Credit

Solid Spread Compression Across The US Credit Complex, With Cash CCCs 65bp Tighter This Week

Weekly USD corporate bond issuance on the light side: 16 tranches for $10.95bn in IG (2023 YTD volume $421.29bn vs 2022 YTD $512.391bn, down 18 % YoY), 6 tranches for $3.325bn in HY (2023 YTD volume $51.837bn vs 2022 YTD $48.746bn, up 6%YoY)

Published ET

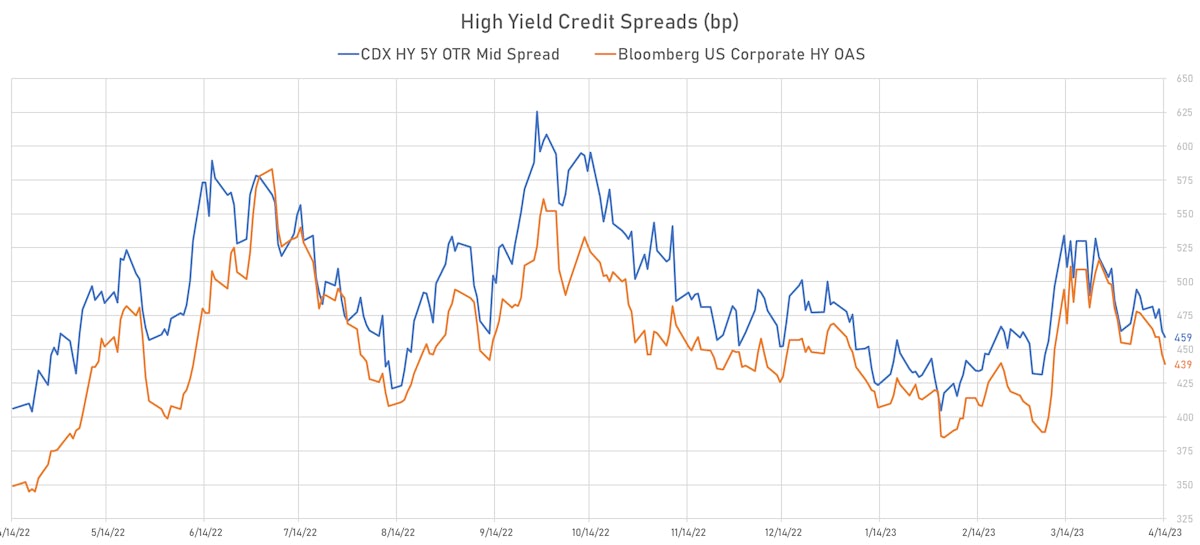

US High Yield Cash & Synthetic Credit Spreads | Sources: phipost.com, Refinitiv & FactSet data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.33% today, with investment grade down -0.34% and high yield down -0.21% (YTD total return: +3.66%)

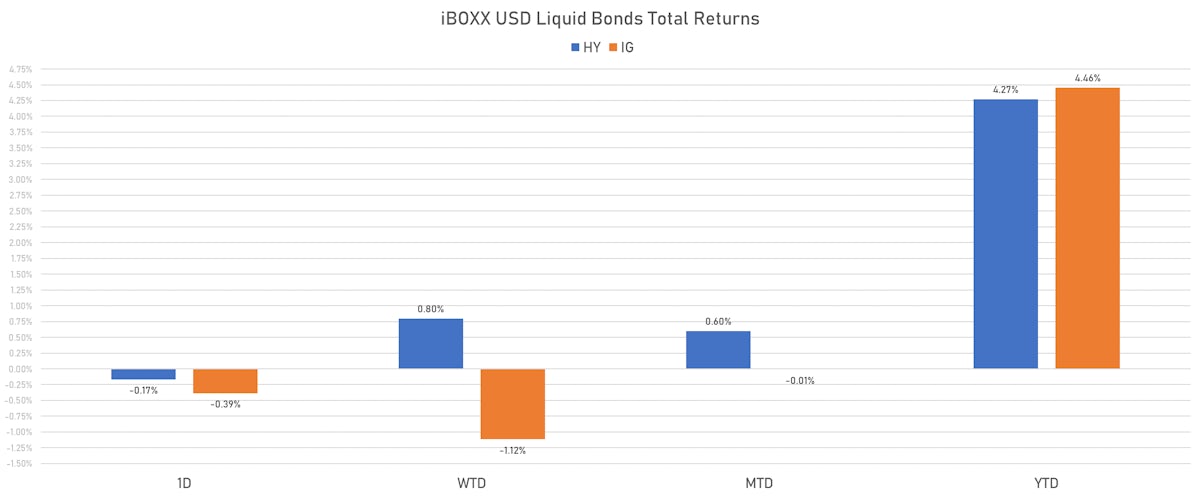

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.385% today (Week-to-date: -1.12%; Month-to-date: -0.01%; Year-to-date: 4.46%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.170% today (Week-to-date: 0.80%; Month-to-date: 0.60%; Year-to-date: 4.27%)

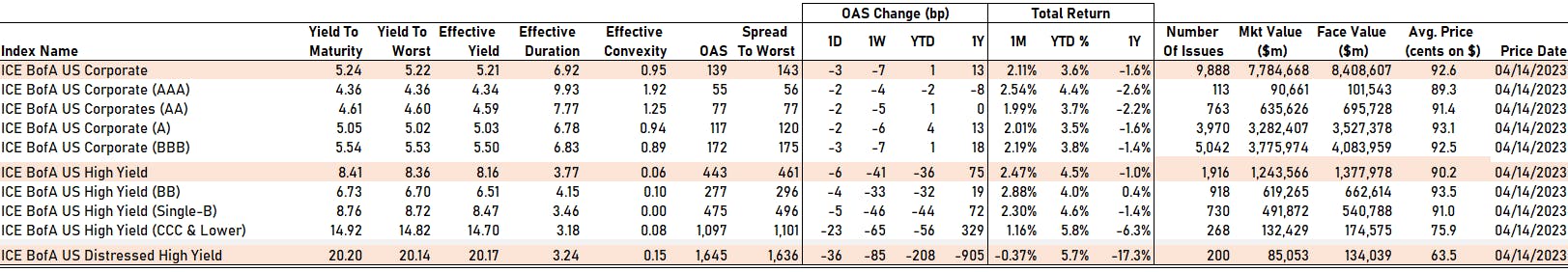

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 145.0 bp (WTD change: -7.0 bp; YTD change: +5.0 bp)

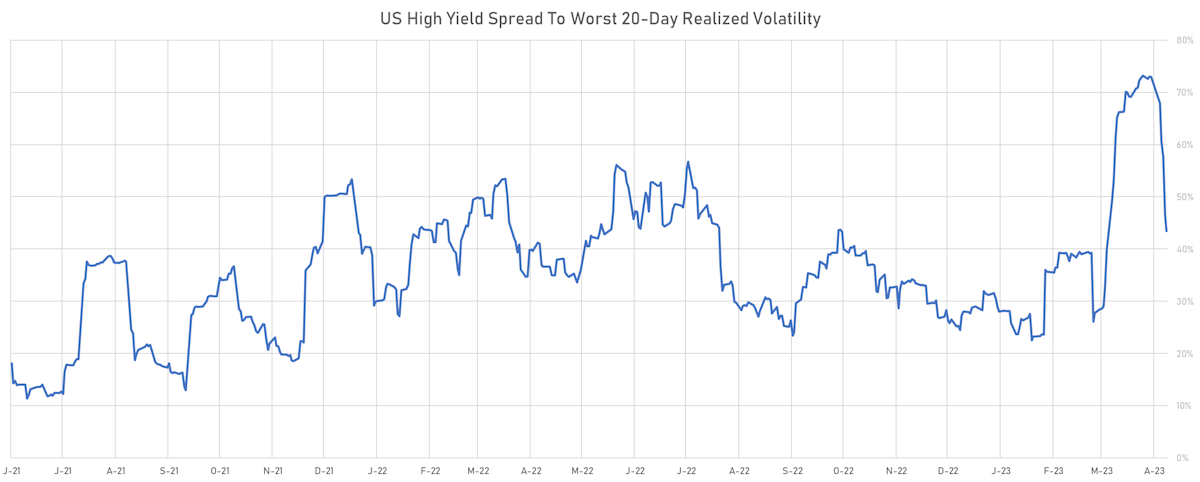

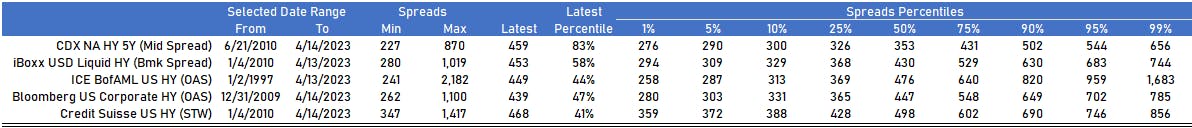

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 468.0 bp (WTD change: -41.0 bp; YTD change: -20.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.11% today (YTD total return: +3.8%)

US High Yield spreads percentiles | Sources: phipost.com, Refinitiv & FactSet data

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -2 bp at 55 bp

- AA down by -2 bp at 77 bp

- A down by -2 bp at 117 bp

- BBB down by -3 bp at 172 bp

- BB down by -4 bp at 277 bp

- B down by -5 bp at 475 bp

- ≤ CCC down by -23 bp at 1,097 bp

ICE BofAML US corporate spreads by rating | Sources: phipost.com, FactSet data

CDS INDICES TODAY (mid-spreads)

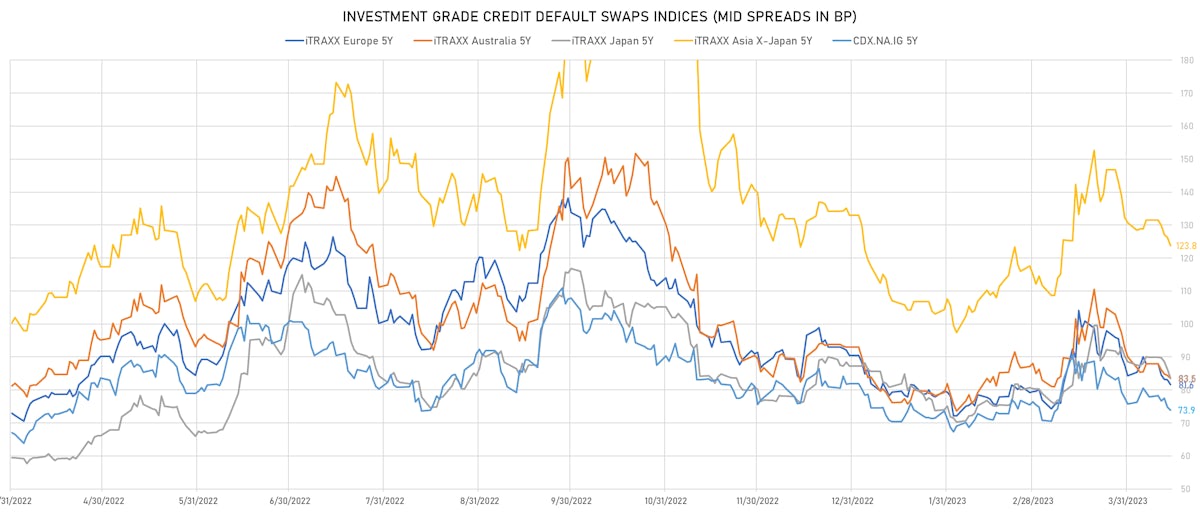

- Markit CDX.NA.IG 5Y down 0.9 bp, now at 74bp (1W change: -3.9bp; YTD change: -7.9bp)

- Markit CDX.NA.IG 10Y down 0.8 bp, now at 111bp (1W change: -3.0bp; YTD change: -6.9bp)

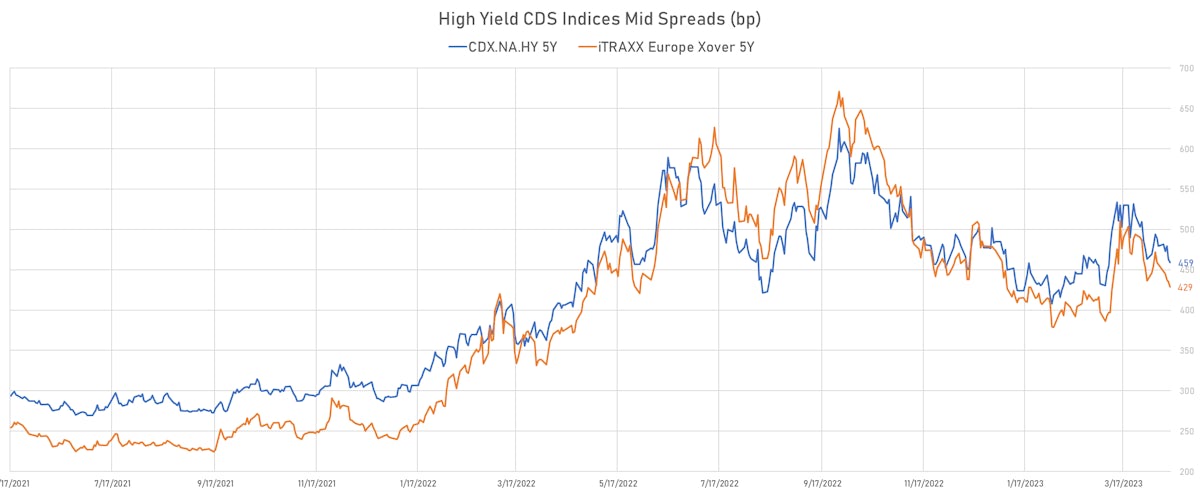

- Markit CDX.NA.HY 5Y down 4.3 bp, now at 459bp (1W change: -20.5bp; YTD change: -25.9bp)

- Markit iTRAXX Europe 5Y down 1.5 bp, now at 82bp (1W change: -6.3bp; YTD change: -8.8bp)

- Markit iTRAXX Europe Crossover 5Y down 6.3 bp, now at 429bp (1W change: -42.8bp; YTD change: -45.1bp)

- Markit iTRAXX Japan 5Y down 2.6 bp, now at 84bp (1W change: -6.2bp; YTD change: -3.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.5 bp, now at 124bp (1W change: -7.7bp; YTD change: -9.2bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Vietnam (rated BB): down 4.9 % to 118 bp (1Y range: 103-181bp)

- Colombia (rated BB+): down 5.6 % to 276 bp (1Y range: 200-394bp)

- Indonesia (rated BBB): down 6.1 % to 86 bp (1Y range: 76-166bp)

- Panama (rated WD): down 6.6 % to 113 bp (1Y range: 96-187bp)

- Brazil (rated BB-): down 6.7 % to 216 bp (1Y range: 208-328bp)

- Peru (rated BBB): down 7.2 % to 101 bp (1Y range: 97-171bp)

- Chile (rated A-): down 7.2 % to 101 bp (1Y range: 81-174bp)

- China (rated A+): down 7.5 % to 66 bp (1Y range: 47-132bp)

- Mexico (rated BBB-): down 8.0 % to 113 bp (1Y range: 103-205bp)

- Malaysia (rated BBB+): down 9.4 % to 64 bp (1Y range: 57-122bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Lumen Technologies Inc (Country: US; rated: LGD5 - 77%): down 1185.7 bp to 3,837.2bp (1Y range: 195-3,837bp)

- Carnival Corp (Country: US; rated: WR): down 119.2 bp to 1,061.1bp (1Y range: 460-2,117bp)

- Community Health Systems Inc (Country: US; rated: B): down 88.2 bp to 2,033.2bp (1Y range: 742-4,371bp)

- Kohls Corp (Country: US; rated: BBB): down 72.0 bp to 716.9bp (1Y range: 356-735bp)

- Transocean Inc (Country: KY; rated: Caa1): down 65.9 bp to 837.0bp (1Y range: 674-2,858bp)

- Pactiv LLC (Country: US; rated: WR): down 60.3 bp to 255.0bp (1Y range: 255-1,041bp)

- Nordstrom Inc (Country: US; rated: BBB-): down 56.7 bp to 641.4bp (1Y range: 339-685bp)

- Unisys Corp (Country: US; rated: B1): down 55.5 bp to 1,395.6bp (1Y range: 310-1,396bp)

- Gap Inc (Country: US; rated: Ba3): down 53.5 bp to 631.0bp (1Y range: 366-819bp)

- Pitney Bowes Inc (Country: US; rated: NR): down 50.6 bp to 1,221.5bp (1Y range: 685-1,783bp)

- Macy's Inc (Country: US; rated: A1): down 45.2 bp to 428.2bp (1Y range: 300-619bp)

- Onemain Finance Corp (Country: US; rated: Ba2): down 45.1 bp to 447.3bp (1Y range: 121-1,042bp)

- Beazer Homes USA Inc (Country: US; rated: A2): down 39.3 bp to 481.6bp (1Y range: 482-899bp)

- DISH DBS Corp (Country: US; rated: B2): up 121.3 bp to 2,512.0bp (1Y range: 567-2,512bp)

- Staples Inc (Country: US; rated: B3): up 132.3 bp to 2,331.1bp (1Y range: 1,101-2,331bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: Caa1): down 121.3 bp to 2,003.3bp (1Y range: 1,286-2,910bp)

- TUI AG (Country: DE; rated: B3-PD): down 59.5 bp to 914.9bp (1Y range: 691-1,725bp)

- Novafives SAS (Country: FR; rated: Caa1): down 36.2 bp to 1,124.7bp (1Y range: 618-2,936bp)

- Ceconomy AG (Country: DE; rated: B1): down 35.9 bp to 1,200.8bp (1Y range: 308-1,763bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 29.1 bp to 1,157.1bp (1Y range: 566-1,739bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): down 27.6 bp to 334.6bp (1Y range: 309-705bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 25.6 bp to 770.7bp (1Y range: 587-1,296bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 25.5 bp to 432.0bp (1Y range: 330-602bp)

- Deutsche Bank AG (Country: DE; rated: baa2): down 22.3 bp to 131.4bp (1Y range: 82-205bp)

- Credit Suisse Group AG (Country: CH; rated: WD): down 20.6 bp to 182.2bp (1Y range: 119-1,267bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 18.3 bp to 253.3bp (1Y range: 199-476bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 17.3 bp to 241.4bp (1Y range: 157-600bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 16.4 bp to 353.2bp (1Y range: 280-496bp)

- ArcelorMittal SA (Country: LU; rated: WD): down 15.0 bp to 232.7bp (1Y range: 133-353bp)

- SES SA (Country: LU; rated: ba1): down 15.0 bp to 201.0bp (1Y range: 100-223bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 26.2 bp to 111.0 bp (CDS basis: -26.1bp), with the yield to worst at 4.7% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS down by 30.2 bp to 128.3 bp, with the yield to worst at 5.1% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS down by 38.4 bp to 99.6 bp, with the yield to worst at 5.0% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 95.3-99.0).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | CUSIP: 983130AV7 | OAS down by 40.8 bp to 181.1 bp, with the yield to worst at 6.1% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 94.8-99.5).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | CUSIP: 77340RAS6 | OAS down by 49.2 bp to 192.1 bp, with the yield to worst at 5.8% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 91.8-95.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 7.38% | Maturity: 15/11/2031 | Rating: BB+ | CUSIP: 337932AC1 | OAS down by 50.0 bp to 176.6 bp (CDS basis: -64.4bp), with the yield to worst at 5.1% and the bond now trading up to 114.3 cents on the dollar (1Y price range: 110.4-116.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.38% | Maturity: 13/11/2025 | Rating: BB | CUSIP: 345397B28 | OAS down by 50.3 bp to 215.8 bp (CDS basis: -33.3bp), with the yield to worst at 6.2% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 89.9-94.3).

- Issuer: Amerigas Partners LP (Valley Forge, Pennsylvania (US)) | Coupon: 5.50% | Maturity: 20/5/2025 | Rating: B+ | CUSIP: 030981AK0 | OAS down by 51.5 bp to 232.2 bp, with the yield to worst at 6.3% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 94.8-99.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.66% | Maturity: 8/9/2024 | Rating: BB | CUSIP: 345397WW9 | OAS down by 52.1 bp to 154.4 bp (CDS basis: -3.0bp), with the yield to worst at 6.1% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 94.6-97.2).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS down by 52.7 bp to 130.4 bp (CDS basis: 110.9bp), with the yield to worst at 5.2% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.90% | Maturity: 16/2/2028 | Rating: BB | CUSIP: 345397B51 | OAS down by 60.1 bp to 265.6 bp (CDS basis: 22.8bp), with the yield to worst at 6.2% and the bond now trading up to 85.7 cents on the dollar (1Y price range: 82.0-88.1).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.95% | Maturity: 28/5/2027 | Rating: BB | CUSIP: 345397C27 | OAS down by 62.5 bp to 239.6 bp (CDS basis: 19.4bp), with the yield to worst at 6.1% and the bond now trading up to 95.4 cents on the dollar (1Y price range: 91.3-97.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.69% | Maturity: 9/6/2025 | Rating: BB | CUSIP: 345397ZJ5 | OAS down by 63.5 bp to 182.7 bp (CDS basis: -19.8bp), with the yield to worst at 6.1% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 94.5-98.2).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.30% | Maturity: 10/2/2025 | Rating: BB | CUSIP: 345397B85 | OAS down by 72.0 bp to 170.3 bp (CDS basis: -14.3bp), with the yield to worst at 6.0% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 90.0-94.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 117.2 bp to 124.5 bp (CDS basis: -90.4bp), with the yield to worst at 5.6% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 91.4-94.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | OAS down by 41.7 bp to 289.0 bp, with the yield to worst at 5.9% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 83.5-91.8).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | OAS down by 42.1 bp to 233.9 bp (CDS basis: 17.2bp), with the yield to worst at 5.3% and the bond now trading up to 83.1 cents on the dollar (1Y price range: 79.4-84.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS down by 42.4 bp to 283.8 bp (CDS basis: 38.3bp), with the yield to worst at 5.7% and the bond now trading up to 86.1 cents on the dollar (1Y price range: 82.0-87.0).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.50% | Maturity: 7/10/2027 | Rating: BB+ | ISIN: XS2240978085 | OAS down by 46.2 bp to 168.2 bp, with the yield to worst at 4.6% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 85.9-92.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS down by 46.9 bp to 320.5 bp (CDS basis: 51.9bp), with the yield to worst at 6.0% and the bond now trading up to 78.1 cents on the dollar (1Y price range: 72.4-78.7).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | OAS down by 47.2 bp to 518.3 bp, with the yield to worst at 8.3% and the bond now trading up to 87.3 cents on the dollar (1Y price range: 79.3-90.5).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | OAS down by 47.4 bp to 242.8 bp (CDS basis: 30.9bp), with the yield to worst at 5.3% and the bond now trading up to 87.0 cents on the dollar (1Y price range: 83.4-88.1).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | OAS down by 48.1 bp to 177.8 bp (CDS basis: 4.1bp), with the yield to worst at 4.9% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 89.4-92.6).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 4.25% | Maturity: 31/5/2028 | Rating: BB+ | ISIN: XS2486825669 | OAS down by 48.3 bp to 194.8 bp, with the yield to worst at 4.9% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 90.2-96.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | OAS down by 49.3 bp to 224.6 bp, with the yield to worst at 5.1% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 89.8-95.2).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | OAS down by 53.2 bp to 274.2 bp, with the yield to worst at 5.8% and the bond now trading up to 83.9 cents on the dollar (1Y price range: 76.6-84.0).

- Issuer: Kennedy Wilson Europe Real Estate Ltd (Saint Helier, Jersey) | Coupon: 3.25% | Maturity: 12/11/2025 | Rating: BB+ | ISIN: XS1321149434 | OAS down by 53.6 bp to 532.6 bp, with the yield to worst at 8.6% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 77.8-87.8).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 2/6/2027 | Rating: BB | ISIN: FR0014006W65 | OAS down by 61.6 bp to 203.3 bp (CDS basis: 30.6bp), with the yield to worst at 4.7% and the bond now trading up to 90.1 cents on the dollar (1Y price range: 86.1-90.6).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 64.6 bp to 369.9 bp (CDS basis: 221.3bp), with the yield to worst at 6.7% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 73.2 bp to 462.5 bp (CDS basis: 206.2bp), with the yield to worst at 7.6% and the bond now trading up to 97.2 cents on the dollar (1Y price range: 88.4-97.4).

RECENT DOMESTIC USD BOND ISSUES

- Churchill Downs Inc (Leisure | Louisville, United States | Rating: B+): US$600m Senior Note (US171484AJ78), fixed rate (6.75% coupon) maturing on 1 May 2031, priced at 100.00 (original spread of 334 bp), callable (8nc3)

- Cleveland-Cliffs Inc (Metals/Mining | Cleveland, United States | Rating: BB-): US$750m Senior Note (USU1852LAM91), fixed rate (6.75% coupon) maturing on 15 April 2030, priced at 100.00 (original spread of 329 bp), callable (7nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EPFW06), floating rate (SOFR + 30.0 bp) maturing on 17 April 2026, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$15,000m Unsecured Note (US3134GYPR72), fixed rate (5.00% coupon) maturing on 19 April 2028, priced at 100.00 (original spread of 20 bp), callable (5nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$300m Unsecured Note (US3134GYPC04), fixed rate (5.38% coupon) maturing on 24 April 2025, priced at 100.00 (original spread of 145 bp), callable (2nc3m)

- Federal Realty OP LP (Real Estate Investment Trust | North Bethesda, United States | Rating: BBB+): US$350m Senior Note (US313747BC00), fixed rate (5.38% coupon) maturing on 1 May 2028, priced at 99.59 (original spread of 195 bp), callable (5nc5)

- Guess? (Textiles/Apparel/Shoes | Los Angeles, United States | Rating: NR): US$275m Bond (US401617AE58), fixed rate (3.75% coupon) maturing on 15 April 2028, priced at 100.00, non callable, convertible

- Jabil Inc (Electronics | Saint Petersburg, United States | Rating: BBB-): US$300m Senior Note (US46656PAA21), fixed rate (5.45% coupon) maturing on 1 February 2029, priced at 99.43 (original spread of 205 bp), callable (6nc6)

- Knife River Hldg (Metals/Mining | Bismarck, United States | Rating: BB-): US$425m Senior Note (US498894AA29), fixed rate (7.75% coupon) maturing on 1 May 2031, priced at 100.00 (original spread of 434 bp), callable (8nc3)

- Knife River Holding Co (Metals/Mining | Bismarck, United States | Rating: BB-): US$425m Senior Note (USU4958CAA28), fixed rate (7.75% coupon) maturing on 1 May 2031, priced at 100.00 (original spread of 434 bp), callable (8nc3)

- Mirum Pharms (Pharmaceuticals | Foster City, United States | Rating: NR): US$316m Bond (US604749AA94), fixed rate (4.00% coupon) maturing on 1 May 2029, priced at 100.00, non callable, convertible

- Protective Life Global Funding (Financial - Other | Wilmington, United States | Rating: A+): US$300m Note (US74368EBN94), fixed rate (5.21% coupon) maturing on 14 April 2026, priced at 100.00 (original spread of 155 bp), non callable

- Take-Two Interactive Software Inc (Information/Data Technology | New York City, United States | Rating: BBB): US$500m Senior Note (US874054AJ85), fixed rate (5.00% coupon) maturing on 28 March 2026, priced at 99.95 (original spread of 125 bp), with a make whole call

- Take-Two Interactive Software Inc (Information/Data Technology | New York City, United States | Rating: BBB): US$500m Senior Note (US874054AK58), fixed rate (4.95% coupon) maturing on 28 March 2028, priced at 99.92 (original spread of 145 bp), callable (5nc5)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$1,500m Senior Note (US931142FD05), fixed rate (4.10% coupon) maturing on 15 April 2033, priced at 100.00 (original spread of 73 bp), callable (10nc10)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$500m Senior Note (US931142FC22), fixed rate (4.00% coupon) maturing on 15 April 2030, priced at 99.81 (original spread of 60 bp), callable (7nc7)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$750m Senior Note (US931142FA65), fixed rate (4.00% coupon) maturing on 15 April 2026, priced at 99.96 (original spread of 30 bp), callable (3nc3)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$750m Senior Note (US931142FB49), fixed rate (3.90% coupon) maturing on 15 April 2028, priced at 99.82 (original spread of 47 bp), callable (5nc5)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$1,500m Senior Note (US931142FE87), fixed rate (4.50% coupon) maturing on 15 April 2053, priced at 99.72 (original spread of 133 bp), callable (30nc30)

- Wells Fargo Bank NA (Banking | Sioux Falls, United States | Rating: A+): US$196m Certificate of Deposit - Retail (US949764AQ79), fixed rate (4.65% coupon) maturing on 14 April 2025, priced at 100.00 (original spread of 70 bp), non callable

- Wells Fargo Bank NA (Banking | Sioux Falls, United States | Rating: A+): US$130m Certificate of Deposit - Retail (US949764AT19), fixed rate (4.70% coupon) maturing on 17 April 2025, priced at 100.00 (original spread of 70 bp), non callable

RECENT INTERNATIONAL USD BOND ISSUES

- American Honda Finance Corp (Leasing | Torrance, Japan | Rating: A-): US$700m Senior Note (US02665WEH07), fixed rate (4.60% coupon) maturing on 17 April 2030, priced at 99.87 (original spread of 115 bp), with a make whole call

- American Honda Finance Corp (Leasing | Torrance, Japan | Rating: A-): US$800m Senior Note (US02665WEF41), fixed rate (4.60% coupon) maturing on 17 April 2025, priced at 99.97 (original spread of 65 bp), with a make whole call

- Banco Do Brasil SA (Cayman Islands Branch) (Banking | George Town, Brazil | Rating: BB-): US$750m Senior Note (US059578AG91), fixed rate (6.25% coupon) maturing on 18 April 2030, priced at 98.61 (original spread of 306 bp), non callable

- Baytex Energy Corp (Oil and Gas | Calgary, Canada | Rating: B+): US$800m Senior Note (USC08047AD12), fixed rate (8.50% coupon) maturing on 30 April 2030, priced at 98.71 (original spread of 537 bp), callable (7nc3)

- CIMA Finance DAC (Financial - Other | Dublin, Ireland | Rating: NR): US$150m Unsecured Note (XS2614623549), fixed rate (4.00% coupon) maturing on 16 April 2026, priced at 100.00, non callable

- Conuma Coal Resources Ltd (Financial - Other | Tumbler Ridge, Canada | Rating: CCC+): US$250m Note (US21240FAA03), fixed rate (13.13% coupon) maturing on 1 May 2028, priced at 97.00 (original spread of 1,044 bp), callable (5nc3)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A33N31), fixed rate (4.55% coupon) maturing on 5 May 2025, priced at 100.00, non callable

- Macquarie Airfinance Holdings Ltd (Financial - Other | London, Australia | Rating: BB+): US$500m Senior Note (USG5S60PAA19), fixed rate (8.38% coupon) maturing on 1 May 2028, priced at 100.00 (original spread of 479 bp), callable (5nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$300m Senior Note (US606822CZ56), floating rate (SOFR + 144.0 bp) maturing on 17 April 2026, priced at 100.00, callable (3nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$1,000m Senior Note (US606822DC52), fixed rate (5.41% coupon) maturing on 19 April 2034, priced at 100.00 (original spread of 193 bp), callable (11nc10)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$500m Senior Note (US606822DA96), fixed rate (5.54% coupon) maturing on 17 April 2026, priced at 100.00 (original spread of 109 bp), callable (3nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$700m Senior Note (US606822CY81), fixed rate (5.24% coupon) maturing on 19 April 2029, priced at 100.00 (original spread of 156 bp), callable (6nc5)

- Nickel Industries Ltd (Metals/Mining | Sydney, Australia | Rating: B+): US$400m Bond (US653890AA15), fixed rate (11.25% coupon) maturing on 21 October 2028, priced at 100.00 (original spread of 803 bp), callable (6nc3)

- OMERS Finance Trust (Financial - Other | Toronto, Canada | Rating: AAA): US$1,000m Senior Note (US682142AJ37), fixed rate (4.00% coupon) maturing on 20 April 2028, priced at 99.73 (original spread of 64 bp), non callable

- Shangrao Investment Holdings International Co Ltd (Financial - Other | Hong Kong | Rating: BBB-): US$120m Senior Note (XS2597408512), fixed rate (7.90% coupon) maturing on 17 April 2026, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Netherlands | Rating: A): €1,500m Note (XS2613658470), fixed rate (3.75% coupon) maturing on 20 April 2025, priced at 99.90 (original spread of 107 bp), non callable

- ABN Amro Bank NV (Banking | Amsterdam, Netherlands | Rating: A): €1,250m Note (XS2613658710), fixed rate (4.38% coupon) maturing on 20 October 2028, priced at 99.95 (original spread of 205 bp), with a regulatory call

- AXA Bank Europe SCF SA (Banking | Fontenay-Sous-Bois, Belgium | Rating: AAA): €750m Obligation Fonciere (Covered Bond) (FR001400H5V1), fixed rate (3.58% coupon) maturing on 14 April 2033, priced at 100.00, callable (10nc1m)

- Assicurazioni Generali SpA (Life Insurance | Trieste, Italy | Rating: NR): €500m Subordinated Note (XS2609970848), fixed rate (5.40% coupon) maturing on 20 April 2033, priced at 100.00 (original spread of 288 bp), callable (10nc10)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, France | Rating: A+): €120m Unsecured Note (XS2491432519), floating rate maturing on 14 August 2028, priced at 100.00, non callable

- Banca Popolare Di Sondrio SpA (Banking | Sondrio, Italy | Rating: NR): €150m Senior Note (XS2589438139), fixed rate (5.50% coupon) maturing on 17 April 2028, priced at 99.57, non callable

- Banco Santander Totta SA (Banking | Lisbon, Spain | Rating: BBB+): €750m Obrigacao Hipotecaria (Covered Bond) (PTBSPAOM0008), fixed rate (3.38% coupon) maturing on 19 April 2028, priced at 99.52 (original spread of 108 bp), non callable

- Bankinter SA (Banking | Madrid, Spain | Rating: AA+): €1,000m Cedula Hipotecaria (Covered Bond) (ES0413679558), floating rate maturing on 13 February 2031, non callable

- Bankinter SA (Banking | Madrid, Spain | Rating: AA+): €1,000m Cedula Hipotecaria (Covered Bond) (ES0413679541), floating rate maturing on 13 November 2028, non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000BLB6JV5), fixed rate (3.00% coupon) maturing on 22 May 2029, priced at 99.87 (original spread of 75 bp), non callable

- Bng Bank NV (Agency | S-Gravenhage, Netherlands | Rating: AAA): €1,500m Senior Note (XS2613259774), fixed rate (3.00% coupon) maturing on 23 April 2030, priced at 99.90 (original spread of 72 bp), non callable

- Bpce SA (Banking | Paris, France | Rating: A): €103,179m Bond (FR001400FOM4), fixed rate (0.04% coupon) maturing on 14 April 2028, priced at 100.00 (original spread of 1 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: A-): €1,250m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000CZ43ZX7), fixed rate (3.13% coupon) maturing on 20 April 2029, priced at 99.96 (original spread of 79 bp), non callable

- Cooperatieve Rabobank UA (Banking | Utrecht, Netherlands | Rating: A+): €1,250m Note (XS2613658041), floating rate maturing on 25 April 2029, priced at 100.00 (original spread of 183 bp), callable (6nc5)

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €1,500m Bond (FR001400HCR4), fixed rate (3.88% coupon) maturing on 20 April 2031, priced at 99.77 (original spread of 163 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDC0), fixed rate (3.00% coupon) maturing on 12 May 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDB2), floating rate maturing on 11 May 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDD8), fixed rate (3.50% coupon) maturing on 11 May 2028, priced at 100.00, non callable

- Federation of Caisses Desjardins Du Quebec (Banking | Levis, Canada | Rating: A+): €750m Covered Bond (Other) (XS2613159719), fixed rate (3.25% coupon) maturing on 18 April 2028, priced at 99.57 (original spread of 108 bp), non callable

- Hera SpA (Gas Utility - Local Distrib | Bologna, Italy | Rating: BBB): €600m Senior Note (XS2613472963), fixed rate (4.25% coupon) maturing on 20 April 2033, priced at 99.52 (original spread of 198 bp), callable (10nc10)

- Hypo Noe Landesbank fuer Niederoesterreich und Wien AG (Banking | Sankt Poelten, Austria | Rating: A): €500m Oeffenlicher Pfandbrief (Covered Bond) (AT0000A33N23), fixed rate (3.25% coupon) maturing on 19 April 2028, priced at 99.81 (original spread of 96 bp), non callable

- Kbc Groep NV (Banking | Brussels, Belgium | Rating: BBB+): €1,000m Bond (BE0002935162), floating rate maturing on 19 April 2030, priced at 99.97 (original spread of 208 bp), callable (7nc6)

- La Banque Postale Home Loan SFH SA (Financial - Other | Paris, France | Rating: NR): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400HF42), fixed rate (3.13% coupon) maturing on 19 February 2029, priced at 99.46 (original spread of 93 bp), non callable

- La Poste SA (Agency | Paris, France | Rating: A+): €150m Bond (FR001400HAT4), fixed rate (0.63% coupon) maturing on 18 January 2036, priced at 67.37 (original spread of 97 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4A8Y8), fixed rate (3.00% coupon) maturing on 18 May 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4A8V4), fixed rate (2.90% coupon) maturing on 19 May 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4A8Z5), fixed rate (3.05% coupon) maturing on 17 May 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4A908), fixed rate (3.10% coupon) maturing on 17 May 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4A916), fixed rate (3.15% coupon) maturing on 17 May 2029, priced at 100.00, non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): €500m Unsecured Note (XS2613666739), fixed rate (4.25% coupon) maturing on 25 April 2028, priced at 100.00, non callable

- National Bank of Canada (Banking | Montreal, Canada | Rating: BBB+): €300m Unsecured Note (XS2614612930), floating rate maturing on 21 April 2025, priced at 100.00, non callable

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Netherlands | Rating: AAA): €1,500m Senior Note (XS2613821300), fixed rate (3.00% coupon) maturing on 20 April 2033, priced at 99.22 (original spread of 77 bp), non callable

- OP Asuntoluottopankki Oyj (Mortgage Banking | Helsinki, Finland | Rating: NR): €1,000m Covered Bond (Other) (XS2613838296), fixed rate (3.13% coupon) maturing on 20 October 2028, priced at 99.58 (original spread of 87 bp), non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €389m Unsecured Note (XS2613358675) zero coupon maturing on 16 March 2026, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Austria | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (XS2613629372), fixed rate (3.38% coupon) maturing on 24 July 2028, priced at 99.94 (original spread of 100 bp), non callable

- Terna Rete Elettrica Nazionale SpA (Utility - Other | Rome, Italy | Rating: BBB+): €750m Senior Note (XS2607193435), fixed rate (3.63% coupon) maturing on 21 April 2029, priced at 99.28 (original spread of 136 bp), callable (6nc6)

- Toyota Motor Finance Netherlands BV (Financial - Other | Amsterdam, Japan | Rating: A+): €500m Senior Note (XS2613667976), fixed rate (3.63% coupon) maturing on 24 April 2025, non callable

- Vseobecna Uverova Banka as (Banking | Bratislava, Italy | Rating: AA+): €500m Covered Bond (Other) (SK4000022828), fixed rate (3.50% coupon) maturing on 13 October 2026, priced at 99.30 (original spread of 125 bp), non callable

RECENT LOANS

- Al-Ansaar General Hospital Ppp (Saudi Arabia), signed a US$ 500m Term Loan, to be used for project finance.

- Almirante Tamandare FPSO (Brazil), signed a US$ 1,630m Term Loan, to be used for general corporate purposes. It matures on 04/05/25 and initial pricing is set at Term SOFR +220.0bp

- Antalya Airport Ppp (Turkey), signed a US$ 163m Capital Expenditure Facility, to be used for project finance.

- Antalya Airport Ppp (Turkey), signed a € 140m Capital Expenditure Facility, to be used for project finance.

- Bcp Asia II Topco II Pte Ltd (Singapore), signed a US$ 160m Term Loan, to be used for leveraged buyout. It matures on 04/06/28 and initial pricing is set at Term SOFR +333.0bp

- Belron International Ltd (United Kingdom), signed a US$ 870m Term Loan B, to be used for general corporate purposes. It matures on 04/06/29 and initial pricing is set at Term SOFR +275.0bp

- Burgess Point Purchaser Corp (United States of America | B-), signed a US$ 150m Term Loan B, to be used for general corporate purposes. It matures on 07/25/29 and initial pricing is set at Term SOFR +525.0bp

- DataBank Holdings Ltd (United States of America), signed a US$ 175m Term Loan, to be used for general corporate purposes and working capital. It matures on 04/06/28.

- DataBank Holdings Ltd (United States of America), signed a US$ 125m Delayed Draw Term Loan, to be used for general corporate purposes and working capital. It matures on 04/06/28.

- Dover Corp (United States of America | BBB+), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/06/28 and initial pricing is set at Term SOFR +80.0bp

- Dover Corp (United States of America | BBB+), signed a US$ 500m 364d Revolver, to be used for general corporate purposes. It matures on 04/05/24 and initial pricing is set at Term SOFR +82.5bp

- EPM (Colombia), signed a US$ 190m Term Loan, to be used for general corporate purposes. It matures on 04/19/33.

- Econergy Pv Portfolio (Italy), signed a € 100m Term Loan, to be used for project finance.

- Enerjisa Wind Power Plant (Turkey), signed a US$ 110m Term Loan, to be used for project finance. It matures on 04/05/30.

- Eoliennes En Mer Iles Dyeu Et (France), signed a € 158m Standby Letter of Credit, to be used for project finance. It matures on 01/05/44.

- Eoliennes En Mer Iles Dyeu Et (France), signed a € 996m Term Loan, to be used for project finance. It matures on 01/05/44.

- Eoliennes En Mer Iles Dyeu Et (France), signed a € 106m Revolving Credit Facility, to be used for project finance. It matures on 01/05/44.

- Goldman Sachs Private Credit (United States of America), signed a US$ 725m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/06/28.

- Hamilton Projects Acquiror (United States of America | BB-), signed a US$ 789m Term Loan B, to be used for project finance. It matures on 06/26/27 and initial pricing is set at Term SOFR +450.0bp

- Hausladen Fruchthandelsgesells (Germany), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes and working capital.

- He Dreiht Offshore Wind Farm (Germany), signed a € 600m Term Loan, to be used for project finance.

- KKR Capital Markets LLC (United States of America), signed a US$ 750m 364d Revolver, to be used for general corporate purposes. It matures on 04/06/24 and initial pricing is set at Term SOFR +275.0bp

- Mondelez International Inc (United States of America | BBB), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/29/23 and initial pricing is set at Term SOFR +84.0bp

- Optiv Sec Inc (United States of America), signed a US$ 725m Term Loan B, to be used for acquisition financing. It matures on 08/17/26 and initial pricing is set at Term SOFR +525.0bp

- Prologis LP (United States of America | A), signed a € 917m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/27 and initial pricing is set at Term SOFR +70.0bp

- Prologis LP (United States of America | A), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/27 and initial pricing is set at Term SOFR +70.0bp

- Raymond James Financial Inc (United States of America | A-), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/06/28 and initial pricing is set at Term SOFR +112.5bp

- Verisk Analytics Inc (United States of America | BBB-), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/05/28 and initial pricing is set at Term SOFR +100.0bp