Credit

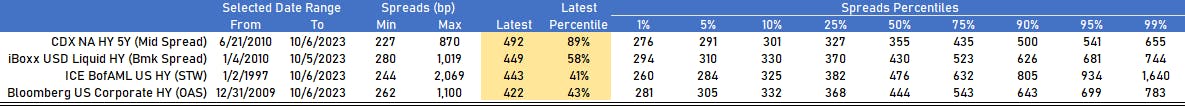

Despite Recent Widening, Cash Spreads Are Still At Reasonable Historical Levels, Credit Fundamentals Healthy For Most Sectors

Limited amount of corporate bond issuance this week: 15 tranches for US$8.9bn in IG (2023 YTD volume US$1.013trn vs 2022 YTD US$1.030trn), none in HY (2023 YTD volume US$134.731bn vs 2022 YTD US$87.001bn)

Published ET

YTD Compression in Cash STW (bp) | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was down -0.45% today, with investment grade down -0.47% and high yield down -0.21% (YTD total return: -1.19%)

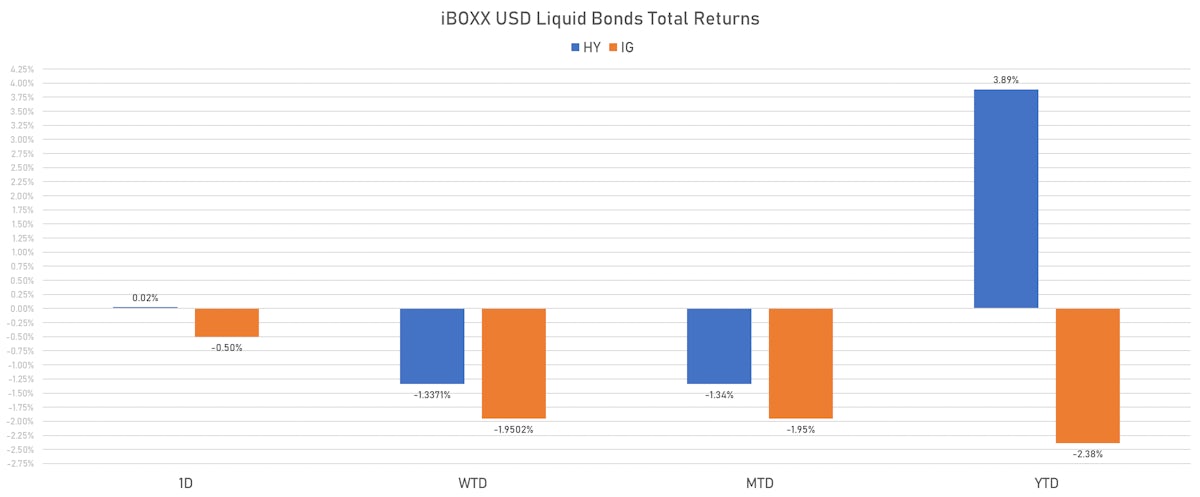

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.498% today (Week-to-date: -1.95%; Month-to-date: -1.95%; Year-to-date: -2.38%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.024% today (Week-to-date: -1.34%; Month-to-date: -1.34%; Year-to-date: 3.89%)

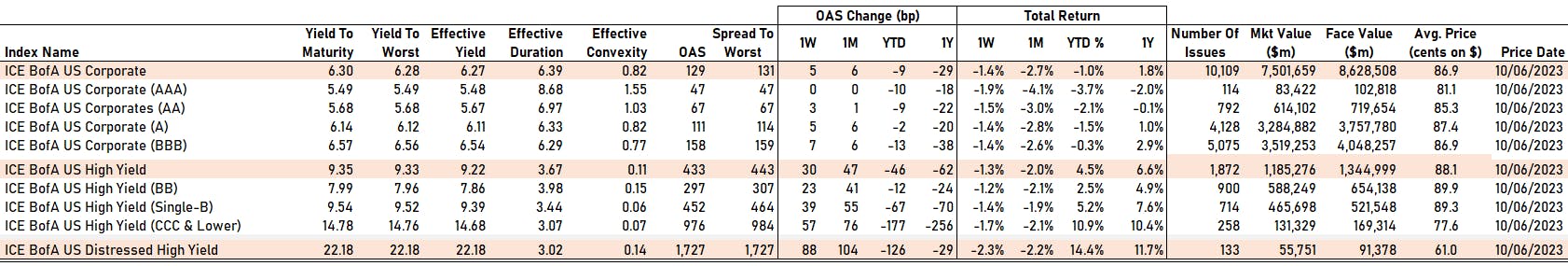

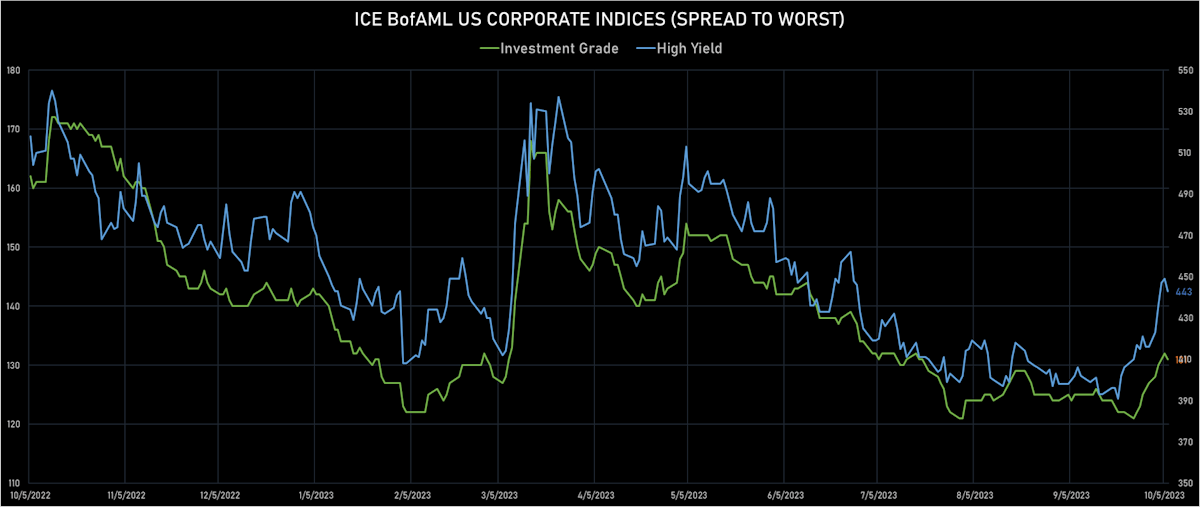

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 131.0 bp (WTD change: +4.0 bp; YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst down -6.0 bp, now at 443.0 bp (WTD change: +27.0 bp; YTD change: -45.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +9.3%)

HY Spreads historical percentiles | Sources: phipost.com, FactSet, Bloomberg, Refinitiv data

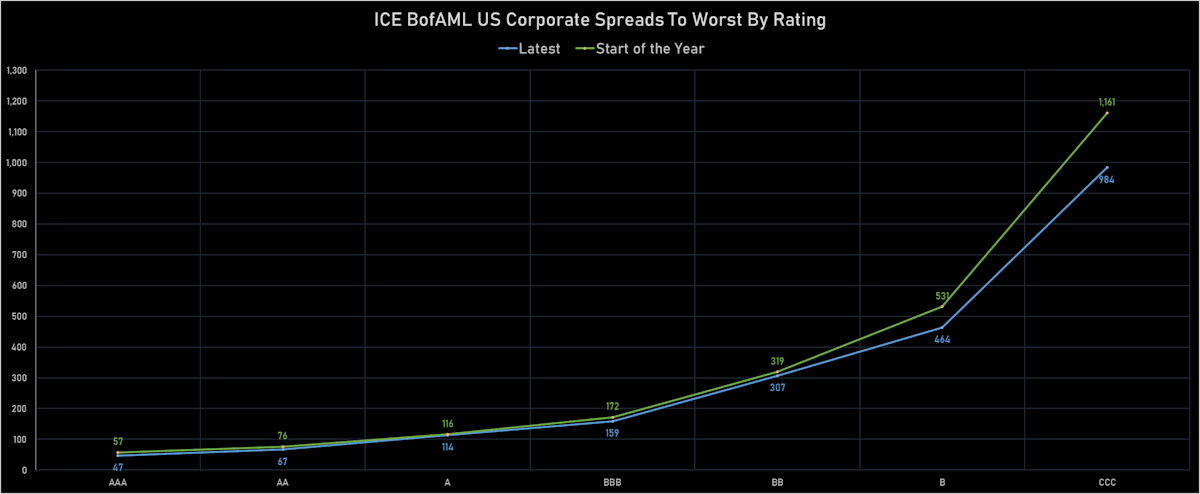

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 47 bp

- AA up by 3 bp at 67 bp

- A up by 5 bp at 111 bp

- BBB up by 7 bp at 158 bp

- BB up by 23 bp at 297 bp

- B up by 39 bp at 452 bp

- ≤ CCC up by 57 bp at 976 bp

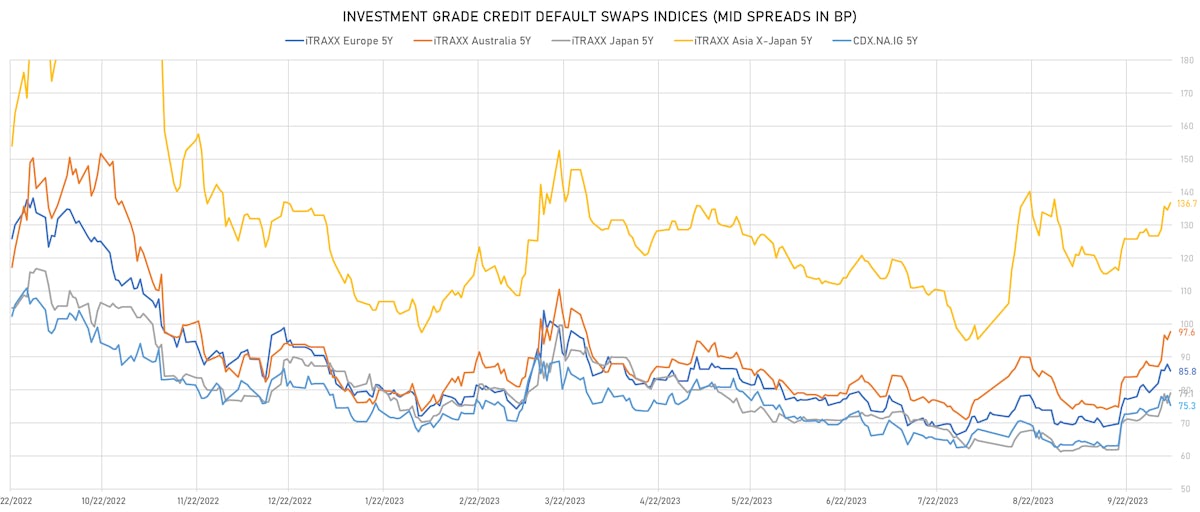

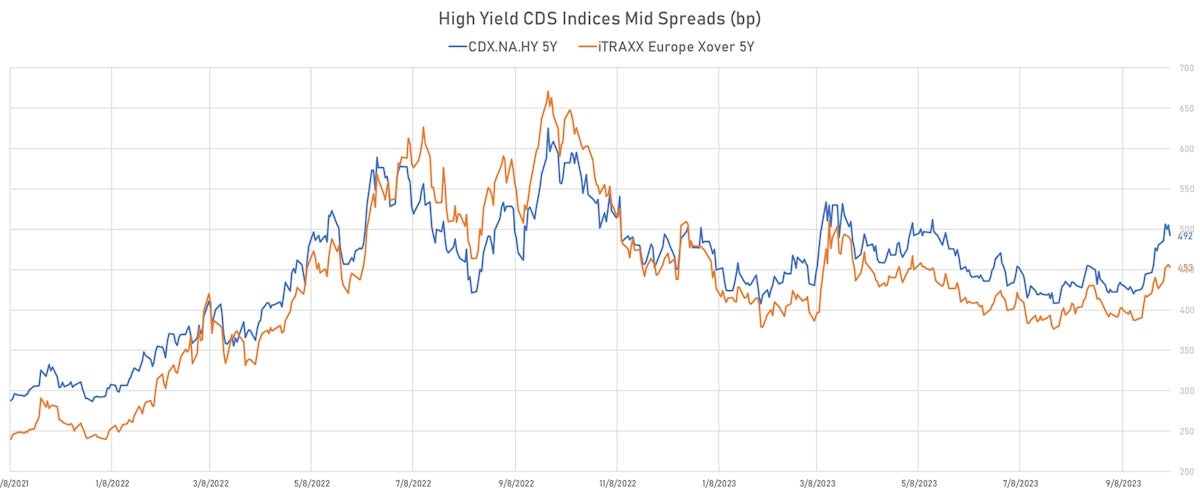

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.9 bp, now at 75bp (1W change: +1.4bp; YTD change: -6.6bp)

- Markit CDX.NA.IG 10Y down 2.9 bp, now at 114bp (1W change: +0.8bp; YTD change: -3.9bp)

- Markit CDX.NA.HY 5Y down 12.9 bp, now at 492bp (1W change: +11.9bp; YTD change: +7.6bp)

- Markit iTRAXX Europe 5Y down 2.0 bp, now at 86bp (1W change: +6.6bp; YTD change: -4.6bp)

- Markit iTRAXX Europe Crossover 5Y down 3.1 bp, now at 453bp (1W change: +26.8bp; YTD change: -20.9bp)

- Markit iTRAXX Japan 5Y up 3.1 bp, now at 79bp (1W change: +6.8bp; YTD change: -8.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 2.1 bp, now at 137bp (1W change: +10.0bp; YTD change: +3.7bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Malaysia (rated BBB+): up 19.7 % to 59 bp (1Y range: 40-122bp)

- Thailand (rated BBB+): up 16.7 % to 59 bp (1Y range: 32-95bp)

- Egypt (rated B): up 15.2 % to 1,729 bp (1Y range: 706-1,837bp)

- Israel (rated A+): up 11.7 % to 56 bp (1Y range: 32-60bp)

- Panama (rated WD): up 10.1 % to 146 bp (1Y range: 89-187bp)

- Peru (rated BBB): up 9.9 % to 94 bp (1Y range: 69-171bp)

- Chile (rated A-): up 9.6 % to 79 bp (1Y range: 54-174bp)

- Philippines (rated BBB): up 8.8 % to 91 bp (1Y range: 66-152bp)

- Colombia (rated BB+): up 8.7 % to 258 bp (1Y range: 197-394bp)

- China (rated A+): up 8.0 % to 87 bp (1Y range: 47-132bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Pitney Bowes Inc (Country: US; rated: NR): down 54.0 bp to 1,342.2bp (1Y range: 747-1,627bp)

- MGM Resorts International (Country: US; rated: NR): up 34.4 bp to 315.4bp (1Y range: 192-423bp)

- AES Corp (Country: US; rated: NR): up 36.3 bp to 196.6bp (1Y range: 120-197bp)

- Onemain Finance Corp (Country: US; rated: WR): up 37.3 bp to 450.0bp (1Y range: 121-1,042bp)

- Staples Inc (Country: US; rated: B3): up 41.9 bp to 5,130.4bp (1Y range: 1,411-5,130bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): up 46.5 bp to 1,077.6bp (1Y range: 511-1,078bp)

- Bombardier Inc (Country: CA; rated: NR): up 47.8 bp to 492.4bp (1Y range: 432-1,007bp)

- Newell Brands Inc (Country: US; rated: Ba2): up 52.9 bp to 499.5bp (1Y range: 83-499bp)

- Xerox Corp (Country: US; rated: WR): up 53.3 bp to 427.1bp (1Y range: 295-517bp)

- Kohls Corp (Country: US; rated: Ba2): up 69.1 bp to 768.9bp (1Y range: 444-783bp)

- Transocean Inc (Country: KY; rated: Caa1): up 86.8 bp to 570.5bp (1Y range: 393-1,566bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 96.2 bp to 617.6bp (1Y range: 390-766bp)

- Anywhere Real Estate Group LLC (Country: US; rated: B1): up 104.6 bp to 1,096.3bp (1Y range: 278-1,096bp)

- Community Health Systems Inc (Country: US; rated: NR): up 191.5 bp to 2,952.9bp (1Y range: 1,258-4,371bp)

- DISH DBS Corp (Country: US; rated: Caa1): up 218.9 bp to 2,221.8bp (1Y range: 1,138-3,084bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Premier Foods Finance PLC (Country: GB; rated: Ba3): up 27.6 bp to 289.1bp (1Y range: 199-476bp)

- Valeo SE (Country: FR; rated: NR): up 28.1 bp to 314.1bp (1Y range: 210-375bp)

- Telecom Italia SpA (Country: IT; rated: NR): up 29.2 bp to 326.6bp (1Y range: 274-545bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 29.5 bp to 488.8bp (1Y range: 280-496bp)

- CMA CGM SA (Country: FR; rated: Ba1): up 31.1 bp to 234.5bp (1Y range: 190-604bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 31.4 bp to 469.2bp (1Y range: 379-602bp)

- thyssenkrupp AG (Country: DE; rated: NR): up 33.4 bp to 175.1bp (1Y range: 144-704bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): up 38.4 bp to 619.7bp (1Y range: 186-620bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): up 43.3 bp to 653.1bp (1Y range: 486-1,213bp)

- TUI AG (Country: DE; rated: B2-PD): up 48.5 bp to 824.5bp (1Y range: 620-1,725bp)

- Altice Finco SA (Country: LU; rated: Caa2): up 61.6 bp to 713.6bp (1Y range: 401-1,021bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 70.7 bp to 816.3bp (1Y range: 632-1,246bp)

- Alstom SA (Country: FR; rated: P-3): up 79.5 bp to 225.7bp (1Y range: 109-310bp)

- Ceconomy AG (Country: DE; rated: NR): up 94.1 bp to 961.7bp (1Y range: 577-1,763bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): up 252.8 bp to 2,008.8bp (1Y range: 1,286-2,910bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Qwest Corp (Monroe, Louisiana (US)) | Coupon: 7.25% | Maturity: 15/9/2025 | Rating: B- | CUSIP: 912920AK1 | OAS up by 133.2 bp to 585.9 bp, with the yield to worst at 10.0% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 80.9-102.7).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB | CUSIP: 65342QAB8 | OAS up by 79.2 bp to 331.2 bp, with the yield to worst at 8.0% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 87.4-95.1).

- Issuer: Onemain Finance Corp (Evansville, Indiana (US)) | Coupon: 6.88% | Maturity: 15/3/2025 | Rating: BB | CUSIP: 85172FAM1 | OAS up by 76.0 bp to 329.3 bp, with the yield to worst at 7.6% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 94.8-100.8).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 5.88% | Maturity: 25/10/2024 | Rating: B+ | CUSIP: 63938CAB4 | OAS up by 76.0 bp to 288.9 bp (CDS basis: -105.8bp), with the yield to worst at 7.0% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 95.1-99.5).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 501797AU8 | OAS up by 73.1 bp to 248.0 bp, with the yield to worst at 6.9% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 103.0-108.0).

- Issuer: Newell Brands Inc (Atlanta, Georgia (US)) | Coupon: 4.88% | Maturity: 1/6/2025 | Rating: BB | CUSIP: 651229BB1 | OAS up by 72.2 bp to 293.0 bp, with the yield to worst at 7.8% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 94.4-98.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | CUSIP: 77340RAS6 | OAS up by 66.8 bp to 285.7 bp, with the yield to worst at 7.7% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 91.8-95.0).

- Issuer: Navient Corp (Wilmington, Delaware (US)) | Coupon: 6.75% | Maturity: 25/6/2025 | Rating: B+ | CUSIP: 63938CAH1 | OAS up by 65.1 bp to 329.8 bp (CDS basis: -93.5bp), with the yield to worst at 7.5% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 95.5-100.5).

- Issuer: Crown Cork & Seal Company Inc (Philadelphia, Pennsylvania (US)) | Coupon: 7.38% | Maturity: 15/12/2026 | Rating: BB- | CUSIP: 228255AH8 | OAS up by 55.4 bp to 281.3 bp, with the yield to worst at 7.0% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-106.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.13% | Maturity: 4/8/2025 | Rating: BB+ | CUSIP: 345397XL2 | OAS up by 51.9 bp to 266.9 bp (CDS basis: -132.2bp), with the yield to worst at 7.4% and the bond now trading down to 94.2 cents on the dollar (1Y price range: 90.2-96.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.69% | Maturity: 9/6/2025 | Rating: BB+ | CUSIP: 345397ZJ5 | OAS up by 50.9 bp to 226.0 bp (CDS basis: -145.1bp), with the yield to worst at 7.6% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 94.5-98.2).

- Issuer: Nustar Logistics LP (San Antonio, Texas (US)) | Coupon: 5.75% | Maturity: 1/10/2025 | Rating: BB- | CUSIP: 67059TAG0 | OAS up by 50.3 bp to 238.0 bp, with the yield to worst at 7.3% and the bond now trading down to 96.4 cents on the dollar (1Y price range: 95.0-99.6).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS up by 49.5 bp to 162.5 bp (CDS basis: -126.3bp), with the yield to worst at 6.5% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 97.1-100.6).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 6.38% | Maturity: 15/8/2025 | Rating: B | CUSIP: 69073TAS2 | OAS up by 35.3 bp to 185.2 bp (CDS basis: 150.4bp), with the yield to worst at 6.2% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 97.0-102.4).

- Issuer: Crown Americas LLC (Philadelphia, Pennsylvania (US)) | Coupon: 4.25% | Maturity: 30/9/2026 | Rating: BB | CUSIP: 22819KAB6 | OAS up by 34.6 bp to 178.9 bp, with the yield to worst at 6.5% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 92.1-97.0)

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Atos SE (Bezons, France) | Coupon: 2.50% | Maturity: 7/11/2028 | Rating: BB | ISIN: FR0013378460 | OAS up by 373.1 bp to 1,101.0 bp, with the yield to worst at 13.3% and the bond now trading down to 59.0 cents on the dollar (1Y price range: 59.0-77.1).

- Issuer: Atos SE (Bezons, France) | Coupon: 1.00% | Maturity: 12/11/2029 | Rating: BB | ISIN: FR0014006G24 | OAS up by 340.3 bp to 1,072.4 bp, with the yield to worst at 13.1% and the bond now trading down to 48.6 cents on the dollar (1Y price range: 48.6-69.0).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 0.75% | Maturity: 14/12/2028 | Rating: CCC+ | ISIN: XS2271332285 | OAS up by 103.0 bp to 966.4 bp, with the yield to worst at 12.5% and the bond now trading down to 55.6 cents on the dollar (1Y price range: 53.8-67.8).

- Issuer: SBB Treasury Oyj (Helsinki, Finland) | Coupon: 1.13% | Maturity: 26/11/2029 | Rating: CCC+ | ISIN: XS2346224806 | OAS up by 91.2 bp to 846.5 bp, with the yield to worst at 11.3% and the bond now trading down to 55.0 cents on the dollar (1Y price range: 50.0-67.0).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB- | ISIN: XS2356316872 | OAS up by 69.4 bp to 808.1 bp (CDS basis: 140.1bp), with the yield to worst at 10.1% and the bond now trading down to 78.0 cents on the dollar (1Y price range: 61.6-82.5).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | OAS up by 67.9 bp to 639.9 bp, with the yield to worst at 9.7% and the bond now trading down to 61.2 cents on the dollar (1Y price range: 40.4-67.3).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | OAS up by 64.7 bp to 494.1 bp, with the yield to worst at 8.4% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 80.6-87.7).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 2.00% | Maturity: 29/9/2028 | Rating: BB- | ISIN: XS2391403354 | OAS up by 64.1 bp to 424.2 bp, with the yield to worst at 7.5% and the bond now trading down to 77.3 cents on the dollar (1Y price range: 73.5-82.6).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS up by 56.9 bp to 278.3 bp, with the yield to worst at 6.0% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 85.3-94.0).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB | ISIN: XS2341724172 | OAS up by 51.9 bp to 586.8 bp, with the yield to worst at 9.2% and the bond now trading down to 75.0 cents on the dollar (1Y price range: 71.3-81.5).

- Issuer: MAS Securities BV (S-Gravenhage, Netherlands) | Coupon: 4.25% | Maturity: 19/5/2026 | Rating: BB | ISIN: XS2339025277 | OAS up by 51.1 bp to 797.2 bp, with the yield to worst at 11.5% and the bond now trading down to 84.2 cents on the dollar (1Y price range: 76.7-85.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 30/7/2027 | Rating: BB- | ISIN: XS1266661013 | OAS up by 51.0 bp to 385.4 bp, with the yield to worst at 6.7% and the bond now trading down to 93.6 cents on the dollar (1Y price range: 86.4-97.8).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB+ | ISIN: XS2332589972 | OAS up by 47.0 bp to 212.1 bp, with the yield to worst at 5.4% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 86.8-92.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 46.3 bp to 723.7 bp (CDS basis: -210.7bp), with the yield to worst at 10.7% and the bond now trading down to 84.9 cents on the dollar (1Y price range: 83.6-92.8).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS down by 47.5 bp to 291.6 bp, with the yield to worst at 6.2% and the bond now trading up to 88.4 cents on the dollar (1Y price range: 76.1-88.8)

RECENT DOMESTIC USD BOND ISSUES

- Atmos Energy Corp (Oil and Gas | Dallas, Texas, United States | Rating: A-): US$500m Senior Note (US049560BA22), fixed rate (6.20% coupon) maturing on 15 November 2053, priced at 99.76 (original spread of 133 bp), callable (30nc30)

- Atmos Energy Corp (Oil and Gas | Dallas, Texas, United States | Rating: A-): US$400m Senior Note (US049560AZ81), fixed rate (5.90% coupon) maturing on 15 November 2033, priced at 99.87 (original spread of 120 bp), callable (10nc10)

- Darden Restaurants Inc (Restaurants | Orlando, Florida, United States | Rating: BBB): US$500m Senior Note (US237194AN56), fixed rate (6.30% coupon) maturing on 10 October 2033, priced at 99.32 (original spread of 213 bp), callable (10nc10)

- Dominion Energy South Carolina Inc (Utility - Other | Cayce, South Carolina, United States | Rating: A): US$500m First Mortgage Note (US25731VAB09), fixed rate (6.25% coupon) maturing on 15 October 2053, priced at 99.43 (original spread of 206 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$500m Bond (US3133EPXZ35), floating rate (SOFR + 16.0 bp) maturing on 6 October 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$160m Bond (US3133EPYC31), fixed rate (5.36% coupon) maturing on 20 October 2027, priced at 100.00, callable (4nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$500m Bond (US3133EPYG45), floating rate (SOFR + 16.5 bp) maturing on 10 October 2025, priced at 100.00, callable (2nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$1,000m Bond (US3133EPYK56), fixed rate (5.13% coupon) maturing on 10 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130AXGS16), floating rate (SOFR + 16.0 bp) maturing on 20 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$400m Bond (US3130AXGB80), floating rate (SOFR + 16.0 bp) maturing on 10 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AAA): US$700m Bond (US3130AXGM46), floating rate (SOFR + 16.0 bp) maturing on 20 October 2025, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Senior Note (US3134H1FE85), fixed rate (6.00% coupon) maturing on 16 October 2026, priced at 100.00 (original spread of 147 bp), callable (3nc3m)

- Fox Corp (Service - Other | New York City, United States | Rating: BBB): US$1,250m Senior Note (US35137LAN55), fixed rate (6.50% coupon) maturing on 13 October 2033, priced at 99.20 (original spread of 190 bp), callable (10nc10)

- Kimco Realty OP LLC (Financial - Other | Jericho, New York, United States | Rating: BBB+): US$500m Senior Note (US49446RBB42), fixed rate (6.40% coupon) maturing on 1 March 2034, priced at 99.59 (original spread of 222 bp), callable (10nc10)

- Public Service Enterprise Group Inc (Utility - Other | Newark, New Jersey, United States | Rating: BBB): US$400m Senior Note (US744573AX43), fixed rate (6.13% coupon) maturing on 15 October 2033, priced at 99.72 (original spread of 204 bp), callable (10nc10)

- Public Service Enterprise Group Inc (Utility - Other | Newark, New Jersey, United States | Rating: BBB): US$600m Senior Note (US744573AW69), fixed rate (5.88% coupon) maturing on 15 October 2028, priced at 99.89 (original spread of 166 bp), callable (5nc5)

- Rivian (Automotive Manufacturer | Irvine, California, United States | Rating: NR): US$1,500m Bond (US76954AAC71), fixed rate (3.63% coupon) maturing on 15 October 2030, priced at 100.00, non callable, convertible

- UL Solutions Inc (Financial - Other | Illinois, United States | Rating: BBB): US$300m Senior Note (US903731AA58), fixed rate (6.50% coupon) maturing on 20 October 2028, priced at 99.87 (original spread of 185 bp), callable (5nc5)

RECENT INTERNATIONAL USD BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): US$750m Note (US00084DBC39), fixed rate (6.58% coupon) maturing on 13 October 2026, priced at 100.00, callable (3nc2)

- Alpha Star Holding VIII Ltd (Financial - Other | Dubai, Dubai, Cayman Islands | Rating: NR): US$300m Islamic Sukuk (Hybrid) (XS2701661303), fixed rate (8.38% coupon) maturing on 12 April 2027, priced at 100.00 (original spread of 397 bp), non callable

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$950m Senior Note (US02665WEQ06), fixed rate (5.80% coupon) maturing on 3 October 2025, priced at 99.91 (original spread of 86 bp), with a make whole call

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$300m Senior Note (US02665WES61), floating rate (SOFRINDX + 79.0 bp) maturing on 3 October 2025, priced at 100.00, non callable

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): US$500m Senior Note (US02665WER88), fixed rate (5.85% coupon) maturing on 4 October 2030, priced at 99.89 (original spread of 154 bp), with a make whole call

- Amwaj Ltd (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$220m Unsecured Note (XS2703963640), fixed rate (7.75% coupon) maturing on 18 April 2035, priced at 100.00, non callable

- Aviation Capital Group LLC (Leasing | Newport Beach, California, Japan | Rating: BBB): US$500m Senior Note (USU0536PAL86), fixed rate (6.75% coupon) maturing on 25 October 2028, priced at 99.12 (original spread of 256 bp), callable (5nc5)

- Bank of Montreal (Toronto Branch) (Banking | Toronto, Ontario, Canada | Rating: NR): US$120m Senior Note (XS2697459670), floating rate (SOFR + 122.0 bp) maturing on 12 October 2028, non callable

- Bhinneka Holding (Financial - Other | George Town, Grand Cayman, Cayman Islands | Rating: NR): US$150m Bond (XS2593090421), fixed rate (5.00% coupon) maturing on 6 October 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$200m Index Linked Security (XS0460107443), floating rate maturing on 22 December 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$500m Note (XS0460082513), fixed rate (5.10% coupon) maturing on 3 November 2025, priced at 100.00, non callable

- Diageo Capital PLC (Financial - Other | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$800m Senior Note (US25243YBK47), fixed rate (5.38% coupon) maturing on 5 October 2026, priced at 99.73 (original spread of 85 bp), callable (3nc3)

- Diageo Capital PLC (Financial - Other | Edinburgh, Midlothian, United Kingdom | Rating: A-): US$900m Senior Note (US25243YBN85), fixed rate (5.63% coupon) maturing on 5 October 2033, priced at 99.63 (original spread of 138 bp), callable (10nc10)

- Emirates NBD Bank PJSC (Banking | Dubai, Dubai, United Arab Emirates | Rating: A): US$750m Senior Note (XS2625209270), fixed rate (5.88% coupon) maturing on 11 October 2028, priced at 99.88 (original spread of 146 bp), non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$1,250m Senior Note (US50046PCE34), fixed rate (5.13% coupon) maturing on 12 May 2026, priced at 99.94 (original spread of 23 bp), non callable

- Korea Investment & Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: BBB): US$5,000m Unsecured Note (XS2703610050), fixed rate (5.50% coupon) maturing on 9 November 2026, priced at 100.00, non callable

- Natwest Markets Secured Funding DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$350m Unsecured Note (XS2702458899), floating rate maturing on 22 December 2033, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A+): US$104m Index Linked Security (US78016NL540) zero coupon maturing on 6 November 2025, priced at 100.00, non callable

- Ubs Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$138m Certificate of Deposit - Retail (US90355GGR11), fixed rate (5.10% coupon) maturing on 5 October 2026, priced at 100.00 (original spread of 46 bp), non callable

- Ubs Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$148m Certificate of Deposit - Retail (US90355GGQ38), fixed rate (5.35% coupon) maturing on 6 October 2025, priced at 100.00 (original spread of 40 bp), non callable

- Uzbekistan, Republic of (Government) (Sovereign | Tashkent, Uzbekistan | Rating: BB-): US$660m Senior Note (XS2701166717), fixed rate (7.85% coupon) maturing on 12 October 2028, priced at 98.89 (original spread of 376 bp), non callable

- Uzbekistan, Republic of (Government) (Sovereign | Tashkent, Uzbekistan | Rating: BB-): US$500m Senior Note (XS2701167012), fixed rate (6.00% coupon) maturing on 10 October 2033, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- Aena SME SA (Airline | Madrid, Madrid, Spain | Rating: A-): €500m Senior Note (ES0205046008), fixed rate (4.25% coupon) maturing on 13 October 2030, priced at 99.62 (original spread of 156 bp), callable (7nc7)

- Azerion Group NV (Publishing | Schiphol-Rijk, Noord-Holland, Netherlands | Rating: NR): €165m Bond (NO0013017657), floating rate (EU03MLIB + 675.0 bp) maturing on 2 October 2026, callable (3nc2)

- Bouygues SA (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €200m Bond (FR001400L8B1), fixed rate (0.50% coupon) maturing on 11 February 2030, priced at 79.88 (original spread of 145 bp), non callable

- Bouygues SA (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €250m Bond (FR001400L8A3), fixed rate (1.38% coupon) maturing on 7 June 2027, priced at 91.45 (original spread of 108 bp), non callable

- Bupa Finance PLC (Financial - Other | London, United Kingdom | Rating: BBB+): €500m Senior Note (XS2690050682), fixed rate (5.00% coupon) maturing on 12 October 2030, priced at 99.76 (original spread of 224 bp), callable (7nc7)

- Carmila SA (Service - Other | Boulogne-Billancourt, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400L1E0), fixed rate (5.50% coupon) maturing on 9 October 2028, priced at 99.47 (original spread of 314 bp), callable (5nc5)

- Compagnie de Financement Foncier SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €500m Covered Bond (Other) (FR001400L933), fixed rate (3.63% coupon) maturing on 16 January 2029, priced at 99.47 (original spread of 100 bp), non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €200m Bond (IT0005566101), fixed rate (4.00% coupon) maturing on 31 October 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: AA-): €400m Bond (IT0005566424), floating rate (EU06MLIB + 0.0 bp) maturing on 5 October 2028, priced at 100.00, non callable

- DZ Privatbank SA (Banking | Strassen, Germany | Rating: A+): €250m Unsecured Note (XS2703169214), fixed rate (1.00% coupon) maturing on 15 December 2027, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKT9), floating rate maturing on 6 November 2026, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VKQ5), fixed rate (3.70% coupon) maturing on 3 November 2025, priced at 100.00, non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: NR): €2,500m Senior Note (EU000A2SCAL3), fixed rate (3.50% coupon) maturing on 11 April 2029, priced at 99.77 (original spread of 75 bp), non callable

- Guala CLOsures SpA (Containers | Milan, Milano, United Kingdom | Rating: B+): €350m Note (XS2702257051), floating rate (EU03MLIB + 400.0 bp) maturing on 29 June 2029, priced at 99.00, callable (6nc1)

- Hamburger Sparkasse AG (Banking | Hamburg, Hamburg, Germany | Rating: AA-): €500m Inhaberschuldverschreibung (DE000A3515S3), fixed rate (4.38% coupon) maturing on 12 February 2029, priced at 99.75 (original spread of 167 bp), non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €2,000m Bond (IT0005566911), floating rate (EU03MLIB + 55.0 bp) maturing on 12 January 2028, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,750m Bond (IT0005567117), floating rate (EU03MLIB + 65.0 bp) maturing on 12 October 2032, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,750m Bond (IT0005566903), floating rate (EU03MLIB + 36.0 bp) maturing on 12 July 2026, priced at 100.00, non callable

- Kookmin Bank (Banking | Seoul, Seoul, South Korea | Rating: A): €500m Covered Bond (Other) (XS2681940370), fixed rate (4.00% coupon) maturing on 13 April 2027, priced at 99.78 (original spread of 124 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €400m Inhaberschuldverschreibung (DE000LB4LDX8), fixed rate (3.20% coupon) maturing on 10 November 2025, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB52J7), fixed rate (3.30% coupon) maturing on 15 November 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB52K5), fixed rate (3.50% coupon) maturing on 15 November 2028, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB52H1), fixed rate (3.00% coupon) maturing on 17 November 2025, priced at 100.00, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €500m Note (XS2702300836), fixed rate (3.68% coupon) maturing on 12 October 2043, priced at 100.00, non callable

- MBH Bank Nyrt (Banking | Budapest, Budapest, Hungary | Rating: NR): €300m Unsecured Note (XS2701655677), fixed rate (8.00% coupon) maturing on 16 October 2026, priced at 100.00, non callable

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): €500m Unsecured Note (XS2702856514), floating rate maturing on 13 October 2025, priced at 100.00, non callable

- Raiffeisen Bank SA (Banking | Bucuresti, Bucuresti, Austria | Rating: BBB): €300m Note (XS2700245561), floating rate maturing on 12 October 2027, priced at 100.00 (original spread of 411 bp), callable (4nc3)

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A): €250m Inhaberschuldverschreibung (AT000B130232), fixed rate (4.00% coupon) maturing on 28 November 2025, priced at 100.00, non callable

- Societe Nationale SNCF SA (Agency | Saint-Denis, Ile-De-France, France | Rating: AA-): €250m Bond (FR001400L5O0), fixed rate (3.13% coupon) maturing on 2 November 2027, priced at 98.14 (original spread of 25 bp), non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): €119m Senior Note (XS2702840351), fixed rate (3.98% coupon) maturing on 13 October 2033, priced at 100.48, non callable

- Valeo SE (Vehicle Parts | Paris, France | Rating: BBB-): €600m Bond (FR001400L9Q7), fixed rate (5.88% coupon) maturing on 12 April 2029, priced at 99.89 (original spread of 316 bp), callable (6nc5)

RECENT LOANS

- ARA USH Investment Holding LLC (United States of America), signed a US$ 199m Term Loan, to be used for general corporate purposes. It matures on 09/30/26.

- Adevinta ASA (Norway | BB-), signed a US$ 4,000m Term Loan, to be used for leveraged buyout.

- Altice France SA (France | B-), signed a € 800m Term Loan B, to be used for refin/ret bank debt. It matures on 10/29/27 and initial pricing is set at EURIBOR +500.0bp

- Aramsco Inc (United States of America | B-), signed a US$ 430m Term Loan B, to be used for 126. It matures on 10/05/30 and initial pricing is set at Term SOFR +475.0bp

- BJ's Wholesale Club Inc (United States of America | BBB-), signed a US$ 400m Term Loan B, to be used for general corporate purposes. It matures on 02/05/29 and initial pricing is set at Term SOFR +225.0bp

- Bocom Leasing Mgmt Hong Kong (Hong Kong | A-), signed a US$ 120m Term Loan, to be used for general corporate purposes and working capital. It matures on 09/30/26.

- CK Hutchison Grp Telecom Fin (Luxembourg | A-), signed a € 1,500m Term Loan, to be used for refin/ret bank debt. It matures on 09/27/24.

- DXP Enterprises Inc (United States of America | B), signed a US$ 550m Term Loan B, to be used for general corporate purposes. It matures on 10/05/30 and initial pricing is set at Term SOFR +475.0bp

- Eiffage SA (France), signed a US$ 147m Term Loan, to be used for capital expenditures.

- Energo Pro Hydropower Plnt Pfl (Czech Republic), signed a € 300m Bridge Loan, to be used for project finance. It matures on 09/28/24.

- Fincantieri SpA (Italy), signed a € 800m Term Loan, to be used for general corporate purposes. It matures on 09/27/28.

- GFL Environmental Corp (Canada), signed a US$ 729m Term Loan B, to be used for general corporate purposes. It matures on 05/31/27 and initial pricing is set at Term SOFR +250.0bp

- Infinisource Inc (United States of America | B), signed a US$ 550m Term Loan B, to be used for general corporate purposes. It matures on 10/10/30 and initial pricing is set at Term SOFR +425.0bp

- Lango Real Estate (Mauritius), signed a US$ 325m Term Loan, to be used for general corporate purposes.

- Neuberger Berman Family (United States of America), signed a US$ 850m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/28/28 and initial pricing is set at Term SOFR +100.0bp

- Odyssee Investissement SASU (France), signed a € 175m Term Loan B, to be used for general corporate purposes. It matures on 10/31/28 and initial pricing is set at EURIBOR +375.0bp

- PAI Partners SAS (France), signed a US$ 640m Term Loan B, to be used for acquisition financing. It matures on 09/30/30 and initial pricing is set at Term SOFR +475.0bp

- PTA BANK (Burundi), signed a US$ 150m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/28/25.

- PTA BANK (Burundi), signed a US$ 150m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/28/26.

- Phoenix Tower Intl LLC (United States of America), signed a € 700m Term Loan, to be used for general corporate purposes, working capital and capital expenditures. It matures on 09/29/30.

- Phoenix Tower Intl LLC (United States of America), signed a € 400m Delayed Draw Term Loan, to be used for general corporate purposes, working capital, and capital expenditures. It matures on 09/29/30.

- PowerSchool (United States of America), signed a US$ 840m Term Loan B, to be used for general corporate purposes. It matures on 08/01/27 and initial pricing is set at Term SOFR +325.0bp

- SYNLAB International GmbH (Germany), signed a € 1,400m Term Loan, to be used for leveraged buyout.

- Star Leasing Co LLC (United States of America), signed a US$ 750m Revolving Credit Facility, to be used for acquisition financing. It matures on 10/27/27.

- Trafigura Pte Ltd (Singapore), signed a US$ 500m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 09/27/26.

- Vier Gas Transport GmbH (Germany | BBB+), signed a € 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/27/28.

- WeddingWire Inc (United States of America | B), signed a US$ 765m Term Loan B, to be used for general corporate purposes. It matures on 01/28/28 and initial pricing is set at Term SOFR +450.0bp

- Worthington Industries Inc (United States of America | BBB), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes, working capital and capital expenditures. It matures on 09/27/28 and initial pricing is set at Term SOFR +162.5bp

RECENT STRUCTURED CREDIT

- Cvc Cordatus Loan Fund Xxix issued a floating-rate CLO in 6 tranches, for a total of € 357 m. Highest-rated tranche offering a spread over the floating rate of 168bp, and the lowest-rated tranche a spread of 761bp. Bookrunners: BNP Paribas SA

- Invesco Euro CLO XI DAC issued a floating-rate CLO in 9 tranches, for a total of € 415 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 963bp. Bookrunners: Goldman Sachs International

- Mariner Finance Issuance Trust 2023-A issued a fixed-rate ABS backed by consumer loan in 5 tranches, for a total of US$ 299 m. Highest-rated tranche offering a yield to maturity of 6.73%, and the lowest-rated tranche a yield to maturity of 11.43%. Bookrunners: Goldman Sachs & Co, Citigroup Global Markets Inc, BMO Capital Markets

- Palmer Square European CLO 2023-2 Designated Activity Co issued a floating-rate CLO in 7 tranches, for a total of € 420 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 765bp. Bookrunners: Barclays Capital Group

- Wilton Park CLO Designated Activity Company issued a floating-rate CLO in 7 tranches, for a total of € 417 m. Highest-rated tranche offering a spread over the floating rate of 170bp, and the lowest-rated tranche a spread of 756bp. Bookrunners: Morgan Stanley International Ltd