Credit

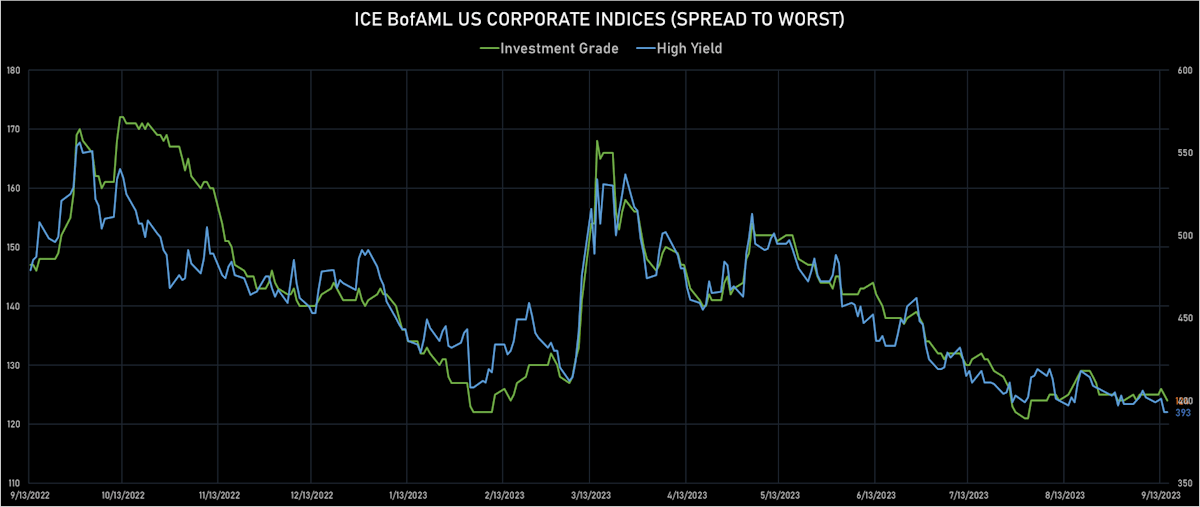

USD HY Overperformed IG This Week, As Spreads Tightened While Duration Sold Off

A decent week for USD bond issuance: 45 tranches for $36.085bn in IG (2023 YTD volume $968.309bn vs 2022 YTD $1.008trn), 14 tranches for $9.15bn (2023 YTD volume $121.297bn vs 2022 YTD $80.376bn)

Published ET

Brazil and Mexico 5Y USD CDS Mid Spreads | Source: Refintiv

DAILY SUMMARY

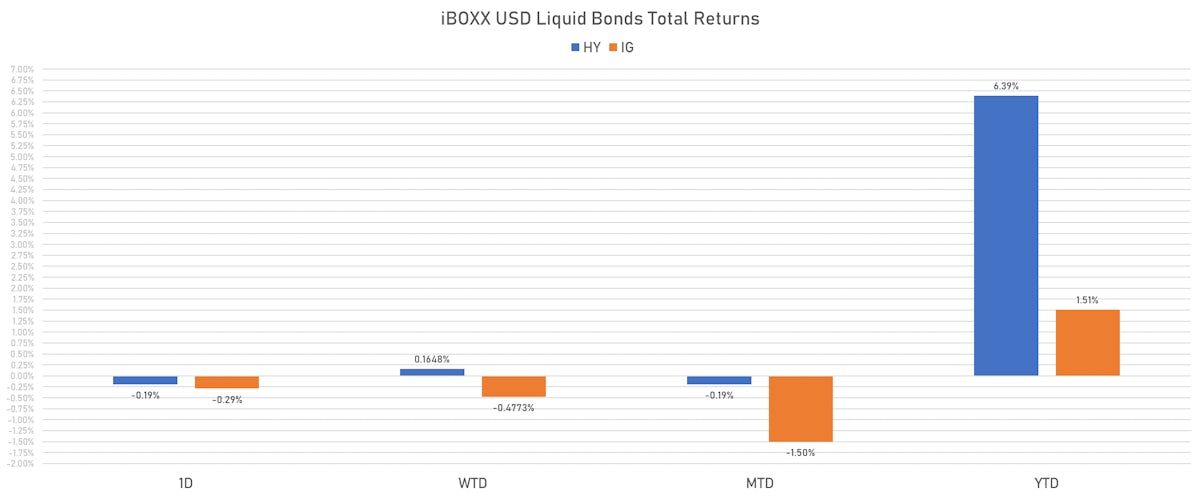

- S&P 500 Bond Index was down -0.23% today, with investment grade down -0.23% and high yield down -0.18% (YTD total return: +1.76%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.290% today (Week-to-date: -0.48%; Month-to-date: -1.50%; Year-to-date: 1.51%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.191% today (Week-to-date: 0.16%; Month-to-date: -0.19%; Year-to-date: 6.39%)

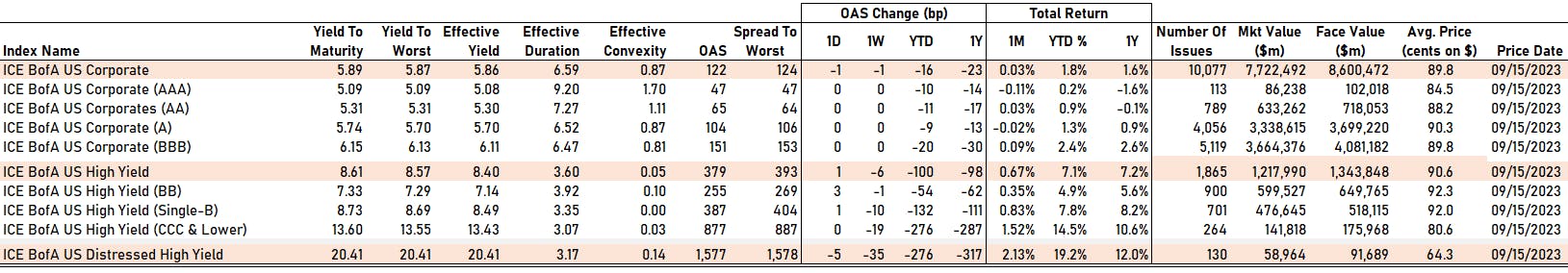

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 124.0 bp (WTD change: -1.0 bp; YTD change: -16.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged 0.0 bp, now at 393.0 bp (WTD change: -9.0 bp; YTD change: -95.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.07% today (YTD total return: +9.8%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 47 bp

- AA unchanged at 65 bp

- A unchanged at 104 bp

- BBB unchanged at 151 bp

- BB up by 3 bp at 255 bp

- B up by 1 bp at 387 bp

- ≤ CCC unchanged at 877 bp

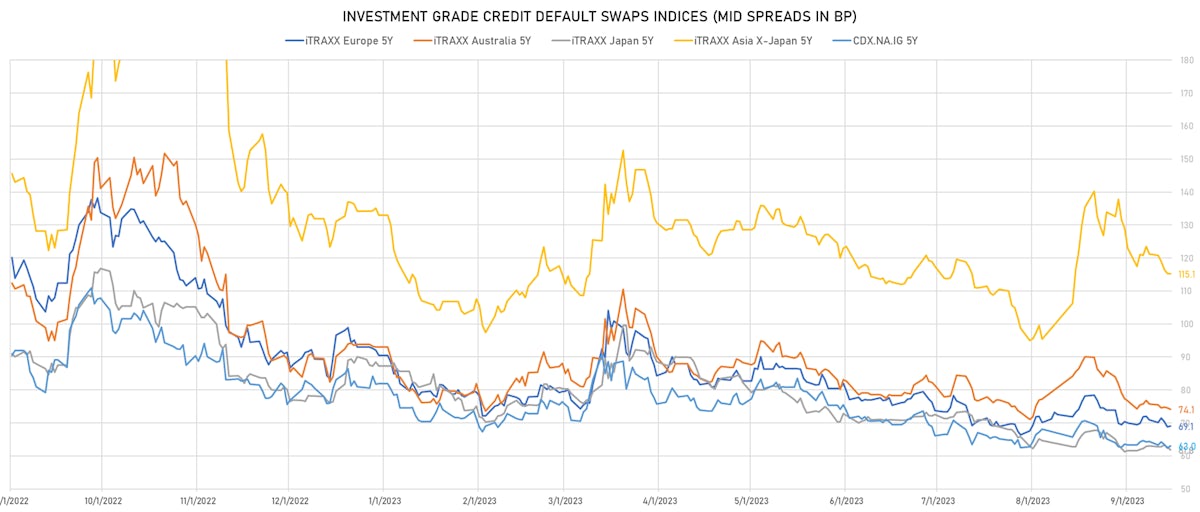

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 63bp (1W change: -1.4bp; YTD change: -18.9bp)

- Markit CDX.NA.IG 10Y up 0.7 bp, now at 105bp (1W change: -0.6bp; YTD change: -12.7bp)

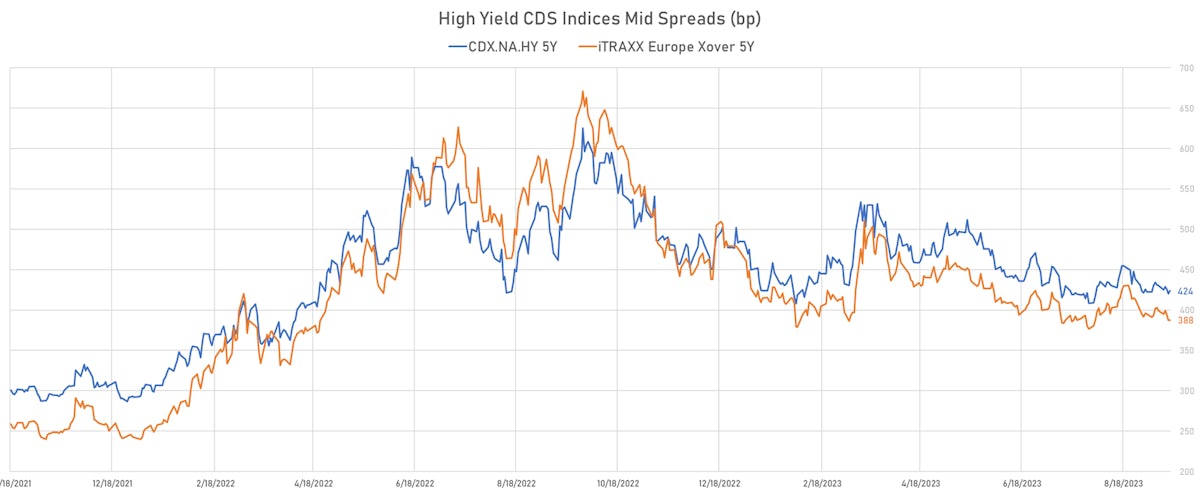

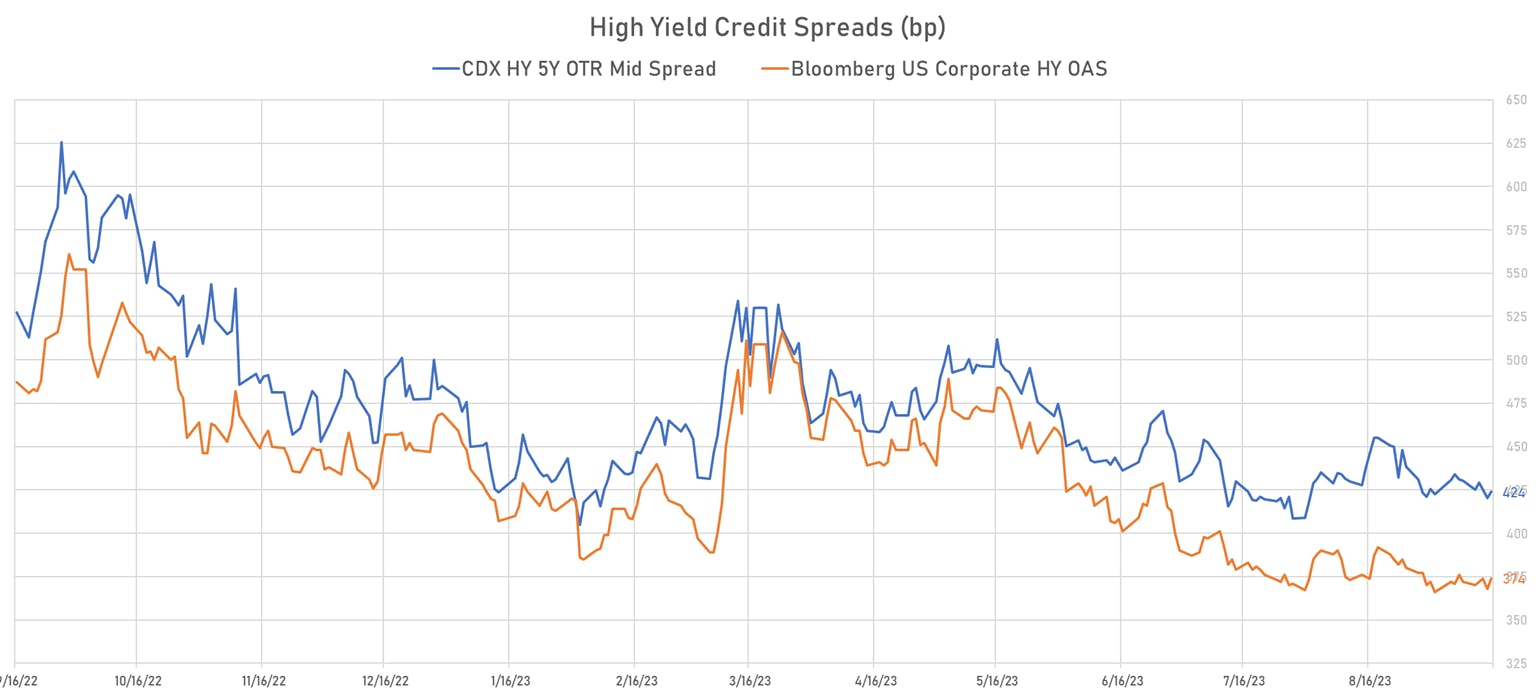

- Markit CDX.NA.HY 5Y up 3.9 bp, now at 424bp (1W change: -6.2bp; YTD change: -60.8bp)

- Markit iTRAXX Europe 5Y up 0.3 bp, now at 69bp (1W change: -1.8bp; YTD change: -21.3bp)

- Markit iTRAXX Europe Crossover 5Y up 0.4 bp, now at 388bp (1W change: -11.3bp; YTD change: -86.5bp)

- Markit iTRAXX Japan 5Y down 0.8 bp, now at 62bp (1W change: -1.2bp; YTD change: -25.3bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.2 bp, now at 115bp (1W change: -6.1bp; YTD change: -17.9bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Mexico (rated BBB-): up 4.4 % to 105 bp (1Y range: 96-205bp)

- Turkey (rated B): up 3.7 % to 390 bp (1Y range: 368-794bp)

- Indonesia (rated BBB): down 2.3 % to 77 bp (1Y range: 73-166bp)

- Colombia (rated BB+): down 2.4 % to 206 bp (1Y range: 197-394bp)

- China (rated A+): down 2.6 % to 69 bp (1Y range: 47-132bp)

- Brazil (rated BB): down 3.0 % to 165 bp (1Y range: 161-313bp)

- Egypt (rated B): down 3.6 % to 1,449 bp (1Y range: 706-1,837bp)

- Philippines (rated BBB): down 3.7 % to 70 bp (1Y range: 66-153bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Staples Inc (Country: US; rated: B3): down 389.8 bp to 4,183.0bp (1Y range: 1,411-4,183bp)

- Nabors Industries Inc (Country: US; rated: BB-): down 58.7 bp to 475.7bp (1Y range: 390-767bp)

- Petroleos Mexicanos (Country: MX; rated: B1): down 53.8 bp to 612.1bp (1Y range: 469-768bp)

- Transocean Inc (Country: KY; rated: Caa1): down 51.8 bp to 417.5bp (1Y range: 393-1,885bp)

- DISH DBS Corp (Country: US; rated: Caa1): down 47.0 bp to 1,785.3bp (1Y range: 1,138-3,084bp)

- Pitney Bowes Inc (Country: US; rated: NR): down 39.4 bp to 1,400.6bp (1Y range: 747-1,783bp)

- K Hovnanian Enterprises Inc (Country: US; rated: B3): down 18.2 bp to 649.0bp (1Y range: 649-1,472bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): down 13.4 bp to 490.0bp (1Y range: 428-772bp)

- Amkor Technology Inc (Country: US; rated: BB+): up 15.9 bp to 157.5bp (1Y range: 126-375bp)

- Community Health Systems Inc (Country: US; rated: NR): up 16.9 bp to 2,423.0bp (1Y range: 1,258-4,371bp)

- Rogers Communications Inc (Pre-merger) (Country: CA; rated: Ba2): up 17.0 bp to 131.8bp (1Y range: 77-144bp)

- Carnival Corp (Country: US; rated: Ba2): up 19.8 bp to 508.5bp (1Y range: 446-2,117bp)

- Avis Budget Group Inc (Country: US; rated: Discontinued): up 37.8 bp to 360.8bp (1Y range: 316-591bp)

- Kohls Corp (Country: US; rated: Ba2): up 45.2 bp to 592.5bp (1Y range: 444-783bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): up 467.3 bp to 6,254.0bp (1Y range: 1,245-6,254bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Altice Finco SA (Country: LU; rated: Caa2): down 258.3 bp to 689.3bp (1Y range: 401-1,021bp)

- Novafives SAS (Country: FR; rated: Caa1): down 132.1 bp to 463.8bp (1Y range: 464-2,936bp)

- CMA CGM SA (Country: FR; rated: Ba1): down 35.3 bp to 186.9bp (1Y range: 187-631bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 34.9 bp to 388.1bp (1Y range: 379-602bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 32.1 bp to 675.6bp (1Y range: 632-1,254bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 22.4 bp to 175.1bp (1Y range: 175-705bp)

- TUI AG (Country: DE; rated: B2-PD): down 16.9 bp to 701.3bp (1Y range: 620-1,725bp)

- Stena AB (Country: SE; rated: B1-PD): down 16.7 bp to 327.0bp (1Y range: 327-730bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 16.4 bp to 432.9bp (1Y range: 280-496bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 16.4 bp to 548.1bp (1Y range: 186-548bp)

- Accor SA (Country: FR; rated: NR): down 15.6 bp to 97.6bp (1Y range: 98-333bp)

- Iceland Bondco PLC (Country: GB; rated: B3): down 14.3 bp to 594.2bp (1Y range: 566-1,739bp)

- Banco de Sabadell SA (Country: ES; rated: Baa3): up 19.7 bp to 277.1bp (1Y range: 130-277bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 54.1 bp to 1,710.2bp (1Y range: 1,286-2,910bp)

- Ceconomy AG (Country: DE; rated: NR): up 73.9 bp to 705.6bp (1Y range: 577-1,763bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Advance Auto Parts Inc (Raleigh, North Carolina (US)) | Coupon: 5.90% | Maturity: 9/3/2026 | Rating: BB+ | CUSIP: 00751YAH9 | OAS up by 75.9 bp to 258.3 bp, with the yield to worst at 7.1% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 58.1-103.2).

- Issuer: Advance Auto Parts Inc (Raleigh, North Carolina (US)) | Coupon: 5.95% | Maturity: 9/3/2028 | Rating: BB+ | CUSIP: 00751YAJ5 | OAS up by 73.4 bp to 254.4 bp, with the yield to worst at 7.1% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 51.6-104.7).

- Issuer: Advance Auto Parts Inc (Raleigh, North Carolina (US)) | Coupon: 1.75% | Maturity: 1/10/2027 | Rating: BB+ | CUSIP: 00751YAF3 | OAS up by 72.3 bp to 245.1 bp, with the yield to worst at 7.1% and the bond now trading down to 81.5 cents on the dollar (1Y price range: 36.5-88.1).

- Issuer: Advance Auto Parts Inc (Raleigh, North Carolina (US)) | Coupon: 3.90% | Maturity: 15/4/2030 | Rating: BB+ | CUSIP: 00751YAE6 | OAS up by 64.9 bp to 283.3 bp, with the yield to worst at 7.3% and the bond now trading down to 82.5 cents on the dollar (1Y price range: 79.4-92.2).

- Issuer: Advance Auto Parts Inc (Raleigh, North Carolina (US)) | Coupon: 3.50% | Maturity: 15/3/2032 | Rating: BB+ | CUSIP: 00751YAG1 | OAS up by 49.7 bp to 289.5 bp, with the yield to worst at 7.2% and the bond now trading down to 76.3 cents on the dollar (1Y price range: 76.2-86.6).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 4.35% | Maturity: 8/12/2026 | Rating: BB+ | CUSIP: 345370CR9 | OAS up by 19.8 bp to 79.1 bp (CDS basis: 48.0bp), with the yield to worst at 5.6% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 39.8-98.3).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS down by 21.3 bp to 91.2 bp, with the yield to worst at 6.1% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 100.3-105.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | CUSIP: 26885BAF7 | OAS down by 25.3 bp to 142.6 bp, with the yield to worst at 6.3% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 95.8-99.8).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS down by 26.3 bp to 86.2 bp (CDS basis: -79.5bp), with the yield to worst at 5.9% and the bond now trading up to 90.6 cents on the dollar (1Y price range: 41.6-92.6).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | CUSIP: 126458AE8 | OAS down by 39.0 bp to 231.7 bp, with the yield to worst at 6.8% and the bond now trading up to 87.8 cents on the dollar (1Y price range: 48.8-90.6).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | CUSIP: 77340RAS6 | OAS down by 40.3 bp to 165.0 bp, with the yield to worst at 6.4% and the bond now trading up to 94.6 cents on the dollar (1Y price range: 91.8-95.0).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | CUSIP: 98421MAA4 | OAS down by 42.8 bp to 245.8 bp, with the yield to worst at 7.2% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 91.8-96.4).

- Issuer: Amerigas Partners LP (Valley Forge, Pennsylvania (US)) | Coupon: 5.75% | Maturity: 20/5/2027 | Rating: B+ | CUSIP: 030981AL8 | OAS down by 72.4 bp to 262.8 bp, with the yield to worst at 7.1% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 88.9-95.8).

- Issuer: Amerigas Partners LP (Valley Forge, Pennsylvania (US)) | Coupon: 5.88% | Maturity: 20/8/2026 | Rating: B+ | CUSIP: 030981AJ3 | OAS down by 77.0 bp to 232.7 bp, with the yield to worst at 6.9% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 91.8-97.5).

- Issuer: Qwest Corp (Monroe, Louisiana (US)) | Coupon: 7.25% | Maturity: 15/9/2025 | Rating: B- | CUSIP: 912920AK1 | OAS down by 111.3 bp to 420.1 bp, with the yield to worst at 8.4% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 80.9-102.7).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS up by 127.4 bp to 981.0 bp, with the yield to worst at 13.2% and the bond now trading down to 70.5 cents on the dollar (1Y price range: 65.2-79.1).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS down by 26.5 bp to 687.6 bp (CDS basis: -138.3bp), with the yield to worst at 10.1% and the bond now trading up to 81.6 cents on the dollar (1Y price range: 77.1-88.3).

- Issuer: Mytilineos SA (Athina, Greece) | Coupon: 2.25% | Maturity: 30/10/2026 | Rating: BB | ISIN: XS2337604479 | OAS down by 26.6 bp to 97.2 bp, with the yield to worst at 4.4% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 89.5-94.4).

- Issuer: Hornbach Baumarkt AG (Bornheim, Germany) | Coupon: 3.25% | Maturity: 25/10/2026 | Rating: BB+ | ISIN: DE000A255DH9 | OAS down by 27.1 bp to 153.7 bp, with the yield to worst at 4.9% and the bond now trading up to 94.9 cents on the dollar (1Y price range: 92.9-95.6).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS down by 27.9 bp to 597.8 bp (CDS basis: -171.8bp), with the yield to worst at 9.4% and the bond now trading up to 87.1 cents on the dollar (1Y price range: 83.6-92.8).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: B+ | ISIN: XS2288109676 | OAS down by 28.0 bp to 302.8 bp (CDS basis: -2.5bp), with the yield to worst at 6.0% and the bond now trading up to 79.3 cents on the dollar (1Y price range: 72.4-79.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 28.1 bp to 304.0 bp (CDS basis: 50.5bp), with the yield to worst at 6.2% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 88.4-103.2).

- Issuer: Iliad SA (Paris, France) | Coupon: 5.38% | Maturity: 14/6/2027 | Rating: BB | ISIN: FR001400EJI5 | OAS down by 31.0 bp to 240.5 bp, with the yield to worst at 5.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 95.5-101.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB+ | ISIN: FR0013299435 | OAS down by 31.9 bp to 34.5 bp (CDS basis: 62.2bp), with the yield to worst at 3.7% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 90.7-94.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 35.9 bp to 388.3 bp, with the yield to worst at 6.7% and the bond now trading up to 85.4 cents on the dollar (1Y price range: 74.8-88.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 36.4 bp to 279.8 bp (CDS basis: -17.6bp), with the yield to worst at 6.0% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 85.3-98.1).

- Issuer: MAS Securities BV (S-Gravenhage, Netherlands) | Coupon: 4.25% | Maturity: 19/5/2026 | Rating: BB | ISIN: XS2339025277 | OAS down by 56.9 bp to 812.0 bp, with the yield to worst at 11.6% and the bond now trading up to 83.6 cents on the dollar (1Y price range: 76.7-83.9).

- Issuer: Vivion Investments SARL (Luxembourg, Luxembourg) | Coupon: 6.50% | Maturity: 28/2/2029 | Rating: BB+ | ISIN: XS2663653140 | OAS down by 130.6 bp to 1,077.6 bp, with the yield to worst at 13.7% and the bond now trading up to 73.3 cents on the dollar (1Y price range: 69.4-73.3).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: CCC+ | ISIN: XS2346224806 | OAS down by 147.6 bp to 682.5 bp, with the yield to worst at 9.5% and the bond now trading up to 60.3 cents on the dollar (1Y price range: 50.0-67.0).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: CCC+ | ISIN: XS2271332285 | OAS down by 151.3 bp to 763.7 bp, with the yield to worst at 10.4% and the bond now trading up to 61.0 cents on the dollar (1Y price range: 53.8-67.8).

RECENT DOMESTIC USD BOND ISSUES

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): US$750m Senior Note (US03027XCE85), fixed rate (5.80% coupon) maturing on 15 November 2028, priced at 99.83 (original spread of 163 bp), callable (5nc5)

- American Tower Corp (Real Estate Investment Trust | Boston, Massachusetts, United States | Rating: BBB-): US$750m Senior Note (US03027XCF50), fixed rate (5.90% coupon) maturing on 15 November 2033, priced at 99.65 (original spread of 202 bp), callable (10nc10)

- Amphastar Pharms (Pharmaceuticals | Rancho Cucamonga, California, United States | Rating: NR): US$345m Bond (US03209RAA14), fixed rate (2.00% coupon) maturing on 15 March 2029, priced at 100.00, non callable, convertible

- B&G Foods Inc (Consumer Products | Parsippany, New Jersey, United States | Rating: B+): US$550m Note (USU07409AC68), fixed rate (8.00% coupon) maturing on 15 September 2028, priced at 99.50 (original spread of 387 bp), callable (5nc2)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$3,750m Senior Note (US06051GLU12), floating rate maturing on 15 September 2034, priced at 100.00 (original spread of 196 bp), callable (11nc10)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$1,500m Senior Note (US06051GLV94), floating rate maturing on 15 September 2027, priced at 100.00 (original spread of 148 bp), callable (4nc3)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$2,750m Senior Note (US06051GLS65), floating rate maturing on 15 September 2029, priced at 100.00 (original spread of 163 bp), callable (6nc5)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$500m Senior Note (US06051GLX50), floating rate (SOFR + 135.0 bp) maturing on 15 September 2027, priced at 100.00, callable (4nc3)

- Centerpoint Energy Houston Electric LLC (Utility - Other | Houston, Texas, United States | Rating: A): US$500m Bond (US15189XBD93), fixed rate (5.20% coupon) maturing on 1 October 2028, priced at 99.89 (original spread of 108 bp), callable (5nc5)

- Corebridge Financial Inc (Property and Casualty Insurance | Houston, Texas, United States | Rating: BBB+): US$500m Senior Note (US21871XAQ25), fixed rate (6.05% coupon) maturing on 15 September 2033, priced at 99.65 (original spread of 217 bp), callable (10nc10)

- Diamond Foreign Asset Co (Oil and Gas | Houston, Texas, United States | Rating: BB-): US$550m Note (USG2761WAB30), fixed rate (8.50% coupon) maturing on 1 October 2030, priced at 100.00 (original spread of 429 bp), callable (7nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$340m Bond (US3133EPWD32), fixed rate (4.88% coupon) maturing on 20 April 2026, priced at 99.91 (original spread of 20 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$780m Bond (US3133EPWB75), floating rate (SOFR + 15.5 bp) maturing on 15 September 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$650m Bond (US3133EPWL57), floating rate (SOFR + 17.0 bp) maturing on 19 September 2025, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EPVZ52), fixed rate (5.67% coupon) maturing on 18 September 2029, priced at 100.00 (original spread of 159 bp), callable (6nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$370m Bond (US3133EPVY87), fixed rate (5.00% coupon) maturing on 15 September 2025, priced at 99.92 (original spread of 19 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$105m Bond (US3133EPWA92), fixed rate (6.22% coupon) maturing on 19 September 2033, priced at 100.00 (original spread of 226 bp), callable (10nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$200m Senior Note (US3134H1CM39), fixed rate (4.50% coupon) maturing on 25 September 2028, priced at 100.00 (original spread of 96 bp), callable (5nc1)

- Freedom Mortgage Corp (Financial - Other | Boca Raton, Florida, United States | Rating: B): US$800m Note (USU31333AH72), fixed rate (12.00% coupon) maturing on 1 October 2028, priced at 98.00 (original spread of 815 bp), callable (5nc2)

- Freedom Mortgage Corp (Financial - Other | Boca Raton, Florida, United States | Rating: B): US$500m Senior Note (USU31333AJ39), fixed rate (12.25% coupon) maturing on 1 October 2030, priced at 98.00 (original spread of 834 bp), callable (7nc3)

- Horace Mann Educators Corp (Financial - Other | Springfield, Illinois, United States | Rating: BBB): US$300m Senior Note (US440327AL82), fixed rate (7.25% coupon) maturing on 15 September 2028, priced at 99.84 (original spread of 319 bp), callable (5nc5)

- Hunt Oil Company of Peru LLC (Lima Branch) (Oil and Gas | San Isidro, Lima, United States | Rating: BBB): US$435m Senior Note (US445640AC90), fixed rate (8.55% coupon) maturing on 18 September 2033, priced at 100.00, callable (10nc10)

- Inter-American Investment Corp (Supranational | Washington, Washington Dc, United States | Rating: AA+): US$500m Senior Note (US45828Q2C02), fixed rate (4.75% coupon) maturing on 19 September 2028, priced at 99.96 (original spread of 34 bp), non callable

- Intuit Inc (Information/Data Technology | Mountain View, California, United States | Rating: A-): US$1,250m Senior Note (US46124HAG11), fixed rate (5.20% coupon) maturing on 15 September 2033, priced at 99.42 (original spread of 134 bp), callable (10nc10)

- Intuit Inc (Information/Data Technology | Mountain View, California, United States | Rating: A-): US$1,250m Senior Note (US46124HAH93), fixed rate (5.50% coupon) maturing on 15 September 2053, priced at 99.17 (original spread of 182 bp), callable (30nc30)

- Intuit Inc (Information/Data Technology | Mountain View, California, United States | Rating: A-): US$750m Senior Note (US46124HAF38), fixed rate (5.13% coupon) maturing on 15 September 2028, priced at 99.80 (original spread of 102 bp), callable (5nc5)

- Intuit Inc (Information/Data Technology | Mountain View, California, United States | Rating: A-): US$750m Senior Note (US46124HAE62), fixed rate (5.25% coupon) maturing on 15 September 2026, priced at 99.91 (original spread of 76 bp), callable (3nc3)

- Marriott International Inc (Lodging | Bethesda, Maryland, United States | Rating: BBB): US$450m Senior Note (US571903BM43), fixed rate (5.45% coupon) maturing on 15 September 2026, priced at 99.35 (original spread of 117 bp), callable (3nc3)

- Marriott International Inc (Lodging | Bethesda, Maryland, United States | Rating: BBB): US$700m Senior Note (US571903BN26), fixed rate (5.55% coupon) maturing on 15 October 2028, priced at 99.43 (original spread of 130 bp), callable (5nc5)

- Marvell Technology Inc (Industrials - Other | Wilmington, Delaware, United States | Rating: BBB-): US$500m Senior Note (US573874AQ74), fixed rate (5.95% coupon) maturing on 15 September 2033, priced at 99.35 (original spread of 200 bp), callable (10nc10)

- Marvell Technology Inc (Industrials - Other | Wilmington, Delaware, United States | Rating: BBB-): US$500m Senior Note (US573874AP91), fixed rate (5.75% coupon) maturing on 15 February 2029, priced at 99.71 (original spread of 167 bp), callable (5nc5)

- Mohawk Industries Inc (Conglomerate/Diversified Mfg | Calhoun, Georgia, United States | Rating: BBB+): US$600m Senior Note (US608190AM61), fixed rate (5.85% coupon) maturing on 18 September 2028, priced at 99.99 (original spread of 145 bp), callable (5nc5)

- Monongahela Power Co (Utility - Other | Fairmont, West Virginia, United States | Rating: A-): US$400m First Mortgage Bond (USU61008AA39), fixed rate (5.85% coupon) maturing on 15 February 2034, priced at 99.82 (original spread of 186 bp), callable (10nc10)

- NFP Corp (Life Insurance | New York City, New York, United States | Rating: B): US$350m Note (US65342RAG56), fixed rate (8.50% coupon) maturing on 1 October 2031, priced at 100.00 (original spread of 421 bp), callable (8nc3)

- Nevada Power Co (Utility - Other | Las Vegas, Nevada, United States | Rating: A): US$500m Note (US641423CG18), fixed rate (6.00% coupon) maturing on 15 March 2054, priced at 99.83 (original spread of 220 bp), callable (31nc30)

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: AA+): US$800m Note (USU7965TAR24), fixed rate (5.45% coupon) maturing on 18 September 2026, priced at 99.98 (original spread of 93 bp), non callable

- Patterson-UTI Energy Inc (Oil and Gas | Houston, Texas, United States | Rating: BBB-): US$400m Senior Note (US703481AD36), fixed rate (7.15% coupon) maturing on 1 October 2033, priced at 99.75 (original spread of 304 bp), callable (10nc10)

- Retail Opportunity Investments Partnership LP (Financial - Other | San Diego, California, United States | Rating: BBB-): US$350m Senior Note (US76132FAC14), fixed rate (6.75% coupon) maturing on 15 October 2028, priced at 99.51 (original spread of 245 bp), callable (5nc5)

- Sierra Pacific Power Co (Utility - Other | Reno, Nevada, United States | Rating: A): US$400m Note (USU82195AD76), fixed rate (5.90% coupon) maturing on 15 March 2054, priced at 99.37 (original spread of 228 bp), callable (31nc30)

- Southern Company Gas Capital Corp (Financial - Other | Atlanta, Georgia, United States | Rating: BBB+): US$500m Senior Note (US8426EPAG30), fixed rate (5.75% coupon) maturing on 15 September 2033, priced at 99.89 (original spread of 190 bp), callable (10nc10)

- Sunoco LP (Oil and Gas | Dallas, Texas, United States | Rating: BB-): US$500m Senior Note (US86765KAA79), fixed rate (7.00% coupon) maturing on 15 September 2028, priced at 100.00 (original spread of 258 bp), callable (5nc2)

- US Foods Inc (Restaurants | Rosemont, Illinois, United States | Rating: B): US$500m Senior Note (USU90375AE39), fixed rate (6.88% coupon) maturing on 15 September 2028, priced at 100.00 (original spread of 255 bp), callable (5nc2)

- US Foods Inc (Restaurants | Rosemont, Illinois, United States | Rating: B): US$500m Senior Note (US90290MAH43), fixed rate (7.25% coupon) maturing on 15 January 2032, priced at 100.00 (original spread of 301 bp), callable (8nc3)

- Veralto (Service - Other | Washington, Washington Dc, United States | Rating: BBB): US$700m Senior Note (US92338CAC73), fixed rate (5.35% coupon) maturing on 18 September 2028, priced at 99.94 (original spread of 126 bp), callable (5nc5)

- Veralto (Service - Other | Washington, Washington Dc, United States | Rating: BBB): US$700m Senior Note (US92338CAA18), fixed rate (5.50% coupon) maturing on 18 September 2026, priced at 99.98 (original spread of 107 bp), callable (3nc3)

- Veralto (Service - Other | Washington, Washington Dc, United States | Rating: BBB): US$700m Senior Note (US92338CAE30), fixed rate (5.45% coupon) maturing on 18 September 2033, priced at 99.70 (original spread of 159 bp), callable (10nc10)

- Veralto Corp (Service - Other | Washington, Washington Dc, United States | Rating: BBB): US$700m Senior Note (USU9226NAA38), fixed rate (5.50% coupon) maturing on 18 September 2026, priced at 99.98 (original spread of 105 bp), callable (3nc3)

- Veralto Corp (Service - Other | Washington, Washington Dc, United States | Rating: BBB): US$700m Senior Note (USU9226NAC93), fixed rate (5.45% coupon) maturing on 18 September 2033, priced at 99.70 (original spread of 156 bp), callable (10nc10)

- Vistra Operations Company LLC (Utility - Other | Irving, Texas, United States | Rating: BBB-): US$650m Note (USU9226VAN74), fixed rate (6.95% coupon) maturing on 15 October 2033, priced at 99.85 (original spread of 301 bp), callable (10nc10)

- Vistra Operations Company LLC (Utility - Other | Irving, Texas, United States | Rating: BB): US$1,100m Senior Note (USU9226VAM91), fixed rate (7.75% coupon) maturing on 15 October 2031, priced at 100.00 (original spread of 362 bp), callable (8nc3)

- Williams Scotsman Inc (Service - Other | Rotterdam New York, New York, United States | Rating: B): US$500m Note (USU96961AA22), fixed rate (7.38% coupon) maturing on 1 October 2031, priced at 100.00 (original spread of 319 bp), callable (8nc3)

RECENT INTERNATIONAL USD BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): US$500m Note (US00084EAF51), floating rate (SOFRINDX + 178.0 bp) maturing on 18 September 2027, priced at 100.00, callable (4nc3)

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): US$1,250m Note (US00084DBA72), fixed rate (6.34% coupon) maturing on 18 September 2027, priced at 100.00 (original spread of 181 bp), callable (4nc3)

- AP Moeller - Maersk A/S (Transportation - Other | Koebenhavn K, Denmark | Rating: BBB): US$750m Senior Note (USK0479SAG32), fixed rate (5.88% coupon) maturing on 14 September 2033, priced at 99.59 (original spread of 196 bp), callable (10nc10)

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$105m Unsecured Note (XS2693369279), fixed rate (5.88% coupon) maturing on 20 May 2030, priced at 101.79, non callable

- Bangkok Bank Public Co Ltd (Hong Kong Branch) (Banking | Thailand | Rating: NR): US$750m Senior Note (US059895AX05), fixed rate (5.50% coupon) maturing on 21 September 2033, priced at 99.48 (original spread of 128 bp), callable (10nc10)

- Bangkok Bank Public Co Ltd (Hong Kong Branch) (Banking | Thailand | Rating: NR): US$500m Senior Note (USY06072AG07), fixed rate (5.30% coupon) maturing on 21 September 2028, priced at 99.59 (original spread of 98 bp), callable (5nc5)

- Banijay Entertainment SAS (Cable/Media | Paris, Ile-De-France, France | Rating: B+): US$400m Note (USF6456QAC62), fixed rate (8.13% coupon) maturing on 1 May 2029, priced at 100.00 (original spread of 373 bp), callable (6nc2)

- Bank of China (Dubai Branch) (Banking | Dubai, Dubai, China (Mainland) | Rating: A): US$500m Senior Note (XS2677539541), floating rate (SOFRINDX + 60.0 bp) maturing on 18 September 2026, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A+): US$150m Unsecured Note (XS2689472640), floating rate maturing on 30 September 2031, priced at 100.00, non callable

- Bausch + Lomb Corp (Financial - Other | Vaughan, Ontario, Canada | Rating: B-): US$1,400m Note (US071705AA56), fixed rate (8.38% coupon) maturing on 1 October 2028, priced at 100.00 (original spread of 398 bp), callable (5nc2)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): US$400m Note (US05571AAN54), floating rate (SOFR + 96.0 bp) maturing on 25 September 2025, priced at 100.00, non callable

- Brooklyn Union Gas Co (Gas Utility - Local Distrib | Brooklyn, New York, United Kingdom | Rating: BBB+): US$400m Senior Note (USU11147AK83), fixed rate (6.39% coupon) maturing on 15 September 2033, priced at 100.00 (original spread of 250 bp), callable (10nc10)

- CITGO Petroleum Corp (Oil and Gas | Houston, Texas, Venezuela | Rating: B-): US$1,100m Note (US17302XAN66), fixed rate (8.38% coupon) maturing on 15 January 2029, priced at 100.00 (original spread of 397 bp), callable (5nc2)

- CNH Industrial Capital LLC (Financial - Other | Racine, Wisconsin, United Kingdom | Rating: BBB): US$500m Senior Note (US12592BAR50), fixed rate (5.50% coupon) maturing on 12 January 2029, priced at 99.40 (original spread of 163 bp), callable (5nc5)

- Caisse d'amortissement De La Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): US$4,000m Senior Note (US12802D2N50), fixed rate (4.88% coupon) maturing on 19 September 2026, priced at 99.99 (original spread of 33 bp), non callable

- China Everbright Bank Co Ltd (Sydney Branch) (Financial - Other | New South Wales, China (Mainland) | Rating: BBB+): US$550m Senior Note (XS2679063862), floating rate (SOFRINDX + 63.0 bp) maturing on 20 September 2026, priced at 100.00, non callable

- EDO Sukuk Ltd (Financial - Other | Cayman Islands | Rating: NR): US$1,000m Islamic Sukuk (Hybrid) (US28135J2A42), fixed rate (5.88% coupon) maturing on 21 September 2033, priced at 99.49 (original spread of 192 bp), non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$180m Unsecured Note (XS2693509114), floating rate maturing on 21 September 2028, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$180m Senior Note (XS2688405757), floating rate maturing on 15 September 2028, priced at 100.00, non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US302154DY27), fixed rate (5.13% coupon) maturing on 18 September 2028, priced at 99.86 (original spread of 103 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US302154DX44), fixed rate (5.38% coupon) maturing on 18 September 2025, priced at 99.89 (original spread of 53 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US302154DZ91), fixed rate (5.13% coupon) maturing on 18 September 2033, priced at 99.14 (original spread of 123 bp), non callable

- Greenfire Resources Inc (Oil and Gas | Canada | Rating: B+): US$300m Note (US39525UAA51), fixed rate (12.00% coupon) maturing on 1 October 2028, priced at 98.00 (original spread of 808 bp), callable (5nc2)

- Kbc Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): US$1,000m Senior Note (US48241FAC86), fixed rate (6.32% coupon) maturing on 21 September 2034, priced at 100.00 (original spread of 240 bp), non callable

- Korea Southern Power Co Ltd (Utility - Other | Busan, Busan, South Korea | Rating: AA-): US$300m Senior Note (XS2682195016), fixed rate (5.38% coupon) maturing on 21 September 2026, priced at 99.45, non callable

- Macquarie Airfinance Holdings Ltd (Financial - Other | London, United Kingdom | Rating: BB+): US$500m Senior Note (US55609NAB47), fixed rate (8.13% coupon) maturing on 30 March 2029, priced at 100.00 (original spread of 372 bp), callable (6nc2)

- Nissan Motor Acceptance Company LLC (Financial - Other | Dallas, Texas, Japan | Rating: BBB-): US$300m Senior Note (USU6547TAE02), fixed rate (6.95% coupon) maturing on 15 September 2026, priced at 99.90 (original spread of 225 bp), with a make whole call

- Nissan Motor Acceptance Company LLC (Financial - Other | Dallas, Texas, Japan | Rating: BBB-): US$700m Senior Note (USU6547TAF76), fixed rate (7.05% coupon) maturing on 15 September 2028, priced at 99.90 (original spread of 288 bp), callable (5nc5)

- Santos Finance Ltd (Financial - Other | South Australia, Australia | Rating: BBB-): US$850m Senior Note (USQ82780AG49), fixed rate (6.88% coupon) maturing on 19 September 2033, priced at 99.59 (original spread of 304 bp), callable (10nc10)

- Sharjah Sukuk Programme Ltd (Financial - Other | George Town, United Arab Emirates | Rating: NR): US$750m Senior Note (XS2680379695), fixed rate (6.09% coupon) maturing on 19 March 2034, priced at 100.00 (original spread of 212 bp), non callable

- Slovenia, Republic of (Government) (Sovereign | Ljubljana, Slovenia | Rating: A-): US$1,000m Senior Note (XS2635185437), fixed rate (5.00% coupon) maturing on 19 September 2033, priced at 99.33 (original spread of 116 bp), non callable

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB): US$1,000m Senior Note (US87264ADC62), fixed rate (5.75% coupon) maturing on 15 January 2034, priced at 99.86 (original spread of 187 bp), callable (10nc10)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington, Germany | Rating: BBB): US$1,000m Senior Note (US87264ADD46), fixed rate (6.00% coupon) maturing on 15 June 2054, priced at 99.83 (original spread of 231 bp), callable (31nc30)

- Trinidad and Tobago, Republic of (Government) (Sovereign | Port Of Spain, Trinidad And Tobago | Rating: BB): US$560m Senior Note (USP93960AJ47), fixed rate (5.95% coupon) maturing on 14 January 2031, priced at 99.27 (original spread of 204 bp), callable (7nc7)

- Turkiye Sinai Kalkinma Bankasi AS (Banking | Istanbul, Turkey | Rating: B-): US$300m Senior Note (US90015YAE95), fixed rate (9.38% coupon) maturing on 19 October 2028, priced at 99.49 (original spread of 529 bp), non callable

- Turkiye Vakiflar Bankasi TAO (Banking | Istanbul, Turkey | Rating: B-): US$750m Unsecured Note (XS2487076239), fixed rate (9.00% coupon) maturing on 12 October 2028, priced at 99.48, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$300m Unsecured Note (XS2522424576) zero coupon maturing on 22 September 2025, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$255m Unsecured Note (XS2522248074) zero coupon maturing on 29 September 2025, priced at 100.00, non callable

- Zensun Enterprises Ltd (Financial - Other | British Virgin Islands | Rating: NR): US$103m Senior Note (XS2674525477), fixed rate (7.00% coupon) maturing on 12 September 2025, priced at 100.00, callable (2nc1m)

RECENT EURO BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €1,000m Unsecured Note (XS2694034971), floating rate maturing on 22 September 2025, priced at 100.00, non callable

- Agence Francaise de Developpement EPIC (Agency | Paris, Ile-De-France, France | Rating: AA-): €500m Bond (FR001400KR43), fixed rate (3.75% coupon) maturing on 20 September 2038, priced at 99.03 (original spread of 101 bp), non callable

- Allianz SE (Property and Casualty Insurance | Muenchen, Bayern, Germany | Rating: AA-): €170m Senior Note (XS2689952344), fixed rate (3.79% coupon) maturing on 20 September 2036, priced at 100.00, non callable

- Allianz SE (Property and Casualty Insurance | Muenchen, Bayern, Germany | Rating: AA-): €130m Senior Note (XS2689948664), fixed rate (3.60% coupon) maturing on 20 September 2028, priced at 100.00, non callable

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €800m Unsecured Note (XS2693294246), floating rate maturing on 20 September 2028, priced at 100.00, non callable

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB+): €500m Covered Bond (Other) (IT0005562142), fixed rate (3.88% coupon) maturing on 18 September 2026, priced at 99.76 (original spread of 119 bp), non callable

- Banijay Entertainment SAS (Cable/Media | Paris, Ile-De-France, France | Rating: B+): €540m Note (XS2690056374), fixed rate (7.00% coupon) maturing on 1 May 2029, priced at 100.00 (original spread of 437 bp), callable (6nc2)

- Bank Millennium SA (Banking | Warsaw, Woj. Mazowieckie, Portugal | Rating: BB): €400m Note (XS2684974046), floating rate maturing on 18 September 2027, priced at 100.00, with a regulatory call

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: AA-): €750m Unsecured Note (XS2692247468), floating rate maturing on 22 September 2025, priced at 100.00, non callable

- Coty Inc (Consumer Products | New York City, New York, Luxembourg | Rating: BB): €500m Note (XS2689093891), fixed rate (5.75% coupon) maturing on 15 September 2028, priced at 100.00 (original spread of 316 bp), callable (5nc2)

- Crelan SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): €600m Bond (BE0002936178), fixed rate (6.00% coupon) maturing on 28 February 2030, priced at 99.58 (original spread of 351 bp), callable (6nc5)

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: AAA): €250m Hypotheken-Namenspfandbrief (covered bond) (XS2689094279), fixed rate (3.50% coupon) maturing on 9 October 2026, priced at 99.83 (original spread of 92 bp), non callable

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €600m Senior Note (XS2689049059), fixed rate (3.50% coupon) maturing on 20 September 2027, priced at 99.90 (original spread of 87 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJW5), fixed rate (4.05% coupon) maturing on 25 September 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJV7), fixed rate (4.00% coupon) maturing on 22 September 2027, priced at 100.00, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €5,000m Senior Note (EU000A3LNF05), fixed rate (3.13% coupon) maturing on 4 December 2030, priced at 99.42 (original spread of 60 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): €500m Senior Note (XS2687921473), fixed rate (3.63% coupon) maturing on 18 September 2027, priced at 99.62 (original spread of 90 bp), non callable

- Fluvius System Operator CV (Utility - Other | Melle, Oost-Vlaanderen, Belgium | Rating: A-): €500m Bond (BE0002964451), fixed rate (3.88% coupon) maturing on 18 March 2031, priced at 98.71 (original spread of 154 bp), callable (8nc7)

- IMCD NV (Food Processors | Rotterdam, Zuid-Holland, Netherlands | Rating: BBB-): €500m Senior Note (XS2677668357), fixed rate (4.88% coupon) maturing on 18 September 2028, priced at 99.05 (original spread of 250 bp), callable (5nc5)

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €200m Inhaberschuldverschreibung (DE000A351Y03), fixed rate (3.25% coupon) maturing on 26 August 2026, priced at 100.02, non callable

- MFB Magyar Fejlesztesi Bank Zrt (Banking | Budapest, Budapest, Hungary | Rating: BBB): €140m Bond (HU0000362934), fixed rate (5.50% coupon) maturing on 29 June 2027, priced at 98.96, non callable

- Mediobanca International Luxembourg SA (Banking | Luxembourg, Italy | Rating: BBB): €350m Unsecured Note (XS2693320934), floating rate maturing on 20 December 2030, priced at 100.00, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A): €300m Senior Note (XS2689473028), floating rate maturing on 18 September 2025, priced at 100.00, non callable

- Pernod Ricard SA (Beverage/Bottling | Paris, Ile-De-France, France | Rating: BBB+): €750m Bond (FR001400KPC2), fixed rate (3.75% coupon) maturing on 15 September 2033, priced at 98.53 (original spread of 130 bp), callable (10nc10)

- Pernod Ricard SA (Beverage/Bottling | Paris, Ile-De-France, France | Rating: BBB+): €600m Bond (FR001400KPB4), fixed rate (3.75% coupon) maturing on 15 September 2027, priced at 99.89 (original spread of 111 bp), callable (4nc4)

- Praemia Healthcare SA (Service - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400KL23), fixed rate (5.50% coupon) maturing on 19 September 2028, priced at 99.89 (original spread of 291 bp), callable (5nc5)

- Romania (Government) (Sovereign | Bucuresti, Bucuresti, Romania | Rating: BBB-): €1,500m Senior Note (XS2689949555), fixed rate (5.50% coupon) maturing on 18 September 2028, priced at 99.93 (original spread of 292 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Bucuresti, Romania | Rating: BBB-): €1,750m Senior Note (XS2689948078), fixed rate (6.38% coupon) maturing on 18 September 2033, priced at 99.19 (original spread of 385 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Bucuresti, Romania | Rating: BBB-): €1,750m Senior Note (XS2689949043), fixed rate (6.38% coupon) maturing on 18 September 2033, priced at 99.19 (original spread of 385 bp), non callable

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A-): €120m Unsecured Note (XS2691050384), floating rate maturing on 15 September 2025, priced at 100.00, non callable

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000RLP1437), floating rate (EU03MLIB + -22.0 bp) maturing on 16 September 2025, non callable

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €300m Inhaberschuldverschreibung (DE000A3LNFJ2), floating rate (EU03MLIB + 95.0 bp) maturing on 18 September 2025, priced at 99.94, non callable

- Veralto Corp (Service - Other | Washington, Washington Dc, United States | Rating: BBB): €500m Senior Note (XS2689127467), fixed rate (4.15% coupon) maturing on 19 September 2031, priced at 99.70 (original spread of 164 bp), callable (8nc8)

- Zuercher Kantonalbank (Banking | Zurich, Zuerich, Switzerland | Rating: AA): €500m Bond (CH1290222392), fixed rate (4.47% coupon) maturing on 15 September 2027, priced at 100.00 (original spread of 166 bp), callable (4nc3)

- saxony, state of (Official and Muni | Dresden, Sachsen, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE0001789360), fixed rate (3.38% coupon) maturing on 21 September 2026, priced at 99.98 (original spread of 56 bp), non callable

RECENT LOANS

- Apax Global Alpha Ltd (Guernsey), signed a € 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/06/26 and initial pricing is set at EURIBOR +335.0bp

- Burger King Worldwide Inc (United States of America), signed a US$ 4,160m Term Loan B, to be used for general corporate purposes. It matures on 09/13/30 and initial pricing is set at Term SOFR +250.0bp

- CMG Mortgage Inc (United States of America), signed a US$ 243m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/22/24.

- Centerra Gold Inc (Canada), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/08/27.

- China Lesso Group Holdings Ltd (China), signed a US$ 600m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/05/27.

- Cornerstone OnDemand Inc (United States of America | B-), signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 10/15/28 and initial pricing is set at Term SOFR +600.0bp

- DFS Furniture Co PLC (United Kingdom), signed a US$ 250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/07/27.

- EnergySolutions LLC (United States of America), signed a US$ 640m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 09/18/30 and initial pricing is set at Term SOFR +425.0bp

- Flynn Restaurant Group LP (United States of America | B), signed a US$ 150m Term Loan B, to be used for general corporate purposes. It matures on 09/14/28 and initial pricing is set at Term SOFR +425.0bp

- Fogo de Chao(Holdings)LLC (United States of America), signed a US$ 550m Term Loan B, to be used for 126. It matures on 09/22/30 and initial pricing is set at Term SOFR +500.0bp

- Forward Air Corp (United States of America | BB-), signed a US$ 925m Term Loan B, to be used for general corporate purposes. It matures on 09/20/30 and initial pricing is set at Term SOFR +400.0bp

- Infra Group NV (Belgium), signed a € 600m Term Loan B, to be used for leveraged buyout. It matures on 01/00/00.

- Iridium Satellite LLC (United States of America | BB), signed a US$ 1,500m Term Loan B, to be used for general corporate purposes. It matures on 09/21/30 and initial pricing is set at Term SOFR +250.0bp

- Mercuria Asia Grp Hldg Pte Ltd (Singapore), signed a US$ 150m Term Loan, to be used for general corporate purposes and working capital. It matures on 09/06/24 and initial pricing is set at Term SOFR +55.0bp

- Nomad Foods Ltd (United Kingdom | BB-), signed a US$ 700m Term Loan B, to be used for general corporate purposes. It matures on 11/09/29 and initial pricing is set at Term SOFR +300.0bp

- Sally Holdings Llc (United States of America | BB-), signed a US$ 400m Term Loan B, to be used for general corporate purposes. It matures on 02/28/30 and initial pricing is set at Term SOFR +225.0bp

- Shyahsin Pkg China Co (China), signed a US$ 537m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/06/28 and initial pricing is set at Term SOFR +400.0bp

- Stanley Black & Decker Inc (United States of America | A-), signed a US$ 1,500m 364d Revolver, to be used for general corporate purposes. It matures on 09/04/24 and initial pricing is set at Term SOFR +85.0bp

- Synthomer PLC (United Kingdom | BB), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/09/27.

- Tamko Building Products Inc (United States of America), signed a US$ 821m Term Loan B, to be used for general corporate purposes. It matures on 09/21/30 and initial pricing is set at Term SOFR +350.0bp

- Thai Sing Potash Trading (Singapore), signed a US$ 1,000m Revolving Credit / Term Loan, to be used for capital expenditures. It matures on 01/00/00.

- Trinseo Materials Op SCA (United States of America | CCC), signed a US$ 1,077m Term Loan, to be used for refin/ret bank debt. It matures on 05/08/28 and initial pricing is set at Term SOFR +850.0bp

- Waterbridge Operating LLC (United States of America | B-), signed a US$ 150m Term Loan B, to be used for general corporate purposes. It matures on 06/21/26 and initial pricing is set at Term SOFR +575.0bp

RECENT STRUCTURED CREDIT

- Affirm Asset Securitization Trust 2023-B issued a fixed-rate ABS backed by consumer loan in 5 tranches, for a total of US$ 750 m. Highest-rated tranche offering a yield to maturity of 6.82%, and the lowest-rated tranche a yield to maturity of 11.32%. Bookrunners: JP Morgan & Co Inc, CIBC World Markets Inc, Barclays Capital Group, Citigroup Global Markets Inc

- Bayfront Infrastructure Capital IV Pte Ltd issued a floating-rate ABS backed by leveraged loans in 4 tranches, for a total of US$ 372 m. Highest-rated tranche offering a spread over the floating rate of 143bp, and the lowest-rated tranche a spread of 490bp. Bookrunners: Oversea-Chinese Banking Corp Ltd, Societe Generale SA, ING, Citi, SMBC Nikko Securities Inc, Standard Chartered Bank

- Bbcms Mortgage Trust 2023-C21 issued a fixed-rate CMBS in 6 tranches, for a total of US$ 516 m. Highest-rated tranche offering a yield to maturity of 5.82%, and the lowest-rated tranche a yield to maturity of 6.38%. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, BMO Capital Markets

- Bsprt 2023-Fl10 Issuer LLC issued a floating-rate CLO in 3 tranches, for a total of US$ 571 m. Highest-rated tranche offering a spread over the floating rate of 226bp, and the lowest-rated tranche a spread of 397bp. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group, Wells Fargo Securities LLC

- CAUTO 2023-1 issued a fixed-rate ABS backed by leases in 3 tranches, for a total of US$ 442 m. Highest-rated tranche offering a yield to maturity of 5.94%, and the lowest-rated tranche a yield to maturity of 7.94%. Bookrunners: Morgan Stanley International Ltd, Barclays Capital Group, Atlas SP Partners LP

- Carvana Auto Receivables Trust 2023-N3 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 268 m. Highest-rated tranche offering a yield to maturity of 6.41%, and the lowest-rated tranche a yield to maturity of 9.49%. Bookrunners: Santander Investment Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp

- Finance Ireland Rmbs No.6 Dac issued a floating-rate RMBS in 5 tranches, for a total of € 254 m. Highest-rated tranche offering a spread over the floating rate of 116bp, and the lowest-rated tranche a spread of 600bp. Bookrunners: Citi, BofA Securities Inc

- Gracie Point International Funding 2023-1 issued a floating-rate ABS backed by receivables in 4 tranches, for a total of US$ 289 m. Highest-rated tranche offering a spread over the floating rate of 195bp, and the lowest-rated tranche a spread of 450bp. Bookrunners: Cantor Fitzgerald Inc

- North Mill Equipment Finance LLC 2023-A issued a fixed-rate ABS backed by equipment leases in 4 tranches, for a total of US$ 433 m. Highest-rated tranche offering a yield to maturity of 5.85%, and the lowest-rated tranche a yield to maturity of 8.44%. Bookrunners: Deutsche Bank Securities Inc, Truist Securities Inc