Credit

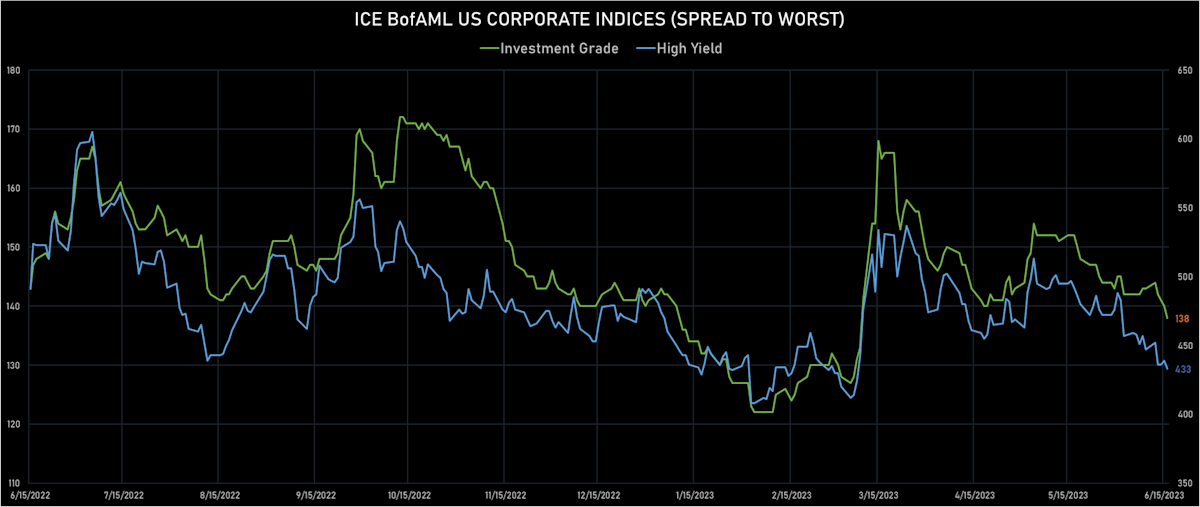

Continued Spread Tightening Across The USD Credit Complex, As Distressed Bonds Total Returns Near 12% YTD

Pretty quiet week for USD corporate bond issuance: 13 tranches for $10.395bn in IG (2023 YTD volume $683.385bn vs 2022 YTD $716.791bn), and just 2 tranches for $895m in HY (2023 YTD volume $86.537bn vs 2022 YTD $67.366bn)

Published ET

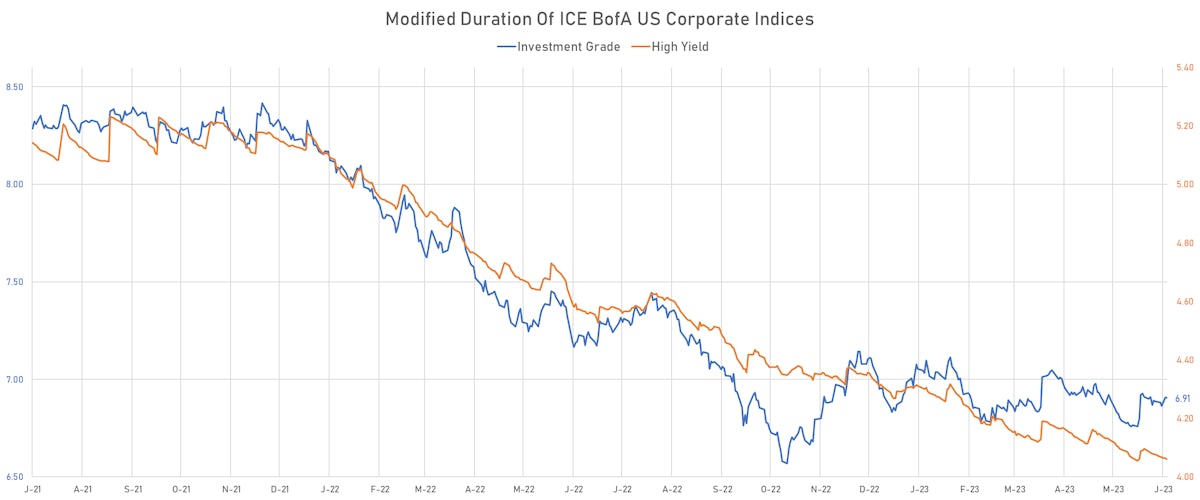

Modified Duration of ICE BofA US Corporate Indices | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

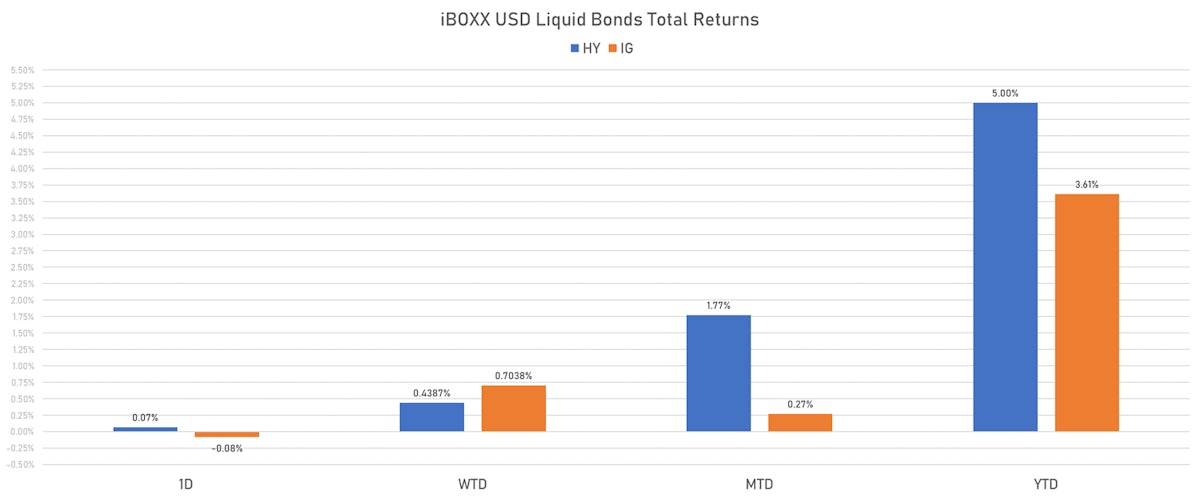

- S&P 500 Bond Index was down -0.08% today, with investment grade down -0.10% and high yield up 0.17% (YTD total return: +2.97%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.084% today (Week-to-date: 0.70%; Month-to-date: 0.27%; Year-to-date: 3.61%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.067% today (Week-to-date: 0.44%; Month-to-date: 1.77%; Year-to-date: 5.00%)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +5.6%)

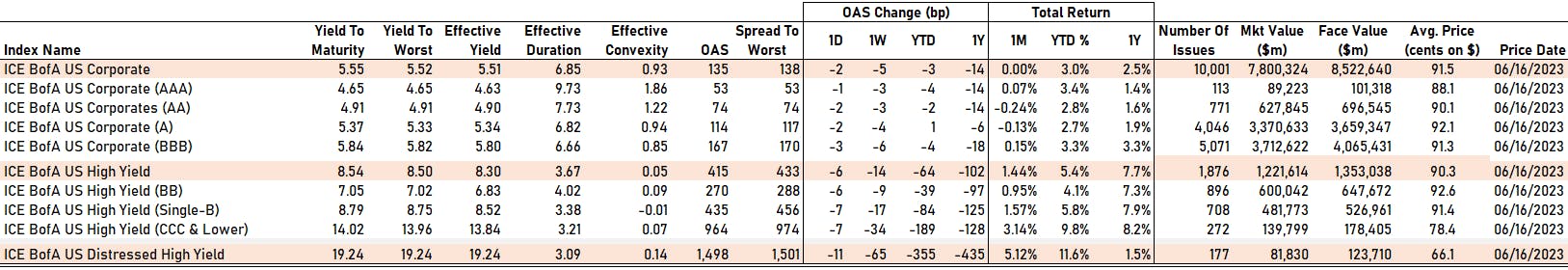

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 53 bp

- AA down by -2 bp at 74 bp

- A down by -2 bp at 114 bp

- BBB down by -3 bp at 167 bp

- BB down by -6 bp at 270 bp

- B down by -7 bp at 435 bp

- ≤ CCC down by -7 bp at 964 bp

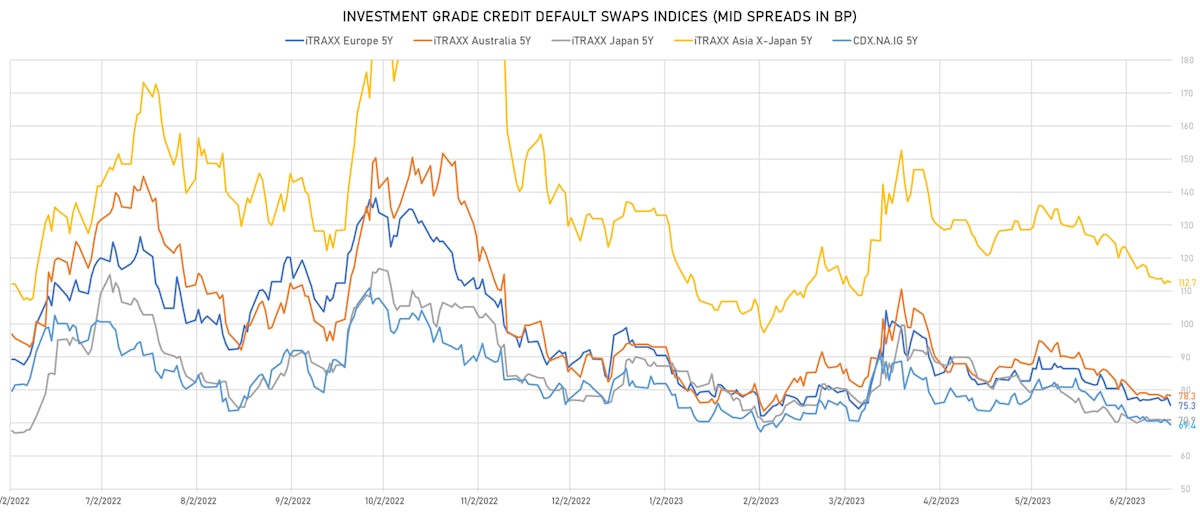

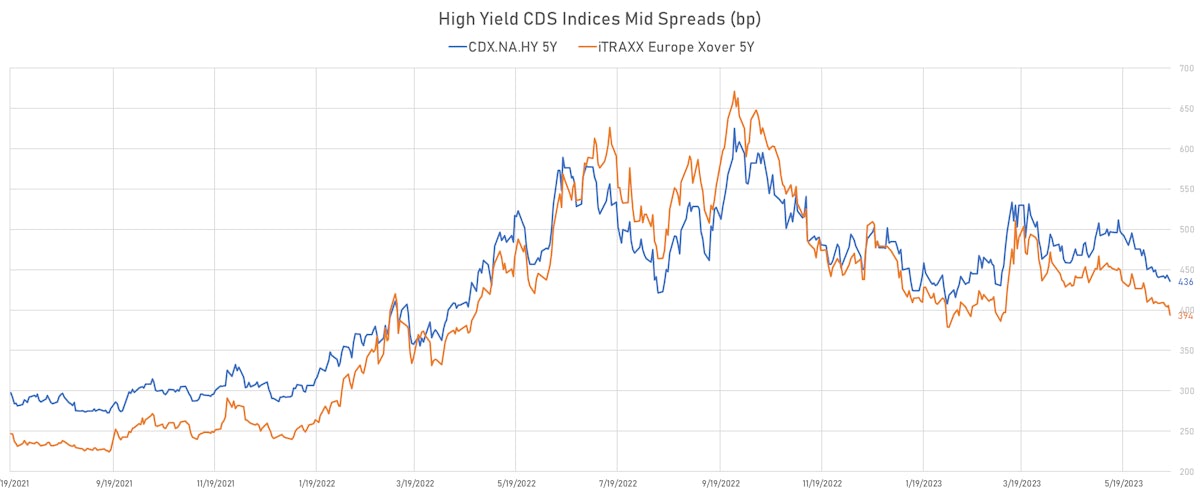

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.0 bp, now at 69bp (1W change: -1.1bp; YTD change: -12.5bp)

- Markit CDX.NA.IG 10Y down 1.0 bp, now at 109bp (1W change: -0.9bp; YTD change: -9.0bp)

- Markit CDX.NA.HY 5Y down 4.0 bp, now at 436bp (1W change: -4.8bp; YTD change: -48.8bp)

- Markit iTRAXX Europe 5Y down 2.3 bp, now at 75bp (1W change: -1.6bp; YTD change: -15.1bp)

- Markit iTRAXX Europe Crossover 5Y down 11.8 bp, now at 394bp (1W change: -14.3bp; YTD change: -80.1bp)

- Markit iTRAXX Japan 5Y unchanged at 71bp (1W change: -0.1bp; YTD change: -16.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.4 bp, now at 113bp (1W change: -1.7bp; YTD change: -20.3bp)

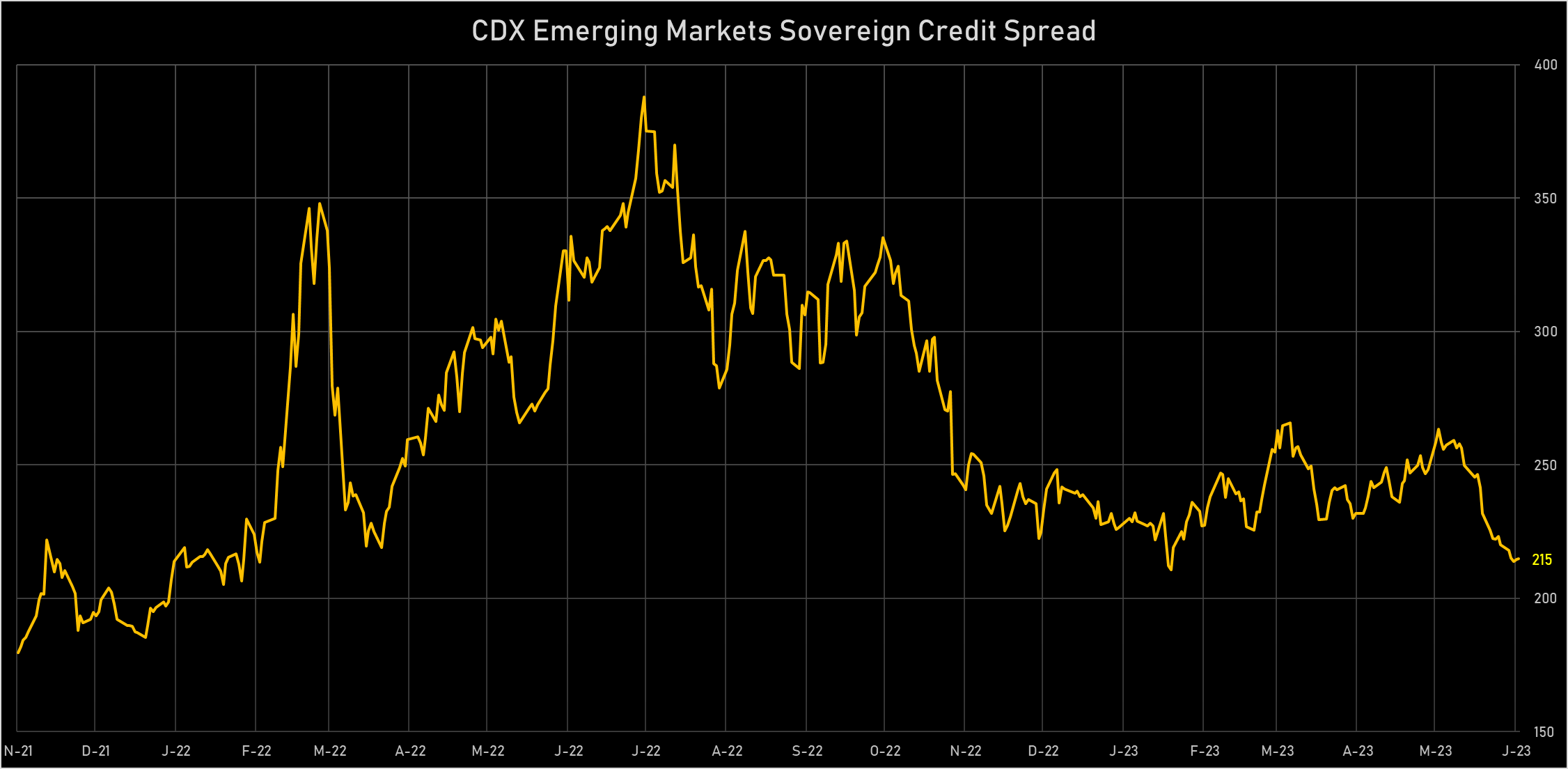

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Egypt (rated B): up 4.8 % to 1,491 bp (1Y range: 706-1,837bp)

- Saudi Arabia (rated A+): down 4.1 % to 55 bp (1Y range: 46-75bp)

- Italy (rated BBB): down 4.1 % to 93 bp (1Y range: 88-179bp)

- Malaysia (rated BBB+): down 4.3 % to 53 bp (1Y range: 54-122bp)

- Peru (rated BBB): down 4.6 % to 80 bp (1Y range: 81-171bp)

- Israel (rated A+): down 5.0 % to 57 bp (1Y range: 43-650bp)

- Brazil (rated BB-): down 5.5 % to 183 bp (1Y range: 185-328bp)

- Turkey (rated B): down 5.9 % to 471 bp (1Y range: 470-892bp)

- China (rated A+): down 5.9 % to 56 bp (1Y range: 47-132bp)

- Nigeria (rated B-): down 9.2 % to 785 bp (1Y range: 377-1,538bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Lumen Technologies Inc (Country: US; rated: NR): down 1649.8 bp to 3,601.9bp (1Y range: 195-3,602bp)

- Community Health Systems Inc (Country: US; rated: NR): down 333.4 bp to 2,179.2bp (1Y range: 1,258-4,371bp)

- Kohls Corp (Country: US; rated: Ba2): down 44.2 bp to 609.9bp (1Y range: 362-783bp)

- Carnival Corp (Country: US; rated: NR): down 40.0 bp to 554.7bp (1Y range: 534-2,117bp)

- American Airlines Group Inc (Country: US; rated: NR): down 34.5 bp to 736.3bp (1Y range: 736-1,644bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 32.7 bp to 724.9bp (1Y range: 725-1,472bp)

- Unisys Corp (Country: US; rated: B1): down 32.5 bp to 960.6bp (1Y range: 432-1,378bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 31.0 bp to 662.4bp (1Y range: 469-768bp)

- Avis Budget Group Inc (Country: US; rated: NR): down 25.5 bp to 353.8bp (1Y range: 348-591bp)

- Xerox Corp (Country: US; rated: NR): down 24.9 bp to 362.0bp (1Y range: 333-544bp)

- Transocean Inc (Country: KY; rated: Caa1): up 57.7 bp to 813.0bp (1Y range: 674-2,858bp)

- Anywhere Real Estate Group LLC (Country: US; rated: LGD4 - 68%): up 67.6 bp to 898.7bp (1Y range: 278-899bp)

- Staples Inc (Country: US; rated: B3): up 106.5 bp to 3,086.2bp (1Y range: 1,393-3,086bp)

- DISH DBS Corp (Country: US; rated: B2): up 124.3 bp to 3,226.7bp (1Y range: 1,138-3,227bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): up 1934.3 bp to 9,365.6bp (1Y range: 1,179-9,366bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Iceland Bondco PLC (Country: GB; rated: B3): down 47.3 bp to 906.9bp (1Y range: 566-1,739bp)

- Telecom Italia SpA (Country: IT; rated: NR): down 32.7 bp to 380.1bp (1Y range: 306-545bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 25.8 bp to 198.8bp (1Y range: 157-600bp)

- Ceconomy AG (Country: DE; rated: WR): down 25.5 bp to 735.4bp (1Y range: 615-1,763bp)

- Renault SA (Country: FR; rated: NR): down 22.4 bp to 275.3bp (1Y range: 236-476bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 20.0 bp to 510.3bp (1Y range: 186-510bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 18.7 bp to 259.6bp (1Y range: 236-705bp)

- ArcelorMittal SA (Country: LU; rated: WD): down 17.3 bp to 203.6bp (1Y range: 133-353bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 14.3 bp to 229.2bp (1Y range: 199-476bp)

- Air France KLM SA (Country: FR; rated: NR): down 13.8 bp to 401.3bp (1Y range: 401-990bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 13.1 bp to 456.1bp (1Y range: 379-602bp)

- TUI AG (Country: DE; rated: B2-PD): down 13.0 bp to 688.7bp (1Y range: 689-1,725bp)

- Elo SA (Country: FR; rated: ): up 14.7 bp to 197.4bp (1Y range: 83-242bp)

- ITV PLC (Country: GB; rated: WR): up 18.3 bp to 160.9bp (1Y range: 146-303bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 102.3 bp to 2,419.8bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: GLP Capital LP (Wyomissing, Pennsylvania (US)) | Coupon: 5.25% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 361841AJ8 | OAS down by 24.0 bp to 148.9 bp, with the yield to worst at 6.5% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 96.6-99.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 5.13% | Maturity: 16/6/2025 | Rating: BB | CUSIP: 345397A60 | OAS down by 25.9 bp to 169.7 bp (CDS basis: -34.1bp), with the yield to worst at 6.6% and the bond now trading up to 97.1 cents on the dollar (1Y price range: 95.3-98.9).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 5.13% | Maturity: 6/6/2027 | Rating: BB+ | CUSIP: 59001ABA9 | OAS down by 27.5 bp to 189.0 bp (CDS basis: -17.1bp), with the yield to worst at 6.0% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 93.8-98.3).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS down by 27.6 bp to 128.8 bp (CDS basis: 206.5bp), with the yield to worst at 5.6% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 97.0-102.4).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS down by 28.6 bp to 133.0 bp, with the yield to worst at 5.8% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.95% | Maturity: 6/3/2026 | Rating: BB | CUSIP: 345397C43 | OAS down by 32.6 bp to 197.1 bp (CDS basis: -36.6bp), with the yield to worst at 6.5% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 98.8-103.6).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | CUSIP: 98421MAA4 | OAS down by 39.4 bp to 262.2 bp, with the yield to worst at 7.0% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 91.8-95.6).

- Issuer: MGM Resorts International (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 15/4/2027 | Rating: B+ | CUSIP: 552953CF6 | OAS down by 39.7 bp to 220.3 bp (CDS basis: -43.0bp), with the yield to worst at 6.3% and the bond now trading up to 96.4 cents on the dollar (1Y price range: 92.6-98.0).

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS down by 45.5 bp to 291.2 bp, with the yield to worst at 7.3% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 94.8-100.8).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | CUSIP: 126458AE8 | OAS down by 48.3 bp to 271.4 bp, with the yield to worst at 6.7% and the bond now trading up to 87.6 cents on the dollar (1Y price range: 82.6-90.6).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS down by 49.0 bp to 265.0 bp (CDS basis: 1.0bp), with the yield to worst at 6.8% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 95.5-100.5).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 4.20% | Maturity: 29/10/2025 | Rating: BB+ | CUSIP: 78442PGD2 | OAS down by 49.5 bp to 278.8 bp, with the yield to worst at 7.1% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 85.1-94.3).

- Issuer: United States Cellular Corp (Chicago, Illinois (US)) | Coupon: 6.70% | Maturity: 15/12/2033 | Rating: BB | CUSIP: 911684AD0 | OAS down by 85.0 bp to 496.8 bp, with the yield to worst at 8.5% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 81.9-94.4).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 4.38% | Maturity: 15/1/2027 | Rating: BB- | CUSIP: 85571BAY1 | OAS down by 91.6 bp to 375.2 bp, with the yield to worst at 7.8% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 80.9-91.3).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 3.63% | Maturity: 15/7/2026 | Rating: BB- | CUSIP: 85571BAU9 | OAS down by 102.9 bp to 338.6 bp, with the yield to worst at 7.5% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 80.8-91.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | OAS down by 34.8 bp to 397.1 bp, with the yield to worst at 7.0% and the bond now trading up to 88.5 cents on the dollar (1Y price range: 76.5-88.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB | ISIN: XS2361255057 | OAS down by 35.4 bp to 372.3 bp, with the yield to worst at 6.7% and the bond now trading up to 83.4 cents on the dollar (1Y price range: 71.9-84.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS down by 37.3 bp to 245.0 bp (CDS basis: 0.8bp), with the yield to worst at 5.6% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 90.6-94.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS down by 37.8 bp to 512.9 bp (CDS basis: -16.1bp), with the yield to worst at 8.5% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 85.9-92.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 40.3 bp to 385.9 bp, with the yield to worst at 6.6% and the bond now trading up to 85.6 cents on the dollar (1Y price range: 74.8-85.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS down by 40.4 bp to 686.1 bp (CDS basis: -51.6bp), with the yield to worst at 9.9% and the bond now trading up to 77.9 cents on the dollar (1Y price range: 72.8-85.1).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS down by 46.5 bp to 321.3 bp, with the yield to worst at 6.0% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 82.7-94.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: B+ | ISIN: XS1824425182 | OAS down by 49.1 bp to 417.3 bp (CDS basis: 42.7bp), with the yield to worst at 7.6% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 88.9-94.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS down by 50.5 bp to 655.3 bp (CDS basis: -53.6bp), with the yield to worst at 9.7% and the bond now trading up to 82.1 cents on the dollar (1Y price range: 77.4-88.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS down by 53.0 bp to 636.0 bp (CDS basis: -74.0bp), with the yield to worst at 9.5% and the bond now trading up to 78.5 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: Samhallsbyggnadsbolaget I Norden AB (Stockholm, Sweden) | Coupon: 1.13% | Maturity: 4/9/2026 | Rating: BB- | ISIN: XS2049823680 | OAS down by 95.8 bp to 923.2 bp, with the yield to worst at 11.6% and the bond now trading up to 71.0 cents on the dollar (1Y price range: 61.2-79.3).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS down by 111.3 bp to 645.1 bp, with the yield to worst at 9.7% and the bond now trading up to 75.8 cents on the dollar (1Y price range: 65.2-79.1).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | OAS down by 149.4 bp to 605.2 bp, with the yield to worst at 9.0% and the bond now trading up to 61.9 cents on the dollar (1Y price range: 40.4-62.5).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: BB- | ISIN: XS2271332285 | OAS down by 180.4 bp to 590.4 bp, with the yield to worst at 8.6% and the bond now trading up to 65.3 cents on the dollar (1Y price range: 53.8-67.8).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: BB- | ISIN: XS2346224806 | OAS down by 181.8 bp to 544.1 bp, with the yield to worst at 8.0% and the bond now trading up to 64.4 cents on the dollar (1Y price range: 52.2-67.0).

RECENT DOMESTIC USD BOND ISSUES

- Calumet Specialty Products Partners LP (Oil and Gas | Indianapolis, Indiana, United States | Rating: CCC+): US$325m Senior Note (US131477AW17), fixed rate (9.75% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 598 bp), callable (5nc2)

- Caterpillar Financial Services Corp (Leasing | Nashville, Tennessee, United States | Rating: A): US$475m Senior Note (US14913UAC45), floating rate (SOFR + 52.0 bp) maturing on 13 June 2025, priced at 100.00, non callable

- Cox Communications Inc (Cable/Media | Atlanta, Georgia, United States | Rating: BBB): US$500m Senior Note (US224044CS42), fixed rate (5.70% coupon) maturing on 15 June 2033, priced at 99.87 (original spread of 197 bp), callable (10nc10)

- Cox Communications Inc (Cable/Media | Atlanta, Georgia, United States | Rating: BBB): US$500m Senior Note (US224044CR68), fixed rate (5.45% coupon) maturing on 15 September 2028, priced at 99.99 (original spread of 155 bp), callable (5nc5)

- Duke Energy Carolinas LLC (Utility - Other | Charlotte, North Carolina, United States | Rating: A): US$500m First & Refunding Mortgage Bond (US26442CBL72), fixed rate (5.40% coupon) maturing on 15 January 2054, priced at 99.64 (original spread of 186 bp), callable (31nc30)

- Extra Space Storage LP (Real Estate Investment Trust | Salt Lake City, Utah, United States | Rating: BBB): US$450m Senior Note (US30225VAK35), fixed rate (5.50% coupon) maturing on 1 July 2030, priced at 98.88 (original spread of 185 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EPMZ53), floating rate (FFQ + 19.0 bp) maturing on 20 June 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPNE16), fixed rate (6.38% coupon) maturing on 21 June 2038, priced at 100.00, callable (15nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$750m Bond (US3133EPNA93), floating rate (SOFR + 19.0 bp) maturing on 20 June 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPNF80), fixed rate (4.82% coupon) maturing on 23 June 2026, priced at 100.00, callable (3nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$175m Bond (US3133EPNH47), fixed rate (3.88% coupon) maturing on 21 June 2028, priced at 99.53, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EPNJ03), floating rate (SOFR + 27.0 bp) maturing on 16 June 2026, priced at 100.00, non callable

- Florida Power & Light Co (Utility - Other | Juno Beach, Florida, United States | Rating: A): US$486m Senior Note (US341081GS02), floating rate (SOFRINDX + -35.0 bp) maturing on 20 June 2073, priced at 100.00, callable (50nc30)

- Fortrea Holdings Inc (Financial - Other | Durham, North Carolina, United States | Rating: BB-): US$570m Note (US34965KAA51), fixed rate (7.50% coupon) maturing on 1 July 2030, priced at 100.00 (original spread of 363 bp), callable (7nc3)

- Global Atlantic (Fin) Co (Property and Casualty Insurance | New York City, New York, United States | Rating: BBB-): US$500m Senior Note (USU3618TAD38), fixed rate (7.95% coupon) maturing on 15 June 2033, priced at 97.83 (original spread of 450 bp), callable (10nc10)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$300m Unsecured Note (XS2482798001) zero coupon maturing on 7 July 2026, non callable

- Lumentum Hldg (Electronics | San Jose, California, United States | Rating: BB-): US$525m Bond (US55024UAG40), fixed rate (1.50% coupon) maturing on 15 December 2029, priced at 100.00, non callable, convertible

- MET Tower Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$450m Note (US58989V2F03), fixed rate (5.40% coupon) maturing on 20 June 2026, priced at 99.92 (original spread of 120 bp), non callable

- PECO Energy Co (Utility - Other | Philadelphia, Pennsylvania, United States | Rating: A+): US$575m First & Refunding Mortgage Bond (US693304BF31), fixed rate (4.90% coupon) maturing on 15 June 2033, priced at 99.80 (original spread of 120 bp), callable (10nc10)

- United Airlines Inc (Airline | Chicago, Illinois, United States | Rating: A-): US$1,320m Enhanced Equipment Trust Certificate (US90932LAJ61), fixed rate (5.80% coupon) maturing on 15 July 2037, priced at 100.00 (original spread of 203 bp), with a make whole call

RECENT INTERNATIONAL USD BOND ISSUES

- Aviation Capital Group LLC (Leasing | Newport Beach, California, Japan | Rating: BBB-): US$500m Senior Note (USU0537CAA00), fixed rate (6.38% coupon) maturing on 15 July 2030, priced at 98.87 (original spread of 273 bp), callable (7nc7)

- Bank of China Ltd (New York Branch) (Banking | New York City, New York, China (Mainland) | Rating: A+): US$500m Bond (XS2632485897), fixed rate (4.63% coupon) maturing on 26 June 2026, priced at 99.75 (original spread of 56 bp), non callable

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$140m Unsecured Note (XS2640422080), fixed rate (4.50% coupon) maturing on 26 June 2028, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): US$400m Bond (FR001400IKQ7), floating rate (SOFR3M + 101.0 bp) maturing on 16 June 2025, priced at 100.00, non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A+): US$250m Unsecured Note (XS2639074181), floating rate maturing on 8 January 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0460039000), fixed rate (4.60% coupon) maturing on 7 July 2025, priced at 100.00, non callable

- Emirates NBD Bank PJSC (Banking | Dubai, Dubai, United Arab Emirates | Rating: A): US$125m Senior Note (XS2638995394), floating rate maturing on 23 June 2025, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$250m Unsecured Note (XS2637697165), fixed rate (0.58% coupon) maturing on 16 June 2028, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$200m Unsecured Note (XS2637697249), fixed rate (4.38% coupon) maturing on 16 June 2026, priced at 100.00 (original spread of 27 bp), non callable

- HDFC Bank (Gandhinagar Branch) (Financial - Other | Gandhinagar, Gujarat, India | Rating: NR): US$150m Unsecured Note (XS2639007405), floating rate maturing on 22 June 2026, priced at 100.00, non callable

- HSBC Holdings PLC (Banking | London, United Kingdom | Rating: BBB): US$2,000m Subordinated Note (US404280DX45), floating rate maturing on 20 June 2034, priced at 100.00 (original spread of 289 bp), callable (11nc10)

- Health and Happiness (H&H) International Holdings Ltd (Food Processors | Rating: BB-): US$200m Note (XS2621755375), fixed rate (13.50% coupon) maturing on 26 June 2026, priced at 97.00, callable (3nc2)

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB+): US$1,250m Note (XS2638075700), fixed rate (6.63% coupon) maturing on 20 June 2033, priced at 99.94 (original spread of 299 bp), with a regulatory call

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB-): US$1,500m Note (XS2638076187), floating rate maturing on 20 June 2054, priced at 100.00 (original spread of 435 bp), callable (31nc30)

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): US$1,250m Depositary Receipt (US46115HBY27), fixed rate (6.63% coupon) maturing on 20 June 2033, priced at 99.94 (original spread of 290 bp), with a regulatory call

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AA-): US$1,000m Unsecured Note (XS2638999461), fixed rate (1.00% coupon) maturing on 22 June 2026, priced at 100.00, non callable

- Malayan Banking Bhd (Banking | Kuala Lumpur, Wilayah Persekutuan, Malaysia | Rating: A-): US$183m Unsecured Note (XS2639990022), floating rate maturing on 23 June 2028, priced at 100.00, non callable

- Marchesi Antinori SpA (Beverage/Bottling | San Casciano In Val Di Pesa, Firenze, Italy | Rating: NR): US$150m Bond (XS2638457064), fixed rate (4.75% coupon) maturing on 26 June 2033, priced at 100.00, non callable

- QNB Finance Ltd (Financial - Other | George Town, Qatar | Rating: NR): US$150m Unsecured Note (XS2639005029), floating rate maturing on 23 June 2025, priced at 100.00, non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): US$500m Bond (FR001400INE7), floating rate (SOFR3M + 110.0 bp) maturing on 16 June 2025, priced at 100.00, non callable

- Xinyuan Real Estate Co Ltd (Service - Other | Beijing, Beijing, China (Mainland) | Rating: NR): US$660m Bond (XS2639416754), fixed rate (1.00% coupon) maturing on 30 September 2027, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- ABANCA Corporacion Bancaria SA (Banking | Betanzos, La Coruna, Spain | Rating: BB): €500m Bond (ES0265936049), floating rate maturing on 23 September 2033, priced at 100.00 (original spread of 516 bp), callable (10nc5)

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A+): €1,000m Senior Note (XS2637963146), fixed rate (3.88% coupon) maturing on 21 December 2026, priced at 99.75 (original spread of 140 bp), non callable

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €750m Subordinated Note (XS2637967139), fixed rate (5.50% coupon) maturing on 21 September 2033, priced at 99.76 (original spread of 314 bp), callable (10nc5)

- Apollo Swedish Bidco AB (Financial - Other | Hagersten, Stockholm, Sweden | Rating: B): €480m Note (XS2637969770), floating rate (EU03MLIB + 500.0 bp) maturing on 5 July 2029, priced at 98.00, callable (6nc1)

- Argenta Spaarbank NV (Banking | Antwerp, Antwerpen, Belgium | Rating: A): €500m Covered Bond (Other) (BE6344564859), fixed rate (3.38% coupon) maturing on 22 June 2028, priced at 99.71 (original spread of 92 bp), non callable

- Autopistas del Atlantico Concesionaria Espanola SA (Transportation - Other | La Coruna, La Coruna, Spain | Rating: AA): €193m Bond (ES0211839271), fixed rate (4.40% coupon) maturing on 26 June 2030 (original spread of 204 bp), non callable

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €200m Unsecured Note (XS2521289723) zero coupon maturing on 10 July 2025, priced at 99.95, non callable

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400ITG9), fixed rate (3.38% coupon) maturing on 27 June 2033, priced at 99.88 (original spread of 92 bp), non callable

- Bankinter SA (Banking | Madrid, Madrid, Spain | Rating: AA+): €250m Cedula Hipotecaria (Covered Bond) (ES0413679566), floating rate maturing on 22 June 2031, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €500m Inhaberschuldverschreibung (DE000BLB6JZ6), fixed rate (4.25% coupon) maturing on 21 June 2027, priced at 99.74 (original spread of 173 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400INH0), fixed rate (3.36% coupon) maturing on 14 June 2033, priced at 100.00 (original spread of 104 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400INJ6), fixed rate (3.42% coupon) maturing on 14 June 2035, priced at 100.00 (original spread of 104 bp), non callable

- Daimler Truck International Finance BV (Financial - Other | Nieuwegein, Utrecht, Germany | Rating: BBB+): €500m Senior Note (XS2623221228), fixed rate (3.88% coupon) maturing on 19 June 2029, priced at 99.44 (original spread of 162 bp), with a make whole call

- Daimler Truck International Finance BV (Financial - Other | Nieuwegein, Utrecht, Germany | Rating: BBB+): €650m Senior Note (XS2623129256), fixed rate (3.88% coupon) maturing on 19 June 2026, priced at 99.82 (original spread of 126 bp), with a make whole call

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): €1,000m Senior Note (XS2637421848), fixed rate (4.75% coupon) maturing on 21 June 2030, priced at 99.79 (original spread of 237 bp), callable (7nc6)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VEV8), floating rate maturing on 6 July 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VEW6), fixed rate (3.00% coupon) maturing on 7 July 2025, priced at 100.00, non callable

- Erste Abwicklungsanstalt (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000EAA06B2), fixed rate (3.13% coupon) maturing on 22 June 2026, priced at 99.69 (original spread of 57 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A35MQ2), fixed rate (3.50% coupon) maturing on 5 July 2030, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A35XT3), fixed rate (2.85% coupon) maturing on 1 August 2026, priced at 100.00, non callable

- Flemish, Community of (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €125m Bond (BE0002953348), fixed rate (3.64% coupon) maturing on 21 June 2038, priced at 100.00, non callable

- Fluvius System Operator CVBA (Utility - Other | Melle, Oost-Vlaanderen, Belgium | Rating: A-): €300m Bond (BE0002952332), fixed rate (4.00% coupon) maturing on 28 June 2027, priced at 101.63, non callable

- Germany, Federal Republic of (Government) (Sovereign | Berlin, Berlin, Germany | Rating: AAA): €4,500m Bundesanleihe (DE0001030757), fixed rate (1.80% coupon) maturing on 15 August 2053, priced at 84.65, non callable

- Jpmorgan Chase Financial Company LLC (Financial - Other | New York City, New York, United States | Rating: NR): €400m Unsecured Note (XS2625196279), fixed rate (1.50% coupon) maturing on 23 May 2028, priced at 100.00, non callable

- La Banque Postale Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: AAA): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR001400ILH4), floating rate maturing on 20 June 2029, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DGE8), fixed rate (3.20% coupon) maturing on 19 July 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DGA6), fixed rate (2.80% coupon) maturing on 19 July 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DGD0), fixed rate (3.15% coupon) maturing on 19 July 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DGC2), fixed rate (3.15% coupon) maturing on 20 July 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DG96), fixed rate (2.90% coupon) maturing on 20 July 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DGB4), fixed rate (3.10% coupon) maturing on 21 July 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DG88), fixed rate (2.90% coupon) maturing on 21 July 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4DGF5), fixed rate (3.20% coupon) maturing on 19 July 2029, priced at 100.00, non callable

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): €500m Unsecured Note (XS2639034631), fixed rate (0.95% coupon) maturing on 21 May 2031, priced at 100.00, non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €120m Senior Note (XS2639582928), fixed rate (4.00% coupon) maturing on 23 June 2033, non callable

- Muenchener Hypothekenbank eG (Banking | Muenchen, Bayern, Germany | Rating: AA-): €500m Hypothekenpfandbrief (Covered Bond) (DE000MHB35J0), fixed rate (3.00% coupon) maturing on 14 August 2030, priced at 99.56 (original spread of 79 bp), non callable

- Saxony-Anhalt, State of (Official and Muni | Magdeburg, Sachsen-Anhalt, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000A351SC5), fixed rate (2.95% coupon) maturing on 20 June 2033, priced at 99.97 (original spread of 61 bp), non callable

- Stellantis NV (Automotive Manufacturer | Hoofddorp, Noord-Holland, Netherlands | Rating: BBB): €1,250m Senior Note (XS2634690114), fixed rate (4.25% coupon) maturing on 16 June 2031, priced at 99.30 (original spread of 203 bp), callable (8nc8)

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €300m Inhaberschuldverschreibung (DE000A3LKBD0), floating rate (EU03MLIB + 100.0 bp) maturing on 21 January 2026, priced at 100.00, non callable

- UniCredit Bank Czech Republic and Slovakia as (Banking | Praha, Praha, Italy | Rating: AA): €500m Covered Bond (Other) (XS2637445276), fixed rate (3.75% coupon) maturing on 20 June 2028, priced at 99.57 (original spread of 144 bp), non callable

- Wendel SE (Financial - Other | Paris, Ile-De-France, France | Rating: BBB): €300m Bond (FR001400ION6), fixed rate (4.50% coupon) maturing on 19 June 2030, priced at 99.40 (original spread of 227 bp), callable (7nc7)

RECENT LOANS

- Agilent Technologies Inc (United States of America | BBB+), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/28 and initial pricing is set at Term SOFR +79.5bp

- Aircraft Leasing Co (Saudi Arabia), signed a US$ 850m Term Loan, to be used for general corporate purposes, aircraft financing. It matures on 06/07/28.

- Alumina Ltd (Australia | BBB-), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/09/26.

- Avista Corp (United States of America | A-), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/08/28 and initial pricing is set at Term SOFR +80.0bp

- Axilone Plastique SASU (France), signed a € 235m Term Loan B, to be used for general corporate purposes. It matures on 01/08/28 and initial pricing is set at EURIBOR +475.0bp

- Bayerische Motoren Werke AG (Germany | A), signed a € 8,000m Revolving Credit Facility, to be used for general corporate purposes.

- Blackstone Private Credit Fund (United States of America | BBB-), signed a US$ 390m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 06/09/28 and initial pricing is set at Term SOFR +175.0bp

- Blackstone Private Credit Fund (United States of America | BBB-), signed a US$ 783m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/09/28.

- Bread Financial Holdings Inc (United States of America), signed a US$ 575m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 06/07/26 and initial pricing is set at Term SOFR +275.0bp

- Bread Financial Holdings Inc (United States of America), signed a US$ 700m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/26 and initial pricing is set at Term SOFR +275.0bp

- Cardenas Markets LLC (United States of America), signed a US$ 460m Term Loan B, to be used for acquisition financing. It matures on 08/01/29 and initial pricing is set at Term SOFR +675.0bp

- Cleveland-Cliffs Inc (United States of America | B), signed a US$ 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/09/28 and initial pricing is set at Term SOFR +150.0bp

- Cop Home Svcs Hldg Inc (United States of America), signed a US$ 150m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 12/31/27 and initial pricing is set at Term SOFR +600.0bp

- Denizbank AS (Turkey), signed a US$ 297m Term Loan, to be used for general corporate purposes. It matures on 06/10/24.

- Distn Solutions Grp Inc (United States of America), signed a US$ 305m Term Loan A, to be used for acquisition financing. It matures on 04/01/27 and initial pricing is set at Term SOFR +250.0bp

- EISA Holding Co Ltd (Hong Kong), signed a US$ 140m Revolving Credit Facility, to be used for general corporate purposes, working capital. It matures on 04/14/25 and initial pricing is set at Term SOFR +170.0bp

- EOG Resources Inc (United States of America | A-), signed a US$ 1,900m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/28 and initial pricing is set at Term SOFR +69.0bp

- Freepoint Commodities LLC (United States of America), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/08/26 and initial pricing is set at Term SOFR +171.0bp

- Freepoint Commodities LLC (United States of America), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/08/24 and initial pricing is set at Term SOFR +111.0bp

- Freepoint Commodities LLC (United States of America), signed a US$ 125m Term Loan, to be used for general corporate purposes, working capital. It matures on 06/09/26.

- Gasverbund Mittelland AG (Sweden), signed a € 250m Term Loan, to be used for general corporate purposes, capital expenditures.

- Graco Inc (United States of America), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/25/26 and initial pricing is set at Term SOFR +187.5bp

- Hotelbeds Group SL (Spain), signed a € 334m Term Loan B, to be used for general corporate purposes. It matures on 09/16/28 and initial pricing is set at EURIBOR +500.0bp

- Insulet Corp (United States of America | B+), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/09/28 and initial pricing is set at Term SOFR +325.0bp

- International Paper Co (United States of America | BBB), signed a US$ 1,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/28 and initial pricing is set at Term SOFR +91.0bp

- J Lohr Winery Corp (United States of America), signed a US$ 120m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/28 and initial pricing is set at Term SOFR +150.0bp

- Jackson Family Wines Inc (United States of America), signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/08/28 and initial pricing is set at Term SOFR +162.5bp

- Mauritius Commercial Bank Ltd (Mauritius), signed a US$ 500m Term Loan, to be used for general corporate purposes. It matures on 06/08/26.

- McCormick & Co Inc (United States of America | BBB), signed a US$ 500m 364d Revolver, to be used for general corporate purposes. It matures on 06/06/24 and initial pricing is set at Term SOFR +112.5bp

- PayPal Holdings Inc (United States of America | A-), signed a US$ 3,800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/28 and initial pricing is set at Term SOFR +75.0bp

- Republic Of Indonesia (Indonesia | BBB), signed a € 2,264m Term Loan, to be used for general corporate purposes. It matures on 06/10/36.

- Smile Doctors LLC (United States of America), signed a US$ 200m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 12/23/28 and initial pricing is set at Term SOFR +590.0bp

- Summerhill City Village LLC (United States of America), signed a US$ 102m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/08/25 and initial pricing is set at Term SOFR +365.0bp

- Summerhill City Village LLC (United States of America), signed a US$ 114m Term Loan, to be used for general corporate purposes

- real estate/ppty acq. It matures on 06/08/26 and initial pricing is set at Term SOFR +365.0bp

- Us Farathane Llc (United States of America), signed a US$ 103m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/07/23 and initial pricing is set at Term SOFR +175.0bp

- Virginia Gas (South Africa), signed a US$ 750m Term Loan, to be used for project finance.

- Vivo Energy Investments Bv (Netherlands | BB+), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes, acquisition financing. It matures on 06/08/26.

- Vivo Energy Investments Bv (Netherlands | BB+), signed a US$ 400m Term Loan, to be used for general corporate purposes, acquisition financing. It matures on 06/08/28.

RECENT STRUCTURED CREDIT

- Allo Issuer Series 2023-1 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 551 m. Highest-rated tranche offering a yield to maturity of 6.61%, and the lowest-rated tranche a yield to maturity of 12.18%. Bookrunners: Morgan Stanley International Ltd, RBC Capital Markets, Bank of America Merrill Lynch, TD Securities (USA) LLC

- Ready Capital Mortgage Financing 2023-Fl12 issued a floating-rate CLO in 6 tranches, for a total of US$ 556 m. Highest-rated tranche offering a spread over the floating rate of 234bp, and the lowest-rated tranche a spread of 455bp. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc, Atlas SP Partners LP

- Santander Bank Auto Credit-Linked Notes Series 2023-A issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 116 m. Highest-rated tranche offering a coupon of 6.03%, and the lowest-rated tranche a yield to maturity of 13.75%. Bookrunners: JP Morgan & Co Inc, Santander Investment Securities Inc