Credit

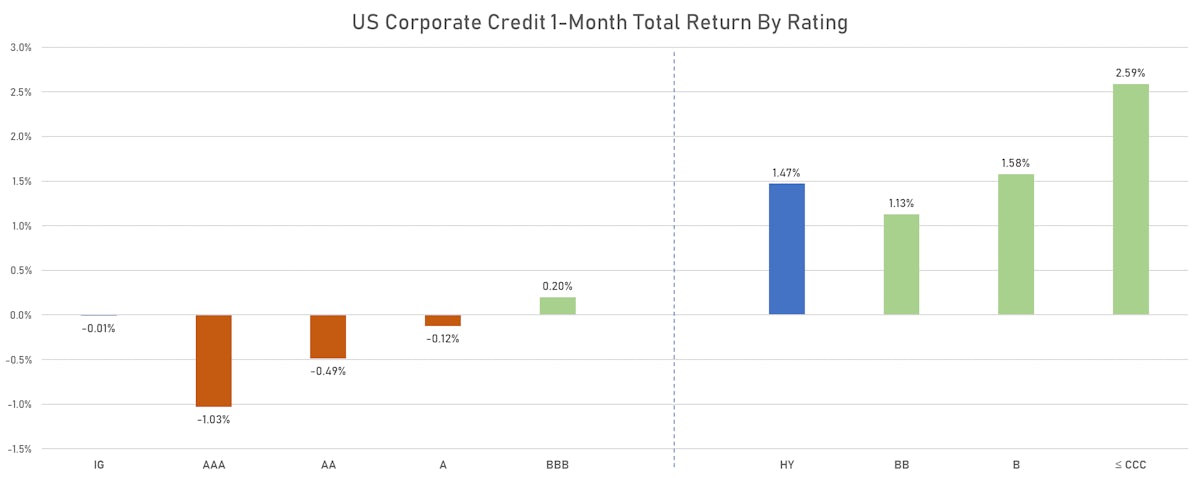

Spread Compression Across The Credit Complex, Led By The Riskiest Assets Classes

Limited supply of new corporate bonds this week: 18 tranches for $15.65bn in IG (2023 YTD volume $786.310bn vs 2022 YTD $824.091bn), 4 tranches for $2.61bn in HY (2023 YTD volume $99.952bn vs 2022 YTD $68.576bn)

Published ET

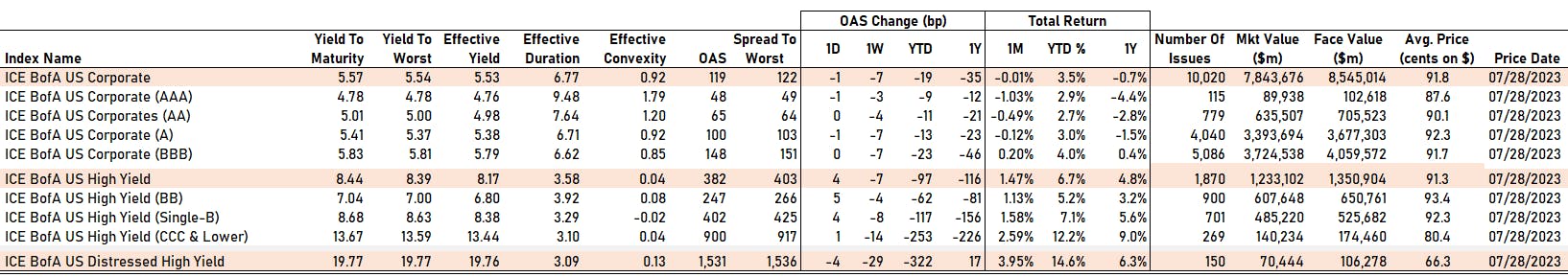

1-Month Total Returns for ICE BofA US Corporate indices | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.26% today, with investment grade up 0.27% and high yield up 0.08% (YTD total return: +3.44%)

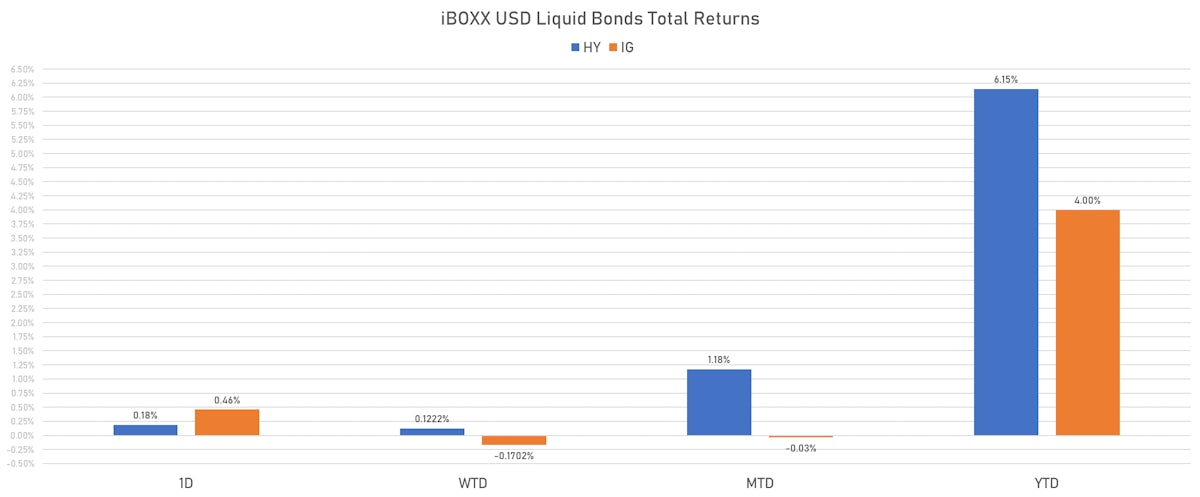

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.458% today (Week-to-date: -0.17%; Month-to-date: -0.03%; Year-to-date: 4.00%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.184% today (Week-to-date: 0.12%; Month-to-date: 1.18%; Year-to-date: 6.15%)

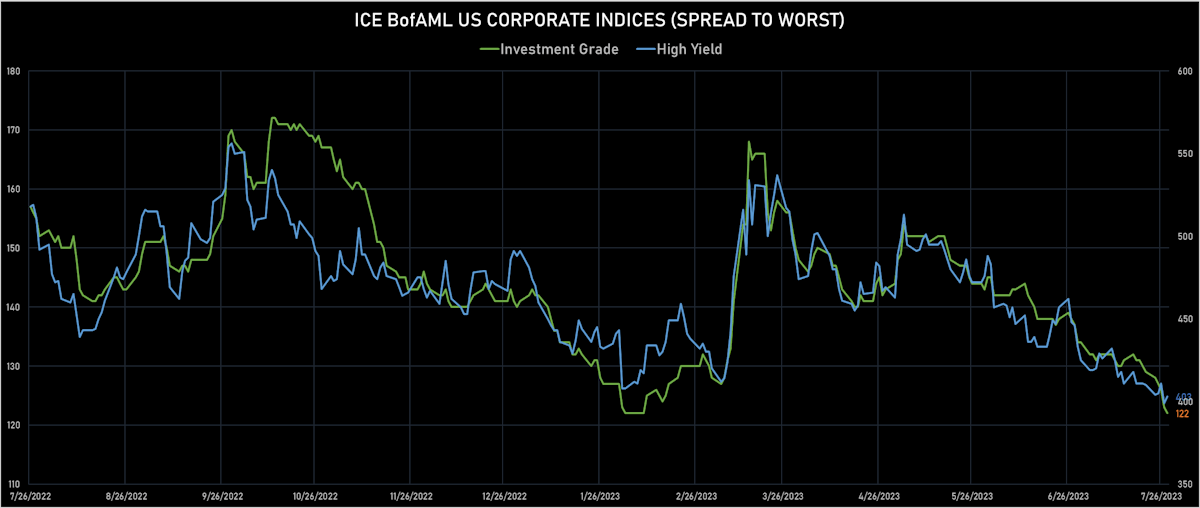

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 122.0 bp (WTD change: -7.0 bp; YTD change: -18.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 403.0 bp (WTD change: -7.0 bp; YTD change: -85.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +7.5%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 48 bp

- AA unchanged at 65 bp

- A down by -1 bp at 100 bp

- BBB unchanged at 148 bp

- BB up by 5 bp at 247 bp

- B up by 4 bp at 402 bp

- ≤ CCC up by 1 bp at 900 bp

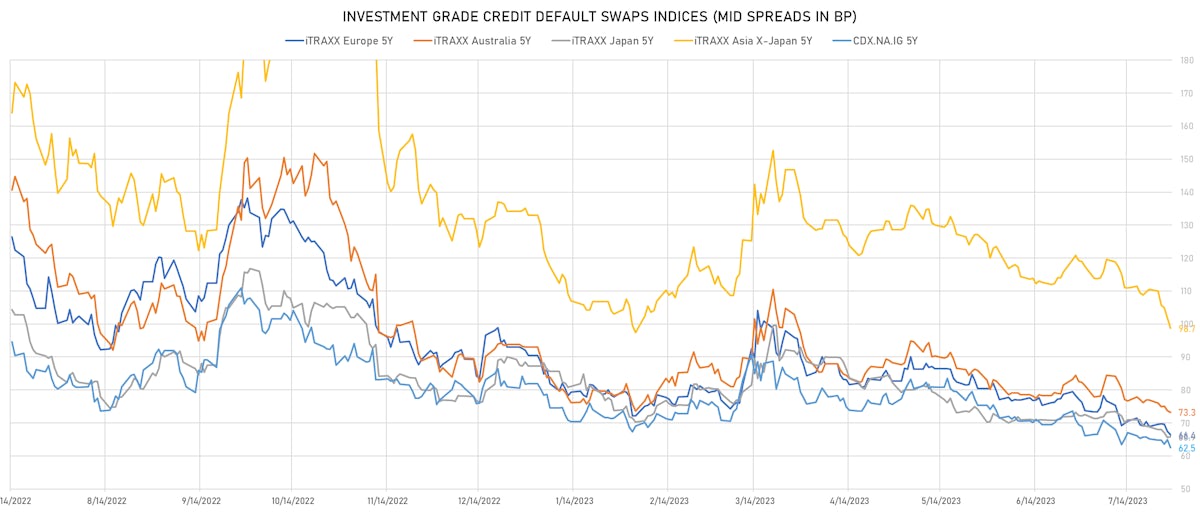

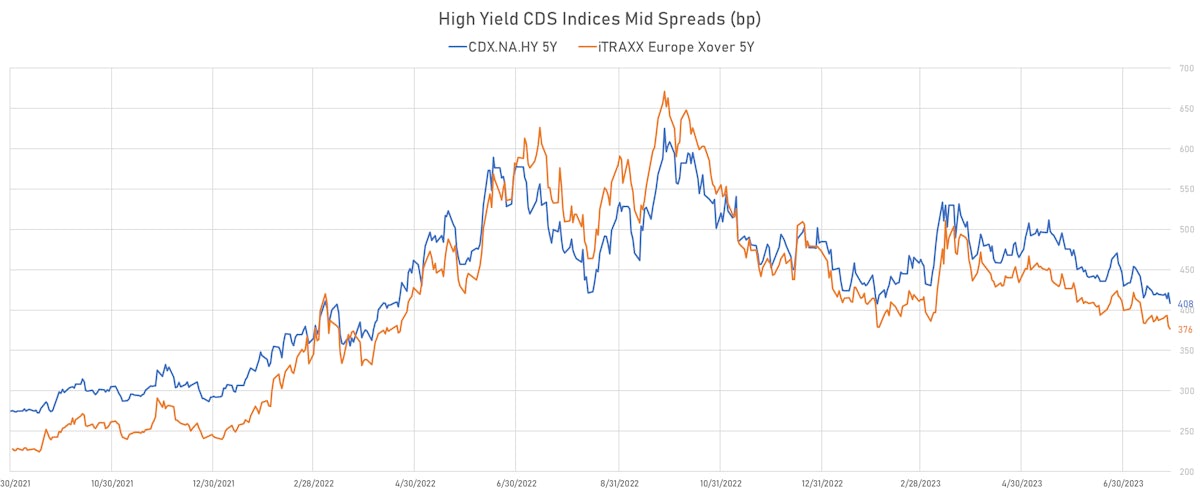

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.4 bp, now at 63bp (1W change: -2.6bp; YTD change: -19.3bp)

- Markit CDX.NA.IG 10Y down 2.3 bp, now at 103bp (1W change: -2.1bp; YTD change: -14.5bp)

- Markit CDX.NA.HY 5Y down 12.7 bp, now at 408bp (1W change: -11.2bp; YTD change: -76.5bp)

- Markit iTRAXX Europe 5Y down 1.0 bp, now at 66bp (1W change: -2.5bp; YTD change: -24.0bp)

- Markit iTRAXX Europe Crossover 5Y down 4.1 bp, now at 376bp (1W change: -10.9bp; YTD change: -97.7bp)

- Markit iTRAXX Japan 5Y up 0.2 bp, now at 66bp (1W change: -2.9bp; YTD change: -21.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 3.2 bp, now at 99bp (1W change: -11.8bp; YTD change: -34.3bp)

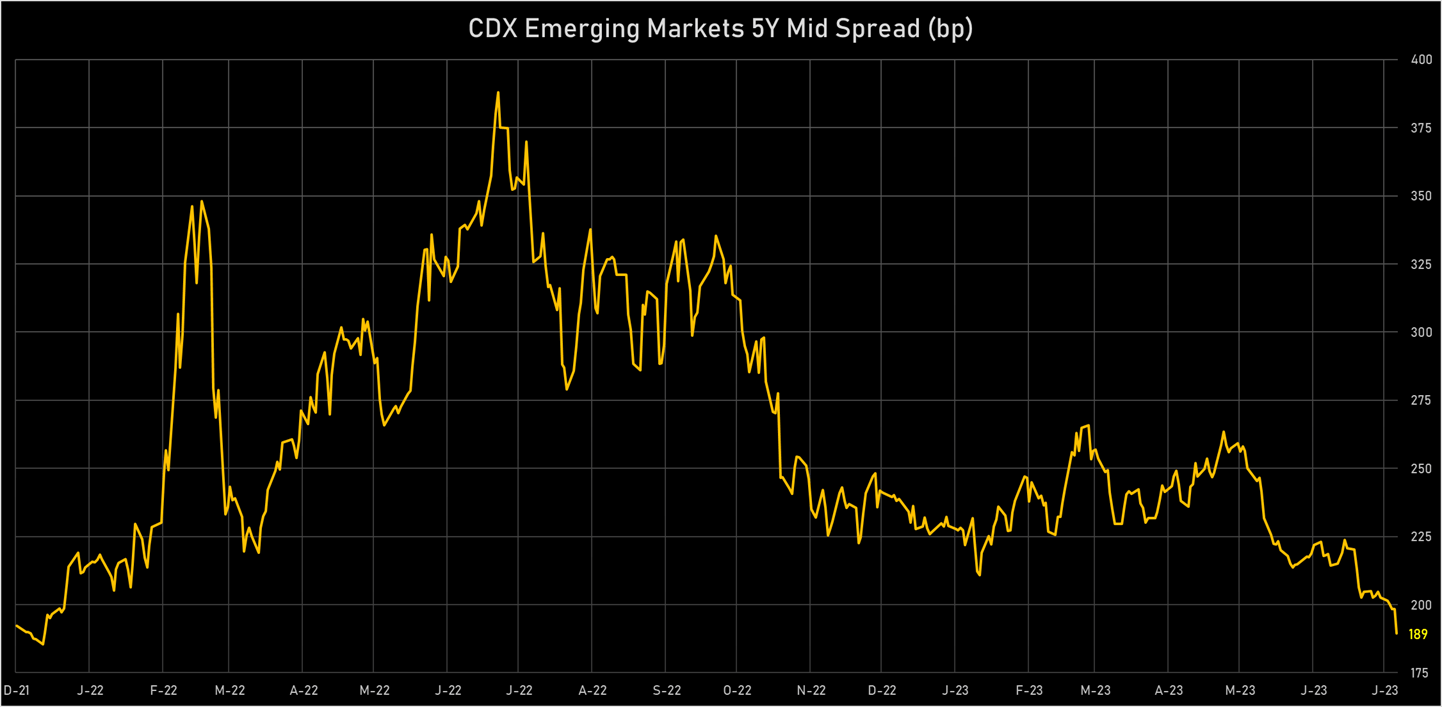

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- South Africa (rated BB-): down 8.3 % to 228 bp (1Y range: 218-349bp)

- Indonesia (rated BBB): down 9.3 % to 74 bp (1Y range: 76-166bp)

- Turkey (rated B): down 10.4 % to 390 bp (1Y range: 421-855bp)

- Philippines (rated BBB): down 10.6 % to 69 bp (1Y range: 71-153bp)

- Panama (rated WD): down 11.2 % to 90 bp (1Y range: 93-187bp)

- Peru (rated BBB): down 12.1 % to 71 bp (1Y range: 72-171bp)

- Latvia (rated A-): down 12.2 % to 65 bp (1Y range: 65-1,112bp)

- Lithuania (rated A): down 12.2 % to 65 bp (1Y range: 65-985bp)

- China (rated A+): down 12.9 % to 54 bp (1Y range: 47-132bp)

- Chile (rated A-): down 16.9 % to 60 bp (1Y range: 64-174bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Lumen Technologies Inc (Country: US; rated: NR): down 24751.6 bp to .0bp (1Y range: -533bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): down 187.4 bp to 5,263.7bp (1Y range: 1,179-5,264bp)

- Community Health Systems Inc (Country: US; rated: NR): down 159.6 bp to 1,882.3bp (1Y range: 1,258-4,371bp)

- DISH DBS Corp (Country: US; rated: Caa1): down 137.0 bp to 2,779.0bp (1Y range: 1,138-3,084bp)

- Gap Inc (Country: US; rated: NR): down 71.9 bp to 476.1bp (1Y range: 429-772bp)

- Kohls Corp (Country: US; rated: Ba2): down 58.8 bp to 491.9bp (1Y range: 377-783bp)

- Nordstrom Inc (Country: US; rated: NR): down 43.9 bp to 462.8bp (1Y range: 419-685bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: NR): down 36.5 bp to 275.3bp (1Y range: 275-1,187bp)

- Carnival Corp (Country: US; rated: Ba2): down 36.4 bp to 473.6bp (1Y range: 466-2,117bp)

- Macy's Inc (Country: US; rated: A1): down 35.3 bp to 365.6bp (1Y range: 300-619bp)

- Newell Brands Inc (Country: US; rated: Ba1): down 34.5 bp to 385.4bp (1Y range: 83-385bp)

- Unisys Corp (Country: US; rated: B1): down 32.5 bp to 880.5bp (1Y range: 432-1,378bp)

- Anywhere Real Estate Group LLC (Country: US; rated: B1): up 46.5 bp to 940.8bp (1Y range: 278-941bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 128.1 bp to 1,588.5bp (1Y range: 747-1,783bp)

- Staples Inc (Country: US; rated: B3): up 396.1 bp to 3,573.7bp (1Y range: 1,393-3,574bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 61.8 bp to 642.9bp (1Y range: 643-1,254bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 58.4 bp to 581.5bp (1Y range: 566-1,739bp)

- TUI AG (Country: DE; rated: B2-PD): down 53.2 bp to 683.1bp (1Y range: 683-1,725bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 43.3 bp to 487.3bp (1Y range: 487-1,290bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 36.6 bp to 400.0bp (1Y range: 379-602bp)

- Ziggo Bond Company BV (Country: NL; rated: WR): down 33.6 bp to 452.9bp (1Y range: 385-584bp)

- Air France KLM SA (Country: FR; rated: NR): down 27.0 bp to 345.6bp (1Y range: 346-925bp)

- Rolls-Royce PLC (Country: GB; rated: Ba3): down 26.0 bp to 190.7bp (1Y range: 191-523bp)

- Ceconomy AG (Country: DE; rated: NR): down 24.2 bp to 653.4bp (1Y range: 653-1,763bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 22.9 bp to 437.5bp (1Y range: 280-496bp)

- Renault SA (Country: FR; rated: NR): down 19.5 bp to 225.4bp (1Y range: 222-453bp)

- Novafives SAS (Country: FR; rated: Caa1): down 19.2 bp to 581.1bp (1Y range: 581-2,936bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 17.9 bp to 2,213.8bp (1Y range: 1,286-2,910bp)

- Stena AB (Country: SE; rated: B1-PD): down 17.1 bp to 395.9bp (1Y range: 396-730bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): up 21.3 bp to 581.0bp (1Y range: 186-581bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 5.13% | Maturity: 16/6/2025 | Rating: BB+ | CUSIP: 345397A60 | OAS up by 46.0 bp to 181.6 bp (CDS basis: -103.6bp), with the yield to worst at 6.9% and the bond now trading down to 96.7 cents on the dollar (1Y price range: 95.3-98.9).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS up by 29.7 bp to 155.9 bp, with the yield to worst at 6.0% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 96.0-98.8).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS up by 12.4 bp to 68.0 bp (CDS basis: -63.0bp), with the yield to worst at 5.9% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 91.4-95.0).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB+ | CUSIP: 345370CR9 | OAS down by 16.3 bp to 48.8 bp (CDS basis: 96.3bp), with the yield to worst at 5.1% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 39.8-98.3).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS down by 19.6 bp to 105.3 bp (CDS basis: -40.6bp), with the yield to worst at 5.7% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 97.1-100.3).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS down by 23.0 bp to 56.2 bp, with the yield to worst at 5.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 95.3-99.0).

- Issuer: Regal Rexnord Corp (Beloit, Wisconsin (US)) | Coupon: 6.05% | Maturity: 15/2/2026 | Rating: BB+ | CUSIP: 758750AC7 | OAS down by 32.8 bp to 130.3 bp, with the yield to worst at 5.8% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 62.4-102.1).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 4.13% | Maturity: 1/12/2026 | Rating: BB- | CUSIP: 26885BAB6 | OAS down by 36.2 bp to 155.3 bp, with the yield to worst at 5.9% and the bond now trading up to 93.8 cents on the dollar (1Y price range: 87.5-94.1).

- Issuer: EQT Corp (Pittsburgh, Pennsylvania (US)) | Coupon: 3.90% | Maturity: 1/10/2027 | Rating: BB+ | CUSIP: 26884LAF6 | OAS down by 38.4 bp to 120.1 bp, with the yield to worst at 5.5% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 90.6-95.3).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS down by 40.0 bp to 134.6 bp (CDS basis: 46.2bp), with the yield to worst at 5.7% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Sabra Health Care LP (Irvine, California (US)) | Coupon: 5.13% | Maturity: 15/8/2026 | Rating: BB+ | CUSIP: 14162VAB2 | OAS down by 45.0 bp to 174.4 bp, with the yield to worst at 6.4% and the bond now trading up to 96.1 cents on the dollar (1Y price range: 39.6-96.9).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B- | CUSIP: 780153BG6 | OAS down by 47.0 bp to 255.4 bp (CDS basis: -17.6bp), with the yield to worst at 6.7% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 79.8-94.5).

- Issuer: Belo Corp (Mc Lean, Virginia (US)) | Coupon: 7.25% | Maturity: 15/9/2027 | Rating: BB- | CUSIP: 080555AF2 | OAS down by 87.1 bp to 355.9 bp (CDS basis: -252.1bp), with the yield to worst at 7.4% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 92.8-98.5).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 3.95% | Maturity: 15/1/2028 | Rating: B | CUSIP: 44106MAX0 | OAS down by 116.7 bp to 580.8 bp, with the yield to worst at 9.9% and the bond now trading up to 78.0 cents on the dollar (1Y price range: 71.1-82.0).

- Issuer: Brightsphere Investment Group Inc (Boston, Massachusetts (US)) | Coupon: 4.80% | Maturity: 27/7/2026 | Rating: BB+ | CUSIP: 10948WAA1 | OAS down by 128.2 bp to 257.9 bp, with the yield to worst at 6.8% and the bond now trading up to 94.2 cents on the dollar (1Y price range: 38.1-94.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS up by 359.0 bp to 255.3 bp, with the yield to worst at 6.2% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 88.0-99.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | OAS up by 156.4 bp to 240.3 bp, with the yield to worst at 5.3% and the bond now trading down to 86.8 cents on the dollar (1Y price range: 75.4-86.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS up by 151.2 bp to 337.9 bp, with the yield to worst at 6.1% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 74.8-87.9).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.00% | Maturity: 12/11/2029 | Rating: BB | ISIN: FR0014006G24 | OAS up by 98.0 bp to 613.5 bp, with the yield to worst at 8.3% and the bond now trading down to 61.9 cents on the dollar (1Y price range: 61.6-69.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS down by 80.5 bp to 682.4 bp (CDS basis: -35.8bp), with the yield to worst at 9.9% and the bond now trading up to 78.2 cents on the dollar (1Y price range: 72.8-85.1).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.88% | Maturity: 15/2/2026 | Rating: BB+ | ISIN: FR0013318102 | OAS down by 84.4 bp to 33.6 bp, with the yield to worst at 3.6% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 93.7-97.4).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | OAS down by 86.3 bp to 509.2 bp, with the yield to worst at 8.1% and the bond now trading up to 65.7 cents on the dollar (1Y price range: 40.4-66.0).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 2.38% | Maturity: 15/1/2027 | Rating: BB+ | ISIN: XS1822791619 | OAS down by 86.8 bp to 481.1 bp, with the yield to worst at 8.0% and the bond now trading up to 83.0 cents on the dollar (1Y price range: 78.0-87.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.88% | Maturity: 6/7/2032 | Rating: BB | ISIN: XS2362416617 | OAS down by 88.1 bp to 381.7 bp, with the yield to worst at 6.8% and the bond now trading up to 80.6 cents on the dollar (1Y price range: 66.1-80.4).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS down by 88.7 bp to 613.6 bp, with the yield to worst at 9.4% and the bond now trading up to 77.2 cents on the dollar (1Y price range: 65.2-79.1).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 1.25% | Maturity: 8/9/2026 | Rating: BB+ | ISIN: XS1485608118 | OAS down by 98.0 bp to 430.2 bp, with the yield to worst at 7.4% and the bond now trading up to 82.6 cents on the dollar (1Y price range: 77.4-91.2).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS down by 99.0 bp to 625.6 bp (CDS basis: -37.9bp), with the yield to worst at 9.4% and the bond now trading up to 79.3 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 112.4 bp to 190.5 bp (CDS basis: 37.0bp), with the yield to worst at 5.1% and the bond now trading up to 97.7 cents on the dollar (1Y price range: 85.3-98.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 115.3 bp to 231.3 bp (CDS basis: 91.5bp), with the yield to worst at 5.5% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 88.4-103.2).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB | ISIN: XS2341724172 | OAS down by 146.0 bp to 415.3 bp, with the yield to worst at 7.3% and the bond now trading up to 80.4 cents on the dollar (1Y price range: 71.3-80.7).

RECENT DOMESTIC USD BOND ISSUES

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): US$1,200m Senior Note (US025816DG18), floating rate maturing on 28 July 2027, priced at 100.00, callable (4nc3)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$300m Senior Note (US025816DJ56), floating rate (SOFRINDX + 97.0 bp) maturing on 28 July 2027, priced at 100.00, callable (4nc3)

- American Express Co (Banking | New York City, New York, United States | Rating: BBB): US$500m Subordinated Note (US025816DK20), floating rate maturing on 28 July 2034, priced at 100.00, callable (11nc10)

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): US$1,500m Senior Note (US025816DH90), floating rate maturing on 27 July 2029, priced at 100.00, callable (6nc5)

- Ares Capital Corp (Financial - Other | New York City, United States | Rating: BBB-): US$600m Senior Note (US04010LBE20), fixed rate (7.00% coupon) maturing on 15 January 2027, priced at 99.26 (original spread of 265 bp), with a make whole call

- Arsenal AIC Parent LLC (Financial - Other | United States | Rating: B+): US$700m Note (USU0414CAB64), fixed rate (8.00% coupon) maturing on 1 October 2030, priced at 100.00 (original spread of 396 bp), callable (7nc3)

- Brand Industrial Services Inc (Service - Other | Kennesaw, Georgia, United States | Rating: B-): US$1,335m Note (USU1052DAB92), fixed rate (10.38% coupon) maturing on 1 August 2030, priced at 100.00 (original spread of 633 bp), callable (7nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$450m Bond (US3133EPRS65), fixed rate (4.88% coupon) maturing on 28 July 2025, priced at 99.78 (original spread of 12 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$500m Bond (US3133EPRL13), floating rate (SOFR + 16.5 bp) maturing on 28 July 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$1,100m Bond (US3133EPRW77), floating rate (SOFR + 16.0 bp) maturing on 4 August 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$225m Bond (US3133EPRK30), floating rate (PRQ + -300.0 bp) maturing on 28 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$2,250m Bond (US3130AWQ528), floating rate (SOFR + 16.0 bp) maturing on 24 July 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$500m Bond (US3130AWQJ24), floating rate (SOFR + 16.0 bp) maturing on 25 July 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYYG17), fixed rate (6.00% coupon) maturing on 16 August 2027, priced at 100.00 (original spread of -1 bp), callable (4nc3m)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$160m Unsecured Note (US3134GYYT38), fixed rate (5.88% coupon) maturing on 8 August 2025, priced at 100.00, callable (2nc6m)

- Fifth Third Bancorp (Banking | Cincinnati, Ohio, United States | Rating: BBB+): US$1,250m Senior Note (US316773DK32), floating rate maturing on 27 July 2029, priced at 100.00, callable (6nc5)

- L3Harris Technologies Inc (Electronics | Melbourne Florida, United States | Rating: BBB): US$1,250m Senior Note (US502431AP47), fixed rate (5.40% coupon) maturing on 15 January 2027, priced at 99.87 (original spread of 85 bp), with a make whole call

- L3Harris Technologies Inc (Electronics | Melbourne Florida, United States | Rating: BBB): US$500m Senior Note (US502431AR03), fixed rate (5.60% coupon) maturing on 31 July 2053, priced at 99.68 (original spread of 155 bp), callable (30nc30)

- L3Harris Technologies Inc (Electronics | Melbourne Florida, United States | Rating: BBB): US$1,500m Senior Note (US502431AQ20), fixed rate (5.40% coupon) maturing on 31 July 2033, priced at 99.89 (original spread of 140 bp), callable (10nc10)

- Penske Truck Leasing Co LP (Leasing | Reading, United States | Rating: BBB): US$1,100m Senior Note (USU71000BN97), fixed rate (6.05% coupon) maturing on 1 August 2028, priced at 99.75 (original spread of 188 bp), callable (5nc5)

- Public Storage (Real Estate Investment Trust | Glendale, California, United States | Rating: A): US$600m Senior Note (US74460WAH07), fixed rate (5.35% coupon) maturing on 1 August 2053, priced at 99.73 (original spread of 192 bp), callable (30nc30)

- Public Storage (Real Estate Investment Trust | Glendale, California, United States | Rating: A): US$500m Senior Note (US74460WAF41), fixed rate (5.13% coupon) maturing on 15 January 2029, priced at 99.92 (original spread of 110 bp), callable (5nc5)

- Public Storage (Real Estate Investment Trust | Glendale, California, United States | Rating: A): US$400m Senior Note (US74460WAJ62), floating rate (SOFRINDX + 60.0 bp) maturing on 25 July 2025, priced at 100.00, non callable

- Public Storage (Real Estate Investment Trust | Glendale, California, United States | Rating: A): US$700m Senior Note (US74460WAG24), fixed rate (5.10% coupon) maturing on 1 August 2033, priced at 99.83 (original spread of 136 bp), callable (10nc10)

- Waste Management Inc (Service - Other | Houston, United States | Rating: BBB+): US$750m Senior Note (US94106LBV09), fixed rate (4.88% coupon) maturing on 15 February 2029, priced at 99.31 (original spread of 75 bp), callable (6nc5)

- Waste Management Inc (Service - Other | Houston, United States | Rating: BBB+): US$1,250m Senior Note (US94106LBW81), fixed rate (4.88% coupon) maturing on 15 February 2034, priced at 98.50 (original spread of 105 bp), callable (11nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- Abu Dhabi Future Energy Company Pjsc (Utility - Other | Abu Dhabi, United Arab Emirates | Rating: A): US$750m Senior Note (XS2651619285), fixed rate (4.88% coupon) maturing on 25 July 2033, priced at 99.50 (original spread of 125 bp), non callable

- Ashtead Capital Inc (Leasing | Fort Mill, South Carolina, United Kingdom | Rating: NR): US$750m Senior Note (USU04503AM76), fixed rate (5.95% coupon) maturing on 15 October 2033, priced at 99.91 (original spread of 231 bp), with a make whole call

- CIMB Bank Bhd (Banking | Kuala Lumpur, Kuala Lumpur, Malaysia | Rating: A-): US$130m Senior Note (XS2660270286), floating rate maturing on 28 July 2028, priced at 100.00, non callable

- China Cinda (2020) I Management Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$400m Unsecured Note (XS2662422802) maturing on 7 February 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$500m Note (XS0460039695), fixed rate (4.80% coupon) maturing on 18 August 2025, priced at 101.00, non callable

- Embraer Netherlands Finance BV (Financial - Other | Amsterdam, Noord-Holland, Brazil | Rating: BB+): US$750m Senior Note (US29082HAD44), fixed rate (7.00% coupon) maturing on 28 July 2030, priced at 99.32 (original spread of 306 bp), callable (7nc7)

- Hangzhou Qiantang New Area Construction and Investment Group Co Ltd (Financial - Other | Hangzhou, Zhejiang, China (Mainland) | Rating: NR): US$300m Bond (XS2654510556), fixed rate (6.28% coupon) maturing on 31 July 2026, priced at 100.00, non callable

- Korea Electric Power Corp (Utility - Other | Naju, Jeollanam-Do, South Korea | Rating: AA): US$1,000m Senior Note (USY4907LAG78), fixed rate (5.38% coupon) maturing on 31 July 2026, priced at 99.80 (original spread of 100 bp), non callable

- Sa Emisora GP (Transportation - Other | Asuncion, Paraguay | Rating: NR): US$3,639m Unsecured Note (PYGPE08F5804), fixed rate (8.25% coupon) maturing on 22 July 2027, priced at 100.00, non callable

- Univision Communications Inc (Cable/Media | New York City, New York, Mexico | Rating: B+): US$500m Note (USU91505AT17), fixed rate (8.00% coupon) maturing on 15 August 2028, priced at 100.00 (original spread of 388 bp), callable (5nc2)

RECENT EURO BOND ISSUES

- Alpha European Private Debt SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €700m Index Linked Security (DE000A3K2V21), floating rate maturing on 27 July 2033, callable (10nc2m)

- Amundi Finance Emissions SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €200m Bond (FR001400HJA5), floating rate (EU03MLIB + 0.0 bp) maturing on 28 July 2025, priced at 100.00, non callable

- Cellnex Telecom (Telecommunications | Barcelona, Spain | Rating: BB+): €1,000m Bond (XS2597741102), fixed rate (2.13% coupon) maturing on 11 August 2030, priced at 100.00, non callable, convertible

- Credit Agrico (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JML2), fixed rate (3.43% coupon) maturing on 15 June 2035, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agrico (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JLZ4), fixed rate (3.67% coupon) maturing on 15 December 2025, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agrico (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMG2), fixed rate (3.42% coupon) maturing on 15 December 2034, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMK4), fixed rate (3.44% coupon) maturing on 15 December 2035, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMI8), fixed rate (3.46% coupon) maturing on 15 June 2036, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMF4), fixed rate (3.41% coupon) maturing on 15 June 2034, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMJ6), fixed rate (3.46% coupon) maturing on 15 June 2037, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM17), fixed rate (3.53% coupon) maturing on 15 December 2026, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMD9), fixed rate (3.39% coupon) maturing on 15 December 2033, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM33), fixed rate (3.50% coupon) maturing on 15 June 2027, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JME7), fixed rate (3.38% coupon) maturing on 15 June 2033, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMC1), fixed rate (3.38% coupon) maturing on 15 December 2032, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM25), fixed rate (3.46% coupon) maturing on 15 December 2027, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM58), fixed rate (3.40% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JMH0), fixed rate (3.46% coupon) maturing on 15 December 2036, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM09), fixed rate (3.58% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM66), fixed rate (3.41% coupon) maturing on 15 December 2028, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole Financement De l'habitat Sfh (Financial - Other | Montrouge, France | Rating: AAA): €3,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400JM41), fixed rate (3.43% coupon) maturing on 15 June 2028, priced at 100.00 (original spread of 100,000 bp), non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €356m Bond (FRCASA010142), fixed rate (3.75% coupon) maturing on 27 July 2033, priced at 100.00 (original spread of 135 bp), non callable

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: A-): €300m Note (XS2660380622), fixed rate (4.13% coupon) maturing on 3 August 2028, priced at 99.44 (original spread of 173 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VGB5), fixed rate (3.10% coupon) maturing on 18 August 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VGD1), floating rate maturing on 17 August 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VGC3), fixed rate (3.70% coupon) maturing on 17 August 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VGG4), fixed rate (3.70% coupon) maturing on 17 August 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A36FK7), fixed rate (3.20% coupon) maturing on 23 February 2027, priced at 100.00, non callable

- Hamburg Commercial Bank AG (Banking | Hamburg, Germany | Rating: A-): €150m Hypothekenpfandbrief (Covered Bond) (DE000HCB0BX6), floating rate (EU03MLIB + 20.0 bp) maturing on 4 August 2025, priced at 100.00, non callable

- Iceland Bondco PLC (Financial - Other | United Kingdom | Rating: B-): €250m Note (XS2660425153), floating rate (EU03MLIB + 550.0 bp) maturing on 15 December 2027, priced at 97.00, callable (4nc1)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €400m Inhaberschuldverschreibung (DE000LB4FMW3), fixed rate (2.00% coupon) maturing on 1 September 2031, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €400m Inhaberschuldverschreibung (DE000LB4FMV5), fixed rate (2.00% coupon) maturing on 30 August 2030, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FM70), fixed rate (3.30% coupon) maturing on 1 September 2025, priced at 100.00 (original spread of 81 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FM39), fixed rate (2.80% coupon) maturing on 31 August 2026, priced at 100.00 (original spread of 54 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FM88), fixed rate (3.20% coupon) maturing on 31 August 2026, priced at 100.00 (original spread of 95 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FM47), fixed rate (2.80% coupon) maturing on 30 August 2027, priced at 100.00 (original spread of 53 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FM96), fixed rate (3.20% coupon) maturing on 30 August 2027, priced at 100.00 (original spread of 95 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €400m Inhaberschuldverschreibung (DE000LB4FMU7), fixed rate (2.00% coupon) maturing on 30 August 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FMB7), fixed rate (3.20% coupon) maturing on 30 August 2029, priced at 100.00 (original spread of 118 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €450m Inhaberschuldverschreibung (DE000LB4FMA9), fixed rate (3.20% coupon) maturing on 30 August 2028, priced at 100.00 (original spread of 105 bp), non callable

- Mizuho International PLC (Securities | London, Japan | Rating: A): €150m Unsecured Note (XS2663135866), floating rate maturing on 4 August 2025, priced at 100.00, non callable

RECENT LOANS

- AQ Carver Buyer Inc (United States of America), signed a US$ 550m Term Loan B, to be used for general corporate purposes. It matures on 07/27/29 and initial pricing is set at Term SOFR +575.0bp

- Anqore Bv (Netherlands), signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 12/21/27 and initial pricing is set at EURIBOR +550.0bp

- Country Garden Holdings Co Ltd (China), signed a US$ 389m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 01/20/26.

- Dun & Bradstreet Corp (United States of America | B-), signed a US$ 2,666m Term Loan B, to be used for general corporate purposes. It matures on 02/08/26 and initial pricing is set at Term SOFR +300.0bp

- FinCo I LLC (United States of America | BB), signed a US$ 800m Term Loan B, to be used for general corporate purposes. It matures on 06/27/28 and initial pricing is set at Term SOFR +300.0bp

- Fondo de Garantia de Depositos (Spain), signed a € 5,000m Term Loan, to be used for general corporate purposes. It matures on 07/20/36.

- GIP II Blue Holding LP (United States of America), signed a US$ 750m Term Loan B, to be used for proceed to sharehlds. It matures on 09/29/28 and initial pricing is set at Term SOFR +450.0bp

- Greenwing Energy (Thailand), signed a € 300m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 07/19/28 and initial pricing is set at EURIBOR +120.0bp

- Guerbet SA (France), signed a € 250m Term Loan, to be used for general corporate purposes. It matures on 07/20/28.

- Guerbet SA (France), signed a € 100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/20/28.

- Hanover Insurance Group Inc (United States of America | BBB-), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/21/28 and initial pricing is set at Term SOFR +112.5bp

- Heidelberger Druckmaschinen AG (Germany), signed a € 350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/21/27.

- High Ridge Aviation Ltd (Republic of Ireland), signed a US$ 500m Term Loan, to be used for general corporate purposes. It matures on 07/19/30.

- Keywords Studios PLC (Republic of Ireland), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/21/27.

- OPAL Fuels Development Pipelin (United States of America), signed a US$ 500m Term Loan, to be used for general corporate purposes. It matures on 08/02/28.

- Prime US REIT (Singapore), signed a US$ 200m Term Loan, to be used for general corporate purposes. It matures on 07/31/24.

- Prime US REIT (Singapore), signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/31/24.

- Steel Dynamics Inc (United States of America | BBB), signed a US$ 1,200m Revolving Credit Facility, to be used for general corporate purposes, working capital. It matures on 07/19/28 and initial pricing is set at Term SOFR +100.0bp

- The Kraft Heinz Co (United States of America | BBB), signed a US$ 4,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/08/28 and initial pricing is set at Term SOFR +175.0bp

- Turkiye Sinai Kalkinma Bankasi (Turkey), signed a € 94m Term Loan, to be used for finance linked-trade. It matures on 07/20/24.

- Valmet Oyj (Finland), signed a € 250m Term Loan, to be used for acquisition financing. It matures on 01/19/28.

- Valmet Oyj (Finland), signed a € 150m Term Loan, to be used for acquisition financing. It matures on 07/19/25.

RECENT STRUCTURED CREDIT

- ACHV ABS Trust 2023-3PL issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 209 m. Highest-rated tranche offering a yield to maturity of 6.60%, and the lowest-rated tranche a yield to maturity of 8.36%. Bookrunners: Jefferies & Co Inc, Truist Securities Inc, Atlas SP Partners LP

- Bain Capital Euro Clo 2023-1 Dac issued a floating-rate CLO in 6 tranches, for a total of € 382 m. Highest-rated tranche offering a spread over the floating rate of 175bp, and the lowest-rated tranche a spread of 535bp. Bookrunners: Jefferies & Co Inc

- Bank Of America Auto Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 914 m. Highest-rated tranche offering a yield to maturity of 5.39%, and the lowest-rated tranche a yield to maturity of 5.83%. Bookrunners: Bank of America Merrill Lynch

- BMO 2023-5c1 Mortgage Trust issued a fixed-rate CMBS in 5 tranches, for a total of US$ 717 m. Highest-rated tranche offering a yield to maturity of 6.28%, and the lowest-rated tranche a yield to maturity of 7.14%. Bookrunners: Goldman Sachs & Co, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, SG Americas Securities LLC, BMO Capital Markets, KeyBanc Capital Markets Inc

- Cairn CLO XVII DAC issued a floating-rate CLO in 7 tranches, for a total of € 407 m. Highest-rated tranche offering a spread over the floating rate of 180bp, and the lowest-rated tranche a spread of 964bp. Bookrunners: JP Morgan & Co Inc

- Clavel Residential 3 Dac issued a floating-rate RMBS in 7 tranches, for a total of € 718 m. Highest-rated tranche offering a spread over the floating rate of 220bp, and the lowest-rated tranche a spread of 450bp. Bookrunners: Morgan Stanley & Co. International plc

- Foursight Capital Automobile Receivables Trust 2023-2 issued a fixed-rate ABS backed by auto receivables in 6 tranches, for a total of US$ 200 m. Highest-rated tranche offering a yield to maturity of 5.62%, and the lowest-rated tranche a yield to maturity of 10.98%. Bookrunners: JP Morgan & Co Inc, Capital One Financial Corp

- Harvest CLO XXX Designated Activity Co issued a floating-rate CLO in 8 tranches, for a total of € 436 m. Highest-rated tranche offering a spread over the floating rate of 175bp, and the lowest-rated tranche a spread of 947bp. Bookrunners: Citi

- J.P. Morgan Mortgage Trust 2023-6 issued a fixed-rate RMBS in 7 tranches, for a total of US$ 368 m. Highest-rated tranche offering a yield to maturity of 5.70%, and the lowest-rated tranche a yield to maturity of 6.07%. Bookrunners: JP Morgan & Co Inc

- Lux Trust 2023-Lion issued a floating-rate CMBS in 3 tranches, for a total of US$ 227 m. Highest-rated tranche offering a spread over the floating rate of 269bp, and the lowest-rated tranche a spread of 394bp. Bookrunners: Goldman Sachs & Co