Credit

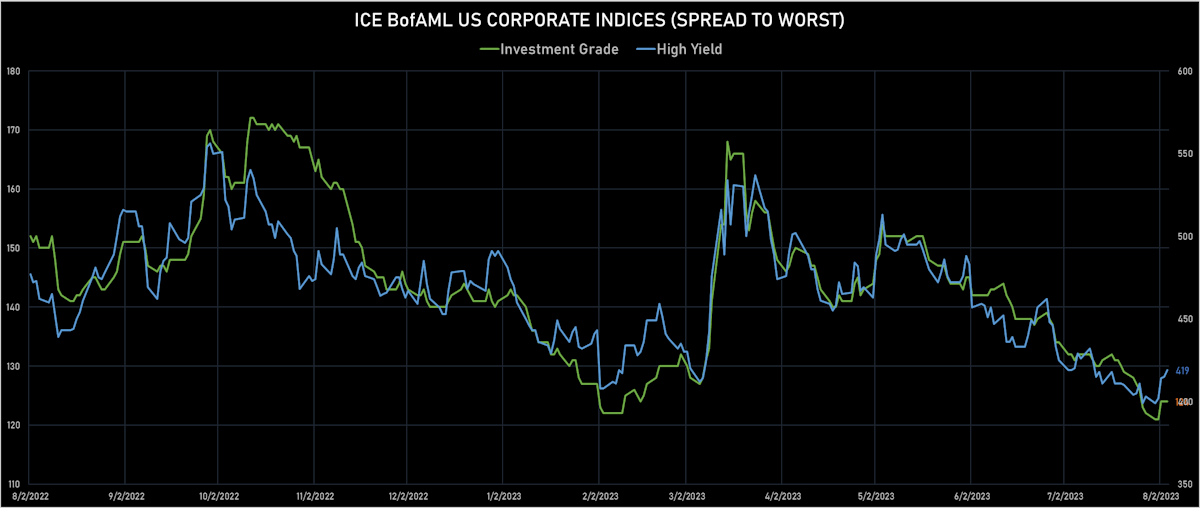

Broad Widening In Credit Spreads, HY-IG Decompression As Risk Markets Take A Breather

Healthy issuance volumes of USD corporate bonds this week: 44 tranches for $34.6bn in IG (2023 YTD volume $820.91bn vs 2022 YTD $881.941bn), and 5 tranches for $2.995bn in HY (2023 YTD volume $102.907bn vs 2022 YTD $71.301bn)

Published ET

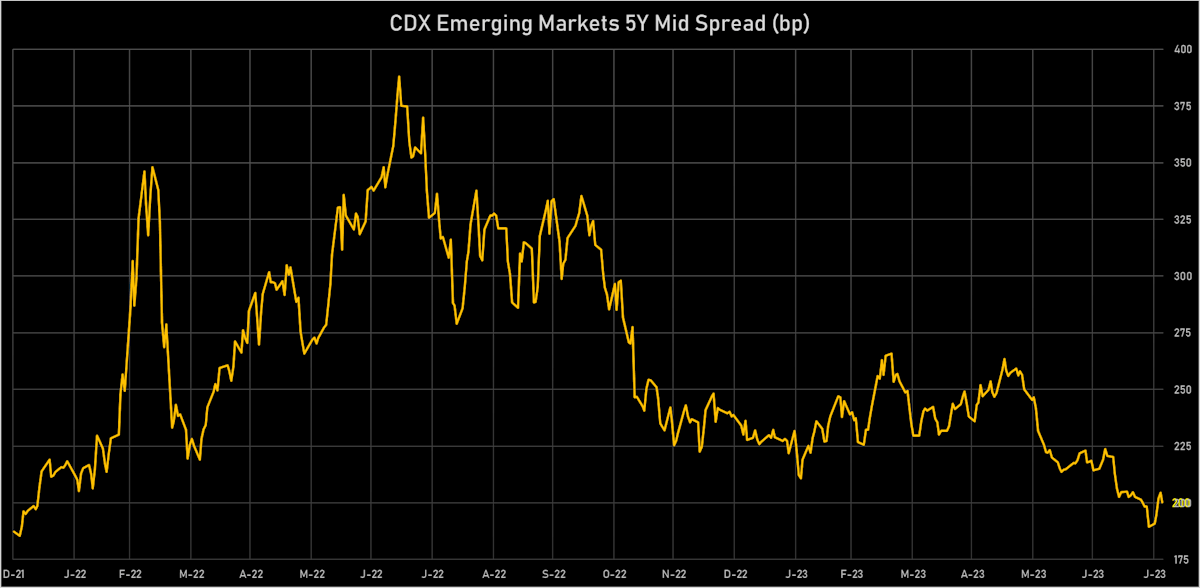

CDX EM 5Y Mid Spread (bp) | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.79% today, with investment grade up 0.82% and high yield up 0.45% (YTD total return: +2.59%)

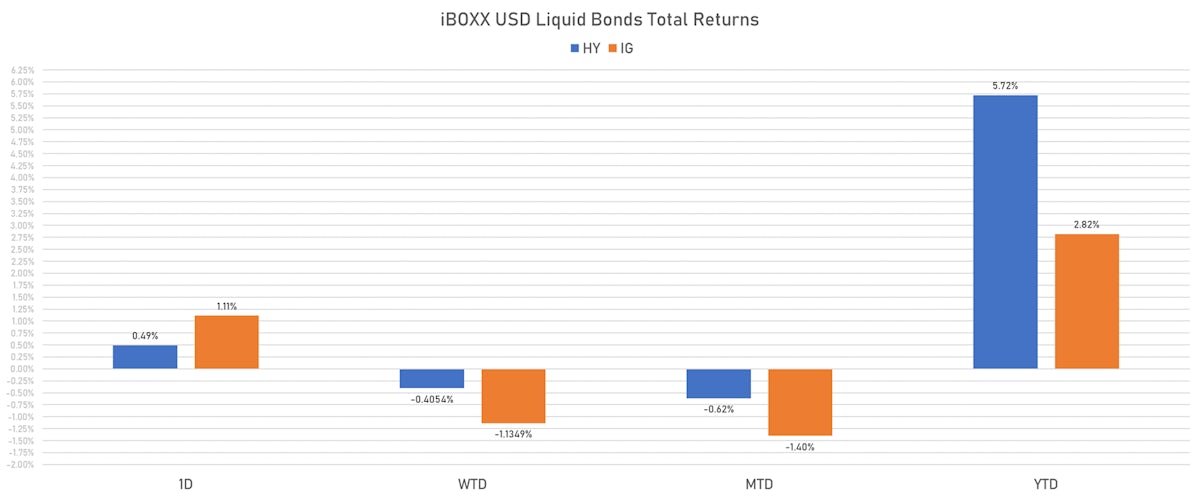

- The iBoxx USD Liquid Investment Grade Total Return Index was up 1.111% today (Week-to-date: -1.13%; Month-to-date: -1.40%; Year-to-date: 2.82%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.494% today (Week-to-date: -0.41%; Month-to-date: -0.62%; Year-to-date: 5.72%)

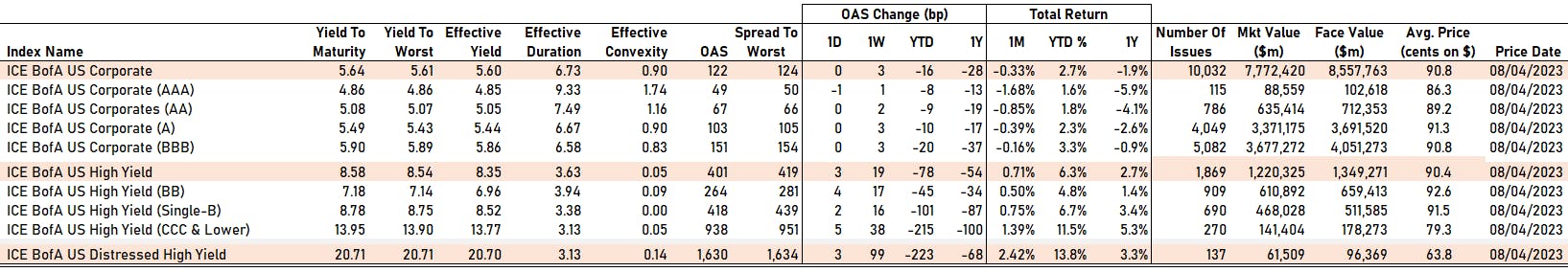

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 124.0 bp (WTD change: +2.0 bp; YTD change: -16.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 419.0 bp (WTD change: +16.0 bp; YTD change: -69.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +7.5%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 49 bp

- AA unchanged at 67 bp

- A unchanged at 103 bp

- BBB unchanged at 151 bp

- BB up by 4 bp at 264 bp

- B up by 2 bp at 418 bp

- ≤ CCC up by 5 bp at 938 bp

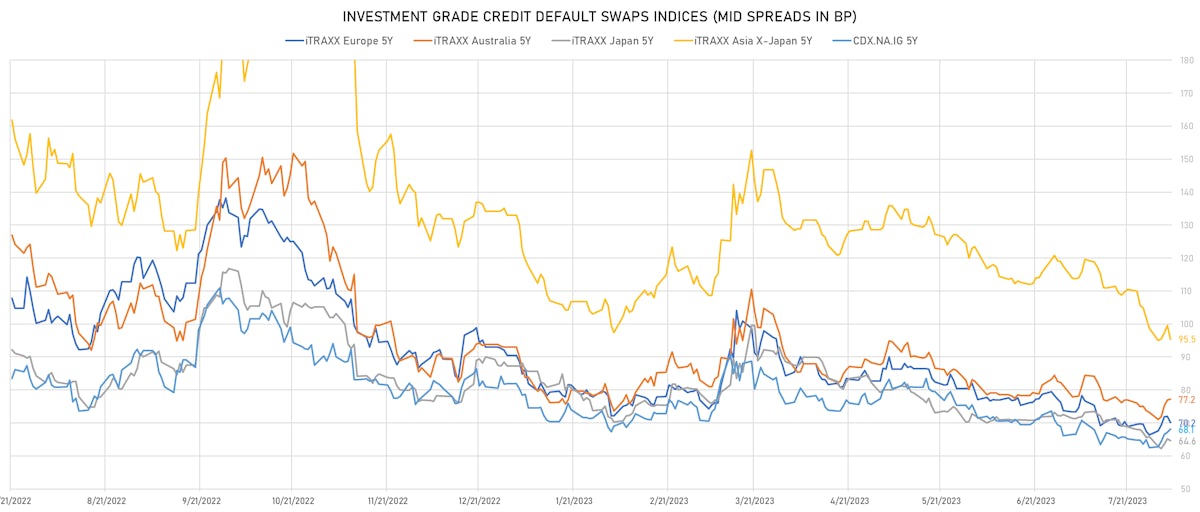

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 68bp (1W change: +5.5bp; YTD change: -13.8bp)

- Markit CDX.NA.IG 10Y up 0.9 bp, now at 108bp (1W change: +5.0bp; YTD change: -9.5bp)

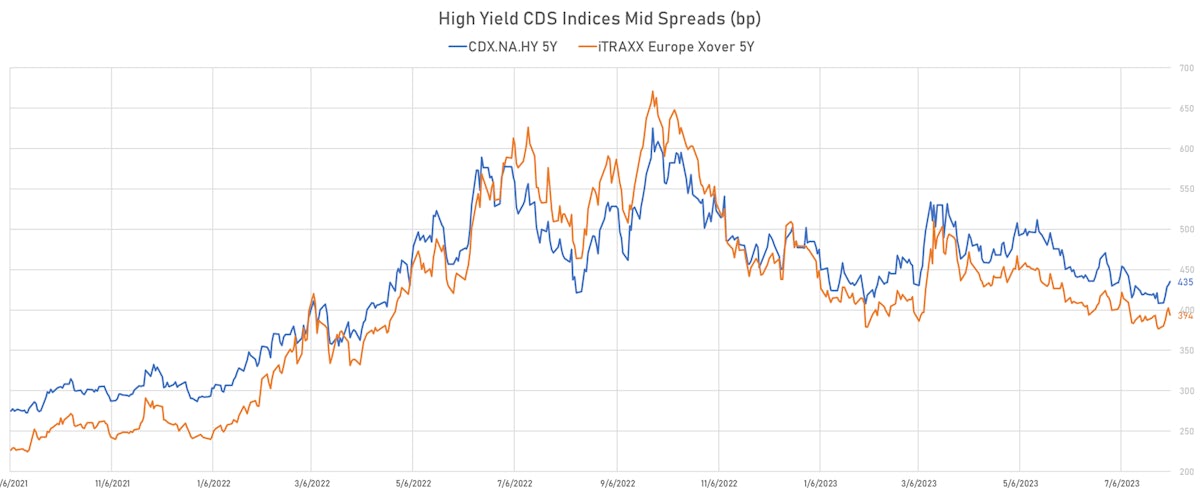

- Markit CDX.NA.HY 5Y up 4.1 bp, now at 435bp (1W change: +26.9bp; YTD change: -49.6bp)

- Markit iTRAXX Europe 5Y down 1.9 bp, now at 70bp (1W change: +3.7bp; YTD change: -20.3bp)

- Markit iTRAXX Europe Crossover 5Y down 8.8 bp, now at 394bp (1W change: +17.3bp; YTD change: -80.5bp)

- Markit iTRAXX Japan 5Y down 0.6 bp, now at 65bp (1W change: -1.3bp; YTD change: -22.6bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 4.1 bp, now at 95bp (1W change: -3.2bp; YTD change: -37.5bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Latvia (rated A-): up 13.8 % to 74 bp (1Y range: 65-1,112bp)

- Brazil (rated BB): up 6.3 % to 172 bp (1Y range: 161-313bp)

- Mexico (rated BBB-): up 5.7 % to 104 bp (1Y range: 97-205bp)

- South Africa (rated BB-): up 4.9 % to 239 bp (1Y range: 218-349bp)

- Egypt (rated B): up 4.6 % to 1,380 bp (1Y range: 706-1,837bp)

- Israel (rated A+): up 4.0 % to 52 bp (1Y range: 35-650bp)

- Panama (rated WD): up 4.0 % to 93 bp (1Y range: 89-187bp)

- Colombia (rated BB+): up 3.9 % to 206 bp (1Y range: 197-394bp)

- Indonesia (rated BBB): up 3.6 % to 77 bp (1Y range: 73-166bp)

- Romania (rated BBB-): down 12.2 % to 149 bp (1Y range: 149-396bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- DISH DBS Corp (Country: US; rated: Caa1): down 242.5 bp to 2,547.7bp (1Y range: 1,138-3,084bp)

- Unisys Corp (Country: US; rated: B1): down 32.4 bp to 848.1bp (1Y range: 432-1,378bp)

- Bath & Body Works Inc (Country: US; rated: NR): down 27.7 bp to 292.7bp (1Y range: 293-332bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): up 21.5 bp to 670.2bp (1Y range: 670-1,472bp)

- Onemain Finance Corp (Country: US; rated: Ba2): up 23.2 bp to 347.7bp (1Y range: 121-1,042bp)

- Avis Budget Group Inc (Country: US; rated: Discontinued): up 24.7 bp to 333.8bp (1Y range: 316-591bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 24.8 bp to 808.2bp (1Y range: 511-1,046bp)

- MGM Resorts International (Country: US; rated: NR): up 26.0 bp to 211.8bp (1Y range: 192-442bp)

- Petroleos Mexicanos (Country: MX; rated: B1): up 35.1 bp to 686.3bp (1Y range: 469-768bp)

- American Airlines Group Inc (Country: US; rated: B-): up 51.5 bp to 722.0bp (1Y range: 722-1,644bp)

- Goodyear Tire & Rubber Co (Country: US; rated: NR): up 72.1 bp to 342.7bp (1Y range: 281-552bp)

- Anywhere Real Estate Group LLC (Country: US; rated: B1): up 72.1 bp to 1,012.9bp (1Y range: 278-1,013bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): up 80.1 bp to 5,343.8bp (1Y range: 1,179-5,344bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 209.4 bp to 1,797.9bp (1Y range: 747-1,798bp)

- Staples Inc (Country: US; rated: B3): up 808.5 bp to 4,382.2bp (1Y range: 1,393-4,382bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Altice Finco SA (Country: LU; rated: Caa2): down 317.1 bp to 1,644.0bp (1Y range: 401-1,644bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 125.2 bp to 2,088.6bp (1Y range: 1,286-2,910bp)

- Stena AB (Country: SE; rated: B1-PD): down 29.1 bp to 366.7bp (1Y range: 367-730bp)

- TUI AG (Country: DE; rated: B2-PD): down 20.6 bp to 662.4bp (1Y range: 620-1,725bp)

- Telecom Italia SpA (Country: IT; rated: NR): down 12.5 bp to 357.2bp (1Y range: 306-545bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): up 10.7 bp to 538.9bp (1Y range: 370-758bp)

- Deutsche Lufthansa AG (Country: DE; rated: NR): up 11.2 bp to 216.8bp (1Y range: 183-541bp)

- Valeo SE (Country: FR; rated: NR): up 11.4 bp to 226.7bp (1Y range: 210-389bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 12.1 bp to 225.9bp (1Y range: 134-420bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 12.4 bp to 593.9bp (1Y range: 566-1,739bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 15.7 bp to 415.7bp (1Y range: 379-602bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 17.9 bp to 505.2bp (1Y range: 486-1,290bp)

- thyssenkrupp AG (Country: DE; rated: NR): up 19.9 bp to 242.8bp (1Y range: 217-705bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 41.6 bp to 684.5bp (1Y range: 632-1,254bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): up 46.1 bp to 627.1bp (1Y range: 186-627bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Spirit AeroSystems Inc (Wichita, Kansas (US)) | Coupon: 4.60% | Maturity: 15/6/2028 | Rating: CCC+ | CUSIP: 85205TAK6 | OAS up by 110.3 bp to 531.7 bp, with the yield to worst at 9.5% and the bond now trading down to 80.8 cents on the dollar (1Y price range: 76.5-86.8).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.25% | Maturity: 30/4/2031 | Rating: B | CUSIP: 382550BJ9 | OAS up by 93.0 bp to 363.3 bp (CDS basis: 54.4bp), with the yield to worst at 7.5% and the bond now trading down to 85.8 cents on the dollar (1Y price range: 83.8-91.0).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS up by 86.3 bp to 220.9 bp (CDS basis: -46.0bp), with the yield to worst at 6.4% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.00% | Maturity: 15/7/2029 | Rating: BB- | CUSIP: 382550BN0 | OAS up by 75.9 bp to 320.1 bp (CDS basis: 33.4bp), with the yield to worst at 7.2% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 83.5-92.0).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.25% | Maturity: 15/7/2031 | Rating: B | CUSIP: 382550BR1 | OAS up by 74.1 bp to 373.5 bp (CDS basis: 46.4bp), with the yield to worst at 7.6% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 81.0-90.0).

- Issuer: Spirit AeroSystems Inc (Wichita, Kansas (US)) | Coupon: 3.85% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 85205TAG5 | OAS up by 74.1 bp to 239.1 bp, with the yield to worst at 6.8% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 90.5-94.9).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 4.88% | Maturity: 15/3/2027 | Rating: B | CUSIP: 382550BG5 | OAS up by 71.3 bp to 229.8 bp (CDS basis: -13.5bp), with the yield to worst at 6.6% and the bond now trading down to 93.6 cents on the dollar (1Y price range: 89.5-96.3).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.63% | Maturity: 30/4/2033 | Rating: B | CUSIP: 382550BK6 | OAS up by 66.0 bp to 380.3 bp (CDS basis: 59.8bp), with the yield to worst at 7.7% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 81.5-89.8).

- Issuer: Tri Pointe Homes Inc (Delaware) (Incline Village, Nevada (US)) | Coupon: 5.70% | Maturity: 15/6/2028 | Rating: BB- | CUSIP: 87265HAG4 | OAS up by 52.4 bp to 257.7 bp, with the yield to worst at 6.7% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 89.8-97.8).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | CUSIP: 98421MAA4 | OAS up by 50.4 bp to 248.8 bp, with the yield to worst at 7.1% and the bond now trading down to 95.1 cents on the dollar (1Y price range: 91.8-96.4).

- Issuer: Amerigas Partners LP (Valley Forge, Pennsylvania (US)) | Coupon: 5.50% | Maturity: 20/5/2025 | Rating: B+ | CUSIP: 030981AK0 | OAS up by 49.2 bp to 248.6 bp, with the yield to worst at 7.2% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 94.8-99.0).

- Issuer: Range Resources Corp (Fort Worth, Texas (US)) | Coupon: 4.88% | Maturity: 15/5/2025 | Rating: BB- | CUSIP: 75281AAS8 | OAS up by 48.7 bp to 104.9 bp, with the yield to worst at 5.8% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 95.3-99.0).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB | CUSIP: 81725WAJ2 | OAS up by 41.3 bp to 209.7 bp, with the yield to worst at 6.4% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 96.5-99.6).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB | CUSIP: 87724RAA0 | OAS up by 34.7 bp to 203.7 bp, with the yield to worst at 6.4% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 95.0-99.4).

- Issuer: United States Cellular Corp (Chicago, Illinois (US)) | Coupon: 6.70% | Maturity: 15/12/2033 | Rating: BB | CUSIP: 911684AD0 | OAS down by 129.4 bp to 377.5 bp, with the yield to worst at 7.5% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 81.9-94.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 125.5 bp to 685.1 bp (CDS basis: -166.3bp), with the yield to worst at 10.2% and the bond now trading down to 85.0 cents on the dollar (1Y price range: 83.6-92.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS up by 100.2 bp to 729.4 bp (CDS basis: -141.2bp), with the yield to worst at 10.5% and the bond now trading down to 76.8 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS up by 84.5 bp to 768.6 bp (CDS basis: -119.8bp), with the yield to worst at 10.8% and the bond now trading down to 75.2 cents on the dollar (1Y price range: 72.8-85.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS up by 55.7 bp to 240.7 bp (CDS basis: -10.9bp), with the yield to worst at 5.6% and the bond now trading down to 96.7 cents on the dollar (1Y price range: 85.3-98.1).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 4.00% | Maturity: 20/7/2026 | Rating: BB+ | ISIN: XS2506285365 | OAS up by 48.3 bp to 159.9 bp, with the yield to worst at 4.9% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 92.6-97.9).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS up by 44.5 bp to 277.6 bp (CDS basis: 46.6bp), with the yield to worst at 5.9% and the bond now trading down to 101.9 cents on the dollar (1Y price range: 88.4-103.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 5.75% | Maturity: 3/8/2026 | Rating: BB+ | ISIN: XS2582404724 | OAS up by 39.0 bp to 201.6 bp, with the yield to worst at 5.1% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 98.2-102.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS up by 38.9 bp to 310.6 bp, with the yield to worst at 5.9% and the bond now trading down to 94.7 cents on the dollar (1Y price range: 82.7-96.0).

- Issuer: MAS Securities BV (S-Gravenhage, Netherlands) | Coupon: 4.25% | Maturity: 19/5/2026 | Rating: BB | ISIN: XS2339025277 | OAS up by 34.6 bp to 802.6 bp, with the yield to worst at 11.4% and the bond now trading down to 83.4 cents on the dollar (1Y price range: 76.7-83.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB | ISIN: XS2361254597 | OAS up by 33.2 bp to 302.1 bp, with the yield to worst at 6.3% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 81.0-91.1).

- Issuer: Iliad SA (Paris, France) | Coupon: 5.38% | Maturity: 14/6/2027 | Rating: BB | ISIN: FR001400EJI5 | OAS up by 31.4 bp to 232.6 bp, with the yield to worst at 5.3% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 95.5-101.4).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: B+ | ISIN: XS2270393379 | OAS down by 31.4 bp to 294.9 bp (CDS basis: 41.0bp), with the yield to worst at 5.9% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 84.3-89.8).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB- | ISIN: XS2356316872 | OAS down by 32.3 bp to 667.1 bp (CDS basis: -10.6bp), with the yield to worst at 8.7% and the bond now trading up to 79.9 cents on the dollar (1Y price range: 61.6-80.1).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | OAS down by 41.9 bp to 66.2 bp, with the yield to worst at 3.8% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 90.2-95.5).

- Issuer: Samhallsbyggnadsbolaget I Norden AB (Stockholm, Sweden) | Coupon: 1.13% | Maturity: 4/9/2026 | Rating: CCC+ | ISIN: XS2049823680 | OAS down by 61.3 bp to 1,095.3 bp, with the yield to worst at 13.5% and the bond now trading up to 68.8 cents on the dollar (1Y price range: 61.2-79.3).

RECENT DOMESTIC USD BOND ISSUES

- Booz Allen Hamilton Inc (Service - Other | Mc Lean, Virginia, United States | Rating: BBB-): US$650m Senior Note (US09951LAC72), fixed rate (5.95% coupon) maturing on 4 August 2033, priced at 99.04 (original spread of 204 bp), callable (10nc10)

- Carnival Corp (Leisure | Miami, Florida, United States | Rating: BB-): US$500m Note (USP2121VAQ79), fixed rate (7.00% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 285 bp), callable (6nc3)

- CenterPnt Energy (Utility - Other | Houston, Texas, United States | Rating: BBB): US$900m Bond (US15189TBC09), fixed rate (4.25% coupon) maturing on 15 August 2026, priced at 100.00, non callable, convertible

- Consumers Energy Co (Utility - Other | Jackson, Michigan, United States | Rating: A): US$500m First Mortgage Bond (US210518DV59), fixed rate (4.90% coupon) maturing on 15 February 2029, priced at 99.95 (original spread of 89 bp), callable (6nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$155m Bond (US3133EPSK21), fixed rate (4.25% coupon) maturing on 7 August 2028, priced at 99.52 (original spread of 20 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPSP18), fixed rate (6.00% coupon) maturing on 8 August 2028, priced at 100.00, callable (5nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$750m Bond (US3133EPSJ57), floating rate (SOFR + 16.5 bp) maturing on 4 August 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPSH91), floating rate (PRQ + -301.0 bp) maturing on 7 August 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$650m Bond (US3130AWTG57), floating rate (SOFR + 16.0 bp) maturing on 8 August 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GYZD76), fixed rate (5.75% coupon) maturing on 14 August 2026, priced at 100.00 (original spread of 138 bp), callable (3nc6m)

- Invitation Homes Operating Partnership LP (Financial - Other | Dallas, Texas, United States | Rating: BBB-): US$350m Senior Note (US46188BAF94), fixed rate (5.50% coupon) maturing on 15 August 2033, priced at 98.64 (original spread of 193 bp), callable (10nc10)

- Invitation Homes Operating Partnership LP (Financial - Other | Dallas, Texas, United States | Rating: BBB-): US$450m Senior Note (US46188BAE20), fixed rate (5.45% coupon) maturing on 15 August 2030, priced at 98.87 (original spread of 179 bp), callable (7nc7)

- Lifepoint Health Inc (Health Care Facilities | Brentwood, Tennessee, United States | Rating: B): US$800m Note (USU53039AJ97), fixed rate (9.88% coupon) maturing on 15 August 2030, priced at 100.00 (original spread of 625 bp), callable (7nc3)

- Norfolk Southern Corp (Railroads | Atlanta, Georgia, United States | Rating: BBB+): US$1,000m Senior Note (US655844CS56), fixed rate (5.35% coupon) maturing on 1 August 2054, priced at 99.42 (original spread of 196 bp), callable (31nc31)

- Norfolk Southern Corp (Railroads | Atlanta, Georgia, United States | Rating: BBB+): US$600m Senior Note (US655844CR73), fixed rate (5.05% coupon) maturing on 1 August 2030, priced at 99.80 (original spread of 119 bp), callable (7nc7)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$300m Senior Note (US69371RS561), fixed rate (5.05% coupon) maturing on 10 August 2026, priced at 99.95 (original spread of 50 bp), non callable

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$300m Senior Note (US69371RS645), fixed rate (4.95% coupon) maturing on 10 August 2028, priced at 99.84 (original spread of 70 bp), non callable

- Public Service Electric And Gas Co (Utility - Other | Newark, New Jersey, United States | Rating: A): US$500m First Mortgage Bond (US74456QCN43), fixed rate (5.20% coupon) maturing on 1 August 2033, priced at 99.87 (original spread of 103 bp), callable (10nc10)

- Public Service Electric And Gas Co (Utility - Other | Newark, New Jersey, United States | Rating: A): US$400m First Mortgage Bond (US74456QCP90), fixed rate (5.45% coupon) maturing on 1 August 2053, priced at 99.75 (original spread of 115 bp), callable (30nc30)

- State Street Corp (Financial - Other | Boston, Massachusetts, United States | Rating: A): US$1,200m Senior Note (US857477CD34), fixed rate (5.27% coupon) maturing on 3 August 2026, priced at 100.00 (original spread of 85 bp), callable (3nc3)

- State Street Corp (Financial - Other | Boston, Massachusetts, United States | Rating: A+): US$300m Senior Note (US857477CE17), floating rate (SOFR + 84.5 bp) maturing on 3 August 2026, priced at 100.00, callable (3nc3)

- TriNet Group Inc (Service - Other | Dublin California, California, United States | Rating: BB): US$400m Senior Note (US896288AC18), fixed rate (7.13% coupon) maturing on 15 August 2031, priced at 100.00 (original spread of 321 bp), callable (8nc3)

- VT Topco Inc (Financial - Other | Livingston, California, United States | Rating: B): US$500m Note (US91838PAA93), fixed rate (8.50% coupon) maturing on 15 August 2030, priced at 100.00 (original spread of 423 bp), callable (7nc3)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: AA): US$400m Senior Note (US94988J6C62), floating rate (SOFR + 80.0 bp) maturing on 1 August 2025, priced at 100.00, callable (2nc2)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: AA): US$2,000m Senior Note (US94988J6B89), fixed rate (5.55% coupon) maturing on 1 August 2025, priced at 99.93 (original spread of 72 bp), callable (2nc2)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: AA): US$400m Senior Note (US94988J6E29), floating rate (SOFR + 106.0 bp) maturing on 7 August 2026, priced at 100.00, callable (3nc3)

- Wells Fargo Bank NA (Banking | Sioux Falls, South Dakota, United States | Rating: AA): US$2,200m Senior Note (US94988J6D46), fixed rate (5.45% coupon) maturing on 7 August 2026, priced at 99.99 (original spread of 95 bp), callable (3nc3)

- Xcel Energy Inc (Utility - Other | Minneapolis, Minnesota, United States | Rating: BBB+): US$800m Senior Note (US98389BBA70), fixed rate (5.45% coupon) maturing on 15 August 2033, priced at 99.87 (original spread of 176 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- BAT Capital Corp (Financial - Other | Wilmington, Delaware, United Kingdom | Rating: BBB): US$1,000m Senior Note (US054989AD07), fixed rate (7.08% coupon) maturing on 2 August 2053, priced at 100.00 (original spread of 349 bp), callable (30nc30)

- BAT Capital Corp (Financial - Other | Wilmington, Delaware, United Kingdom | Rating: BBB): US$750m Senior Note (US054989AC24), fixed rate (7.08% coupon) maturing on 2 August 2043, priced at 100.00 (original spread of 335 bp), callable (20nc20)

- BAT Capital Corp (Financial - Other | Wilmington, Delaware, United Kingdom | Rating: BBB): US$1,000m Senior Note (US054989AA67), fixed rate (6.34% coupon) maturing on 2 August 2030, priced at 100.00 (original spread of 226 bp), callable (7nc7)

- BAT Capital Corp (Financial - Other | Wilmington, Delaware, United Kingdom | Rating: BBB): US$1,250m Senior Note (US054989AB41), fixed rate (6.42% coupon) maturing on 2 August 2033, priced at 100.00 (original spread of 257 bp), callable (10nc10)

- BAT International Finance PLC (Financial - Other | London, United Kingdom | Rating: BBB): US$1,000m Senior Note (US05530QAQ38), fixed rate (5.93% coupon) maturing on 2 February 2029, priced at 100.00 (original spread of 188 bp), callable (6nc5)

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): US$1,500m Note (US05964HAU95), fixed rate (5.59% coupon) maturing on 8 August 2028, priced at 100.00 (original spread of 153 bp), with a regulatory call

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: BBB): US$2,000m Subordinated Note (US05964HAV78), fixed rate (6.92% coupon) maturing on 8 August 2033, priced at 100.00 (original spread of 312 bp), with a regulatory call

- Central Parent LLC (Financial - Other | Rating: B+): US$755m Note (US154915AA07), fixed rate (8.00% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 387 bp), callable (6nc2)

- China Cinda (2020) I Management Ltd (Financial - Other | Tortola, China (Mainland) | Rating: BBB+): US$400m Senior Note (XS2662422802), fixed rate (5.75% coupon) maturing on 7 February 2027, priced at 99.72 (original spread of 130 bp), callable (4nc3)

- Columbia Pipe (Financial - Other | Canada | Rating: BBB): US$700m Senior Note (US19828AAB35), fixed rate (6.04% coupon) maturing on 15 August 2028, priced at 100.00 (original spread of 180 bp), callable (5nc5)

- Columbia Pipe (Financial - Other | Canada | Rating: BBB): US$300m Senior Note (US19828AAA51), fixed rate (6.06% coupon) maturing on 15 August 2026, priced at 100.00 (original spread of 150 bp), callable (3nc3)

- Columbia Pipelin (Financial - Other | Canada | Rating: BBB+): US$750m Senior Note (US19828TAA43), fixed rate (5.93% coupon) maturing on 15 August 2030, priced at 100.00 (original spread of 177 bp), callable (7nc7)

- Columbia Pipelin (Financial - Other | Canada | Rating: BBB+): US$600m Senior Note (US19828TAE64), fixed rate (6.50% coupon) maturing on 15 August 2043, priced at 100.00 (original spread of 259 bp), callable (20nc20)

- Columbia Pipelin (Financial - Other | Canada | Rating: BBB+): US$1,250m Senior Note (US19828TAC09), fixed rate (6.54% coupon) maturing on 15 November 2053, priced at 99.96 (original spread of 278 bp), callable (30nc30)

- Columbia Pipelin (Financial - Other | Canada | Rating: BBB+): US$500m Senior Note (US19828TAD81), fixed rate (6.71% coupon) maturing on 15 August 2063, priced at 100.00 (original spread of 310 bp), callable (40nc40)

- Columbia Pipelin (Financial - Other | Canada | Rating: BBB+): US$1,500m Senior Note (USU2100VAB90), fixed rate (6.04% coupon) maturing on 15 November 2033, priced at 99.96 (original spread of 195 bp), callable (10nc10)

- Columbia Pipelines Operating Company LLC (Financial - Other | Canada | Rating: BBB+): US$500m Senior Note (USU2100VAD56), fixed rate (6.71% coupon) maturing on 15 August 2063, priced at 100.00 (original spread of 252 bp), callable (40nc40)

- Columbia Pipelines Operating Company LLC (Financial - Other | Canada | Rating: BBB+): US$1,250m Senior Note (USU2100VAC73), fixed rate (6.54% coupon) maturing on 15 November 2053, priced at 99.96 (original spread of 235 bp), callable (30nc30)

- Columbia Pipelines Operating Company LLC (Financial - Other | Canada | Rating: BBB+): US$600m Senior Note (USU2100VAE30), fixed rate (6.50% coupon) maturing on 15 August 2043, priced at 100.00 (original spread of 213 bp), callable (20nc20)

- Columbia Pipelines Operating Company LLC (Financial - Other | Canada | Rating: BBB+): US$750m Senior Note (USU2100VAA18), fixed rate (5.93% coupon) maturing on 15 August 2030, priced at 100.00 (original spread of 175 bp), callable (7nc7)

- Columbia Pipelines Operating Company LLC (Financial - Other | Canada | Rating: BBB+): US$1,500m Senior Note (US19828TAB26), fixed rate (6.04% coupon) maturing on 15 November 2033, priced at 99.96 (original spread of 207 bp), callable (10nc10)

- Daimler Truck Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: NR): US$500m Senior Note (US233853AU41), fixed rate (5.50% coupon) maturing on 20 September 2033, priced at 99.41 (original spread of 174 bp), with a make whole call

- Daimler Truck Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: NR): US$600m Senior Note (US233853AS94), fixed rate (5.60% coupon) maturing on 8 August 2025, priced at 99.96 (original spread of 85 bp), with a make whole call

- Daimler Truck Finance North America LLC (Financial - Other | Portland, Oregon, Germany | Rating: NR): US$500m Senior Note (US233853AT77), fixed rate (5.40% coupon) maturing on 20 September 2028, priced at 99.90 (original spread of 133 bp), with a make whole call

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$105m Unsecured Note (XS2664622631), floating rate maturing on 8 August 2028, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$150m Unsecured Note (XS2664784704), floating rate maturing on 9 August 2028, priced at 100.00, non callable

- GS Caltex Corp (Oil and Gas | Seoul, Seoul, South Korea | Rating: BBB): US$300m Senior Note (USY29011DG83), fixed rate (5.38% coupon) maturing on 7 August 2028, priced at 99.65 (original spread of 128 bp), non callable

- Lloyds Banking Group PLC (Banking | Spalding, United Kingdom | Rating: BBB+): US$1,500m Senior Note (US539439AY57), fixed rate (5.99% coupon) maturing on 7 August 2027, priced at 100.00 (original spread of 147 bp), callable (4nc3)

- Lloyds Banking Group PLC (Banking | Spalding, United Kingdom | Rating: BBB+): US$500m Senior Note (US53944YAW30), floating rate (SOFRINDX + 156.0 bp) maturing on 7 August 2027, priced at 100.00, callable (4nc3)

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A): US$700m Senior Note (US58769JAJ60), fixed rate (5.38% coupon) maturing on 1 August 2025, priced at 99.97 (original spread of 61 bp), with a make whole call

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A): US$750m Senior Note (USU5876JAK17), fixed rate (5.20% coupon) maturing on 3 August 2026, priced at 99.89 (original spread of 76 bp), with a make whole call

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A): US$400m Senior Note (US58769JAH05), floating rate (SOFR + 57.0 bp) maturing on 1 August 2025, priced at 100.00, non callable

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A): US$750m Senior Note (USU5876JAM72), fixed rate (5.05% coupon) maturing on 3 August 2033, priced at 99.56 (original spread of 133 bp), with a make whole call

- Mercedes-Benz Finance North America LLC (Financial - Other | Montvale, New Jersey, Germany | Rating: A): US$900m Senior Note (US58769JAL17), fixed rate (5.10% coupon) maturing on 3 August 2028, priced at 99.88 (original spread of 102 bp), with a make whole call

- New York State Electric & Gas Corp (Utility - Other | Rochester, New York, Spain | Rating: A-): US$400m Senior Note (US649840CV58), fixed rate (5.85% coupon) maturing on 15 August 2033, priced at 99.84 (original spread of 168 bp), callable (10nc10)

- New York State Electric & Gas Corp (Utility - Other | Rochester, New York, Spain | Rating: A-): US$350m Senior Note (USU64962AF73), fixed rate (5.65% coupon) maturing on 15 August 2028, priced at 99.80 (original spread of 140 bp), callable (5nc5)

- Pioneer Reward Ltd (Financial - Other | China (Mainland) | Rating: BBB+): US$800m Senior Note (XS2663498314), fixed rate (5.25% coupon) maturing on 9 August 2026, priced at 99.81 (original spread of 75 bp), non callable

- Pioneer Reward Ltd (Financial - Other | China (Mainland) | Rating: NR): US$700m Unsecured Note (XS2663626765), fixed rate (5.00% coupon) maturing on 9 August 2026, priced at 100.00, non callable

- Rain Carbon Inc (Financial - Other | Stamford, Connecticut, India | Rating: B): US$450m Note (US75079LAB71), fixed rate (12.25% coupon) maturing on 1 September 2029, priced at 100.00 (original spread of 795 bp), callable (6nc3)

- UBS Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$109m Certificate of Deposit - Retail (US90355GFB77), fixed rate (4.50% coupon) maturing on 2 August 2028, priced at 100.00 (original spread of 48 bp), non callable

- UBS Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$150m Certificate of Deposit - Retail (US90355GEY89), fixed rate (5.05% coupon) maturing on 4 August 2025, priced at 100.00 (original spread of 30 bp), non callable

- Yibin Grace Group Co Ltd (Service - Other | Lishui, Sichuan, China (Mainland) | Rating: NR): US$150m Bond (XS2656498313), fixed rate (6.00% coupon) maturing on 9 August 2026, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB+): €1,250m Senior Note (XS2662538425), fixed rate (4.92% coupon) maturing on 8 August 2030, priced at 100.00 (original spread of 243 bp), callable (7nc6)

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): €250m Unsecured Note (XS2664508699), floating rate maturing on 11 August 2025, priced at 100.00, non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €160m Senior Note (XS2665176298), fixed rate (4.00% coupon) maturing on 25 September 2028, priced at 100.00, non callable

- illimity Bank SpA (Banking | Milan, Milano, Italy | Rating: NR): €160m Unsecured Note (XS2665492885), floating rate maturing on 9 August 2026, priced at 100.00, non callable

RECENT LOANS

- AMS (United Kingdom), signed a US$ 333m Term Loan B, to be used for general corporate purposes. It matures on 06/27/27 and initial pricing is set at Term SOFR +600.0bp

- Asurion LLC (United States of America | B), signed a US$ 600m Term Loan B, to be used for general corporate purposes. It matures on 08/19/28 and initial pricing is set at Term SOFR +425.0bp

- Avient Corp (United States of America | BB-), signed a US$ 832m Term Loan B, to be used for general corporate purposes. It matures on 08/03/29 and initial pricing is set at Term SOFR +250.0bp

- Avolon Aerospace Funding 4 (Luxembourg), signed a US$ 950m Term Loan, to be used for capital expenditures. It matures on 07/28/30.

- Biogen Inc (United States of America | BBB+), signed a US$ 1,500m Bridge Loan, to be used for acquisition financing. It matures on 07/26/24.

- Boeing Co (United States of America | BBB-), signed a US$ 800m 364d Revolver, to be used for general corporate purposes. It matures on 08/24/24 and initial pricing is set at Term SOFR +162.5bp

- Boeing Co (United States of America | BBB-), signed a US$ 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at Term SOFR +162.5bp

- Boswell Springs Wind Project (United States of America), signed a US$ 282m Bridge Loan, to be used for project finance. It matures on 07/26/24.

- Boswell Springs Wind Project (United States of America), signed a US$ 203m Term Loan, to be used for project finance. It matures on 07/26/33.

- Ceridian HCM Inc (United States of America | CCC), signed a US$ 648m Term Loan B, to be used for general corporate purposes. It matures on 04/30/25 and initial pricing is set at Term SOFR +250.0bp

- Citadel Sec LP (United States of America | BBB-), signed a US$ 3,550m Term Loan, to be used for general corporate purposes. Initial pricing is set at Term SOFR +250.0bp

- Curium Sas (France), signed a US$ 1,066m Term Loan B, to be used for general corporate purposes. It matures on 07/02/29 and initial pricing is set at Term SOFR +475.0bp

- Curium Sas (France), signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 07/02/29.

- Duke Energy Corp (United States of America | BBB), signed a US$ 600m Revolving Credit Facility, to be used for leveraged buyout. It matures on 09/26/28.

- Duke Energy Corp (United States of America | BBB), signed a US$ 343m Term Loan, to be used for leveraged buyout. It matures on 03/26/25.

- Duke Energy Corp (United States of America | BBB), signed a US$ 200m Term Loan, to be used for leveraged buyout. It matures on 03/26/25.

- E Anglia Three Offshore Wind (United Kingdom), signed a € 500m Term Loan, to be used for project finance. It matures on 07/26/32.

- EDP Energias de Portugal SA (Portugal | BBB), signed a € 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/28/28.

- EDP Finance BV (Netherlands | BBB), signed a € 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/27/28.

- Energies Green Sarl (France), signed a € 150m Bridge Loan, to be used for acquisition financing. It matures on 06/15/24.

- Gestamp Automocion SA (Spain | BB+), signed a € 300m Revolving Credit Facility, to be used for working capital. It matures on 07/30/24.

- Groupe Premium SAS (France), signed a € 300m Term Loan, to be used for leveraged buyout.

- Harmony Biosciences Hldg Inc (United States of America), signed a US$ 185m Term Loan B, to be used for general corporate purposes. It matures on 07/26/28 and initial pricing is set at Term SOFR +400.0bp

- Howmet Aerospace Inc (United States of America | BB+), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/27/28 and initial pricing is set at Term SOFR +89.0bp

- Indra Sistemas SA (Spain), signed a € 500m Revolving Credit Facility, to be used for working capital. It matures on 07/27/28.

- J&J Ventures Gaming LLC (United States of America | B), signed a US$ 375m Term Loan B, to be used for acquisition financing. It matures on 04/26/28 and initial pricing is set at Term SOFR +400.0bp

- Lundin Mining Corp (Canada), signed a US$ 800m Term Loan, to be used for general corporate purposes. It matures on 07/28/26 and initial pricing is set at Term SOFR +265.0bp

- Lundin Mining Corp (Canada), signed a US$ 400m Term Loan, to be used for general corporate purposes.

- Oak Solar (United States of America), signed a US$ 211m Term Loan, to be used for project finance.

- PPG Industries Inc (United States of America | BBB+), signed a US$ 2,300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/27/28 and initial pricing is set at Term SOFR +75.0bp

- Repsol SA (Spain | BBB+), signed a € 575m Term Loan, to be used for general corporate purposes.

- Select Medical Corp (United States of America | B-), signed a US$ 2,100m Term Loan B, to be used for general corporate purposes. It matures on 03/01/27 and initial pricing is set at Term SOFR +300.0bp

- Select Medical Corp (United States of America | B-), signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/06/27 and initial pricing is set at Term SOFR +250.0bp

- Septodont Holding SAS (France), signed a € 100m Term Loan A, to be used for general corporate purposes. It matures on 07/27/29.

- Septodont Holding SAS (France), signed a € 110m Capital Expenditure Facility, to be used for general corporate purposes. It matures on 07/27/29.

- Septodont Holding SAS (France), signed a € 165m Term Loan B, to be used for general corporate purposes. It matures on 07/27/30.

RECENT STRUCTURED CREDIT

- Areit 2023-Cre8 issued a floating-rate CLO in 6 tranches, for a total of US$ 487 m. Highest-rated tranche offering a spread over the floating rate of 225bp, and the lowest-rated tranche a spread of 550bp. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, Wells Fargo Securities LLC

- Frontier Issuer LLC 2023-1 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 1,528 m. Highest-rated tranche offering a yield to maturity of 6.91%, and the lowest-rated tranche a yield to maturity of 11.81%. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, JP Morgan & Co Inc, Fifth Third Securities Inc, Barclays Capital Group, Deutsche Bank Securities Inc, Citizen Securities & Investment Ltd, TD Securities (USA) LLC

- GoodLeap Sustainable Home Solutions Trust 2023-3 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 304 m. Highest-rated tranche offering a yield to maturity of 6.53%, and the lowest-rated tranche a yield to maturity of 10.17%. Bookrunners: Goldman Sachs & Co, Barclays Capital Group, Citigroup Global Markets Inc, Bank of America Merrill Lynch, Atlas SP Partners LP

- GS Mortgage Securities Corp Trust 2023-Ship issued a fixed-rate CMBS in 4 tranches, for a total of US$ 798 m. Highest-rated tranche offering a yield to maturity of 4.58%, and the lowest-rated tranche a yield to maturity of 6.39%. Bookrunners: Goldman Sachs & Co