Credit

USD Cash Spreads Mixed This Week, With Renewed Compression In The CCCs/BBs OAS Ratio

USD bond issuance returns as earnings start rolling in: 19 tranches for $30.75bn in IG (2023 YTD volume $452.04bn vs 2022 YTD $567.541bn), 6 tranches for $3.615bn in HY (2023 YTD volume $53.327bn vs 2022 YTD $49.646bn)

Published ET

ICE BofAML US CCCs / BBs OAS Ratio | Source: Refinitiv

DAILY SUMMARY

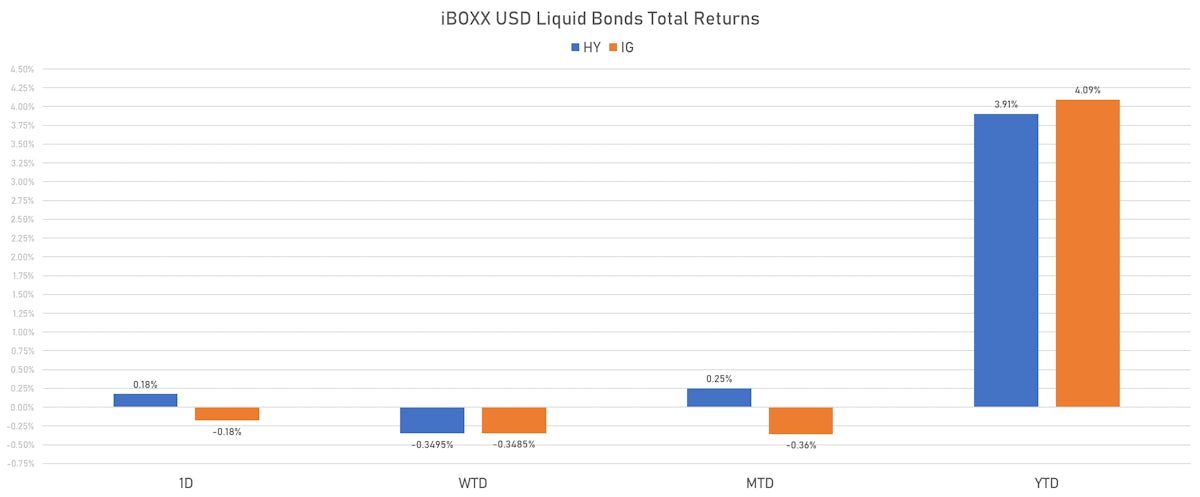

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.179% today (Week-to-date: -0.35%; Month-to-date: -0.36%; Year-to-date: 4.09%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.176% today (Week-to-date: -0.35%; Month-to-date: 0.25%; Year-to-date: 3.91%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 142.0 bp (WTD change: -2.0 bp; YTD change: +2.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 472.0 bp (WTD change: +4.0 bp; YTD change: -16.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +4.1%)

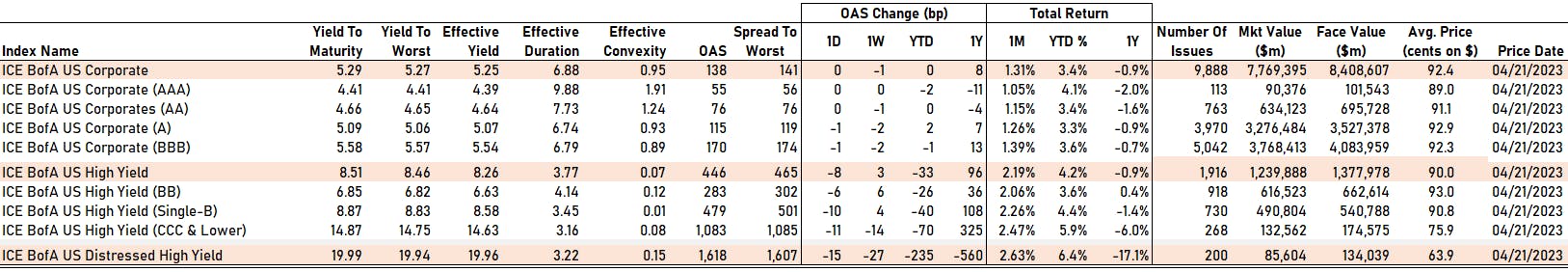

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 55 bp

- AA unchanged at 76 bp

- A down by -1 bp at 115 bp

- BBB down by -1 bp at 170 bp

- BB down by -6 bp at 283 bp

- B down by -10 bp at 479 bp

- ≤ CCC down by -11 bp at 1,083 bp

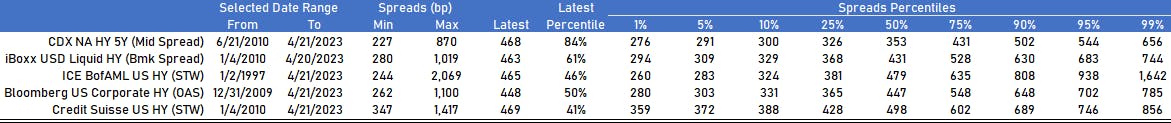

CDS INDICES TODAY (mid-spreads)

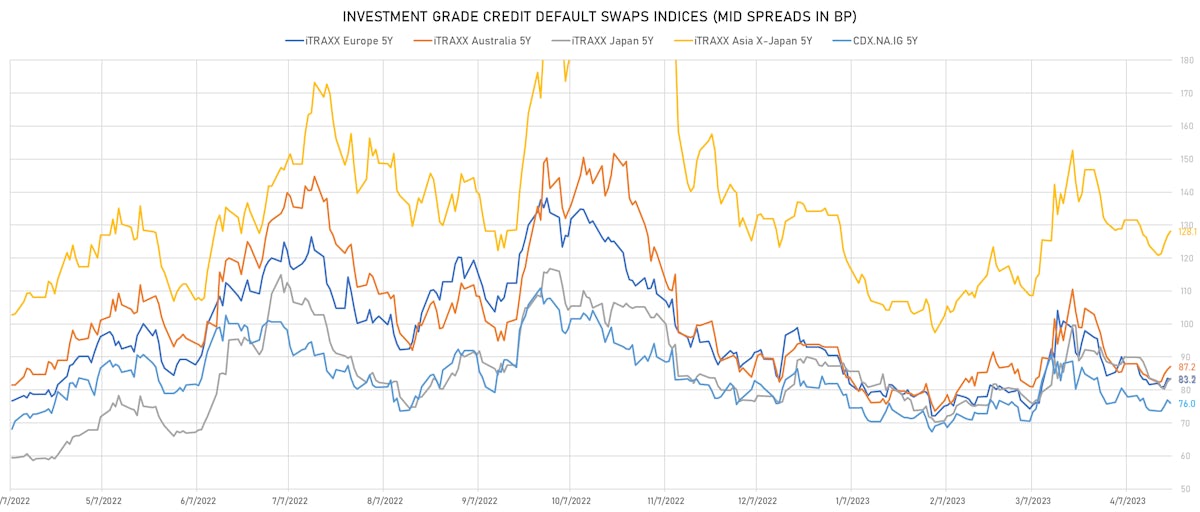

- Markit CDX.NA.IG 5Y down 0.9 bp, now at 76bp (1W change: +2.1bp; YTD change: -5.8bp)

- Markit CDX.NA.IG 10Y down 0.8 bp, now at 113bp (1W change: +2.3bp; YTD change: -4.6bp)

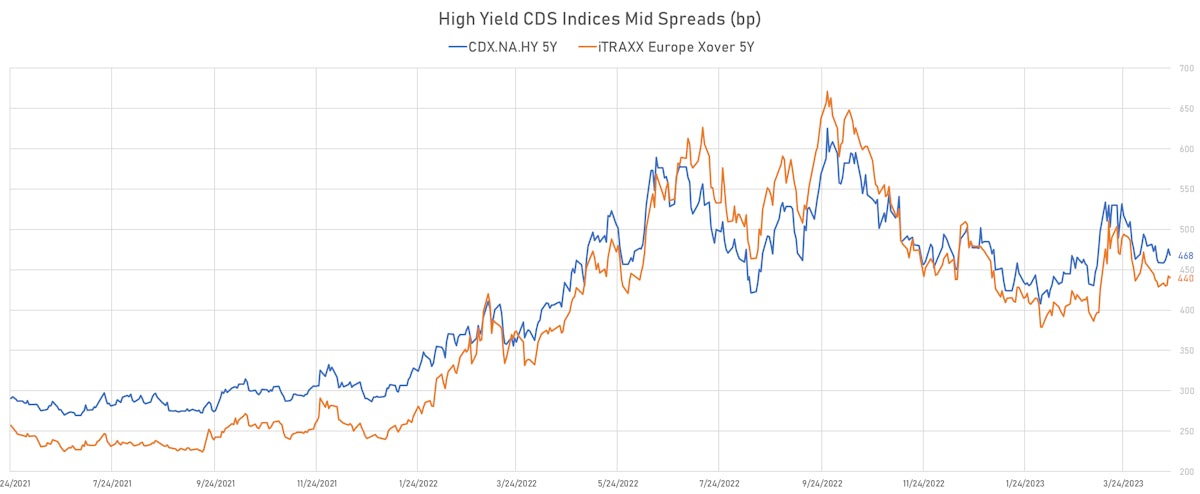

- Markit CDX.NA.HY 5Y down 7.8 bp, now at 468bp (1W change: +9.0bp; YTD change: -16.8bp)

- Markit iTRAXX Europe 5Y down 0.3 bp, now at 83bp (1W change: +1.6bp; YTD change: -7.2bp)

- Markit iTRAXX Europe Crossover 5Y down 2.0 bp, now at 440bp (1W change: +11.3bp; YTD change: -33.8bp)

- Markit iTRAXX Japan 5Y up 1.1 bp, now at 84bp (1W change: -0.1bp; YTD change: -3.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 1.5 bp, now at 128bp (1W change: +4.3bp; YTD change: -4.9bp)

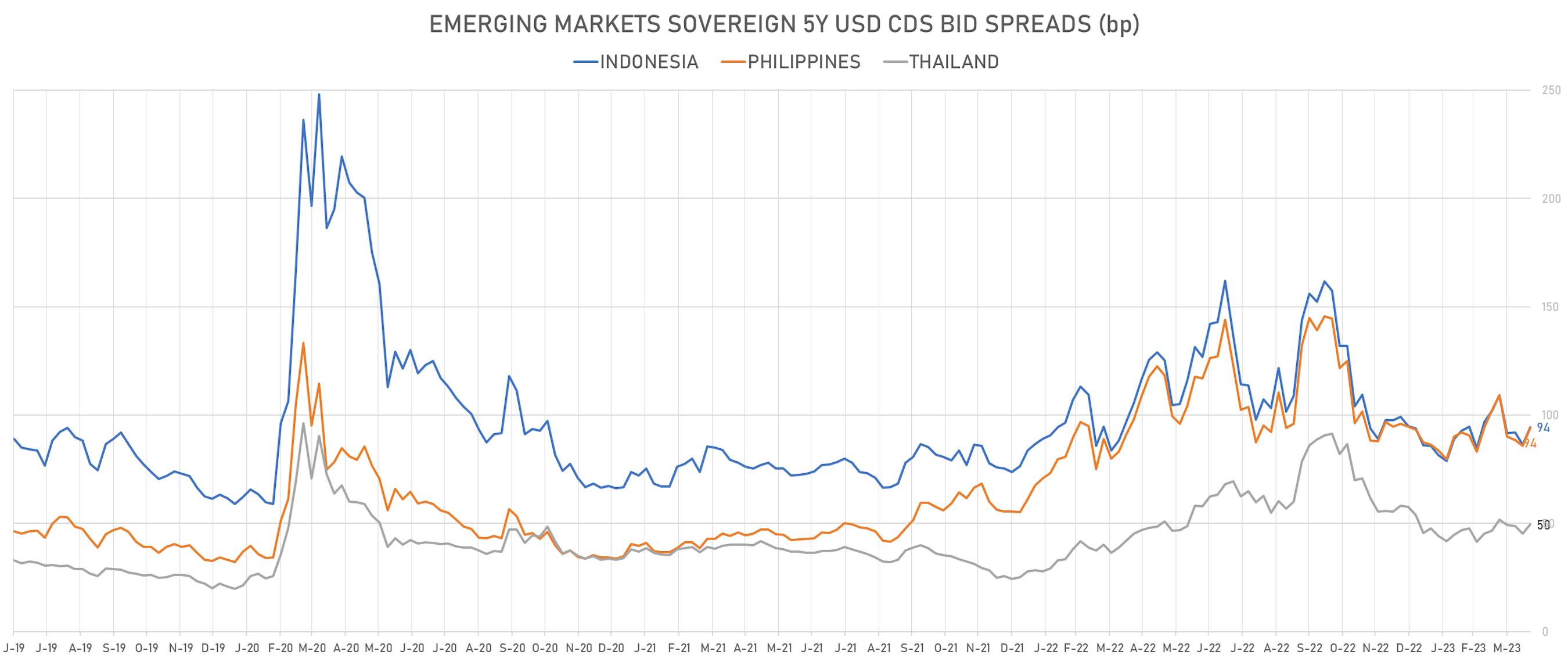

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Jamaica (rated B+): up 15.4 % to 391 bp (1Y range: 338-392bp)

- Egypt (rated B+): up 13.2 % to 1,546 bp (1Y range: 598-1,590bp)

- Malaysia (rated BBB+): up 11.2 % to 72 bp (1Y range: 57-122bp)

- Philippines (rated BBB): up 9.5 % to 94 bp (1Y range: 79-153bp)

- Indonesia (rated BBB): up 9.3 % to 94 bp (1Y range: 76-166bp)

- Panama (rated WD): up 8.6 % to 122 bp (1Y range: 96-187bp)

- China (rated A+): up 7.5 % to 71 bp (1Y range: 47-132bp)

- Vietnam (rated BB): up 6.3 % to 125 bp (1Y range: 103-181bp)

- Turkey (rated B): up 5.7 % to 552 bp (1Y range: 487-892bp)

- Brazil (rated BB-): up 5.5 % to 228 bp (1Y range: 208-328bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: NR): down 221.4 bp to 1,811.7bp (1Y range: 751-4,371bp)

- Unisys Corp (Country: US; rated: B1): down 52.2 bp to 1,343.4bp (1Y range: 331-1,378bp)

- Univision Communications Inc (Country: US; rated: B1): down 44.0 bp to 428.6bp (1Y range: 429-658bp)

- Avon Products Inc (Country: GB; rated: WR): down 42.0 bp to 323.9bp (1Y range: 316-452bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): up 27.1 bp to 315.7bp (1Y range: 244-446bp)

- Ford Motor Co (Country: US; rated: A3): up 28.8 bp to 324.7bp (1Y range: 254-456bp)

- Murphy Oil Corp (Country: US; rated: A1): up 31.3 bp to 238.5bp (1Y range: 219-446bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 37.3 bp to 950.8bp (1Y range: 761-1,472bp)

- Transocean Inc (Country: KY; rated: Caa1): up 38.0 bp to 875.0bp (1Y range: 674-2,858bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 38.3 bp to 872.0bp (1Y range: 416-1,046bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 42.1 bp to 616.4bp (1Y range: 390-887bp)

- Carnival Corp (Country: US; rated: WR): up 43.2 bp to 1,106.7bp (1Y range: 462-2,117bp)

- Staples Inc (Country: US; rated: B3): up 255.8 bp to 2,586.9bp (1Y range: 1,101-2,587bp)

- DISH DBS Corp (Country: US; rated: B2): up 355.0 bp to 2,867.0bp (1Y range: 572-2,867bp)

- Lumen Technologies Inc (Country: US; rated: LGD5 - 77%): up 422.1 bp to 4,259.4bp (1Y range: 195-4,259bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ceconomy AG (Country: DE; rated: B1): down 168.5 bp to 1,032.3bp (1Y range: 308-1,763bp)

- TUI AG (Country: DE; rated: B3-PD): down 47.9 bp to 866.9bp (1Y range: 691-1,725bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 12.4 bp to 1,990.9bp (1Y range: 1,286-2,910bp)

- Vivendi SE (Country: FR; rated: A1): up 13.2 bp to 129.2bp (1Y range: 34-129bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 14.1 bp to 924.4bp (1Y range: 401-1,021bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 15.7 bp to 1,172.8bp (1Y range: 566-1,739bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): up 16.9 bp to 638.6bp (1Y range: 370-758bp)

- Valeo SE (Country: FR; rated: P-3): up 17.9 bp to 303.3bp (1Y range: 235-389bp)

- Telecom Italia SpA (Country: IT; rated: BB-): up 21.9 bp to 379.4bp (1Y range: 306-545bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 26.5 bp to 892.3bp (1Y range: 429-1,254bp)

- Novafives SAS (Country: FR; rated: Caa1): up 29.3 bp to 1,154.0bp (1Y range: 618-2,936bp)

- Renault SA (Country: FR; rated: A-): up 31.6 bp to 311.9bp (1Y range: 236-476bp)

- CMA CGM SA (Country: FR; rated: WR): up 46.5 bp to 323.8bp (1Y range: 243-648bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 69.9 bp to 840.6bp (1Y range: 598-1,296bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 134.9 bp to 497.4bp (1Y range: 186-505bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Global Net Lease Inc (New York City, New York (US)) | Coupon: 3.75% | Maturity: 15/12/2027 | Rating: BB- | CUSIP: 37892AAA8 | OAS up by 89.2 bp to 639.1 bp, with the yield to worst at 10.1% and the bond now trading down to 76.6 cents on the dollar (1Y price range: 76.6-86.3).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS up by 55.0 bp to 381.1 bp (CDS basis: -84.9bp), with the yield to worst at 7.4% and the bond now trading down to 97.4 cents on the dollar (1Y price range: 95.5-100.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.70% | Maturity: 10/8/2026 | Rating: BB | CUSIP: 345397B77 | OAS up by 52.2 bp to 289.1 bp (CDS basis: -66.7bp), with the yield to worst at 6.8% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 85.9-90.9).

- Issuer: Xerox Corp (Norwalk, Connecticut (US)) | Coupon: 3.80% | Maturity: 15/5/2024 | Rating: BB | CUSIP: 984121CJ0 | OAS up by 49.9 bp to 174.4 bp (CDS basis: -7.5bp), with the yield to worst at 6.4% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 95.8-98.1).

- Issuer: Western Digital Corp (San Jose, California (US)) | Coupon: 4.75% | Maturity: 15/2/2026 | Rating: BB | CUSIP: 958102AM7 | OAS up by 41.8 bp to 240.6 bp, with the yield to worst at 6.2% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 93.0-97.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.39% | Maturity: 8/1/2026 | Rating: BB | CUSIP: 345397XU2 | OAS up by 38.7 bp to 285.6 bp (CDS basis: -80.4bp), with the yield to worst at 6.8% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 92.1-97.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.66% | Maturity: 8/9/2024 | Rating: BB | CUSIP: 345397WW9 | OAS up by 36.4 bp to 190.8 bp (CDS basis: -34.8bp), with the yield to worst at 6.5% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 94.6-97.2).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.69% | Maturity: 9/6/2025 | Rating: BB | CUSIP: 345397ZJ5 | OAS up by 28.8 bp to 211.5 bp (CDS basis: -43.8bp), with the yield to worst at 6.4% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 94.5-98.2).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS up by 26.4 bp to 156.8 bp (CDS basis: 101.4bp), with the yield to worst at 5.5% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 7.38% | Maturity: 15/1/2026 | Rating: BB | CUSIP: 247361ZZ4 | OAS down by 21.7 bp to 107.0 bp (CDS basis: 35.6bp), with the yield to worst at 5.1% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 101.8-105.9).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 25.3 bp to 99.2 bp (CDS basis: -62.6bp), with the yield to worst at 5.4% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 91.4-94.8).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | CUSIP: 690872AB2 | OAS down by 29.7 bp to 166.6 bp, with the yield to worst at 5.6% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 96.0-98.8).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS down by 30.6 bp to 113.9 bp (CDS basis: -66.0bp), with the yield to worst at 5.1% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 97.3-100.6).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | CUSIP: 02376RAE2 | OAS down by 50.2 bp to 362.5 bp (CDS basis: 486.7bp), with the yield to worst at 7.4% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 85.0-94.0).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS down by 53.5 bp to 202.9 bp, with the yield to worst at 6.0% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 96.0-98.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS up by 42.8 bp to 508.4 bp (CDS basis: 206.7bp), with the yield to worst at 8.1% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 88.4-97.4).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS up by 37.4 bp to 407.2 bp (CDS basis: 226.9bp), with the yield to worst at 7.1% and the bond now trading down to 92.9 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | OAS up by 26.1 bp to 379.2 bp, with the yield to worst at 6.8% and the bond now trading down to 76.3 cents on the dollar (1Y price range: 73.9-79.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | OAS up by 21.8 bp to 436.4 bp, with the yield to worst at 7.5% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 81.0-88.7).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 1.25% | Maturity: 15/1/2029 | Rating: BB+ | ISIN: XS2300292963 | OAS down by 21.0 bp to 144.8 bp, with the yield to worst at 4.6% and the bond now trading up to 83.3 cents on the dollar (1Y price range: 79.5-84.9).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | OAS down by 21.0 bp to 492.6 bp, with the yield to worst at 7.9% and the bond now trading up to 85.6 cents on the dollar (1Y price range: 76.5-85.8).

- Issuer: Cellnex Telecom SA (Barcelona, Spain) | Coupon: 1.00% | Maturity: 20/4/2027 | Rating: BB+ | ISIN: XS2102934697 | OAS down by 21.6 bp to 91.9 bp, with the yield to worst at 4.1% and the bond now trading up to 88.4 cents on the dollar (1Y price range: 84.8-88.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB | ISIN: XS2265369657 | OAS down by 21.6 bp to 166.6 bp (CDS basis: -12.0bp), with the yield to worst at 4.7% and the bond now trading up to 94.2 cents on the dollar (1Y price range: 89.7-94.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | OAS down by 21.6 bp to 216.1 bp, with the yield to worst at 4.7% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 89.8-95.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | OAS down by 22.4 bp to 483.8 bp, with the yield to worst at 8.1% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 79.3-90.5).

- Issuer: Wizz Air Finance Company BV (Amsterdam, Netherlands) | Coupon: 1.00% | Maturity: 19/1/2026 | Rating: BB+ | ISIN: XS2433361719 | OAS down by 28.2 bp to 254.5 bp, with the yield to worst at 5.6% and the bond now trading up to 87.7 cents on the dollar (1Y price range: 82.1-89.2).

- Issuer: illimity Bank SpA (Milan, Italy) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS down by 33.4 bp to 369.7 bp, with the yield to worst at 7.1% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 97.6-102.6).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: B+ | ISIN: XS2270393379 | OAS down by 34.8 bp to 389.6 bp (CDS basis: 1.9bp), with the yield to worst at 6.7% and the bond now trading up to 86.9 cents on the dollar (1Y price range: 84.3-88.5).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | OAS down by 40.7 bp to 262.1 bp, with the yield to worst at 5.7% and the bond now trading up to 88.6 cents on the dollar (1Y price range: 81.9-89.5).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS down by 44.5 bp to 406.5 bp, with the yield to worst at 7.5% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 88.0-97.5).

RECENT DOMESTIC USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A): US$5,000m Senior Note (US06051GLH01), floating rate maturing on 25 April 2034, priced at 100.00 (original spread of 174 bp), callable (11nc10)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A): US$3,500m Senior Note (US06051GLG28), floating rate maturing on 25 April 2029, priced at 100.00 (original spread of 141 bp), callable (6nc5)

- Bank of New York Mellon Corp (Securities | New York City, New York, United States | Rating: A+): US$1,500m Senior Note (US06406RBQ92), floating rate maturing on 26 April 2027, priced at 100.00 (original spread of 83 bp), callable (4nc3)

- Bank of New York Mellon Corp (Securities | New York City, New York, United States | Rating: A+): US$1,000m Senior Note (US06406RBR75), floating rate maturing on 26 April 2034, priced at 100.00 (original spread of 143 bp), callable (11nc10)

- Cargill Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: A): US$600m Senior Note (US141781CA03), fixed rate (4.50% coupon) maturing on 24 June 2026, priced at 99.80 (original spread of 66 bp), with a make whole call

- Cargill Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: A): US$500m Senior Note (US141781CB85), fixed rate (4.75% coupon) maturing on 24 April 2033, priced at 99.71 (original spread of 123 bp), callable (10nc10)

- Citigroup Global Markets Holdings Inc (Securities | New York City, New York, United States | Rating: A): US$818m Index Linked Security (US17331HFN17) maturing on 23 April 2025, priced at 100.00, callable (2nc3m)

- Enovix (Electronics | Fremont, California, United States | Rating: NR): US$150m Bond (US293594AC17), fixed rate (3.00% coupon) maturing on 1 May 2028, priced at 100.00, non callable, convertible

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AAA): US$700m Bond (US3133EPGJ85), floating rate (SOFR + 13.5 bp) maturing on 21 April 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AAA): US$260m Bond (US3133EPGW96), fixed rate (3.88% coupon) maturing on 25 April 2028, priced at 99.84 (original spread of 22 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AAA): US$175m Bond (US3133EPGS84), fixed rate (4.25% coupon) maturing on 24 July 2025, priced at 99.92 (original spread of 1 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AAA): US$175m Bond (US3133EPHF54), fixed rate (4.13% coupon) maturing on 27 October 2025, priced at 99.87, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AAA): US$200m Bond (US3133EPHE89), fixed rate (4.25% coupon) maturing on 28 April 2025, priced at 99.81, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AAA): US$140m Bond (US3133EPGT67), fixed rate (3.88% coupon) maturing on 26 April 2027, priced at 99.58 (original spread of 19 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AAA): US$300m Unsecured Note (US3134GYQA39), fixed rate (5.50% coupon) maturing on 1 May 2026, priced at 100.00 (original spread of 170 bp), callable (3nc3m)

- Lindblad Expeditions Holdings Inc (Financial - Other | New York City, New York, United States | Rating: B-): US$275m Note (US535219AA75), fixed rate (9.00% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 531 bp), callable (5nc2)

- Mars Inc (Food Processors | Mc Lean, Virginia, United States | Rating: A+): US$1,000m Senior Note (USU57346AR62), fixed rate (4.75% coupon) maturing on 20 April 2033, priced at 99.84 (original spread of 122 bp), callable (10nc10)

- Mars Inc (Food Processors | Mc Lean, Virginia, United States | Rating: A+): US$500m Senior Note (USU57346AQ89), fixed rate (4.65% coupon) maturing on 20 April 2031, priced at 100.00 (original spread of 109 bp), callable (8nc8)

- Mars Inc (Food Processors | Mc Lean, Virginia, United States | Rating: A+): US$1,000m Senior Note (US571676AT26), fixed rate (4.55% coupon) maturing on 20 April 2028, priced at 99.93 (original spread of 87 bp), callable (5nc5)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A+): US$3,250m Senior Note (US61747YFE05), floating rate maturing on 21 April 2034, priced at 100.00 (original spread of 171 bp), callable (11nc10)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A+): US$2,750m Senior Note (US61747YFD22), floating rate maturing on 20 April 2029, priced at 100.00 (original spread of 141 bp), callable (6nc5)

- Morgan Stanley Bank NA (Banking | Salt Lake City, Utah, United States | Rating: AA-): US$1,500m Senior Note (US61690U4T48), fixed rate (4.75% coupon) maturing on 21 April 2026, priced at 100.00 (original spread of 80 bp), callable (3nc3)

- Porch Group (Information/Data Technology | Seattle, Washington, United States | Rating: NR): US$333m Bond (US733245AC80), fixed rate (6.75% coupon) maturing on 1 October 2028, priced at 95.00, callable (5nc1), convertible

- Wells Fargo & Co (Banking | San Francisco, California, United States | Rating: A+): US$3,750m Senior Note (US95000U3D31), floating rate maturing on 24 April 2034, priced at 100.00 (original spread of 179 bp), callable (11nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Abu Dhabi National Energy Company PJSC (Utility - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$1,000m Senior Note (US00388WAM38), fixed rate (4.70% coupon) maturing on 24 April 2033, priced at 100.00 (original spread of 112 bp), non callable

- Abu Dhabi National Energy Company PJSC (Utility - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$500m Senior Note (XS2600246552), fixed rate (4.38% coupon) maturing on 24 January 2029, priced at 99.39 (original spread of 84 bp), non callable

- Allwyn Entertainment Financing (UK) PLC (Financial - Other | London, Liechtenstein | Rating: NR): US$700m Note (US02007VAA89), fixed rate (7.88% coupon) maturing on 30 April 2029, priced at 100.00 (original spread of 421 bp), callable (6nc3)

- Alpha Star Holding VII Ltd (Financial - Other | Dubai, Dubai, Cayman Islands | Rating: NR): US$400m Islamic Sukuk (Hybrid) (XS2615583510), fixed rate (7.75% coupon) maturing on 27 April 2026, priced at 100.00 (original spread of 386 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$3,500m Senior Note (US045167FW84), fixed rate (3.75% coupon) maturing on 25 April 2028, priced at 99.73 (original spread of 17 bp), non callable

- CK Hutchison 23 (Financial - Other | Hong Kong | Rating: NR): US$1,250m Senior Note (US12570FAA93), fixed rate (4.75% coupon) maturing on 21 April 2028, priced at 99.80 (original spread of 110 bp), callable (5nc5)

- CK Hutchison 23 (Financial - Other | Hong Kong | Rating: NR): US$1,250m Senior Note (US12570FAB76), fixed rate (4.88% coupon) maturing on 21 April 2033, priced at 99.53 (original spread of 135 bp), callable (10nc10)

- CK Hutchison International (23) Ltd (Financial - Other | Hong Kong | Rating: NR): US$1,250m Senior Note (USG21819AA80), fixed rate (4.75% coupon) maturing on 21 April 2028, priced at 99.80 (original spread of 110 bp), callable (5nc5)

- CK Hutchison International (23) Ltd (Financial - Other | Hong Kong | Rating: NR): US$1,250m Senior Note (USG21819AB63), fixed rate (4.88% coupon) maturing on 21 April 2033, priced at 99.53 (original spread of 135 bp), callable (10nc10)

- CSC Holdings LLC (Cable/Media | Bethpage, New York, Luxembourg | Rating: B+): US$1,000m Senior Note (US126307BM89), fixed rate (11.25% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 783 bp), callable (5nc2)

- Canada (Government) (Sovereign | Ottawa, Ontario, Canada | Rating: AA+): US$4,000m Bond (US135087Q560), fixed rate (3.75% coupon) maturing on 26 April 2028, priced at 99.56 (original spread of 11 bp), non callable

- Clarios Global LP (Industrials - Other | Toronto, Bermuda | Rating: B): US$750m Senior Note (US18060TAC99), fixed rate (6.75% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 305 bp), callable (5nc2)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460015240), fixed rate (4.35% coupon) maturing on 12 May 2025, priced at 100.00, non callable

- Diamond 2 (Financial - Other | United Kingdom | Rating: BB-): US$400m Note (US25276VAA35), fixed rate (7.95% coupon) maturing on 28 July 2026, priced at 99.38 (original spread of 443 bp), callable (3nc2)

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): US$150m Unsecured Note (XS2616719485), floating rate maturing on 8 May 2028, priced at 100.00, non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$4,000m Senior Note (US298785JW79), fixed rate (3.63% coupon) maturing on 15 July 2030, priced at 99.32 (original spread of 11 bp), non callable

- ICBC (London) PLC (Banking | London, China (Mainland) | Rating: NR): US$140m Unsecured Note (XS2616291865), floating rate maturing on 27 April 2026, priced at 100.00, non callable

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$2,500m Bond (US471048CW64), fixed rate (4.25% coupon) maturing on 27 April 2026, priced at 99.84 (original spread of 39 bp), non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$1,000m Senior Note (US471068AX45), fixed rate (4.13% coupon) maturing on 27 April 2028, priced at 99.52 (original spread of 61 bp), non callable

- Kevlar SpA (Financial - Other | Milan, Milano, Italy | Rating: NR): US$790m Depositary Receipt (US49272YAB92), fixed rate (6.50% coupon) maturing on 1 September 2029, priced at 84.00 (original spread of 664 bp), callable (6nc2)

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$1,000m Senior Note (US50046PCC77), fixed rate (4.25% coupon) maturing on 10 December 2025, priced at 99.95 (original spread of 33 bp), non callable

- Kookmin Bank (Banking | Seoul, Seoul, South Korea | Rating: A+): US$500m Senior Note (US50050HAU05), fixed rate (4.63% coupon) maturing on 21 April 2028, priced at 99.89 (original spread of 99 bp), non callable

- L&F (Machinery | Daegu, Daegu, South Korea | Rating: NR): US$500m Bond (XS2615199176), fixed rate (2.50% coupon) maturing on 26 April 2030, priced at 100.00, non callable, convertible

- Mauritius Commercial Bank Ltd (Banking | Port Louis, Mauritius | Rating: BBB-): US$300m Senior Note (XS2614704893), fixed rate (7.95% coupon) maturing on 26 April 2028, priced at 100.00 (original spread of 446 bp), non callable

- Mexico (United Mexican States) (Government) (Sovereign | Miguel Hidalgo, Mexico, D.F., Mexico | Rating: BBB-): US$2,941m Senior Note (US91087BAX82), fixed rate (6.34% coupon) maturing on 4 May 2053, priced at 100.00 (original spread of 260 bp), callable (30nc30)

- New Development Bank (Supranational | Shanghai, Shanghai, China (Mainland) | Rating: AA): US$1,250m Senior Note (XS2598333701), fixed rate (5.13% coupon) maturing on 26 April 2026, priced at 99.79 (original spread of 118 bp), non callable

- Ontario Teachers Finance Trust (Securities | Toronto, Ontario, Canada | Rating: NR): US$1,500m Senior Note (US68329AAP30), fixed rate (4.25% coupon) maturing on 25 April 2028, priced at 99.89 (original spread of 59 bp), non callable

- Pertamina Geothermal Energy PT Tbk (Utility - Other | Jakarta, Dki Jakarta, Indonesia | Rating: BBB-): US$400m Senior Note (US69379VAA70), fixed rate (5.15% coupon) maturing on 27 April 2028, priced at 100.00 (original spread of 151 bp), callable (5nc5)

- Pingdu City State-owned Assets Management Co Ltd (Financial - Other | Qingdao, Shandong, China (Mainland) | Rating: NR): US$200m Bond (XS2614579113), fixed rate (7.70% coupon) maturing on 26 April 2026, priced at 100.00, non callable

- SUEK-Finance OOO (Financial - Other | Moscow, Moscow, Bermuda | Rating: NR): US$300m Bond (RU000A1064Y6), fixed rate (3.35% coupon) maturing on 15 September 2026, priced at 100.00 (original spread of 1,152 bp), non callable

- Shinhan Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$200m Index Linked Security (KR6SH0004RH6) zero coupon maturing on 14 May 2026, priced at 100.00, non callable

- Shinhan Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$200m Index Linked Security (KR6SH0004RJ2) zero coupon maturing on 15 May 2026, priced at 100.00, non callable

- Sumitomo Mitsui Finance and Leasing Co Ltd (Leasing | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (XS2613209753), fixed rate (5.35% coupon) maturing on 25 April 2028, priced at 100.00 (original spread of 170 bp), non callable

- UBS Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$100m Certificate of Deposit - Retail (US90355GCR56), fixed rate (4.75% coupon) maturing on 21 April 2025, priced at 100.00 (original spread of 52 bp), non callable

RECENT EURO BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A+): €150m Senior Note (XS2615283632) zero coupon maturing on 21 April 2026, priced at 89.43, non callable

- Acciona Energia Financiacion Filiales SA (Financial - Other | Alcobendas, Madrid, Spain | Rating: NR): €500m Senior Note (XS2610209129), fixed rate (3.75% coupon) maturing on 25 April 2030, priced at 99.28 (original spread of 152 bp), callable (7nc7)

- Adif High Speed (Agency | Madrid, Madrid, Spain | Rating: BBB): €500m Bond (ES0200002089), fixed rate (3.90% coupon) maturing on 30 April 2033, priced at 99.85 (original spread of 143 bp), non callable

- Allwyn Entertainment Financing (UK) PLC (Financial - Other | London, Liechtenstein | Rating: NR): €665m Note (XS2615937690), fixed rate (7.25% coupon) maturing on 30 April 2030, priced at 100.00 (original spread of 482 bp), callable (7nc3)

- Austria, Republic of (Government) (Sovereign | Wien, Wien, Austria | Rating: AA+): €3,000m Bundesanleihe (AT0000A33SH3), fixed rate (2.90% coupon) maturing on 23 May 2029, priced at 99.71 (original spread of 55 bp), non callable

- Austria, Republic of (Government) (Sovereign | Wien, Wien, Austria | Rating: AA+): €2,000m Bundesanleihe (AT0000A33SK7), fixed rate (3.15% coupon) maturing on 20 October 2053, priced at 98.91 (original spread of 71 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €1,250m Bond (FR001400HMF8), fixed rate (4.38% coupon) maturing on 2 May 2030, priced at 99.45 (original spread of 205 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000BLB9T80), fixed rate (3.10% coupon) maturing on 28 April 2025, priced at 100.00, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €250m Hypothekenpfandbrief (Covered Bond) (DE000BLB9T98), floating rate (EU03MLIB + 8.0 bp) maturing on 30 July 2030, priced at 100.00, non callable

- Belfius Banque SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: A+): €102m Senior Note (BE6343192710), fixed rate (3.93% coupon) maturing on 24 April 2030, priced at 100.00, non callable

- CVC Cordatus Loan Fund 25 DAC (Financial - Other | Dublin, Ireland | Rating: NR): €244m Bond (XS2540118515), floating rate maturing on 20 May 2036, priced at 100.00, non callable

- Cargill Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: A): €500m Senior Note (XS2610788569), fixed rate (3.88% coupon) maturing on 24 April 2030, priced at 99.62 (original spread of 150 bp), callable (7nc7)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €1,000m Inhaberschuldverschreibung (DE000DW6C4H1), fixed rate (2.85% coupon) maturing on 16 May 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C4J7), fixed rate (3.00% coupon) maturing on 15 May 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €150m Inhaberschuldverschreibung (DE000DW6C4L3), fixed rate (3.00% coupon) maturing on 1 June 2027, priced at 100.00, callable (4nc2)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C4K5), fixed rate (3.15% coupon) maturing on 17 May 2028, priced at 100.00, non callable

- Diageo Finance PLC (Financial - Other | London, United Kingdom | Rating: A-): €500m Unsecured Note (XS2615917585), fixed rate (1.00% coupon) maturing on 26 June 2025, priced at 100.00, non callable

- Emissionskonsortium der gemeinsamen Landesfoerderinstitute bestehend aus (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: NR): €1,000m Jumbo Landesschatzanweisung (DE000A351P20), fixed rate (3.00% coupon) maturing on 26 April 2030, priced at 99.25 (original spread of 70 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A33TM1), fixed rate (3.10% coupon) maturing on 23 November 2026, priced at 100.00, non callable

- Eurogrid GmbH (Utility - Other | Berlin, Berlin, Belgium | Rating: BBB+): €650m Senior Note (XS2615183501), fixed rate (3.72% coupon) maturing on 27 April 2030, priced at 100.00 (original spread of 129 bp), callable (7nc7)

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: AA): €4,000m Senior Note (EU000A2SCAH1), fixed rate (3.00% coupon) maturing on 15 December 2028, priced at 99.61 (original spread of 61 bp), non callable

- Gruenenthal GmbH (Pharmaceuticals | Stolberg, Nordrhein-Westfalen, Germany | Rating: NR): €300m Senior Note (XS2615563082), fixed rate (6.75% coupon) maturing on 15 May 2030, priced at 100.00, callable (7nc3)

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Inhaberschuldverschreibung (DE000A1RQEJ9), floating rate (EU06MLIB + -22.0 bp) maturing on 27 October 2026, priced at 100.73, non callable

- Ibercaja Banco SA (Banking | Zaragoza, Zaragoza, Spain | Rating: AA+): €1,000m Cedula Hipotecaria (Covered Bond) (ES0444251088), floating rate maturing on 20 April 2033, non callable

- Ibercaja Banco SA (Banking | Zaragoza, Zaragoza, Spain | Rating: AA+): €1,000m Cedula Hipotecaria (Covered Bond) (ES0444251096), floating rate maturing on 20 April 2037, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €2,500m Index Linked Security (IT0005543803), fixed rate (1.50% coupon) maturing on 15 May 2029, priced at 98.87 (original spread of 127 bp), non callable, inflation protected

- Jyske Bank A/S (Banking | Silkeborg, Denmark | Rating: A): €500m Note (XS2615271629), fixed rate (5.00% coupon) maturing on 26 October 2028, priced at 99.97 (original spread of 246 bp), callable (6nc5)

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €3,000m Inhaberschuldverschreibung (DE000A30V9M4), fixed rate (2.88% coupon) maturing on 7 June 2033, priced at 99.09 (original spread of 58 bp), non callable

- KommuneKredit (Agency | Kobenhavn K, Denmark | Rating: AAA): €500m Senior Note (XS2615916850), fixed rate (3.38% coupon) maturing on 26 April 2043, priced at 98.86 (original spread of 84 bp), non callable

- Kuntarahoitus Oyj (Agency | Helsinki, Etela-Suomen, Finland | Rating: AA+): €1,000m Senior Note (XS2615680399), fixed rate (3.13% coupon) maturing on 29 July 2030, priced at 99.72 (original spread of 73 bp), non callable

- LVMH Moet Hennessy Louis Vuitton SE (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A+): €1,000m Senior Note (FR001400HJE7), fixed rate (3.38% coupon) maturing on 21 October 2025, priced at 99.95 (original spread of 67 bp), callable (3nc2)

- Monitchem Holdco 3 SA (Financial - Other | Luxembourg, Luxembourg | Rating: B-): €250m Note (XS2615007288), floating rate (EU03MLIB + 525.0 bp) maturing on 1 May 2028, priced at 97.50, callable (5nc1)

- Monitchem Holdco 3 SA (Financial - Other | Luxembourg, Luxembourg | Rating: B-): €420m Note (XS2615006470), fixed rate (8.75% coupon) maturing on 1 May 2028, priced at 100.00 (original spread of 625 bp), callable (5nc2)

- Muenchener Hypothekenbank eG (Banking | Muenchen, Bayern, Germany | Rating: AA-): €750m Hypothekenpfandbrief (Covered Bond) (DE000MHB34J3), fixed rate (3.13% coupon) maturing on 14 August 2029, priced at 99.76 (original spread of 76 bp), non callable

- National Bank of Canada (Banking | Montreal, Quebec, Canada | Rating: A-): €1,000m Covered Bond (Other) (XS2615559130), fixed rate (3.50% coupon) maturing on 25 April 2028, priced at 99.91 (original spread of 103 bp), non callable

- POP Asuntoluottopankki Oyj (Mortgage Banking | Espoo, Etela-Suomen, Finland | Rating: NR): €250m Covered Bond (Other) (FI4000550371), fixed rate (3.63% coupon) maturing on 26 April 2028 (original spread of 110 bp), non callable

- Permanent TSB Group Holdings PLC (Banking | Dublin, Dublin, Ireland | Rating: BB+): €650m Senior Note (XS2611221032), fixed rate (6.63% coupon) maturing on 25 April 2028, priced at 99.61 (original spread of 419 bp), callable (5nc4)

- Porsche Automobil Holding SE (Automotive Manufacturer | Stuttgart, Baden-Wuerttemberg, Germany | Rating: NR): €750m Senior Note (XS2615940215), fixed rate (4.50% coupon) maturing on 27 September 2028, priced at 99.65 (original spread of 211 bp), callable (5nc5)

- Sfil SA (Agency | Issy-Les-Moulineaux, France | Rating: AA): €750m Bond (FR001400HMX1), fixed rate (3.25% coupon) maturing on 25 November 2030, priced at 99.72, non callable

- Sydney Airport Finance Company Pty Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: NR): €1,000m Note (XS2613209670), fixed rate (4.38% coupon) maturing on 3 May 2033, priced at 99.46 (original spread of 199 bp), callable (10nc10)

- TVL Finance PLC (Financial - Other | Saint Helier, Luxembourg | Rating: NR): €250m Note (XS2615792947), floating rate (EU03MLIB + 550.0 bp) maturing on 28 April 2028, priced at 98.00, callable (5nc1)

- Transurban Finance Company Pty Ltd (Financial - Other | Melbourne, Victoria, Australia | Rating: BBB+): €650m Note (XS2614623978), fixed rate (4.23% coupon) maturing on 26 April 2033, priced at 100.00 (original spread of 176 bp), callable (10nc10)

- voestalpine (Metals/Mining | Linz, Oberoesterreich, Austria | Rating: NR): €250m Bond (AT0000A33R11), fixed rate (2.75% coupon) maturing on 28 April 2028, priced at 100.00, non callable, convertible

RECENT LOANS

- Action Nederland BV (Netherlands), signed a € 2,285m Term Loan B, to be used for general corporate purposes. It matures on 09/08/28 and initial pricing is set at EURIBOR +400.0bp

- Akbank TAS (Turkey), signed a US$ 246m Term Loan, to be used for general corporate purposes and finance linked-trade. It matures on 04/14/24 and initial pricing is set at Term SOFR +425.0bp

- Ampac Packaging LLC (United States of America), signed a US$ 245m Term Loan B, to be used for general corporate purposes. It matures on 11/03/25 and initial pricing is set at Term SOFR +375.0bp

- Applied Systems Inc (United States of America | B-), signed a US$ 290m Term Loan B, to be used for general corporate purposes. It matures on 09/19/26 and initial pricing is set at Term SOFR +450.0bp

- Beijing Energy Intl Hldg Co (Hong Kong), signed a US$ 125m Term Loan, to be used for general corporate purposes and working capital. It matures on 04/12/24.

- Best Buy Co Inc (United States of America | BBB+), signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/12/28.

- Copenhagen Fund CI IV (Denmark), signed a € 500m Term Loan, to be used for general corporate purposes. It matures on 05/12/26.

- Emerson Electric Co (United States of America | A), signed a US$ 8,175m Bridge Loan, to be used for acquisition financing. It matures on 04/18/24.

- Freddys Frozen Custard & (United States of America), signed a US$ 115m Term Loan A, to be used for general corporate purposes. It matures on 04/14/28 and initial pricing is set at Term SOFR +260.0bp

- Globe Life Inc (United States of America | A), signed a US$ 170m Delayed Draw Term Loan, to be used for refinancing. It matures on 11/15/24.

- ITC Holding Co LLC (United States of America | BBB), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/14/28.

- Imagefirst Healthcare Laundry (United States of America), signed a US$ 215m Term Loan B, to be used for general corporate purposes. It matures on 04/27/28 and initial pricing is set at Term SOFR +500.0bp

- Internet Brands Inc (United States of America), signed a US$ 4,741m Term Loan B, to be used for general corporate purposes. It matures on 04/20/28 and initial pricing is set at Term SOFR +425.0bp

- Lennox International Inc (United States of America | BBB), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/14/26 and initial pricing is set at Term SOFR +125.0bp

- Manuchehr Ventures Llc (United States of America), signed a US$ 192m Term Loan A, to be used for general corporate purposes. It matures on 11/23/26 and initial pricing is set at Term SOFR +250.0bp

- Marvell Technology Inc (United States of America | BBB-), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/14/28 and initial pricing is set at Term SOFR +112.5bp

- Marvell Technology Inc (United States of America | BBB-), signed a US$ 875m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 12/07/23 and initial pricing is set at Term SOFR +125.0bp

- Marvell Technology Inc (United States of America | BBB-), signed a US$ 875m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 12/07/25 and initial pricing is set at Term SOFR +137.5bp

- Palo Alto Networks Inc (United States of America), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/13/28 and initial pricing is set at Term SOFR +112.5bp

- Rhi Magnesita Gmbh (Austria), signed a € 150m Term Loan, to be used for general corporate purposes. It matures on 04/01/26.

- Rompetrol Rafinare Sa (Romania), signed a US$ 532m Term Loan, to be used for general corporate purposes.

- Somfy Activities SA (France), signed a € 350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/13/28.

- TowerVision India Pvt Ltd (India), signed a US$ 160m Term Loan, to be used for leveraged buyout. It matures on 04/19/28 and initial pricing is set at Term SOFR +360.0bp

- Trevise Holdings 1 (France | B), signed a € 446m Term Loan B, to be used for acquisition financing. It matures on 07/21/29 and initial pricing is set at EURIBOR +500.0bp

- Varta AG (Germany), signed a € 100m Term Loan, to be used for general corporate purposes. It matures on 12/13/26.

- Varta AG (Germany), signed a € 135m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/13/26.

- Vedanta Ltd (India), signed a US$ 1,000m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/14/26 and initial pricing is set at Term SOFR +1,100.0bp

- Vetter Pharma-Fertigung GmbH (Germany), signed a € 275m Revolving Credit Facility, to be used for working capital. It matures on 04/13/30.

RECENT STRUCTURED CREDIT

- First Help Financial Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 305 m. Highest-rated tranche offering a yield to maturity of 5.96%, and the lowest-rated tranche a yield to maturity of 8.04%. Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc

- Hill Fl 2023-1 issued a floating-rate ABS backed by auto receivables in 4 tranches, for a total of € 469 m. Highest-rated tranche offering a spread over the floating rate of 76bp, and the lowest-rated tranche a spread of 440bp. Bookrunners: Commerzbank AG, RBC Capital Markets, BofA Securities Inc