Credit

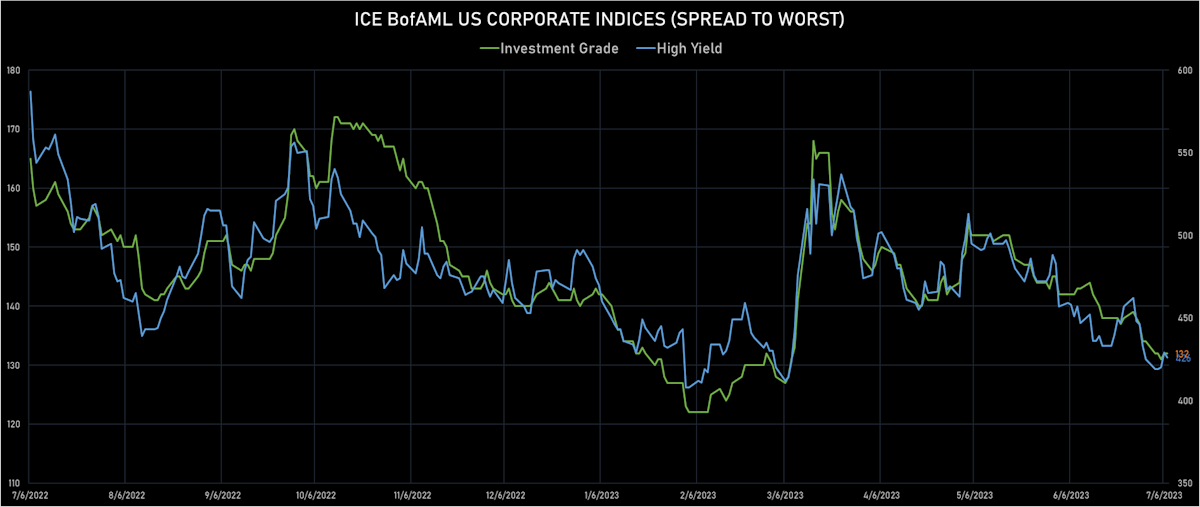

Spreads Mixed This Week In The US Credit Complex, With Cash Outperforming Synthetics

Fairly quiet week of USD corporate bond issuance (IFR data): 17 tranches for US$12.8bn in IG (2023 YTD volume US$728bn vs 2022 YTD US$750bn), none in HY(2023 YTD volume US$94bn vs 2022 YTD US$68bn)

Published ET

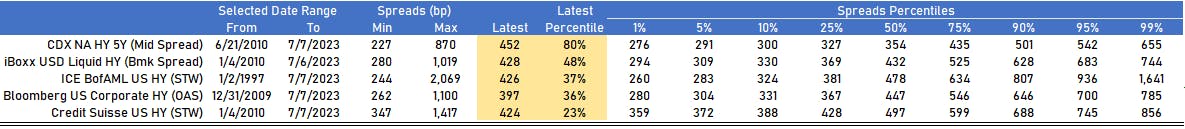

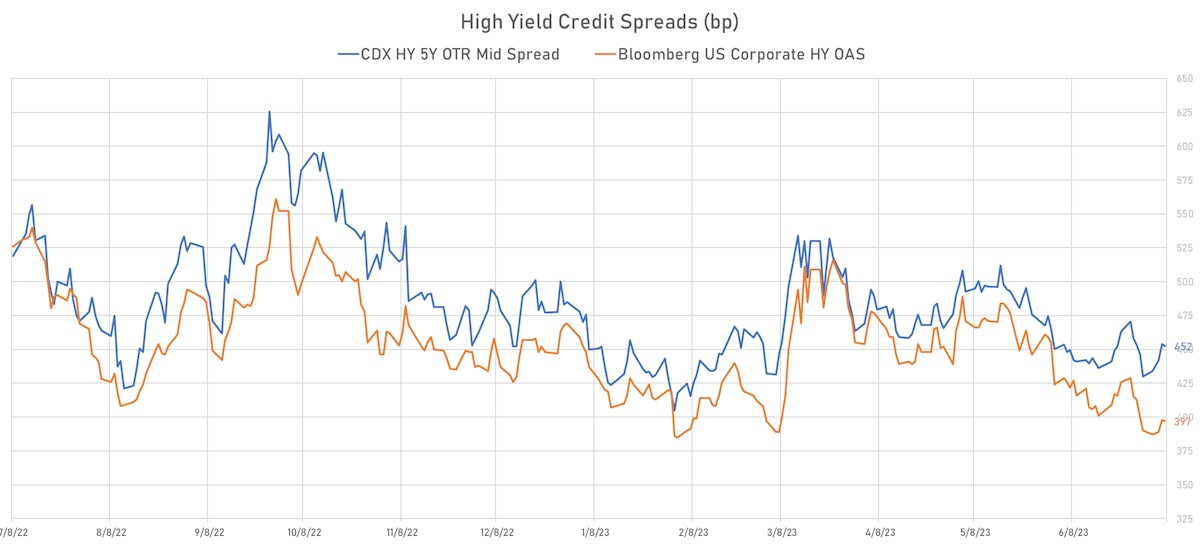

CDX HY 5Y Mid Spread vs Bloomberg US HY OAS | Sources: phipost.com, Refinitiv, FactSet data

DAILY SUMMARY

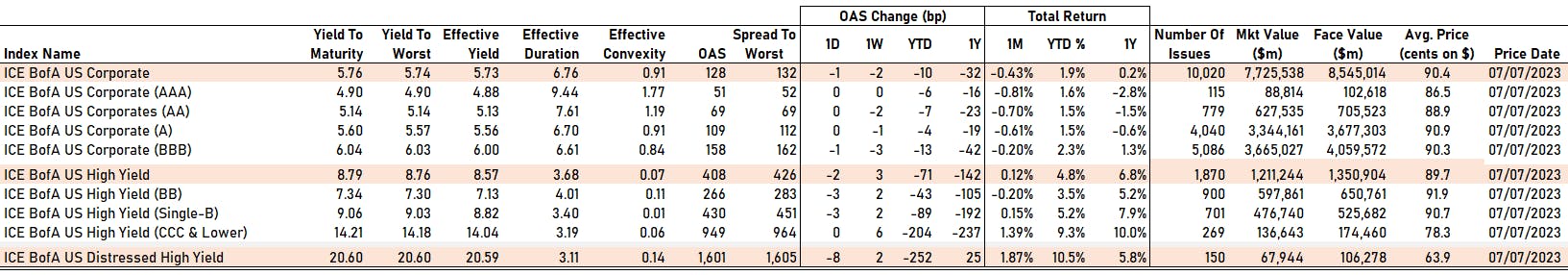

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.07% and high yield up 0.11% (YTD total return: +1.96%)

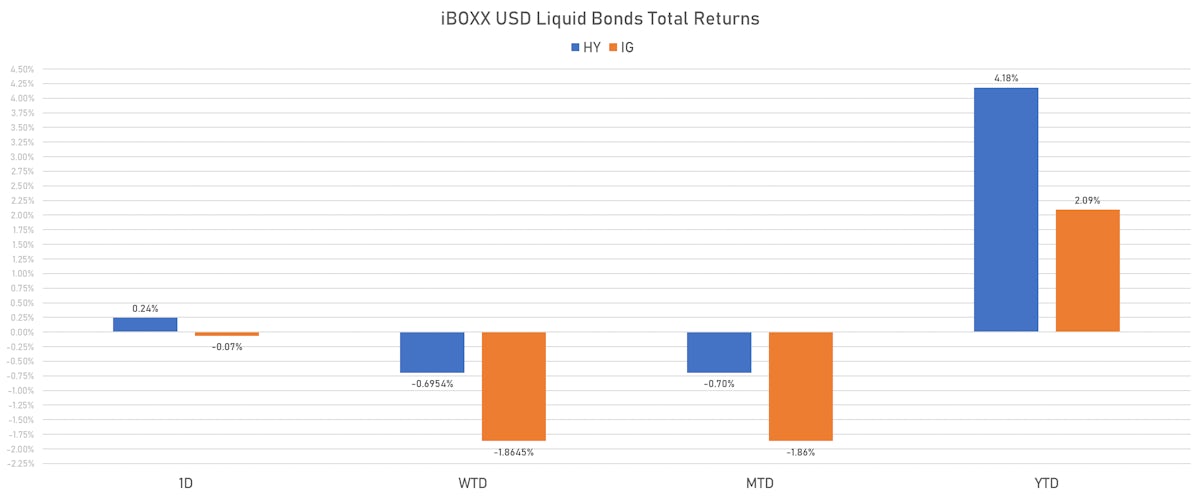

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.066% today (Week-to-date: -1.86%; Month-to-date: -1.86%; Year-to-date: 2.09%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.242% today (Week-to-date: -0.70%; Month-to-date: -0.70%; Year-to-date: 4.18%)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: +6.8%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 51 bp

- AA unchanged at 69 bp

- A unchanged at 109 bp

- BBB down by -1 bp at 158 bp

- BB down by -3 bp at 266 bp

- B down by -3 bp at 430 bp

- ≤ CCC unchanged at 949 bp

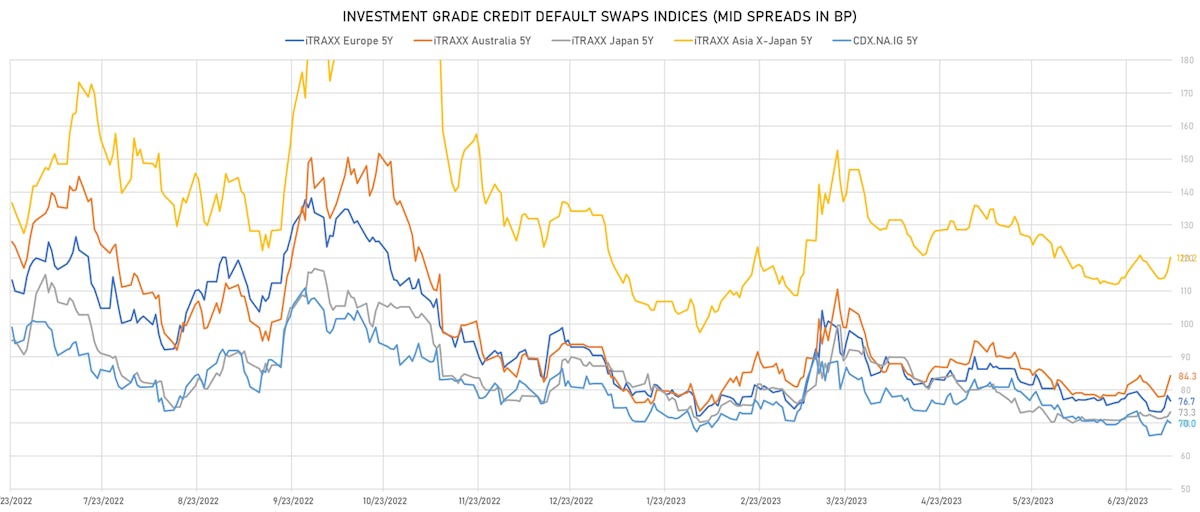

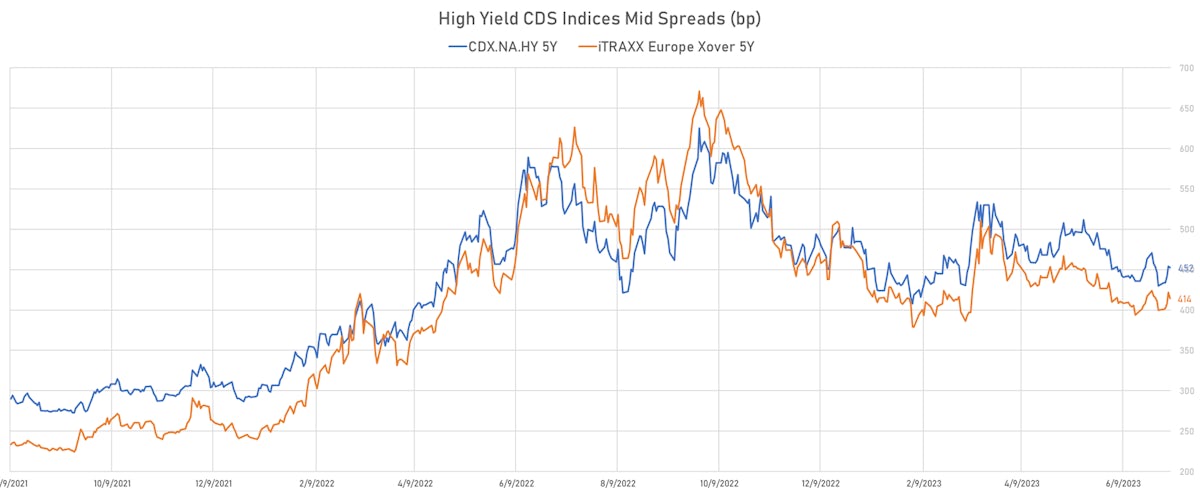

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 70bp (1W change: +3.9bp; YTD change: -11.9bp)

- Markit CDX.NA.IG 10Y down 1.4 bp, now at 110bp (1W change: +3.5bp; YTD change: -8.2bp)

- Markit CDX.NA.HY 5Y down 1.7 bp, now at 452bp (1W change: +22.7bp; YTD change: -32.5bp)

- Markit iTRAXX Europe 5Y down 1.6bp, now at 77bp (1W change: +2.9bp; YTD change: -13.7bp)

- Markit iTRAXX Europe Crossover 5Y down 7.8 bp, now at 414bp (1W change: +14.3bp; YTD change: -59.9bp)

- Markit iTRAXX Japan 5Y up 1.4 bp, now at 73bp (1W change: +0.8bp; YTD change: -13.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 4.3 bp, now at 120bp (1W change: +2.7bp; YTD change: -12.8bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Malaysia (rated BBB+): up 9.3 % to 57 bp (1Y range: 51-122bp)

- China (rated A+): up 8.9 % to 64 bp (1Y range: 47-132bp)

- Chile (rated A-): up 6.0 % to 76 bp (1Y range: 70-174bp)

- Philippines (rated BBB): up 5.1% to 84 bp (1Y range: 76-153bp)

- Thailand (rated BBB+): up 5.0 % to 52 bp (1Y range: 42-95bp)

- Indonesia (rated BBB): up 4.5 % to 88 bp (1Y range: 76-166bp)

- Vietnam (rated BB): up 3.4 % to 114 bp (1Y range: 103-181bp)

- Colombia (rated BB+): up 3.1 % to 244 bp (1Y range: 221-394bp)

- Mexico (rated BBB-): up 3.0 % to 106 bp (1Y range: 100-205bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: CCC+): down 4789.3 bp to 9,564.6bp (1Y range: 1,179-9,565bp)

- DISH DBS Corp (Country: US; rated: B2): down 93.9 bp to 2,948.5bp (1Y range: 1,138-3,084bp)

- Sabre Holdings Corp (Country: US; rated: B3): down 51.3 bp to 1,788.1bp (1Y range: 548-1,788bp)

- Transocean Inc (Country: KY; rated: Caa1): down 41.2 bp to 768.2bp (1Y range: 673-2,858bp)

- Community Health Systems Inc (Country: US; rated: NR): down 28.7 bp to 2,390.7bp (1Y range: 1,258-4,371bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 13.1 bp to 694.2bp (1Y range: 694-1,472bp)

- MBIA Inc (Country: US; rated: NR): up 11.3 bp to 423.0bp (1Y range: 220-534bp)

- KB Home (Country: US; rated: NR): up 11.8 bp to 170.7bp (1Y range: 163-473bp)

- Ally Financial Inc (Country: US; rated: A2): up 16.5 bp to 262.2bp (1Y range: 219-411bp)

- Newell Brands Inc (Country: US; rated: Ba1): up 16.7 bp to 488.6bp (1Y range: 83-489bp)

- United States Steel Corp (Country: US; rated: BBB-): up 18.6 bp to 409.3bp (1Y range: 351-769bp)

- Anywhere Real Estate Group LLC (Country: US; rated: LGD4 - 68%): up 22.7 bp to 896.4bp (1Y range: 278-896bp)

- Gap Inc (Country: US; rated: NR): up 31.3 bp to 561.8bp (1Y range: 429-819bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 32.3 bp to 811.2bp (1Y range: 511-1,046bp)

- Lumen Technologies Inc (Country: US; rated: NR): up 142.9 bp to 4,425.2bp (1Y range: 195-4,425bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 26.6 bp to 551.5bp (1Y range: 370-758bp)

- Renault SA (Country: FR; rated: NR): up 9.4 bp to 273.6bp (1Y range: 236-476bp)

- Alstom SA (Country: FR; rated: P-3): up 9.9 bp to 133.2bp (1Y range: 122-313bp)

- Deutsche Lufthansa AG (Country: DE; rated: NR): up 10.4 bp to 218.5bp (1Y range: 183-606bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): up 12.9 bp to 250.2bp (1Y range: 227-523bp)

- Ziggo Bond Company BV (Country: NL; rated: WR): up 13.6 bp to 524.3bp (1Y range: 385-584bp)

- Telecom Italia SpA (Country: IT; rated: NR): up 15.2 bp to 386.7bp (1Y range: 306-545bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): up 16.7 bp to 596.7bp (1Y range: 186-597bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 20.7 bp to 2,318.5bp (1Y range: 1,286-2,910bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 23.4 bp to 477.9bp (1Y range: 379-602bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 25.8 bp to 479.8bp (1Y range: 280-496bp)

- Novafives SAS (Country: FR; rated: Caa1): up 34.2 bp to 602.5bp (1Y range: 603-2,936bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 41.0 bp to 783.2bp (1Y range: 566-1,739bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 47.1 bp to 764.7bp (1Y range: 644-1,254bp)

- Altice Finco SA (Country: LU; rated: Caa2): up 199.2 bp to 1,348.0bp (1Y range: 401-1,348bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Hughes Satellite Systems Corp (Englewood, Colorado (US)) | Coupon: 6.63% | Maturity: 1/8/2026 | Rating: B | CUSIP: 444454AF9 | OAS up by 185.4 bp to 642.4 bp, with the yield to worst at 10.3% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 87.0-97.8).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS up by 89.6 bp to 166.6 bp (CDS basis: -104.5bp), with the yield to worst at 6.3% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 97.1-100.3).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS up by 84.2 bp to 250.6 bp (CDS basis: -28.5bp), with the yield to worst at 6.8% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 84.1 bp to 186.3 bp (CDS basis: -189.7bp), with the yield to worst at 7.1% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 91.4-95.0).

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS up by 68.4 bp to 317.5 bp, with the yield to worst at 7.5% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 94.8-100.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | CUSIP: 02376RAE2 | OAS up by 64.1 bp to 250.9 bp, with the yield to worst at 6.9% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 85.0-95.4).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 501797AU8 | OAS up by 56.4 bp to 173.1 bp, with the yield to worst at 6.4% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 105.0-108.0).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS up by 55.1 bp to 149.3 bp, with the yield to worst at 5.9% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 96.0-98.8).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 81725WAJ2 | OAS up by 37.9 bp to 168.9 bp, with the yield to worst at 6.1% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 7.38% | Maturity: 15/1/2026 | Rating: BB | CUSIP: 247361ZZ4 | OAS up by 24.2 bp to 79.1 bp (CDS basis: -28.3bp), with the yield to worst at 5.7% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 101.8-105.9).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS down by 16.8 bp to 67.5 bp (CDS basis: -57.0bp), with the yield to worst at 5.6% and the bond now trading up to 90.4 cents on the dollar (1Y price range: 88.0-92.6).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.25% | Maturity: 1/9/2030 | Rating: BB+ | CUSIP: 337932AP2 | OAS down by 26.0 bp to 125.7 bp (CDS basis: -64.3bp), with the yield to worst at 5.4% and the bond now trading up to 80.8 cents on the dollar (1Y price range: 78.2-84.0).

- Issuer: GLP Capital LP (Wyomissing, Pennsylvania (US)) | Coupon: 5.25% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 361841AJ8 | OAS down by 31.8 bp to 110.9 bp, with the yield to worst at 6.4% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 96.6-99.7).

- Issuer: GLP Capital LP (Wyomissing, Pennsylvania (US)) | Coupon: 5.38% | Maturity: 15/4/2026 | Rating: BB+ | CUSIP: 361841AH2 | OAS down by 43.8 bp to 126.7 bp, with the yield to worst at 6.3% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 94.7-100.7).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS down by 61.7 bp to 46.6 bp (CDS basis: -13.0bp), with the yield to worst at 5.3% and the bond now trading up to 99.4 cents on the dollar (1Y price range: 97.3-100.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS up by 11.5 bp to 211.7 bp (CDS basis: 6.8bp), with the yield to worst at 5.7% and the bond now trading down to 93.9 cents on the dollar (1Y price range: 92.5-95.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | OAS up by 9.8 bp to 382.6 bp, with the yield to worst at 7.1% and the bond now trading down to 76.2 cents on the dollar (1Y price range: 73.9-79.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 9.4 bp to 242.9 bp (CDS basis: 16.8bp), with the yield to worst at 5.9% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 92.1-96.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS up by 6.6 bp to 336.2 bp, with the yield to worst at 6.6% and the bond now trading down to 86.1 cents on the dollar (1Y price range: 76.1-88.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS down by 5.6 bp to 629.7 bp (CDS basis: -46.6bp), with the yield to worst at 9.6% and the bond now trading up to 82.4 cents on the dollar (1Y price range: 77.4-88.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS down by 6.1 bp to 605.3 bp (CDS basis: -63.4bp), with the yield to worst at 9.4% and the bond now trading up to 79.0 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 0.88% | Maturity: 15/7/2026 | Rating: BB+ | ISIN: XS2365097455 | OAS down by 6.2 bp to 92.7 bp, with the yield to worst at 4.5% and the bond now trading up to 89.7 cents on the dollar (1Y price range: 86.5-90.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.00% | Maturity: 20/7/2026 | Rating: BB+ | ISIN: XS2506285365 | OAS down by 6.8 bp to 140.8 bp, with the yield to worst at 5.0% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 92.6-97.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | OAS down by 8.0 bp to 120.0 bp (CDS basis: 35.0bp), with the yield to worst at 4.7% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 89.8-94.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: B+ | ISIN: XS0214965963 | OAS down by 9.7 bp to 432.9 bp (CDS basis: 58.9bp), with the yield to worst at 6.9% and the bond now trading up to 75.7 cents on the dollar (1Y price range: 72.4-83.0).

- Issuer: Samhallsbyggnadsbolaget I Norden AB (Stockholm, Sweden) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS down by 10.7 bp to 662.9 bp (CDS basis: -45.0bp), with the yield to worst at 9.9% and the bond now trading up to 78.1 cents on the dollar (1Y price range: 72.8-85.1).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | OAS down by 15.4 bp to 394.5 bp, with the yield to worst at 7.2% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 76.5-88.6).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS down by 25.0 bp to 250.4 bp, with the yield to worst at 6.3% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 97.6-102.6).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 2.25% | Maturity: 13/7/2027 | Rating: BB+ | ISIN: FR0013422623 | OAS down by 43.7 bp to 355.5 bp, with the yield to worst at 6.7% and the bond now trading up to 83.6 cents on the dollar (1Y price range: 81.9-89.0).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: BB- | ISIN: XS2271332285 | OAS down by 68.8 bp to 723.5 bp, with the yield to worst at 10.1% and the bond now trading up to 60.8 cents on the dollar (1Y price range: 53.8-67.8).

RECENT DOMESTIC USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$350m Bond (US3133EPPR01), fixed rate (4.63% coupon) maturing on 10 April 2026, priced at 99.69 (original spread of 12 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPPQ28), floating rate (FFQ + 18.0 bp) maturing on 7 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,000m Bond (US3130AWLH13), floating rate (SOFR + 16.0 bp) maturing on 10 July 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$315m Unsecured Note (US3134GYW653), fixed rate (5.98% coupon) maturing on 17 July 2025, priced at 100.00 (original spread of 118 bp), callable (2nc1m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$415m Unsecured Note (US3134GYWP34), fixed rate (6.07% coupon) maturing on 18 July 2025, priced at 100.00, callable (2nc1m)

- International Finance Corp (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$2,000m Senior Note (US45950KDD90), fixed rate (4.50% coupon) maturing on 13 July 2028, priced at 99.89 (original spread of 13 bp), non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$500m Senior Note (US24422EXA27), floating rate (SOFR + 50.0 bp) maturing on 3 July 2025, priced at 100.00, non callable

RECENT INTERNATIONAL USD BOND ISSUES

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$800m Senior Note (US02665WEM91), fixed rate (5.13% coupon) maturing on 7 July 2028, priced at 99.96 (original spread of 91 bp), with a make whole call

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$950m Senior Note (US02665WEK36), fixed rate (5.25% coupon) maturing on 7 July 2026, priced at 99.88 (original spread of 70 bp), with a make whole call

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$244m Unsecured Note (XS2649537664), fixed rate (7.75% coupon) maturing on 18 April 2035, priced at 100.00, non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): US$1,400m Note (US06675FBA49), fixed rate (5.90% coupon) maturing on 13 July 2026, priced at 100.00 (original spread of 130 bp), with a regulatory call

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): US$750m Note (US06675FBB22), fixed rate (5.79% coupon) maturing on 13 July 2028, priced at 100.00 (original spread of 155 bp), with a regulatory call

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): US$350m Note (USF0803NAF99), floating rate (SOFRINDX + 140.0 bp) maturing on 13 July 2026, priced at 100.00, with a regulatory call

- Deutsche Bank AG (New York Branch) (Banking | New York City, New York, Germany | Rating: BBB-): US$1,250m Note (US25160PAN78), floating rate maturing on 13 July 2027, priced at 100.00 (original spread of 224 bp), callable (4nc3)

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$120m Unsecured Note (XS2649262461), fixed rate (4.86% coupon) maturing on 12 July 2026, priced at 100.00 (original spread of 42 bp), non callable

- Hubei New Tongdu Urban Investment Development Group Co Ltd (Financial - Other | Huangshi, Hubei, China (Mainland) | Rating: NR): US$209m Bond (XS2599145401), fixed rate (7.50% coupon) maturing on 10 July 2026, priced at 100.00, non callable

- PhosAgro PAO (Chemicals | Moscow, Moscow, Russia | Rating: NR): US$500m Bond (RU000A106G56), fixed rate (2.60% coupon) maturing on 16 September 2028, priced at 100.00, non callable

- Powerlong Real Estate Holdings Ltd (Service - Other | Shanghai, Shanghai | Rating: NR): US$401m Note (XS2647488878), fixed rate (6.95% coupon) maturing on 6 December 2025, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Senningerberg, Netherlands | Rating: NR): US$200m Unsecured Note (XS2649714974) zero coupon maturing on 18 August 2026, priced at 100.00, non callable

- Toyota Motor Corp (Automotive Manufacturer | Toyota-Shi, Aichi-Ken, Japan | Rating: A+): US$500m Senior Note (US892331AP43), fixed rate (5.28% coupon) maturing on 13 July 2026, priced at 100.00 (original spread of 58 bp), callable (3nc3)

- Toyota Motor Corp (Automotive Manufacturer | Toyota-Shi, Aichi-Ken, Japan | Rating: A+): US$500m Senior Note (US892331AR09), fixed rate (5.12% coupon) maturing on 13 July 2033, priced at 100.00 (original spread of 108 bp), callable (10nc10)

- Toyota Motor Corp (Automotive Manufacturer | Toyota-Shi, Aichi-Ken, Japan | Rating: A+): US$500m Senior Note (US892331AQ26), fixed rate (5.12% coupon) maturing on 13 July 2028, priced at 100.00 (original spread of 75 bp), callable (5nc5)

RECENT EURO BOND ISSUES

- Aeroporti di Roma SpA (Airline | Ciampino, Roma, Italy | Rating: BBB): €400m Senior Note (XS2644240975), fixed rate (4.88% coupon) maturing on 10 July 2033, priced at 99.12 (original spread of 256 bp), callable (10nc10)

- Austria, Republic of (Government) (Sovereign | Wien, Wien, Austria | Rating: AA+): €107m Senior Note (XS2648467145) zero coupon maturing on 30 June 2027, priced at 90.33, non callable

- Avis Budget Finance PLC (Financial - Other | Saint Helier, United States | Rating: NR): €400m Senior Note (XS2648489388), fixed rate (7.25% coupon) maturing on 31 July 2030, priced at 100.00 (original spread of 486 bp), callable (7nc3)

- BMW Finance NV (Financial - Other | Rijswijk, Zuid-Holland, Germany | Rating: AAA): €300m Senior Note (XS2649033359), floating rate (EU03MLIB + 20.0 bp) maturing on 11 July 2025, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000BLB6J02), fixed rate (3.50% coupon) maturing on 11 January 2027, priced at 99.69 (original spread of 79 bp), non callable

- Cirsa Finance International SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €650m Bill (XS2649696890), floating rate maturing on 31 July 2028, priced at 100.00, non callable

- Cirsa Finance International SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €650m Bond (XS2649697278), floating rate maturing on 31 July 2028, priced at 100.00, non callable

- Cirsa Finance International SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €650m Bond (XS2649695736) maturing on 31 July 2028, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €300m Bond (IT0005552614), fixed rate (3.75% coupon) maturing on 27 July 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €200m Bond (IT0005552606), fixed rate (3.00% coupon) maturing on 27 July 2025, priced at 100.00, non callable

- Credit Agricole Public Sector SCF SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: AAA): €500m Obligation Fonciere (Covered Bond) (FR001400J4X8), fixed rate (3.75% coupon) maturing on 13 July 2026, priced at 99.88 (original spread of 81 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C631), fixed rate (3.10% coupon) maturing on 1 August 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C649), fixed rate (3.40% coupon) maturing on 31 July 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VFH4), floating rate maturing on 10 July 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VFJ0), floating rate maturing on 10 July 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VFK8), fixed rate (3.80% coupon) maturing on 3 August 2028, priced at 100.00 (original spread of 121 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Note (XS2648075658), floating rate (EU03MLIB + 50.0 bp) maturing on 11 July 2025, priced at 100.00, non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: BBB+): €500m Hypothekenpfandbrief (Covered Bond) (DE000A31RJS7), fixed rate (3.63% coupon) maturing on 13 October 2026, priced at 99.65 (original spread of 84 bp), non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: AA-): €3,000m Senior Note (EU000A2SCAJ7), fixed rate (3.00% coupon) maturing on 10 July 2030, priced at 99.31 (original spread of 70 bp), non callable

- Green Bidco S A (Financial - Other | Madrid, Madrid | Rating: NR): €270m Note (XS2647351142), fixed rate (10.25% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 762 bp), callable (5nc2)

- HT Troplast GmbH (Chemicals | Berlin, Berlin, Germany | Rating: B): €380m Note (XS2649707929), fixed rate (9.38% coupon) maturing on 15 July 2028, priced at 100.00, callable (5nc2)

- Investitionsbank Berlin (Banking | Berlin, Berlin, Germany | Rating: NR): €500m Inhaberschuldverschreibung (DE000A30V232), fixed rate (3.13% coupon) maturing on 12 July 2030, priced at 99.34 (original spread of 74 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5W3), fixed rate (3.35% coupon) maturing on 9 August 2029, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5Q5), fixed rate (3.00% coupon) maturing on 9 August 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5Y9), fixed rate (2.00% coupon) maturing on 11 August 2031, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5X1), fixed rate (2.00% coupon) maturing on 9 August 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5P7), fixed rate (3.05% coupon) maturing on 10 August 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5V5), fixed rate (3.35% coupon) maturing on 9 August 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5S1), fixed rate (3.30% coupon) maturing on 11 August 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5N2), fixed rate (3.10% coupon) maturing on 11 August 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5T9), fixed rate (3.35% coupon) maturing on 10 August 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4F5U7), fixed rate (3.35% coupon) maturing on 9 August 2027, priced at 100.00, non callable

- Malta, Republic of (Government) (Sovereign | Valletta, Malta | Rating: A+): €243m Bond (MT0000013665), fixed rate (3.50% coupon) maturing on 7 July 2028, priced at 100.00, non callable

- Paris, City of (Official and Muni | Paris, Ile-De-France, France | Rating: AA-): €300m Bond (FR001400J4K5), fixed rate (3.50% coupon) maturing on 10 July 2043, priced at 99.12 (original spread of 103 bp), non callable

- Raiffeisenlandesbank Oberoesterreich AG (Banking | Linz, Oberoesterreich, Austria | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (AT0000A367F4), fixed rate (3.63% coupon) maturing on 13 December 2027, priced at 99.66 (original spread of 109 bp), non callable

- Remy Cointreau SA (Beverage/Bottling | Cognac, Nouvelle-Aquitaine, France | Rating: BBB-): €300m Bond (BE0002959402), fixed rate (4.50% coupon) maturing on 18 July 2028, priced at 101.88, non callable