Credit

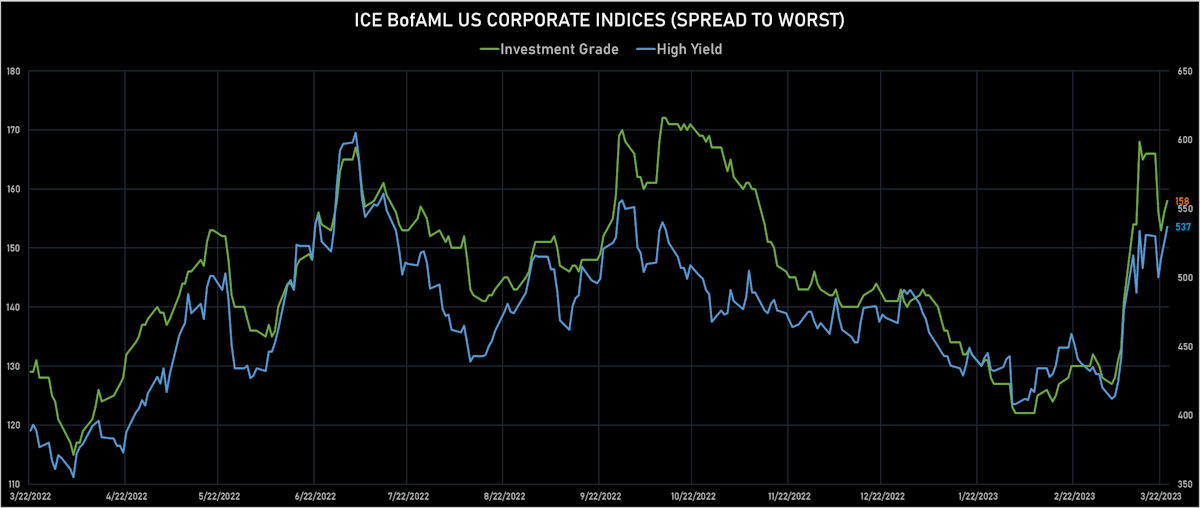

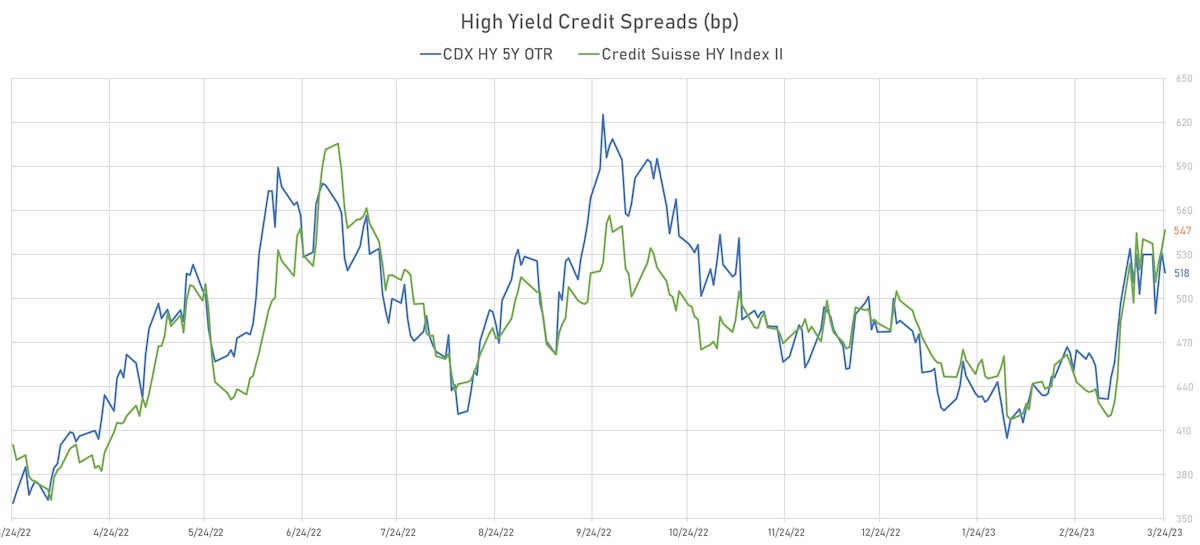

USD HY-IG Cash Spreads Over 100bp Wider In Past 3 weeks While Synthetics Do Slightly Better

The IG bond primary market reopened in the US this week with 28 Tranches for $21.05bn (2023 YTD volume $375.715bn vs 2022 YTD $430.541bn, down 12.7% YoY), while high yield issuance was nonexistent for the third straight week (2023 YTD volume $39.575bn vs 2022 YTD $38.676bn, up 2% YoY)

Published ET

High Yield Cash 5Y CDX HY Spreads | Sources: phipost.com, Refinitiv & Credit Suisse data

DAILY SUMMARY

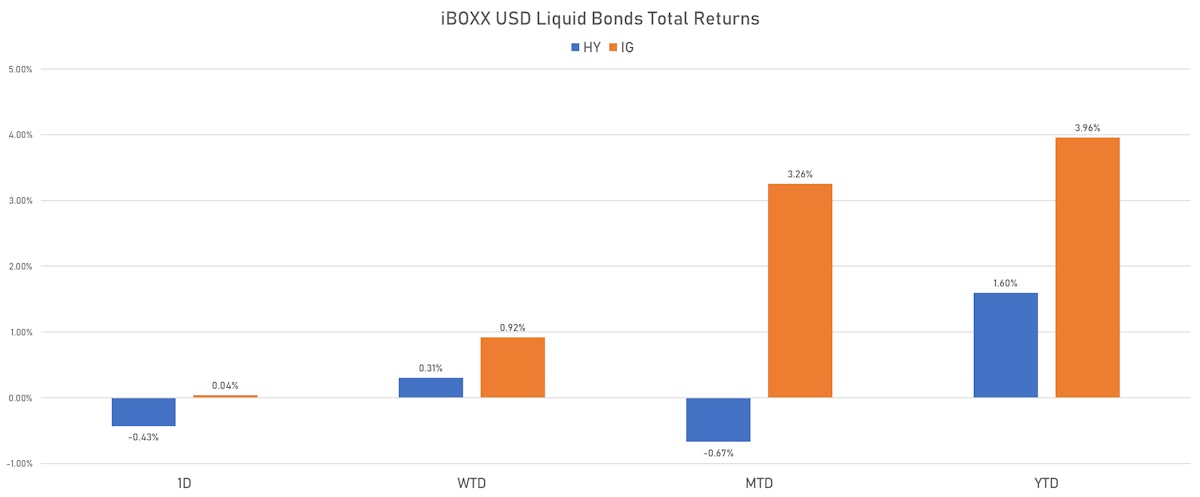

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.040% today (Week-to-date: 0.92%; Month-to-date: 3.26%; Year-to-date: 3.96%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.430% today (Week-to-date: 0.31%; Month-to-date: -0.67%; Year-to-date: 1.60%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 156.0 bp (WTD change: -8.0 bp; YTD change: +16.0 bp)

- ICE BofA US High Yield Index spread to worst up 12.0 bp, now at 525.0 bp (WTD change: +6.0 bp; YTD change: +37.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.22% today (YTD total return: +1.5%)

Deutsche Bank Subordinated 5Y EUR CDS Mid Spread | Source: Refinitiv

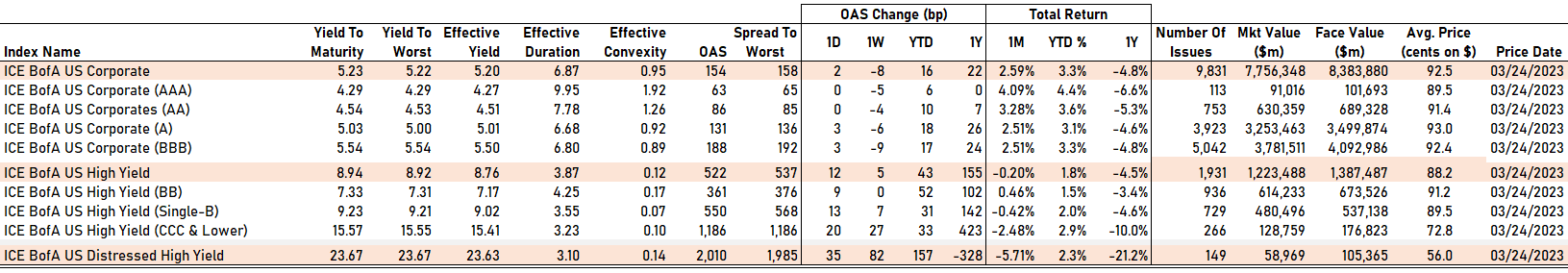

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 63 bp

- AA unchanged at 86 bp

- A up by 3 bp at 131 bp

- BBB up by 3 bp at 188 bp

- BB up by 9 bp at 361 bp

- B up by 13 bp at 550 bp

- ≤ CCC up by 20 bp at 1186 bp

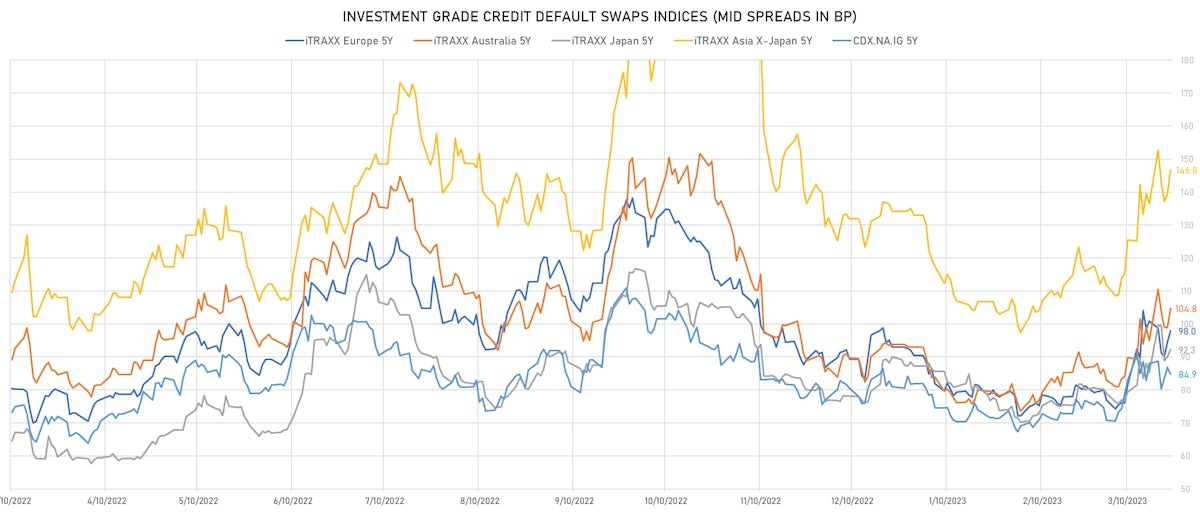

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.0 bp, now at 85bp (1W change: -3.1bp; YTD change: +3.0bp)

- Markit CDX.NA.IG 10Y down 2.3 bp, now at 120bp (1W change: -3.8bp; YTD change: +2.1bp)

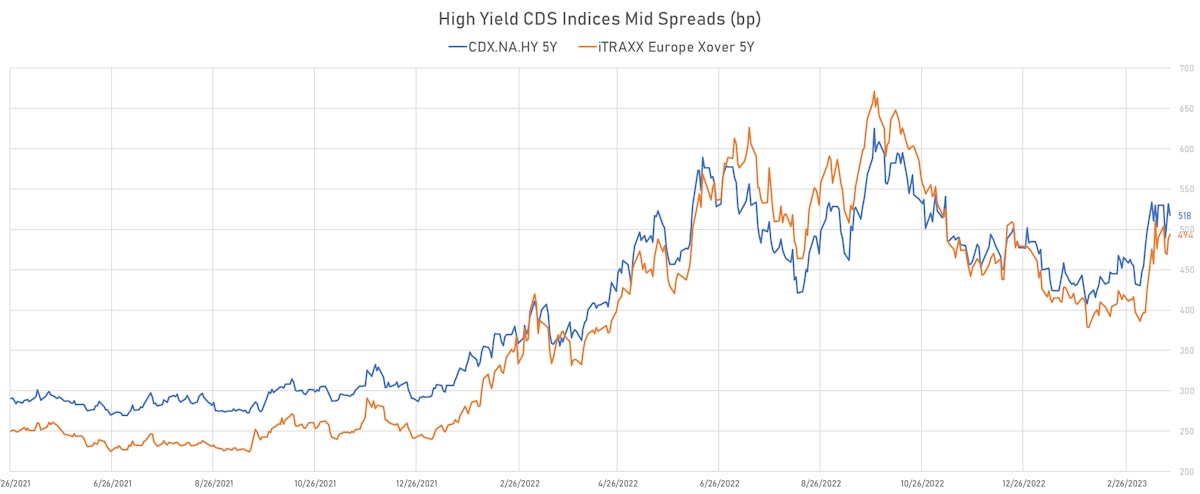

- Markit CDX.NA.HY 5Y down 13.9 bp, now at 518bp (1W change: -12.1bp; YTD change: +32.9bp)

- Markit iTRAXX Europe 5Y up 3.5 bp, now at 98bp (1W change: -2.9bp; YTD change: +7.5bp)

- Markit iTRAXX Europe Crossover 5Y up 5.4 bp, now at 494bp (1W change: +4.1bp; YTD change: +19.9bp)

- Markit iTRAXX Japan 5Y up 2.3 bp, now at 92bp (1W change: +6.9bp; YTD change: +5.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 7.4 bp, now at 147bp (1W change: +10.1bp; YTD change: +13.8bp)

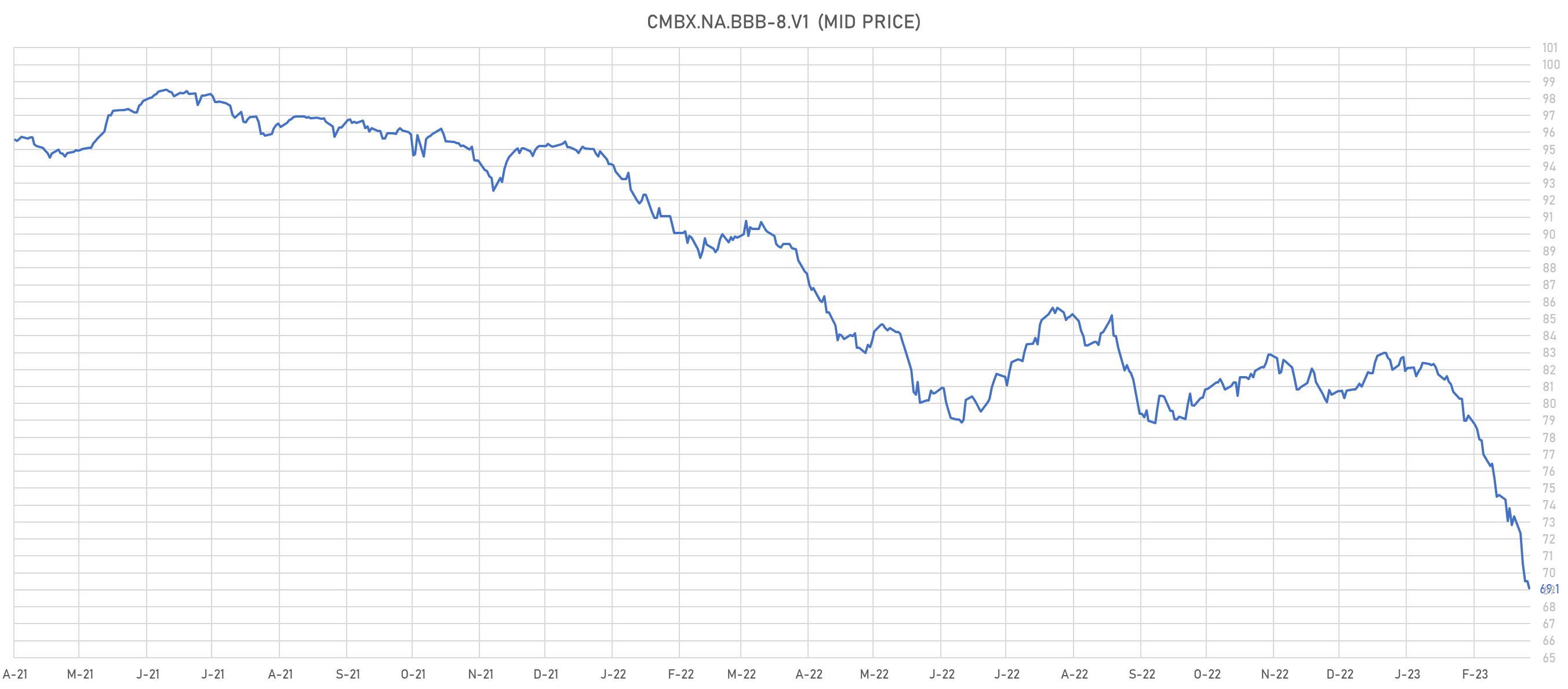

CMBX BBB- Mid Price | Sources: phipost.com, Refinitiv data

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS TODAY

- Argentina (rated CCC-): up 651.5 basis points to 8,224 bp (1Y range: 2,979-31,336bp)

- Egypt (rated B+): up 69.9 basis points to 1,392 bp (1Y range: 352-1,453bp)

- Jamaica (rated B+): up 52.1 basis points to 392 bp (1Y range: 338-390bp)

- Serbia (rated BB+): up 32.5 basis points to 271 bp (1Y range: 131-356bp)

- Philippines (rated BBB): up 6.6 basis points to 109 bp (1Y range: 76-153bp)

- Malaysia (rated BBB+): up 6.5 basis points to 83 bp (1Y range: 57-122bp)

- China (rated A+): up 5.8 basis points to 86 bp (1Y range: 47-132bp)

- Thailand (rated BBB+): up 5.3 basis points to 52 bp (1Y range: 36-95bp)

- Lithuania (rated A): up 5.0 basis points to 90 bp (1Y range: 69-985bp)

- Latvia (rated A-): up 4.0 basis points to 89 bp (1Y range: 67-1,112bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: B3): down 7894.9 bp to .0bp (1Y range: -3,726bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 109.9 bp to 1,225.4bp (1Y range: 435-2,117bp)

- Tegna Inc (Country: US; rated: Ba3): down 69.5 bp to 403.7bp (1Y range: 182-786bp)

- Transocean Inc (Country: KY; rated: Caa1): up 61.7 bp to 1,210.3bp (1Y range: 674-2,858bp)

- Avis Budget Group Inc (Country: US; rated: A2): up 66.9 bp to 456.7bp (1Y range: 269-591bp)

- Gap Inc (Country: US; rated: Ba2): up 67.9 bp to 682.9bp (1Y range: 333-819bp)

- American Airlines Group Inc (Country: US; rated: NR): up 76.0 bp to 1,084.3bp (1Y range: 607-1,644bp)

- Community Health Systems Inc (Country: US; rated: B): up 76.5 bp to 2,179.5bp (1Y range: 702-4,371bp)

- Nordstrom Inc (Country: US; rated: BBB-): up 81.2 bp to 687.4bp (1Y range: 339-687bp)

- Unisys Corp (Country: US; rated: B1): up 92.8 bp to 1,305.9bp (1Y range: 295-1,306bp)

- Pitney Bowes Inc (Country: US; rated: B1): up 119.8 bp to 1,284.1bp (1Y range: 625-1,783bp)

- Kohls Corp (Country: US; rated: BBB): up 151.2 bp to 774.1bp (1Y range: 356-774bp)

- Staples Inc (Country: US; rated: B3): up 332.3 bp to 2,176.6bp (1Y range: 1,101-2,177bp)

- DISH DBS Corp (Country: US; rated: B2): up 343.1 bp to 2,315.5bp (1Y range: 545-2,316bp)

- Lumen Technologies Inc (Country: US; rated: B2): up 493.1 bp to 3,472.5bp (1Y range: 195-3,472bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: Caa3): down 40239.2 bp to .0bp (1Y range: -6,079bp)

- Credit Suisse Group AG (Country: CH; rated: C): down 733.9 bp to 234.7bp (1Y range: 117-1,267bp)

- Syngenta AG (Country: CH; rated: Ba1): down 37.2 bp to 128.7bp (1Y range: 129-241bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): down 29.5 bp to 384.8bp (1Y range: 308-705bp)

- PostNL NV (Country: NL; rated: WR): down 17.9 bp to 184.5bp (1Y range: 52-203bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 17.4 bp to 681.7bp (1Y range: 370-758bp)

- Electrolux AB (Country: SE; rated: NR): down 17.3 bp to 145.8bp (1Y range: 36-164bp)

- UBS AG (Country: CH; rated: PP-1): up 18.1 bp to 134.8bp (1Y range: 54-149bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 21.7 bp to 379.3bp (1Y range: 212-496bp)

- Barclays Bank PLC (Country: GB; rated: baa1): up 27.9 bp to 139.9bp (1Y range: 70-150bp)

- Deutsche Bank AG (Country: DE; rated: baa2): up 30.0 bp to 197.5bp (1Y range: 77-198bp)

- Ceconomy AG (Country: DE; rated: B1): up 30.5 bp to 1,245.1bp (1Y range: 293-1,763bp)

- Air France KLM SA (Country: FR; rated: C): up 48.2 bp to 517.0bp (1Y range: 409-990bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 60.4 bp to 928.1bp (1Y range: 416-1,254bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 436.9 bp to 2,009.0bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 2.65% | Maturity: 15/6/2026 | Rating: BB | CUSIP: 67623CAD1 | OAS up by 364.8 bp to 1,180.2 bp, with the yield to worst at 15.3% and the bond now trading down to 68.3 cents on the dollar (1Y price range: 68.3-81.4).

- Issuer: Lumen Technologies Inc (Monroe, Louisiana (US)) | Coupon: 5.63% | Maturity: 1/4/2025 | Rating: CCC+ | CUSIP: 156700AZ9 | OAS up by 300.1 bp to 1,133.0 bp, with the yield to worst at 15.0% and the bond now trading down to 83.5 cents on the dollar (1Y price range: 81.0-96.6).

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 2.40% | Maturity: 1/2/2027 | Rating: BB | CUSIP: 67623CAE9 | OAS up by 264.0 bp to 1,061.6 bp, with the yield to worst at 14.1% and the bond now trading down to 65.8 cents on the dollar (1Y price range: 65.8-78.0).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 4.20% | Maturity: 29/10/2025 | Rating: BB+ | CUSIP: 78442PGD2 | OAS up by 252.1 bp to 702.2 bp, with the yield to worst at 10.5% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 85.1-94.3).

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 4.50% | Maturity: 1/2/2025 | Rating: BB | CUSIP: 81618TAC4 | OAS up by 146.5 bp to 771.5 bp, with the yield to worst at 11.9% and the bond now trading down to 87.9 cents on the dollar (1Y price range: 87.7-94.3).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 7.50% | Maturity: 15/9/2025 | Rating: B+ | CUSIP: 81761LAA0 | OAS up by 134.6 bp to 495.9 bp, with the yield to worst at 8.5% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 95.0-100.3).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 3.50% | Maturity: 1/6/2031 | Rating: BB | CUSIP: 852234AP8 | OAS up by 85.4 bp to 376.2 bp, with the yield to worst at 7.0% and the bond now trading down to 77.5 cents on the dollar (1Y price range: 77.5-86.4).

- Issuer: Regal Rexnord Corp (Beloit, Wisconsin (US)) | Coupon: 6.05% | Maturity: 15/2/2026 | Rating: BB+ | CUSIP: 758750AC7 | OAS down by 39.2 bp to 168.2 bp, with the yield to worst at 5.4% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 98.6-102.1).

- Issuer: CDW LLC (Vernon Hills, Illinois (US)) | Coupon: 2.67% | Maturity: 1/12/2026 | Rating: BB+ | CUSIP: 12513GBG3 | OAS down by 42.4 bp to 193.2 bp, with the yield to worst at 5.5% and the bond now trading up to 90.4 cents on the dollar (1Y price range: 87.2-91.0).

- Issuer: Spirit AeroSystems Inc (Wichita, Kansas (US)) | Coupon: 3.85% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 85205TAG5 | OAS down by 43.5 bp to 250.5 bp, with the yield to worst at 5.9% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 90.5-94.9).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 44.9 bp to 194.3 bp, with the yield to worst at 5.8% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS down by 45.5 bp to 200.9 bp, with the yield to worst at 5.5% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: DPL Inc (Dayton, Ohio (US)) | Coupon: 4.13% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 233293AR0 | OAS down by 57.8 bp to 222.1 bp (CDS basis: -43.0bp), with the yield to worst at 5.8% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 93.4-95.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.13% | Maturity: 25/3/2024 | Rating: B+ | CUSIP: 78442FET1 | OAS down by 65.2 bp to 360.4 bp (CDS basis: -209.8bp), with the yield to worst at 7.5% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 97.0-100.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 142.6 bp to 77.8 bp (CDS basis: -35.4bp), with the yield to worst at 4.8% and the bond now trading up to 94.7 cents on the dollar (1Y price range: 91.4-94.7).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS up by 151.7 bp to 1,106.1 bp, with the yield to worst at 13.9% and the bond now trading down to 65.4 cents on the dollar (1Y price range: 65.3-79.1).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: B+ | ISIN: XS2270393379 | OAS up by 65.0 bp to 500.4 bp (CDS basis: -82.6bp), with the yield to worst at 7.4% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 84.3-88.5).

- Issuer: illimity Bank SpA (Milan, Italy) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS up by 57.0 bp to 437.0 bp, with the yield to worst at 7.4% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 97.9-102.6).

- Issuer: Unipol Gruppo SpA (Bologna, Italy) | Coupon: 3.50% | Maturity: 29/11/2027 | Rating: BB+ | ISIN: XS1725580622 | OAS up by 41.1 bp to 189.6 bp, with the yield to worst at 4.7% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 94.0-100.6).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | OAS down by 35.4 bp to 340.0 bp, with the yield to worst at 6.1% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 82.1-88.0).

- Issuer: Iliad SA (Paris, France) | Coupon: 5.38% | Maturity: 14/6/2027 | Rating: BB | ISIN: FR001400EJI5 | OAS down by 35.8 bp to 297.7 bp, with the yield to worst at 5.8% and the bond now trading up to 97.9 cents on the dollar (1Y price range: 95.5-101.4).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | OAS down by 40.2 bp to 357.3 bp, with the yield to worst at 6.1% and the bond now trading up to 82.0 cents on the dollar (1Y price range: 75.4-85.4).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 11/2/2028 | Rating: BB | ISIN: FR0014001YB0 | OAS down by 43.5 bp to 314.6 bp, with the yield to worst at 5.9% and the bond now trading up to 82.8 cents on the dollar (1Y price range: 80.0-86.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | OAS down by 44.7 bp to 242.0 bp (CDS basis: 2.9bp), with the yield to worst at 5.2% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 89.8-94.9).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | OAS down by 45.7 bp to 352.5 bp, with the yield to worst at 6.3% and the bond now trading up to 82.3 cents on the dollar (1Y price range: 77.7-86.1).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.25% | Maturity: 15/9/2025 | Rating: BB | ISIN: XS2229875989 | OAS down by 48.4 bp to 231.6 bp (CDS basis: -7.6bp), with the yield to worst at 5.1% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 93.2-97.5).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB | ISIN: XS2332589972 | OAS down by 49.5 bp to 241.1 bp, with the yield to worst at 5.1% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 86.8-91.9).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS down by 49.9 bp to 360.0 bp, with the yield to worst at 6.2% and the bond now trading up to 90.1 cents on the dollar (1Y price range: 85.3-93.2).

- Issuer: SIG Combibloc PurchaseCo SARL (Munsbach, Luxembourg) | Coupon: 2.13% | Maturity: 18/6/2025 | Rating: BB+ | ISIN: XS2189594315 | OAS down by 51.3 bp to 143.3 bp, with the yield to worst at 4.1% and the bond now trading up to 94.9 cents on the dollar (1Y price range: 92.7-96.9).

- Issuer: Iliad SA (Paris, France) | Coupon: 2.38% | Maturity: 17/6/2026 | Rating: BB | ISIN: FR0013518420 | OAS down by 64.6 bp to 269.3 bp, with the yield to worst at 5.3% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 87.6-92.5).

RECENT DOMESTIC USD BOND ISSUES

- American International Group Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: BBB): US$750m Senior Note (US026874DS37), fixed rate (5.13% coupon) maturing on 27 March 2033, priced at 99.53 (original spread of 189 bp), callable (10nc10)

- Brown-Forman Corp (Beverage/Bottling | Louisville, Kentucky, United States | Rating: A-): US$650m Senior Note (US115637AU43), fixed rate (4.75% coupon) maturing on 15 April 2033, priced at 99.70 (original spread of 124 bp), callable (10nc10)

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, Texas, United States | Rating: A): US$300m Mortgage Bond (US15189XBC11), fixed rate (5.30% coupon) maturing on 1 April 2053, priced at 99.92 (original spread of 198 bp), callable (30nc30)

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, Texas, United States | Rating: A): US$600m Mortgage Bond (US15189XBB38), fixed rate (4.95% coupon) maturing on 1 April 2033, priced at 99.76 (original spread of 150 bp), callable (10nc10)

- Customers Bank (Banking | Phoenixville, Pennsylvania, United States | Rating: NR): US$125m Certificate of Deposit - Retail (US23204HNP90), fixed rate (5.05% coupon) maturing on 24 March 2026, priced at 100.00 (original spread of 141 bp), non callable

- Duke Energy Indiana LLC (Utility - Other | Charlotte, North Carolina, United States | Rating: A): US$500m First Mortgage Bond (US26443TAD81), fixed rate (5.40% coupon) maturing on 1 April 2053, priced at 99.91 (original spread of 216 bp), callable (30nc30)

- Duke Energy Ohio Inc (Utility - Other | Charlotte, North Carolina, United States | Rating: A): US$375m First Mortgage Bond (US26442EAJ91), fixed rate (5.25% coupon) maturing on 1 April 2033, priced at 99.94 (original spread of 175 bp), callable (10nc10)

- Duke Energy Ohio Inc (Utility - Other | Charlotte, North Carolina, United States | Rating: A): US$375m First Mortgage Bond (US26442EAK64), fixed rate (5.65% coupon) maturing on 1 April 2053, priced at 99.88 (original spread of 228 bp), callable (30nc30)

- Extra Space Storage LP (Real Estate Investment Trust | Salt Lake City, Utah, United States | Rating: BBB): US$500m Senior Note (US30225VAJ61), fixed rate (5.70% coupon) maturing on 1 April 2028, priced at 99.82 (original spread of 210 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$140m Bond (US3133EPEC50), fixed rate (5.93% coupon) maturing on 28 March 2033, priced at 100.00 (original spread of 104 bp), callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EPER20), fixed rate (4.00% coupon) maturing on 28 March 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EPEH48), fixed rate (3.88% coupon) maturing on 30 March 2026, priced at 99.78, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$130m Bond (US3133EPEK76), fixed rate (4.62% coupon) maturing on 3 April 2028, priced at 100.00 (original spread of 46 bp), callable (5nc2)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$400m Unsecured Note (US3134GYNN86), fixed rate (5.73% coupon) maturing on 3 April 2025, priced at 100.00 (original spread of 58 bp), callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$1,000m Unsecured Note (US3134GYNL21), fixed rate (5.68% coupon) maturing on 3 April 2025, priced at 100.00 (original spread of 47 bp), callable (2nc3m)

- Indiana Michigan Power Co (Utility - Other | Columbus, Ohio, United States | Rating: A-): US$500m Senior Note (US454889AV81), fixed rate (5.63% coupon) maturing on 1 April 2053, priced at 99.97 (original spread of 229 bp), callable (30nc30)

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$1,000m Note (US59217HDZ73), fixed rate (5.15% coupon) maturing on 28 March 2033, priced at 99.86 (original spread of 174 bp), non callable

- NiSource Inc (Utility - Other | Merrillville, Indiana, United States | Rating: BBB): US$750m Senior Note (US65473PAN50), fixed rate (5.25% coupon) maturing on 30 March 2028, priced at 99.83 (original spread of 156 bp), callable (5nc5)

- Oklahoma Gas And Electric Co (Utility - Other | Oklahoma City, Oklahoma, United States | Rating: A-): US$350m Senior Note (US678858BY62), fixed rate (5.60% coupon) maturing on 1 April 2053, priced at 99.51 (original spread of 231 bp), callable (30nc30)

- Prologis LP (Real Estate Investment Trust | San Francisco, United States | Rating: A): US$450m Senior Note (US74340XCF69), fixed rate (5.25% coupon) maturing on 15 June 2053, priced at 99.83 (original spread of 160 bp), callable (30nc30)

- Prologis LP (Real Estate Investment Trust | San Francisco, United States | Rating: A): US$750m Senior Note (US74340XCE94), fixed rate (4.75% coupon) maturing on 15 June 2033, priced at 99.82 (original spread of 140 bp), callable (10nc10)

- Public Service Electric And Gas Co (Utility - Other | Newark, United States | Rating: A): US$400m Senior Note (US74456QCM69), fixed rate (5.13% coupon) maturing on 15 March 2053, priced at 99.94 (original spread of 142 bp), callable (30nc29)

- Public Service Electric And Gas Co (Utility - Other | Newark, United States | Rating: A): US$500m Senior Note (US74456QCL86), fixed rate (4.65% coupon) maturing on 15 March 2033, priced at 99.91 (original spread of 122 bp), callable (10nc10)

- Republic Services Inc (Service - Other | Phoenix, Arizona, United States | Rating: BBB+): US$800m Senior Note (US760759BC31), fixed rate (5.00% coupon) maturing on 1 April 2034, priced at 99.49 (original spread of 145 bp), callable (11nc11)

- Republic Services Inc (Service - Other | Phoenix, Arizona, United States | Rating: BBB+): US$400m Senior Note (US760759BB57), fixed rate (4.88% coupon) maturing on 1 April 2029, priced at 99.58 (original spread of 122 bp), callable (6nc6)

- Southwest Gas Corp (Gas Utility - Local Distrib | Las Vegas, Nevada, United States | Rating: BBB): US$300m Senior Note (US845011AH89), fixed rate (5.45% coupon) maturing on 23 March 2028, priced at 99.85 (original spread of 175 bp), callable (5nc5)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A-): US$1,750m Senior Note (US91324PEX69), fixed rate (5.20% coupon) maturing on 15 April 2063, priced at 99.26 (original spread of 158 bp), callable (40nc40)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A-): US$2,000m Senior Note (US91324PEW86), fixed rate (5.05% coupon) maturing on 15 April 2053, priced at 99.32 (original spread of 143 bp), callable (30nc30)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A-): US$1,250m Senior Note (US91324PEU21), fixed rate (4.25% coupon) maturing on 15 January 2029, priced at 99.81 (original spread of 88 bp), callable (6nc6)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A-): US$1,500m Senior Note (US91324PEV04), fixed rate (4.50% coupon) maturing on 15 April 2033, priced at 99.37 (original spread of 118 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): US$300m Unsecured Note (XS2491760521) zero coupon maturing on 31 March 2033, priced at 100.00, non callable

- Medtronic Global Holdings SCA (Health Care Supply | Luxembourg, Ireland | Rating: A): US$1,000m Senior Note (US58507LBC28), fixed rate (4.50% coupon) maturing on 30 March 2033, priced at 99.38 (original spread of 115 bp), callable (10nc10)

- Medtronic Global Holdings SCA (Health Care Supply | Luxembourg, Ireland | Rating: A): US$1,000m Senior Note (US58507LBB45), fixed rate (4.25% coupon) maturing on 30 March 2028, priced at 99.69 (original spread of 88 bp), callable (5nc5)

- Nutrien Ltd (Chemicals | Saskatoon, Canada | Rating: BBB): US$750m Senior Note (US67077MBB37), fixed rate (5.80% coupon) maturing on 27 March 2053, priced at 99.37 (original spread of 215 bp), callable (30nc30)

- Nutrien Ltd (Chemicals | Saskatoon, Canada | Rating: BBB): US$750m Senior Note (US67077MBA53), fixed rate (4.90% coupon) maturing on 27 March 2028, priced at 99.82 (original spread of 150 bp), callable (5nc5)

- Panama, Republic of (Government) (Sovereign | Panama | Rating: BBB-): US$1,000m Bond (US698299BV52), fixed rate (6.85% coupon) maturing on 28 March 2054, priced at 100.00 (original spread of 353 bp), callable (31nc31)

- QNB Finance Ltd (Financial - Other | George Town, Qatar | Rating: NR): US$200m Unsecured Note (XS2604815337), floating rate maturing on 29 March 2030, priced at 100.00, non callable

- Shriram Finance Ltd (Financial - Other | Mumbai, India | Rating: BB-): US$150m Unsecured Note (XS2606114457), floating rate maturing on 28 September 2026, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- Credit Agricole Corporate and Investment Bank SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €180m Unsecured Note (XS2395312023), floating rate maturing on 30 March 2030, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €150m Inhaberschuldverschreibung (DE000DW6C3V4), fixed rate (3.00% coupon) maturing on 4 May 2029, priced at 100.00, callable (6nc1)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €150m Inhaberschuldverschreibung (DE000DW6C3T8), fixed rate (2.75% coupon) maturing on 5 May 2027, priced at 100.00, callable (4nc2)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VCB4), floating rate maturing on 13 April 2029, priced at 100.00, with a special call

- Eurofima European Company for the Financing of Railroad Rolling Stock (Supranational | Basel, Basel-Stadt, Switzerland | Rating: AA): €290m Unsecured Note (XS2604370978), fixed rate (3.13% coupon) maturing on 30 March 2033, priced at 100.00, non callable

- Finsbury Castle DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €500m Unsecured Note (XS2603877585) zero coupon maturing on 24 March 2028, non callable

- IHO Verwaltungs GmbH (Financial - Other | Herzogenaurach, Germany | Rating: BB+): €500m Senior Note (XS2606019383), fixed rate (8.75% coupon) maturing on 15 May 2028, priced at 98.96, callable (5nc2)

- Investitionsbank Schleswig Holstein (Agency | Kiel, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A30VNQ7), floating rate (EU03MLIB + 0.0 bp) maturing on 31 March 2025, priced at 100.24, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Italy | Rating: BBB-): €250m Senior Note (XS2600999739), floating rate (ESTR + 140.0 bp) maturing on 23 March 2035, priced at 100.00 (original spread of 100,000 bp), non callable

- KommuneKredit (Agency | Kobenhavn K, Denmark | Rating: AAA): €105m Unsecured Note (XS2603883633) zero coupon maturing on 17 November 2029, priced at 82.76, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QYB1), fixed rate (2.60% coupon) maturing on 26 April 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QYD7), fixed rate (2.90% coupon) maturing on 26 April 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QW19), fixed rate (2.55% coupon) maturing on 24 April 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QYC9), fixed rate (2.85% coupon) maturing on 24 April 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QW35), fixed rate (2.80% coupon) maturing on 24 April 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QYE5), fixed rate (2.95% coupon) maturing on 24 April 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3QYF2), fixed rate (3.00% coupon) maturing on 24 April 2029, priced at 100.00, non callable

- Malta, Republic of (Government) (Sovereign | Valletta, Malta | Rating: A+): €128m Bond (MT0000013582), fixed rate (3.40% coupon) maturing on 24 March 2027, priced at 100.00, non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €1,500m Unsecured Note (XS2604710660) zero coupon maturing on 3 April 2028, priced at 100.00, non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €600m Unsecured Note (XS2605909790), fixed rate (1.00% coupon) maturing on 29 March 2027, priced at 100.00, non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €700m Unsecured Note (XS2605909956), fixed rate (1.00% coupon) maturing on 29 March 2028, priced at 100.00, non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €300m Unsecured Note (XS2605909444), fixed rate (1.00% coupon) maturing on 29 March 2033, priced at 100.00, non callable

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €500m Landesschatzanweisung (DE000RLP1411), fixed rate (2.75% coupon) maturing on 27 March 2030 (original spread of 73 bp), non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: A-): €750m Senior Note (XS2604699327), fixed rate (4.25% coupon) maturing on 29 March 2029, priced at 99.86 (original spread of 221 bp), non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: A-): €1,000m Senior Note (XS2604697891), fixed rate (3.88% coupon) maturing on 29 March 2026, priced at 99.76 (original spread of 166 bp), non callable

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: NR): €400m Unsecured Note (XS2605926026), floating rate maturing on 31 March 2025, priced at 100.00, non callable

- Wendel SE (Financial - Other | Paris, Ile-De-France, France | Rating: BBB): €750m Bond (FR001400GVB0), fixed rate (2.63% coupon) maturing on 27 March 2026, priced at 100.00, non callable, convertible

- Saxony, state of (Official and Muni | Dresden, Sachsen, Germany | Rating: AAA): €500m Landesschatzanweisung (DE0001789352), fixed rate (2.88% coupon) maturing on 29 March 2028, priced at 99.91 (original spread of 66 bp), non callable

RECENT STRUCTURED CREDIT

- Kapitus Asset Securitization LLC 2023-1 issued a fixed-rate ABS backed by sm business loan in 4 tranches, for a total of US$ 100 m. Highest-rated tranche offering a yield to maturity of 6.90%, and the lowest-rated tranche a yield to maturity of 13.16%. Bookrunners: Guggenheim Securities LLC

- Metronet Infrastructure Issuer LLC Series 2023-1 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 554 m. Highest-rated tranche offering a yield to maturity of 6.56%, and the lowest-rated tranche a yield to maturity of 8.01%. Bookrunners: Goldman Sachs & Co, Barclays Capital Group, Scotia Capital (USA) Inc., Bank of America Merrill Lynch, KKR Capital Markets LLC, MUFG Securities Americas Inc, Truist Securities Inc, TD Securities (USA) LLC