Credit

Losses Across The US Credit Complex, With Modest Spread Widening Amplifying The Move In Rates

High-quality bond issuance jumped this week as corporates are back to work: 74 tranches for $57.53bn in IG (2023 YTD volume $932.224bn vs 2022 YTD $988.591bn), 3 tranches for $815m in HY (2023 YTD volume $112.147bn vs 2022 YTD $78.876bn)

Published ET

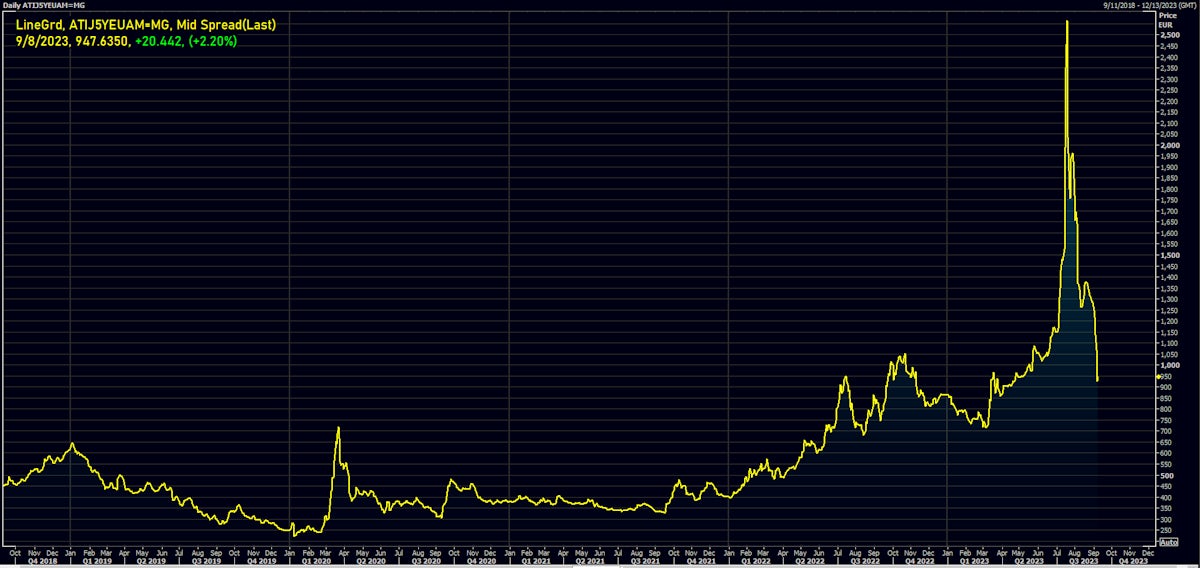

Altice Finco SNRFOR Mid Spread (bp) | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was up 0.16% today, with investment grade up 0.15% and high yield up 0.20% (YTD total return: +2.06%)

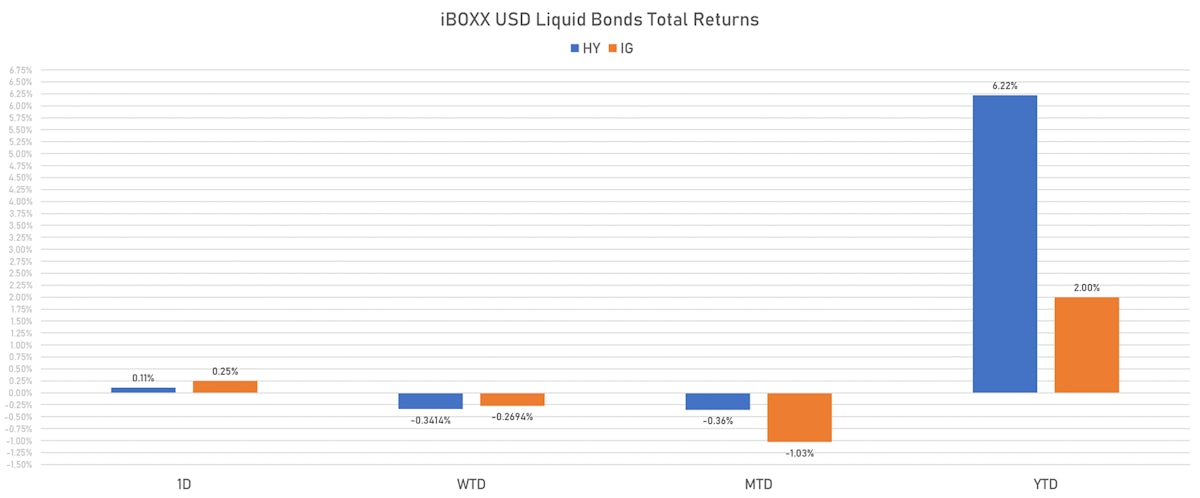

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.251% today (Week-to-date: -0.27%; Month-to-date: -1.03%; Year-to-date: 2.00%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.108% today (Week-to-date: -0.34%; Month-to-date: -0.36%; Year-to-date: 6.22%)

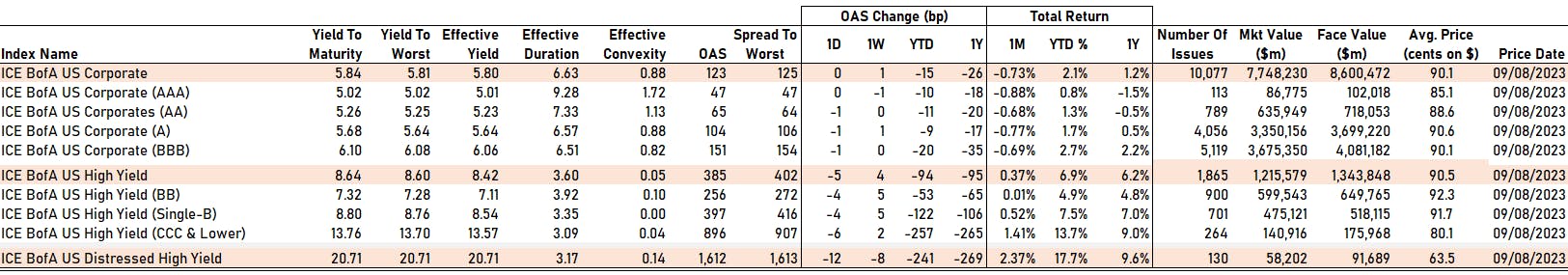

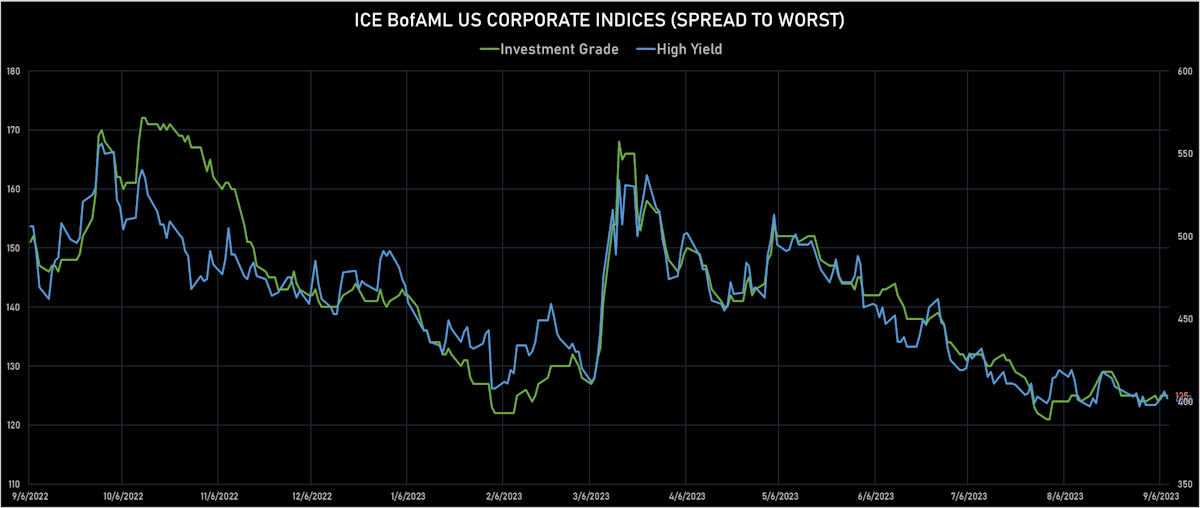

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 125.0 bp (WTD change: +1.0 bp; YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 402.0 bp (WTD change: +4.0 bp; YTD change: -86.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.10% today (YTD total return: +9.2%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 47 bp

- AA down by -1 bp at 65 bp

- A down by -1 bp at 104 bp

- BBB down by -1 bp at 151 bp

- BB down by -4 bp at 256 bp

- B down by -4 bp at 397 bp

- ≤ CCC down by -6 bp at 896 bp

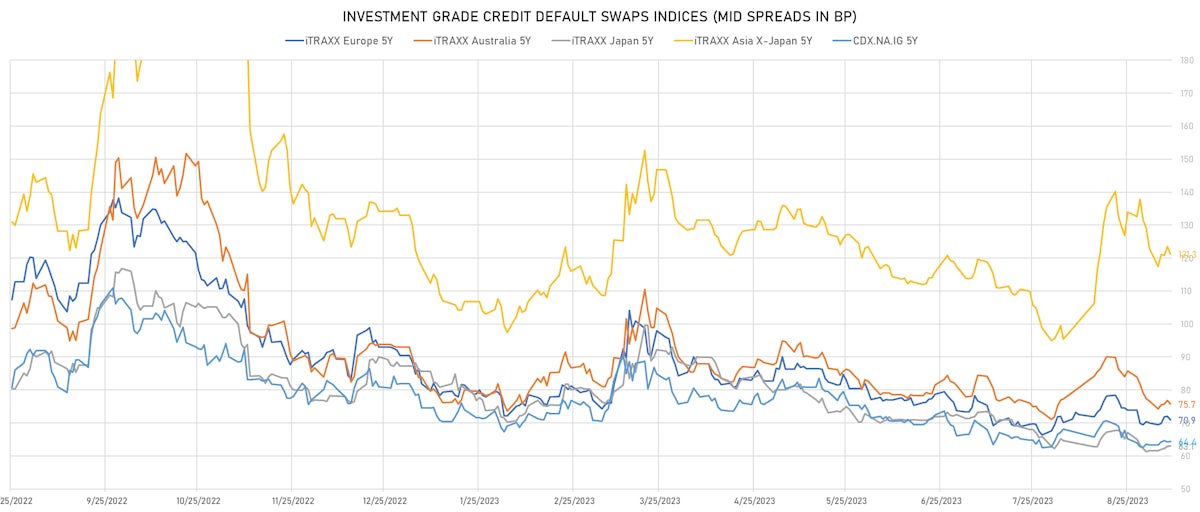

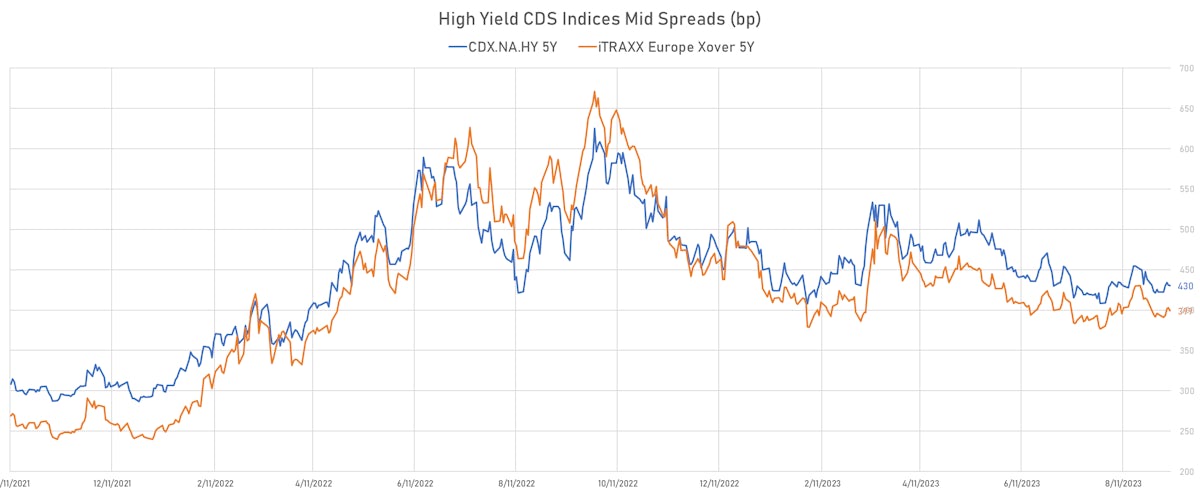

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 64bp (1W change: +1.0bp; YTD change: -17.5bp)

- Markit CDX.NA.IG 10Y up 0.1 bp, now at 106bp (1W change: +1.0bp; YTD change: -12.1bp)

- Markit CDX.NA.HY 5Y down 0.8 bp, now at 430bp (1W change: +7.8bp; YTD change: -54.6bp)

- Markit iTRAXX Europe 5Y down 1.1 bp, now at 71bp (1W change: +1.0bp; YTD change: -19.5bp)

- Markit iTRAXX Europe Crossover 5Y down 4.1 bp, now at 399bp (1W change: +4.0bp; YTD change: -75.2bp)

- Markit iTRAXX Japan 5Y up 0.2 bp, now at 63bp (1W change: +1.5bp; YTD change: -24.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.2 bp, now at 121bp (1W change: -1.7bp; YTD change: -11.7bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Panama (rating WD): up 5.2 % to 110 bp (1Y range: 89-187bp)

- Chile (rated A-): up 4.9 % to 58 bp (1Y range: 54-174bp)

- Colombia (rated BB+): up 2.1 % to 211 bp (1Y range: 197-394bp)

- Brazil (rated BB): up 2.1 % to 170 bp (1Y range: 161-313bp)

- Philippines (rated BBB): up 1.7 % to 73 bp (1Y range: 66-153bp)

- Mexico (rated BBB-): up 1.6 % to 100 bp (1Y range: 96-205bp)

- Italy (rated BBB): up 1.1 % to 87 bp (1Y range: 86-179bp)

- Serbia (rated BB+): down 1.4 % to 213 bp (1Y range: 213-356bp)

- Kazakhstan (rated BBB): down 1.5 % to 128 bp (1Y range: 128-278bp)

- Israel (rated A+): down 1.9 % to 53 bp (1Y range: 35-650bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- DISH DBS Corp (Country: US; rated: Caa1): down 172.9 bp to 1,832.4bp (1Y range: 1,138-3,084bp)

- Staples Inc (Country: US; rated: B3): down 171.8 bp to 4,572.7bp (1Y range: 1,411-4,573bp)

- Anywhere Real Estate Group LLC (Country: US; rated: B1): down 168.0 bp to 921.1bp (1Y range: 278-921bp)

- Petroleos Mexicanos (Country: MX; rated: B1): down 34.8 bp to 665.9bp (1Y range: 469-768bp)

- Ford Motor Co (Country: US; rated: BBB-): down 22.2 bp to 245.3bp (1Y range: 244-446bp)

- Ford Motor Credit Company LLC (Country: US; rated: F3): down 17.5 bp to 229.5bp (1Y range: 229-446bp)

- Nabors Industries Inc (Country: US; rated: BB-): down 17.0 bp to 537.1bp (1Y range: 390-767bp)

- Nordstrom Inc (Country: US; rated: NR): up 27.0 bp to 556.3bp (1Y range: 429-685bp)

- Carnival Corp (Country: US; rated: Ba2): up 28.0 bp to 488.6bp (1Y range: 446-2,117bp)

- Macy's Inc (Country: US; rated: A1): up 30.6 bp to 441.4bp (1Y range: 300-619bp)

- Paramount Global (Country: US; rated: Baa3): up 30.8 bp to 256.5bp (1Y range: 57-257bp)

- Kohls Corp (Country: US; rated: Ba2): up 45.9 bp to 547.3bp (1Y range: 444-783bp)

- Univision Communications Inc (Country: US; rated: B1): up 68.6 bp to 420.0bp (1Y range: 317-658bp)

- Community Health Systems Inc (Country: US; rated: NR): up 81.0 bp to 2,406.1bp (1Y range: 1,258-4,371bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): up 127.3 bp to 5,786.7bp (1Y range: 1,221-5,787bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Altice Finco SA (Country: LU; rated: Caa2): down 300.2 bp to 947.6bp (1Y range: 401-1,021bp)

- Telecom Italia SpA (Country: IT; rated: NR): down 12.8 bp to 299.4bp (1Y range: 294-545bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 10.7 bp to 197.5bp (1Y range: 197-705bp)

- ArcelorMittal SA (Country: LU; rated: WD): down 7.9 bp to 181.8bp (1Y range: 181-353bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 6.2 bp to 564.5bp (1Y range: 186-564bp)

- Airbus SE (Country: NL; rated: A-): up 5.7 bp to 67.0bp (1Y range: 51-154bp)

- Holcim AG (Country: CH; rated: A1): up 6.4 bp to 106.6bp (1Y range: 69-180bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 7.0 bp to 195.4bp (1Y range: 157-600bp)

- Valeo SE (Country: FR; rated: NR): up 7.7 bp to 244.2bp (1Y range: 210-389bp)

- Renault SA (Country: FR; rated: BB): up 8.4 bp to 239.1bp (1Y range: 219-453bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 9.1 bp to 707.6bp (1Y range: 632-1,254bp)

- TUI AG (Country: DE; rated: B2-PD): up 10.9 bp to 718.2bp (1Y range: 620-1,725bp)

- Air France KLM SA (Country: FR; rated: B-): up 10.9 bp to 421.8bp (1Y range: 347-925bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 39.7 bp to 568.0bp (1Y range: 486-1,290bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 57.3 bp to 1,656.1bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 2.65% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 67623CAD1 | OAS up by 193.6 bp to 1,201.8 bp, with the yield to worst at 16.4% and the bond now trading down to 69.5 cents on the dollar (1Y price range: 63.0-81.4).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B- | CUSIP: 143658BN1 | OAS up by 55.5 bp to 361.7 bp (CDS basis: -52.6bp), with the yield to worst at 8.1% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 71.0-94.3).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | CUSIP: 26885BAF7 | OAS up by 37.9 bp to 167.9 bp, with the yield to worst at 6.4% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 95.8-99.8).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS up by 25.7 bp to 112.5 bp (CDS basis: -106.0bp), with the yield to worst at 6.0% and the bond now trading down to 90.1 cents on the dollar (1Y price range: 41.6-92.6).

- Issuer: H.B. Fuller Company (Saint Paul, Minnesota (US)) | Coupon: 4.00% | Maturity: 15/2/2027 | Rating: BB- | CUSIP: 359694AB2 | OAS down by 24.7 bp to 144.9 bp, with the yield to worst at 5.2% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 89.5-96.4).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.85% | Maturity: 15/7/2026 | Rating: BB+ | CUSIP: 29336UAF4 | OAS down by 27.5 bp to 145.4 bp, with the yield to worst at 6.0% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 94.0-98.1).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.95% | Maturity: 28/5/2027 | Rating: BB+ | CUSIP: 345397C27 | OAS down by 30.5 bp to 203.8 bp (CDS basis: -55.3bp), with the yield to worst at 6.6% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 41.6-97.6).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB+ | CUSIP: 345370CR9 | OAS down by 30.7 bp to 59.3 bp (CDS basis: 74.9bp), with the yield to worst at 5.4% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 39.8-98.3).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 7.38% | Maturity: 15/11/2031 | Rating: BB+ | CUSIP: 337932AC1 | OAS down by 33.3 bp to 161.0 bp (CDS basis: -57.8bp), with the yield to worst at 5.5% and the bond now trading up to 111.4 cents on the dollar (1Y price range: 108.6-117.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.90% | Maturity: 10/2/2029 | Rating: BB+ | CUSIP: 345397B93 | OAS down by 34.1 bp to 217.5 bp (CDS basis: -15.4bp), with the yield to worst at 6.5% and the bond now trading up to 83.1 cents on the dollar (1Y price range: 52.2-86.1).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.80% | Maturity: 12/5/2028 | Rating: BB+ | CUSIP: 345397C92 | OAS down by 36.6 bp to 207.9 bp (CDS basis: -27.3bp), with the yield to worst at 6.5% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 55.9-101.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.39% | Maturity: 8/1/2026 | Rating: BB+ | CUSIP: 345397XU2 | OAS down by 40.7 bp to 203.0 bp (CDS basis: -70.4bp), with the yield to worst at 6.5% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 64.5-97.3).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 1/3/2029 | Rating: BB | CUSIP: 38869AAC1 | OAS down by 40.9 bp to 196.9 bp, with the yield to worst at 6.2% and the bond now trading up to 86.5 cents on the dollar (1Y price range: 85.0-89.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.38% | Maturity: 13/11/2025 | Rating: BB+ | CUSIP: 345397B28 | OAS down by 41.5 bp to 145.1 bp (CDS basis: -60.9bp), with the yield to worst at 6.5% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 71.7-94.3).

- Issuer: DISH DBS Corp (Englewood, Colorado (US)) | Coupon: 5.88% | Maturity: 15/11/2024 | Rating: CCC | CUSIP: 25470XAW5 | OAS down by 126.9 bp to 613.9 bp (CDS basis: 143.1bp), with the yield to worst at 10.3% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 80.0-96.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB+ | ISIN: XS2332589972 | OAS up by 29.9 bp to 167.9 bp, with the yield to worst at 4.9% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 86.8-92.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS up by 27.7 bp to 301.4 bp (CDS basis: -42.0bp), with the yield to worst at 6.1% and the bond now trading down to 95.7 cents on the dollar (1Y price range: 85.3-98.1).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 1.25% | Maturity: 8/9/2026 | Rating: BB+ | ISIN: XS1485608118 | OAS down by 25.3 bp to 379.2 bp, with the yield to worst at 7.0% and the bond now trading up to 84.4 cents on the dollar (1Y price range: 77.4-91.2).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 6.88% | Maturity: 15/2/2028 | Rating: B+ | ISIN: XS2581393134 | OAS down by 26.7 bp to 341.3 bp (CDS basis: -87.4bp), with the yield to worst at 6.2% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 95.9-102.7).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 2.38% | Maturity: 15/1/2027 | Rating: BB+ | ISIN: XS1822791619 | OAS down by 27.9 bp to 447.1 bp, with the yield to worst at 7.5% and the bond now trading up to 84.4 cents on the dollar (1Y price range: 78.0-87.7).

- Issuer: Globalworth Real Estate Investments Ltd (St Martin, Guernsey) | Coupon: 2.95% | Maturity: 29/7/2026 | Rating: BB+ | ISIN: XS2208868914 | OAS down by 29.4 bp to 1,008.5 bp, with the yield to worst at 12.9% and the bond now trading up to 76.0 cents on the dollar (1Y price range: 73.5-83.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS down by 35.6 bp to 718.5 bp (CDS basis: -118.8bp), with the yield to worst at 10.3% and the bond now trading up to 80.8 cents on the dollar (1Y price range: 77.1-88.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS down by 37.9 bp to 695.9 bp (CDS basis: -135.8bp), with the yield to worst at 10.1% and the bond now trading up to 78.1 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: Eramet SA (Paris, France) | Coupon: 7.00% | Maturity: 22/5/2028 | Rating: BB | ISIN: FR001400HZE3 | OAS down by 39.9 bp to 501.7 bp, with the yield to worst at 8.2% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 92.9-103.6).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS down by 40.2 bp to 734.7 bp (CDS basis: -107.6bp), with the yield to worst at 10.4% and the bond now trading up to 76.7 cents on the dollar (1Y price range: 72.8-85.1).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: CCC+ | ISIN: XS2346224806 | OAS down by 44.6 bp to 816.7 bp, with the yield to worst at 10.8% and the bond now trading up to 56.1 cents on the dollar (1Y price range: 50.0-67.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS down by 54.1 bp to 627.0 bp (CDS basis: -148.0bp), with the yield to worst at 9.6% and the bond now trading up to 86.6 cents on the dollar (1Y price range: 83.6-92.8).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: CCC+ | ISIN: XS2271332285 | OAS down by 64.2 bp to 908.0 bp, with the yield to worst at 11.8% and the bond now trading up to 57.1 cents on the dollar (1Y price range: 53.8-67.8).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS down by 76.7 bp to 574.6 bp, with the yield to worst at 9.1% and the bond now trading up to 85.2 cents on the dollar (1Y price range: 80.6-85.9).

- Issuer: Euronet Worldwide Inc (Leawood, Kansas (US)) | Coupon: 1.38% | Maturity: 22/5/2026 | Rating: BB | ISIN: XS2001315766 | OAS down by 620.1 bp to 168.2 bp, with the yield to worst at 4.9% and the bond now trading up to 90.6 cents on the dollar (1Y price range: 87.4-91.8).

RECENT DOMESTIC USD BOND ISSUES

- CSG Systems Int (Service - Other | Englewood, Colorado, United States | Rating: BB+): US$375m Bond (US126349AG47), fixed rate (3.88% coupon) maturing on 15 September 2028, priced at 100.00, non callable, convertible

- Crescent Energy Finance LLC (Financial - Other | New York City, United States | Rating: NR): US$150m Senior Note (USU4526LAE75), fixed rate (9.25% coupon) maturing on 15 February 2028, priced at 101.13 (original spread of 455 bp), callable (4nc1)

- Duke Energy Corp (Utility - Other | Charlotte, North Carolina, United States | Rating: BBB): US$600m Senior Note (US26441CBZ77), fixed rate (5.75% coupon) maturing on 15 September 2033, priced at 99.92 (original spread of 187 bp), callable (10nc10)

- JPMorgan Chase Financial Company LLC (Financial - Other | New York City, United States | Rating: NR): US$170m Unsecured Note (XS1449769758), floating rate maturing on 22 September 2028, priced at 100.00, non callable

- Liberty Media (Cable/Media | Englewood, Colorado, United States | Rating: NR): US$1,000m Bond (US531229AR32), fixed rate (2.38% coupon) maturing on 30 September 2053, priced at 100.00, callable (30nc5), convertible

- Morgan Stanley Finance LLC (Financial - Other | New York City, United States | Rating: A-): US$130m Unsecured Note (XS2059827878), fixed rate (0.01% coupon) maturing on 31 December 2028, priced at 100.00, non callable

- Sabre GLBL Inc (Service - Other | Southlake, United States | Rating: B-): US$853m Note (USU86043AG86), fixed rate (8.63% coupon) maturing on 1 June 2027, callable (4nc1)

RECENT INTERNATIONAL USD BOND ISSUES

- Bank of China (London Branch) (Banking | London, China (Mainland) | Rating: A): US$600m Senior Note (XS2675743160), floating rate (SOFRINDX + 59.0 bp) maturing on 14 September 2026, priced at 100.00, non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB): US$1,000m Note (US12803RAC88), fixed rate (6.84% coupon) maturing on 13 September 2034, priced at 100.00 (original spread of 255 bp), callable (11nc10)

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): US$600m Senior Note (US2027A0KR94), floating rate (SOFR + 63.0 bp) maturing on 12 September 2025, priced at 100.00, non callable

- DBS Group Holdings Ltd (Banking | Singapore | Rating: AA-): US$750m Senior Note (US24023KAK43), floating rate (SOFR + 61.0 bp) maturing on 12 September 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$500m Note (XS0460041162), fixed rate (4.80% coupon) maturing on 29 September 2025, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$150m Unsecured Note (XS2685589934), floating rate maturing on 14 September 2028, priced at 100.00, non callable

- Mitsubishi HC Finance America LLC (Financial - Other | New York City, New York, Japan | Rating: A-): US$500m Senior Note (US606790AB96), fixed rate (5.81% coupon) maturing on 12 September 2028, priced at 100.00 (original spread of 173 bp), callable (5nc5)

- Nippon Life Insurance Co (Life Insurance | Osaka, Osaka-Fu, Japan | Rating: A-): US$930m Subordinated Note (US654579AM33), fixed rate (6.25% coupon) maturing on 13 September 2053, priced at 100.00, callable (30nc10)

- Nomura International Funding Pte Ltd (Financial - Other | Japan | Rating: NR): US$233m Unsecured Note (XS2617697359), fixed rate (7.10% coupon) maturing on 29 September 2030, priced at 100.00, non callable

- Nordic Investment Bank (Supranational | Helsinki, Etela-Suomen, Finland | Rating: AAA): US$1,000m Senior Note (US65562YAK47), fixed rate (5.00% coupon) maturing on 15 October 2025, priced at 99.87 (original spread of 4 bp), non callable

- State Bank of India (London Branch) (Banking | London, India | Rating: NR): US$750m Unsecured Note (XS2685328465), fixed rate (1.00% coupon) maturing on 19 September 2028, priced at 100.00, non callable

- Swedbank AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): US$10,000m Unsecured Note (XS2681128711), floating rate maturing on 12 September 2028, priced at 100.00, non callable

- Swedbank AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): US$10,000m Unsecured Note (XS2681139320), floating rate maturing on 12 September 2028, priced at 100.00, non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): US$1,250m Senior Note (US87031CAM55), fixed rate (4.88% coupon) maturing on 14 September 2026, priced at 99.83, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): US$1,750m Covered Bond (Other) (US89117GY359), fixed rate (5.14% coupon) maturing on 13 September 2028, priced at 100.00 (original spread of 71 bp), non callable

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Virginia, Germany | Rating: BBB+): US$900m Senior Note (USU9273ADR33), fixed rate (5.70% coupon) maturing on 12 September 2026, priced at 99.96 (original spread of 105 bp), with a make whole call

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Virginia, Germany | Rating: BBB+): US$500m Senior Note (US928668BY79), floating rate (SOFR + 93.0 bp) maturing on 12 September 2025, priced at 100.00, non callable

- Volkswagen Group of America Finance LLC (Financial - Other | Herndon, Virginia, Germany | Rating: BBB+): US$800m Senior Note (US928668BU57), fixed rate (5.80% coupon) maturing on 12 September 2025, priced at 99.99 (original spread of 85 bp), with a make whole call

RECENT EURO BOND ISSUES

- Banco di Desio e della Brianza SpA (Banking | Desio, Monza E Brianza, Italy | Rating: NR): €400m Covered Bond (Other) (IT0005561250), fixed rate (4.00% coupon) maturing on 13 March 2028, priced at 99.93 (original spread of 145 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €750m Bond (FR001400KO38), fixed rate (4.13% coupon) maturing on 18 September 2030, priced at 99.71 (original spread of 164 bp), non callable

- Boels Topholding BV (Service - Other | Sittard, Limburg, Belgium | Rating: BB-): €400m Note (XS2679767249), fixed rate (6.25% coupon) maturing on 15 February 2029, priced at 100.00 (original spread of 372 bp), callable (5nc2)

- Ceska Sporitelna as (Banking | Praha, Praha, Austria | Rating: A): €500m Unsecured Note (XS2679750278), fixed rate (5.74% coupon) maturing on 8 March 2028, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €200m Bond (IT0005560633), fixed rate (3.75% coupon) maturing on 29 September 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C870), fixed rate (2.95% coupon) maturing on 3 October 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €200m Inhaberschuldverschreibung (DE000DW6C896), fixed rate (3.40% coupon) maturing on 1 October 2027, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C888), fixed rate (3.20% coupon) maturing on 2 October 2026, priced at 100.00, non callable

- DZ Privatbank SA (Banking | Strassen, Germany | Rating: A+): €250m Note (XS2681541673), fixed rate (4.09% coupon) maturing on 15 September 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJL8), fixed rate (3.80% coupon) maturing on 28 September 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJK0), fixed rate (3.50% coupon) maturing on 28 September 2026, priced at 100.00, non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €2,500m Senior Note (XS2679922828), fixed rate (3.45% coupon) maturing on 13 September 2038, priced at 99.57 (original spread of 72 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J859), fixed rate (2.85% coupon) maturing on 11 October 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J883), fixed rate (3.20% coupon) maturing on 13 October 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J8B7), fixed rate (3.25% coupon) maturing on 11 October 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J8C5), fixed rate (3.25% coupon) maturing on 11 October 2029, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J8F8), fixed rate (2.00% coupon) maturing on 13 October 2031, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J8A9), fixed rate (3.20% coupon) maturing on 11 October 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J842), fixed rate (2.85% coupon) maturing on 12 October 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J891), fixed rate (3.15% coupon) maturing on 12 October 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4J8D3), fixed rate (3.25% coupon) maturing on 11 October 2030, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB5139), fixed rate (3.10% coupon) maturing on 18 October 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €150m Inhaberschuldverschreibung (DE000HLB43M0), fixed rate (3.71% coupon) maturing on 14 July 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB5105), fixed rate (2.75% coupon) maturing on 20 October 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB5113), fixed rate (3.00% coupon) maturing on 18 October 2027, priced at 100.00, non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €500m Unsecured Note (XS2680596876), floating rate maturing on 27 September 2027, priced at 100.00, non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Spain | Rating: A): €120m Unsecured Note (XS2686006474), floating rate maturing on 15 September 2025, priced at 100.00, non callable

- Sartorius Fin (Financial - Other | Schiphol, Noord-Holland, Germany | Rating: NR): €650m Senior Note (XS2676395077), fixed rate (4.38% coupon) maturing on 14 September 2029, priced at 99.83 (original spread of 185 bp), callable (6nc6)

RECENT LOANS

- African Export-Import Bank (Egypt), signed a US$ 400m Term Loan, to be used for general corporate purposes. It matures on 08/30/30.

- Alabama Power (United States of America | A), signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/31/26 and initial pricing is set at Term SOFR +110.0bp

- CPI Property Group SA (Czech Republic | BBB-), signed a € 635m Term Loan, to be used for general corporate purposes. It matures on 08/30/26.

- Columbia Pipeline Group Inc (United States of America), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/31/26.

- CompuGrp Medical SE & Co KGaA (Germany), signed a € 200m Term Loan, to be used for general corporate purposes. It matures on 07/28/28.

- Danaher Corp (United States of America | A-), signed a US$ 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/31/28 and initial pricing is set at Term SOFR +79.5bp

- Ecopetrol SA (Colombia | BB+), signed a US$ 1,000m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 09/13/30.

- Intl Container Terminal Svcs (Philippines), signed a US$ 750m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 08/31/29.

- Lowe's Cos Inc (United States of America | A-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/01/28 and initial pricing is set at Term SOFR +69.0bp

- Tapestry Inc (United States of America | BBB), signed a US$ 350m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 08/30/28 and initial pricing is set at Term SOFR +150.0bp

- Tapestry Inc (United States of America | BBB), signed a US$ 1,050m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 08/30/26 and initial pricing is set at Term SOFR +137.5bp