Credit

Duration In Driver's Seat, As US Cash Spreads Broadly Unchanged Over The Past Week

Solid weekly US new issue volumes: 43 tranches for $35.1bn in IG (2023 YTD volume $535.04bn vs 2022 YTD $618.041bn), 5 tranches for $3.74bn in IG (2023 YTD volume $68.112.6bn vs 2022 YTD $55.371bn)

Published ET

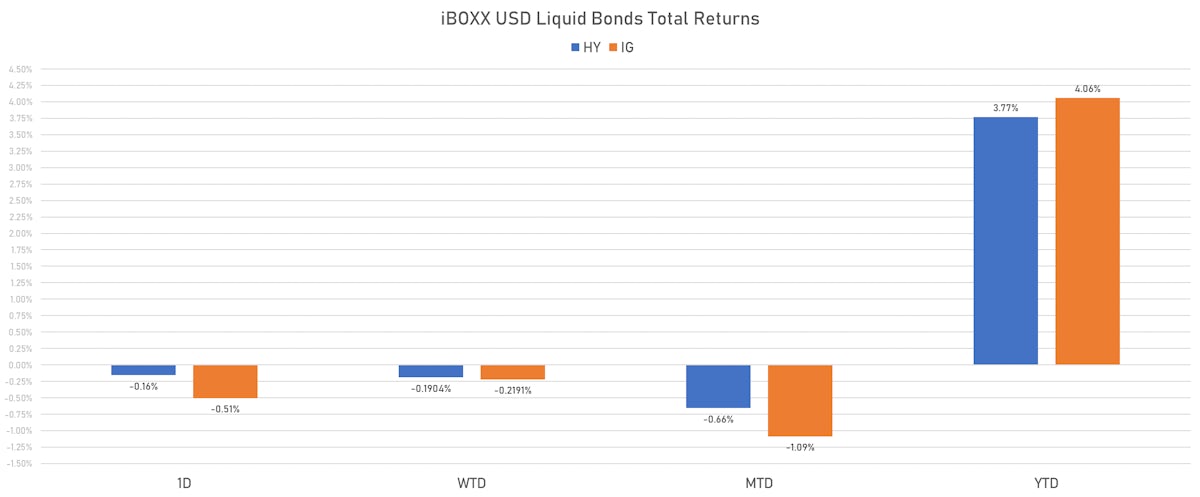

iBOXX USD Liquid Bonds Total Returns | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.36% today, with investment grade down -0.38% and high yield down -0.17% (YTD total return: +3.53%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.507% today (Week-to-date: -0.22%; Month-to-date: -1.09%; Year-to-date: 4.06%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.156% today (Week-to-date: -0.19%; Month-to-date: -0.66%; Year-to-date: 3.77%)

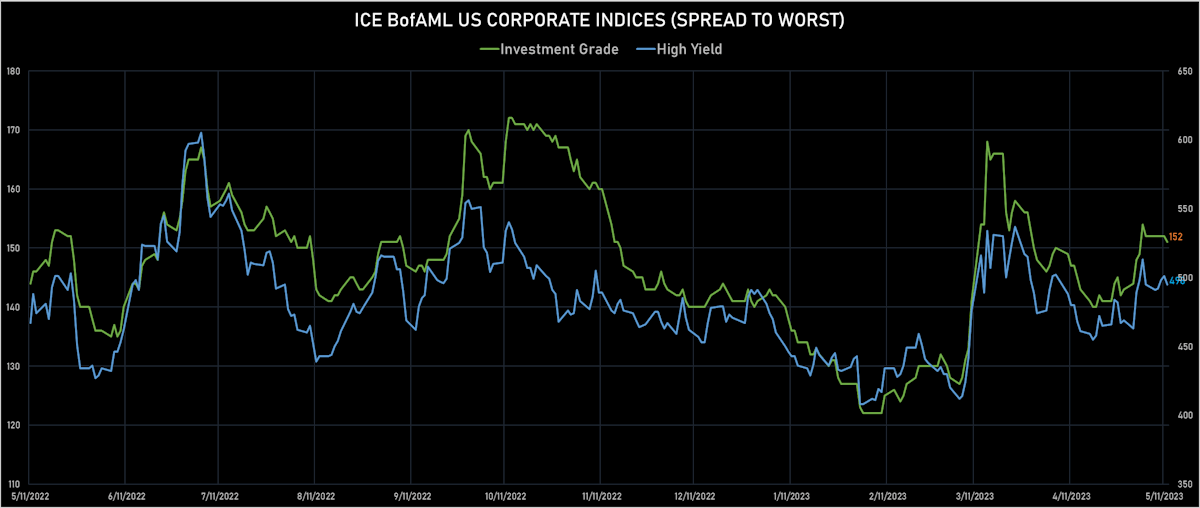

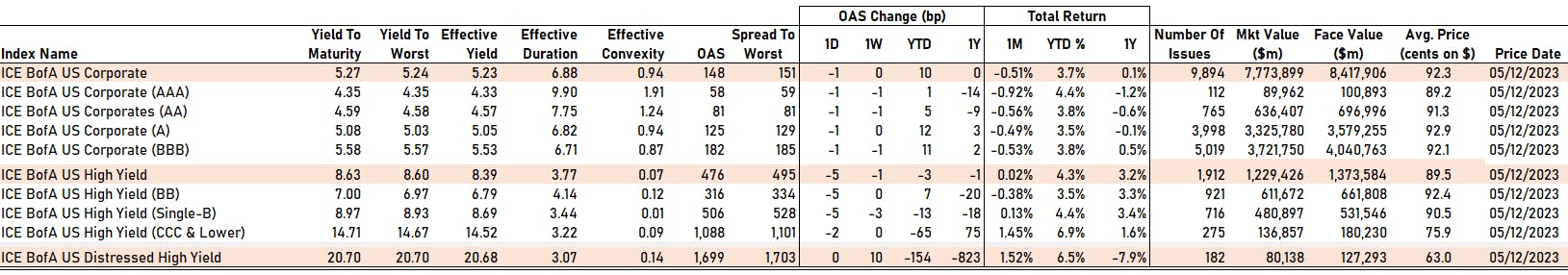

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 151.0 bp (WTD change: -1.0 bp; YTD change: +11.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged 0.0 bp, now at 495.0 bp (WTD change: +4.0 bp; YTD change: +7.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +4.0%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 58 bp

- AA down by -1 bp at 81 bp

- A down by -1 bp at 125 bp

- BBB down by -1 bp at 182 bp

- BB down by -5 bp at 316 bp

- B down by -5 bp at 506 bp

- ≤ CCC down by -2 bp at 1,088 bp

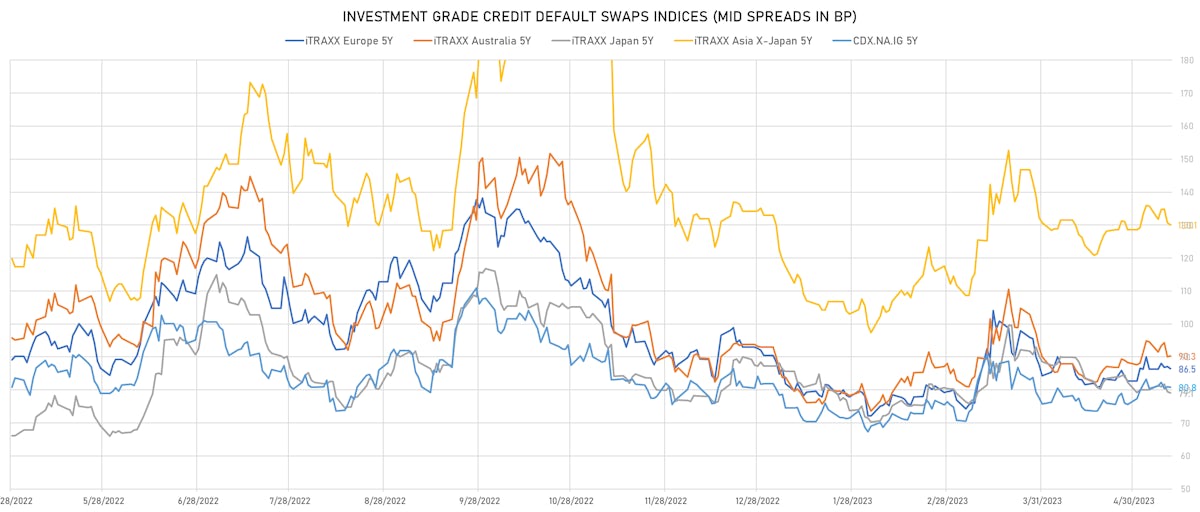

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 81bp (1W change: +0.3bp; YTD change: -1.0bp)

- Markit CDX.NA.IG 10Y up 0.1 bp, now at 117bp (1W change: +0.6bp; YTD change: -0.8bp)

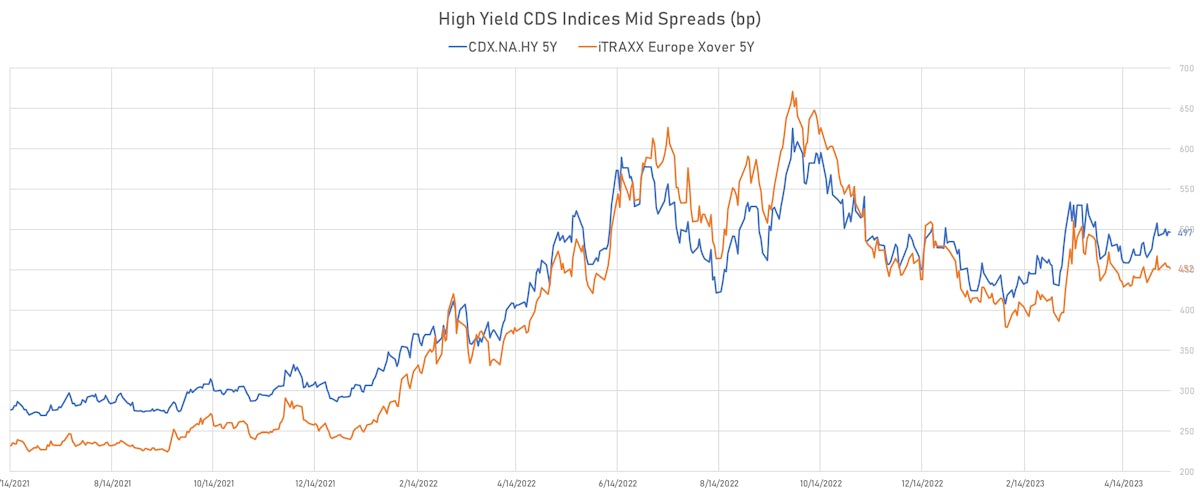

- Markit CDX.NA.HY 5Y down 0.6 bp, now at 497bp (1W change: +4.0bp; YTD change: +11.7bp)

- Markit iTRAXX Europe 5Y down 0.6 bp, now at 86bp (1W change: +0.2bp; YTD change: -4.0bp)

- Markit iTRAXX Europe Crossover 5Y down 2.5 bp, now at 452bp (1W change: -15.3bp; YTD change: -22.3bp)

- Markit iTRAXX Japan 5Y down 0.4 bp, now at 79bp (1W change: -0.9bp; YTD change: -8.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.6 bp, now at 130bp (1W change: -5.6bp; YTD change: -2.9bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- South Africa (rated BB-): up 9.6 % to 318 bp (1Y range: 229-377bp)

- Egypt (rated B): up 7.4 % to 1,765 bp (1Y range: 706-1,740bp)

- Thailand (rated BBB+): up 4.1 % to 52 bp (1Y range: 42-95bp)

- Kenya (rated B): down 2.9 % to 749 bp (1Y range: 447-928bp)

- Chile (rated A-): down 3.0 % to 94 bp (1Y range: 81-174bp)

- Ecuador (rated WD): down 3.3 % to 339 bp (1Y range: 178-351bp)

- Malaysia (rated BBB+): down 3.9 % to 69 bp (1Y range: 57-122bp)

- Philippines (rated BBB): down 4.4 % to 92 bp (1Y range: 79-153bp)

- China (rated A+): down 6.6 % to 69 bp (1Y range: 47-132bp)

- Turkey (rated B): down 11.6 % to 487 bp (1Y range: 479-892bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Turkiye Is Bankasi AS (Country: TR; rated: WR): down 68.0 bp to 603.9bp (1Y range: 604-1,110bp)

- Carnival Corp (Country: US; rated: WR): down 64.7 bp to 934.0bp (1Y range: 678-2,117bp)

- Goodyear Tire & Rubber Co (Country: US; rated: NR): down 57.0 bp to 366.5bp (1Y range: 342-552bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: NR): down 49.3 bp to 465.9bp (1Y range: 466-1,584bp)

- Unisys Corp (Country: US; rated: B1): down 36.5 bp to 1,211.3bp (1Y range: 432-1,378bp)

- Newell Brands Inc (Country: US; rated: Ba1): up 34.5 bp to 489.5bp (1Y range: 83-490bp)

- MBIA Inc (Country: US; rated: CCC-): up 36.4 bp to 392.5bp (1Y range: 220-534bp)

- Macy's Inc (Country: US; rated: A1): up 44.8 bp to 543.7bp (1Y range: 300-619bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 44.9 bp to 412.3bp (1Y range: 124-412bp)

- Gap Inc (Country: US; rated: NR): up 56.0 bp to 730.9bp (1Y range: 429-819bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 86.2 bp to 1,646.5bp (1Y range: 747-1,783bp)

- Community Health Systems Inc (Country: US; rated: NR): up 163.4 bp to 2,251.9bp (1Y range: 1,196-4,371bp)

- Staples Inc (Country: US; rated: B3): up 195.4 bp to 2,975.4bp (1Y range: 1,393-2,975bp)

- DISH DBS Corp (Country: US; rated: B2): up 437.6 bp to 4,785.1bp (1Y range: 1,004-4,785bp)

- Lumen Technologies Inc (Country: US; rated: NR): up 1425.5 bp to 6,296.5bp (1Y range: 195-6,297bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 59.3 bp to 785.7bp (1Y range: 691-1,725bp)

- Novafives SAS (Country: FR; rated: Caa1): down 37.7 bp to 1,141.6bp (1Y range: 618-2,936bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 35.7 bp to 760.8bp (1Y range: 679-1,296bp)

- Ceconomy AG (Country: DE; rated: WR): down 30.7 bp to 1,002.7bp (1Y range: 396-1,763bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 18.7 bp to 789.1bp (1Y range: 634-1,254bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 17.1 bp to 617.9bp (1Y range: 370-758bp)

- Hammerson PLC (Country: GB; rated: A2): down 14.3 bp to 306.7bp (1Y range: 238-482bp)

- GKN Holdings Ltd (Country: GB; rated: Ba1): down 11.4 bp to 98.5bp (1Y range: 91-314bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 9.6 bp to 269.5bp (1Y range: 248-498bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): down 9.5 bp to 283.9bp (1Y range: 227-523bp)

- Alstom SA (Country: FR; rated: P-3): down 9.0 bp to 174.0bp (1Y range: 127-313bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 8.8 bp to 2,139.9bp (1Y range: 1,286-2,910bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 11.4 bp to 378.6bp (1Y range: 280-496bp)

- thyssenkrupp AG (Country: DE; rated: NR): up 22.1 bp to 381.3bp (1Y range: 309-705bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 27.3 bp to 973.7bp (1Y range: 401-1,021bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Qwest Corp (Monroe, Louisiana (US)) | Coupon: 7.25% | Maturity: 15/9/2025 | Rating: B+ | CUSIP: 912920AK1 | OAS up by 177.3 bp to 1,032.6 bp, with the yield to worst at 13.4% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 87.0-102.7).

- Issuer: Icahn Enterprises LP (Sunny Isles Beach, Florida (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: BB- | CUSIP: 451102BZ9 | OAS up by 151.4 bp to 653.3 bp, with the yield to worst at 9.9% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 79.0-96.4).

- Issuer: Icahn Enterprises LP (Sunny Isles Beach, Florida (US)) | Coupon: 4.38% | Maturity: 1/2/2029 | Rating: BB- | CUSIP: 451102CC9 | OAS up by 108.5 bp to 618.9 bp, with the yield to worst at 9.6% and the bond now trading down to 77.0 cents on the dollar (1Y price range: 73.6-89.0).

- Issuer: Xerox Corp (Norwalk, Connecticut (US)) | Coupon: 3.80% | Maturity: 15/5/2024 | Rating: BB | CUSIP: 984121CJ0 | OAS up by 56.1 bp to 203.8 bp (CDS basis: -68.9bp), with the yield to worst at 6.6% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 95.8-98.1).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS up by 40.9 bp to 182.5 bp (CDS basis: 75.8bp), with the yield to worst at 5.6% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: Phillips 66 Co (Houston, United States) | Coupon: 2.45% | Maturity: 15/12/2024 | Rating: BB- | CUSIP: 718547AB8 | OAS up by 37.1 bp to 63.2 bp, with the yield to worst at 5.0% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.6-96.5).

- Issuer: Howmet Aerospace Inc (Pittsburgh, United States) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS down by 18.5 bp to 98.2 bp, with the yield to worst at 5.0% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 100.8-105.5).

- Issuer: FirstEnergy Corp (Akron, United States) | Coupon: 7.38% | Maturity: 15/11/2031 | Rating: BB+ | CUSIP: 337932AC1 | OAS down by 28.8 bp to 154.1 bp (CDS basis: -31.4bp), with the yield to worst at 4.8% and the bond now trading up to 116.4 cents on the dollar (1Y price range: 110.4-116.8).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 31.7 bp to 127.7 bp, with the yield to worst at 5.4% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB | CUSIP: 65342QAB8 | OAS down by 46.3 bp to 237.0 bp, with the yield to worst at 5.8% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 90.8-95.1).

- Issuer: American Airlines Group Inc (Fort Worth, United States) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | CUSIP: 02376RAE2 | OAS down by 48.3 bp to 266.9 bp (CDS basis: 567.7bp), with the yield to worst at 6.3% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 85.0-94.9).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | CUSIP: 65342QAL6 | OAS down by 57.1 bp to 209.4 bp, with the yield to worst at 5.5% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 89.5-94.0).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 3.13% | Maturity: 2/11/2026 | Rating: BB+ | CUSIP: 78442PGE0 | OAS down by 67.9 bp to 374.8 bp, with the yield to worst at 7.1% and the bond now trading up to 86.9 cents on the dollar (1Y price range: 80.0-89.0).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | CUSIP: 690872AB2 | OAS down by 69.0 bp to 123.7 bp (CDS basis: 210.5bp), with the yield to worst at 5.0% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 96.0-99.0).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 4.88% | Maturity: 15/3/2027 | Rating: B | CUSIP: 382550BG5 | OAS down by 71.2 bp to 224.9 bp (CDS basis: 102.1bp), with the yield to worst at 5.7% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 89.5-96.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: BB+ | ISIN: XS2271332285 | OAS up by 194.6 bp to 931.0 bp, with the yield to worst at 11.7% and the bond now trading down to 55.4 cents on the dollar (1Y price range: 53.8-67.8).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: BB+ | ISIN: XS2346224806 | OAS up by 157.7 bp to 872.7 bp, with the yield to worst at 11.0% and the bond now trading down to 53.6 cents on the dollar (1Y price range: 52.4-67.0).

- Issuer: Fastighets AB Balder (Goeteborg, Sweden) | Coupon: 1.88% | Maturity: 23/1/2026 | Rating: BB+ | ISIN: XS1677912393 | OAS up by 31.3 bp to 542.9 bp, with the yield to worst at 8.2% and the bond now trading down to 84.4 cents on the dollar (1Y price range: 79.1-86.6).

- Issuer: Globalworth Real Estate Investments Ltd (St Martin, Guernsey) | Coupon: 2.95% | Maturity: 29/7/2026 | Rating: BB+ | ISIN: XS2208868914 | OAS up by 30.0 bp to 884.6 bp, with the yield to worst at 11.5% and the bond now trading down to 77.1 cents on the dollar (1Y price range: 76.2-83.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS up by 28.2 bp to 669.9 bp (CDS basis: -65.2bp), with the yield to worst at 9.5% and the bond now trading down to 82.2 cents on the dollar (1Y price range: 81.2-88.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS up by 27.9 bp to 655.8 bp (CDS basis: -87.2bp), with the yield to worst at 9.4% and the bond now trading down to 78.4 cents on the dollar (1Y price range: 77.8-83.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 23.5 bp to 459.4 bp (CDS basis: 237.6bp), with the yield to worst at 7.4% and the bond now trading up to 97.9 cents on the dollar (1Y price range: 88.4-97.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 28/7/2027 | Rating: BB- | ISIN: XS1266661013 | OAS down by 23.8 bp to 427.6 bp, with the yield to worst at 6.7% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 86.4-94.8).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | OAS down by 24.3 bp to 482.2 bp, with the yield to worst at 7.6% and the bond now trading up to 77.1 cents on the dollar (1Y price range: 71.8-83.0).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 24.8 bp to 370.1 bp (CDS basis: 225.9bp), with the yield to worst at 6.5% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 27.5 bp to 524.6 bp, with the yield to worst at 7.7% and the bond now trading up to 80.3 cents on the dollar (1Y price range: 74.8-85.1).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS down by 28.3 bp to 379.9 bp, with the yield to worst at 6.3% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 88.0-94.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS down by 28.5 bp to 489.3 bp, with the yield to worst at 7.3% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 82.7-92.9).

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | OAS down by 31.1 bp to 306.8 bp, with the yield to worst at 6.1% and the bond now trading up to 91.4 cents on the dollar (1Y price range: 89.4-92.3).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC+ | ISIN: XS1713464524 | OAS down by 65.6 bp to 972.5 bp, with the yield to worst at 11.4% and the bond now trading up to 77.0 cents on the dollar (1Y price range: 66.6-80.0).

RECENT DOMESTIC USD BOND ISSUES

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,000m Senior Note (US037833EV87), fixed rate (4.30% coupon) maturing on 10 May 2033, priced at 99.91 (original spread of 81 bp), callable (10nc10)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,500m Senior Note (US037833ET32), fixed rate (4.00% coupon) maturing on 10 May 2028, priced at 99.81 (original spread of 55 bp), callable (5nc5)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,000m Senior Note (US037833ES58), fixed rate (4.42% coupon) maturing on 8 May 2026, priced at 100.00 (original spread of 70 bp), callable (3nc1)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,250m Senior Note (US037833EW60), fixed rate (4.85% coupon) maturing on 10 May 2053, priced at 99.50 (original spread of 147 bp), callable (30nc30)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$500m Senior Note (US037833EU05), fixed rate (4.15% coupon) maturing on 10 May 2030, priced at 99.73 (original spread of 70 bp), callable (7nc7)

- Ball Corp (Containers | Westminster, Colorado, United States | Rating: BB+): US$1,000m Senior Note (US058498AZ97), fixed rate (6.00% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 251 bp), callable (6nc3)

- Baltimore Gas and Electric Co (Utility - Other | Baltimore, Maryland, United States | Rating: A-): US$700m Senior Note (US059165EQ94), fixed rate (5.40% coupon) maturing on 1 June 2053, priced at 99.95 (original spread of 198 bp), callable (30nc30)

- Bloom Energy (Utility - Other | San Jose, California, United States | Rating: NR): US$550m Bond (US093712AJ60), fixed rate (3.00% coupon) maturing on 1 June 2028, priced at 100.00, non callable, convertible

- Calderys Financing LLC (Financial - Other | Beverly Hills, California, United States | Rating: B): US$550m Note (US128786AA80), fixed rate (11.25% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 785 bp), callable (5nc2)

- Caterpillar Financial Services Corp (Leasing | Nashville, Tennessee, United States | Rating: A): US$1,250m Senior Note (US14913UAA88), fixed rate (4.35% coupon) maturing on 15 May 2026, priced at 99.95 (original spread of 65 bp), with a make whole call

- Citigroup Global Markets Holdings Inc (Securities | New York City, New York, United States | Rating: A): US$135m Senior Note (XS2565545188), floating rate (SOFR + 120.0 bp) maturing on 26 May 2028, priced at 100.00, non callable

- ConocoPhillips Co (Oil and Gas | Houston, Texas, United States | Rating: A-): US$1,100m Senior Note (US20826FBE51), fixed rate (5.30% coupon) maturing on 15 May 2053, priced at 99.38 (original spread of 189 bp), callable (30nc30)

- DTE Energy Co (Utility - Other | Detroit, Michigan, United States | Rating: BBB): US$800m Senior Note (US233331BJ54), fixed rate (4.88% coupon) maturing on 1 June 2028, priced at 99.95 (original spread of 141 bp), callable (5nc5)

- EIDP Inc (Consumer Products | Indianapolis, Indiana, United States | Rating: A-): US$600m Senior Note (US263534CQ07), fixed rate (4.50% coupon) maturing on 15 May 2026, priced at 99.87 (original spread of 95 bp), callable (3nc3)

- EIDP Inc (Consumer Products | Indianapolis, Indiana, United States | Rating: A-): US$600m Senior Note (US263534CR89), fixed rate (4.80% coupon) maturing on 15 May 2033, priced at 99.64 (original spread of 145 bp), callable (10nc10)

- Edison International (Utility - Other | Rosemead, California, United States | Rating: BBB-): US$600m Senior Note (US281020AY36), fixed rate (5.25% coupon) maturing on 15 November 2028, priced at 99.81 (original spread of 190 bp), callable (6nc5)

- Entergy Mississippi LLC (Service - Other | Jackson, Mississippi, United States | Rating: A): US$300m First Mortgage Bond (US29366WAD83), fixed rate (5.00% coupon) maturing on 1 September 2033, priced at 99.94 (original spread of 149 bp), callable (10nc10)

- Estee Lauder Companies Inc (Consumer Products | New York City, New York, United States | Rating: A+): US$600m Senior Note (US29736RAU41), fixed rate (5.15% coupon) maturing on 15 May 2053, priced at 99.46 (original spread of 178 bp), callable (30nc30)

- Estee Lauder Companies Inc (Consumer Products | New York City, New York, United States | Rating: A+): US$700m Senior Note (US29736RAT77), fixed rate (4.65% coupon) maturing on 15 May 2033, priced at 99.90 (original spread of 117 bp), callable (10nc10)

- Estee Lauder Companies Inc (Consumer Products | New York City, New York, United States | Rating: A+): US$700m Senior Note (US29736RAS94), fixed rate (4.38% coupon) maturing on 15 May 2028, priced at 99.90 (original spread of 92 bp), callable (5nc5)

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$450m Senior Note (US30040WAV00), fixed rate (4.75% coupon) maturing on 15 May 2026, priced at 99.94 (original spread of 109 bp), with a make whole call

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$800m Senior Note (US30040WAU27), fixed rate (5.13% coupon) maturing on 15 May 2033, priced at 99.84 (original spread of 170 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$250m Bond (US3133EPJX43), fixed rate (3.63% coupon) maturing on 17 February 2026, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$862m Bond (US3133EPJR74), floating rate (SOFR + 16.0 bp) maturing on 15 May 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EPJV86), floating rate (FFQ + 14.0 bp) maturing on 19 May 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$154m Bond (US3133EPKA21), fixed rate (4.00% coupon) maturing on 18 August 2025, priced at 100.00 (original spread of 2 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,000m Bond (US3130AVYD88), floating rate (SOFR + 15.0 bp) maturing on 12 May 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,000m Bond (US3130AVYT31), floating rate (SOFR + 15.0 bp) maturing on 19 May 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYSA11), fixed rate (5.20% coupon) maturing on 16 May 2025, priced at 100.00, callable (2nc6m)

- Foundry JV Holdco LLC (Financial - Other | Wilmington, Delaware, United States | Rating: A-): US$1,100m Note (US350930AA10), fixed rate (5.88% coupon) maturing on 25 January 2034, priced at 98.76 (original spread of 260 bp), callable (11nc10)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$180m Unsecured Note (XS2482260994), fixed rate (2.15% coupon) maturing on 22 June 2028, priced at 100.00, non callable

- Granite Constr (Service - Other | Watsonville, California, United States | Rating: NR): US$374m Bond (US387328AC10), fixed rate (3.75% coupon) maturing on 15 May 2028, priced at 100.00, non callable, convertible

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, North Carolina, United States | Rating: A): US$1,000m Senior Note (US438516CM68), fixed rate (4.50% coupon) maturing on 15 January 2034, priced at 99.12 (original spread of 115 bp), callable (11nc10)

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, North Carolina, United States | Rating: A): US$750m Senior Note (US438516CL85), fixed rate (4.25% coupon) maturing on 15 January 2029, priced at 99.77 (original spread of 85 bp), callable (6nc6)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, New Jersey, United States | Rating: A+): US$750m Senior Note (US58933YBL83), fixed rate (4.90% coupon) maturing on 17 May 2044, priced at 99.40 (original spread of 142 bp), callable (21nc21)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, New Jersey, United States | Rating: A+): US$1,500m Senior Note (US58933YBK01), fixed rate (4.50% coupon) maturing on 17 May 2033, priced at 99.91 (original spread of 100 bp), callable (10nc10)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, New Jersey, United States | Rating: A+): US$1,500m Senior Note (US58933YBM66), fixed rate (5.00% coupon) maturing on 17 May 2053, priced at 99.60 (original spread of 159 bp), callable (30nc30)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, New Jersey, United States | Rating: A+): US$500m Senior Note (US58933YBH71), fixed rate (4.05% coupon) maturing on 17 May 2028, priced at 99.92 (original spread of 57 bp), callable (5nc5)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, New Jersey, United States | Rating: A+): US$1,000m Senior Note (US58933YBN40), fixed rate (5.15% coupon) maturing on 17 May 2063, priced at 99.56 (original spread of 186 bp), callable (40nc40)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, New Jersey, United States | Rating: A+): US$750m Senior Note (US58933YBJ38), fixed rate (4.30% coupon) maturing on 17 May 2030, priced at 99.88 (original spread of 82 bp), callable (7nc7)

- Northern Oil and Gas Inc (Gas Utility - Local Distrib | Minnetonka, Minnesota, United States | Rating: B): US$500m Senior Note (US665530AB71), fixed rate (8.75% coupon) maturing on 15 June 2031, priced at 98.57 (original spread of 580 bp), callable (8nc3)

- Ohio Power Co (Utility - Other | Columbus, Ohio, United States | Rating: BBB+): US$400m Senior Note (US677415CV13), fixed rate (5.00% coupon) maturing on 1 June 2033, priced at 99.53 (original spread of 160 bp), callable (10nc10)

- Oncor Electric Delivery Company LLC (Utility - Other | Dallas, Texas, United States | Rating: A): US$400m Note (USU68279AK18), fixed rate (4.95% coupon) maturing on 15 September 2052, priced at 95.21 (original spread of 145 bp), callable (29nc29)

- Oncor Electric Delivery Company LLC (Utility - Other | Dallas, Texas, United States | Rating: A): US$600m Note (US68233JCN28), fixed rate (4.30% coupon) maturing on 15 May 2028, priced at 99.79 (original spread of 85 bp), callable (5nc5)

- Owens-Brockway Glass Container Inc (Containers | Perrysburg, Ohio, United States | Rating: B+): US$690m Senior Note (US69073TAU79), fixed rate (7.25% coupon) maturing on 15 May 2031, priced at 100.00 (original spread of 388 bp), callable (8nc3)

- Ryder System Inc (Service - Other | Miami, Florida, United States | Rating: BBB): US$650m Senior Note (US78355HKW87), fixed rate (5.25% coupon) maturing on 1 June 2028, priced at 99.87 (original spread of 190 bp), callable (5nc5)

- Schlumberger Investment SA (Financial - Other | Luxembourg, United States | Rating: A): US$500m Senior Note (US806854AL93), fixed rate (4.85% coupon) maturing on 15 May 2033, priced at 99.91 (original spread of 135 bp), callable (10nc10)

- Schlumberger Investment SA (Financial - Other | Luxembourg, United States | Rating: A): US$500m Senior Note (US806854AK11), fixed rate (4.50% coupon) maturing on 15 May 2028, priced at 99.81 (original spread of 105 bp), callable (5nc5)

- Texas Instruments Inc (Electronics | Dallas, Texas, United States | Rating: AA-): US$1,200m Senior Note (US882926AA67), fixed rate (5.05% coupon) maturing on 18 May 2063, priced at 99.17 (original spread of 137 bp), callable (40nc40)

- Transmedics Grp (Health Care Supply | Andover, Massachusetts, United States | Rating: NR): US$460m Bond (US89377MAA71), fixed rate (1.50% coupon) maturing on 1 June 2028, priced at 100.00, non callable, convertible

- Wayfair (Retail Stores - Other | Boston, Massachusetts, United States | Rating: NR): US$600m Bond (US94419LAQ41), fixed rate (3.50% coupon) maturing on 15 November 2028, priced at 100.00, non callable, convertible

- Welltower OP (Real Estate Investment Trust | Toledo, Ohio, United States | Rating: BBB+): US$1,035m Bond (US95041AAB44), fixed rate (2.75% coupon) maturing on 15 May 2028, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- BP Capital Markets America Inc (Financial - Other | Chicago, Illinois, United Kingdom | Rating: A-): US$1,500m Senior Note (US10373QBV14), fixed rate (4.89% coupon) maturing on 11 September 2033, priced at 100.00 (original spread of 140 bp), callable (10nc10)

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Poland | Rating: A-): US$500m Unsecured Note (XS2625207571), fixed rate (3.00% coupon) maturing on 23 May 2033, priced at 100.00, non callable

- Bayfront Infrastructure Management Pte Ltd (Financial - Other | Singapore, Singapore | Rating: AAA): US$500m Senior Note (XS2599087876), fixed rate (4.26% coupon) maturing on 16 May 2026, priced at 100.00 (original spread of 52 bp), non callable

- Bell Telephone Company of Canada or Bell Canada (Quebec,CA) (Financial - Other | Canada | Rating: BBB+): US$850m Senior Note (US0778FPAL33), fixed rate (5.10% coupon) maturing on 11 May 2033, priced at 99.93 (original spread of 160 bp), callable (10nc10)

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$1,500m Senior Note (XS2624016932), fixed rate (3.50% coupon) maturing on 19 May 2028, priced at 99.71 (original spread of 27 bp), non callable

- China Construction Bank Corp (Sydney Branch) (Banking | Sydney, New South Wales, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2623522930) maturing on 29 May 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A34CS2), fixed rate (3.00% coupon) maturing on 30 June 2025, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$1,500m Senior Note (XS2613748545), fixed rate (3.88% coupon) maturing on 16 May 2026, priced at 99.44 (original spread of 42 bp), non callable

- MDGH GMTN (RSC) Ltd (Financial - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: NR): US$500m Senior Note (US55285GAC87), fixed rate (5.08% coupon) maturing on 22 May 2053, priced at 100.00 (original spread of 135 bp), callable (30nc30)

- MDGH GMTN (RSC) Ltd (Financial - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: NR): US$1,000m Senior Note (XS2624479288), fixed rate (4.38% coupon) maturing on 22 November 2033, priced at 99.35 (original spread of 105 bp), callable (11nc10)

- Sharjah, Emirate of (Official and Muni | Sharjah, Sharjah, United Arab Emirates | Rating: BB+): US$200m Unsecured Note (XS2625070250), floating rate maturing on 23 May 2025, priced at 100.00, non callable

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB-): US$1,250m Senior Note (US87264ADB89), fixed rate (5.75% coupon) maturing on 15 January 2054, priced at 99.60 (original spread of 234 bp), callable (31nc30)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB-): US$900m Senior Note (US87264ADA07), fixed rate (4.80% coupon) maturing on 15 July 2028, priced at 99.79 (original spread of 139 bp), callable (5nc5)

- Willis North America Inc (Financial - Other | Nashville, Tennessee, United Kingdom | Rating: BBB-): US$750m Senior Note (US970648AM30), fixed rate (5.35% coupon) maturing on 15 May 2033, priced at 99.73 (original spread of 195 bp), callable (10nc10)

RECENT EURO BOND ISSUES

- ABANCA Corporacion Bancaria SA (Banking | Betanzos, La Coruna, Spain | Rating: BBB-): €500m Participacion Preferente (ES0365936048), floating rate maturing on 18 May 2026, priced at 99.76 (original spread of 290 bp), callable (3nc2)

- AT&T Inc (Telecommunications | Dallas, United States | Rating: BBB): €1,250m Senior Note (XS2590758822), fixed rate (4.30% coupon) maturing on 18 November 2034, priced at 99.92 (original spread of 209 bp), callable (12nc11)

- AT&T Inc (Telecommunications | Dallas, United States | Rating: BBB): €1,000m Senior Note (XS2590758665), fixed rate (3.95% coupon) maturing on 30 April 2031, priced at 99.88 (original spread of 184 bp), callable (8nc8)

- AT&T Inc (Telecommunications | Dallas, United States | Rating: BBB): €1,000m Senior Note (XS2590758400), fixed rate (3.55% coupon) maturing on 18 November 2025, priced at 99.89 (original spread of 116 bp), callable (3nc2)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): €500m Senior Note (XS2622275969), fixed rate (4.63% coupon) maturing on 16 May 2031, priced at 99.36 (original spread of 248 bp), callable (8nc8)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): €600m Senior Note (XS2622275886), fixed rate (4.13% coupon) maturing on 16 May 2027, priced at 99.87 (original spread of 185 bp), callable (4nc4)

- Aprr SA (Service - Other | Saint-Apollinaire, Bourgogne-Franche-Comte, France | Rating: A-): €700m Senior Note (FR001400I145), fixed rate (3.13% coupon) maturing on 24 January 2030, priced at 98.55 (original spread of 121 bp), callable (7nc6)

- Australia Pacific Airports (Melbourne) Pty Ltd (Airline | Victoria, Australia | Rating: BBB+): €500m Unsecured Note (XS2624503509), fixed rate (1.00% coupon) maturing on 22 May 2033, priced at 100.00, non callable

- BP Capital Markets BV (Financial - Other | Middlesex, United Kingdom | Rating: A-): €750m Senior Note (XS2620585658), fixed rate (3.77% coupon) maturing on 12 May 2030, priced at 100.00 (original spread of 155 bp), non callable

- BP Capital Markets BV (Financial - Other | Middlesex, United Kingdom | Rating: A-): €750m Senior Note (XS2620585906), fixed rate (4.32% coupon) maturing on 12 May 2035, priced at 100.00 (original spread of 199 bp), non callable

- Banca Comerciala Romana SA (Banking | Bucuresti, Bucuresti, Austria | Rating: BBB): €700m Inhaberschuldverschreibung (AT0000A34CN3), floating rate maturing on 19 May 2027, priced at 100.00, callable (4nc3)

- Bausparkasse Wuestenrot AG (Banking | Salzburg, Salzburg, Austria | Rating: BBB+): €250m Hypothekenpfandbrief (Covered Bond) (AT0000A34D99), fixed rate (3.25% coupon) maturing on 19 May 2027, priced at 99.85 (original spread of 111 bp), non callable

- Booking Holdings Inc (Service - Other | Norwalk, Connecticut, United States | Rating: A-): €500m Senior Note (XS2621007231), fixed rate (3.63% coupon) maturing on 12 November 2028, priced at 99.92 (original spread of 140 bp), callable (6nc5)

- Booking Holdings Inc (Service - Other | Norwalk, Connecticut, United States | Rating: A-): €1,250m Senior Note (XS2621007660), fixed rate (4.13% coupon) maturing on 12 May 2033, priced at 99.43 (original spread of 186 bp), callable (10nc10)

- Bper Banca SpA (Banking | Modena, Modena, Italy | Rating: BB+): €400m Bond (IT0005543233), fixed rate (4.75% coupon) maturing on 26 May 2026, priced at 100.00, non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB+): €1,000m Note (XS2623501181), floating rate maturing on 16 May 2027, priced at 99.83 (original spread of 226 bp), callable (4nc3)

- Caterpillar Financial Services Corp (Leasing | Nashville, Tennessee, United States | Rating: A): €500m Unsecured Note (XS2623668634) zero coupon maturing on 25 May 2026, priced at 100.00, non callable

- Cedacri SpA (Information/Data Technology | Milan, Milano | Rating: B): €275m Note (XS2622213002), floating rate (EU03MLIB + 550.0 bp) maturing on 15 May 2028, priced at 94.00, with a make whole call

- Centurion Bidco SpA (Information/Data Technology | Milan, Milano, Luxembourg | Rating: NR): €385m Note (XS2620212386), fixed rate (11.13% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 898 bp), callable (5nc2)

- Compagnie de Financement Foncier SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,000m Obligation Fonciere (Covered Bond) (FR001400HZD5), fixed rate (3.13% coupon) maturing on 17 May 2029, priced at 99.44 (original spread of 103 bp), non callable

- Corning Inc (Electronics | Corning, New York, United States | Rating: BBB+): €300m Senior Note (XS2621757405), fixed rate (3.88% coupon) maturing on 15 May 2026, priced at 99.99 (original spread of 145 bp), non callable

- Corning Inc (Electronics | Corning, New York, United States | Rating: BBB+): €550m Senior Note (XS2621757744), fixed rate (4.13% coupon) maturing on 15 May 2031, priced at 99.67 (original spread of 195 bp), non callable

- Credit Mutuel Arkea SA (Banking | Le Relecq-Kerhuon, Bretagne, France | Rating: AA-): €500m Note (FR001400I186), fixed rate (3.88% coupon) maturing on 22 May 2028, priced at 99.86 (original spread of 178 bp), with a regulatory call

- Crown European Holdings SA (Containers | United States | Rating: BB+): €500m Senior Note (XS2623223513), fixed rate (5.00% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 274 bp), callable (5nc5)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C4V2), fixed rate (2.60% coupon) maturing on 2 June 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C4W0), fixed rate (2.75% coupon) maturing on 1 June 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C4X8), fixed rate (3.00% coupon) maturing on 30 November 2029, priced at 100.00, non callable

- Dana Financing Luxembourg SARL (Financial - Other | Luxembourg, United States | Rating: B+): €425m Senior Note (XS2623489627), fixed rate (8.50% coupon) maturing on 15 July 2031, priced at 100.00 (original spread of 630 bp), callable (8nc3)

- Danske Kiinnitysluottopankki Oyj (Mortgage Banking | Helsinki, Etela-Suomen, Denmark | Rating: NR): €500m Covered Bond (Other) (XS2621830848), fixed rate (3.13% coupon) maturing on 12 January 2027, priced at 99.97 (original spread of 94 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €600m Senior Note (XS2624017070), fixed rate (3.25% coupon) maturing on 19 May 2033, priced at 98.91 (original spread of 117 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000A351NR4), fixed rate (3.13% coupon) maturing on 19 October 2026, priced at 99.84 (original spread of 88 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDZ1), fixed rate (3.25% coupon) maturing on 1 June 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VDY4), floating rate maturing on 30 May 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000A351TP5), fixed rate (3.13% coupon) maturing on 19 May 2033, priced at 99.47 (original spread of 87 bp), non callable

- Eramet SA (Metals/Mining | Paris, Ile-De-France, France | Rating: BB): €500m Bond (FR001400HZE3), fixed rate (7.00% coupon) maturing on 22 May 2028, priced at 100.00, callable (5nc5)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A34CZ7), fixed rate (3.50% coupon) maturing on 9 June 2027, priced at 100.00, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €5,000m Senior Note (EU000A3K4D82), fixed rate (2.75% coupon) maturing on 5 October 2026, priced at 99.72 (original spread of 52 bp), non callable

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): €600m Senior Note (XS2623496085), fixed rate (6.13% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 385 bp), with a make whole call

- Groep Brussel Lambert NV (Chemicals | Brussels, Bruxelles-Capitale, Belgium | Rating: A+): €500m Bond (BE0002938190), fixed rate (4.00% coupon) maturing on 15 May 2033, priced at 99.66 (original spread of 171 bp), callable (10nc10)

- Hamburger Sparkasse AG (Banking | Hamburg, Hamburg, Germany | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (DE000A351M80), fixed rate (3.00% coupon) maturing on 15 September 2028, priced at 99.79 (original spread of 84 bp), non callable

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, North Carolina, United States | Rating: A): €500m Senior Note (XS2624938739), fixed rate (3.75% coupon) maturing on 17 May 2032, priced at 99.13, callable (9nc9)

- Honeywell International Inc (Conglomerate/Diversified Mfg | Charlotte, North Carolina, United States | Rating: A): €650m Senior Note (XS2624938655), fixed rate (3.50% coupon) maturing on 17 May 2027, priced at 99.80 (original spread of 131 bp), callable (4nc4)

- Hypo Vorarlberg Bank AG (Banking | Bregenz, Vorarlberg, Austria | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (AT0000A34CR4), fixed rate (3.25% coupon) maturing on 16 February 2028, priced at 99.94 (original spread of 104 bp), non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €2,000m Bond (IT0005545642), fixed rate (4.00% coupon) maturing on 20 June 2028, priced at 100.00, non callable

- Investitionsund Strukturbank Rheinland-Pfalz ISB (Financial - Other | Mainz, Rheinland-Pfalz, Germany | Rating: NR): €150m Inhaberschuldverschreibung (DE000A351PS7), fixed rate (3.00% coupon) maturing on 19 May 2026, priced at 99.72 (original spread of 72 bp), non callable

- Islandsbanki hf (Banking | Kopavogur, Iceland | Rating: BBB): €300m Note (XS2553604690), fixed rate (7.38% coupon) maturing on 17 May 2026, priced at 100.00 (original spread of 497 bp), with a regulatory call

- L'Oreal SA (Consumer Products | Clichy, Ile-De-France, France | Rating: AA+): €1,000m Bond (FR001400HX73), fixed rate (3.13% coupon) maturing on 19 May 2025, priced at 99.80, callable (2nc2)

- L'Oreal SA (Consumer Products | Clichy, Ile-De-France, France | Rating: AA+): €1,000m Bond (FR001400HX81), fixed rate (2.88% coupon) maturing on 19 May 2028, priced at 99.47, callable (5nc5)

- MBT Systems (Financial - Other | Hohenstein-Ernstthal, Sachsen, Switzerland | Rating: NR): €216m Bond (CH1239464675), fixed rate (3.75% coupon) maturing on 17 May 2029, priced at 100.00, non callable, convertible

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: BBB+): €1,000m Senior Note (XS2623518821), floating rate maturing on 16 February 2029, priced at 100.00 (original spread of 250 bp), callable (6nc5)

- OI European Group BV (Containers | Schiedam, Zuid-Holland, United States | Rating: NR): €600m Senior Note (XS2624554163), fixed rate (6.25% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 408 bp), callable (5nc2)

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A-): €250m Inhaberschuldverschreibung (AT000B078860), fixed rate (3.63% coupon) maturing on 16 June 2026, priced at 100.00, non callable

- San Marino, Republic of (Government) (Sovereign | San Marino | Rating: BB): €350m Senior Note (XS2619991883), fixed rate (6.50% coupon) maturing on 19 January 2027, priced at 99.79 (original spread of 429 bp), non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €650m Unsecured Note (XS2623556326), fixed rate (1.00% coupon) maturing on 31 May 2028, priced at 100.00, non callable

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): €1,750m Sakerstallda Obligation (Covered Bond) (XS2623820953), fixed rate (3.25% coupon) maturing on 4 November 2025, priced at 99.79 (original spread of 89 bp), non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400HTQ0), fixed rate (3.33% coupon) maturing on 11 May 2027, priced at 100.00, non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400HV00), fixed rate (3.31% coupon) maturing on 11 May 2026, priced at 100.00, non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400HV26), fixed rate (3.50% coupon) maturing on 11 May 2033, priced at 100.00, non callable

- Sparebank 1 Boligkreditt AS (Mortgage Banking | Stavanger, Rogaland, Norway | Rating: A): €750m Covered Bond (Other) (XS2624502105), fixed rate (3.00% coupon) maturing on 19 May 2030, priced at 99.45 (original spread of 26 bp), non callable

- Sparebank 1 Boligkreditt AS (Mortgage Banking | Stavanger, Rogaland, Norway | Rating: A): €750m Unsecured Note (XS2624502287), floating rate maturing on 20 May 2030, priced at 100.00, non callable

- Sparkasse Hannover (Banking | Hannover, Niedersachsen, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000A351TJ8), fixed rate (3.13% coupon) maturing on 17 May 2030, priced at 99.92 (original spread of 95 bp), non callable

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €250m Landesschatzanweisung (DE000RLP1429), floating rate (EU03MLIB + -26.0 bp) maturing on 29 May 2025, non callable

- Tele2 AB (Telecommunications | Stockholm, Stockholm, Sweden | Rating: BBB): €500m Senior Note (XS2623868994), fixed rate (3.75% coupon) maturing on 22 November 2029, priced at 99.78 (original spread of 170 bp), callable (7nc6)

- Teollisuuden Voima Oyj (Utility - Other | Eurajoki, Lansi-Suomen, Finland | Rating: BBB-): €500m Unsecured Note (XS2625194225), fixed rate (1.00% coupon) maturing on 19 May 2025, priced at 100.00, non callable

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €500m Senior Note (DE000A3LHK72), fixed rate (4.00% coupon) maturing on 16 September 2025, priced at 99.71 (original spread of 166 bp), callable (2nc2)

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €500m Senior Note (DE000A3LHK80), fixed rate (4.25% coupon) maturing on 16 May 2028, priced at 99.94 (original spread of 208 bp), callable (5nc5)

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €750m Hypothekenpfandbrief (Covered Bond) (DE000HV2AZT8), fixed rate (3.00% coupon) maturing on 17 May 2027, priced at 99.63 (original spread of 84 bp), non callable

RECENT LOANS

- AL NGPL Holdings LLC (United States of America), signed a US$ 425m Term Loan B, to be used for general corporate purposes. It matures on 03/15/28 and initial pricing is set at Term SOFR +375.0bp

- Bright Food (Group) Co Ltd (China | BBB), signed a US$ 350m Term Loan, to be used for general corporate purposes. It matures on 05/05/24 and initial pricing is set at Term SOFR +110.0bp

- Cimc Finl Leasing (Hong Kong) (Hong Kong), signed a US$ 130m Revolving Credit / Term Loan, to be used for general corporate purposes

- Dhaka RAD Elevated Expressway (Bangladesh), signed a US$ 200m Revolving Credit / Term Loan, to be used for capital expenditures

- Far East Horizon Ltd (Hong Kong | BBB-), signed a US$ 1,200m Revolving Credit / Term Loan, to be used for general corporate purposes

- Formosa Ha Tinh Steel Corp (Vietnam), signed a US$ 938m Revolving Credit / Term Loan, to be used for general corporate purposes and working capital. It matures on 01/27/26 and initial pricing is set at Term SOFR +80.0bp

- Fosun International Ltd (Hong Kong | BB-), signed a US$ 167m Term Loan, to be used for general corporate purposes. It matures on 05/05/26 and initial pricing is set at Term SOFR +200.0bp

- Fosun International Ltd (Hong Kong | BB-), signed a € 151m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/05/26 and initial pricing is set at EURIBOR +175.0bp

- INEOS Group AG (United Kingdom), signed a US$ 785m Term Loan, to be used for acquisition financing. It matures on 11/04/26.

- Magna Wind Farm Portfolio (Finland), signed a € 197m Term Loan, to be used for project finance

- Molnlycke Health Care AB (Sweden), signed a € 350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/05/28.

- Oxbow Carbon LLC (United States of America | BB-), signed a US$ 325m Revolving Credit Facility, to be used for general corporate purposes

- Oxbow Carbon LLC (United States of America | BB-), signed a US$ 225m Term Loan A, to be used for general corporate purposes

- Oxbow Carbon LLC (United States of America | BB-), signed a US$ 350m Term Loan B, to be used for general corporate purposes. It matures on 05/05/30 and initial pricing is set at Term SOFR +400.0bp

- Perfetti Van Melle Group BV (Italy), signed a € 300m Revolving Credit Facility, to be used for capital expenditures

- Perfetti Van Melle Group BV (Italy), signed a € 300m Term Loan, to be used for capital expenditures

- RCS & RDS SA (Romania | BB-), signed a € 150m Term Loan, to be used for capital expenditures. It matures on 01/04/28.

- RCS & RDS SA (Romania | BB-), signed a € 250m Term Loan, to be used for capital expenditures. It matures on 05/04/28.

- RCS & RDS SA (Romania | BB-), signed a € 100m Revolving Credit Facility, to be used for capital expenditures. It matures on 05/04/25.

- Ryman Hospitality Ppty Inc (United States of America | B), signed a US$ 375m Term Loan B, to be used for general corporate purposes. It matures on 05/10/30 and initial pricing is set at Term SOFR +275.0bp

- Smiths Group PLC (United Kingdom | BBB+), signed a US$ 800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/05/28.

- Teleperformance SE (France | BBB), signed a € 2,050m Term Loan, to be used for acquisition financing

- Tyson Foods Inc (United States of America | BBB+), signed a US$ 750m Delayed Draw Term Loan, to be used for refin/ret bank debt. It matures on 05/03/28 and initial pricing is set at Term SOFR +162.5bp

- Tyson Foods Inc (United States of America | BBB+), signed a US$ 1,000m Term Loan, to be used for refin/ret bank debt. It matures on 05/03/26 and initial pricing is set at Term SOFR +87.5bp

- Viet Lao Power Jsc (Vietnam), signed a US$ 400m Revolving Credit / Term Loan, to be used for general corporate purposes and capital expenditures

- Wiener Stadtwerke GmbH (Austria), signed a € 1,700m Revolving Credit Facility, to be used for general corporate purposes

RECENT STRUCTURED CREDIT

- Exeter Automobile Receivables Trust 2023-2 issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 592 m. Highest-rated tranche offering a yield to maturity of 5.59%, and the lowest-rated tranche a yield to maturity of 9.75%. Bookrunners: Deutsche Bank Securities Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp

- Gls Auto Receivables Issuer Trust 2023-2 issued a fixed-rate ABS backed by auto receivables in 6 tranches, for a total of US$ 296 m. Highest-rated tranche offering a yield to maturity of 5.43%, and the lowest-rated tranche a yield to maturity of 9.37%. Bookrunners: Deutsche Bank Securities Inc, Wells Fargo Securities LLC

- Goodleap Sustainable Home Solutions Trust 2023-2 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 284 m. Highest-rated tranche offering a yield to maturity of 5.93%, and the lowest-rated tranche a yield to maturity of 10.27%. Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, Bank of America Merrill Lynch, Atlas SP Partners LP