Credit

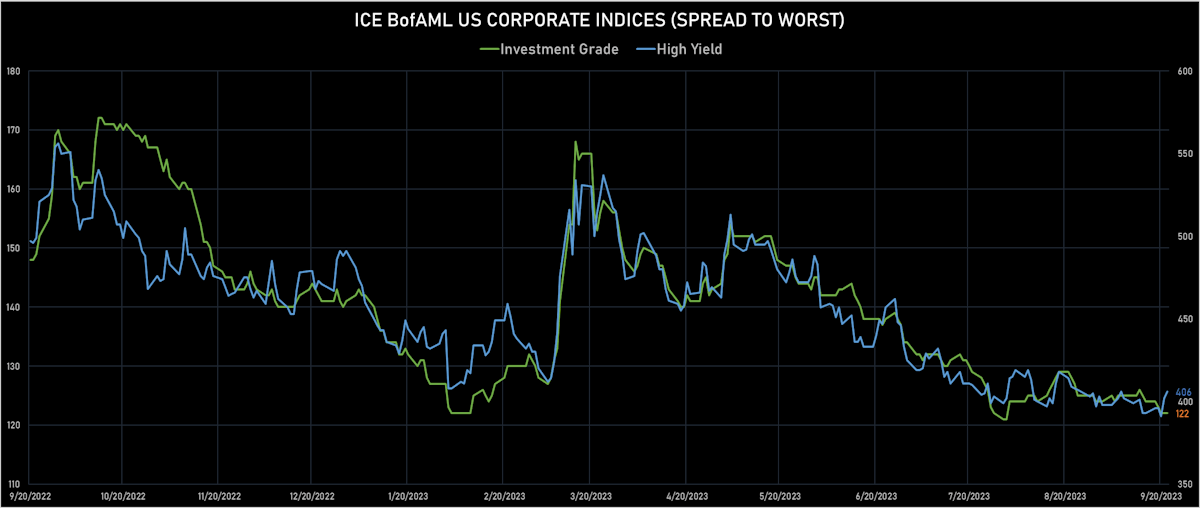

Move To Quality In USD Credit Pushes HY Spreads Wider, IG Spreads Tighter

More modest levels of USD bond issuance this week: 21 tranches for $16.65bn in IG (2023 YTD volume $984.959bn vs 2022 YTD $1.014trn), 12 tranches for $8.333bn in HY (2023 YTD volume $129.631bn vs 2022 YTD $86.376bn)

Published ET

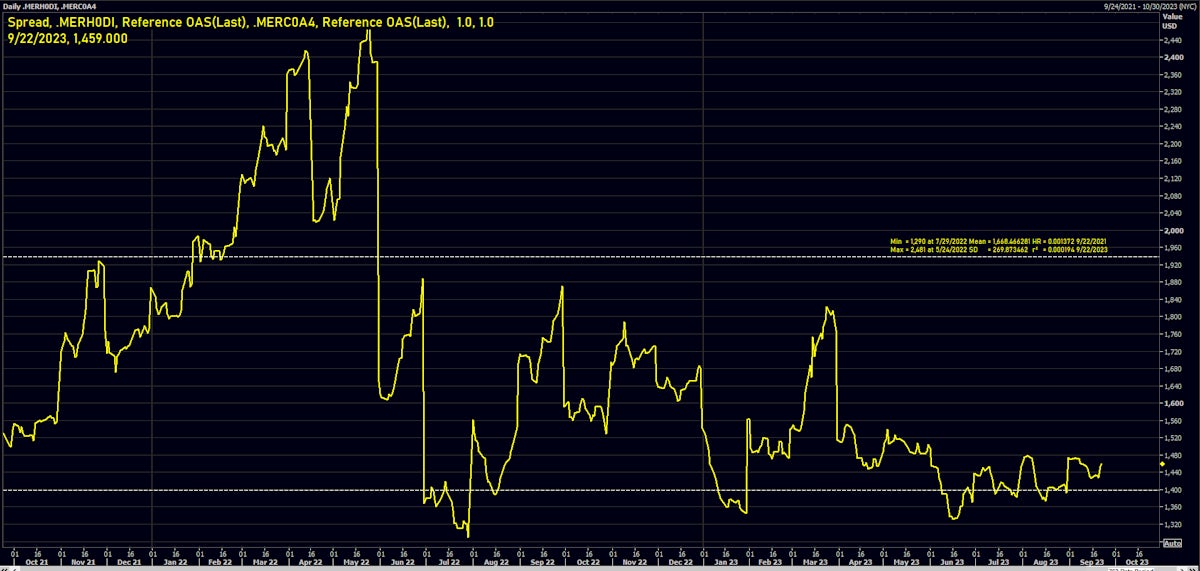

Pick Up In the Distressed Spread: ICE BofA USD BBB - Distressed Indices OAS | Source: Refinitiv

DAILY SUMMARY

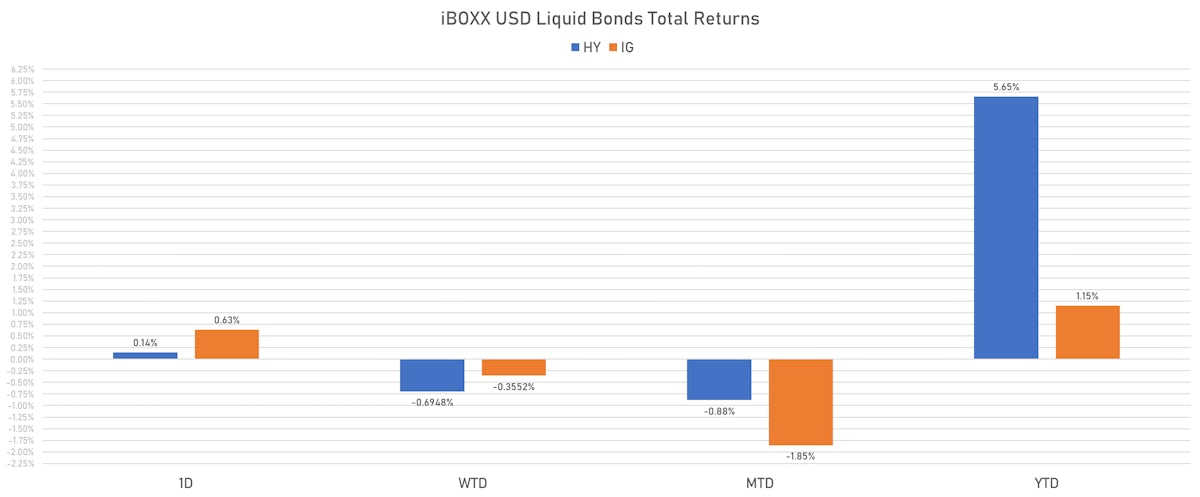

- S&P 500 Bond Index was up 0.44% today, with investment grade up 0.45% and high yield up 0.25% (YTD total return: +1.44%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.631% today (Week-to-date: -0.36%; Month-to-date: -1.85%; Year-to-date: 1.15%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.145% today (Week-to-date: -0.69%; Month-to-date: -0.88%; Year-to-date: 5.65%)

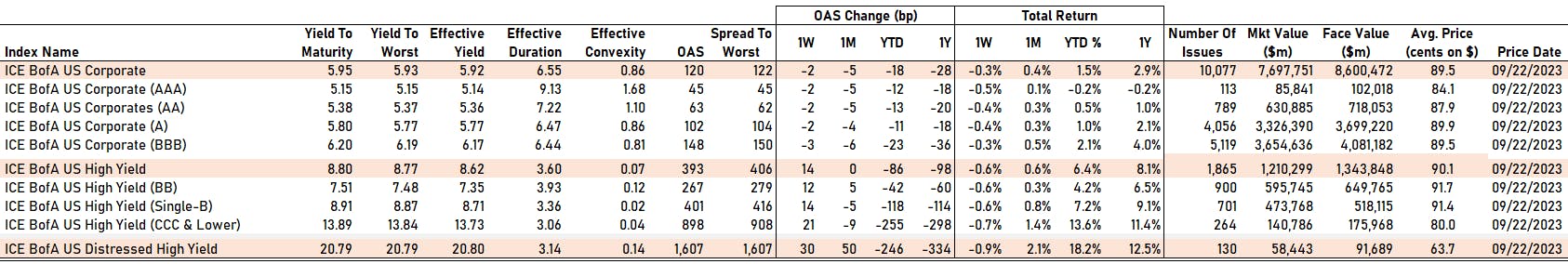

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 122.0 bp (WTD change: -2.0 bp; YTD change: -18.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 406.0 bp (WTD change: +13.0 bp; YTD change: -82.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +9.9%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 45 bp

- AA unchanged at 63 bp

- A unchanged at 102 bp

- BBB unchanged at 148 bp

- BB up by 4 bp at 267 bp

- B up by 3 bp at 401 bp

- ≤ CCC up by 4 bp at 898 bp

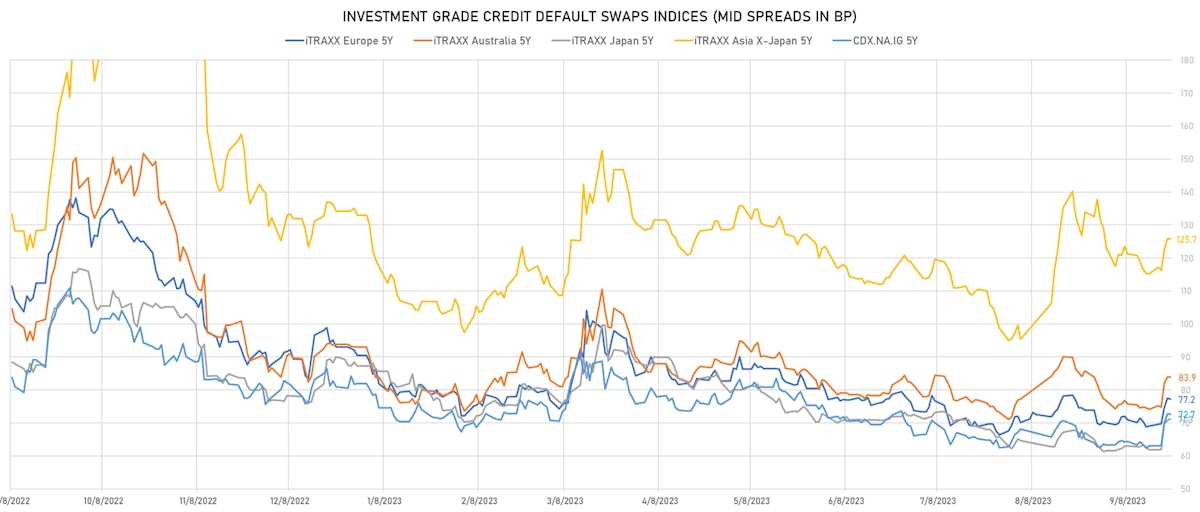

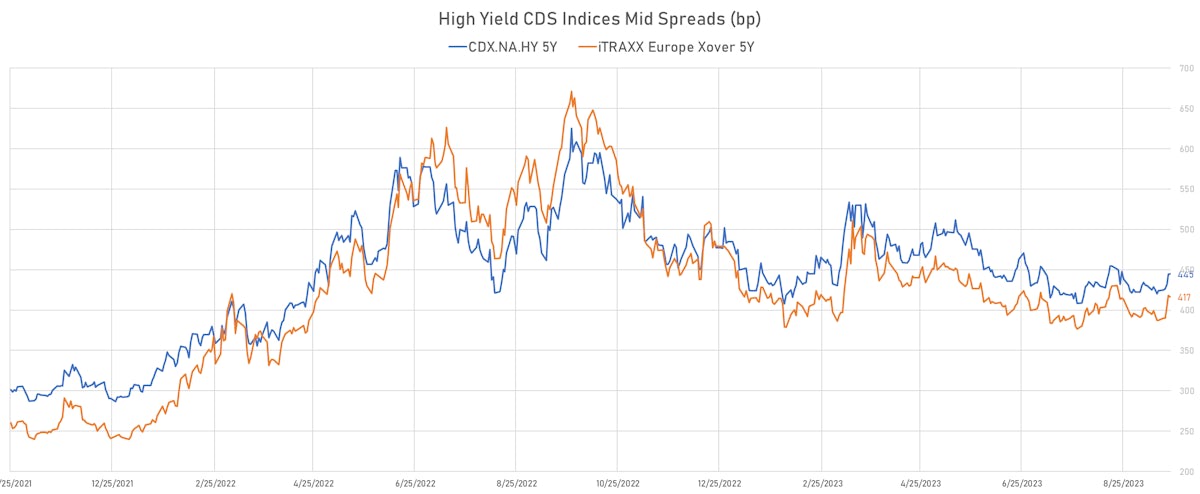

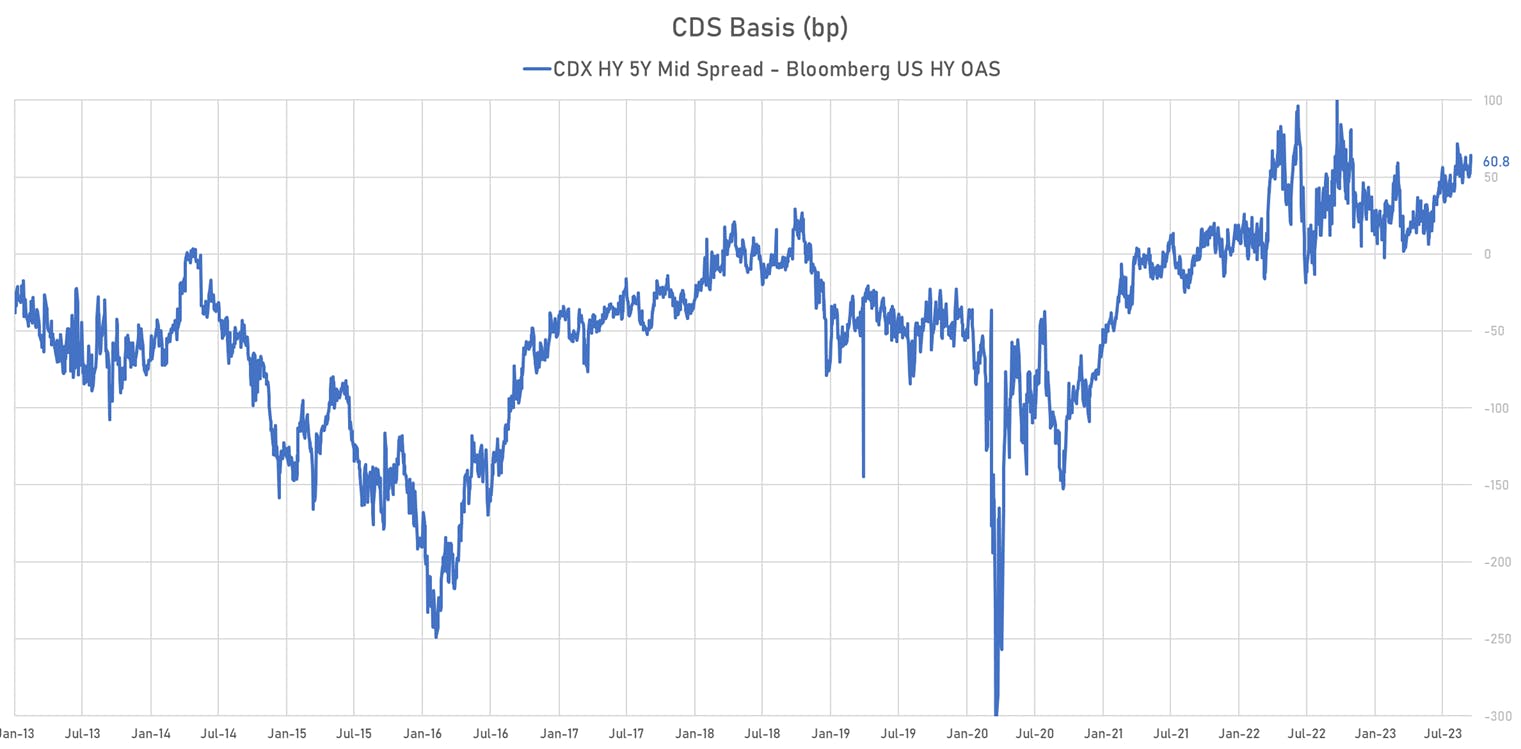

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y unchanged at 73bp (1W change: +9.7bp; YTD change: -9.2bp)

- Markit CDX.NA.IG 10Y down 0.1 bp, now at 112bp (1W change: +7.1bp; YTD change: -5.5bp)

- Markit CDX.NA.HY 5Y up 0.5 bp, now at 445bp (1W change: +20.7bp; YTD change: -40.1bp)

- Markit iTRAXX Europe 5Y down 0.3 bp, now at 77bp (1W change: +8.1bp; YTD change: -13.2bp)

- Markit iTRAXX Europe Crossover 5Y down 1.4 bp, now at 417bp (1W change: +28.9bp; YTD change: -57.6bp)

- Markit iTRAXX Japan 5Y up 0.4 bp, now at 71bp (1W change: +9.4bp; YTD change: -15.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 0.2 bp, now at 126bp (1W change: +10.6bp; YTD change: -7.3bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Chile (rated A-): up 16.0 % to 67 bp (1Y range: 54-174bp)

- Mexico (rated BBB-): up 15.9 % to 121 bp (1Y range: 96-205bp)

- Vietnam (rated BB): up 15.7 % to 135 bp (1Y range: 103-181bp)

- Philippines (rated BBB): up 14.5 % to 80 bp (1Y range: 66-153bp)

- Peru (rated BBB): up 14.4 % to 80 bp (1Y range: 69-171bp)

- Indonesia (rated BBB): up 14.4 % to 88 bp (1Y range: 73-166bp)

- China (rated A+): up 13.6 % to 78 bp (1Y range: 47-132bp)

- Panama (rated WD): up 12.9 % to 123 bp (1Y range: 89-187bp)

- Italy (rated BBB): up 10.7 % to 98 bp (1Y range: 86-179bp)

- Brazil (rated BB): up 9.7 % to 180 bp (1Y range: 161-313bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Pitney Bowes Inc (Country: US; rated: NR): down 58.4 bp to 1,342.2bp (1Y range: 747-1,783bp)

- Transocean Inc (Country: KY; rated: Caa1): up 53.7 bp to 471.2bp (1Y range: 393-1,885bp)

- Carnival Corp (Country: US; rated: Ba2): up 59.0 bp to 565.4bp (1Y range: 446-2,117bp)

- Goodyear Tire & Rubber Co (Country: US; rated: NR): up 62.0 bp to 387.2bp (1Y range: 281-552bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 63.8 bp to 539.5bp (1Y range: 390-767bp)

- Macy's Inc (Country: US; rated: A1): up 70.9 bp to 516.9bp (1Y range: 300-619bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): up 71.6 bp to 561.0bp (1Y range: 428-772bp)

- Nordstrom Inc (Country: US; rated: NR): up 76.6 bp to 634.2bp (1Y range: 429-685bp)

- Gap Inc (Country: US; rated: NR): up 83.5 bp to 524.3bp (1Y range: 407-772bp)

- DISH DBS Corp (Country: US; rated: Caa1): up 94.8 bp to 1,880.2bp (1Y range: 1,138-3,084bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 97.6 bp to 995.4bp (1Y range: 511-1,046bp)

- Kohls Corp (Country: US; rated: Ba2): up 121.9 bp to 712.0bp (1Y range: 444-783bp)

- Community Health Systems Inc (Country: US; rated: NR): up 197.9 bp to 2,620.9bp (1Y range: 1,258-4,371bp)

- Staples Inc (Country: US; rated: B3): up 1023.2 bp to 5,206.2bp (1Y range: 1,411-5,206bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): up 7037.8 bp to 13,291.7bp (1Y range: 1,326-13,292bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Stena AB (Country: SE; rated: Ba3-PD): down 29.5 bp to 297.5bp (1Y range: 298-730bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 24.2 bp to 1,686.0bp (1Y range: 1,286-2,910bp)

- Air France KLM SA (Country: FR; rated: B-): up 23.5 bp to 450.5bp (1Y range: 347-925bp)

- ArcelorMittal SA (Country: LU; rated: WD): up 25.5 bp to 201.1bp (1Y range: 181-353bp)

- Rolls-Royce PLC (Country: GB; rated: Ba2): up 25.7 bp to 201.7bp (1Y range: 174-523bp)

- Ziggo Bond Company BV (Country: NL; rated: WR): up 28.4 bp to 484.4bp (1Y range: 385-584bp)

- Renault SA (Country: FR; rated: BB): up 32.1 bp to 266.6bp (1Y range: 219-453bp)

- Lanxess AG (Country: DE; rated: WR): up 35.7 bp to 208.7bp (1Y range: 121-303bp)

- Valeo SE (Country: FR; rated: NR): up 36.0 bp to 275.2bp (1Y range: 210-389bp)

- Elo SA (Country: FR; rated: ): up 39.4 bp to 208.5bp (1Y range: 83-242bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 43.2 bp to 431.3bp (1Y range: 379-602bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 49.2 bp to 603.0bp (1Y range: 486-1,290bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 62.9 bp to 738.5bp (1Y range: 632-1,254bp)

- Altice Finco SA (Country: LU; rated: Caa2): up 80.5 bp to 769.8bp (1Y range: 401-1,021bp)

- Ceconomy AG (Country: DE; rated: NR): up 137.1 bp to 842.7bp (1Y range: 577-1,763bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | CUSIP: 77340RAS6 | OAS up by 56.0 bp to 221.0 bp, with the yield to worst at 6.9% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 91.8-95.0).

- Issuer: Under Armour Inc (Baltimore, Maryland (US)) | Coupon: 3.25% | Maturity: 15/6/2026 | Rating: BB- | CUSIP: 904311AA5 | OAS up by 39.9 bp to 209.5 bp, with the yield to worst at 6.8% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 87.5-93.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS up by 35.1 bp to 232.9 bp (CDS basis: -62.5bp), with the yield to worst at 6.6% and the bond now trading down to 98.1 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Nustar Logistics LP (San Antonio, Texas (US)) | Coupon: 6.00% | Maturity: 1/6/2026 | Rating: BB- | CUSIP: 67059TAF2 | OAS up by 33.5 bp to 195.3 bp, with the yield to worst at 6.7% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 94.3-98.8).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS up by 32.6 bp to 123.8 bp, with the yield to worst at 6.3% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 100.3-105.5).

- Issuer: DPL Inc (Dayton, Ohio (US)) | Coupon: 4.13% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 233293AR0 | OAS up by 27.9 bp to 204.2 bp (CDS basis: -63.5bp), with the yield to worst at 6.8% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 93.4-96.4).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS up by 25.6 bp to 129.9 bp (CDS basis: -104.9bp), with the yield to worst at 5.9% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS down by 16.1 bp to 105.1 bp (CDS basis: -55.7bp), with the yield to worst at 5.9% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 97.3-100.6).

- Issuer: GXO Logistics Inc (Greenwich, Connecticut (US)) | Coupon: 1.65% | Maturity: 15/7/2026 | Rating: BB+ | CUSIP: 36262GAB7 | OAS down by 21.6 bp to 126.8 bp, with the yield to worst at 6.2% and the bond now trading up to 88.1 cents on the dollar (1Y price range: 34.7-88.4).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS down by 24.3 bp to 61.9 bp (CDS basis: -46.8bp), with the yield to worst at 5.7% and the bond now trading up to 90.9 cents on the dollar (1Y price range: 41.6-92.6).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS down by 28.2 bp to 159.3 bp (CDS basis: 176.3bp), with the yield to worst at 6.1% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 97.0-102.4).

- Issuer: Ashland LLC (Dublin Ohio, Ohio (US)) | Coupon: 3.38% | Maturity: 1/9/2031 | Rating: BB+ | CUSIP: 04433LAA0 | OAS down by 29.6 bp to 214.3 bp, with the yield to worst at 6.5% and the bond now trading up to 80.0 cents on the dollar (1Y price range: 78.0-84.4).

- Issuer: Ford Motor Co (Dearborn, Michigan (US)) | Coupon: 6.38% | Maturity: 1/2/2029 | Rating: BB+ | CUSIP: 345370BZ2 | OAS down by 31.4 bp to 240.4 bp (CDS basis: 50.5bp), with the yield to worst at 6.6% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 64.2-101.8).

- Issuer: Lumen Technologies Inc (Monroe, Louisiana (US)) | Coupon: 7.60% | Maturity: 15/9/2039 | Rating: CCC- | CUSIP: 156700AM8 | OAS down by 406.2 bp to 2,295.9 bp, with the yield to worst at 25.0% and the bond now trading up to 31.0 cents on the dollar (1Y price range: 27.0-71.3).

- Issuer: Lumen Technologies Inc (Monroe, Louisiana (US)) | Coupon: 7.65% | Maturity: 15/3/2042 | Rating: CCC- | CUSIP: 156700AT3 | OAS down by 412.5 bp to 2,254.1 bp, with the yield to worst at 24.6% and the bond now trading up to 31.0 cents on the dollar (1Y price range: 26.5-69.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS up by 72.2 bp to 706.4 bp, with the yield to worst at 9.3% and the bond now trading down to 69.8 cents on the dollar (1Y price range: 64.8-77.1).

- Issuer: Iliad SA (Paris, France) | Coupon: 5.38% | Maturity: 14/6/2027 | Rating: BB | ISIN: FR001400EJI5 | OAS up by 46.8 bp to 275.6 bp, with the yield to worst at 5.7% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 95.5-101.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS up by 38.3 bp to 709.9 bp (CDS basis: -165.4bp), with the yield to worst at 10.4% and the bond now trading down to 77.6 cents on the dollar (1Y price range: 74.5-83.7).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 36.2 bp to 176.3 bp (CDS basis: -6.5bp), with the yield to worst at 5.0% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 92.1-97.2).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 34.5 bp to 211.4 bp (CDS basis: -54.4bp), with the yield to worst at 5.4% and the bond now trading down to 93.6 cents on the dollar (1Y price range: 90.6-95.0).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 11/2/2028 | Rating: BB | ISIN: FR0014001YB0 | OAS up by 34.0 bp to 273.1 bp, with the yield to worst at 6.0% and the bond now trading down to 84.1 cents on the dollar (1Y price range: 80.0-87.3).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS up by 32.8 bp to 256.1 bp, with the yield to worst at 5.8% and the bond now trading down to 89.4 cents on the dollar (1Y price range: 83.7-92.3).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: CCC+ | ISIN: XS2346224806 | OAS up by 32.6 bp to 686.5 bp, with the yield to worst at 9.6% and the bond now trading down to 60.0 cents on the dollar (1Y price range: 50.0-67.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 16/5/2027 | Rating: BB+ | ISIN: XS2408458730 | OAS up by 31.4 bp to 196.2 bp (CDS basis: -13.6bp), with the yield to worst at 5.2% and the bond now trading down to 91.7 cents on the dollar (1Y price range: 86.3-92.7).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | OAS up by 31.4 bp to 208.1 bp, with the yield to worst at 5.4% and the bond now trading down to 91.6 cents on the dollar (1Y price range: 85.9-92.9).

- Issuer: Eramet SA (Paris, France) | Coupon: 7.00% | Maturity: 22/5/2028 | Rating: BB | ISIN: FR001400HZE3 | OAS down by 33.1 bp to 428.2 bp, with the yield to worst at 7.6% and the bond now trading up to 97.2 cents on the dollar (1Y price range: 92.9-103.6).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 1.25% | Maturity: 8/9/2026 | Rating: BB+ | ISIN: XS1485608118 | OAS down by 35.0 bp to 356.3 bp, with the yield to worst at 6.7% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 77.4-91.2).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS down by 37.3 bp to 490.4 bp, with the yield to worst at 8.4% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 80.6-87.3).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 0.99% | Maturity: 15/10/2026 | Rating: BB+ | ISIN: XS2390849318 | OAS down by 41.9 bp to 991.0 bp, with the yield to worst at 13.3% and the bond now trading up to 70.3 cents on the dollar (1Y price range: 65.2-79.1).

- Issuer: Euronet Worldwide Inc (Leawood, Kansas (US)) | Coupon: 1.38% | Maturity: 22/5/2026 | Rating: BB | ISIN: XS2001315766 | OAS down by 108.1 bp to 173.4 bp, with the yield to worst at 5.1% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 87.4-91.8).

RECENT DOMESTIC USD BOND ISSUES

- Bank of America NA (Banking | Charlotte, North Carolina, United States | Rating: A+): US$107m Certificate of Deposit - Retail (US06051V2Y10), fixed rate (5.50% coupon) maturing on 22 September 2025, priced at 100.00, callable (2nc1)

- Equipmentshare.Com Inc (Information/Data Technology | Montana, United States | Rating: B-): US$400m Note (USU26947AB43), fixed rate (9.00% coupon) maturing on 15 May 2028, priced at 97.75, callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EPXD23), fixed rate (5.74% coupon) maturing on 4 October 2027, priced at 100.00 (original spread of 44 bp), callable (4nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EPWS01), fixed rate (5.20% coupon) maturing on 25 September 2026, priced at 100.00, callable (3nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$325m Bond (US3133EPWK74), fixed rate (4.50% coupon) maturing on 22 September 2028, priced at 99.83 (original spread of 7 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EPXB66), fixed rate (4.63% coupon) maturing on 28 September 2027, priced at 100.00 (original spread of 17 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$1,050m Bond (US3133EPWW13), floating rate (SOFR + 15.5 bp) maturing on 25 September 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EPWV30), floating rate (FFQ + 15.0 bp) maturing on 26 September 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$400m Bond (US3133EPWR28), floating rate (PRQ + -303.0 bp) maturing on 25 September 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$3m Bond (US3130AXCV80), fixed rate (6.55% coupon) maturing on 28 September 2043, priced at 100.00 (original spread of 224 bp), callable (20nc6m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,250m Bond (US3130AXBC19), floating rate (SOFR + 15.5 bp) maturing on 25 September 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$750m Bond (US3130AXBV99), floating rate (SOFR + 15.5 bp) maturing on 29 September 2025, priced at 100.00, non callable

- Gtcr W-2 Merger Sub LLC (Financial - Other | United States | Rating: BB): US$2,175m Note (USU3732NAA38), fixed rate (7.50% coupon) maturing on 15 January 2031, priced at 100.00 (original spread of 313 bp), callable (7nc3)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$3,500m Senior Note (US459058KW25), fixed rate (4.63% coupon) maturing on 1 August 2028, priced at 99.98 (original spread of 15 bp), non callable

- Interstate Power and Light Co (Utility - Other | Cedar Rapids, Iowa, United States | Rating: BBB+): US$300m Senior Debenture (US461070AU86), fixed rate (5.70% coupon) maturing on 15 October 2033, priced at 99.46 (original spread of 145 bp), callable (10nc10)

- NCR Atleos Escrow Corp (Financial - Other | United States | Rating: NR): US$1,350m Note (USU6377RAA78), fixed rate (9.50% coupon) maturing on 1 April 2029, priced at 98.75 (original spread of 522 bp), callable (6nc3)

- Oceaneering International Inc (Oilfield Machinery and Services | Houston, Texas, United States | Rating: BB-): US$200m Senior Note (US675232AC62), fixed rate (6.00% coupon) maturing on 1 February 2028, priced at 91.50 (original spread of 370 bp), callable (4nc4)

- Star Parent Inc (Financial - Other | Menlo Park, California, United States | Rating: B): US$1,000m Note (US855170AA41), fixed rate (9.00% coupon) maturing on 1 October 2030, priced at 100.00 (original spread of 426 bp), callable (7nc3)

- Sunnova Energy Corp (Utility - Other | Houston, Texas, United States | Rating: B): US$400m Senior Note (USU8675TAD29), fixed rate (11.75% coupon) maturing on 1 October 2028, priced at 97.26 (original spread of 794 bp), callable (5nc5)

- TTX Co (Railroads | Chicago, Illinois, United States | Rating: A): US$300m Senior Note (US87302TCQ94), fixed rate (5.50% coupon) maturing on 25 September 2026, priced at 99.89 (original spread of 80 bp), callable (3nc3)

- Viasat Inc (Telecommunications | Carlsbad, United States | Rating: CCC+): US$733m Senior Note (US92552VAQ32), fixed rate (7.50% coupon) maturing on 30 May 2031, priced at 100.00 (original spread of 1,094 bp), callable (8nc3)

- Vital Energy Inc (Oil and Gas | Tulsa, Oklahoma, United States | Rating: B-): US$500m Senior Note (US516806AJ59), fixed rate (9.75% coupon) maturing on 15 October 2030, priced at 98.74 (original spread of 559 bp), callable (7nc3)

RECENT INTERNATIONAL USD BOND ISSUES

- Adams Homes Inc (Financial - Other | Rating: BB-): US$250m Senior Note (US00623PAB76), fixed rate (9.25% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 466 bp), callable (5nc2)

- AerCap Ireland Capital DAC (Financial - Other | Ireland | Rating: BBB): US$850m Senior Note (US00774MBE49), fixed rate (6.15% coupon) maturing on 30 September 2030, priced at 99.37 (original spread of 187 bp), callable (7nc7)

- AerCap Ireland Capital DAC (Financial - Other | Ireland | Rating: BBB): US$900m Senior Note (US00774MBD65), fixed rate (6.10% coupon) maturing on 15 January 2027, priced at 99.54 (original spread of 150 bp), callable (3nc3)

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$150m Unsecured Note (XS2695024369), fixed rate (4.88% coupon) maturing on 14 February 2035, priced at 100.00, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$150m Unsecured Note (XS2695024104), fixed rate (2.63% coupon) maturing on 31 March 2036, priced at 100.00, non callable

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$156m Unsecured Note (XS2696810980), fixed rate (6.75% coupon) maturing on 17 January 2048, priced at 100.00, non callable

- Banco Bradesco SA (Cayman Islands Branch) (Banking | George Town, Brazil | Rating: NR): US$1m Unsecured Note (XS2694843652), fixed rate (7.04% coupon) maturing on 10 July 2028, priced at 100.00, non callable

- Banco Bradesco SA (Cayman Islands Branch) (Banking | George Town, Brazil | Rating: NR): US$1m Unsecured Note (XS2694843819), fixed rate (6.95% coupon) maturing on 10 July 2028, priced at 100.00, non callable

- Bank of Montreal (Toronto Branch) (Banking | Toronto, Ontario, Canada | Rating: NR): US$120m Unsecured Note (XS2697459670), floating rate maturing on 12 October 2028, priced at 100.00, non callable

- China Everbright Bank Company Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: NR): US$162m Certificate of Deposit (XS2696699698), floating rate maturing on 28 September 2026, priced at 100.00, non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): US$1,250m Note (US23636BBE83), fixed rate (6.26% coupon) maturing on 22 September 2026, priced at 100.00, callable (3nc2)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$500m Bond (XS0460079055), floating rate maturing on 12 October 2033, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$1,000m Bond (XS0460078917), floating rate maturing on 15 October 2030, priced at 100.00, non callable

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB-): US$1,250m Subordinated Note (US29250NBT19), fixed rate (8.50% coupon) maturing on 15 January 2084, priced at 100.00, callable (60nc10)

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB-): US$750m Subordinated Note (US29250NBS36), fixed rate (8.25% coupon) maturing on 15 January 2084, priced at 100.00, callable (60nc5)

- Equinox Gold (Metals/Mining | Vancouver, British Columbia, Canada | Rating: NR): US$173m Bond (US29446YAA47), fixed rate (4.75% coupon) maturing on 15 October 2028, priced at 100.00, non callable, convertible

- GN Bondco LLC (Financial - Other | Unable To Collect Data For The Field 'Tr.Headquarterscity' And Some Specific Identifier(S)., Unable To Collect Data For The Field 'Tr.Ultimateparentcountryhq' And Some Specific Identifier(S). | Rating: NR): US$725m Note (USU3828QAA14), fixed rate (9.50% coupon) maturing on 15 October 2031, priced at 98.00 (original spread of 542 bp), callable (8nc3)

- Hyundai Capital America (Financial - Other | Irvine, California, South Korea | Rating: BBB+): US$800m Senior Note (US44891ACM71), fixed rate (5.95% coupon) maturing on 21 September 2026, priced at 99.89 (original spread of 125 bp), with a make whole call

- Hyundai Capital America (Financial - Other | Irvine, California, South Korea | Rating: BBB+): US$700m Senior Note (US44891CCN11), fixed rate (6.10% coupon) maturing on 21 September 2028, priced at 99.94 (original spread of 165 bp), callable (5nc5)

- Industrial Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$600m Senior Note (US45604HAN70), fixed rate (5.38% coupon) maturing on 4 October 2028, priced at 99.65 (original spread of 85 bp), non callable

- International Petroleum Corp (Oil and Gas | Vancouver, British Columbia, Canada | Rating: B): US$150m Bond (NO0013024927), fixed rate (7.25% coupon) maturing on 1 February 2027, callable (3nc1)

- Mercer International Inc (Chemicals | Vancouver, British Columbia, Canada | Rating: B): US$200m Senior Note (US588056BC44), fixed rate (12.88% coupon) maturing on 1 October 2028, priced at 100.00 (original spread of 831 bp), callable (5nc2)

- NIO (Automotive Manufacturer | Shanghai, Shanghai, China (Mainland) | Rating: NR): US$500m Bond (US62914VAH96), fixed rate (4.63% coupon) maturing on 15 October 2030, priced at 100.00, non callable, convertible

- NIO (Automotive Manufacturer | Shanghai, Shanghai, China (Mainland) | Rating: NR): US$500m Bond (US62914VAG14), fixed rate (3.88% coupon) maturing on 15 October 2029, priced at 100.00, non callable, convertible

- National Australia Bank Ltd (Banking | Melbourne, Victoria, Australia | Rating: AA-): US$350m Senior Note (XS2695028279), floating rate (SOFR + 98.0 bp) maturing on 28 September 2028, priced at 100.00 (original spread of 98 bp), non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$300m Unsecured Note (XS2522339030), floating rate maturing on 22 September 2025, priced at 100.00, non callable

- United Arab Emirates (Government) (Sovereign | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$1,500m Senior Note (XS2684502623), fixed rate (4.92% coupon) maturing on 25 September 2033, priced at 100.00 (original spread of 60 bp), non callable

RECENT EURO BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €500m Senior Note (XS2694034971), floating rate (EU03MLIB + 38.0 bp) maturing on 22 September 2025, priced at 100.00, non callable

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,500m Bond (FR001400KY44), floating rate maturing on 26 September 2032, priced at 99.39 (original spread of 157 bp), callable (9nc8)

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €300m Unsecured Note (XS2696902837), fixed rate (1.00% coupon) maturing on 4 January 2034, priced at 100.00, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000BLB9UT0), floating rate (EU06MLIB + 97.8 bp) maturing on 26 September 2031, priced at 100.00, non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €500m Senior Note (XS2695039128), fixed rate (3.50% coupon) maturing on 27 September 2038, priced at 99.21 (original spread of 73 bp), non callable

- Bremen Free Hanseatic, City of (Official and Muni | Bremen, Bremen, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A30V364), fixed rate (3.25% coupon) maturing on 27 September 2030, priced at 99.88 (original spread of 62 bp), non callable

- Cheplapharm Arzneimittel GmbH (Pharmaceuticals | Greifswald, Mecklenburg-Vorpommern, Germany | Rating: B+): €300m Note (XS2695600960), fixed rate (7.50% coupon) maturing on 15 May 2030, priced at 100.50 (original spread of 473 bp), callable (7nc3)

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB-): €600m Inhaberschuldverschreibung (DE000CZ439B6), fixed rate (5.24% coupon) maturing on 25 March 2029, priced at 99.73 (original spread of 260 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €200m Inhaberschuldverschreibung (DE000DW6C938), fixed rate (3.35% coupon) maturing on 16 October 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €200m Inhaberschuldverschreibung (DE000DW6C920), fixed rate (3.10% coupon) maturing on 17 October 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKL6), fixed rate (4.04% coupon) maturing on 2 October 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKB7), fixed rate (3.85% coupon) maturing on 12 October 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJZ8), floating rate maturing on 12 October 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKK8), fixed rate (3.96% coupon) maturing on 2 October 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKH4), fixed rate (4.00% coupon) maturing on 29 September 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKG6), fixed rate (3.90% coupon) maturing on 29 September 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKA9), fixed rate (3.55% coupon) maturing on 12 October 2026, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A375A8), fixed rate (4.00% coupon) maturing on 31 October 2029, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Pfandbrief Anleihe (Covered Bond) (AT0000A37595), fixed rate (3.25% coupon) maturing on 17 January 2028, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A375B6), fixed rate (3.50% coupon) maturing on 31 October 2025, priced at 100.00, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €150m Inhaberschuldverschreibung (AT0000A373P1), fixed rate (4.00% coupon) maturing on 25 October 2033, priced at 100.00, non callable

- ING Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: AAA): €2,500m Unsecured Note (XS2696124366), fixed rate (3.65% coupon) maturing on 23 September 2026, priced at 100.00, non callable

- Invema (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €600m Unsecured Note (XS2695030416), fixed rate (3.00% coupon) maturing on 4 January 2029, non callable

- Katjes International GmbH & Co KG (Financial - Other | Emmerich Am Rhein, Nordrhein-Westfalen, Germany | Rating: NR): €115m Bond (NO0012888769), fixed rate (6.75% coupon) maturing on 21 September 2028, priced at 100.00 (original spread of 381 bp), callable (5nc2)

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): €250m Senior Note (XS2696474340), fixed rate (2.88% coupon) maturing on 23 May 2030, priced at 97.45 (original spread of 66 bp), non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): €250m Senior Note (XS2696139042), fixed rate (3.38% coupon) maturing on 23 May 2028, priced at 100.00, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €1,000m Senior Note (XS2694863841), fixed rate (3.25% coupon) maturing on 26 September 2033, priced at 99.82 (original spread of 54 bp), non callable

- Mercedes-Benz Finance Canada Inc (Financial - Other | Montreal, Quebec, Germany | Rating: NR): €500m Unsecured Note (XS2696700298), floating rate maturing on 29 September 2025, priced at 100.00, non callable

- Mercedes-Benz International Finance BV (Financial - Other | Nieuwegein, Utrecht, Germany | Rating: NR): €500m Senior Note (DE000A3LNY11), floating rate (EU03MLIB + 20.0 bp) maturing on 29 September 2025, non callable

- RCI Banque SA (Financial - Other | Paris, Ile-De-France, France | Rating: BBB-): €750m Bond (FR001400KXW4), fixed rate (4.63% coupon) maturing on 2 October 2026, priced at 99.88 (original spread of 168 bp), callable (3nc3)

- RCI Banque SA (Financial - Other | Paris, Ile-De-France, France | Rating: BBB-): €750m Bond (FR001400KY69), fixed rate (4.88% coupon) maturing on 2 October 2029, priced at 99.71 (original spread of 226 bp), callable (6nc6)

- S Bank Ltd (Banking | Helsinki, Etela-Suomen, Finland | Rating: BBB): €500m Covered Bond (Other) (FI4000560990), fixed rate (3.75% coupon) maturing on 26 September 2028, priced at 99.83 (original spread of 110 bp), non callable

- Snam IT (Gas Utility - Local Distrib | San Donato Milanese, Milano, Italy | Rating: BBB): €500m Bond (XS2693301124), fixed rate (3.25% coupon) maturing on 29 September 2028, priced at 100.00, non callable, convertible

- Telecom Italia SpA (Telecommunications | Rome, Roma, Italy | Rating: B+): €750m Senior Note (XS2696040851), fixed rate (7.88% coupon) maturing on 31 July 2028, priced at 102.00, callable (5nc5)

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €149m Hypothekenpfandbrief (Covered Bond) (DE000HV2AZ11), fixed rate (3.33% coupon) maturing on 26 June 2028, priced at 100.00, non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €149m Hypothekenpfandbrief (Covered Bond) (DE000HV2AZ37), fixed rate (3.24% coupon) maturing on 26 September 2033, priced at 100.00, non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €149m Hypothekenpfandbrief (Covered Bond) (DE000HV2AZ29), fixed rate (3.29% coupon) maturing on 26 September 2028, priced at 100.00, non callable

- UniCredit Bank Czech Republic and Slovakia as (Banking | Praha, Praha, Italy | Rating: NR): €430m Note (XS2694873485), floating rate (EU03MLIB + 301.0 bp) maturing on 27 September 2029, priced at 100.00, callable (6nc5)

- Vlaamse Gemeenschapscommissie (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €1,250m Bond (BE0002965466), fixed rate (3.63% coupon) maturing on 22 June 2032, priced at 99.59 (original spread of 99 bp), non callable

- Vlaamse Gemeenschapscommissie (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA): €1,500m Bond (BE0002966472), fixed rate (4.00% coupon) maturing on 26 September 2042, priced at 99.58 (original spread of 111 bp), non callable

- Webuild SpA (Building Products | Rozzano, Milano, Italy | Rating: BB): €450m Senior Note (XS2681940297), fixed rate (7.00% coupon) maturing on 27 September 2028, priced at 98.89 (original spread of 459 bp), callable (5nc5)

RECENT LOANS

- A-Gas (UK) Ltd (United Kingdom), signed a US$ 520m Term Loan B

- Adira Dinamika Multifinance (Indonesia), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/13/26.

- Alliance Entertainment Corp (United States of America), signed a US$ 175m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/31/23 and initial pricing is set at Term SOFR +300.0bp

- Analogic Corp (United States of America), signed a US$ 340m Term Loan A, to be used for general corporate purposes. It matures on 09/26/28 and initial pricing is set at Term SOFR +400.0bp

- Applus Services SA (Spain), signed a € 1,258m Term Loan, to be used for leveraged buyout.

- Baldwin Risk Partners LLC (United States of America | B-), signed a US$ 170m Term Loan B, to be used for general corporate purposes. It matures on 10/28/27 and initial pricing is set at Term SOFR +350.0bp

- Bausch & Lomb Inc (United States of America), signed a US$ 500m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 09/15/28 and initial pricing is set at Term SOFR +400.0bp

- Bcp Renaissance Parent Llc (United States of America | B+), signed a US$ 1,017m Term Loan B, to be used for general corporate purposes. It matures on 10/31/28 and initial pricing is set at Term SOFR +350.0bp

- Beacon Rail Metro Finco Sarl (Luxembourg), signed a US$ 889m Term Loan, to be used for capital expenditures.

- Black Bear MN LLC (United States of America), signed a US$ 145m Term Loan, to be used for real estate/ppty acq. It matures on 09/15/26.

- Burger King Worldwide Inc (United States of America), signed a US$ 5,175m Term Loan B, to be used for general corporate purposes. It matures on 09/15/30 and initial pricing is set at Term SOFR +225.0bp

- CPM Holdings Inc (United States of America | B), signed a US$ 1,215m Term Loan B, to be used for general corporate purposes. It matures on 09/22/28 and initial pricing is set at Term SOFR +450.0bp

- Capstone Copper Corp (Canada), signed a US$ 700m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/21/27.

- Cavender Stores Ltd (United States of America), signed a US$ 130m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/02/28 and initial pricing is set at Term SOFR +175.0bp

- Cegid SA (France | B+), signed a € 700m Term Loan B, to be used for general corporate purposes. It matures on 07/22/28 and initial pricing is set at EURIBOR +400.0bp

- Core Industrial Partners LLC (United States of America), signed a US$ 189m Revolving Credit Facility, to be used for acquisition financing. It matures on 09/15/33.

- Eli Lilly & Co (United States of America | A+), signed a US$ 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/01/27 and initial pricing is set at Term SOFR +62.5bp

- Eli Lilly & Co (United States of America | A+), signed a US$ 4,000m 364d Revolver, to be used for general corporate purposes. It matures on 09/12/24 and initial pricing is set at Term SOFR +62.5bp

- Engie SA (France | BBB+), signed a € 4,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/13/28.

- GCP Reit V Mh LLC (United States of America), signed a US$ 128m Term Loan, to be used for general corporate purposes. It matures on 09/30/25 and initial pricing is set at Term SOFR +160.0bp

- GIP Pilot Acquisition Partners (United States of America), signed a US$ 1,100m Term Loan B, to be used for acquisition financing. It matures on 09/20/30 and initial pricing is set at Term SOFR +300.0bp

- Genuine Financial Holdings (United States of America | B), signed a US$ 750m Term Loan B, to be used for general corporate purposes. It matures on 09/21/30 and initial pricing is set at Term SOFR +400.0bp

- Goldman Sachs BDC Inc (United States of America), signed a US$ 1,695m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/18/28 and initial pricing is set at Term SOFR +175.0bp

- Grain Millers Inc (United States of America), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/31/23 and initial pricing is set at Term SOFR +200.0bp

- Guardian Life Ins Co (United States of America), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/25/28 and initial pricing is set at Term SOFR +62.5bp

- Helios Towers Africa Ltd (United Kingdom), signed a US$ 120m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/14/28.

- Helios Towers Africa Ltd (United Kingdom), signed a US$ 300m Term Loan, to be used for general corporate purposes. It matures on 09/14/28.

- Helios Towers Africa Ltd (United Kingdom), signed a US$ 300m Term Loan, to be used for general corporate purposes. It matures on 09/14/28.

- Ineos Olefins Belgium NV (United Kingdom), signed a € 400m Bridge Loan, to be used for project finance. It matures on 09/14/24.

- Jack Doheny Supplies Inc (United States of America), signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/30/26.

- Kleinfelder Group Inc (United States of America), signed a US$ 380m Term Loan B, to be used for leveraged buyout. It matures on 09/18/30 and initial pricing is set at Term SOFR +625.0bp

- Legends Hospitality LLC (United States of America), signed a US$ 1,550m Term Loan B, to be used for acquisition financing. It matures on 09/27/30 and initial pricing is set at Term SOFR +600.0bp

- Legends Hospitality LLC (United States of America), signed a US$ 200m Revolving Credit Facility, to be used for acquisition financing.

- Medrina LLC (United States of America), signed a US$ 175m Term Loan, to be used for acquisition financing. It matures on 09/29/29 and initial pricing is set at Term SOFR +600.0bp

- Merit Energy Capital Co I LLC (United States of America), signed a US$ 610m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/22/27 and initial pricing is set at Term SOFR +325.0bp

- Mid Continent Coal & Coke Co (United States of America), signed a US$ 140m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/04/26 and initial pricing is set at Term SOFR +200.0bp

- NCR Atleos LLC (United States of America), signed a US$ 500m Revolving Credit Facility, to be used for spinoff. It matures on 09/22/28.

- NCR Atleos LLC (United States of America), signed a US$ 1,050m Term Loan B, to be used for spinoff. It matures on 09/22/30 and initial pricing is set at Term SOFR +475.0bp

- NCR Atleos LLC (United States of America), signed a US$ 835m Term Loan A, to be used for spinoff. It matures on 09/22/28.

- PT Graha Teknologi Nusantara (Indonesia), signed a US$ 404m Revolving Credit / Term Loan, to be used for project finance.

- Pathstone Federal Street LLC (United States of America), signed a US$ 161m Term Loan, to be used for acquisition financing. It matures on 05/15/29 and initial pricing is set at Term SOFR +675.0bp

- Pinnacle Midstream Ii LLC (United States of America), signed a US$ 125m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/20/27.

- Project Black LP (United States of America), signed a US$ 325m 364d Revolver, to be used for real estate/ppty acq. It matures on 09/20/24 and initial pricing is set at Term SOFR +275.0bp

- Republic Of The Philippines (Philippines | BBB+), signed a US$ 303m Revolving Credit / Term Loan, to be used for capital expenditures.

- SESI LLC (United States of America), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/25/28 and initial pricing is set at Term SOFR +250.0bp

- SSC VII (United States of America), signed a US$ 300m Revolving Credit Facility, to be used for real estate/ppty acq. It matures on 09/29/25 and initial pricing is set at Term SOFR +250.0bp

- Saudi Arabia (Saudi Arabia | A), signed a US$ 11,000m Term Loan, to be used for general corporate purposes. It matures on 10/01/33 and initial pricing is set at Term SOFR +100.0bp

- SoftBank Group Corp (Japan | BB), signed a US$ 4,715m 364d Revolver, to be used for general corporate purposes capital expenditures. It matures on 09/20/24.

- Stifel Financial Corp (United States of America | BBB-), signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/25/28 and initial pricing is set at Term SOFR +150.0bp

- Summit JV MR 1 LLC (United States of America), signed a US$ 125m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/15/27 and initial pricing is set at Term SOFR +215.0bp

- TPG Holdings I-A LLC (United States of America), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/22/30 and initial pricing is set at Term SOFR +100.0bp

- Universal Mgmt Svcs Inc (United States of America), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/30/27 and initial pricing is set at Term SOFR +150.0bp

- ViaSat Inc (United States of America | B), signed a US$ 617m Term Loan B, to be used for general corporate purposes. It matures on 05/30/30 and initial pricing is set at Term SOFR +450.0bp

- Volcafe USA (United States of America), signed a US$ 205m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/13/24.

- WEX Inc (United States of America | BB-), signed a US$ 200m Term Loan A, to be used for general corporate purposes. It matures on 04/01/26 and initial pricing is set at Term SOFR +200.0bp

- WEX Inc (United States of America | BB-), signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/01/26 and initial pricing is set at Term SOFR +200.0bp

- WT Microelectronics Co Ltd (Taiwan), signed a US$ 3,800m Bridge Loan, to be used for acquisition financing. It matures on 09/14/24.

- WW Grainger Inc (United States of America | A+), signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/27/28.

RECENT STRUCTURED CREDIT

- Arbour CLO Xii Dac issued a floating-rate CLO in 7 tranches, for a total of € 420 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 965bp. Bookrunners: JP Morgan & Co Inc

- Aurium CLO Xi Dac issued a floating-rate CLO in 7 tranches, for a total of € 352 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 912bp. Bookrunners: BNP Paribas SA

- Carvana Auto Receivables Trust 2023- P4 issued a fixed-rate ABS backed by auto receivables in 8 tranches, for a total of US$ 231 m. Highest-rated tranche offering a yield to maturity of 5.75%, and the lowest-rated tranche a yield to maturity of 8.05%. Bookrunners: Santander Investment Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp

- Eagle Re 2023-1 issued a floating-rate RMBS in 4 tranches, for a total of US$ 353 m. Highest-rated tranche offering a spread over the floating rate of 200bp, and the lowest-rated tranche a spread of 685bp. Bookrunners: Goldman Sachs & Co, Barclays Capital Group, RBC Capital Markets, Citigroup Global Markets Inc, Bank of America Merrill Lynch, Atlas SP Partners LP

- Foundation Finance Trust 2023-2 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 363 m. Highest-rated tranche offering a yield to maturity of 6.53%, and the lowest-rated tranche a yield to maturity of 9.10%. Bookrunners: Goldman Sachs & Co, Guggenheim Securities LLC, BNP Paribas Securities Corp

- Mosaic Solar Loan Trust 2023-4 issued a fixed-rate ABS backed by certificates in 4 tranches, for a total of US$ 149 m. Highest-rated tranche offering a yield to maturity of 6.40%, and the lowest-rated tranche a yield to maturity of 9.80%. Bookrunners: SMBC Nikko Securities America Inc, MUFG Securities Americas Inc

- Octane Receivables Trust 2023-3 issued a fixed-rate ABS backed by equipment leases in 6 tranches, for a total of US$ 361 m. Highest-rated tranche offering a yield to maturity of 5.85%, and the lowest-rated tranche a yield to maturity of 10.92%. Bookrunners: JP Morgan & Co Inc, Mizuho Securities USA Inc, Truist Securities Inc, Atlas SP Partners LP

- Prosper Marketplace Issuance Trust Series 2023-1 issued a fixed-rate ABS backed by consumer loan in 5 tranches, for a total of US$ 251 m. Highest-rated tranche offering a yield to maturity of 7.06%, and the lowest-rated tranche a yield to maturity of 17.16%. Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc

- Revocar 2023-2 Ug issued a floating-rate ABS backed by auto receivables in 4 tranches, for a total of € 527 m. Highest-rated tranche offering a spread over the floating rate of 62bp, and the lowest-rated tranche a spread of 650bp. Bookrunners: UniCredit Group, Banco Santander SA