Credit

Strong Rebound In USD HY Credit, Led By BBs Overperformance (OAS -73bp WoW)

Decent week for US$ bond issuance: 39 tranches for $24.825bn in IG (2023 YTD volume $400.54bn vs 2022 YTD $466.941bn), 2 tranches for $600m in HY (2023 YTD volume $40.175bn vs 2022 YTD $41.626bn)

Published ET

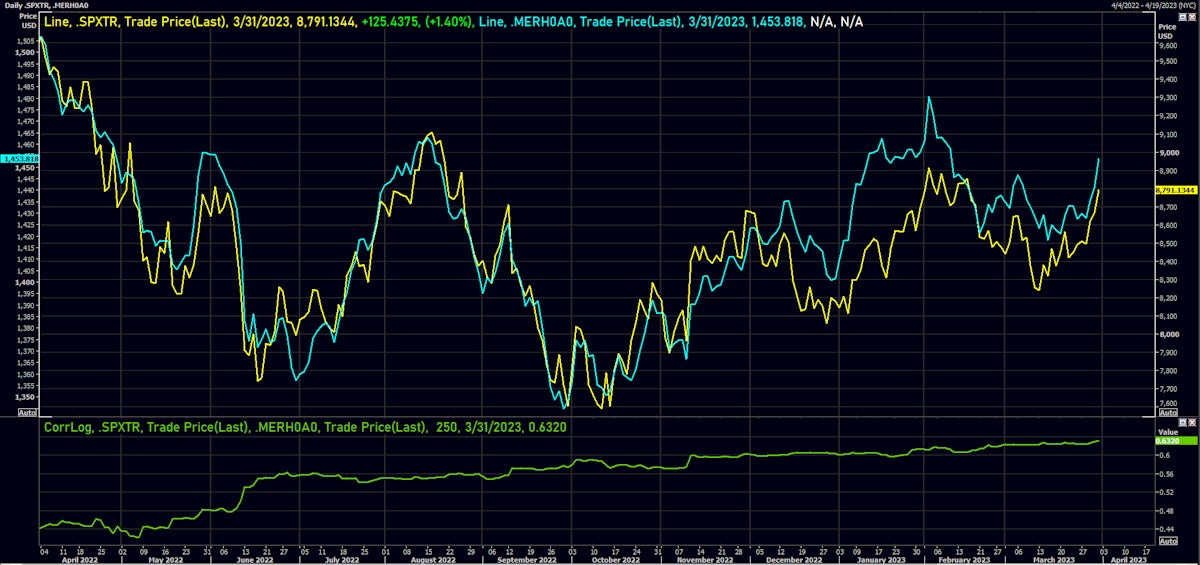

S&P 500 Total Return Index & ICE BofAML US HY Index | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was up 0.63% today, with investment grade up 0.61% and high yield up 0.77% (YTD total return: +3.48%)

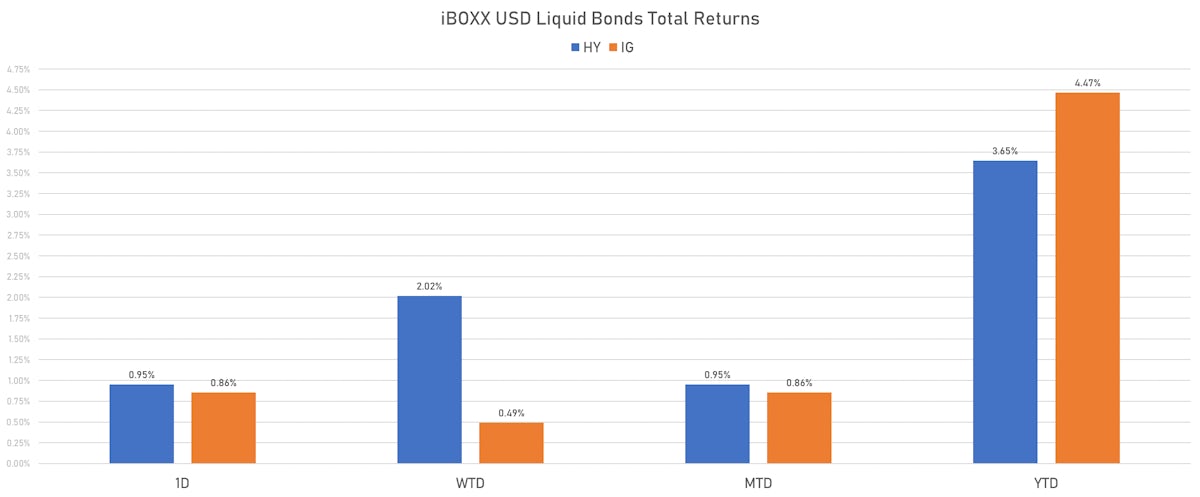

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.856% today (Week-to-date: 0.49%; Month-to-date: 0.86%; Year-to-date: 4.47%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.951% today (Week-to-date: 2.02%; Month-to-date: 0.95%; Year-to-date: 3.65%)

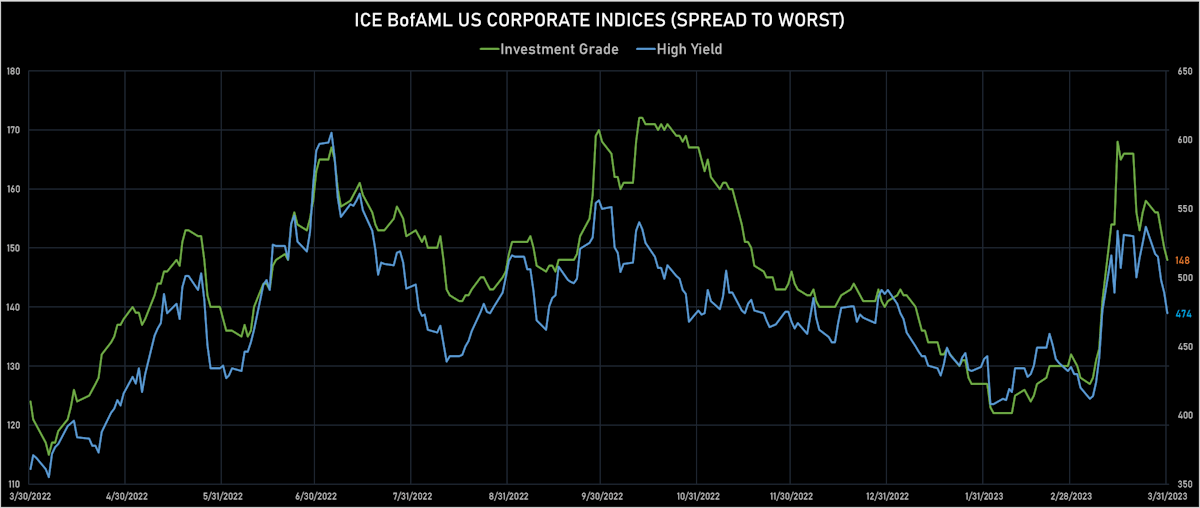

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 148.0 bp (WTD change: -8.0 bp; YTD change: +8.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged 0.0 bp, now at 474.0 bp (WTD change: -43.0 bp; YTD change: -14.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.19% today (YTD total return: +3.0%)

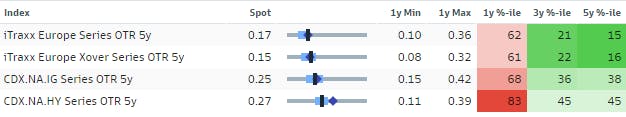

3M 25-delta / ATM Implied Volatility Percentiles for credit indices | Source: GS Strats

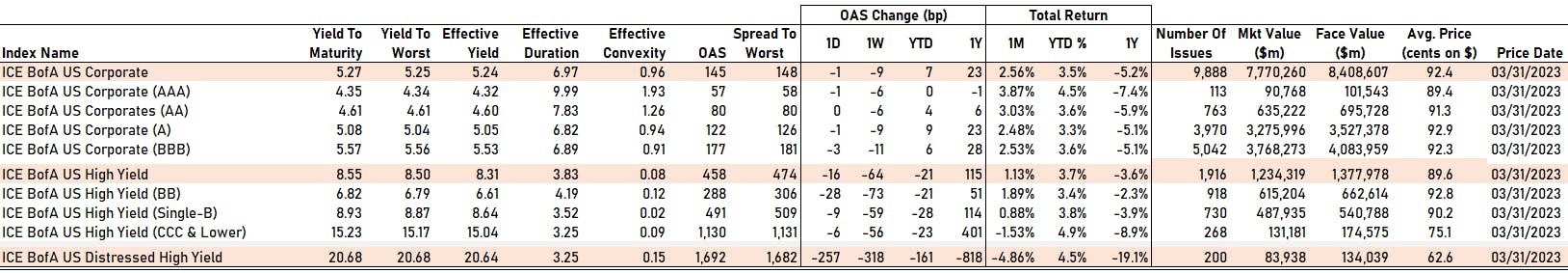

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 57 bp

- AA unchanged at 80 bp

- A down by -1 bp at 122 bp

- BBB down by -3 bp at 177 bp

- BB down by -28 bp at 288 bp

- B down by -9 bp at 491 bp

- ≤ CCC down by -6 bp at 1,130 bp

CDS INDICES TODAY (mid-spreads)

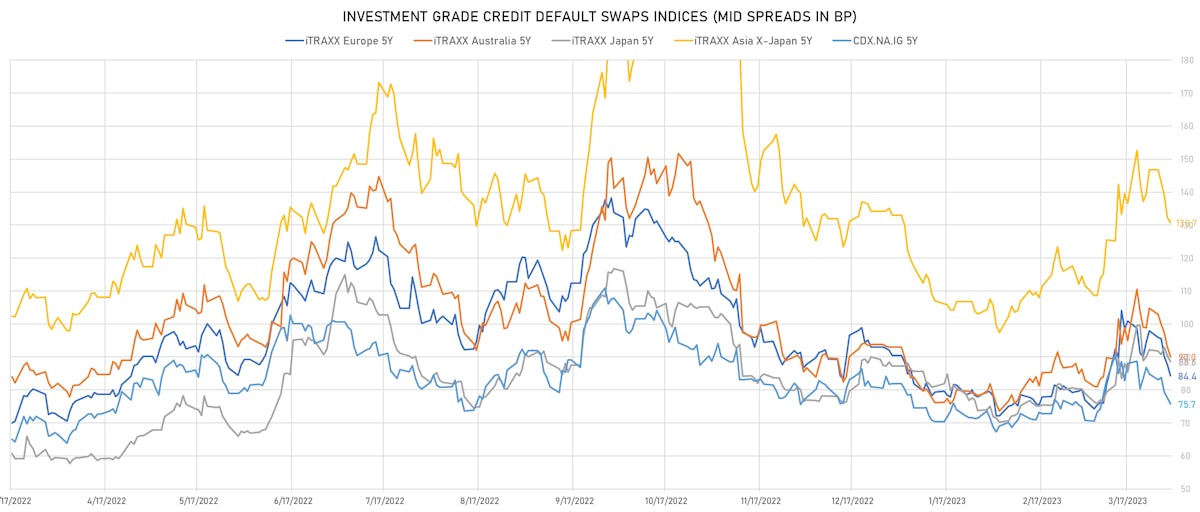

- Markit CDX.NA.IG 5Y down 1.8 bp, now at 76bp (1W change: -9.1bp; YTD change: -6.1bp)

- Markit CDX.NA.IG 10Y down 1.2 bp, now at 112bp (1W change: -8.1bp; YTD change: -6.0bp)

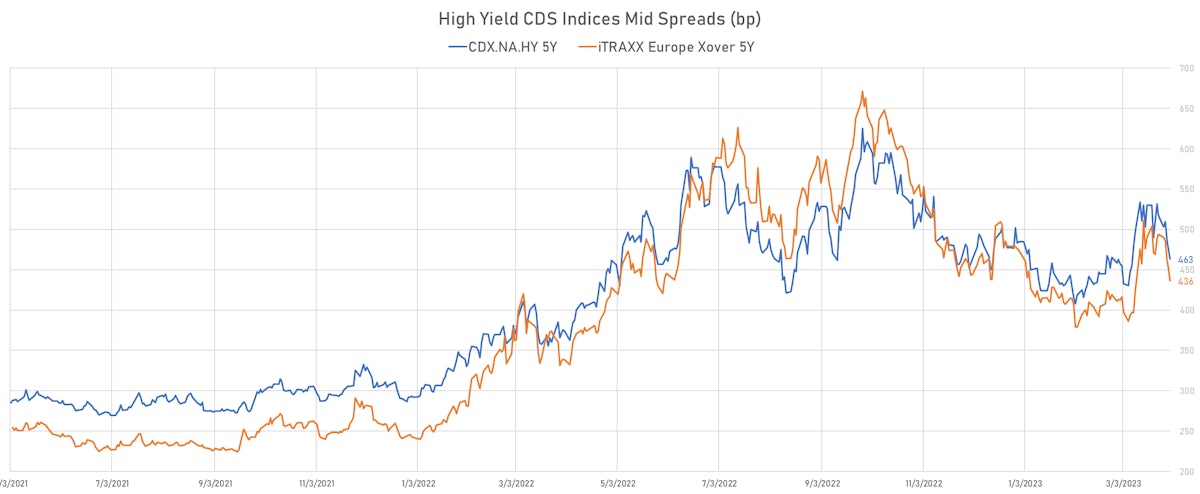

- Markit CDX.NA.HY 5Y down 12.8 bp, now at 463bp (1W change: -54.4bp; YTD change: -21.5bp)

- Markit iTRAXX Europe 5Y down 3.3 bp, now at 84bp (1W change: -13.6bp; YTD change: -6.1bp)

- Markit iTRAXX Europe Crossover 5Y down 16.4 bp, now at 436bp (1W change: -57.7bp; YTD change: -37.8bp)

- Markit iTRAXX Japan 5Y down 1.7 bp, now at 89bp (1W change: -3.6bp; YTD change: +1.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 1.6 bp, now at 131bp (1W change: -16.1bp; YTD change: -2.3bp)

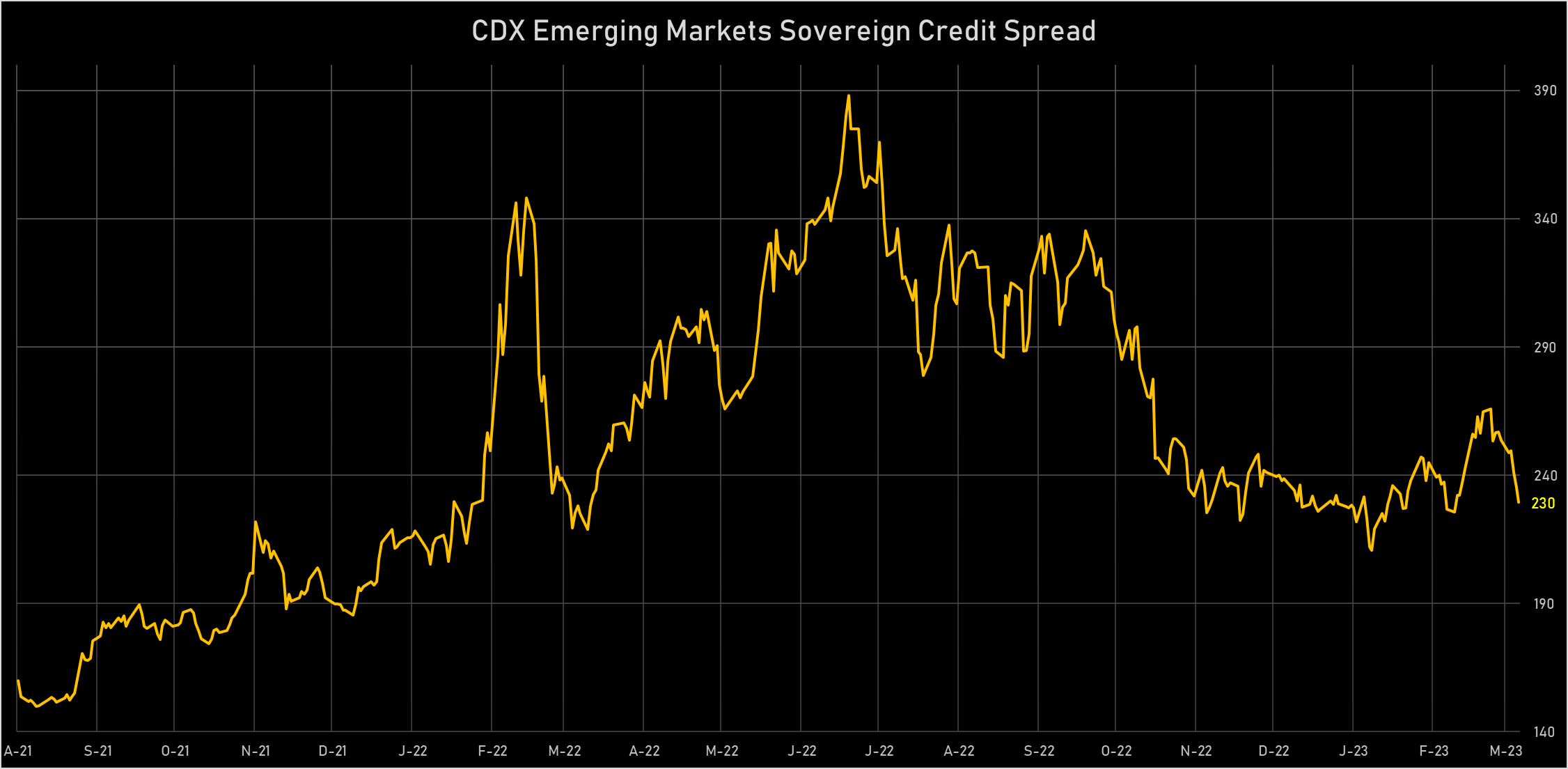

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Chile (rated A-): down 12.5 % to 102 bp (1Y range: 65-174bp)

- Colombia (rated BB+): down 12.9 % to 284 bp (1Y range: 179-394bp)

- Mexico (rated BBB-): down 13.6 % to 118 bp (1Y range: 94-205bp)

- Serbia (rated BB+): down 14.0 % to 259 bp (1Y range: 131-356bp)

- Peru (rated BBB): down 15.5 % to 106 bp (1Y range: 74-171bp)

- Indonesia (rated BBB): down 15.9 % to 92 bp (1Y range: 76-166bp)

- China (rated A+): down 16.2 % to 72 bp (1Y range: 47-132bp)

- Malaysia (rated BBB+): down 17.1 % to 69 bp (1Y range: 57-122bp)

- Philippines (rated BBB): down 17.3 % to 90 bp (1Y range: 77-153bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: CCC+): down 7894.9 bp to .0bp (1Y range: -4,305bp)

- Transocean Inc (Country: KY; rated: Caa1): down 269.4 bp to 940.9bp (1Y range: 674-2,858bp)

- DISH DBS Corp (Country: US; rated: B2): down 264.5 bp to 2,051.1bp (1Y range: 545-2,208bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): down 137.0 bp to 1,079.2bp (1Y range: 435-2,117bp)

- American Airlines Group Inc (Country: US; rated: NR): down 133.6 bp to 945.7bp (1Y range: 607-1,644bp)

- Nabors Industries Inc (Country: US; rated: BB-): down 100.8 bp to 590.9bp (1Y range: 390-887bp)

- Avient Corp (Country: US; rated: A2): down 82.0 bp to 225.0bp (1Y range: 54-429bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): down 80.5 bp to 555.8bp (1Y range: 443-772bp)

- Gap Inc (Country: US; rated: Ba3): down 79.9 bp to 604.0bp (1Y range: 337-819bp)

- Pactiv LLC (Country: US; rated: WR): down 79.9 bp to 326.4bp (1Y range: 326-1,041bp)

- Pitney Bowes Inc (Country: US; rated: NR): down 77.0 bp to 1,207.0bp (1Y range: 625-1,783bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): down 73.2 bp to 349.4bp (1Y range: 124-401bp)

- Kohls Corp (Country: US; rated: BBB): down 69.9 bp to 696.5bp (1Y range: 356-710bp)

- Staples Inc (Country: US; rated: B3): up 88.9 bp to 2,265.6bp (1Y range: 1,101-2,266bp)

- Lumen Technologies Inc (Country: US; rated: LGD5 - 77%): up 262.9 bp to 3,746.9bp (1Y range: 195-3,747bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: Caa3): down 40239.2 bp to .0bp (1Y range: -7,511bp)

- Novafives SAS (Country: FR; rated: Caa1): down 301.2 bp to 976.0bp (1Y range: 618-2,936bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 105.0 bp to 823.0bp (1Y range: 416-1,254bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 76.9 bp to 819.5bp (1Y range: 535-1,296bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 74.4 bp to 863.8bp (1Y range: 401-1,021bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 66.8 bp to 1,191.4bp (1Y range: 566-1,739bp)

- Ceconomy AG (Country: DE; rated: B1): down 64.4 bp to 1,180.6bp (1Y range: 293-1,763bp)

- Telecom Italia SpA (Country: IT; rated: BB-): down 53.3 bp to 337.1bp (1Y range: 306-545bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): down 50.2 bp to 275.7bp (1Y range: 134-420bp)

- Deutsche Bank AG (Country: DE; rated: baa2): down 50.0 bp to 147.5bp (1Y range: 78-205bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 49.9 bp to 631.9bp (1Y range: 370-758bp)

- Credit Suisse Group AG (Country: CH; rated: AA low): down 46.6 bp to 188.1bp (1Y range: 117-1,267bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 36.4 bp to 444.8bp (1Y range: 300-602bp)

- TUI AG (Country: DE; rated: B3-PD): up 59.6 bp to 979.8bp (1Y range: 683-1,725bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 149.9 bp to 2,158.9bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS down by 62.9 bp to 126.3 bp (CDS basis: -20.5bp), with the yield to worst at 5.2% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 97.1-100.3).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS down by 68.7 bp to 131.7 bp, with the yield to worst at 5.1% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: CDW LLC (Vernon Hills, Illinois (US)) | Coupon: 2.67% | Maturity: 1/12/2026 | Rating: BB+ | CUSIP: 12513GBG3 | OAS down by 70.3 bp to 122.9 bp, with the yield to worst at 5.0% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 87.2-92.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 71.1 bp to 123.2 bp, with the yield to worst at 5.4% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS down by 72.7 bp to 128.2 bp, with the yield to worst at 5.0% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS down by 81.5 bp to 129.5 bp (CDS basis: 139.1bp), with the yield to worst at 5.2% and the bond now trading up to 97.1 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: MGM Resorts International (Las Vegas, Nevada (US)) | Coupon: 5.75% | Maturity: 15/6/2025 | Rating: B+ | CUSIP: 552953CE9 | OAS down by 86.0 bp to 146.8 bp (CDS basis: -33.1bp), with the yield to worst at 5.4% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 96.9-100.0).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS down by 94.2 bp to 131.2 bp, with the yield to worst at 5.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 95.3-98.3).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS down by 94.4 bp to 83.7 bp, with the yield to worst at 5.0% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 100.8-103.4).

- Issuer: Las Vegas Sands Corp (Las Vegas, Nevada (US)) | Coupon: 2.90% | Maturity: 25/6/2025 | Rating: BB+ | CUSIP: 517834AH0 | OAS down by 95.3 bp to 118.7 bp, with the yield to worst at 5.4% and the bond now trading up to 94.6 cents on the dollar (1Y price range: 91.8-94.6).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 105.6 bp to 100.7 bp (CDS basis: 13.0bp), with the yield to worst at 4.6% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 5.13% | Maturity: 16/6/2025 | Rating: BB | CUSIP: 345397A60 | OAS down by 107.3 bp to 188.4 bp (CDS basis: -5.5bp), with the yield to worst at 6.1% and the bond now trading up to 97.7 cents on the dollar (1Y price range: 95.3-98.9).

- Issuer: Western Digital Corp (San Jose, California (US)) | Coupon: 4.75% | Maturity: 15/2/2026 | Rating: BB | CUSIP: 958102AM7 | OAS down by 113.5 bp to 217.1 bp, with the yield to worst at 5.9% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 93.0-97.3).

- Issuer: Under Armour Inc (Baltimore, Maryland (US)) | Coupon: 3.25% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 904311AA5 | OAS down by 117.1 bp to 196.4 bp, with the yield to worst at 5.6% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 87.5-93.8).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 4.20% | Maturity: 29/10/2025 | Rating: BB+ | CUSIP: 78442PGD2 | OAS down by 257.5 bp to 444.7 bp, with the yield to worst at 8.2% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 85.1-94.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 1.50% | Maturity: 15/3/2027 | Rating: BB+ | ISIN: XS2080318053 | OAS down by 68.8 bp to 133.0 bp (CDS basis: 23.7bp), with the yield to worst at 4.2% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 86.0-89.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS down by 70.5 bp to 185.3 bp (CDS basis: 15.3bp), with the yield to worst at 4.9% and the bond now trading up to 94.9 cents on the dollar (1Y price range: 92.7-95.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS down by 75.7 bp to 190.9 bp (CDS basis: 44.9bp), with the yield to worst at 4.8% and the bond now trading up to 95.7 cents on the dollar (1Y price range: 92.3-95.9).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS down by 78.4 bp to 488.3 bp, with the yield to worst at 8.1% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 88.0-97.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.88% | Maturity: 6/7/2032 | Rating: BB+ | ISIN: XS2362416617 | OAS down by 78.9 bp to 527.7 bp, with the yield to worst at 8.1% and the bond now trading up to 72.8 cents on the dollar (1Y price range: 66.1-78.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 79.2 bp to 426.0 bp (CDS basis: 200.5bp), with the yield to worst at 7.2% and the bond now trading up to 92.7 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS down by 85.0 bp to 220.3 bp (CDS basis: -5.6bp), with the yield to worst at 5.1% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 90.6-93.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | OAS down by 85.5 bp to 535.8 bp, with the yield to worst at 8.2% and the bond now trading up to 76.7 cents on the dollar (1Y price range: 71.9-82.1).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 85.7 bp to 535.3 bp, with the yield to worst at 7.9% and the bond now trading up to 79.2 cents on the dollar (1Y price range: 74.8-85.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS down by 86.5 bp to 284.7 bp (CDS basis: 19.2bp), with the yield to worst at 5.6% and the bond now trading up to 86.2 cents on the dollar (1Y price range: 82.0-87.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS down by 95.1 bp to 320.7 bp (CDS basis: 33.6bp), with the yield to worst at 5.9% and the bond now trading up to 78.1 cents on the dollar (1Y price range: 72.4-78.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS down by 104.2 bp to 509.4 bp, with the yield to worst at 7.6% and the bond now trading up to 87.7 cents on the dollar (1Y price range: 82.7-92.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.75% | Maturity: 30/7/2025 | Rating: BB- | ISIN: XS1266662334 | OAS down by 107.9 bp to 358.2 bp, with the yield to worst at 6.9% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 92.9-97.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | OAS down by 112.7 bp to 443.6 bp, with the yield to worst at 7.5% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 81.0-88.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS down by 130.5 bp to 366.7 bp, with the yield to worst at 6.4% and the bond now trading up to 91.5 cents on the dollar (1Y price range: 88.0-94.3).

RECENT DOMESTIC USD BOND ISSUES

- Allstate Corp (Property and Casualty Insurance | Northbrook, Illinois, United States | Rating: A-): US$750m Senior Note (US020002BK68), fixed rate (5.25% coupon) maturing on 30 March 2033, priced at 99.83 (original spread of 171 bp), callable (10nc10)

- Amphenol Corp (Electronics | Wallingford, Connecticut, United States | Rating: BBB+): US$350m Senior Note (US032095AM37), fixed rate (4.75% coupon) maturing on 30 March 2026, priced at 99.66 (original spread of 107 bp), with a make whole call

- Archer-Daniels-Midland Co (Food Processors | Chicago, Illinois, United States | Rating: A): US$500m Senior Note (US039482AE41), fixed rate (4.50% coupon) maturing on 15 August 2033, priced at 99.07 (original spread of 108 bp), callable (10nc10)

- Berry Global Inc (Industrials - Other | Evansville, Indiana, United States | Rating: BBB-): US$500m Note (US08576PAK75), fixed rate (5.50% coupon) maturing on 15 April 2028, priced at 99.10 (original spread of 210 bp), callable (5nc5)

- Citigroup Global Markets Holdings Inc (Securities | New York City, New York, United States | Rating: A): US$120m Unsecured Note (XS2565580334), fixed rate (0.85% coupon) maturing on 29 March 2028, priced at 100.00, non callable

- Customers Bank (Banking | Phoenixville, Pennsylvania, United States | Rating: NR): US$150m Certificate of Deposit - Retail (US23204HNV68), fixed rate (5.00% coupon) maturing on 31 March 2026, priced at 100.00 (original spread of 113 bp), non callable

- EnLink Midstream LLC (Oil and Gas | Dallas, Texas, United States | Rating: BBB-): US$300m Senior Note (USU26790AD49), fixed rate (6.50% coupon) maturing on 1 September 2030, priced at 99.00 (original spread of 311 bp), callable (7nc7)

- General Mills Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: BBB): US$1,000m Senior Note (US370334CT90), fixed rate (4.95% coupon) maturing on 29 March 2033, priced at 99.80 (original spread of 145 bp), callable (10nc10)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$152m Senior Note (XS2480975825) zero coupon maturing on 19 April 2028, non callable

- Labl Inc (Industrials - Other | Green Bay, Wisconsin, United States | Rating: B-): US$300m Senior Note (USU5022TAE65), fixed rate (9.50% coupon) maturing on 1 November 2028, priced at 100.00 (original spread of 585 bp), callable (6nc3)

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$1,000m Senior Note (US548661EQ61), fixed rate (5.15% coupon) maturing on 1 July 2033, priced at 100.00 (original spread of 160 bp), callable (10nc10)

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$500m Senior Note (US548661ER45), fixed rate (5.75% coupon) maturing on 1 July 2053, priced at 99.87 (original spread of 237 bp), callable (30nc30)

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$500m Senior Note (US548661ES28), fixed rate (5.85% coupon) maturing on 1 April 2063, priced at 99.85 (original spread of 265 bp), callable (40nc40)

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$1,000m Senior Note (US548661EP88), fixed rate (4.80% coupon) maturing on 1 April 2026, priced at 99.98 (original spread of 95 bp), callable (3nc3)

- Metropolitan Edison Co (Utility - Other | Akron, Ohio, United States | Rating: BBB): US$425m Senior Note (USU5919UAG41), fixed rate (5.20% coupon) maturing on 1 April 2028, priced at 99.86 (original spread of 165 bp), callable (5nc5)

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA+): US$600m Note (US64952WFB46), fixed rate (4.70% coupon) maturing on 2 April 2026, priced at 99.90 (original spread of 91 bp), non callable

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA+): US$300m Note (US64953BBA52), floating rate (SOFR + 93.0 bp) maturing on 2 April 2026, priced at 100.00, non callable

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$500m Senior Note (US69371RS496), fixed rate (4.45% coupon) maturing on 30 March 2026, priced at 99.93 (original spread of 68 bp), non callable

- Pacific Gas and Electric Co (Utility - Other | Oakland, California, United States | Rating: BBB-): US$750m First Mortgage Bond (US694308KK29), fixed rate (6.70% coupon) maturing on 1 April 2053, priced at 99.64 (original spread of 321 bp), callable (30nc30)

- Pacific Life Global Funding II (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$400m Note (US6944PM2U04), fixed rate (4.90% coupon) maturing on 4 April 2028, priced at 99.61 (original spread of 135 bp), non callable

- Pennsylvania Electric Co (Utility - Other | Akron, Ohio, United States | Rating: BBB): US$300m Senior Note (USU70842AE69), fixed rate (5.15% coupon) maturing on 30 March 2026, priced at 99.86 (original spread of 140 bp), with a make whole call

- Penske Truck Leasing Co LP (Leasing | Reading, Pennsylvania, United States | Rating: BBB): US$750m Senior Note (US709599BT09), fixed rate (5.55% coupon) maturing on 1 May 2028, priced at 99.54 (original spread of 205 bp), callable (5nc5)

- Phillips 66 Co (Oil and Gas | Houston, Texas, United States | Rating: BBB+): US$500m Senior Note (US718547AR30), fixed rate (5.30% coupon) maturing on 30 June 2033, priced at 99.53 (original spread of 182 bp), callable (10nc10)

- Phillips 66 Co (Oil and Gas | Houston, Texas, United States | Rating: BBB+): US$750m Senior Note (US718547AT95), fixed rate (4.95% coupon) maturing on 1 December 2027, priced at 99.77 (original spread of 140 bp), callable (5nc5)

- Pioneer Natural Resources Co (Oil and Gas | Irving, Texas, United States | Rating: BBB): US$1,100m Senior Note (US723787AV90), fixed rate (5.10% coupon) maturing on 29 March 2026, priced at 99.95 (original spread of 132 bp), with a make whole call

- Public Service Company of Colorado (Utility - Other | Denver, Colorado, United States | Rating: A): US$850m First Mortgage Bond (US744448CY50), fixed rate (5.25% coupon) maturing on 1 April 2053, priced at 99.30 (original spread of 187 bp), callable (30nc30)

- Rexford Industrial Realty LP (Financial - Other | Los Angeles, California, United States | Rating: BBB): US$300m Senior Note (US76169XAC83), fixed rate (5.00% coupon) maturing on 15 June 2028, priced at 98.98 (original spread of 171 bp), callable (5nc5)

- Southwestern Electric Power Co (Utility - Other | Columbus, Ohio, United States | Rating: BBB): US$350m Senior Note (US845437BU53), fixed rate (5.30% coupon) maturing on 1 April 2033, priced at 99.87 (original spread of 178 bp), callable (10nc10)

- Stem Inc (Service - Other | San Francisco, California, United States | Rating: NR): US$200m Bond (US85859NAC65), fixed rate (4.25% coupon) maturing on 1 April 2030, priced at 100.00, non callable, convertible

- Virginia Electric and Power Co (Utility - Other | Richmond, Virginia, United States | Rating: BBB+): US$750m Senior Note (US927804GK44), fixed rate (5.00% coupon) maturing on 1 April 2033, priced at 99.72 (original spread of 151 bp), callable (10nc10)

- Virginia Electric and Power Co (Utility - Other | Richmond, Virginia, United States | Rating: BBB+): US$750m Senior Note (US927804GL27), fixed rate (5.45% coupon) maturing on 1 April 2053, priced at 99.33 (original spread of 211 bp), callable (30nc30)

- Western Midstream Operating LP (Oil and Gas | The Woodlands, Texas, United States | Rating: BB+): US$750m Senior Note (US958667AE72), fixed rate (6.15% coupon) maturing on 1 April 2033, priced at 99.73 (original spread of 263 bp), callable (10nc10)

- Wisconsin Power and Light Co (Utility - Other | Madison, Wisconsin, United States | Rating: A-): US$300m Senior Debenture (US976826BR76), fixed rate (4.95% coupon) maturing on 1 April 2033, priced at 99.83 (original spread of 148 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- AIA Group Ltd (Life Insurance | Hong Kong | Rating: A+): US$600m Senior Note (US00131MAP86), fixed rate (4.95% coupon) maturing on 4 April 2033, priced at 99.65 (original spread of 145 bp), callable (10nc10)

- Aerotropolis City Development Group Co Ltd (Transportation - Other | Chengdu, Sichuan, China (Mainland) | Rating: BB+): US$175m Bond (XS2599011116), fixed rate (6.90% coupon) maturing on 11 April 2026, priced at 100.00, non callable

- Al Rajhi Sukuk Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: A-): US$1,000m Islamic Sukuk (Hybrid) (XS2607535684), fixed rate (4.75% coupon) maturing on 5 April 2028, priced at 99.89 (original spread of 110 bp), non callable

- Avadel Finance Cayman Ltd (Financial - Other | Chesterfield Missouri, Missouri, Ireland | Rating: NR): US$106m Bond (US05337YAD04), fixed rate (6.00% coupon) maturing on 1 April 2027, priced at 100.00, non callable, convertible

- Aviation Capital Group LLC (Leasing | Newport Beach, California, Japan | Rating: BBB-): US$600m Senior Note (USU0536PAK04), fixed rate (6.25% coupon) maturing on 15 April 2028, priced at 99.20 (original spread of 275 bp), callable (5nc5)

- Bank Mandiri (Persero) Tbk PT (Banking | Jakarta Selatan, Dki Jakarta, Indonesia | Rating: BBB-): US$300m Senior Note (XS2577785921), fixed rate (5.50% coupon) maturing on 4 April 2026, priced at 99.58 (original spread of 183 bp), non callable

- City National Bank (California) (Banking | Los Angeles, California, Canada | Rating: A): US$552m Certificate of Deposit - Retail (US178180GY59), fixed rate (5.00% coupon) maturing on 31 March 2028, priced at 100.00 (original spread of 132 bp), non callable

- City National Bank (California) (Banking | Los Angeles, California, Canada | Rating: A): US$448m Certificate of Deposit - Retail (US178180GX76), fixed rate (5.10% coupon) maturing on 31 March 2026, priced at 100.00 (original spread of 113 bp), non callable

- Costa Rica, Republic of (Government) (Sovereign | San Jose, San Jose, Costa Rica | Rating: B): US$1,500m Senior Note (USP3699PGM34), fixed rate (6.55% coupon) maturing on 3 April 2034, priced at 100.00 (original spread of 309 bp), callable (11nc11)

- HBIS Group Hong Kong Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$300m Bond (XS2550871185) maturing on 31 October 2025, priced at 100.00, non callable

- Hyundai Capital America (Financial - Other | Irvine, California, South Korea | Rating: BBB+): US$1,200m Senior Note (US44891ACB17), fixed rate (5.50% coupon) maturing on 30 March 2026, priced at 99.64 (original spread of 175 bp), with a make whole call

- Hyundai Capital America (Financial - Other | Irvine, California, South Korea | Rating: BBB+): US$500m Senior Note (US44891ACE55), fixed rate (5.80% coupon) maturing on 1 April 2030, priced at 99.60 (original spread of 225 bp), callable (7nc7)

- Hyundai Capital America (Financial - Other | Irvine, California, South Korea | Rating: BBB+): US$800m Senior Note (US44891ACD72), fixed rate (5.60% coupon) maturing on 30 March 2028, priced at 99.72 (original spread of 202 bp), callable (5nc5)

- Korea Mine Rehabilitation and Mineral Resources Corp (Service - Other | Wonju, Gangwon-Do, South Korea | Rating: A+): US$500m Senior Note (XS2600704956), fixed rate (5.38% coupon) maturing on 11 May 2028, priced at 99.23 (original spread of 186 bp), non callable

- Korea National Oil Corp (Agency | Ulsan, Ulsan, South Korea | Rating: AA): US$450m Senior Note (US50065XAP96), fixed rate (4.88% coupon) maturing on 3 April 2028, priced at 99.83 (original spread of 135 bp), non callable

- Korea National Oil Corp (Agency | Ulsan, Ulsan, South Korea | Rating: AA): US$550m Senior Note (US50065XAQ79), fixed rate (4.75% coupon) maturing on 3 April 2026, priced at 99.45 (original spread of 120 bp), non callable

- Latina Offshore Ltd (Financial - Other | Miguel Hidalgo, Mexico, D.F., Mexico | Rating: NR): US$130m Bond (NO0012864414), fixed rate (7.00% coupon) maturing on 13 April 2028, callable (5nc1m)

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A-): US$300m Senior Note (USU5876JAD73), floating rate (SOFR + 93.0 bp) maturing on 30 March 2025, priced at 100.00, non callable

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A-): US$1,000m Senior Note (USU5876JAF22), fixed rate (4.80% coupon) maturing on 30 March 2026, priced at 99.87 (original spread of 105 bp), with a make whole call

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A-): US$700m Senior Note (USU5876JAE56), fixed rate (4.95% coupon) maturing on 30 March 2025, priced at 99.97 (original spread of 95 bp), with a make whole call

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A-): US$1,000m Senior Note (USU5876JAG05), fixed rate (4.80% coupon) maturing on 30 March 2028, priced at 99.86 (original spread of 123 bp), with a make whole call

- Netherlands Development Finance Company NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$500m Senior Note (XS2608635178), fixed rate (4.38% coupon) maturing on 4 April 2025, priced at 99.85 (original spread of 28 bp), non callable

- Northern Star Resources Ltd (Metals/Mining | Subiaco, Western Australia, Australia | Rating: BBB-): US$600m Senior Note (US66573RAA68), fixed rate (6.13% coupon) maturing on 11 April 2033, priced at 99.01 (original spread of 270 bp), callable (10nc10)

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): US$150m Unsecured Note (XS2607552697), fixed rate (3.98% coupon) maturing on 13 April 2026, priced at 100.00, non callable

- Poland, Republic of (Government) (Sovereign | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): US$2,500m Senior Note (US731011AW25), fixed rate (5.50% coupon) maturing on 4 April 2053, priced at 98.77 (original spread of 211 bp), callable (30nc30)

- Poland, Republic of (Government) (Sovereign | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): US$2,500m Senior Note (US731011AV42), fixed rate (4.88% coupon) maturing on 4 October 2033, priced at 99.25 (original spread of 142 bp), callable (11nc10)

- Sudameris Bank SAECA (Banking | Asuncion, Ireland | Rating: NR): US$115,000m Bond (PYSUD01F4937), fixed rate (9.27% coupon) maturing on 26 March 2026, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,500m Covered Bond (Other) (XS2607079493), fixed rate (3.44% coupon) maturing on 4 April 2025, priced at 100.00 (original spread of 90 bp), non callable

- Bank of Montreal (Banking | Toronto, Ontario, Canada | Rating: A+): €2,000m Bond (XS2607350985), fixed rate (3.38% coupon) maturing on 4 July 2026, priced at 99.98 (original spread of 102 bp), non callable

- Berlin, State of (Official and Muni | Berlin, Berlin, Germany | Rating: AA+): €1,000m Jumbo Landesschatzanweisung (DE000A3MQYQ9), fixed rate (2.88% coupon) maturing on 5 April 2029, priced at 99.76 (original spread of 68 bp), non callable

- CIMA Finance DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €228m Unsecured Note (XS2609462002), floating rate maturing on 25 March 2053, priced at 100.00, non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: AAA): €1,500m Covered Bond (Other) (XS2607063497), fixed rate (3.25% coupon) maturing on 31 March 2027, priced at 99.59 (original spread of 111 bp), non callable

- Codeis Securities SA (Financial - Other | Senningerberg, France | Rating: NR): €223m Unsecured Note (XS1846535752), floating rate maturing on 20 December 2027, priced at 102.75, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C300), fixed rate (2.20% coupon) maturing on 2 May 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VCQ2), floating rate maturing on 27 April 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VCH1), floating rate maturing on 20 April 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VCK5), fixed rate (3.70% coupon) maturing on 20 April 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VCJ7), fixed rate (3.00% coupon) maturing on 24 April 2025, priced at 100.00, non callable

- Flemish, Community of (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €1,250m Bond (BE0002934157), fixed rate (3.25% coupon) maturing on 5 April 2033, priced at 99.20 (original spread of 100 bp), non callable

- General Mills Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: BBB): €750m Senior Note (XS2605914105), fixed rate (3.91% coupon) maturing on 13 April 2029, priced at 100.00 (original spread of 169 bp), callable (6nc6)

- Greece, Republic of (Government) (Sovereign | Athina, Attiki, Greece | Rating: BB-): €2,500m Senior Note (GR0114033583), fixed rate (3.88% coupon) maturing on 15 June 2028, priced at 99.81 (original spread of 161 bp), non callable

- Harley-Davidson Financial Services Inc (Financial - Other | Carson City, Nevada, United States | Rating: BBB-): €700m Senior Note (XS2607183980), fixed rate (5.13% coupon) maturing on 5 April 2026, priced at 99.70 (original spread of 280 bp), callable (3nc3)

- Holding d'infrastructures Des Metiers De l'environnement SAS (Financial - Other | Issy-Les-Moulineaux, Ile-De-France, Netherlands | Rating: BBB-): €300m Senior Note (XS2608828641), fixed rate (4.50% coupon) maturing on 6 April 2027, priced at 99.60 (original spread of 226 bp), with a make whole call

- Koninklijke Ahold Delhaize NV (Retail Stores - Food/Drug | Zaandam, Noord-Holland, Netherlands | Rating: BBB+): €500m Senior Note (XS2596537972), fixed rate (3.50% coupon) maturing on 4 April 2028, priced at 99.85 (original spread of 129 bp), callable (5nc5)

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AA-): €500m Covered Bond (Other) (XS2545731759), fixed rate (3.71% coupon) maturing on 11 April 2027, priced at 100.00 (original spread of 141 bp), non callable

- Malta, Republic of (Government) (Sovereign | Valletta, Malta | Rating: A+): €240m Bond (MT0000013616), fixed rate (4.00% coupon) maturing on 30 March 2032, priced at 100.00, non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €600m Note (XS2606297864), fixed rate (4.00% coupon) maturing on 5 April 2028, priced at 99.95 (original spread of 173 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,000m Senior Note (DE000NWB0AT4), fixed rate (2.88% coupon) maturing on 5 April 2033, priced at 99.03 (original spread of 70 bp), non callable

- National Gas Transmission PLC (Gas Utility - Local Distrib | London, United Kingdom | Rating: BBB+): €550m Senior Note (XS2607040958), fixed rate (4.25% coupon) maturing on 5 April 2030, priced at 99.96 (original spread of 202 bp), callable (7nc7)

- Nexans SA (Industrials - Other | Courbevoie, Ile-De-France, France | Rating: BB+): €400m Bond (FR001400H0F5), fixed rate (5.50% coupon) maturing on 5 April 2028, priced at 100.00 (original spread of 321 bp), callable (5nc5)

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: AA+): €250m Hypothekenpfandbrief (Covered Bond) (DE000NLB4RL0), floating rate (EU06MLIB + 4.0 bp) maturing on 25 March 2027, priced at 100.00, non callable

- RCI Banque SA (Financial - Other | Paris, Ile-De-France, France | Rating: BBB-): €750m Bond (FR001400H2O3), fixed rate (4.50% coupon) maturing on 6 April 2027, priced at 99.82 (original spread of 234 bp), callable (4nc4)

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €750m Bond (FR001400H5F4), fixed rate (3.38% coupon) maturing on 6 April 2025, priced at 99.88 (original spread of 67 bp), callable (2nc2)

- Securitas Treasury Ireland DAC (Financial - Other | Dublin, Sweden | Rating: NR): €600m Senior Note (XS2607381436), fixed rate (4.25% coupon) maturing on 4 April 2027, priced at 99.92 (original spread of 194 bp), callable (4nc4)

- Siemens Energy Finance BV (Financial - Other | Zoeterwoude, Zuid-Holland, Germany | Rating: NR): €750m Senior Note (XS2601458602), fixed rate (4.00% coupon) maturing on 5 April 2026, priced at 99.73 (original spread of 158 bp), callable (3nc3)

- Siemens Energy Finance BV (Financial - Other | Zoeterwoude, Zuid-Holland, Germany | Rating: NR): €750m Senior Note (XS2601459162), fixed rate (4.25% coupon) maturing on 5 April 2029, priced at 99.48 (original spread of 205 bp), callable (6nc6)

- Societe du Grand Paris (Agency | Saint-Denis, Ile-De-France, France | Rating: AA): €1,000m Bond (FR001400H4K7), fixed rate (3.70% coupon) maturing on 25 May 2053, priced at 99.43 (original spread of 135 bp), non callable

- Stadshypotek AB (Mortgage Banking | Stockholm, Stockholm, Sweden | Rating: AA-): €1,000m Sakerstallda Obligation (Covered Bond) (XS2607344079), fixed rate (3.13% coupon) maturing on 4 April 2028, priced at 99.98 (original spread of 89 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €500m Covered Bond (Other) (XS2603552014), fixed rate (3.63% coupon) maturing on 6 April 2026, priced at 100.00 (original spread of 121 bp), non callable

- Swedbank Hypotek AB (Mortgage Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): €1,000m Sakerstallda Obligation (Covered Bond) (XS2607781882), fixed rate (3.13% coupon) maturing on 5 July 2028, priced at 99.69 (original spread of 91 bp), non callable

- Virtuo Finance SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €202m Unsecured Note (XS2606994155), floating rate maturing on 23 October 2030, priced at 100.00, non callable

- Virtuo Finance SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €101m Unsecured Note (XS2606993934), floating rate maturing on 23 October 2030, priced at 100.00, non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,250m Bond (XS2606993694), fixed rate (3.46% coupon) maturing on 4 April 2025, priced at 100.00 (original spread of 87 bp), non callable

- Wolters Kluwer NV (Publishing | Alphen Aan Den Rijn, Zuid-Holland, Netherlands | Rating: BBB+): €700m Bond (XS2592516210), fixed rate (3.75% coupon) maturing on 3 April 2031, priced at 99.42 (original spread of 165 bp), callable (8nc8)

RECENT LOANS

- Albea Beauty Holdings SA (France | B-), signed a € 95m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/24/27.

- Blackstone Real Partners X LP (United States of America), signed a US$ 425m Revolving Credit Facility, to be used for real estate/ppty acq. It matures on 08/09/24 and initial pricing is set at Term SOFR +170.0bp

- China Merchants Union (BVI) (Hong Kong), signed a US$ 900m Term Loan, to be used for working capital. It matures on 03/30/26.

- Chn Png An Ins Ovrs (Hldg) Ltd (Hong Kong), signed a US$ 143m Term Loan, to be used for general corporate purposes. It matures on 03/30/26 and initial pricing is set at Term SOFR +160.0bp

- Chn Png An Ins Ovrs (Hldg) Ltd (Hong Kong), signed a US$ 157m Term Loan, to be used for general corporate purposes. It matures on 03/30/26 and initial pricing is set at Term SOFR +160.0bp

- Convoy Km Apartments Owner LLC (United States of America), signed a US$ 151m Term Loan, to be used for real estate/ppty acq. It matures on 03/24/27 and initial pricing is set at Term SOFR +300.0bp

- DCRT (United States of America), signed a US$ 264m Term Loan, to be used for real estate/ppty acq. It matures on 03/15/29.

- Drug Royalty III LP (Cayman Islands), signed a US$ 225m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 03/30/26.

- ERG SpA (Italy), signed a € 100m Term Loan, to be used for general corporate purposes. It matures on 03/23/28.

- Endesa SA (Spain | BBB+), signed a € 425m Term Loan, to be used for general corporate purposes. It matures on 03/24/28.

- Energean Oil & Gas SA (Greece), signed a US$ 350m Term Loan, to be used for general corporate purposes. It matures on 03/23/25.

- Howden Group Holdings Ltd (United Kingdom | B), signed a US$ 500m Term Loan B, to be used for acquisition financing. It matures on 04/07/30 and initial pricing is set at Term SOFR +400.0bp

- Inabata & Co Ltd (Japan), signed a US$ 200m Revolving Credit Facility, to be used for working capital. It matures on 03/31/26.

- Krispy Kreme Doughnuts Inc (United States of America), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/23/28.

- Krispy Kreme Doughnuts Inc (United States of America), signed a US$ 700m Term Loan A, to be used for general corporate purposes. It matures on 03/23/28.

- Melissa & Doug LLC (United States of America), signed a US$ 260m Term Loan B, to be used for general corporate purposes. It matures on 06/21/26 and initial pricing is set at Term SOFR +550.0bp

- Mitre Corp (United States of America), signed a US$ 375m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/23/28 and initial pricing is set at Term SOFR +200.0bp

- Oncor Electric Delivery Co LLC (United States of America | A), signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 04/30/24 and initial pricing is set at Term SOFR +95.0bp

- PY22 (Paraguay), signed a US$ 135m Term Loan, to be used for general corporate purposes.

- Pan American Silver Corp (Canada), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/08/25.

- Pan American Silver Corp (Canada), signed a US$ 500m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 01/01/26.

- Realterm Logistics Income (United States of America), signed a US$ 425m Term Loan, to be used for general corporate purposes. It matures on 08/06/26 and initial pricing is set at Term SOFR +155.0bp

- Realterm Logistics Income (United States of America), signed a US$ 425m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/06/24 and initial pricing is set at Term SOFR +160.0bp

- Rizal Commercial Banking Corp (Philippines), signed a US$ 150m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 03/23/26 and initial pricing is set at Term SOFR +105.0bp

- Robinhood Sec Llc (United States of America), signed a US$ 2,175m 364d Revolver, to be used for general corporate purposes and working capital. It matures on 03/22/24 and initial pricing is set at Term SOFR +250.0bp

- Rogers Corp (United States of America), signed a US$ 450m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/24/28 and initial pricing is set at Term SOFR +175.0bp

- STARK Group A/S (Denmark), signed a € 450m Term Loan B, to be used for general corporate purposes. It matures on 05/19/28.

- San Miguel Corp (Philippines), signed a US$ 1,200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 03/22/28.

- Stena Finans AB (Sweden), signed a € 93m Revolving Credit Facility, to be used for ship financing. It matures on 03/23/28.

- Sumitomo Corp (Japan | BBB+), signed a US$ 1,060m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/23/25 and initial pricing is set at Term SOFR +50.0bp

- Turk Eximbank (Turkey), signed a € 150m 364d Revolver, to be used for general corporate purposes. It matures on 04/19/24 and initial pricing is set at EURIBOR +365.0bp

- Turk Eximbank (Turkey), signed a US$ 162m 364d Revolver, to be used for general corporate purposes. It matures on 04/19/24 and initial pricing is set at Term SOFR +390.0bp

- US Silica Co (United States of America | B), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/23/28 and initial pricing is set at Term SOFR +475.0bp

- US Silica Co (United States of America | B), signed a US$ 950m Term Loan B, to be used for general corporate purposes. It matures on 03/23/30 and initial pricing is set at Term SOFR +475.0bp

- Uniti Group Inc (United States of America | CCC), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/10/27 and initial pricing is set at Term SOFR +400.0bp

- Vattenfall AB (Sweden | BBB+), signed a € 3,000m Term Loan, to be used for general corporate purposes and restructuring.