Credit

Credit Update: 27 March 2021

Pretty quiet day for credit, both in the primary and secondary market

Published ET

Sources: ϕpost, Refinitiv Eikon data

MARKET SUMMARY

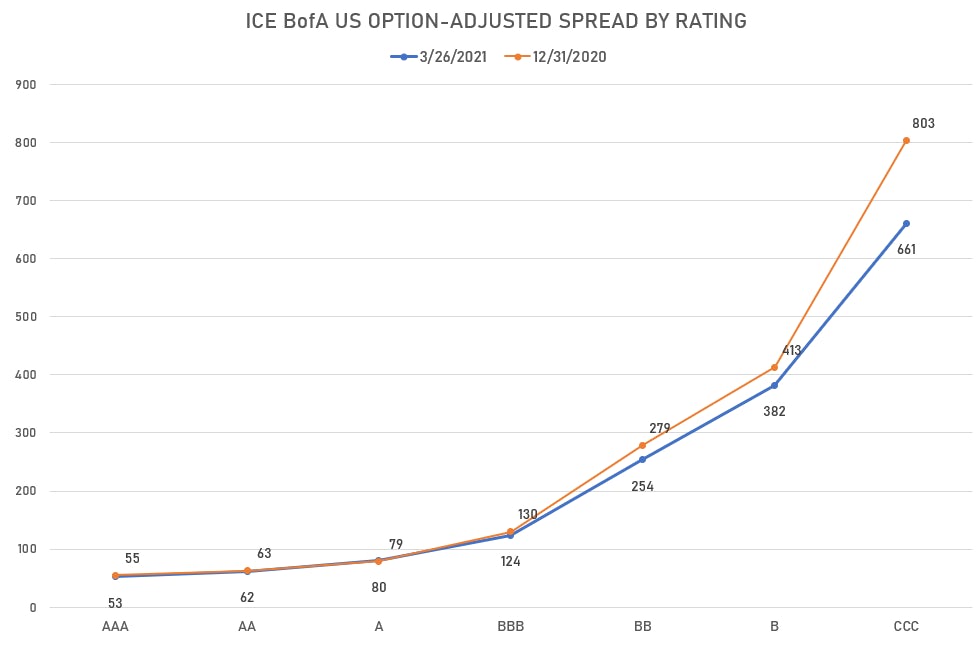

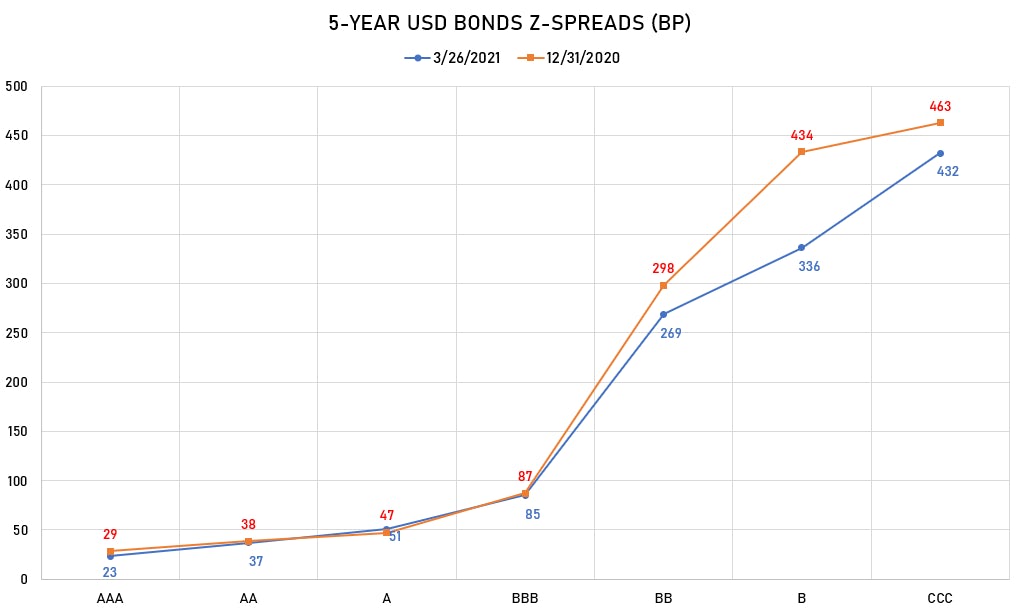

- US corporate spreads very modestly tighter on the day

- 1-day performance: US aggregate bond index down 0.27%, investment grade S&P 500 bonds down 0.20% and S&P500 high-yield unchanged

- Sectors that did relatively better today in the S&P 500 bond index: Real Estate (down only 0.02%) and Utilities (down 0.08%)

- Sectors that did relatively worse: Materials (down 0.25%), Industrials (down 0.23%), and Information Technology (down 0.22%)

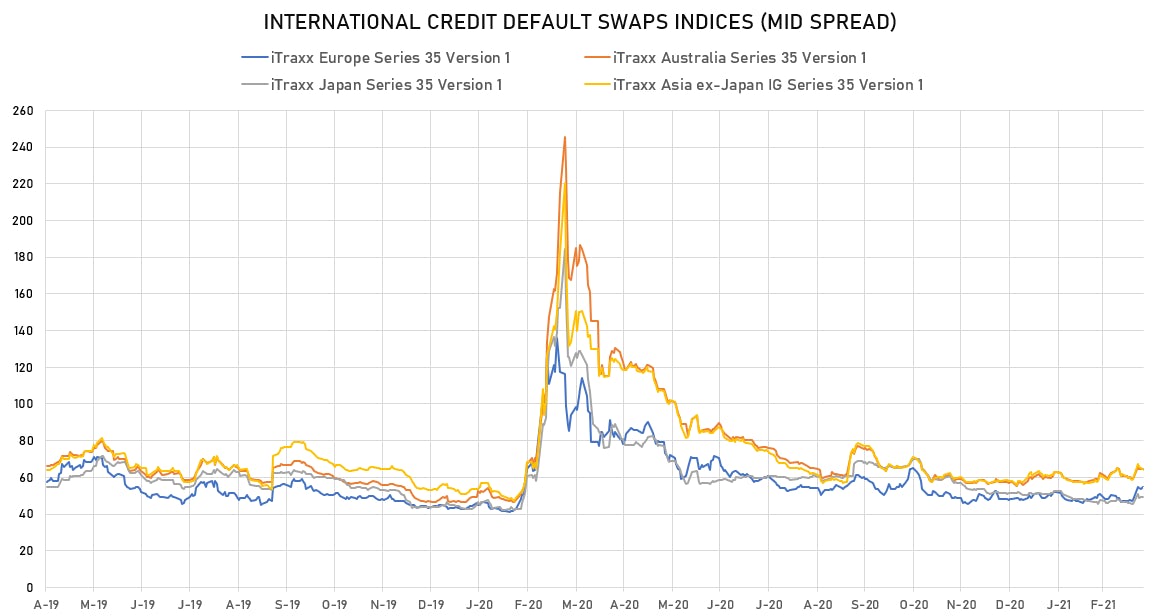

- Implied default probability in the CDX IG 5Y down 0.1%(to 4.85%) and CDX HY 5Y down 0.5% (to 18.2%)

NOTABLE BONDS ISSUED TODAY

- Burford Capital, a British investment manager rated BB-: US$400m, 7-year (non-call 3) senior unsecured note with a coupon of 6.25%, priced at par

- New Fortress Energy, rated B+ (644393AB6): US$1,500m senior secured note, with a maturity of 5.5 years (non-call 2) and a coupon of 6.50%, priced at par for a benchmark spread of 554 bps

- CAR Inc (XS2293887035): high yield US$250m, 3-year (non-call 2) senior note offering a 9.75% coupon, priced at 99.3660 for a yield of 10%

- Copper Mountain Mining Corp (NO0010968415): underwritten 5-year (non-call 3) US$250m, 8.00% coupon, high-yield bond priced at par

- Frontier Securitization XXXI (XS2318327777): US$300m 6-year floating-rate note

- Oasis Midstream Partners LP (US67421QAA04): B rated US$450m 8-year (non-call 3), 8.00% coupon, senior note priced at par for a 669 benchmark spread

- Douglas (XS2326498289), a German retailer: EUR 1,300m high-yield bond, with a coupon of 6% and a maturity of 5 years (non-call 2) priced at par, for a benchmark spread of 670bp

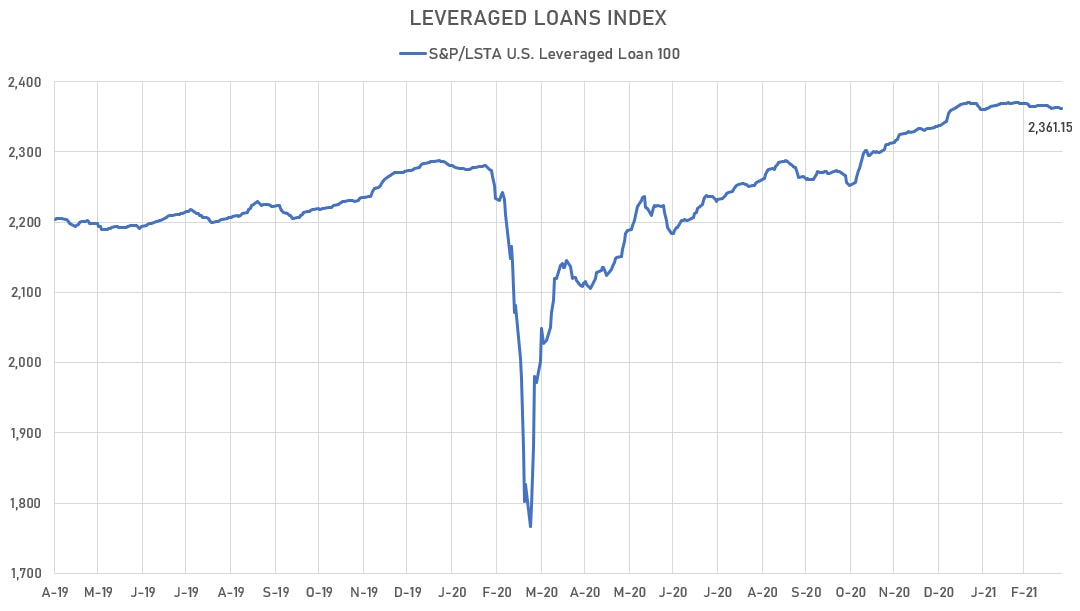

NOTABLE NEW USD LOANS

- Genesis Energy LP, a gas transportation pipelines owner and operator, headquartered in Houston, Texas, with a B+ long-term rating: $300m 3-year highly leveraged Term Loan A + $700m revolving credit facility, both pricing at LIBOR +375.000bps

- Aa Metals Inc, a metal wholesaler located in Orlando, Florida: $125m leveraged revolving credit facility (4.75 year maturity) priced at LIBOR +250.000bps

- Workforce Logiq, based in Florida: $375m leveraged revolving credit facility (2.33 year maturity) priced at LIBOR +250bps

- Valor Equity Partners V LP, a commodity contracts dealer located in Illinois: $300m January 2024 term loan