Credit

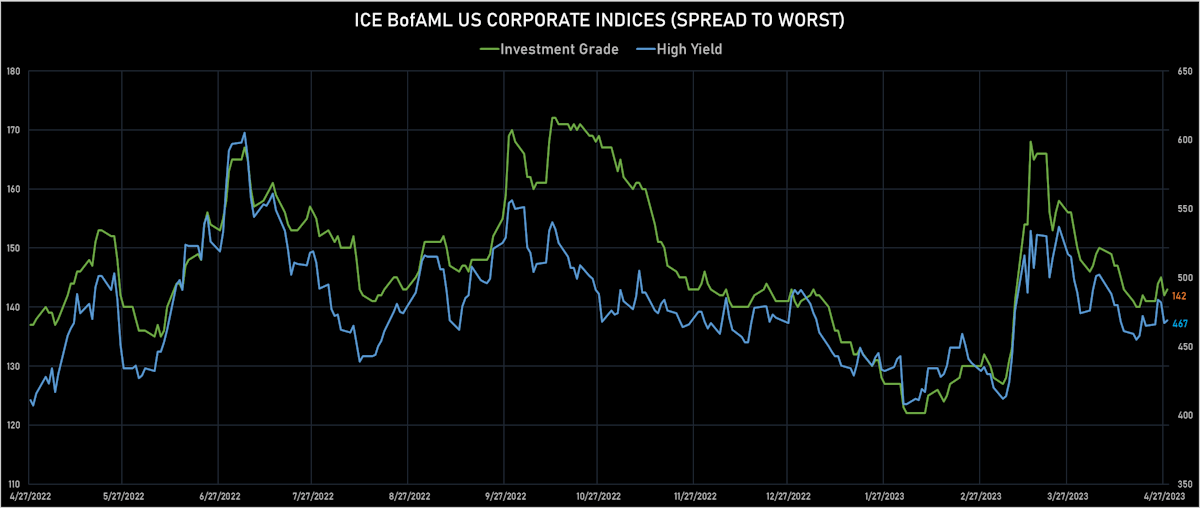

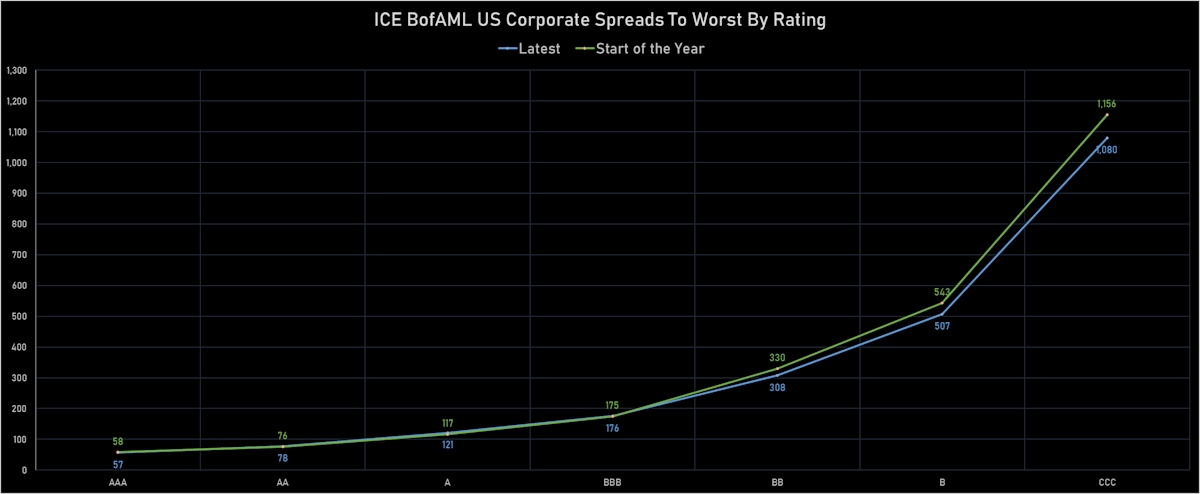

Despite The Volatility Scare In March, USD Cash Spreads Have Barely Moved YTD

Modest amount of US$ bond issuance for corporates this week: 21 tranches for $17.85bn in IG (2023 YTD volume $469.89bn vs 2022 YTD $577.641bn), 4 tranches for $3.12bn in HY (2023 YTD volume $58.572bn vs 2022 YTD $54.171bn)

Published ET

ICE BofAML USD Cash Spreads YTD Changes | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.58% today, with investment grade up 0.60% and high yield up 0.36% (YTD total return: +4.29%)

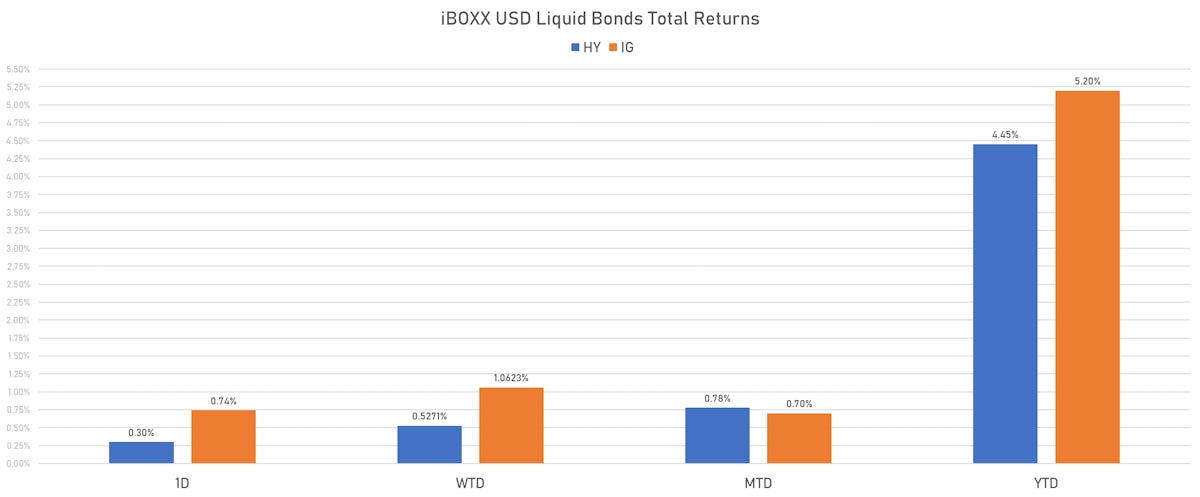

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.741% today (Week-to-date: 1.06%; Month-to-date: 0.70%; Year-to-date: 5.20%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.300% today (Week-to-date: 0.53%; Month-to-date: 0.78%; Year-to-date: 4.45%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 143.0 bp (WTD change: +2.0 bp; YTD change: +3.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged 0.0 bp, now at 469.0 bp (WTD change: +3.0 bp; YTD change: -19.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +4.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 56 bp

- AA up by 1 bp at 78 bp

- A up by 1 bp at 117 bp

- BBB up by 1 bp at 172 bp

- BB up by 2 bp at 287 bp

- B up by 1 bp at 483 bp

- ≤ CCC down by -1 bp at 1,077 bp

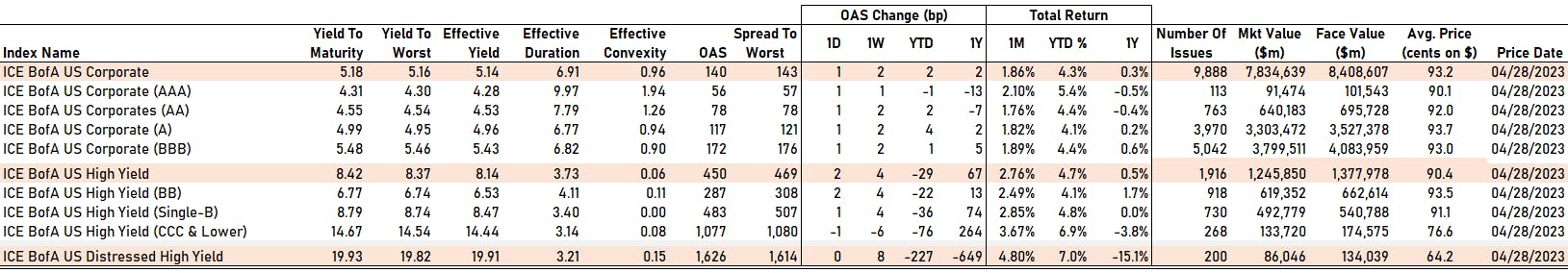

USD HIGH YIELD CASH SPREADS PERCENTILES

CDS INDICES TODAY (mid-spreads)

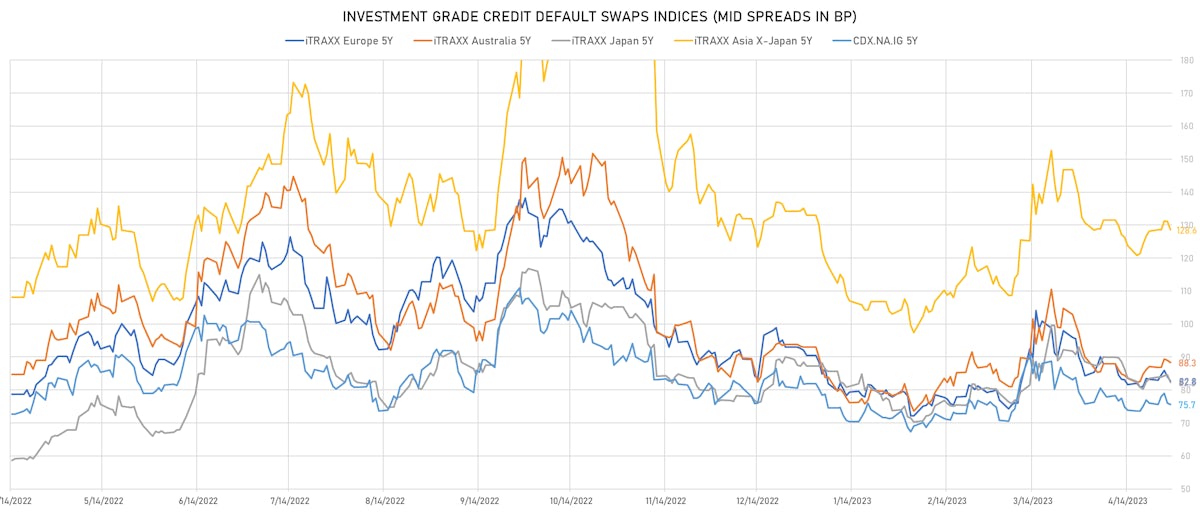

- Markit CDX.NA.IG 5Y down 0.4 bp, now at 76bp (1W change: -0.4bp; YTD change: -6.2bp)

- Markit CDX.NA.IG 10Y down 0.3 bp, now at 113bp (1W change: -0.6bp; YTD change: -5.3bp)

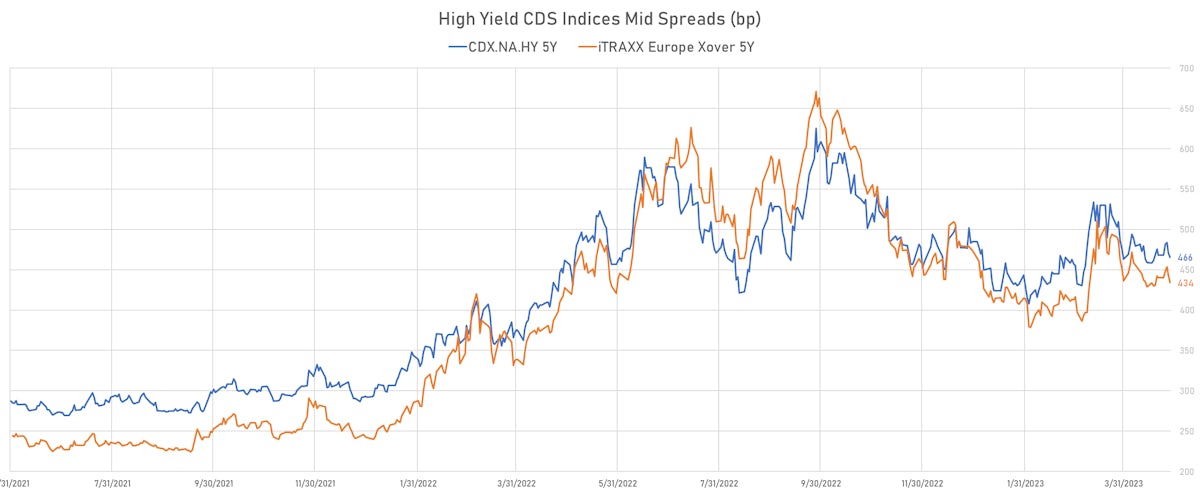

- Markit CDX.NA.HY 5Y down 5.1 bp, now at 466bp (1W change: -2.3bp; YTD change: -19.2bp)

- Markit iTRAXX Europe 5Y down 1.4 bp, now at 83bp (1W change: -0.5bp; YTD change: -7.7bp)

- Markit iTRAXX Europe Crossover 5Y down 9.4 bp, now at 434bp (1W change: -6.2bp; YTD change: -40.0bp)

- Markit iTRAXX Japan 5Y down 2.3 bp, now at 82bp (1W change: -1.2bp; YTD change: -4.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.5 bp, now at 129bp (1W change: +0.5bp; YTD change: -4.4bp)

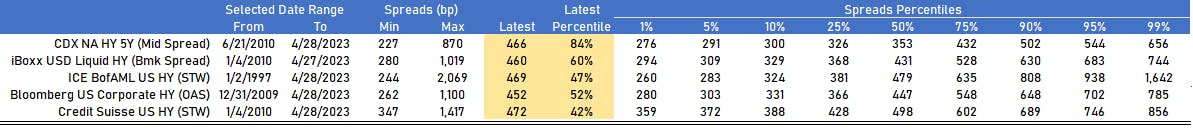

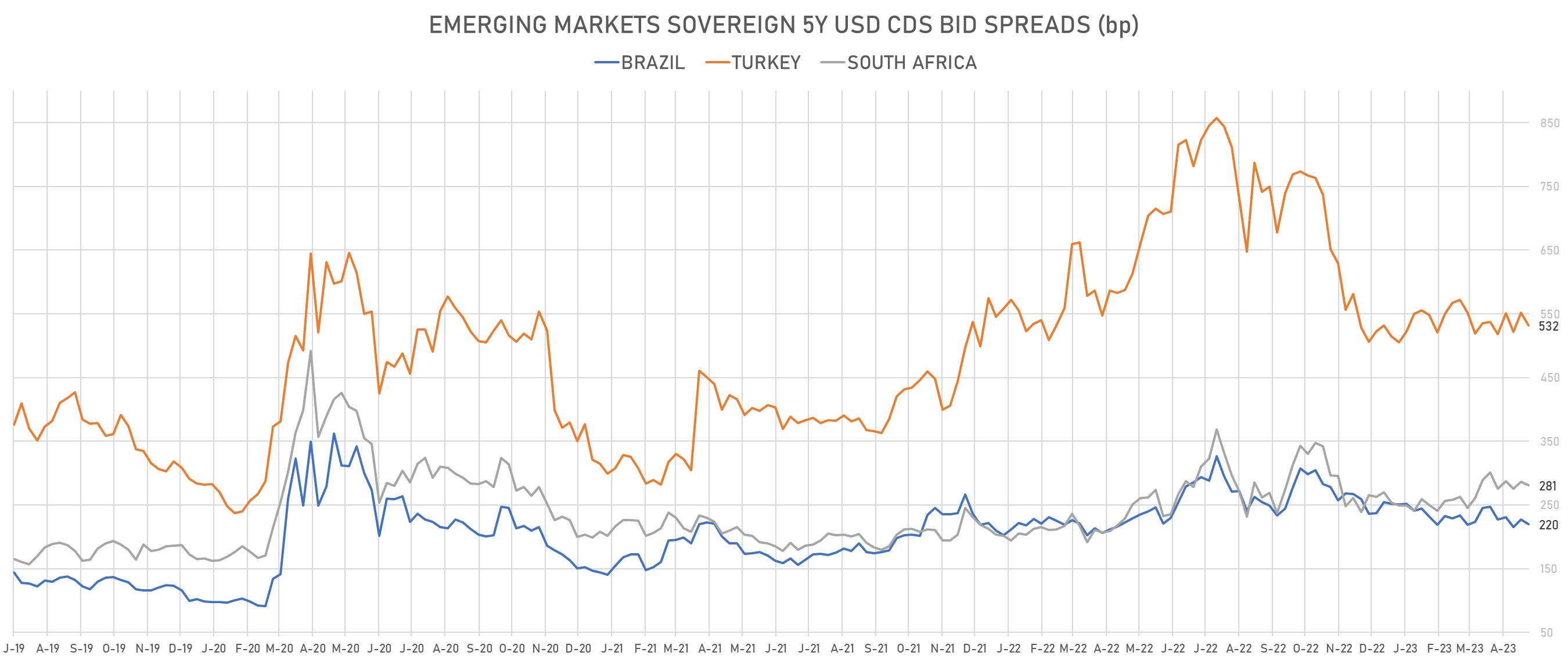

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Colombia (rated BB+): up 5.5 % to 281 bp (1Y range: 200-394bp)

- Italy (rated BBB): up 4.6 % to 107 bp (1Y range: 88-179bp)

- Egypt (rated B+): up 3.5 % to 1,546 bp (1Y range: 598-1,590bp)

- Brazil (rated BB-): down 3.3 % to 228 bp (1Y range: 208-328bp)

- Turkey (rated B): down 3.6 % to 552 bp (1Y range: 487-892bp)

- Malaysia (rated BBB+): down 4.4 % to 72 bp (1Y range: 57-122bp)

- Peru (rated BBB): down 5.3 % to 103 bp (1Y range: 97-171bp)

- Chile (rated A-): down 5.4 % to 103 bp (1Y range: 81-174bp)

- Mexico (rated BBB-): down 5.7 % to 118 bp (1Y range: 103-205bp)

- Jamaica (rated B+): down 13.4 % to 391 bp (1Y range: 338-392bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: NR): down 311.9 bp to 1,499.9bp (1Y range: 896-4,371bp)

- Beazer Homes USA Inc (Country: US; rated: NR): down 66.7 bp to 422.5bp (1Y range: 423-899bp)

- Mattel Inc (Country: US; rated: WR): down 64.7 bp to 212.5bp (1Y range: 213-328bp)

- Xerox Corp (Country: US; rated: NR): down 33.7 bp to 409.6bp (1Y range: 333-544bp)

- Tenet Healthcare Corp (Country: US; rated: NR): down 28.9 bp to 296.1bp (1Y range: 296-590bp)

- KB Home (Country: US; rated: BB): down 25.7 bp to 209.3bp (1Y range: 209-485bp)

- Univision Communications Inc (Country: US; rated: B1): down 22.7 bp to 407.3bp (1Y range: 407-658bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 26.1 bp to 898.1bp (1Y range: 432-1,046bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 49.6 bp to 1,000.4bp (1Y range: 761-1,472bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 68.2 bp to 1,309.9bp (1Y range: 685-1,783bp)

- Transocean Inc (Country: KY; rated: Caa1): up 109.2 bp to 984.3bp (1Y range: 674-2,858bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 127.9 bp to 744.3bp (1Y range: 390-887bp)

- Staples Inc (Country: US; rated: B3): up 156.0 bp to 2,742.9bp (1Y range: 1,140-2,743bp)

- DISH DBS Corp (Country: US; rated: B2): up 284.9 bp to 3,152.0bp (1Y range: 614-3,152bp)

- Lumen Technologies Inc (Country: US; rated: LGD5 - 76%): up 699.1 bp to 4,958.4bp (1Y range: 195-4,958bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 112.9 bp to 779.4bp (1Y range: 469-1,254bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 50.9 bp to 1,121.9bp (1Y range: 566-1,739bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 43.9 bp to 796.7bp (1Y range: 660-1,296bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: b1): down 23.6 bp to 343.6bp (1Y range: 344-790bp)

- TUI AG (Country: DE; rated: B3-PD): down 19.5 bp to 847.5bp (1Y range: 691-1,725bp)

- Hammerson PLC (Country: GB; rated: A2): down 15.4 bp to 332.7bp (1Y range: 215-482bp)

- Stellantis NV (Country: NL; rated: BBB high): up 14.8 bp to 174.5bp (1Y range: 99-569bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 16.5 bp to 513.9bp (1Y range: 186-514bp)

- Nokia Oyj (Country: FI; rated: LGD4 - 63%): up 18.0 bp to 155.4bp (1Y range: 113-237bp)

- United States of America (Country: US; rated: AAA): up 18.8 bp to 70.3bp (1Y range: 14-71bp)

- thyssenkrupp AG (Country: DE; rated: NR): up 19.1 bp to 352.6bp (1Y range: 309-705bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 21.0 bp to 945.5bp (1Y range: 401-1,021bp)

- Ceconomy AG (Country: DE; rated: B1): up 21.6 bp to 1,053.9bp (1Y range: 334-1,763bp)

- Novafives SAS (Country: FR; rated: Caa1): up 28.0 bp to 1,182.1bp (1Y range: 618-2,936bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 110.4 bp to 2,101.2bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Kohls Corp (Menomonee Falls, Wisconsin (US)) | Coupon: 4.25% | Maturity: 17/7/2025 | Rating: BB- | CUSIP: 500255AU8 | OAS up by 47.9 bp to 320.9 bp (CDS basis: 47.4bp), with the yield to worst at 7.0% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 92.0-97.0).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 15/3/2028 | Rating: BB | CUSIP: 38869AAB3 | OAS up by 46.4 bp to 226.1 bp, with the yield to worst at 5.5% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 86.6-92.3).

- Issuer: Western Digital Corp (San Jose, California (US)) | Coupon: 4.75% | Maturity: 15/2/2026 | Rating: BB | CUSIP: 958102AM7 | OAS up by 36.3 bp to 276.9 bp, with the yield to worst at 6.4% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 93.0-97.4).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 4.75% | Maturity: 15/7/2027 | Rating: BB | CUSIP: 38869AAA5 | OAS down by 23.9 bp to 178.9 bp, with the yield to worst at 5.4% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 92.9-97.0).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | CUSIP: 852234AN3 | OAS down by 31.7 bp to 239.6 bp, with the yield to worst at 5.9% and the bond now trading up to 90.1 cents on the dollar (1Y price range: 85.0-93.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.39% | Maturity: 8/1/2026 | Rating: BB | CUSIP: 345397XU2 | OAS down by 40.1 bp to 245.5 bp (CDS basis: -39.3bp), with the yield to worst at 6.3% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 92.1-97.3).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: B+ | CUSIP: 410345AL6 | OAS down by 43.4 bp to 297.6 bp, with the yield to worst at 6.7% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 89.8-96.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS down by 44.9 bp to 336.2 bp (CDS basis: -59.7bp), with the yield to worst at 6.9% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 95.5-100.5).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS down by 45.3 bp to 139.5 bp, with the yield to worst at 5.1% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 97.0-102.4).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS down by 50.8 bp to 152.1 bp, with the yield to worst at 5.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 96.0-98.8).

- Issuer: American Airlines Group Inc (Fort Worth, United States) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | CUSIP: 02376RAE2 | OAS down by 78.6 bp to 283.9 bp (CDS basis: 560.4bp), with the yield to worst at 6.5% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 85.0-94.3).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 4.20% | Maturity: 29/10/2025 | Rating: BB+ | CUSIP: 78442PGD2 | OAS down by 79.1 bp to 352.8 bp, with the yield to worst at 7.2% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 85.1-94.3).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS down by 81.9 bp to 257.8 bp (CDS basis: -32.6bp), with the yield to worst at 6.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.50% | Maturity: 15/8/2028 | Rating: BB | CUSIP: 98421MAB2 | OAS down by 84.5 bp to 504.3 bp, with the yield to worst at 8.4% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 80.0-87.5).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | CUSIP: 98421MAA4 | OAS down by 143.7 bp to 309.8 bp, with the yield to worst at 6.9% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 91.8-95.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | OAS up by 47.3 bp to 303.6 bp (CDS basis: -26.1bp), with the yield to worst at 5.9% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 83.4-88.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS up by 44.5 bp to 226.2 bp (CDS basis: 9.5bp), with the yield to worst at 5.3% and the bond now trading down to 94.2 cents on the dollar (1Y price range: 92.7-95.5).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 2/6/2027 | Rating: BB | ISIN: FR0014006W65 | OAS up by 44.1 bp to 267.7 bp (CDS basis: -30.0bp), with the yield to worst at 5.1% and the bond now trading down to 88.3 cents on the dollar (1Y price range: 86.1-90.6).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | OAS up by 43.4 bp to 227.4 bp (CDS basis: -41.5bp), with the yield to worst at 5.3% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 89.4-92.9).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | OAS up by 40.0 bp to 336.0 bp, with the yield to worst at 6.3% and the bond now trading down to 82.4 cents on the dollar (1Y price range: 76.6-84.1).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | OAS up by 38.5 bp to 238.5 bp (CDS basis: -34.8bp), with the yield to worst at 5.2% and the bond now trading down to 89.2 cents on the dollar (1Y price range: 87.3-90.5).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | OAS up by 37.6 bp to 289.7 bp (CDS basis: -35.1bp), with the yield to worst at 5.8% and the bond now trading down to 81.6 cents on the dollar (1Y price range: 79.4-84.0).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 11/2/2028 | Rating: BB | ISIN: FR0014001YB0 | OAS up by 34.3 bp to 292.6 bp, with the yield to worst at 5.8% and the bond now trading down to 83.3 cents on the dollar (1Y price range: 80.0-86.6).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS up by 33.4 bp to 451.3 bp, with the yield to worst at 7.4% and the bond now trading down to 82.5 cents on the dollar (1Y price range: 76.1-85.4).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 1.50% | Maturity: 15/3/2027 | Rating: BB+ | ISIN: XS2080318053 | OAS up by 32.8 bp to 157.3 bp (CDS basis: -27.4bp), with the yield to worst at 4.4% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 86.0-89.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS up by 32.2 bp to 517.1 bp, with the yield to worst at 7.7% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 82.7-92.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 31.4 bp to 209.3 bp (CDS basis: 69.0bp), with the yield to worst at 5.0% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 92.3-96.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 28/7/2027 | Rating: BB- | ISIN: XS1266661013 | OAS up by 30.8 bp to 446.5 bp, with the yield to worst at 7.0% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 86.4-94.8).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 38.8 bp to 368.5 bp (CDS basis: 220.7bp), with the yield to worst at 6.6% and the bond now trading up to 94.2 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 44.5 bp to 463.8 bp (CDS basis: 204.8bp), with the yield to worst at 7.5% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 88.4-97.4).

RECENT DOMESTIC USD BOND ISSUES

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$1,250m Senior Note (US025816DE69), floating rate maturing on 1 May 2026, priced at 100.00, callable (3nc2)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$1,250m Senior Note (US025816DF35), floating rate maturing on 1 May 2034, priced at 100.00, callable (11nc10)

- Constellation Brands Inc (Beverage/Bottling | Victor, United States | Rating: BBB-): US$750m Senior Note (US21036PBP27), fixed rate (4.90% coupon) maturing on 1 May 2033, priced at 99.31 (original spread of 147 bp), callable (10nc10)

- Crown Castle Inc (Real Estate Investment Trust | Houston, United States | Rating: BBB-): US$600m Senior Note (US22822VBB62), fixed rate (4.80% coupon) maturing on 1 September 2028, priced at 99.77 (original spread of 127 bp), callable (5nc5)

- Crown Castle Inc (Real Estate Investment Trust | Houston, United States | Rating: BBB-): US$750m Senior Note (US22822VBC46), fixed rate (5.10% coupon) maturing on 1 May 2033, priced at 99.91 (original spread of 168 bp), callable (10nc10)

- ERAC USA Finance LLC (Financial - Other | St. Louis, United States | Rating: BBB+): US$1,000m Senior Note (USU29490AW68), fixed rate (4.60% coupon) maturing on 1 May 2028, priced at 99.63 (original spread of 120 bp), callable (5nc5)

- ERAC USA Finance LLC (Financial - Other | St. Louis, United States | Rating: BBB+): US$1,000m Senior Note (USU29490AY25), fixed rate (5.40% coupon) maturing on 1 May 2053, priced at 99.50 (original spread of 209 bp), callable (30nc30)

- ERAC USA Finance LLC (Financial - Other | St. Louis, United States | Rating: BBB+): US$1,000m Senior Note (USU29490AX42), fixed rate (4.90% coupon) maturing on 1 May 2033, priced at 99.71 (original spread of 155 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133EPHJ76), fixed rate (6.08% coupon) maturing on 28 April 2033, priced at 100.00 (original spread of 270 bp), callable (10nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133EPHU22), fixed rate (3.88% coupon) maturing on 3 May 2029, priced at 99.78, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133EPHH11), fixed rate (4.00% coupon) maturing on 28 April 2026, priced at 99.94 (original spread of 15 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$545m Bond (US3133EPHV05), floating rate (SOFR + 13.5 bp) maturing on 5 May 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$418m Bond (US3133EPHG38), floating rate (SOFR + 12.0 bp) maturing on 1 May 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EPHT58), fixed rate (3.63% coupon) maturing on 3 May 2028, priced at 99.55, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$300m Bond (US3130AVTR30), fixed rate (5.50% coupon) maturing on 8 May 2025, priced at 100.00 (original spread of 155 bp), callable (2nc1m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: NR): US$300m Unsecured Note (US3134GYQX32), fixed rate (5.55% coupon) maturing on 9 May 2025, priced at 100.00 (original spread of 158 bp), callable (2nc1m)

- Gs Finance Corp (Financial - Other | New York City, United States | Rating: NR): US$108m Index Linked Security (US36265J4904) zero coupon maturing on 28 April 2028, priced at 100.00, with a special call

- Morgan Stanley Finance II Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$250m Unsecured Note (XS2599479958) zero coupon maturing on 30 June 2026, priced at 100.00, non callable

- Private Export Funding Corp (Service - Other | New York City, United States | Rating: NR): US$300m Note (US742651DZ21), fixed rate (3.90% coupon) maturing on 15 October 2027, priced at 99.84 (original spread of 43 bp), non callable

- Providence St Joseph Health Obligated Group (Financial - Other | United States | Rating: A): US$585m Bond (US743820AC66), fixed rate (5.40% coupon) maturing on 1 October 2033, priced at 100.00 (original spread of 200 bp), callable (10nc10)

- Six Flags Entertainment Corp (Leisure | Arlington, United States | Rating: B-): US$800m Senior Note (US83001AAD46), fixed rate (7.25% coupon) maturing on 15 May 2031, priced at 99.25 (original spread of 426 bp), callable (8nc3)

- Talen Energy Supply LLC (Utility - Other | Allentown, United States | Rating: B+): US$1,200m Note (US87422VAK44), fixed rate (8.63% coupon) maturing on 1 June 2030, priced at 100.00 (original spread of 515 bp), callable (7nc3)

- Trident TPI Holdings Inc (Containers | Wayne, United States | Rating: CCC): US$620m Senior Note (USU89588AC85), fixed rate (12.75% coupon) maturing on 31 December 2028, priced at 98.94 (original spread of 954 bp), callable (6nc3)

RECENT INTERNATIONAL USD BOND ISSUES

- Agricultural Bank of China (Dubai Branch) (Banking | Dubai, China (Mainland) | Rating: A): US$150m Certificate of Deposit (XS2619357911) zero coupon maturing on 2 May 2025, priced at 90.48, non callable

- Anglo American Capital PLC (Financial - Other | London, United Kingdom | Rating: BBB): US$900m Senior Note (US034863BD17), fixed rate (5.50% coupon) maturing on 2 May 2033, priced at 99.48 (original spread of 205 bp), callable (10nc10)

- BOC Aviation (USA) Corp (Leasing | New York City, China (Mainland) | Rating: A-): US$500m Senior Note (US66980P2B40), fixed rate (4.88% coupon) maturing on 3 May 2033, priced at 98.91 (original spread of 160 bp), callable (10nc10)

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: A): US$300m Unsecured Note (XS2618906072), floating rate maturing on 4 May 2028, priced at 100.00, non callable

- Benteler International AG (Vehicle Parts | Salzburg, Austria | Rating: BB-): US$500m Note (USA1113CAA20), fixed rate (10.50% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 691 bp), callable (5nc2)

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A-): US$1,250m Senior Note (US13607LNF66), fixed rate (5.14% coupon) maturing on 28 April 2025, priced at 100.00 (original spread of 108 bp), non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A-): US$1,000m Senior Note (US13607LNG40), fixed rate (5.00% coupon) maturing on 28 April 2028, priced at 100.00 (original spread of 143 bp), callable (5nc5)

- Cassa Depositi e Prestiti SpA (Agency | Rome, Italy | Rating: BBB): US$1,000m Depositary Receipt (US147918AA40), fixed rate (5.75% coupon) maturing on 5 May 2026, priced at 99.81 (original spread of 200 bp), non callable

- Cassa Depositi e Prestiti SpA (Agency | Rome, Italy | Rating: BBB-): US$1,000m Senior Note (XS2616750563), fixed rate (5.75% coupon) maturing on 5 May 2026, priced at 99.81 (original spread of 200 bp), non callable

- Empresa Nacional del Petroleo (Oil and Gas | Las Condes, Chile | Rating: BB+): US$500m Senior Note (US29245JAN28), fixed rate (6.15% coupon) maturing on 10 May 2033, priced at 99.70 (original spread of 281 bp), callable (10nc10)

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): US$150m Senior Note (XS2616719485), floating rate (SOFRINDX + 19.0 bp) maturing on 8 May 2028, priced at 100.00, non callable

- Korea Ocean Business Corp (Leasing | Busan, South Korea | Rating: AA-): US$300m Senior Note (XS2614258403), fixed rate (4.50% coupon) maturing on 3 May 2028, priced at 99.04 (original spread of 110 bp), non callable

- Magyar Export Import Bank Zrt (Agency | Budapest, Hungary | Rating: BBB-): US$1,250m Senior Note (US55977YAA64), fixed rate (6.13% coupon) maturing on 4 December 2027, priced at 99.24 (original spread of 280 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A): US$900m Senior Note (US78016HZQ63), fixed rate (5.00% coupon) maturing on 2 May 2033, priced at 99.79 (original spread of 154 bp), with a make whole call

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A): US$1,600m Senior Note (US78016FZY32), fixed rate (4.95% coupon) maturing on 25 April 2025, priced at 99.94 (original spread of 87 bp), non callable

- SMBC Aviation Capital Finance DAC (Financial - Other | Dublin, Japan | Rating: BBB+): US$650m Senior Note (USG82296AG21), fixed rate (5.45% coupon) maturing on 3 May 2028, priced at 99.83 (original spread of 200 bp), callable (5nc5)

- Sasol Financing USA LLC (Financial - Other | Houston, South Africa | Rating: NR): US$1,000m Senior Note (US80386WAF23), fixed rate (8.75% coupon) maturing on 3 May 2029, priced at 100.00 (original spread of 524 bp), callable (6nc6)

- State Bank of India (London Branch) (Banking | London, India | Rating: BBB-): US$750m Senior Note (XS2615928863), fixed rate (4.88% coupon) maturing on 5 May 2028, priced at 99.70 (original spread of 145 bp), non callable

- Stronghold Securities SARL (Financial - Other | Capellen, Luxembourg | Rating: NR): US$216m Unsecured Note (XS2618693142), floating rate maturing on 5 August 2028, priced at 100.00, non callable

- Swedish Export Credit Corp (Agency | Stockholm, Sweden | Rating: AA+): US$1,250m Senior Note (US87031CAK99), fixed rate (4.00% coupon) maturing on 15 July 2025, priced at 99.77 (original spread of 50 bp), non callable

- nVent Finance SARL (Financial - Other | Luxembourg, United Kingdom | Rating: BBB-): US$500m Senior Note (US67078AAF03), fixed rate (5.65% coupon) maturing on 15 May 2033, priced at 99.72 (original spread of 218 bp), callable (10nc10)

RECENT EURO BOND ISSUES

- AB Sveriges Sakerstallda Obligationer (publ) (Financial - Other | Solna, Sweden | Rating: AAA): €1,000m Sakerstallda Obligation (Covered Bond) (XS2617508481), fixed rate (3.25% coupon) maturing on 3 May 2028, priced at 99.53 (original spread of 91 bp), non callable

- ADLER Financing (Financial - Other | Netherlands | Rating: B): €937m Inhaberschuldverschreibung (DE000A3LF6J0), fixed rate (6.25% coupon) maturing on 30 June 2025 (original spread of 300 bp), callable (2nc1)

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Austria | Rating: A): €750m Covered Bond (Other) (XS2618704014), fixed rate (3.38% coupon) maturing on 4 May 2026, priced at 99.77 (original spread of 92 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: A): €1,250m Senior Note (XS2616651589), floating rate (EU03MLIB + 105.0 bp) maturing on 26 July 2028, priced at 100.00, non callable

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: AA-): €1,000m Senior Note (XS2618508340), floating rate (EU03MLIB + 43.0 bp) maturing on 2 May 2025, priced at 100.00, with a regulatory call

- Bankinter SA (Banking | Madrid, Spain | Rating: A-): €500m Participacion Preferente (ES0213679OO6), floating rate maturing on 3 May 2030, priced at 99.93 (original spread of 200 bp), callable (7nc6)

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, France | Rating: A+): €300m Bond (FR001400HO25), floating rate (EU03MLIB + 32.0 bp) maturing on 28 April 2025, priced at 100.00, non callable

- Benteler International AG (Vehicle Parts | Salzburg, Austria | Rating: BB-): €525m Note (XS2619048965), fixed rate (9.38% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 693 bp), callable (5nc2)

- Berlin, State of (Official and Muni | Berlin, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A3MQYR7), fixed rate (3.00% coupon) maturing on 4 May 2028, priced at 99.97 (original spread of 66 bp), non callable

- Bormioli Pharma SpA (Industrials - Other | Parma, Jersey | Rating: B-): €350m Note (XS2616352162), floating rate (EU03MLIB + 550.0 bp) maturing on 15 May 2028, priced at 95.50, callable (5nc1)

- Bpce SA (Banking | Paris, France | Rating: A): €120m Bond (FR001400HJY5), floating rate (EU03MLIB + 40.0 bp) maturing on 26 April 2025, priced at 99.96, non callable

- Carrefour Banque SA (Banking | Evry, France | Rating: BBB): €500m Bond (FR001400HQM5), fixed rate (4.08% coupon) maturing on 5 May 2027, priced at 100.00 (original spread of 164 bp), callable (4nc4)

- Cheplapharm Arzneimittel GmbH (Pharmaceuticals | Greifswald, Germany | Rating: B): €425m Note (XS2618869445), fixed rate (7.50% coupon) maturing on 15 May 2030, priced at 100.00 (original spread of 530 bp), callable (7nc3)

- Cheplapharm Arzneimittel GmbH (Pharmaceuticals | Greifswald, Germany | Rating: B): €325m Note (XS2618840628), floating rate (EU03MLIB + 475.0 bp) maturing on 15 May 2030, priced at 99.00, callable (7nc1)

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €286m Bond (FRCASA010092), fixed rate (3.70% coupon) maturing on 28 April 2033, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €900m Bond (FR001400HM92), fixed rate (3.96% coupon) maturing on 26 October 2029, priced at 100.00, non callable

- Diageo Finance PLC (Financial - Other | London, United Kingdom | Rating: A-): €500m Senior Note (XS2615917585), fixed rate (3.50% coupon) maturing on 26 June 2025, priced at 99.79 (original spread of 69 bp), callable (2nc2)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A347P5), fixed rate (5.15% coupon) maturing on 2 June 2031, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A347Y7), floating rate (EU03MLIB + 0.0 bp) maturing on 6 June 2028, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A34634), fixed rate (2.85% coupon) maturing on 7 June 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A347Z4), fixed rate (3.35% coupon) maturing on 6 June 2025, priced at 100.00, non callable

- Ethias NV (Property and Casualty Insurance | Liege, Belgium | Rating: BBB): €250m Subordinated Note (BE6343437255), fixed rate (6.75% coupon) maturing on 5 May 2033, priced at 100.00 (original spread of 447 bp), callable (10nc10)

- European Union (Supranational | Brussels, Belgium | Rating: AAA): €7,000m Senior Note (EU000A3K4D74), fixed rate (3.38% coupon) maturing on 4 October 2038, priced at 99.52 (original spread of 85 bp), non callable

- Finland, Republic of (Government) (Sovereign | Helsinki, Finland | Rating: AA+): €3,000m Bond (FI4000550249), fixed rate (3.00% coupon) maturing on 15 September 2033, priced at 99.73 (original spread of 64 bp), non callable

- Frigo Debtco PLC (Financial - Other | Ireland | Rating: NR): €150m Bond (XS2603999009) maturing on 6 April 2028, priced at 100.00, non callable

- Germany, Federal Republic of (Government) (Sovereign | Berlin, Germany | Rating: AAA): €5,250m Bundesanleihe (DE000BU3Z005), fixed rate (2.30% coupon) maturing on 15 February 2033, priced at 98.71 (original spread of 0 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Italy | Rating: BBB-): €6,500m Buono del Tesoro Poliennali (IT0005544082), fixed rate (4.35% coupon) maturing on 1 November 2033, priced at 99.85 (original spread of 197 bp), non callable

- KBC Bank NV (Banking | Brussels, Belgium | Rating: AAA): €1,000m Belgian Mortgage Pandbrieven (Covered Bond) (BE0002937184), fixed rate (3.30% coupon) maturing on 26 April 2031, priced at 100.00, non callable

- KEB Hana Bank (Banking | Seoul, South Korea | Rating: A): €600m Covered Bond (Other) (XS2594123585), fixed rate (3.75% coupon) maturing on 4 May 2026, priced at 99.93 (original spread of 124 bp), non callable

- Kruk SA (Financial - Other | Wroclaw, Poland | Rating: BB-): €150m Bond (NO0012903444), floating rate (EU03MLIB + 650.0 bp) maturing on 10 May 2028, priced at 100.00, callable (5nc3)

- La Banque Postale SA (Banking | Paris, France | Rating: A): €1,000m Bond (FR001400HOZ2), fixed rate (4.00% coupon) maturing on 3 May 2028, priced at 99.91 (original spread of 171 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €750m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB386A8), fixed rate (3.25% coupon) maturing on 4 November 2026, priced at 99.75 (original spread of 77 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB4843), fixed rate (2.45% coupon) maturing on 1 December 2026, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB4850), fixed rate (2.75% coupon) maturing on 1 December 2028, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB4835), fixed rate (2.35% coupon) maturing on 1 December 2025, non callable

- Lansforsakringar Hypotek AB (publ) (Mortgage Banking | Stockholm, Sweden | Rating: NR): €500m Sakerstallda Obligation (Covered Bond) (XS2618711068), fixed rate (3.25% coupon) maturing on 4 May 2029, priced at 99.77 (original spread of 96 bp), non callable

- Loxam SAS (Leasing | Caudan, France | Rating: BB-): €300m Note (XS2618428077), fixed rate (6.38% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 429 bp), callable (5nc2)

- NN Group NV (Life Insurance | S-Gravenhage, Netherlands | Rating: BBB-): €1,000m Subordinated Note (XS2616652637), floating rate maturing on 3 November 2043, priced at 99.66 (original spread of 369 bp), callable (21nc10)

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Germany | Rating: AA): €150m Landesschatzanweisung (DE000NRW0N34), fixed rate (2.92% coupon) maturing on 4 May 2063, non callable

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): €650m Senior Note (XS2617256065), fixed rate (3.25% coupon) maturing on 2 August 2026, priced at 99.84 (original spread of 62 bp), with a make whole call

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): €650m Senior Note (XS2617256149), fixed rate (3.25% coupon) maturing on 2 August 2031, priced at 99.75 (original spread of 90 bp), with a make whole call

- Raiffeisen Schweiz Genossenschaft (Banking | Sankt Gallen, Switzerland | Rating: A+): €500m Bond (CH1251998238), fixed rate (4.84% coupon) maturing on 3 November 2028, priced at 100.00 (original spread of 242 bp), with a regulatory call

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Spain | Rating: A): €500m Note (XS2618690981), fixed rate (4.13% coupon) maturing on 5 May 2028, priced at 99.50 (original spread of 188 bp), non callable

- Sika Capital BV (Financial - Other | Utrecht, Switzerland | Rating: A-): €1,000m Senior Note (XS2616008541), fixed rate (3.75% coupon) maturing on 3 November 2026, priced at 99.93 (original spread of 126 bp), callable (4nc3)

- Sika Capital BV (Financial - Other | Utrecht, Switzerland | Rating: A-): €750m Senior Note (XS2616008970), fixed rate (3.75% coupon) maturing on 3 May 2030, priced at 99.45 (original spread of 152 bp), callable (7nc7)

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Sweden | Rating: A+): €1,000m Note (XS2619751576), fixed rate (3.88% coupon) maturing on 9 May 2028, priced at 99.90 (original spread of 154 bp), with a regulatory call

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): €1,250m Note (XS2618499177), fixed rate (3.75% coupon) maturing on 5 May 2026, priced at 99.72 (original spread of 124 bp), with a regulatory call

- TDC NET AS (Financial - Other | Kobenhavn Sv, Denmark | Rating: BB): €500m Note (XS2615584328), fixed rate (6.50% coupon) maturing on 1 June 2031, priced at 99.99 (original spread of 421 bp), callable (8nc8)

- Telstra Group Ltd (Financial - Other | Melbourne, Australia | Rating: A-): €500m Senior Note (XS2613162424), fixed rate (3.75% coupon) maturing on 4 May 2031, priced at 99.87 (original spread of 147 bp), callable (8nc8)

- Var Energi ASA (Oil and Gas | Sandnes, Italy | Rating: BBB-): €600m Senior Note (XS2599156192), fixed rate (5.50% coupon) maturing on 4 May 2029, priced at 99.70 (original spread of 325 bp), callable (6nc6)

- Volkswagen Bank GmbH (Banking | Braunschweig, Germany | Rating: BBB): €1,000m Note (XS2617442525), fixed rate (4.25% coupon) maturing on 7 January 2026, priced at 99.94 (original spread of 169 bp), non callable

- Volkswagen Bank GmbH (Banking | Braunschweig, Germany | Rating: BBB): €500m Note (XS2617457127), fixed rate (4.63% coupon) maturing on 3 May 2031, priced at 99.65 (original spread of 240 bp), non callable

- Volkswagen Bank GmbH (Banking | Braunschweig, Germany | Rating: BBB): €500m Note (XS2617456582), fixed rate (4.38% coupon) maturing on 3 May 2028, priced at 99.54 (original spread of 211 bp), non callable

RECENT LOANS

- Atnahs Pharma UK Ltd (United Kingdom), signed a € 160m Term Loan B, to be used for general corporate purposes. It matures on 08/07/26 and initial pricing is set at EURIBOR +400.0bp

- Bracket Intermediate Hldg Corp (United States of America | B-), signed a US$ 980m Term Loan B, to be used for general corporate purposes. It matures on 05/02/28 and initial pricing is set at Term SOFR +500.0bp

- Bracket Intermediate Hldg Corp (United States of America | B-), signed a US$ 130m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 05/02/28 and initial pricing is set at Term SOFR +500.0bp

- Clarios Global LP (Canada | B-), signed a US$ 2,750m Term Loan B, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at Term SOFR +375.0bp

- Concentrix Corp (United States of America | BBB), signed a US$ 1,043m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/27/26 and initial pricing is set at Term SOFR +112.5bp

- Concentrix Corp (United States of America | BBB), signed a US$ 2,145m Term Loan, to be used for general corporate purposes. It matures on 12/27/26 and initial pricing is set at Term SOFR +112.5bp

- Dowlais Group plc (United Kingdom), signed a US$ 400m Term Loan, to be used for general corporate purposes and a spinoff. It matures on 04/20/26 and initial pricing is set at Term SOFR +140.0bp

- Dowlais Group plc (United Kingdom), signed a US$ 660m Revolving Credit Facility, to be used for general corporate purposes, working capital, and a spinoff. It matures on 04/20/26 and initial pricing is set at Term SOFR +160.0bp

- Energy Dvlp Oman Llc (Oman | BB), signed a US$ 2,500m Term Loan, to be used for general corporate purposes and capital expenditures. It matures on 08/28/28 and initial pricing is set at Term SOFR +205.0bp

- Foot Locker Inc (United States of America | BB+), signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes, working capital, and capital expenditures. It matures on 07/14/25 and initial pricing is set at Term SOFR +200.0bp

- Gardner Denver Inc (United States of America | BBB-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/21/28.

- Greystar Via Celere Portfolio (Spain), signed a € 198m Term Loan, to be used for project finance. It matures on 04/21/30.

- Gunvor Singapore Pte Ltd (Singapore), signed a US$ 550m 364d Revolver, to be used for general corporate purposes and working capital. It matures on 04/18/24 and initial pricing is set at Term SOFR +100.0bp

- Industrial Bank Of Korea (South Korea | AA-), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 04/21/26 and initial pricing is set at Term SOFR +80.0bp

- Kenan Advantage Group Inc (United States of America | CCC), signed a US$ 300m Term Loan, to be used for refin/ret bank debt. It matures on 08/20/27 and initial pricing is set at Term SOFR +725.0bp

- Kenan Advantage Group Inc (United States of America | CCC), signed a US$ 1,200m Term Loan B, to be used for general corporate purposes. It matures on 03/24/26 and initial pricing is set at Term SOFR +375.0bp

- Kenan Advantage Group Inc (United States of America | CCC), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/24/26 and initial pricing is set at Term SOFR +375.0bp

- Kenan Advantage Group Inc (United States of America | CCC), signed a US$ 250m Term Loan B, to be used for general corporate purposes. It matures on 03/24/26 and initial pricing is set at Term SOFR +400.0bp

- Kerala State Elecity Board (India), signed a US$ 110m Revolving Credit / Term Loan, to be used for general corporate purposes.

- Kronosnet (Spain), signed a € 158m Term Loan B, to be used for general corporate purposes. It matures on 10/20/29 and initial pricing is set at EURIBOR +575.0bp

- Lendlease Global Commercial (Singapore), signed a € 300m Revolving Credit Facility, to be used for general corporate purposes and working capital.

- MidCap Financial Services LLC (United States of America), signed a US$ 1,705m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/19/28.

- MidOcean Energy LLC (United States of America), signed a US$ 3,000m Bridge Loan, to be used for acquisition financing. It matures on 04/19/24.

- Nigeria Liquified Natural Gas (Nigeria), signed a US$ 500m Export Credit, to be used for project finance. It matures on 01/00/00 and initial pricing is set at Term SOFR +150.0bp

- Nigeria Liquified Natural Gas (Nigeria), signed a US$ 500m Term Loan, to be used for project finance. It matures on 01/00/00 and initial pricing is set at Term SOFR +325.0bp

- Nigerian National Petroleum Co (Nigeria), signed a US$ 200m Term Loan, to be used for capital expenditures. It matures on 01/00/00 and initial pricing is set at Term SOFR +500.0bp

- Nigerian National Petroleum Co (Nigeria), signed a US$ 550m Term Loan, to be used for capital expenditures. It matures on 01/00/00 and initial pricing is set at Term SOFR +500.0bp

- Nigerian National Petroleum Co (Nigeria), signed a US$ 150m Term Loan, to be used for capital expenditures. It matures on 01/00/00 and initial pricing is set at Term SOFR +500.0bp

- ONGC Videsh Ltd (India | BBB-), signed a US$ 500m Term Loan, to be used for refin/ret bank debt. It matures on 04/21/28 and initial pricing is set at Term SOFR +119.2bp

- Orlen Synthos Green Energy (Poland), signed a US$ 1,000m Term Loan, to be used for project finance.

- Orlen Synthos Green Energy (Poland), signed a US$ 3,000m Term Loan, to be used for project finance.

- PPG Industries Inc (United States of America | BBB+), signed a € 500m Term Loan, to be used for general corporate purposes. It matures on 04/19/26 and initial pricing is set at EURIBOR +79.0bp

- Panaderias Navarras SA SPV (Spain), signed a € 275m Term Loan B, to be used for general corporate purposes. It matures on 12/27/27 and initial pricing is set at EURIBOR +475.0bp

- Petrofac Ltd (Jersey | BB-), signed a US$ 180m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/21/24.

- Repsol SA (Spain | BBB+), signed a € 300m Term Loan, to be used for general corporate purposes.

- Sonic Healthcare Ltd (Australia), signed a € 184m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/22/27.

- Talen Energy Supply LLC (United States of America | BB), signed a US$ 825m Term Loan B, to be used for general corporate purposes. It matures on 04/27/30 and initial pricing is set at Term SOFR +450.0bp

- Talen Energy Supply LLC (United States of America | BB), signed a US$ 545m Term Loan C, to be used for general corporate purposes. It matures on 04/27/30 and initial pricing is set at Term SOFR +450.0bp

- Tank Holding Corp (United States of America), signed a US$ 350m Term Loan B, to be used for general corporate purposes

- acquisition financing. It matures on 03/31/28 and initial pricing is set at Term SOFR +575.0bp

- Titan Acquisition Holdings LP (United States of America), signed a US$ 675m Delayed Draw Term Loan, to be used for 126. It matures on 04/27/30 and initial pricing is set at Term SOFR +475.0bp

- Trident Tpi Holdings Inc (United States of America | CCC+), signed a € 232m Term Loan B, to be used for general corporate purposes. It matures on 09/17/28 and initial pricing is set at EURIBOR +500.0bp

- Trident Tpi Holdings Inc (United States of America | CCC+), signed a US$ 880m Term Loan B, to be used for general corporate purposes. It matures on 09/17/28 and initial pricing is set at Term SOFR +450.0bp

- WT Microelectronics Co Ltd (Taiwan), signed a US$ 252m Revolving Credit Facility, to be used for working capital. It matures on 04/25/28 and initial pricing is set at Other +70.0bp

RECENT STRUCTURED CREDIT

- Blue Stream Issuer LLC Series 2023-1 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 450 m. Highest-rated tranche offering a yield to maturity of 5.52%, and the lowest-rated tranche a yield to maturity of 9.63%. Bookrunners: Morgan Stanley & Co, Barclays Capital Group

- Carvana Auto Receivables Trust 2023-N1 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 455 m. Highest-rated tranche offering a yield to maturity of 5.85%, and the lowest-rated tranche a yield to maturity of 10.47%. Bookrunners: Santander Investment Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp

- Fannie Mae Connecticut Avenue Securities Trust 2023-R03 issued a floating-rate Agency RMBS in 3 tranches, for a total of US$ 622 m. Highest-rated tranche offering a spread over the floating rate of 250bp, and the lowest-rated tranche a spread of 635bp. Bookrunners: Nomura Securities Co Ltd, Morgan Stanley International Ltd

- Lendmark Funding Trust 2023-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 348 m. Highest-rated tranche offering a yield to maturity of 5.59%, and the lowest-rated tranche a yield to maturity of 8.69%. Bookrunners: Goldman Sachs & Co, Barclays Capital Group, RBC Capital Markets, Citigroup Global Markets Inc, BMO Capital Markets, Mizuho Securities USA Inc

- Woodmont 2023-11 Trust issued a floating-rate CLO in 5 tranches, for a total of US$ 738 m. Highest-rated tranche offering a spread over the floating rate of 255bp, and the lowest-rated tranche a spread of 690bp. Bookrunners: Wells Fargo Securities LLC