Credit

Broad Selloff In USD Credit, As Yields Rise, Spreads Widen Across The Complex

Decent levels of issuance considering the backdrop this week: 23 tranches for $19.6bn in IG (2023 YTD volume $1.004trn vs 2022 YTD $1.016trn), 7 tranches for $5.1bn in HY (2023 YTD volume $134.731bn vs 2022 YTD $86.376bn)

Published ET

Royal Caribbean & Carnival 5Y USD CDS Mid Spreads | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was up 0.04% today, with investment grade up 0.02% and high yield up 0.22% (YTD total return: +0.43%)

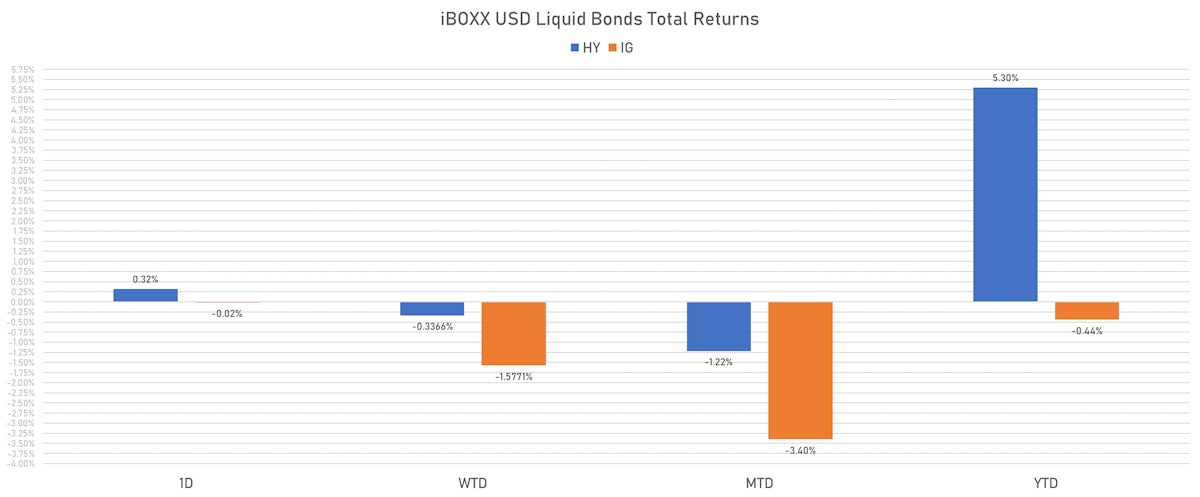

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.020% today (Week-to-date: -1.58%; Month-to-date: -3.40%; Year-to-date: -0.44%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.322% today (Week-to-date: -0.34%; Month-to-date: -1.22%; Year-to-date: 5.30%)

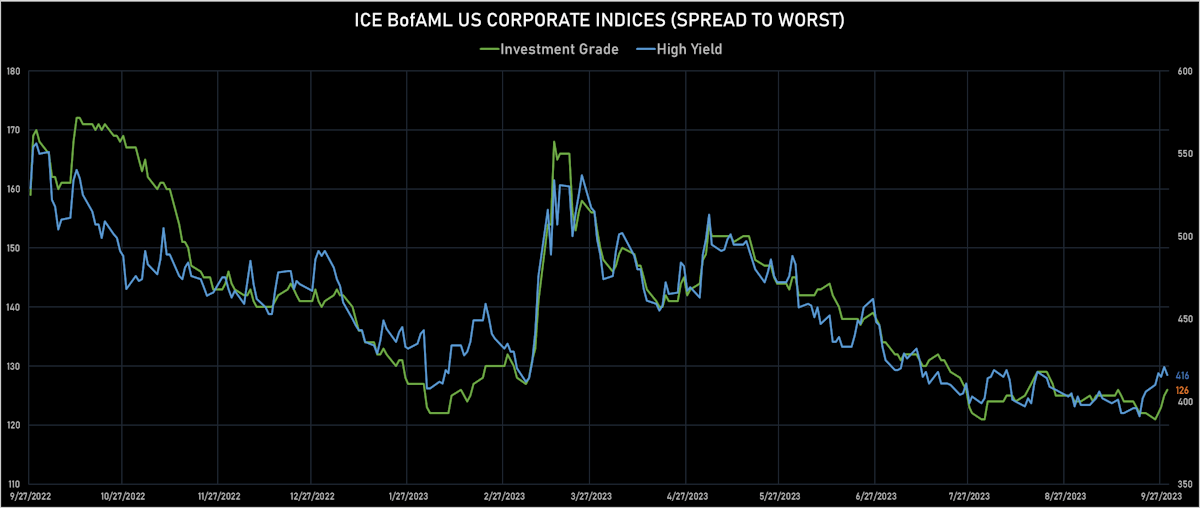

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 126.0 bp (WTD change: +4.0 bp; YTD change: -14.0 bp)

- ICE BofA US High Yield Index spread to worst down -5.0 bp, now at 416.0 bp (WTD change: +10.0 bp; YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +9.7%)

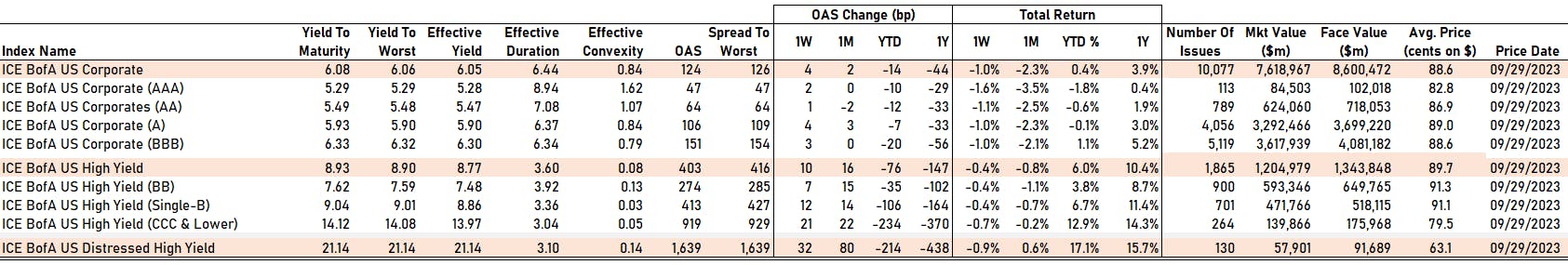

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 2 bp at 47 bp

- AA up by 1 bp at 64 bp

- A up by 4 bp at 106 bp

- BBB up by 3 bp at 151 bp

- BB up by 7 bp at 274 bp

- B up by 12 bp at 413 bp

- ≤ CCC up by 21 bp at 919 bp

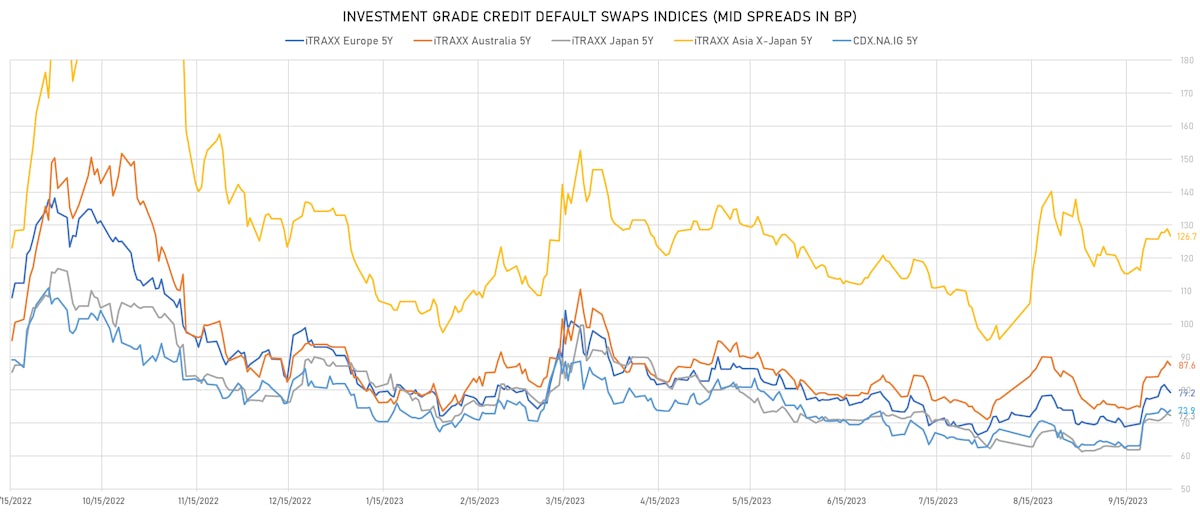

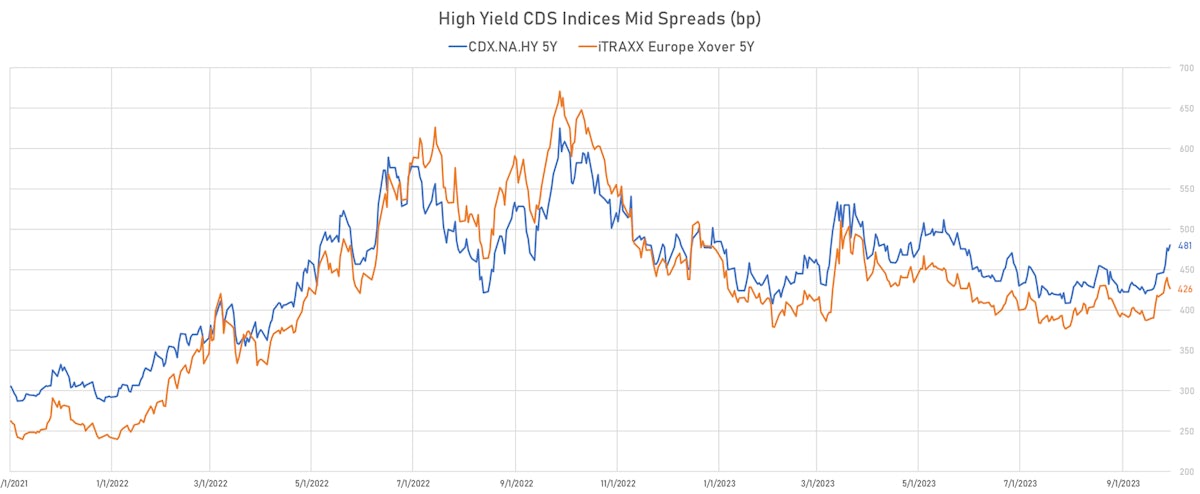

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.8 bp, now at 74bp (1W change: +1.2bp; YTD change: -8.0bp)

- Markit CDX.NA.IG 10Y up 0.8 bp, now at 113bp (1W change: +0.9bp; YTD change: -4.7bp)

- Markit CDX.NA.HY 5Y up 7.3 bp, now at 481bp (1W change: +35.8bp; YTD change: -4.3bp)

- Markit iTRAXX Europe 5Y down 1.1 bp, now at 79bp (1W change: +2.0bp; YTD change: -11.2bp)

- Markit iTRAXX Europe Crossover 5Y down 5.0 bp, now at 426bp (1W change: +10.0bp; YTD change: -47.7bp)

- Markit iTRAXX Japan 5Y down 0.5 bp, now at 72bp (1W change: +1.0bp; YTD change: -14.9bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 2.1 bp, now at 127bp (1W change: +1.0bp; YTD change: -6.3bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Nigeria (rated B-): up 10.0 % to 740 bp (1Y range: 562-885bp)

- Saudi Arabia (rated A+): up 9.9 % to 52 bp (1Y range: 45-75bp)

- Italy (rated BBB): up 9.6 % to 107 bp (1Y range: 86-179bp)

- Panama (rated WD): up 8.4 % to 133 bp (1Y range: 89-187bp)

- Chile (rated A-): up 7.3 % to 73 bp (1Y range: 54-174bp)

- Peru (rated BBB): up 7.2 % to 85 bp (1Y range: 69-171bp)

- Poland (rated A-): up 7.1 % to 63 bp (1Y range: 52-162bp)

- Colombia (rated BB+): up 5.7 % to 238 bp (1Y range: 197-394bp)

- South Africa (rated BB-): up 5.4 % to 279 bp (1Y range: 218-349bp)

- Philippines (rated BBB): up 4.3 % to 84 bp (1Y range: 66-153bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Gap Inc (Country: US; rated: NR): down 27.7 bp to 498.3bp (1Y range: 407-772bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa2): down 26.1 bp to 667.4bp (1Y range: 648-1,472bp)

- Macy's Inc (Country: US; rated: A1): down 25.0 bp to 494.5bp (1Y range: 300-563bp)

- Petroleos Mexicanos (Country: MX; rated: B1): up 24.4 bp to 682.7bp (1Y range: 469-768bp)

- Avis Budget Group Inc (Country: US): up 27.1 bp to 440.8bp (1Y range: 316-591bp)

- Newell Brands Inc (Country: US; rated: Ba2): up 29.7 bp to 446.5bp (1Y range: 83-447bp)

- Xerox Corp (Country: US; rated: NR): up 37.8 bp to 367.9bp (1Y range: 295-544bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: Ba3): up 41.9 bp to 325.8bp (1Y range: 269-1,187bp)

- Pitney Bowes Inc (Country: US; rated: NR): up 51.4 bp to 1,396.2bp (1Y range: 747-1,719bp)

- Anywhere Real Estate Group LLC (Country: US; rated: B1): up 52.7 bp to 991.7bp (1Y range: 278-992bp)

- Carnival Corp (Country: US; rated: Ba2): up 67.3 bp to 632.7bp (1Y range: 446-2,117bp)

- DISH DBS Corp (Country: US; rated: Caa1): up 122.8 bp to 2,002.9bp (1Y range: 1,138-3,084bp)

- Community Health Systems Inc (Country: US; rated: NR): up 140.6 bp to 2,761.5bp (1Y range: 1,258-4,371bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Altice Finco SA (Country: LU; rated: Caa2): down 117.7 bp to 652.1bp (1Y range: 401-1,021bp)

- Air France KLM SA (Country: FR; rated: B-): down 40.5 bp to 410.0bp (1Y range: 347-925bp)

- ThyssenKrupp AG (Country: DE; rated: NR): down 40.2 bp to 141.7bp (1Y range: 142-705bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: B1): down 10.7 bp to 285.0bp (1Y range: 285-708bp)

- Valeo SE (Country: FR; rated: NR): up 10.8 bp to 286.0bp (1Y range: 210-389bp)

- BASF SE (Country: DE; rated: BBB+): up 11.7 bp to 80.0bp (1Y range: 53-154bp)

- Lanxess AG (Country: DE; rated: WR): up 13.3 bp to 222.1bp (1Y range: 121-295bp)

- Ziggo Bond Company BV (Country: NL; rated: WR): up 13.4 bp to 497.8bp (1Y range: 385-584bp)

- CMA CGM SA (Country: FR; rated: Ba1): up 13.6 bp to 203.4bp (1Y range: 190-631bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 13.8 bp to 615.7bp (1Y range: 566-1,739bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): up 16.4 bp to 261.5bp (1Y range: 199-476bp)

- Ceconomy AG (Country: DE; rated: NR): up 24.9 bp to 867.6bp (1Y range: 577-1,763bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 30.0 bp to 224.9bp (1Y range: 157-600bp)

- TUI AG (Country: DE; rated: B2-PD): up 53.5 bp to 775.9bp (1Y range: 620-1,725bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 70.0 bp to 1,756.0bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Office Properties Income Trust (Newton, Massachusetts (US)) | Coupon: 2.40% | Maturity: 1/2/2027 | Rating: B | CUSIP: 67623CAE9 | OAS up by 216.8 bp to 1,415.4 bp, with the yield to worst at 18.5% and the bond now trading down to 60.3 cents on the dollar (1Y price range: 56.3-78.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS up by 73.8 bp to 135.7 bp (CDS basis: -124.0bp), with the yield to worst at 6.4% and the bond now trading down to 89.6 cents on the dollar (1Y price range: 41.6-92.6).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: B- | CUSIP: 02376RAE2 | OAS up by 71.2 bp to 296.8 bp, with the yield to worst at 7.4% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 85.0-96.5).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: B+ | CUSIP: 410345AL6 | OAS up by 68.4 bp to 328.1 bp, with the yield to worst at 8.1% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 89.8-96.8).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 6.69% | Maturity: 15/1/2027 | Rating: BB | CUSIP: 501797AQ7 | OAS up by 55.4 bp to 335.0 bp, with the yield to worst at 7.5% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 96.3-101.5).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 3.88% | Maturity: 15/10/2026 | Rating: BB | CUSIP: 65342QAL6 | OAS up by 54.8 bp to 254.4 bp, with the yield to worst at 7.1% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 89.5-94.1).

- Issuer: Advance Auto Parts Inc (Raleigh, North Carolina (US)) | Coupon: 5.90% | Maturity: 9/3/2026 | Rating: BB+ | CUSIP: 00751YAH9 | OAS up by 47.0 bp to 285.3 bp, with the yield to worst at 7.5% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 58.1-103.2).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 5.25% | Maturity: 1/2/2028 | Rating: BB | CUSIP: 501797AN4 | OAS up by 46.8 bp to 298.1 bp, with the yield to worst at 7.1% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 92.0-96.4).

- Issuer: Newell Brands Inc (Atlanta, Georgia (US)) | Coupon: 4.88% | Maturity: 1/6/2025 | Rating: BB | CUSIP: 651229BB1 | OAS up by 39.4 bp to 220.8 bp, with the yield to worst at 7.0% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 94.4-98.9).

- Issuer: EnLink Midstream Partners LP (Dallas, Texas (US)) | Coupon: 4.85% | Maturity: 15/7/2026 | Rating: BB+ | CUSIP: 29336UAF4 | OAS up by 36.5 bp to 208.2 bp, with the yield to worst at 6.7% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 94.0-98.1).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.38% | Maturity: 13/11/2025 | Rating: BB+ | CUSIP: 345397B28 | OAS up by 34.4 bp to 190.8 bp (CDS basis: -98.2bp), with the yield to worst at 7.1% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 71.7-94.3).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 4.38% | Maturity: 15/12/2027 | Rating: BB- | CUSIP: 29275YAC6 | OAS up by 34.2 bp to 214.6 bp, with the yield to worst at 6.6% and the bond now trading down to 90.9 cents on the dollar (1Y price range: 90.0-94.5).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS up by 34.1 bp to 164.0 bp (CDS basis: -141.9bp), with the yield to worst at 6.2% and the bond now trading down to 95.6 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 7.38% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 247361ZZ4 | OAS up by 32.2 bp to 153.5 bp (CDS basis: -80.7bp), with the yield to worst at 6.6% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 101.0-105.9).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 5.25% | Maturity: 1/7/2025 | Rating: BB+ | CUSIP: 058498AT3 | OAS up by 22.5 bp to 148.6 bp (CDS basis: -101.2bp), with the yield to worst at 6.2% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 97.1-100.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: CCC+ | ISIN: XS2271332285 | OAS up by 105.0 bp to 880.6 bp, with the yield to worst at 11.6% and the bond now trading down to 57.8 cents on the dollar (1Y price range: 53.8-67.8).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB- | ISIN: XS2356316872 | OAS up by 87.6 bp to 682.0 bp (CDS basis: 179.1bp), with the yield to worst at 9.0% and the bond now trading down to 80.2 cents on the dollar (1Y price range: 61.6-82.5).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: CCC+ | ISIN: XS2346224806 | OAS up by 78.0 bp to 783.5 bp, with the yield to worst at 10.6% and the bond now trading down to 56.9 cents on the dollar (1Y price range: 50.0-67.0).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | OAS up by 62.1 bp to 569.4 bp, with the yield to worst at 8.9% and the bond now trading down to 63.6 cents on the dollar (1Y price range: 40.4-67.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 55.7 bp to 675.7 bp (CDS basis: -175.0bp), with the yield to worst at 10.3% and the bond now trading down to 85.7 cents on the dollar (1Y price range: 83.6-92.8).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS up by 52.5 bp to 246.1 bp (CDS basis: -71.1bp), with the yield to worst at 5.7% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 90.6-95.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB+ | ISIN: FR0013299435 | OAS up by 52.4 bp to 48.6 bp (CDS basis: 60.5bp), with the yield to worst at 3.7% and the bond now trading down to 93.4 cents on the dollar (1Y price range: 90.7-94.7).

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB | ISIN: XS2102392276 | OAS up by 48.4 bp to 329.2 bp, with the yield to worst at 6.5% and the bond now trading down to 90.7 cents on the dollar (1Y price range: 76.5-92.4).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: B+ | ISIN: XS2270393379 | OAS up by 46.7 bp to 331.8 bp (CDS basis: -95.3bp), with the yield to worst at 6.4% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 84.3-90.4).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.00% | Maturity: 12/11/2029 | Rating: BB | ISIN: FR0014006G24 | OAS up by 41.1 bp to 759.9 bp, with the yield to worst at 9.9% and the bond now trading down to 57.3 cents on the dollar (1Y price range: 57.5-69.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | OAS up by 40.9 bp to 396.5 bp, with the yield to worst at 6.9% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 82.7-96.0).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.88% | Maturity: 15/2/2026 | Rating: BB+ | ISIN: FR0013318102 | OAS up by 40.8 bp to 150.0 bp, with the yield to worst at 4.9% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 93.7-97.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB | ISIN: XS2361254597 | OAS up by 35.5 bp to 384.8 bp, with the yield to worst at 7.2% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 81.0-91.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS up by 33.9 bp to 205.5 bp (CDS basis: -14.6bp), with the yield to worst at 5.3% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 92.1-97.2).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS down by 42.7 bp to 473.0 bp, with the yield to worst at 8.2% and the bond now trading up to 87.3 cents on the dollar (1Y price range: 80.6-87.7).

RECENT DOMESTIC USD BOND ISSUES

- Citibank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$1,750m Senior Bank Note (US17325FBA57), fixed rate (5.86% coupon) maturing on 29 September 2025, priced at 100.00 (original spread of 73 bp), callable (2nc2)

- Citibank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$2,500m Senior Bank Note (US17325FBB31), fixed rate (5.80% coupon) maturing on 29 September 2028, priced at 100.00 (original spread of 118 bp), callable (5nc5)

- Citibank NA (Banking | Sioux Falls, South Dakota, United States | Rating: A+): US$750m Senior Bank Note (US17325FAZ18), floating rate (SOFR + 80.5 bp) maturing on 29 September 2025, priced at 100.00, callable (2nc2)

- Constellation Energy Generation LLC (Utility - Other | Kennett Square, Pennsylvania, United States | Rating: BBB): US$500m Senior Note (US210385AD21), fixed rate (6.13% coupon) maturing on 15 January 2034, priced at 99.91 (original spread of 160 bp), callable (10nc10)

- Constellation Energy Generation LLC (Utility - Other | Kennett Square, Pennsylvania, United States | Rating: BBB): US$900m Senior Note (US210385AE04), fixed rate (6.50% coupon) maturing on 1 October 2053, priced at 99.96 (original spread of 180 bp), callable (30nc30)

- Duke Energy Florida LLC (Utility - Other | St. Petersburg, Florida, United States | Rating: A): US$200m First Mortgage Bond (US26444HAP64), floating rate (SOFRINDX + -35.0 bp) maturing on 15 October 2073, priced at 100.00, callable (50nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$102m Bond (US3133EPXY69), fixed rate (4.95% coupon) maturing on 13 March 2026, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$160m Bond (US3133EPXJ92), fixed rate (6.45% coupon) maturing on 3 October 2033, priced at 100.00, callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPXK65), fixed rate (6.70% coupon) maturing on 3 October 2033, priced at 100.00, callable (10nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$575m Bond (US3133EPXS91), floating rate (SOFR + 15.5 bp) maturing on 6 October 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPXE06), fixed rate (5.48% coupon) maturing on 2 October 2028, priced at 100.00 (original spread of 89 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$500m Bond (US3133EPXH37), floating rate (SOFR + 16.5 bp) maturing on 3 October 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EPXV21), fixed rate (4.63% coupon) maturing on 5 April 2029, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$241m Bond (US3130AXF297), fixed rate (4.97% coupon) maturing on 13 February 2026, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$221m Bond (US3130AXF602), fixed rate (4.95% coupon) maturing on 13 March 2026, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$108m Bond (US3130AXF453), fixed rate (4.77% coupon) maturing on 12 February 2027, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$401m Bond (US3130AXEW46), fixed rate (4.67% coupon) maturing on 15 March 2028, priced at 100.00, non callable

- Inter-American Development Bank (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$500m Senior Note (US45828RAA32), floating rate (SOFRINDX + 35.0 bp) maturing on 5 October 2028, priced at 100.00, non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$500m Senior Note (US459058KX08), floating rate (SOFRINDX + 46.0 bp) maturing on 4 October 2030, priced at 100.00, non callable

- Sitio Royalties Operating Partnership LP (Oil and Gas | Philadelphia, Pennsylvania, United States | Rating: B): US$600m Senior Note (USU82772AB79), fixed rate (7.88% coupon) maturing on 1 November 2028, priced at 100.00 (original spread of 322 bp), callable (5nc2)

- Western Midstream Operating LP (Oil and Gas | The Woodlands, Texas, United States | Rating: BBB-): US$600m Senior Note (US958667AF48), fixed rate (6.35% coupon) maturing on 15 January 2029, priced at 99.79 (original spread of 170 bp), callable (5nc5)

RECENT INTERNATIONAL USD BOND ISSUES

- Acushnet Co (Industrials - Other | Fairhaven, Massachusetts, South Korea | Rating: BB): US$350m Senior Note (US005095AA29), fixed rate (7.38% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 274 bp), callable (5nc2)

- Australia and New Zealand Banking Group Ltd (Banking | Sydney, New South Wales, Australia | Rating: A+): US$650m Senior Note (US05252ADH14), floating rate (SOFR + 64.0 bp) maturing on 3 October 2025, priced at 100.00, non callable

- Australia and New Zealand Banking Group Ltd (New York Branch) (Banking | New York City, New York, Australia | Rating: NR): US$1,000m Senior Note (US05253JAY73), fixed rate (5.67% coupon) maturing on 3 October 2025, priced at 100.00 (original spread of 55 bp), non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A+): US$334m Unsecured Note (XS2700208528), floating rate maturing on 12 October 2026, priced at 100.00, non callable

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: A): US$300m Bond (FR001400KUT6), floating rate (SOFR + 98.0 bp) maturing on 25 September 2025, priced at 100.00 (original spread of 200,000 bp), non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A-): US$350m Senior Note (US13607LWU33), floating rate (SOFRINDX + 122.0 bp) maturing on 2 October 2026, priced at 100.00, non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A-): US$1,100m Senior Note (US13607LWW98), fixed rate (6.09% coupon) maturing on 3 October 2033, priced at 100.00 (original spread of 162 bp), callable (10nc10)

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A-): US$700m Senior Note (US13607LWV16), fixed rate (5.99% coupon) maturing on 3 October 2028, priced at 100.00 (original spread of 143 bp), callable (5nc5)

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A-): US$850m Senior Note (US13607LWT69), fixed rate (5.93% coupon) maturing on 2 October 2026, priced at 100.00 (original spread of 111 bp), with a make whole call

- Cooperatieve Rabobank UA (New York Branch) (Banking | New York City, New York, Netherlands | Rating: A+): US$700m Note (US21688AAY82), fixed rate (5.50% coupon) maturing on 5 October 2026, priced at 99.72 (original spread of 77 bp), non callable

- Cooperatieve Rabobank UA (New York Branch) (Banking | New York City, New York, Netherlands | Rating: A+): US$300m Note (US21688AAZ57), floating rate (SOFR + 90.0 bp) maturing on 5 October 2026, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A-): US$1,750m Note (US22535WAJ62), floating rate maturing on 3 October 2029, priced at 100.00 (original spread of 169 bp), callable (6nc5)

- Five Holdings (BVI ) Ltd (Financial - Other | British Virgin Islands | Rating: B+): US$350m Note (US33829QAA04), fixed rate (9.38% coupon) maturing on 3 October 2028, priced at 99.03, callable (5nc2)

- Glencore Funding LLC (Financial - Other | Stamford, Connecticut, Switzerland | Rating: BBB+): US$750m Senior Note (US378272BP27), fixed rate (6.38% coupon) maturing on 6 October 2030, priced at 99.45 (original spread of 180 bp), callable (7nc7)

- Glencore Funding LLC (Financial - Other | Stamford, Connecticut, Switzerland | Rating: BBB+): US$1,000m Senior Note (US378272BQ00), fixed rate (6.50% coupon) maturing on 6 October 2033, priced at 99.62 (original spread of 198 bp), callable (10nc10)

- Industrial and Commercial Bank of China Ltd (Singapore Branch) (Banking | China (Mainland) | Rating: NR): US$800m Unsecured Note (XS2699256710), floating rate maturing on 23 October 2026, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): US$200m Unsecured Note (XS2698043606), fixed rate (5.80% coupon) maturing on 6 October 2031, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): US$200m Unsecured Note (XS2698043515), fixed rate (5.80% coupon) maturing on 6 October 2025, priced at 100.00, non callable

- Mineral Resources Ltd (Service - Other | Perth, Western Australia, Australia | Rating: BB): US$1,100m Senior Note (USQ60976AD18), fixed rate (9.25% coupon) maturing on 1 October 2028, priced at 100.00 (original spread of 459 bp), callable (5nc2)

- NBN Co Ltd (Service - Other | North Sydney, New South Wales, Australia | Rating: AA-): US$500m Senior Note (US62878V2G43), fixed rate (6.00% coupon) maturing on 6 October 2033, priced at 99.73 (original spread of 144 bp), callable (10nc10)

- NBN Co Ltd (Service - Other | North Sydney, New South Wales, Australia | Rating: AA-): US$750m Senior Note (US62878U2F87), fixed rate (5.75% coupon) maturing on 6 October 2028, priced at 99.93 (original spread of 108 bp), callable (5nc5)

- Pilgrims Pride Corp (Food Processors | Greeley, Colorado, Brazil | Rating: BB): US$500m Senior Note (US72147KAL26), fixed rate (6.88% coupon) maturing on 15 May 2034, priced at 98.10 (original spread of 265 bp), callable (11nc10)

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): US$1,250m Senior Note (US87031CAN39), fixed rate (4.88% coupon) maturing on 4 October 2030, priced at 99.30 (original spread of 42 bp), non callable

- Transocean Aquila Ltd (Financial - Other | Switzerland | Rating: B): US$325m Note (USG90916AA87), fixed rate (8.00% coupon) maturing on 30 September 2028, priced at 100.00 (original spread of 337 bp), callable (5nc2)

- We Soda Invts (Chemicals | Turkey | Rating: NR): US$800m Note (US92943TAA16), fixed rate (9.50% coupon) maturing on 6 October 2028, priced at 100.00, callable (5nc2)

RECENT EURO BOND ISSUES

- ABANCA Corporacion Bancaria SA (Banking | Betanzos, La Coruna, Spain | Rating: BBB-): €500m Bond (ES0265936056), floating rate maturing on 2 April 2030, priced at 99.64 (original spread of 335 bp), callable (7nc6)

- ALD SA (Leasing | Reuil-Malmaison, Ile-De-France, France | Rating: A-): €1,000m Bond (FR001400L4Y2), floating rate (EU03MLIB + 65.0 bp) maturing on 6 October 2025, priced at 100.00, non callable

- ALD SA (Leasing | Reuil-Malmaison, Ile-De-France, France | Rating: A-): €1,000m Bond (FR001400L4V8), fixed rate (4.88% coupon) maturing on 6 October 2028, priced at 99.92 (original spread of 215 bp), with a make whole call

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €300m Subordinated Note (XS2696902837), fixed rate (7.00% coupon) maturing on 5 January 2034, priced at 99.53 (original spread of 440 bp), callable (10nc5)

- Bendigo and Adelaide Bank Ltd (Banking | Bendigo, Victoria, Australia | Rating: BBB+): €500m Covered Bond (Other) (XS2680753568), fixed rate (4.02% coupon) maturing on 4 October 2026, priced at 100.00 (original spread of 121 bp), non callable

- Berlin, State of (Official and Muni | Berlin, Germany | Rating: AA+): €200m Landesschatzanweisung (DE000A351PG2), floating rate (EU06MLIB + 0.0 bp) maturing on 9 April 2029, priced at 100.86, non callable

- Ca Auto Bank SpA (Financial - Other | Torino, France | Rating: BBB+): €140m Unsecured Note (XS2700264604), fixed rate (4.48% coupon) maturing on 19 December 2025, priced at 100.00, non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000CZ439E0), fixed rate (3.25% coupon) maturing on 27 October 2025, priced at 100.00, non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: AA+): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000A31RJY5), floating rate (EU03MLIB + 20.0 bp) maturing on 28 September 2026, priced at 100.06, non callable

- ESB Finance DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: A-): €500m Senior Note (XS2697970536), fixed rate (4.25% coupon) maturing on 3 March 2036, priced at 98.98, callable (12nc12)

- ESB Finance DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: A-): €500m Senior Note (XS2697983869), fixed rate (4.00% coupon) maturing on 3 October 2028, priced at 99.67 (original spread of 122 bp), callable (5nc5)

- Electrolux AB (Electronics | Stockholm, Stockholm, Sweden | Rating: BBB+): €300m Senior Note (XS2698045130), fixed rate (4.50% coupon) maturing on 2 October 2028, priced at 100.00 (original spread of 175 bp), non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A+): €4m Inhaberschuldverschreibung (AT0000A377Y4), fixed rate (3.90% coupon) maturing on 5 October 2027, priced at 100.00, non callable

- Glqc II (Financial - Other | Dublin, Dublin, United States | Rating: NR): €2,500m Bond (XS2524140709), floating rate maturing on 26 September 2033, priced at 100.00, non callable

- Iccrea Banca SpA Istituto Centrale del Credito Cooperativo (Banking | Rome, Roma, Italy | Rating: BB+): €150m Bond (IT0005565491), floating rate maturing on 29 September 2028, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €500m Senior Note (XS2696903728), fixed rate (4.50% coupon) maturing on 2 October 2025, priced at 99.95 (original spread of 131 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €3,000m Senior Note (XS2698047771), fixed rate (3.25% coupon) maturing on 24 March 2031, priced at 99.88 (original spread of 60 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3S8), fixed rate (3.35% coupon) maturing on 1 November 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3K5), fixed rate (3.00% coupon) maturing on 1 November 2028, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3W0), fixed rate (3.50% coupon) maturing on 1 November 2032, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3H1), fixed rate (2.95% coupon) maturing on 2 November 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3V2), fixed rate (3.40% coupon) maturing on 3 November 2031, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3L3), fixed rate (3.05% coupon) maturing on 3 November 2031, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3P4), fixed rate (3.30% coupon) maturing on 3 November 2025, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3J7), fixed rate (2.95% coupon) maturing on 1 November 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3T6), fixed rate (3.35% coupon) maturing on 1 November 2029, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3Q2), fixed rate (3.25% coupon) maturing on 2 November 2026, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3U4), fixed rate (3.40% coupon) maturing on 1 November 2030, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000LB4L3R0), fixed rate (3.30% coupon) maturing on 1 November 2027, priced at 100.00, non callable

- Lower Austria, State of (Official and Muni | Sankt Poelten, Niederoesterreich, Austria | Rating: AA): €500m Inhaberschuldverschreibung (AT0000A377E6), fixed rate (3.63% coupon) maturing on 4 October 2033, priced at 99.46 (original spread of 102 bp), non callable

- National Bank of Greece SA (Banking | Athina, Attiki, Greece | Rating: BB-): €500m Subordinated Note (XS2595343059), fixed rate (8.00% coupon) maturing on 3 January 2034, priced at 100.06 (original spread of 511 bp), callable (10nc5)

- OTP Bank Nyrt (Banking | Budapest, Budapest, Hungary | Rating: BBB-): €650m Note (XS2698603326), floating rate maturing on 5 October 2027, priced at 99.72 (original spread of 334 bp), callable (4nc3)

- Piaggio & C SpA (Automotive Manufacturer | Pontedera, Pisa, Italy | Rating: BB-): €250m Senior Note (XS2696224406), fixed rate (6.50% coupon) maturing on 5 October 2030, priced at 100.00 (original spread of 378 bp), callable (7nc3)

- Pinnacle Bidco PLC (Financial - Other | Leeds, United Kingdom | Rating: B-): €380m Senior Note (XS2696092068), fixed rate (8.25% coupon) maturing on 11 October 2028, priced at 100.00 (original spread of 553 bp), callable (5nc2)

- Raiffeisen Bank SA (Banking | Bucuresti, Austria | Rating: NR): €300m Unsecured Note (XS2700245561), fixed rate (1.00% coupon) maturing on 11 October 2028, priced at 100.00, non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €274m Unsecured Note (XS2659693993) zero coupon maturing on 31 December 2099, priced at 100.00, non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €1,670m Unsecured Note (XS2659692599) zero coupon maturing on 31 December 2099, priced at 100.00, non callable

- Slovenska Sporitelna as (Banking | Bratislava, Bratislavsky Kraj, Austria | Rating: A): €300m Inhaberschuldverschreibung (AT0000A377W8), floating rate maturing on 4 October 2028, priced at 99.64 (original spread of 268 bp), callable (5nc4)

- Suez SA (Service - Other | Paris, Ile-De-France, France | Rating: NR): €600m Bond (FR001400L461), fixed rate (6.63% coupon) maturing on 5 October 2043, priced at 98.59, callable (20nc20)

- TeamSystem SpA (Information/Data Technology | Pesaro, Pesaro E Urbino, United States | Rating: B-): €195m Bond (XS2689127897), floating rate maturing on 5 October 2030, priced at 100.00, non callable

- Wienerberger AG (Building Products | Wien, Wien, Austria | Rating: BBB-): €350m Inhaberschuldverschreibung (AT0000A37249), fixed rate (4.88% coupon) maturing on 4 October 2028, priced at 98.41 (original spread of 250 bp), callable (5nc5)

RECENT LOANS

- Ampac Packaging LLC (United States of America), signed a US$ 2,085m Term Loan B, to be used for general corporate purposes. It matures on 09/26/28 and initial pricing is set at Term SOFR +475.0bp

- BMC Software Inc (United States of America | CCC+), signed a US$ 650m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/29/28 and initial pricing is set at Term SOFR +375.0bp

- BMC Software Inc (United States of America | CCC+), signed a US$ 3,047m Term Loan B, to be used for general corporate purposes. It matures on 09/29/30 and initial pricing is set at Term SOFR +425.0bp

- BME Grp Hldg BV (Netherlands), signed a € 195m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/21/29.

- Balama Graphite Mine (Mozambique), signed a US$ 150m Term Loan, to be used for project finance. It matures on 09/20/36.

- Burger King Worldwide Inc (United States of America), signed a US$ 1,275m Term Loan A, to be used for general corporate purposes. It matures on 09/21/28.

- Burger King Worldwide Inc (United States of America), signed a US$ 1,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/21/28.

- Ceyhan Petrochemical Scheme (Turkey), signed a US$ 550m Term Loan, to be used for project finance.

- ChampionX Corp (United States of America | BBB), signed a US$ 620m Term Loan B, to be used for general corporate purposes, and working capital. It matures on 06/07/29 and initial pricing is set at Term SOFR +275.0bp.

- Chart Industries Inc (United States of America | B), signed a US$ 1,781m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 09/25/30 and initial pricing is set at Term SOFR +325.0bp

- EQM Midstream Partners LP (United States of America | BB-), signed a US$ 1,549m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/29/28 and initial pricing is set at Term SOFR +275.0bp

- Enbridge Inc (Canada | BBB+), signed a US$ 9,380m Bridge Loan, to be used for acquisition financing. It matures on 09/20/24 and initial pricing is set at Term SOFR +112.5bp

- Enefit Green AS (Estonia), signed a € 180m Term Loan, to be used for project finance. It matures on 09/20/35.

- Eureka Hunter Pipeline LLC (United States of America), signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 03/29/27 and initial pricing is set at Term SOFR +275.0bp

- Fiskars Oyj Abp (Finland), signed a € 130m Bridge Loan, to be used for acquisition financing. It matures on 09/21/24.

- Formula One World (United Kingdom), signed a US$ 1,700m Term Loan B, to be used for general corporate purposes. It matures on 01/15/30 and initial pricing is set at Term SOFR +250.0bp

- GeoStabilization Intl LLC (United States of America | B), signed a US$ 175m Term Loan, to be used for general corporate purposes. It matures on 12/31/28 and initial pricing is set at Term SOFR +525.0bp

- Heartwood Partners IV LP (United States of America), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/22/26.

- Heimstaden Bostad AB (Sweden | BBB), signed a € 700m Term Loan, to be used for general corporate purposes, and capital expenditures. It matures on 09/20/28.

- Heritage-Crystal Clean LLC (United States of America), signed a US$ 600m Term Loan B, to be used for leveraged buyout. It matures on 10/10/30.

- Hyland Software Inc (United States of America), signed a US$ 150m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at Term SOFR +600.0bp

- Hyland Software Inc (United States of America), signed a US$ 3,250m Term Loan, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at Term SOFR +600.0bp

- Ignis Solar PV (Spain), signed a € 335m Term Loan, to be used for project finance.

- Ingram Micro Inc (United States of America | BB-), signed a US$ 1,410m Term Loan B, to be used for general corporate purposes. It matures on 07/02/28 and initial pricing is set at Term SOFR +300.0bp

- Interstate Waste Services Inc (United States of America | B), signed a US$ 500m Term Loan B, to be used for recapitalization. It matures on 10/04/30 and initial pricing is set at Term SOFR +450.0bp

- Liberty Solar (United States of America), signed a US$ 120m Term Loan, to be used for project finance.

- MI OPCO Holdings Inc (United States of America), signed a US$ 550m Term Loan B, to be used for general corporate purposes. It matures on 04/05/29 and initial pricing is set at Term SOFR +575.0bp

- MI OPCO Holdings Inc (United States of America), signed a US$ 650m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 04/05/29 and initial pricing is set at Term SOFR +575.0bp

- MKS Instruments Inc (United States of America | BB), signed a US$ 3,573m Term Loan B, to be used for general corporate purposes. It matures on 08/17/29 and initial pricing is set at Term SOFR +250.0bp

- Martin Marietta Materials Inc (United States of America | BBB+), signed a US$ 400m Term Loan, to be used for general corporate purposes. It matures on 09/19/24 and initial pricing is set at Term SOFR +70.0bp

- Ocp Battery Sys And Solar Pv (El Salvador), signed a € 100m Term Loan, to be used for project finance.

- Orsted A/S (Denmark | BBB+), signed a € 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/21/26.

- Pacific Dental Services Inc (United States of America | B), signed a US$ 200m Term Loan B, to be used for general corporate purposes. It matures on 09/21/28 and initial pricing is set at Term SOFR +350.0bp

- Prologis Targeted US Logistics (United States of America | A-), signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 01/15/27 and initial pricing is set at Term SOFR +80.0bp

- Prometric Inc (United States of America), signed a US$ 572m Term Loan B, to be used for general corporate purposes. It matures on 01/29/28 and initial pricing is set at Term SOFR +525.0bp

- Qatar National Bank Qpsc (Qatar | A+), signed a US$ 667m Term Loan, to be used for general corporate purposes. It matures on 10/09/26 and initial pricing is set at Term SOFR +60.0bp

- Qatar National Bank Qpsc (Qatar | A+), signed a US$ 667m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/21/26 and initial pricing is set at Term SOFR +60.0bp

- Qatar National Bank Qpsc (Qatar | A+), signed a US$ 666m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/21/26 and initial pricing is set at Term SOFR +60.0bp

- Ssh Grp Hldg Inc (United States of America | B-), signed a US$ 850m Term Loan B, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at Term SOFR +475.0bp

- Techem GmbH (Germany), signed a € 3,000m Term Loan B

- Transact Holdings Inc (United States of America | B), signed a US$ 110m Term Loan B, to be used for general corporate purposes. It matures on 04/30/26 and initial pricing is set at Term SOFR +475.0bp

- Truck Hero Inc (United States of America | CCC), signed a US$ 180m Term Loan B, to be used for acquisition financing. It matures on 01/29/28 and initial pricing is set at Term SOFR +500.0bp

- Ucity Square One Owner LLC (United States of America), signed a US$ 600m Term Loan, to be used for real estate/property acquisitions. It matures on 09/21/26 and initial pricing is set at Term SOFR +250.0bp

- Upfield Nederland BV (Netherlands), signed a US$ 215m Term Loan B, to be used for general corporate purposes. It matures on 01/06/28 and initial pricing is set at Term SOFR +475.0bp

- Upfield Nederland BV (Netherlands), signed a € 185m Term Loan B, to be used for general corporate purposes. It matures on 01/06/28 and initial pricing is set at EURIBOR +500.0bp

- Verkor Dunkirk EV Gigafactory (France), signed a € 600m Term Loan, to be used for project finance.

- Vertex Aerospace LLC (United States of America), signed a US$ 913m Term Loan B, to be used for general corporate purposes. It matures on 12/06/28 and initial pricing is set at Term SOFR +325.0bp

- WP Carey Inc (United States of America | BBB+), signed a US$ 335m Term Loan, to be used for spinoff. It matures on 09/20/25 and initial pricing is set at Term SOFR +500.0bp

- WP Carey Inc (United States of America | BBB+), signed a US$ 120m Term Loan, to be used for spinoff. It matures on 09/20/28.

- Watlow Elec Mnfg Co (United States of America | B), signed a US$ 175m Term Loan B, to be used for general corporate purposes. It matures on 03/19/28 and initial pricing is set at Term SOFR +375.0bp

RECENT STRUCTURED CREDIT

- Indigo Credit Management I DAC issued a fixed-rate CLO in 7 tranches, for a total of € 340 m. Highest-rated tranche offering a yield to maturity of 1.78%, and the lowest-rated tranche a yield to maturity of 10.56%. Bookrunners: JP Morgan & Co Inc