Credit

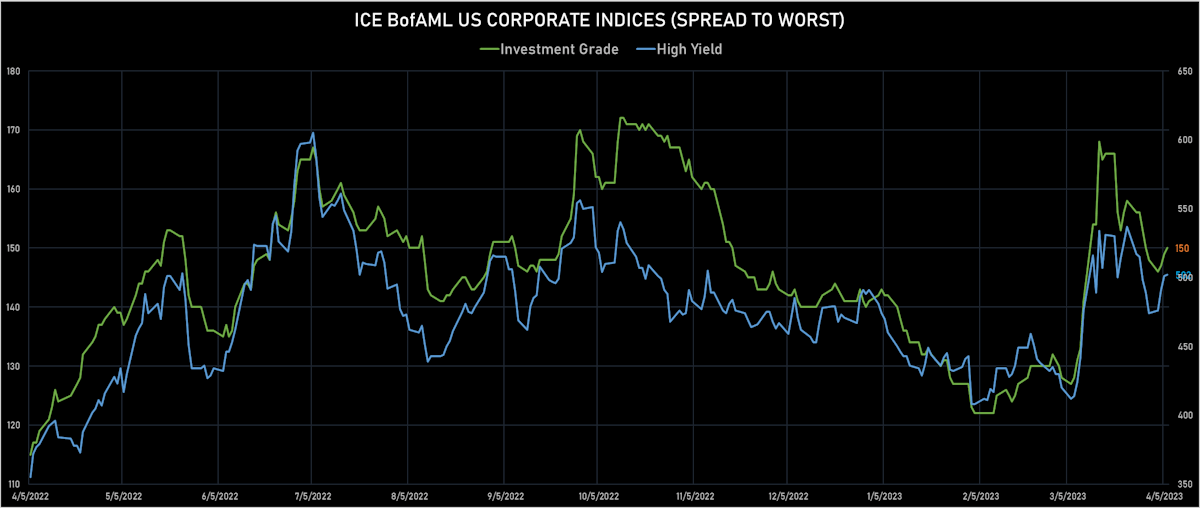

Despite The Significant Recent Widening Across The Complex, USD Credit Spreads Are Close To Unchanged YTD

Short week to kick off April after a very slow month of March: 15 tranches for $9.8bn in USD IG (2023 YTD volume $410.34bn vs 2022 YTD $480.291bn) in IG, 7 tranches for $8.337bn in HY (2023 YTD volume $48.512bn vs 2022 YTD $47.611bn)

Published ET

ICE BofAML US IG & HY Spreads To Worst | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

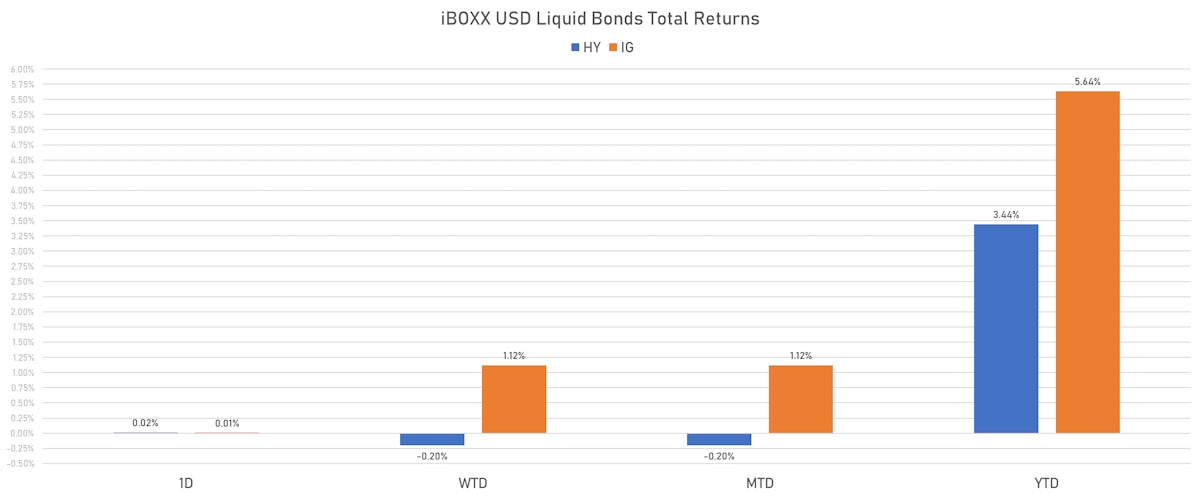

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.009% today (Week-to-date: 1.12%; Month-to-date: 1.12%; Year-to-date: 5.64%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.015% today (Week-to-date: -0.20%; Month-to-date: -0.20%; Year-to-date: 3.44%)

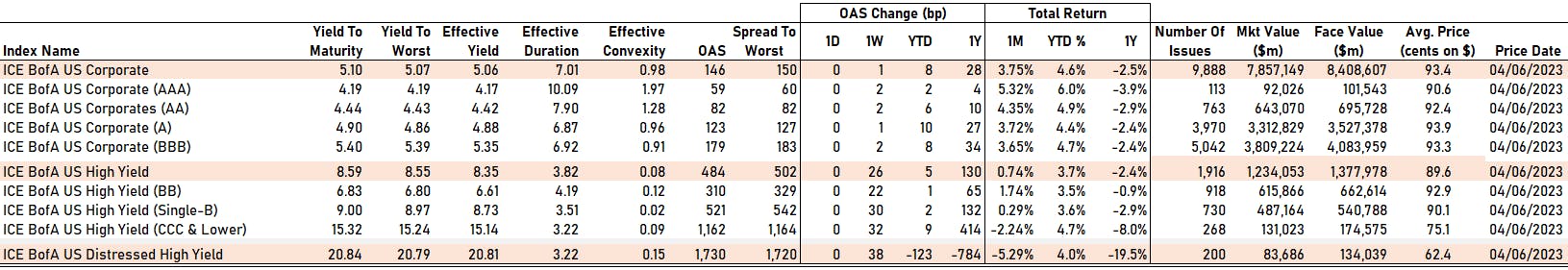

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 150.0 bp (WTD change: +2.0 bp; YTD change: +10.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 502.0 bp (WTD change: +28.0 bp; YTD change: +14.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 59 bp

- AA unchanged at 82 bp

- A unchanged at 123 bp

- BBB unchanged at 179 bp

- BB unchanged at 310 bp

- B unchanged at 521 bp

- ≤ CCC unchanged at 1,162 bp

CDS INDICES TODAY (mid-spreads)

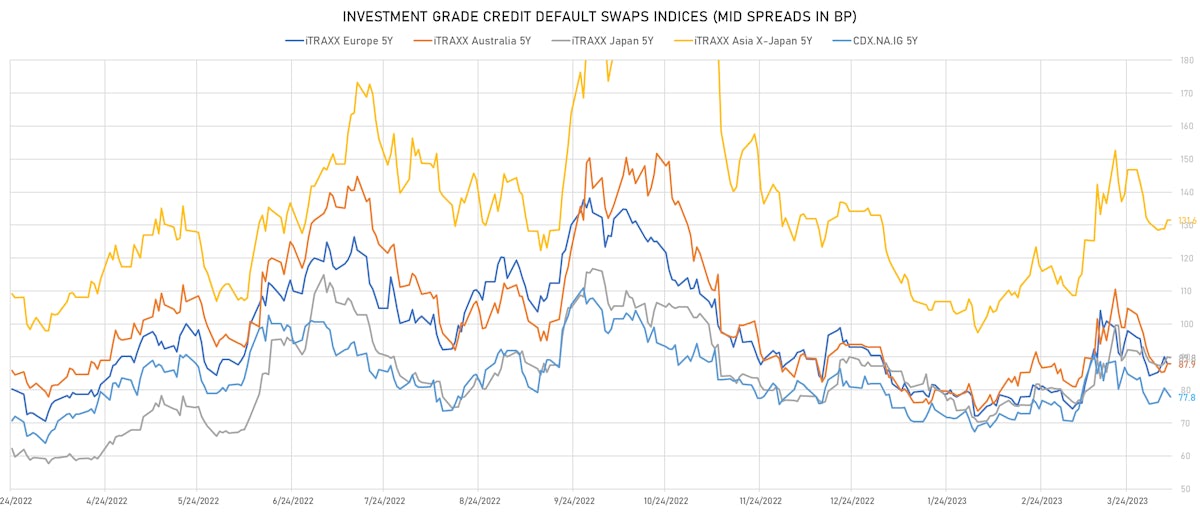

- Markit CDX.NA.IG 5Y down 1.4 bp, now at 78bp (1W change: +2.1bp; YTD change: -4.0bp)

- Markit CDX.NA.IG 10Y down 1.4 bp, now at 114bp (1W change: +2.1bp; YTD change: -3.9bp)

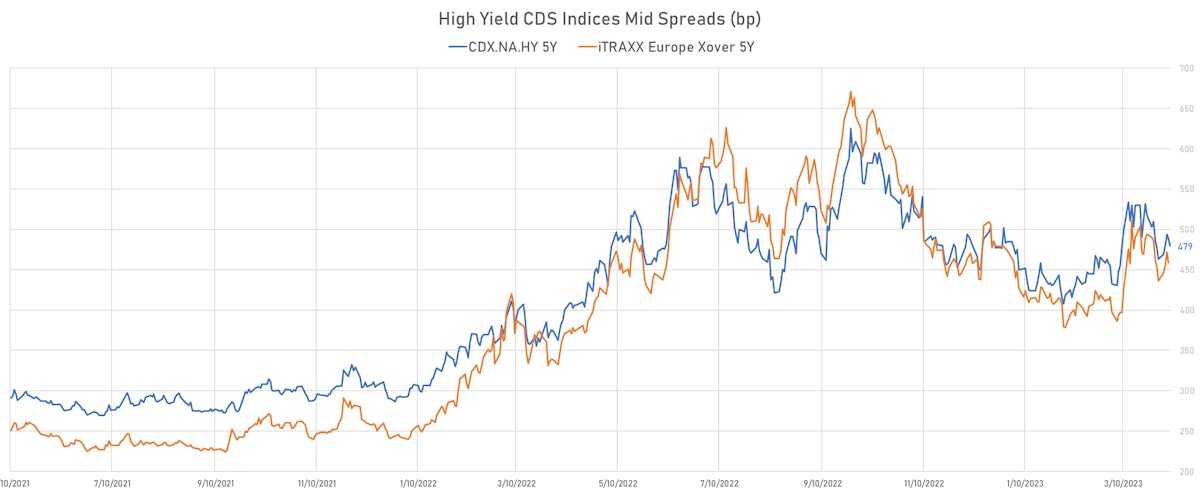

- Markit CDX.NA.HY 5Y down 9.9 bp, now at 479bp (1W change: +16.1bp; YTD change: -5.4bp)

- Markit iTRAXX Europe 5Y unchanged at 88bp (1W change: +3.6bp; YTD change: -2.5bp)

- Markit iTRAXX Europe Crossover 5Y down 12.8 bp, now at 459bp (1W change: +6.3bp; YTD change: -15.1bp)

- Markit iTRAXX Japan 5Y down 0.3 bp, now at 90bp (1W change: +1.2bp; YTD change: +2.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y unchanged at 132bp (1W change: +0.9bp; YTD change: -1.4bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Chile (rated A-): up 6.5 % to 109 bp (1Y range: 75-174bp)

- Czech Republic (rated AA-): up 5.6 % to 75 bp (1Y range: 4-77bp)

- Israel (rated A+): up 5.2 % to 61 bp (1Y range: 43-78bp)

- Italy (rated BBB): up 4.6 % to 112 bp (1Y range: 88-179bp)

- Panama (rated WD): up 4.4 % to 121 bp (1Y range: 86-187bp)

- Mexico (rated BBB-): up 4.1 % to 123 bp (1Y range: 103-205bp)

- Peru (rated BBB): up 3.2 % to 109 bp (1Y range: 88-171bp)

- Colombia (rated BB+): up 3.1 % to 293 bp (1Y range: 185-394bp)

- Malaysia (rated BBB+): up 2.7 % to 71 bp (1Y range: 57-122bp)

- Jamaica (rated B+): down 13.3 % to 391 bp (1Y range: 338-392bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- KB Home (Country: US; rated: BB): up 28.6 bp to 265.6bp (1Y range: 241-485bp)

- MDC Holdings Inc (Country: US; rated: A1): up 31.0 bp to 190.8bp (1Y range: 154-321bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): up 38.0 bp to 593.8bp (1Y range: 443-772bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: NR): up 44.1 bp to 586.6bp (1Y range: 401-1,584bp)

- Lincoln National Corp (Country: US; rated: A3): up 45.0 bp to 327.6bp (1Y range: 98-332bp)

- Tegna Inc (Country: US; rated: Ba3): up 49.9 bp to 434.9bp (1Y range: 182-786bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 52.6 bp to 829.4bp (1Y range: 401-1,046bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 66.6 bp to 1,272.1bp (1Y range: 665-1,783bp)

- Nordstrom Inc (Country: US; rated: BBB-): up 76.0 bp to 698.0bp (1Y range: 339-698bp)

- Gap Inc (Country: US; rated: Ba3): up 79.7 bp to 684.5bp (1Y range: 353-819bp)

- Kohls Corp (Country: US; rated: BBB): up 93.1 bp to 788.9bp (1Y range: 356-789bp)

- Unisys Corp (Country: US; rated: B1): up 103.8 bp to 1,451.1bp (1Y range: 299-1,451bp)

- Carnival Corp (Country: US; rated: WR): up 116.9 bp to 1,180.2bp (1Y range: 454-2,117bp)

- DISH DBS Corp (Country: US; rated: B2): up 335.1 bp to 2,390.8bp (1Y range: 567-2,391bp)

- Lumen Technologies Inc (Country: US; rated: LGD5 - 77%): up 1276.0 bp to 5,022.9bp (1Y range: 195-5,023bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: DISH DBS Corp (Englewood, Colorado (US)) | Coupon: 5.88% | Maturity: 15/11/2024 | Rating: B- | CUSIP: 25470XAW5 | OAS up by 315.8 bp to 1,290.7 bp (CDS basis: -46.6bp), with the yield to worst at 16.0% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 80.8-96.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 94.4 bp to 241.7 bp (CDS basis: -209.6bp), with the yield to worst at 6.6% and the bond now trading down to 91.7 cents on the dollar (1Y price range: 91.4-94.8).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS up by 53.6 bp to 183.1 bp (CDS basis: 82.2bp), with the yield to worst at 5.6% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.95% | Maturity: 6/3/2026 | Rating: BB | CUSIP: 345397C43 | OAS up by 51.0 bp to 275.0 bp (CDS basis: -65.7bp), with the yield to worst at 6.6% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 98.8-103.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 5.13% | Maturity: 16/6/2025 | Rating: BB | CUSIP: 345397A60 | OAS up by 40.1 bp to 228.5 bp (CDS basis: -48.2bp), with the yield to worst at 6.4% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 95.3-98.9).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS up by 36.5 bp to 137.2 bp (CDS basis: -37.1bp), with the yield to worst at 4.9% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS up by 30.3 bp to 158.5 bp, with the yield to worst at 5.2% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS up by 29.8 bp to 122.8 bp (CDS basis: -74.1bp), with the yield to worst at 5.1% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 88.0-91.4).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS up by 28.7 bp to 160.4 bp, with the yield to worst at 5.3% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: Tri Pointe Homes Inc (Delaware) (Incline Village, Nevada (US)) | Coupon: 5.88% | Maturity: 15/6/2024 | Rating: BB- | CUSIP: 962178AN9 | OAS down by 22.8 bp to 127.1 bp, with the yield to worst at 5.4% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 98.0-100.0).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 6.00% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 59001AAY8 | OAS down by 28.4 bp to 121.3 bp (CDS basis: 84.8bp), with the yield to worst at 5.1% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 99.0-100.8).

- Issuer: EQT Corp (Pittsburgh, Pennsylvania (US)) | Coupon: 3.90% | Maturity: 1/10/2027 | Rating: BB+ | CUSIP: 26884LAF6 | OAS down by 41.1 bp to 151.7 bp, with the yield to worst at 5.1% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 90.6-95.3).

- Issuer: H.B. Fuller Company (Saint Paul, Minnesota (US)) | Coupon: 4.00% | Maturity: 15/2/2027 | Rating: BB- | CUSIP: 359694AB2 | OAS down by 50.5 bp to 220.3 bp, with the yield to worst at 5.1% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 89.5-94.9).

- Issuer: United States Cellular Corp (Chicago, Illinois (US)) | Coupon: 6.70% | Maturity: 15/12/2033 | Rating: BB | CUSIP: 911684AD0 | OAS down by 80.8 bp to 449.0 bp, with the yield to worst at 7.7% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 86.3-94.4).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | CUSIP: 85571BAU9 | OAS down by 94.9 bp to 490.6 bp, with the yield to worst at 8.4% and the bond now trading up to 85.6 cents on the dollar (1Y price range: 80.8-91.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB | ISIN: FR0013299435 | OAS up by 53.8 bp to 97.5 bp (CDS basis: 71.3bp), with the yield to worst at 3.6% and the bond now trading down to 92.4 cents on the dollar (1Y price range: 90.7-94.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS up by 46.5 bp to 367.4 bp (CDS basis: 17.6bp), with the yield to worst at 6.2% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 72.4-78.7).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS up by 39.9 bp to 326.2 bp (CDS basis: 8.7bp), with the yield to worst at 5.9% and the bond now trading down to 85.4 cents on the dollar (1Y price range: 82.0-87.0).

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS up by 38.8 bp to 539.5 bp, with the yield to worst at 7.2% and the bond now trading down to 75.0 cents on the dollar (1Y price range: 64.8-77.1).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB | ISIN: XS2341724172 | OAS up by 37.4 bp to 553.4 bp, with the yield to worst at 8.3% and the bond now trading down to 75.7 cents on the dollar (1Y price range: 71.3-77.4).

- Issuer: SIG Combibloc PurchaseCo SARL (Munsbach, Luxembourg) | Coupon: 2.13% | Maturity: 18/6/2025 | Rating: BB+ | ISIN: XS2189594315 | OAS up by 36.0 bp to 107.8 bp, with the yield to worst at 3.8% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 92.7-96.9).

- Issuer: Globalworth Real Estate Investments Ltd (St Martin, Guernsey) | Coupon: 2.95% | Maturity: 29/7/2026 | Rating: BB+ | ISIN: XS2208868914 | OAS up by 35.2 bp to 798.6 bp, with the yield to worst at 10.4% and the bond now trading down to 78.6 cents on the dollar (1Y price range: 77.6-83.3).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 4.13% | Maturity: 24/5/2027 | Rating: BB+ | ISIN: FR001400AK26 | OAS up by 34.8 bp to 140.0 bp, with the yield to worst at 4.3% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 96.5-100.0).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB+ | ISIN: FR0013449998 | OAS up by 30.3 bp to 146.9 bp, with the yield to worst at 4.2% and the bond now trading down to 87.9 cents on the dollar (1Y price range: 84.2-88.7).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.88% | Maturity: 15/2/2026 | Rating: BB+ | ISIN: FR0013318102 | OAS up by 29.7 bp to 119.6 bp, with the yield to worst at 4.2% and the bond now trading down to 96.2 cents on the dollar (1Y price range: 93.7-96.9).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS up by 28.1 bp to 639.8 bp, with the yield to worst at 9.3% and the bond now trading down to 82.8 cents on the dollar (1Y price range: 80.6-83.7).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.00% | Maturity: 12/11/2029 | Rating: BB | ISIN: FR0014006G24 | OAS up by 27.7 bp to 498.3 bp, with the yield to worst at 6.8% and the bond now trading down to 65.8 cents on the dollar (1Y price range: 61.6-69.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 27.7 bp to 241.1 bp (CDS basis: 4.2bp), with the yield to worst at 5.3% and the bond now trading down to 93.3 cents on the dollar (1Y price range: 90.6-93.9).

- Issuer: Standard Building Solutions Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | OAS up by 27.3 bp to 357.3 bp, with the yield to worst at 6.0% and the bond now trading down to 86.5 cents on the dollar (1Y price range: 84.3-88.1).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | OAS up by 27.0 bp to 328.3 bp, with the yield to worst at 5.9% and the bond now trading down to 83.5 cents on the dollar (1Y price range: 75.4-85.4).

RECENT DOMESTIC USD BOND ISSUES

- Cloud Software Group Inc (Information/Data Technology | Palo Alto, United States | Rating: CCC): US$3,838m Note (US18912UAA07), fixed rate (9.00% coupon) maturing on 30 September 2029, priced at 98.00 (original spread of 1,063 bp), callable (6nc2)

- Duke Energy Corp (Utility - Other | Charlotte, United States | Rating: BBB): US$1,725m Bond (US26441CBX20), fixed rate (4.13% coupon) maturing on 15 April 2026, priced at 100.00, non callable, convertible

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$225m Bond (US3133EPFU40), fixed rate (3.50% coupon) maturing on 12 April 2028, priced at 99.77, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EPFS93), fixed rate (5.18% coupon) maturing on 13 October 2026, priced at 100.00 (original spread of 161 bp), callable (4nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EPFT76), fixed rate (3.75% coupon) maturing on 13 April 2026, priced at 99.92, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$550m Bond (US3133EPFH39), floating rate (SOFR + 13.0 bp) maturing on 10 April 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$500m Bond (US3133EPFG55), floating rate (SOFR + 16.0 bp) maturing on 10 April 2025, priced at 100.00, callable (2nc2)

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, United States | Rating: BB): US$1,500m Senior Note (US345397C924), fixed rate (6.80% coupon) maturing on 12 May 2028, priced at 99.99 (original spread of 330 bp), callable (5nc5)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, United States | Rating: BBB-): US$1,000m Senior Note (US37045XEG79), fixed rate (5.85% coupon) maturing on 6 April 2030, priced at 99.80 (original spread of 247 bp), callable (7nc7)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, United States | Rating: BBB-): US$1,250m Senior Note (US37045XEF96), fixed rate (5.40% coupon) maturing on 6 April 2026, priced at 99.87 (original spread of 175 bp), with a make whole call

- Georgetown University (Financial - Other | Washington, United States | Rating: A-): US$300m Bond (US37310PAF80), fixed rate (5.12% coupon) maturing on 1 April 2053, priced at 100.00, callable (30nc29)

- Inter-American Development Bank (Supranational | Washington, United States | Rating: AAA): US$2,250m Senior Note (US4581X0EJ31), fixed rate (3.50% coupon) maturing on 12 April 2033, priced at 99.19 (original spread of 25 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, United States | Rating: AAA): US$5,000m Bond (US459058KT95), fixed rate (3.50% coupon) maturing on 12 July 2028, priced at 99.83 (original spread of 13 bp), non callable

- Jackson National Life Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$300m Note (US46849MCH07), fixed rate (5.25% coupon) maturing on 12 April 2028, priced at 99.83 (original spread of 202 bp), non callable

- Massmutual Global Funding II (Financial - Other | Wilmington, United States | Rating: NR): US$750m Note (US57629X6E33), fixed rate (4.50% coupon) maturing on 10 April 2026, priced at 99.93 (original spread of 91 bp), non callable

- Matador Resources Co (Oil and Gas | Dallas, United States | Rating: B+): US$500m Senior Note (US576485AF30), fixed rate (6.88% coupon) maturing on 15 April 2028, priced at 98.96 (original spread of 359 bp), callable (5nc2)

- McCormick & Company Inc (Food Processors | Hunt Valley, United States | Rating: BBB): US$500m Senior Note (US579780AT48), fixed rate (4.95% coupon) maturing on 15 April 2033, priced at 99.94 (original spread of 153 bp), callable (10nc10)

- Micron Technology Inc (Electronics | Boise, United States | Rating: BBB-): US$900m Senior Note (US595112CB74), fixed rate (5.88% coupon) maturing on 15 September 2033, priced at 99.51 (original spread of 265 bp), callable (10nc10)

- Micron Technology Inc (Electronics | Boise, United States | Rating: BBB-): US$600m Senior Note (US595112CA91), fixed rate (5.38% coupon) maturing on 15 April 2028, priced at 99.88 (original spread of 205 bp), callable (5nc5)

- Noble Finance 2 LLC (Financial - Other | United States | Rating: B): US$600m Senior Note (US65505PAA57), fixed rate (8.00% coupon) maturing on 15 April 2030, priced at 100.00 (original spread of 460 bp), callable (7nc3)

- Realty Income Corp (Real Estate Investment Trust | San Diego, United States | Rating: A-): US$600m Senior Note (US756109BT03), fixed rate (4.90% coupon) maturing on 15 July 2033, priced at 98.02 (original spread of 185 bp), callable (10nc10)

- Realty Income Corp (Real Estate Investment Trust | San Diego, United States | Rating: A-): US$400m Senior Note (US756109BS20), fixed rate (4.70% coupon) maturing on 15 December 2028, priced at 98.95 (original spread of 155 bp), callable (6nc6)

RECENT INTERNATIONAL USD BOND ISSUES

- Agricultural Bank of China Ltd (Macau Branch) (Banking | China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2610425923), fixed rate (4.70% coupon) maturing on 11 April 2025, priced at 100.00, non callable

- Brazil, Federative Republic of (Government) (Sovereign | Brasilia, Brazil | Rating: BB-): US$2,250m Bond (US105756CF53), fixed rate (6.00% coupon) maturing on 20 October 2033, priced at 98.85 (original spread of 286 bp), with a make whole call

- CNH Industrial Capital LLC (Financial - Other | Racine, United Kingdom | Rating: BBB): US$600m Senior Note (US12592BAQ77), fixed rate (4.55% coupon) maturing on 10 April 2028, priced at 98.86 (original spread of 140 bp), callable (5nc5)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0460014862), fixed rate (4.25% coupon) maturing on 28 April 2025, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: NR): US$125m Certificate of Deposit (XS2610450012), floating rate maturing on 10 April 2026, priced at 100.00, non callable

- Jordan, Hashemite Kingdom of (Government) (Sovereign | Jordan | Rating: B+): US$1,250m Senior Note (US41809JAB17), fixed rate (7.50% coupon) maturing on 13 January 2029, priced at 98.81 (original spread of 434 bp), non callable

- KfW (Agency | Frankfurt, Germany | Rating: AAA): US$3,000m Senior Note (US500769JX36), fixed rate (3.63% coupon) maturing on 1 April 2026, priced at 99.71 (original spread of 9 bp), non callable

- Pilgrims Pride Corp (Food Processors | Greeley, Brazil | Rating: BB-): US$1,000m Senior Note (US72147KAK43), fixed rate (6.25% coupon) maturing on 1 July 2033, priced at 99.31 (original spread of 300 bp), callable (10nc10)

- Quebec, Province of (Official and Muni | Quebec City, Canada | Rating: AA-): US$3,500m Senior Note (US748148SD69), fixed rate (3.63% coupon) maturing on 13 April 2028, priced at 99.99 (original spread of 35 bp), non callable

- REC Limited (Agency | Gurgaon, India | Rating: BBB-): US$750m Senior Note (US74947LAD64), fixed rate (5.63% coupon) maturing on 11 April 2028, priced at 99.85 (original spread of 213 bp), non callable

- SK Hynix Inc (Electronics | Icheon, South Korea | Rating: BBB): US$1,700m Bond (XS2607736407), fixed rate (1.75% coupon) maturing on 11 April 2030, priced at 100.00, non callable, convertible

- Shinhan Bank (Banking | Seoul, South Korea | Rating: A): US$500m Bond (US82460CBF05), fixed rate (4.50% coupon) maturing on 12 April 2028, priced at 99.57 (original spread of 119 bp), non callable

- Turkey, Republic of (Government) (Sovereign | Ankara, Turkey | Rating: B-): US$2,500m Senior Note (US900123DJ66), fixed rate (9.13% coupon) maturing on 13 July 2030, priced at 99.12 (original spread of 600 bp), non callable

- Valaris Ltd (Oil and Gas | Hamilton, Bermuda | Rating: B): US$700m Note (USG9460GAC53), fixed rate (8.38% coupon) maturing on 30 April 2030, priced at 100.00 (original spread of 506 bp), callable (7nc3)

- ZF North America Capital Inc (Financial - Other | Northville, Germany | Rating: BB+): US$600m Senior Note (USU98737AF34), fixed rate (6.88% coupon) maturing on 14 April 2028, priced at 99.69 (original spread of 356 bp), callable (5nc5)

- ZF North America Capital Inc (Financial - Other | Northville, Germany | Rating: BB+): US$600m Senior Note (USU98737AG17), fixed rate (7.13% coupon) maturing on 14 April 2030, priced at 99.59 (original spread of 382 bp), callable (7nc7)

RECENT EURO BOND ISSUES

- AXA SA (Life Insurance | Paris, Ile-De-France, France | Rating: A+): €1,000m Subordinated Note (XS2610457967), floating rate maturing on 11 July 2043, priced at 99.54 (original spread of 324 bp), callable (20nc10)

- Arval Service Lease SA (Financial - Other | Paris, Ile-De-France, France | Rating: A-): €800m Bond (FR001400H8D3), fixed rate (4.25% coupon) maturing on 11 November 2025, priced at 99.88 (original spread of 182 bp), callable (3nc3)

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400H9B5), fixed rate (4.25% coupon) maturing on 13 April 2031, priced at 99.36 (original spread of 218 bp), callable (8nc7)

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €2,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400H8X1), fixed rate (3.25% coupon) maturing on 12 April 2028, priced at 99.86 (original spread of 96 bp), non callable

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €250m Unsecured Note (XS2610473733), fixed rate (4.00% coupon) maturing on 13 April 2026, priced at 100.00, non callable

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): €1,000m Unsecured Note (XS2577826386), fixed rate (1.00% coupon) maturing on 24 January 2031, priced at 100.00 (original spread of 205 bp), non callable

- Council of Europe Development Bank (Supranational | Paris, Ile-De-France, France | Rating: AAA): €1,000m Bond (XS2610236528), fixed rate (2.88% coupon) maturing on 13 April 2030, priced at 99.56 (original spread of 67 bp), non callable

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: NR): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400H9H2), fixed rate (3.13% coupon) maturing on 18 October 2030, priced at 99.95 (original spread of 103 bp), non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €300m Bond (IT0005541229), fixed rate (3.00% coupon) maturing on 28 April 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €500m Bond (IT0005541310), fixed rate (4.00% coupon) maturing on 28 April 2025, priced at 100.00, non callable

- Cyprus, Republic of (Government) (Sovereign | Nicosia, Cyprus | Rating: BB+): €1,000m Senior Note (XS2610236445), fixed rate (4.13% coupon) maturing on 13 April 2033, priced at 99.25 (original spread of 190 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C375), fixed rate (3.00% coupon) maturing on 3 May 2028, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C367), fixed rate (2.80% coupon) maturing on 30 April 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C359), fixed rate (2.65% coupon) maturing on 2 May 2025, priced at 100.00, non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: A+): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000A3MQU11), fixed rate (3.00% coupon) maturing on 29 October 2027, priced at 99.54 (original spread of 79 bp), non callable

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): €1,000m Senior Note (XS2608652934), fixed rate (3.13% coupon) maturing on 13 April 2028, priced at 99.65 (original spread of 95 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (AT0000A33MP9), fixed rate (3.13% coupon) maturing on 14 October 2027, priced at 99.89 (original spread of 97 bp), non callable

- Hamburgische Investitions und Foerderbank (Banking | Hamburg, Hamburg, Germany | Rating: AAA): €250m Inhaberschuldverschreibung (DE000A2LQZ75), fixed rate (2.88% coupon) maturing on 14 April 2033, priced at 99.07 (original spread of 73 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €2,000m Senior Note (XS2611177382), fixed rate (3.10% coupon) maturing on 14 April 2038, priced at 99.65 (original spread of 78 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €10,000m Buono del Tesoro Poliennali (IT0005542359), fixed rate (4.00% coupon) maturing on 30 October 2031, priced at 99.89 (original spread of 178 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB48F3), fixed rate (2.40% coupon) maturing on 19 May 2026, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB48G1), fixed rate (2.85% coupon) maturing on 19 May 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB48H9), fixed rate (3.00% coupon) maturing on 19 May 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000HLB48E6), fixed rate (2.30% coupon) maturing on 19 May 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB48L1), fixed rate (2.40% coupon) maturing on 10 November 2026, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB48M9), fixed rate (2.65% coupon) maturing on 10 November 2027, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB48K3), fixed rate (2.25% coupon) maturing on 10 November 2025, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Inhaberschuldverschreibung (DE000HLB48P2), fixed rate (3.11% coupon) maturing on 17 January 2031, priced at 100.00, non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €600m Bond (IT0005539504), floating rate maturing on 26 April 2027, priced at 100.00, non callable

- Mercedes-Benz International Finance BV (Financial - Other | Nieuwegein, Utrecht, Germany | Rating: NR): €500m Inhaberschuldverschreibung (DE000A3LGGL0), fixed rate (3.40% coupon) maturing on 13 April 2025, priced at 99.95 (original spread of 68 bp), non callable

- Nordex SE (Machinery | Hamburg, Hamburg, Germany | Rating: NR): €333m Bond (DE000A351MA2), fixed rate (4.25% coupon) maturing on 14 April 2030, priced at 100.00, non callable, convertible

- Orange SA (Telecommunications | Issy-Les-Moulineaux, Ile-De-France, France | Rating: BBB+): €1,000m Bond (FR001400GDJ1), fixed rate (5.38% coupon) perpetual , priced at 99.29 (original spread of 340 bp), callable (Pnc7)

- Regie Autonome des Transports Parisiens EPIC (Agency | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR001400H8C5), fixed rate (3.25% coupon) maturing on 11 April 2033, priced at 99.18 (original spread of 101 bp), non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): €1,250m Note (XS2610235801), fixed rate (3.25% coupon) maturing on 13 April 2026, priced at 99.97 (original spread of 77 bp), non callable

RECENT LOANS

- AMO Holding 11 S.A. (Luxembourg), signed a US$ 2,000m Revolving Credit / Term Loan, to be used for general corporate purposes.

- AMO Holding 11 S.A. (Luxembourg), signed a US$ 3,000m Revolving Credit / Term Loan, to be used for general corporate purposes.

- Adani Group (India), signed a US$ 3,000m Bridge Loan, to be used for general corporate purposes. It matures on 07/25/27.

- Adani Group (India), signed a US$ 1,000m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 07/25/27.

- Alibaba Group Holding Ltd (China | A+), signed a US$ 4,000m Term Loan, to be used for general corporate purposes. It matures on 05/29/28 and initial pricing is set at Term SOFR +85.0bp

- Apleona GmbH (Germany), signed a € 210m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 04/30/28 and initial pricing is set at EURIBOR +475.0bp

- Banijay Entertainment SNC (France | B+), signed a € 555m Term Loan B, to be used for general corporate purposes. It matures on 03/04/28 and initial pricing is set at EURIBOR +450.0bp

- Banijay Entertainment SNC (France | B+), signed a US$ 560m Term Loan B, to be used for general corporate purposes. It matures on 03/04/28 and initial pricing is set at Term SOFR +375.0bp

- CSN Mineracao SA (Brazil), signed a US$ 1,400m Revolving Credit / Term Loan, to be used for capital expenditures.

- Calpine Development Holdings (United States of America), signed a US$ 1,158m Revolving Credit Facility, to be used for project finance. It matures on 03/29/28.

- Dometic Group AB (Sweden | BB-), signed a US$ 220m Term Loan, to be used for general corporate purposes. It matures on 03/31/26.

- Dometic Group AB (Sweden | BB-), signed a € 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/26.

- Foundation Bldg Materials LLC (United States of America), signed a US$ 850m Revolving Credit Facility, to be used for acquisition financing. It matures on 03/31/26.

- Gruppo Mauro Saviola (Italy), signed a € 200m Term Loan, to be used for general corporate purposes.

- Las Vegas Raiders (United States of America), signed a US$ 150m Term Loan A, to be used for acquisition financing. It matures on 03/31/28 and initial pricing is set at Term SOFR +200.0bp

- PCL Construction (Canada), signed a US$ 450m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/31/25.

- PDC Brands (United States of America), signed a US$ 649m Term Loan B, to be used for general corporate purposes. It matures on 06/30/26 and initial pricing is set at Term SOFR +600.0bp

- Pacira Biosciences Inc (United States of America), signed a US$ 150m Term Loan A, to be used for general corporate purposes. It matures on 03/31/28 and initial pricing is set at Term SOFR +400.0bp

- SCUR Alpha 1503 GmbH (Germany), signed a € 1,450m Term Loan B, to be used for acquisition financing. It matures on 03/30/30.

- SCUR Alpha 1503 GmbH (Germany), signed a US$ 1,581m Term Loan B, to be used for acquisition financing. It matures on 03/30/30.

- Solaben Electricidad Dos SA (Spain), signed a € 108m Term Loan, to be used for project finance. It matures on 06/29/37.

- Solaben Electricidad Tres (Spain), signed a € 108m Term Loan, to be used for project finance. It matures on 06/29/37.

- THACO (Vietnam), signed a US$ 160m Term Loan, to be used for general corporate purposes. It matures on 03/28/24.

- Tennessee Valley Authority (United States of America), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/29/26.

- Unitek Acquisition Inc (United States of America), signed a US$ 115m Term Loan, to be used for general corporate purposes. It matures on 03/31/28 and initial pricing is set at Term SOFR +425.0bp

- Vietcombank (Vietnam | BB), signed a US$ 135m Revolving Credit / Term Loan, to be used for capital expenditures.

- Vietcombank (Vietnam | BB), signed a US$ 165m Revolving Credit / Term Loan, to be used for capital expenditures.

- Worley Ltd (Australia | BBB), signed a US$ 800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/13/28.

- Worley Ltd (Australia | BBB), signed a US$ 400m Term Loan, to be used for general corporate purposes. It matures on 04/13/27.

RECENT STRUCTURED CREDIT

- ACHV ABS Trust 2023-2PL issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 135 m. Highest-rated tranche offering a yield to maturity of 6.42%, and the lowest-rated tranche a yield to maturity of 8.91%. Bookrunners: Jefferies & Co Inc, Truist Securities Inc, Atlas SP Partners LP

- CVC Cordatus Loan Fund Xxvii Dac issued a floating-rate CLO in 9 tranches, for a total of € 430 m. Highest-rated tranche offering a spread over the floating rate of 190bp, and the lowest-rated tranche a spread of 1,038bp. Bookrunners: Goldman Sachs International

- Dilosk Rmbs No 6 Sts Dac issued a floating-rate RMBS in 4 tranches, for a total of € 538 m. Highest-rated tranche offering a spread over the floating rate of 131bp, and the lowest-rated tranche a spread of 600bp. Bookrunners: Natixis, BofA Securities Inc