Credit

USD Credit Largely Unchanged This Week, With Slight HY-IG Spread Decompression

USD corporate bond issuance reopens with 2Q23 earnings season: 25 tranches for $30.575bn in IG this week (2023 YTD volume $770.66bn vs 2022 YTD $805.491bn, -4.3% YoY), 6 tranches for $2.835bn in HY (2023 YTD volume $97.342bn vs 2022 YTD $68.576bn, +41.9% YoY)

Published ET

IBOXX USD Liquid Bonds HY vs CDX HY 5Y | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was up 0.07% today, with investment grade up 0.07% and high yield up 0.05% (YTD total return: +3.65%)

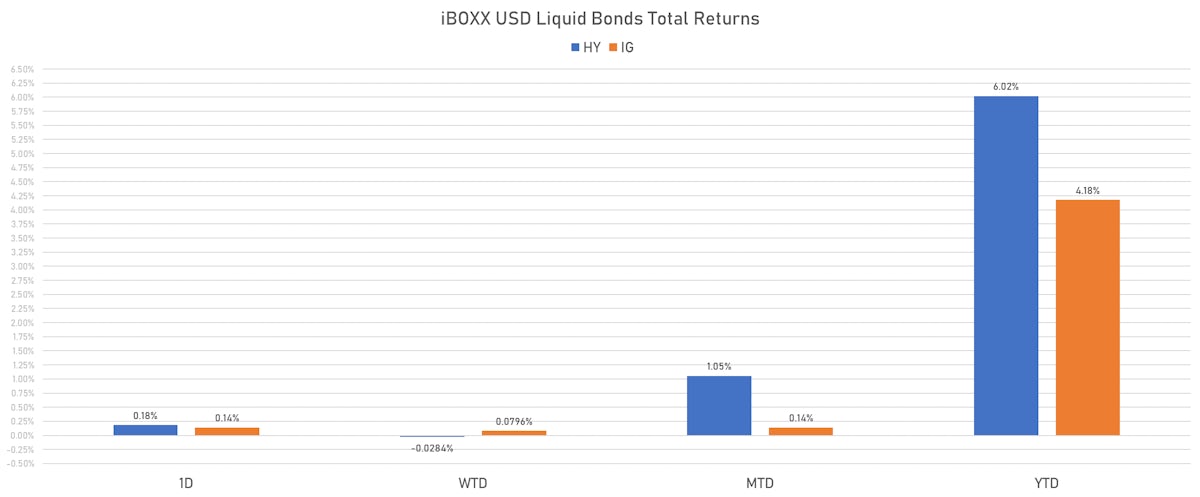

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.140% today (Week-to-date: 0.08%; Month-to-date: 0.14%; Year-to-date: 4.18%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.182% today (Week-to-date: -0.03%; Month-to-date: 1.05%; Year-to-date: 6.02%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 129.0 bp (WTD change: -2.0 bp; YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 410.0 bp (WTD change: -1.0 bp; YTD change: -78.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +7.4%)

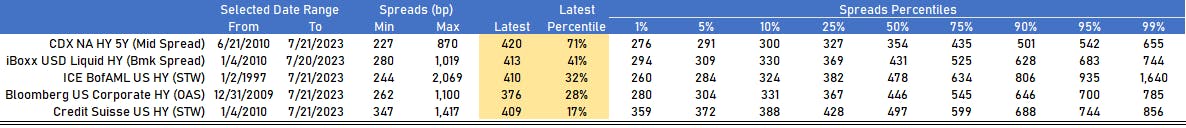

USD HY SPREADS PERCENTILES

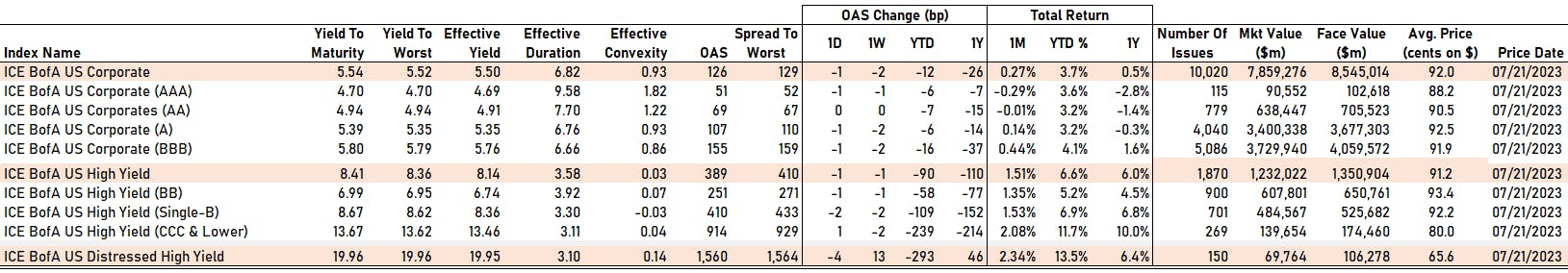

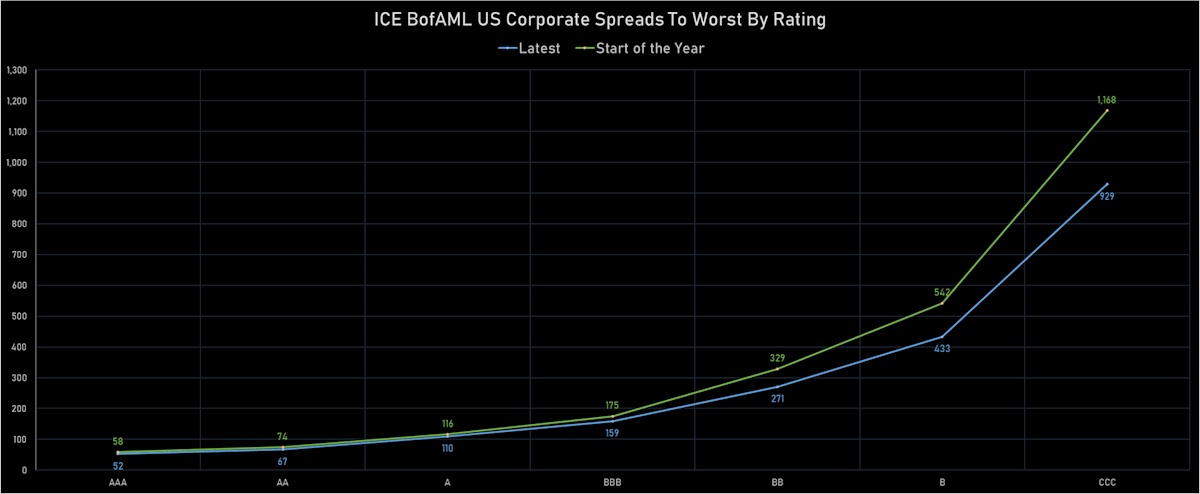

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 51 bp

- AA unchanged at 69 bp

- A down by -1 bp at 107 bp

- BBB down by -1 bp at 155 bp

- BB down by -1 bp at 251 bp

- B down by -2 bp at 410 bp

- ≤ CCC up by 1 bp at 914 bp

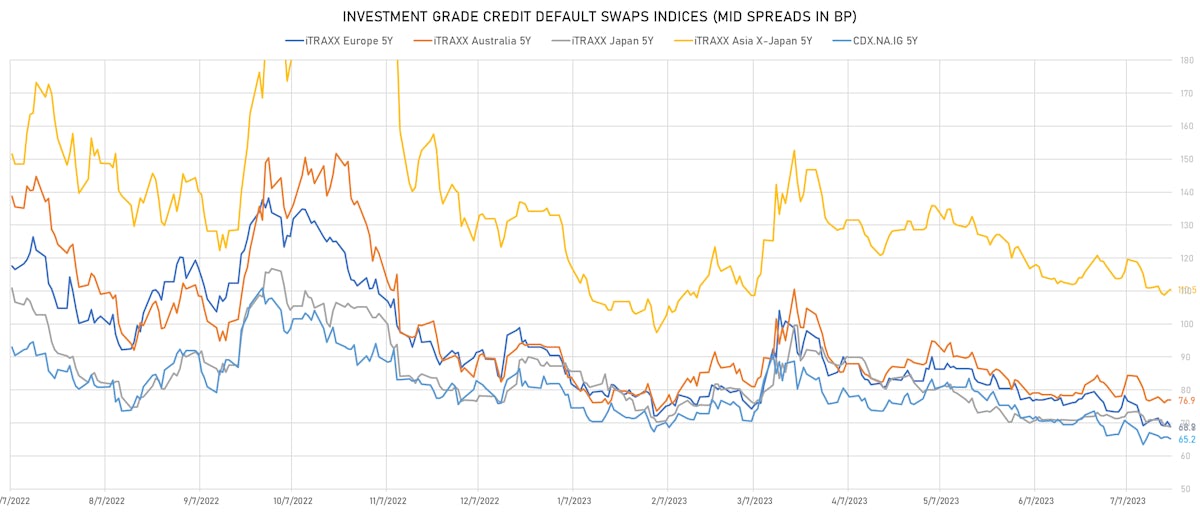

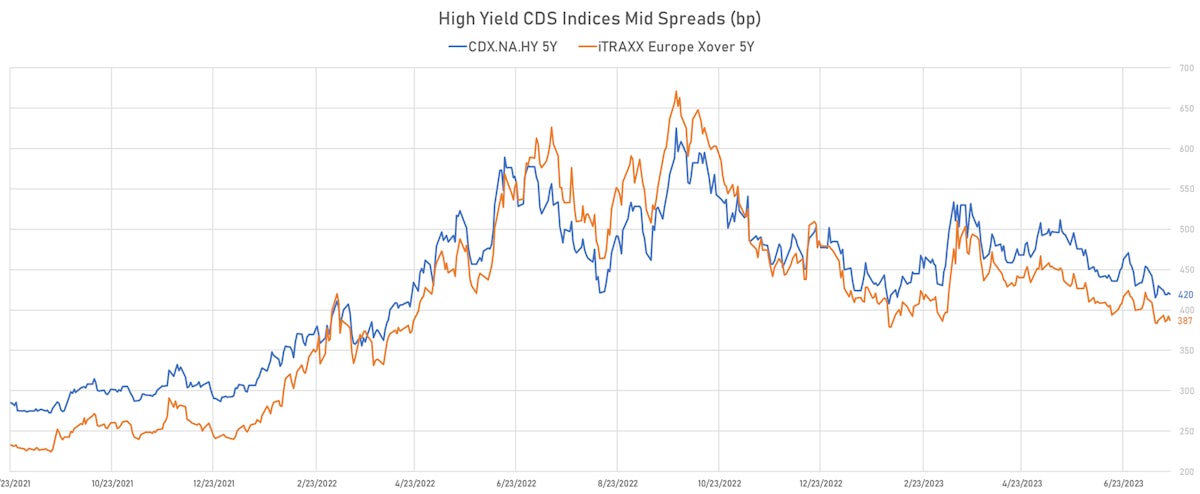

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 65bp (1W change: -1.9bp; YTD change: -16.7bp)

- Markit CDX.NA.IG 10Y down 0.4 bp, now at 106bp (1W change: -1.6bp; YTD change: -12.4bp)

- Markit CDX.NA.HY 5Y down 1.5 bp, now at 420bp (1W change: -10.3bp; YTD change: -65.3bp)

- Markit iTRAXX Europe 5Y down 1.5 bp, now at 69bp (1W change: -1.6bp; YTD change: -21.5bp)

- Markit iTRAXX Europe Crossover 5Y down 5.2 bp, now at 387bp (1W change: 0.0bp; YTD change: -86.9bp)

- Markit iTRAXX Japan 5Y down 0.3 bp, now at 69bp (1W change: -2.2bp; YTD change: -18.4bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 0.9 bp, now at 111bp (1W change: -0.3bp; YTD change: -22.5bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Peru (rated BBB): up 9.9 % to 80 bp (1Y range: 72-171bp)

- Lithuania (rated A): up 7.2 % to 74 bp (1Y range: 68-985bp)

- Latvia (rated A-): up 7.2 % to 74 bp (1Y range: 67-1,112bp)

- Vietnam (rated BB): up 5.3 % to 115 bp (1Y range: 103-181bp)

- Egypt (rated B): up 5.2 % to 1,283 bp (1Y range: 706-1,837bp)

- Panama (rated WD): up 4.0 % to 101 bp (1Y range: 96-187bp)

- China (rated A+): up 3.1 % to 62 bp (1Y range: 47-132bp)

- Israel (rated A+): up 2.9 % to 54 bp (1Y range: 43-650bp)

- Mexico (rated BBB-): up 2.5 % to 100 bp (1Y range: 97-205bp)

- Colombia (rated BB+): down 3.4 % to 214 bp (1Y range: 214-394bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Lumen Technologies Inc (Country: US; rated: NR): down 7038.2 bp to .0bp (1Y range: -533bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): down 1431.6 bp to 5,451.1bp (1Y range: 1,179-5,451bp)

- Transocean Inc (Country: KY; rated: Caa1): down 72.1 bp to 581.5bp (1Y range: 550-2,674bp)

- Sirius XM Radio Inc (Country: US; rated: Ba3): down 46.1 bp to 216.1bp (1Y range: 175-352bp)

- Staples Inc (Country: US; rated: B3): down 34.9 bp to 3,177.6bp (1Y range: 1,393-3,178bp)

- Unisys Corp (Country: US; rated: B1): down 24.8 bp to 913.0bp (1Y range: 432-1,378bp)

- Goodyear Tire & Rubber Co (Country: US; rated: NR): down 24.6 bp to 298.7bp (1Y range: 299-552bp)

- Community Health Systems Inc (Country: US; rated: NR): down 24.0 bp to 2,041.9bp (1Y range: 1,258-4,371bp)

- Paramount Global (Country: US; rated: Baa3): up 22.8 bp to 254.5bp (1Y range: 57-255bp)

- American Airlines Group Inc (Country: US; rated: B-): up 25.4 bp to 657.9bp (1Y range: 658-1,644bp)

- DISH DBS Corp (Country: US; rated: B2): up 28.6 bp to 2,916.1bp (1Y range: 1,138-3,084bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 41.5 bp to 1,460.5bp (1Y range: 747-1,783bp)

- RR Donnelley & Sons Co (Country: US; rated: B3): up 47.7 bp to 388.5bp (1Y range: 215-434bp)

- Petroleos Mexicanos (Country: MX; rated: B1): up 61.3 bp to 676.9bp (1Y range: 469-768bp)

- Anywhere Real Estate Group LLC (Country: US; rated: LGD4 - 68%): up 68.6 bp to 894.3bp (1Y range: 278-894bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Iceland Bondco PLC (Country: GB; rated: B3): down 96.6 bp to 639.9bp (1Y range: 566-1,739bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 25.8 bp to 2,231.7bp (1Y range: 1,286-2,910bp)

- CMA CGM SA (Country: FR; rated: Ba1): down 13.6 bp to 240.6bp (1Y range: 241-631bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 12.4 bp to 228.9bp (1Y range: 222-705bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 10.5 bp to 530.6bp (1Y range: 531-1,290bp)

- Telecom Italia SpA (Country: IT; rated: NR): up 5.5 bp to 379.3bp (1Y range: 306-545bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): up 6.3 bp to 230.5bp (1Y range: 199-476bp)

- Stora Enso Oyj (Country: FI; rated: WR): up 8.9 bp to 102.8bp (1Y range: 84-167bp)

- Ceconomy AG (Country: DE; rated: NR): up 9.1 bp to 677.5bp (1Y range: 633-1,763bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 12.2 bp to 157.6bp (1Y range: 138-267bp)

- Nokia Oyj (Country: FI; rated: LGD4 - 63%): up 12.3 bp to 149.5bp (1Y range: 113-203bp)

- Deutsche Lufthansa AG (Country: DE; rated: NR): up 13.8 bp to 212.4bp (1Y range: 183-541bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 14.6 bp to 194.6bp (1Y range: 157-600bp)

- Electrolux AB (Country: SE; rated: NR): up 26.5 bp to 120.0bp (1Y range: 92-164bp)

- Altice Finco SA (Country: LU; rated: Caa2): up 436.3 bp to 1,960.8bp (1Y range: 401-1,961bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 3.95% | Maturity: 15/1/2028 | Rating: B | CUSIP: 44106MAX0 | OAS up by 144.1 bp to 697.5 bp, with the yield to worst at 11.0% and the bond now trading down to 74.8 cents on the dollar (1Y price range: 71.1-82.0).

- Issuer: Meritage Homes Corp (Scottsdale, Arizona (US)) | Coupon: 6.00% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 59001AAY8 | OAS up by 12.7 bp to 65.6 bp (CDS basis: 31.0bp), with the yield to worst at 5.3% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.0-101.4).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS down by 16.1 bp to 65.3 bp (CDS basis: -52.5bp), with the yield to worst at 5.3% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 41.6-92.6).

- Issuer: Crown Americas LLC (Philadelphia, Pennsylvania (US)) | Coupon: 4.25% | Maturity: 30/9/2026 | Rating: BB | CUSIP: 22819KAB6 | OAS down by 23.5 bp to 118.0 bp, with the yield to worst at 5.5% and the bond now trading up to 95.4 cents on the dollar (1Y price range: 92.1-97.0).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.15% | Maturity: 1/6/2025 | Rating: BB+ | CUSIP: 29336UAE7 | OAS down by 24.6 bp to 112.9 bp, with the yield to worst at 5.7% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 94.4-97.8).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.25% | Maturity: 1/9/2030 | Rating: BB+ | CUSIP: 337932AP2 | OAS down by 27.4 bp to 141.7 bp (CDS basis: -79.2bp), with the yield to worst at 5.3% and the bond now trading up to 81.5 cents on the dollar (1Y price range: 78.2-84.0).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB+ | CUSIP: 345370CR9 | OAS down by 28.7 bp to 65.1 bp (CDS basis: 79.9bp), with the yield to worst at 5.2% and the bond now trading up to 97.2 cents on the dollar (1Y price range: 39.8-98.3).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 4.25% | Maturity: 15/9/2028 | Rating: BB+ | CUSIP: 343412AF9 | OAS down by 29.5 bp to 134.9 bp, with the yield to worst at 5.3% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 89.3-95.6).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | CUSIP: 26885BAF7 | OAS down by 33.9 bp to 131.2 bp, with the yield to worst at 6.0% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 95.8-99.8).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS down by 35.8 bp to 104.1 bp, with the yield to worst at 5.7% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 3.00% | Maturity: 15/1/2029 | Rating: BB+ | CUSIP: 443201AB4 | OAS down by 51.1 bp to 138.7 bp, with the yield to worst at 5.3% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 83.5-89.3).

- Issuer: SLM Corp (Newark Delaware, Delaware (US)) | Coupon: 4.20% | Maturity: 29/10/2025 | Rating: BB+ | CUSIP: 78442PGD2 | OAS down by 55.5 bp to 202.6 bp, with the yield to worst at 6.5% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 85.1-94.5).

- Issuer: Howmet Aerospace Inc (Pittsburgh, United States) | Coupon: 6.75% | Maturity: 15/1/2028 | Rating: BB+ | CUSIP: 022249AU0 | OAS down by 56.2 bp to 172.3 bp, with the yield to worst at 5.4% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 101.0-105.5).

- Issuer: Nordstrom Inc (Seattle, Washington (US)) | Coupon: 4.00% | Maturity: 15/3/2027 | Rating: BB+ | CUSIP: 655664AS9 | OAS down by 68.0 bp to 286.7 bp (CDS basis: 37.1bp), with the yield to worst at 7.0% and the bond now trading up to 89.5 cents on the dollar (1Y price range: 83.0-90.3).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 177.9 bp to 55.6 bp (CDS basis: -52.7bp), with the yield to worst at 5.7% and the bond now trading up to 94.2 cents on the dollar (1Y price range: 91.4-95.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: B+ | ISIN: XS1824425182 | OAS up by 157.4 bp to 555.6 bp (CDS basis: -89.8bp), with the yield to worst at 9.1% and the bond now trading down to 88.6 cents on the dollar (1Y price range: 88.5-94.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 145.4 bp to 635.1 bp (CDS basis: -132.1bp), with the yield to worst at 9.8% and the bond now trading down to 85.7 cents on the dollar (1Y price range: 85.6-92.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS up by 128.1 bp to 717.3 bp (CDS basis: -146.1bp), with the yield to worst at 10.4% and the bond now trading down to 76.8 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS up by 102.3 bp to 763.4 bp (CDS basis: -117.9bp), with the yield to worst at 10.7% and the bond now trading down to 75.3 cents on the dollar (1Y price range: 72.8-85.1).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 4.00% | Maturity: 20/7/2026 | Rating: BB+ | ISIN: XS2506285365 | OAS up by 25.8 bp to 151.5 bp, with the yield to worst at 4.9% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 92.6-97.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 16.2 bp to 281.0 bp (CDS basis: -28.7bp), with the yield to worst at 6.0% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 92.1-96.4).

- Issuer: illimity Bank SpA (Milan, Italy) | Coupon: 6.63% | Maturity: 9/12/2025 | Rating: BB- | ISIN: XS2564398753 | OAS up by 13.7 bp to 244.7 bp, with the yield to worst at 6.1% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 97.6-102.6).

- Issuer: Eutelsat SA (Issy-Les-Moulineaux, France) | Coupon: 2.25% | Maturity: 13/7/2027 | Rating: BB+ | ISIN: FR0013422623 | OAS up by 11.8 bp to 360.5 bp, with the yield to worst at 6.5% and the bond now trading down to 84.1 cents on the dollar (1Y price range: 81.9-89.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 7.88% | Maturity: 31/7/2028 | Rating: B+ | ISIN: XS2637954582 | OAS up by 9.7 bp to 463.7 bp (CDS basis: -108.6bp), with the yield to worst at 7.8% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 100.0-100.6).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 7.38% | Maturity: 15/9/2029 | Rating: BB- | ISIN: XS2592804434 | OAS up by 9.7 bp to 380.2 bp, with the yield to worst at 6.8% and the bond now trading down to 102.1 cents on the dollar (1Y price range: 97.7-102.8).

- Issuer: Eramet SA (Paris, France) | Coupon: 7.00% | Maturity: 22/5/2028 | Rating: BB | ISIN: FR001400HZE3 | OAS up by 7.4 bp to 305.6 bp, with the yield to worst at 6.2% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 99.9-103.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB+ | ISIN: XS2013574384 | OAS up by 6.7 bp to 112.0 bp (CDS basis: 27.8bp), with the yield to worst at 4.5% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 89.8-94.9).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 4.88% | Maturity: 18/1/2027 | Rating: BB+ | ISIN: XS2577572188 | OAS down by 8.7 bp to 152.8 bp, with the yield to worst at 4.6% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 97.3-100.9).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 0.88% | Maturity: 15/7/2026 | Rating: BB+ | ISIN: XS2365097455 | OAS down by 12.8 bp to 74.8 bp, with the yield to worst at 4.1% and the bond now trading up to 90.7 cents on the dollar (1Y price range: 86.5-90.8).

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | OAS down by 29.0 bp to 374.2 bp, with the yield to worst at 6.8% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 76.5-89.3).

RECENT DOMESTIC USD BOND ISSUES

- Autozone Inc (Vehicle Parts | Memphis, Tennessee, United States | Rating: BBB): US$300m Senior Note (US053332BF83), fixed rate (5.20% coupon) maturing on 1 August 2033, priced at 99.84 (original spread of 174 bp), callable (10nc10)

- Autozone Inc (Vehicle Parts | Memphis, Tennessee, United States | Rating: BBB): US$450m Senior Note (US053332BE19), fixed rate (5.05% coupon) maturing on 15 July 2026, priced at 99.88 (original spread of 80 bp), with a make whole call

- Beacon Roofing Supply Inc (Building Products | Herndon, Virginia, United States | Rating: BB-): US$600m Note (US073685AK54), fixed rate (6.50% coupon) maturing on 1 August 2030, priced at 100.00 (original spread of 259 bp), callable (7nc3)

- Conagra Brands Inc (Food Processors | Chicago, Illinois, United States | Rating: BBB-): US$500m Senior Note (US205887CJ91), fixed rate (5.30% coupon) maturing on 1 October 2026, priced at 99.86 (original spread of 112 bp), with a make whole call

- Concentrix Corp (Service - Other | Newark California, United States | Rating: BBB-): US$800m Senior Note (US20602DAA90), fixed rate (6.65% coupon) maturing on 2 August 2026, priced at 99.90 (original spread of 235 bp), callable (3nc3)

- Concentrix Corp (Service - Other | Newark California, United States | Rating: BBB-): US$550m Senior Note (US20602DAC56), fixed rate (6.85% coupon) maturing on 2 August 2033, priced at 99.84 (original spread of 313 bp), callable (10nc10)

- Concentrix Corp (Service - Other | Newark California, United States | Rating: BBB-): US$800m Senior Note (US20602DAB73), fixed rate (6.60% coupon) maturing on 2 August 2028, priced at 99.98 (original spread of 263 bp), callable (5nc5)

- Crescent Energy Finance LLC (Financial - Other | New York City, New York, United States | Rating: NR): US$300m Senior Note (USU4526LAD92), fixed rate (9.25% coupon) maturing on 15 February 2028, priced at 98.00 (original spread of 573 bp), callable (5nc2)

- Federal Agricultural Mortgage Corp (Agency | Washington, United States | Rating: NR): US$115m Unsecured Note (US31422X5C29), floating rate (SOFR + 20.0 bp) maturing on 21 July 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPQV04), fixed rate (6.00% coupon) maturing on 24 July 2030, priced at 100.00 (original spread of 232 bp), callable (7nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPQX69), fixed rate (6.25% coupon) maturing on 26 July 2038, priced at 100.00, callable (15nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EPQT57), fixed rate (5.65% coupon) maturing on 25 July 2033, priced at 100.00 (original spread of 213 bp), callable (10nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$850m Bond (US3133EPQQ19), floating rate (SOFR + 16.0 bp) maturing on 21 July 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133EPRD96), floating rate (SOFR + 16.5 bp) maturing on 28 July 2025, priced at 100.00, callable (2nc2)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$2,500m Bond (US3130AWP611), floating rate (SOFR + 16.0 bp) maturing on 25 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$350m Bond (US3130AWPV60), floating rate (SOFR + 16.0 bp) maturing on 28 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$550m Bond (US3130AWPA24), floating rate (SOFR + 16.0 bp) maturing on 30 July 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$211m Unsecured Note (US3134GYXU10), fixed rate (6.00% coupon) maturing on 26 July 2027, priced at 100.00 (original spread of 201 bp), callable (4nc3m)

- HEICO Corp (Industrials - Other | Hollywood, Florida, United States | Rating: BBB): US$600m Senior Note (US422806AB58), fixed rate (5.35% coupon) maturing on 1 August 2033, priced at 99.63 (original spread of 182 bp), callable (10nc10)

- HEICO Corp (Industrials - Other | Hollywood, Florida, United States | Rating: BBB): US$600m Senior Note (US422806AA75), fixed rate (5.25% coupon) maturing on 1 August 2028, priced at 99.86 (original spread of 143 bp), callable (5nc5)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$3,000m Senior Note (US459058KU68), fixed rate (4.00% coupon) maturing on 25 July 2030, priced at 99.80 (original spread of 16 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$340m Unsecured Note (XS2657138660), fixed rate (5.35% coupon) maturing on 27 July 2026, priced at 100.00, non callable

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$2,500m Senior Note (US46647PDU75), floating rate maturing on 24 July 2029, priced at 100.00 (original spread of 148 bp), callable (6nc5)

- Jefferies Financial Group Inc (Financial - Other | New York City, New York, United States | Rating: BBB): US$1,000m Senior Note (US47233WBM01), fixed rate (5.88% coupon) maturing on 21 July 2028, priced at 99.44 (original spread of 216 bp), callable (5nc5)

- LCM Investments Holdings II LLC (Financial - Other | Tampa, Florida, United States | Rating: B): US$500m Senior Note (US50190EAC84), fixed rate (8.25% coupon) maturing on 1 August 2031, priced at 100.00 (original spread of 447 bp), callable (8nc3)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$2,250m Senior Note (US61747YFF79), floating rate maturing on 20 July 2029, priced at 100.00 (original spread of 159 bp), callable (6nc5)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: A-): US$2,500m Senior Note (US61747YFG52), floating rate maturing on 21 July 2034, priced at 100.00 (original spread of 188 bp), callable (11nc10)

- Morgan Stanley Bank NA (Banking | Salt Lake City, Utah, United States | Rating: A+): US$1,200m Senior Bank Note (US61690U7U83), fixed rate (5.48% coupon) maturing on 16 July 2025, priced at 100.00 (original spread of 73 bp), callable (2nc2)

- Morgan Stanley Bank NA (Banking | Salt Lake City, United States | Rating: A+): US$800m Senior Bank Note (US61690U7V66), floating rate (SOFR + 78.0 bp) maturing on 16 July 2025, priced at 100.00, callable (2nc2)

- Mut of Omaha (Financial - Other | Delaware, United States | Rating: NR): US$400m Note (US62829D2A73), fixed rate (5.80% coupon) maturing on 27 July 2026, priced at 99.92 (original spread of 152 bp), non callable

- Mutual of Omaha Companies Global Funding (Financial - Other | Delaware, United States | Rating: NR): US$400m Note (US62829E2A55), fixed rate (5.80% coupon) maturing on 27 July 2026, priced at 99.92 (original spread of 150 bp), non callable

- Piedmont Operating Partnership LP (Home Builders | Atlanta, Georgia, United States | Rating: BBB): US$400m Senior Note (US720198AG56), fixed rate (9.25% coupon) maturing on 20 July 2028, priced at 99.00 (original spread of 551 bp), callable (5nc5)

- Wells Fargo & Co (Banking | San Francisco, California, United States | Rating: BBB+): US$4,250m Senior Note (US95000U3E14), floating rate maturing on 25 July 2029, priced at 100.00 (original spread of 166 bp), callable (6nc5)

- Wells Fargo & Co (Banking | San Francisco, California, United States | Rating: BBB+): US$4,250m Senior Note (US95000U3F88), floating rate maturing on 25 July 2034, priced at 100.00 (original spread of 192 bp), callable (11nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Abu Dhabi Future Energy Company Pjsc (Utility - Other | Abu Dhabi, United Arab Emirates | Rating: A): US$750m Senior Note (XS2651619285), fixed rate (4.88% coupon) maturing on 25 July 2033, priced at 99.50 (original spread of 138 bp), non callable

- Almarai Sukuk Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$750m Islamic Sukuk (Hybrid) (XS2641777235), fixed rate (5.23% coupon) maturing on 25 July 2033, priced at 100.00 (original spread of 156 bp), non callable

- Boston Gas Co (Gas Utility - Local Distrib | Waltham, Massachusetts, United Kingdom | Rating: BBB+): US$400m Senior Note (US100743AN37), fixed rate (6.12% coupon) maturing on 20 July 2053, priced at 100.00 (original spread of 218 bp), callable (30nc30)

- CDP Financial Inc (Financial - Other | Hammond, Quebec, Canada | Rating: AAA): US$1,500m Senior Note (USC23264AV31), fixed rate (4.25% coupon) maturing on 25 July 2028, priced at 99.52 (original spread of 60 bp), non callable

- Coty Inc (Consumer Products | New York City, New York, Luxembourg | Rating: BB): US$750m Note (USU2206AAA08), fixed rate (6.63% coupon) maturing on 15 July 2030, priced at 100.00 (original spread of 277 bp), callable (7nc3)

- Dar Al-Arkan Sukuk Company Ltd (Financial - Other | George Town, Cayman Islands | Rating: B+): US$600m Islamic Sukuk (Hybrid) (XS2648078322), fixed rate (8.00% coupon) maturing on 25 February 2029, priced at 98.88, non callable

- Kommunalbanken AS (Agency | Oslo, Oslo, Norway | Rating: AAA): US$200m Unsecured Note (XS2657628751), fixed rate (5.45% coupon) maturing on 27 July 2026, priced at 100.00 (original spread of 40 bp), non callable

- Manitoba, Province of (Official and Muni | Winnipeg, Canada | Rating: A+): US$1,000m Senior Debenture (US563469VC69), fixed rate (4.30% coupon) maturing on 27 July 2033, priced at 99.71 (original spread of 50 bp), non callable

- Mirae Asset Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: BBB): US$400m Bond (XS2651633609), fixed rate (6.88% coupon) maturing on 26 July 2026, priced at 99.52 (original spread of 275 bp), non callable

- Ontario Gaming GTA LP (Leisure | North York, Canada | Rating: B): US$400m Note (USC6908MAA65), fixed rate (8.00% coupon) maturing on 1 August 2030, priced at 100.00 (original spread of 402 bp), callable (7nc2)

- RR Donnelley & Sons Co (Service - Other | Chicago, Illinois | Rating: B-): US$285m Note (USU25783AH12), fixed rate (9.75% coupon) maturing on 31 July 2028, priced at 95.28, callable (5nc1m)

- SMBC Aviation Capital Finance DAC (Financial - Other | Dublin, Dublin, Japan | Rating: A-): US$1,000m Senior Note (US78448TAK88), fixed rate (5.70% coupon) maturing on 25 July 2033, priced at 99.66 (original spread of 195 bp), callable (10nc10)

- Shinhan Financial Group Co Ltd (Banking | Seoul, Seoul, South Korea | Rating: A): US$500m Senior Note (US824596AC41), fixed rate (5.00% coupon) maturing on 24 July 2028, priced at 99.73 (original spread of 110 bp), non callable

- Standard Chartered Bank (Banking | London, United Kingdom | Rating: A+): US$104m Unsecured Note (XS2658161778), floating rate maturing on 17 February 2032, priced at 100.00, non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$813m Unsecured Note (XS2636410354), fixed rate (4.29% coupon) maturing on 20 January 2028, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): €750m Senior Note (XS2657613720), fixed rate (3.75% coupon) maturing on 25 October 2027, priced at 99.53 (original spread of 133 bp), with a make whole call

- Bank of Cyprus PCL (Banking | Nicosia, Cyprus | Rating: BB-): €350m Note (XS2648493570), floating rate maturing on 25 July 2028, priced at 100.00 (original spread of 467 bp), callable (5nc4)

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400JHH0), fixed rate (4.01% coupon) maturing on 20 June 2030, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400JHB3), fixed rate (4.00% coupon) maturing on 20 March 2030, priced at 100.00 (original spread of 176 bp), non callable

- DS Smith PLC (Containers | London, United Kingdom | Rating: BBB-): €650m Senior Note (XS2654098222), fixed rate (4.50% coupon) maturing on 27 July 2030, priced at 99.52 (original spread of 214 bp), callable (7nc7)

- DS Smith PLC (Containers | London, United Kingdom | Rating: BBB-): €850m Senior Note (XS2654097927), fixed rate (4.38% coupon) maturing on 27 July 2027, priced at 99.75 (original spread of 175 bp), callable (4nc4)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C7K8), fixed rate (3.30% coupon) maturing on 17 August 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Germany | Rating: A+): €500m Inhaberschuldverschreibung (DE000DW6C7J0), fixed rate (3.05% coupon) maturing on 15 August 2025, priced at 100.00, non callable

- Energia Group ROI Financeco DAC (Financial - Other | Dublin, Ireland | Rating: NR): €600m Senior Note (XS2656464844), fixed rate (6.88% coupon) maturing on 31 July 2028, priced at 100.00 (original spread of 432 bp), callable (5nc2)

- Energo Pro as (Utility - Other | Praha, Czech Republic | Rating: AA+): €300m Bond (XS2656462806), fixed rate (4.26% coupon) maturing on 27 July 2035, priced at 100.00, non callable

- Energo Pro as (Utility - Other | Praha, Czech Republic | Rating: B+): €300m Bond (XS2656461667), fixed rate (4.26% coupon) maturing on 27 July 2035, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A36FH3), fixed rate (3.75% coupon) maturing on 31 August 2028, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A36FJ9), floating rate (EU03MLIB + 0.0 bp) maturing on 30 August 2030, priced at 100.00, non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €250m Inhaberschuldverschreibung (DE000A351MR6), floating rate (EU06MLIB + 0.0 bp) maturing on 27 July 2026, priced at 101.09, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB50P8), fixed rate (3.00% coupon) maturing on 25 August 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB50Q6), fixed rate (3.15% coupon) maturing on 25 August 2027, priced at 100.00, non callable

- Leasys Italia SpA (Service - Other | Rome, Roma, France | Rating: NR): €750m Senior Note (XS2656537664), fixed rate (4.50% coupon) maturing on 26 July 2026, priced at 99.95 (original spread of 170 bp), callable (3nc3)

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): €1,500m Covered Bond (Other) (XS2656481004), fixed rate (3.50% coupon) maturing on 25 July 2028, priced at 100.00 (original spread of 102 bp), non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: NR): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JHR9), fixed rate (3.63% coupon) maturing on 31 July 2026, priced at 99.92 (original spread of 71 bp), non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: NR): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JHS7), fixed rate (3.38% coupon) maturing on 31 July 2030, priced at 99.74 (original spread of 98 bp), non callable

- Terna Rete Elettrica Nazionale SpA (Utility - Other | Rome, Roma, Italy | Rating: BBB): €650m Senior Note (XS2655852726), fixed rate (3.88% coupon) maturing on 24 July 2033, priced at 99.11 (original spread of 155 bp), callable (10nc10)

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): €850m Senior Note (XS2655865546), fixed rate (3.85% coupon) maturing on 24 July 2030, priced at 99.87 (original spread of 140 bp), non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €100m Bond (IT0005552143), fixed rate (4.05% coupon) maturing on 24 July 2027, priced at 100.00, non callable

RECENT LOANS

- Bangladesh (Bangladesh | BB-), signed a US$ 300m Revolving Credit / Term Loan, to be used for general corporate purposes.

- Centromotion (United States of America), signed a US$ 450m Term Loan, maturing on 07/25/30.

- Copenhagen Infrastructure (Denmark), signed a € 1,000m Term Loan, to be used for general corporate purposes.

- Helexia Solar PV Assets (France), signed a € 90m Term Loan, to be used for project finance.

- Kiaka Gold Project (Burkina Faso), signed a US$ 165m Term Loan, to be used for project finance.

- Mitsubishi Corp (Japan | A), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/12/24.

- Nomura Micro Science Co Ltd (Japan), signed a US$ 135m Term Loan, to be used for working capital. It matures on 07/14/24.

- Proudreed (France), signed a € 474m Mortgage Financing, to be used for general corporate purposes. It matures on 07/14/28.

- Riwal Holding Group BV (Netherlands), signed a € 375m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/12/25.

- Seatrium Ltd (Singapore), signed a € 720m Revolving Credit / Term Loan, to be used for capital expenditures

- finance linked-trade.

- TDF Infrastructure SAS (France), signed a € 325m Revolving Credit Facility, to be used for general corporate purposes

- capital expenditures. It matures on 07/14/28.

- TDF Infrastructure SAS (France), signed a € 175m Capital Expenditure Facility, to be used for capital expenditures. It matures on 07/14/26.

- Zentiva as (Slovak Republic), signed a € 1,480m Term Loan B, to be used for refin/ret bank debt. It matures on 09/25/28 and initial pricing is set at EURIBOR +500.0bp

RECENT STRUCTURED CREDIT

- Adams Outdoor Advertising Billboard Securitization 2023-1 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 607 m. Highest-rated tranche offering a yield to maturity of 6.97%, and the lowest-rated tranche a yield to maturity of 11.71%. Bookrunners: Morgan Stanley International Ltd, Barclays Capital Group

- Benchmark 2023-V3 Mortgage Trust issued a fixed-rate CMBS in 6 tranches, for a total of US$ 855 m. Highest-rated tranche offering a yield to maturity of 5.83%, and the lowest-rated tranche a yield to maturity of 7.97%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, BMO Capital Markets

- Consumer Portfolio Services Auto Receivables Trust 2023-C issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 292 m. Highest-rated tranche offering a yield to maturity of 5.98%, and the lowest-rated tranche a yield to maturity of 9.66%. Bookrunners: Capital One Financial Corp, Citigroup Global Markets Inc

- Dilosk Rmbs No 7 Dac issued a floating-rate RMBS in 7 tranches, for a total of € 218 m. Highest-rated tranche offering a spread over the floating rate of 100bp, and the lowest-rated tranche a spread of 633bp. Bookrunners: Natixis, BofA Securities Inc

- Fannie Mae Connecticut Avenue Securities Trust 2023-R06 issued a floating-rate Agency RMBS in 4 tranches, for a total of US$ 766 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 590bp. Bookrunners: Bank of America Merrill Lynch, StoneX Group Inc

- Morgan Stanley Residential Mortgage Loan Trust 2023-2 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 255 m. Highest-rated tranche offering a yield to maturity of 7.72%, and the lowest-rated tranche a yield to maturity of 9.02%. Bookrunners: Morgan Stanley International Ltd

- Nassau Euro CLO III Designated Activity Co issued a floating-rate CLO in 6 tranches, for a total of € 411 m. Highest-rated tranche offering a spread over the floating rate of 195bp, and the lowest-rated tranche a spread of 746bp. Bookrunners: Barclays Capital Group

- SC Germany SA Compartment Consumer 2023-1 issued a floating-rate ABS backed by consumer loan in 6 tranches, for a total of € 872 m. Highest-rated tranche offering a spread over the floating rate of 72bp, and the lowest-rated tranche a spread of 875bp. Bookrunners: ING Bank NV, Deutsche Bank, Banco Santander SA