Decent Credit Spread Compression This Week, As Duration Sell-Off Hit The Complex

Solid levels of corporate bond issuance as 1Q23 earnings season ended: 51 tranches for $60.55bn in IG (2023 YTD volume $595.59bn vs 2022 YTD $651.441bn), 7 tranches for $7.48bn in HY (2023 YTD volume $75.592.6bn vs 2022 YTD $56.371bn)

Published ET

Turkish Government 5Y USD CDS Mid Spread | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was down -0.20% today, with investment grade down -0.21% and high yield down -0.05% (YTD total return: +2.02%)

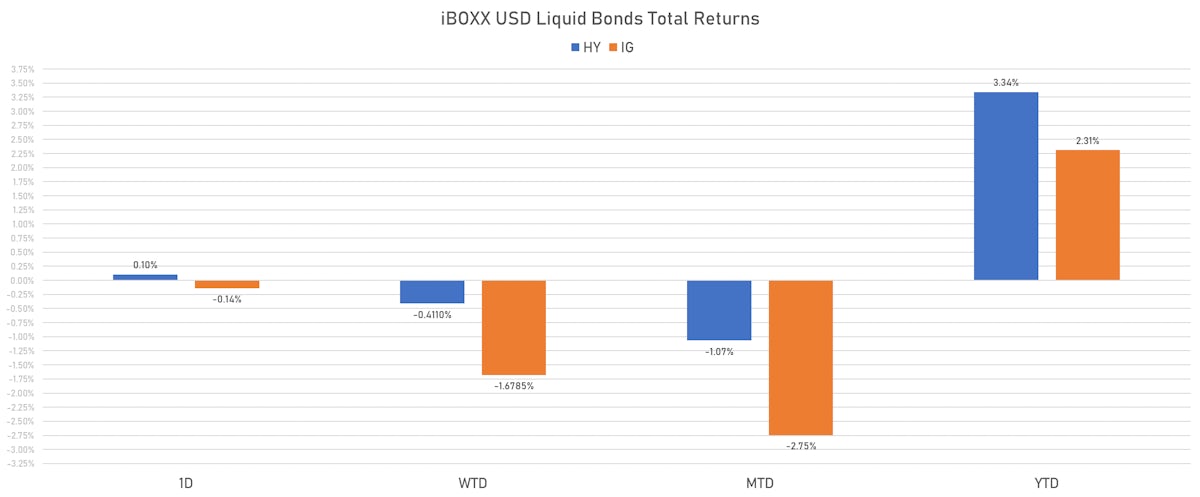

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.138% today (Week-to-date: -1.68%; Month-to-date: -2.75%; Year-to-date: 2.31%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.104% today (Week-to-date: -0.41%; Month-to-date: -1.07%; Year-to-date: 3.34%)

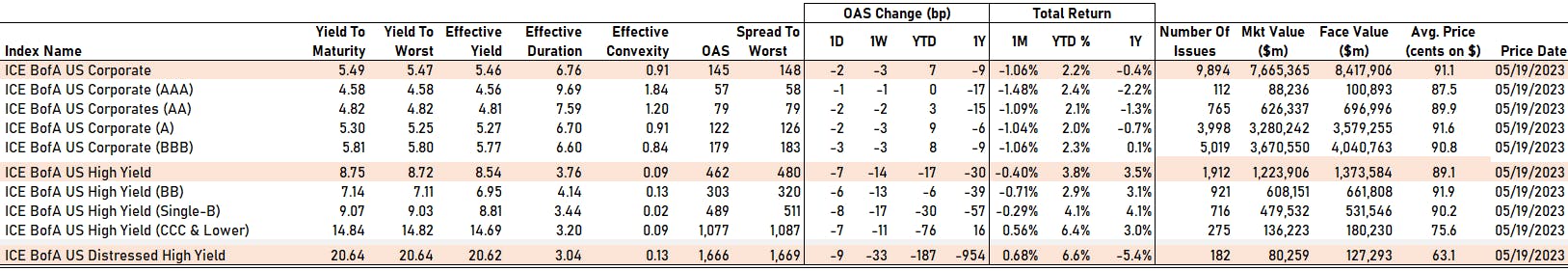

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 148.0 bp (WTD change: -4.0 bp; YTD change: +8.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 480.0 bp (WTD change: -15.0 bp; YTD change: -8.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +3.9%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 57 bp

- AA down by -2 bp at 79 bp

- A down by -2 bp at 122 bp

- BBB down by -3 bp at 179 bp

- BB down by -6 bp at 303 bp

- B down by -8 bp at 489 bp

- ≤ CCC down by -7 bp at 1,077 bp

CDS INDICES TODAY (mid-spreads)

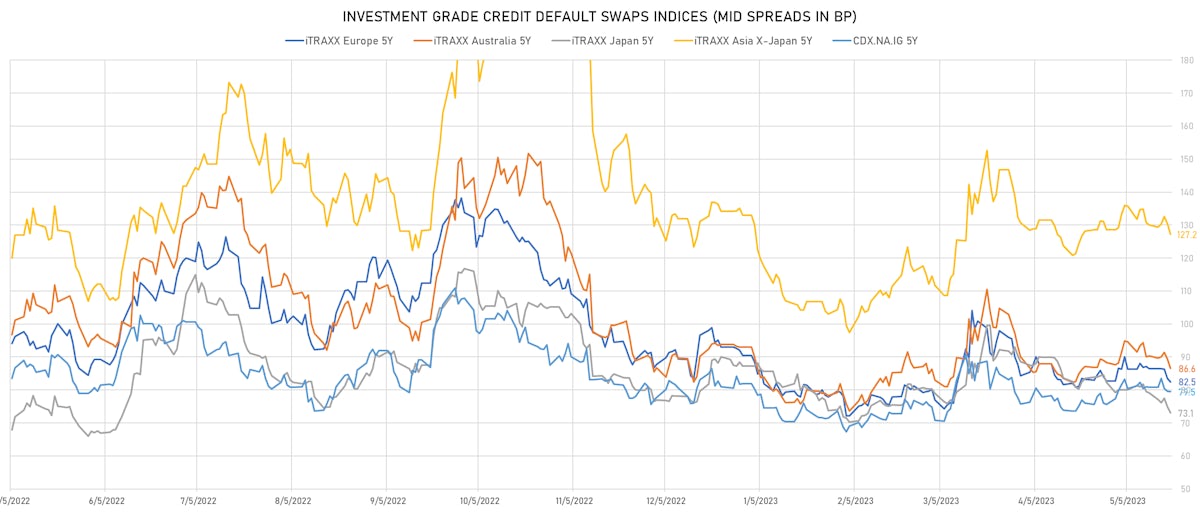

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 79bp (1W change: -1.4bp; YTD change: -2.4bp)

- Markit CDX.NA.IG 10Y down 0.1 bp, now at 116bp (1W change: -1.0bp; YTD change: -1.8bp)

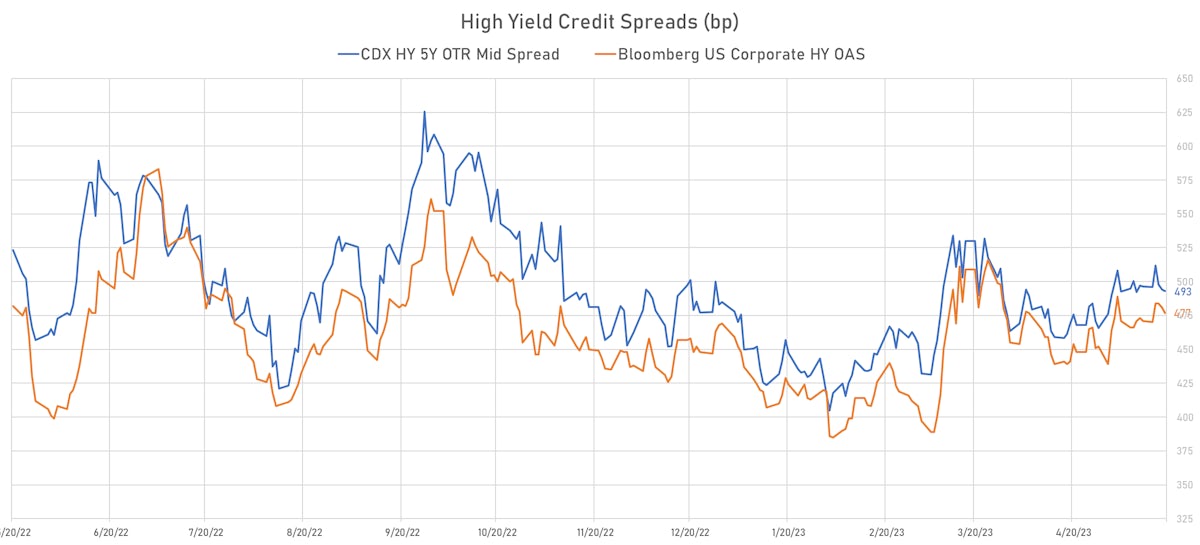

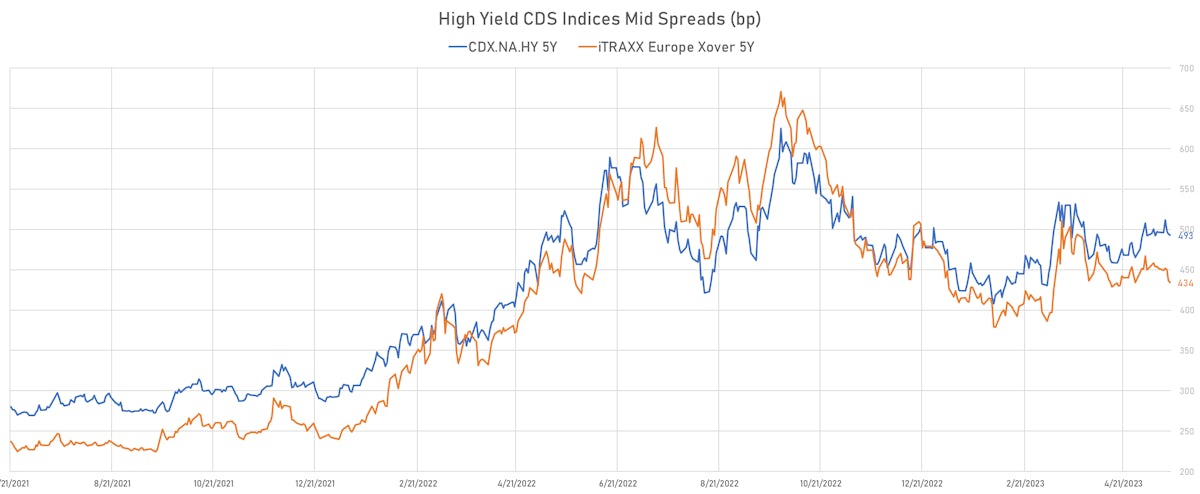

- Markit CDX.NA.HY 5Y down 1.2 bp, now at 493bp (1W change: -3.5bp; YTD change: +8.2bp)

- Markit iTRAXX Europe 5Y down 1.0 bp, now at 83bp (1W change: -4.0bp; YTD change: -7.9bp)

- Markit iTRAXX Europe Crossover 5Y down 2.7 bp, now at 434bp (1W change: -17.6bp; YTD change: -39.9bp)

- Markit iTRAXX Japan 5Y down 1.8 bp, now at 73bp (1W change: -6.0bp; YTD change: -14.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 3.2 bp, now at 127bp (1W change: -2.9bp; YTD change: -5.8bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Indonesia (rated BBB): down 4.1 % to 94 bp (1Y range: 76-166bp)

- Vietnam (rated BB): down 4.7 % to 122 bp (1Y range: 103-181bp)

- Colombia (rated BB+): down 4.8 % to 298 bp (1Y range: 200-394bp)

- Philippines (rated BBB): down 5.1 % to 92 bp (1Y range: 79-153bp)

- Panama (rated WD): down 6.7 % to 126 bp (1Y range: 96-187bp)

- Peru (rated BBB): down 7.6 % to 100 bp (1Y range: 95-171bp)

- Egypt (rated B): down 8.2 % to 1,765 bp (1Y range: 706-1,740bp)

- Chile (rated A-): down 8.5 % to 94 bp (1Y range: 81-174bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- DISH DBS Corp (Country: US; rated: B2): down 821.1 bp to 3,964.0bp (1Y range: 1,004-3,964bp)

- Anywhere Real Estate Group LLC (Country: US; rated: LGD4 - 68%): down 73.0 bp to 1,013.7bp (1Y range: 278-1,014bp)

- Unisys Corp (Country: US; rated: B1): down 64.2 bp to 1,147.1bp (1Y range: 432-1,378bp)

- Transocean Inc (Country: KY; rated: Caa1): down 56.5 bp to 949.5bp (1Y range: 674-2,858bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): down 47.3 bp to 365.0bp (1Y range: 124-401bp)

- Macy's Inc (Country: US; rated: A1): down 44.2 bp to 499.5bp (1Y range: 300-619bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 42.1 bp to 984.3bp (1Y range: 761-1,472bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): down 38.3 bp to 921.4bp (1Y range: 483-1,046bp)

- Onemain Finance Corp (Country: US; rated: Ba2): down 31.5 bp to 472.5bp (1Y range: 121-1,042bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 69.7 bp to 1,716.2bp (1Y range: 747-1,783bp)

- Akbank TAS (Country: TR; rated: WR): up 81.0 bp to 646.7bp (1Y range: 558-1,002bp)

- Staples Inc (Country: US; rated: B3): up 119.0 bp to 3,094.3bp (1Y range: 1,393-3,094bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WR): up 179.0 bp to 782.9bp (1Y range: 686-1,110bp)

- Community Health Systems Inc (Country: US; rated: NR): up 307.1 bp to 2,559.0bp (1Y range: 1,196-4,371bp)

- Lumen Technologies Inc (Country: US; rated: NR): up 501.4 bp to 6,797.9bp (1Y range: 195-6,798bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 383.2 bp to 758.4bp (1Y range: 618-2,936bp)

- Ceconomy AG (Country: DE; rated: WR): down 118.0 bp to 884.7bp (1Y range: 442-1,763bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 53.7 bp to 327.6bp (1Y range: 309-705bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 49.4 bp to 739.7bp (1Y range: 634-1,254bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 42.8 bp to 1,080.2bp (1Y range: 566-1,739bp)

- TUI AG (Country: DE; rated: B3-PD): down 37.6 bp to 748.1bp (1Y range: 691-1,725bp)

- Alstom SA (Country: FR; rated: P-3): down 35.6 bp to 138.4bp (1Y range: 127-313bp)

- Air France KLM SA (Country: FR; rated: NR): down 34.5 bp to 457.7bp (1Y range: 409-990bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 33.7 bp to 727.1bp (1Y range: 679-1,296bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 27.2 bp to 2,112.7bp (1Y range: 1,286-2,910bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: BB low): down 27.0 bp to 316.5bp (1Y range: 316-790bp)

- CMA CGM SA (Country: FR; rated: WR): down 20.0 bp to 306.6bp (1Y range: 243-648bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 19.6 bp to 223.3bp (1Y range: 157-600bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 17.1 bp to 522.5bp (1Y range: 186-523bp)

- Deutsche Bank AG (Country: DE; rated: baa2): down 16.5 bp to 130.2bp (1Y range: 84-205bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Howmet Aerospace Inc (Pittsburgh, United States) | Coupon: 5.90% | Maturity: 1/2/2027 | Rating: BB+ | CUSIP: 013817AJ0 | OAS down by 24.4 bp to 143.1 bp, with the yield to worst at 5.1% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 98.3-102.5).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 7.38% | Maturity: 15/1/2026 | Rating: BB | CUSIP: 247361ZZ4 | OAS down by 25.2 bp to 90.6 bp (CDS basis: 57.2bp), with the yield to worst at 5.0% and the bond now trading up to 105.1 cents on the dollar (1Y price range: 101.8-105.9).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS down by 28.9 bp to 151.7 bp, with the yield to worst at 5.5% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS down by 34.7 bp to 147.8 bp (CDS basis: 106.1bp), with the yield to worst at 5.5% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.69% | Maturity: 9/6/2025 | Rating: BB | CUSIP: 345397ZJ5 | OAS down by 36.8 bp to 227.9 bp (CDS basis: -31.4bp), with the yield to worst at 6.7% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 94.5-98.2).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.13% | Maturity: 4/8/2025 | Rating: BB | CUSIP: 345397XL2 | OAS down by 37.6 bp to 242.1 bp (CDS basis: -28.5bp), with the yield to worst at 6.6% and the bond now trading up to 94.7 cents on the dollar (1Y price range: 93.2-96.9).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 501797AU8 | OAS down by 43.2 bp to 144.7 bp, with the yield to worst at 5.6% and the bond now trading up to 106.9 cents on the dollar (1Y price range: 105.3-108.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 5.13% | Maturity: 16/6/2025 | Rating: BB | CUSIP: 345397A60 | OAS down by 43.4 bp to 215.3 bp (CDS basis: -17.5bp), with the yield to worst at 6.5% and the bond now trading up to 97.1 cents on the dollar (1Y price range: 95.3-98.9).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.13% | Maturity: 1/12/2026 | Rating: BB- | CUSIP: 26885BAB6 | OAS down by 44.6 bp to 288.4 bp, with the yield to worst at 6.6% and the bond now trading up to 91.4 cents on the dollar (1Y price range: 87.5-92.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.30% | Maturity: 10/2/2025 | Rating: BB | CUSIP: 345397B85 | OAS down by 46.6 bp to 217.5 bp (CDS basis: -35.3bp), with the yield to worst at 6.6% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 90.0-94.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.38% | Maturity: 13/11/2025 | Rating: BB | CUSIP: 345397B28 | OAS down by 49.5 bp to 251.0 bp (CDS basis: -45.5bp), with the yield to worst at 6.7% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 89.9-94.3).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 4.20% | Maturity: 29/10/2025 | Rating: BB+ | CUSIP: 78442PGD2 | OAS down by 56.4 bp to 359.4 bp, with the yield to worst at 7.5% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 85.1-94.3).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.75% | Maturity: 15/1/2031 | Rating: BB- | CUSIP: 26885BAL4 | OAS down by 58.3 bp to 370.5 bp, with the yield to worst at 7.3% and the bond now trading up to 84.4 cents on the dollar (1Y price range: 78.8-87.0).

- Issuer: Western Digital Corp (San Jose, California (US)) | Coupon: 2.85% | Maturity: 1/2/2029 | Rating: BB | CUSIP: 958102AQ8 | OAS down by 59.1 bp to 319.9 bp, with the yield to worst at 6.9% and the bond now trading up to 80.8 cents on the dollar (1Y price range: 77.0-82.9).

- Issuer: Western Digital Corp (San Jose, California (US)) | Coupon: 4.75% | Maturity: 15/2/2026 | Rating: BB | CUSIP: 958102AM7 | OAS down by 70.7 bp to 218.5 bp, with the yield to worst at 6.1% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 93.0-97.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | OAS up by 171.2 bp to 485.0 bp, with the yield to worst at 7.9% and the bond now trading down to 86.6 cents on the dollar (1Y price range: 86.3-92.3).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB | ISIN: XS2341724172 | OAS down by 41.2 bp to 509.6 bp, with the yield to worst at 8.2% and the bond now trading up to 76.7 cents on the dollar (1Y price range: 71.3-77.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.88% | Maturity: 6/7/2032 | Rating: BB+ | ISIN: XS2362416617 | OAS down by 43.5 bp to 481.0 bp, with the yield to worst at 7.8% and the bond now trading up to 74.8 cents on the dollar (1Y price range: 66.1-78.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 30/7/2027 | Rating: BB- | ISIN: XS1266661013 | OAS down by 43.9 bp to 373.5 bp, with the yield to worst at 6.4% and the bond now trading up to 94.2 cents on the dollar (1Y price range: 86.4-94.8).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | OAS down by 45.5 bp to 273.4 bp, with the yield to worst at 5.8% and the bond now trading up to 84.1 cents on the dollar (1Y price range: 76.6-84.3).

- Issuer: Iliad SA (Paris, France) | Coupon: 2.38% | Maturity: 17/6/2026 | Rating: BB | ISIN: FR0013518420 | OAS down by 46.6 bp to 181.4 bp, with the yield to worst at 4.8% and the bond now trading up to 92.2 cents on the dollar (1Y price range: 87.6-92.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 49.3 bp to 465.3 bp, with the yield to worst at 7.3% and the bond now trading up to 82.0 cents on the dollar (1Y price range: 74.8-85.1).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS down by 52.2 bp to 375.8 bp, with the yield to worst at 6.8% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 76.1-85.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 53.3 bp to 405.0 bp (CDS basis: 279.5bp), with the yield to worst at 7.1% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 88.4-98.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | OAS down by 57.2 bp to 462.1 bp, with the yield to worst at 7.6% and the bond now trading up to 79.6 cents on the dollar (1Y price range: 71.9-82.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 57.2 bp to 310.2 bp (CDS basis: 306.5bp), with the yield to worst at 6.1% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 85.3-95.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | OAS down by 58.3 bp to 401.6 bp, with the yield to worst at 7.1% and the bond now trading up to 86.5 cents on the dollar (1Y price range: 81.0-88.7).

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 3.88% | Maturity: 28/7/2026 | Rating: BB- | ISIN: XS2437324333 | OAS down by 60.7 bp to 424.9 bp, with the yield to worst at 7.4% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 79.3-92.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS down by 62.0 bp to 423.7 bp, with the yield to worst at 6.9% and the bond now trading up to 90.6 cents on the dollar (1Y price range: 82.7-92.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS down by 93.0 bp to 265.5 bp, with the yield to worst at 5.7% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 88.0-94.3).

- RECENT DOMESTIC USD BOND ISSUES

- AES Corp (Utility - Other | Arlington, Virginia, United States | Rating: BBB-): US$900m Senior Note (US00130HCH66), fixed rate (5.45% coupon) maturing on 1 June 2028, priced at 99.94 (original spread of 205 bp), callable (5nc5)

- Bank of New York Mellon (Banking | New York City, New York, United States | Rating: AA): US$500m Senior Note (US06405LAD38), floating rate maturing on 22 May 2026, priced at 100.00 (original spread of 94 bp), callable (3nc2)

- BlackRock Inc (Securities | New York City, New York, United States | Rating: AA-): US$1,250m Senior Note (US09247XAT81), fixed rate (4.75% coupon) maturing on 25 May 2033, priced at 99.00 (original spread of 131 bp), callable (10nc10)

- CNA Financial Corp (Property and Casualty Insurance | Chicago, Illinois, United States | Rating: BBB): US$400m Senior Note (US126117AX87), fixed rate (5.50% coupon) maturing on 15 June 2033, priced at 99.35 (original spread of 210 bp), callable (10nc10)

- Capstone Borrower Inc (Financial - Other | New York City, United States | Rating: B-): US$400m Note (USU13922AA41), fixed rate (8.00% coupon) maturing on 15 June 2030, priced at 100.00 (original spread of 451 bp), callable (7nc3)

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A-): US$1,300m Senior Note (US808513CE32), floating rate maturing on 19 May 2034, priced at 100.00, callable (11nc10)

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A-): US$1,200m Senior Note (US808513CD58), floating rate maturing on 19 May 2029, priced at 100.00, callable (6nc5)

- FMC Corp (Industrials - Other | Philadelphia, Pennsylvania, United States | Rating: BBB-): US$500m Senior Note (US302491AW57), fixed rate (5.15% coupon) maturing on 18 May 2026, priced at 99.96 (original spread of 153 bp), callable (3nc3)

- FMC Corp (Industrials - Other | Philadelphia, Pennsylvania, United States | Rating: BBB-): US$500m Senior Note (US302491AY14), fixed rate (6.38% coupon) maturing on 18 May 2053, priced at 99.76 (original spread of 301 bp), callable (30nc30)

- FMC Corp (Industrials - Other | Philadelphia, Pennsylvania, United States | Rating: BBB-): US$500m Senior Note (US302491AX31), fixed rate (5.65% coupon) maturing on 18 May 2033, priced at 99.99 (original spread of 236 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133EPKN42), floating rate (PRQ + -302.0 bp) maturing on 23 May 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$105m Bond (US3133EPKX24), fixed rate (4.00% coupon) maturing on 26 May 2026, priced at 100.00 (original spread of 7 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$250m Bond (US3130AW6P07), fixed rate (5.65% coupon) maturing on 28 May 2025, priced at 100.00 (original spread of 36 bp), callable (2nc1m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$500m Bond (US3130AW4S63), floating rate (SOFR + 14.0 bp) maturing on 19 May 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$350m Bond (US3130AW3R99), floating rate (SOFR + 15.0 bp) maturing on 16 May 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: NR): US$300m Unsecured Note (US3134GYSS29), fixed rate (5.52% coupon) maturing on 28 May 2025, priced at 100.00, callable (2nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, United States | Rating: AA+): US$300m Unsecured Note (US3134GYSQ62), fixed rate (5.52% coupon) maturing on 28 May 2025, priced at 100.00, callable (2nc3m)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A+): US$750m First Mortgage Bond (US341081GQ46), fixed rate (4.80% coupon) maturing on 15 May 2033, priced at 99.97 (original spread of 130 bp), callable (10nc10)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A+): US$750m First Mortgage Bond (US341081GN15), fixed rate (4.40% coupon) maturing on 15 May 2028, priced at 99.93 (original spread of 96 bp), callable (5nc5)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A): US$500m Senior Note (US341081GR29), fixed rate (4.45% coupon) maturing on 15 May 2026, priced at 99.95 (original spread of 80 bp), callable (3nc3)

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A+): US$500m First Mortgage Bond (US341081GP62), fixed rate (4.63% coupon) maturing on 15 May 2030, priced at 99.96 (original spread of 123 bp), callable (7nc7)

- Iqvia Inc (Information/Data Technology | Durham, United States | Rating: BB): US$500m Senior Note (US46266TAD00), fixed rate (6.50% coupon) maturing on 15 May 2030, priced at 100.00 (original spread of 288 bp), callable (7nc3)

- Iqvia Inc (Information/Data Technology | Durham, United States | Rating: BBB-): US$750m Note (USU46093AF49), fixed rate (5.70% coupon) maturing on 15 May 2028, priced at 99.99 (original spread of 200 bp), callable (5nc5)

- LKQ Corp (Vehicle Parts | Chicago, Illinois, United States | Rating: BBB-): US$600m Senior Note (US501889AE98), fixed rate (6.25% coupon) maturing on 15 June 2033, priced at 99.29 (original spread of 285 bp), callable (10nc10)

- LKQ Corp (Vehicle Parts | Chicago, Illinois, United States | Rating: BBB-): US$800m Senior Note (US501889AC33), fixed rate (5.75% coupon) maturing on 15 June 2028, priced at 99.73 (original spread of 235 bp), callable (5nc5)

- National Fuel Gas Co (Gas Utility - Local Distrib | Williamsville, New York, United States | Rating: BBB-): US$300m Senior Note (US636180BS91), fixed rate (5.50% coupon) maturing on 1 October 2026, priced at 99.78 (original spread of 212 bp), with a make whole call

- National Rural Utilities Cooperative Finance Corp (Financial - Other | Dulles, United States | Rating: BBB): US$300m Nota de Liquidez (US637432PB56), fixed rate (7.13% coupon) maturing on 15 September 2053, priced at 100.00, callable (30nc5)

- Ovintiv Inc (Oil and Gas | Denver, Colorado, United States | Rating: BBB-): US$400m Senior Note (US69047QAD43), fixed rate (7.10% coupon) maturing on 15 July 2053, priced at 99.80 (original spread of 363 bp), callable (30nc30)

- Ovintiv Inc (Oil and Gas | Denver, Colorado, United States | Rating: BBB-): US$600m Senior Note (US69047QAA04), fixed rate (5.65% coupon) maturing on 15 May 2025, priced at 99.99 (original spread of 160 bp), with a special call

- Ovintiv Inc (Oil and Gas | Denver, Colorado, United States | Rating: BBB-): US$700m Senior Note (US69047QAB86), fixed rate (5.65% coupon) maturing on 15 May 2028, priced at 99.97 (original spread of 215 bp), callable (5nc5)

- Ovintiv Inc (Oil and Gas | Denver, Colorado, United States | Rating: BBB-): US$600m Senior Note (US69047QAC69), fixed rate (6.25% coupon) maturing on 15 July 2033, priced at 99.79 (original spread of 275 bp), callable (10nc10)

- Pacificorp (Utility - Other | Portland, Oregon, United States | Rating: A+): US$1,200m First Mortgage Bond (US695114DA39), fixed rate (5.50% coupon) maturing on 15 May 2054, priced at 99.96 (original spread of 207 bp), callable (31nc31)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$3,000m Senior Note (US716973AF98), fixed rate (5.11% coupon) maturing on 19 May 2043, priced at 98.00 (original spread of 169 bp), callable (20nc20)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$6,000m Senior Note (US716973AG71), fixed rate (5.30% coupon) maturing on 19 May 2053, priced at 99.85 (original spread of 175 bp), callable (30nc30)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$5,000m Senior Note (US716973AE24), fixed rate (4.75% coupon) maturing on 19 May 2033, priced at 99.85 (original spread of 125 bp), callable (10nc10)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$4,000m Senior Note (US716973AH54), fixed rate (5.34% coupon) maturing on 19 May 2063, priced at 98.06 (original spread of 212 bp), callable (40nc40)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$3,000m Senior Note (US716973AB84), fixed rate (4.45% coupon) maturing on 19 May 2026, priced at 99.88 (original spread of 96 bp), callable (3nc3)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$4,000m Senior Note (US716973AC67), fixed rate (4.45% coupon) maturing on 19 May 2028, priced at 99.88 (original spread of 95 bp), callable (5nc5)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$3,000m Senior Note (US716973AD41), fixed rate (4.65% coupon) maturing on 19 May 2030, priced at 99.82 (original spread of 115 bp), callable (7nc7)

- Pfizer Invst (Financial - Other | United States | Rating: A): US$3,000m Senior Note (US716973AA02), fixed rate (4.65% coupon) maturing on 19 May 2025, priced at 99.94 (original spread of 60 bp), with a special call

- Puget Sound Energy Inc (Utility - Other | Bellevue, Washington, United States | Rating: A-): US$400m First Mortgage Bond (US745332CL85), fixed rate (5.45% coupon) maturing on 1 June 2053, priced at 100.00 (original spread of 206 bp), callable (30nc30)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: A-): US$700m First & Refunding Mortgage Bond (US842400HX47), fixed rate (5.88% coupon) maturing on 1 December 2053, priced at 99.79 (original spread of 240 bp), callable (31nc30)

- Southern California Edison Co (Utility - Other | Rosemead, California, United States | Rating: A-): US$400m First & Refunding Mortgage Bond (US842400HW63), fixed rate (4.90% coupon) maturing on 1 June 2026, priced at 99.89 (original spread of 113 bp), callable (3nc3)

- Southern California Gas Co (Gas Utility - Local Distrib | Los Angeles, California, United States | Rating: A+): US$500m First Mortgage Bond (US842434CY66), fixed rate (5.75% coupon) maturing on 1 June 2053, priced at 99.52 (original spread of 226 bp), callable (30nc30)

- Southern California Gas Co (Gas Utility - Local Distrib | Los Angeles, California, United States | Rating: A+): US$500m First Mortgage Bond (US842434CZ32), fixed rate (5.20% coupon) maturing on 1 June 2033, priced at 99.81 (original spread of 168 bp), callable (10nc10)

- Southern Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB): US$750m Senior Note (US842587DR51), fixed rate (5.20% coupon) maturing on 15 June 2033, priced at 99.82 (original spread of 183 bp), callable (10nc10)

- Southern Co (Utility - Other | Atlanta, Georgia, United States | Rating: BBB): US$750m Senior Note (US842587DQ78), fixed rate (4.85% coupon) maturing on 15 June 2028, priced at 99.85 (original spread of 146 bp), callable (5nc5)

- State Street Corp (Financial - Other | Boston, Massachusetts, United States | Rating: A): US$1,000m Senior Note (US857477CC50), floating rate maturing on 18 May 2034, priced at 100.00 (original spread of 169 bp), callable (11nc10)

- State Street Corp (Financial - Other | Boston, Massachusetts, United States | Rating: A): US$1,000m Senior Note (US857477CB77), floating rate maturing on 18 May 2026, priced at 100.00 (original spread of 86 bp), callable (3nc2)

- Veeco (Electronics | Plainview, New York, United States | Rating: NR): US$205m Bond (US922417AH37), fixed rate (2.88% coupon) maturing on 1 June 2029, priced at 100.00, non callable, convertible

- Venture Global LNG Inc (Oil and Gas | Washington, United States | Rating: BB-): US$2,000m Note (US92332YAB74), fixed rate (8.38% coupon) maturing on 1 June 2031, priced at 100.00 (original spread of 471 bp), callable (8nc3)

- Venture Global LNG Inc (Oil and Gas | Washington, United States | Rating: BB-): US$2,000m Note (US92332YAA91), fixed rate (8.13% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 433 bp), callable (5nc2)

- Weyerhaeuser Co (Real Estate Investment Trust | Seattle, Washington, United States | Rating: BBB): US$750m Senior Note (US962166CC62), fixed rate (4.75% coupon) maturing on 15 May 2026, priced at 99.67 (original spread of 120 bp), with a make whole call

- XPO Inc (Service - Other | Greenwich, Connecticut, United States | Rating: BB-): US$450m Senior Note (US98379KAB89), fixed rate (7.13% coupon) maturing on 1 June 2031, priced at 100.00 (original spread of 364 bp), callable (8nc3)

- XPO Inc (Service - Other | Greenwich, Connecticut, United States | Rating: BB+): US$830m Note (USU9840LAA36), fixed rate (6.25% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 274 bp), callable (5nc2)

RECENT INTERNATIONAL USD BOND ISSUES

- Aldar Inv Propts (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: BBB+): US$500m Islamic Sukuk (Hybrid) (XS2627338580), fixed rate (4.88% coupon) maturing on 24 May 2033, priced at 98.73 (original spread of 150 bp), non callable

- Amcor Finance (USA) Inc (Financial - Other | Miramar, Florida, United Kingdom | Rating: BBB): US$500m Senior Note (US02343UAJ43), fixed rate (5.63% coupon) maturing on 26 May 2033, priced at 99.02 (original spread of 217 bp), callable (10nc10)

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$162m Unsecured Note (XS2626285824), fixed rate (7.75% coupon) maturing on 18 April 2035, priced at 100.00, non callable

- BOC Aviation Ltd (Leasing | Singapore, China (Mainland) | Rating: A-): US$500m Senior Note (XS2625985515), fixed rate (4.50% coupon) maturing on 23 May 2028, priced at 99.44 (original spread of 111 bp), callable (5nc5)

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Woj. Mazowieckie, Poland | Rating: A): US$1,750m Senior Note (US06237MAA18), fixed rate (5.38% coupon) maturing on 22 May 2033, priced at 99.76 (original spread of 190 bp), non callable

- Caisse d'amortissement De La Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): US$3,000m Senior Note (US12802D2M77), fixed rate (3.75% coupon) maturing on 24 May 2028, priced at 99.84 (original spread of 25 bp), non callable

- Council of Europe Development Bank (Supranational | Paris, Ile-De-France, France | Rating: AA+): US$1,000m Senior Note (US222213BC32), fixed rate (3.75% coupon) maturing on 25 May 2026, priced at 99.79 (original spread of 14 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB-): US$279m Note (XS2629058293), floating rate maturing on 20 December 2029, priced at 100.00, callable (7nc6)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460038374), fixed rate (4.10% coupon) maturing on 9 June 2025, priced at 100.00, non callable

- Eaton Corp (Utility - Other | Cleveland, Ohio, Ireland | Rating: A-): US$500m Senior Note (US278062AK03), fixed rate (4.35% coupon) maturing on 18 May 2028, priced at 99.92 (original spread of 90 bp), callable (5nc5)

- Electricite de France SA (Utility - Other | Paris, Ile-De-France, France | Rating: BBB+): US$1,000m Senior Note (USF29416AB40), fixed rate (5.70% coupon) maturing on 23 May 2028, priced at 99.85 (original spread of 215 bp), callable (5nc5)

- Electricite de France SA (Utility - Other | Paris, Ile-De-France, France | Rating: BBB+): US$1,000m Senior Note (USF29416AC23), fixed rate (6.25% coupon) maturing on 23 May 2033, priced at 99.90 (original spread of 270 bp), callable (10nc10)

- Electricite de France SA (Utility - Other | Paris, Ile-De-France, France | Rating: BBB+): US$1,000m Senior Note (USF29416AD06), fixed rate (6.90% coupon) maturing on 23 May 2053, priced at 99.32 (original spread of 310 bp), callable (30nc30)

- First Quantum Minerals Ltd (Metals/Mining | Vancouver, British Columbia, Canada | Rating: B+): US$1,300m Senior Note (US335934AU96), fixed rate (8.63% coupon) maturing on 1 June 2031, priced at 100.00 (original spread of 519 bp), callable (8nc3)

- ITC Holdings Corp (Utility - Other | Novi, Michigan, Canada | Rating: A-): US$300m Senior Note (USU4501WAL64), fixed rate (4.95% coupon) maturing on 22 September 2027, priced at 100.07 (original spread of 135 bp), callable (4nc4)

- ITC Holdings Corp (Utility - Other | Novi, Canada | Rating: A-): US$500m Senior Note (USU4501WAK81), fixed rate (5.40% coupon) maturing on 1 June 2033, priced at 99.85 (original spread of 188 bp), callable (10nc10)

- Japan International Cooperation Agency (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$1,250m Bond (US47109LAG95), fixed rate (4.00% coupon) maturing on 23 May 2028, priced at 99.63 (original spread of 55 bp), non callable

- KODITGlobal 23 1 (Financial - Other | Rating: AA): US$300m Senior Note (XS2618701002), fixed rate (4.95% coupon) maturing on 25 May 2026, priced at 100.00, non callable

- KSA Sukuk Ltd (Financial - Other | George Town, Grand Cayman, Saudi Arabia | Rating: A+): US$3,000m Islamic Sukuk (Hybrid) (US48266XAG07), fixed rate (4.27% coupon) maturing on 22 May 2029, priced at 100.00 (original spread of 87 bp), non callable

- KSA Sukuk Ltd (Financial - Other | George Town, Grand Cayman, Saudi Arabia | Rating: A+): US$3,000m Islamic Sukuk (Hybrid) (US48266XAH89), fixed rate (4.51% coupon) maturing on 22 May 2033, priced at 100.00 (original spread of 102 bp), non callable

- KommuneKredit (Agency | Kobenhavn K, Denmark | Rating: AAA): US$1,000m Senior Note (XS2626775758), fixed rate (3.75% coupon) maturing on 24 May 2028, priced at 99.67 (original spread of 24 bp), non callable

- Lyb International Finance III LLC (Financial - Other | Houston, Texas, United Kingdom | Rating: BBB): US$500m Senior Note (US50249AAL70), fixed rate (5.63% coupon) maturing on 15 May 2033, priced at 99.90 (original spread of 205 bp), callable (10nc10)

- Meritz Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: NR): US$200m Index Linked Security (KR6MZ0002RY0) zero coupon maturing on 10 June 2026, priced at 100.00, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$1,000m Senior Note (XS2627035178), fixed rate (3.88% coupon) maturing on 26 May 2026, priced at 99.67 (original spread of 18 bp), non callable

- New Development Bank (Supranational | Shanghai, China (Mainland) | Rating: AA): US$200m Unsecured Note (XS2624983875), floating rate maturing on 18 May 2028, priced at 100.00, non callable

- Nogaholding Sukuk Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$750m Islamic Sukuk (Hybrid) (XS2627125672), fixed rate (6.63% coupon) maturing on 25 May 2033, priced at 100.00 (original spread of 306 bp), non callable

- OTP Bank Nyrt (Banking | Budapest, Budapest, Hungary | Rating: BBB-): US$500m Note (XS2626773381), fixed rate (7.50% coupon) maturing on 25 May 2027, priced at 100.00 (original spread of 357 bp), callable (4nc3)

- Odfjell Rig 3 Ltd (Financial - Other | Hamilton, Bermuda | Rating: BB-): US$390m Bond (NO0012921172), fixed rate (9.25% coupon) maturing on 31 May 2028 (original spread of 567 bp), callable (5nc3)

- Societe Generale SA (Banking | Paris, France | Rating: A-): US$110m Unsecured Note (XS2593447860), floating rate maturing on 9 June 2028, priced at 100.00, non callable

- THI Capital Co Ltd (Financial - Other | Jinan, Shandong, China (Mainland) | Rating: A-): US$300m Bond (XS2616460056), fixed rate (5.10% coupon) maturing on 19 May 2026, priced at 100.00 (original spread of 71 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$700m Senior Note (US89236TKU87), fixed rate (4.55% coupon) maturing on 17 May 2030, priced at 99.84 (original spread of 118 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$1,000m Senior Note (US89236TKT15), fixed rate (4.45% coupon) maturing on 18 May 2026, priced at 99.94 (original spread of 82 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$300m Senior Note (US89236TKV60), floating rate (SOFR + 89.0 bp) maturing on 18 May 2026, priced at 100.00, non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: AAA): US$1,750m Covered Bond (Other) (US96122XAQ16), fixed rate (4.18% coupon) maturing on 22 May 2028, priced at 100.00 (original spread of 77 bp), non callable

RECENT EURO BOND ISSUES

- Adler Pelzer Holding GmbH (Automotive Manufacturer | Hagen, Nordrhein-Westfalen | Rating: B-): €400m Note (XS2623604233), fixed rate (9.50% coupon) maturing on 1 April 2027, priced at 92.50 (original spread of 1,034 bp), callable (4nc11m)

- Akzo Nobel NV (Chemicals | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €500m Senior Note (XS2625136531), fixed rate (4.00% coupon) maturing on 24 May 2033, priced at 99.42 (original spread of 188 bp), callable (10nc10)

- Arion banki hf (Banking | Reykjavik, United Kingdom | Rating: BBB): €300m Note (XS2620752811), fixed rate (7.25% coupon) maturing on 25 May 2026, priced at 100.00 (original spread of 482 bp), with a regulatory call

- Australia Pacific Airports (Melbourne) Pty Ltd (Airline | Victoria, Australia | Rating: BBB+): €500m Note (XS2624503509), fixed rate (4.38% coupon) maturing on 24 May 2033, priced at 98.73 (original spread of 213 bp), callable (10nc10)

- BMW Finance NV (Financial - Other | Rijswijk, Zuid-Holland, Germany | Rating: A): €750m Senior Note (XS2625968693), fixed rate (3.25% coupon) maturing on 22 November 2026, priced at 100.00 (original spread of 96 bp), non callable

- BMW Finance NV (Financial - Other | Rijswijk, Zuid-Holland, Germany | Rating: A): €750m Senior Note (XS2625968776), fixed rate (3.63% coupon) maturing on 22 May 2035, priced at 99.92 (original spread of 129 bp), non callable

- BMW Finance NV (Financial - Other | Rijswijk, Zuid-Holland, Germany | Rating: A): €500m Senior Note (XS2625968347), fixed rate (3.25% coupon) maturing on 22 July 2030, priced at 99.33 (original spread of 117 bp), non callable

- BNP Paribas Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400I2W5), fixed rate (3.00% coupon) maturing on 24 May 2028, priced at 99.45 (original spread of 87 bp), non callable

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,250m Bond (FR001400I4X9), fixed rate (4.13% coupon) maturing on 24 May 2033, priced at 99.87 (original spread of 181 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: BBB): €1,500m Subordinated Note (XS2626699982), fixed rate (5.75% coupon) maturing on 23 August 2033, priced at 99.74 (original spread of 358 bp), callable (10nc5)

- Bank fuer Tirol und Vorarlberg AG (Banking | Innsbruck, Tirol, Austria | Rating: NR): €250m Hypothekenpfandbrief (Covered Bond) (AT0000A34GU9), fixed rate (3.38% coupon) maturing on 21 May 2027, priced at 99.76 (original spread of 121 bp), non callable

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €4,000m Obligation Lineaire (BE0000359688), fixed rate (3.45% coupon) maturing on 22 June 2043, priced at 99.99 (original spread of 91 bp), non callable

- Berlin Hyp AG (Banking | Berlin, Germany | Rating: AA-): €750m Covered Bond (Other) (DE000BHY0GT7), fixed rate (2.88% coupon) maturing on 24 May 2030, priced at 99.28 (original spread of 83 bp), non callable

- Carlsberg Breweries A/S (Beverage/Bottling | Kobenhavn V, Denmark | Rating: BBB): €750m Senior Note (XS2624683301), fixed rate (3.50% coupon) maturing on 26 November 2026, priced at 99.98 (original spread of 125 bp), callable (4nc3)

- Credit Industriel et Commercial SA (Banking | Paris, Ile-De-France, France | Rating: A+): €120m Unsecured Note (XS2626808948), fixed rate (6.50% coupon) maturing on 30 June 2031, priced at 100.00, non callable

- Credit Mutuel Arkea SA (Banking | Le Relecq-Kerhuon, Bretagne, France | Rating: A): €104m Senior Note (FR001400I2P9), fixed rate (3.98% coupon) maturing on 19 May 2033, priced at 100.00, non callable

- Danone SA (Food Processors | Paris, Ile-De-France, France | Rating: BBB+): €800m Bond (FR001400I3C5), fixed rate (3.47% coupon) maturing on 22 May 2031, priced at 100.00 (original spread of 123 bp), callable (8nc8)

- Davide Campari Milano NV (Beverage/Bottling | Sesto San Giovanni, Milano, Luxembourg | Rating: NR): €300m Senior Note (XS2623930117), fixed rate (4.71% coupon) maturing on 18 May 2030, priced at 100.00 (original spread of 244 bp), callable (7nc7)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VED6), fixed rate (2.75% coupon) maturing on 9 June 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VEC8), floating rate (HICPEXTM + 0.0 bp) maturing on 9 June 2027, priced at 100.00, non callable

- Eni SpA (Oil and Gas | Rome, Roma, Italy | Rating: BBB+): €750m Senior Note (XS2623957078), fixed rate (3.63% coupon) maturing on 19 May 2027, priced at 99.98 (original spread of 136 bp), with a make whole call

- Eni SpA (Oil and Gas | Rome, Roma, Italy | Rating: BBB+): €1,250m Senior Note (XS2623956773), fixed rate (4.25% coupon) maturing on 19 May 2033, priced at 99.51 (original spread of 201 bp), with a make whole call

- Equitable Bank (Banking | Toronto, Canada | Rating: BBB-): €500m Unsecured Note (XS2629069498), fixed rate (3.88% coupon) maturing on 28 May 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A34QP8), fixed rate (2.60% coupon) maturing on 5 July 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A34JL2), fixed rate (3.20% coupon) maturing on 9 June 2025, priced at 100.00 (original spread of 70 bp), non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €5,000m Senior Note (XS2626024868), fixed rate (2.75% coupon) maturing on 30 July 2030, priced at 99.21 (original spread of 69 bp), non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €200m Unsecured Note (XS2628487105), fixed rate (0.56% coupon) maturing on 5 June 2034, priced at 100.00, non callable

- European Stability Mechanism (Supranational | Luxembourg, Luxembourg | Rating: NR): €2,000m Senior Note (EU000A1Z99S3), fixed rate (3.00% coupon) maturing on 23 August 2033, priced at 99.60 (original spread of 73 bp), non callable

- Ferrovie dello Stato Italiane SpA (Agency | Rome, Roma, Italy | Rating: BBB): €600m Senior Note (XS2627121259), fixed rate (4.13% coupon) maturing on 23 May 2029, priced at 99.45 (original spread of 198 bp), non callable

- Ferrovie dello Stato Italiane SpA (Agency | Rome, Roma, Italy | Rating: BBB): €500m Senior Note (XS2627121507), fixed rate (4.50% coupon) maturing on 23 May 2033, priced at 98.94 (original spread of 229 bp), non callable

- Fiserv Inc (Information/Data Technology | Brookfield, Wisconsin, United States | Rating: BBB): €800m Senior Note (XS2626288257), fixed rate (4.50% coupon) maturing on 24 May 2031, priced at 99.57 (original spread of 233 bp), callable (8nc8)

- Fortum Oyj (Utility - Other | Espoo, Etela-Suomen, Finland | Rating: BBB): €500m Senior Note (XS2606264005), fixed rate (4.00% coupon) maturing on 26 May 2028, priced at 99.69 (original spread of 177 bp), callable (5nc5)

- Fortum Oyj (Utility - Other | Espoo, Etela-Suomen, Finland | Rating: BBB): €650m Senior Note (XS2606261597), fixed rate (4.50% coupon) maturing on 26 May 2033, priced at 99.78 (original spread of 221 bp), callable (10nc10)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, Texas, United States | Rating: BBB): €600m Senior Note (XS2625985945), fixed rate (4.50% coupon) maturing on 22 November 2027, priced at 99.81 (original spread of 230 bp), with a make whole call

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: A-): €1,750m Senior Note (XS2621539910), floating rate maturing on 23 May 2033, priced at 100.00 (original spread of 260 bp), callable (10nc9)

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €1,500m Senior Note (XS2624976077), floating rate maturing on 23 May 2029, priced at 99.66 (original spread of 233 bp), callable (6nc5)

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB+): €1,500m Senior Note (XS2624977554), floating rate maturing on 23 May 2034, priced at 99.15 (original spread of 255 bp), callable (11nc10)

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €2,000m Bond (IT0005545642), fixed rate (4.00% coupon) maturing on 20 June 2028, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,000m Note (XS2625195891), fixed rate (4.00% coupon) maturing on 19 May 2026, priced at 99.88 (original spread of 163 bp), with a regulatory call

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,250m Note (XS2625196352), fixed rate (4.88% coupon) maturing on 19 May 2030, priced at 100.00 (original spread of 268 bp), with a regulatory call

- Investitionsund Strukturbank Rheinland-Pfalz ISB (Financial - Other | Mainz, Rheinland-Pfalz, Germany | Rating: NR): €125m Inhaberschuldverschreibung (DE000A351NV6), fixed rate (2.88% coupon) maturing on 22 October 2027, priced at 99.79 (original spread of 82 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €1,270m Senior Note (XS2624502360), floating rate maturing on 17 May 2033, priced at 100.00, non callable

- Johnson Controls International PLC (Service - Other | Cork, Cork, Ireland | Rating: BBB): €800m Senior Note (XS2626007939), fixed rate (4.25% coupon) maturing on 23 May 2035, priced at 98.89 (original spread of 199 bp), callable (12nc12)

- Jyske Realkredit A/S (Financial - Other | Kongens Lyngby, Denmark | Rating: A): €750m Saerligt Daekkede Obligation (Covered Bond) (DK0009412553), fixed rate (3.25% coupon) maturing on 1 July 2030 (original spread of 103 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €3,000m Senior Note (XS2626288760), fixed rate (2.75% coupon) maturing on 15 May 2030, priced at 99.81 (original spread of 60 bp), non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): €500m Senior Note (XS2625986836), fixed rate (2.88% coupon) maturing on 23 May 2030, priced at 99.55 (original spread of 75 bp), non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): €750m Senior Note (XS2623871196), fixed rate (3.38% coupon) maturing on 23 May 2028, priced at 99.76 (original spread of 115 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB49T2), fixed rate (2.40% coupon) maturing on 22 December 2027, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €750m Inhaberschuldverschreibung (DE000HLB49S4), fixed rate (2.00% coupon) maturing on 22 December 2025, non callable

- Lonza Finance International NV (Financial - Other | Bornem, Antwerpen, Switzerland | Rating: NR): €500m Senior Note (BE6343825251), fixed rate (3.88% coupon) maturing on 25 May 2033, priced at 99.09 (original spread of 165 bp), callable (10nc10)

- Lottomatica SpA (Gaming | Rome, Roma, Luxembourg | Rating: BB-): €565m Note (XS2628390366), fixed rate (7.13% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 485 bp), callable (5nc2)

- Lottomatica SpA (Gaming | Rome, Roma, Luxembourg | Rating: BB-): €550m Bond (XS2628487956), floating rate (EU03MLIB + 412.5 bp) maturing on 1 June 2028, priced at 99.00, callable (5nc1)

- Lottomatica SpA (Gaming | Rome, Roma, Luxembourg | Rating: BB-): €550m Note (XS2628487527), floating rate (EU03MLIB + 412.5 bp) maturing on 1 June 2028, priced at 99.00, callable (5nc1)

- Prologis Euro Finance LLC (Financial - Other | Denver, Colorado, United States | Rating: A): €750m Senior Note (XS2625194811), fixed rate (4.63% coupon) maturing on 23 May 2033, priced at 99.59 (original spread of 234 bp), callable (10nc10)

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Covered Bond (Other) (XS2626022656), fixed rate (3.38% coupon) maturing on 27 September 2027, priced at 99.77 (original spread of 123 bp), non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €750m Bond (IT0005545287), fixed rate (3.70% coupon) maturing on 31 May 2028, priced at 100.00, non callable

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: A): €500m Senior Note (XS2626343375), fixed rate (3.63% coupon) maturing on 25 May 2027, priced at 99.81 (original spread of 136 bp), callable (4nc4)

- de Volksbank NV (Banking | Utrecht, Utrecht, Netherlands | Rating: BBB+): €500m Note (XS2626691906), fixed rate (4.63% coupon) maturing on 23 November 2027, priced at 99.81 (original spread of 248 bp), callable (5nc4)

RECENT LOANS

- 3M Co (United States of America | A), signed a US$ 4,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/11/28 and initial pricing is set at Term SOFR +62.5bp

- Antilooppi Oy (Finland), signed a € 568m Term Loan, to be used for general corporate purposes and real estate/ppty acq. It matures on 05/11/26.

- Atlantic Aviation Corp (United States of America), signed a US$ 750m Term Loan B, to be used for general corporate purposes. It matures on 09/23/28 and initial pricing is set at Term SOFR +400.0bp

- Autostrade Per l'Italia SpA (Italy | BBB-), signed a € 650m Revolving Credit Facility, to be used for general corporate purposes

- CF Industries Holdings Inc (United States of America | BBB), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes, working capital, and capital expenditures. It matures on 12/05/24 and initial pricing is set at Term SOFR +112.5bp

- CRH PLC (Republic of Ireland | BBB+), signed a € 3,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/11/28.

- China Huadian Corp Ltd (China | A-), signed a US$ 130m Revolving Credit / Term Loan, to be used for capital expenditures

- China Three Gorges Corp (China | A), signed a US$ 297m Revolving Credit / Term Loan, to be used for general corporate purposes

- Dentsply Sirona Inc (United States of America | BBB), signed a US$ 700m Revolving Credit Facility, to be used for general corporate purposes, and working capital. It matures on 05/12/28 and initial pricing is set at Term SOFR +80.0bp

- Edison International Corp (United States of America | BBB-), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/13/28 and initial pricing is set at Term SOFR +150.0bp

- Encore Capital Group Inc (United States of America), signed a US$ 1,180m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/01/27 and initial pricing is set at Term SOFR +250.0bp

- Florentinum Asset As (Czech Republic), signed a € 147m Term Loan, to be used for real estate/ppty acq

- GTECH SpA (Italy | BB+), signed a € 350m Revolving Credit Facility, to be used for working capital, and refin/ret bank debt. It matures on 01/00/00 and initial pricing is set at EURIBOR +350.0bp

- GTECH SpA (Italy | BB+), signed a € 600m Term Loan, to be used for working capital, and refin/ret bank debt. It matures on 05/12/28 and initial pricing is set at EURIBOR +508.7bp

- Hyve Group PLC (United Kingdom), signed a US$ 162m Delayed Draw Term Loan, to be used for leveraged buyout. It matures on 05/19/30 and initial pricing is set at Term SOFR +725.0bp

- Hyve Group PLC (United Kingdom), signed a € 97m Term Loan, to be used for leveraged buyout. It matures on 05/19/30 and initial pricing is set at EURIBOR +725.0bp

- Hyve Group PLC (United Kingdom), signed a US$ 107m Term Loan, to be used for leveraged buyout. It matures on 05/19/30.

- IGD SIIQ SpA (Italy | BB+), signed a € 250m Term Loan, to be used for general corporate purposes. It matures on 05/11/28.

- ITT Inc (United States of America | BBB), signed a US$ 700m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/05/26 and initial pricing is set at Term SOFR +90.0bp

- MOS Holdings Inc (United States of America), signed a US$ 2,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/19/26 and initial pricing is set at Term SOFR +200.0bp

- MoneyGram International Inc (United States of America | B), signed a US$ 500m Term Loan B, to be used for leveraged buyout. It matures on 05/23/30 and initial pricing is set at Term SOFR +550.0bp

- Nelson Global Products Inc (United States of America), signed a US$ 340m Term Loan B, to be used for general corporate purposes

- OptiGroup AB (Sweden), signed a € 100m Term Loan B, to be used for general corporate purposes. It matures on 03/12/29 and initial pricing is set at EURIBOR +525.0bp

- RLJ Lodging Trust (United States of America | B+), signed a US$ 600m Revolving Credit Facility, to be used for general corporate purposes, working capital and capital expenditures. It matures on 05/10/27 and initial pricing is set at Term SOFR +195.0bp

- RLJ Lodging Trust (United States of America | B+), signed a US$ 225m Term Loan, to be used for general corporate purposes. It matures on 05/10/26 and initial pricing is set at Term SOFR +220.0bp

- RLJ Lodging Trust (United States of America | B+), signed a US$ 400m Term Loan, to be used for general corporate purposes, working capital and capital expenditures. It matures on 05/18/25 and initial pricing is set at Term SOFR +190.0bp

- Sandfire Resources Ltd (Australia), signed a US$ 226m Term Loan, to be used for general corporate purposes. It matures on 12/31/28.

- Sandfire Resources Ltd (Australia), signed a US$ 226m Term Loan, to be used for general corporate purposes. It matures on 12/31/28.

- Southern California Edison Co (United States of America | BBB), signed a US$ 3,350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/13/28 and initial pricing is set at Term SOFR +125.0bp

- Swedish Orphan Biovitrum AB (Sweden), signed a € 800m Term Loan, to be used for acquisition financing

- The IMA Financial Group Inc (United States of America | B), signed a US$ 200m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 11/01/28 and initial pricing is set at Term SOFR +425.0bp

- Westconnect Fibre Expansion (Germany), signed a € 1,300m Term Loan, to be used for project finance

- inVentiv Health Inc (United States of America | CCC), signed a US$ 500m Revolving Credit Facility, to be used for leveraged buyout

- inVentiv Health Inc (United States of America | CCC), signed a US$ 2,200m Term Loan, to be used for leveraged buyout

- inVentiv Health Inc (United States of America | CCC), signed a US$ 1,500m Bridge Loan, to be used for leveraged buyout. It matures on 05/24/24.

RECENT STRUCTURED CREDIT

- Credit Acceptance Auto Loan Trust 2023-2 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 400 m. Highest-rated tranche offering a yield to maturity of 5.92%, and the lowest-rated tranche a yield to maturity of 7.15%. Bookrunners: Wells Fargo Securities LLC, BMO Capital Markets

- Hotwire Funding Series 2023-1 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 454 m. Highest-rated tranche offering a yield to maturity of 5.69%, and the lowest-rated tranche a yield to maturity of 7.00%. Bookrunners: Morgan Stanley International Ltd, Barclays Capital Group, Deutsche Bank Securities Inc, Bank of America Merrill Lynch

- Lad Auto Receivables Trust 2023-2 issued a fixed-rate ABS backed by auto receivables in 6 tranches, for a total of US$ 557 m. Highest-rated tranche offering a yield to maturity of 5.42%, and the lowest-rated tranche a yield to maturity of 6.30%. Bookrunners: JP Morgan & Co Inc, Mizuho Securities USA Inc

- Margay CLO I DAC issued a floating-rate CLO in 5 tranches, for a total of € 305 m. Highest-rated tranche offering a spread over the floating rate of 195bp, and the lowest-rated tranche a spread of 640bp. Bookrunners: NatWest Markets, Bank of America Merrill Lynch

Mission Lane Credit Card Master Trust Series 2023-A issued a fixed-rate ABS backed by receivables in 5 tranches, for a total of US$ 525 m. Highest-rated tranche offering a yield to maturity of 7.23%, and the lowest-rated tranche a yield to maturity of 15.73%. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group

Octane Receivables Trust 2023-2 issued a fixed-rate ABS backed by consumer loan in 5 tranches, for a total of US$ 357 m. Highest-rated tranche offering a yield to maturity of 5.68%, and the lowest-rated tranche a yield to maturity of 7.38%. Bookrunners: JP Morgan & Co Inc, Truist Securities Inc, Atlas SP Partners LP

Onemain Financial Issuance Trust 2023-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 825 m. Highest-rated tranche offering a yield to maturity of 5.50%, and the lowest-rated tranche a yield to maturity of 7.50%. Bookrunners: RBC Capital Markets, Mizuho Securities USA Inc, BNP Paribas Securities Corp

Porsche Financial Auto Securitization Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,040 m. Highest-rated tranche offering a yield to maturity of 4.72%, and the lowest-rated tranche a yield to maturity of 5.42%. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC, SG Americas Securities LLC, Bank of America Merrill Lynch

Veros Auto Receivables Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 214 m. Highest-rated tranche offering a yield to maturity of 7.12%, and the lowest-rated tranche a yield to maturity of 11.46%. Bookrunners: Capital One Financial Corp, Deutsche Bank Securities Inc

Verus Securitization Trust 2023-4 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 574 m. Highest-rated tranche offering a coupon of 7.40%, and the lowest-rated tranche a yield to maturity of 8.67%. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc, Barclays Capital Group, Wells Fargo Securities LLC, Natixis Securities Americas LLC, Atlas SP Partners LP