Credit

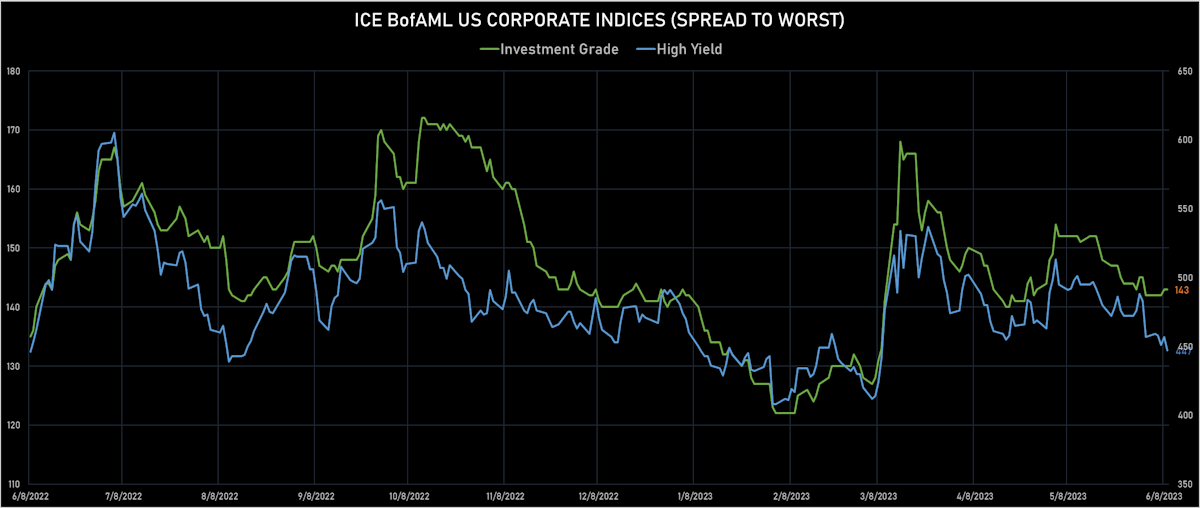

Lower Odds Of US Recession / Credit Crunch Continue To Support Spread Compression In High Yield

A good rebound in issuance volumes of US$ corporate bonds this week: 57 tranches for $48.45bn in IG (2023 YTD volume $672.99bn vs 2022 YTD $716.791bn), 4 tranches for $4.325bn in HY (2023 YTD volume $85.642.6bn vs 2022 YTD $66.071bn)

Published ET

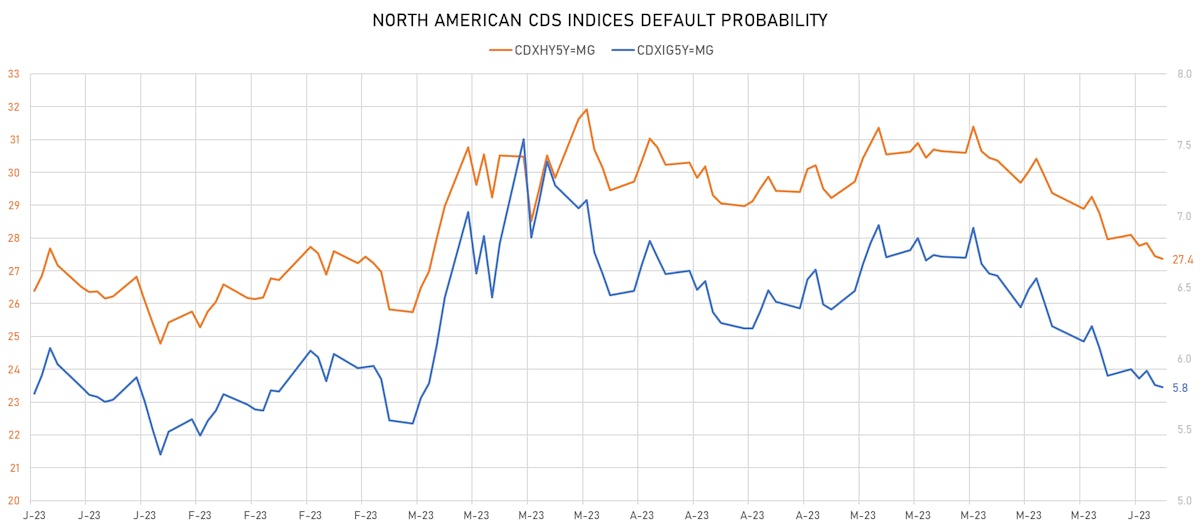

CDS Indices Implied Default Probabilities | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

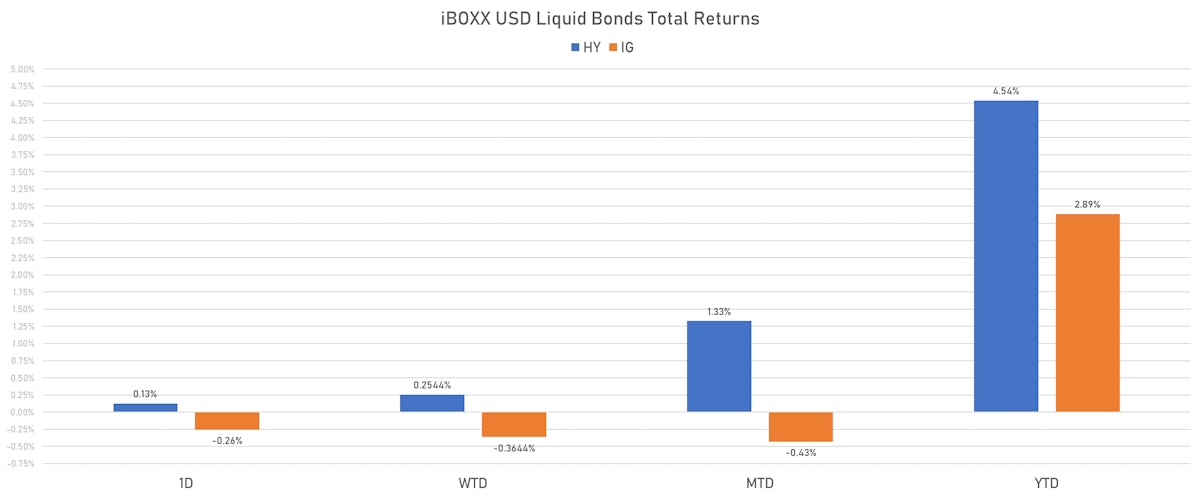

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.256% today (Week-to-date: -0.36%; Month-to-date: -0.43%; Year-to-date: 2.89%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.127% today (Week-to-date: 0.25%; Month-to-date: 1.33%; Year-to-date: 4.54%)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.21% today (YTD total return: +4.9%)

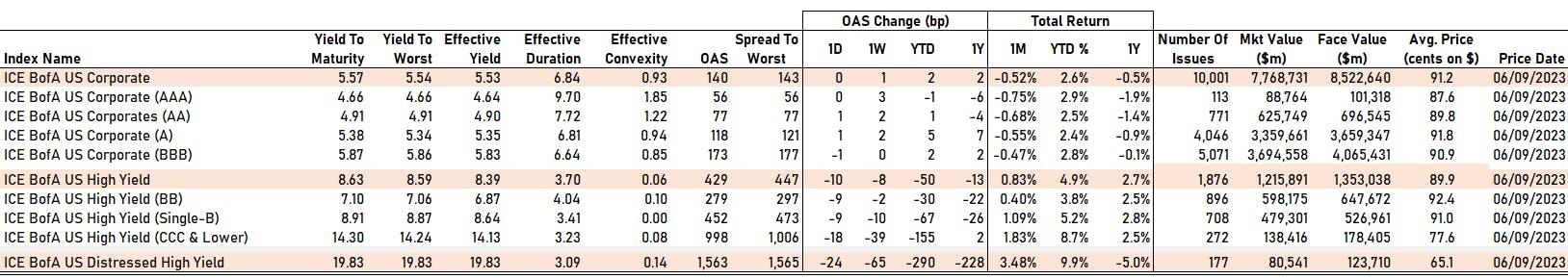

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 56 bp

- AA up by 1 bp at 77 bp

- A up by 1 bp at 118 bp

- BBB down by -1 bp at 173 bp

- BB down by -9 bp at 279 bp

- B down by -9 bp at 452 bp

- ≤ CCC down by -18 bp at 998 bp

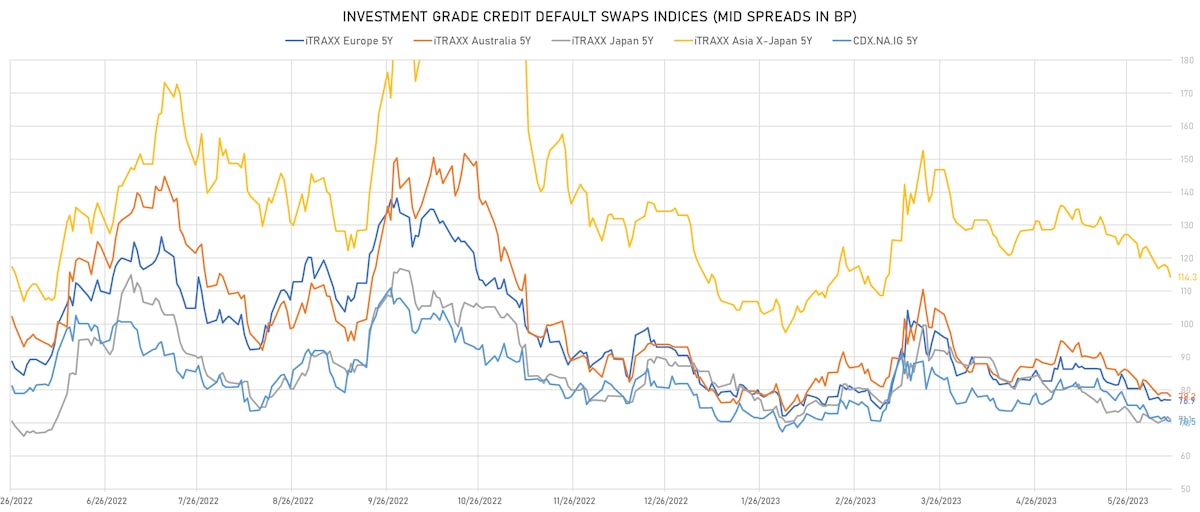

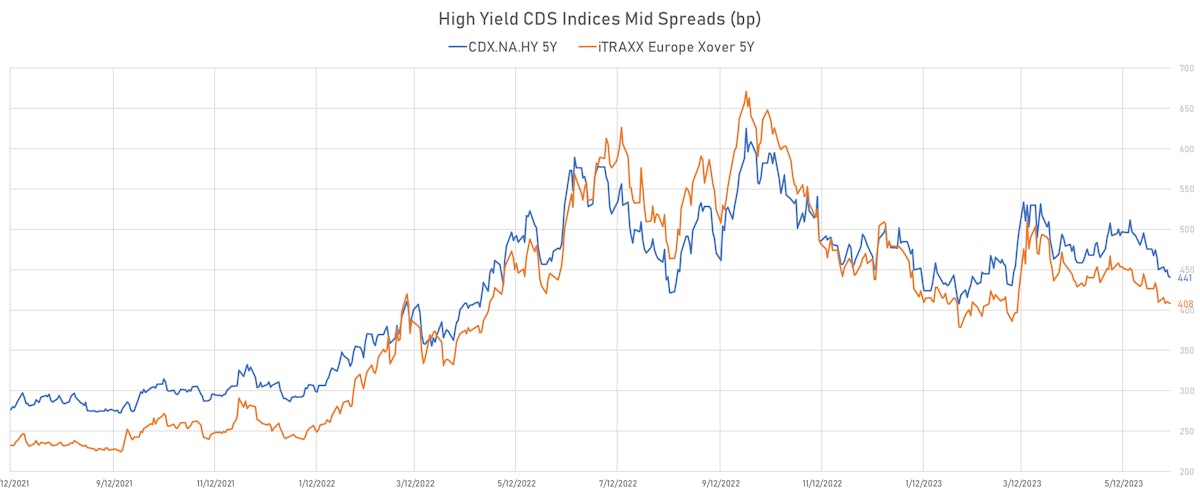

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 71bp (1W change: -1.0bp; YTD change: -11.3bp)

- Markit CDX.NA.IG 10Y down 0.1 bp, now at 110bp (1W change: +1.3bp; YTD change: -8.1bp)

- Markit CDX.NA.HY 5Y down 1.3 bp, now at 441bp (1W change: -9.5bp; YTD change: -44.0bp)

- Markit iTRAXX Europe 5Y unchanged at 77bp (1W change: -0.1bp; YTD change: -13.5bp)

- Markit iTRAXX Europe Crossover 5Y down 1.1 bp, now at 408bp (1W change: -1.4bp; YTD change: -65.8bp)

- Markit iTRAXX Japan 5Y down 0.8 bp, now at 71bp (1W change: -1.2bp; YTD change: -16.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 3.0 bp, now at 114bp (1W change: -9.1bp; YTD change: -18.7bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Brazil (rated BB-): down 4.3 % to 194 bp (1Y range: 195-328bp)

- Peru (rated BBB): down 4.9 % to 84 bp (1Y range: 86-171bp)

- Chile (rated A-): down 5.5 % to 75 bp (1Y range: 77-174bp)

- Saudi Arabia (rated A+): down 5.5 % to 57 bp (1Y range: 46-75bp)

- Italy (rated BBB): down 5.8 % to 97 bp (1Y range: 88-179bp)

- Malaysia (rated BBB+): down 7.9 % to 56 bp (1Y range: 57-122bp)

- Turkey (rated B): down 8.2 % to 500 bp (1Y range: 478-892bp)

- Colombia (rated BB+): down 8.7 % to 244 bp (1Y range: 221-394bp)

- South Africa (rated BB-): down 10.8 % to 266 bp (1Y range: 230-377bp)

- Nigeria (rated B-): down 30.8 % to 865 bp (1Y range: 377-1,538bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: DISH DBS Corp (Englewood, Colorado (US)) | Coupon: 5.88% | Maturity: 15/11/2024 | Rating: B- | CUSIP: 25470XAW5 | OAS up by 329.1 bp to 1,497.7 bp (CDS basis: 32.3bp), with the yield to worst at 18.3% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 80.0-96.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.30% | Maturity: 10/2/2025 | Rating: BB | CUSIP: 345397B85 | OAS up by 60.8 bp to 197.4 bp (CDS basis: -70.1bp), with the yield to worst at 6.8% and the bond now trading down to 92.7 cents on the dollar (1Y price range: 90.0-94.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 40.5 bp to 99.9 bp (CDS basis: -67.9bp), with the yield to worst at 5.8% and the bond now trading down to 93.6 cents on the dollar (1Y price range: 91.4-95.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.66% | Maturity: 8/9/2024 | Rating: BB | CUSIP: 345397WW9 | OAS up by 34.3 bp to 165.0 bp (CDS basis: -38.0bp), with the yield to worst at 6.7% and the bond now trading down to 96.2 cents on the dollar (1Y price range: 94.6-97.2).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS up by 24.0 bp to 122.3 bp, with the yield to worst at 5.4% and the bond now trading down to 98.6 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS down by 27.2 bp to 121.3 bp, with the yield to worst at 5.5% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 96.0-98.8).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | CUSIP: 77340RAS6 | OAS down by 30.9 bp to 150.7 bp, with the yield to worst at 5.8% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 91.8-95.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.85% | Maturity: 15/7/2026 | Rating: BB+ | CUSIP: 29336UAF4 | OAS down by 38.0 bp to 118.8 bp, with the yield to worst at 5.3% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 94.0-97.8).

- Issuer: Spirit AeroSystems Inc (Wichita, Kansas (US)) | Coupon: 3.85% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 85205TAG5 | OAS down by 38.2 bp to 211.7 bp, with the yield to worst at 6.2% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 90.5-94.9).

- Issuer: DPL Inc (Dayton, Ohio (US)) | Coupon: 4.13% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 233293AR0 | OAS down by 44.3 bp to 144.0 bp (CDS basis: 26.3bp), with the yield to worst at 5.8% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 93.4-96.4).

- Issuer: Block Inc (San Francisco, California (US)) | Coupon: 2.75% | Maturity: 1/6/2026 | Rating: BB | CUSIP: 852234AN3 | OAS down by 48.0 bp to 159.2 bp, with the yield to worst at 5.6% and the bond now trading up to 91.3 cents on the dollar (1Y price range: 85.0-93.9).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS down by 68.0 bp to 42.3 bp, with the yield to worst at 4.8% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 94.4-97.8).

- Issuer: Nordstrom Inc (Seattle, Washington (US)) | Coupon: 6.95% | Maturity: 15/3/2028 | Rating: BB+ | CUSIP: 655664AH3 | OAS down by 69.8 bp to 341.5 bp (CDS basis: 116.3bp), with the yield to worst at 7.1% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 91.4-100.0).

- Issuer: Diversified Healthcare Trust (Newton, Massachusetts (US)) | Coupon: 4.75% | Maturity: 15/2/2028 | Rating: CC | CUSIP: 81721MAM1 | OAS down by 153.0 bp to 860.2 bp, with the yield to worst at 12.3% and the bond now trading up to 72.6 cents on the dollar (1Y price range: 56.9-73.8).

- Issuer: Qwest Corp (Monroe, Louisiana (US)) | Coupon: 7.25% | Maturity: 15/9/2025 | Rating: B+ | CUSIP: 912920AK1 | OAS down by 370.1 bp to 884.9 bp, with the yield to worst at 12.6% and the bond now trading up to 88.8 cents on the dollar (1Y price range: 80.9-102.7).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS up by 35.1 bp to 409.7 bp (CDS basis: 6.9bp), with the yield to worst at 6.8% and the bond now trading down to 75.3 cents on the dollar (1Y price range: 72.4-78.7).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 33.4 bp to 282.2 bp (CDS basis: -14.3bp), with the yield to worst at 5.8% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 90.6-94.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS up by 32.6 bp to 349.0 bp (CDS basis: 15.2bp), with the yield to worst at 6.3% and the bond now trading down to 84.4 cents on the dollar (1Y price range: 82.0-87.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 31.6 bp to 427.5 bp, with the yield to worst at 6.9% and the bond now trading up to 84.2 cents on the dollar (1Y price range: 74.8-85.1).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 4.25% | Maturity: 31/5/2028 | Rating: BB+ | ISIN: XS2486825669 | OAS down by 31.8 bp to 212.2 bp, with the yield to worst at 5.0% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 90.2-96.8).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | OAS down by 31.9 bp to 415.0 bp, with the yield to worst at 7.1% and the bond now trading up to 85.6 cents on the dollar (1Y price range: 80.2-88.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS down by 32.6 bp to 367.8 bp, with the yield to worst at 6.3% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 82.7-93.1).

- Issuer: Mundys SpA (Milan, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB | ISIN: XS2301390089 | OAS down by 34.2 bp to 236.0 bp (CDS basis: -48.9bp), with the yield to worst at 5.2% and the bond now trading up to 85.5 cents on the dollar (1Y price range: 82.6-87.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB | ISIN: XS2361255057 | OAS down by 35.3 bp to 414.3 bp, with the yield to worst at 7.0% and the bond now trading up to 82.1 cents on the dollar (1Y price range: 71.9-82.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 37.0 bp to 359.6 bp (CDS basis: 175.7bp), with the yield to worst at 6.6% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 88.4-100.1).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS down by 37.4 bp to 321.8 bp, with the yield to worst at 6.1% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 76.1-88.2).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS down by 39.0 bp to 550.7 bp (CDS basis: -33.6bp), with the yield to worst at 8.7% and the bond now trading up to 87.5 cents on the dollar (1Y price range: 85.9-92.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB | ISIN: XS2361254597 | OAS down by 46.5 bp to 340.9 bp, with the yield to worst at 6.5% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 81.0-88.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | OAS down by 46.6 bp to 213.5 bp, with the yield to worst at 5.1% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 88.0-94.8).

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB- | ISIN: XS2346972263 | OAS down by 82.4 bp to 300.5 bp, with the yield to worst at 6.1% and the bond now trading up to 91.2 cents on the dollar (1Y price range: 86.2-92.3).

RECENT DOMESTIC USD BOND ISSUES

- Ally Financial Inc (Financial - Other | Detroit, United States | Rating: BBB): US$850m Senior Note (US02005NBT63), floating rate maturing on 13 June 2029, priced at 100.00, callable (6nc5)

- Bread Fincl Hldg (Information/Data Technology | Columbus, Ohio, United States | Rating: NR): US$275m Bond (US018581AM03), fixed rate (4.25% coupon) maturing on 15 June 2028, priced at 100.00, non callable, convertible

- Burlington Northern Santa Fe LLC (Railroads | Fort Worth, Texas, United States | Rating: AA-): US$1,600m Senior Note (US12189LBK61), fixed rate (5.20% coupon) maturing on 15 April 2054, priced at 99.95 (original spread of 168 bp), callable (31nc30)

- Capital One Financial Corp (Financial - Other | Mclean, Virginia, United States | Rating: BBB): US$1,750m Senior Note (US14040HDA05), floating rate maturing on 8 June 2034, priced at 100.00 (original spread of 277 bp), callable (11nc10)

- Capital One Financial Corp (Financial - Other | Mclean, Virginia, United States | Rating: BBB): US$1,750m Senior Note (US14040HCZ64), floating rate maturing on 8 June 2029, priced at 100.00 (original spread of 260 bp), callable (6nc5)

- Cheniere Energy Partners LP (Gas Utility - Local Distrib | Houston, Texas, United States | Rating: BB+): US$1,400m Senior Note (US16411QAP63), fixed rate (5.95% coupon) maturing on 30 June 2033, priced at 99.77 (original spread of 228 bp), callable (10nc10)

- Dollar General Corp (Retail Stores - Other | Goodlettsville, Tennessee, United States | Rating: BBB): US$1,000m Senior Note (US256677AP01), fixed rate (5.45% coupon) maturing on 5 July 2033, priced at 99.84 (original spread of 186 bp), callable (10nc10)

- Dollar General Corp (Retail Stores - Other | Goodlettsville, Tennessee, United States | Rating: BBB): US$500m Senior Note (US256677AN52), fixed rate (5.20% coupon) maturing on 5 July 2028, priced at 99.97 (original spread of 140 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$250m Bond (US3133EPMF99), fixed rate (4.69% coupon) maturing on 9 June 2026, priced at 100.00 (original spread of 57 bp), callable (3nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$175m Bond (US3133EPMU66), fixed rate (4.25% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 5 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$1,000m Bond (US3130AWER77), fixed rate (4.63% coupon) maturing on 6 June 2025, priced at 99.92 (original spread of 8 bp), non callable

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$900m Senior Note (US345397D260), fixed rate (6.95% coupon) maturing on 10 June 2026, priced at 100.00 (original spread of 284 bp), callable (3nc3)

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$850m Senior Note (US345397D427), fixed rate (7.20% coupon) maturing on 10 June 2030, priced at 100.00 (original spread of 343 bp), callable (7nc7)

- Fortune Brands Innovations Inc (Industrials - Other | Deerfield, Illinois, United States | Rating: BBB): US$600m Senior Note (US34964CAH97), fixed rate (5.88% coupon) maturing on 1 June 2033, priced at 99.84 (original spread of 220 bp), callable (10nc10)

- HUB International Ltd (Life Insurance | Chicago, United States | Rating: B): US$2,175m Note (USU4434TAH42), fixed rate (7.25% coupon) maturing on 15 June 2030, priced at 100.00 (original spread of 346 bp), callable (7nc3)

- Hewlett Packard Enterprise Co (Information/Data Technology | Spring, Texas, United States | Rating: BBB): US$550m Senior Note (US42824CBP32), fixed rate (5.25% coupon) maturing on 1 July 2028, priced at 99.89 (original spread of 151 bp), callable (5nc5)

- IONIS Pharma (Industrials - Other | Carlsbad, California, United States | Rating: NR): US$500m Bond (US462222AE08), fixed rate (1.75% coupon) maturing on 15 June 2028, priced at 100.00, non callable, convertible

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$500m Unsecured Note (XS2636437712), fixed rate (5.75% coupon) maturing on 15 June 2026, priced at 100.00, non callable

- Interpublic Group of Companies Inc (Service - Other | New York City, New York, United States | Rating: BBB): US$300m Senior Note (US460690BU38), fixed rate (5.38% coupon) maturing on 15 June 2033, priced at 98.75 (original spread of 185 bp), callable (10nc10)

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$300m Senior Note (US24422EWY12), floating rate (SOFR + 79.0 bp) maturing on 8 June 2026, priced at 100.00, non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$1,000m Senior Note (US24422EWZ86), fixed rate (4.70% coupon) maturing on 10 June 2030, priced at 99.91 (original spread of 97 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$600m Senior Note (US24422EWX39), fixed rate (4.75% coupon) maturing on 8 June 2026, priced at 99.94 (original spread of 65 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$600m Senior Note (US24422EWW55), fixed rate (4.95% coupon) maturing on 6 June 2025, priced at 99.94 (original spread of 50 bp), non callable

- Massmutual Global Funding II (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$600m Note (US57629W6H81), fixed rate (5.05% coupon) maturing on 14 June 2028, priced at 99.88 (original spread of 122 bp), non callable

- Mckesson Corp (Pharmaceuticals | Irving, Texas, United States | Rating: BBB+): US$400m Senior Note (US581557BT10), fixed rate (4.90% coupon) maturing on 15 July 2028, priced at 99.79 (original spread of 103 bp), callable (5nc5)

- Mckesson Corp (Pharmaceuticals | Irving, Texas, United States | Rating: BBB+): US$600m Senior Note (US581557BU82), fixed rate (5.10% coupon) maturing on 15 July 2033, priced at 99.36 (original spread of 140 bp), callable (10nc10)

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA+): US$750m Note (US64952WFD02), fixed rate (4.90% coupon) maturing on 13 June 2028, priced at 99.91 (original spread of 107 bp), non callable

- Northwestern Mutual Life Insurance Co (Life Insurance | Milwaukee, Wisconsin, United States | Rating: AA+): US$700m Note (US66815L2M02), fixed rate (4.90% coupon) maturing on 12 June 2028, priced at 99.97 (original spread of 107 bp), non callable

- Owl Rock Core Income Corp (Financial - Other | New York City, New York, United States | Rating: BBB-): US$500m Senior Note (US69120VAR24), fixed rate (7.95% coupon) maturing on 13 June 2028, priced at 99.35 (original spread of 425 bp), callable (5nc5)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): US$1,000m Senior Note (US693475BQ72), floating rate maturing on 12 June 2026, priced at 100.00, callable (3nc2)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): US$2,500m Senior Note (US693475BR55), floating rate maturing on 12 June 2029, priced at 100.00, callable (6nc5)

- Piedmont Natural Gas Company Inc (Gas Utility - Local Distrib | Charlotte, North Carolina, United States | Rating: BBB+): US$350m Senior Note (US720186AQ82), fixed rate (5.40% coupon) maturing on 15 June 2033, priced at 100.00 (original spread of 173 bp), callable (10nc10)

- RHP Hotel Properties LP (Service - Other | Nashville, Tennessee, United States | Rating: B+): US$400m Senior Note (USU76453AF32), fixed rate (7.25% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 332 bp), callable (5nc2)

- Reinsurance Group of America Inc (Life Insurance | Chesterfield Missouri, Missouri, United States | Rating: BBB): US$400m Senior Note (US759351AR05), fixed rate (6.00% coupon) maturing on 15 September 2033, priced at 99.64 (original spread of 242 bp), callable (10nc10)

- Truist Financial Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$1,750m Senior Note (US89788MAP77), floating rate maturing on 8 June 2034, priced at 100.00 (original spread of 213 bp), callable (11nc10)

- Truist Financial Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$1,500m Senior Note (US89788MAN20), floating rate maturing on 8 June 2027, priced at 100.00 (original spread of 164 bp), callable (4nc3)

- US Bancorp (Banking | Minneapolis, Minnesota, United States | Rating: A-): US$1,750m Senior Note (US91159HJN17), floating rate maturing on 12 June 2034, priced at 100.00 (original spread of 202 bp), callable (11nc10)

- US Bancorp (Banking | Minneapolis, Minnesota, United States | Rating: A-): US$1,750m Senior Note (US91159HJM34), floating rate maturing on 12 June 2029, priced at 100.00 (original spread of 189 bp), callable (6nc5)

- Ventas Realty (Real Estate Investment Trust | Louisville, Kentucky, United States | Rating: BBB+): US$750m Bond (US92277GAY35), fixed rate (3.75% coupon) maturing on 1 June 2026, priced at 100.00, non callable, convertible

- Vistra Operations Company LLC (Utility - Other | Irving, United States | Rating: NR): US$450m Note (US92840VAN29), fixed rate (7.23% coupon) maturing on 17 May 2028, priced at 100.00 (original spread of 338 bp), callable (5nc5)

RECENT INTERNATIONAL USD BOND ISSUES

- ASB Bank Ltd (Banking | Auckland, Australia | Rating: A+): US$650m Senior Note (US00216NAG43), fixed rate (5.35% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 115 bp), non callable

- Aker BP ASA (Oil and Gas | Lysaker, Akershus, Norway | Rating: BBB): US$500m Senior Note (USR0139KAF77), fixed rate (5.60% coupon) maturing on 13 June 2028, priced at 99.91 (original spread of 171 bp), callable (5nc5)

- Aker BP ASA (Oil and Gas | Lysaker, Akershus, Norway | Rating: BBB): US$1,000m Senior Note (US00973RAM51), fixed rate (6.00% coupon) maturing on 13 June 2033, priced at 99.76 (original spread of 234 bp), callable (10nc10)

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$2,000m Senior Note (US04517PBU57), fixed rate (4.63% coupon) maturing on 13 June 2025, priced at 100.00 (original spread of 11 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$2,000m Senior Note (US04517PBT84), fixed rate (3.88% coupon) maturing on 14 June 2033, priced at 99.26 (original spread of 25 bp), non callable

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, New South Wales, Australia | Rating: A+): US$1,350m Covered Bond (Other) (US05252FAE07), fixed rate (4.68% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 55 bp), non callable

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: AA-): US$1,500m Note (US05581KAF84), fixed rate (5.34% coupon) maturing on 12 June 2029, priced at 100.00 (original spread of 148 bp), callable (6nc5)

- Bacardi Ltd (Beverage/Bottling | Pembroke, Bermuda | Rating: BBB-): US$700m Senior Note (USG0706JAB47), fixed rate (5.40% coupon) maturing on 15 June 2033, priced at 99.63 (original spread of 179 bp), callable (10nc10)

- Bacardi Ltd (Beverage/Bottling | Pembroke, Bermuda | Rating: BBB-): US$400m Senior Note (USG0706JAA63), fixed rate (5.25% coupon) maturing on 15 January 2029, priced at 99.98 (original spread of 144 bp), callable (6nc5)

- Bacardi Ltd (Beverage/Bottling | Pembroke, Bermuda | Rating: BBB-): US$400m Senior Note (US05635JAC45), fixed rate (5.90% coupon) maturing on 15 June 2043, priced at 99.64 (original spread of 233 bp), callable (20nc20)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A-): US$750m Senior Note (US06418GAD97), fixed rate (5.25% coupon) maturing on 12 June 2028, priced at 99.83 (original spread of 150 bp), with a make whole call

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A-): US$1,100m Senior Note (US06418GAC15), fixed rate (5.45% coupon) maturing on 12 June 2025, priced at 99.97 (original spread of 101 bp), with a make whole call

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A-): US$400m Senior Note (US06418GAB32), floating rate (SOFRINDX + 109.0 bp) maturing on 12 June 2025, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A+): US$155m Unsecured Note (XS2637130019), floating rate maturing on 30 June 2031, priced at 100.00, non callable

- Brookfield Capi (Financial - Other | New York City, New York, Canada | Rating: A-): US$550m Senior Note (US11259NAA28), fixed rate (6.09% coupon) maturing on 14 June 2033, priced at 100.00 (original spread of 230 bp), callable (10nc10)

- CMB International Leasing Management Ltd (Financial - Other | China (Mainland) | Rating: BBB+): US$103m Senior Note (XS2634723907), floating rate maturing on 13 June 2026, priced at 100.00, non callable

- China Merchants Bank Co Ltd (London Branch) (Banking | London, China (Mainland) | Rating: A): US$400m Senior Note (XS2633220293), floating rate (SOFRINDX + 65.0 bp) maturing on 13 June 2026, priced at 100.00, non callable

- Commercial Bank of Dubai PSC (Banking | Dubai, Dubai, United Arab Emirates | Rating: A-): US$500m Bond (XS2633553933), fixed rate (5.32% coupon) maturing on 14 June 2028, priced at 100.00 (original spread of 149 bp), non callable

- Finnvera Oyj (Agency | Helsinki, Finland | Rating: AA+): US$1,000m Senior Note (XS2636756657), fixed rate (4.00% coupon) maturing on 15 June 2028, priced at 99.45 (original spread of 26 bp), non callable

- General Investments (Cayman) Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$126m Unsecured Note (XS2637383733), floating rate maturing on 30 June 2032, priced at 100.00, non callable

- Guatemala, Republic of (Government) (Sovereign | Guatemala City, Guatemala | Rating: BB): US$1,000m Senior Note (US401494AW96), fixed rate (6.60% coupon) maturing on 13 June 2036, priced at 100.00 (original spread of 286 bp), callable (13nc13)

- Industrial and Commercial Bank of China Ltd (Dubai Branch) (Banking | Dubai, Dubai, China (Mainland) | Rating: NR): US$130m Unsecured Note (XS2636509130), floating rate maturing on 16 June 2026, priced at 100.00, non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$1,000m Senior Note (XS2634694967), fixed rate (4.75% coupon) maturing on 2 July 2025, priced at 99.97 (original spread of 17 bp), non callable

- Kuntarahoitus Oyj (Agency | Helsinki, Etela-Suomen, Finland | Rating: AA+): US$1,000m Senior Note (US62630CEH07), fixed rate (4.13% coupon) maturing on 15 December 2027, priced at 99.93 (original spread of 28 bp), non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$1,250m Senior Note (US515110CD49), fixed rate (3.88% coupon) maturing on 14 June 2028, priced at 99.47 (original spread of 13 bp), non callable

- Macquarie Bank Ltd (Banking | Sydney, New South Wales, Australia | Rating: A): US$700m Senior Note (US55608PBM59), fixed rate (5.21% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 116 bp), non callable

- Macquarie Bank Ltd (Banking | Sydney, New South Wales, Australia | Rating: A): US$300m Senior Note (US55608RBN98), floating rate (SOFR + 124.0 bp) maturing on 15 June 2026, priced at 100.00, non callable

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): US$750m Senior Note (US55608KBN46), floating rate maturing on 15 June 2034, priced at 100.00 (original spread of 234 bp), callable (11nc10)

- National Australia Bank Ltd (New York Branch) (Banking | New York City, New York, Australia | Rating: NR): US$1,000m Senior Note (US63253QAE44), fixed rate (4.90% coupon) maturing on 13 June 2028, priced at 99.83 (original spread of 115 bp), non callable

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB): US$700m Senior Note (US636274AD47), fixed rate (5.60% coupon) maturing on 12 June 2028, priced at 100.00 (original spread of 167 bp), callable (5nc5)

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB): US$800m Senior Note (US636274AE20), fixed rate (5.81% coupon) maturing on 12 June 2033, priced at 100.00 (original spread of 202 bp), callable (10nc10)

- Natwest Group PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$1,250m Senior Note (US639057AK45), fixed rate (5.81% coupon) maturing on 13 September 2029, priced at 100.00 (original spread of 207 bp), callable (6nc5)

- Palomino Funding (Financial - Other | Unable To Collect Data For The Field 'Tr.Headquarterscity' And Some Specific Identifier(S)., Unable To Collect Data For The Field 'Tr.Ultimateparentcountryhq' And Some Specific Identifier(S). | Rating: NR): US$450m Note (US69754AAA88), fixed rate (7.23% coupon) maturing on 17 May 2028, priced at 100.00 (original spread of 338 bp), callable (5nc5)

- Santander Holdings USA Inc (Banking | Boston, Spain | Rating: BBB-): US$500m Senior Note (US80282KBG04), floating rate maturing on 12 June 2029, priced at 100.00, callable (6nc5)

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): US$145m Note (XS2633877241), floating rate (SOFR + 120.0 bp) maturing on 12 June 2028, priced at 100.00, non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): US$700m Note (US86959NAM11), fixed rate (5.25% coupon) maturing on 15 June 2026, priced at 99.90 (original spread of 113 bp), non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): US$500m Note (US86959LAN38), floating rate (SOFR + 125.0 bp) maturing on 15 June 2026, priced at 100.00, non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: A): US$1,000m Note (US86959NAP42), fixed rate (5.50% coupon) maturing on 15 June 2028, priced at 99.56 (original spread of 185 bp), non callable

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): US$850m Note (US87020PAV94), fixed rate (5.47% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 132 bp), non callable

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): US$400m Note (US870195AA25), floating rate (SOFRINDX + 138.0 bp) maturing on 15 June 2026, priced at 100.00, non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): US$1,000m Senior Note (US87031CAL72), fixed rate (4.13% coupon) maturing on 14 June 2028, priced at 99.54 (original spread of 32 bp), non callable

- Vale Overseas Ltd (Financial - Other | Rio De Janeiro, Rio De Janeiro, Brazil | Rating: BBB-): US$1,500m Senior Note (US91911TAR41), fixed rate (6.13% coupon) maturing on 12 June 2033, priced at 99.12 (original spread of 245 bp), callable (10nc10)

- Xingchang International Co Ltd (Financial - Other | Huzhou, Zhejiang, China (Mainland) | Rating: NR): US$160m Senior Note (XS2574742834), fixed rate (6.95% coupon) maturing on 12 June 2026, priced at 100.00, non callable

- Zhongtai International Finance BVI Company Ltd (Financial - Other | Hong Kong, China (Mainland) | Rating: NR): US$200m Bond (XS2590538380), fixed rate (6.70% coupon) maturing on 12 June 2025, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- 3i Group PLC (Financial - Other | London, United Kingdom | Rating: BBB+): €500m Senior Note (XS2626289222), fixed rate (4.88% coupon) maturing on 14 June 2029, priced at 98.51 (original spread of 278 bp), callable (6nc6)

- Achmea BV (Life Insurance | Zeist, Utrecht, Netherlands | Rating: A): €500m Unsecured Note (XS2635416857), fixed rate (1.00% coupon) maturing on 16 June 2043, priced at 100.00, non callable

- Achmea BV (Life Insurance | Zeist, Utrecht, Netherlands | Rating: A): €500m Unsecured Note (XS2637069357), fixed rate (1.00% coupon) maturing on 16 December 2033, priced at 100.00, non callable

- Albania, Republic of (Government) (Sovereign | Tirane, Tirana County, Albania | Rating: B+): €600m Senior Note (XS2636412301), fixed rate (5.90% coupon) maturing on 9 June 2028, priced at 99.06 (original spread of 375 bp), non callable

- Alliander NV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A+): €500m Senior Note (XS2635647154), fixed rate (3.25% coupon) maturing on 13 June 2028, priced at 99.29 (original spread of 101 bp), callable (5nc5)

- Athora Holding Ltd (Service - Other | Pembroke, Bermuda | Rating: A-): €600m Senior Note (XS2628821790), fixed rate (6.63% coupon) maturing on 16 June 2028, priced at 99.66 (original spread of 431 bp), callable (5nc5)

- Autostrade per l'Italia SpA (Transportation - Other | Rome, Italy | Rating: BBB-): €750m Unsecured Note (XS2636745882), fixed rate (5.13% coupon) maturing on 14 June 2033, priced at 99.62 (original spread of 275 bp), callable (10nc10)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €300m Unsecured Note (XS2517540550) zero coupon maturing on 14 June 2052, priced at 100.00, non callable

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB+): €750m Note (IT0005549479), floating rate maturing on 14 June 2028, priced at 99.96 (original spread of 347 bp), callable (5nc4)

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: A-): €750m Subordinated Note (XS2636592102), fixed rate (5.75% coupon) maturing on 15 September 2033, priced at 99.37 (original spread of 350 bp), callable (10nc5)

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €1,000m Note (XS2634826031), fixed rate (4.25% coupon) maturing on 12 June 2030, priced at 99.89 (original spread of 195 bp), non callable

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): €1,000m Senior Note (XS2634687912), fixed rate (4.13% coupon) maturing on 12 June 2028, priced at 100.00 (original spread of 175 bp), callable (5nc5)

- Belfius Banque SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: A): €750m Note (BE6344187966), fixed rate (3.88% coupon) maturing on 12 June 2028, priced at 99.56 (original spread of 160 bp), non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): €750m Bond (FR001400IJ13), floating rate maturing on 14 June 2034 (original spread of 225 bp), callable (11nc10)

- Cassa Centrale Raiffeisen dell Alto Adige SpA (Banking | Bolzano, Bolzano, Italy | Rating: BBB): €200m Senior Note (XS2634567429), fixed rate (5.38% coupon) maturing on 16 June 2028, priced at 99.50 (original spread of 308 bp), non callable

- Cassa Depositi e Prestiti SpA (Agency | Rome, Roma, Italy | Rating: BBB): €175m Bond (IT0005548877), fixed rate (4.07% coupon) maturing on 8 June 2030, priced at 100.00 (original spread of 180 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €750m Hypothekenpfandbrief (Covered Bond) (DE000CZ43Z23), fixed rate (3.13% coupon) maturing on 13 June 2033, priced at 99.33 (original spread of 82 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €750m Oeffenlicher Pfandbrief (Covered Bond) (DE000CZ43Z15), fixed rate (3.38% coupon) maturing on 12 December 2025, priced at 99.83 (original spread of 77 bp), non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €500m Bond (IT0005548224), fixed rate (4.00% coupon) maturing on 30 June 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €1,000m Obbligazione Bancaria Garantita (Covered Bond) (IT0005549396), fixed rate (3.50% coupon) maturing on 15 January 2030, priced at 99.38 (original spread of 130 bp), non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €200m Bond (IT0005548091), fixed rate (3.00% coupon) maturing on 30 June 2025, priced at 100.00, non callable

- Croatia, Republic of (Government) (Sovereign | Zagreb, Zagrebacka Zupanija, Croatia | Rating: BBB): €1,500m Senior Note (XS2636439684), fixed rate (4.00% coupon) maturing on 14 June 2035, priced at 99.56 (original spread of 170 bp), non callable

- DNB Bank ASA (Banking | Oslo, Oslo, Norway | Rating: A-): €500m Senior Note (XS2635428274), fixed rate (5.00% coupon) maturing on 13 September 2033 (original spread of 265 bp), callable (10nc10)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C5R7), fixed rate (3.00% coupon) maturing on 3 July 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €150m Inhaberschuldverschreibung (DE000DW6C5U1), fixed rate (3.00% coupon) maturing on 7 July 2027, priced at 100.00, callable (4nc2)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C5Q9), fixed rate (2.75% coupon) maturing on 4 July 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VER6), fixed rate (3.30% coupon) maturing on 3 July 2028, priced at 100.00, non callable

- Edenred SE (Service - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: A-): €700m Bond (FR001400IIU3), fixed rate (3.63% coupon) maturing on 13 June 2031, priced at 99.25 (original spread of 142 bp), callable (8nc8)

- Edenred SE (Service - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: A-): €500m Bond (FR001400IIT5), fixed rate (3.63% coupon) maturing on 13 December 2026, priced at 99.66 (original spread of 118 bp), callable (4nc3)

- Eika Boligkreditt AS (Mortgage Banking | Oslo, Oslo, Norway | Rating: NR): €500m Covered Bond (Other) (XS2636611332), fixed rate (3.25% coupon) maturing on 14 June 2033, priced at 99.25 (original spread of 96 bp), non callable

- Enexis Holding NV (Utility - Other | S-Hertogenbosch, Noord-Brabant, Netherlands | Rating: AA-): €500m Senior Note (XS2634616572), fixed rate (3.63% coupon) maturing on 12 June 2034, priced at 99.93 (original spread of 128 bp), callable (11nc11)

- France, Republic of (Government) (Sovereign | Paris, Ile-De-France, France | Rating: AA-): €3,000m Obligation Assimilable du Tresor indexee sur l'inflation (FR001400IKW5), fixed rate (0.55% coupon) maturing on 1 March 2039, priced at 98.57, non callable, inflation protected

- IPD 3 BV (Financial - Other | Luchthaven Schiphol, Noord-Holland, United States | Rating: B): €475m Note (XS2631199168), floating rate (EU03MLIB + 475.0 bp) maturing on 15 June 2028, priced at 99.00, callable (5nc1)

- IPD 3 BV (Financial - Other | Luchthaven Schiphol, Noord-Holland, United States | Rating: B): €500m Note (XS2631199085), fixed rate (8.00% coupon) maturing on 15 June 2028, priced at 100.00 (original spread of 556 bp), callable (5nc2)

- Ile-de-France Mobilites (Agency | Paris, Ile-De-France, France | Rating: AA-): €500m Bond (FR001400IKC7), fixed rate (3.70% coupon) maturing on 14 June 2038, priced at 99.91 (original spread of 107 bp), non callable

- IsDB Trust Services No.2 SARL (Financial - Other | Luxembourg | Rating: NR): €150m Unsecured Note (XS2635642940), fixed rate (3.36% coupon) maturing on 12 June 2026, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €5,000m Inhaberschuldverschreibung (DE000A351MM7), fixed rate (2.88% coupon) maturing on 29 May 2026, priced at 99.65 (original spread of 40 bp), non callable

- Kutxabank SA (Banking | Bilbao, Vizcaya, Spain | Rating: NR): €500m Bond (ES0343307031), floating rate maturing on 15 June 2027, priced at 99.74 (original spread of 190 bp), callable (4nc3)

- La Poste SA (Agency | Paris, Ile-De-France, France | Rating: A+): €850m Bond (FR001400IIS7), fixed rate (4.00% coupon) maturing on 12 June 2035, priced at 98.97 (original spread of 163 bp), callable (12nc12)

- La Poste SA (Agency | Paris, Ile-De-France, France | Rating: A+): €650m Bond (FR001400IIR9), fixed rate (3.75% coupon) maturing on 12 June 2030, priced at 99.30 (original spread of 154 bp), callable (7nc7)

- Linde PLC (Industrials - Other | Woking, Surrey, United Kingdom | Rating: A): €750m Senior Note (XS2634593938), fixed rate (3.38% coupon) maturing on 12 June 2029, priced at 99.64 (original spread of 110 bp), callable (6nc6)

- Linde PLC (Industrials - Other | Woking, Surrey, United Kingdom | Rating: A): €500m Senior Note (XS2634593854), fixed rate (3.63% coupon) maturing on 12 June 2025, priced at 99.88 (original spread of 79 bp), with a make whole call

- Linde PLC (Industrials - Other | Woking, Surrey, United Kingdom | Rating: A): €650m Senior Note (XS2634594076), fixed rate (3.63% coupon) maturing on 12 June 2034, priced at 99.71 (original spread of 129 bp), callable (11nc11)

- Lithuania, Republic of (Government) (Sovereign | Vilnius, Vilniaus, Lithuania | Rating: A+): €1,250m Senior Note (XS2604821228), fixed rate (3.88% coupon) maturing on 14 June 2033, priced at 99.37 (original spread of 157 bp), non callable

- Muenchener Hypothekenbank eG (Banking | Muenchen, Bayern, Germany | Rating: AA-): €500m Hypothekenpfandbrief (Covered Bond) (DE000MHB35J0), fixed rate (3.00% coupon) maturing on 14 August 2030, priced at 99.56 (original spread of 79 bp), non callable

- National Bank of Canada (Banking | Montreal, Quebec, Canada | Rating: BBB+): €500m Senior Note (XS2635167880), floating rate (EU03MLIB + 55.0 bp) maturing on 13 June 2025, priced at 100.00, non callable

- Nationale Nederlanden Bank NV (Banking | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €1,250m Covered Bond (Other) (NL0015001GS6), fixed rate (3.20% coupon) maturing on 9 June 2032, priced at 100.00, non callable

- Natixis Pfandbriefbank AG (Mortgage Banking | Frankfurt, Hessen, France | Rating: NR): €250m Hypothekenpfandbrief (Covered Bond) (DE000A14J0P2), fixed rate (3.38% coupon) maturing on 15 December 2025, priced at 99.89 (original spread of 99 bp), non callable

- Nord Lb Covered Finance Bank SA (Banking | Findel, Luxembourg | Rating: NR): €250m Unsecured Note (XS2635409993), floating rate maturing on 19 June 2025, priced at 100.00, non callable

- OP Yrityspankki Oyj (Banking | Helsinki, Etela-Suomen, Finland | Rating: AA-): €650m Note (XS2635622595), fixed rate (4.00% coupon) maturing on 13 June 2028, priced at 99.99 (original spread of 162 bp), non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): €250m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A35HV2), floating rate (EU06MLIB + 0.0 bp) maturing on 18 December 2028, priced at 100.00, non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): €500m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A35HU4), floating rate (EU06MLIB + 0.0 bp) maturing on 16 June 2028, priced at 100.00, non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): €500m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A35HT6), floating rate (EU06MLIB + 0.0 bp) maturing on 16 June 2025, priced at 100.00, non callable

- RELX Finance BV (Financial - Other | Amsterdam, Noord-Holland, United Kingdom | Rating: BBB+): €750m Senior Note (XS2631867533), fixed rate (3.75% coupon) maturing on 12 June 2031, priced at 99.82 (original spread of 149 bp), callable (8nc8)

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €500m Bond (FR001400IJT3), fixed rate (3.25% coupon) maturing on 12 June 2028, priced at 99.45 (original spread of 98 bp), callable (5nc5)

- Schneider Electric SE (Electronics | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €500m Bond (FR001400IJU1), fixed rate (3.50% coupon) maturing on 12 June 2033, priced at 99.21 (original spread of 121 bp), callable (10nc10)

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): €1,250m Note (XS2635183069), floating rate (EU03MLIB + 45.0 bp) maturing on 13 June 2025, priced at 100.00, non callable

- Spain, Kingdom of (Government) (Sovereign | Madrid, Madrid, Spain | Rating: BBB+): €13,000m Obligacion del Estado (ES0000012L78), fixed rate (3.55% coupon) maturing on 31 October 2033, priced at 99.96 (original spread of 105 bp), non callable

- State of Baden-Wuerttemberg (Official and Muni | Stuttgart, Germany | Rating: AA+): €200m Landesschatzanweisung (DE000A14JZW8), floating rate (EU06MLIB + 0.0 bp) maturing on 19 June 2028, priced at 100.97, non callable

- Sumitomo Mitsui Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €600m Senior Note (XS2629485447), fixed rate (4.49% coupon) maturing on 12 June 2030, priced at 100.00 (original spread of 220 bp), non callable

- Thales SA (Electronics | Courbevoie, Ile-De-France, France | Rating: A-): €500m Bond (FR001400IIO6), fixed rate (3.63% coupon) maturing on 14 June 2029, priced at 99.19 (original spread of 139 bp), callable (6nc6)

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,250m Obbligazione Bancaria Garantita (Covered Bond) (IT0005549370), fixed rate (3.50% coupon) maturing on 31 July 2030, priced at 99.71 (original spread of 125 bp), non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,750m Obbligazione Bancaria Garantita (Covered Bond) (IT0005549362), fixed rate (3.38% coupon) maturing on 31 January 2027, priced at 99.72 (original spread of 102 bp), non callable

- Universal Music Group NV (Publishing | Hilversum, Noord-Holland, Netherlands | Rating: BBB+): €750m Senior Note (XS2631848665), fixed rate (4.00% coupon) maturing on 13 June 2031, priced at 99.38 (original spread of 177 bp), callable (8nc8)