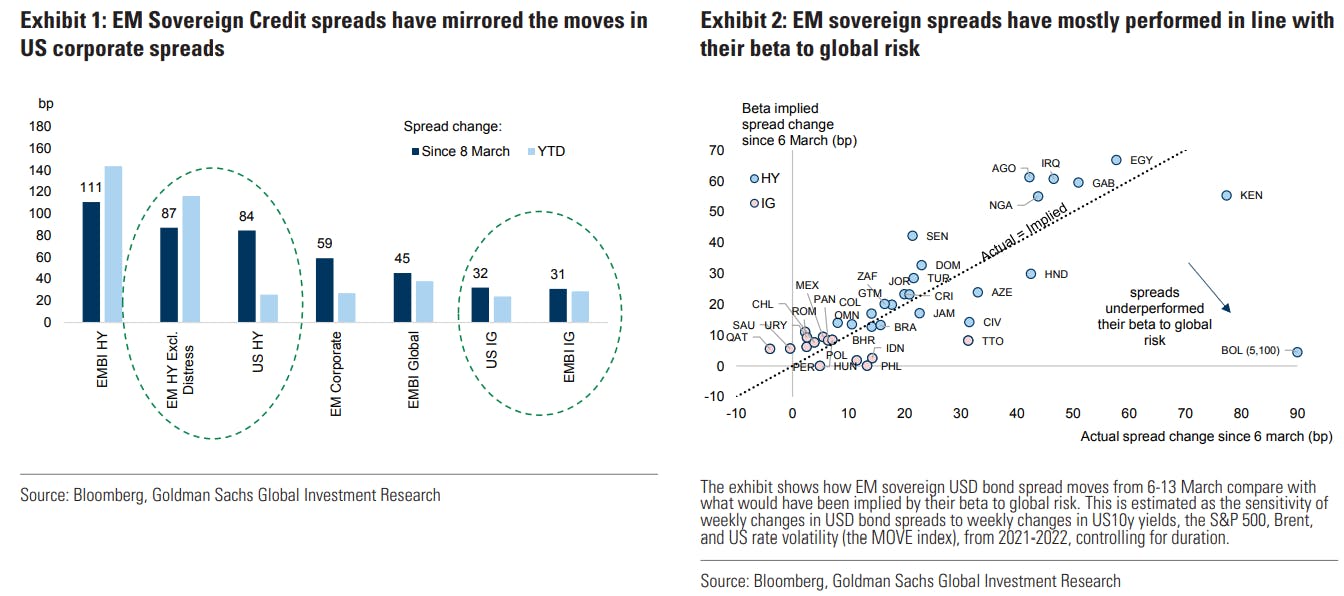

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Italy (rated BBB): up 20.9 % to 115 bp (1Y range: 88-179bp)

- Mexico (rated BBB-): up 19.7 % to 137 bp (1Y range: 93-205bp)

- Slovenia (rated A): up 17.0 % to 52 bp (1Y range: 40-80bp)

- Panama (rating WD): up 16.1 % to 119 bp (1Y range: 75-187bp)

- Colombia (rated BB+): up 15.9 % to 331 bp (1Y range: 171-394bp)

- Chile (rated A-): up 15.7 % to 114 bp (1Y range: 65-174bp)

- Peru (rated BBB): up 15.2 % to 119 bp (1Y range: 72-171bp)

- Jamaica (rated B+): up 15.0 % to 389 bp (1Y range: 338-390bp)

- Saudi Arabia (rated A): up 14.6 % to 66 bp (1Y range: 46-75bp)

- Egypt (rated B+): up 14.1 % to 1,411 bp (1Y range: 352-1,453bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: B1): down 2839.1 bp to 7,894.9bp (1Y range: 686-7,895bp)

- Tegna Inc (Country: US; rated: Ba3): up 81.4 bp to 473.3bp (1Y range: 182-786bp)

- Ally Financial Inc (Country: US; rated: A2): up 87.2 bp to 409.7bp (1Y range: 131-411bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 117.2 bp to 651.9bp (1Y range: 390-887bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 122.6 bp to 771.3bp (1Y range: 379-1,046bp)

- Onemain Finance Corp (Country: US; rated: Ba2): up 128.4 bp to 523.4bp (1Y range: 121-1,042bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 144.5 bp to 984.0bp (1Y range: 761-1,472bp)

- Unisys Corp (Country: US; rated: B1): up 157.0 bp to 1,213.1bp (1Y range: 291-1,213bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 194.7 bp to 1,164.2bp (1Y range: 625-1,783bp)

- American Airlines Group Inc (Country: US; rated: NR): up 214.4 bp to 1,008.3bp (1Y range: 607-1,644bp)

- Community Health Systems Inc (Country: US; rated: B): up 244.6 bp to 2,103.0bp (1Y range: 695-4,371bp)

- DISH DBS Corp (Country: US; rated: B2): up 259.4 bp to 1,972.4bp (1Y range: 545-1,972bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 309.0 bp to 1,335.3bp (1Y range: 435-2,117bp)

- Transocean Inc (Country: KY; rated: Caa1): up 316.8 bp to 1,148.6bp (1Y range: 674-2,858bp)

- Lumen Technologies Inc (Country: US; rated: B2): up 743.5 bp to 2,979.4bp (1Y range: 195-2,979bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): down 10073.8 bp to .0bp (1Y range: -5,963bp)

- Telecom Italia SpA (Country: IT; rated: BB-): up 58.5 bp to 395.3bp (1Y range: 306-545bp)

- Air France KLM SA (Country: FR; rated: C): up 58.6 bp to 468.8bp (1Y range: 409-990bp)

- Stena AB (Country: SE; rated: B1-PD): up 61.8 bp to 507.1bp (1Y range: 438-865bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 63.7 bp to 466.9bp (1Y range: 300-602bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): up 74.1 bp to 414.3bp (1Y range: 302-705bp)

- Deutsche Bank AG (Country: DE; rated: baa2): up 75.4 bp to 167.5bp (1Y range: 77-184bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 118.3 bp to 1,241.1bp (1Y range: 566-1,739bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 142.3 bp to 888.1bp (1Y range: 535-1,296bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 148.7 bp to 867.6bp (1Y range: 416-1,254bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 181.2 bp to 942.9bp (1Y range: 401-1,021bp)

- Ceconomy AG (Country: DE; rated: B1): up 220.5 bp to 1,214.5bp (1Y range: 287-1,763bp)

- Novafives SAS (Country: FR; rated: Caa1): up 228.2 bp to 1,289.3bp (1Y range: 618-2,936bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 235.2 bp to 1,572.1bp (1Y range: 1,286-2,910bp)

- Credit Suisse Group AG (Country: CH; rated: BBB low): up 551.9 bp to 968.6bp (1Y range: 117-969bp)

RECENT DOMESTIC USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$818m Bond (US3133EPDY89), fixed rate (4.05% coupon) maturing on 1 July 2026, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$370m Bond (US3133EPDM42), floating rate (SOFR + 18.0 bp) maturing on 20 March 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EPDW24), fixed rate (4.13% coupon) maturing on 21 March 2025, priced at 100.00 (original spread of 28 bp), non callable

- Freshpet Inc (Retail Stores - Food/Drug | Secaucus, New Jersey, United States | Rating: NR): US$350m Bond (US358039AA39), fixed rate (3.00% coupon) maturing on 1 April 2028, priced at 100.00, non callable, convertible

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$482m Certificate of Deposit - Retail (US949764AF15), fixed rate (5.25% coupon) maturing on 17 March 2025, priced at 100.00 (original spread of 131 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0460014516), fixed rate (3.70% coupon) maturing on 11 April 2025, priced at 100.00, non callable

- FEC Finance Ltd (Financial - Other | Hong Kong | Rating: NR): US$200m Unsecured Note (XS2600833417), fixed rate (6.75% coupon) maturing on 21 March 2025, priced at 100.00, non callable

- Jordan, Hashemite Kingdom of (Government) (Sovereign | Jordan | Rating: B+): US$1,000m Senior Note (XS2602742285), fixed rate (8.25% coupon) maturing on 4 April 2033, priced at 100.00, non callable

- Mime Petroleum AS (Oil and Gas | Lysaker, Luxembourg | Rating: NR): US$120m Bond (NO0012867318), fixed rate (13.00% coupon) maturing on 17 September 2025, callable (3nc1)

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: AA-): US$122m Senior Note (US78014RLS75), floating rate maturing on 17 March 2025, priced at 100.00, non callable

- Shengzhou Investment Holding Group Co Ltd (Financial - Other | Shaoxing, China (Mainland) | Rating: NR): US$250m Senior Note (XS2593085181), fixed rate (6.50% coupon) maturing on 21 March 2026, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €150m Unsecured Note (XS2484916981) zero coupon maturing on 7 July 2027, priced at 100.00, non callable

- Brambles Finance Plc (Financial - Other | Addlestone, Surrey, Australia | Rating: BBB+): €500m Senior Note (XS2596458591), fixed rate (4.25% coupon) maturing on 22 March 2031, priced at 99.56 (original spread of 224 bp), callable (8nc8)

- Brandenburg, State of (Official and Muni | Potsdam, Brandenburg, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A3E5SR2), floating rate (EU06MLIB + 0.0 bp) maturing on 21 March 2028, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €500m Bond (IT0005536781), fixed rate (4.00% coupon) maturing on 31 March 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €300m Bond (IT0005536807), fixed rate (3.25% coupon) maturing on 31 March 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C3R2), fixed rate (2.60% coupon) maturing on 17 April 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C3Q4), fixed rate (2.40% coupon) maturing on 17 April 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBV4), fixed rate (3.30% coupon) maturing on 6 April 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBT8), floating rate maturing on 6 April 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBY8), floating rate maturing on 30 March 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBU6), fixed rate (2.70% coupon) maturing on 11 April 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBS0), floating rate maturing on 24 March 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €3,000m Hypothekenpfandbrief (Covered Bond) (AT0000A33982), floating rate (EU03MLIB + 0.0 bp) maturing on 22 March 2030, priced at 100.00, non callable

- Finsbury Castle DAC (Financial - Other | Dublin, Ireland | Rating: NR): €500m Unsecured Note (XS2603208823) zero coupon maturing on 24 March 2028, non callable

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): €500m Unsecured Note (XS2567574517), fixed rate (4.20% coupon) maturing on 6 April 2028, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): €135m Senior Note (XS2599142648), fixed rate (4.82% coupon) maturing on 16 March 2040, priced at 100.00, with a make whole call

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €250m Inhaberschuldverschreibung (DE000LB3Q8Y1), fixed rate (3.05% coupon) maturing on 13 April 2026, priced at 100.00 (original spread of 108 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €250m Inhaberschuldverschreibung (DE000LB3Q8Z8), fixed rate (3.10% coupon) maturing on 13 April 2027, priced at 100.00 (original spread of 124 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €250m Inhaberschuldverschreibung (DE000LB3Q914), fixed rate (3.20% coupon) maturing on 13 April 2029, priced at 100.00 (original spread of 143 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €250m Inhaberschuldverschreibung (DE000LB3Q906), fixed rate (3.15% coupon) maturing on 13 April 2028, priced at 100.00 (original spread of 133 bp), non callable