Credit

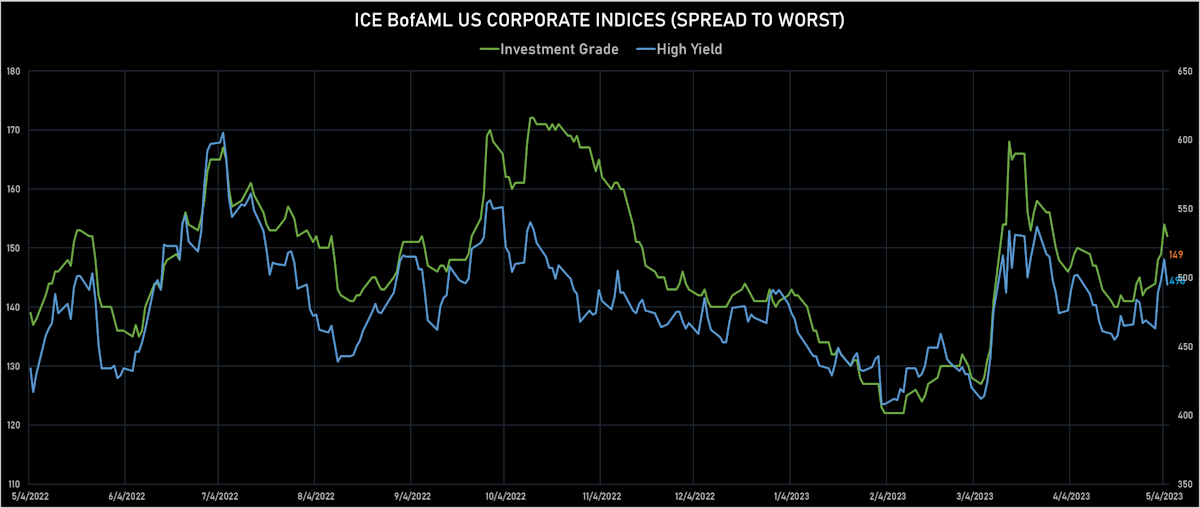

USD Cash Spreads Broadly Wider This Week, Despite Strong Finish On Friday

USD corporate bond issuance rebounded this week (IFR Markets data): 29 tranches for $30.05bn in IG (2023 YTD volume $499.94bn vs 2022 YTD $593.89bn), 6 tranches for $5.8bn in HY (2023 YTD volume $64.372bn vs 2022 YTD $54.171bn)

Published ET

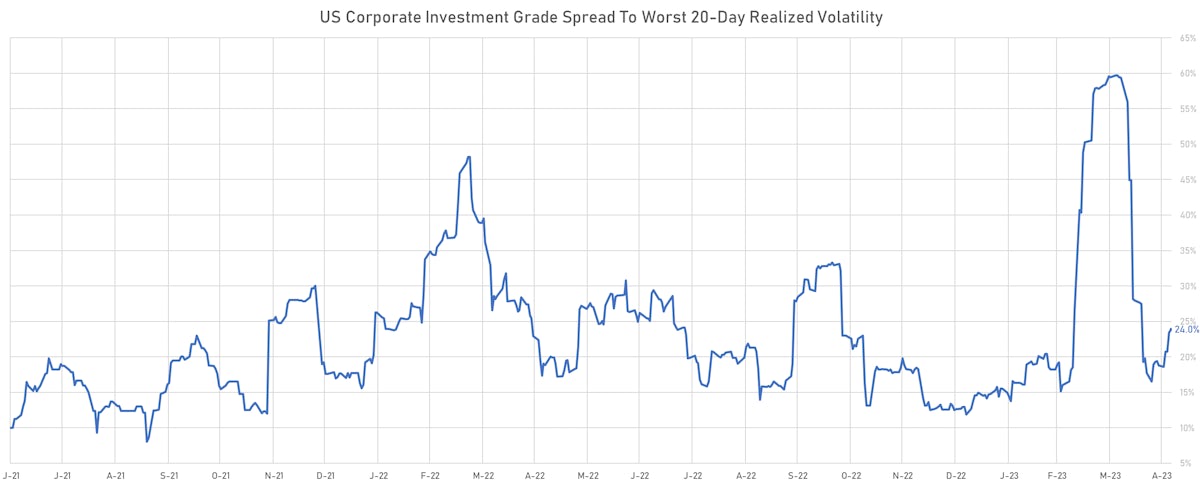

IG Cash STW 1M Realized Volatility (annualized) | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.25% today, with investment grade down -0.29% and high yield up 0.17% (YTD total return: +3.64%)

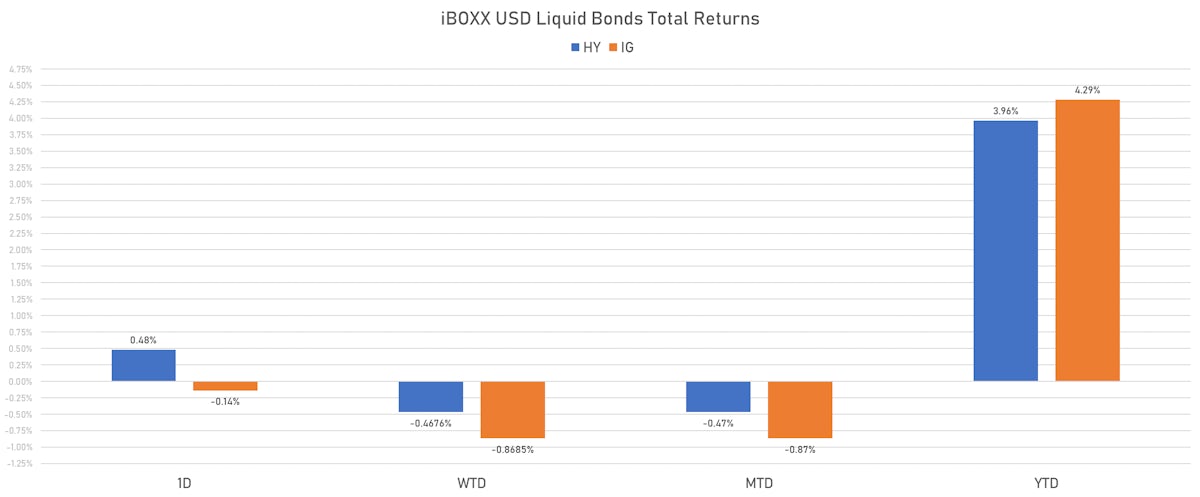

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.139% today (Week-to-date: -0.87%; Month-to-date: -0.87%; Year-to-date: 4.29%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.483% today (Week-to-date: -0.47%; Month-to-date: -0.47%; Year-to-date: 3.96%)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +4.0%)

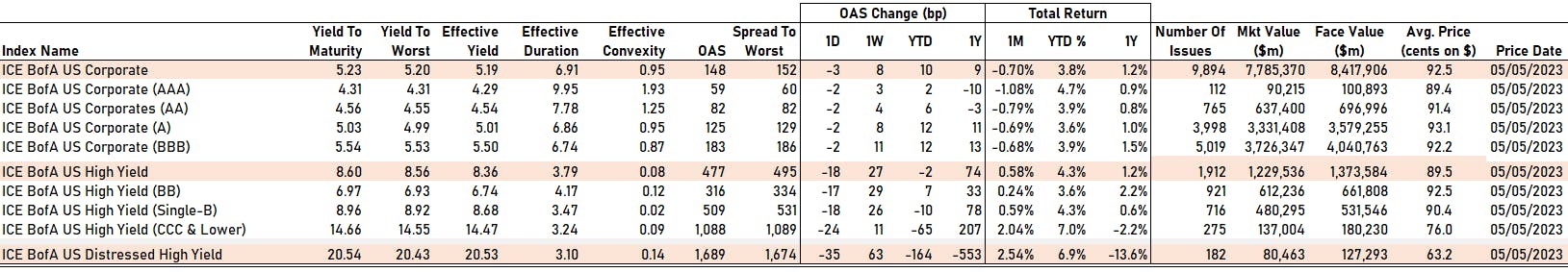

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -2 bp at 59 bp

- AA down by -2 bp at 82 bp

- A down by -2 bp at 125 bp

- BBB down by -2 bp at 183 bp

- BB down by -17 bp at 316 bp

- B down by -18 bp at 509 bp

- ≤ CCC down by -24 bp at 1,088 bp

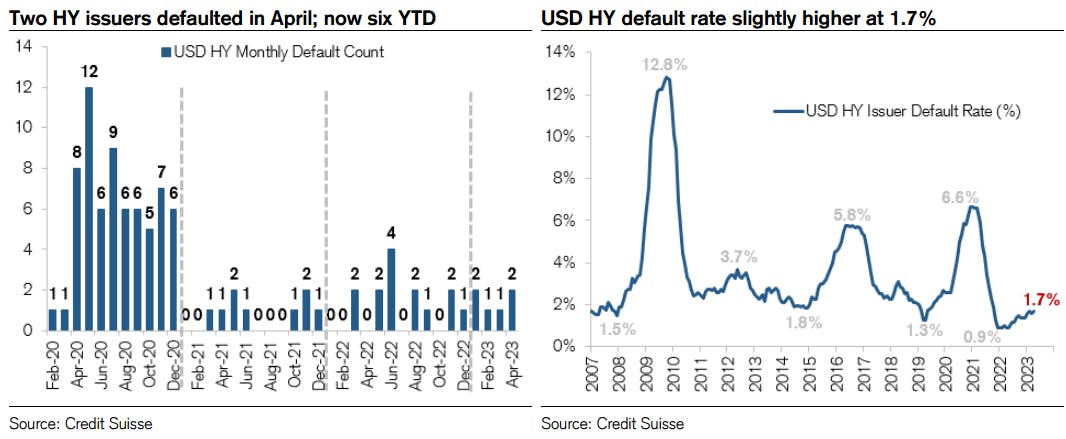

USD HY DEFAULT RATES TICK HIGHER

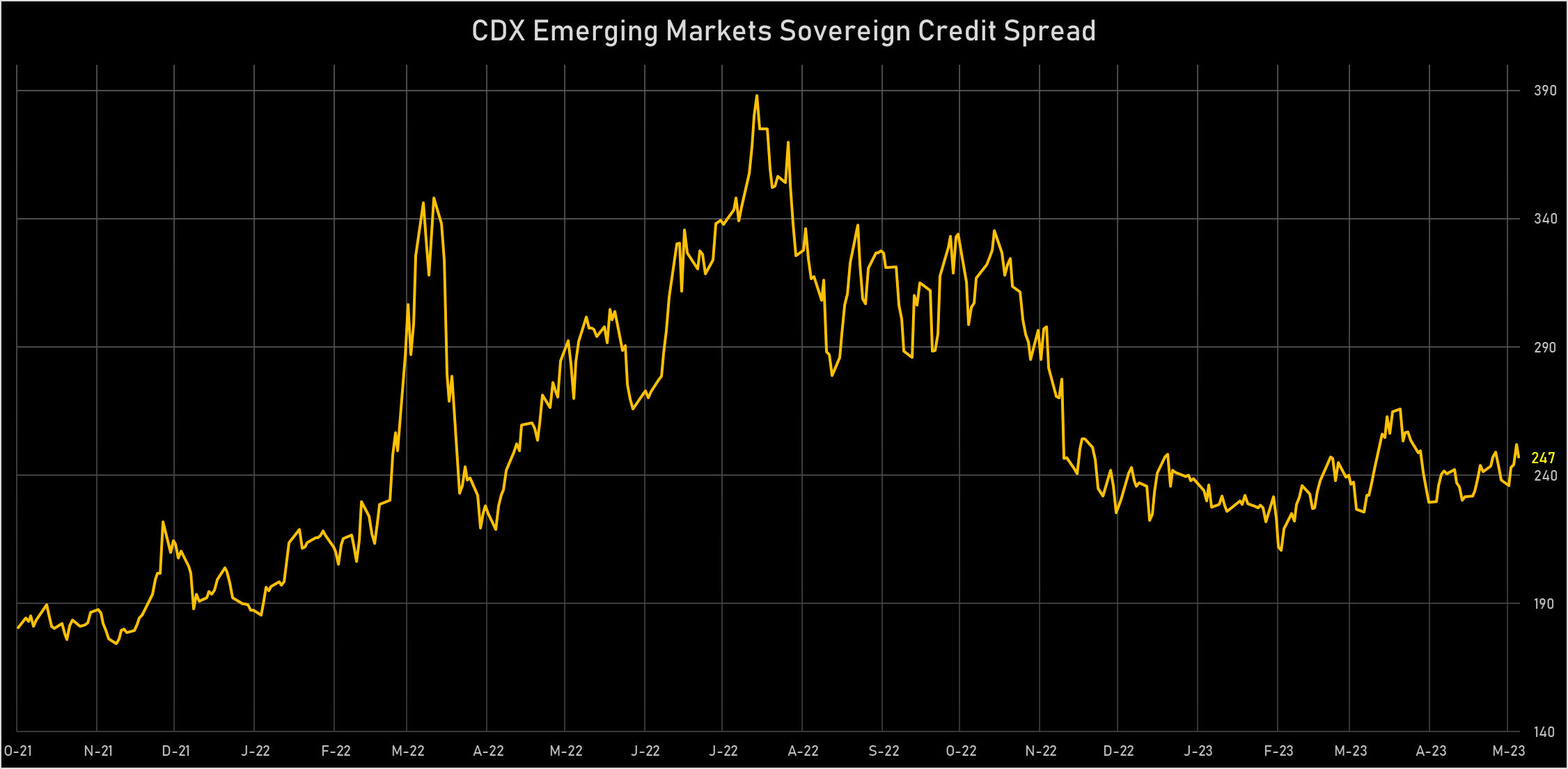

CDS INDICES TODAY (mid-spreads)

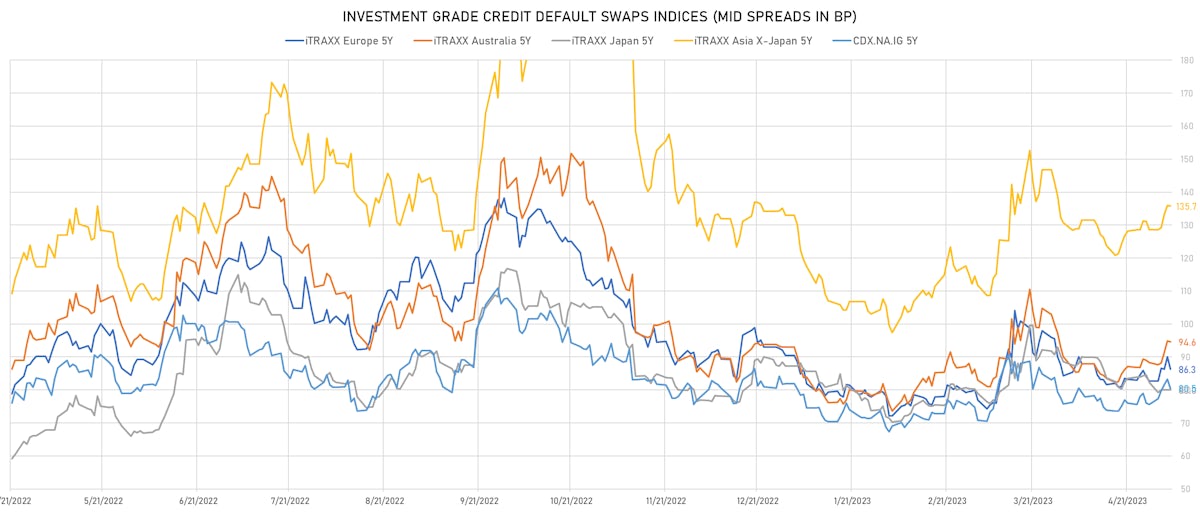

- Markit CDX.NA.IG 5Y down 2.8 bp, now at 80bp (1W change: +4.8bp; YTD change: -1.4bp)

- Markit CDX.NA.IG 10Y down 2.5 bp, now at 116bp (1W change: +3.8bp; YTD change: -1.4bp)

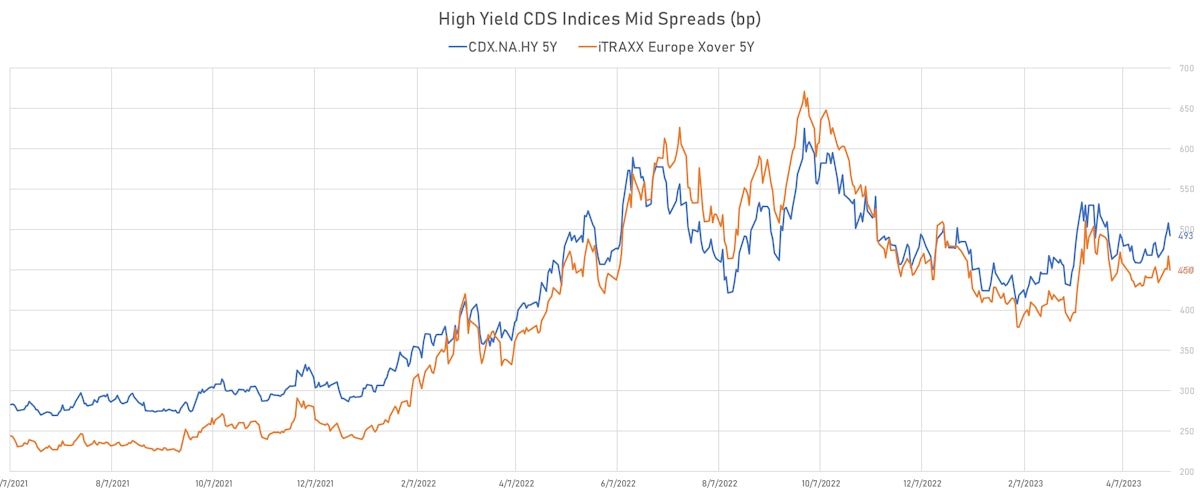

- Markit CDX.NA.HY 5Y down 15.6 bp, now at 493bp (1W change: +26.9bp; YTD change: +7.7bp)

- Markit iTRAXX Europe 5Y down 3.7 bp, now at 86bp (1W change: +3.6bp; YTD change: -4.1bp)

- Markit iTRAXX Europe Crossover 5Y down 17.4 bp, now at 450bp (1W change: +6.1bp; YTD change: -24.5bp)

- Markit iTRAXX Japan 5Y unchanged 0.0 bp, now at 80bp (1W change: -2.3bp; YTD change: -7.2bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.1 bp, now at 136bp (1W change: +7.2bp; YTD change: +2.7bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Ecuador (rated WD): up 93.0 % to 343 bp (1Y range: 178-351bp)

- Jamaica (rated B+): up 15.4 % to 391 bp (1Y range: 338-392bp)

- Mexico (rated BBB-): up 6.6 % to 118 bp (1Y range: 103-205bp)

- Nigeria (rated B-): up 5.8 % to 1,266 bp (1Y range: 377-1,538bp)

- Kenya (rated B): up 5.8 % to 754 bp (1Y range: 447-928bp)

- Egypt (rated B): up 5.4 % to 1,682 bp (1Y range: 706-1,682bp)

- Malaysia (rated BBB+): up 5.1 % to 72 bp (1Y range: 57-122bp)

- China (rated A+): up 4.6 % to 74 bp (1Y range: 47-132bp)

- Philippines (rated BBB): up 4.1 % to 96 bp (1Y range: 79-153bp)

- Lithuania (rated A): down 6.5 % to 87 bp (1Y range: 69-985bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Community Health Systems Inc (Country: US; rated: NR): down 311.9 bp to 1,499.9bp (1Y range: 896-4,371bp)

- Beazer Homes USA Inc (Country: US; rated: NR): down 66.7 bp to 422.5bp (1Y range: 423-899bp)

- Mattel Inc (Country: US; rated: WR): down 64.7 bp to 212.5bp (1Y range: 213-328bp)

- Xerox Corp (Country: US; rated: NR): down 33.7 bp to 409.6bp (1Y range: 333-544bp)

- Tenet Healthcare Corp (Country: US; rated: NR): down 28.9 bp to 296.1bp (1Y range: 296-590bp)

- KB Home (Country: US; rated: BB): down 25.7 bp to 209.3bp (1Y range: 209-485bp)

- Univision Communications Inc (Country: US; rated: B1): down 22.7 bp to 407.3bp (1Y range: 407-658bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 26.1 bp to 898.1bp (1Y range: 432-1,046bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 49.6 bp to 1,000.4bp (1Y range: 761-1,472bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 68.2 bp to 1,309.9bp (1Y range: 685-1,783bp)

- Transocean Inc (Country: KY; rated: Caa1): up 109.2 bp to 984.3bp (1Y range: 674-2,858bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 127.9 bp to 744.3bp (1Y range: 390-887bp)

- Staples Inc (Country: US; rated: B3): up 156.0 bp to 2,742.9bp (1Y range: 1,140-2,743bp)

- DISH DBS Corp (Country: US; rated: B2): up 284.9 bp to 3,152.0bp (1Y range: 614-3,152bp)

- Lumen Technologies Inc (Country: US; rated: LGD5 - 76%): up 699.1 bp to 4,958.4bp (1Y range: 195-4,958bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Telecom Italia SpA (Country: IT; rated: BB-): down 23.9 bp to 361.8bp (1Y range: 306-545bp)

- Ceconomy AG (Country: DE; rated: WR): down 20.5 bp to 1,033.4bp (1Y range: 360-1,763bp)

- Hammerson PLC (Country: GB; rated: A2): down 11.7 bp to 321.0bp (1Y range: 234-482bp)

- Electrolux AB (Country: SE; rated: NR): down 10.2 bp to 125.2bp (1Y range: 54-164bp)

- Stellantis NV (Country: NL; rated: BBB high): up 10.1 bp to 184.6bp (1Y range: 99-569bp)

- Clariant AG (Country: CH; rated: LGD4 - 63%): up 10.4 bp to 141.7bp (1Y range: 100-181bp)

- Barclays Bank PLC (Country: GB; rated: baa1): up 10.7 bp to 123.3bp (1Y range: 74-150bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 12.9 bp to 192.0bp (1Y range: 165-268bp)

- Nokia Oyj (Country: FI; rated: LGD4 - 63%): up 13.2 bp to 168.7bp (1Y range: 113-237bp)

- Publicis Groupe SA (Country: FR; rated: BBB+): up 14.4 bp to 87.6bp (1Y range: 71-151bp)

- WPP 2005 Ltd (Country: GB; rated: ): up 14.7 bp to 101.8bp (1Y range: 82-176bp)

- Renault SA (Country: FR; rated: A-): up 16.1 bp to 338.4bp (1Y range: 236-476bp)

- Pearson PLC (Country: GB; rated: Baa3): up 19.4 bp to 103.6bp (1Y range: 67-138bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 28.4 bp to 807.8bp (1Y range: 526-1,254bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 29.8 bp to 2,131.1bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Icahn Enterprises LP (Sunny Isles Beach, Florida (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: BB- | CUSIP: 451102BZ9 | OAS up by 189.0 bp to 501.9 bp, with the yield to worst at 8.4% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 85.3-96.4).

- Issuer: Icahn Enterprises LP (Sunny Isles Beach, Florida (US)) | Coupon: 4.38% | Maturity: 1/2/2029 | Rating: BB- | CUSIP: 451102CC9 | OAS up by 168.1 bp to 510.4 bp, with the yield to worst at 8.5% and the bond now trading down to 81.0 cents on the dollar (1Y price range: 78.0-89.0).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.00% | Maturity: 15/3/2027 | Rating: B+ | CUSIP: 63938CAK4 | OAS up by 103.7 bp to 529.6 bp (CDS basis: -130.9bp), with the yield to worst at 8.6% and the bond now trading down to 87.3 cents on the dollar (1Y price range: 85.5-93.0).

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS up by 100.0 bp to 500.5 bp, with the yield to worst at 8.5% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 94.8-100.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS up by 94.2 bp to 430.4 bp (CDS basis: -112.4bp), with the yield to worst at 7.7% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 95.5-100.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: B+ | CUSIP: 410345AL6 | OAS up by 77.3 bp to 374.9 bp, with the yield to worst at 7.3% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 89.8-96.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS up by 70.5 bp to 328.3 bp (CDS basis: -68.5bp), with the yield to worst at 6.9% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | CUSIP: 65342QAL6 | OAS up by 59.3 bp to 266.5 bp, with the yield to worst at 6.1% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 89.5-94.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS up by 49.7 bp to 200.3 bp, with the yield to worst at 5.7% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 94.4-96.9).

- Issuer: DPL Inc (Dayton, Ohio (US)) | Coupon: 4.13% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 233293AR0 | OAS up by 48.5 bp to 220.7 bp (CDS basis: -46.8bp), with the yield to worst at 5.9% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 93.4-96.4).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B | CUSIP: 983130AV7 | OAS up by 46.1 bp to 216.6 bp, with the yield to worst at 6.3% and the bond now trading down to 98.1 cents on the dollar (1Y price range: 94.8-99.5).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS up by 42.7 bp to 148.3 bp, with the yield to worst at 5.3% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 95.3-99.0).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS up by 42.5 bp to 157.0 bp (CDS basis: -74.1bp), with the yield to worst at 5.0% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS up by 34.5 bp to 174.0 bp, with the yield to worst at 5.3% and the bond now trading down to 101.3 cents on the dollar (1Y price range: 97.0-102.4).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B- | CUSIP: 780153BH4 | OAS down by 94.5 bp to 329.6 bp (CDS basis: 102.4bp), with the yield to worst at 6.8% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 81.0-91.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS up by 29.2 bp to 397.6 bp (CDS basis: 221.6bp), with the yield to worst at 6.8% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | OAS up by 29.0 bp to 343.9 bp, with the yield to worst at 6.4% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 89.4-92.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 26.0 bp to 491.8 bp (CDS basis: 16.1bp), with the yield to worst at 7.9% and the bond now trading down to 89.1 cents on the dollar (1Y price range: 87.6-92.8).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | OAS up by 24.1 bp to 243.5 bp, with the yield to worst at 5.0% and the bond now trading down to 86.2 cents on the dollar (1Y price range: 82.9-88.0).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS up by 21.0 bp to 484.9 bp (CDS basis: 229.1bp), with the yield to worst at 7.6% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 88.4-97.5).

- Issuer: Kennedy Wilson Europe Real Estate Ltd (Saint Helier, Jersey) | Coupon: 3.25% | Maturity: 12/11/2025 | Rating: BB+ | ISIN: XS1321149434 | OAS up by 19.5 bp to 550.3 bp, with the yield to worst at 8.6% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 77.8-88.6).

- Issuer: Iliad SA (Paris, France) | Coupon: 2.38% | Maturity: 17/6/2026 | Rating: BB | ISIN: FR0013518420 | OAS up by 18.1 bp to 240.6 bp, with the yield to worst at 5.2% and the bond now trading down to 91.2 cents on the dollar (1Y price range: 87.6-92.5).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | OAS up by 17.0 bp to 239.7 bp (CDS basis: -15.0bp), with the yield to worst at 5.3% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 89.4-92.9).

- Issuer: Telefonaktiebolaget LM Ericsson (Stockholm, Sweden) | Coupon: 1.00% | Maturity: 26/5/2029 | Rating: BB+ | ISIN: XS2345996743 | OAS up by 15.9 bp to 222.8 bp (CDS basis: -14.6bp), with the yield to worst at 5.0% and the bond now trading down to 78.8 cents on the dollar (1Y price range: 73.8-80.0).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB | ISIN: XS2332589972 | OAS up by 15.6 bp to 175.3 bp, with the yield to worst at 4.6% and the bond now trading down to 91.2 cents on the dollar (1Y price range: 86.8-92.0).

- Issuer: illimity Bank SpA (Milan, Italy) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS up by 15.6 bp to 368.9 bp, with the yield to worst at 6.8% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 97.6-102.6).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 27/3/2026 | Rating: BB+ | ISIN: XS1969645255 | OAS up by 15.4 bp to 222.3 bp, with the yield to worst at 5.2% and the bond now trading down to 94.1 cents on the dollar (1Y price range: 92.3-95.8).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | OAS up by 15.1 bp to 299.7 bp (CDS basis: 1.6bp), with the yield to worst at 5.8% and the bond now trading down to 81.6 cents on the dollar (1Y price range: 79.4-84.0).

- Issuer: Verallia SA (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BBB- | ISIN: FR0014003G27 | OAS down by 16.1 bp to 96.1 bp, with the yield to worst at 3.8% and the bond now trading up to 89.6 cents on the dollar (1Y price range: 84.5-89.9).

- Issuer: Verallia SA (Courbevoie, France) | Coupon: 1.88% | Maturity: 10/11/2031 | Rating: BBB- | ISIN: FR0014006EG0 | OAS down by 27.9 bp to 128.2 bp, with the yield to worst at 4.2% and the bond now trading up to 83.4 cents on the dollar (1Y price range: 77.0-83.5).

RECENT DOMESTIC USD BOND ISSUES

- Alabama Power Co (Utility - Other | Birmingham, Alabama, United States | Rating: A-): US$200m Senior Note (US010392GA07), floating rate (SOFRINDX + -35.0 bp) maturing on 15 May 2073, priced at 100.00, callable (50nc30)

- Boston Properties LP (Leisure | Boston, Massachusetts, United States | Rating: BBB+): US$750m Senior Note (US10112RBH66), fixed rate (6.50% coupon) maturing on 15 January 2034, priced at 99.70 (original spread of 320 bp), callable (11nc10)

- CMS Energy (Utility - Other | Jackson, Michigan, United States | Rating: BBB): US$700m Bond (US125896BW94), fixed rate (3.38% coupon) maturing on 1 May 2028, priced at 100.00, non callable, convertible

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$1,000m Senior Note (US20030NEE76), fixed rate (4.80% coupon) maturing on 15 May 2033, priced at 99.69 (original spread of 131 bp), callable (10nc10)

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$1,000m Senior Note (US20030NED93), fixed rate (4.55% coupon) maturing on 15 January 2029, priced at 99.78 (original spread of 97 bp), callable (6nc6)

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$1,400m Senior Note (US20030NEG25), fixed rate (5.50% coupon) maturing on 15 May 2064, priced at 99.53 (original spread of 225 bp), callable (41nc41)

- Comcast Corp (Cable/Media | Philadelphia, Pennsylvania, United States | Rating: A-): US$1,600m Senior Note (US20030NEF42), fixed rate (5.35% coupon) maturing on 15 May 2053, priced at 99.57 (original spread of 199 bp), callable (30nc30)

- Dexcom (Machinery | San Diego, California, United States | Rating: NR): US$1,100m Bond (US252131AL12), fixed rate (0.38% coupon) maturing on 15 May 2028, priced at 100.00, non callable, convertible

- Equifax Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB): US$700m Senior Note (US294429AW53), fixed rate (5.10% coupon) maturing on 1 June 2028, priced at 99.70 (original spread of 176 bp), callable (5nc5)

- Equipmentshare.Com Inc (Information/Data Technology | Columbia, Montana, United States | Rating: B-): US$640m Note (USU26947AA69), fixed rate (9.00% coupon) maturing on 15 May 2028, priced at 94.26 (original spread of 715 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$140m Bond (US3133EPJP19), fixed rate (3.63% coupon) maturing on 12 May 2027, priced at 100.00 (original spread of 26 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$427m Bond (US3130AVWL23), floating rate (SOFR + 12.0 bp) maturing on 1 May 2025, priced at 100.00, non callable

- FirstEnergy (Utility - Other | Akron, Ohio, United States | Rating: BBB-): US$1,500m Bond (US337932AQ09), fixed rate (4.00% coupon) maturing on 1 May 2026, priced at 100.00, non callable, convertible

- GATX Corp (Railroads | Chicago, Illinois, United States | Rating: BBB): US$400m Senior Note (US361448BL67), fixed rate (5.45% coupon) maturing on 15 September 2033, priced at 99.82 (original spread of 199 bp), callable (10nc10)

- Georgia Power Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB+): US$1,000m Senior Note (US373334KT78), fixed rate (4.95% coupon) maturing on 17 May 2033, priced at 99.83 (original spread of 148 bp), callable (10nc10)

- Georgia Power Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB+): US$750m Senior Note (US373334KS95), fixed rate (4.65% coupon) maturing on 16 May 2028, priced at 99.87 (original spread of 114 bp), callable (5nc5)

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): US$1,500m Senior Note (XS2521885843), fixed rate (4.50% coupon) maturing on 6 June 2025, priced at 100.00, non callable

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$1,250m Senior Note (US404119CQ00), fixed rate (5.50% coupon) maturing on 1 June 2033, priced at 99.93 (original spread of 199 bp), callable (10nc10)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$1,000m Senior Note (US404119CR82), fixed rate (5.90% coupon) maturing on 1 June 2053, priced at 96.72 (original spread of 278 bp), callable (30nc30)

- HCA Inc (Health Care Facilities | Nashville, Tennessee, United States | Rating: BBB-): US$1,000m Senior Note (US404119CP27), fixed rate (5.20% coupon) maturing on 1 June 2028, priced at 99.84 (original spread of 160 bp), callable (5nc5)

- Heartland Dental LLC (Health Care Facilities | Effingham, Illinois, United States | Rating: B-): US$535m Note (US42239PAB58), fixed rate (10.50% coupon) maturing on 30 April 2028, priced at 100.00 (original spread of 693 bp), callable (5nc2)

- Hershey Co (Food Processors | Hershey, Pennsylvania, United States | Rating: A): US$400m Senior Note (US427866BJ63), fixed rate (4.50% coupon) maturing on 4 May 2033, priced at 99.80 (original spread of 100 bp), callable (10nc10)

- Hershey Co (Food Processors | Hershey, Pennsylvania, United States | Rating: A): US$350m Senior Note (US427866BH08), fixed rate (4.25% coupon) maturing on 4 May 2028, priced at 99.86 (original spread of 70 bp), callable (5nc5)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): US$2,500m Senior Note (US30303M8Q83), fixed rate (5.60% coupon) maturing on 15 May 2053, priced at 99.72 (original spread of 226 bp), callable (30nc30)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): US$1,750m Senior Note (US30303M8R66), fixed rate (5.75% coupon) maturing on 15 May 2063, priced at 99.70 (original spread of 252 bp), callable (40nc40)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): US$1,000m Senior Note (US30303M8M79), fixed rate (4.80% coupon) maturing on 15 May 2030, priced at 99.77 (original spread of 124 bp), callable (7nc7)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): US$1,500m Senior Note (US30303M8L96), fixed rate (4.60% coupon) maturing on 15 May 2028, priced at 99.98 (original spread of 99 bp), callable (5nc5)

- Meta Platforms Inc (Service - Other | Menlo Park, California, United States | Rating: A+): US$1,750m Senior Note (US30303M8N52), fixed rate (4.95% coupon) maturing on 15 May 2033, priced at 99.95 (original spread of 148 bp), callable (10nc10)

- Navient Corp (Financial - Other | Wilmington, Delaware, United States | Rating: B+): US$500m Senior Note (US63938CAN83), fixed rate (9.38% coupon) maturing on 25 July 2030, priced at 99.93 (original spread of 635 bp), callable (7nc6)

- Northern States Power Co (Utility - Other | Minneapolis, Minnesota, United States | Rating: A): US$800m First Mortgage Bond (US665772CX54), fixed rate (5.10% coupon) maturing on 15 May 2053, priced at 99.25 (original spread of 182 bp), callable (30nc30)

- THC 6.750 05/15/31 '26 (Health Care Facilities | Dallas, Texas, United States | Rating: B+): US$1,350m Note (US88033GDT40), fixed rate (6.75% coupon) maturing on 15 May 2031, priced at 100.00 (original spread of 337 bp), callable (8nc3)

- Tenet Healthcare Corp (Health Care Facilities | Dallas, Texas, United States | Rating: B+): US$1,350m Note (USU88030BN79), fixed rate (6.75% coupon) maturing on 15 May 2031, priced at 100.00 (original spread of 337 bp), callable (8nc3)

- Tractor Supply Co (Retail Stores - Other | Brentwood, Tennessee, United States | Rating: BBB): US$750m Senior Note (US892356AB23), fixed rate (5.25% coupon) maturing on 15 May 2033, priced at 99.56 (original spread of 175 bp), callable (10nc10)

- Verizon Communications Inc (Telecommunications | New York City, New York, United States | Rating: BBB+): US$1,000m Senior Note (US92343VGT52), fixed rate (5.05% coupon) maturing on 9 May 2033, priced at 99.84 (original spread of 163 bp), callable (10nc10)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$250m Certificate of Deposit - Retail (US949764BW39), fixed rate (4.85% coupon) maturing on 5 May 2025, priced at 100.00, non callable

RECENT INTERNATIONAL USD BOND ISSUES

- Avolon Holdings Funding Ltd (Financial - Other | Dublin, Dublin, China (Mainland) | Rating: BBB-): US$750m Senior Note (US05401AAS06), fixed rate (6.38% coupon) maturing on 4 May 2028, priced at 98.96 (original spread of 324 bp), callable (5nc5)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$2,000m Senior Note (US06738ECF07), floating rate maturing on 9 May 2027, priced at 100.00 (original spread of 195 bp), callable (4nc3)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$2,000m Senior Note (US06738ECG89), floating rate maturing on 9 May 2034, priced at 100.00 (original spread of 278 bp), callable (11nc10)

- Caisse Des Depots Et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): US$600m Bond (FR001400HOV1), floating rate (SOFR + 34.0 bp) maturing on 3 May 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460015596), fixed rate (4.10% coupon) maturing on 30 May 2025, priced at 100.00, non callable

- Emerald Debt Merger Sub LLC (Financial - Other | Wilmington, Delaware | Rating: NR): US$2,275m Note (US29103CAA62), fixed rate (6.63% coupon) maturing on 15 December 2030, priced at 100.00 (original spread of 339 bp), callable (8nc3)

- Glencore Funding LLC (Financial - Other | Stamford, Connecticut, Switzerland | Rating: BBB+): US$500m Senior Note (US378272BL13), fixed rate (5.70% coupon) maturing on 8 May 2033, priced at 99.83 (original spread of 230 bp), callable (10nc10)

- Glencore Funding LLC (Financial - Other | Stamford, Connecticut, Switzerland | Rating: BBB+): US$500m Senior Note (US378272BK30), fixed rate (5.40% coupon) maturing on 8 May 2028, priced at 99.96 (original spread of 195 bp), callable (5nc5)

- SK On Co Ltd (Vehicle Parts | Seoul, Seoul, South Korea | Rating: AA-): US$900m Senior Note (XS2612749908), fixed rate (5.38% coupon) maturing on 11 May 2026, priced at 99.91 (original spread of 155 bp), non callable

- STE Transcore Holdings Inc (Service - Other | Wilmington, Delaware, Singapore | Rating: NR): US$500m Unsecured Note (XS2620557285), fixed rate (1.00% coupon) maturing on 16 May 2026, priced at 100.00, non callable

- VistaJet Malta Finance PLC (Financial - Other | Luqa, Switzerland | Rating: B-): US$500m Senior Note (USX9816MAA81), fixed rate (9.50% coupon) maturing on 1 June 2028, priced at 99.00 (original spread of 689 bp), callable (5nc2)

RECENT EURO BOND ISSUES

- Amundi Finance Emissions SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €150m Bond (FR001400FYD2), floating rate (EU03MLIB + 0.0 bp) maturing on 5 May 2025, priced at 100.00, non callable

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €1,000m Note (XS2620201421), floating rate maturing on 10 May 2026, priced at 99.93 (original spread of 151 bp), callable (3nc2)

- Carrefour SA (Retail Stores - Food/Drug | Massy, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400HU68), fixed rate (3.75% coupon) maturing on 10 October 2030, priced at 99.65 (original spread of 163 bp), callable (7nc7)

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €500m Bond (IT0005543852), fixed rate (3.75% coupon) maturing on 31 May 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €300m Bond (IT0005543860), fixed rate (3.00% coupon) maturing on 31 May 2025, priced at 100.00, non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): €1,000m Unsecured Note (XS2620722079), fixed rate (3.25% coupon) maturing on 10 May 2028, priced at 100.00, non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): €1,250m Unsecured Note (XS2620722152), fixed rate (3.25% coupon) maturing on 10 May 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDS6), floating rate maturing on 25 May 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €3,000m Index Linked Security (XS2609983072), floating rate maturing on 31 October 2033, priced at 100.00, with a make whole call

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDT4), fixed rate (2.80% coupon) maturing on 26 May 2025, priced at 100.00, non callable

- Emerald Debt Merger Sub LLC (Financial - Other | Wilmington, Delaware | Rating: NR): €455m Note (XS2621830681), fixed rate (6.38% coupon) maturing on 15 December 2030, priced at 100.00 (original spread of 421 bp), callable (8nc3)

- Fluvius System Operator CVBA (Utility - Other | Melle, Oost-Vlaanderen, Belgium | Rating: A-): €700m Bond (BE0002939206), fixed rate (3.88% coupon) maturing on 9 May 2033, priced at 99.35 (original spread of 159 bp), callable (10nc10)

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: A-): €350m Hypothekenpfandbrief (Covered Bond) (DE000HCB0BT4), floating rate (EU03MLIB + 14.0 bp) maturing on 10 November 2025, priced at 100.00, non callable

- Kraft Heinz Foods Co (Food Processors | Pittsburgh, Pennsylvania, United States | Rating: BBB): €600m Unsecured Note (XS2622214745), floating rate (EU03MLIB + 50.0 bp) maturing on 9 May 2025, priced at 100.00, callable (2nc1)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3MYD6), fixed rate (2.90% coupon) maturing on 7 June 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3MYE4), fixed rate (2.95% coupon) maturing on 7 June 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB38EU0), fixed rate (2.65% coupon) maturing on 7 June 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB38ET2), fixed rate (2.60% coupon) maturing on 8 June 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3NE71), fixed rate (3.00% coupon) maturing on 7 June 2029, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB38K57), fixed rate (2.80% coupon) maturing on 9 June 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB3MYC8), fixed rate (2.85% coupon) maturing on 8 June 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB37GG6), fixed rate (2.55% coupon) maturing on 9 June 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000HLB49B0), fixed rate (2.40% coupon) maturing on 16 June 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000HLB49C8), fixed rate (3.00% coupon) maturing on 16 June 2028, priced at 100.00, non callable

- Nordea Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: A-): €1,000m Note (XS2618906585), fixed rate (4.13% coupon) maturing on 5 May 2028, priced at 99.70 (original spread of 194 bp), with a regulatory call

- Paccar Financial Europe BV (Financial - Other | Eindhoven, Noord-Brabant, United States | Rating: A+): €500m Senior Note (XS2621812192), fixed rate (3.38% coupon) maturing on 15 May 2026, priced at 99.81 (original spread of 106 bp), non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €250m Inhaberschuldverschreibung (AT000B130216), fixed rate (3.50% coupon) maturing on 15 December 2025, priced at 100.00, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €250m Inhaberschuldverschreibung (AT000B078852), fixed rate (3.75% coupon) maturing on 16 June 2028, priced at 100.00, non callable

- Schleswig-Holstein, State of (Official and Muni | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €650m Jumbo Landesschatzanweisung (DE000SHFM881), fixed rate (2.88% coupon) maturing on 10 May 2028, priced at 99.81 (original spread of 68 bp), non callable

- Sparkasse Pforzheim Calw (Banking | Pforzheim, Baden-Wuerttemberg, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000A351TH2), fixed rate (3.00% coupon) maturing on 11 May 2029, priced at 99.72 (original spread of 86 bp), non callable

- Standard Chartered PLC (Banking | London, United Kingdom | Rating: A-): €1,000m Senior Note (XS2618731256), fixed rate (4.87% coupon) maturing on 10 May 2031, priced at 100.00 (original spread of 271 bp), callable (8nc7)

RECENT LOANS

- Africa Finance Corp (Nigeria), signed a US$ 500m Term Loan, to be used for general corporate purposes. It matures on 04/26/26.

- Archer Ltd (Norway), signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 04/27/27 and initial pricing is set at Term SOFR +550.0bp

- Belfor USA Group Inc (United States of America | B), signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 04/04/26 and initial pricing is set at Term SOFR +425.0bp

- Bunker Holding A/S (Denmark), signed a US$ 1,110m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/27/28.

- Burgan Bank KPSC (Kuwait | BBB+), signed a US$ 800m Term Loan, to be used for general corporate purposes. It matures on 04/26/26.

- C-SAIL Renewable Energy Invest (Cayman Islands), signed a US$ 297m Revolving Credit / Term Loan, to be used for capital expenditures. It matures on 04/27/24.

- CME Group Inc (United States of America | AA-), signed a US$ 7,000m 364d Revolver, to be used for general corporate purposes. It matures on 04/24/24 and initial pricing is set at Term SOFR +150.0bp

- California Resources Corp (United States of America | BB-), signed a US$ 592m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/26/26 and initial pricing is set at Term SOFR +300.0bp

- Carrier Global Corp (United States of America | BBB), signed a € 500m Bridge Loan, to be used for acquisition financing. It matures on 04/25/24.

- Carrier Global Corp (United States of America | BBB), signed a € 7,700m Bridge Loan, to be used for acquisition financing. It matures on 04/25/24.

- Clark Associates Co LLC (United States of America), signed a US$ 125m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 04/26/28.

- Clark Associates Co LLC (United States of America), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/26/28.

- ECOM Agroindustrial Asia Ltd (Singapore), signed a US$ 117m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 04/26/26.

- ECOM Agroindustrial Asia Ltd (Singapore), signed a US$ 233m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 04/26/24.

- F-Secure Oyj (Finland), signed a € 202m Term Loan, to be used for acquisition financing. It matures on 04/27/26.

- Falko Regional Aircraft Ltd (United Kingdom), signed a US$ 388m Term Loan, to be used for general corporate purposes.

- Firebirds International LLC (United States of America), signed a US$ 185m Revolving Credit Facility, to be used for general corporate purposes.

- Ford Motor Co (United States of America | BB+), signed a US$ 3,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/26/26 and initial pricing is set at Term SOFR +137.5bp

- GL Events SA (France), signed a € 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/26/28.

- Heartland Dental Care LLC (United States of America), signed a US$ 1,380m Term Loan B, to be used for general corporate purposes. It matures on 04/30/28 and initial pricing is set at Term SOFR +500.0bp

- Hershey Co (United States of America | A), signed a US$ 1,350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/26/28 and initial pricing is set at Term SOFR +41.0bp

- Invesco Ltd (United States of America | BBB+), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes, working capital and capital expenditures. It matures on 04/26/28 and initial pricing is set at Term SOFR +112.5bp

- Lundin Mining Corp (Canada), signed a US$ 1,750m Revolving Credit Facility, to be used for general corporate purposes and acquisition financing. It matures on 04/26/28 and initial pricing is set at Term SOFR +250.0bp

- MRC Global Inc (United States of America), signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 05/02/28 and initial pricing is set at Term SOFR +400.0bp

- Magna International Inc (Canada | A-), signed a US$ 2,700m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/24/28 and initial pricing is set at Term SOFR +100.0bp

- Merrill Communications LLC (United States of America), signed a US$ 365m Term Loan B, to be used for general corporate purposes. It matures on 12/22/27 and initial pricing is set at Term SOFR +450.0bp

- Merrill Communications LLC (United States of America), signed a US$ 300m Term Loan B, to be used for refin/ret bank debt. It matures on 12/22/27 and initial pricing is set at Term SOFR +450.0bp

- Minera Las Bambas SAC (Peru), signed a US$ 275m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 04/26/26.

- Ministry Of Econ And Fin Cote (Ivory Coast), signed a € 178m Term Loan, to be used for capital expenditures.

- Mitsui OSK Lines Ltd (Japan), signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/27/30.

- New Gold Inc-New Afton Mine (Canada), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/22/26.

- Nvent Fin S.A R.L. (Luxembourg | BBB-), signed a US$ 300m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 04/26/28 and initial pricing is set at Term SOFR +100.0bp

- ORIX Corp (Japan | A-), signed a US$ 280m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/26/25.

- Perdaman Chem & Fertilizers (Australia), signed a US$ 3,000m Revolving Credit / Term Loan, to be used for capital expenditures.

- Pernod Ricard SA (France | BBB+), signed a € 2,100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/27/28.

- Post Holdings Inc (United States of America | B+), signed a US$ 400m Term Loan B, to be used for general corporate purposes

- working capital. It matures on 04/26/26 and initial pricing is set at Term SOFR +225.0bp

- Quebrada Blanca Phase 2 (Chile), signed a US$ 750m Term Loan, to be used for project finance.

- Sligro Food Group NV (Netherlands), signed a € 260m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/28/28.

- Social Finance Inc (United States of America), signed a US$ 560m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/28/28 and initial pricing is set at Term SOFR +100.0bp

- Sunpower Corp (United States of America), signed a US$ 450m Term Loan, to be used for general corporate purposes.

- T5@Charlotte II LP (United States of America), signed a US$ 325m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 04/16/26.

- The Cigna Group (United States of America | A-), signed a US$ 4,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/27/28 and initial pricing is set at Term SOFR +87.5bp

- The Cigna Group (United States of America | A-), signed a US$ 1,000m 364d Revolver, to be used for general corporate purposes. It matures on 04/26/24 and initial pricing is set at Term SOFR +87.5bp

- Vingroup JSC (Vietnam), signed a US$ 1,000m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 04/27/28.

RECENT STRUCTURED CREDIT

- Chase Home Lending Mortgage Trust 2023-RPL1 issued a fixed-rate RMBS in 4 tranches, for a total of US$ 416 m. Highest-rated tranche offering a yield to maturity of 4.05%, and the lowest-rated tranche a yield to maturity of 5.41%. Bookrunners: JP Morgan & Co Inc

- Foundation Finance Trust 2023-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 236 m. Highest-rated tranche offering a yield to maturity of 5.72%, and the lowest-rated tranche a yield to maturity of 9.23%. Bookrunners: Goldman Sachs & Co, Guggenheim Partners LLC

- Lobel Automobile Receivables Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 154 m. Highest-rated tranche offering a yield to maturity of 6.97%, and the lowest-rated tranche a yield to maturity of 8.31%. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- Prestige Automobile Receivables Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 6 tranches, for a total of US$ 282 m. Highest-rated tranche offering a yield to maturity of 5.55%, and the lowest-rated tranche a yield to maturity of 9.88%. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- Velocity Commercial Capital Loan Trust 2023-2 issued a fixed-rate CMBS in 6 tranches, for a total of US$ 220 m. Highest-rated tranche offering a coupon of 6.22%, and the lowest-rated tranche a yield to maturity of 8.99%. Bookrunners: Barclays Capital Group, Citigroup Global Markets Inc, Performance Trust Capital