Credit

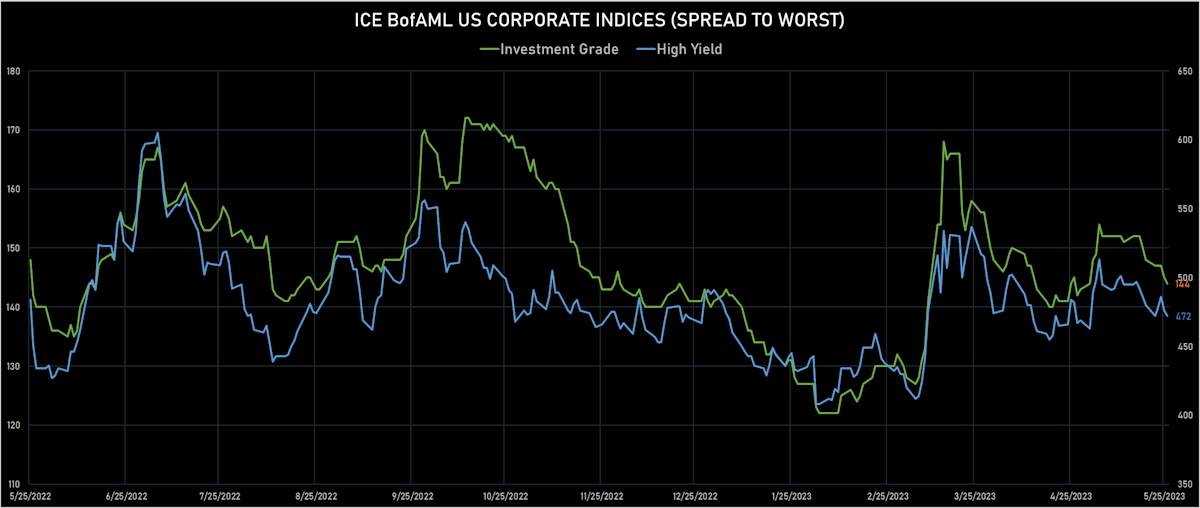

Decent Price Action In US Credit This Week Despite Duration Sell-Off, With Spreads Slightly Tighter

Modest amount of corporate bond issuance in the past week: 17 tranches for $14.45bn in IG (2023 YTD volume $610.04bn vs 2022 YTD $652.141bn), 9 tranches for $5.1bn (2023 YTD volume $80.692.6bn vs 2022 YTD $56.371bn)

Published ET

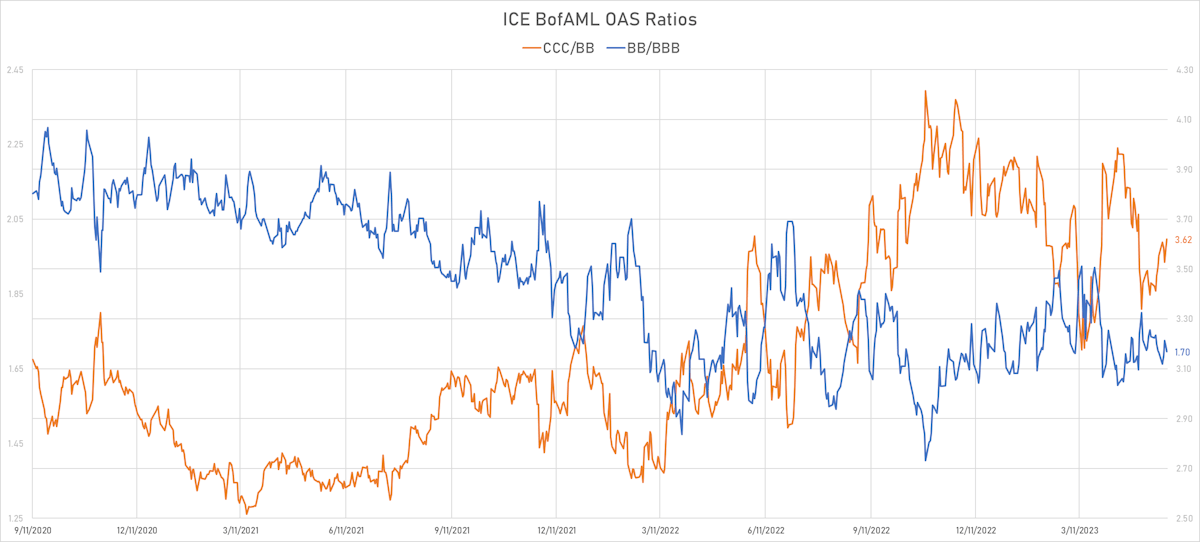

ICE BofA Indices OAS Ratios | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

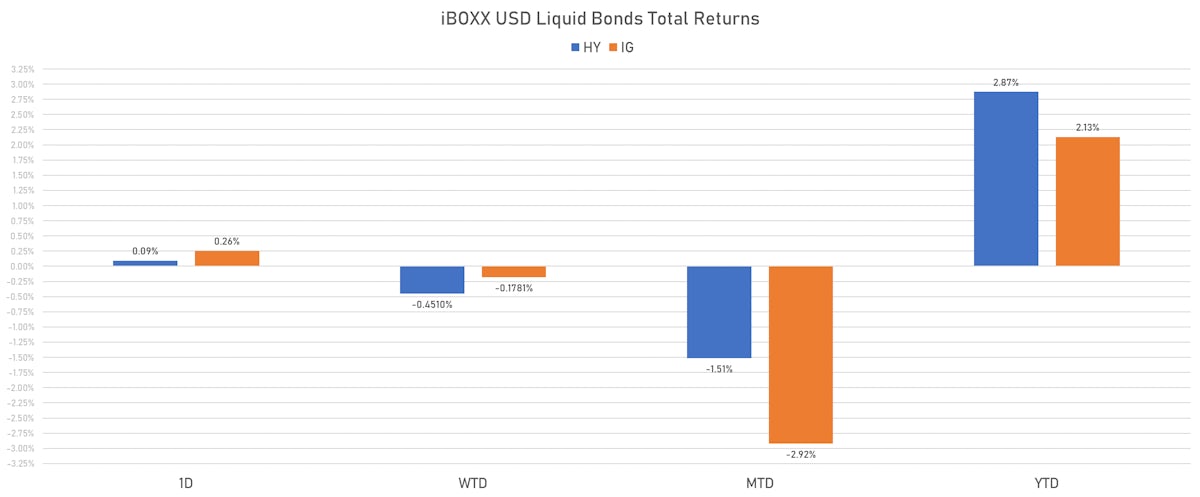

- S&P 500 Bond Index was up 0.15% today, with investment grade up 0.16% and high yield up 0.03% (YTD total return: +1.81%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.256% today (Week-to-date: -0.18%; Month-to-date: -2.92%; Year-to-date: 2.13%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.090% today (Week-to-date: -0.45%; Month-to-date: -1.51%; Year-to-date: 2.87%)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +3.6%)

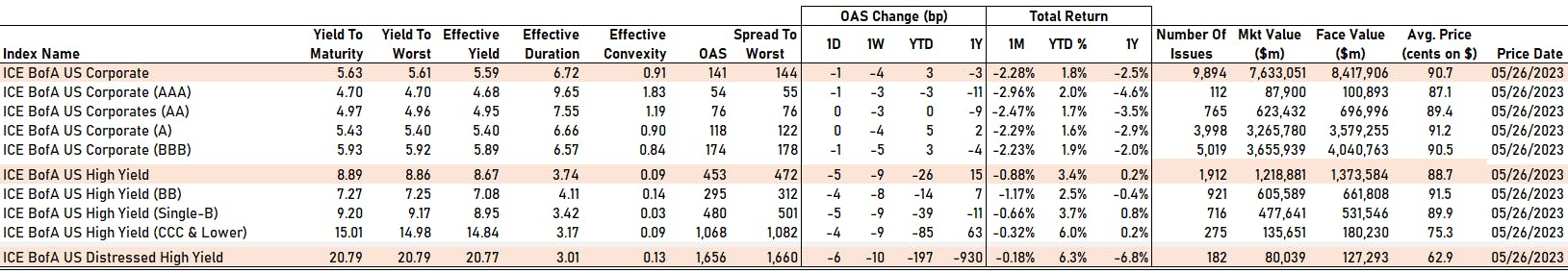

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 54 bp

- AA unchanged at 76 bp

- A unchanged at 118 bp

- BBB down by -1 bp at 174 bp

- BB down by -4 bp at 295 bp

- B down by -5 bp at 480 bp

- ≤ CCC down by -4 bp at 1,068 bp

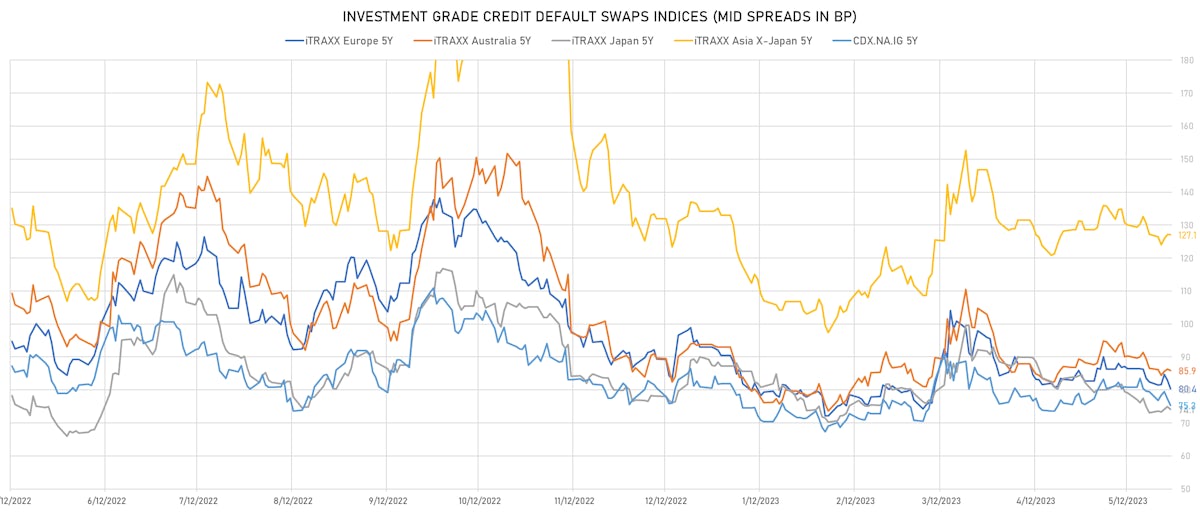

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.0 bp, now at 75bp (1W change: -4.1bp; YTD change: -6.5bp)

- Markit CDX.NA.IG 10Y down 1.8 bp, now at 113bp (1W change: -3.3bp; YTD change: -5.1bp)

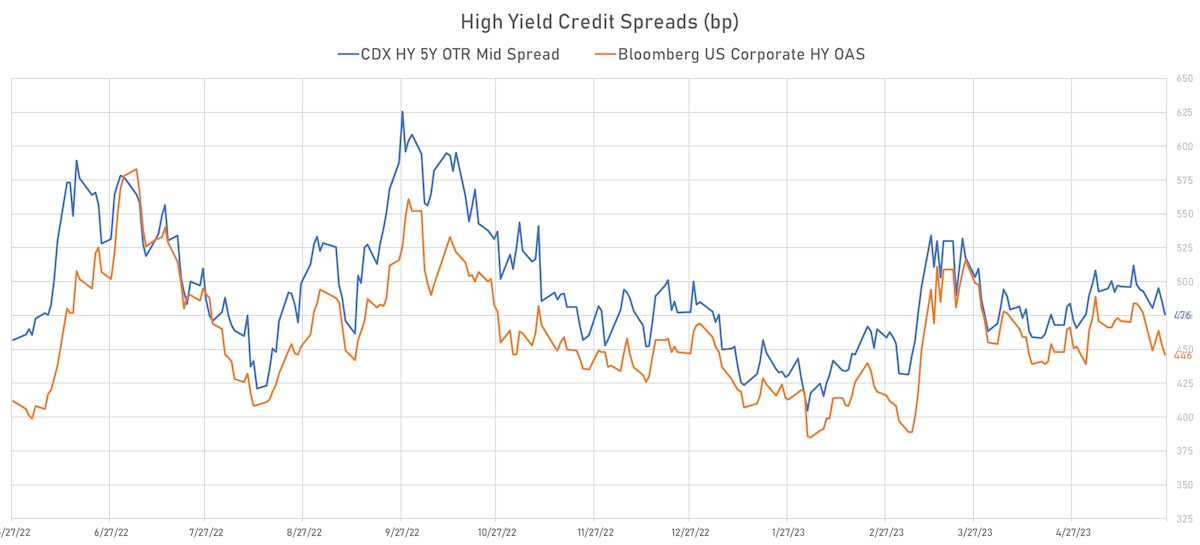

- Markit CDX.NA.HY 5Y down 9.5 bp, now at 476bp (1W change: -17.2bp; YTD change: -9.0bp)

- Markit iTRAXX Europe 5Y down 2.6 bp, now at 80bp (1W change: -2.1bp; YTD change: -10.1bp)

- Markit iTRAXX Europe Crossover 5Y down 10.2 bp, now at 427bp (1W change: -7.6bp; YTD change: -47.5bp)

- Markit iTRAXX Japan 5Y down 0.9 bp, now at 74bp (1W change: +1.0bp; YTD change: -13.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y unchanged at 127bp (1W change: -0.1bp; YTD change: -5.9bp)

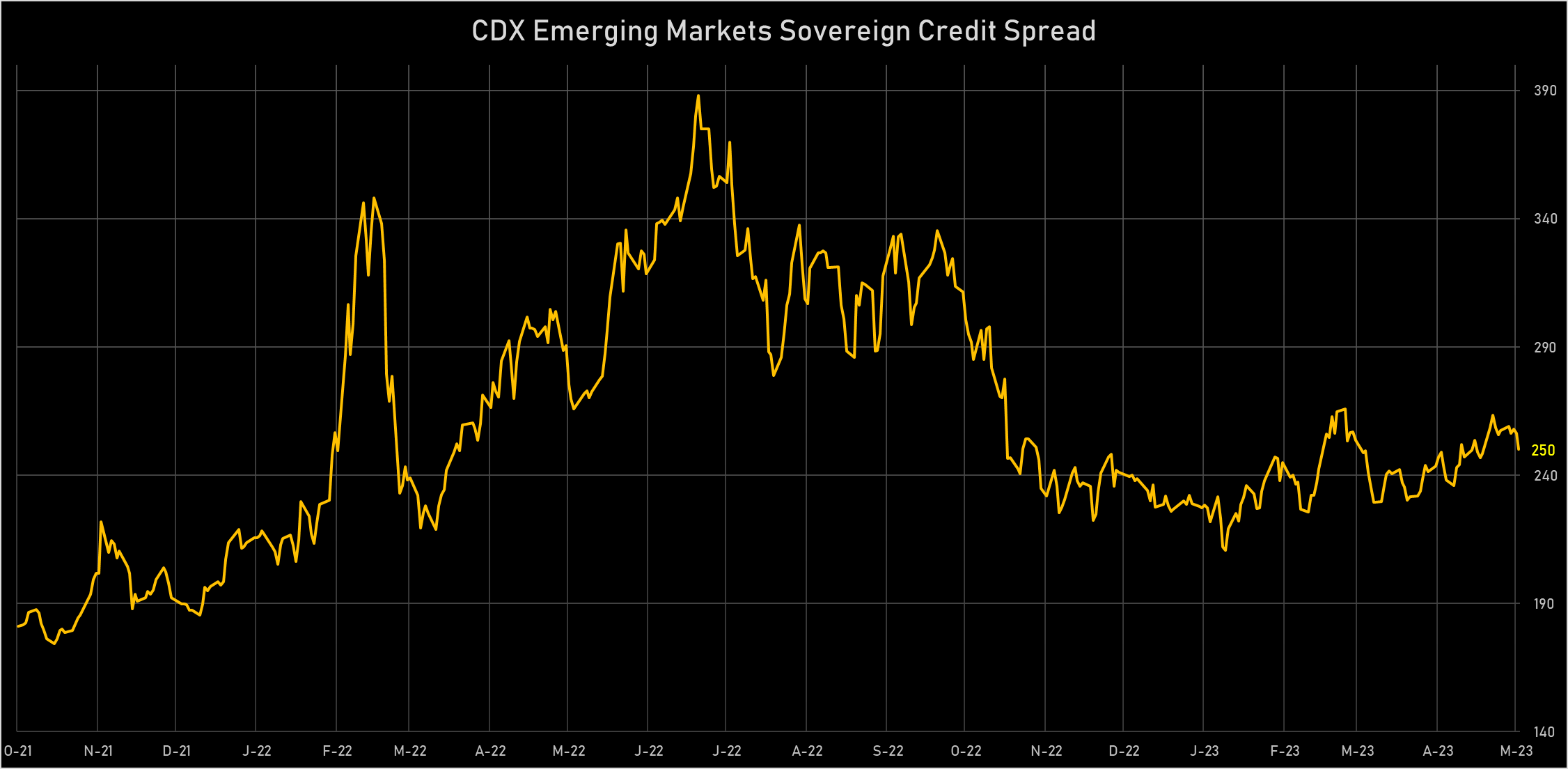

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Kenya (rated B): up 24.2 % to 915 bp (1Y range: 447-928bp)

- Nigeria (rated B-): up 7.0 % to 1,323 bp (1Y range: 377-1,538bp)

- Egypt (rated B): up 6.7 % to 1,729 bp (1Y range: 706-1,837bp)

- Israel (rated A+): up 5.2 % to 61 bp (1Y range: 43-78bp)

- Mexico (rated BBB-): down 3.4 % to 114 bp (1Y range: 103-205bp)

- Panama (rated WD): down 3.5 % to 113 bp (1Y range: 96-187bp)

- Chile (rated A-): down 3.6 % to 83 bp (1Y range: 81-174bp)

- Malaysia (rated BBB+): down 4.4 % to 64 bp (1Y range: 57-122bp)

- Italy (rated BBB): down 8.1 % to 105 bp (1Y range: 88-179bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- DISH DBS Corp (Country: US; rated: B2): down 328.0 bp to 3,636.0bp (1Y range: 1,004-3,636bp)

- Kohls Corp (Country: US; rated: Ba2): down 108.3 bp to 734.5bp (1Y range: 362-783bp)

- Gap Inc (Country: US; rated: NR): down 101.5 bp to 656.7bp (1Y range: 429-819bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): down 94.5 bp to 820.8bp (1Y range: 483-1,046bp)

- Transocean Inc (Country: KY; rated: Caa1): down 85.8 bp to 856.3bp (1Y range: 674-2,858bp)

- Nordstrom Inc (Country: US; rated: NR): down 80.7 bp to 567.5bp (1Y range: 362-685bp)

- Anywhere Real Estate Group LLC (Country: US; rated: LGD4 - 68%): down 67.3 bp to 945.6bp (1Y range: 278-946bp)

- Carnival Corp (Country: US; rated: WR): down 60.2 bp to 842.7bp (1Y range: 678-2,117bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): down 58.2 bp to 372.5bp (1Y range: 335-604bp)

- Unisys Corp (Country: US; rated: B1): down 52.8 bp to 1,094.3bp (1Y range: 432-1,378bp)

- Murphy Oil Corp (Country: US; rated: A1): down 49.1 bp to 236.3bp (1Y range: 219-446bp)

- Nabors Industries Inc (Country: US; rated: BB-): down 49.0 bp to 790.7bp (1Y range: 390-887bp)

- Pitney Bowes Inc (Country: US; rated: NR): down 48.6 bp to 1,666.8bp (1Y range: 747-1,783bp)

- Community Health Systems Inc (Country: US; rated: NR): up 38.3 bp to 2,597.3bp (1Y range: 1,196-4,371bp)

- Lumen Technologies Inc (Country: US; rated: NR): up 1443.1 bp to 8,241.0bp (1Y range: 195-8,241bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Credit Suisse Group AG (Country: CH; rated: WD): down 38.6 bp to 122.7bp (1Y range: 123-1,267bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 34.9 bp to 223.2bp (1Y range: 223-498bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 18.7 bp to 588.7bp (1Y range: 370-758bp)

- Vivendi SE (Country: FR; rated: A1): down 18.0 bp to 102.5bp (1Y range: 34-102bp)

- UBS AG (Country: CH; rated: PP-1): down 15.1 bp to 80.7bp (1Y range: 54-149bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 14.3 bp to 1,065.9bp (1Y range: 566-1,739bp)

- Ceconomy AG (Country: DE; rated: WR): down 13.3 bp to 871.4bp (1Y range: 461-1,763bp)

- thyssenkrupp AG (Country: DE; rated: NR): up 11.9 bp to 339.5bp (1Y range: 309-705bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 15.4 bp to 483.6bp (1Y range: 379-602bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 19.6 bp to 408.6bp (1Y range: 280-496bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 19.7 bp to 759.4bp (1Y range: 634-1,254bp)

- Telecom Italia SpA (Country: IT; rated: NR): up 25.0 bp to 397.1bp (1Y range: 306-545bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): up 25.0 bp to 547.5bp (1Y range: 186-548bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 101.4 bp to 1,075.6bp (1Y range: 401-1,076bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 108.5 bp to 2,221.2bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 6.00% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 59001AAY8 | OAS down by 20.3 bp to 103.9 bp (CDS basis: 49.9bp), with the yield to worst at 5.5% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 99.0-101.4).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS down by 21.5 bp to 120.3 bp, with the yield to worst at 5.4% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB | CUSIP: 345370CR9 | OAS down by 22.6 bp to 125.2 bp (CDS basis: 116.6bp), with the yield to worst at 5.6% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 93.6-98.3).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 26.1 bp to 136.3 bp (CDS basis: -72.0bp), with the yield to worst at 5.4% and the bond now trading up to 97.3 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Tri Pointe Homes Inc (Delaware) (Incline Village, Nevada (US)) | Coupon: 5.88% | Maturity: 15/6/2024 | Rating: BB- | CUSIP: 962178AN9 | OAS down by 28.0 bp to 125.5 bp, with the yield to worst at 5.9% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 98.0-100.0).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS down by 34.0 bp to 112.0 bp (CDS basis: -53.6bp), with the yield to worst at 5.5% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 97.3-100.6).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS down by 36.0 bp to 107.4 bp (CDS basis: -39.8bp), with the yield to worst at 5.5% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 97.1-100.3).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS down by 36.3 bp to 67.8 bp, with the yield to worst at 5.3% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 100.8-105.5).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS down by 37.6 bp to 125.0 bp, with the yield to worst at 5.5% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 96.0-98.8).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 38.2 bp to 41.0 bp (CDS basis: -7.8bp), with the yield to worst at 5.2% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 91.4-95.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.30% | Maturity: 10/2/2025 | Rating: BB | CUSIP: 345397B85 | OAS down by 38.8 bp to 178.7 bp (CDS basis: -39.1bp), with the yield to worst at 6.6% and the bond now trading up to 92.9 cents on the dollar (1Y price range: 90.0-94.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS down by 39.7 bp to 126.6 bp, with the yield to worst at 5.6% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 94.4-96.9).

- Issuer: Nordstrom Inc (Seattle, Washington (US)) | Coupon: 4.00% | Maturity: 15/3/2027 | Rating: BB+ | CUSIP: 655664AS9 | OAS down by 69.7 bp to 403.1 bp (CDS basis: 58.2bp), with the yield to worst at 8.0% and the bond now trading up to 86.3 cents on the dollar (1Y price range: 83.0-90.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | CUSIP: 98421MAA4 | OAS down by 77.0 bp to 330.6 bp, with the yield to worst at 7.6% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 91.8-95.6).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS down by 78.1 bp to 70.5 bp, with the yield to worst at 5.1% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 95.3-99.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 57.3 bp to 601.2 bp (CDS basis: -73.9bp), with the yield to worst at 9.4% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 85.9-92.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: B+ | ISIN: XS1824425182 | OAS up by 30.3 bp to 507.2 bp (CDS basis: -15.0bp), with the yield to worst at 8.5% and the bond now trading down to 89.1 cents on the dollar (1Y price range: 88.9-94.0).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | OAS up by 19.4 bp to 289.6 bp, with the yield to worst at 6.1% and the bond now trading down to 89.3 cents on the dollar (1Y price range: 83.5-91.8).

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS up by 16.7 bp to 562.7 bp, with the yield to worst at 7.8% and the bond now trading down to 73.3 cents on the dollar (1Y price range: 64.8-77.1).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.00% | Maturity: 12/11/2029 | Rating: BB | ISIN: FR0014006G24 | OAS up by 16.5 bp to 510.7 bp, with the yield to worst at 7.3% and the bond now trading down to 64.5 cents on the dollar (1Y price range: 61.6-69.0).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS up by 16.0 bp to 266.5 bp, with the yield to worst at 5.9% and the bond now trading down to 88.7 cents on the dollar (1Y price range: 83.7-90.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | OAS up by 15.5 bp to 285.2 bp, with the yield to worst at 5.9% and the bond now trading down to 83.9 cents on the dollar (1Y price range: 77.7-86.1).

- Issuer: illimity Bank SpA (Milan, Italy) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS down by 15.4 bp to 324.4 bp, with the yield to worst at 6.7% and the bond now trading up to 99.4 cents on the dollar (1Y price range: 97.6-102.6).

- Issuer: PHOENIX PIB Dutch Finance BV (Maarssen, Netherlands) | Coupon: 2.38% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2212959352 | OAS down by 15.8 bp to 101.2 bp, with the yield to worst at 4.0% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 93.1-95.5).

- Issuer: Wizz Air Finance Company BV (Amsterdam, Netherlands) | Coupon: 1.00% | Maturity: 19/1/2026 | Rating: BB+ | ISIN: XS2433361719 | OAS down by 16.3 bp to 229.1 bp, with the yield to worst at 5.5% and the bond now trading up to 88.4 cents on the dollar (1Y price range: 82.1-89.2).

- Issuer: Huhtamaki Oyj (Espoo, Finland) | Coupon: 4.25% | Maturity: 9/6/2027 | Rating: BB+ | ISIN: FI4000523550 | OAS down by 18.6 bp to 138.6 bp, with the yield to worst at 4.5% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 95.5-99.5).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS down by 19.2 bp to 231.1 bp, with the yield to worst at 5.4% and the bond now trading up to 92.5 cents on the dollar (1Y price range: 85.3-93.2).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS down by 20.7 bp to 355.1 bp, with the yield to worst at 6.7% and the bond now trading up to 85.7 cents on the dollar (1Y price range: 76.1-86.1).

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | OAS down by 24.9 bp to 458.6 bp, with the yield to worst at 7.6% and the bond now trading up to 86.6 cents on the dollar (1Y price range: 76.5-86.6).

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | OAS down by 28.2 bp to 456.8 bp, with the yield to worst at 7.9% and the bond now trading up to 87.0 cents on the dollar (1Y price range: 86.2-92.3).

RECENT DOMESTIC USD BOND ISSUES

- AEP Texas Inc (Utility - Other | Columbus, Ohio, United States | Rating: BBB): US$450m Senior Note (US00108WAR16), fixed rate (5.40% coupon) maturing on 1 June 2033, priced at 99.84 (original spread of 175 bp), callable (10nc10)

- Ameren Illinois Co (Utility - Other | Collinsville, Illinois, United States | Rating: A): US$500m First Mortgage Bond (US02361DBA72), fixed rate (4.95% coupon) maturing on 1 June 2033, priced at 99.70 (original spread of 127 bp), callable (10nc10)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): US$850m Senior Note (US03027XCD03), fixed rate (5.55% coupon) maturing on 15 July 2033, priced at 99.65 (original spread of 188 bp), callable (10nc10)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): US$650m Senior Note (US03027XCC20), fixed rate (5.25% coupon) maturing on 15 July 2028, priced at 99.71 (original spread of 155 bp), callable (5nc5)

- Amerigas Partners LP (Oil and Gas | Valley Forge, Pennsylvania, United States | Rating: B+): US$500m Senior Note (USU03030AB65), fixed rate (9.38% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 562 bp), callable (5nc2)

- BGC Partners Inc (Financial - Other | New York City, New York, United States | Rating: BBB-): US$350m Senior Note (US05541TAQ40), fixed rate (8.00% coupon) maturing on 25 May 2028, priced at 100.00 (original spread of 429 bp), callable (5nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB): US$3,200m Subordinated Note (US17327CAR43), floating rate maturing on 25 May 2034, priced at 100.00 (original spread of 235 bp), callable (11nc10)

- Diamond Escrow Issuer LLC (Financial - Other | Beverly Hills, California, United States | Rating: NR): US$1,700m Note (USU2526KAA17), fixed rate (9.75% coupon) maturing on 15 November 2028, priced at 100.00 (original spread of 612 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$175m Bond (US3133EPLD50), fixed rate (3.88% coupon) maturing on 30 May 2028, priced at 99.73 (original spread of 18 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$832m Bond (US3133EPLA12), floating rate (SOFR + 17.0 bp) maturing on 2 June 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPLG81), floating rate (FFQ + 17.5 bp) maturing on 2 June 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$175m Bond (US3133EPLC77), fixed rate (4.13% coupon) maturing on 26 February 2026, priced at 99.80 (original spread of 17 bp), non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYTB84), fixed rate (5.63% coupon) maturing on 28 May 2025, priced at 100.00 (original spread of 131 bp), callable (2nc3m)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$2,500m Senior Note (US46647PDR47), floating rate maturing on 1 June 2034, priced at 100.00 (original spread of 161 bp), callable (11nc10)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$500m Senior Note (US539830BZ19), fixed rate (4.45% coupon) maturing on 15 May 2028, priced at 99.82 (original spread of 75 bp), callable (5nc5)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$850m Senior Note (US539830CA58), fixed rate (4.75% coupon) maturing on 15 February 2034, priced at 99.67 (original spread of 110 bp), callable (11nc10)

- Lockheed Martin Corp (Aerospace | Bethesda, Maryland, United States | Rating: A-): US$650m Senior Note (US539830CB32), fixed rate (5.20% coupon) maturing on 15 February 2055, priced at 99.24 (original spread of 176 bp), callable (32nc31)

- National Securities Clearing Corp (Financial - Other | New York City, New York, United States | Rating: AA+): US$400m Senior Note (USU7000RAG75), fixed rate (5.15% coupon) maturing on 30 May 2025, priced at 99.96 (original spread of 85 bp), with a make whole call

- National Securities Clearing Corp (Financial - Other | New York City, New York, United States | Rating: AA+): US$600m Senior Note (USU7000RAH58), fixed rate (5.00% coupon) maturing on 30 May 2028, priced at 99.73 (original spread of 130 bp), callable (5nc5)

- Penske Truck Leasing Co LP (Leasing | Reading, Pennsylvania, United States | Rating: BBB): US$500m Senior Note (US709599BV54), fixed rate (6.20% coupon) maturing on 15 June 2030, priced at 99.73 (original spread of 250 bp), callable (7nc7)

- Penske Truck Leasing Co LP (Leasing | Reading, Pennsylvania, United States | Rating: BBB): US$700m Senior Note (US709599BU71), fixed rate (5.75% coupon) maturing on 24 May 2026, priced at 99.88 (original spread of 180 bp), callable (3nc3)

- Pricoa Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$500m Note (US74153WCS61), fixed rate (5.10% coupon) maturing on 30 May 2028, priced at 99.95 (original spread of 138 bp), non callable

- Progressive Corp (Property and Casualty Insurance | Village Of Mayfield, Ohio, United States | Rating: A): US$500m Senior Note (US743315BB84), fixed rate (4.95% coupon) maturing on 15 June 2033, priced at 99.94 (original spread of 137 bp), callable (10nc10)

- Tilray Brands (Pharmaceuticals | New York City, New York, United States | Rating: NR): US$150m Bond (US88688TAC45), fixed rate (5.20% coupon) maturing on 15 June 2027, priced at 100.00, non callable, convertible

- Travelers Companies Inc (Property and Casualty Insurance | Saint Paul, Minnesota, United States | Rating: A): US$750m Senior Note (US89417EAS81), fixed rate (5.45% coupon) maturing on 25 May 2053, priced at 99.60 (original spread of 182 bp), callable (30nc30)

RECENT INTERNATIONAL USD BOND ISSUES

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$750m Senior Note (US02665WEJ62), fixed rate (5.00% coupon) maturing on 23 May 2025, priced at 99.93 (original spread of 76 bp), with a make whole call

- BSF Sukuk Company Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$900m Islamic Sukuk (Hybrid) (XS2623560781), fixed rate (4.75% coupon) maturing on 31 May 2028, priced at 99.68 (original spread of 105 bp), non callable

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): US$250m Unsecured Note (XS2631873424), floating rate maturing on 8 January 2026, priced at 100.00, non callable

- China Construction Bank Corp (Sydney Branch) (Banking | Sydney, New South Wales, China (Mainland) | Rating: A+): US$500m Senior Note (XS2623522930), fixed rate (4.50% coupon) maturing on 31 May 2026, priced at 99.78 (original spread of 58 bp), non callable

- Fertiglobe PLC (Service - Other | Abu Dhabi, Abu Dhabi, Netherlands | Rating: BBB-): US$500m Unsecured Note (XS2499100589), fixed rate (6.58% coupon) maturing on 6 July 2027, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Dubai Branch) (Banking | Dubai, Dubai, China (Mainland) | Rating: NR): US$122m Unsecured Note (XS2631283111), floating rate maturing on 1 June 2026, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$4,000m Senior Note (USD4S46MLM53), fixed rate (3.88% coupon) maturing on 15 June 2028, priced at 99.90 (original spread of 32 bp), non callable

- Khazanah Cap (Financial - Other | Labuan, Labuan, Malaysia | Rating: A-): US$750m Senior Note (XS2629043691), fixed rate (4.88% coupon) maturing on 1 June 2033, priced at 100.00 (original spread of 118 bp), non callable

- Kubota Credit US (Financial - Other | Grapevine, Japan | Rating: NR): US$500m Bond (XS2544560639), fixed rate (4.96% coupon) maturing on 31 May 2026, priced at 100.00 (original spread of 93 bp), callable (3nc3)

- MAF Sukuk Ltd (Financial - Other | George Town, Grand Cayman, United Arab Emirates | Rating: BBB): US$500m Islamic Sukuk (Hybrid) (XS2626291129), fixed rate (5.00% coupon) maturing on 1 June 2033, priced at 99.02 (original spread of 140 bp), non callable

- MFB Magyar Fejlesztesi Bank Zrt (Banking | Budapest, Budapest, Hungary | Rating: BBB): US$1,125m Senior Note (XS2630760796), fixed rate (6.50% coupon) maturing on 29 June 2028, priced at 98.90 (original spread of 295 bp), non callable

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$1,000m Senior Note (XS2630112287), fixed rate (4.00% coupon) maturing on 1 June 2028, priced at 99.92 (original spread of 25 bp), non callable

- Seagate HDD Cayman (Financial - Other | George Town, Ireland | Rating: BB-): US$500m Senior Note (USG79456AR38), fixed rate (8.25% coupon) maturing on 15 December 2029, priced at 100.00 (original spread of 444 bp), callable (7nc3)

- Seagate HDD Cayman (Financial - Other | George Town, Ireland | Rating: BB-): US$500m Senior Note (USG79456AS11), fixed rate (8.50% coupon) maturing on 15 July 2031, priced at 100.00 (original spread of 479 bp), callable (8nc3)

- Tokyo, Metropolitan of (Official and Muni | Shinjuku, Tokyo-To, Japan | Rating: A+): US$500m Senior Note (US59173LAG59), fixed rate (4.63% coupon) maturing on 1 June 2026, priced at 99.73 (original spread of 69 bp), non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$150m Unsecured Note (XS2025088555), fixed rate (5.30% coupon) maturing on 30 May 2025, priced at 100.00 (original spread of 178 bp), non callable

- Werner Finco LP (Financial - Other | Rating: CCC+): US$400m Note (US95076PAC77), fixed rate (11.50% coupon) maturing on 15 June 2028, priced at 99.07 (original spread of 786 bp), callable (5nc2)

RECENT EURO BOND ISSUES

- Agence Francaise de Developpement EPIC (Agency | Paris, Ile-De-France, France | Rating: AA-): €2,000m Bond (FR001400I822), fixed rate (3.38% coupon) maturing on 25 May 2033, priced at 99.33 (original spread of 97 bp), non callable

- Agence France Locale SA (Agency | Lyon, Auvergne-Rhone-Alpes, France | Rating: AA-): €500m Bond (FR001400I9C2), fixed rate (3.63% coupon) maturing on 20 June 2038, priced at 98.60 (original spread of 110 bp), non callable

- Aib Mortgage Bank Unlimited Co (Banking | Dublin, Dublin, Ireland | Rating: AAA): €1,000m Asset Covered Security (Covered Bond) (XS2629504338), floating rate (EU01MLIB + 26.0 bp) maturing on 15 November 2028, priced at 100.00, non callable

- Aib Mortgage Bank Unlimited Co (Banking | Dublin, Dublin, Ireland | Rating: AAA): €1,000m Asset Covered Security (Covered Bond) (XS2630115462), floating rate (EU01MLIB + 26.0 bp) maturing on 15 May 2029, priced at 100.00, non callable

- Aib Mortgage Bank Unlimited Co (Banking | Dublin, Dublin, Ireland | Rating: AAA): €1,000m Asset Covered Security (Covered Bond) (XS2630115546), floating rate (EU01MLIB + 26.0 bp) maturing on 15 November 2029, priced at 100.00, non callable

- Aktia Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: A-): €500m Covered Bond (Other) (XS2630109226), fixed rate (3.38% coupon) maturing on 31 May 2027, priced at 99.80 (original spread of 92 bp), non callable

- Allianz SE (Property and Casualty Insurance | Muenchen, Bayern, Germany | Rating: AA): €1,250m Subordinated Note (DE000A351U49), floating rate maturing on 25 July 2053, priced at 100.02 (original spread of 329 bp), callable (30nc10)

- Banca Transilvania SA (Banking | Cluj-Napoca, Cluj, Romania | Rating: BB+): €150m Unsecured Note (XS2631416448), fixed rate (8.88% coupon) maturing on 27 April 2027, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A+): €330m Unsecured Note (XS2630801491), fixed rate (4.00% coupon) maturing on 16 June 2025, priced at 100.00, non callable

- Bayer AG (Pharmaceuticals | Leverkusen, Nordrhein-Westfalen, Germany | Rating: BBB): €750m Senior Note (XS2630111982), fixed rate (4.00% coupon) maturing on 26 August 2026, priced at 99.93 (original spread of 149 bp), callable (3nc3)

- Bayer AG (Pharmaceuticals | Leverkusen, Nordrhein-Westfalen, Germany | Rating: BBB): €1,500m Senior Note (XS2630111719), fixed rate (4.63% coupon) maturing on 26 May 2033, priced at 99.09 (original spread of 228 bp), callable (10nc10)

- Bayer AG (Pharmaceuticals | Leverkusen, Nordrhein-Westfalen, Germany | Rating: BBB): €750m Senior Note (XS2630112014), fixed rate (4.25% coupon) maturing on 26 August 2029, priced at 99.87 (original spread of 189 bp), callable (6nc6)

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €250m Pfandbrief Anleihe (Covered Bond) (DE000BLB6JY9), fixed rate (5.13% coupon) maturing on 1 June 2026, priced at 99.72, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €150m Inhaberschuldverschreibung (DE000BLB9UC6), fixed rate (3.20% coupon) maturing on 2 June 2025, priced at 100.00, non callable

- Berlin Hyp AG (Banking | Berlin, Berlin, Germany | Rating: AA-): €200m Inhaberschuldverschreibung (DE000BHY0JZ8), fixed rate (3.70% coupon) maturing on 31 May 2028, priced at 100.00, non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €250m Unsecured Note (XS2631415556), fixed rate (3.43% coupon) maturing on 18 December 2040, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400I7P8), fixed rate (5.75% coupon) maturing on 1 June 2033, priced at 99.78 (original spread of 336 bp), callable (10nc5)

- Brandenburg, State of (Official and Muni | Potsdam, Brandenburg, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A30V6W9), floating rate (EU06MLIB + -20.0 bp) maturing on 31 May 2027, priced at 100.75, non callable

- Caisse Des Depots Et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR001400I3M4), fixed rate (3.00% coupon) maturing on 25 May 2028, priced at 99.54 (original spread of 68 bp), non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB+): €6,500m Cedula Hipotecaria (Covered Bond) (ES0440609479), floating rate maturing on 29 September 2030, non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BB+): €1,000m Subordinated Note (XS2630417124), floating rate maturing on 30 May 2034, priced at 99.94 (original spread of 379 bp), callable (11nc6)

- Continental AG (Vehicle Parts | Hannover, Niedersachsen, Germany | Rating: BBB): €750m Senior Note (XS2630117328), fixed rate (4.00% coupon) maturing on 1 June 2028, priced at 99.45 (original spread of 168 bp), callable (5nc5)

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €600m Bond (FR001400I6X4), fixed rate (3.87% coupon) maturing on 26 November 2029, priced at 100.00 (original spread of 87 bp), non callable

- Credito Emiliano SpA (Banking | Reggio Nell'Emilia, Reggio Emilia, Italy | Rating: BB+): €400m Note (XS2606341787), floating rate maturing on 30 May 2029, priced at 99.74 (original spread of 323 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €750m Inhaberschuldverschreibung (DE000DW6C425), fixed rate (3.00% coupon) maturing on 19 June 2026, priced at 100.00, non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: A+): €500m Hypothekenpfandbrief (Covered Bond) (DE000A3MQU45), fixed rate (3.25% coupon) maturing on 31 May 2033, priced at 99.92 (original spread of 82 bp), non callable

- Danfoss Finance II BV (Financial - Other | Rotterdam, Zuid-Holland, Denmark | Rating: NR): €500m Bond (XS2628785466), fixed rate (4.13% coupon) maturing on 2 December 2029, priced at 99.71 (original spread of 167 bp), callable (7nc6)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VEG9), floating rate maturing on 15 June 2029, priced at 100.00, with a special call

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VEH7), fixed rate (3.45% coupon) maturing on 15 June 2028, priced at 100.00, non callable

- Dexia Credit Local SA (Banking | Courbevoie, Ile-De-France, Belgium | Rating: BBB-): €1,500m Senior Note (XS2630524713), fixed rate (3.13% coupon) maturing on 1 June 2028, priced at 99.46 (original spread of 80 bp), non callable

- Diamond Escrow (Financial - Other | Beverly Hills, California, United States | Rating: NR): €630m Note (XS2628988730), fixed rate (9.63% coupon) maturing on 15 November 2028, priced at 100.00 (original spread of 720 bp), callable (5nc2)

- Diamond Escrow Issuer LLC (Financial - Other | Beverly Hills, California, United States | Rating: NR): €630m Note (XS2628989894), fixed rate (9.63% coupon) maturing on 15 November 2028, priced at 100.00 (original spread of 740 bp), callable (5nc2)

- Equitable Bank (Banking | Toronto, Ontario, Canada | Rating: BBB-): €300m Covered Bond (Other) (XS2629069498), fixed rate (3.88% coupon) maturing on 28 May 2026, priced at 99.93 (original spread of 128 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A35383), floating rate (EU03MLIB + 0.0 bp) maturing on 30 June 2028, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A352N0), fixed rate (3.05% coupon) maturing on 21 December 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): €500m Inhaberschuldverschreibung (AT0000A34QR4), floating rate maturing on 30 May 2030, priced at 99.43 (original spread of 198 bp), callable (7nc6)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A35375), fixed rate (3.50% coupon) maturing on 30 June 2026, priced at 100.00, non callable

- Ing Belgique NV (Banking | Brussels, Bruxelles-Capitale, Netherlands | Rating: A+): €1,250m Belgian Mortgage Pandbrieven (Covered Bond) (BE0002947282), fixed rate (3.38% coupon) maturing on 31 May 2027, priced at 99.81 (original spread of 92 bp), non callable

- International Fund for Agricultural Development (Supranational | Rome, Roma, United States | Rating: NR): €115m Unsecured Note (XS2630467657), fixed rate (3.50% coupon) maturing on 1 June 2038, priced at 100.00, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €4,000m Index Linked Security (IT0005547812), fixed rate (2.40% coupon) maturing on 15 May 2039, priced at 99.67 (original spread of 189 bp), non callable, inflation protected

- KBC Bank NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €750m Covered Bond (Other) (BE0002948298), fixed rate (3.25% coupon) maturing on 30 May 2028, priced at 99.82 (original spread of 87 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1C7), fixed rate (3.00% coupon) maturing on 30 June 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1A1), fixed rate (2.80% coupon) maturing on 29 June 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1D5), fixed rate (3.05% coupon) maturing on 29 June 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C193), fixed rate (2.75% coupon) maturing on 30 June 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1B9), fixed rate (2.85% coupon) maturing on 28 June 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1F0), fixed rate (3.15% coupon) maturing on 28 June 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1E3), fixed rate (3.10% coupon) maturing on 28 June 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4C1G8), fixed rate (3.20% coupon) maturing on 28 June 2029, priced at 100.00, non callable

- Legrand SA (Electronics | Limoges, Nouvelle-Aquitaine, France | Rating: A-): €700m Bond (FR001400I5S6), fixed rate (3.50% coupon) maturing on 29 May 2029, priced at 99.86 (original spread of 111 bp), callable (6nc6)

- Lloyds Bank Corporate Markets PLC (Banking | London, United Kingdom | Rating: A): €750m Senior Note (XS2628821873), fixed rate (4.13% coupon) maturing on 30 May 2027, priced at 99.83 (original spread of 171 bp), non callable

- Malta, Republic of (Government) (Sovereign | Valletta, Malta | Rating: A+): €106m Bond (MT0000013699), fixed rate (4.00% coupon) maturing on 26 November 2043, priced at 99.24 (original spread of 104 bp), non callable

- Mercedes-Benz International Finance BV (Financial - Other | Nieuwegein, Utrecht, Germany | Rating: A): €1,000m Senior Note (DE000A3LH6U5), fixed rate (3.70% coupon) maturing on 30 May 2031, priced at 99.68 (original spread of 137 bp), non callable

- Mercedes-Benz International Finance BV (Financial - Other | Nieuwegein, Utrecht, Germany | Rating: A): €1,000m Senior Note (DE000A3LH6T7), fixed rate (3.50% coupon) maturing on 30 May 2026, priced at 99.83 (original spread of 97 bp), non callable

- Motion Finco SARL (Financial - Other | Luxembourg, United Kingdom | Rating: B+): €700m Note (XS2623257685), fixed rate (7.38% coupon) maturing on 15 June 2030, priced at 100.00 (original spread of 499 bp), callable (7nc3)

- Muenchener Hypothekenbank eG (Banking | Muenchen, Bayern, Germany | Rating: AA-): €250m Hypothekenpfandbrief (Covered Bond) (DE000MHB4826), floating rate (EU06MLIB + -14.0 bp) maturing on 2 June 2026, priced at 100.00, non callable

- NIBC Bank NV (Banking | S-Gravenhage, Zuid-Holland, United States | Rating: BBB): €500m Note (XS2630448434), fixed rate (6.38% coupon) maturing on 1 December 2025, priced at 99.82 (original spread of 386 bp), with a regulatory call

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,000m Senior Note (DE000NWB0AU2), fixed rate (3.00% coupon) maturing on 31 May 2030, priced at 99.38 (original spread of 85 bp), non callable

- Novo Banco SA (Banking | Lisbon, Spain | Rating: NR): €500m Subordinated Note (PTNOBLOM0001), fixed rate (9.88% coupon) maturing on 1 December 2033, priced at 100.00, callable (11nc5)

- Raiffeisenbank Austria dd (Banking | Zagreb, Zagrebacka Zupanija, Austria | Rating: NR): €300m Note (XS2630490394), floating rate maturing on 5 June 2027, priced at 100.00 (original spread of 515 bp), callable (4nc3)

- Region of Bruxelles-Capitale (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €160m Bond (BE0002945260), fixed rate (3.98% coupon) maturing on 24 May 2055, priced at 98.99, non callable

- Robert Bosch GmbH (Industrials - Other | Gerlingen, Baden-Wuerttemberg, Germany | Rating: A): €1,000m Senior Note (XS2629468278), fixed rate (3.63% coupon) maturing on 2 June 2030, priced at 99.42 (original spread of 132 bp), callable (7nc7)

- Robert Bosch GmbH (Industrials - Other | Gerlingen, Baden-Wuerttemberg, Germany | Rating: A): €750m Senior Note (XS2629470506), fixed rate (3.63% coupon) maturing on 2 June 2027, priced at 100.00 (original spread of 113 bp), callable (4nc4)

- Robert Bosch GmbH (Industrials - Other | Gerlingen, Baden-Wuerttemberg, Germany | Rating: A): €1,250m Senior Note (XS2629470845), fixed rate (4.00% coupon) maturing on 2 June 2035, priced at 99.98 (original spread of 147 bp), callable (12nc12)

- Robert Bosch GmbH (Industrials - Other | Gerlingen, Baden-Wuerttemberg, Germany | Rating: A): €1,500m Senior Note (XS2629470761), fixed rate (4.38% coupon) maturing on 2 June 2043, priced at 99.46 (original spread of 174 bp), callable (20nc20)

- Schleswig-Holstein, State of (Official and Muni | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000SHFM899), fixed rate (3.00% coupon) maturing on 5 June 2030, priced at 99.38, non callable

- Stora Enso Oyj (Conglomerate/Diversified Mfg | Helsinki, Etela-Suomen, Finland | Rating: BBB-): €500m Senior Note (XS2629064267), fixed rate (4.25% coupon) maturing on 1 September 2029, priced at 99.64 (original spread of 194 bp), callable (6nc6)

- Stora Enso Oyj (Conglomerate/Diversified Mfg | Helsinki, Etela-Suomen, Finland | Rating: BBB-): €500m Senior Note (XS2629062568), fixed rate (4.00% coupon) maturing on 1 June 2026, priced at 99.93 (original spread of 142 bp), callable (3nc3)

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: BBB+): €750m Note (XS2629047254), fixed rate (4.63% coupon) maturing on 30 May 2026, priced at 99.92 (original spread of 188 bp), callable (3nc2)

- Teollisuuden Voima Oyj (Utility - Other | Eurajoki, Lansi-Suomen, Finland | Rating: BBB-): €600m Senior Note (XS2625194225), fixed rate (4.75% coupon) maturing on 1 June 2030, priced at 99.88 (original spread of 239 bp), callable (7nc7)

- Toyota Motor Finance Netherlands BV (Financial - Other | Amsterdam, Noord-Holland, Japan | Rating: A+): €400m Unsecured Note (XS2629467387), floating rate maturing on 28 May 2025, priced at 100.00, non callable

- Van Lanschot Kempen NV (Banking | S-Hertogenbosch, Noord-Brabant, Netherlands | Rating: BBB+): €500m Covered Bond (Other) (XS2629466900), fixed rate (3.50% coupon) maturing on 31 May 2026, priced at 99.76 (original spread of 98 bp), non callable

- Vodafone Group PLC (Telecommunications | Newbury, Berkshire, United Kingdom | Rating: BB+): €750m Junior Subordinated Note (XS2630490717), fixed rate (6.50% coupon) maturing on 30 August 2084, priced at 99.42 (original spread of 423 bp), callable (61nc6)

- WPP Finance SA (Financial - Other | Levallois-Perret, Ile-De-France, United Kingdom | Rating: BBB): €750m Senior Note (XS2626022573), fixed rate (4.13% coupon) maturing on 30 May 2028, priced at 99.46 (original spread of 182 bp), callable (5nc5)

- Werfen SA (Health Care Facilities | L'Hospitalet De Llobregat, Barcelona, Spain | Rating: BBB-): €500m Senior Note (XS2630465875), fixed rate (4.63% coupon) maturing on 6 June 2028, priced at 99.14 (original spread of 233 bp), callable (5nc5)

RECENT LOANS

- ASTM SpA (Italy), signed a € 450m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/19/28.

- Affidea BV (Italy), signed a € 150m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 07/13/29 and initial pricing is set at EURIBOR +500.0bp

- Booking Holdings Inc (United States of America | A-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 05/17/28 and initial pricing is set at Term SOFR +137.5bp

- Corelogic Inc (United States of America | CCC), signed a US$ 900m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/17/28.

- Diversified Energy Co PLC (United States of America), signed a US$ 375m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/11/26 and initial pricing is set at Term SOFR +300.0bp

- Eagle Bulk Shipping Inc (United States of America), signed a US$ 185m Revolving Credit Facility, to be used for refin/ret bank debt. It matures on 09/28/28 and initial pricing is set at Term SOFR +275.0bp

- Eagle Bulk Shipping Inc (United States of America), signed a US$ 300m Term Loan, to be used for refin/ret bank debt. It matures on 09/28/28 and initial pricing is set at Term SOFR +275.0bp

- Elisa Oyj (Finland | BBB), signed a € 170m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/17/28.

- Fed Democratic Republic Of (Nepal), signed a US$ 300m Revolving Credit / Term Loan, to be used for capital expenditures.

- Helios Technologies Inc (United States of America), signed a US$ 150m Term Loan A, to be used for general corporate purposes. It matures on 10/28/25 and initial pricing is set at Term SOFR +275.0bp

- MOS Holdings Inc (United States of America), signed a US$ 700m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 05/18/33 and initial pricing is set at Term SOFR +175.0bp

- NetCo JV (Italy), signed a € 2,000m Term Loan, to be used for project finance and capital expenditures.

- Paul Reinhart AG (Switzerland), signed a US$ 250m Revolving Credit Facility, to be used for general corporate purposes.

- Peninsula Petroleum (United States of America), signed a US$ 180m Term Loan, to be used for general corporate purposes. It matures on 05/17/25.

- Peninsula Petroleum (United States of America), signed a US$ 270m Term Loan, to be used for general corporate purposes. It matures on 05/17/25.

- Ping An Intl Finl Leasing Co (China), signed a US$ 557m Revolving Credit / Term Loan, to be used for general corporate purposes.

- PotlatchDeltic Corp (United States of America | BBB-), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/14/27 and initial pricing is set at Term SOFR +85.0bp

- QNB Finansbank AS (Turkey), signed a € 144m Term Loan, to be used for general corporate purposes. It matures on 05/19/24 and initial pricing is set at EURIBOR +400.0bp

- QNB Finansbank AS (Turkey), signed a US$ 171m Term Loan, to be used for general corporate purposes. It matures on 05/19/24 and initial pricing is set at Term SOFR +425.0bp

- Swarovski Intl Holding AG (Switzerland), signed a € 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/19/25.

- Wynn Resorts Finance LLC (United States of America | B+), signed a US$ 681m Revolving Credit Facility, to be used for general corporate purposes, working capital, and capital expenditures. It matures on 09/20/27 and initial pricing is set at Term SOFR +175.0bp

- Wynn Resorts Finance LLC (United States of America | B+), signed a US$ 749m Term Loan A, to be used for general corporate purposes, working capital and capital expenditures. It matures on 09/20/27 and initial pricing is set at Term SOFR +175.0bp

RECENT STRUCTURED CREDIT

- Bauhinia ILBS 1 Ltd issued a floating-rate CLO in 5 tranches, for a total of US$ 364 m. Highest-rated tranche offering a spread over the floating rate of 160bp, and the lowest-rated tranche a spread of 595bp. Bookrunners: ING, Mitsubishi UFJ Financial Group, Standard Chartered Bank

- Bx 2023-Delc Mortgage Trust issued a floating-rate CMBS in 7 tranches, for a total of US$ 948 m. Highest-rated tranche offering a spread over the floating rate of 269bp, and the lowest-rated tranche a spread of 919bp. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group, SG Americas Securities LLC, BMO Capital Markets, Bank of America Merrill Lynch

- Carvana Auto Receivables Trust 2023-P2 issued a fixed-rate ABS backed by auto receivables in 8 tranches, for a total of US$ 400 m. Highest-rated tranche offering a yield to maturity of 5.46%, and the lowest-rated tranche a yield to maturity of 8.64%. Bookrunners: Santander Investment Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp

- Lendbuzz Securitization Trust 2023-2 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 155 m. Highest-rated tranche offering a yield to maturity of 5.84%, and the lowest-rated tranche a yield to maturity of 11.56%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc

- Madison Park Euro Funding XIX DAC issued a floating-rate CLO in 9 tranches, for a total of € 421 m. Highest-rated tranche offering a spread over the floating rate of 190bp, and the lowest-rated tranche a spread of 1,000bp. Bookrunners: Natixis

- Mosaic Solar Loan Trust 2023-3 issued a fixed-rate ABS backed by certificates in 4 tranches, for a total of US$ 301 m. Highest-rated tranche offering a yield to maturity of 6.07%, and the lowest-rated tranche a yield to maturity of 14.22%. Bookrunners: SG Americas Securities LLC, BNP Paribas Securities Corp