Credit

Continued Hedging In USD HY Reflected In Wider Cash-CDX Basis And Payer-Receiver Swaptions Skew

Tepid weekly volumes for USD corporate issuance: 14 tranches for US$11.6bn in IG (2023 YTD volume US$740.085bn vs 2022 YTD US$759.641bn), 1 tranche for US$500m in HY (2023 YTD volume US$94.507bn vs 2022 YTD US$67.816bn)

Published ET

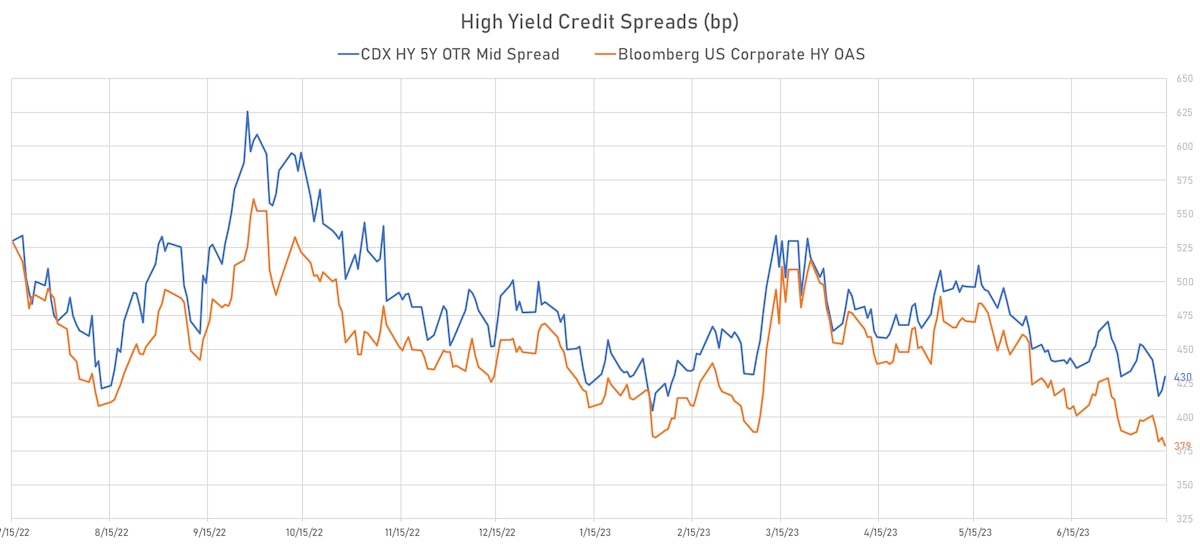

USD High Yield Cash and CDX Spreads | Sources: phipost.com, FactSet data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.38% today, with investment grade down -0.40% and high yield down -0.10% (YTD total return: +3.57%)

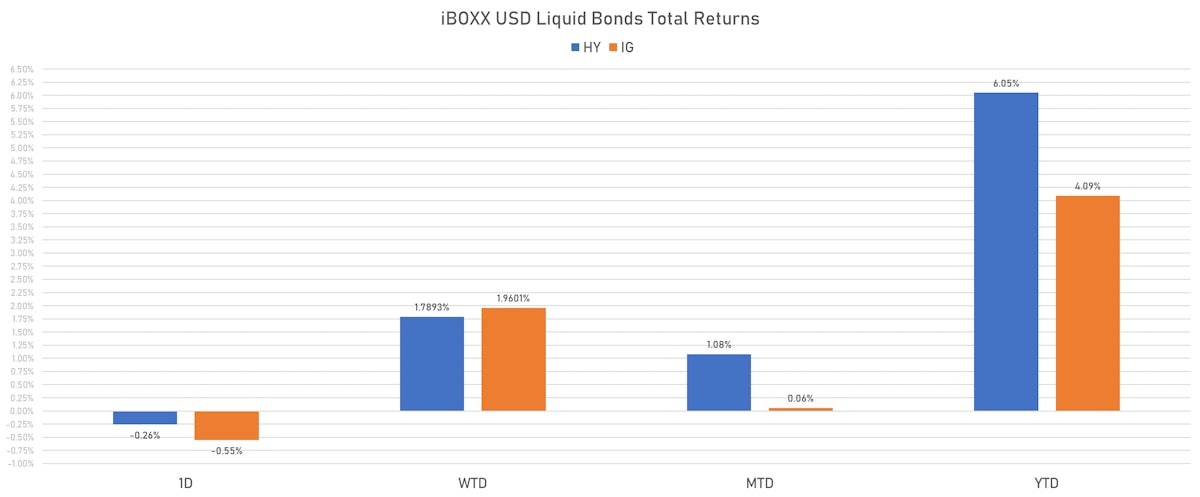

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.553% today (Week-to-date: 1.96%; Month-to-date: 0.06%; Year-to-date: 4.09%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.257% today (Week-to-date: 1.79%; Month-to-date: 1.08%; Year-to-date: 6.05%)

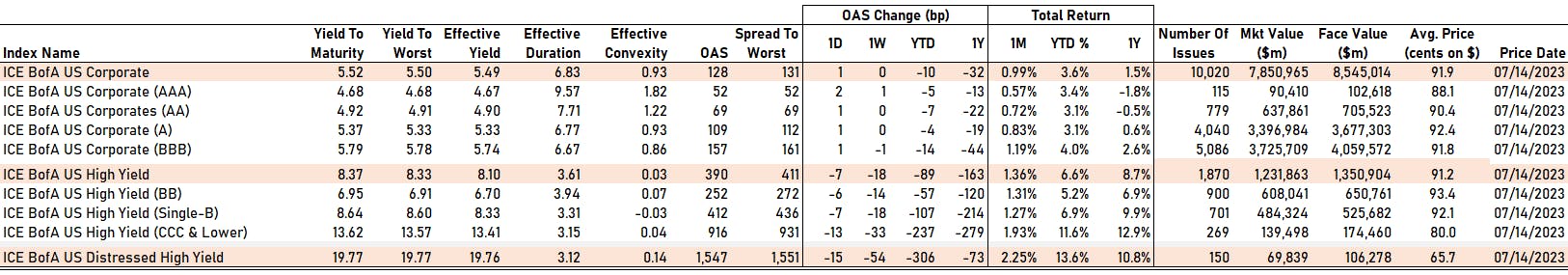

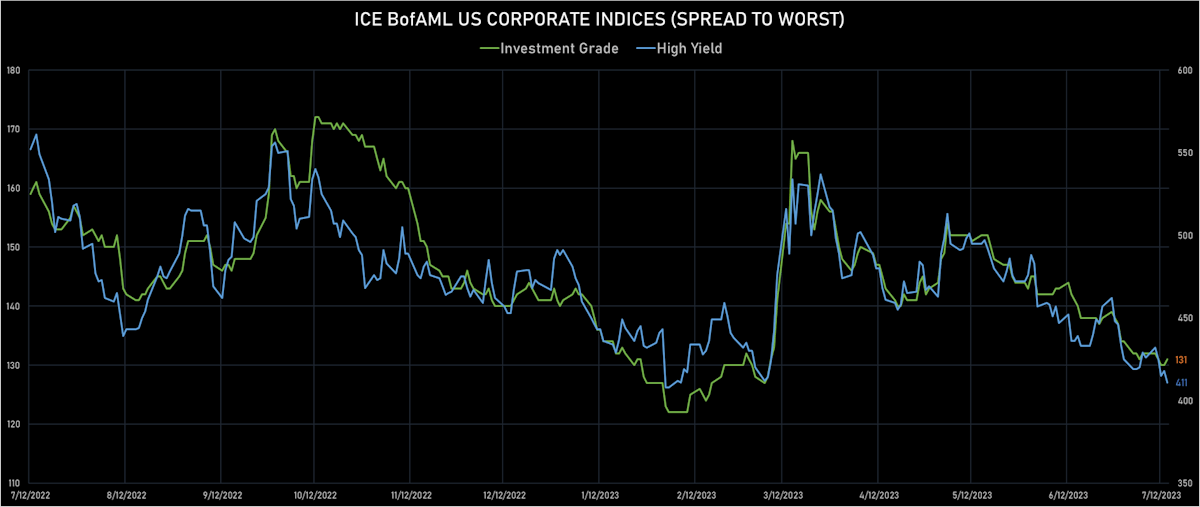

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 131.0 bp (WTD change: -1.0 bp; YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 411.0 bp (WTD change: -15.0 bp; YTD change: -77.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +7.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 2 bp at 52 bp

- AA up by 1 bp at 69 bp

- A up by 1 bp at 109 bp

- BBB up by 1 bp at 157 bp

- BB down by -6 bp at 252 bp

- B down by -7 bp at 412 bp

- ≤ CCC down by -13 bp at 916 bp

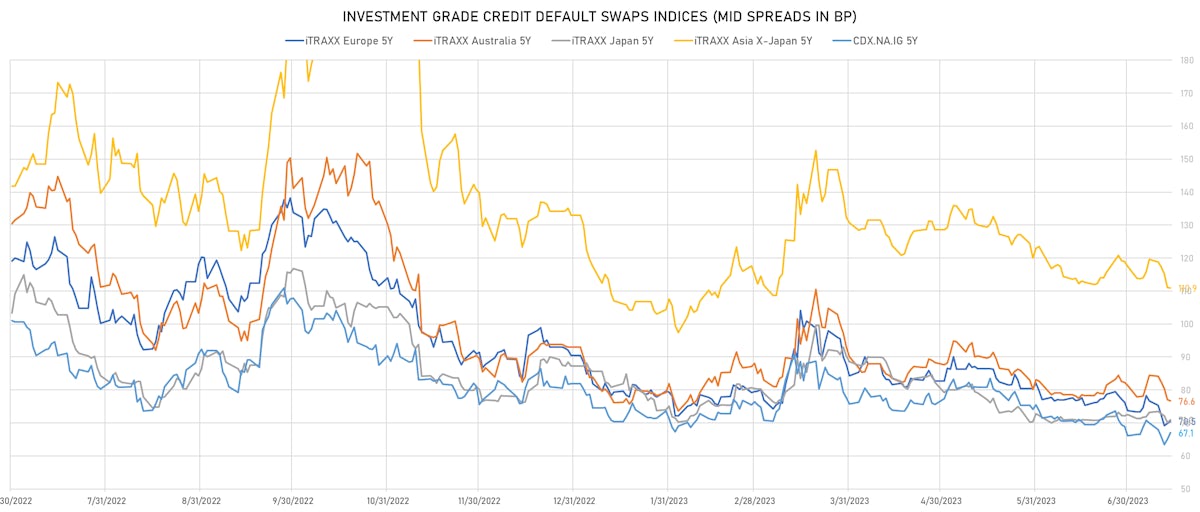

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.0 bp, now at 67bp (1W change: -3.0bp; YTD change: -14.8bp)

- Markit CDX.NA.IG 10Y up 2.1 bp, now at 107bp (1W change: -2.5bp; YTD change: -10.8bp)

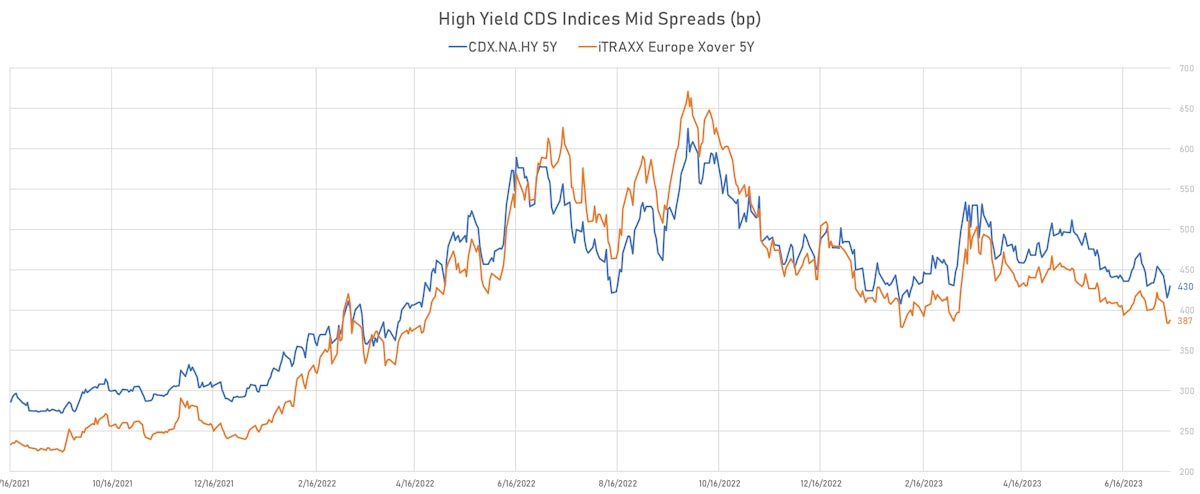

- Markit CDX.NA.HY 5Y up 10.3 bp, now at 430bp (1W change: -22.5bp; YTD change: -55.0bp)

- Markit iTRAXX Europe 5Y up 0.6 bp, now at 71bp (1W change: -6.2bp; YTD change: -19.9bp)

- Markit iTRAXX Europe Crossover 5Y up 3.6 bp, now at 387bp (1W change: -27.0bp; YTD change: -86.9bp)

- Markit iTRAXX Japan 5Y up 0.8 bp, now at 71bp (1W change: -2.3bp; YTD change: -16.2bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.2 bp, now at 111bp (1W change: -8.7bp; YTD change: -22.1bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Saudi Arabia (rated A+): down 7.6 % to 52 bp (1Y range: 46-75bp)

- Mexico (rated BBB-): down 8.0 % to 97 bp (1Y range: 97-205bp)

- Philippines (rated BBB): down 8.3 % to 77 bp (1Y range: 76-153bp)

- Indonesia (rated BBB): down 8.4 % to 80 bp (1Y range: 76-166bp)

- Colombia (rated BB+): down 9.3 % to 221 bp (1Y range: 221-394bp)

- Bulgaria (rated BBB): down 9.5 % to 95 bp (1Y range: 95-140bp)

- Turkey (rated B): down 10.4 % to 443 bp (1Y range: 430-892bp)

- Malaysia (rated BBB+): down 11.0 % to 51 bp (1Y range: 51-122bp)

- Egypt (rated B): down 22.4 % to 1,220 bp (1Y range: 706-1,837bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Staples Inc (Country: US; rated: B3): down 620.1 bp to 3,212.5bp (1Y range: 1,393-3,213bp)

- Community Health Systems Inc (Country: US; rated: NR): down 324.8 bp to 2,065.9bp (1Y range: 1,258-4,371bp)

- Transocean Inc (Country: KY; rated: Caa1): down 110.1 bp to 649.9bp (1Y range: 628-2,858bp)

- Avon Products Inc (Country: GB; rated: WR): down 108.5 bp to 92.6bp (1Y range: 93-452bp)

- Nabors Industries Inc (Country: US; rated: BB-): down 102.8 bp to 641.9bp (1Y range: 390-887bp)

- Newell Brands Inc (Country: US; rated: Ba1): down 75.3 bp to 414.9bp (1Y range: 83-415bp)

- Anywhere Real Estate Group LLC (Country: US; rated: LGD4 - 68%): down 70.6 bp to 825.8bp (1Y range: 278-844bp)

- Unisys Corp (Country: US; rated: B1): down 65.1 bp to 937.8bp (1Y range: 432-1,378bp)

- Pitney Bowes Inc (Country: US; rated: NR): down 64.5 bp to 1,418.9bp (1Y range: 747-1,783bp)

- DISH DBS Corp (Country: US; rated: B2): down 61.0 bp to 2,887.5bp (1Y range: 1,138-3,084bp)

- Tegna Inc (Country: US; rated: Ba3): down 59.1 bp to 312.5bp (1Y range: 182-786bp)

- Kohls Corp (Country: US; rated: Ba2): down 57.4 bp to 555.6bp (1Y range: 377-783bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 55.6 bp to 638.6bp (1Y range: 639-1,472bp)

- American Airlines Group Inc (Country: US; rated: NR): down 45.6 bp to 632.5bp (1Y range: 632-1,644bp)

- Lumen Technologies Inc (Country: US; rated: NR): up 2613.0 bp to 7,038.2bp (1Y range: 195-7,038bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 78.7 bp to 541.2bp (1Y range: 541-1,296bp)

- Ceconomy AG (Country: DE; rated: NR): down 69.1 bp to 668.4bp (1Y range: 630-1,763bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 61.0 bp to 2,257.6bp (1Y range: 1,286-2,910bp)

- Stena AB (Country: SE; rated: B1-PD): down 58.7 bp to 414.5bp (1Y range: 415-791bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 57.2 bp to 707.4bp (1Y range: 644-1,254bp)

- CMA CGM SA (Country: FR; rated: Ba1): down 49.1 bp to 254.2bp (1Y range: 243-648bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 46.6 bp to 736.5bp (1Y range: 566-1,739bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 41.9 bp to 241.3bp (1Y range: 236-705bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 40.1 bp to 437.8bp (1Y range: 379-602bp)

- Ziggo Bond Company BV (Country: NL; rated: WR): down 39.7 bp to 484.6bp (1Y range: 385-584bp)

- Air France KLM SA (Country: FR; rated: NR): down 39.6 bp to 375.0bp (1Y range: 375-990bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 35.7 bp to 561.0bp (1Y range: 186-561bp)

- Renault SA (Country: FR; rated: NR): down 29.8 bp to 243.8bp (1Y range: 236-476bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): down 28.6 bp to 221.6bp (1Y range: 218-523bp)

- Altice Finco SA (Country: LU; rated: Caa2): up 176.4 bp to 1,524.4bp (1Y range: 401-1,524bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS up by 58.9 bp to 105.5 bp (CDS basis: -82.5bp), with the yield to worst at 5.5% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 97.3-100.6).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 47.2 bp to 233.5 bp (CDS basis: -236.0bp), with the yield to worst at 7.3% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 91.4-95.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS up by 45.3 bp to 139.9 bp, with the yield to worst at 5.9% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 3.00% | Maturity: 15/1/2029 | Rating: BB+ | CUSIP: 443201AB4 | OAS up by 43.9 bp to 189.8 bp, with the yield to worst at 5.7% and the bond now trading down to 86.5 cents on the dollar (1Y price range: 83.5-89.3).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.25% | Maturity: 1/9/2030 | Rating: BB+ | CUSIP: 337932AP2 | OAS up by 43.4 bp to 169.1 bp (CDS basis: -107.9bp), with the yield to worst at 5.4% and the bond now trading down to 80.6 cents on the dollar (1Y price range: 78.2-84.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS up by 31.1 bp to 137.5 bp, with the yield to worst at 5.8% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 94.4-97.8).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS up by 20.4 bp to 81.1 bp, with the yield to worst at 5.3% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 95.3-99.0).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 6.00% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 59001AAY8 | OAS down by 28.0 bp to 52.9 bp (CDS basis: 96.7bp), with the yield to worst at 5.0% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 99.0-101.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.13% | Maturity: 17/8/2027 | Rating: BB+ | CUSIP: 345397A86 | OAS down by 39.1 bp to 202.3 bp (CDS basis: -37.1bp), with the yield to worst at 6.1% and the bond now trading up to 92.5 cents on the dollar (1Y price range: 86.9-94.3).

- Issuer: MGM Resorts International (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 1/9/2026 | Rating: B+ | CUSIP: 552953CD1 | OAS down by 48.6 bp to 180.8 bp (CDS basis: -78.7bp), with the yield to worst at 5.9% and the bond now trading up to 95.4 cents on the dollar (1Y price range: 91.1-95.6).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS down by 62.4 bp to 188.2 bp (CDS basis: 18.4bp), with the yield to worst at 6.0% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 15/6/2026 | Rating: B+ | CUSIP: 63938CAJ7 | OAS down by 67.0 bp to 328.4 bp (CDS basis: -23.0bp), with the yield to worst at 7.0% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 93.5-100.3).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | CUSIP: 98421MAA4 | OAS down by 68.2 bp to 209.4 bp, with the yield to worst at 6.4% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 91.8-96.4).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS down by 68.7 bp to 262.8 bp (CDS basis: -8.7bp), with the yield to worst at 6.5% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 95.5-100.5).

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS down by 87.6 bp to 229.9 bp, with the yield to worst at 6.4% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 94.8-100.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 6.88% | Maturity: 15/2/2028 | Rating: B+ | ISIN: XS2581393134 | OAS up by 58.3 bp to 471.8 bp (CDS basis: -129.3bp), with the yield to worst at 7.3% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 95.9-102.7).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 51.9 bp to 272.5 bp (CDS basis: -38.1bp), with the yield to worst at 6.0% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 90.6-94.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS up by 47.1 bp to 369.5 bp (CDS basis: -40.7bp), with the yield to worst at 6.7% and the bond now trading down to 83.3 cents on the dollar (1Y price range: 82.0-87.0).

- Issuer: Telecom Italia Finance SA (Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: B+ | ISIN: XS0161100515 | OAS up by 40.9 bp to 428.6 bp (CDS basis: 20.0bp), with the yield to worst at 7.2% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 102.0-107.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS up by 33.7 bp to 399.1 bp (CDS basis: -18.0bp), with the yield to worst at 6.9% and the bond now trading down to 75.2 cents on the dollar (1Y price range: 72.4-78.7).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS up by 29.8 bp to 585.8 bp, with the yield to worst at 9.3% and the bond now trading down to 84.0 cents on the dollar (1Y price range: 80.6-84.7).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS down by 30.5 bp to 201.0 bp, with the yield to worst at 5.3% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 83.7-91.0).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB | ISIN: XS2341724172 | OAS down by 31.0 bp to 527.6 bp, with the yield to worst at 8.5% and the bond now trading up to 76.2 cents on the dollar (1Y price range: 71.3-77.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | OAS down by 31.7 bp to 325.7 bp, with the yield to worst at 6.5% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 86.2-92.4).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | OAS down by 32.5 bp to 172.3 bp, with the yield to worst at 5.0% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 85.9-92.3).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.88% | Maturity: 15/2/2026 | Rating: BB+ | ISIN: FR0013318102 | OAS down by 37.2 bp to 95.6 bp, with the yield to worst at 4.3% and the bond now trading up to 95.7 cents on the dollar (1Y price range: 93.7-97.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 41.0 bp to 300.7 bp (CDS basis: 120.7bp), with the yield to worst at 6.3% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 88.4-101.0).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 42.8 bp to 249.8 bp (CDS basis: 49.7bp), with the yield to worst at 5.8% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 85.3-96.7).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB- | ISIN: XS2356316872 | OAS down by 60.2 bp to 689.9 bp (CDS basis: -29.3bp), with the yield to worst at 9.1% and the bond now trading up to 78.8 cents on the dollar (1Y price range: 61.6-78.9).

- Issuer: Samhallsbyggnadsbolaget I Norden AB (Stockholm, Sweden) | Coupon: 1.13% | Maturity: 4/9/2026 | Rating: BB- | ISIN: XS2049823680 | OAS down by 237.2 bp to 671.4 bp, with the yield to worst at 9.5% and the bond now trading up to 76.5 cents on the dollar (1Y price range: 61.2-79.3).

RECENT DOMESTIC USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133EPQL22), floating rate (SOFR + 15.5 bp) maturing on 17 July 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$170m Bond (US3133EPQD06), fixed rate (4.25% coupon) maturing on 17 July 2028, priced at 99.67 (original spread of 47 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPQE88), floating rate (PRQ + -298.5 bp) maturing on 17 July 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$120m Bond (US3133EPQC23), fixed rate (4.63% coupon) maturing on 17 July 2026, priced at 99.88 (original spread of 36 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$700m Bond (US3133EPPZ27), floating rate (SOFR + 17.5 bp) maturing on 14 July 2025, priced at 100.00, callable (2nc2)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AAA): US$1,000m Bond (US3130AWN632), fixed rate (4.00% coupon) maturing on 30 June 2028, priced at 99.73, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$1,000m Bond (US3130AWNG12), floating rate (SOFR + 16.0 bp) maturing on 14 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$1,160m Bond (US3130AWNJ50), floating rate (SOFR + 16.0 bp) maturing on 21 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$1,181m Bond (US3130AWNS59), floating rate (SOFR + 16.0 bp) maturing on 28 July 2025, priced at 100.00, non callable

- John Deere Capital Corp (Financial - Other | Madison, Wisconsin, United States | Rating: A): US$1,500m Senior Note (US24422EXB00), fixed rate (4.95% coupon) maturing on 14 July 2028, priced at 99.85 (original spread of 102 bp), non callable

- MetLife Inc (Life Insurance | New York City, New York, United States | Rating: A-): US$1,000m Senior Note (US59156RCE62), fixed rate (5.38% coupon) maturing on 15 July 2033, priced at 99.40 (original spread of 172 bp), callable (10nc10)

- Pacific Life Global Funding II (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$450m Senior Note (US6944PL2U22), fixed rate (5.50% coupon) maturing on 18 July 2028, priced at 99.90 (original spread of 167 bp), non callable

- University of Southern California (Service - Other | Los Angeles, California, United States | Rating: AA): US$500m Bond (US914886AH93), fixed rate (4.98% coupon) maturing on 1 October 2053, priced at 100.00 (original spread of 158 bp), callable (30nc30)

RECENT INTERNATIONAL USD BOND ISSUES

- Abu Dhabi Commercial Bank PJSC (Banking | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: A): US$500m Senior Note (XS2651081304), fixed rate (5.38% coupon) maturing on 18 July 2028, priced at 99.67 (original spread of 153 bp), non callable

- Aircastle Ltd (Leasing | Stamford, Japan | Rating: BBB-): US$650m Senior Note (US00928QAX97), fixed rate (6.50% coupon) maturing on 18 July 2028, priced at 99.82 (original spread of 260 bp), callable (5nc5)

- Azul Secured (Financial - Other | Brazil | Rating: NR): US$800m Note (US05501WAC64), fixed rate (11.93% coupon) maturing on 28 August 2028, priced at 98.77, callable (5nc3)

- Azul Secured Finance LLP (Financial - Other | Brazil | Rating: NR): US$800m Note (USU0551YAC94), fixed rate (11.93% coupon) maturing on 28 August 2028, priced at 98.77 (original spread of 877 bp), callable (5nc3)

- CICC Hong Kong Finance 2016 MTN Ltd (Financial - Other | Road Town, China (Mainland) | Rating: BBB+): US$500m Senior Note (XS2648007495), fixed rate (5.44% coupon) maturing on 18 July 2026, priced at 100.00 (original spread of 132 bp), non callable

- CPPIB Capital Inc (Financial - Other | Toronto, Canada | Rating: AAA): US$1,500m Senior Note (US22411WAZ95), fixed rate (4.25% coupon) maturing on 20 July 2028, priced at 99.55 (original spread of 66 bp), non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A-): US$450m Senior Note (US13607LSL89), fixed rate (5.62% coupon) maturing on 17 July 2026, priced at 100.00 (original spread of 107 bp), with a make whole call

- Cooperatieve Rabobank UA (New York Branch) (Banking | New York City, New York, Netherlands | Rating: A+): US$850m Note (US21688AAW27), fixed rate (5.50% coupon) maturing on 18 July 2025, priced at 99.94 (original spread of 70 bp), non callable

- Cooperatieve Rabobank UA (New York Branch) (Banking | New York City, Netherlands | Rating: A+): US$650m Note (US21688AAX00), floating rate (SOFRINDX + 70.0 bp) maturing on 18 July 2025, priced at 100.00, non callable

- Credit Agricole Corporate and Investment Bank SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): US$225m Senior Note (XS2395330868), fixed rate (6.20% coupon) maturing on 14 July 2028, priced at 100.00, callable (5nc1)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$500m Note (XS0460039349), fixed rate (4.75% coupon) maturing on 4 August 2025, priced at 101.00, non callable

- Doosan Enerbility Co Ltd (Utility - Other | Changwon, Gyeongsangnam-Do, South Korea | Rating: AA): US$300m Bond (XS2644967304), fixed rate (5.50% coupon) maturing on 17 July 2026, priced at 99.78 (original spread of 124 bp), non callable

- Export-Import Bank of China (Agency | Beijing, China (Mainland) | Rating: A+): US$130m Unsecured Note (XS2654684385), floating rate maturing on 21 July 2028, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, China (Mainland) | Rating: A+): US$200m Unsecured Note (XS2654722227), floating rate maturing on 21 July 2028, priced at 100.00, non callable

- Hongkong Land Finance (Cayman Islands) Company Ltd (Financial - Other | Grand Cayman, Hong Kong | Rating: A): US$400m Senior Note (XS2648476302), fixed rate (5.25% coupon) maturing on 14 July 2033, priced at 99.77 (original spread of 156 bp), callable (10nc10)

- Itti SAECA (Information/Data Technology | Asuncion, Paraguay | Rating: NR): US$728m Bond (PYITI02F5677), fixed rate (8.00% coupon) maturing on 26 June 2028, priced at 100.00, non callable

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$1,500m Bond (US471048CX48), fixed rate (4.63% coupon) maturing on 19 July 2028, priced at 99.43 (original spread of 80 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$4,000m Senior Note (US500769JY19), fixed rate (4.13% coupon) maturing on 15 July 2033, priced at 99.49 (original spread of 47 bp), non callable

- Korea Hydro & Nuclear Power Co Ltd (Utility - Other | Gyeongju, Gyeongsangbuk-Do, South Korea | Rating: AA-): US$500m Senior Note (USY4899GGB33), fixed rate (5.00% coupon) maturing on 18 July 2028, priced at 99.33 (original spread of 126 bp), non callable

- LG Chem (Chemicals | Seoul, Seoul, South Korea | Rating: A-): US$1,000m Bond (XS2647856777), fixed rate (1.60% coupon) maturing on 18 July 2030, priced at 100.00, non callable, convertible

- LG Chem (Chemicals | Seoul, Seoul, South Korea | Rating: A-): US$1,000m Bond (XS2647856348), fixed rate (1.25% coupon) maturing on 18 July 2028, priced at 100.00, non callable, convertible

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): US$350m Senior Note (US78016HZR47), floating rate (SOFRINDX + 108.0 bp) maturing on 20 July 2026, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A+): US$1,000m Senior Note (US78016HZS20), fixed rate (5.20% coupon) maturing on 1 August 2028, priced at 99.95 (original spread of 128 bp), with a make whole call

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A+): US$1,000m Senior Note (US78016FZZ07), fixed rate (5.20% coupon) maturing on 20 July 2026, priced at 99.99 (original spread of 98 bp), non callable

- Seadrill Finance (Financial - Other | Hamilton, Bermuda | Rating: BB-): US$500m Note (US81172QAA22), fixed rate (8.38% coupon) maturing on 1 August 2030, priced at 100.00 (original spread of 451 bp), callable (7nc3)

- Sobha Sukuk (Financial - Other | Dubai, United Arab Emirates | Rating: BB-): US$300m Islamic Sukuk (Hybrid) (XS2633136234), fixed rate (8.75% coupon) maturing on 17 July 2028, priced at 100.00 (original spread of 527 bp), callable (5nc3)

- Telegram Group Inc (Financial - Other | Tortola, British Virgin Islands | Rating: NR): US$320m Bond (XS2647280457), fixed rate (7.00% coupon) maturing on 22 March 2026, priced at 100.00, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$1,250m Senior Note (US89115A2U52), fixed rate (5.52% coupon) maturing on 17 July 2028, priced at 100.00 (original spread of 166 bp), with a make whole call

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$1,800m Senior Note (US89115A2S07), fixed rate (5.53% coupon) maturing on 17 July 2026, priced at 100.00 (original spread of 131 bp), with a make whole call

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$450m Senior Note (US89115A2T89), floating rate (SOFR + 108.0 bp) maturing on 17 July 2026, priced at 100.00, non callable

- Yangzhou Urban Construction State Owned Assets Holding Group Co Ltd (Financial - Other | Yangzhou, China (Mainland) | Rating: BBB): US$300m Senior Note (XS2648383714), fixed rate (5.48% coupon) maturing on 20 July 2026, priced at 99.95, non callable

RECENT EURO BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Hessen, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000AAR0397), fixed rate (3.88% coupon) maturing on 18 May 2026, priced at 99.97 (original spread of 81 bp), non callable

- Banque Stellantis France SA (Banking | Poissy, France | Rating: BBB+): €500m Bond (FR001400JEA2), fixed rate (4.00% coupon) maturing on 21 January 2027, priced at 99.66 (original spread of 137 bp), callable (4nc3)

- Bpce SA (Banking | Paris, France | Rating: A): €396m Bond (FR001400JA60), floating rate (EU03MLIB + 40.0 bp) maturing on 18 July 2025, priced at 100.00 (original spread of 41 bp), non callable

- Brandenburg, State of (Official and Muni | Potsdam, Brandenburg, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A30V6X7), fixed rate (3.00% coupon) maturing on 20 July 2033, priced at 99.18 (original spread of 65 bp), non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB-): €500m Note (XS2652072864), floating rate maturing on 19 July 2034, priced at 99.41 (original spread of 256 bp), callable (11nc10)

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB-): €1,000m Note (XS2649712689), floating rate maturing on 19 July 2029, priced at 99.58 (original spread of 231 bp), callable (6nc5)

- Cirsa Finance International SARL (Financial - Other | Luxembourg, Luxembourg | Rating: B): €325m Note (XS2649696890), floating rate (EU03MLIB + 450.0 bp) maturing on 31 July 2028, priced at 98.00, callable (5nc1)

- Commonwealth Bank of Australia (Banking | Sydney, Australia | Rating: A+): €106m Unsecured Note (XS2655344815), fixed rate (1.48% coupon) maturing on 19 January 2038, priced at 100.00, non callable

- DNB Bank ASA (Banking | Oslo, Oslo, Norway | Rating: A-): €1,000m Note (XS2652069480), floating rate maturing on 19 July 2028, priced at 99.88 (original spread of 167 bp), callable (5nc4)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VFU7), fixed rate (3.25% coupon) maturing on 4 August 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VFV5), floating rate maturing on 7 August 2026, priced at 101.00, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €4,500m Buono del Tesoro Poliennali (IT0005556011), fixed rate (3.85% coupon) maturing on 15 September 2026, priced at 100.52 (original spread of 112 bp), non callable

- Korea Housing Finance Corp (Agency | Busan, South Korea | Rating: AA-): €150m Unsecured Note (XS2654806830), fixed rate (3.74% coupon) maturing on 12 April 2027, priced at 100.00, non callable

- Landesbank Berlin AG (Banking | Berlin, Berlin, Germany | Rating: AAA): €250m Hypothekenpfandbrief (Covered Bond) (DE000A162BL3), fixed rate (3.50% coupon) maturing on 19 April 2028, priced at 99.78 (original spread of 84 bp), non callable

- Nordic Investment Bank (Supranational | Helsinki, Etela-Suomen, Finland | Rating: AAA): €150m Unsecured Note (XS2652083390), fixed rate (3.35% coupon) maturing on 20 July 2026, priced at 100.00, non callable

- Prev V2 SARL (Financial - Other | Luxembourg, Netherlands | Rating: NR): €122m Bond (XS2638368477), fixed rate (12.68% coupon) maturing on 31 March 2028, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Senningerberg, Netherlands | Rating: NR): €103m Unsecured Note (XS2654096523) zero coupon maturing on 1 January 2057, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Senningerberg, Netherlands | Rating: NR): €199m Unsecured Note (XS2653217716) zero coupon maturing on 5 January 2057, priced at 100.00, non callable

- State of Baden-Wuerttemberg (Official and Muni | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A14JZY4), floating rate (EU06MLIB + -15.0 bp) maturing on 19 July 2029, priced at 100.81, non callable

- Tdf Infrastructure SAS (Telecommunications | Montrouge, Luxembourg | Rating: NR): €600m Bond (FR001400J861), fixed rate (5.63% coupon) maturing on 21 July 2028, priced at 99.82 (original spread of 306 bp), callable (5nc5)

- Telecom Italia SpA (Telecommunications | Rome, Italy | Rating: B+): €750m Senior Note (XS2637954582), fixed rate (7.88% coupon) maturing on 31 July 2028, priced at 100.00 (original spread of 528 bp), callable (5nc5)

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): €1,000m Senior Note (XS2652775789), floating rate (EU03MLIB + 45.0 bp) maturing on 21 July 2025, priced at 100.00, non callable

- Zagrebacki Holding doo (Financial - Other | Zagreb, Croatia | Rating: B+): €305m Bond (HRZGHOO287A8), fixed rate (4.90% coupon) maturing on 11 July 2028, priced at 99.83, non callable

RECENT LOANS

- Archkey Holdings Inc (United States of America | B), signed a US$ 315m Term Loan B, to be used for general corporate purposes. It matures on 06/25/28 and initial pricing is set at Term SOFR +525.0bp

- Atom Hoteles Iberia SL (Spain), signed a € 199m Term Loan, to be used for general corporate purposes. It matures on 07/07/30 and initial pricing is set at EURIBOR +200.0bp

- Bunge Ltd Finance Corp (United States of America | BBB+), signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 08/05/27 and initial pricing is set at Term SOFR +90.0bp

- Bunge Ltd Finance Corp (United States of America | BBB+), signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 10/29/28 and initial pricing is set at Term SOFR +110.0bp

- Bunge Ltd Finance Corp (United States of America | BBB+), signed a US$ 865m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/29/26 and initial pricing is set at Term SOFR +100.0bp

- Bunge Ltd Finance Corp (United States of America | BBB+), signed a US$ 300m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 07/07/28 and initial pricing is set at Term SOFR +100.0bp

- CBRE Group Inc (United States of America | BBB+), signed a € 275m Term Loan, to be used for general corporate purposes.

- Expleo Group SAS (France), signed a € 485m Term Loan B, to be used for general corporate purposes. It matures on 09/05/27 and initial pricing is set at EURIBOR +500.0bp

- Future Fiber Networks Llc (United States of America), signed a US$ 350m Revolving Credit Facility, to be used for general corporate purposes.

- Grenergy Renovables SA (Spain), signed a US$ 148m Term Loan, to be used for general corporate purposes.

- Grenke AG (Germany | BBB), signed a € 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/05/26.

- Miltenyi Biotec GmbH (Germany), signed a € 375m Term Loan, to be used for capital expenditures.

- Okeanis Eco Tankers Corp (Greece), signed a US$ 113m Term Loan, to be used for general corporate purposes. It matures on 07/05/28 and initial pricing is set at Term SOFR +190.0bp

- Promosolar Juwi 17 SL (Spain), signed a € 235m Term Loan, to be used for project finance. It matures on 07/07/41.

- Thai Credit Retail Bank PCL (Thailand), signed a US$ 105m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 07/05/26.

- Zimmer Biomet Holdings Inc (United States of America | BBB), signed a US$ 1,000m 364d Revolver, to be used for general corporate purposes. It matures on 07/05/24 and initial pricing is set at Term SOFR +81.5bp

- Zimmer Biomet Holdings Inc (United States of America | BBB), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/07/28 and initial pricing is set at Term SOFR +79.5bp

RECENT STRUCTURED CREDIT

- CFG Investment Ltd 2023-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 154 m. Highest-rated tranche offering a yield to maturity of 8.56%, and the lowest-rated tranche a yield to maturity of 16.80%. Bookrunners: Guggenheim Securities LLC

- Palmer Square European Loan Funding 2023-2 Dac issued a floating-rate CLO in 5 tranches, for a total of € 356 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 733bp. Bookrunners: JP Morgan & Co Inc

- Reach Abs Trust 2023-1 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 225 m. Highest-rated tranche offering a yield to maturity of 7.05%, and the lowest-rated tranche a yield to maturity of 12.27%. Bookrunners: Capital One Financial Corp, Truist Securities Inc, Atlas SP Partners LP

- Sierra Timeshare 2023-2 Receivables Funding LLC issued a fixed-rate ABS backed by timeshare loans in 4 tranches, for a total of US$ 300 m. Highest-rated tranche offering a yield to maturity of 5.80%, and the lowest-rated tranche a yield to maturity of 9.72%. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc, Bank of America Merrill Lynch, Atlas SP Partners LP