Credit

Cash Spreads Tightened Slightly While Payer Skew In CDX Swaptions Pushed Up By Geopolitical Risk

Limited USD bond supply as 3Q23 earnings season kicks off: 14 tranches for $13.25bn in IG (2023 YTD volume US$1.027trn vs 2022 YTD US$1.031trn), 4 tranches for $2.705bn in HY (2023 YTD volume US$137.436bn vs 2022 YTD US$87.661bn)

Published ET

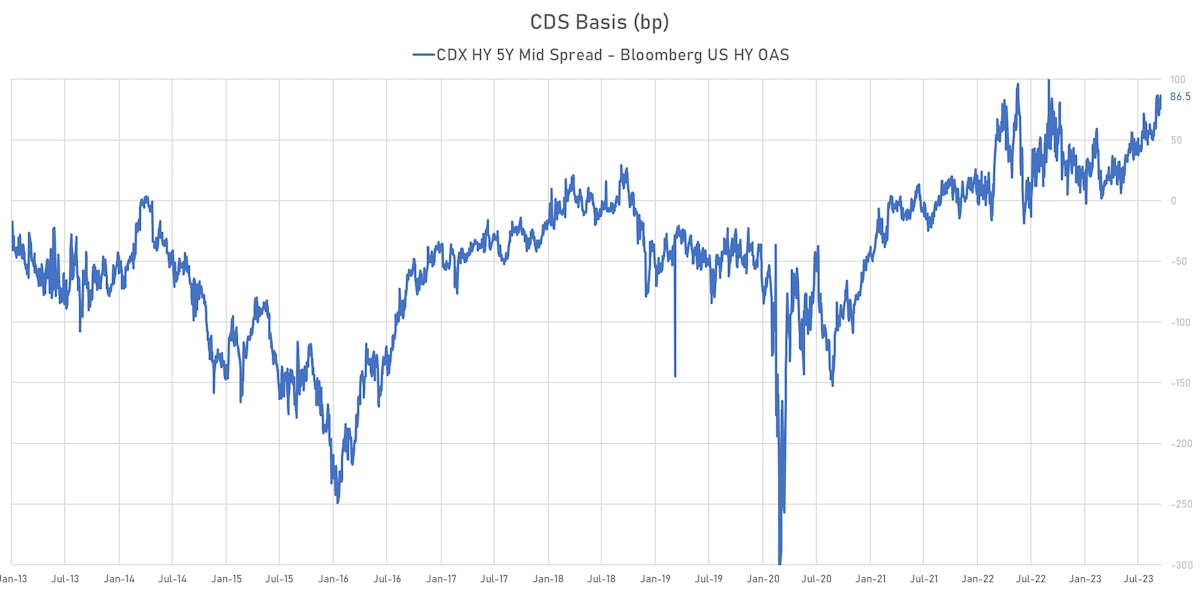

Spread Between CDX HY 5Y and Bloomberg USD HY cash index | Sources: phipost.com, Refinitiv data

DAILY SUMMARY

- S&P 500 Bond Index was up 0.54% today, with investment grade up 0.57% and high yield up 0.22% (YTD total return: +0.14%)

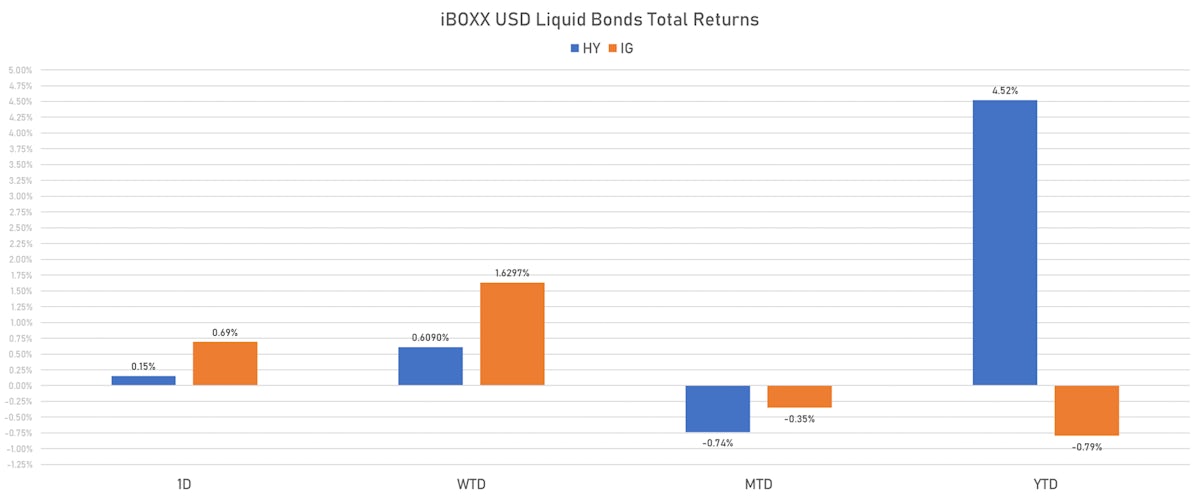

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.691% today (Week-to-date: 1.63%; Month-to-date: -0.35%; Year-to-date: -0.79%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.152% today (Week-to-date: 0.61%; Month-to-date: -0.74%; Year-to-date: 4.52%)

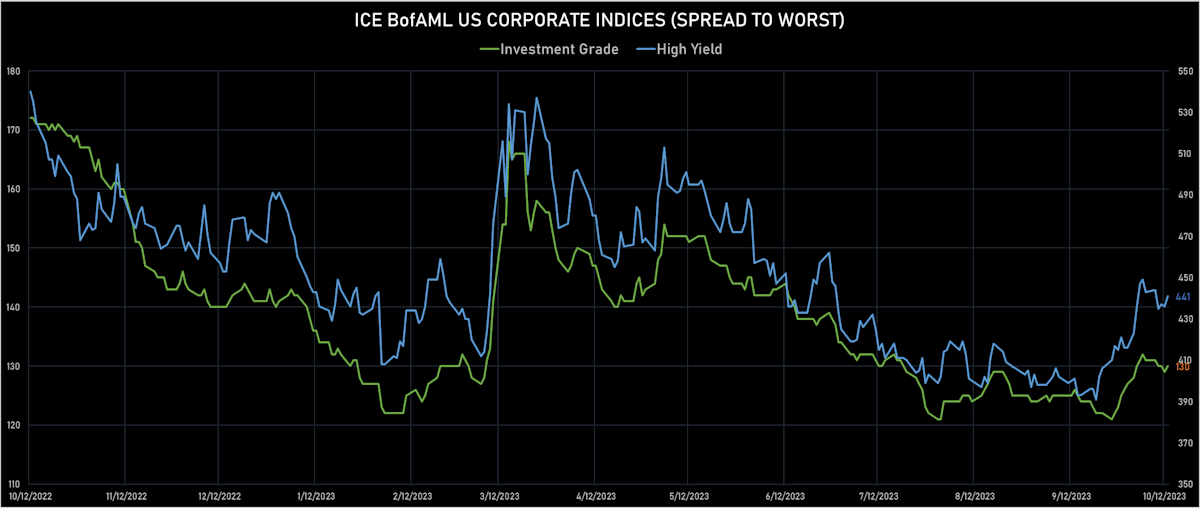

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 130.0 bp (WTD change: -1.0 bp; YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 441.0 bp (WTD change: -2.0 bp; YTD change: -47.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +9.8%)

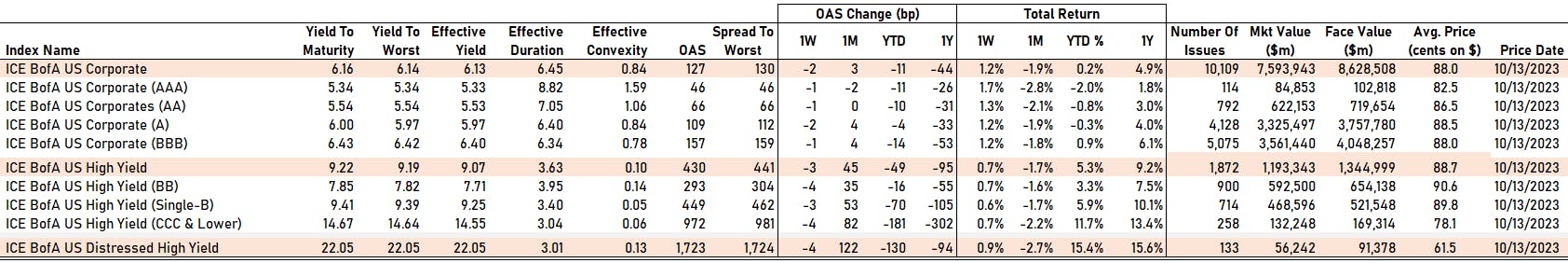

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -1 bp at 46 bp

- AA down by -1 bp at 66 bp

- A down by -2 bp at 109 bp

- BBB down by -1 bp at 157 bp

- BB down by -4 bp at 293 bp

- B down by -3 bp at 449 bp

- ≤ CCC down by -4 bp at 972 bp

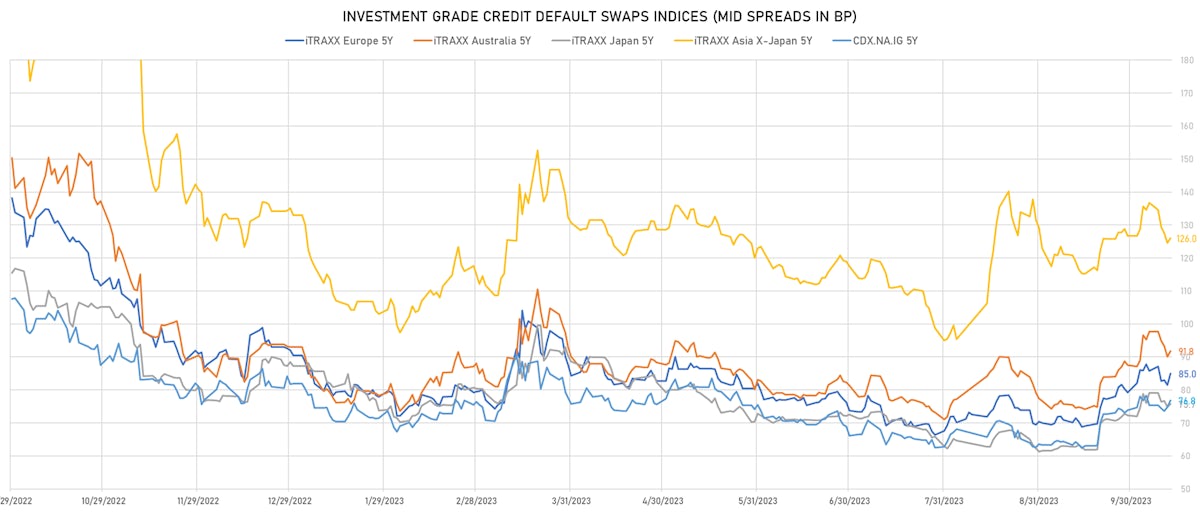

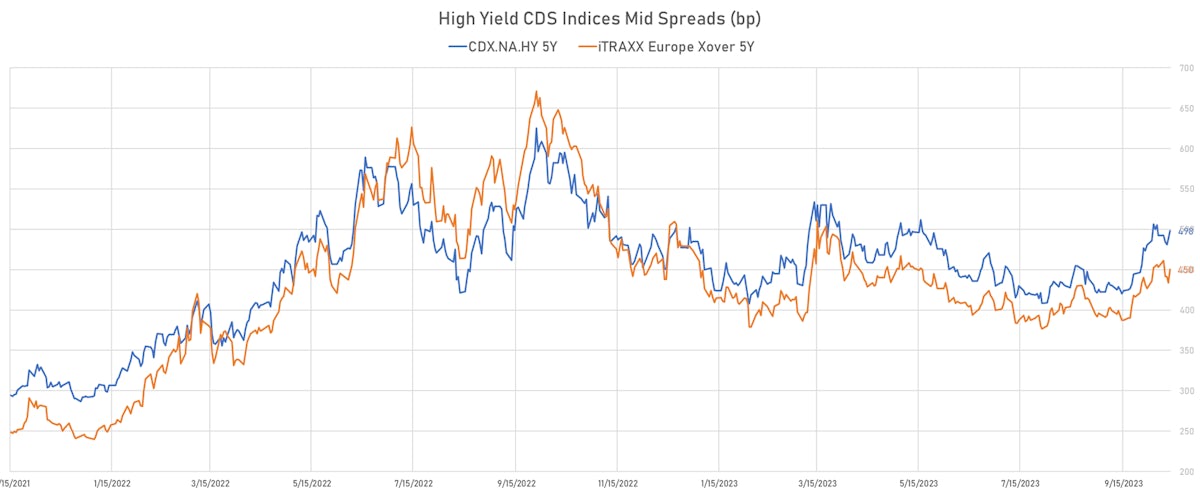

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.0 bp, now at 77bp (1W change: +1.5bp; YTD change: -5.1bp)

- Markit CDX.NA.IG 10Y up 1.9 bp, now at 116bp (1W change: +1.5bp; YTD change: -2.3bp)

- Markit CDX.NA.HY 5Y up 10.4 bp, now at 498bp (1W change: +6.0bp; YTD change: +13.6bp)

- Markit iTRAXX Europe 5Y up 3.5 bp, now at 85bp (1W change: -0.8bp; YTD change: -5.5bp)

- Markit iTRAXX Europe Crossover 5Y up 16.6 bp, now at 450bp (1W change: -2.8bp; YTD change: -23.7bp)

- Markit iTRAXX Japan 5Y up 0.9 bp, now at 76bp (1W change: -3.4bp; YTD change: -11.5bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 1.5 bp, now at 126bp (1W change: -10.7bp; YTD change: -7.0bp)

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Israel (rated A+): up 84.7 % to 100 bp (1Y range: 32-104bp)

- Qatar (rated AA-): up 55.1 % to 63 bp (1Y range: 32-65bp)

- Saudi Arabia (rated A+): up 31.8 % to 73 bp (1Y range: 45-75bp)

- Egypt (rated B): up 7.0 % to 1,850 bp (1Y range: 706-1,850bp)

- Mexico (rated BBB-): down 6.0 % to 126 bp (1Y range: 96-199bp)

- Chile (rated A-): down 6.4 % to 76 bp (1Y range: 54-174bp)

- Brazil (rated BB): down 6.4 % to 183 bp (1Y range: 161-305bp)

- China (rated A+): down 6.6 % to 82 bp (1Y range: 47-132bp)

- Colombia (rated BB+): down 6.7 % to 246 bp (1Y range: 197-394bp)

- Philippines (rated BBB): down 6.8 % to 85 bp (1Y range: 66-148bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Liberty Interactive LLC (Country: US; rated: CCC+): down 20548.1 bp to .0bp (1Y range: -4,305bp)

- Staples Inc (Country: US; rated: B3): down 207.3 bp to 4,923.1bp (1Y range: 1,411-4,923bp)

- Pitney Bowes Inc (Country: US; rated: NR): down 83.4 bp to 1,265.5bp (1Y range: 747-1,627bp)

- Nabors Industries Inc (Country: US; rated: BB-): down 56.7 bp to 561.0bp (1Y range: 390-766bp)

- Transocean Inc (Country: KY; rated: Caa1): down 47.1 bp to 523.4bp (1Y range: 393-1,566bp)

- Gap Inc (Country: US; rated: NR): down 37.9 bp to 492.0bp (1Y range: 407-732bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): down 27.5 bp to 528.9bp (1Y range: 428-760bp)

- Avis Budget Group Inc (Country: US; rated: Discontinued): down 24.4 bp to 430.5bp (1Y range: 316-558bp)

- DISH DBS Corp (Country: US; rated: Caa1): down 23.9 bp to 2,197.9bp (1Y range: 1,138-3,084bp)

- Domtar Corp (Country: US; rated: LGD3 - 40%): down 21.5 bp to 1,051.2bp (1Y range: 511-1,051bp)

- Petroleos Mexicanos (Country: MX; rated: B1): down 21.2 bp to 672.8bp (1Y range: 469-768bp)

- Murphy Oil Corp (Country: US; rated: A1): down 19.5 bp to 173.0bp (1Y range: 139-334bp)

- Carnival Corp (Country: US; rated: Ba2): up 27.2 bp to 677.6bp (1Y range: 446-2,097bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: Ba3): up 30.2 bp to 371.3bp (1Y range: 269-1,117bp)

- Tenet Healthcare Corp (Country: US; rated: LGD3 - 45%): up 36.9 bp to 379.2bp (1Y range: 246-590bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WR): down 93.3 bp to 559.8bp (1Y range: 486-1,192bp)

- Boparan Finance PLC (Country: GB; rated: Caa1): down 59.7 bp to 1,949.1bp (1Y range: 1,286-2,910bp)

- Telecom Italia SpA (Country: IT; rated: NR): down 22.9 bp to 303.8bp (1Y range: 274-545bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 22.5 bp to 597.2bp (1Y range: 186-597bp)

- ArcelorMittal SA (Country: LU; rated: WD): down 19.2 bp to 206.5bp (1Y range: 181-232bp)

- Renault SA (Country: FR; rated: BB): down 18.9 bp to 269.4bp (1Y range: 219-411bp)

- Volvo Car AB (Country: SE; rated: WR): down 18.1 bp to 259.9bp (1Y range: 251-292bp)

- Glencore International AG (Country: CH; rated: WR): down 15.6 bp to 168.4bp (1Y range: 138-230bp)

- Hammerson PLC (Country: GB; rated: NR): down 14.0 bp to 243.5bp (1Y range: 241-474bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 10.4 bp to 458.7bp (1Y range: 379-602bp)

- Alstom SA (Country: FR; rated: P-3): up 13.6 bp to 239.4bp (1Y range: 109-310bp)

- Deutsche Lufthansa AG (Country: DE; rated: NR): up 14.5 bp to 255.9bp (1Y range: 183-496bp)

- Fresenius SE & Co KGaA (Country: DE; rated: BBB-): up 16.2 bp to 161.6bp (1Y range: 126-221bp)

- Air France KLM SA (Country: FR; rated: B-): up 24.7 bp to 432.1bp (1Y range: 347-918bp)

- Altice Finco SA (Country: LU; rated: Caa2): up 112.9 bp to 826.5bp (1Y range: 401-1,021bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 4.75% | Maturity: 15/7/2027 | Rating: BB | CUSIP: 38869AAA5 | OAS up by 30.3 bp to 205.9 bp, with the yield to worst at 6.7% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 92.9-97.0).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 7.38% | Maturity: 15/11/2031 | Rating: BB+ | CUSIP: 337932AC1 | OAS down by 26.4 bp to 163.2 bp (CDS basis: -38.6bp), with the yield to worst at 5.9% and the bond now trading up to 108.6 cents on the dollar (1Y price range: 106.4-117.4).

- Issuer: Crown Americas LLC (Philadelphia, Pennsylvania (US)) | Coupon: 4.25% | Maturity: 30/9/2026 | Rating: BB | CUSIP: 22819KAB6 | OAS down by 26.6 bp to 152.3 bp, with the yield to worst at 6.2% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 92.1-97.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.95% | Maturity: 10/6/2026 | Rating: BB+ | CUSIP: 345397D26 | OAS down by 30.6 bp to 186.2 bp (CDS basis: -74.4bp), with the yield to worst at 6.8% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 47.1-101.4).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.00% | Maturity: 1/10/2025 | Rating: BB | CUSIP: 81725WAJ2 | OAS down by 32.2 bp to 185.8 bp, with the yield to worst at 6.4% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 96.3-99.6).

- Issuer: Howmet Aerospace Inc (Pittsburgh, United States) | Coupon: 5.90% | Maturity: 1/2/2027 | Rating: BB+ | CUSIP: 013817AJ0 | OAS down by 32.5 bp to 198.9 bp, with the yield to worst at 6.2% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 96.8-102.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.39% | Maturity: 8/1/2026 | Rating: BB+ | CUSIP: 345397XU2 | OAS down by 34.3 bp to 233.1 bp (CDS basis: -94.5bp), with the yield to worst at 7.0% and the bond now trading up to 94.4 cents on the dollar (1Y price range: 64.5-97.3).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB | CUSIP: 81725WAH6 | OAS down by 40.2 bp to 151.5 bp, with the yield to worst at 6.3% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.70% | Maturity: 10/8/2026 | Rating: BB+ | CUSIP: 345397B77 | OAS down by 43.3 bp to 205.0 bp (CDS basis: -84.4bp), with the yield to worst at 6.9% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 36.0-90.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | CUSIP: 77340RAS6 | OAS down by 45.6 bp to 240.1 bp, with the yield to worst at 7.2% and the bond now trading up to 93.8 cents on the dollar (1Y price range: 91.8-95.0).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 501797AU8 | OAS down by 46.2 bp to 201.8 bp, with the yield to worst at 6.5% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 103.0-108.0).

- Issuer: Crown Cork & Seal Company Inc (Philadelphia, Pennsylvania (US)) | Coupon: 7.38% | Maturity: 15/12/2026 | Rating: BB- | CUSIP: 228255AH8 | OAS down by 49.5 bp to 231.8 bp, with the yield to worst at 6.6% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 100.0-106.0).

- Issuer: DPL Inc (Dayton, Ohio (US)) | Coupon: 4.35% | Maturity: 15/4/2029 | Rating: BB | CUSIP: 233293AQ2 | OAS down by 74.0 bp to 326.4 bp (CDS basis: 9.8bp), with the yield to worst at 7.8% and the bond now trading up to 84.0 cents on the dollar (1Y price range: 80.6-92.3).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS down by 81.5 bp to 74.2 bp (CDS basis: -47.8bp), with the yield to worst at 5.8% and the bond now trading up to 91.0 cents on the dollar (1Y price range: 41.6-92.6).

- Issuer: Qwest Corp (Monroe, Louisiana (US)) | Coupon: 7.25% | Maturity: 15/9/2025 | Rating: B- | CUSIP: 912920AK1 | OAS down by 97.5 bp to 488.4 bp, with the yield to worst at 9.1% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 80.9-102.7).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: B+ | ISIN: XS2270393379 | OAS up by 29.3 bp to 402.2 bp (CDS basis: -167.1bp), with the yield to worst at 7.0% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 84.3-90.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS down by 27.8 bp to 265.3 bp, with the yield to worst at 6.0% and the bond now trading up to 89.4 cents on the dollar (1Y price range: 83.7-92.3).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | OAS down by 28.9 bp to 244.9 bp, with the yield to worst at 5.6% and the bond now trading up to 92.9 cents on the dollar (1Y price range: 85.3-94.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS down by 29.2 bp to 274.1 bp (CDS basis: -23.2bp), with the yield to worst at 5.8% and the bond now trading up to 87.0 cents on the dollar (1Y price range: 82.0-87.9).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.13% | Maturity: 30/4/2029 | Rating: BB+ | ISIN: XS2332590475 | OAS down by 29.4 bp to 252.1 bp, with the yield to worst at 5.6% and the bond now trading up to 83.0 cents on the dollar (1Y price range: 78.0-86.6).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | OAS down by 31.3 bp to 207.7 bp, with the yield to worst at 5.6% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 85.9-92.9).

- Issuer: Iliad SA (Paris, France) | Coupon: 1.88% | Maturity: 11/2/2028 | Rating: BB | ISIN: FR0014001YB0 | OAS down by 31.8 bp to 280.9 bp, with the yield to worst at 6.0% and the bond now trading up to 84.1 cents on the dollar (1Y price range: 80.0-87.3).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | OAS down by 32.3 bp to 262.7 bp, with the yield to worst at 5.9% and the bond now trading up to 87.3 cents on the dollar (1Y price range: 81.4-89.8).

- Issuer: Standard Building Solutions Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | OAS down by 36.0 bp to 301.4 bp, with the yield to worst at 6.0% and the bond now trading up to 88.3 cents on the dollar (1Y price range: 84.3-89.4).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.88% | Maturity: 15/2/2026 | Rating: BB+ | ISIN: FR0013318102 | OAS down by 36.0 bp to 126.9 bp, with the yield to worst at 4.7% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 93.7-97.4).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS down by 36.7 bp to 277.0 bp (CDS basis: 16.8bp), with the yield to worst at 6.0% and the bond now trading up to 96.1 cents on the dollar (1Y price range: 85.3-98.1).

- Issuer: Iliad SA (Paris, France) | Coupon: 5.38% | Maturity: 14/6/2027 | Rating: BB | ISIN: FR001400EJI5 | OAS down by 38.1 bp to 263.4 bp, with the yield to worst at 5.6% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 95.5-101.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 7.88% | Maturity: 31/7/2028 | Rating: B+ | ISIN: XS2637954582 | OAS down by 38.4 bp to 354.2 bp (CDS basis: -79.1bp), with the yield to worst at 6.8% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 100.0-104.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 6.88% | Maturity: 15/2/2028 | Rating: B+ | ISIN: XS2581393134 | OAS down by 45.4 bp to 357.4 bp (CDS basis: -95.6bp), with the yield to worst at 6.3% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 95.9-102.7).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB+ | ISIN: XS2265369657 | OAS down by 58.8 bp to 143.2 bp (CDS basis: -11.6bp), with the yield to worst at 4.7% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 89.7-95.6).

RECENT DOMESTIC USD BOND ISSUES

- Civitas Resources Inc (Oil and Gas | Denver, Colorado, United States | Rating: B+): US$1,000m Senior Note (US17888HAC79), fixed rate (8.63% coupon) maturing on 1 November 2030, priced at 100.00 (original spread of 407 bp), callable (7nc3)

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, Texas, United States | Rating: BBB-): US$1,000m Senior Note (US29273VAT70), fixed rate (6.40% coupon) maturing on 1 December 2030, priced at 99.89 (original spread of 198 bp), callable (7nc7)

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, Texas, United States | Rating: BBB-): US$1,000m Senior Note (US29273VAR15), fixed rate (6.05% coupon) maturing on 1 December 2026, priced at 99.94 (original spread of 148 bp), callable (3nc3)

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, Texas, United States | Rating: BBB-): US$1,500m Senior Note (US29273VAU44), fixed rate (6.55% coupon) maturing on 1 December 2033, priced at 99.89 (original spread of 212 bp), callable (10nc10)

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, Texas, United States | Rating: BBB-): US$500m Senior Note (US29273VAS97), fixed rate (6.10% coupon) maturing on 1 December 2028, priced at 99.89 (original spread of 172 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$215m Bond (US3133EPYM13), fixed rate (4.75% coupon) maturing on 13 October 2027, priced at 99.93 (original spread of 26 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$500m Bond (US3133EPYR00), floating rate (SOFR + 16.0 bp) maturing on 17 October 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$160m Bond (US3133EPYT65), fixed rate (5.52% coupon) maturing on 20 October 2028, priced at 100.00, callable (5nc2)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,350m Bond (US3130AXH848), floating rate (SOFR + 16.0 bp) maturing on 14 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$500m Bond (US3130AXHC54), floating rate (SOFR + 16.0 bp) maturing on 20 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$250m Bond (US3130AXJ331), floating rate (SOFR + 16.0 bp) maturing on 16 October 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$150m Bond (US3130AXJK52), fixed rate (4.89% coupon) maturing on 1 July 2026, priced at 100.00, non callable

- General Mills Inc (Food Processors | Minneapolis, Minnesota, United States | Rating: BBB): US$500m Senior Note (US370334CW20), fixed rate (5.50% coupon) maturing on 17 October 2028, priced at 99.47 (original spread of 122 bp), callable (5nc5)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$150m Unsecured Note (XS2706174765), fixed rate (4.85% coupon) maturing on 19 October 2026, priced at 100.00 (original spread of 29 bp), non callable

- J M Smucker Co (Food Processors | Orrville, Ohio, United States | Rating: BBB): US$750m Senior Note (US832696AY47), fixed rate (6.50% coupon) maturing on 15 November 2043, priced at 99.08 (original spread of 224 bp), callable (20nc20)

- J M Smucker Co (Food Processors | Orrville, Ohio, United States | Rating: BBB): US$1,000m Senior Note (US832696AX63), fixed rate (6.20% coupon) maturing on 15 November 2033, priced at 99.94 (original spread of 188 bp), callable (10nc10)

- J M Smucker Co (Food Processors | Orrville, Ohio, United States | Rating: BBB): US$1,000m Senior Note (US832696AZ12), fixed rate (6.50% coupon) maturing on 15 November 2053, priced at 99.29 (original spread of 237 bp), callable (30nc30)

- J M Smucker Co (Food Processors | Orrville, Ohio, United States | Rating: BBB): US$750m Senior Note (US832696AW80), fixed rate (5.90% coupon) maturing on 15 November 2028, priced at 99.96 (original spread of 146 bp), callable (5nc5)

- NCL Corporation Ltd (Leisure | Miami, Florida, United States | Rating: B+): US$790m Note (US62886HBN08), fixed rate (8.13% coupon) maturing on 15 January 2029, priced at 100.00 (original spread of 393 bp), callable (5nc2)

- PagerDuty (Information/Data Technology | San Francisco, California, United States | Rating: NR): US$350m Bond (US69553PAC41), fixed rate (1.50% coupon) maturing on 15 October 2028, priced at 100.00, non callable, convertible

- Viper Energy Partners LP (Oil and Gas | Midland, Texas, United States | Rating: BB-): US$400m Senior Note (US92763MAB19), fixed rate (7.38% coupon) maturing on 1 November 2031, priced at 100.00 (original spread of 267 bp), callable (8nc3)

RECENT INTERNATIONAL USD BOND ISSUES

- Aluar Aluminio Argentino SAIC (Metals/Mining | Buenos Aires, Buenos Aires, Argentina | Rating: NR): US$138m Bond (AR0183513875), fixed rate (7.00% coupon) maturing on 12 October 2028, priced at 100.00, callable (5nc2)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): US$300m Note (USF11494BW47), floating rate (SOFR + 198.0 bp) maturing on 19 October 2027, priced at 100.00, callable (4nc3)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): US$1,350m Note (USF11494BZ77), floating rate maturing on 19 October 2034, priced at 100.00 (original spread of 265 bp), callable (11nc10)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): US$1,100m Note (US05571AAQ85), floating rate maturing on 19 October 2027, priced at 100.00 (original spread of 202 bp), callable (4nc3)

- Bpce SA (Banking | Paris, Ile-De-France, France | Rating: BBB+): US$1,250m Note (US05571AAR68), floating rate maturing on 19 October 2029, priced at 100.00 (original spread of 233 bp), callable (6nc5)

- Industrial and Commercial Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$1,000m Unsecured Note (XS2706176547), fixed rate (5.00% coupon) maturing on 26 October 2026, priced at 100.00, non callable

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$500m Senior Note (US471048CY21), fixed rate (4.88% coupon) maturing on 18 October 2028, priced at 99.62 (original spread of 55 bp), non callable

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$2,000m Senior Note (US500769KB96), fixed rate (4.75% coupon) maturing on 29 October 2030, priced at 99.72 (original spread of 19 bp), non callable

- Lseries DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$200m Unsecured Note (XS2705065261) zero coupon maturing on 24 October 2029, non callable

- Lseries DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$200m Unsecured Note (XS2707193681), floating rate maturing on 31 October 2032, priced at 100.00, non callable

- Lseries DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$500m Unsecured Note (XS2705065006) zero coupon maturing on 24 October 2029, non callable

- Nationwide Building Society (Financial - Other | Swindon, Wiltshire, United Kingdom | Rating: BBB+): US$1,250m Note (US63861WAJ45), floating rate maturing on 18 October 2027, priced at 100.00 (original spread of 210 bp), callable (4nc3)

- Newfold Digital Holdings Group Inc (Information/Data Technology | Burlington, Massachusetts | Rating: B): US$515m Note (US650929AA08), fixed rate (11.75% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 710 bp), callable (5nc2)

- Shinhan Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$213m Index Linked Security (KR6SH0005EY6) zero coupon maturing on 23 October 2026, priced at 100.00, non callable

RECENT EURO BOND ISSUES

- Achmea Bank NV (Banking | Tilburg, Noord-Brabant, Netherlands | Rating: A-): €500m Covered Bond (Other) (XS2706237513), fixed rate (3.75% coupon) maturing on 19 October 2026, priced at 99.97 (original spread of 101 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: BBB+): €2,000m Note (XS2705604234), fixed rate (4.88% coupon) maturing on 18 October 2031, priced at 99.38 (original spread of 239 bp), with a regulatory call

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: BBB+): €1,250m Note (XS2705604077), fixed rate (4.63% coupon) maturing on 18 October 2027, priced at 99.69 (original spread of 203 bp), callable (4nc3)

- Bank of China Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: A): €300m Senior Note (XS2702157855), fixed rate (4.00% coupon) maturing on 19 October 2026, priced at 99.65 (original spread of 140 bp), non callable

- Belfius Banque SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €1,000m Covered Bond (Other) (BE0002970516), fixed rate (3.63% coupon) maturing on 18 October 2028, priced at 99.92 (original spread of 99 bp), non callable

- Caisse Des Depots Et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA-): €500m Bond (FR001400LFC1), fixed rate (3.38% coupon) maturing on 25 November 2030, priced at 99.93, non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, Ile-De-France, France | Rating: NR): €750m Obligation Fonciere (Covered Bond) (FR001400LDK9), fixed rate (3.63% coupon) maturing on 17 January 2029, priced at 99.86 (original spread of 102 bp), non callable

- Cassa Depositi e Prestiti SpA (Agency | Rome, Roma, Italy | Rating: BBB): €500m Senior Note (IT0005568123), fixed rate (4.75% coupon) maturing on 18 October 2030, priced at 99.37 (original spread of 227 bp), non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400LA09), fixed rate (4.36% coupon) maturing on 10 April 2030, priced at 100.00 (original spread of 168 bp), non callable

- Danish Ship Finance A/S (Mortgage Banking | Kobenhavn K, Denmark | Rating: BBB+): €800m Saerligt Daekkede Obligation (Covered Bond) (DK0004133725), fixed rate (0.90% coupon) maturing on 19 October 2026, priced at 100.00 (original spread of -177 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJX3), fixed rate (4.35% coupon) maturing on 10 October 2028, priced at 100.00 (original spread of 118 bp), callable (5nc1)

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: BBB+): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000A31RJX7), floating rate (EU03MLIB + 20.0 bp) maturing on 16 October 2026, priced at 100.06, non callable

- European Union (Supranational | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €4,000m Senior Note (EU000A3K4EL9), fixed rate (4.00% coupon) maturing on 4 April 2044, priced at 99.79 (original spread of 97 bp), non callable

- Hamburgische Investitionsund Foerderbank (Banking | Hamburg, Hamburg, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A2LQZ91), floating rate (EU03MLIB + 5.0 bp) maturing on 15 October 2032, priced at 99.85, non callable

- Indigo Group SA (Service - Other | Puteaux, Ile-De-France, France | Rating: BBB): €650m Bond (FR001400LCK1), fixed rate (4.50% coupon) maturing on 18 April 2030, priced at 98.77 (original spread of 210 bp), callable (7nc6)

- Industrial and Commercial Bank of China Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: NR): €500m Unsecured Note (XS2706208506), fixed rate (4.00% coupon) maturing on 24 October 2026, priced at 100.00, non callable

- J&T Banka as (Banking | Praha 8 - Karlin, Praha, Czech Republic | Rating: NR): €300m Unsecured Note (XS2705065188), fixed rate (4.00% coupon) maturing on 18 October 2026, priced at 100.00, non callable

- Jefferies Financial Group Inc (Financial - Other | New York City, New York, United States | Rating: BBB): €10,000m Unsecured Note (XS2704594717), fixed rate (5.02% coupon) maturing on 17 October 2033, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB52U4), fixed rate (2.60% coupon) maturing on 28 May 2027, priced at 100.00, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €225m Inhaberschuldverschreibung (DE000HLB52V2), fixed rate (2.90% coupon) maturing on 30 May 2028, priced at 100.00, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €500m Senior Note (XS2702300836), fixed rate (3.68% coupon) maturing on 12 October 2043, priced at 100.00 (original spread of 73 bp), non callable

- MBH Bank Nyrt (Banking | Budapest, Budapest, Hungary | Rating: NR): €350m Note (XS2701655677), floating rate maturing on 19 October 2027, priced at 100.00 (original spread of 580 bp), callable (4nc3)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): €500m Unsecured Note (XS2706264087), floating rate maturing on 20 October 2025, priced at 100.00, non callable

- Nationale Nederlanden Bank NV (Banking | S-Gravenhage, Zuid-Holland, Netherlands | Rating: A-): €750m Covered Bond (Other) (NL0015001R87), fixed rate (3.63% coupon) maturing on 16 October 2026, priced at 99.87 (original spread of 97 bp), non callable

- Region of Bruxelles-Capitale (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €200m Bond (BE0002968494), fixed rate (4.44% coupon) maturing on 31 October 2068, priced at 100.00, non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): €150m Senior Note (XS2671235609), floating rate maturing on 25 April 2039, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €500m Covered Bond (Other) (XS2698464885), fixed rate (4.09% coupon) maturing on 19 April 2028, priced at 100.00 (original spread of 142 bp), non callable

- Thales SA (Electronics | Courbevoie, Ile-De-France, France | Rating: A): €600m Bond (FR001400L263), fixed rate (4.25% coupon) maturing on 18 October 2031, priced at 99.14 (original spread of 168 bp), callable (8nc8)

- Thales SA (Electronics | Courbevoie, Ile-De-France, France | Rating: A): €600m Bond (FR001400L255), fixed rate (4.13% coupon) maturing on 18 October 2028, priced at 99.61 (original spread of 153 bp), callable (5nc5)

- Thales SA (Electronics | Courbevoie, Ile-De-France, France | Rating: A): €600m Bond (FR001400L248), fixed rate (4.00% coupon) maturing on 18 October 2025, priced at 99.78 (original spread of 93 bp), callable (2nc2)

- UniCredit Bank Hungary Zrt (Banking | Budapest, Budapest, Italy | Rating: NR): €280m Note (XS2702168621), floating rate (EU03MLIB + 442.0 bp) maturing on 19 October 2029, priced at 100.00, callable (6nc5)

RECENT LOANS

- APi Group Corp (United States of America | BB-), signed a US$ 985m Term Loan B, to be used for general corporate purposes. It matures on 01/03/29 and initial pricing is set at Term SOFR +250.0bp

- APi Group Corp (United States of America | BB-), signed a US$ 1,027m Term Loan B, to be used for general corporate purposes. It matures on 01/04/29 and initial pricing is set at Term SOFR +225.0bp

- AmerisourceBergen Corp (United States of America | BBB+), signed a US$ 2,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/06/28 and initial pricing is set at Term SOFR +80.5bp

- Bunge Finance Europe (Netherlands | BBB), signed a US$ 1,750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/06/26.

- City Green Light Srl (Italy), signed a € 200m Term Loan, to be used for capital expenditures. It matures on 10/04/30.

- Delfingen Industry SA (France), signed a € 213m Term Loan, to be used for general corporate purposes.

- Florence Grp Spa (Italy), signed a € 575m Term Loan B, to be used for general corporate purposes, and a leveraged buyout. It matures on 10/16/30.

- Nestle SA (Switzerland | AA-), signed a € 6,500m Term Loan, to be used for general corporate purposes.

- Nestle SA (Switzerland | AA-), signed a € 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/05/27.

- Nestle SA (Switzerland | AA-), signed a US$ 2,700m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/05/27.

- Par Pacific Holdings Inc (United States of America), signed a US$ 900m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/26/28 and initial pricing is set at Term SOFR +125.0bp

- Rosen Europe BV (Netherlands), signed a US$ 1,500m Term Loan, to be used for general corporate purposes.

- Scandinavian Airlines Sys Ab (Sweden), signed a US$ 700m Term Loan, to be used for general corporate purposes. It matures on 10/06/30 and initial pricing is set at Term SOFR +650.0bp

- Suse Software Solutions (Germany), signed a € 500m Term Loan B, to be used for leveraged buyout.

- The ADT Corp (United States of America | BB), signed a US$ 1,400m Term Loan B, to be used for general corporate purposes. It matures on 10/10/30 and initial pricing is set at Term SOFR +275.0bp

- Trafigura Group Pte Ltd (Singapore), signed a US$ 200m Revolving Credit Facility, to be used for ship financing.

- Trafigura Group Pte Ltd (Singapore), signed a US$ 200m Revolving Credit Facility, to be used for ship financing.

- Trident OGX Congo (Republic of Congo), signed a US$ 300m Revolving Credit Facility, to be used for capital expenditures.

- Vantage Data Ctrs Mgmt Co LLC (United States of America), signed a US$ 450m Term Loan, to be used for general corporate purposes.